UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06318

CONSULTING GROUP CAPITAL MARKETS FUNDS

(Exact name of registrant as specified in charter)

2000 Westchester Avenue

Purchase, NY 10577

(Address of principal executive offices)(Zip code)

CT Corp

155 Federal Street Suite 700

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 454-3965

Date of fiscal year end: August 31

Date of reporting period: August 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking rules.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS

Consulting Group

Capital Markets Funds

Annual Report

| Ÿ | | Large Capitalization Growth Investments |

| Ÿ | | Large Capitalization Value Equity Investments |

| Ÿ | | Small Capitalization Growth Investments |

| Ÿ | | Small Capitalization Value Equity Investments |

| Ÿ | | International Equity Investments |

| Ÿ | | Emerging Markets Equity Investments |

| Ÿ | | Core Fixed Income Investments |

| Ÿ | | International Fixed Income Investments |

| Ÿ | | Municipal Bond Investments |

| Ÿ | | Money Market Investments |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER,

Given the finish to last year, investors were operating under the assumption that better than expected economic growth and higher long-term interest rates would be the base case for 2014. Unfortunately, on the economic front, this calendar year got off to a weak start, owing in part to harsh winter weather, but incoming data though the spring and summer months returned activity more in line with recent trends. Looking ahead, the U.S. economy is projected to produce a growth rate for 2014 as a whole that is little changed from last year’s +2.2% experience.

Divergent economic prospects around the globe produced somewhat mixed results for equity markets in the annual reporting period ended August 31, 2014. With U.S. interest rates, especially for longer-dated maturities, moving lower, a key headwind for the emerging markets (EM) was removed, and resulted in EM equity returns outpacing its global counterparts. On the flip side, continued economic concerns and uncertainty regarding the Ukraine/Russia situation weighed on the Euro Zone, as core countries such as Germany and France underperformed, accordingly. Domestically, U.S. equity markets continued their upward ascent through the reporting period. Advances were essentially broadly-based across economic sectors, and reversing last years’ experience, equity investments in large-cap companies outperformed stocks of riskier small capitalization companies.

The bond market has put in an unexpected performance thus far in 2014. Unlike last year’s ‘temper tantrum’ sell-off, longer-dated rates have actually come down significantly with the U.S. Treasury 10-year yield falling almost 70 basis points from the 2013 year-end tally. In anticipation of an eventual U.S. Federal Reserve (“FED”) rate hike, perhaps by mid-2015, short-term rates have underperformed and moved very little, flattening the yield curve (the difference between short and long-term rates) as a result. With the latest round of Quantitative Easing (QE3) expected to end in October, the fixed income markets have shifted their focus to the potential timing for what is being called ‘lift-off’ or the FED’s first rate hike. In terms of domestic fixed income, positive year-to-date returns have been recorded among all broad categories, with Investment Grade Corporates and Municipals registering the top performances. Along the same lines as the equity markets, EM debt was the outperformer on the international stage. Euro Zone sovereign debt markets, especially for periphery countries like Spain and Italy, have rallied considerably as the European Central Bank (ECB) has stepped up their easing campaign.

Consulting Group Capital Markets (CGCM) Funds

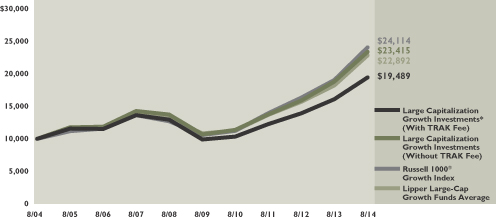

Large Capitalization Growth Investments posted a total return of +24.4% in the yearly fiscal period ended August 31, 2014, lower than the +26.3% total return results of the Russell 1000® Growth Index i and below the +25.1% performance of the average mutual fund included in Lipper’s Large-Cap Growth investment category ii. An underweight exposure to the Consumer Staples sector and an overweight allocation to the Health Care sector, combined with positive stock selections in the Health Care (pharmaceuticals) sector, contributed to relative returns, but were not enough to counter detracting contributions from investments in the Financials (diversified financial services), Materials (chemicals), and Information Technology (internet software & services) sectors, which unfavorably affected performance in the twelve-month period.

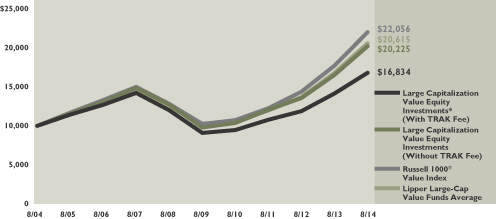

Large Capitalization Value Equity registered a gain of +22.4% in the fiscal year, trailing the +24.4% advance of the Russell 1000 Value® Index iii and the average +22.8% rise in the performance of mutual funds included in the Lipper Large-Cap Value investment category iv. An overweight allocation to the Information Technology sector, in addition to, favorable security picks in the Energy (oil, gas & consumable fuels) and Health Care (pharmaceuticals) sectors benefitted relative performance, but were offset by negative contributions from stock picks in the Consumer Discretionary (specialty retail) and Information Technology (electronic equipment instruments & components) sectors, which subtracted from returns in the annual period.

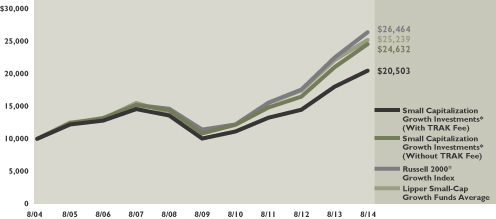

I

Small Capitalization Growth Investments climbed +16.9% over the yearly performance period, as compared to the +17.3% increase of the Russell 2000 Growth® Index v and the +14.0% return of the average mutual fund included in the Lipper Small-Cap Growth investment category vi. Contributions from positive stock selections in the Health Care (pharmaceuticals, health care equipment & supplies) and Materials (paper & forest products) sectors enhanced returns in the one-year period. On the other hand, detracting contributions from an exposure to cash and stock picks in the Information Technology (software) and Consumer Staples (food & staples retailing) sectors hurt relative performance.

Small Capitalization Value Investments generated an advance of +20.2% in the annual reporting period ended August 31, 2014. Absolute performance exceeded the +18.1% increase in the returns of the Russell 2000® Value Index vii and the +19.3% gain of the average mutual fund included in Lipper’s Small-Cap Value investment category viii. Stock selections in an array of economic sectors including Industrials (trading companies & distributors, commercial services & supplies), Materials (metals & mining), Energy (oil, gas & consumable fuels), Information Technology (software), and Consumer Staples (food products) were behind relative returns in the twelve-month period. Sector positioning, including an underweight allocation to the Financials sector as well as an overweight exposure to the Industrials and Materials sectors, also added value in the period and positively affected relative performance.

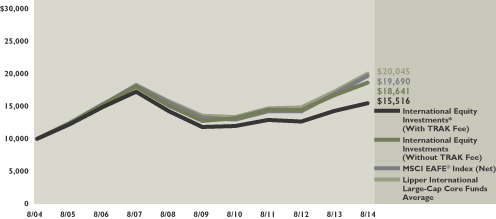

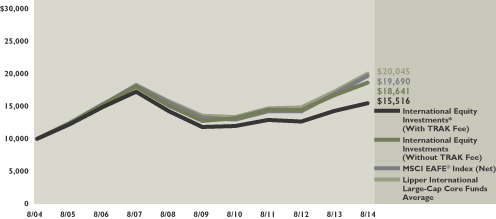

International Equity Investments rose +11.5%, as compared to the +16.4% return of the MSCI EAFE® Index (Net) ix and the +15.6% increase in the performance of the average mutual fund included in Lipper’s International Large-Cap Core investment category x. Favorable stock selections in the U.S. as well as Japan and in the Health Care (pharmaceuticals) sector aided relative returns over the fiscal annual period. Conversely, sector positioning, including an overweight allocation to the Consumer Discretionary sector as well as an exposure to cash, in addition to, unsuccessful stock picks in the Information Technology (internet software & services) and Financials (banks) sectors detracted from relative performance results. At the same time, country security holdings in the United Kingdom and Germany combined with an overweight position in the U.S. as well as Canada, and an underweight allocation to Spain, also hindered relative returns. On a separate note, asset management changes were made in the line-up of investment managers of the fund as OppenheimerFunds, Inc. and Causeway Capital Management LLC commenced as new sub-advisers during the fiscal year.

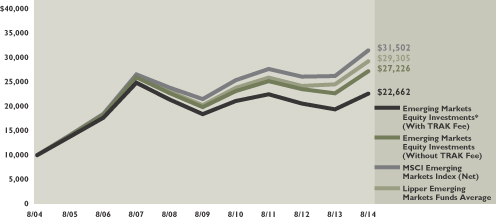

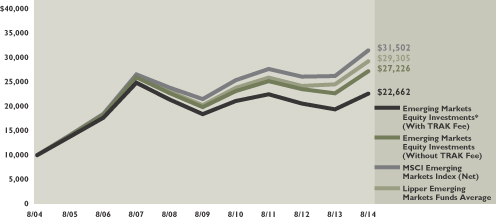

Emerging Markets Equity Investments registered twelve-month performance of +20.0%, in-line with the +20.0% return of the MSCI Emerging Markets Index (Net) xi and ahead of the +18.9% advance of the average mutual fund included in Lipper’s Emerging Markets investment category xii. An overweight exposure to India and Brazil and an underweight allocation to Chile, in addition to, positive stock picks in the Financials (banks), Health Care (pharmaceuticals), and Consumer Staples (beverages) sectors benefited relative performance in the twelve-month period ended August 31, 2014. A selective underweight allocation to the Materials sector, combined with individual holdings in India, Taiwan, and Hong Kong also boosted relative returns during the fiscal year. In contrast, from a sector perspective, an overweight allocation to Consumer Staples and an underweight position in Information Technology, in addition to, selective detracting security holdings in the Energy (energy equipment & services) and Industrials (construction & engineering) sectors, hampered relative returns in the one-year period. Negative contributions from an overweight exposure to Russia and country security positions in Russia, the U.S., South Africa, and China additionally hurt relative performance.

Core Fixed Income ascended +6.1% in the fiscal year, exceeding the +5.7% return of its market benchmark, the Barclays Capital U.S. Aggregate BondTM Index xiii, and in-line with the +6.1% rise for the average mutual fund included in Lipper’s Core Bond investment category xiv. Favorable contributions from investment grade and high yield sector selections benefited relative performance, offsetting declines from interest rate management (duration, yield curve positioning) and individual security selections, which diminished relative returns in the period.

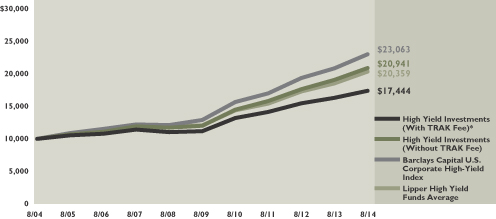

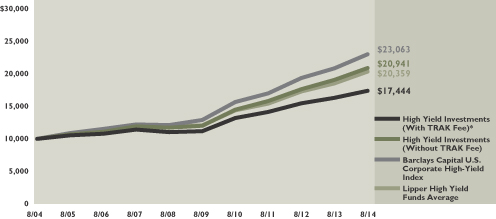

High Yield Investments experienced an increase of +9.8% in the annual fiscal reporting period, below the +10.6% advance of the Barclays Capital U.S. High Yield Index xv, but ahead of the +9.3% average return of mutual funds included in Lipper’s High Yield investment category xvi. Bond selections, namely in Telecommunications and Energy, contributed positively to excess returns in the fiscal year. At the same time, however, interest rate management (yield curve positioning) and sector selections, on the aggregate, generally subtracted from yearly performance.

II

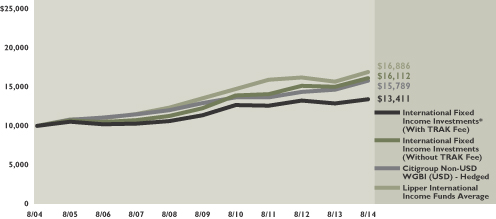

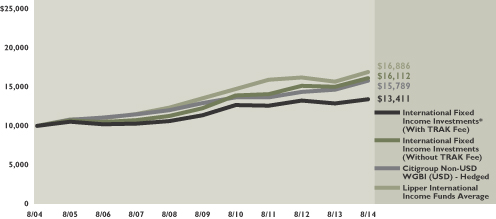

International Fixed Income Investments’ fiscal year return advanced +7.4%, as compared to the +7.9% return of the Citigroup Non-USD World Government Bond Index (USD) Hedged xvii and the +7.8% gain for the average mutual fund included in Lipper’s International Income investment category xviii. Contributions from country allocations particularly investments in emerging markets debt, currency decisions, and an exposure to investment grade corporates, high yield, and mortgage-backed securities aided results, although interest rate management (duration, yield curve positioning) and individual bond picks detracted from relative returns in the yearly period.

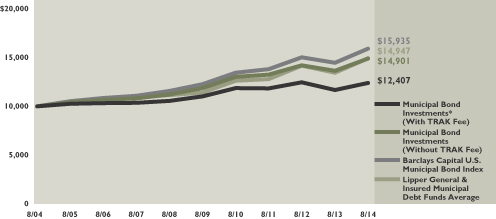

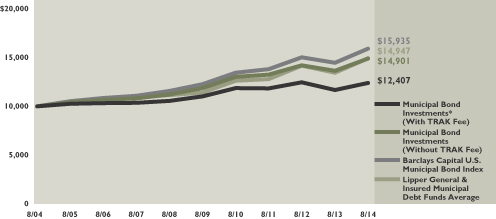

Municipal Bond Investments twelve-month performance of +9.2% in the fiscal period ended August 31, 2014 fell short of the +10.1% return of the Barclays Capital U.S. Municipal Bond Index xix as well as the +11.1% increase in the average mutual fund included in Lipper’s General & Insured Municipal Debt investment category xx. Positioning along the yield curve and an emphasis on higher credit quality issues affected relative performance during the year. In the yearly time period, long maturity municipals were typically the best performers, and additionally, lower-rated municipal debt generally outperformed their higher-rated counterparts.

Additional information regarding the investment managers of the CGCM Funds and commentary specific to each individual sub-adviser is available in the Annual Report following this Shareholder Letter.

Equity and fixed income investors in the CGCM Funds, by and large, finished the fiscal year ended August 31, 2014, in positive territory, but the path towards achieving absolute total return gains was not a straight line. Global macro events sent the markets on a challenging expedition as both stocks and bonds experienced intervals of volatility during the annual reporting period. As past history has shown, unpredictable periods of stock and bond price gyrations can and do occur periodically during a market cycle. These unforeseen instances serve as a reminder of how important it is for investors to maintain a balanced, diversified portfolio and a long-term perspective, consistent with individual goals, time horizons, and risk tolerances. Market participants are encouraged to review personal investment plans periodically and discuss particular individual investment concerns and needs with your Financial Advisor.

We thank you for your continued confidence in Morgan Stanley Wealth Management and support as shareholders of the CGCM Funds.

Sincerely,

James J. Tracy

Chief Executive Officer

October 30, 2014

III

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month-end, please visit our website at https://morganstanley.com/cgcm.

Shares of the Funds are available to participants in certain investment advisory programs sponsored by Morgan Stanley, including TRAK® CGCM, Select UMA, Consulting Group Advisor and Portfolio Management. The services offered through these programs may provide investors with asset allocation recommendations, which are implemented through the Funds. Under an investment advisory program, an investor typically pays an advisory fee that may vary based on a number of factors. The maximum shareholder fee (in addition to annual fund operating expenses) for assets invested in the Consulting Group Capital Markets Funds (“Trust”) through the TRAK® CGCM or Consulting Group Advisor investment advisory programs is 2.00% of average quarter-end net assets. The maximum shareholder fee (in addition to annual fund operating expenses) for assets invested in the Trust through the Select UMA and the Portfolio Management investment advisory programs is 2.50% and 3.00% of average quarter-end net assets, respectively. The maximum shareholder fees vary between the investment advisory programs because of differences in the services provided through the programs and other factors. Investors existing prior to April 1, 2010, will be assessed a maximum shareholder fee (in addition to annual fund operating expenses) for all assets invested in the Trust under TRAK® CGCM of 1.50% of average quarter-end net assets. These fees may be reduced in certain circumstances. These fees may be paid either by redemption of shares of the Funds or by a separate payment.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

RISKS: Certain of the Funds may invest in derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging or developing markets. Investments in small or medium-capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies. Certain of the Funds may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

| i. | The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| ii. | The Lipper Large-Cap Growth Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap growth funds typically have above-average characteristics compared to the S&P 500 Index. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| iii. | The Russell 1000® Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| iv. | The Lipper Large-Cap Value Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap value funds typically have below-average characteristics compared to the S&P 500 Index. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| v. | The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| vi. | The Lipper Small-Cap Growth Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap growth funds typically have above-average characteristics compared to the S&P SmallCap 600 Index. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| vii. | The Russell 2000® Value Index measures the performance of those Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| viii. | The Lipper Small-Cap Value Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap growth funds typically have below-average characteristics compared to the S&P SmallCap 600 Index. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| ix. | The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE®) Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Net total return indexes reinvest dividends after the deduction of withholding taxes, using (for international indexes) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| x. | The Lipper International Large-Cap Core Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies outside of the U.S. with market capitalizations (on a three-year weighted basis) above Lipper’s international large-cap floor. International large-cap core funds typically have average characteristics |

IV

| | compared to their large-cap-specific subset of the MSCI EAFE® Index. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| xi. | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index (Net) consists of the following 21 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Net total return indexes reinvest dividends after the deduction of withholding taxes, using (for international indexes) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| xii. | The Lipper Emerging Markets Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that seek long-term capital appreciation by investing at least 65% of total assets in emerging market equity securities, where “emerging market” is defined by a country’s GNP per capita or other economic measures. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| xiii. | The Barclays Capital U.S. Aggregate BondTM Index is a broad-based index that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| xiv. | The Lipper Core Bond Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that invest at least 85% of their assets in domestic investment-grade debt issues (rated in top four grades) with any remaining in investment in non-benchmark sectors such as high-yield, global and emerging market debt. These funds maintain dollar-weighted average maturities of five to ten years. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| xv. | The Barclays Capital U.S. Corporate High-Yield Index measures the market of U.S. dollar-denominated, non-investment grade, fixed rate, taxable corporate bonds. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| xvi. | The Lipper High Yield Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that aim at high (relative) current yield from fixed income securities, have no quality or maturity restrictions, and tend to invest in lower grade debt issues. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| xvii. | The Citigroup Non-USD World Government Bond Index (USD) Hedged and Unhedged are each sub-indices of the Citigroup World Government Bond Index (“WGBI”), which is comprised of the global sovereign debt of over 20 countries representative in the Americas, EMEA, EMU, Asia Pacific, and Japan regions. The Non-U.S. Dollar WGBI includes all WGBI markets except the United States and is stated in U.S. dollar hedged or unhedged base currency terms. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| xviii. | The Lipper International Income Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that state in their prospectus that they invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least three countries, excluding the United States, except in periods of market weakness. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

| xix. | The Barclays Capital U.S. Municipal Index covers the U.S. dollar-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| xx. | The Lipper General & Insured Municipal Debt Funds Average is an equally weighted average of all active funds available within the investment category. The classification includes funds that either invest primarily in municipal debt issues rated in the top four credit ratings or invest primarily in municipal debt issues insured as to timely payment. The total return of the Lipper Funds Average does not include the effect of sales charges. Please note that an investor cannot invest directly in a mutual funds classification average or an index. |

V

| | | | |

Performance of the Consulting Group Capital Markets Funds For the Year Ended August 31, 2014†* | | | |

| |

| Large Capitalization Growth Investments | | | 24.35 | % |

Russell 1000® Growth Index (1) | | | 26.29 | |

| |

| Large Capitalization Value Equity Investments | | | 22.37 | |

Russell 1000® Value Index (2) | | | 24.43 | |

| |

| Small Capitalization Growth Investments | | | 16.91 | |

Russell 2000® Growth Index (3) | | | 17.30 | |

| |

| Small Capitalization Value Equity Investments | | | 20.17 | |

Russell 2000® Value Index (4) | | | 18.10 | |

| |

| International Equity Investments | | | 11.45 | |

The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE®) Index (Net) (5) | | | 16.43 | |

| |

| Emerging Markets Equity Investments | | | 19.97 | |

MSCI Emerging Markets Index (Net) (6) | | | 19.98 | |

| |

| Core Fixed Income Investments | | | 6.10 | |

Barclays Capital U.S. Aggregate BondTM Index (7) | | | 5.66 | |

| |

| High Yield Investments | | | 9.75 | |

Barclays Capital U.S. Corporate High-Yield Index (8) | | | 10.58 | |

| |

| International Fixed Income Investments | | | 7.36 | |

Citigroup Non-USD World Government Bond Index (USD) Hedged (9) | | | 7.85 | |

| |

| Municipal Bond Investments | | | 9.24 | |

Barclays Capital U.S. Municipal Index (10) | | | 10.14 | |

| |

| Money Market Investments** | | | 0.00 | |

90-day Treasury Bill Index | | | 0.04 | |

See pages 27 through 29 for all footnotes.

VI

Large Capitalization Growth Investments

|

| ABOUTTHE SUBADVISERS |

Ÿ Jackson Square Partners, LLC (“JSP”) |

| JSP invests primarily in common stocks of large capitalization growth-oriented companies that JSP believes have long-term capital appreciation potential and are expected to grow faster than the U.S. economy. Using a bottom up approach, JSP seeks to select securities of companies that it believes have attractive end market potential, dominant business models and strong free cash flow generation that are attractively priced compared to the intrinsic value of the securities. JSP also considers a company’s operational efficiencies, management’s plans for capital allocation and the company’s shareholder orientation. |

|

Ÿ Wells Capital Management, Inc. (“Wells”) |

| Wells employs both proprietary screens and intensive grassroots research in order to identify high-growth companies expected to outperform their peers. Wells’ philosophy is firmly rooted in the belief that successful investing is the result of focusing on companies with favorable underlying fundamentals, strong growth potential and solid management teams. Security selection is based on fundamental research. This research process works to “surround” an investment by focusing on the company’s financials and verifying fundamentals with the management team, mid-level employees, customers, competitors, suppliers and/or distributors. |

|

Ÿ Westfield Capital Management Company, L.P. (“Westfield”) |

| Westfield uses an active management style and favors investing in earnings growth stocks given a conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Westfield believes that reasonably priced stocks with high earnings potential are best identified through in-depth, fundamental research. |

For the period of September 1, 2013, through August 31, 2014, the Sub-advisers for CGCM Large Capitalization Growth Investments (“Fund”) were Jackson Square Partners, LLC (“JSP”) (formerly, Delaware Investments Fund Advisers), Wells Capital Management, Inc. (“Wells”), Westfield Capital Management Company, L.P. (“Westfield”) and Frontier Capital Management Co., LLC (“Frontier”).

The portion of the Fund managed by JSP underperformed the Fund’s market index benchmark, the Russell 1000® Growth Index, for the year ended August 31, 2014. Strong stock selection in the Health Care and Consumer Staples sectors was overshadowed by weak relative performance in the Financial Services and Materials & Processing sectors. Additionally, the strategy sold a long term holding within the Technology sector and the resulting relative underweight to this strong performing stock further detracted from performance. Shifts in market sentiment during the period suggest that many investors appear to be struggling with accurately predicting the pace of global economic recovery and are assessing factors that threaten economic fundamentals (for example, central bank actions and fiscal policy debates across the globe). In such an uncertain macroeconomic environment, JSP believes the quality of a company’s business model, competitive position, and management may prove to be of utmost importance. Regardless of the economic outcome, JSP remains consistent in their long-term investment philosophy: In wanting to own what are viewed as strong secular-growth companies with solid business models and competitive positions that can grow market share and have the potential to deliver shareholder value in a variety of market environments.

The portion of the Fund managed by Wells underperformed the Fund’s market index benchmark, the Russell 1000® Growth Index, for the year ended August 31, 2014. In contrast to 2013’s fundamentally driven equity market, mixed economic data and a number of geopolitical events have led to increased uncertainty and reduced investor risk tolerances thus far in 2014. A profound “risk off” trade became evident in March and April as higher growth, higher valuation stocks sold off sharply in favor of the perceived safety of low valuation and higher dividend yielding equities. Wells used this volatility to increase the earnings quality and near term earnings visibility of the portfolio. Wells has reduced exposure to “longer duration” growth stocks while maintaining the growth profile and high active share. As is typically the case with a fundamentally based, bottom-up manager, security selection was the primary determinant of absolute and relative returns. While they represented a small absolute weight within the portfolio, holdings within the Consumer Staples sector proved to be a significant contributor to returns as strength was visible within the beverage industry. Positioning with the Health Care sector remains focused on firms that are “saving lives or saving dollars”. Given the significant innovation implicit in the bio-pharma industry, these stocks were a focal point within the sector and a significant contributor to returns over the past year. Security selection within the Technology sector also proved additive to returns as holdings within the Information Technology services and Internet Software & Services industries displayed considerable strength. Unfortunately, this strength was overshadowed by disappointing security selection within the Consumer Discretionary sector. A combination of weather related weakness and company specific issues weighed on returns within the specialty retail industry. Positioning

1

|

Ÿ Frontier Capital Management Co., LLC (“Frontier”) |

| Frontier is a research-driven firm specializing in the management of growth-oriented U.S. equity portfolios. Frontier believes that growth must be purchased at a reasonable price and that fundamental, bottom-up research is the cornerstone to adding value. The firm’s philosophy since its founding in 1980 is that stock prices ultimately follow earnings growth. Frontier believes that there are three key drivers of long-term, consistent performance and look for companies that possess, improving business models; unrecognized earnings power; and attractive valuations. |

within the Financials sector also detracted from returns as weakness was apparent among bank holdings.

The portion of the Fund managed by Westfield performed in-line with the Fund’s market index benchmark, the Russell 1000® Growth Index, for the year ended August 31, 2014. The U.S. stock market posted double-digit gains during the trailing twelve-month period, reaching all-time highs in August. Employment levels and participation are strengthening and U.S. housing — a source of concern at the beginning of the summer — has stabilized and improved. The Consumer Discretionary sector was the biggest driver of relative returns. The underweight of the sector helped, but it was positive stock selection, particularly within the casino & gaming and internet retail sub-industries, that led to the majority of incremental gains. Investments in Health Care and Energy also augmented relative performance. Information Technology and Materials were the only meaningful detractors from performance. As has often been the case, the many reasons to feel positive about the economy and the markets are tempered by mitigating factors. Manufacturing data in both Europe and China weakened considerably, capital spending in the Middle East is being delayed, and Russia’s economy remains a risk. While Russia’s economic and political woes should not have an immediate impact on the U.S., they pose a potential hit to the Eurozone economy, and in turn, to earnings of U.S. multinationals. In recognition of these factors, Westfield is reassessing its investments with global exposure and reallocating funds to those areas that benefit the most from continued strength within domestic economy.

The portion of the Fund managed by Frontier emphasizes mid-cap growth stocks. Frontier’s relative performance was driven by strength in Technology, Financial Services and Energy. The best performing stock in technology was a semiconductors company which benefitted from strong demand for an array of wireless devices. Within Financials, a data systems company continued to capitalize on its big data capabilities and deliver solid results. In Energy, a resources company has consistently over delivered with its production and reserve growth profile. Offsetting these areas was the Consumer sector, where an investment in a vitamin store underperformed after reporting disappointing same store sales metrics. After strong gains over the past several years, Frontier is not surprised to see the market consolidate given international tensions as well as a pending inflection in Federal Reserve policy. Taking a longer term perspective, Frontier sees ample reasons to be positive about the domestic economy. Five years into a recovery that has been largely consumer and government driven, Frontier believes fundamentals support renewed capital spending that in time will benefit sectors such as Technology, Industrials and Energy infrastructure, all areas where they are overweight. Frontier continues to be watchful of international developments and expects to make adjustments accordingly.

2

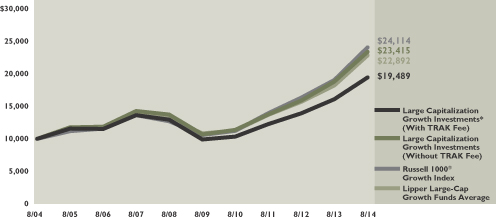

The following graph depicts the performance of Large Capitalization Growth Investments vs. the Russell 1000® Growth Index1 and the Lipper Large-Cap Growth Funds Average.11

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2014 LARGE CAPITALIZATION GROWTH INVESTMENTS Comparison of $10,000 Investment in the Portfolio with the Russell 1000® Growth Index and the Lipper Large-Cap Growth investment category |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | LARGE CAPITALIZATION GROWTH INVESTMENTS Average Annual Total Returns for the Period Ended August 31, 2014† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

1000

Growth

Index*** | | Lipper

Large-Cap

Growth

Funds

Average*** |

| | Since inception (11/18/1991) | | | | 8.26 | % | | | | 6.49 | % | | | | 8.87 | % | | | | 8.72 | % |

| | 10 year | | | | 8.88 | | | | | 6.90 | | | | | 9.20 | | | | | 8.55 | |

| | 5 year | | | | 16.90 | | | | | 14.39 | | | | | 17.82 | | | | | 16.07 | |

| | 3 year | | | | 19.32 | | | | | 16.52 | | | | | 19.95 | | | | | 18.56 | |

| | | 1 year | | | | 24.35 | | | | | 20.82 | | | | | 26.29 | | | | | 25.06 | |

| | *** | | Inception returns of the market indices and Lipper investment category averages are calculated from the end of the inception month. |

See pages 27 through 29 for all footnotes.

3

Large Capitalization Value Equity Investments

|

| ABOUTTHE SUBADVISERS |

Ÿ Cambiar Investors, LLC (“Cambiar”) |

| Cambiar utilizes a bottom-up process that seeks to identify companies that are attractively priced, demonstrate positive developments not yet recognized by the market and offer significant appreciation potential within a one- to two-year time frame. |

|

Ÿ NFJ Investment Group, LLC (“NFJ”) |

| The NFJ investment process initially screens for positive fundamentals by applying a screen over a universe of approximately 800 stocks in order to identify companies with positive fundamental characteristics. After the screen has been applied, NFJ then conducts in-depth research and analysis by reviewing each of the remaining 150-200 possible investments for low price-to-earnings multiples, high dividend yields, positive prospective earnings and quality operations. As part of the portfolio construction process, industry concentration is mitigated by avoiding overexposure to any one sector by restricting the number of stocks held within a single industry. The portfolio generally holds 40 to 50 companies. NFJ’s process involves regular portfolio and universe monitoring for buy and sell candidates. NFJ continually repeats its research process in order to identify new buy and sell candidates. The sell discipline is an important part of NFJ’s process. A stock is sold when an alternative stock with equally strong fundamentals demonstrates a substantially lower price-to-earnings ratio, and/or a substantially higher dividend yield. |

|

Ÿ HGK Asset Management, Inc. (“HGK”) |

| HGK invests in undervalued securities through disciplined, fundamentally driven quantitative and qualitative security analysis. This analysis is coupled with a risk adverse approach to portfolio construction. HGK’s value driven domestic equity investment process has been employed in its current form since 1991. The equity team screens for disciplined companies with improving cash flows selling below their discounted present value. Rigorous qualitative fundamental analysis is applied to make the final security selection. During this analysis, the equity team focuses on undervalued companies that operate from a position of competitive advantage and whose management teams understand the principles of shareholder wealth creation. |

For the period from September 1, 2013, through August 31, 2014, the Sub-advisers for Large Capitalization Value Equity Investments (“Fund”) were Cambiar Investors, LLC (“Cambiar”), NFJ Investment Group, LLC (“NFJ”), HGK Asset Management, Inc. (“HGK”) and Artisan Partners Limited Partnership (“Artisan”).

The portion of the Fund managed by Cambiar underperformed the Fund’s market index benchmark, the Russell 1000® Value Index, for the year ended August 31, 2014. One result of the rising tide investment environment over the past year has been a lack of differentiation at the sector level; i.e., the market has been tightly correlated. As we progress in the economic cycle, security selection in the context of company specific fundamentals and tight adherence to valuation should be more relevant to forward outperformance — a potentially good backdrop for stock picking managers such as Cambiar. For the trailing twelve months, Cambiar’s Energy positions comprised the strongest value-add. Cambiar has been constructive on energy services companies that have high exposure to North America land projects, where volumes continue to move higher and pricing has stabilized. The expectation for pricing to increase will be another important earnings driver for these companies. Related beneficiaries from increased energy production in the U.S. include refineries as well as chemical companies, which can take advantage of lower input costs to increase margins as well as raise market share. Although positive on an absolute basis, Cambiar’s holdings in the Consumer Discretionary and Technology sectors were unable to keep pace with the benchmark, and subsequently a source of relative underperformance. Holdings in the Industrials sector were another source of modest underperformance; after maintaining an overweight allocation to industrials coming out of the 2008-09 financial crisis, Cambiar has been a net seller of industrials over the past year. While many forecast that industrial companies are poised to benefit from an expected uptick in capital spending, such optimism appears to be largely reflected in the multiples of which many of these stocks are trading — not an overly attractive investment profile in Cambiar’s opinion.

The portion of the Fund managed by NFJ performed in-line with the Fund’s market index benchmark, the Russell 1000® Value Index, for the year ended August 31, 2014. The twelve-month reporting period was a generally positive market environment, punctuated by two negative months — January of 2014 and July of 2014 — and the U.S. Federal Reserve (“FED”) tapering quantitative easing. The reporting period opened with investors braced for tighter U.S. monetary policy in the fall of 2013, followed by the realization of that policy shift toward the end of that year. The FED incrementally pulled back its monthly stimulus and closed out the reporting period with the purchase of $35 billion in agency mortgage-based and longer-term Treasury securities beginning in July. Relative returns were due to positive sector weight deviations offset by a small cash position and slightly negative stock selection. Issue selection was strongest in the Industrials and Health Care sectors, while the strategy’s Consumer Discretionary and Materials holdings lagged those sectors within the benchmark. The strategy’s overweight in Information Technology and Materials boosted performance, along with an underweight in the Utilities sector. Within the benchmark, the Information Technology and Materials sectors generated the strongest absolute returns, gaining 41% and 30%, respectively over the trailing one-year period. Conversely, Utilities was the third weakest economic sector, after Telecommunication Services and Consumer Staples. The

4

|

Ÿ Artisan Partners Limited Partnership (“Artisan”) |

| The Artisan mid-cap value strategy employs a bottom-up investment process to construct a diversified portfolio of U.S. mid-cap value companies that Artisan’s mid-cap value investment team believes are undervalued, in solid financial condition and have attractive business economics. Artisan believes companies with these characteristics are less likely to experience eroding values over the long-term. |

Fund’s underweight position in Health Care and overweight in Energy were headwinds, and failed to keep pace with the benchmark’s total return during the reporting period.

The portion of the Fund managed by HGK outperformed the Fund’s market index benchmark, the Russell 1000® Value Index, for the fiscal year ended August 31, 2014. The fiscal year provided strongly positive equity returns as the global economy accelerated in the face of recession in Europe, slow growth in emerging markets, instability in the Middle East and prospects for less accommodative monetary policy. In spite of these headwinds, economic data surprised to the upside with the U.S. leading global economic recovery. Outperformance for the fiscal year can be attributed to strong security selection driven by bottom up stock picking as well as effective sector allocation. The strongest stock picks were in the Health Care, Staples and Technology Sectors. The strongest sector allocation was a result of being underweighted in the Financial Services sector. Conversely, on a relative basis, security selection in the Consumer Discretionary and Energy sectors were the largest detractors, as HGK’s holdings provided strongly positive returns but trailed the benchmark’s sector return. Despite the market rally during the period, HGK believes there are many opportunities for capital appreciation in the equity market for investors utilizing a disciplined valuation method. The most pronounced opportunity lies in the valuation disconnect between companies that have intelligently invested in preparation for a better economic environment and those who have cut costs too aggressively. HGK’s valuation work suggests that the market is discounting these strong operators, providing them with a number of opportunities. HGK continues to maintain a well-diversified portfolio and utilize its rigorous quantitative and qualitative analysis to find value in all economic sectors.

The portion of the Fund managed by Artisan emphasizes mid-cap value stocks. U.S. mid-cap stocks were aided by ongoing liquidity from the U.S. Federal Reserve (“FED”) and continued growth in the U.S. economy. Inflation remained tame, providing the FED with more leeway to keep short-term interest rates low for longer. Relative returns were held back by select holdings in the Consumer Discretionary and Technology sectors. Additionally, a cash position was a meaningful drag on performance. In the Consumer Discretionary sector, key detractors included handbags designer, a home goods retailer, and a toy company. The returns in the Technology sector were held back by a phone number database administrator. On the positive side, the Energy and Consumer Staples sectors were sources of outperformance and the portfolio benefited from a low weighting in the Utilities sector. With the market moving up faster than underlying business fundamentals over the past two years, finding attractive value opportunities has become more challenging for the Artisan investment team. At present, the team is a bit wary about current risk/reward dynamics priced into the market. That could change if business performance surprises to the upside or a bit of risk aversion creeps back into the market. Regardless, Artisan believes its focus on cash-producing businesses in sound financial condition, selling at undemanding valuations should continue to serve the portfolio well.

5

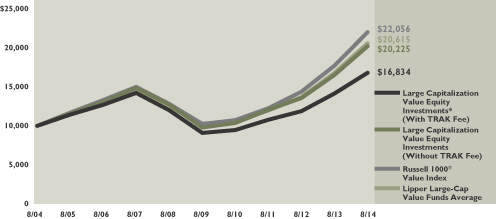

The following graph depicts the performance of the Large Capitalization Value Equity Investments vs. the Russell 1000® Value Index2 and the Lipper Large-Cap Value Funds Average.12

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2014 LARGE CAPITALIZATION VALUE EQUITY INVESTMENTS Comparison of $10,000 Investment in the Portfolio with the Russell 1000® Value Index and the Lipper Large-Cap Value investment category |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | LARGE CAPITALIZATION VALUE EQUITY INVESTMENTS Average Annual Total Returns for the Period Ended August 31, 2014† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

1000

Value

Index*** | | Lipper

Large-Cap

Value

Funds

Average*** |

| | Since inception (11/18/1991) | | | | 8.26 | % | | | | 6.49 | % | | | | 10.76 | % | | | | 9.74 | % |

| | 10 year | | | | 7.29 | | | | | 5.34 | | | | | 8.23 | | | | | 7.43 | |

| | 5 year | | | | 15.57 | | | | | 13.09 | | | | | 16.62 | | | | | 14.86 | |

| | 3 year | | | | 18.76 | | | | | 15.97 | | | | | 21.57 | | | | | 19.73 | |

| | | 1 year | | | | 22.37 | | | | | 18.90 | | | | | 24.43 | | | | | 22.77 | |

| | *** | | Inception returns of the market indices and Lipper investment category averages are calculated from the end of the inception month. |

See pages 27 through 29 for all footnotes.

6

Small Capitalization Growth Investments

|

| ABOUTTHE SUBADVISERS |

Ÿ Wall Street Associates (“Wall Street”) |

| Wall Street follows a bottom-up investment style. It looks for companies with superior earnings growth, strong balance sheets, attractive valuations and potentially positive earnings surprises. |

|

Ÿ Westfield Capital Management Company, L.P. (“Westfield”) |

| Westfield favors investing in earnings growth stocks given a conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is Westfield’s belief that the small capitalization portion of the market is under-researched, and therefore less efficient, than the large capitalization sector. |

For the period of September 1, 2013, through August 31, 2014, the Sub-advisers for the CGCM Small Capitalization Growth Investments (“Fund”) were Wall Street Associates (“Wall Street”), and Westfield Capital Management Company, L.P. (“Westfield”).

The portion of the Fund managed by Wall Street underperformed the Fund’s market index benchmark, the Russell 2000® Growth Index, for the year ended August 31, 2014. Stocks produced strong double-digit returns for the year ended August 31, 2014, although it was not a straight upwards move. As the fiscal year began, U.S. equity markets were in recovery mode following a mid-summer pullback. Investor’s confidence and tolerance for risk increased and stocks rallied fiercely into year-end 2013. Small cap stocks then had a bumpy ride from February through May, as investors violently rotated away from stocks that were small in size as well as those with high growth characteristics, due to fears of imminent U.S. Federal Reserve (“FED”) tapering and unrest in Russia and Ukraine. Hardest hit were those stocks with the highest revenue growth rates, particularly Technology and Biotechnology stocks. Those groups have since rallied back from correction territory on improving economic news and solid second quarter earnings reports. The Health Care sector provided the greatest contribution to portfolio return, driven by investments in medical equipment, instrumentation and pharmaceutical companies. Investments in the Energy and Materials sectors added significantly to portfolio returns. The producer durables and financial services groups were also additive to results. The largest detractor from performance for the period was the Technology sector, particularly software stocks. Consumer Discretionary stocks produced lackluster results for the period and were a drag on performance. Wall Street anticipates market levels will be higher over the next twelve-months, driven by earnings growth and continued improvement in the domestic economy. Risk control and stock selection are critically important and the asset manager continues to actively manage exposures and construct portfolios with companies experiencing sustainable long-term earnings growth rates.

The portion of the Fund managed by Westfield outperformed the Fund’s market index benchmark, the Russell 2000® Growth Index, for the year ended August 31, 2014. The U.S. stock market posted double-digit gains during the trailing twelve-month period, reaching all-time highs in August. Its advance, however, was not uniform, with small capitalization stocks correcting sharply in March-April and again in July. Small cap valuations did become extended by the end of 2013. However, Westfield believes the performance divergence between small and large caps over the spring and summer was primarily due to investors assessing emerging geopolitical and macroeconomic risks and preferring the relative safety and liquidity of larger cap stocks. The outperformance was fairly broad-based, with seven economic sectors generating incremental gains. Investments within Health Care drove most of the upside. Westfield continues to carry a substantial overweight in the Health Care sector and favors high quality names within biotechnology and pharmaceuticals. They have also been increasingly enthusiastic about growth prospects within the Contract Research Organization segment of the life sciences tools industry. The Materials sector also contributed significantly to performance results. The portfolio’s active exposure to Materials increased during the period; however, this overweight is not an expression of an overly bullish macro viewpoint, it is built upon their analysis

7

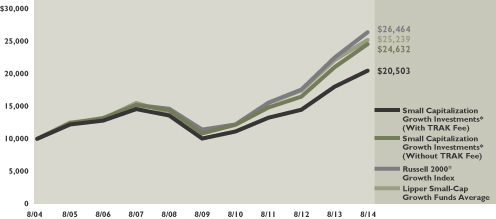

The following graph depicts the performance of Small Capitalization Growth Investments vs. the Russell 2000® Growth Index3 and the Lipper Small-Cap Growth Funds Average.13

of stock-specific risk/reward opportunities. The Industrials sector was the only meaningful detractor from relative results, held back by stock-specific weakness within office services & supplies. Westfield was pleased that the Russell 2000® Growth Index of small capitalization stocks outperformed broad market benchmarks in August. There are good reasons for the strength of domestic equities. Most of the economic news in the United States is positive and this dynamic tends to favor smaller, U.S.-centric companies. As economic growth in the U.S. accelerates, Westfield feels comfortable that they can identify more appreciation potential in individual small cap stocks.

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2014 SMALL CAPITALIZATION GROWTH INVESTMENTS Comparison of $10,000 Investment in the Portfolio with the Russell 2000® Growth Index and the Lipper Small-Cap Growth investment category |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | SMALL CAPITALIZATION GROWTH INVESTMENTS Average Annual Total Returns for the Period Ended August 31, 2014† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

2000

Growth

Index*** | | Lipper

Small-Cap

Growth

Funds

Average*** |

| | Since inception (11/18/1991) | | | | 9.58 | % | | | | 7.79 | % | | | | 7.92 | % | | | | 10.18 | % |

| | 10 year | | | | 9.43 | | | | | 7.44 | | | | | 10.22 | | | | | 9.60 | |

| | 5 year | | | | 17.80 | | | | | 15.28 | | | | | 18.29 | | | | | 17.77 | |

| | 3 year | | | | 18.39 | | | | | 15.61 | | | | | 19.21 | | | | | 17.54 | |

| | | 1 year | | | | 16.91 | | | | | 13.59 | | | | | 17.30 | | | | | 14.00 | |

| | *** | | Inception returns of the market indices and Lipper investment category averages are calculated from the end of the inception month. |

See pages 27 through 29 for all footnotes.

8

Small Capitalization Value Equity Investments

|

| ABOUTTHE SUBADVISERS |

Ÿ Rutabaga Capital Management LLC (“Rutabaga”) |

| Rutabaga focuses exclusively on micro- and small capitalization stocks and looks to unearth uncommon or currently out-of-favor stocks. The firm’s analysts employ extensive bottom-up fundamental research to identify high quality companies with catalysts to increase margins and intrinsic value but are neglected or misperceived by the market. |

|

Ÿ NFJ Investment Group LLC (“NFJ”) |

| NFJ employs an active management style that invests in a diversified portfolio of small capitalization common stocks that it believes are undervalued in the marketplace generally and within their respective industries. NFJ also considers valuation factors such as price-to-book, price-to-cash flow, dividend policy and industry outlook in selecting stocks for investment. |

|

Ÿ Delaware Investments Fund Advisers (“Delaware”) |

| Delaware will invest, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in the equity securities of small capitalization companies or in other investments with similar economic characteristics. Delaware will consider small capitalization companies to be companies with market capitalizations not exceeding $3 billion or the highest month-end market capitalization value of any stock in the Russell 2000® Index for the previous twelve months, whichever is greater. Securities of companies whose market capitalizations no longer meet this definition after purchase still will be considered to be securities of small capitalization companies for purpose of the investment policy. The size of the companies in the Index change with market conditions and the composition of the Index. |

For the period September 1, 2013, through August 31, 2014, the Sub-advisers for CGCM Small Capitalization Value Equity Investments (“Fund”) were Rutabaga Capital Management LLC (“Rutabaga”), NFJ Investment Group LLC (“NFJ”), and Delaware Investments Fund Advisers (“Delaware”).

The portion of the Fund managed by Rutabaga outperformed the Fund’s market index benchmark, the Russell 2000® Value Index, for the year ended August 31, 2014. Sector allocation was a slight headwind as Rutabaga held exposure to the top two performing sectors, Energy and Health Care, and were overweight in the worst performing sector, Consumer Discretionary. The investment manager’s top three performing stocks benefitted from improving commodity prices (particularly, silicon prices), increasing construction activity, and a buy-out by a competitor for a reasonable premium. Only two stocks significantly underperformed during the twelve-month period, and in both cases, new management teams are in place with credible turnaround strategies. Rutabaga remains committed to finding companies that are neglected and attractively valued and that possess internal catalysts to grow their earnings faster than other investors are expecting.

The portion of the Fund managed by NFJ outperformed the Fund’s market index benchmark, the Russell 2000® Value Index, for the year ended August 31, 2014. The twelve-month reporting period was a generally positive market environment, punctuated by three sharply negative months — January of 2014, April of 2014, and July of 2014 — and the U.S. Federal Reserve (“FED”) tapering quantitative easing. A hallmark of the NFJ investment process is downside protection and during those three down months, the strategy outperformed the Russell 2000® Value Index. The reporting period opened with investors braced for tighter U.S. monetary policy in the fall of 2013, followed by the realization of that policy shift toward the end of that year. The FED incrementally pulled back its monthly stimulus and closed out the reporting period with the purchase of $35 billion in agency mortgage-based and longer-term Treasury securities beginning in July. Within the benchmark, the more defensive Health Care and Utilities economic sectors, followed by Materials and Industrials names appreciated over the trailing one-year period. Laggards included Telecommunications Services stocks, the only sector to fall to a loss during the period, as well as the benchmark’s Consumer Staples and Consumer Discretionary companies. Strong absolute and relative performance was due to positive stock selection and sector allocation, albeit to a lesser degree. Issue selection was strongest in Consumer Staples and Energy, while stock picks lagged in the Consumer Discretionary and Information Technology sectors. The strategy’s overweight positions in Materials and Industrials, and underweight in Financials boosted returns. Conversely, an overweight in Consumer Staples dampened relative performance.

The portion of the Fund managed by Delaware outperformed the Fund’s market index benchmark, the Russell 2000® Value Index, for the year ended August 31, 2014. Economic growth remained modest for the fifth consecutive year with gross domestic product (GDP) growth averaging between 2.0% – 2.5%, although the quarterly variation was wide. The continued modest growth rate enabled the FED to maintain an extremely accommodative monetary policy accompanied by very low interest rates. Corporate balance sheets remained in excellent shape and share

9

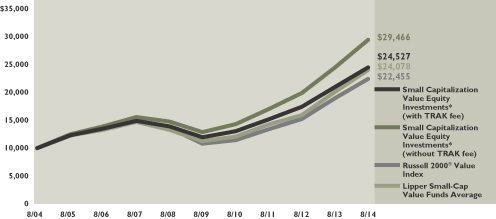

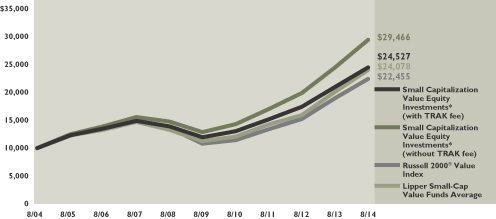

The following graph depicts the performance of Small Capitalization Value Equity Investments vs. the Russell 2000® Value Index4 and the Lipper Small-Cap Value Funds Average.14

buybacks and increasing dividends continued at strong levels while merger and acquisition activity also increased. All of these appear to be indications that corporations are more confident in the economy and their ability to return excess capital to shareholders. With interest rates remaining very low and the FED continuing an extremely accommodative monetary policy, the equity markets enjoyed strong returns with most sectors within the small-cap value index having returns in excess of 15%.

From a performance standpoint, strong stock selection in the Capital Spending, Energy, and Technology sectors were major factors in outperforming on a relative basis, and offset the negative impact from underweighting Real Estate Investment Trusts (REITs). Individual stock selection contributed the majority of outperformance for the portfolio while sector allocations also had an overall positive impact on performance.

|

HISTORICAL PERFORMANCE FOR THE TEN-YEAR PERIOD ENDED AUGUST 31, 2014 SMALL CAPITALIZATION VALUE EQUITY INVESTMENTS Comparison of $10,000 Investment in the Portfolio with the Russell 2000® Value Index and the Lipper Small-Cap Value investment category |

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.morganstanley.com/cgcm.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | | | | | | | |

| | | SMALL CAPITALIZATION VALUE EQUITY INVESTMENTS Average Annual Total Returns for the Period Ended August 31, 2014† |

| | | | | Without

Annual

Advisory

Program

Fee | | With

Annual

Advisory

Program

Fee* | | Russell

2000

Value

Index*** | | Lipper

Small-Cap

Value

Funds

Average*** |

| | Since inception (11/18/1991) | | | | 11.05 | % | | | | 9.23 | % | | | | 11.98 | % | | | | 11.24 | % |

| | 10 year | | | | 11.41 | | | | | 9.38 | | | | | 8.43 | | | | | 9.12 | |

| | 5 year | | | | 17.95 | | | | | 15.42 | | | | | 15.74 | | | | | 16.47 | |

| | 3 year | | | | 20.05 | | | | | 17.23 | | | | | 18.78 | | | | | 19.08 | |

| | | 1 year | | | | 20.17 | | | | | 16.76 | | | | | 18.10 | | | | | 19.30 | |

| | *** | | Inception returns of the market indices and Lipper investment category averages are calculated from the end of the inception month. |

See pages 27 through 29 for all footnotes.

10

International Equity Investments

|

| ABOUTTHE SUBADVISERS |

Ÿ Schroder Investment Management North America, Inc. (“Schroders”) |

| Schroders uses a bottom-up growth oriented approach towards stock selection and employs a fundamental, research driven process to identify quality growth companies with attractive medium-term growth and valuation, quality management and financial position, and a sustainable competitive advantage. Schroders’ “best ideas” portfolio blends both core and opportunistic holdings. |

|

Ÿ Philadelphia International Advisors LP (“PIA”) |

| PIA utilizes a fundamental bottom-up process and quantitative screening in its approach to international investing. It selects stocks to buy and sell by evaluating a company’s growth outlook and market valuation based on traditional value characteristics, positive company-specific catalysts and other operating and financial conditions. It selects countries primarily by evaluating a country’s valuation ratios such as price-to-earnings and dividend yield, prospective economic growth, government policies and other factors. |

|

Ÿ OppenheimerFunds, Inc. (“OFI”) |

| OFI’s Global Equity team seeks to generate alpha through high conviction decisions driven by fundamental bottom-up analysis. Several secular growth themes are used as a way to focus attention on segments of the global marketplace that may grow faster than world GDP. The team’s investment process is driven by a number of very powerful, long-term economic, demographic and technological forces summarized as MANTRA® — Mass Affluence, New Technologies, Restructuring and Aging. The portfolio managers utilize a bottom-up, fundamental investment approach, and seek to invest initially in high-quality companies that are temporarily out of favor; trading at attractive valuations; and which demonstrate sustainable, above-average growth potential over a three- to five-year time horizon. The process is index agnostic, searching for companies with high growth rates and high quality balance sheets with minimal focus with respect to region or country, sector or security. |

|

Ÿ Causeway Capital Management LLC (“Causeway”) |

Causeway’s international developed market investment philosophy is based on a long-term value strategy and the investment team applies an active, bottom-up, research-intensive approach towards stock selection. |

For the period September 1, 2013, through August 31, 2014, the Sub-advisers for CGCM International Equity Investments (“Fund”) were Schroder Investment Management North America Inc. (“Schroders”) and Philadelphia International Advisors LP (“PIA”), while OppenheimerFunds, Inc. (“OFI”) began on May 23, 2014 and Causeway Capital Management LLC (“Causeway”) began on August 20, 2014.

The portion of the Fund managed by Schroders outperformed the Fund’s market index benchmark, the MSCI EAFE® Index (Net), for the year ended August 31, 2014. International equity markets were positive over the year, supported by low volatility and central bank accommodation. The modest recovery in the global economy continued to support solid cash flow generation and healthy earnings growth for most companies. Diverging growth within regions and central bank action were central themes. While the U.S. economic recovery prompted concerns about policy tightening, a slowing eurozone battling persistently low inflation prompted policy loosening in Europe. Geopolitical tension in the Ukraine and Middle East also dominated sentiment and affected energy prices. Stock selection was the main driver behind relative performance, particularly in the Health Care sector where Schroders’ positions in U.K. companies that were at the centre of intense merger and acquisition speculation were beneficial. Holdings in the Industrial sector also added to returns, especially in Canada. On a regional basis, Schroders’ stock selection within Japan was especially beneficial as a number of their positions overcame the market weakness related to the consumption tax increase in April. The rally in peripheral Europe hurt performance, as a result of a significant underweight allocation given a cautious view on risk, valuations and growth within that region. Schroders continues to pursue companies with strong business models that are also supported by longer-term secular growth trends. One example is an exposure to the growth in mobile services and internet connectivity, which remains in the early stages. Overall, Schroders remains focused on identifying companies with attractive growth in earnings that is underestimated by the market.

The portion of the Fund managed by PIA outperformed the Fund’s market index benchmark, the MSCI EAFE® Index (Net), for the year ended August 31, 2014. Despite some geo-political tensions out of the Ukraine and Middle East, optimism in the global economic recovery, assurances from central bankers, and increased merger and acquisition activity helped push global equities higher during the period. All sectors posted positive returns for the period with the more defensive Health Care, Telecommunications, and Utilities leading the way. With the exception of Japan, which underperformed early in 2014 due to the consumption tax hike, all major non-U.S. regions posted double-digit returns for the period in U.S. dollar terms. The portfolio’s allocation to international small cap securities was the greatest driver of outperformance as stock selection was quite strong within Industrials, Financials, and Consumer Discretionary. Amongst larger capitalization holdings, stock selection in Materials and Health Care also positively impacted net returns. Stock selection within the Energy sector was the largest detractor as select holdings underperformed the market. The portfolio’s underweight to the Telecommunications sector also modestly weighed on relative returns. Regionally, strong selection in Japanese and Continental European holdings (namely within

11

|

| Causeway’s investment approach seeks to identify under-priced stocks of high quality companies believed to be exhibiting superior financial strength as compared to peers. In addition to fundamental analysis, quantitative research is considered an integral part of the process and is used for screenings of investment candidates as well as risk management. Portfolio managers work as a team to make investment decisions and are supported by the firm’s dedicated fundamental and quantitative research analysts. Analysts and portfolio managers are assigned global industry-specific research responsibilities. Fundamental research is further organized into four research clusters: financials/materials, consumer/energy, industrials/manufacturing, and health care/technology. Causeway’s unconstrained, international established market value equity approach invests in a variety of market capitalization ranges, but primarily in large- and mid-capitalization non-U.S. developed market companies. Causeway can also invest in small-cap issues and less developed emerging markets. Value-driven security characteristics may include low price/earnings ratio, low price/book ratio, low price/cash flow ratio and high dividend yield, but may also include out-of-favor companies that may have high rates of growth of earnings. Sector and regional weights are byproducts of the investment process. |

France, Sweden, Italy, and the Netherlands) generated positive gains while select emerging market stocks were a slight detraction.