Annual Report

Municipal Bond Market Overview

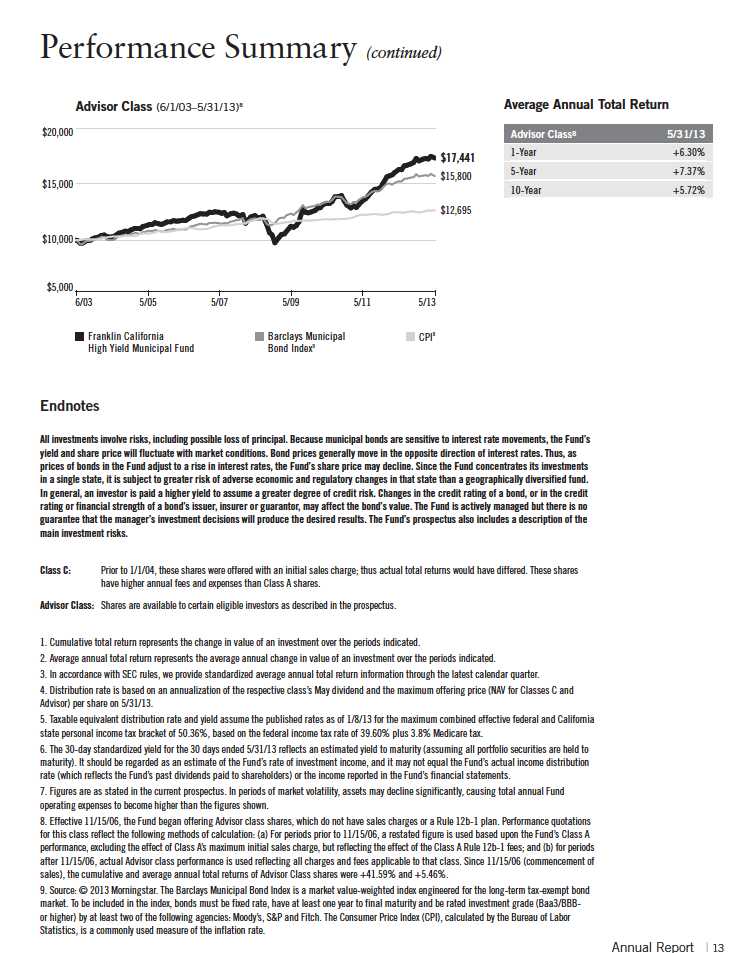

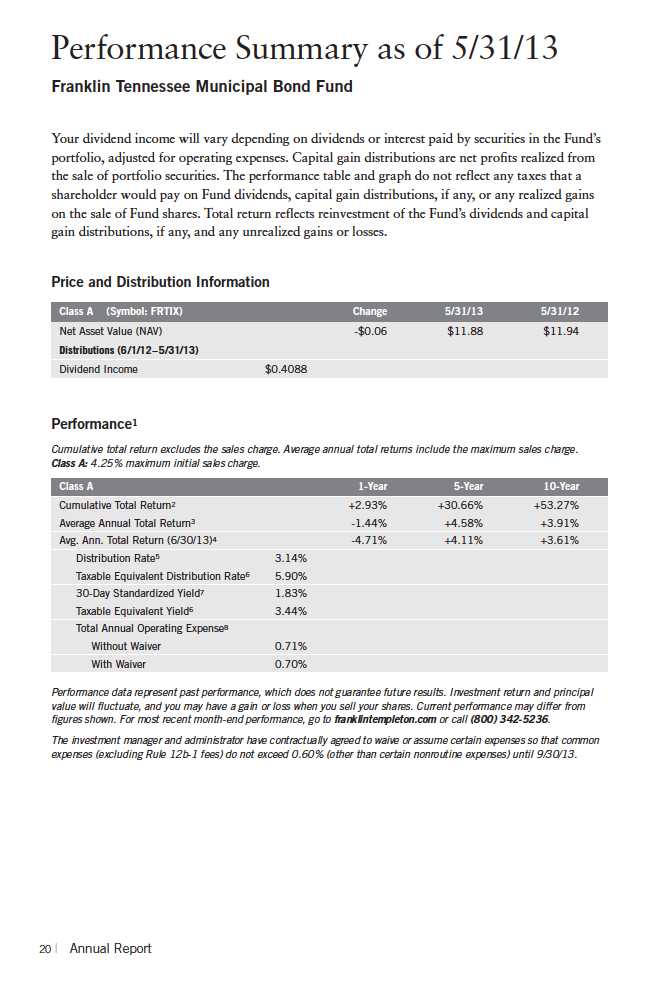

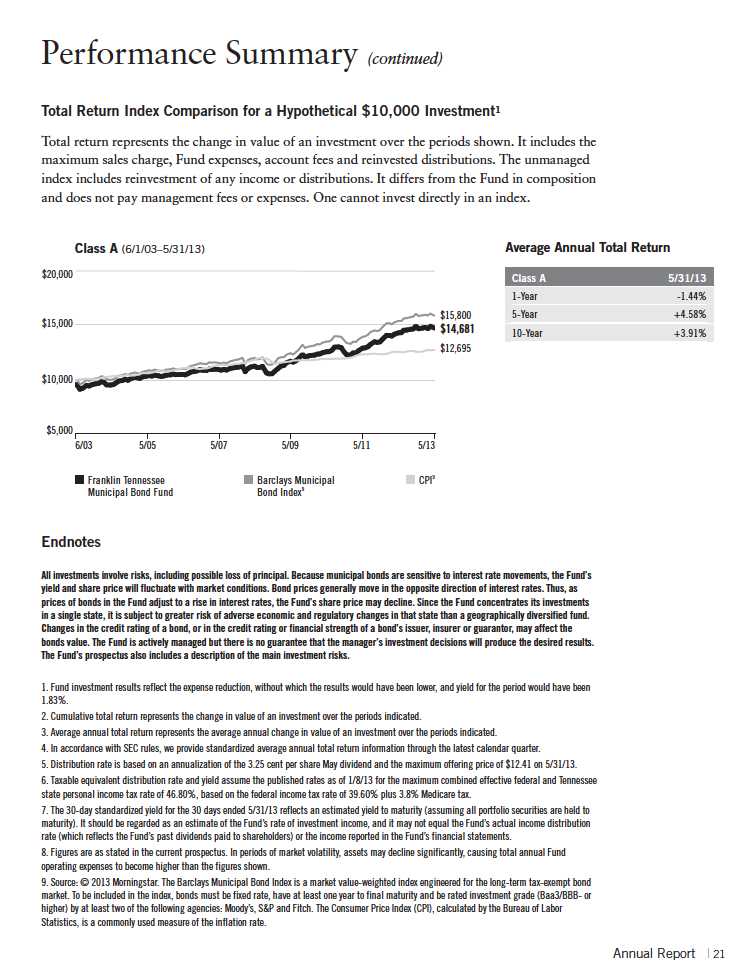

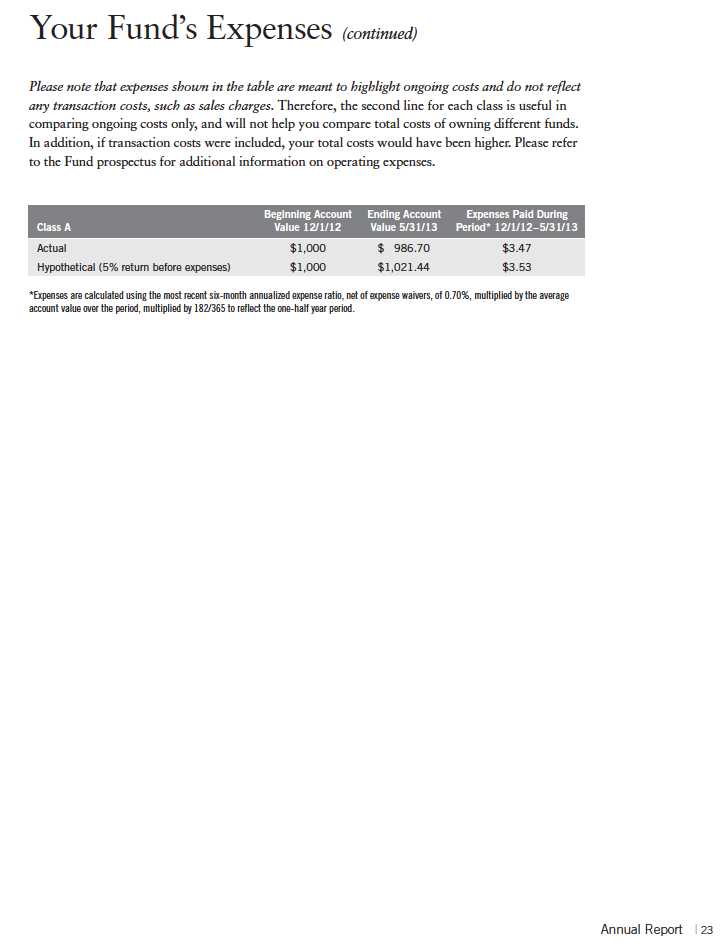

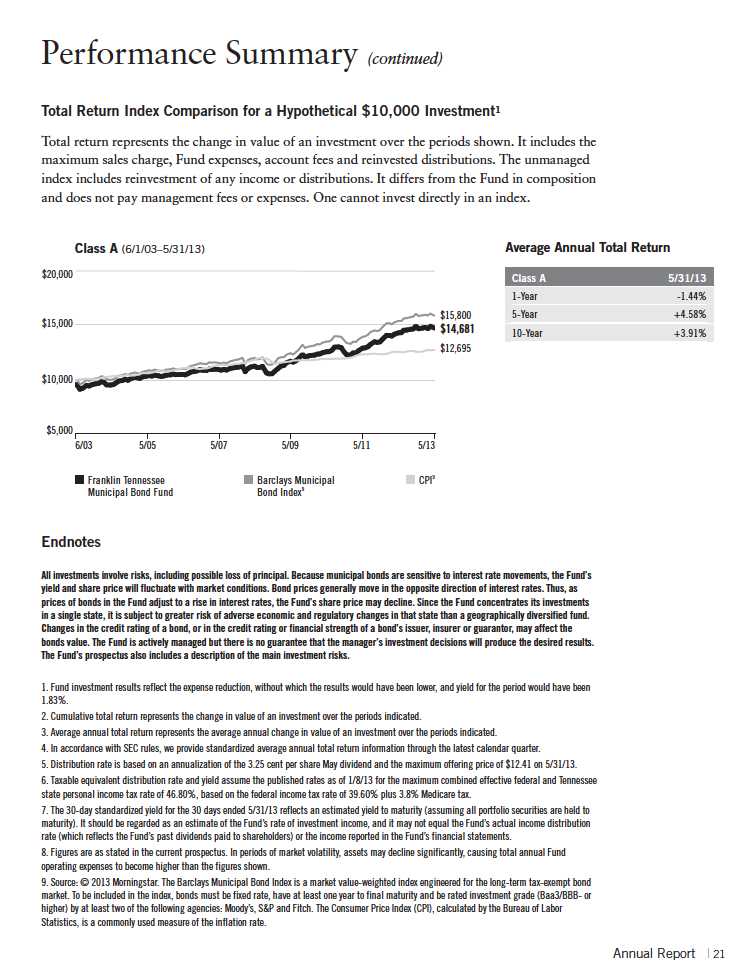

For the 12-month period ended May 31, 2013, the municipal bond market produced solid returns. The Barclays Municipal Bond Index, which tracks investment-grade municipal securities, returned +3.05%.1 In comparison, the Barclays U.S. Treasury Index had a -0.89% return.1 The tax-exempt nature of most municipal bond coupon payments included in the Barclays Municipal Bond Index further enhanced the relative strength of municipal bond performance for the period under review.

The municipal market delivered positive performance even though Moody s Investors Service, Standard & Poor s (S&P) and Fitch Ratings, the three largest independent municipal bond rating agencies, lowered credit ratings of several municipalities during the review period. In 2012, the agencies collectively issued 1,469 downgrades to 838 upgrades. S&P was the only firm to boost more ratings than it downgraded, whereas Moody s was the most aggressive, cutting 824 ratings while upgrading 187. Some of the more noteworthy downgrades over the past 12 months included Connecticut, Illinois, Pennsylvania and Puerto Rico. Despite the high number of downgrades during 2012, actual monetary defaults amounted to $2.7 billion or 0.072% of issues.2 Low default rates have been a characteristic of the municipal bond market since the Great Depression ended.

During most of the period, investors continued to buy municipal bonds and bond funds at a strong pace. According to the Investment Company Institute, investors committed $32.2 billion in new net purchases to municipal bond funds for the 12-month period.3 Concurrent with investors appetite for municipal bonds, municipalities throughout the country borrowed for new purposes at the slowest rate since 1997. Strong demand for municipal bonds coupled with low supply drove the municipal market s positive performance.

The municipal bond market faced short-term challenges during the 12-month period. After the November elections, discussions about ways to achieve deficit reduction included possibly changing municipal bonds tax-exempt status. Investor nervousness about such changes prompted outflows from municipal bond mutual funds in December that reached the highest weekly level since

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

2. Source: BofA Merrill Lynch Global Research, Muni Commentary: Monetary and Fiscal Policy in Flux, 1/4/13.

3. Source: Investment Company Institute, Washington, DC 2013.

4 | Annual Report

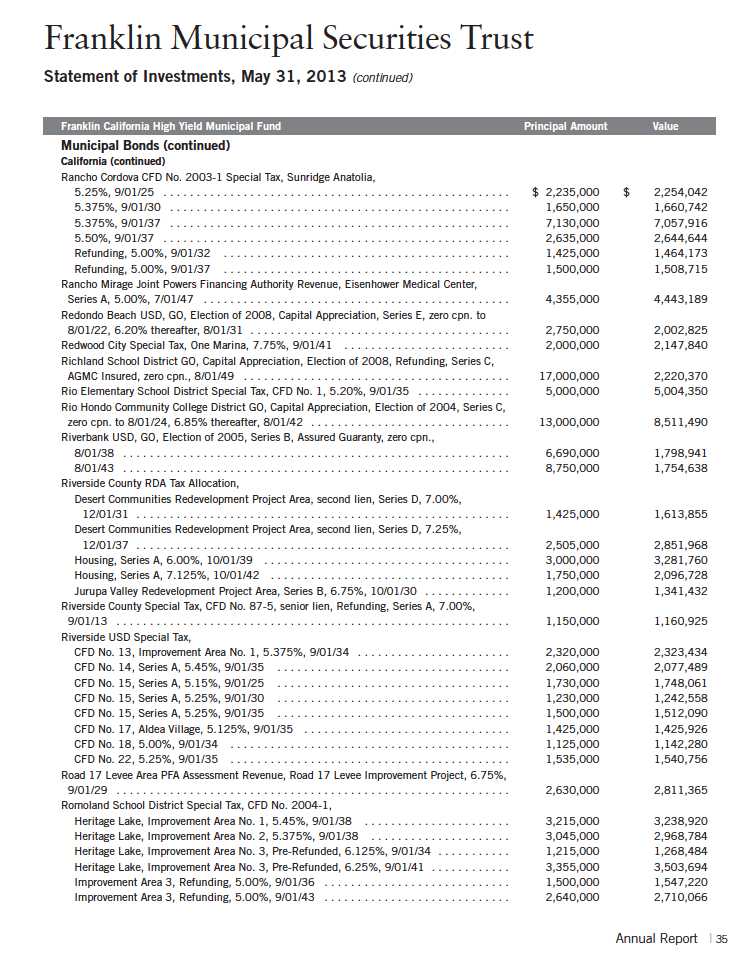

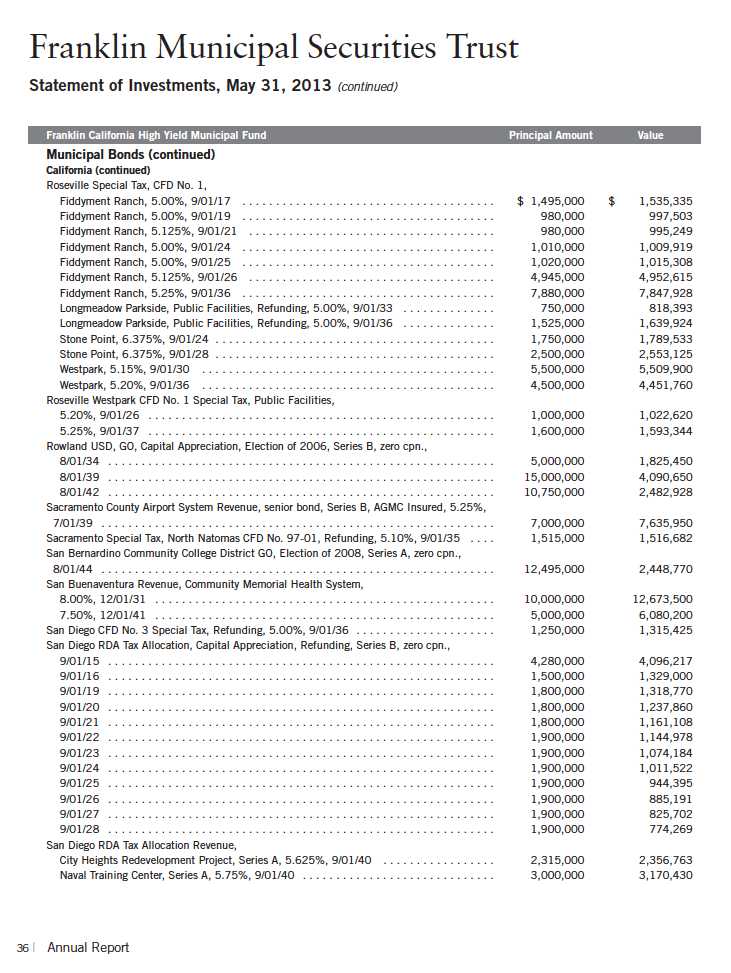

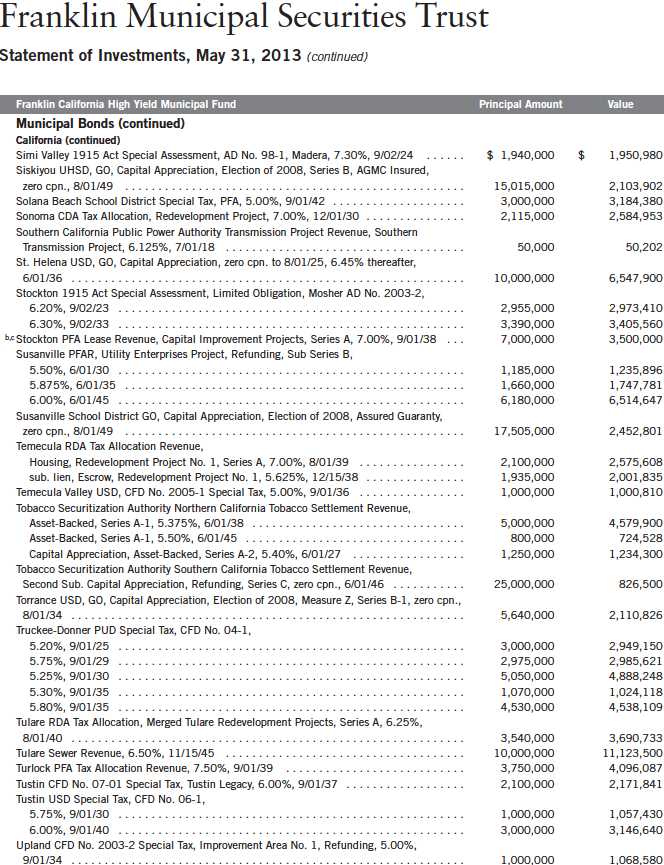

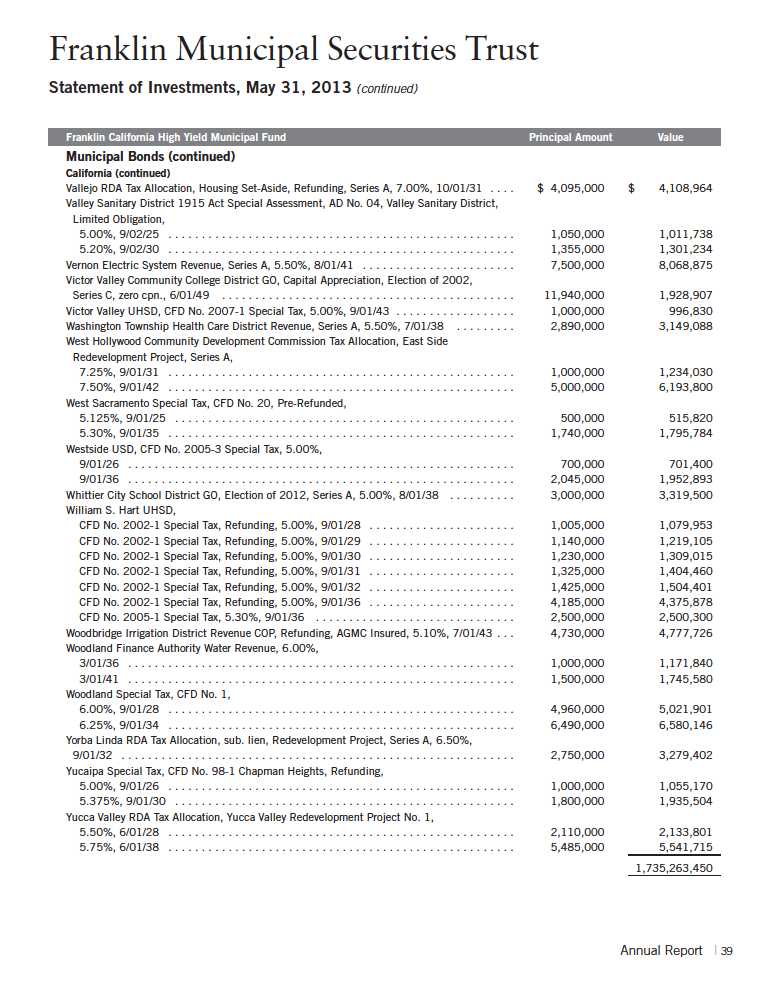

38 | Annual Report

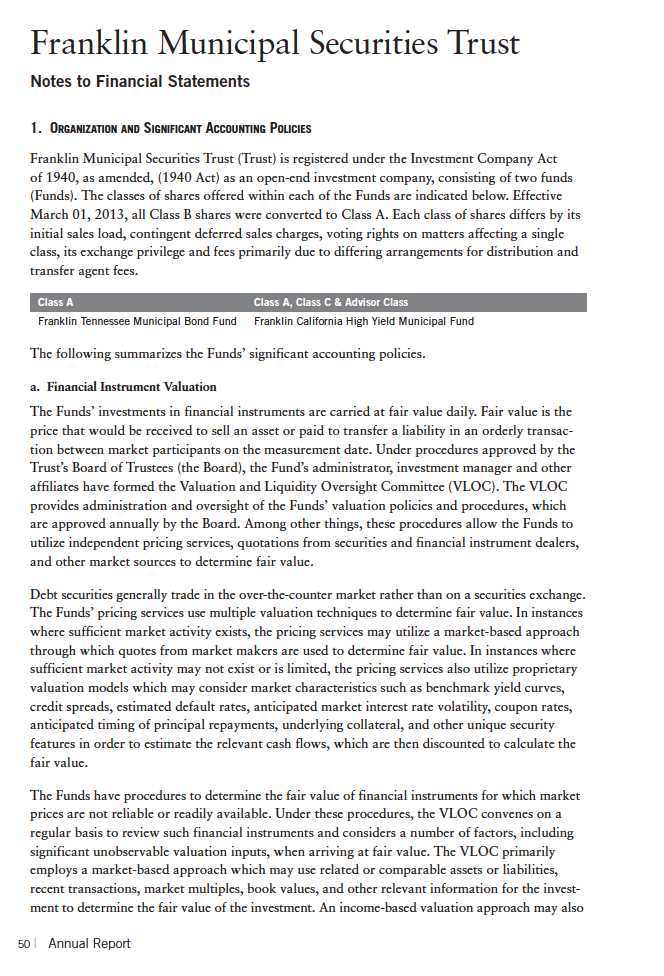

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

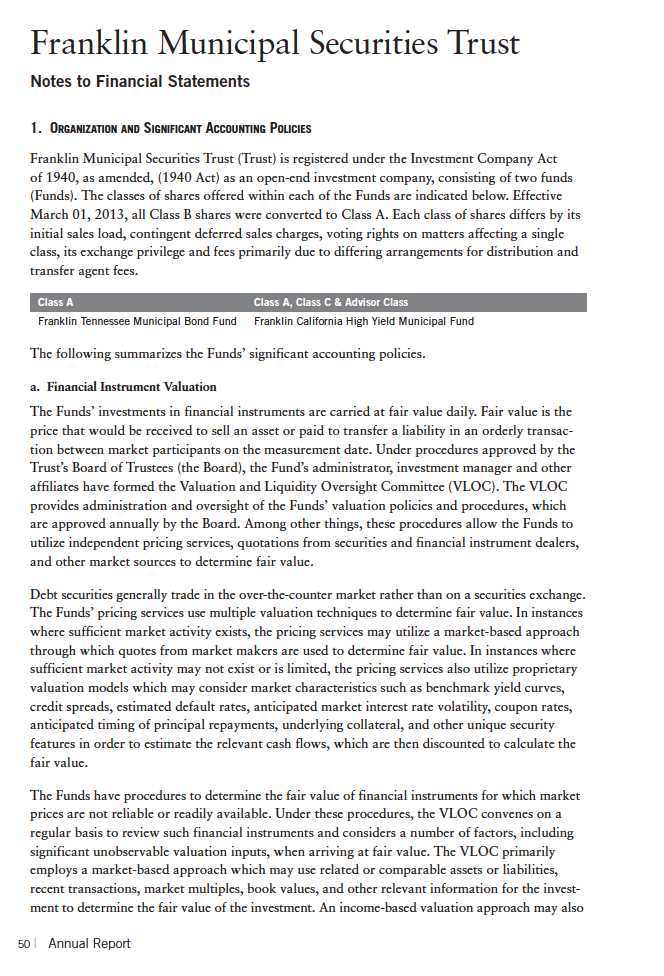

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) a. Financial Instrument Valuation (continued)

be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Securities Purchased on a When-Issued Basis

The Funds purchase securities on a when-issued basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Funds will generally purchase these securities with the intention of holding the securities, they may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

c. Income Taxes

It is each fund s policy to qualify as a regulated investment company under the Internal Revenue Code. Each fund intends to distribute to shareholders substantially all of its income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

Each fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of May 31, 2013, and for all open tax years, each fund has determined that no liability for unrecognized tax benefits is required in each fund s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These

Annual Report | 51

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) d. Security Transactions, Investment Income, Expenses and Distributions (continued)

reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Insurance

The scheduled payments of interest and principal for each insured municipal security in the Trust are insured by either a new issue insurance policy or a secondary insurance policy. Some municipal securities in the Funds are secured by collateral guaranteed by an agency of the U.S. government. Depending on the type of coverage, premiums for insurance are either added to the cost basis of the security or paid by a third party.

Insurance companies typically insure municipal bonds that tend to be of very high quality, with the majority of underlying municipal bonds rated A or better. However, an event involving an insurer could have an adverse effect on the value of the securities insured by that insurance company. There is no guarantee the insurer will be able to fulfill its obligations under the terms of the policy.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

g. Guarantees and Indemnifications

Under the Trust s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Funds, enters into contracts with service providers that contain general indemnification clauses. The Trust s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

52 | Annual Report

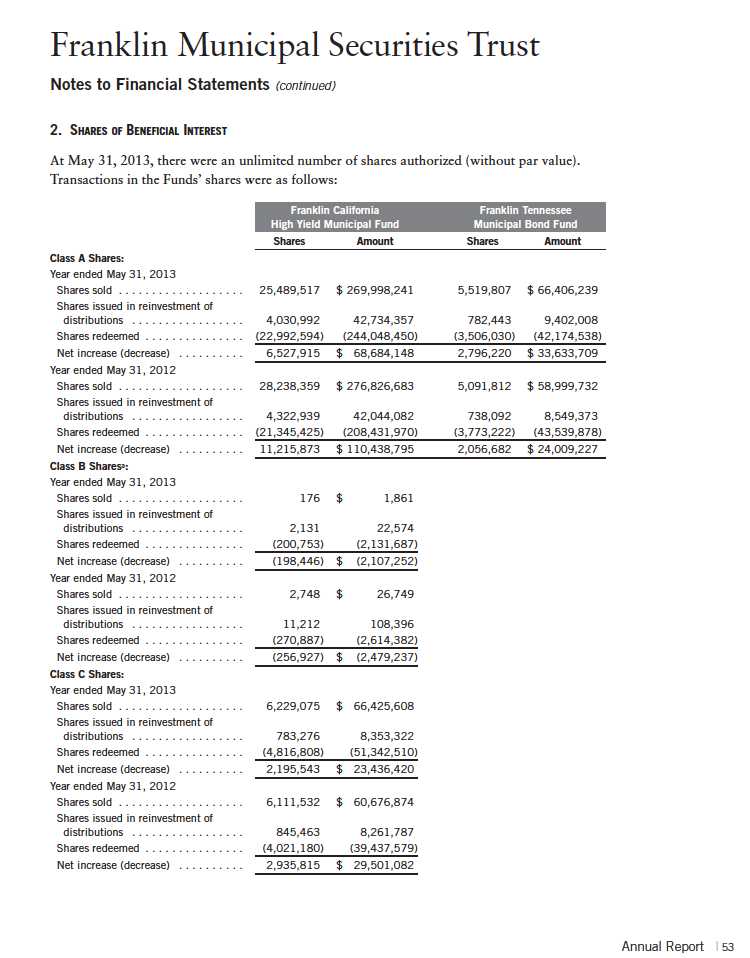

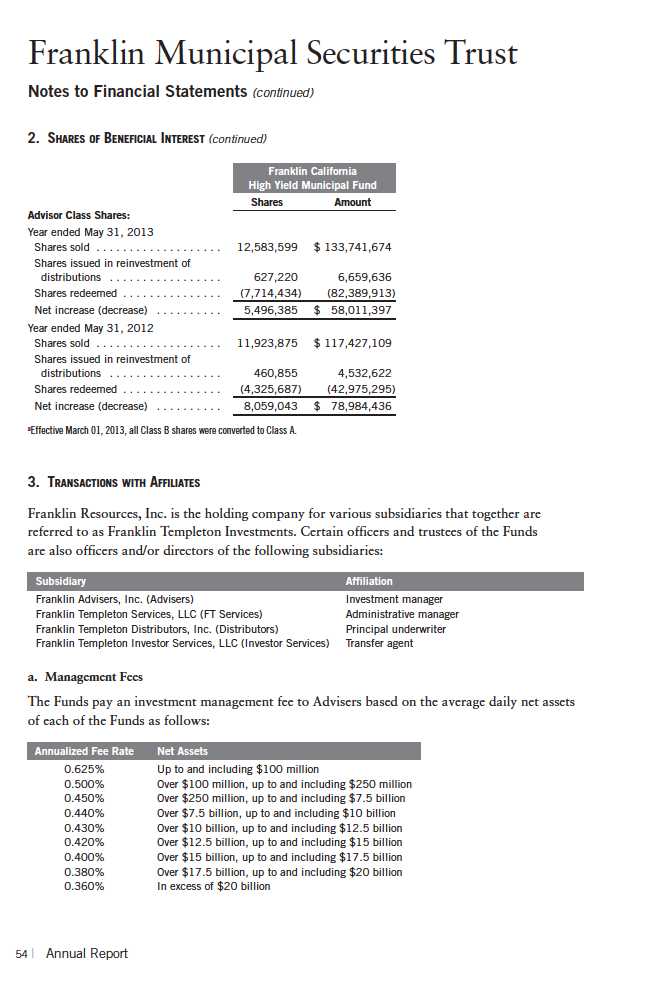

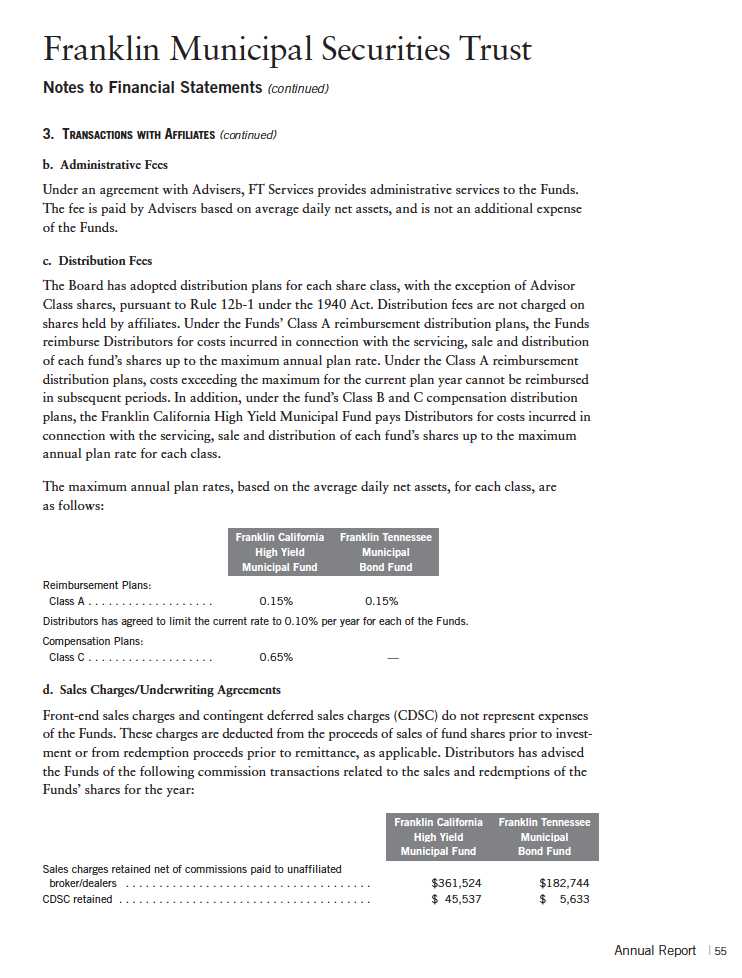

Franklin Municipal Securities Trust

Notes to Financial Statements (continued)

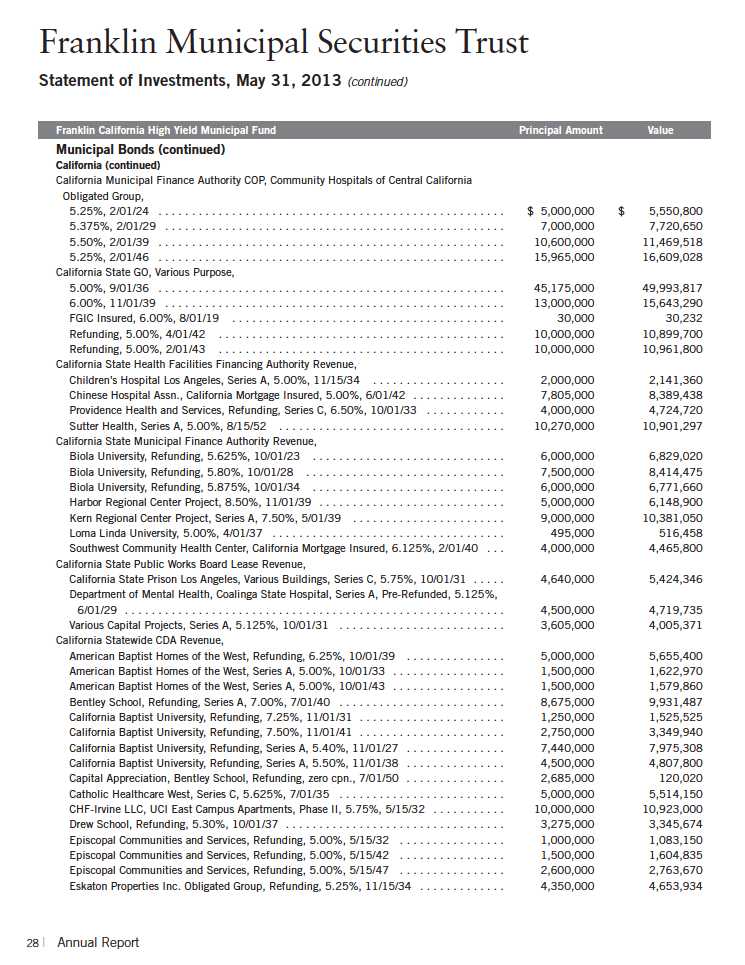

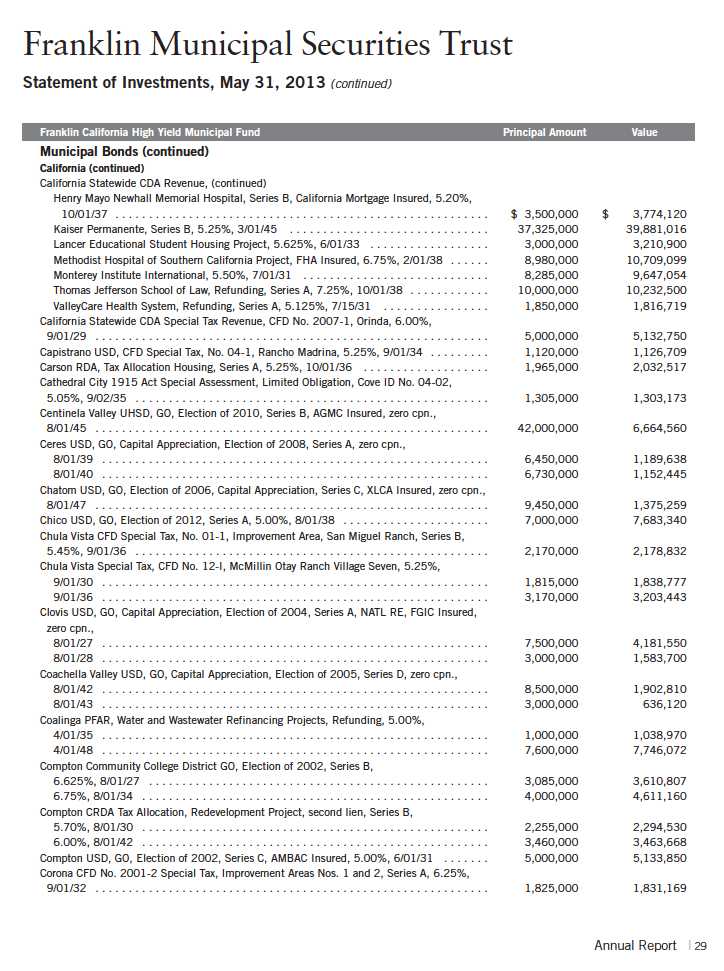

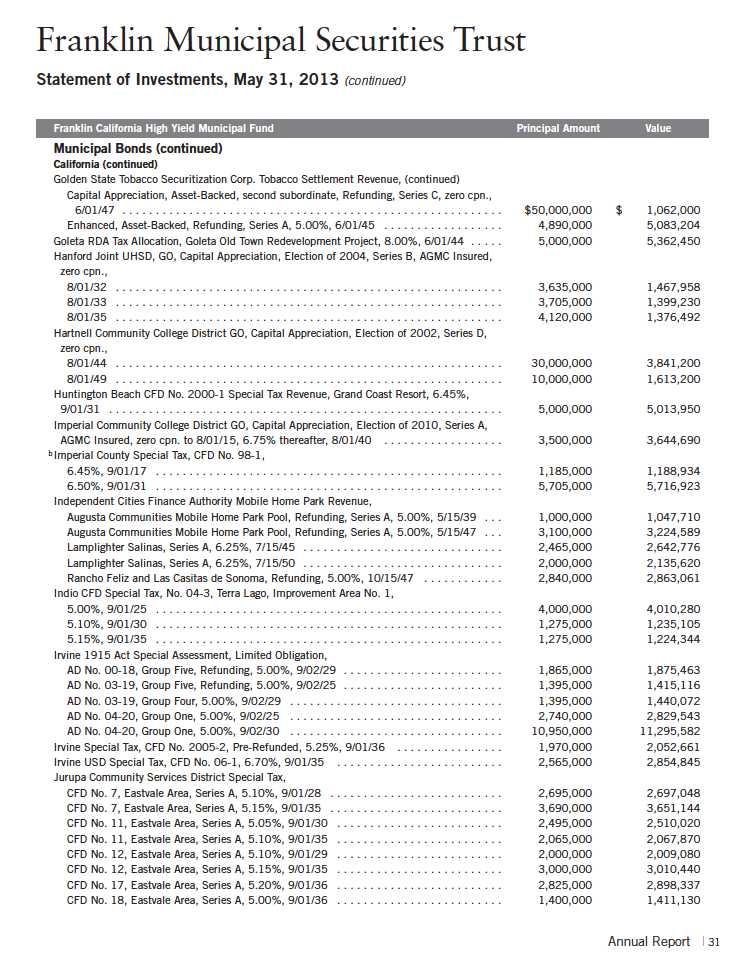

6. CREDIT RISK AND DEFAULTED SECURITIES

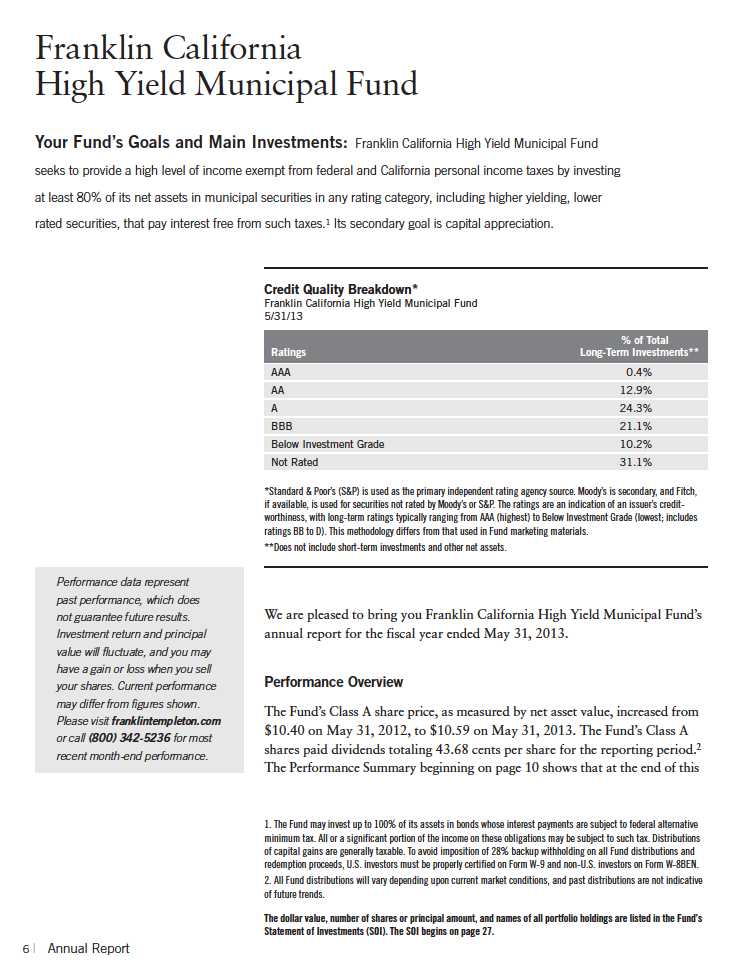

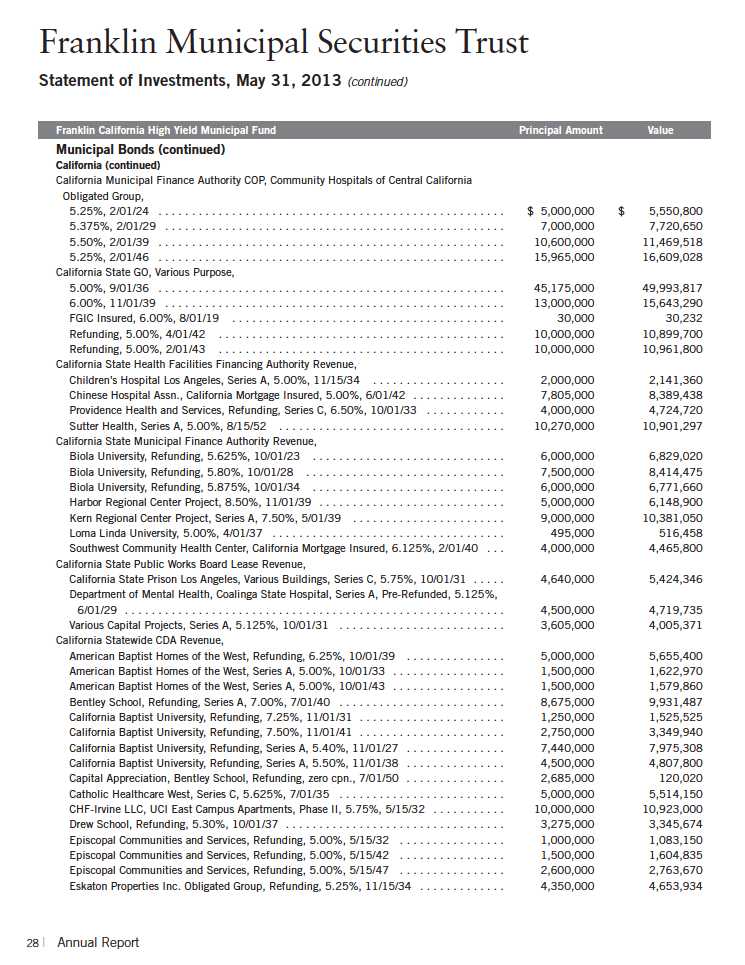

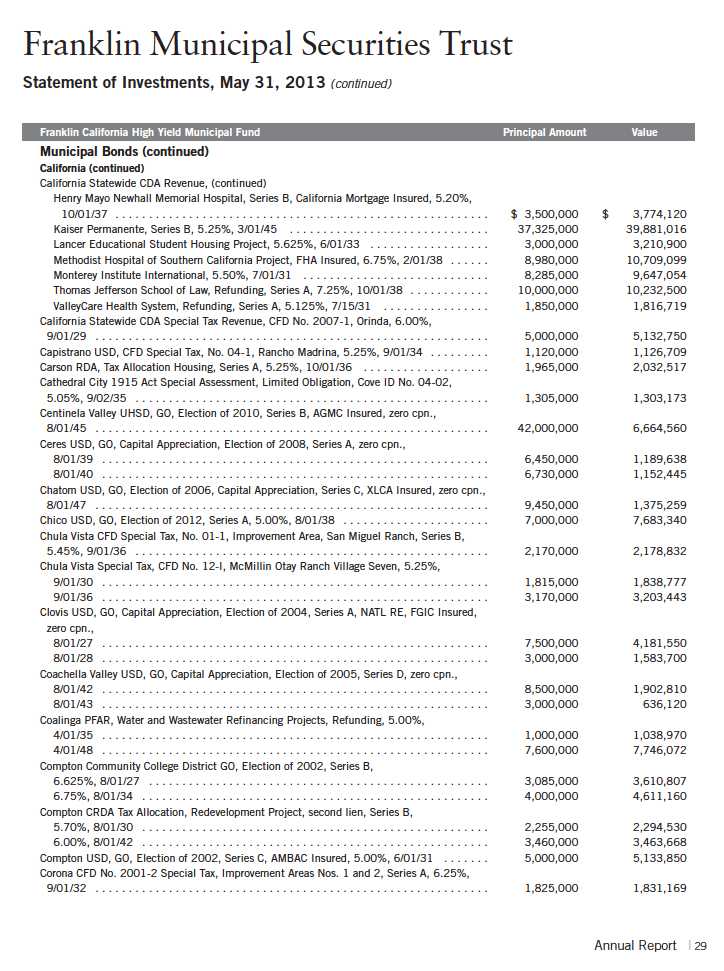

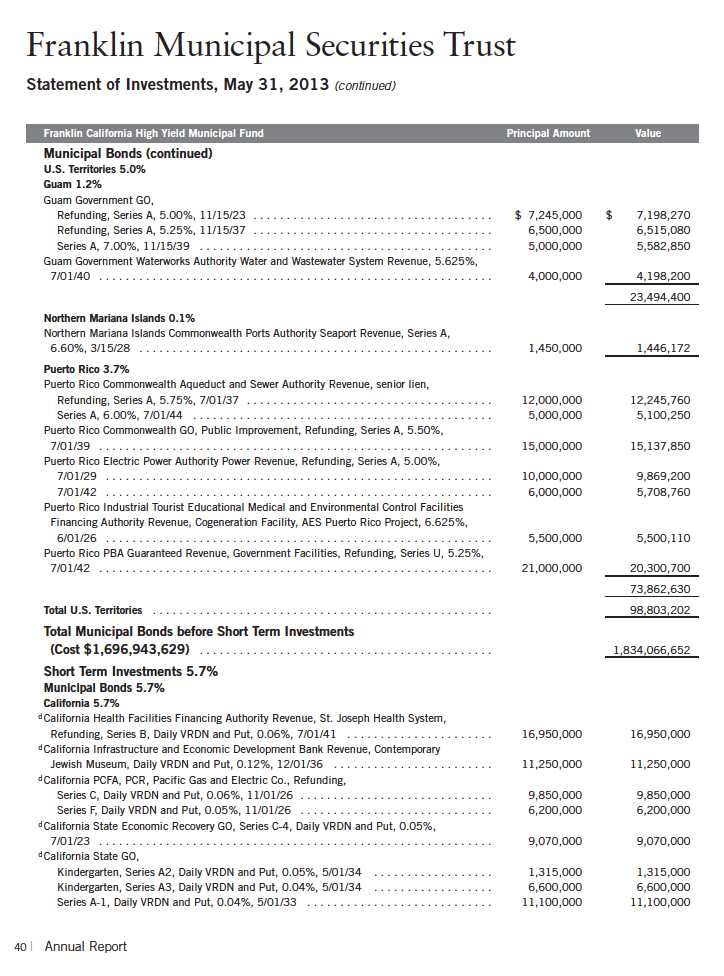

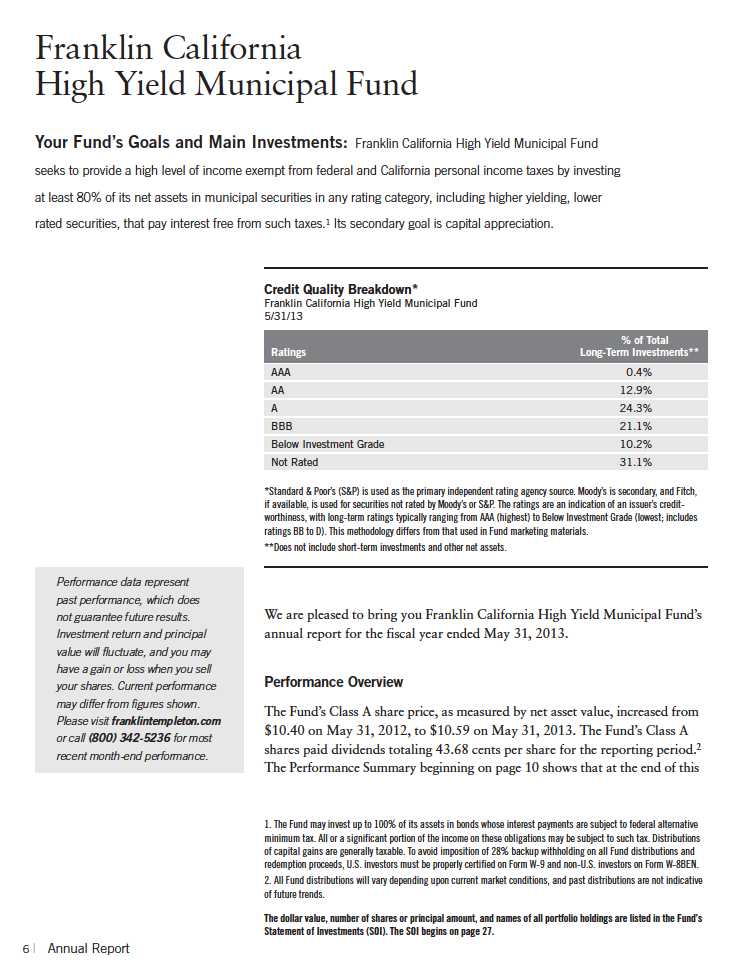

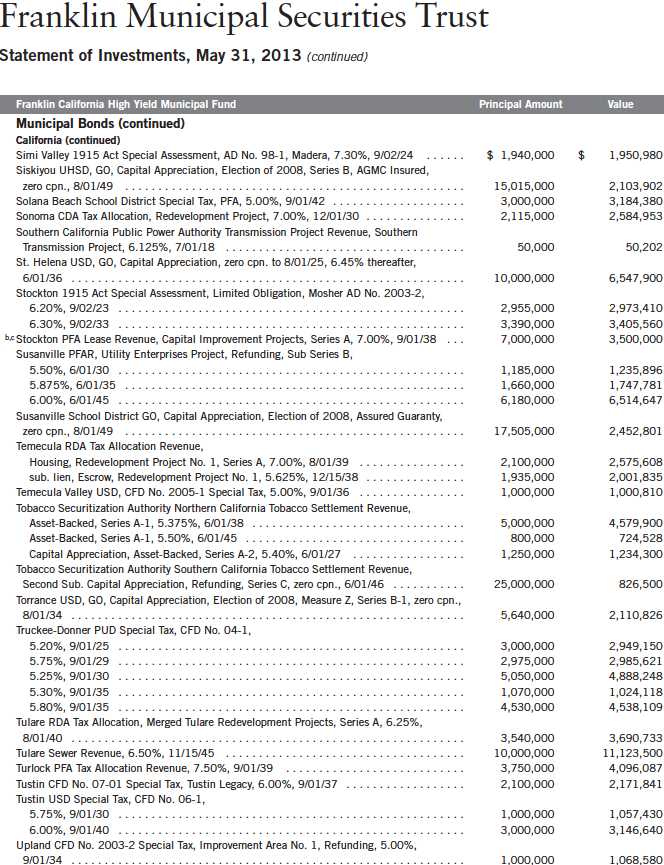

At May 31, 2013, the Franklin California High Yield Municipal Fund had 26.20% of its portfolio invested in high yield securities rated below investment grade. These securities may be more sensitive to economic conditions causing greater price volatility and are potentially subject to a greater risk of loss due to default than higher rated securities.

The Franklin California High Yield Municipal Fund held a defaulted security and/or other securities for which the income has been deemed uncollectible. At May 31, 2013, the value of this security was $3,500,000, representing 0.18% of the fund s net assets. The Fund discontinues accruing income on securities for which income has been deemed uncollectible and provides an estimate for losses on interest receivable. The security has been identified on the accompanying Statement of Investments.

7. CONCENTRATION OF RISK

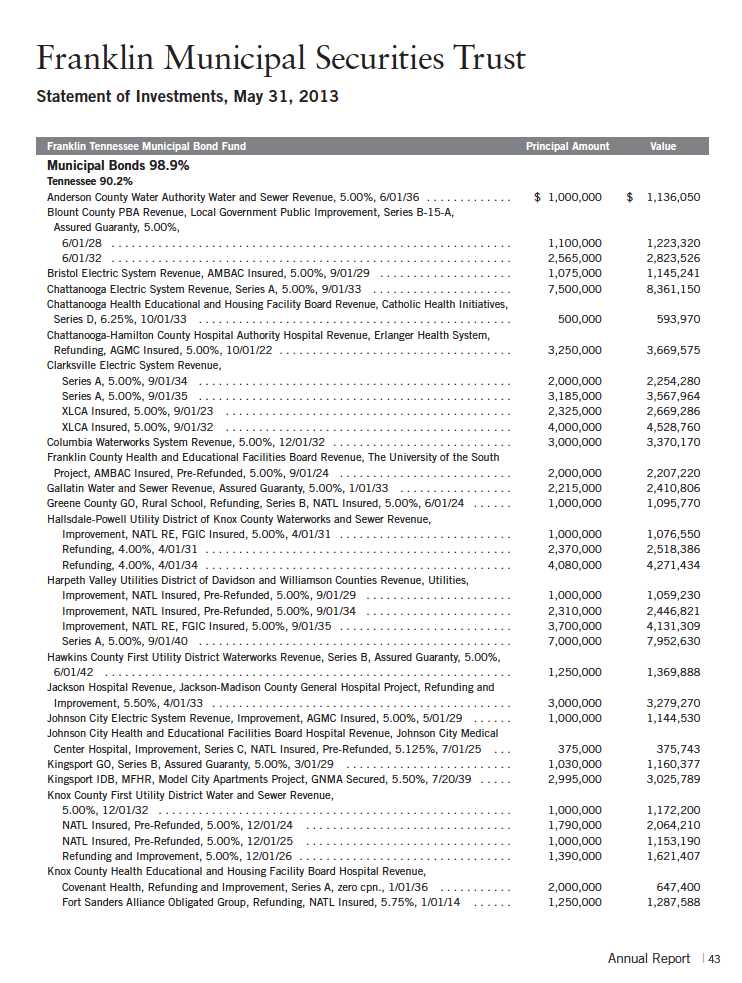

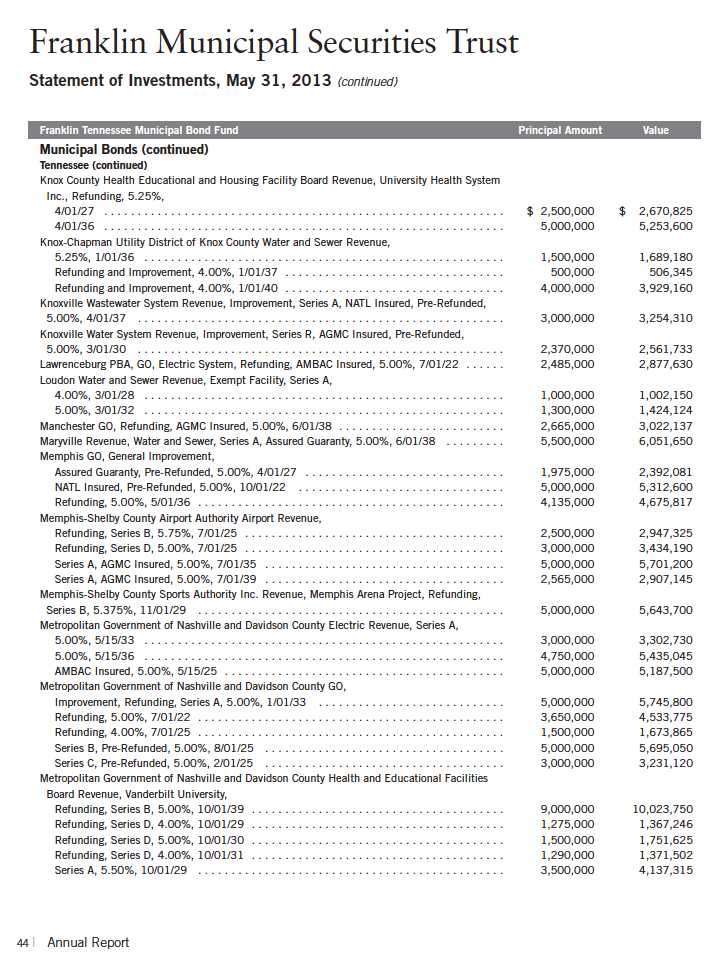

Each of the Funds invests a large percentage of its total assets in obligations of issuers within its respective state and U.S. territories. Such concentration may subject the Funds to risks associated with industrial or regional matters, and economic, political or legal developments occurring within those states and U.S. territories. In addition, investments in these securities are sensitive to interest rate changes and credit risk of the issuer and may subject the funds to increased market volatility. The market for these investments may be limited, which may make them difficult to buy or sell.

8. CREDIT FACILITY

The Funds, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 17, 2014. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Funds shall, in addition to interest charged on any borrowings made by the Funds and other costs incurred by the Funds, pay their share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon their relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.07% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses on the Statements of Operations. During the year ended May 31, 2013, the Funds did not use the Global Credit Facility.

58 | Annual Report

Franklin Municipal Securities Trust

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Municipal Securities Trust

In our opinion, the accompanying statements of assets and liabilities, including the statements of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin California High Yield Municipal Fund and Franklin Tennessee Municipal Bond Fund (separate portfolios of Franklin Municipal Securities Trust, hereafter referred to as the Funds ) at May 31, 2013, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as financial statements ) are the responsibility of the Funds management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2013 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California July 19, 2013

Annual Report | 61

Franklin Municipal Securities Trust

Tax Information (unaudited)

Under Section 852(b)(5)(A) of the Internal Revenue Code, the Funds hereby report 100% of the distributions paid from net investment income as exempt-interest dividends for the fiscal year ended May 31, 2013. A portion of the Fund s exempt-interest dividends may be subject to the federal alternative minimum tax. By mid-February 2014, shareholders will be notified of amounts for use in preparing their 2013 income tax returns.

62 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held February 26, 2013, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for each of the two separate tax-exempt funds within the Trust (Fund(s)). In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for each Fund, along with periodic reports on expenses, shareholder services, legal and compliance matters, pricing, and other services provided by the Investment Manager (Manager) and its affiliates, as well as a third-party survey of transfer agent fees charged funds within the Franklin Templeton Investments complex in comparison with those charged other fund complexes deemed comparable. Information furnished specifically in connection with the renewal process included a report for each Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper reports compared each Fund s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Funds by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and an analysis concerning transfer agent fees charged by an affiliate of the Manager.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. While the investment management agreements for both Funds were considered at the same Board meeting, the Board dealt with each Fund separately. In approving continuance of the investment management agreement for each Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of each Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board s decision.

NATURE, EXTENT AND QUALITY OF SERVICE. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Funds and their shareholders. In addition to investment performance and expenses discussed later, the Board s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for each Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other

68 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned well during the Florida hurricanes and blackouts experienced in previous years, and that those operations in the New York/New Jersey area ran smoothly during the more recent Hurricane Sandy. Consideration was also given to the experience of each Fund s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management s determination of a portfolio manager s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person s fund management area so as to be aligned with the interests of shareholders. The Board also took into account the quality of transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager and the continuous enhancements to the Franklin Templeton website. Particular attention was given to management s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, management s efforts in establishing a global credit facility for the benefit of the Funds and other accounts managed by Franklin Templeton Investments to provide a source of cash for temporary and emergency purposes or to meet unusual redemption requests as well as the strong financial position of the Manager s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of each Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings during the year, particular attention in assessing performance was given to the Lipper reports furnished for the agreement renewals. The Lipper reports prepared for each individual Fund showed its investment performance in comparison with a performance universe selected by Lipper. The following summarizes the performance results for each of the Funds.

Franklin California High Yield Municipal Fund The Lipper report for this Fund showed the investment performance of its Class A shares for the year ended December 31, 2012, and the previous 10 years ended that date in comparison with a performance universe consisting of all retail and institutional California municipal debt funds as selected by Lipper. Such comparison showed that

Annual Report | 69

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

the Fund s income return during 2012, as shown in the Lipper report, and for the previous three-, five- and 10-year periods on an annualized basis to be in the highest or best performing quintile of its performance universe. The Lipper report showed the Fund s total return during 2012 to also be in the highest quintile of its Lipper performance universe and on an annualized basis to be in the highest or best performing quintile of such universe for each of the previous three-, five- and 10-year periods. The Board was satisfied with the Fund s performance, as shown in the Lipper report.

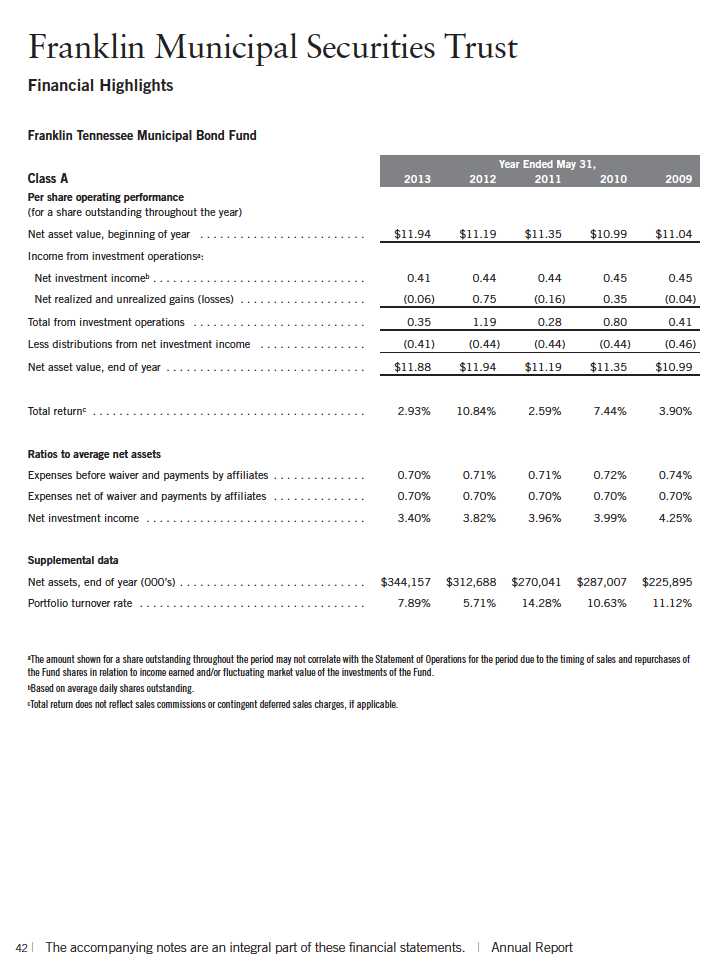

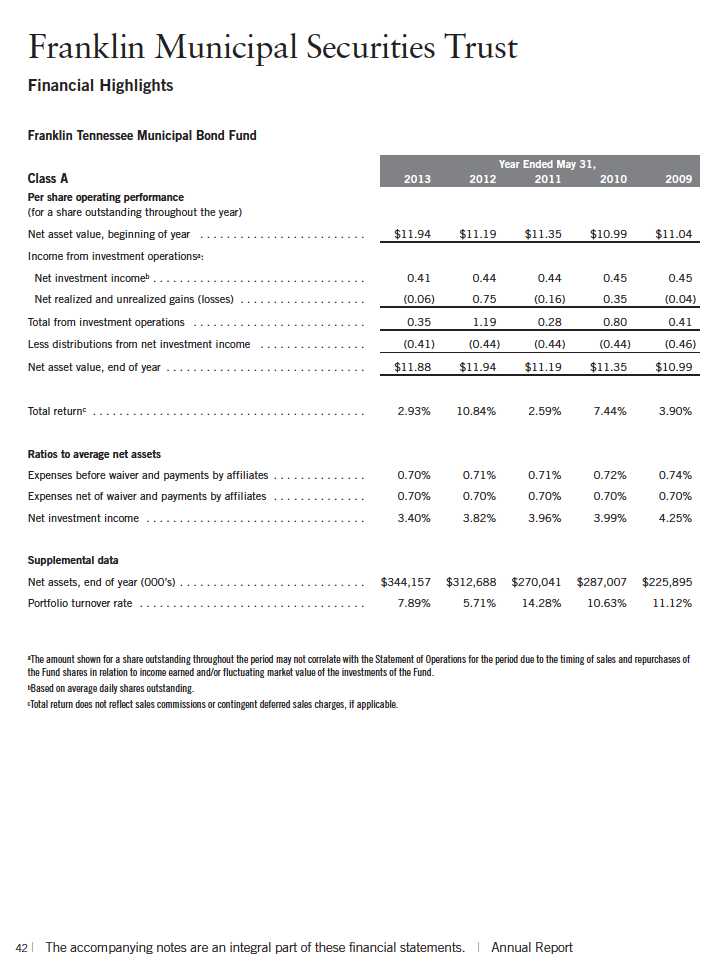

Franklin Tennessee Municipal Bond Fund The Lipper report for this Fund showed the investment performance of its only share class for the year ended December 31, 2012, and the previous 10 years ended that date in comparison with a performance universe consisting of all retail and institutional other states municipal debt funds as selected by Lipper. Such comparison showed the Fund s income return in 2012, as shown in the Lipper report, to be in the second-highest performing quintile of its performance universe, and during each of the previous three-, five- and 10-year periods on an annualized basis to also be in the second-highest quintile of such universe. The Lipper report showed the Fund s total return during 2012 to be in the middle performing quintile of its Lipper performance universe, and on an annualized basis to be in the second-highest performing quintile of its performance universe for the previous three-year period, and in the highest or best performing quintile of such universe for each of the previous five- and 10-year periods. The Board was satisfied with the Fund s performance as shown in the Lipper report.

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fees and total expense ratio of each Fund compared with those of a group of other funds selected by Lipper as its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on each Fund s contractual investment management fee in comparison with the contractual investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expense ratio of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes administrative charges as being part of a management fee, and total expenses, for comparative consistency, were shown by Lipper for Fund Class A shares. The Lipper report for Franklin California High Yield Municipal Fund showed its contractual investment management fee rate to be within one basis point of its Lipper expense group median and its actual total expense ratio to be in the least expensive quintile of such expense group. The Board was satisfied with such comparative expenses. The Lipper report for Franklin Tennessee Municipal Bond Fund showed its contractual investment management fee rate to be below the median of its Lipper expense group, and its actual total expense ratio to be in the least expensive quintile of such expense group. The Board was satisfied with such comparative expenses.

70 | Annual Report

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of each Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2012, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to each Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted that, while being continuously refined and reflecting changes in the Manager s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Funds made in prior years and that the Funds independent registered public accounting firm had been engaged by the Manager to periodically review the reasonableness of the allocation methodologies solely for use by the Funds Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to each Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also took into account management s expenditures in improving shareholder services provided the Funds, as well as the need to implement systems and meet additional regulatory and compliance requirements resulting from statutes such as the Sarbanes-Oxley and Dodd-Frank Acts and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services. Based upon its consideration of all these factors, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to each Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Funds grow larger and the extent to which this is reflected in the level of management fees charged. While recognizing any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appeared as some funds get larger, at some point economies of scale do result in the manager realizing a larger profit margin on management services provided such fund. The Board also noted that any economies of scale are shared with each of these Funds and their shareholders through management fee breakpoints existing in each of the Fund s investment management agreements so that as a Fund grows in size, its effective management fee rate declines. The fee structure under the investment management agreement for

Annual Report | 71

Franklin Municipal Securities Trust

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

each Fund provides an initial fee of 0.625% on the first $100 million of assets; 0.50% on the next $150 million of assets; and 0.45% on the next $7.25 billion of assets with additional breakpoints continuing thereafter until reaching a final breakpoint for assets in excess of $20 billion. At December 31, 2012, the net assets of Franklin California High Yield Municipal Fund were approximately $1.9 billion and those of Franklin Tennessee Municipal Bond Fund were approximately $338 million. The Board believed that to the extent economies of scale may be realized by the Manager and its affiliates, the schedule of fees under the investment management agreements for both Funds provided a sharing of benefits with each Fund and its shareholders.

Proxy Voting Policies and Procedures

The Trust s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Trust s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission s website at sec.gov. The filed form may also be viewed and copied at the Commission s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Householding of Reports and Prospectuses

You will receive each Funds financial reports every six months as well as an annual updated summary prospectus (prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the financial reports and summary prospectus. This process, called householding, will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 632-2301. At any time you may view current prospectuses/summary prospectuses and financial reports on our website. If you choose, you may receive these documents through electronic delivery.

72 | Annual Report