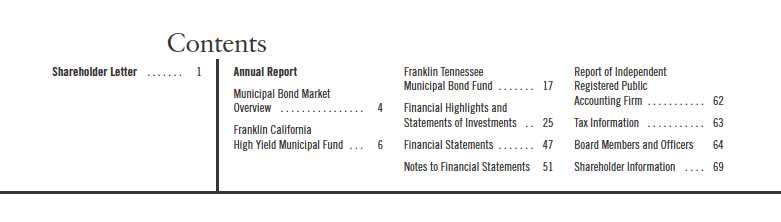

Annual Report

Municipal Bond Market Overview

For the 12 months ended May 31, 2012, the municipal bond market posted robust gains as measured by the +10.40% return of the Barclays Municipal Bond Index, which tracks investment-grade securities.1 Over the reporting period municipal bonds generally outperformed Treasuries, which returned +9.05% according to the Barclays U.S. Treasury Index, which tracks various U.S. Treasury securities.1

During the reporting period, domestic and global events affected the municipal bond market. Domestically, the Federal Reserve Board’s (Fed’s) commitment to maintain an accommodative monetary policy stance with historically low interest rates supported the municipal market. The market was further supported by an extended period of low supply, thus reducing the availability of bonds to meet investor demand. In Europe, several countries struggled with financial challenges that resulted in a flight to quality benefiting the U.S. Treasury market, as well as the municipal bond market.

From a credit perspective, on August 2, 2011, the U.S. raised its debt ceiling and avoided defaulting on its debt obligations. Independent credit rating agency Standard & Poor’s (S&P) lowered the country’s long-term Treasury bond rating to AA+ from AAA, citing political risks and a rising debt burden.2 All municipal bonds backed by the U.S. government or government-sponsored enterprises (GSEs) were also downgraded along with the country’s rating and those of GSEs. S&P’s downgrade of U.S. Treasury securities led to the review of more than 11,000 municipal credits supported by federal programs and agency escrows. Primarily, prerefunded municipal bonds and housing bonds tied to federal subsidy programs were affected by the downgrade, although they generally still carried high-grade ratings. Furthermore, on July 19, 2011, independent credit rating agency Moody’s Investors Service placed five Aaa-rated states on its watch list for potential rating cuts partly based on their dependency on federal funding. After the debt ceiling was raised, Moody’s reconfirmed the Aaa rating to states and public finance issuers previously identified as directly or indirectly linked to the U.S. government.2

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. These do not indicate ratings of the Funds.

4 | Annual Report

Congress enacted the Budget Control Act of 2011 with the intention of reducing the federal deficit by approximately $2 trillion by 2021. While the plan of action is unknown, one can expect reduced federal funding, which would impact state and local programs dependent on federal subsidies. State and local officials may need to reevaluate current budget forecasts and the potential effects. Despite facing fiscal restraints and broad budget cuts to achieve balance, many states continued to show mild growth in revenues, and the actual default rate for municipal bonds was very low.

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income while seeking value in the municipal bond market.

The foregoing information reflects our analysis and opinions as of May 31, 2012, the end of the reporting period. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

Annual Report | 5

Franklin California

High Yield Municipal Fund

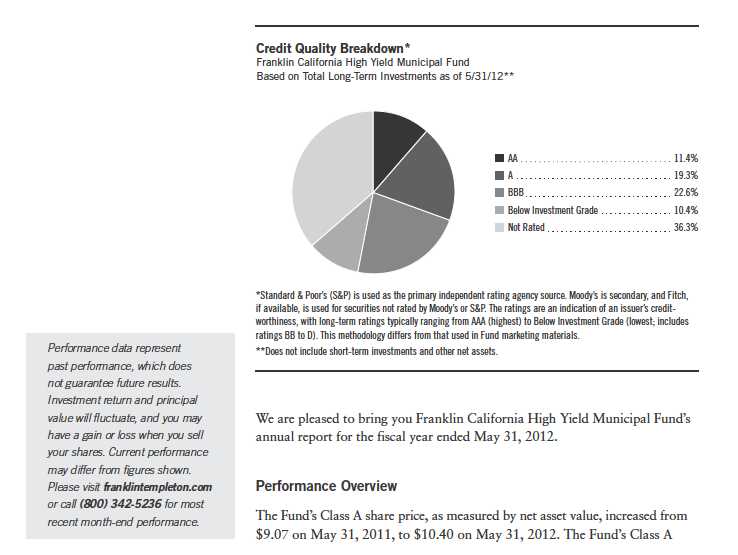

Your Fund’s Goals and Main Investments: Franklin California High Yield Municipal Fund seeks to provide a high level of income exempt from federal and California personal income taxes by investing at least 80% of its net assets in municipal securities, including higher yielding, lower rated securities, that pay interest free from such taxes.1 Its secondary goal is capital appreciation.

1. The Fund may invest up to 100% of its assets in bonds whose interest payments are subject to federal alternative minimum tax. All or a significant portion of the income on these obligations may be subject to such tax. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

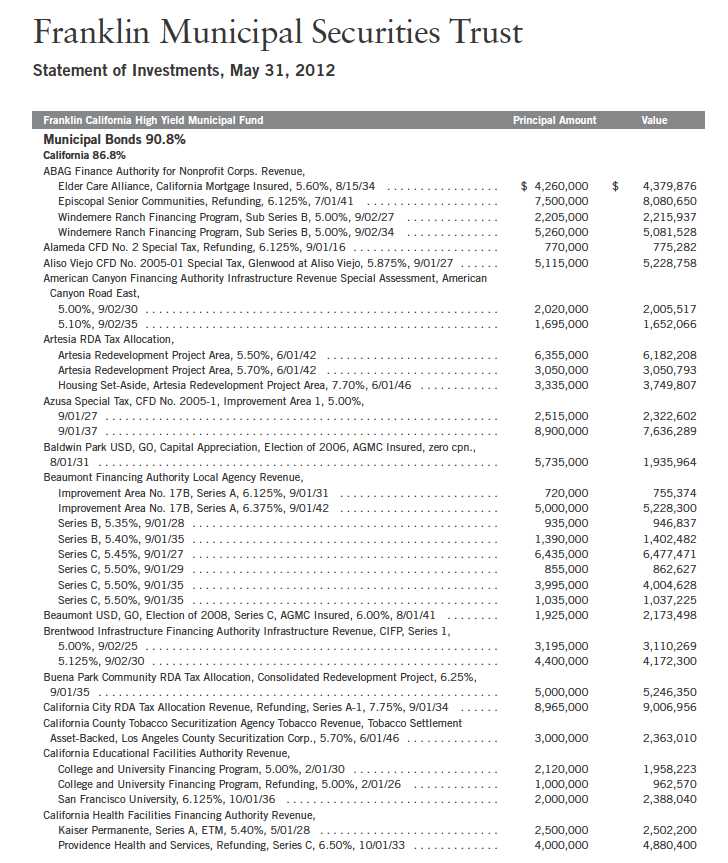

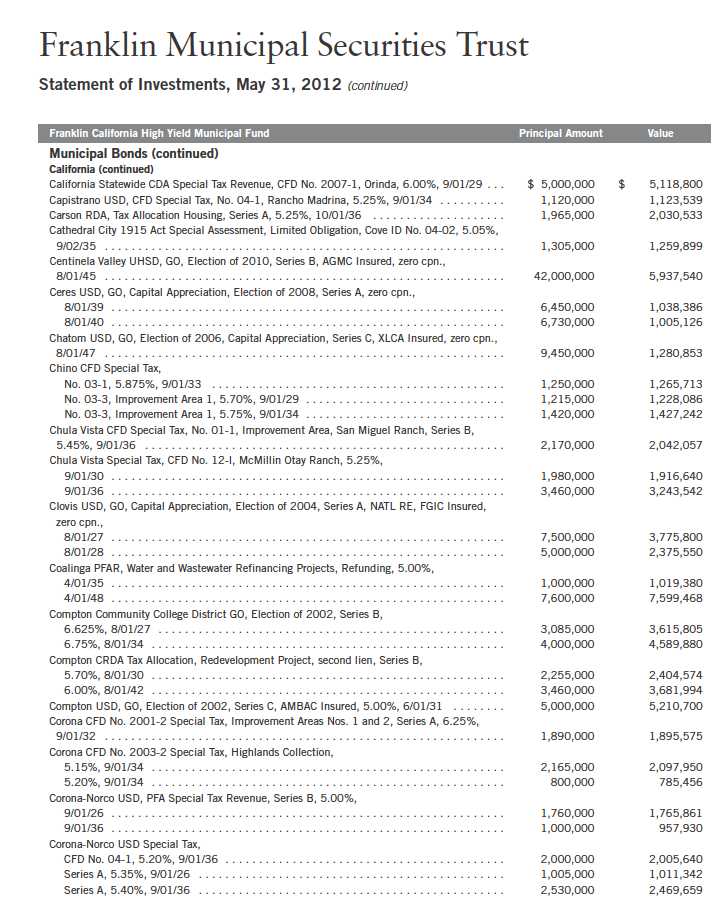

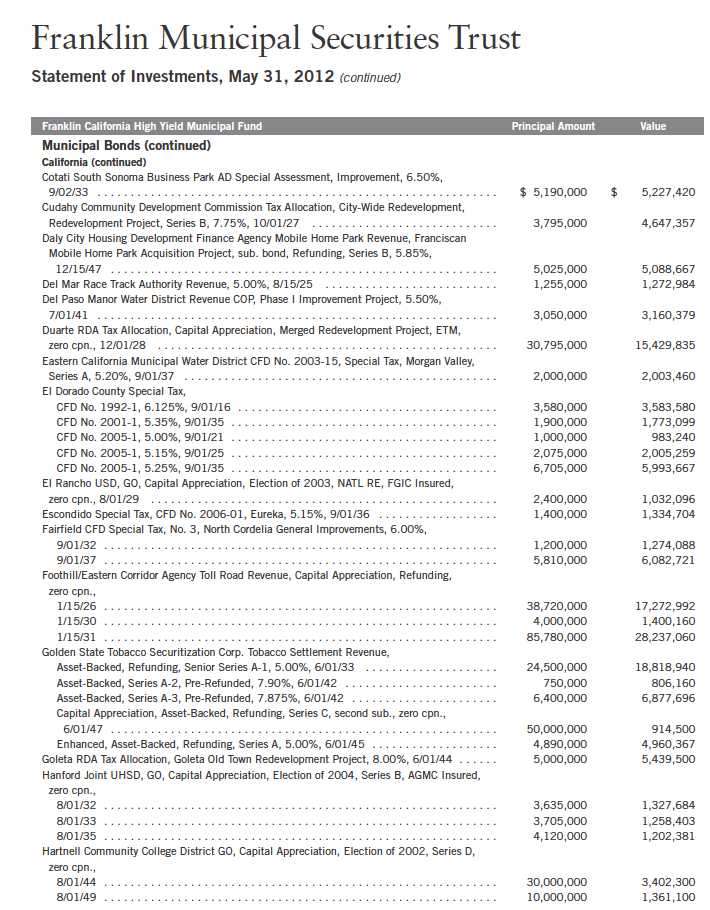

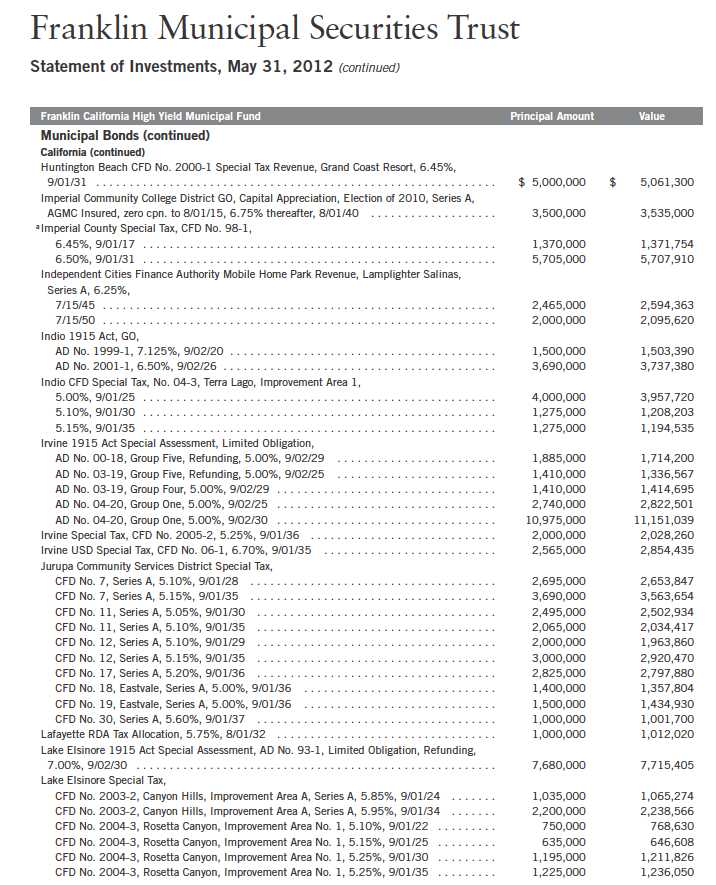

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 29.

6 | Annual Report

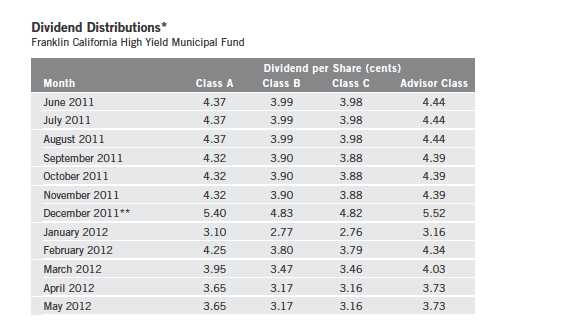

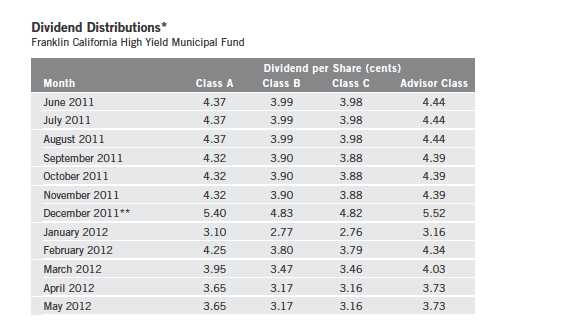

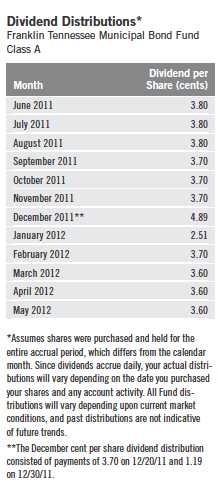

*Assumes shares were purchased and held for the entire accrual period, which differs from the calendar month. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**The December cent per share dividend distribution consisted of payments on 12/21/11 and 12/30/11 for each class as follows: Class A, 4.25 and 1.15; Class B, 3.80 and 1.03; Class C, 3.79 and 1.03; and Advisor Class, 4.34 and 1.18.

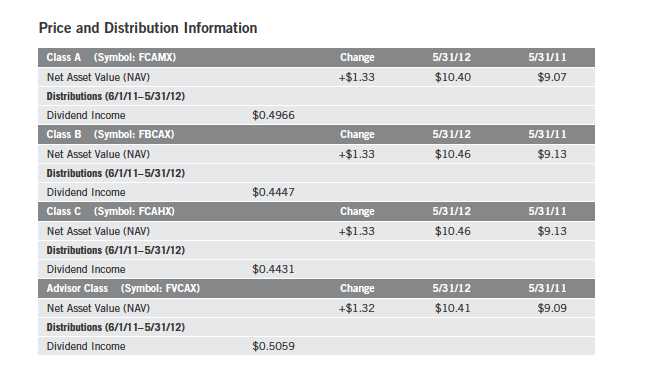

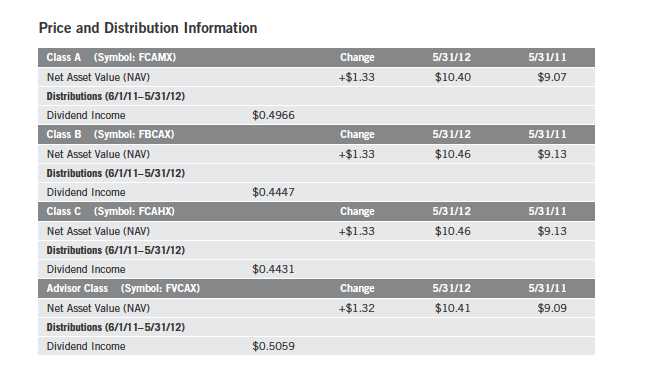

shares paid dividends totaling 49.66 cents per share for the reporting period.2 The Performance Summary beginning on page 10 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 4.03% based on an annualization of the current 3.65 cent per share monthly dividend and the maximum offering price of $10.86 on May 31, 2012. An investor in the 2012 maximum combined effective federal and California personal income tax bracket of 41.05% would need to earn a distribution rate of 6.84% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class B, C and Advisor shares’ performance, please see the Performance Summary. The reduction in dividend distributions from the start to the end of the period under review reflected generally declining interest rates. Additionally, investor demand was strong for municipal bonds in an environment of limited tax-exempt supply. These factors resulted in reduced income for the portfolio and caused dividends to decline overall.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Annual Report | 7

State Update

California’s economy continued its post-recession recovery albeit at a slower pace than the nation as a whole. Persistently weak real estate markets, high foreclosure rates and low homebuilding activity hindered the state’s economy, reducing its citizens’ household wealth levels. California’s 10.8% unemployment rate in May was significantly higher than the 8.2% national rate.3 The mining and logging, information, and professional and business services sectors posted the strongest 12-month growth rates, while the government and other services sectors declined.

California enacted an on-time fiscal year 2012 (ended June 30, 2012) budget that addressed a budget shortfall with deep spending cuts across state services and employment. This approach to the budget gap relied on a recent, above-par revenue trend but had built-in spending-cut triggers if the additional revenues did not materialize. Nevertheless, as state revenues during the first half of fiscal year 2012 were below expectations, mandated mid-year spending cuts, including reductions to health services and education, came into effect in mid-December. The governor filed an initiative calling for increased income taxes for high-income earners for five years and a temporary increase to the sales tax, with the additional revenues dedicated solely to funding education.

In January 2012, the state forecast it would face a fiscal year 2013 projected budget gap resulting from an accumulated deficit from fiscal year 2012 and a 2013 structural deficit. In May 2012, the Department of Finance released its revised budget, which projected the deficit to be larger than previously estimated for fiscal year 2013. State officials attributed the increased shortfall to lower-than-expected tax collections, constitutionally mandated annual increases in education spending (arising from Proposition 98) and health spending cuts that were blocked by the federal government.

The state’s net tax-supported debt was $2,559 per capita and 6.0% of personal income, compared with the $1,117 and 2.8% national medians.4 Although California’s debt levels ranked among the nation’s highest, they were relatively moderate given the state’s large budget. However, Californians’ debt ratios are likely to increase in the next few years, with sizable outstanding tax-supported debt and unused voter authorizations for the future issuance of general fund backed general obligation (GO) bonds. Independent credit rating agency Standard & Poor’s (S&P) in February 2012 affirmed California’s GO bond

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, “Median Report: 2012 State Debt Medians Report,” 5/22/12.

8 | Annual Report

rating of A- (the lowest of any state) and upgraded its outlook to positive from stable.5 S&P’s rating and revised outlook acknowledged the state’s economic depth and diversity, prominent higher-education institutions, innovative businesses and sectors, as well as improved liquidity and budgeting flexibility that helps maintain adequate cash for priority payments. These positives were counterbalanced by California’s large debt, retirement benefit and budgetary liabilities, cuts to higher education funding that may affect prominent state universities, as well as potentially onerous governance rules that have contributed to delayed fiscal decision making over the years.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders while balancing risk and return within the Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or exotic derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets. We generally stay fully invested to help maximize income distribution.

Manager’s Discussion

Consistent with our strategy, we sought to remain fully invested in bonds that maintain an average weighted maturity of 15 to 30 years with good call features. Based on the combination of our value-oriented philosophy of investing primarily for income and a positively sloping municipal yield curve, we favored the use of longer term bonds. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

Thank you for your continued participation in Franklin California High Yield Municipal Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

5. This does not indicate S&P’s rating of the Fund.

Annual Report | 9

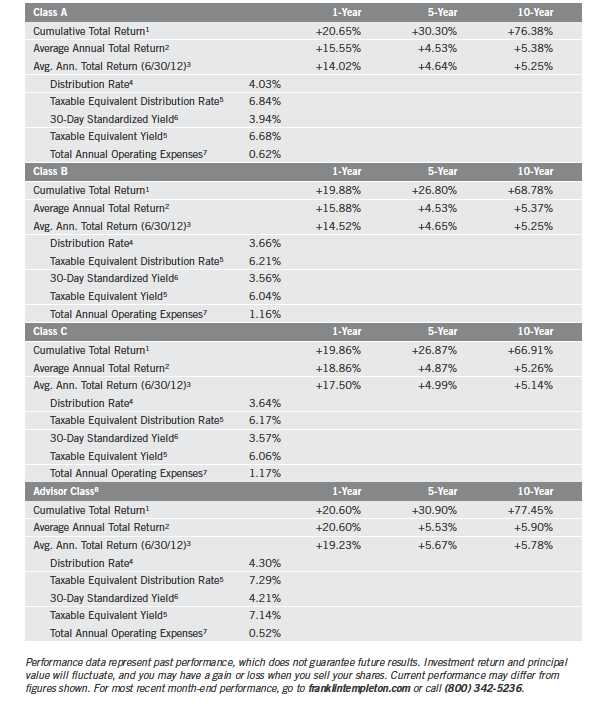

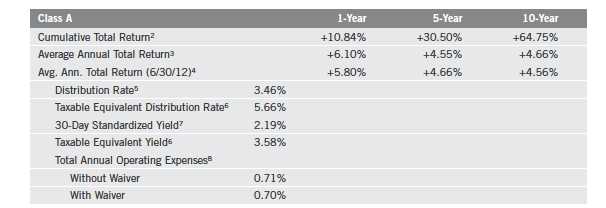

Performance Summary as of 5/31/12

Franklin California High Yield Municipal Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

10 | Annual Report

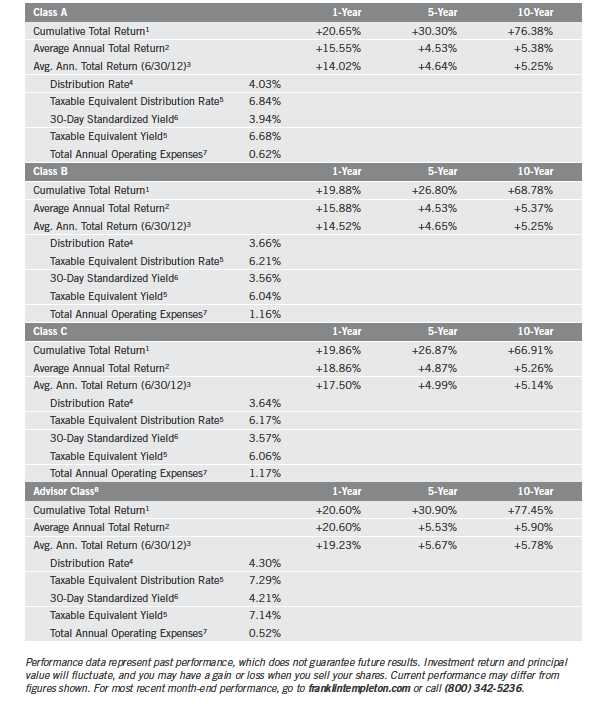

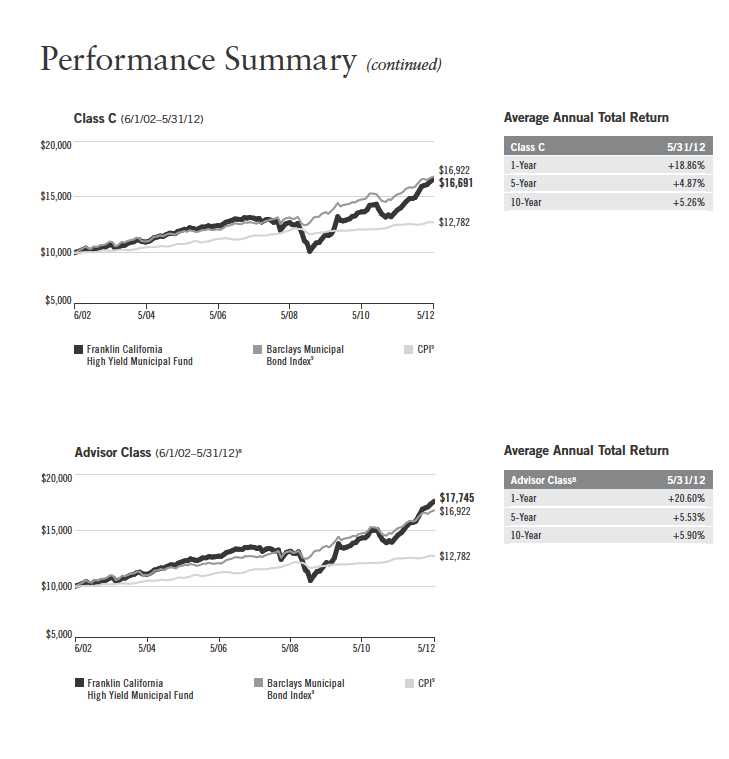

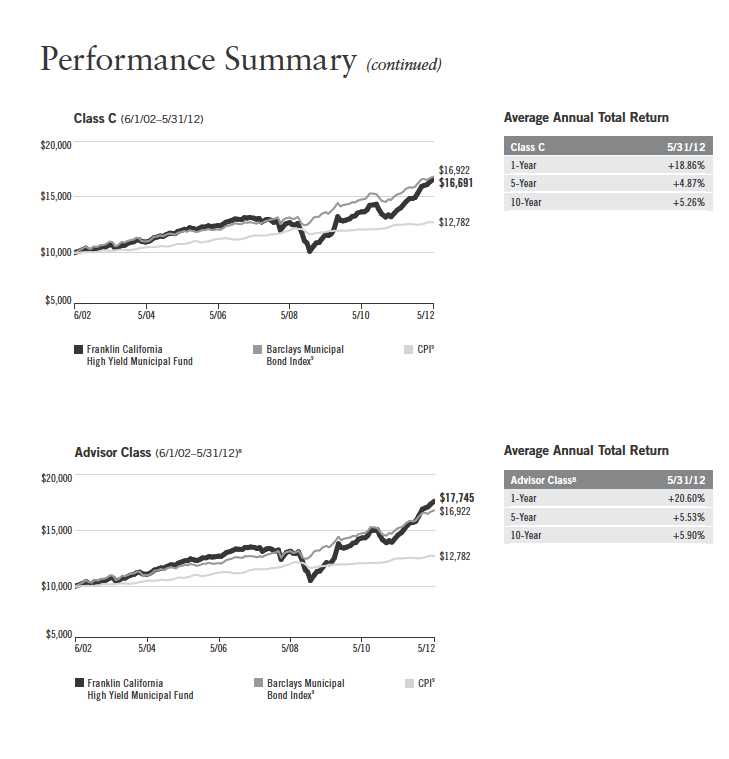

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

Annual Report | 11

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

12 | Annual Report

Annual Report | 13

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. Since the Fund concentrates its investments in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. In general, an investor is paid a higher yield to assume a greater degree of credit risk. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes B, C and Advisor) per share on 5/31/12.

5. Taxable equivalent distribution rate and yield assume the published rates as of 12/28/11 for the maximum combined effective federal and California state personal income tax bracket of 41.05%, based on the federal income tax rate of 35.00%.

6. The 30-day standardized yield for the 30 days ended 5/31/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 11/15/06, the Fund began offering Advisor class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 11/15/06, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 11/15/06, actual Advisor class performance is used reflecting all charges and fees applicable to that class. Since 11/15/06 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +33.20% and +5.31%.

9. Source: © 2012 Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

14 | Annual Report

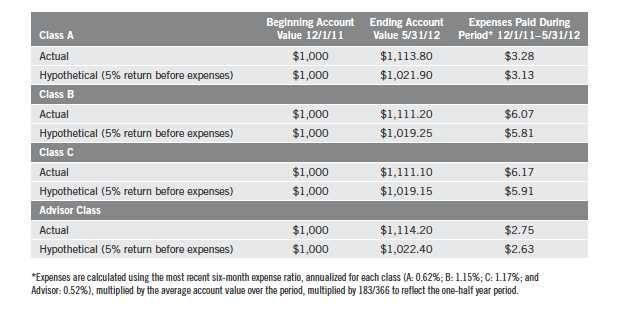

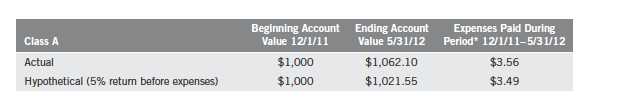

Your Fund’s Expenses

Franklin California High Yield Municipal Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 15

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

16 | Annual Report

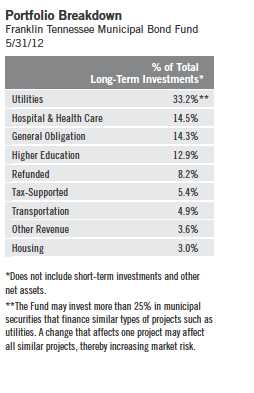

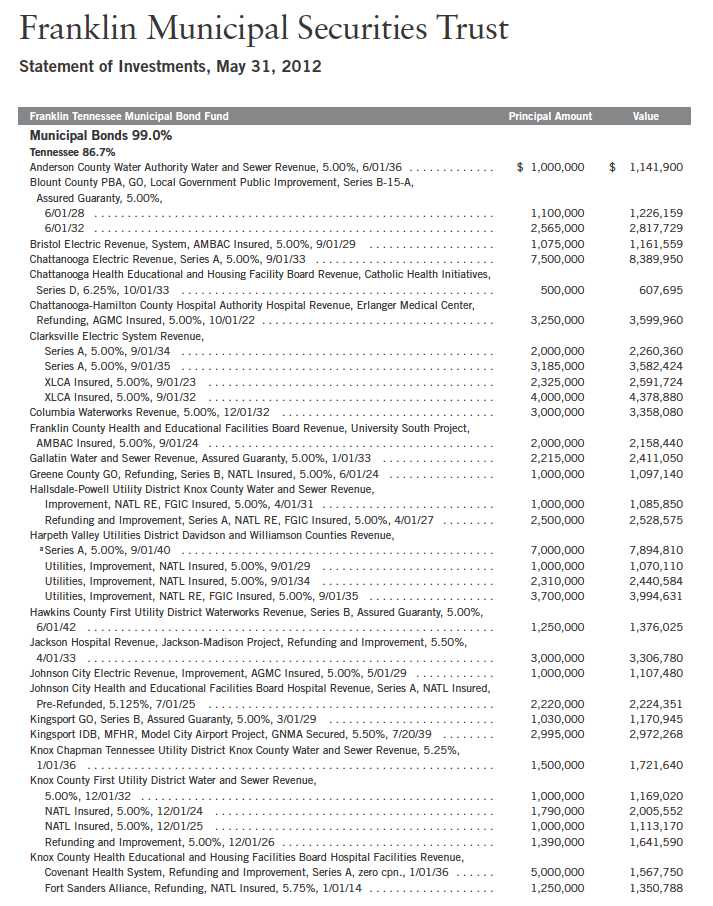

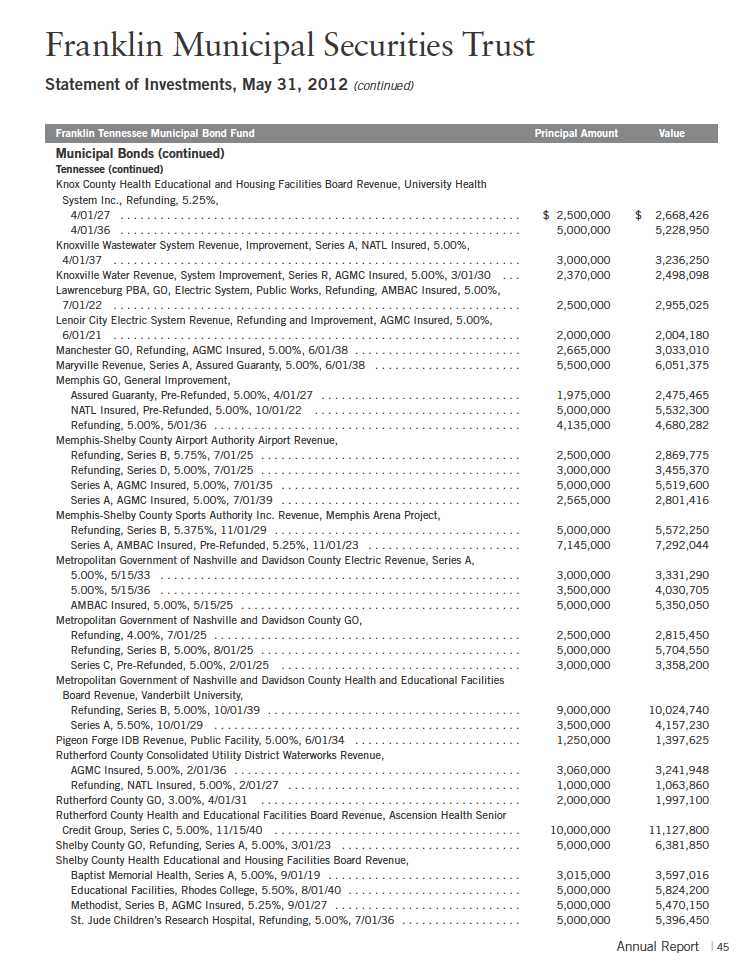

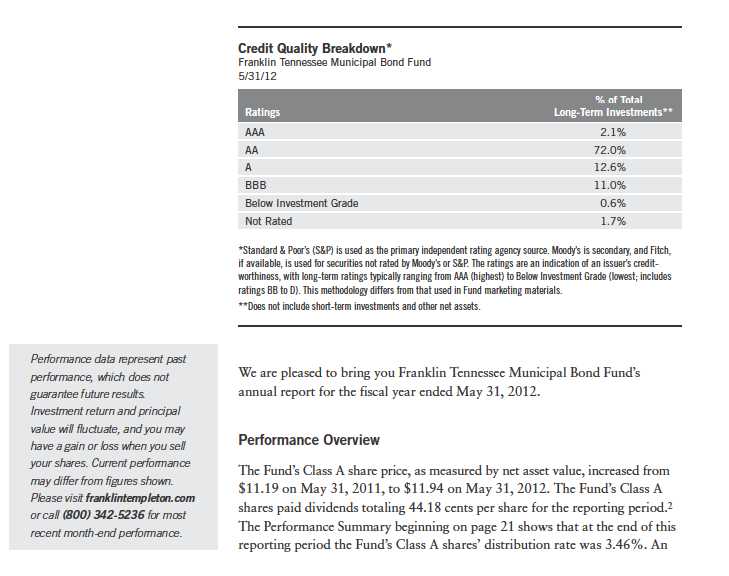

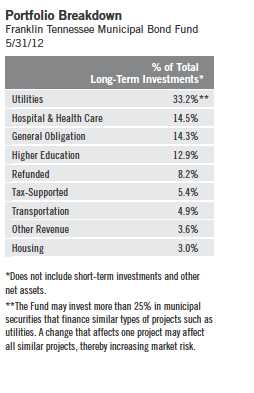

Franklin Tennessee Municipal Bond Fund

Your Fund’s Goal and Main Investments: Franklin Tennessee Municipal Bond Fund seeks to maximize income exempt from federal and Tennessee personal income taxes, consistent with prudent investing and the preservation of capital, by investing at least 80% of its net assets in investment grade municipal securities that pay interest free from such taxes.1

1. The Fund may invest as much as 100% of its assets in bonds whose interest payments are subject to federal alternative minimum tax. All or a significant portion of the income on these obligations may be subject to such tax. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

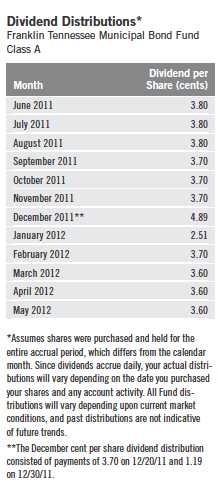

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

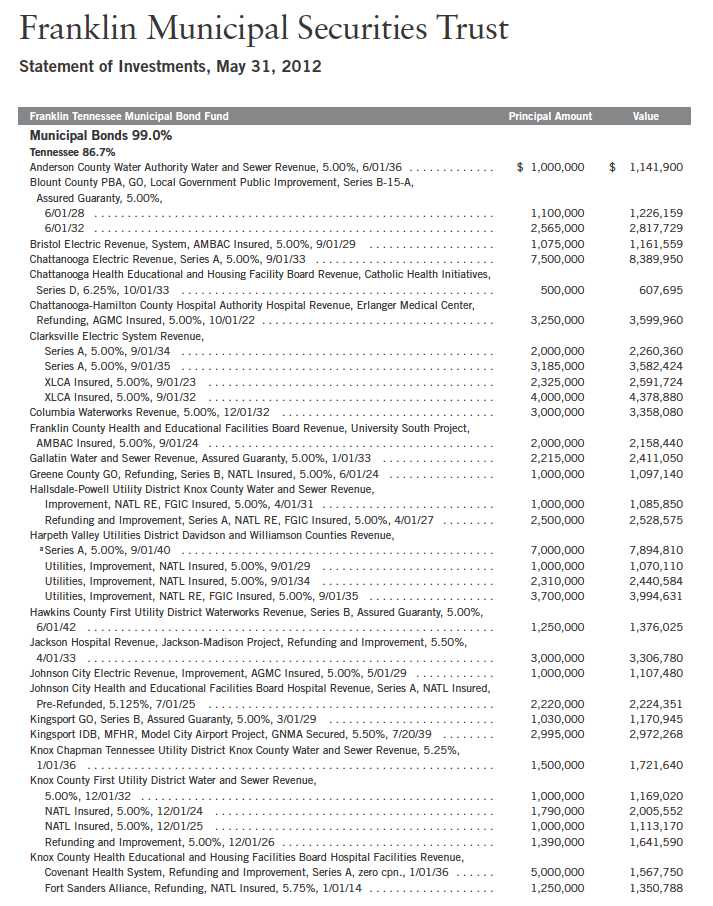

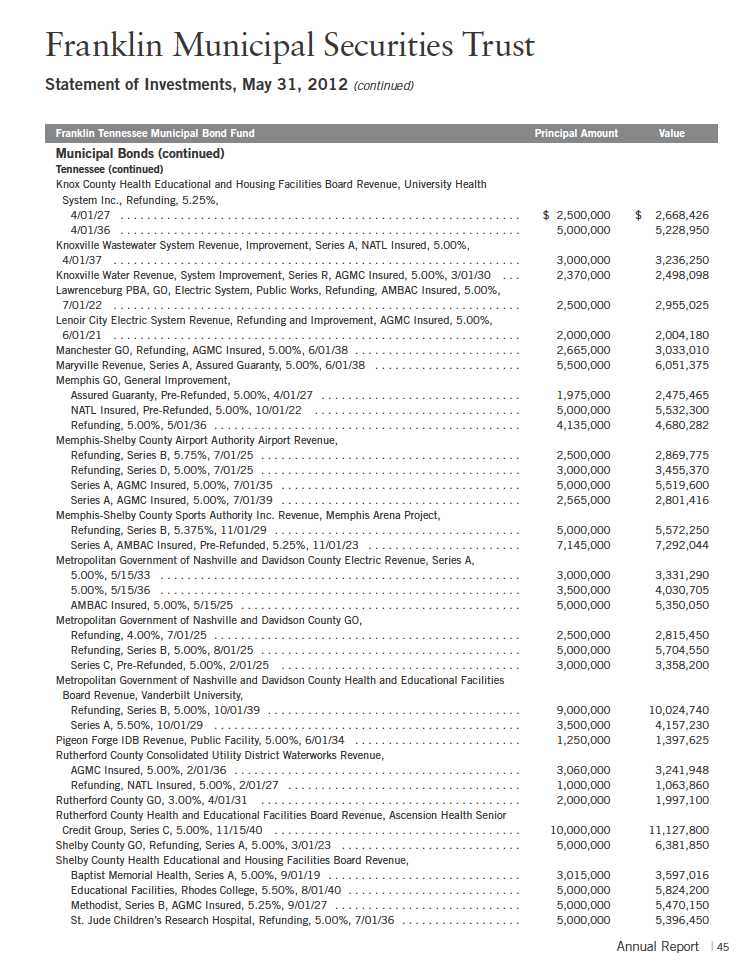

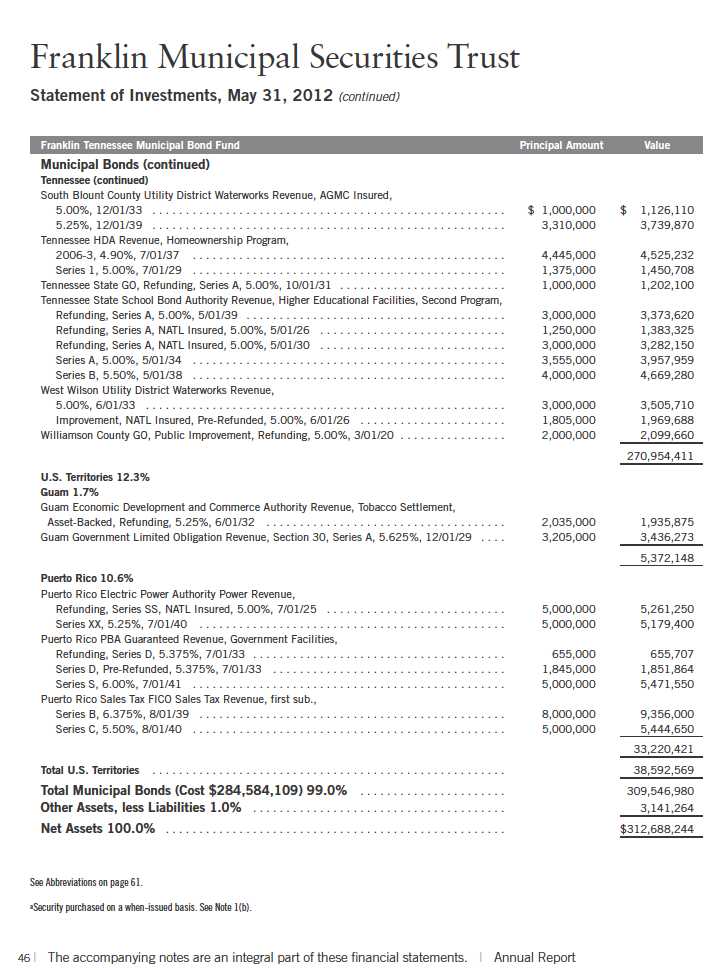

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 44.

Annual Report | 17

investor in the 2012 maximum combined effective federal and Tennessee personal income tax bracket of 38.90% would need to earn a distribution rate of 5.66% from a taxable investment to match the Fund’s Class A tax-free distribution rate. The reduction in dividend distributions from the start to the end of the period under review reflected generally declining interest rates. Additionally, investor demand was strong for municipal bonds in an environment of limited tax-exempt supply. These factors resulted in reduced income for the portfolio and caused dividends to decline overall.

State Update

During the Fund’s fiscal year under review, Tennessee’s economy continued to improve as key revenues exceeded official estimates and the state’s economic development initiatives attracted private sector investment. The state made the largest bond issuance in its history and intended to use the proceeds to fund ongoing economic development efforts and to retire existing obligations. Indicative of high demand for Tennessee bonds, the offering was nearly four times oversubscribed. During 2011, personal income rose, and building permits increased during the last half of 2011 to the highest level in three years. Although state mortgage delinquency rates were slightly higher than the nation’s and housing prices continued to decline, national foreclosure rates far exceeded those in Tennessee.

Tennessee benefited from expanded industrial development that increased per-capita personal income and related tax revenues. State officials estimated that economic development grants for Hemlock Semiconductor, Wacker Chemie and Electrolux may create 2,650 permanent jobs.3 Due to these efforts, its perceived business-friendly regulations and tax structure, as well as lower cost of living and vicinity to major U.S. economic and population centers, Tennessee has gained a number of manufacturers as well as FedEx, the state’s biggest employer. In the automotive industry, General Motors announced it expected to add 1,900 jobs over the next two years at the formerly idle Spring Hill plant, and Volkswagen’s new plant in Chattanooga may result in another 2,000 permanent jobs, not to mention Nissan’s plans to build electric motors and batteries as well as motors for Mercedes Benz.4 This expected expansion in auto manufacturing has the potential to create thousands of other jobs in related industries.

The state’s unemployment rate declined from 9.4% at the beginning of the period, compared with the 9.0% national rate at that time, to 7.9% in May

3. Moody’s Investors Service, “New Issue: Moody’s Assigns Aaa to Tennessee’s $385 Million of General Obligation Bonds, 2012 Refunding Series A,” 2/9/12.

4. Source: Tennessee Comptroller of the Treasury.

18 | Annual Report

2012, which was lower than the 8.2% national rate.5 The manufacturing; professional and business services; and mining, logging and construction sectors had the greatest gains during the Fund’s fiscal year, while the trade, transportation and utilities sector, one of the state’s largest areas of employment, lost jobs along with the information and financial activities sectors. In keeping with its trend of having among the lowest net tax-supported debt of all states during the past 20 years, Tennessee’s debt levels were 1.0% of personal income and $343 per capita, both very low compared with the national medians of 2.8% and $1,117.6

The General Assembly unanimously approved the fiscal year 2012 (ended June 30, 2012) budget and the governor signed it into law in June 2011. Calendar year 2011 sales tax revenues, which constituted a substantial amount of overall collections, were up year-over-year and may indicate the strength of the current recovery, although these levels are less than the pre-recession peak. At the end of January 2012, Governor Haslam proposed a fiscal year 2013 budget intended to curb spending below projected revenue growth and build reserves to replace funds withdrawn since the recession.

Independent credit rating agency Moody’s Investors Service affirmed its Aaa rating for Tennessee’s general obligation bonds and upgraded to a stable outlook based on the state’s relatively lower level of financial and economic exposure to the U.S. economy. Moody’s cited the state’s relatively strong finances with adequate reserves, well-funded pensions, low debt levels and long history of conservative fiscal policy.7 Some challenges cited include no personal income tax on wages and governance limitations such as requiring legislative approval for any mid-year budget reductions.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders while balancing risk and return within the Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or exotic derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets. We generally stay fully invested to help maximize income distribution.

5. Source: Bureau of Labor Statistics.

6. Source: Moody’s Investors Service, “Median Report: 2012 State Debt Medians Report,” 5/22/12.

7. This does not indicate Moody’s rating of the Fund.

Annual Report | 19

Manager’s Discussion

Consistent with our strategy, we sought to remain fully invested in bonds that maintain an average weighted maturity of 15 to 30 years with good call features. Based on the combination of our value-oriented philosophy of investing primarily for income and a positively sloping municipal yield curve, we favored the use of longer term bonds. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

Thank you for your continued participation in Franklin Tennessee Municipal Bond Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

20 | Annual Report

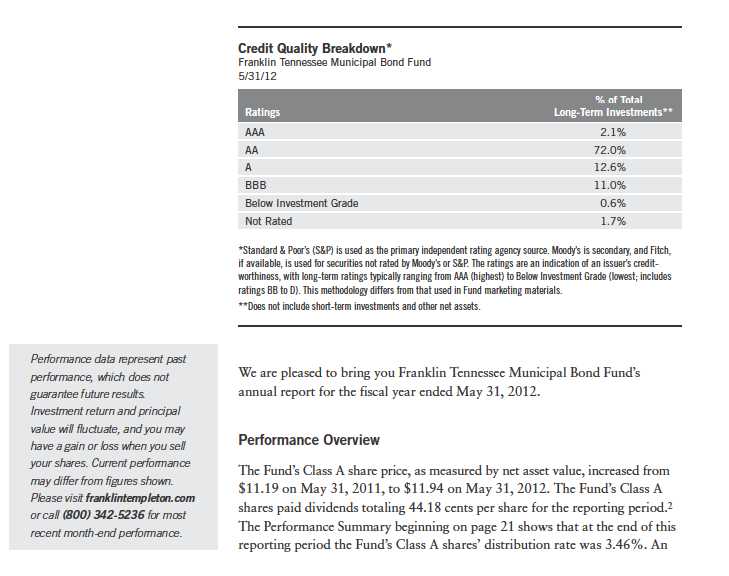

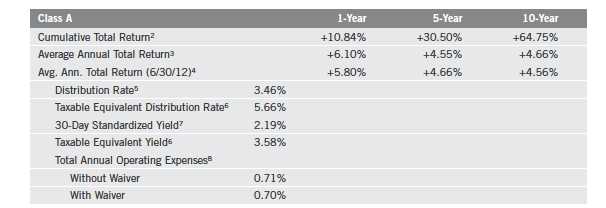

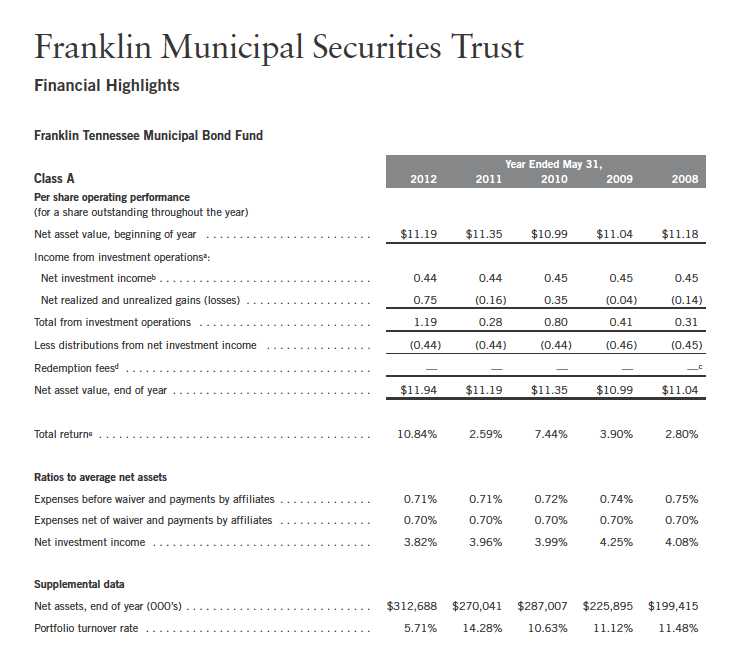

Performance Summary as of 5/31/12

Franklin Tennessee Municipal Bond Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance1

Cumulative total return excludes the sales charge. Average annual total returns include the maximum sales charge.

Class A: 4.25% maximum initial sales charge.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees) do not exceed 0.60% (other than certain nonroutine expenses) until 9/30/12.

Annual Report | 21

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes the maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the

Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus,

as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond

issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment

decisions will produce the desired results. Since the Fund concentrates its investments in a single state, it is subject to greater risk of adverse

economic and regulatory changes in that state than a geographically diversified fund. The Fund’s prospectus also includes a description of the

main investment risks.

1. Fund investment results reflect the expense reduction, without which the Fund’s distribution rate and total return would have been lower, and yield

for the period would have been 2.19%.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the current 3.60 cent per share monthly dividend and the maximum offering price of $12.47 per

share on 5/31/12.

6. Taxable equivalent distribution rate and yield assume the published rates as of 12/28/11 for the maximum combined effective federal and

Tennessee state personal income tax rate of 38.90%, based on the federal income tax rate of 35.00%.

7. The 30-day standardized yield for the 30 days ended 5/31/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

8. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly,

causing total annual Fund operating expenses to become higher than the figures shown.

9. Source: © 2012 Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond

market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or

higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S.

Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

22 | Annual Report

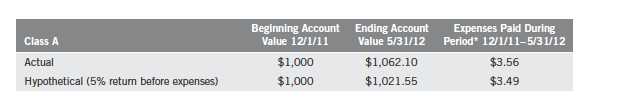

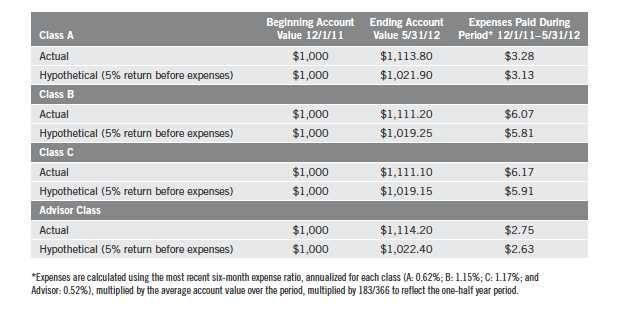

Your Fund’s Expenses

Franklin Tennessee Municipal Bond Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 23

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, of 0.70%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

24 | Annual Report

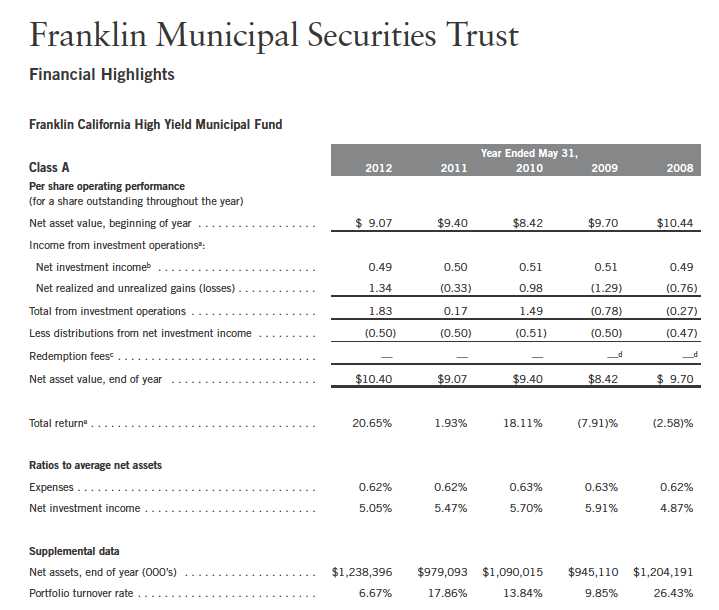

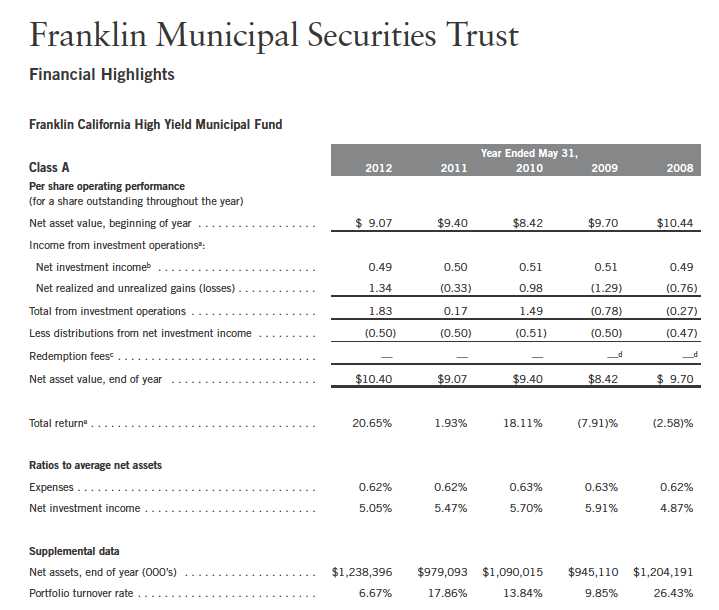

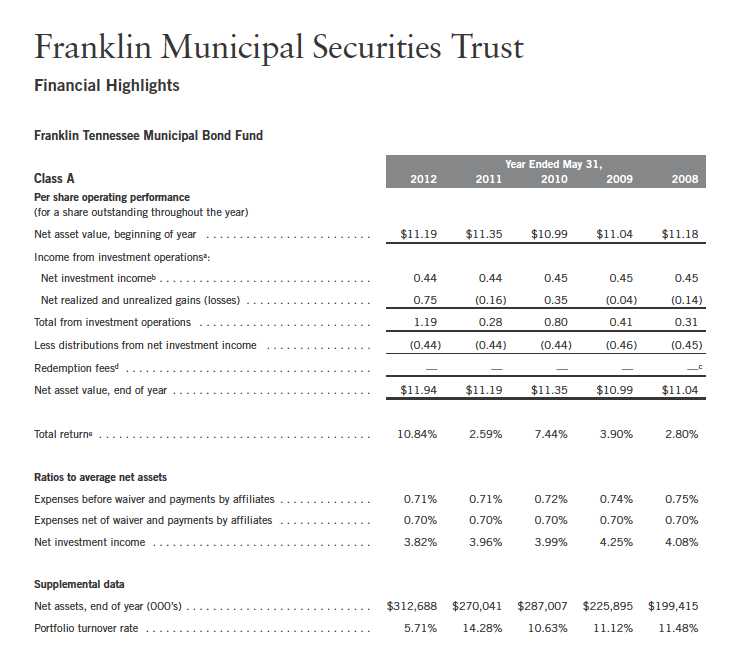

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

Annual Report | The accompanying notes are an integral part of these financial statements. | 25

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

26 | The accompanying notes are an integral part of these financial statements. | Annual Report

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

Annual Report | The accompanying notes are an integral part of these financial statements. | 27

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

28 | The accompanying notes are an integral part of these financial statements. | Annual Report

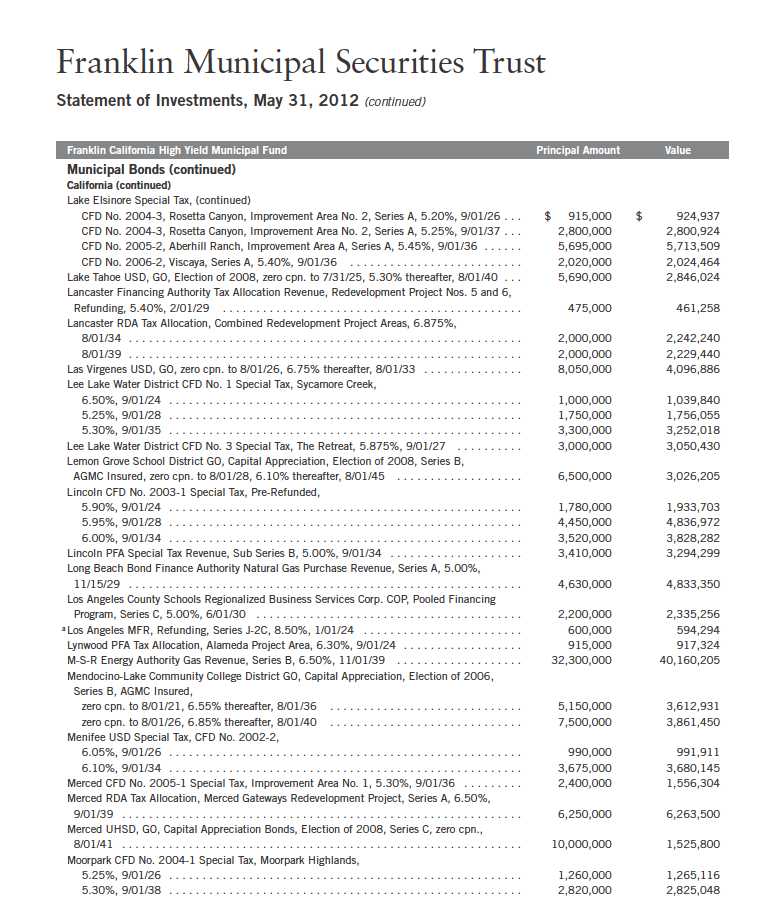

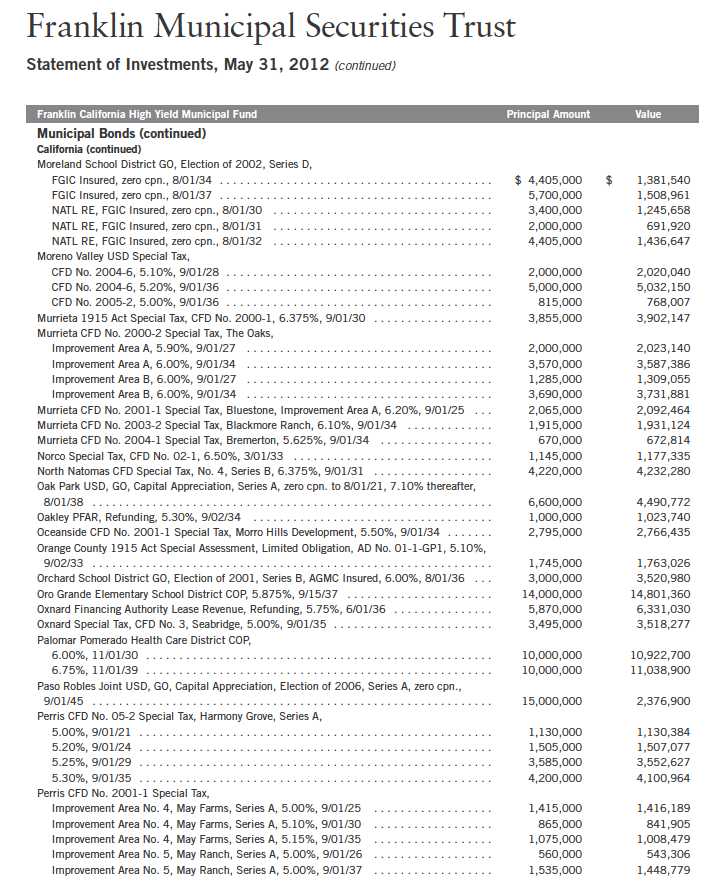

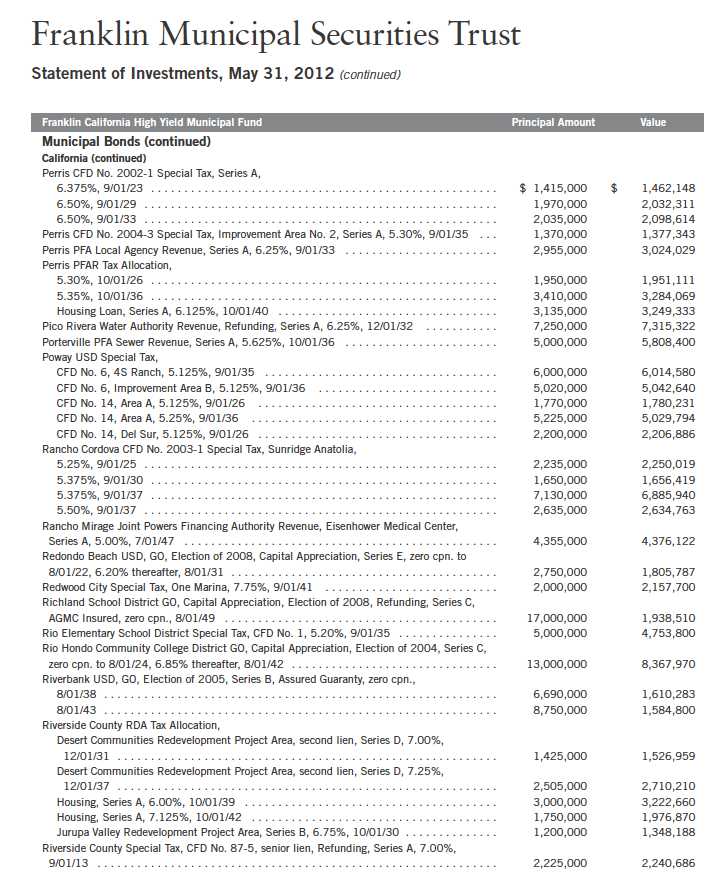

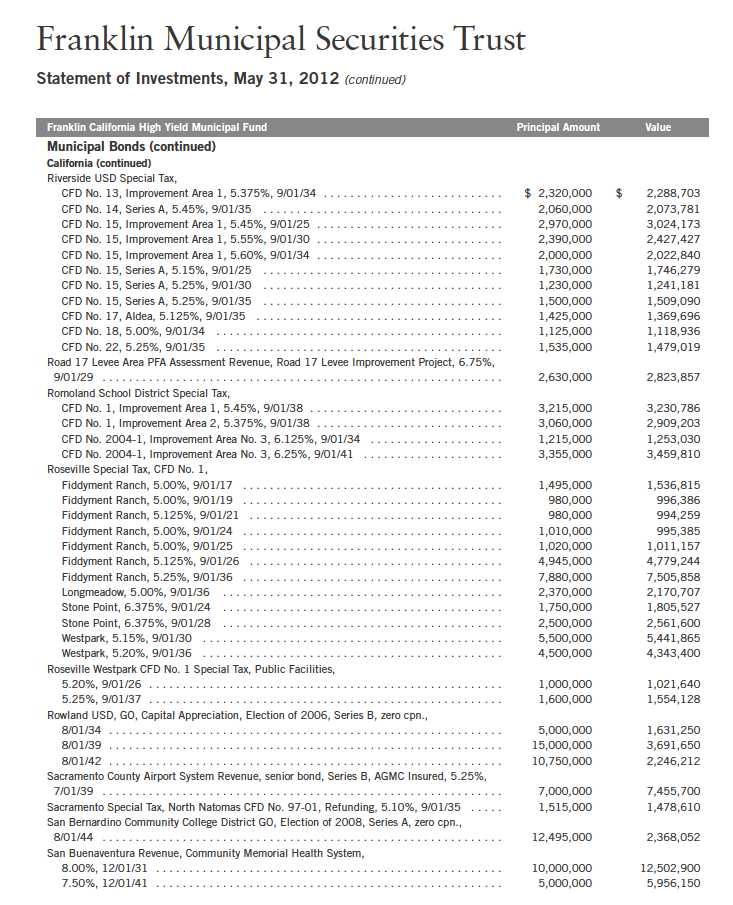

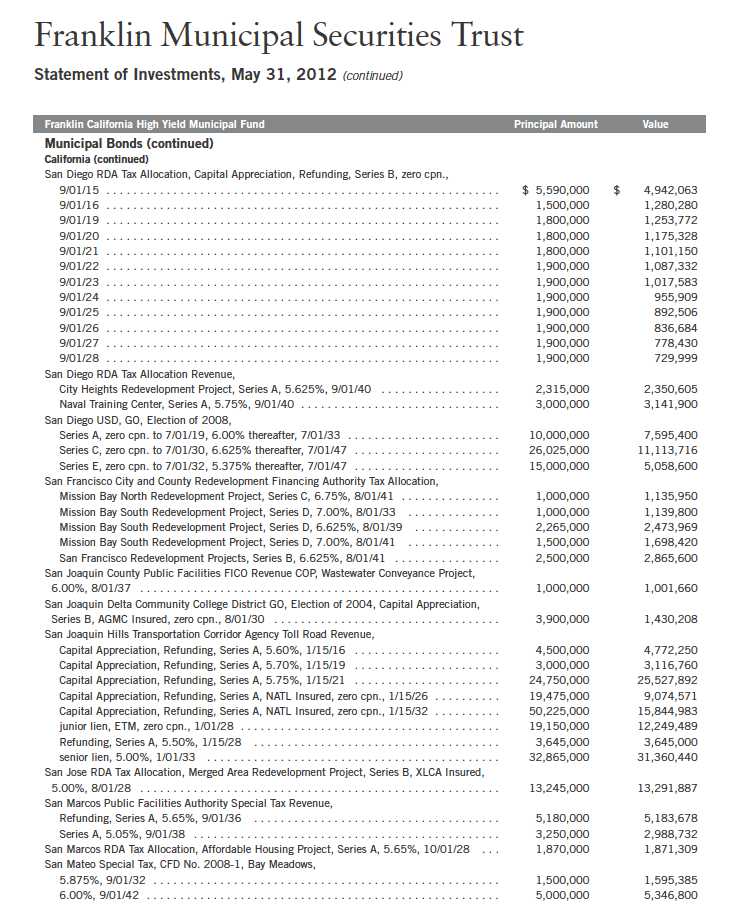

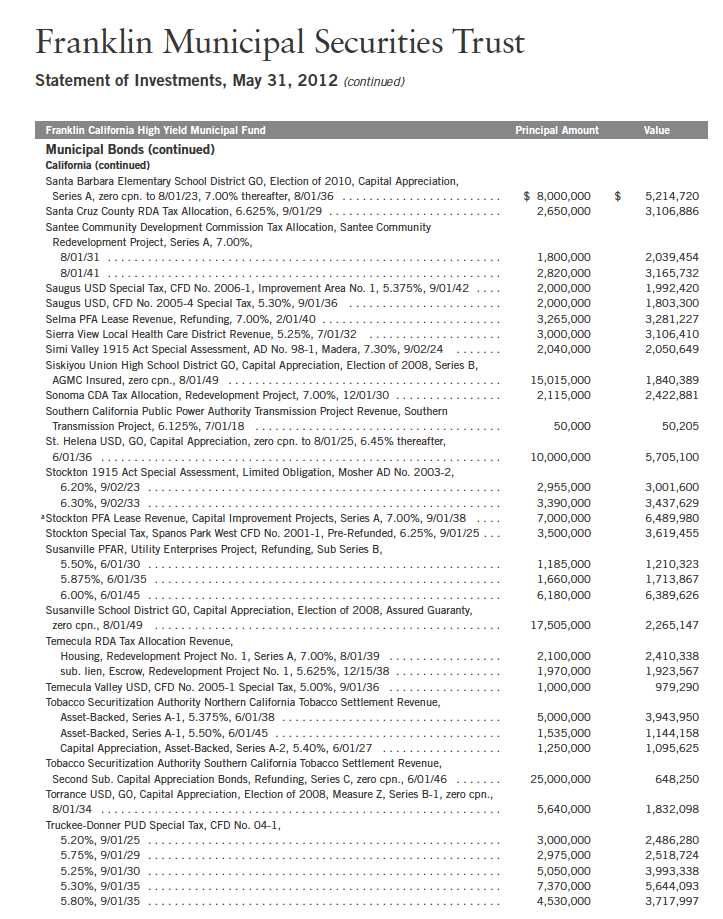

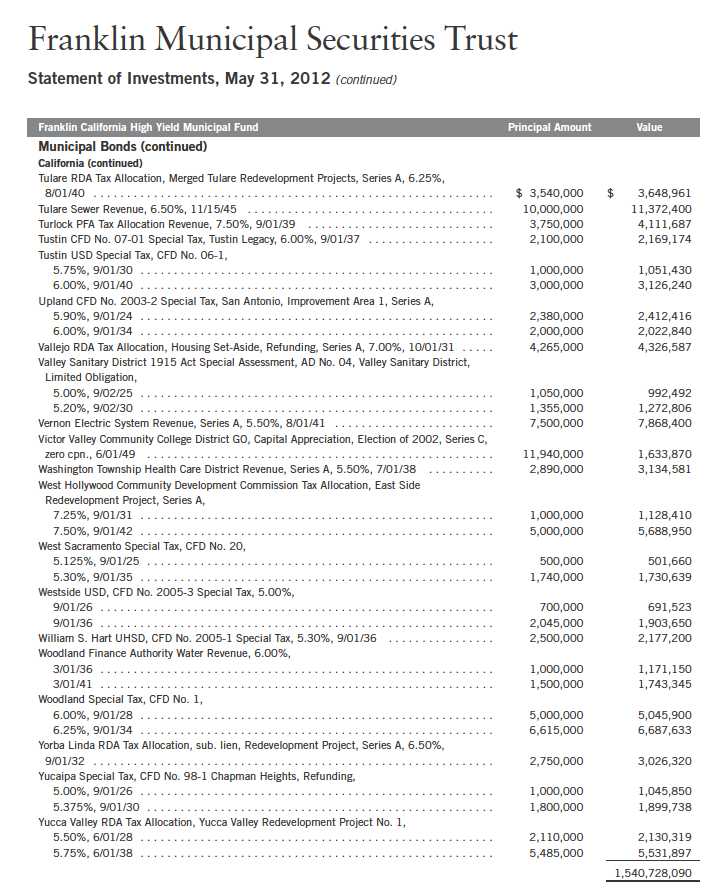

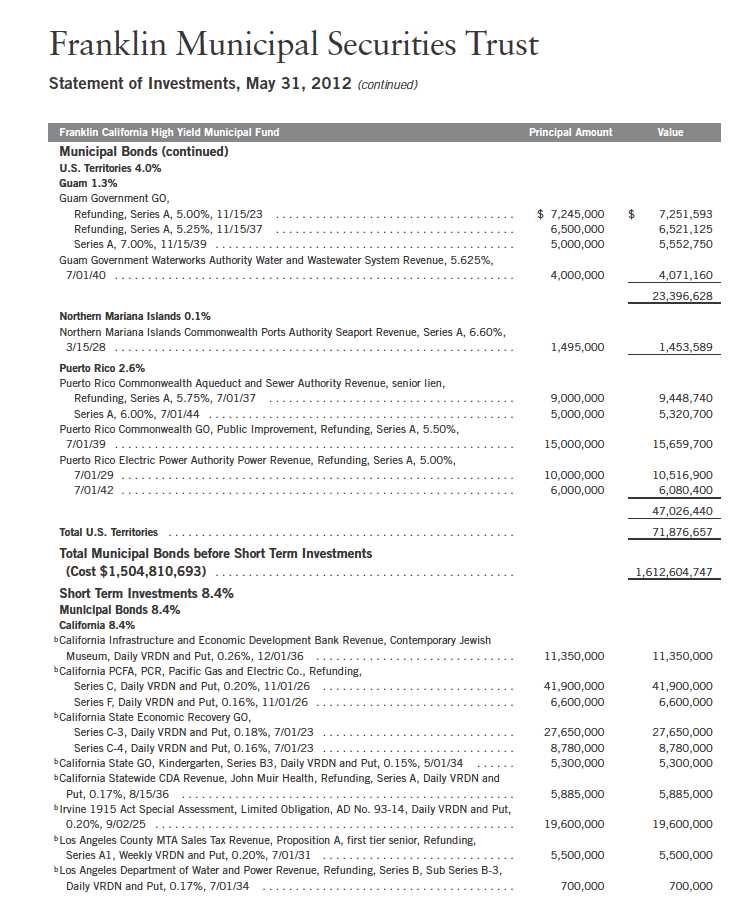

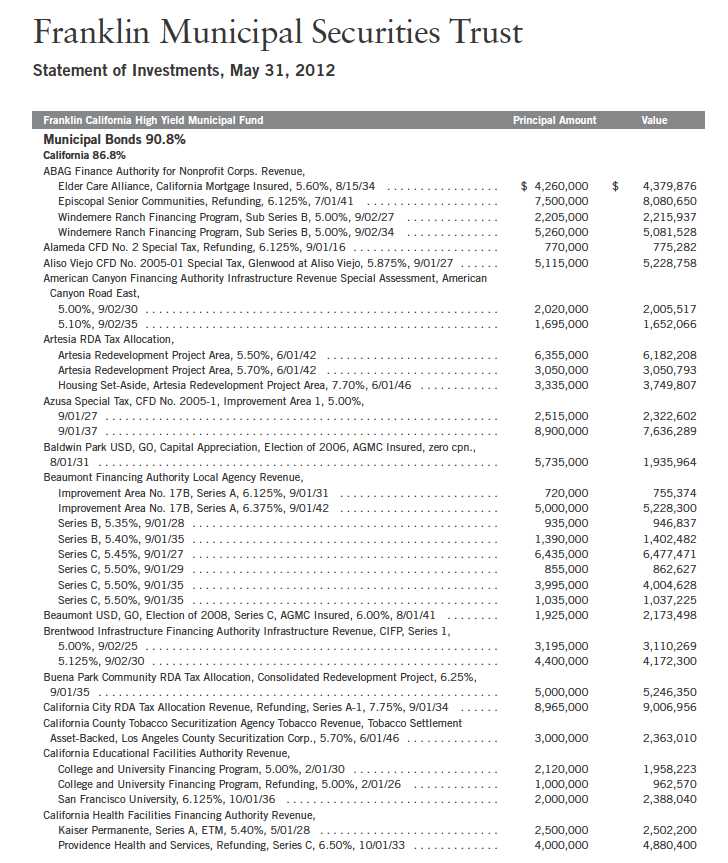

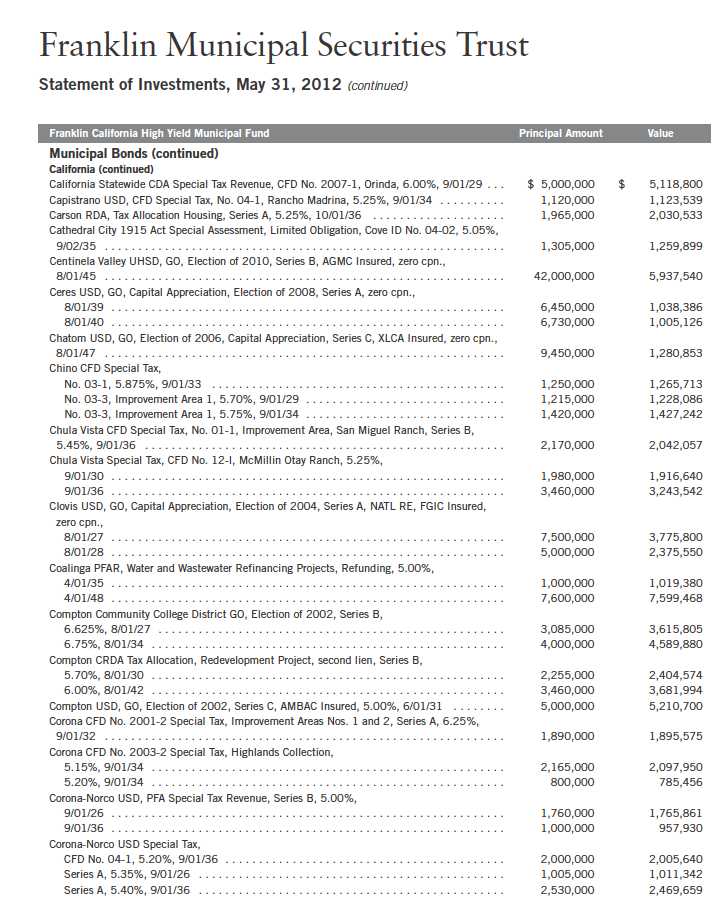

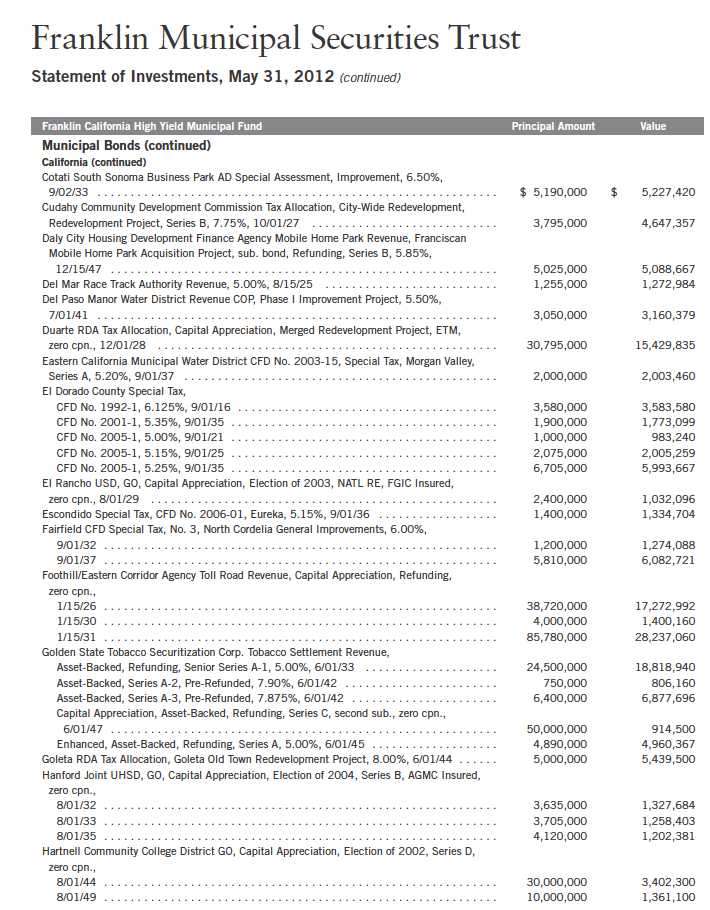

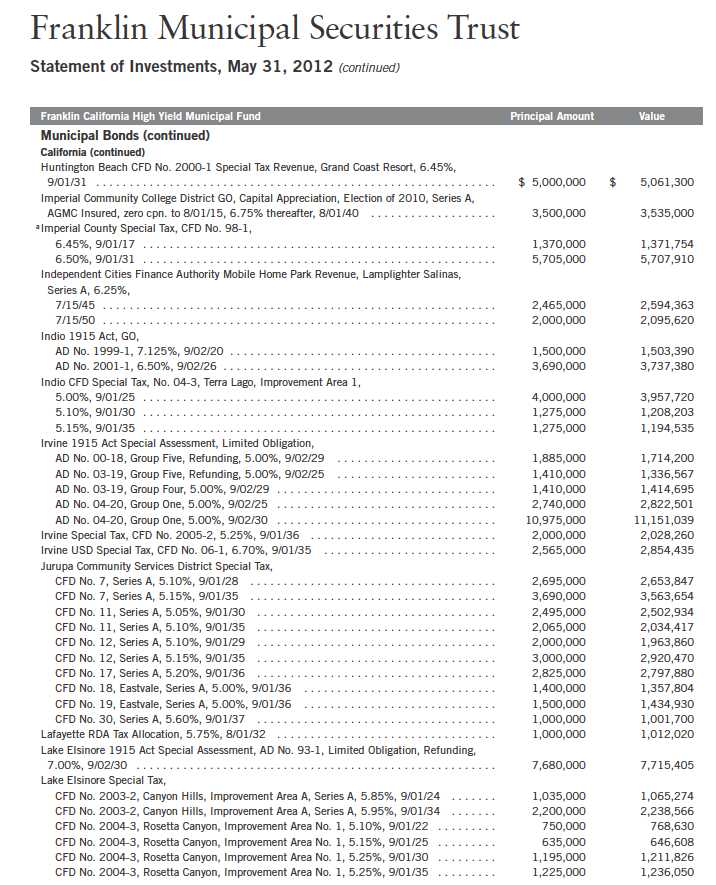

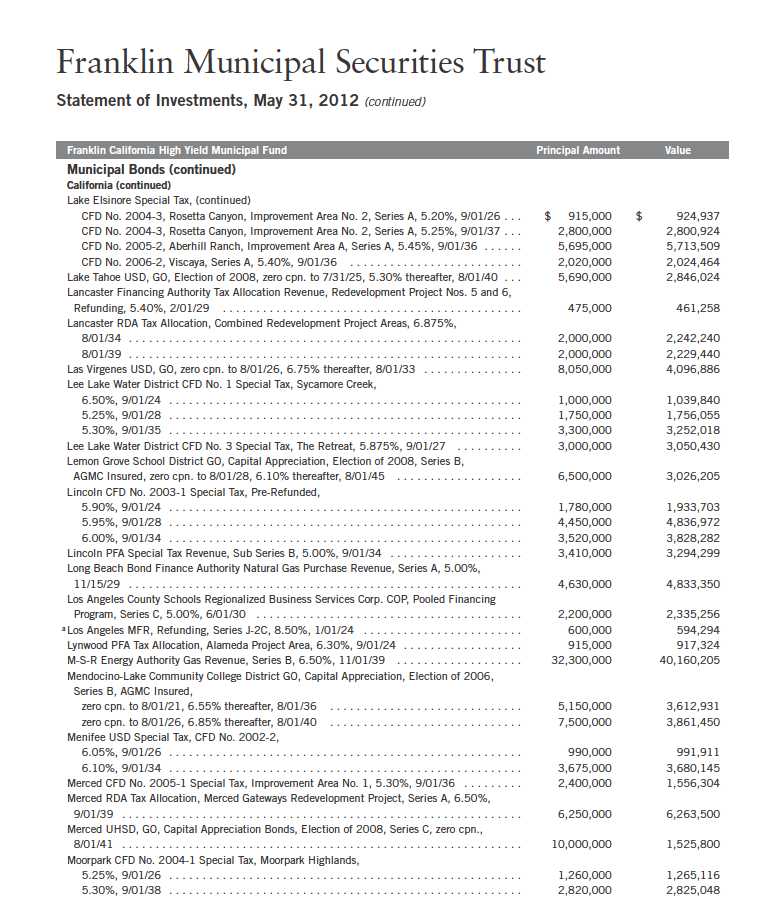

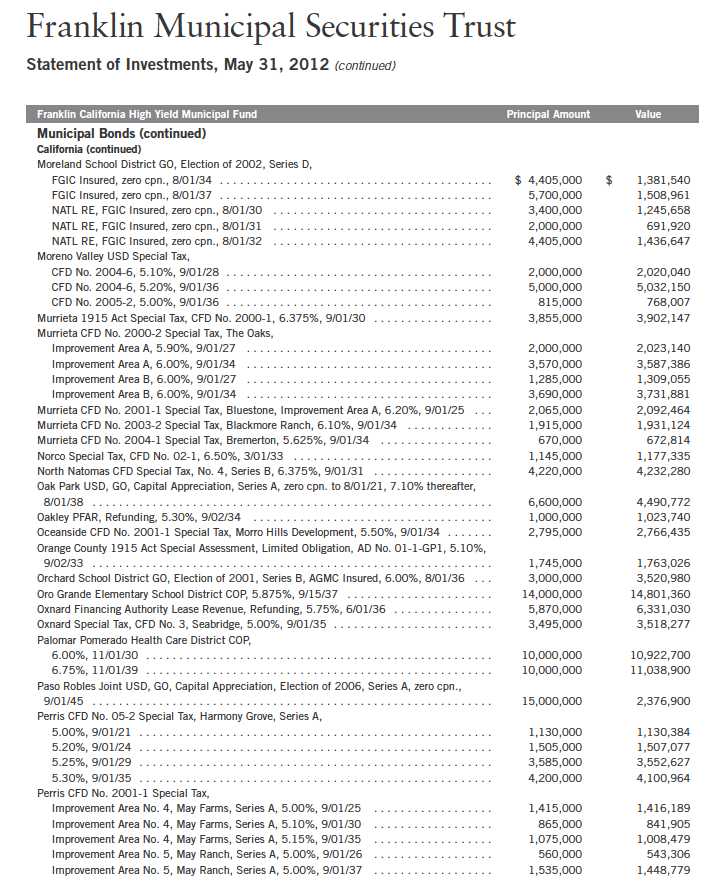

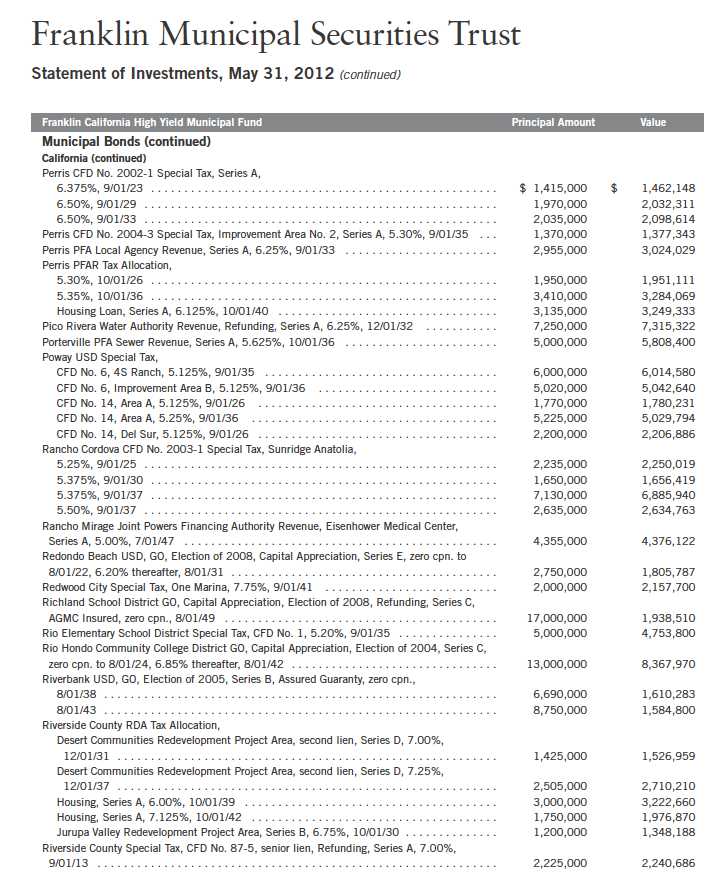

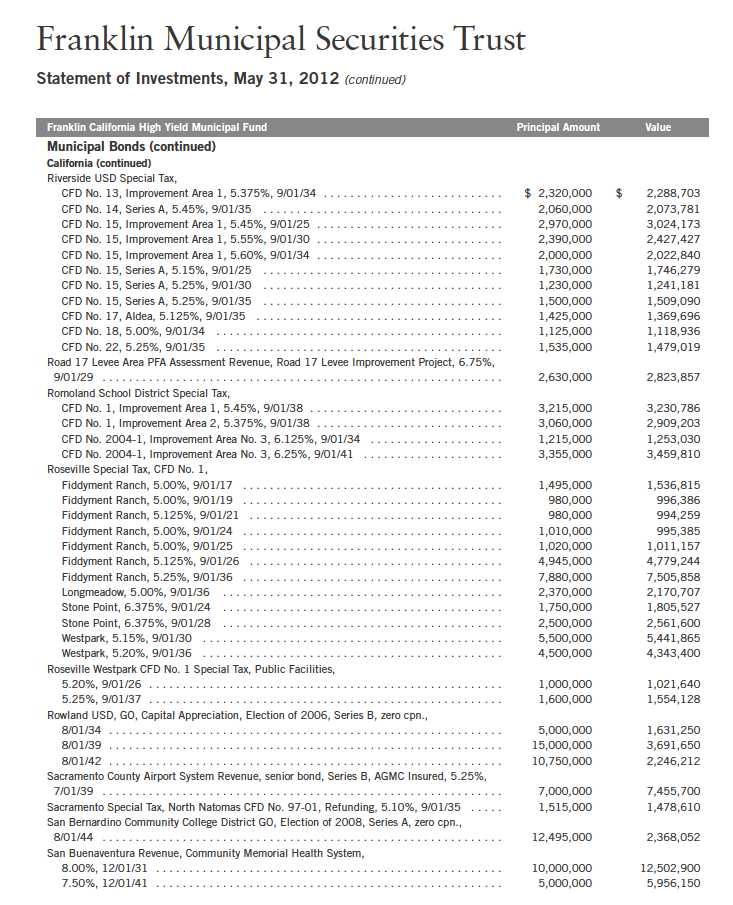

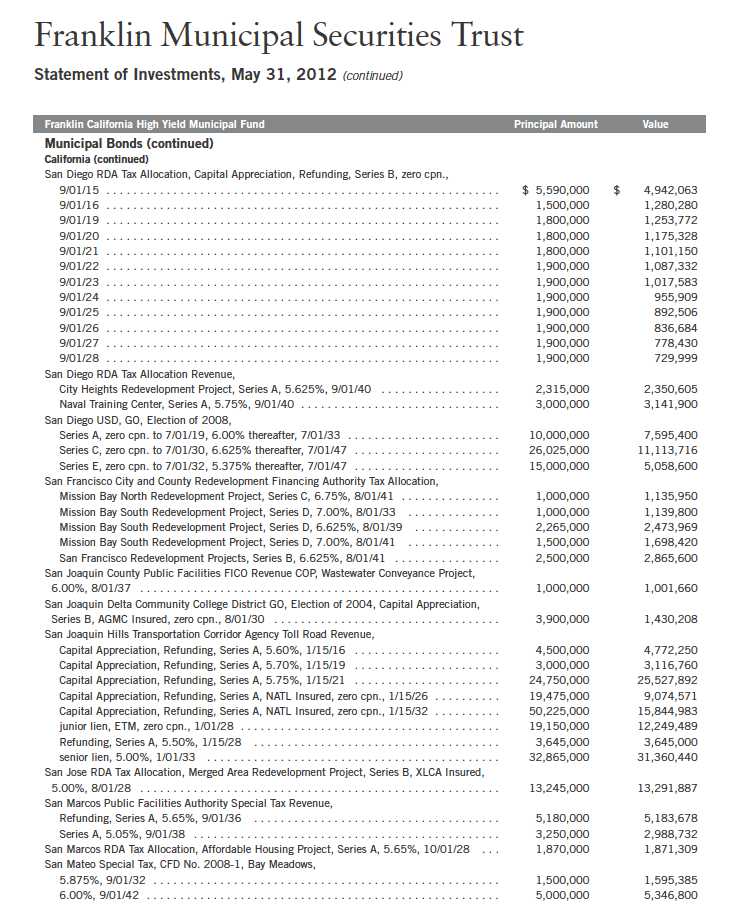

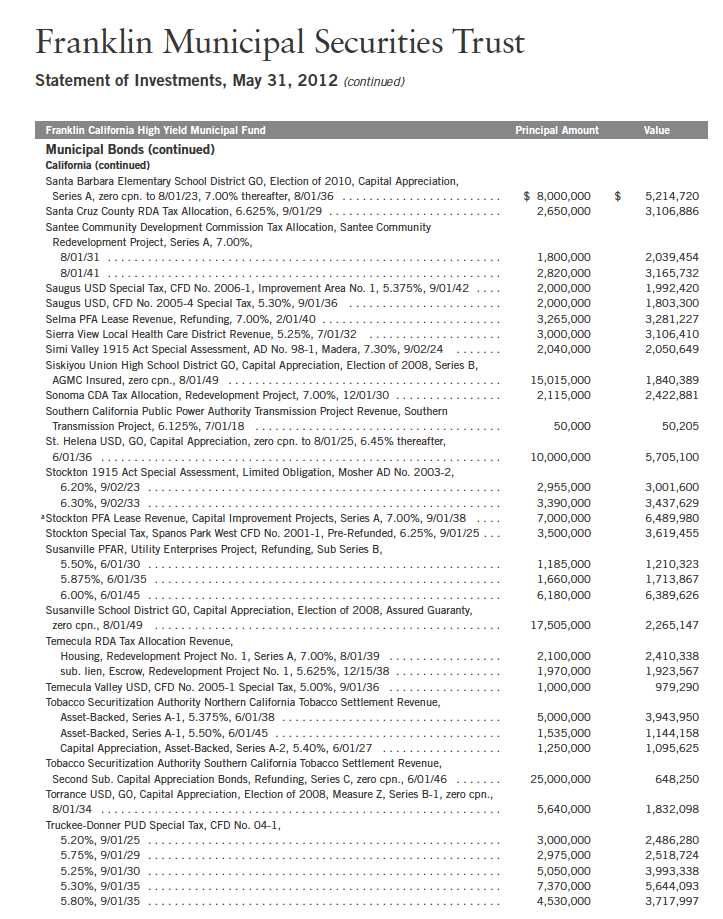

Annual Report | 29

30 | Annual Report

Annual Report | 31

32 | Annual Report

Annual Report | 33

34 | Annual Report

Annual Report | 35

36 | Annual Report

Annual Report | 37

38 | Annual Report

Annual Report | 39

40 | Annual Report

Annual Report | 41

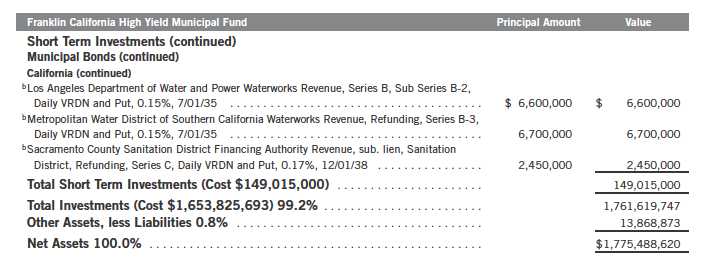

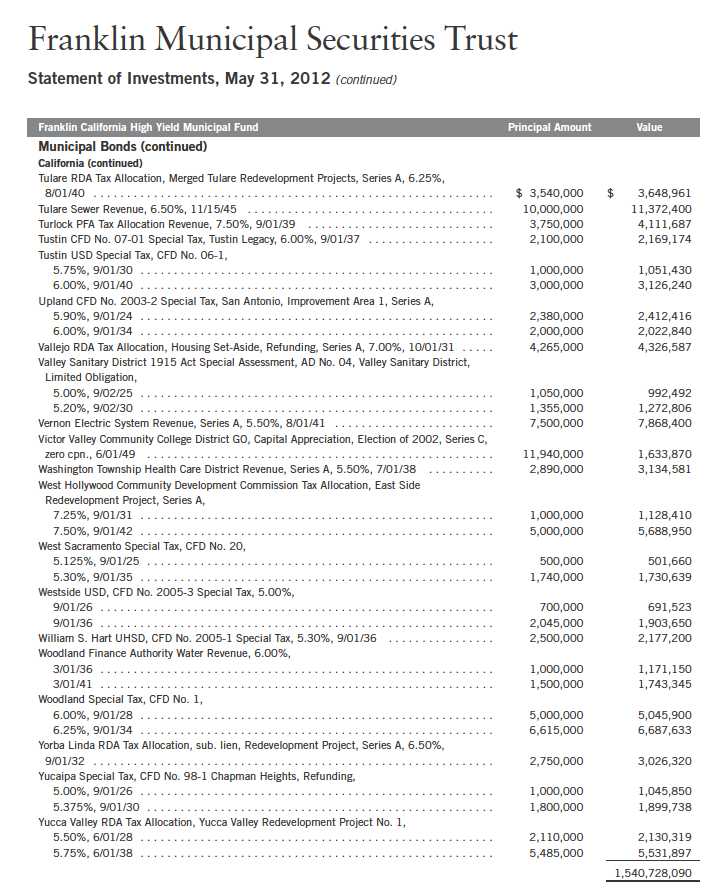

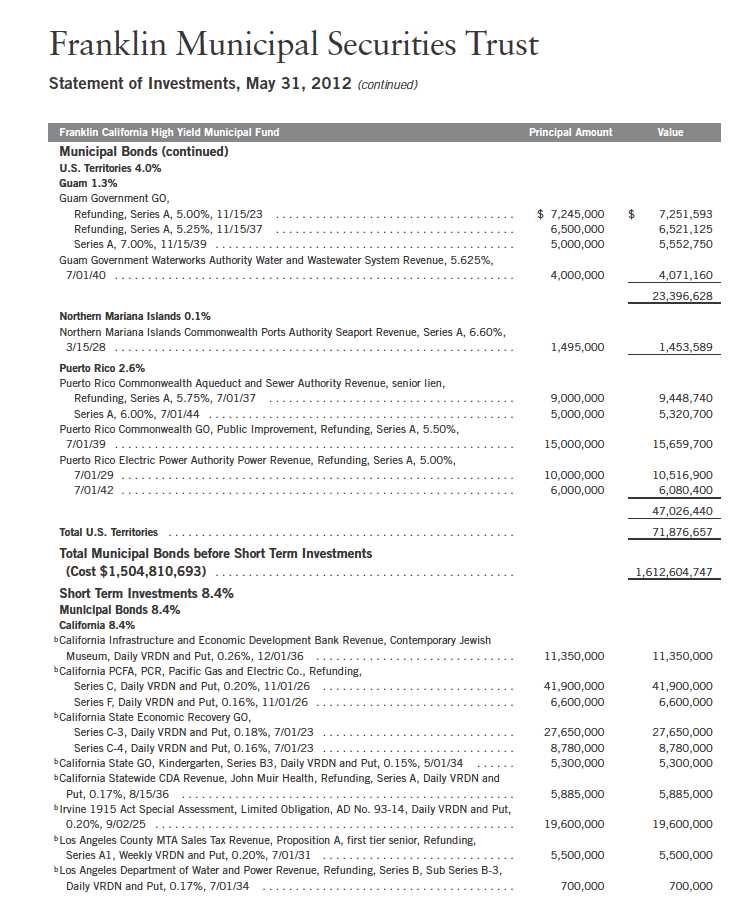

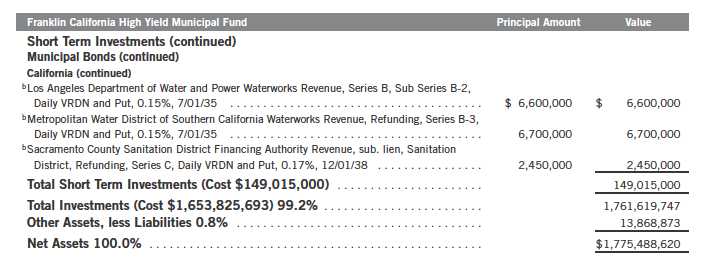

Franklin Municipal Securities Trust

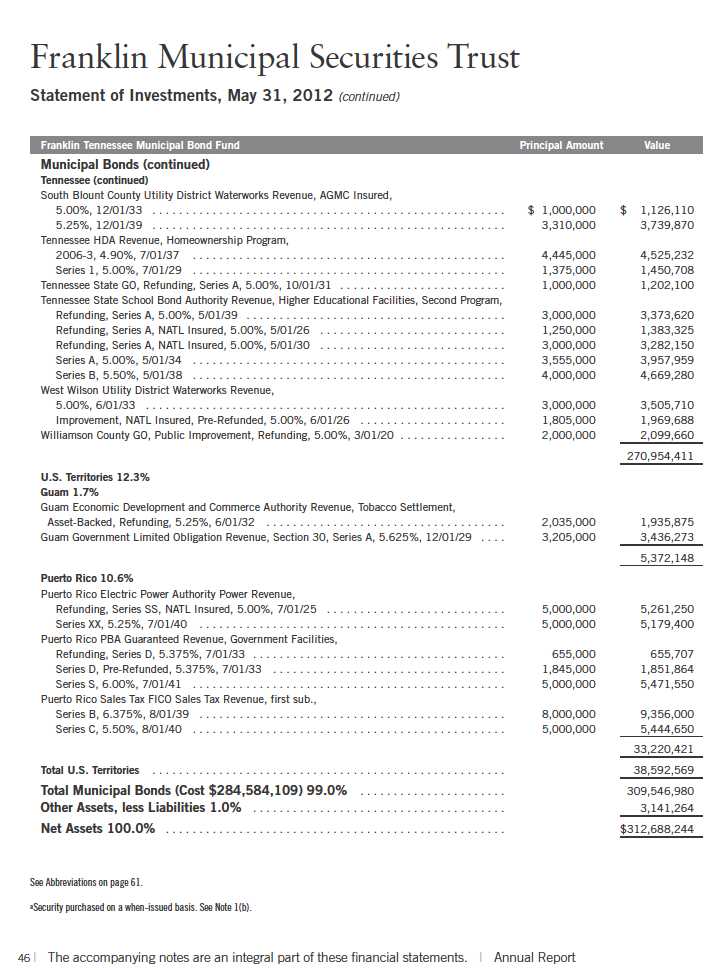

Statement of Investments, May 31, 2012 (continued)

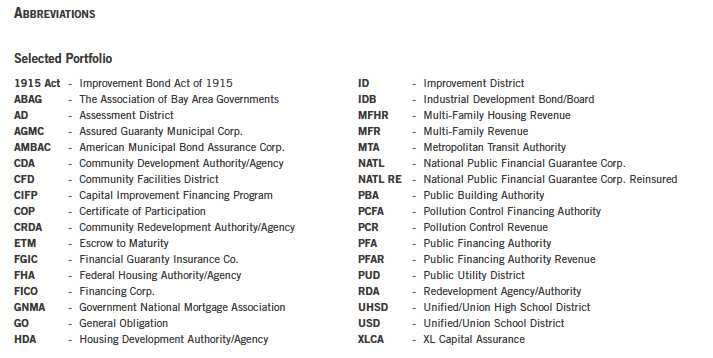

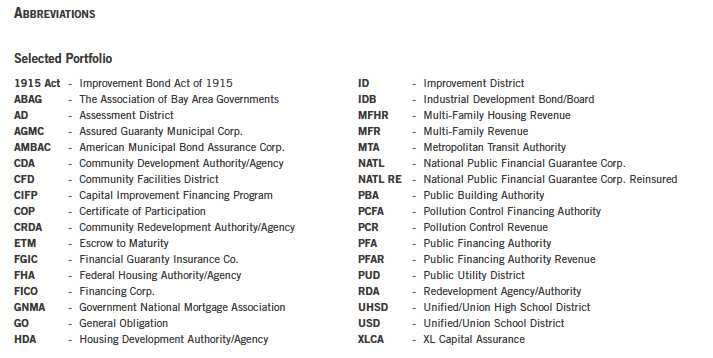

See Abbreviations on page 61.

aSecurity has been deemed illiquid because it may not be able to be sold within seven days. At May 31, 2012, the aggregate value of these securities was $14,163,938, representing

0.80% of net assets.

bVariable rate demand notes (VRDNs) are tax-exempt obligations which contain a floating or variable interest rate adjustment formula and an unconditional right of demand to

receive payment of the principal balance plus accrued interest at specified dates. The coupon rate shown represents the rate at period end.

42 | The accompanying notes are an integral part of these financial statements. | Annual Report

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

Annual Report | The accompanying notes are an integral part of these financial statements. | 43

44 | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 47

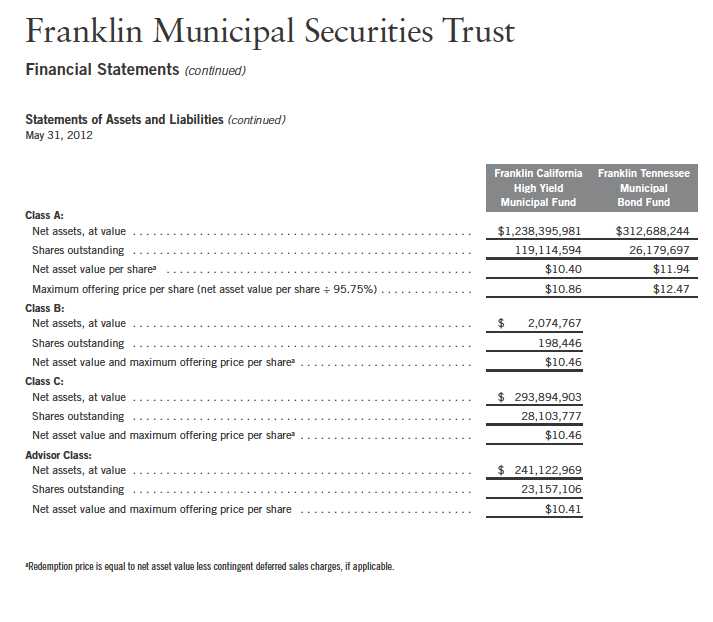

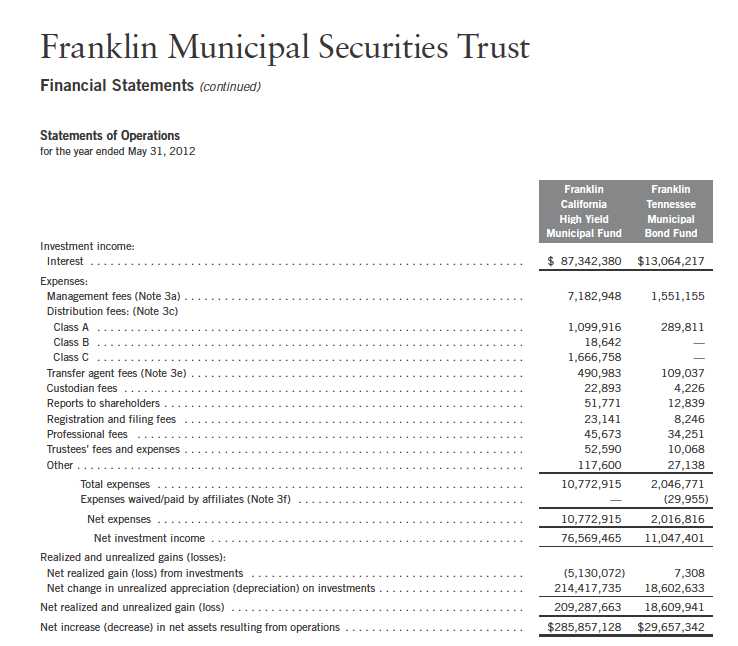

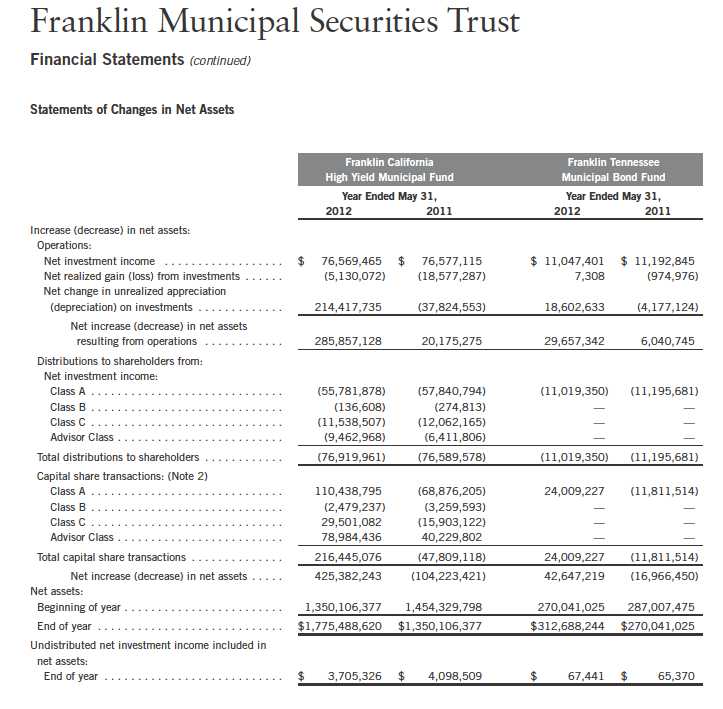

48 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 49

50 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Municipal Securities Trust

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

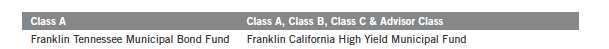

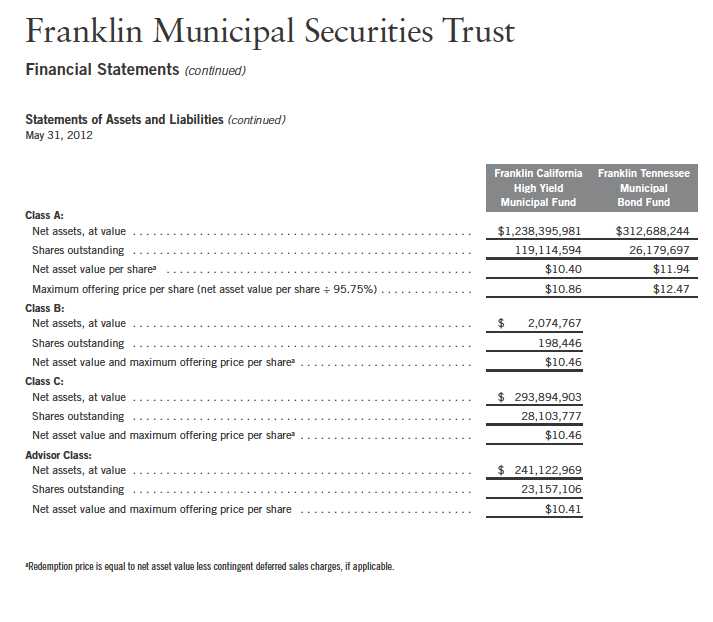

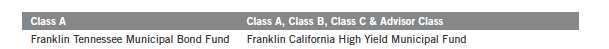

Franklin Municipal Securities Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of two funds (Funds). The classes of shares offered within each of the Funds are indicated below. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Funds’ significant accounting policies.

a. Financial Instrument Valuation

The Funds’ investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Funds’ valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Funds to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Funds’ pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Funds have procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions

Annual Report | 51

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Securities Purchased on a When-Issued Basis

The Funds purchase securities on a when-issued basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Funds will generally purchase these securities with the intention of holding the securities, they may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

c. Income Taxes

It is each fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. Each fund intends to distribute to shareholders substantially all of its income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

Each fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of May 31, 2012, and for all open tax years, each fund has determined that no liability for unrecognized tax benefits is required in each fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

52 | Annual Report

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Insurance

The scheduled payments of interest and principal for each insured municipal security in the Trust are insured by either a new issue insurance policy or a secondary insurance policy. Some municipal securities in the Funds are secured by collateral guaranteed by an agency of the U.S. government. Depending on the type of coverage, premiums for insurance are either added to the cost basis of the security or paid by a third party.

Insurance companies typically insure municipal bonds that tend to be of very high quality, with the majority of underlying municipal bonds rated A or better. However, an event involving an insurer could have an adverse effect on the value of the securities insured by that insurance company. There is no guarantee the insurer will be able to fulfill its obligations under the terms of the policy.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

g. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Funds, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

Annual Report | 53

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

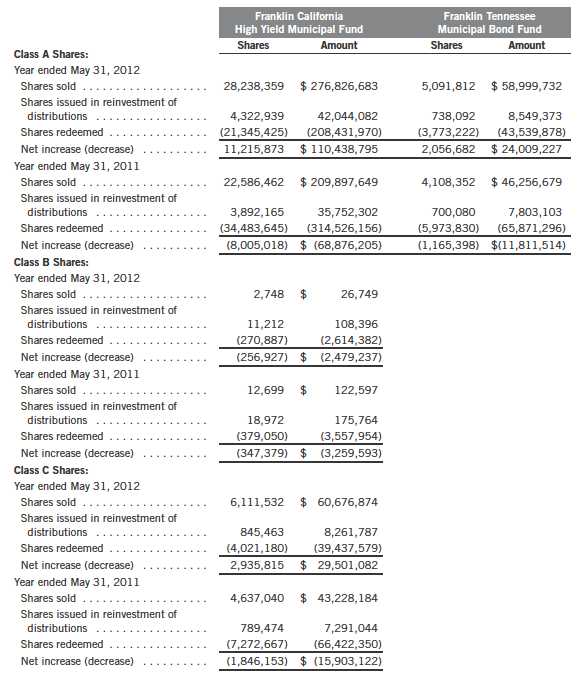

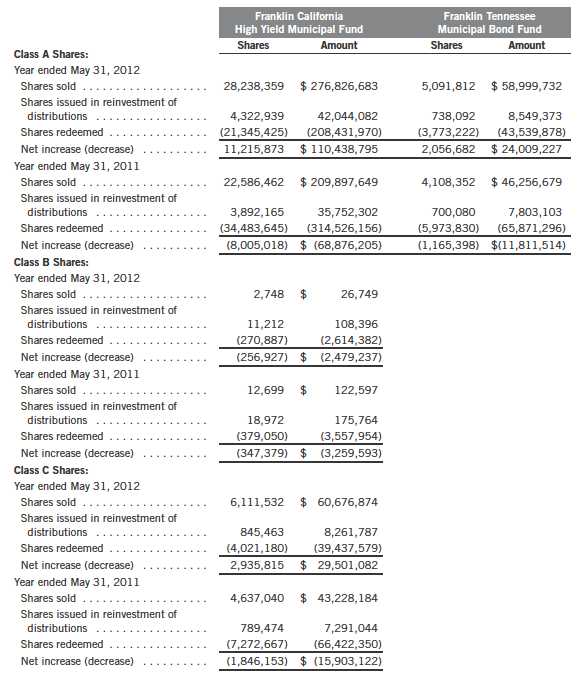

2. SHARES OF BENEFICIAL INTEREST

At May 31, 2012, there were an unlimited number of shares authorized (without par value).

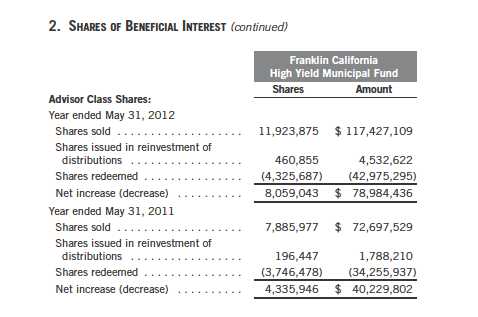

Transactions in the Funds’ shares were as follows:

54 | Annual Report

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Funds are also officers and/or directors of the following subsidiaries:

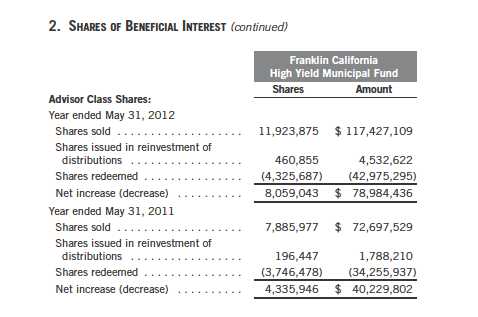

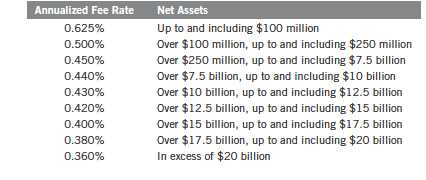

a. Management Fees

The Funds pay an investment management fee to Advisers based on the average daily net assets of each of the Funds as follows:

Annual Report | 55

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES (continued) b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Funds. The fee is paid by Advisers based on average daily net assets, and is not an additional expense of the Funds.

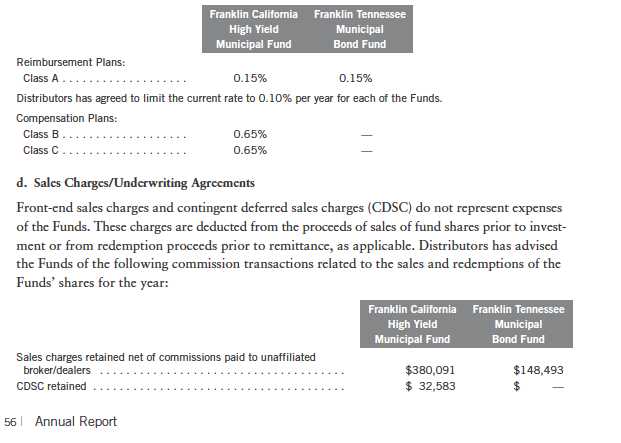

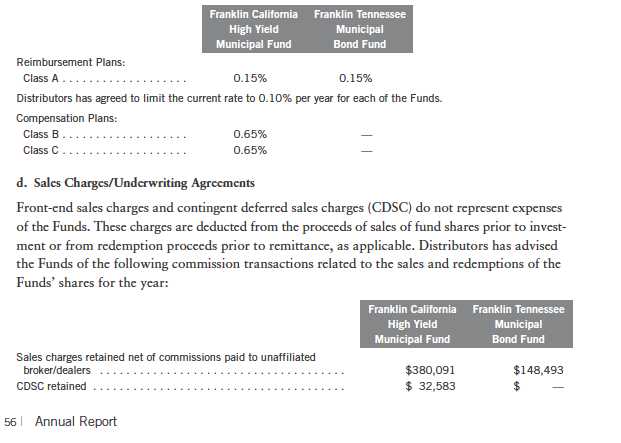

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Funds’ Class A reimbursement distribution plans, the Funds reimburse Distributors for costs incurred in connection with the servicing, sale and distribution of each fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plans, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Franklin California High Yield Municipal Fund’s Class B and C compensation distribution plans, the fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of each fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES (continued) e. Transfer Agent Fees

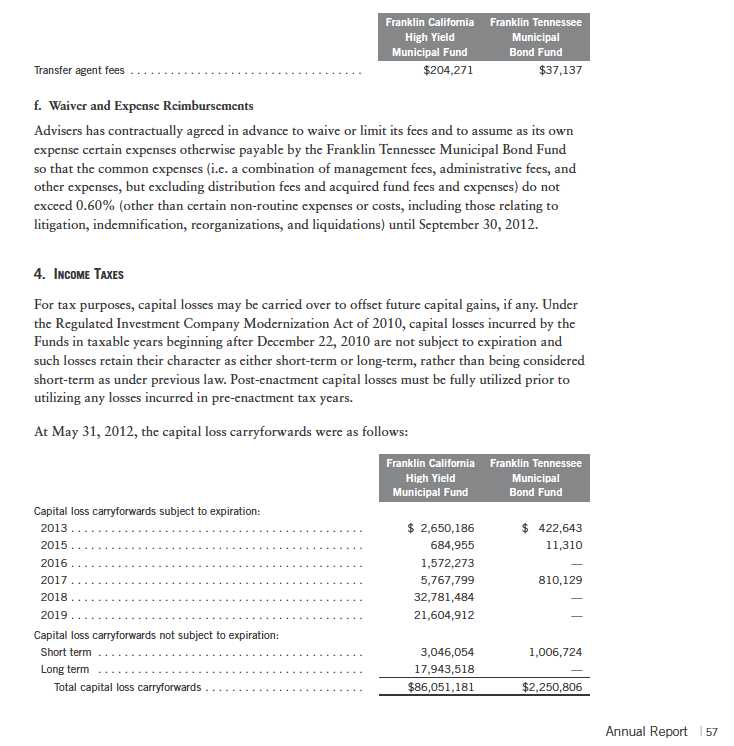

For the year ended May 31, 2012, the Funds paid transfer agent fees as noted in the Statements of Operations of which the following amounts were retained by Investor Services:

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

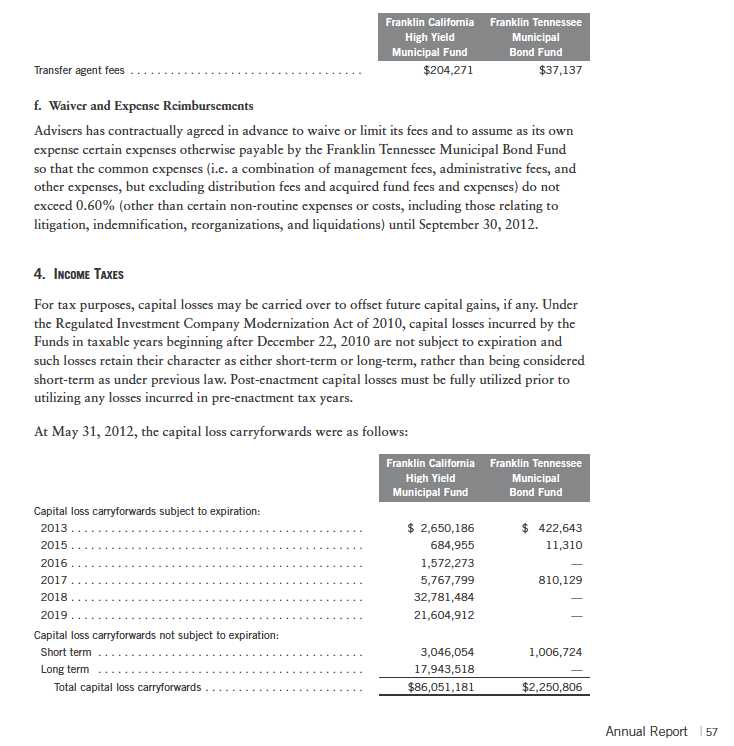

4. INCOME TAXES (continued)

On May 31, 2012, the Franklin California High Yield Municipal Fund and the Franklin Tennessee Municipal Bond Fund had expired pre-enactment capital loss carryforwards of $7,294,061 and $984,101, respectively, which were reclassified to paid-in capital.

For tax purposes, the Funds may elect to defer any portion of a post-October capital loss to the first day of the following fiscal year. At May 31, 2012, the Franklin California High Yield Municipal Fund deferred post-October capital losses of $2,698,178.

The tax character of distributions paid during the years ended May 31, 2012 and 2011, was as follows:

58 | Annual Report

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

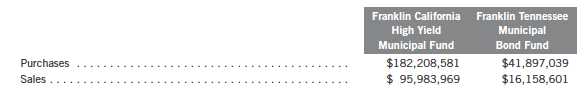

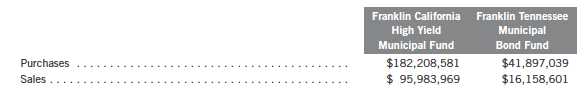

5. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the year ended May 31, 2012, were as follows:

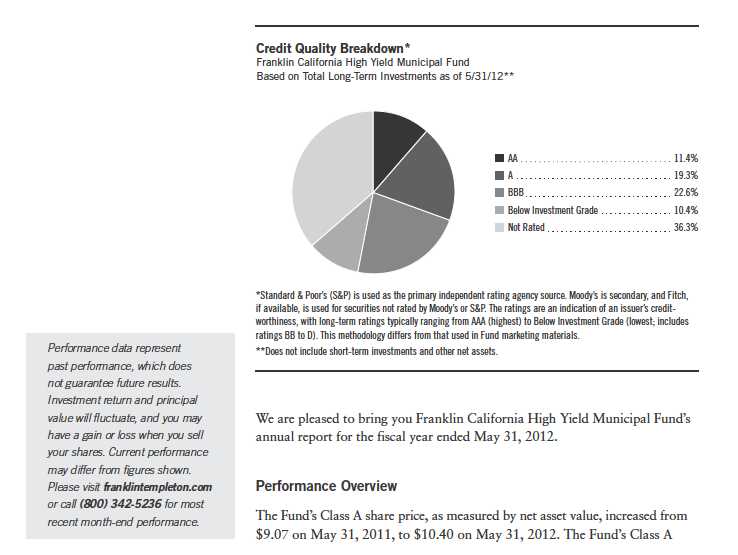

6. CREDIT RISK

At May 31, 2012, the Franklin California High Yield Municipal Fund had 30.10% of its portfolio invested in high yield securities rated below investment grade. These securities may be more sensitive to economic conditions causing greater price volatility and are potentially subject to a greater risk of loss due to default than higher rated securities.

7. CONCENTRATION OF RISK

Each of the Funds invests a large percentage of its total assets in obligations of issuers within its respective state and U.S. territories. Such concentration may subject the Funds to risks associated with industrial or regional matters, and economic, political or legal developments occurring within those states and U.S. territories. In addition, investments in these securities are sensitive to interest rate changes and credit risk of the issuer and may subject the funds to increased market volatility. The market for these investments may be limited, which may make them difficult to buy or sell.

8. CREDIT FACILITY

The Funds, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18, 2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Funds shall, in addition to interest charged on any borrowings made by the Funds and other costs incurred by the Funds, pay their share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon their relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statements of Operations. During the year ended May 31, 2012, the Funds did not use the Global Credit Facility.

Annual Report | 59

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

9. FAIR VALUE MEASUREMENTS

The Funds follow a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Funds’ own market assumptions (unobservable inputs). These inputs are used in determining the value of the Funds’ financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of financial instruments)

The inputs or methodology used for valuing financial instruments are not an indication of the risk associated with investing in those financial instruments.

For movements between the levels within the fair value hierarchy, the Funds have adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At May 31, 2012, all of the Funds’ investments in financial instruments carried at fair value were valued using Level 2 inputs.

10. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Funds believe the adoption of this ASU will not have a material impact on their financial statements.

11. SUBSEQUENT EVENTS

The Funds have evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

60 | Annual Report

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

Annual Report | 61

Franklin Municipal Securities Trust

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Municipal Securities Trust

In our opinion, the accompanying statements of assets and liabilities, including the statements of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin California High Yield Municipal Fund and Franklin Tennessee Municipal Bond Fund (separate portfolios of Franklin Municipal Securities Trust, hereafter referred to as the “Funds”) at May 31, 2012, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

July 18, 2012

62 | Annual Report

Franklin Municipal Securities Trust

Tax Information (unaudited)

Under Section 852(b)(5)(A) of the Internal Revenue Code, the Funds hereby report 100% of the distributions paid from net investment income as exempt-interest dividends for the fiscal year ended May 31, 2012. A portion of the Fund’s exempt-interest dividends may be subject to the federal alternative minimum tax. By mid-February 2013, shareholders will be notified of amounts for use in preparing their 2012 income tax returns.

Annual Report | 63

Franklin Municipal Securities Trust

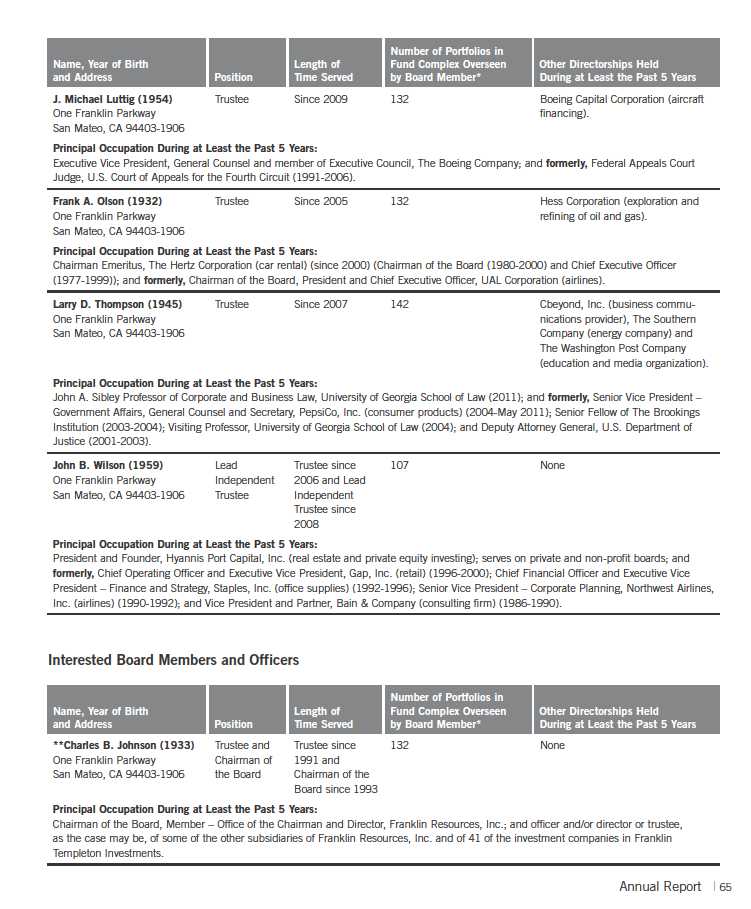

Board Members and Officers

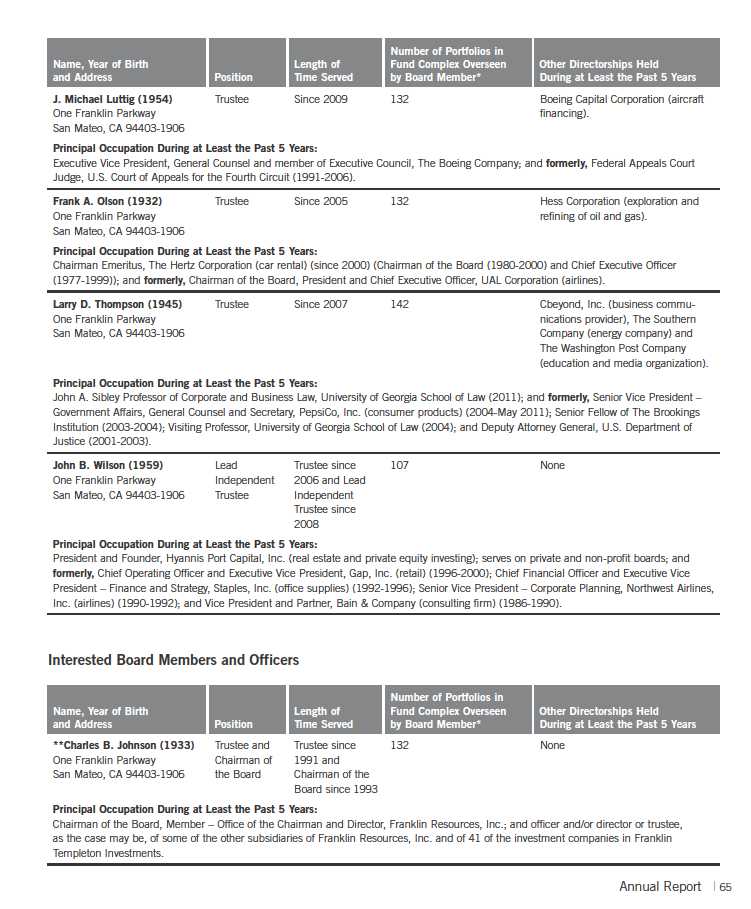

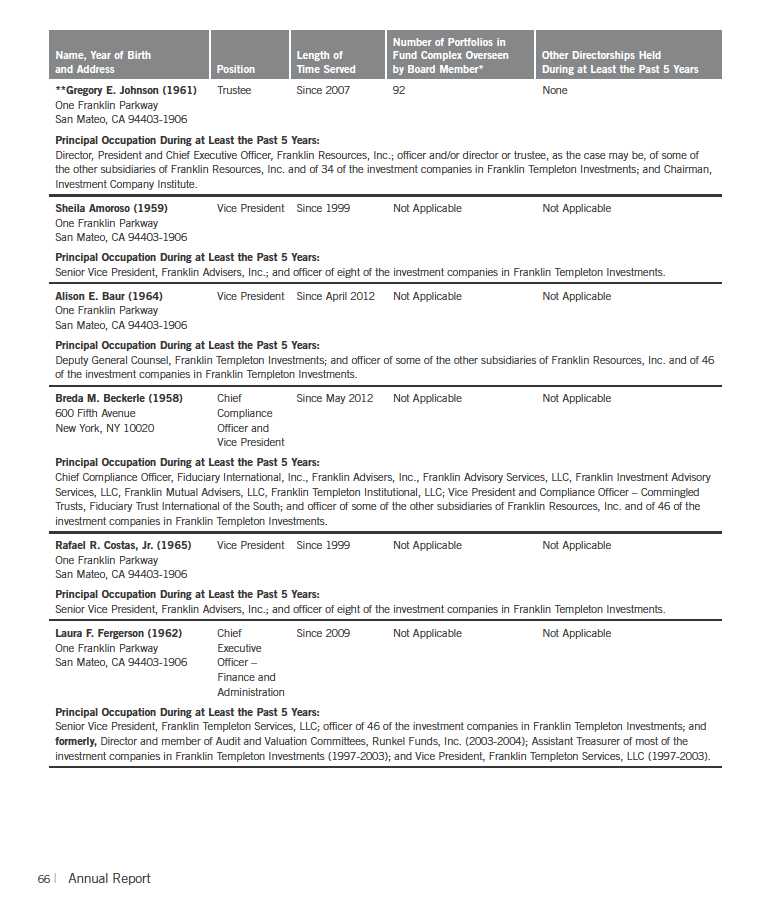

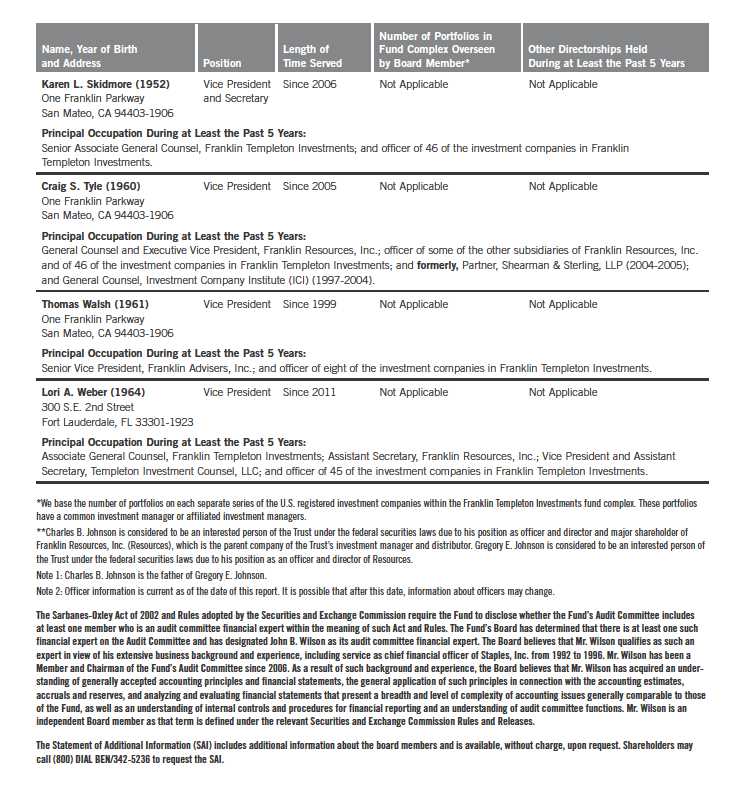

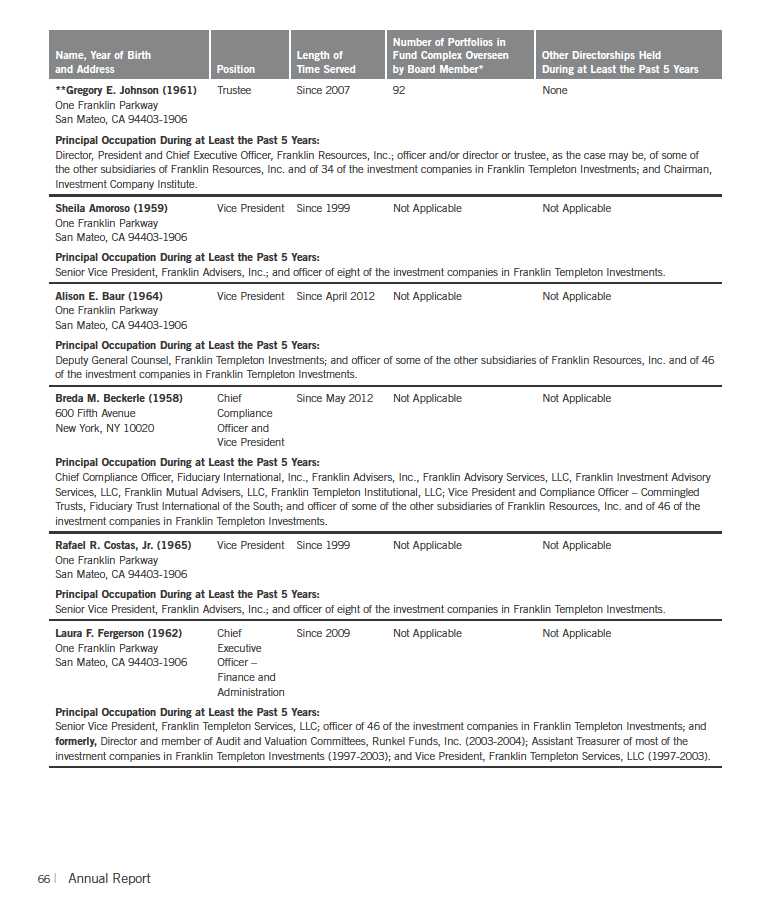

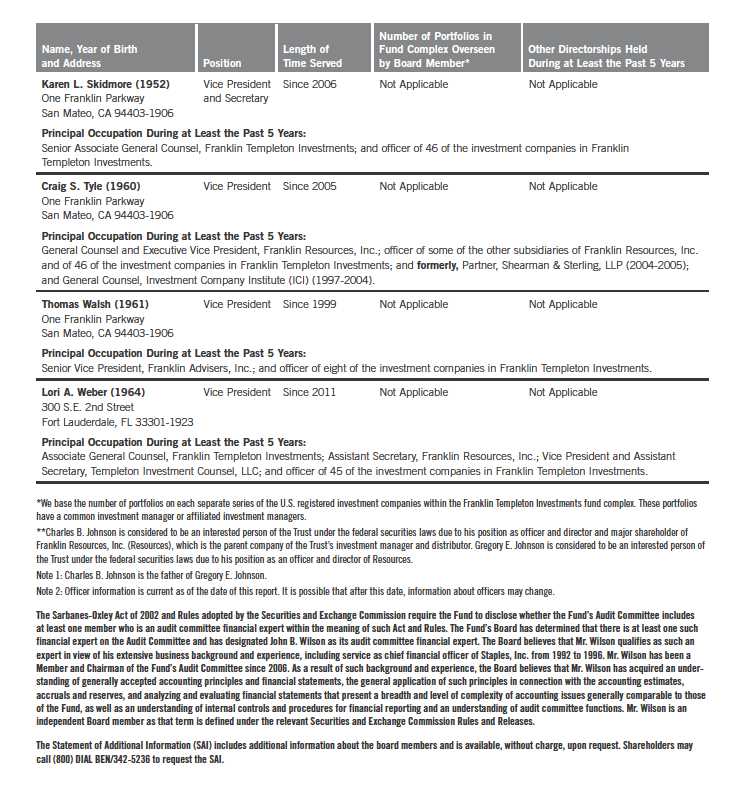

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, principal occupations during at least the past five years and number of portfolios overseen in the Franklin Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

64 | Annual Report

68 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held February 28, 2012, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for each of the two separate tax-exempt funds within the Trust (Fund(s)). In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for each Fund, as well as periodic reports on expenses, shareholder services, legal and compliance matters, pricing, and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for each Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper reports compared each Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Funds by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and an analysis concerning transfer agent fees charged by an affiliate of the Manager.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. While the investment management agreements for both Funds were considered at the same Board meeting, the Board dealt with each Fund separately. In approving continuance of the investment management agreement for each Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of each Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICE. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Funds and their shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for each Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy

Annual Report | 69

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management’s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in previous years. Consideration was also given to the experience of each Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person’s fund management area so as to be aligned with the interests of shareholders. The Board also took into account the quality of transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager and the continuous enhancements to the Franklin Templeton website. Particular attention was given to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, management’s efforts in establishing a global credit facility for the benefit of the Funds and other accounts managed by Franklin Templeton Investments to provide a source of cash for temporary and emergency purposes or to meet unusual redemption requests as well as the strong financial position of the Manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of each Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings during the year, particular attention in assessing performance was given to the Lipper reports furnished for the agreement renewals. The Lipper reports prepared for each individual Fund showed its investment performance in comparison with a performance universe selected by Lipper. The following summarizes the performance results for each of the Funds.

Franklin California High Yield Municipal Fund – The Lipper report for this Fund showed the investment performance of its Class A shares for the year ended December 31, 2011, and the previous 10 years ended that date in comparison with a performance universe consisting of all retail and institutional California municipal debt funds as selected by Lipper. Such comparison showed the Fund’s income return during 2011, as shown in the Lipper report, and for the previous three-, five- and 10-year periods on an annualized basis to be in the highest or best performing quintile of its performance universe. The Lipper report showed the Fund’s total return during 2011 to also

70 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

be in the highest quintile of its Lipper performance universe and on an annualized basis to be in the highest quintile of such universe for each of the previous three- and 10-year periods, and in the middle quintile of such universe for the previous five-year period. The Board was satisfied with the Fund’s performance, as shown in the Lipper report.

Franklin Tennessee Municipal Bond Fund – The Lipper report for this Fund showed the investment performance of its only share class for the year ended December 31, 2011, and the previous 10 years ended that date in comparison with a performance universe consisting of all retail and institutional “other states” municipal debt funds as selected by Lipper. Such comparison showed the Fund’s income return in 2011, as shown in the Lipper report, to be above the median of its performance universe, and during each of the previous three-, five- and 10-year periods on an annualized basis to be in the second-highest quintile of such universe. The Lipper report showed the Fund’s total return during 2011 to be in the second-highest quintile of its Lipper performance universe, and on an annualized basis to be in the middle quintile of its performance universe for the previous three-year period, and in the highest or best performing quintile of such universe for each of the previous five- and 10-year periods. The Board was satisfied with the Fund’s performance as shown in the Lipper report.

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fees and total expense ratio of each Fund compared with those of a group of other funds selected by Lipper as its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on each Fund’s contractual investment management fee in comparison with the contractual investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expense ratio of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes administrative charges as being part of a management fee and total expenses, for comparative consistency, were shown by Lipper for Fund Class A shares in the case of Franklin California High Yield Municipal Fund. The Lipper report for Franklin California High Yield Municipal Fund showed its contractual investment management fee rate to be within one basis point of its Lipper expense group median and its actual total expense ratio to be in the least expensive quintile of such expense group. The Board was satisfied with such comparative expenses. The Lipper report for Franklin Tennessee Municipal Bond Fund showed its contractual investment management fee rate to be below the median of its Lipper expense group, and its actual total expense ratio to be in the least expensive quintile of such expense group. The Board was satisfied with such comparative expenses, noting that they were partially subsidized by management.

Annual Report | 71

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of each Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2011, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to each Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Funds made in prior years and that the Funds’ independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Funds’ Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to each Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also took into account management’s expenditures in improving shareholder services provided the Funds, as well as the need to implement systems and meet additional regulatory and compliance requirements resulting from statutes such as the Sarbanes-Oxley and Dodd-Frank Acts and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services. Based upon its consideration of all these factors, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to each Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Funds grow larger and the extent to which this is reflected in the level of management fees charged. While recognizing any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appeared as some funds get larger, at some point economies of scale do result in the manager realizing a larger profit margin on management services provided such fund. The Board also noted that any economies of scale are shared with each of these Funds and their shareholders through management fee breakpoints existing in each of the Fund’s investment management agreements so that as a Fund grows in size, its effective management fee rate declines. The fee structure under the investment management agreement for

72 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

each Fund provides an initial fee of 0.625% on the first $100 million of assets; 0.50% on the next $150 million of assets; and 0.45% on the next $7.25 billion of assets with additional breakpoints continuing thereafter until reaching a final breakpoint for assets in excess of $20 billion. At December 31, 2011, the net assets of Franklin California High Yield Municipal Fund were approximately $1.55 billion and those of Franklin Tennessee Municipal Bond Fund were approximately $289 million. The Board believed that to the extent economies of scale may be realized by the Manager and its affiliates, the schedule of fees under the investment management agreements for both Funds provided a sharing of benefits with each Fund and its shareholders.

Proxy Voting Policies and Procedures