UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-06400

The Advisors’ Inner Circle Fund

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: December 31, 2023

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

The Advisors’ Inner Circle Fund

HAMLIN HIGH DIVIDEND EQUITY FUND

| | | | | | |

| | Annual Report | | December 31, 2023 | | |

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

The Fund files its complete schedule of investments of fund holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year or as an exhibit to its report on Form N-PORT (Form N-Q for filings prior to March 31, 2020). The Fund’s Forms N-Q and Form N-PORT reports are available on the SEC’s website at https://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to fund securities, as well as information relating to how the Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-855-HHD-FUND and (ii) on the SEC’s website at https://www.sec.gov.

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

Dear Shareholders:

PERFORMANCE & PORTFOLIO CHANGES

The Hamlin High Dividend Equity Fund institutional class returned 9.46% in the fourth quarter of 2023, lagging the S&P 500’s 11.69% increase and in line with the Russell 1000 Value Index’s 9.50% and Dow Jones U.S. Select Dividend’s 10.17% return. In 2023, the Hamlin High Dividend Equity Fund’s 13.67% return compares favorably the Russell 1000 Value Index’s 11.46% increase and was well ahead of the Dow Jones U.S. Select Dividend Index’s 1.53% return. We attribute this favorable outcome to our lower Regional Bank and Utility sector exposure and strong company-specific execution from our eclectic, concentrated holdings. Our lag relative to the S&P 500 Index’s impressive 26.29% return reflects that index’s 28% weighting in the so-called “Magnificent Seven” low/no-dividend tech stocks to which we have no exposure. Those stocks jumped over 100% on average in 2023.1

Within the portfolio, relative sector contributors to performance this quarter were Real Estate, Consumer Discretionary, and Materials. Relative sector detractors were Industrials, Energy, and Consumer Staples. The largest individual stock performance contributors were Broadcom Inc., Lamar Advertising Company, M.D.C. Holdings Inc., Ares Management Corporation, and Target Corporation. The weakest performers were Genuine Parts Company, ConocoPhillips, Enterprise Products Partners L.P., Unilever PLC ADR, and Comcast Corporation. There were no purchases or sales during the quarter.

Twenty-five of Hamlin’s twenty-six year end holdings increased their dividends in 2023, with an average increase of 8.6%. This welcome action validates our research analysis and increases portfolio cash flow. Corporate boards generally announce dividend increases only when they envision strong cash flow growth in the future. While past performance does not predict future results, we note that our current portfolio holdings have increased their dividends at a 11.8% compound annual rate over the last three years.

| | 1 | AAPL (+49% in 2023), MSFT (+58%), AMZN (+81%), NVDA (+239%), GOOGL (+58%), META (+194%), and TSLA (+102%) represented 27.94% of the S&P 500 Index as of 12/31/2023. Source. Bloomberg. |

1

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

MARKET OUTLOOK

This time last year, your Hamlin equity team was wondering what could confound the pundits’ predictions for earnings and stock market weakness in 2023. Knowing that markets rarely accommodate consensus thinking, we are wondering what could go wrong in 2024 given double digit earnings growth forecasts, market expectations for sharply lower Federal Funds, and constructive investor sentiment.2

Slowing inflation may remove last year’s pricing tailwind for revenue growth, and stocks have done little on average in the January through October periods of election years. The inverted yield curve continues to predict recession as the economy digests recent interest rate hikes and on-going quantitative tightening. Stocks have done fine during prior inversions… until they didn’t. 10-year Treasury yields have been below 3-month Treasury Bill yields for 14 months.3 The curve was inverted for 19 months entering 2008, and stocks gained 25% during the first 15 months of that episode.4 At 19.6x bottoms-up consensus earnings estimates for 2024, valuation is less than compelling relative to an average 15.8x NTM PE multiple over the last twenty years.5

While concerned about these equity market headwinds, we know that we cannot predict market cycles. Meanwhile, Covid-related dynamics could portend a shallow recession or even a slow-down to “Goldilocks” growth. We sense that some of our management teams might be reluctant to reduce headcount, having felt the pinch of labor shortages as the Pandemic receded. Similarly, policy makers’ reaction to the

| | 2 | The CBOE Volatility Index (VIX), a popular measure of the stock market’s expectation of volatility based on S&P 500 Index options activity and often regarded a contrarian indicator, closed 2023 at 12.45. This level is 30% below its 10-year average and at the low end of its 9.14 – 82.69 range over that period. Source: Factset. As of 12/31/2023, 90% of stocks in the S&P 1500 were above their 50-day moving average, a level where the markets have paused or headed lower. Source: The Daily Shot, S&P & CRSP. |

| | 3 | The 3-month T-Bill yield has yielded higher than the 10-year T-Note since 11/2/2022. Source: Factset. |

| | 4 | The 10-year T-Note yield was below the Federal Funds Effective rate from 7/3/2006 – 1/22/2008. The S&P 500 Index rose 25.20% from the start of the inversion through 10/9/2007. |

| | 5 | As of 12/31/2023, the S&P 500 Index traded at 4,769.83 and the 2024 consensus EPS estimate was $243.51. Average 20-year NTM PE measured daily from 12/31/2003 – 12/31/2023. We note that the equal weighted NTM PE sits at a more attractive 16.1x. Source: Factset. NTM PE, or next twelve-month price to earnings, is a ratio that measures analyst expectations for earnings per share over the next year to the current stock price. | |

2

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

sharp Covid recession drove consumer net worth well above trend line. While most stimulus checks were spent and the savings rate is low, money market fund balances are $1 trillion above 2019 levels. The aggregate value of securities accounts and homes has soared to $155.7 trillion. With income growth exceeding CPI and with strong balance sheets, consumers can continue to spend.

There are other stock market tailwinds. Declining inflation has historically been good for stocks. The inflation trend is friendly as lower rents will impact the CPI with a lag, and a lower “quit rate” should restrain wage growth. Earnings began to grow again in the recent two quarters, despite a drag from shrinking materials and energy sector profits. Stocks may have room to run should they celebrate a Fed Pivot to the same degree as they have in the past.6 Looking beyond 2024, we believe that discount rates should remain elevated for the foreseeable future. Fed Funds have likely peaked for the cycle, but we think ZIRP is over.7 Moreover, the equity risk premium may have increased. We expect margin volatility. Deglobalization and onshoring of supply chains should be costly, price increases will be harder to come by, and populist polices such as Modern Monetary Theory may also render the economic cycle inherently more volatile. This dynamic may support value-oriented equities at a time when the gap between Value and Growth performance and valuation is historically stretched.

We remain excited about our companies’ long-term revenue growth prospects driven by product cycles and market share gain opportunities, and we expect earnings growth for our twenty-six holdings in 2024. While our conversations with company management teams generally focus on through-the-cycle earnings power, purchases reflect our best assessment of earnings risk in a downturn. We are equally excited about several watchlist companies that meet Hamlin criteria and trade more cheaply than the broader market. We are comforted to own quality businesses with an average net debt-to-capital ratio of 37.3% and median 25.5% return on equity. Valuation remains attractive with a 15.9x average PE multiple and a generous 3.4% current dividend yield.

| | 6 | The S&P 500 Index has increased 16.35% on average between the last rate hike and first rate cut in the past 5 rate cycles. As of 12/31/23, the S&P 500 has increased 5.12% since the last rate hike in July of 2023. |

| | 7 | Acronym for Zero Interest Rate Policy under which the Federal Reserve generally kept interest rates pinned to the floor for more than a decade. |

3

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

We remind you that we are not managing your account to track or beat the S&P 500 Index. We don’t select securities to align your portfolio with any index’s sector weightings or holdings. Our goal is to construct a quality portfolio with high current income. We strive to help our institutions and individual clients meet their spending objectives. We aim to preserve financial security and lifestyles by protecting against inflation with future dividend increases and long-term capital appreciation.

Finally, Hamlin remains contrarily bullish on the interest rate environment. Fed Funds at 5% means that retirees can earn a decent return on risk-free CD’s; policy makers have rates to cut one day in the future; and the end of the free money era might foster a more rational capacity and pricing environment for surviving businesses.

While our conversations with company management teams generally focus on through-the-cycle earnings power, we are trying to estimate earnings in both the soft landing and recessionary scenarios. We remain excited about our companies’ revenue growth prospects driven by product cycles and market share gain opportunities. While optimistic about our holdings’ prospects and valuations, choppiness and even an undercut of October 2022 lows at some point would not surprise us. In an uncertain environment, we are comforted to own quality businesses with an average net debt-to-capital ratio of 35.9%, median 25.1% return on equity, and weighted average 15.5x forward P/E multiple.4 We remind you that we are not managing the fund to track or beat the S&P 500 Index. We don’t select securities to align your portfolio with any index’s sector weightings or holdings. Our goal is to construct a quality portfolio with high current income. We strive to help our institutions and individual clients meet their spending objectives, preserve financial security and lifestyles by protecting against inflation with future dividend increases and long-term capital appreciation.

4

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

There is no guarantee that companies will declare dividends or if declared, that they will remain at current levels or increase over time. Companies may reduce or eliminate dividends at any time. There is no guarantee that the Fund will achieve or maintain its investment strategy.

Mutual fund investing involves risk, including possible loss of principal. There can be no assurance that the Portfolio will achieve its stated objectives. Bond and bond funds will decrease in values as interest rates rise. A company may reduce or eliminate its dividend, causing losses to the fund. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, differences in generally accepted accounting principles, or from social, economic, or political instability in other nations.

This material represents the manager’s assessment of the Fund and market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular. Please consult your tax/financial advisor for further information.

5

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 (Unaudited) |

Definition of Comparative Indices

The S&P 500 Index is a market-value weighted index consisting of 500 common stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the Index proportionate to its market value.

Lipper Equity Income Fund Index consists of funds that seek relatively high current income and growth of income through investing 65% or more of their portfolio.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity Universe. It includes those Russell 1000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years).

6

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 (Unaudited) |

|

|

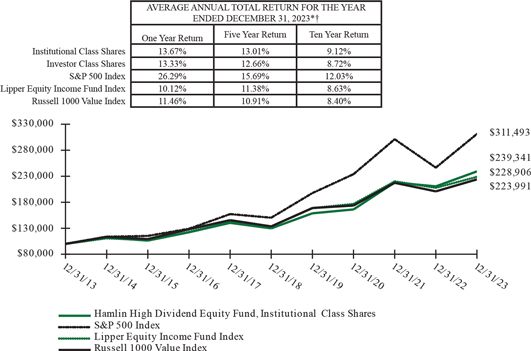

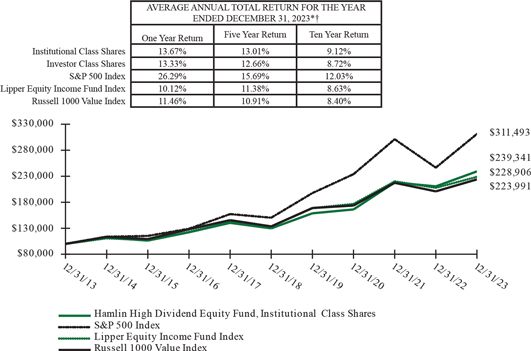

GROWTH OF A $100,000 INVESTMENT |

† The graph is based on only Institutional Class Shares; performance for Investor Class Shares would be lower due to differences in fee structures.

*If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

The Fund’s performance assumes the reinvestment of dividends and capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 6.

7

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 |

| | | | |

|

SECTOR WEIGHTINGS (Unaudited)†: |

| † | Percentages based on total investments. |

| | | | | | | | | | | | |

| | | |

SCHEDULE OF INVESTMENTS | | | | | | | | | | | | |

| | | |

COMMON STOCK — 99.0% | | | | | | | | | | | | |

| | |

| | | Shares | | | Value |

| | | |

Communication Services — 4.9% | | | | | | | | | | | | |

Comcast, Cl A | | | 976,237 | | | | | | | $ | 42,807,992 | |

Interpublic Group | | | 490,628 | | | | | | | | 16,014,098 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 58,822,090 | |

| | | | | | | | | | | | |

| | | |

Consumer Discretionary — 8.2% | | | | | | | | | | | | |

Genuine Parts | | | 166,556 | | | | | | | | 23,068,006 | |

Home Depot | | | 126,766 | | | | | | | | 43,930,757 | |

MDC Holdings | | | 585,723 | | | | | | | | 32,361,196 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 99,359,959 | |

| | | | | | | | | | | | |

| | | |

Consumer Staples — 13.7% | | | | | | | | | | | | |

Keurig Dr Pepper | | | 1,181,700 | | | | | | | | 39,374,244 | |

Procter & Gamble | | | 339,535 | | | | | | | | 49,755,459 | |

Target | | | 245,888 | | | | | | | | 35,019,369 | |

Unilever ADR | | | 863,444 | | | | | | | | 41,859,765 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 166,008,837 | |

| | | | | | | | | | | | |

| | | |

Energy — 9.2% | | | | | | | | | | | | |

ConocoPhillips | | | 492,280 | | | | | | | | 57,138,940 | |

Enterprise Products Partners (A) | | | 2,057,469 | | | | | | | | 54,214,308 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 111,353,248 | |

| | | | | | | | | | | | |

| | | |

Financials — 17.6% | | | | | | | | | | | | |

Ares Management, Cl A | | | 492,292 | | | | | | | | 58,543,365 | |

CME Group, Cl A | | | 245,277 | | | | | | | | 51,655,336 | |

Morgan Stanley | | | 521,412 | | | | | | | | 48,621,669 | |

The accompanying notes are an integral part of the financial statements.

8

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 |

| | | | | | | | | | | | |

| | | |

COMMON STOCK — continued | | | | | | | | | | | | |

| | |

| | | Shares | | | Value |

| | | |

Financials— continued | | | | | | | | | | | | |

Old Republic International | | | 1,832,747 | | | | | | | $ | 53,882,762 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 212,703,132 | |

| | | | | | | | | | | | |

| | | |

Health Care — 8.4% | | | | | | | | | | | | |

AbbVie | | | 357,474 | | | | | | | | 55,397,746 | |

Johnson & Johnson | | | 298,708 | | | | | | | | 46,819,492 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 102,217,238 | |

| | | | | | | | | | | | |

| | | |

Industrials — 18.0% | | | | | | | | | | | | |

Cummins | | | 182,676 | | | | | | | | 43,763,689 | |

Paychex | | | 337,658 | | | | | | | | 40,218,444 | |

Snap-on | | | 167,576 | | | | | | | | 48,402,652 | |

United Parcel Service, Cl B | | | 246,193 | | | | | | | | 38,708,926 | |

Watsco | | | 110,964 | | | | | | | | 47,544,745 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 218,638,456 | |

| | | | | | | | | | | | |

| | | |

Information Technology — 10.8% | | | | | | | | | | | | |

Broadcom | | | 77,831 | | | | | | | | 86,878,854 | |

Texas Instruments | | | 256,022 | | | | | | | | 43,641,510 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 130,520,364 | |

| | | | | | | | | | | | |

| | | |

Real Estate — 4.4% | | | | | | | | | | | | |

Lamar Advertising, Cl A ‡ | | | 500,448 | | | | | | | | 53,187,613 | |

| | | | | | | | | | | | |

| | | |

Utilities — 3.8% | | | | | | | | | | | | |

Public Service Enterprise Group | | | 760,936 | | | | | | | | 46,531,236 | |

| | | | | | | | | | | | |

| | | |

TOTAL COMMON STOCK

(Cost $854,864,917) | | | | | | | | | | | 1,199,342,173 | |

| | | | | | | | | | | | |

| | | | | | | | | |

| | | |

SHORT-TERM INVESTMENT — 0.9% | | | | | | | | | | | | |

| | | |

FIRST AMERICAN GOVERNMENT OBLIGATIONS FUND - CL X, 5.299% (B)

(Cost $11,215,095) | | | 11,215,095 | | | | | | | | 11,215,095 | |

| | | | | | | | | | | | |

| | | |

TOTAL INVESTMENTS— 99.9%

(Cost $866,080,012) | | | | | | | | | | $ | 1,210,557,268 | |

| | | | | | | | | | | | |

|

Percentages are based on Net Assets of $1,212,060,547. |

The accompanying notes are an integral part of the financial statements.

9

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND December 31, 2023 |

‡ Real Estate Investment Trust

(A) Securities considered Master Limited Partnership. At December 31, 2023, these securities amounted to $54,214,308 or 4.5% of net assets.

(B) Rate shown is the 7-day effective yield as of December 31, 2023.

ADR — American Depositary Receipt

Cl — Class

As of December 31, 2023, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

10

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

| | | | |

| |

STATEMENT OF ASSETS AND LIABILITIES | | | | |

| |

Assets: | | | | |

Investments, at Value (Cost $866,080,012) | | | $ 1,210,557,268 | |

Dividends Receivable | | | 1,499,326 | |

Receivable for Capital Shares Sold | | | 1,388,244 | |

Reclaim Receivable | | | 126,410 | |

Prepaid Expenses | | | 54,731 | |

| | | | |

| |

Total Assets | | | 1,213,625,979 | |

| | | | |

| |

Liabilities: | | | | |

Payable due to Adviser | | | 747,596 | |

Payable for Capital Shares Redeemed | | | 638,182 | |

Payable due to Administrator | | | 78,675 | |

Distribution Fees Payable (Investor Class Shares) | | | 2,737 | |

Chief Compliance Officer Fees Payable | | | 1,980 | |

Payable due to Trustees | | | 38 | |

Other Accrued Expenses and Other Payables | | | 96,224 | |

| | | | |

| |

Total Liabilities | | | 1,565,432 | |

| | | | |

| |

Commitments and Contingencies† | | | | |

Net Assets | | | $ 1,212,060,547 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in Capital | | | $ 872,067,582 | |

Total Distributable Earnings | | | 339,992,965 | |

| | | | |

Net Assets | | | $1,212,060,547 | |

| | | | |

Outstanding Shares of Beneficial Interest

Institutional Class Shares (unlimited authorization — no par value) | | | 38,969,879 | |

| | | | |

Outstanding Shares of Beneficial Interest

Investor Class Shares (unlimited authorization — no par value) | | | 497,577 | |

| | | | |

Net Asset Value, Offering and Redemption Price Per Share*

Institutional Class Shares ($1,196,754,144 ÷ 38,969,879 shares) | | | $30.71 | |

| | | | |

Net Asset Value, Offering and Redemption Price Per Share*

Investor Class Shares ($15,306,403 ÷ 497,577 shares) | | | $30.76 | |

| | | | |

| † | See Note 5 in the Notes to Financial Statements. |

| * | Redemption price per share may vary depending on the length of time Shares are held. |

The accompanying notes are an integral part of the financial statements.

11

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND FOR THE YEAR ENDED DECEMBER 31, 2023 |

| | | | |

| |

STATEMENT OF OPERATIONS | | | | |

| |

Investment Income: | | | | |

Dividends | | $ | 34,407,251 | |

Dividends from Master Limited Partnerships | | | 3,953,025 | |

Less: Return of Capital Distributions | | | (3,953,025 | ) |

| | | | |

| |

Total Investment Income | | | 34,407,251 | |

| | | | |

| |

Expenses: | | | | |

Investment Advisory Fees | | | 9,406,145 | |

Administration Fees | | | 892,421 | |

Distribution Fees (Investor Class Shares) | | | 34,842 | |

Trustees’ Fees | | | 24,757 | |

Shareholder Servicing Fees (Investor Class Shares) | | | 6,969 | |

Chief Compliance Officer Fees | | | 5,839 | |

Transfer Agent Fees | | | 106,407 | |

Registration and Filing Fees | | | 80,365 | |

Legal Fees | | | 54,522 | |

Custodian Fees | | | 47,039 | |

Printing Fees | | | 33,000 | |

Audit Fees | | | 26,488 | |

Other Expenses | | | 29,089 | |

| | | | |

| |

Total Expenses | | | 10,747,883 | |

| | | | |

Less: | | | | |

Waiver of Investment Advisory Fees | | | (1,299,667 | ) |

| | | | |

| |

Net Expenses | | | 9,448,216 | |

| | | | |

| |

Net Investment Income | | | 24,959,035 | |

| | | | |

| |

Net Realized Loss on Investments | | | (1,065,598 | ) |

Net Change in Unrealized Appreciation on Investments | | | 121,742,615 | |

| | | | |

| |

Net Realized and Unrealized Gain on Investments | | | 120,677,017 | |

| | | | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 145,636,052 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

12

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND |

| | | | | | | | |

| | |

STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | | |

| | |

| | | Year

Ended

December 31,

2023 | | | Year

Ended

December 31,

2022 | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 24,959,035 | | | $ | 21,623,495 | |

Net Realized Gain (Loss) on Investments | | | (1,065,598 | ) | | | 17,421,265 | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | | |

Investments | | | 121,742,615 | | | | (56,090,346 | ) |

| | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | 145,636,052 | | | | (17,045,586 | ) |

| | | | | | | | |

| | |

Distribution of Income: | | | | | | | | |

Institutional Class Shares | | | (24,041,333 | ) | | | (39,286,436 | ) |

Investor Class Shares | | | (265,338 | ) | | | (472,184 | ) |

Return of Capital: | | | | | | | | |

Institutional Class Shares | | | (1,061,130 | ) | | | (967,831 | ) |

Investor Class Shares | | | (11,711 | ) | | | (11,405 | ) |

| | | | | | | | |

Total Distributions | | | (25,379,512 | ) | | | (40,737,856 | ) |

| | | | | | | | |

| | |

Capital Share Transactions:(1) | | | | | | | | |

Institutional Class Shares: | | | | | | | | |

Issued | | | 230,513,619 | | | | 418,310,270 | |

Reinvestment of Distributions | | | 22,898,232 | | | | 37,653,179 | |

Redeemed | | | (181,076,904 | ) | | | (189,012,955 | ) |

| | | | | | | | |

| | |

Increase in Net Assets From Institutional Class Shares Transactions | | | 72,334,947 | | | | 266,950,494 | |

| | | | | | | | |

Investor Class Shares: | | | | | | | | |

Issued | | | 4,111,214 | | | | 5,101,531 | |

Reinvestment of Distributions | | | 276,585 | | | | 482,094 | |

Redeemed | | | (3,409,254 | ) | | | (4,198,520 | ) |

| | | | | | | | |

| | |

Increase in Net Assets From Investor Class Shares Transactions | | | 978,545 | | | | 1,385,105 | |

| | | | | | | | |

| | |

Net Increase in Net Assets From Share Transactions | | | 73,313,492 | | | | 268,335,599 | |

| | | | | | | | |

| | |

Total Increase in Net Assets | | | 193,570,032 | | | | 210,552,157 | |

| | | | | | | | |

| | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 1,018,490,515 | | | | 807,938,358 | |

| | | | | | | | |

End of Year | | $ | 1,212,060,547 | | | $ | 1,018,490,515 | |

| | | | | | | | |

| (1) | For share transactions, see Note 6 in the Notes to Financial Statements. |

| | Amounts | designated as “-“ are $0. |

The accompanying notes are an integral part of the financial statements.

13

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND |

| | | | | | | | | | | | | | | | | | | | |

|

FINANCIAL HIGHLIGHTS | |

| | | | | | | Selected Per Share Data & Ratios | |

| | | | | | | For a Share Outstanding Throughout The Year | |

| |

| | | Years Ended December 31, | |

| Institutional Class Shares | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

Net Asset Value, Beginning of Year | | | $27.61 | | | | $29.85 | | | | $23.79 | | | | $23.56 | | | | $19.84 | |

| | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income* | | | 0.65 | | | | 0.70 | | | | 0.69 | | | | 0.62 | | | | 0.62 | |

Net Realized and Unrealized Gain (Loss) | | | 3.10 | | | | (1.76) | | | | 6.68 | | | | 0.39 | | | | 3.77 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 3.75 | | | | (1.06) | | | | 7.37 | | | | 1.01 | | | | 4.39 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.62) | | | | (0.64) | | | | (0.67) | | | | (0.60) | | | | (0.64) | |

Net Realized Gains | | | — | | | | (0.51 | ) | | | (0.62 | ) | | | — | | | | — | |

Return of Capital | | | (0.03) | | | | (0.03) | | | | (0.02) | | | | (0.18) | | | | (0.03) | |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.65) | | | | (1.18) | | | | (1.31) | | | | (0.78) | | | | (0.67) | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | | $30.71 | | | | $27.61 | | | | $29.85 | | | | $23.79 | | | | $23.56 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return† | | | 13.67% | | | | (3.45)% | | | | 31.26% | | | | 4.68% | | | | 22.26% | |

| | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (Thousands) | | | $1,196,754 | | | | $1,005,657 | | | | $795,408 | | | | $605,030 | | | | $798,994 | |

Ratio of Expenses to Average Net Assets | | | 0.85% | | | | 0.85% | | | | 0.85% | | | | 0.85% | | | | 0.85% | |

Ratio of Expenses to Average Net Assets (Excluding Waivers, Reimbursements and Fees Paid Indirectly) | | | 0.97% | | | | 0.98% | | | | 1.00% | | | | 1.01% | | | | 1.03% | |

Ratio of Net Investment Income to Average Net Assets | | | 2.26% | | | | 2.49% | | | | 2.49% | | | | 2.92% | | | | 2.78% | |

Portfolio Turnover Rate | | | 15% | | | | 27% | | | | 31% | | | | 88% | | | | 21% | |

| * | Per share calculations were performed using average shares for the period. |

| † | Return shown does not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return would have been lower had the Adviser not waived its fee and/or reimbursed other expenses. |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

14

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND |

| | |

| |

FINANCIAL HIGHLIGHTS | | |

| | Selected Per Share Data & Ratios |

| | For a Share Outstanding Throughout The Year |

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| Investor Class Shares | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

Net Asset Value, Beginning of Year | | | $27.66 | | | | $29.90 | | | | $23.83 | | | | $23.60 | | | | $19.88 | |

| | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income* | | | 0.56 | | | | 0.60 | | | | 0.60 | | | | 0.54 | | | | 0.55 | |

Net Realized and Unrealized Gain (Loss) | | | 3.11 | | | | (1.75) | | | | 6.70 | | | | 0.40 | | | | 3.76 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 3.67 | | | | (1.15) | | | | 7.30 | | | | 0.94 | | | | 4.31 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.55) | | | | (0.55) | | | | (0.59) | | | | (0.54) | | | | (0.56) | |

Net Realized Gains | | | — | | | | (0.51) | | | | (0.62) | | | | — | | | | — | |

Return of Capital | | | (0.02) | | | | (0.03) | | | | (0.02) | | | | (0.17) | | | | (0.03) | |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.57) | | | | (1.09) | | | | (1.23) | | | | (0.71) | | | | (0.59) | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | | $30.76 | | | | $27.66 | | | | $29.90 | | | | $23.83 | | | | $23.60 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return† | | | 13.33% | | | | (3.75)% | | | | 30.88% | | | | 4.36% | | | | 21.83% | |

| | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (Thousands) | | | $15,306 | | | | $12,834 | | | | $12,530 | | | | $10,419 | | | | $11,069 | |

Ratio of Expenses to Average Net Assets | | | 1.15% | | | | 1.15% | | | | 1.15% | | | | 1.15% | | | | 1.17% | |

Ratio of Expenses to Average Net Assets (Excluding Waivers, Reimbursements and Fees Paid Indirectly) | | | 1.27% | | | | 1.28% | | | | 1.30% | | | | 1.31% | | | | 1.34% | |

Ratio of Net Investment Income to Average Net Assets | | | 1.96% | | | | 2.14% | | | | 2.15% | | | | 2.56% | | | | 2.47% | |

Portfolio Turnover Rate | | | 15% | | | | 27% | | | | 31% | | | | 88% | | | | 21% | |

| * | Per share calculations were performed using average shares for the period. |

| † | Return shown does not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return would have been lower had the Adviser not waived its fee and/or reimbursed other expenses. |

| | Amounts designated as “—” are either not applicable, $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

15

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

|

NOTES TO FINANCIAL STATEMENTS |

The Advisors’ Inner Circle Fund (the “Trust”) is organized as a Massachusetts business trust under an Amended and Restated Agreement and Declaration of Trust dated February 18, 1997. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with 27 funds. The financial statements herein are those of the Hamlin High Dividend Equity Fund (the “Fund”). The Fund is diversified and its investment objective is to seek high current income and long-term capital appreciation. The financial statements of the remaining funds of the Trust are presented separately. The assets of the Fund are segregated, and a shareholder’s interest is limited to the fund in which shares are held.

| 2. | Significant Accounting Policies: |

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund. The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of Estimates — The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 pm ET if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent quoted bid price. For securities traded on the NASDAQ Stock Market (the “NASDAQ”), the NASDAQ Official Closing Price will be used. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates.

16

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures (the “Fair Value Procedures”) established by the Adviser and approved by the Trust’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the “valuation designee” to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) of the Adviser.

Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time, when under normal conditions, it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Fund may fair value its securities if an event that may materially affect the value of the Fund’s securities that traded outside of the United States (a “Significant Event”) has occurred between the time of the security’s last close and the time that the Fund calculates its net asset value. A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include, but are not limited to: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If the Adviser becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its net asset value, it may request that a Committee meeting be called. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

17

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Other significant observable inputs (includes quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, adjusted quoted prices on foreign equity securities that were adjusted in accordance with pricing procedures approved by the Board, etc.); and |

| | • | | Level 3 — Prices, inputs or proprietary modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Federal Income Taxes — It is the Fund’s intention to continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986 (the “Code”), as amended. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the year ended December 31, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. For the year ended December 31, 2023, the Fund did not recognize any interest or penalties.

18

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

Security Transactions and Investment Income — Security transactions are accounted for on trade date basis for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on the specific identification method. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from settlement date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend, if such information is obtained subsequent to the ex-dividend date.

Return of Capital Estimates — Distributions received from investments in master limited partnerships (“MLPs”) generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

Investments in REITs — Dividend income from Real Estate Investment Trusts (“REITs”) is recorded based on the income included in distributions received from the REIT investments using published REIT reclassifications, including some management estimates when actual amounts are not available. Distributions received in excess of this estimated amount are recorded as a reduction of the cost of investments or reclassified to capital gains. The actual amounts of income, return of capital, and capital gains are only determined by each REIT after its fiscal year-end, and may differ from the estimated amounts.

Master Limited Partnerships — Entities commonly referred to as “MLPs” are generally organized under state law as limited partnerships or limited liability companies. The Fund intends to primarily invest in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986, and whose interests or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real estate rents, gain from the sale or disposition of real property, income and gain from mineral or natural resources activities, income and gain from the transportation or storage of certain fuels, and, in certain circumstances, income and gain from commodities or futures, forwards and options with respect to commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals,

19

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. An investment in MLP units involves certain risks which differ from an investment in the securities of a corporation. Holders of MLP units have limited control and voting rights on matters affecting the partnership. In addition, there are certain tax risks associated with an investment in MLP units and conflicts of interest exist between common unit holders and the general partner, including those arising from incentive distribution payments. As a partnership, an MLP has no tax liability at the entity level. If, as a result of a change in current law or a change in an MLP’s business, an MLP were treated as a corporation for federal income tax purposes, such MLP would be obligated to pay federal income tax on its income at the corporate tax rate. If an MLP were classified as a corporation for federal income tax purposes, the amount of cash available for distribution by the MLP would be reduced and distributions received by investors would be taxed under federal income tax laws applicable to corporate dividends (as dividend income, return of capital, or capital gain). Therefore, treatment of an MLP as a corporation for federal income tax purposes would result in a reduction in the after-tax return to investors, likely causing a reduction in the value of the Fund’s shares.

Classes — Class specific expenses, such as distribution fees, are borne by that class of shares. Income, realized and unrealized gains/losses and non-class specific expenses are allocated to the respective class on the basis of relative net assets.

Expenses — Expenses that are directly related to the Fund are charged to the Fund. Other operating expenses of the Trust are prorated to the funds based on the number of funds and/or relative daily net assets.

Dividends and Distributions to Shareholders — The Fund distributes substantially all of its net investment income semi-annually. Distributions from net realized capital gains, if any, are declared and paid annually. All distributions are recorded on the ex-dividend date.

Redemption Fees — The Fund retains redemption fees of 2.00% on redemptions of capital shares held for less than 7 days. Such fees are retained by the Fund

20

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

for the benefit of the remaining shareholders and are recorded as additions to fund capital. For the year ended December 31, 2023, the Fund retained no fees.

Line of Credit — The Fund entered into an agreement, which may be renewed annually, which enables it to participate in a $50 million unsecured committed revolving line of credit on a first come, first serve basis, with U.S. Bank National Association (the “Custodian”) which expires July 29, 2024. The proceeds from the borrowings shall be used to finance the Fund’s short-term general working capital requirements, including the funding of shareholder redemptions. Interest is charged to the Fund based on its borrowings during the year at the Custodian’s current reference rate. As of December 31, 2023, there were no borrowings outstanding.

| 3. | Transactions with Affiliates: |

Certain officers of the Trust are also officers of SEI Investments Global Funds Services (the “Administrator”), a wholly owned subsidiary of SEI Investments Company, and/or SEI Investments Distribution Co. (the “Distributor”). Such officers are paid no fees by the Trust, other than the Chief Compliance Officer (“CCO”) as described below, for serving as officers of the Trust.

A portion of the services provided by the CCO and his staff, who are employees of the Administrator, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s advisors and service providers, as required by SEC regulations. The CCO’s services and fees have been approved by and are reviewed by the Board.

| 4. | Administration, Distribution, Shareholder Servicing, Custodian and Transfer Agent Agreements: |

The Fund and the Administrator are parties to an Administration Agreement under which the Administrator provides administrative services to the Fund. For these services, the Administrator is paid an asset-based fee, which will vary depending on the number of share classes and the average daily net assets of the Fund. For the year ended December 31, 2023, the Fund was charged $892,421 for these services.

21

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

The Fund has adopted the Distribution Plan (the “Plan”) for the Investor Class Shares. Under the Plan, the Distributor, or third parties that enter into agreements with the Distributor, may receive up to 0.25% of the Fund’s average daily net assets attributable to Investor Class Shares as compensation for distribution services. The Distributor will not receive any compensation for the distribution of Institutional Class Shares of the Fund. For the year ended December 31, 2023, the Fund’s Investor Class Shares incurred $34,842 of distribution fees, an effective rate of 0.25%.

The Fund has entered into shareholder servicing agreements with third-party service providers pursuant to which the service providers provide certain shareholder services to Fund shareholders (the “Service Plan”). Under the Service Plan, the Fund may pay service providers a fee at a rate of up to 0.25% annually of the average daily net assets attributable to Investor Class Shares, subject to the arrangement for provision of shareholder and administrative services. For the year ended December 31, 2023, the Fund’s Investor Class Shares incurred $6,969 of shareholder servicing fees, an effective rate of 0.05%.

U.S. Bank National Association serves as Custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased or sold by the Fund.

SS&C Global Investor & Distribution Solutions, Inc. (formerly, DST Systems, Inc.) serves as the transfer agent and dividend disbursing agent for the Fund under a transfer agency agreement with the Trust. The Fund is able to earn cash management credits to offset transfer agent expenses. During the year ended December 31, 2023, the Fund did not earn any cash management credits.

| 5. | Investment Advisory Agreement: |

Under the terms of an investment advisory agreement, Hamlin Capital Management, LLC (the “Adviser”) provides investment advisory services to the Fund at a fee, which is calculated daily and paid monthly at an annual rate of 0.85% of the Fund’s average daily net assets. The Adviser has contractually agreed to reduce fees and reimburse expenses to the extent necessary to keep the Institutional Class Shares’ total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses) from exceeding 0.85% of the Fund’s Institutional Class Shares’ average daily net assets until April 30, 2024. The Adviser has contractually agreed to reduce fees and reimburse expenses to the extent necessary to keep the Investor Class Shares’ total annual operating expenses (excluding 12b-1 fees, shareholder servicing fees, interest, taxes, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses) from exceeding 0.85% of the Fund’s Investor Class Shares’ average

22

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

daily net assets until April 30, 2024. This Agreement may be terminated: (i) by the Board, for any reason at any time; or (ii) by the Adviser, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on April 30, 2024. In addition, if at any point it becomes unnecessary for the Adviser to reduce fees or make expense reimbursements, the board may permit the Adviser to retain the difference between total annual operating expenses and 0.85% to recapture all or a portion of its prior reductions or reimbursements made during the preceding three-year period. During the year ended December 31, 2023, the Fund did not recoup any previously waived fees.

As of December 31, 2023, the amount the Adviser may seek as reimbursement of previously waived fees and reimbursed expenses is as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Period | | | | Subject to Repayment until December 31: | | | | | | | | Amount | |

| | | | | |

01/01/2021 – 12/31/2021 | | 2024 | | | | | | | | | | $ | 1,050,214 | | | | | |

| | | | | |

01/01/2022 – 12/31/2022 | | 2025 | | | | | | | | | | | 1,174,490 | | | | | |

| | | | | |

01/01/2023 – 12/31/2023 | | 2026 | | | | | | | | | | | 1,299,667 | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | $ | 3,524,371 | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Year Ended December 31, 2023 | | | Year Ended December 31, 2022 | |

| | |

Share Transactions: | | | | | | | | |

Institutional Class Shares | | | | | | | | |

Issued | | | 8,069,995 | | | | 15,116,342 | |

Reinvestment of Distributions | | | 768,272 | | | | 1,376,115 | |

Redeemed | | | (6,293,125 | ) | | | (6,714,760 | ) |

| | |

Net Institutional Class Shares Capital Share Transactions | | | 2,545,142 | | | | 9,777,697 | |

Investor Class Shares | | | | | | | | |

Issued | | | 139,705 | | | | 175,656 | |

Reinvestment of Distributions | | | 9,259 | | | | 17,593 | |

Redeemed | | | (115,356 | ) | | | (148,358 | ) |

| | |

Net Investor Class Shares Capital Share Transactions | | | 33,608 | | | | 44,891 | |

| | |

Net Increase in Shares Outstanding From Share Transactions | | | 2,578,750 | | | | 9,822,588 | |

| | | | | | | | |

23

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

| 7. | Investment Transactions: |

For the year ended December 31, 2023, the Fund made purchases of $264,680,593 and sales of $166,540,976 in investment securities other than long-term U.S. Government and short-term securities. There were no purchases or sales of long-term U.S. Government securities.

| 8. | Federal Tax Information: |

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent, they are charged or credited to paid-in capital and distributable earnings, in the period that the differences arise.

The following permanent differences, primarily attributable to reclass of distributions and return of capital from investments in securities, including MLP’s and REITs, have been reclassified to/from the following accounts during the year ended December 31, 2023:

| | | | |

Distributable Earnings | | Paid in Capital |

$ 1,420 | | $ | | (1,420) |

The tax character of dividends and distributions paid during the years ended December 31, 2022 and December 31, 2023, was as follows:

| | | | | | | | | | | | | | | | |

Period | | Income

Distribution | | | Long-Term Capital Gain | | | Return of Capital | | | Total | |

| | | | | | | | | | | | | |

2023 | | $ | 24,306,671 | | | $ | – | | | $ | 1,072,841 | | | $ | 25,379,512 | |

2022 | | | 21,570,325 | | | | 18,188,295 | | | | 979,236 | | | | 40,737,856 | |

As of December 31, 2023, the components of distributable earnings on a tax basis were as follows:

| | | | |

Undistributed Ordinary Income | | $ | – | |

Post October Losses | | | – | |

Unrealized Appreciation | | | 341,829,507 | |

Capital Loss Carryforwards | | | (1,836,538) | |

Other Temporary Differences | | | (4) | |

| | | | |

| |

Total Accumulated Earnings (Losses) | | $ | 339,992,965 | |

| | | | |

24

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

The difference between Federal tax cost and book cost is primarily due to wash sales, partnerships and real estate investment trust.

The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments (including foreign currency and derivatives, if applicable) held by the Fund at December 31, 2023 were as follows:

| | | | | | |

Federal Tax

Cost | | Aggregate

Gross

Unrealized

Appreciation | | Aggregate

Gross

Unrealized

Depreciation | | Net

Unrealized

Appreciation |

| | | | | | | |

| $868,727,761 | | $345,347,122 | | ($3,517,615) | | $341,829,507 |

9. Concentration of Risks:

As with all mutual funds, there is no guarantee that a Fund will achieve its investment objective. You could lose money by investing in a Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The principal risk factors affecting shareholders’ investments in the Fund are set forth below.

Equity Risk – Since it purchases equity securities, the Fund is subject to the risk that stock prices will fall over short or extended periods of time. This price volatility is the principal risk of investing in the Fund. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund.

Dividend Paying Stocks Risk – The Fund’s emphasis on dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Also, a company may reduce or eliminate its dividend.

Mid-Capitalization Company Risk – The mid-capitalization companies in which the Fund may invest may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, mid-cap stocks may be more volatile than those of larger companies.

25

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

Sector Risk – Given the Fund’s focus on dividend-paying securities, the Fund may, from time to time, have a greater exposure to higher dividend yield sectors and industries than the broad equity market. As a result, the value of the Fund’s shares may be especially sensitive to factors and economic risks that specifically affect those sectors. The Fund’s share price may fluctuate more widely than the value of shares of a mutual fund that invests in a broader range of sectors. The specific risks for each of the sectors in which the Fund may focus its investments include the additional risks described below:

• Financial Services - Companies in the financial services sector are subject to extensive governmental regulation which may limit both the amounts and types of loans and other financial commitments they can make, the interest rates and fees they can charge, the scope of their activities, the prices they can charge and the amount of capital they must maintain.

• Consumer Staples - Companies in the consumer staples sector are subject to government regulation affecting their products which may negatively impact such companies’ performance. The success of food, beverage, household and personal products companies may be strongly affected by consumer interest, marketing campaigns and other factors affecting supply and demand.

• Consumer Discretionary - Companies in the consumer discretionary sector are subject to the performance of the overall international economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending.

• Energy - Companies in the energy sector are subject to supply and demand, exploration and production spending, world events and economic conditions, swift price and supply fluctuations, energy conservation, the success of exploration projects, liabilities for environmental damage and general civil liabilities and tax and other governmental regulatory policies.

Value Stock Risk – The Fund pursues a value approach to investing. If the Adviser’s assessment of a company’s value or prospects for exceeding earnings expectations or market conditions is wrong, the Fund could suffer losses or perform poorly relative to other funds.

Foreign Company Risk – Investing in foreign companies poses additional risks since political and economic events unique to a country or region will affect those markets and their issuers. In addition, periodic U.S. Government restrictions on investments in issuers from certain foreign countries may require the Fund to sell such investments at inopportune times, which could result in losses to the Fund.

26

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

REIT Risk – REITs are susceptible to the risks associated with direct ownership of real estate, such as: declines in property values; increases in property taxes, operating expenses, interest rates or competition; overbuilding; zoning changes; and losses from casualty or condemnation.

MLP Risk – MLPs often own several properties or businesses (or own interests) that are related to oil and gas industries or other natural resources, but they also may finance other projects. To the extent that an MLP’s interests are all in a particular industry, the MLP will be negatively impacted by economic events adversely impacting that industry. Additional risks of investing in an MLP also include those involved in investing in a partnership as opposed to a corporation, such as limited control of management, limited voting rights and tax risks.

| 10. | Concentration of Shareholders: |

At December 31, 2023, 63% of Institutional Class Shares total shares outstanding were held by three record shareholders and 66% of Investor Class Shares total shares outstanding were held by two record shareholders each owning 10% or greater of the aggregate total shares outstanding. These shareholders were comprised of omnibus accounts that were held on behalf of various individual shareholders.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be established; however, based on experience, the risk of loss from such claim is considered remote.

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no additional disclosures and/or adjustments were required to the financial statements.

27

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Shareholders of Hamlin High Dividend Equity Fund and the Board of Trustees of The Advisors’ Inner Circle Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Hamlin High Dividend Equity Fund (the “Fund”) (one of the funds constituting The Advisors’ Inner Circle Fund (“the Trust”)), including the schedule of investments, as of December 31, 2023, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting The Advisors’ Inner Circle Fund) at December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodians. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Hamlin Capital Management investment companies since 2012.

Philadelphia, Pennsylvania

February 29, 2024

28

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

|

DISCLOSURE OF FUND EXPENSES (Unaudited) |

All mutual funds have operating expenses. As a shareholder of a mutual fund, your investment is affected by these ongoing costs, which include (among others) costs for fund management, administrative services, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these are deducted from the mutual fund’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of the mutual fund’s average net assets; this percentage is known as the mutual fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (July 1, 2023 to December 31, 2023).

The table on the next page illustrates your Fund’s costs in two ways:

| • | | Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return. |

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your ending starting account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

| • | | Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other mutual funds. |

29

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

|

DISCLOSURE OF FUND EXPENSES (Unaudited) |

Note: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | | | | | | | | | | | | | |

| | | Beginning Account Value 7/01/23 | | | Ending Account Value 12/31/23 | | | Annualized Expense Ratios | | Expenses Paid During Period* | |

| | | | |

Actual Fund Return | | | | | | | | | | | | | | |

Investor Class Shares | | | $1,000.00 | | | $ | 1,063.70 | | | 1.15% | | | $5.98 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,065.30 | | | 0.85 | | | 4.42 | |

| | | | |

Hypothetical 5% Return | | | | | | | | | | | | | | |

Investor Class Shares | | | $1,000.00 | | | $ | 1,019.41 | | | 1.15% | | | $5.85 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,020.92 | | | 0.85 | | | 4.33 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

30

[THIS PAGE INTENTIONALLY LEFT BLANK]

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

|

|

TRUSTEES AND OFFICERS OF THE ADVISORS’ INNER CIRCLE FUND (Unaudited) |

Set forth below are the names, years of birth, positions with the Trust, length of term of office, and the principal occupations for the last five years of each of the persons currently serving as Trustees and Officers of the Trust. Unless otherwise noted, the business address of each Trustee is SEI Investments Company, 1 Freedom Valley Drive, Oaks, Pennsylvania 19456. Trustees who are deemed not to be “interested persons” of the Trust are referred to as “Independent Trustees.” Messrs. Nesher and Klauder

| | | | |

Name and Year of Birth | | Position with Trust and Length of Time Served1 | | Principal Occupations in the Past Five Years |

| | |

INTERESTED TRUSTEES 3 4 | | | | |

| | |

Robert Nesher (Born: 1946) | | Chairman of the Board of Trustees (since 1991) | | SEI employee 1974 to present; currently performs various services on behalf of SEI Investments for which Mr. Nesher is compensated. President, Chief Executive Officer and Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. President and Director of SEI Structured Credit Fund, LP. Vice Chairman of Winton Series Trust to 2017. Vice Chairman of Winton Diversified Opportunities Fund (closed-end investment company), The Advisors’ Inner Circle Fund III, Gallery Trust, Schroder Series Trust and Schroder Global Series Trust to 2018. |

N. Jeffrey Klauder (Born: 1952) | | Trustee (since 2018) | | Senior Advisor of SEI Investments since 2018. Executive Vice President and General Counsel of SEI Investments, 2004 to 2018. |

| 1 | Each Trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns, or is removed in accordance with the Trust’s Declaration of Trust. |

| 2 | Directorships of Companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies under the 1940 Act. |

| 3 | Denotes Trustees who may be deemed to be “interested” persons of the Fund as that term is defined in the 1940 Act by virtue of their affiliation with the Distributor and/or its affiliates. |

| 4 | Trustees oversee 27 funds in The Advisors’ Inner Circle Fund. |

32

| | |

| THE ADVISORS’ INNER CIRCLE FUND | | HAMLIN HIGH DIVIDEND EQUITY FUND DECEMBER 31, 2023 |

are Trustees who may be deemed to be “interested” persons of the Trust as that term is defined in the 1940 Act by virtue of their affiliation with the Trust’s Distributor. The Trust’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-855-HHD-FUND. The following chart lists Trustees and Officers as of December 31, 2023.

|

| Other Directorships |

| Held in the Past Five Years2 |

| |

| Current Directorships: Trustee of The Advisors’ Inner Circle Fund II, Bishop Street Funds, Frost Family of Funds, Catholic Responsible Investments Funds, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. Director of SEI Structured Credit Fund, LP, SEI Global Master Fund plc, SEI Global Assets Fund plc, SEI Global Investments Fund plc, SEI Investments—Global Funds Services, Limited, SEI Investments Global, Limited, SEI Investments (Europe) Ltd., SEI Investments—Unit Trust Management (UK) Limited, SEI Multi-Strategy Funds PLC and SEI Global Nominee Ltd. |

|

|

|

|

|

|

|

Former Directorships: Trustee of The KP Funds to 2022. |