UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06441 |

| | |

| | |

| | |

AMERICAN CENTURY INTERNATIONAL BOND FUNDS |

(Exact name of registrant as specified in charter) |

| | |

| | |

| | |

4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

(Address of principal executive offices) | (Zip Code) |

| | |

| | |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

(Name and address of agent for service) |

| | |

| | |

Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| | |

Date of fiscal year end: | 06-30 |

| | |

| | |

Date of reporting period: | 06-30-2013 |

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT | JUNE 30, 2013 |

Global Bond Fund

President’s Letter | 2 |

Market Perspective | 3 |

Performance | 4 |

Portfolio Commentary | 6 |

Fund Characteristics | 8 |

Shareholder Fee Example | 9 |

Schedule of Investments | 11 |

Statement of Assets and Liabilities | 26 |

Statement of Operations | 27 |

Statement of Changes in Net Assets | 28 |

Notes to Financial Statements | 29 |

Financial Highlights | 36 |

Report of Independent Registered Public Accounting Firm | 38 |

Management | 39 |

Approval of Management Agreement | 42 |

Additional Information | 47 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the 12 months ended June 30, 2013. It provides investment performance, market analysis, and portfolio information, presented with the expert perspective of our portfolio management team.

Annual reports remain important vehicles for conveying information about fund returns, including key factors that affected fund performance. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Generally Favorable Fiscal-Year Returns for U.S. Stocks and High-Yield Bonds

The 12-month reporting period began in the summer of 2012 with uncertainties caused by slowing economies, as well as the upcoming November elections and year-end fiscal deadlines in the U.S. It ended with more uncertainty about the future of U.S. monetary stimulus. In between, aggressive monetary intervention by central banks encouraged investors to take more risk, generally boosting stocks at the expense of government bonds.

U.S. mid-cap, small-cap, and value stock indices achieved performance leadership during the period, outpacing the S&P 500 Index’s 20.60% return. U.S. stocks generally outperformed non-U.S. equities—the MSCI EAFE Index returned 18.62% and the MSCI Emerging Markets Index advanced 2.87%, affected by slowing growth in emerging market economies.

Slower emerging market growth also hindered commodity price gains and helped keep inflation under control. As a result, assets used as inflation hedges, including inflation-indexed securities and precious metals, lagged other assets. Gold, in particular, plunged, starting last October. And Treasury inflation-protected securities (TIPS) were among the lowest performers in the U.S. bond market. Bond index returns generally ranged from approximately 10% gains for U.S. corporate high-yield indices all the way down to negative returns for longer-maturity global Treasury benchmarks.

Despite signs of improvement in 2013, U.S. economic growth is subpar compared with past recession recoveries, and remains vulnerable to threats that could trigger another slowdown and market volatility. Therefore, we continue to believe in a disciplined, diversified, long-term investment approach, using professionally managed stock and bond portfolios—as appropriate—for meeting financial goals. We appreciate your continued trust in us in this volatile environment.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

By David MacEwen, Chief Investment Officer, Fixed Income

Global bonds posted modestly positive returns for the 12 months ended June 30, 2013. However, for U.S. investors with unhedged currency exposure, a stronger U.S. dollar led to negative overall returns for non-U.S. bonds (see the table below).

On the economic front, global economic growth slowed early in the period, particularly in the U.S. and Europe, but also in emerging economies such as China and India. In response, central banks around the world took steps to support their respective economies. The European Central Bank pledged to help stabilize and support bond markets in fiscally troubled countries; the Federal Reserve in the U.S. and the Bank of England in the U.K. implemented additional quantitative easing measures; and the Bank of Japan embarked on an aggressive program of economic stimulus measures to end deflation and revive the long-dormant Japanese economy.

By early 2013, global economic conditions began to improve. In the U.S., a recovery in the housing market and a declining unemployment rate led the Federal Reserve to signal that it may taper back its quantitative easing measures before the end of the year. This development pushed global bond yields higher near the end of the reporting period.

Other events impacting global fixed-income markets during the period included major elections in the U.S. and Japan, the U.S. government’s efforts to resolve the fiscal cliff and the sequester (which involved the expiration of certain federal tax cuts and the implementation of automatic federal budget cuts), and a contentious bailout of the banking system in Cyprus.

U.S. bond yields rose the most for the 12 months, while yields in Japan were relatively stable. European bond markets performed best, led by peripheral countries such as Italy and Spain. The Japanese bond market generated modestly positive performance, while the U.S. bond market declined for the period. From a sector perspective, corporate bonds and other non-government securities outperformed government bonds on a global basis during the reporting period.

A stronger U.S. dollar reduced non-U.S. bond returns for U.S. investors. In particular, the dollar appreciated by 24% versus the Japanese yen, reflecting the changing central bank policies in each country. The U.S. dollar also appreciated by 3% against the British pound and 12% against the Australian dollar. The main exception was the euro—the dollar declined by about 3% versus the euro for the 12-month period.

Major Currency and Global Bond Market Returns |

For the 12 months ended June 30, 2013 |

Currency Returns* | |

U.S. Dollar vs. Euro | -2.78% |

U.S. Dollar vs. Japanese Yen | 24.07% |

International Bond Market Returns (in U.S. dollars) | |

Barclays Global Treasury ex-U.S. Bond Index | -5.92% |

Barclays Global Aggregate Bond Index (USD, hedged) | 1.70% |

*All percentage changes in foreign exchange rates are calculated on the basis of that currency per one U.S. dollar.

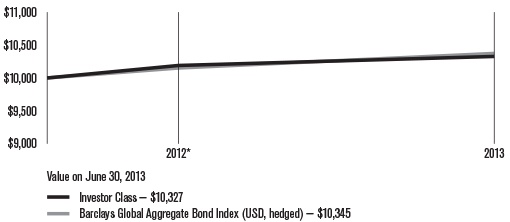

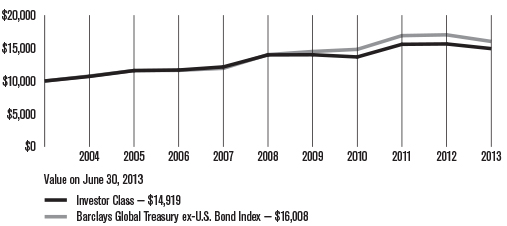

Total Returns as of June 30, 2013 |

| | | | Average

Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception Date |

Investor Class | AGBVX | 1.34% | 2.30% | 1/31/12 |

Barclays Global Aggregate

Bond Index (USD, hedged) | — | 1.70% | 2.43% | — |

Institutional Class | AGBNX | 1.53% | 2.50% | 1/31/12 |

A Class No sales charge* With sales charge* | AGBAX | 1.11% -3.44% | 2.06% -1.20% | 1/31/12 |

C Class | AGBTX | 0.32% | 1.29% | 1/31/12 |

R Class | AGBRX | 0.78% | 1.76% | 1/31/12 |

*Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Growth of $10,000 Over Life of Class |

$10,000 investment made January 31, 2012 |

*From 1/31/12, the Investor Class’s inception date. Not annualized.

Total Annual Fund Operating Expenses |

Investor Class | Institutional Class | A Class | C Class | R Class |

0.96% | 0.76% | 1.21% | 1.96% | 1.46% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Portfolio Managers: John Lovito, Simon Chester, Edward Boyle, Robert Gahagan, and David MacEwen

Performance Summary

Global Bond returned 1.34%* for the fiscal year ended June 30, 2013, compared with the 1.70% return of the fund’s benchmark index, the Barclays Global Aggregate Bond Index (USD, hedged). (See pages 4 and 5 for additional performance comparisons.)

The positive performance for both Global Bond and its benchmark index, which is hedged to remove the effects of currency fluctuations, reflected the modestly positive returns in global bond markets for the reporting period (see page 3 for more details). Sector allocation in the U.S. portion of the portfolio detracted from portfolio performance compared with the benchmark.

U.S. Bond Component Detracted

The fund’s U.S. bond holdings, which comprised about 40% of the portfolio, contributed to the fund’s underperformance of its benchmark. This underperformance occurred largely during the last six months of the period, when overweight positions in Treasury inflation-protected securities (TIPS), which are not represented in the benchmark, and investment-grade corporate bonds weighed on results.

An overweight position in mortgage-backed securities also detracted from performance as mortgage-backed securities declined during the reporting period. However, security selection in this segment of the portfolio contributed positively to relative results; in particular, exposure to commercial mortgage-backed securities and non-government-agency residential mortgage-backed securities boosted performance.

Other favorable strategies in the U.S. portion of the portfolio included an underweight position in Treasury securities, which lagged during the 12-month period, and a small position in high-yield corporate securities, which were the best-performing sector of the U.S. bond market during the period.

As interest rates increased late in the reporting period, we reduced the portfolio’s exposure to corporate bonds, taking profits in selected securities and shifting the proceeds into more-liquid segments of the bond market. In addition, we sold some mortgage-backed securities comprised of conventional fixed-rate 30-year mortgages and replaced them with shorter-term adjustable-rate mortgages that typically fare better in a rising interest rate environment.

Non-U.S. Holdings Outperformed

The fund’s non-U.S. bond holdings, which comprised the remaining 60% of the portfolio, contributed positively to performance versus the benchmark index. Exposure to credit-related bonds outside of the U.S. added value as non-government securities outperformed government bonds thanks to strong investor demand for higher-yielding investments. The fund’s non-government bonds in

*All fund returns referenced in this commentary are for Investor Class shares.

this segment of the portfolio include corporate bonds, secured bonds (which are typically backed by mortgages or other loans), and securities issued by supra-national organizations (such as the European Investment Bank).

The fund’s non-U.S. bond market positioning generated mixed results for the 12-month period. An underweight position in Germany, combined with overweight positions in Norway and Sweden, added value during the period. In addition, an overweight position in Spain and a corresponding underweight position in Italy contributed positively to performance. On the downside, underweight positions in core European markets other than Germany (including France and Belgium) and in Asia (specifically Japan and South Korea) detracted from relative results.

Currency Positioning Mixed but Positive Overall

Although the portfolio typically hedges its foreign currency exposure, we take modest tactical currency positions in an effort to add value to performance. During the fiscal year, the fund’s currency positioning aided results. The most beneficial position was an underweight in the Japanese yen, which declined sharply against all major currencies as the Bank of Japan enacted aggressive economic stimulus measures. Overweight positions in the Norwegian krone and the Swedish krona also added value during the period.

On the downside, overweight positions in the currencies of resource-based economies, such as the Australian dollar and New Zealand dollar, weighed on performance as slowing economic growth in emerging markets reduced demand for commodities. An underweight position in the euro, which appreciated against the U.S. dollar, also detracted from portfolio performance.

Toward the end of the period, we eliminated the fund’s overweight positions in the commodity-oriented currencies, as well as its underweight position in the Japanese yen. We also shifted to an overweight position in the U.S. dollar, as expectations of higher interest rates in the U.S. should help strengthen the dollar in the near term.

Positioning for the Future

Economies in developed regions of the world have largely stabilized, but growth has slowed somewhat in developing economies such as China and Brazil. It remains to be seen whether these economies will begin to recover in the coming months or decelerate further. In addition, any policy shifts by the Federal Reserve (the U.S. central bank) in the second half of the year could negatively impact growth in the U.S. and other developed countries.

We continue to believe that global bond yields will remain in a relatively narrow range in the second half of 2013, but at a higher level than in the recent past. We see value in credit-related securities, both in the U.S. and abroad, as investor demand for yield remains robust.

JUNE 30, 2013 |

Portfolio at a Glance |

Average Duration (effective) | 6.0 years |

Weighted Average Life | 8.2 years |

| | |

Bond Holdings by Country | % of net assets |

United States | 42.8% |

Japan | 15.5% |

United Kingdom | 6.7% |

France(1) | 4.6% |

Germany(1) | 3.9% |

Italy(1) | 3.4% |

Spain(1) | 3.2% |

Canada | 2.8% |

Netherlands(1) | 2.2% |

Multi-National | 2.2% |

Other Countries | 9.9% |

Cash and Equivalents(2) | 2.8% |

(1)These countries are members of the eurozone. (2)Includes temporary cash investments and other assets and liabilities. |

| | |

Types of Investments in Portfolio | % of net assets |

Sovereign Governments and Agencies | 45.0% |

Corporate Bonds | 24.2% |

U.S. Government Agency Mortgage-Backed Securities | 13.3% |

Collateralized Mortgage Obligations | 5.9% |

U.S. Treasury Securities | 4.9% |

Commercial Mortgage-Backed Securities | 3.2% |

Municipal Securities | 0.7% |

Temporary Cash Investments | 4.1% |

Other Assets and Liabilities | (1.3)% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2013 to June 30, 2013.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning

Account Value 1/1/13 | Ending

Account Value 6/30/13 | Expenses Paid During Period(1) 1/1/13 – 6/30/13 | Annualized

Expense Ratio(1) |

Actual | | | | |

Investor Class | $1,000 | $982.30 | $4.72 | 0.96% |

Institutional Class | $1,000 | $983.30 | $3.74 | 0.76% |

A Class | $1,000 | $981.30 | $5.94 | 1.21% |

C Class | $1,000 | $978.30 | $9.61 | 1.96% |

R Class | $1,000 | $980.30 | $7.17 | 1.46% |

Hypothetical | | | | |

Investor Class | $1,000 | $1,020.03 | $4.81 | 0.96% |

Institutional Class | $1,000 | $1,021.03 | $3.81 | 0.76% |

A Class | $1,000 | $1,018.79 | $6.06 | 1.21% |

C Class | $1,000 | $1,015.08 | $9.79 | 1.96% |

R Class | $1,000 | $1,017.56 | $7.30 | 1.46% |

(1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

JUNE 30, 2013

Sovereign Governments and Agencies — 45.0% | |

AUSTRALIA — 1.0% | |

Australia Government Bond, 5.75%, 7/15/22 | AUD | | 150,000 | | | $158,616 | |

New South Wales Treasury Corp., 5.50%, 3/1/17 | AUD | | 145,000 | | | 143,045 | |

| | | | | | | 301,661 | |

AUSTRIA — 1.1% | |

Austria Government Bond, 3.40%, 10/20/14(1) | EUR | | 100,000 | | | 135,739 | |

Austria Government Bond, 4.35%, 3/15/19(1) | EUR | | 75,000 | | | 114,051 | |

Austria Government Bond, 3.90%, 7/15/20(1) | EUR | | 40,000 | | | 60,152 | |

Austria Government Bond, 4.15%, 3/15/37(1) | EUR | | 10,000 | | | 16,103 | |

| | | | | | | 326,045 | |

BELGIUM — 0.6% | |

Belgium Government Bond, 4.00%, 3/28/18 | EUR | | 30,000 | | | 43,836 | |

Belgium Government Bond, 3.75%, 9/28/20 | EUR | | 25,000 | | | 36,415 | |

Belgium Government Bond, 5.00%, 3/28/35 | EUR | | 65,000 | | | 106,079 | |

| | | | | | | 186,330 | |

BRAZIL — 0.2% | |

Brazilian Government International Bond, 5.875%, 1/15/19 | | 40,000 | | | 45,760 | |

CANADA — 2.4% | |

Canadian Government Bond, 4.00%, 6/1/17 | CAD | | 170,000 | | | 176,055 | |

Canadian Government Bond, 3.75%, 6/1/19 | CAD | | 65,000 | | | 67,851 | |

Canadian Government Bond, 3.25%, 6/1/21 | CAD | | 170,000 | | | 173,285 | |

Canadian Government Bond, 5.75%, 6/1/33 | CAD | | 55,000 | | | 75,117 | |

Canadian Government Bond, 4.00%, 6/1/41 | CAD | | 30,000 | | | 34,519 | |

Province of British Columbia, 4.10%, 12/18/19 | CAD | | 65,000 | | | 67,409 | |

Province of Ontario Canada, 1.60%, 9/21/16 | | 40,000 | | | 40,612 | |

Province of Ontario Canada, 4.65%, 6/2/41 | CAD | | 70,000 | | | 74,721 | |

| | | | | | | 709,569 | |

COLOMBIA† | |

Colombia Government International Bond, 4.375%, 7/12/21 | | 10,000 | | | 10,440 | |

CZECH — 0.1% | |

Czech Republic Government Bond, 4.70%, 9/12/22 | CZK | | 600,000 | | | 35,838 | |

DENMARK — 0.3% | |

Denmark Government Bond, 4.00%, 11/15/19 | DKK | | 350,000 | | | 72,015 | |

Denmark Government Bond, 4.50%, 11/15/39 | DKK | | 55,000 | | | 13,563 | |

| | | | | | | 85,578 | |

FINLAND — 0.2% | |

Finland Government Bond, 1.625%, 9/15/22 | EUR | | 45,000 | | | 57,291 | |

FRANCE — 2.1% | |

France Government Bond OAT, 4.00%, 4/25/14 | EUR | | 55,000 | | | 73,863 | |

France Government Bond OAT, 3.25%, 10/25/21 | EUR | | 200,000 | | | 285,157 | |

France Government Bond OAT, 5.50%, 4/25/29 | EUR | | 75,000 | | | 129,444 | |

France Government Bond OAT, 4.75%, 4/25/35 | EUR | | 75,000 | | | 121,465 | |

| | | | | | | 609,929 | |

GERMANY — 2.4% | |

Bundesobligation, 2.00%, 2/26/16 | EUR | | 90,000 | | | 122,512 | |

Bundesrepublik Deutschland, 2.25%, 9/4/20 | EUR | | 290,000 | | | 405,762 | |

Bundesrepublik Deutschland, 4.25%, 7/4/39 | EUR | | 95,000 | | | 166,275 | |

| | | | | | | 694,549 | |

IRELAND — 0.5% | |

Ireland Government Bond, 4.00%, 1/15/14 | EUR | | 70,000 | | | 92,890 | |

Ireland Government Bond, 5.90%, 10/18/19 | EUR | | 35,000 | | | 51,361 | |

| | | | | | | 144,251 | |

ITALY — 3.1% | |

Italy Buoni Poliennali Del Tesoro, 3.75%, 8/1/15 | EUR | | 185,000 | | | 248,281 | |

Italy Buoni Poliennali Del Tesoro, 4.50%, 5/1/23 | EUR | | 400,000 | | | $521,180 | |

Italy Buoni Poliennali Del Tesoro, 4.00%, 2/1/37 | EUR | | 135,000 | | | 157,567 | |

| | | | | | | 927,028 | |

JAPAN — 15.5% | |

Japan Government Ten Year Bond, 1.20%, 6/20/15 | JPY | | 143,300,000 | | | 1,475,295 | |

Japan Government Ten Year Bond, 1.50%, 9/20/18 | JPY | | 105,000,000 | | | 1,122,391 | |

Japan Government Ten Year Bond, 1.00%, 12/20/21 | JPY | | 83,000,000 | | | 853,651 | |

Japan Government Thirty Year Bond, 2.40%, 3/20/37 | JPY | | 88,300,000 | | | 1,002,493 | |

Japan Government Thirty Year Bond, 2.00%, 9/20/41 | JPY | | 12,000,000 | | | 125,997 | |

| | | | | | | 4,579,827 | |

MEXICO — 0.4% | |

Mexican Bonos, 6.50%, 6/9/22 | MXN | | 900,000 | | | 73,354 | |

Mexico Government International Bond, 5.95%, 3/19/19 | | 30,000 | | | 34,485 | |

Mexico Government International Bond, 6.05%, 1/11/40 | | 20,000 | | | 21,900 | |

| | | | | | | 129,739 | |

MULTI-NATIONAL — 2.2% | |

European Investment Bank, 2.50%, 7/15/15 | EUR | | 130,000 | | | 176,477 | |

European Investment Bank, MTN, 3.625%, 1/15/21 | EUR | | 50,000 | | | 73,455 | |

European Investment Bank, MTN, 2.25%, 10/14/22 | EUR | | 200,000 | | | 262,599 | |

International Bank for Reconstruction & Development, MTN, 3.875%, 5/20/19 | EUR | | 85,000 | | | 127,169 | |

| | | | | | | 639,700 | |

NETHERLANDS — 1.5% | |

Netherlands Government Bond, 4.00%, 7/15/16(1) | EUR | | 140,000 | | | 201,053 | |

Netherlands Government Bond, 3.50%, 7/15/20(1) | EUR | | 150,000 | | | 220,667 | |

Netherlands Government Bond, 4.00%, 1/15/37(1) | EUR | | 20,000 | | | 32,330 | |

| | | | | | | 454,050 | |

NEW ZEALAND — 0.1% | |

New Zealand Government Bond, 5.00%, 3/15/19 | NZD | | 50,000 | | | 41,463 | |

NORWAY — 1.4% | |

Norway Government Bond, 4.25%, 5/19/17 | NOK | | 250,000 | | | 45,178 | |

Norway Government Bond, 3.75%, 5/25/21 | NOK | | 2,000,000 | | | 362,835 | |

| | | | | | | 408,013 | |

PERU† | |

Peruvian Government International Bond, 6.55%, 3/14/37 | | 10,000 | | | 11,850 | |

POLAND† | |

Poland Government International Bond, 3.00%, 3/17/23 | | 10,000 | | | 9,050 | |

SINGAPORE — 0.2% | |

Singapore Government Bond, 3.125%, 9/1/22 | SGD | | 60,000 | | | 50,514 | |

SOUTH AFRICA — 0.3% | |

South Africa Government Bond, 7.75%, 2/28/23 | ZAR | | 700,000 | | | 71,505 | |

SOUTH KOREA — 0.1% | |

Korea Development Bank (The), 3.25%, 3/9/16 | | 40,000 | | | 41,437 | |

SPAIN — 2.6% | |

Spain Government Bond, 4.50%, 1/31/18 | EUR | | 500,000 | | | 675,654 | |

Spain Government Bond, 5.85%, 1/31/22 | EUR | | 60,000 | | | 85,112 | |

| | | | | | | 760,766 | |

SWEDEN — 1.8% | |

Sweden Government Bond, 6.75%, 5/5/14 | SEK | | 1,000,000 | | | 156,369 | |

Sweden Government Bond, 4.25%, 3/12/19 | SEK | | 450,000 | | | 76,299 | |

Sweden Government Bond, 3.50%, 6/1/22 | SEK | | 1,780,000 | | | 295,576 | |

| | | | | | | 528,244 | |

SWITZERLAND — 0.5% | |

Switzerland Government Bond, 2.00%, 4/28/21 | CHF | | 135,000 | | | 156,050 | |

UNITED KINGDOM — 4.4% | |

United Kingdom Gilt, 4.00%, 9/7/16 | GBP | | 210,000 | | | 352,086 | |

United Kingdom Gilt, 3.75%, 9/7/21 | GBP | | 170,000 | | | $288,460 | |

United Kingdom Gilt, 4.25%, 3/7/36 | GBP | | 125,000 | | | 216,544 | |

United Kingdom Gilt, 4.50%, 12/7/42 | GBP | | 185,000 | | | 333,455 | |

United Kingdom Gilt, 4.25%, 12/7/55 | GBP | | 60,000 | | | 105,092 | |

| | | | | | | 1,295,637 | |

TOTAL SOVEREIGN GOVERNMENTS AND AGENCIES (Cost $14,455,926) | | | 13,312,114 | |

Corporate Bonds — 24.2% | |

AEROSPACE AND DEFENSE — 0.2% | |

Lockheed Martin Corp., 4.25%, 11/15/19 | | 20,000 | | | 21,794 | |

United Technologies Corp., 5.70%, 4/15/40 | | 10,000 | | | 11,761 | |

United Technologies Corp., 4.50%, 6/1/42 | | 10,000 | | | 9,912 | |

| | | | | | | 43,467 | |

AUTOMOBILES — 0.1% | |

Ford Motor Credit Co. LLC, 5.875%, 8/2/21 | | 30,000 | | | 32,745 | |

BEVERAGES — 0.4% | |

Anheuser-Busch InBev Finance, Inc., 4.00%, 1/17/43 | | 10,000 | | | 9,104 | |

Anheuser-Busch InBev Worldwide, Inc., 7.75%, 1/15/19 | | 40,000 | | | 50,633 | |

Brown-Forman Corp., 3.75%, 1/15/43 | | 10,000 | | | 8,803 | |

Coca-Cola Co. (The), 1.80%, 9/1/16 | | 30,000 | | | 30,627 | |

SABMiller Holdings, Inc., 2.45%, 1/15/17(1) | | 20,000 | | | 20,329 | |

SABMiller Holdings, Inc., 3.75%, 1/15/22(1) | | 10,000 | | | 10,190 | |

| | | | | | | 129,686 | |

BIOTECHNOLOGY — 0.2% | |

Amgen, Inc., 2.125%, 5/15/17 | | 20,000 | | | 20,095 | |

Amgen, Inc., 4.10%, 6/15/21 | | 10,000 | | | 10,498 | |

Amgen, Inc., 5.375%, 5/15/43 | | 10,000 | | | 10,393 | |

Gilead Sciences, Inc., 4.40%, 12/1/21 | | 20,000 | | | 21,503 | |

| | | | | | | 62,489 | |

CAPITAL MARKETS — 0.3% | |

Fidelity International Ltd., MTN, 6.75%, 10/19/20 | GBP | | 50,000 | | | 83,801 | |

Jefferies Group, Inc., 5.125%, 4/13/18 | | 10,000 | | | 10,500 | |

| | | | | | | 94,301 | |

CHEMICALS — 0.2% | |

Ashland, Inc., 4.75%, 8/15/22(1) | | 10,000 | | | 9,925 | |

Eastman Chemical Co., 3.60%, 8/15/22 | | 20,000 | | | 19,303 | |

Ecolab, Inc., 4.35%, 12/8/21 | | 10,000 | | | 10,570 | |

Hexion US Finance Corp. / Hexion Nova Scotia Finance ULC, 8.875%, 2/1/18 | | 25,000 | | | 25,625 | |

| | | | | | | 65,423 | |

COMMERCIAL BANKS — 3.5% | |

Abbey National Treasury Services plc, MTN, 5.125%, 4/14/22 (Secured) | GBP | | 100,000 | | | 173,013 | |

Bank of America N.A., 5.30%, 3/15/17 | | 50,000 | | | 54,260 | |

Bank of Montreal, MTN, 1.45%, 4/9/18 | | 10,000 | | | 9,660 | |

Bank of Nova Scotia, 2.55%, 1/12/17 | | 20,000 | | | 20,596 | |

Barclays Bank plc, MTN, VRN, 4.875%, 12/15/14 | EUR | | 40,000 | | | 38,357 | |

BB&T Corp., MTN, 2.05%, 6/19/18 | | 10,000 | | | 9,862 | |

Capital One Financial Corp., 2.15%, 3/23/15 | | 10,000 | | | 10,161 | |

Commerzbank AG, MTN, 7.75%, 3/16/21 | EUR | | 100,000 | | | 137,389 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, 3.875%, 2/8/22 | | 10,000 | | | 10,083 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, MTN, 3.75%, 11/9/20 | EUR | | 70,000 | | | 92,970 | |

HSBC Bank plc, 3.50%, 6/28/15(1) | | 20,000 | | | 20,979 | |

ING Bank NV, MTN, 3.875%, 12/23/16 | GBP | | 50,000 | | | 80,435 | |

KFW, 2.00%, 6/1/16 | | 50,000 | | | 51,749 | |

KFW, 3.875%, 1/21/19 | EUR | | 70,000 | | | 104,099 | |

KFW, MTN, 4.625%, 1/4/23 | EUR | | 70,000 | | | 112,483 | |

PNC Funding Corp., 3.625%, 2/8/15 | | 40,000 | | | 41,742 | |

Royal Bank of Scotland plc (The), 4.375%, 3/16/16 | | 10,000 | | | 10,590 | |

U.S. Bancorp., MTN, 2.95%, 7/15/22 | | $10,000 | | | $ 9,289 | |

Wells Fargo & Co., 2.10%, 5/8/17 | | 30,000 | | | 30,126 | |

Wells Fargo & Co., 5.625%, 12/11/17 | | 20,000 | | | 22,749 | |

| | | | | | | 1,040,592 | |

COMMERCIAL SERVICES AND SUPPLIES — 0.1% | |

Republic Services, Inc., 3.55%, 6/1/22 | | 10,000 | | | 9,745 | |

Waste Management, Inc., 2.60%, 9/1/16 | | 20,000 | | | 20,668 | |

| | | | | | | 30,413 | |

COMMUNICATIONS EQUIPMENT — 0.1% | |

Apple, Inc., 1.00%, 5/3/18 | | 20,000 | | | 19,221 | |

Apple, Inc., 2.40%, 5/3/23 | | 10,000 | | | 9,289 | |

| | | | | | | 28,510 | |

COMPUTERS AND PERIPHERALS — 0.1% | |

Hewlett-Packard Co., 4.30%, 6/1/21 | | 20,000 | | | 19,578 | |

Hewlett-Packard Co., 4.65%, 12/9/21 | | 10,000 | | | 10,013 | |

Seagate HDD Cayman, 4.75%, 6/1/23(1) | | 10,000 | | | 9,375 | |

| | | | | | | 38,966 | |

CONSTRUCTION MATERIALS† | |

Owens Corning, 4.20%, 12/15/22 | | 10,000 | | | 9,703 | |

CONSUMER FINANCE — 0.5% | |

American Express Credit Corp., MTN, 2.75%, 9/15/15 | | 70,000 | | | 72,638 | |

American Express Credit Corp., MTN, 2.375%, 3/24/17 | | 10,000 | | | 10,215 | |

Credit Suisse (New York), 5.50%, 5/1/14 | | 40,000 | | | 41,636 | |

Equifax, Inc., 3.30%, 12/15/22 | | 10,000 | | | 9,400 | |

SLM Corp., 6.25%, 1/25/16 | | 20,000 | | | 21,275 | |

| | | | | | | 155,164 | |

DIVERSIFIED CONSUMER SERVICES† | |

Catholic Health Initiatives, 2.95%, 11/1/22 | | 10,000 | | | 9,359 | |

DIVERSIFIED FINANCIAL SERVICES — 4.4% | |

Ally Financial, Inc., 8.30%, 2/12/15 | | 40,000 | | | 43,200 | |

Bank of America Corp., 4.50%, 4/1/15 | | 10,000 | | | 10,493 | |

Bank of America Corp., 3.75%, 7/12/16 | | $40,000 | | | $41,955 | |

Bank of America Corp., 6.50%, 8/1/16 | | 10,000 | | | 11,281 | |

Bank of America Corp., 5.75%, 12/1/17 | | 40,000 | | | 44,484 | |

Bank of America Corp., 5.70%, 1/24/22 | | 10,000 | | | 11,114 | |

Bank of America Corp., MTN, 4.75%, 4/3/17 | EUR | | 50,000 | | | 72,094 | |

Citigroup, Inc., 5.50%, 2/15/17 | | $20,000 | | | 21,883 | |

Citigroup, Inc., 6.125%, 11/21/17 | | 60,000 | | | 68,237 | |

Citigroup, Inc., 4.50%, 1/14/22 | | 10,000 | | | 10,431 | |

Citigroup, Inc., 4.05%, 7/30/22 | | 10,000 | | | 9,624 | |

Credit Agricole SA, MTN, 7.375%, 12/18/23 | GBP | | 50,000 | | | 86,640 | |

General Electric Capital Corp., 4.375%, 9/16/20 | | $50,000 | | | 52,988 | |

General Electric Capital Corp., MTN, 6.00%, 8/7/19 | | 70,000 | | | 81,336 | |

Goldman Sachs Group, Inc. (The), 5.95%, 1/18/18 | | 50,000 | | | 55,979 | |

Goldman Sachs Group, Inc. (The), 5.75%, 1/24/22 | | 50,000 | | | 55,217 | |

HSBC Holdings plc, 5.10%, 4/5/21 | | 30,000 | | | 32,997 | |

HSBC Holdings plc, MTN, 6.25%, 3/19/18 | EUR | | 100,000 | | | 150,393 | |

JPMorgan Chase & Co., 3.45%, 3/1/16 | | $10,000 | | | 10,436 | |

JPMorgan Chase & Co., 6.00%, 1/15/18 | | 60,000 | | | 68,516 | |

JPMorgan Chase & Co., 4.625%, 5/10/21 | | 20,000 | | | 21,165 | |

JPMorgan Chase & Co., 3.25%, 9/23/22 | | 10,000 | | | 9,507 | |

Morgan Stanley, 4.75%, 3/22/17 | | 10,000 | | | 10,613 | |

Morgan Stanley, 6.625%, 4/1/18 | | 30,000 | | | 34,027 | |

Morgan Stanley, 4.875%, 11/1/22 | | 10,000 | | | 9,892 | |

Morgan Stanley, 3.75%, 2/25/23 | | 10,000 | | | 9,576 | |

Morgan Stanley, MTN, 4.50%, 2/23/16 | EUR | | 50,000 | | | 69,502 | |

RL Finance Bonds PLC, VRN, 6.125%, 12/15/15 | GBP | | 50,000 | | | 70,534 | |

Royal Bank of Scotland Group plc, 6.125%, 12/15/22 | | $10,000 | | | $ 9,544 | |

Societe Generale SA, 2.50%, 1/15/14 | | 100,000 | | | 101,240 | |

Syngenta Finance NV, 3.125%, 3/28/22 | | 10,000 | | | 9,822 | |

| | | | | | | 1,294,720 | |

DIVERSIFIED TELECOMMUNICATION SERVICES — 1.1% | |

AT&T, Inc., 2.625%, 12/1/22 | | 10,000 | | | 9,167 | |

AT&T, Inc., 6.55%, 2/15/39 | | 30,000 | | | 34,594 | |

AT&T, Inc., 4.30%, 12/15/42 | | 10,000 | | | 8,753 | |

Deutsche Telekom International Finance BV, 6.75%, 8/20/18 | | 30,000 | | | 36,189 | |

France Telecom SA, MTN, 3.875%, 4/9/20 | EUR | | 50,000 | | | 70,788 | |

Frontier Communications Corp., 7.125%, 3/15/19 | | 25,000 | | | 26,438 | |

Telefonica Emisiones SAU, 5.46%, 2/16/21 | | 20,000 | | | 20,659 | |

Telefonica Emisiones SAU, MTN, 5.375%, 2/2/18 | GBP | | 50,000 | | | 80,295 | |

Virgin Media Finance plc, 8.375%, 10/15/19 | | 31,000 | | | 33,790 | |

| | | | | | | 320,673 | |

ELECTRONIC EQUIPMENT, INSTRUMENTS AND COMPONENTS — 0.1% | |

Jabil Circuit, Inc., 7.75%, 7/15/16 | | 20,000 | | | 22,750 | |

Jabil Circuit, Inc., 5.625%, 12/15/20 | | 10,000 | | | 10,400 | |

| | | | | | | 33,150 | |

ENERGY EQUIPMENT AND SERVICES — 0.1% | |

Ensco plc, 3.25%, 3/15/16 | | 20,000 | | | 20,909 | |

Ensco plc, 4.70%, 3/15/21 | | 10,000 | | | 10,629 | |

Transocean, Inc., 6.375%, 12/15/21 | | 10,000 | | | 11,253 | |

| | | | | | | 42,791 | |

FOOD AND STAPLES RETAILING — 0.3% | |

CVS Caremark Corp., 2.75%, 12/1/22 | | 30,000 | | | 28,069 | |

Safeway, Inc., 4.75%, 12/1/21 | | 10,000 | | | 10,201 | |

Wal-Mart Stores, Inc., 5.625%, 4/15/41 | | 20,000 | | | 23,248 | |

Walgreen Co., 1.80%, 9/15/17 | | 10,000 | | | 9,881 | |

Walgreen Co., 3.10%, 9/15/22 | | 10,000 | | | 9,490 | |

| | | | | | | 80,889 | |

FOOD PRODUCTS — 0.2% | |

Kraft Foods Group, Inc., 5.00%, 6/4/42 | | 10,000 | | | 10,177 | |

Mondelez International, Inc., 6.50%, 2/9/40 | | 10,000 | | | 11,984 | |

TreeHouse Foods, Inc., 7.75%, 3/1/18 | | 45,000 | | | 47,756 | |

| | | | | | | 69,917 | |

GAS UTILITIES — 0.6% | |

El Paso Corp., 7.25%, 6/1/18 | | 40,000 | | | 44,494 | |

El Paso Pipeline Partners Operating Co. LLC, 6.50%, 4/1/20 | | 10,000 | | | 11,619 | |

Energy Transfer Partners LP, 6.50%, 2/1/42 | | 10,000 | | | 10,710 | |

Enterprise Products Operating LLC, 5.20%, 9/1/20 | | 30,000 | | | 33,606 | |

Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | | 20,000 | | | 22,470 | |

Plains All American Pipeline LP/PAA Finance Corp., 3.65%, 6/1/22 | | 10,000 | | | 9,842 | |

Sunoco Logistics Partners Operations LP, 3.45%, 1/15/23 | | 20,000 | | | 18,606 | |

TransCanada PipeLines Ltd., 2.50%, 8/1/22 | | 20,000 | | | 18,470 | |

Williams Cos., Inc. (The), 3.70%, 1/15/23 | | 10,000 | | | 9,304 | |

Williams Partners LP, 4.125%, 11/15/20 | | 10,000 | | | 10,091 | |

| | | | | | | 189,212 | |

HEALTH CARE EQUIPMENT AND SUPPLIES — 0.3% | |

Baxter International, Inc., 3.20%, 6/15/23 | | 10,000 | | | 9,823 | |

Biomet, Inc., 6.50%, 8/1/20 | | 50,000 | | | 51,781 | |

Medtronic, Inc., 2.75%, 4/1/23 | | 20,000 | | | 18,722 | |

| | | | | | | 80,326 | |

HEALTH CARE PROVIDERS AND SERVICES — 0.7% | |

Aetna, Inc., 2.75%, 11/15/22 | | 10,000 | | | 9,223 | |

DaVita HealthCare Partners, Inc., 5.75%, 8/15/22 | | $50,000 | | | $50,125 | |

Express Scripts Holding Co., 2.65%, 2/15/17 | | 40,000 | | | 40,753 | |

HCA, Inc., 7.875%, 2/15/20 | | 30,000 | | | 32,381 | |

Healthsouth Corp., 8.125%, 2/15/20 | | 40,000 | | | 43,500 | |

UnitedHealth Group, Inc., 4.25%, 3/15/43 | | 10,000 | | | 9,171 | |

WellPoint, Inc., 3.125%, 5/15/22 | | 10,000 | | | 9,495 | |

| | | | | | | 194,648 | |

HOTELS, RESTAURANTS AND LEISURE — 0.1% | |

Royal Caribbean Cruises Ltd., 5.25%, 11/15/22 | | 20,000 | | | 19,700 | |

Wyndham Worldwide Corp., 2.95%, 3/1/17 | | 20,000 | | | 20,254 | |

| | | | | | | 39,954 | |

HOUSEHOLD DURABLES† | |

Lennar Corp., 4.75%, 12/15/17 | | 10,000 | | | 10,050 | |

INDUSTRIAL CONGLOMERATES† | |

General Electric Co., 4.125%, 10/9/42 | | 10,000 | | | 9,354 | |

INSURANCE — 1.6% | |

Allstate Corp. (The), 4.50%, 6/15/43 | | 10,000 | | | 9,910 | |

American International Group, Inc., 5.85%, 1/16/18 | | 20,000 | | | 22,526 | |

American International Group, Inc., 6.40%, 12/15/20 | | 20,000 | | | 23,218 | |

American International Group, Inc., 4.875%, 6/1/22 | | 10,000 | | | 10,673 | |

Berkshire Hathaway, Inc., 3.00%, 5/15/22 | | 10,000 | | | 9,688 | |

Berkshire Hathaway, Inc., 4.50%, 2/11/43 | | 20,000 | | | 19,102 | |

CNP Assurances, VRN, 4.75%, 12/22/16 | EUR | | 50,000 | | | 59,773 | |

Generali Finance BV, VRN, 6.21%, 6/16/16 | GBP | | 50,000 | | | 68,823 | |

Hartford Financial Services Group, Inc., 5.125%, 4/15/22 | | 10,000 | | | 10,895 | |

International Lease Finance Corp., 5.75%, 5/15/16 | | 10,000 | | | 10,325 | |

Lincoln National Corp., 6.25%, 2/15/20 | | 20,000 | | | 22,954 | |

Mapfre SA, VRN, 5.92%, 7/24/17 | EUR | | 50,000 | | | 59,225 | |

Markel Corp., 4.90%, 7/1/22 | | 10,000 | | | 10,650 | |

MetLife, Inc., 6.75%, 6/1/16 | | 30,000 | | | 34,354 | |

Prudential Financial, Inc., 5.375%, 6/21/20 | | 20,000 | | | 22,444 | |

QBE Insurance Group Ltd., MTN, 6.125%, 9/28/15 | GBP | | 50,000 | | | 82,795 | |

| | | | | | | 477,355 | |

IT SERVICES — 0.1% | |

Fidelity National Information Services, Inc., 5.00%, 3/15/22 | | 10,000 | | | 10,075 | |

International Business Machines Corp., 1.95%, 7/22/16 | | 20,000 | | | 20,512 | |

| | | | | | | 30,587 | |

LIFE SCIENCES TOOLS AND SERVICES† | |

Thermo Fisher Scientific, Inc., 3.60%, 8/15/21 | | 10,000 | | | 9,820 | |

MACHINERY — 0.1% | |

Caterpillar Financial Services Corp., MTN, 2.85%, 6/1/22 | | 20,000 | | | 19,144 | |

MEDIA — 1.4% | |

Comcast Corp., 5.90%, 3/15/16 | | 30,000 | | | 33,790 | |

Comcast Corp., 6.40%, 5/15/38 | | 30,000 | | | 35,962 | |

Discovery Communications LLC, 5.625%, 8/15/19 | | 20,000 | | | 22,979 | |

DISH DBS Corp., 6.75%, 6/1/21 | | 50,000 | | | 53,375 | |

Lamar Media Corp., 7.875%, 4/15/18 | | 70,000 | | | 74,900 | |

News America, Inc., 3.00%, 9/15/22 | | 10,000 | | | 9,346 | |

Time Warner Cable, Inc., 6.75%, 7/1/18 | | 30,000 | | | 34,364 | |

Time Warner, Inc., 4.875%, 3/15/20 | | 20,000 | | | 21,828 | |

Time Warner, Inc., 5.375%, 10/15/41 | | 10,000 | | | 10,160 | |

Univision Communications, Inc., 6.875%, 5/15/19(1) | | 55,000 | | | 58,025 | |

Viacom, Inc., 4.375%, 9/15/14 | | $30,000 | | | $31,284 | |

Walt Disney Co. (The), MTN, 2.35%, 12/1/22 | | 20,000 | | | 18,503 | |

| | | | | | | 404,516 | |

METALS AND MINING — 0.4% | |

Alcoa, Inc., 5.40%, 4/15/21 | | 10,000 | | | 9,745 | |

FMG Resources Pty Ltd., 7.00%, 11/1/15(1) | | 50,000 | | | 50,750 | |

Freeport-McMoRan Copper & Gold, Inc., 3.875%, 3/15/23(1) | | 10,000 | | | 9,063 | |

Newmont Mining Corp., 3.50%, 3/15/22 | | 10,000 | | | 8,568 | |

Vale Overseas Ltd., 5.625%, 9/15/19 | | 30,000 | | | 32,459 | |

Xstrata Canada Financial Corp., 4.95%, 11/15/21(1) | | 10,000 | | | 9,693 | |

| | | | | | | 120,278 | |

MULTI-UTILITIES — 1.2% | |

Consolidated Edison Co. of New York, Inc., 3.95%, 3/1/43 | | 10,000 | | | 9,096 | |

Constellation Energy Group, Inc., 5.15%, 12/1/20 | | 10,000 | | | 10,979 | |

Consumers Energy Co., 2.85%, 5/15/22 | | 10,000 | | | 9,686 | |

Dominion Resources, Inc., 2.75%, 9/15/22 | | 10,000 | | | 9,331 | |

Dominion Resources, Inc., 4.90%, 8/1/41 | | 10,000 | | | 10,145 | |

Duke Energy Corp., 6.30%, 2/1/14 | | 50,000 | | | 51,599 | |

Duke Energy Corp., 1.625%, 8/15/17 | | 20,000 | | | 19,646 | |

Duke Energy Corp., 3.55%, 9/15/21 | | 10,000 | | | 9,999 | |

Enel SpA, MTN, 6.25%, 6/20/19 | GBP | | 50,000 | | | 82,666 | |

Exelon Generation Co. LLC, 4.00%, 10/1/20 | | 10,000 | | | 10,156 | |

Exelon Generation Co. LLC, 5.60%, 6/15/42 | | 10,000 | | | 10,093 | |

FirstEnergy Corp., 4.25%, 3/15/23 | | 10,000 | | | 9,304 | |

Florida Power Corp., 3.85%, 11/15/42 | | 10,000 | | | 8,791 | |

GDF Suez, MTN, 2.75%, 10/18/17 | EUR | | 40,000 | | | 55,094 | |

Ipalco Enterprises, Inc., 5.00%, 5/1/18 | | 10,000 | | | 10,350 | |

Pacific Gas & Electric Co., 5.80%, 3/1/37 | | 10,000 | | | 11,397 | |

Progress Energy, Inc., 3.15%, 4/1/22 | | 10,000 | | | 9,591 | |

San Diego Gas & Electric Co., 3.00%, 8/15/21 | | 20,000 | | | 20,128 | |

| | | | | | | 358,051 | |

OIL, GAS AND CONSUMABLE FUELS — 1.6% | |

Alpha Natural Resources, Inc., 6.00%, 6/1/19 | | 50,000 | | | 40,875 | |

Anadarko Petroleum Corp., 5.95%, 9/15/16 | | 20,000 | | | 22,446 | |

Apache Corp., 4.75%, 4/15/43 | | 10,000 | | | 9,532 | |

BP Capital Markets plc, 4.50%, 10/1/20 | | 20,000 | | | 21,721 | |

Chevron Corp., 2.43%, 6/24/20 | | 10,000 | | | 9,952 | |

ConocoPhillips Holding Co., 6.95%, 4/15/29 | | 10,000 | | | 12,779 | |

Denbury Resources, Inc., 4.625%, 7/15/23 | | 10,000 | | | 9,238 | |

Devon Energy Corp., 5.60%, 7/15/41 | | 10,000 | | | 10,410 | |

Marathon Petroleum Corp., 3.50%, 3/1/16 | | 20,000 | | | 21,005 | |

Newfield Exploration Co., 5.625%, 7/1/24 | | 50,000 | | | 48,750 | |

Noble Energy, Inc., 4.15%, 12/15/21 | | 20,000 | | | 20,676 | |

Peabody Energy Corp., 6.50%, 9/15/20 | | 25,000 | | | 25,188 | |

Pemex Project Funding Master Trust, 6.625%, 6/15/35 | | 30,000 | | | 31,650 | |

Petro-Canada, 6.80%, 5/15/38 | | 10,000 | | | 11,637 | |

Petrobras International Finance Co. – Pifco, 5.75%, 1/20/20 | | 10,000 | | | 10,450 | |

Petrobras International Finance Co. – Pifco, 5.375%, 1/27/21 | | 30,000 | | | 30,277 | |

Phillips 66, 4.30%, 4/1/22 | | 10,000 | | | 10,345 | |

Pioneer Natural Resources Co., 3.95%, 7/15/22 | | 10,000 | | | 9,887 | |

SandRidge Energy, Inc., 8.75%, 1/15/20 | | 40,000 | | | 41,000 | |

Shell International Finance BV, 2.375%, 8/21/22 | | 20,000 | | | 18,716 | |

Shell International Finance BV, 3.625%, 8/21/42 | | $10,000 | | | $ 8,877 | |

Statoil ASA, 2.45%, 1/17/23 | | 10,000 | | | 9,277 | |

Talisman Energy, Inc., 7.75%, 6/1/19 | | 20,000 | | | 24,328 | |

| | | | | | | 459,016 | |

PAPER AND FOREST PRODUCTS — 0.1% | |

Georgia-Pacific LLC, 5.40%, 11/1/20(1) | | 20,000 | | | 22,326 | |

International Paper Co., 6.00%, 11/15/41 | | 10,000 | | | 10,686 | |

| | | | | | | 33,012 | |

PHARMACEUTICALS — 0.6% | |

AbbVie, Inc., 1.75%, 11/6/17(1) | | 20,000 | | | 19,608 | |

AbbVie, Inc., 4.40%, 11/6/42(1) | | 10,000 | | | 9,336 | |

Actavis, Inc., 1.875%, 10/1/17 | | 10,000 | | | 9,755 | |

Bristol-Myers Squibb Co., 3.25%, 8/1/42 | | 10,000 | | | 8,103 | |

GlaxoSmithKline Capital plc, 2.85%, 5/8/22 | | 10,000 | | | 9,612 | |

Merck & Co., Inc., 2.80%, 5/18/23 | | 10,000 | | | 9,475 | |

Merck & Co., Inc., 3.60%, 9/15/42 | | 10,000 | | | 8,684 | |

Roche Holdings, Inc., 6.00%, 3/1/19(1) | | 30,000 | | | 35,849 | |

Valeant Pharmaceuticals International, 6.50%, 7/15/16(1) | | 55,000 | | | 56,925 | |

| | | | | | | 167,347 | |

REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.8% | |

American Tower Corp., 4.50%, 1/15/18 | | 10,000 | | | 10,672 | |

American Tower Corp., 4.70%, 3/15/22 | | 10,000 | | | 10,099 | |

BRE Properties, Inc., 3.375%, 1/15/23 | | 10,000 | | | 9,327 | |

DDR Corp., 3.375%, 5/15/23 | | 10,000 | | | 9,178 | |

DDR Corp., 4.75%, 4/15/18 | | 10,000 | | | 10,753 | |

Essex Portfolio LP, 3.625%, 8/15/22 | | 10,000 | | | 9,654 | |

HCP, Inc., 3.75%, 2/1/16 | | 40,000 | | | 42,137 | |

Health Care REIT, Inc., 3.75%, 3/15/23 | | 20,000 | | | 19,040 | |

Host Hotels & Resorts LP, 3.75%, 10/15/23 | | $10,000 | | | 9,185 | |

Kilroy Realty LP, 3.80%, 1/15/23 | | 10,000 | | | 9,380 | |

Reckson Operating Partnership LP, 6.00%, 3/31/16 | | 20,000 | | | 21,804 | |

Simon Property Group LP, 5.10%, 6/15/15 | | 60,000 | | | 64,892 | |

Ventas Realty LP/Ventas Capital Corp., 4.00%, 4/30/19 | | 10,000 | | | 10,408 | |

Ventas Realty LP/Ventas Capital Corp., 4.75%, 6/1/21 | | 10,000 | | | 10,517 | |

| | | | | | | 247,046 | |

ROAD AND RAIL — 0.4% | |

Burlington Northern Santa Fe LLC, 3.60%, 9/1/20 | | 20,000 | | | 20,767 | |

Burlington Northern Santa Fe LLC, 4.45%, 3/15/43 | | 10,000 | | | 9,366 | |

CSX Corp., 4.25%, 6/1/21 | | 10,000 | | | 10,699 | |

Firstgroup plc, 6.125%, 1/18/19 | GBP | | 40,000 | | | 65,894 | |

| | | | | | | 106,726 | |

SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 0.1% | |

Intel Corp., 1.35%, 12/15/17 | | $20,000 | | | 19,586 | |

SOFTWARE — 0.1% | |

Oracle Corp., 2.50%, 10/15/22 | | 20,000 | | | 18,470 | |

SPECIALTY RETAIL — 0.5% | |

Home Depot, Inc. (The), 5.95%, 4/1/41 | | 10,000 | | | 11,970 | |

Sonic Automotive, Inc., 7.00%, 7/15/22 | | 50,000 | | | 54,750 | |

Staples, Inc., 4.375%, 1/12/23 | | 20,000 | | | 19,414 | |

United Rentals North America, Inc., 5.75%, 7/15/18 | | 50,000 | | | 52,750 | |

| | | | | | | 138,884 | |

TEXTILES, APPAREL AND LUXURY GOODS — 0.2% | |

Gap, Inc. (The), 5.95%, 4/12/21 | | 10,000 | | | 11,073 | |

L Brands, Inc., 6.625%, 4/1/21 | | 40,000 | | | 43,650 | |

| | | | | | | 54,723 | |

THRIFTS AND MORTGAGE FINANCE — 1.1% | |

Cie de Financement Foncier, 4.375%, 4/25/19 (Secured) | EUR | | 100,000 | | | $149,835 | |

Cie de Financement Foncier, MTN, 4.50%, 5/16/18 (Secured) | EUR | | 110,000 | | | 163,996 | |

| | | | | | | 313,831 | |

TOBACCO — 0.2% | |

Altria Group, Inc., 9.25%, 8/6/19 | | $10,000 | | | 13,255 | |

Altria Group, Inc., 2.85%, 8/9/22 | | 10,000 | | | 9,259 | |

Philip Morris International, Inc., 4.125%, 5/17/21 | | 20,000 | | | 21,163 | |

| | | | | | | 43,677 | |

WIRELESS TELECOMMUNICATION SERVICES — 0.1% | |

Cellco Partnership/Verizon Wireless Capital LLC, 8.50%, 11/15/18 | | 20,000 | | | 25,995 | |

TOTAL CORPORATE BONDS (Cost $7,205,578) | | | 7,154,566 | |

U.S. Government Agency Mortgage-Backed Securities(2) — 13.3% | |

ADJUSTABLE-RATE U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES — 3.8% | |

FHLMC, VRN, 1.75%, 7/15/13 | | 125,000 | | | 125,326 | |

FHLMC, VRN, 1.85%, 7/15/13 | | 123,955 | | | 124,826 | |

FHLMC, VRN, 1.97%, 7/15/13 | | 90,987 | | | 91,857 | |

FHLMC, VRN, 1.98%, 7/15/13 | | 55,000 | | | 55,694 | |

FHLMC, VRN, 2.08%, 7/15/13 | | 33,366 | | | 33,421 | |

FHLMC, VRN, 2.36%, 7/15/13 | | 106,459 | | | 105,723 | |

FHLMC, VRN, 2.37%, 7/15/13 | | 123,944 | | | 122,751 | |

FHLMC, VRN, 2.90%, 7/15/13 | | 45,457 | | | 46,446 | |

FHLMC, VRN, 3.24%, 7/15/13 | | 7,954 | | | 8,371 | |

FHLMC, VRN, 3.29%, 7/15/13 | | 85,790 | | | 88,652 | |

FHLMC, VRN, 3.81%, 7/15/13 | | 14,275 | | | 14,996 | |

FHLMC, VRN, 4.36%, 7/15/13 | | 125,283 | | | 131,959 | |

FHLMC, VRN, 5.40%, 7/15/13 | | 8,799 | | | 9,373 | |

FHLMC, VRN, 5.80%, 7/15/13 | | 25,476 | | | 26,930 | |

FHLMC, VRN, 5.97%, 7/15/13 | | 27,292 | | | 29,395 | |

FHLMC, VRN, 6.13%, 7/15/13 | | 8,859 | | | 9,546 | |

FNMA, VRN, 2.71%, 7/25/13 | | 26,216 | | | 26,622 | |

FNMA, VRN, 3.83%, 7/25/13 | | 14,576 | | | 15,333 | |

FNMA, VRN, 3.93%, 7/25/13 | | 17,207 | | | 18,167 | |

FNMA, VRN, 5.41%, 7/25/13 | | 14,157 | | | 15,261 | |

FNMA, VRN, 5.96%, 7/25/13 | | 26,404 | | | 28,879 | |

| | | | | | | 1,129,528 | |

FIXED-RATE U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES — 9.5% | |

FHLMC, 6.00%, 2/1/38 | | 10,622 | | | 11,515 | |

FHLMC, 4.00%, 12/1/40 | | 12,038 | | | 12,645 | |

FHLMC, 4.00%, 4/1/41 | | 57,644 | | | 60,770 | |

FNMA, 4.00%, 7/15/13(3) | | 75,000 | | | 78,129 | |

FNMA, 4.50%, 7/15/13(3) | | 75,000 | | | 79,371 | |

FNMA, 5.50%, 7/15/13(3) | | 150,000 | | | 162,932 | |

FNMA, 5.00%, 7/1/31 | | 84,496 | | | 93,487 | |

FNMA, 5.50%, 5/1/33 | | 26,589 | | | 29,103 | |

FNMA, 5.00%, 11/1/33 | | 18,904 | | | 20,452 | |

FNMA, 5.00%, 9/1/35 | | 93,967 | | | 101,180 | |

FNMA, 6.00%, 4/1/37 | | 31,533 | | | 34,974 | |

FNMA, 6.00%, 7/1/37 | | 45,270 | | | 50,230 | |

FNMA, 6.00%, 8/1/37 | | 33,453 | | | 36,629 | |

FNMA, 5.50%, 1/1/39 | | 72,827 | | | 78,994 | |

FNMA, 5.50%, 3/1/39 | | 9,302 | | | 10,090 | |

FNMA, 4.50%, 6/1/39 | | 140,914 | | | 152,334 | |

FNMA, 5.00%, 8/1/39 | | 11,817 | | | 13,026 | |

FNMA, 4.50%, 3/1/40 | | 228,626 | | | 246,774 | |

FNMA, 3.50%, 12/1/40 | | 75,043 | | | 76,270 | |

FNMA, 4.00%, 12/1/40 | | 59,680 | | | 62,471 | |

FNMA, 4.00%, 5/1/41 | | 88,341 | | | 92,074 | |

FNMA, 4.50%, 7/1/41 | | 88,497 | | | 95,081 | |

FNMA, 4.50%, 9/1/41 | | 44,603 | | | 47,580 | |

FNMA, 4.00%, 12/1/41 | | 104,121 | | | 109,094 | |

FNMA, 4.00%, 1/1/42 | | 54,591 | | | 57,002 | |

FNMA, 3.50%, 5/1/42 | | 91,913 | | | 93,463 | |

FNMA, 3.50%, 6/1/42 | | 48,000 | | | 48,831 | |

FNMA, 3.50%, 9/1/42 | | 47,835 | | | 48,648 | |

FNMA, 3.50%, 9/1/42 | | 67,821 | | | 68,930 | |

FNMA, 3.00%, 11/1/42 | | $48,795 | | | $47,743 | |

GNMA, 6.00%, 7/15/33 | | 11,055 | | | 12,412 | |

GNMA, 5.00%, 3/20/36 | | 104,187 | | | 113,647 | |

GNMA, 5.50%, 1/15/39 | | 9,042 | | | 10,311 | |

GNMA, 5.50%, 9/15/39 | | 69,762 | | | 76,405 | |

GNMA, 4.50%, 10/15/39 | | 25,470 | | | 27,597 | |

GNMA, 5.00%, 10/15/39 | | 39,572 | | | 43,502 | |

GNMA, 4.50%, 1/15/40 | | 42,353 | | | 45,323 | |

GNMA, 4.00%, 12/15/40 | | 33,228 | | | 35,115 | |

GNMA, 4.50%, 12/15/40 | | 101,507 | | | 110,001 | |

GNMA, 4.00%, 1/20/41 | | 136,755 | | | 144,330 | |

GNMA, 4.00%, 12/15/41 | | 64,676 | | | 67,914 | |

| | | | | | | 2,806,379 | |

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Cost $3,988,690) | | | 3,935,907 | |

Collateralized Mortgage Obligations(2) — 5.9% | |

Banc of America Funding Corp., Series 2004-2, Class 3A1, 5.50%, 9/20/34 | | 24,852 | | | 25,992 | |

Banc of America Mortgage Securities, Inc., Series 2004-L, Class 2A1, VRN, 3.00%, 7/1/13 | | 9,618 | | | 9,351 | |

Banc of America Mortgage Securities, Inc., Series 2005-1, Class 1A15, 5.50%, 2/25/35 | | 10,000 | | | 10,258 | |

Banc of America Mortgage Securities, Inc., Series 2007-1, Class 1A16, 5.625%, 3/25/37 | | 110,761 | | | 100,178 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2004-12, Class 2A1, VRN, 2.85%, 7/1/13 | | 10,500 | | | 10,138 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-1, Class A1, VRN, 2.37%, 7/1/13 | | 26,204 | | | 25,282 | |

Countrywide Home Loan Mortgage Pass-Through Trust, Series 2004-4, Class A19, 5.25%, 5/25/34 | | 12,774 | | | 13,146 | |

First Horizon Mortgage Pass-Through Trust, Series 2005-AR3, Class 4A1, VRN, 5.29%, 7/1/13 | | 11,944 | | | 11,634 | |

GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1, VRN, 2.66%, 7/1/13 | | 23,788 | | | 23,490 | |

JPMorgan Mortgage Trust, Series 2005-A4, Class 2A1, VRN, 2.78%, 7/1/13 | | 7,108 | | | 6,964 | |

JPMorgan Mortgage Trust, Series 2005-A6, Class 7A1, VRN, 3.01%, 7/1/13 | | 37,359 | | | 34,507 | |

JPMorgan Mortgage Trust, Series 2006-A3, Class 7A1, VRN, 2.90%, 7/1/13 | | 29,166 | | | 28,254 | |

JPMorgan Mortgage Trust, Series 2013-1, Class 2A2, VRN, 2.50%, 7/1/13(1) | | 102,465 | | | 103,074 | |

MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A7, VRN, 2.63%, 7/1/13 | | 28,053 | | | 28,742 | |

Merrill Lynch Mortgage Investors Trust, Series 2005-A2, Class A1, VRN, 2.54%, 7/1/13 | | 62,090 | | | 60,451 | |

PHHMC Mortgage Pass-Through Certificates, Series 2007-6, Class A1, VRN, 5.73%, 7/1/13 | | 9,959 | | | 10,326 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2004-A, Class A1, VRN, 4.90%, 7/1/13 | | 33,246 | | | 33,425 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2004-K, Class 2A6, VRN, 4.73%, 7/1/13 | | 87,999 | | | 88,744 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2004-Z, Class 2A2, VRN, 2.62%, 7/1/13 | | 78,136 | | | 79,250 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-17, Class 1A1, 5.50%, 1/25/36 | | 38,051 | | | 38,393 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-18, Class 1A1, 5.50%, 1/25/36 | | 92,901 | | | 89,314 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-5, Class 1A1, 5.00%, 5/25/20 | | $5,688 | | | $ 5,961 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR16, Class 3A2, VRN, 2.68%, 7/1/13 | | 18,746 | | | 18,941 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR2, Class 3A1, VRN, 2.66%, 7/1/13 | | 100,378 | | | 101,410 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-10, Class A4 SEQ, 6.00%, 8/25/36 | | 106,133 | | | 108,888 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-11, Class A9 SEQ, 6.50%, 9/25/36 | | 119,382 | | | 117,247 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-13, Class A5, 6.00%, 10/25/36 | | 29,791 | | | 30,206 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-3, Class A9 SEQ, 5.50%, 3/25/36 | | 66,118 | | | 65,947 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR15, Class A1, VRN, 5.47%, 7/1/13 | | 16,921 | | | 14,936 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR2, Class 2A3, VRN, 2.64%, 7/1/13 | | 14,706 | | | 14,195 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR5, Class 2A1, VRN, 2.64%, 7/1/13 | | 14,772 | | | 13,396 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-10, Class 1A5, 6.00%, 7/25/37 | | 107,280 | | | 103,537 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-11, Class A3 SEQ, 6.00%, 8/25/37 | | 99,585 | | | 97,575 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-13, Class A1, 6.00%, 9/25/37 | | 39,914 | | | 40,071 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-14, Class 2A2, 5.50%, 10/25/22 | | 78,827 | | | 83,718 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-16, Class 1A1, 6.00%, 12/28/37 | | 92,136 | | | 96,095 | |

Wells Fargo Mortgage-Backed Securities Trust, Series 2007-3, Class 3A1, 5.50%, 4/25/22 | | 6,310 | | | 6,522 | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $1,760,029) | | | 1,749,558 | |

U.S. Treasury Securities — 4.9% | |

U.S. Treasury Bonds, 5.50%, 8/15/28 | | 50,000 | | | 65,066 | |

U.S. Treasury Bonds, 2.75%, 11/15/42 | | 175,000 | | | 151,129 | |

U.S. Treasury Bonds, 3.125%, 2/15/43 | | 200,000 | | | 186,969 | |

U.S. Treasury Notes, 1.875%, 10/31/17(4) | | 50,000 | | | 51,434 | |

U.S. Treasury Notes, 2.625%, 4/30/18 | | 45,000 | | | 47,718 | |

U.S. Treasury Notes, 1.00%, 5/31/18 | | 490,000 | | | 481,425 | |

U.S. Treasury Notes, 1.375%, 6/30/18(5) | | 60,000 | | | 59,946 | |

U.S. Treasury Notes, 1.75%, 5/15/23 | | 450,000 | | | 421,207 | |

TOTAL U.S. TREASURY SECURITIES (Cost $1,515,800) | | | 1,464,894 | |

Commercial Mortgage-Backed Securities(2) — 3.2% | |

Banc of America Commercial Mortgage, Inc., Series 2004-1, Class A4 SEQ, 4.76%, 11/10/39 | | 48,373 | | | 48,793 | |

Banc of America Merrill Lynch Commercial Mortgage, Inc., Series 2004-2, Class A5 SEQ, 4.58%, 11/10/38 | | 50,000 | | | 50,940 | |

Bank of America Merrill Lynch Commercial Mortgage Securities Trust, Series 2012-PARK, Class A SEQ, 2.96%, 12/10/30(1) | | 75,000 | | | 70,784 | |

BB-UBS Trust, Series 2012-SHOW, Class A, 3.43%, 11/5/36(1) | | 50,000 | | | 47,136 | |

| | | | | | | |

| | | Principal Amount | | | Value | |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 2005-CD1, Class AM, VRN, 5.39%, 7/1/13 | | $55,000 | | | $58,736 | |

Commercial Mortgage Pass-Through Certificates, Series 2004-LB2A, Class A4 SEQ, 4.72%, 3/10/39 | | 62,599 | | | 63,498 | |

GE Capital Commercial Mortgage Corp., Series 2005-C3, Class A5, VRN, 4.98%, 7/1/13 | | 14,141 | | | 14,161 | |

Greenwich Capital Commercial Funding Corp., Series 2005-GG3, Class A3 SEQ, 4.57%, 8/10/42 | | 13,569 | | | 13,560 | |

Greenwich Capital Commercial Funding Corp., Series 2005-GG3, Class A4, VRN, 4.80%, 7/1/13 | | 50,000 | | | 52,210 | |

GS Mortgage Securities Corp. II, Series 2004-GG2, Class A6 SEQ, VRN, 5.40%, 7/1/13 | | 50,000 | | | 51,457 | |

GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4 SEQ, 4.76%, 7/10/39 | | 50,000 | | | 52,973 | |

GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4A SEQ, 4.75%, 7/10/39 | | 75,000 | | | 78,871 | |

GS Mortgage Securities Corp. II, Series 2012-ALOH, Class A SEQ, 3.55%, 4/10/34(1) | | 75,000 | | | 74,303 | |

Irvine Core Office Trust, Series 2013-IRV, Class A2, VRN, 3.31%, 7/10/13(1) | | 50,000 | | | 47,365 | |

LB-UBS Commercial Mortgage Trust, Series 2005-C5, Class AM, VRN, 5.02%, 7/11/13 | | 35,000 | | | 37,087 | |

Morgan Stanley Capital I, Series 2005-T17, Class A5 SEQ, 4.78%, 12/13/41 | | 73,825 | | | 76,977 | |

Wachovia Bank Commercial Mortgage Trust, Series 2004-C15, Class A3 SEQ, 4.50%, 10/15/41 | | 12,872 | | | 13,014 | |

Wachovia Bank Commercial Mortgage Trust, Series 2004-C15, Class A4 SEQ, 4.80%, 10/15/41 | | 100,000 | | | 104,023 | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $989,353) | | | 955,888 | |

Municipal Securities — 0.7% | |

California GO, (Building Bonds), 7.30%, 10/1/39 | | 20,000 | | | 26,063 | |

Illinois GO, Series 2010-3, (Building Bonds), 6.73%, 4/1/35 | | 20,000 | | | 21,285 | |

Maryland State Transportation Authority Rev., (Building Bonds), 5.75%, 7/1/41 | | 30,000 | | | 34,307 | |

Missouri Highways & Transportation Commission Rev., (Building Bonds), 5.45%, 5/1/33 | | 25,000 | | | 27,919 | |

New Jersey State Turnpike Authority Rev., Series 2010 A, (Building Bonds), 7.10%, 1/1/41 | | 25,000 | | | 32,429 | |

Ohio State University (The) Rev., (Building Bonds), 4.91%, 6/1/40 | | 25,000 | | | 24,847 | |

Pennsylvania Turnpike Commission Rev., Series 2010 B, (Building Bonds), 5.56%, 12/1/49 | | 25,000 | | | 27,276 | |

TOTAL MUNICIPAL SECURITIES (Cost $207,441) | | | 194,126 | |

Temporary Cash Investments — 4.1% | |

Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations, 1.00%, 1/15/14, valued at $159,170), in a joint trading account at 0.06%, dated 6/28/13, due 7/1/13 (Delivery value $155,915) | | | 155,914 | |

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 4.25%, 11/15/40, valued at $476,582), in a joint trading account at 0.05%, dated 6/28/13, due 7/1/13 (Delivery value $467,746) | | | 467,744 | |

Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 3.125%, 11/15/41, valued at $158,587), in a joint trading account at 0.04%, dated 6/28/13, due 7/1/13 (Delivery value $155,916) | | | 155,915 | |

| | | | | | | |

| | | Shares | | | Value | |

SSgA U.S. Government Money Market Fund | | 427,374 | | | $427,374 | |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $1,206,947) | | | 1,206,947 | |

TOTAL INVESTMENT SECURITIES — 101.3% (Cost $31,329,764) | | | 29,974,000 | |

OTHER ASSETS AND LIABILITIES — (1.3)% | | | (389,807 | ) |

TOTAL NET ASSETS — 100.0% | | | $29,584,193 | |

Forward Foreign Currency Exchange Contracts

| | | | | | | | | |

Currency Purchased | | Currency Sold | | Counterparty | Settlement Date | | Unrealized Gain (Loss) | |

AUD | | 227,000 | | USD | | 209,757 | | Barclays Bank plc | 9/17/2013 | | $(3,313 | ) |

AUD | | 30,000 | | USD | | 28,316 | | Westpac Group | 9/17/2013 | | (1,033 | ) |

USD | | 511,341 | | AUD | | 541,749 | | Westpac Group | 9/17/2013 | | 18,649 | |

USD | | 66,846 | | AUD | | 70,000 | | Westpac Group | 9/17/2013 | | 3,185 | |

USD | | 27,290 | | BRL | | 60,000 | | Barclays Bank plc | 9/17/2013 | | 814 | |

CAD | | 12,500 | | USD | | 11,918 | | Barclays Bank plc | 9/17/2013 | | (54 | ) |

USD | | 473,799 | | CAD | | 485,023 | | HSBC Holdings plc | 9/17/2013 | | 13,469 | |

USD | | 322,363 | | CAD | | 330,000 | | HSBC Holdings plc | 9/17/2013 | | 9,164 | |

CHF | | 1,750 | | USD | | 1,857 | | Barclays Bank plc | 9/17/2013 | | (3 | ) |

USD | | 133,952 | | CHF | | 123,423 | | UBS AG | 9/17/2013 | | 3,193 | |

USD | | 32,559 | | CHF | | 30,000 | | UBS AG | 9/17/2013 | | 776 | |

USD | | 43,328 | | CLP | | 22,000,000 | | Barclays Bank plc | 9/17/2013 | | 549 | |

CNY | | 390,000 | | USD | | 63,295 | | HSBC Holdings plc | 9/17/2013 | | (482 | ) |

USD | | 43,272 | | COP | | 83,000,002 | | Barclays Bank plc | 9/17/2013 | | 406 | |

USD | | 39,481 | | CZK | | 756,971 | | Deutsche Bank | 9/17/2013 | | 1,591 | |

USD | | 91,656 | | DKK | | 510,000 | | Barclays Bank plc | 9/17/2013 | | 2,579 | |

EUR | | 120,000 | | USD | | 160,028 | | Barclays Bank plc | 9/17/2013 | | (3,777 | ) |

EUR | | 40,000 | | USD | | 52,041 | | Barclays Bank plc | 9/17/2013 | | 43 | |

USD | | 6,708,181 | | EUR | | 5,030,269 | | Barclays Bank plc | 9/17/2013 | | 158,336 | |

USD | | 52,052 | | EUR | | 40,000 | | Barclays Bank plc | 9/17/2013 | | (31 | ) |

GBP | | 72,000 | | USD | | 110,305 | | Barclays Bank plc | 9/17/2013 | | (852 | ) |

GBP | | 60,000 | | USD | | 94,012 | | HSBC Holdings plc | 9/17/2013 | | (2,801 | ) |

GBP | | 10,000 | | USD | | 15,738 | | HSBC Holdings plc | 9/17/2013 | | (536 | ) |

USD | | 2,453,037 | | GBP | | 1,565,575 | | HSBC Holdings plc | 9/17/2013 | | 73,074 | |

USD | | 15,364 | | GBP | | 10,000 | | Westpac Group | 9/17/2013 | | 162 | |

HUF | | 7,531,690 | | USD | | 33,621 | | Deutsche Bank | 9/17/2013 | | (633 | ) |

USD | | 32,477 | | HUF | | 7,499,999 | | Deutsche Bank | 9/17/2013 | | (372 | ) |

USD | | 32,406 | | HUF | | 7,500,001 | | Deutsche Bank | 9/17/2013 | | (443 | ) |

IDR | | 717,838,913 | | USD | | 70,091 | | UBS AG | 9/17/2013 | | (404 | ) |

USD | | 15,705 | | INR | | 925,144 | | UBS AG | 9/17/2013 | | 408 | |

USD | | 40,000 | | INR | | 2,470,600 | | Westpac Group | 9/17/2013 | | (852 | ) |

JPY | | 30,800,000 | | USD | | 321,785 | | Barclays Bank plc | 9/17/2013 | | (11,129 | ) |

USD | | 4,274,433 | | JPY | | 409,132,497 | | Barclays Bank plc | 9/17/2013 | | 147,835 | |

USD | | 808,229 | | JPY | | 78,806,363 | | Barclays Bank plc | 9/17/2013 | | 13,371 | |

KRW | | 31,000,005 | | USD | | 27,331 | | HSBC Holdings plc | 9/17/2013 | | (290 | ) |

| | | | | | | | | |

Currency Purchased | | Currency Sold | | Counterparty | Settlement Date | | Unrealized Gain (Loss) | |

USD | | 55,384 | | KRW | | 62,999,998 | | HSBC Holdings plc | 9/17/2013 | | $431 | |

USD | | 40,000 | | KRW | | 46,410,000 | | HSBC Holdings plc | 9/17/2013 | | (482 | ) |

USD | | 26,268 | | KRW | | 29,879,799 | | HSBC Holdings plc | 9/17/2013 | | 205 | |

USD | | 78,690 | | MXN | | 1,020,016 | | Barclays Bank plc | 9/17/2013 | | 504 | |

USD | | 20,970 | | MXN | | 270,000 | | Barclays Bank plc | 9/17/2013 | | 274 | |

USD | | 37,151 | | MYR | | 120,000 | | Westpac Group | 9/17/2013 | | (457 | ) |

USD | | 27,825 | | MYR | | 90,000 | | Westpac Group | 9/17/2013 | | (381 | ) |

USD | | 24,659 | | MYR | | 80,000 | | Westpac Group | 9/17/2013 | | (413 | ) |

NOK | | 85,625 | | USD | | 13,979 | | Barclays Bank plc | 9/17/2013 | | 79 | |

NOK | | 230,000 | | USD | | 40,030 | | Deutsche Bank | 9/17/2013 | | (2,268 | ) |

USD | | 21,743 | | NOK | | 130,000 | | Barclays Bank plc | 9/17/2013 | | 400 | |

USD | | 311,442 | | NOK | | 1,800,000 | | Deutsche Bank | 9/17/2013 | | 15,917 | |

USD | | 153,918 | | NOK | | 889,582 | | Deutsche Bank | 9/17/2013 | | 7,867 | |

USD | | 40,000 | | NOK | | 244,814 | | Deutsche Bank | 9/17/2013 | | (194 | ) |

NZD | | 1,250 | | USD | | 971 | | Barclays Bank plc | 9/17/2013 | | (7 | ) |

USD | | 32,097 | | NZD | | 40,000 | | Westpac Group | 9/17/2013 | | 1,267 | |

USD | | 15,339 | | NZD | | 19,344 | | Westpac Group | 9/17/2013 | | 430 | |

PEN | | 60,000 | | USD | | 21,429 | | Barclays Bank plc | 9/17/2013 | | (3 | ) |

USD | | 25,381 | | PEN | | 70,000 | | Barclays Bank plc | 9/17/2013 | | 384 | |

USD | | 16,328 | | PHP | | 700,000 | | Westpac Group | 9/17/2013 | | 90 | |

USD | | 28,238 | | PLN | | 90,000 | | Deutsche Bank | 9/17/2013 | | 1,280 | |

RUB | | 900,000 | | USD | | 28,005 | | Westpac Group | 9/17/2013 | | (941 | ) |

USD | | 80,000 | | RUB | | 2,676,800 | | Westpac Group | 9/17/2013 | | (492 | ) |

USD | | 27,064 | | RUB | | 900,000 | | Westpac Group | 9/17/2013 | | 1 | |

SEK | | 129,800 | | USD | | 19,244 | | Barclays Bank plc | 9/17/2013 | | 78 | |

SEK | | 630,000 | | USD | | 96,638 | | Deutsche Bank | 9/17/2013 | | (2,854 | ) |

SEK | | 140,000 | | USD | | 21,594 | | Deutsche Bank | 9/17/2013 | | (754 | ) |

USD | | 692,781 | | SEK | | 4,516,366 | | Deutsche Bank | 9/17/2013 | | 20,463 | |

USD | | 17,873 | | SEK | | 120,000 | | Deutsche Bank | 9/17/2013 | | 9 | |

USD | | 71,726 | | SGD | | 90,000 | | HSBC Holdings plc | 9/17/2013 | | 710 | |

USD | | 54,835 | | SGD | | 68,805 | | HSBC Holdings plc | 9/17/2013 | | 543 | |

USD | | 49,047 | | THB | | 1,530,000 | | Westpac Group | 9/17/2013 | | (90 | ) |

USD | | 47,075 | | TRY | | 90,000 | | Deutsche Bank | 9/17/2013 | | 967 | |

USD | | 54,876 | | TWD | | 1,660,000 | | HSBC Holdings plc | 9/17/2013 | | (560 | ) |

USD | | 54,573 | | TWD | | 1,650,000 | | HSBC Holdings plc | 9/17/2013 | | (530 | ) |

USD | | 51,233 | | TWD | | 1,530,000 | | HSBC Holdings plc | 9/17/2013 | | 138 | |

USD | | 47,020 | | TWD | | 1,420,000 | | HSBC Holdings plc | 9/17/2013 | | (402 | ) |

USD | | 73,225 | | ZAR | | 748,261 | | Deutsche Bank | 9/17/2013 | | (1,640 | ) |

USD | | 17,969 | | ZAR | | 180,000 | | Deutsche Bank | 9/17/2013 | | (41 | ) |

| | | | | | | | | | | | $460,127 | |

Futures Contracts | |

Contracts Sold | Expiration Date | | Underlying Face Amount at Value | | Unrealized Gain (Loss) |

| 2 | | Euro-Bund 10-Year Bonds | September 2013 | | $368,419 | | | $4,318 | |

| 7 | | U.S. Treasury 10-Year Notes | September 2013 | | 885,937 | | | 19,015 | |

| | | | | | $1,254,356 | | | $23,333 | |

Notes to Schedule of Investments

AUD = Australian Dollar BRL = Brazilian Real CAD = Canadian Dollar CHF = Swiss Franc CLP = Chilean Peso CNY = Chinese Yuan COP = Colombian Peso CZK = Czech Koruna DKK = Danish Krone EUR = Euro FHLMC = Federal Home Loan Mortgage Corporation FNMA = Federal National Mortgage Association GBP = British Pound GNMA = Government National Mortgage Association GO = General Obligation HUF = Hungarian Forint IDR = Indonesian Rupiah INR = Indian Rupee JPY = Japanese Yen KRW = South Korea Won MTN = Medium Term Note MXN = Mexican Peso MYR = Malaysian Ringgit NOK = Norwegian Krone NZD = New Zealand Dollar PEN = Peruvian Nuevo Sol | PHP = Philippine Peso PLN = Polish Zloty RUB = Russian Rouble SEK = Swedish Krona SEQ = Sequential Payer SGD = Singapore Dollar THB = Thai Baht TRY = Turkish Lira TWD = Taiwanese Dollar USD = United States Dollar VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end. ZAR = South African Rand † Category is less than 0.05% of total net assets. (1) Security was purchased under Rule 144A of the Securities Act of 1933 or is a private placement and, unless registered under the Act or exempted from registration, may only be sold to qualified institutional investors. The aggregate value of these securities at the period end was $1,465,130, which represented 5.0% of total net assets. (2) Final maturity date indicated, unless otherwise noted. (3) Forward commitment. Settlement date is indicated. (4) Security, or a portion thereof, has been pledged at the custodian bank or with a broker for margin requirements on futures contracts. At the period end, the aggregate value of securities pledged was $36,004. (5) When-issued security. The issue price and yield are fixed on the date of the commitment, but payment and delivery are scheduled for a future date. |

See Notes to Financial Statements.

Statement of Assets and Liabilities |

JUNE 30, 2013 | |

Assets | |

Investment securities, at value (cost of $31,329,764) | | $29,974,000 | |

Cash | | 3,026 | |

Foreign currency holdings, at value (cost of $62,325) | | 61,658 | |

Receivable for investments sold | | 99,066 | |

Receivable for capital shares sold | | 96 | |

Receivable for variation margin on futures contracts | | 547 | |

Unrealized gain on forward foreign currency exchange contracts | | 499,641 | |

Interest receivable | | 269,697 | |

| | | 30,907,731 | |

| | | | |

Liabilities | | | |

Payable for investments purchased | | 1,256,969 | |

Payable for variation margin on futures contracts | | 158 | |

Unrealized loss on forward foreign currency exchange contracts | | 39,514 | |

Accrued management fees | | 22,059 | |

Distribution and service fees payable | | 4,838 | |

| | | 1,323,538 | |

| | | | |

Net Assets | | $29,584,193 | |

| | | | |

Net Assets Consist of: | | | |

Capital paid in | | $29,697,044 | |

Undistributed net investment income | | 665,125 | |

Undistributed net realized gain | | 95,696 | |

Net unrealized depreciation | | (873,672 | ) |

| | | $29,584,193 | |

| | | | | | | | | | |

| | | Net assets | | | Shares outstanding | | | Net asset value per share | |

Investor Class | | $9,590,025 | | | 960,921 | | | $9.98 | |

Institutional Class | | $7,744,656 | | | 775,264 | | | $9.99 | |

A Class | | $6,729,458 | | | 675,171 | | | $9.97* | |

C Class | | $2,781,289 | | | 280,101 | | | $9.93 | |

R Class | | $2,738,765 | | | 275,128 | | | $9.95 | |

*Maximum offering price $10.44 (net asset value divided by 0.955).

See Notes to Financial Statements.

YEAR ENDED JUNE 30, 2013 | |

Investment Income (Loss) | |

Income: | | | |

Interest | | $ 667,381 | |

| | | | |

Expenses: | | | |

Management fees | | 263,411 | |

Distribution and service fees: | | | |

A Class | | 16,942 | |

C Class | | 27,825 | |

R Class | | 13,884 | |

Trustees’ fees and expenses | | 2,045 | |

Other expenses | | 12 | |

| | | 324,119 | |

| | | | |

Net investment income (loss) | | 343,262 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | |

Net realized gain (loss) on: | | | |

Investment transactions | | 34,748 | |

Futures contract transactions | | 15,903 | |

Foreign currency transactions | | 915,627 | |

| | | 966,278 | |

| | | | |

Change in net unrealized appreciation (depreciation) on: | | | |

Investments | | (1,244,615 | ) |

Futures contracts | | 28,275 | |

Translation of assets and liabilities in foreign currencies | | 219,635 | |

| | | (996,705 | ) |

| | | | |

Net realized and unrealized gain (loss) | | (30,427 | ) |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ 312,835 | |

See Notes to Financial Statements.

Statement of Changes in Net Assets |

YEAR ENDED JUNE 30, 2013 AND PERIOD ENDED JUNE 30, 2012 |

Increase (Decrease) in Net Assets | June 30, 2013 | | | June 30, 2012(1) | |

Operations |

Net investment income (loss) | $343,262 | | | $147,416 | |

Net realized gain (loss) | 966,278 | | | 230,791 | |

Change in net unrealized appreciation (depreciation) | (996,705 | ) | | 123,033 | |

Net increase (decrease) in net assets resulting from operations | 312,835 | | | 501,240 | |

| | | | | | |

Distributions to Shareholders | | | | | |

From net investment income: | | | | | |

Investor Class | (288,448 | ) | | — | |

Institutional Class | (267,461 | ) | | — | |

A Class | (204,567 | ) | | — | |

C Class | (65,224 | ) | | — | |

R Class | (77,792 | ) | | — | |

From net realized gains: | | | | | |

Investor Class | (11,399 | ) | | — | |

Institutional Class | (10,045 | ) | | — | |

A Class | (8,707 | ) | | — | |