UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06481

Franklin Municipal Securities Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: _650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 5/31/17

Item 1. Reports to Stockholders.

| | | | | | |

| | | | Annual Report

and Shareholder Letter May 31, 2017 |

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Dear Shareholder:

Overall, the 12 months ended May 31, 2017, benefited from mostly upbeat economic data and better corporate earnings in the U.S., signs of improvement in the Chinese and European economies and ongoing expansionary monetary policies from key central banks. The U.S. job market remained healthy as the unemployment rate declined.

After maintaining its target interest rate in the 0.25%–0.50% range for nearly a year, the U.S. Federal Reserve (Fed), at its December meeting, increased its target range for the federal funds rate to 0.50%–0.75%. In March, the Fed raised its target range 0.25% for the second time in three months to 0.75%–1.00%. The 10-year U.S. Treasury yield began the period at 1.84% and rose to 2.21% at period-end. Fixed income markets, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, had a +1.58% total return for the 12 months ended May 31, 2017.1 Investment-grade municipal bonds, as measured by the Bloomberg Barclays Municipal Bond Index, had a +1.46% total return for the 12-month period.1

A couple of weeks after the end of the reporting period, the Fed raised its target range a quarter point to 1.00%–1.25%. Despite

low inflation, the Fed made this decision amid signs of a strengthening labor market and moderately rising economic activity.

In addition, Franklin Municipal Securities Trust’s annual report includes more detail about municipal bond market conditions and discussions from the portfolio managers. On our website, franklintempleton.com, you can find updated commentary by our municipal bond experts. Municipal bonds can provide tax-free income and diversification from equities. Despite periods of volatility, municipal bonds historically have had a solid long-term record of performance, driven mostly by their income component. Please remember all securities markets fluctuate, as do mutual fund share prices.

As always, we recommend investors consult their financial advisors to help them make the best decisions for the long term. In a constantly changing market environment, we remain committed to our disciplined strategy as we manage the Fund, keeping in mind the trust you have placed in us. We appreciate your confidence in us and encourage you to contact us when you have questions about your Franklin Templeton tax-free investment.

1. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

| | | | | | |

| franklintempleton.com | | Not part of the annual report | | | 1 | |

Sincerely,

Rupert H. Johnson, Jr.

Chairman

Franklin Municipal Securities Trust

Sheila Amoroso

Rafael R. Costas Jr.

Senior Vice Presidents and Co-Directors

Franklin Municipal Bond Department

This letter reflects our analysis and opinions as of May 31, 2017, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, state, industry, security or fund. Statements of fact are from sources considered reliable.

Contents

Annual Report

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

| | | | | | |

| | 2 | | | Not part of the annual report | | franklintempleton.com |

Annual Report

Municipal Bond Market Overview

The municipal bond market outperformed the U.S. Treasury market, but underperformed U.S. stock markets during the 12-month period ended May 31, 2017. Investment-grade municipal bonds, as measured by the Bloomberg Barclays Municipal Bond Index, posted a +1.46% total return for the period, while U.S. Treasuries, as measured by the Bloomberg Barclays U.S. Treasury Index, had a 0.00% total return.1 U.S. equities, as represented by the Standard & Poor’s® 500 Index, outperformed both municipals and U.S. Treasuries with a +17.47% total return for the reporting period.1

Donald Trump’s U.S. presidential victory in November shocked financial markets and pushed U.S. equities to all-time highs on the promise of lower taxes, deregulation and significant infrastructure spending. These same factors stoked fears among bond investors of inflation and higher interest rates. As a result, both the municipal bond market and U.S. Treasury market sold off sharply immediately following the election. Fixed income markets quickly stabilized, however, and generated positive returns from December through the end of the reporting period.

The election also resulted in Republican control of both the White House and Congress, marking the first time in six years that one party has controlled both the Executive and Legislative branches. Many forecasters believe the Trump presidency could usher in a new era of higher growth for the U.S. economy. As of period-end, however, there are still more questions than answers about the new administration’s ability to implement its agenda and the timing of any related legislation.

The Federal Reserve (Fed) raised its target range for the federal funds rate by 0.25% two times during the reporting period: once in December and again in March. The target range of the federal funds rate currently stands at 0.75%–1.00%. The Fed also increased the discount rate by 0.25% to 1.50% in March. After raising its target range by 0.25% just once in both 2015 and 2016, in March the Fed indicated that it expects three such increases in 2017. In its March press release, the central bank cited expanding economic activity and strong labor markets, while noting that monetary policy will remain accommodative until its desired 2% inflation target is attained.

Investors displayed a healthy appetite for risky assets through most of the period. Municipal bonds with shorter maturities generally performed better than bonds with longer maturities and high yield tax-exempt bonds outperformed their investment-grade counterparts. The Bloomberg Barclays High Yield Municipal Bond Index generated a +4.60% total return for the period and the Bloomberg Barclays Municipal Long (22+ Years) Bond Index returned +1.45%.1

Approximately $374 billion in municipal bonds were issued over the past 12 months. However, this was offset by the approximately $350 billion in municipal bonds that either matured or were called out of the market, making net supply slightly positive for the period at $24 billion.2 This net positive supply picture created a somewhat weaker technical backdrop that contributed to tepid returns for the period.

Overall, benchmark 10-year and 30-year tax-exempt interest rates ended the period higher than where they began, despite touching record low levels in July. Bond prices will decline as interest rates rise, impacting total return performance. However, bouts of volatility such as the one experienced following the election provide opportunities for Franklin Templeton’s actively managed investment strategies to seek to take advantage of market dislocations and potentially increase the income of its portfolios. In periods of low and declining interest rates, as has been the environment over the past several years, issuers can “pre-refund” their debt. As a result, our funds have heightened exposure to these pre-refunded bonds, which tend to be short duration, high quality securities. In addition to generating income at higher than current market rates, they also enhance portfolio liquidity and help reduce volatility.

Several developments affected Puerto Rico bonds over the reporting period. On May 3, 2017, the Puerto Rico federal Oversight Board filed for Title III (bankruptcy) under the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) for Puerto Rico’s central government, and followed with a similar filing for COFINA on May 5, 2017. In doing so, the Oversight Board made the determination that Puerto Rico and COFINA each met the requirements for commencing a Title III proceeding, including that good faith efforts to reach a consensual restructuring with creditors were made without having reached an agreement. Judge Laura

1. Source: Morningstar. Treasuries, if held to maturity, offer a fixed rate of return and a fixed principal value; their interest payments and principal are guaranteed.

See www.franklintempletondatasources.com for additional data provider information.

2. Source: Goldman Sachs Securities Division, Bloomberg.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 3 | |

Taylor Swain, a district court judge in the Southern District of New York, is presiding over the process, and the first hearing was held on May 17, 2017, in San Juan. Legal counsel for Franklin, OppenheimerFunds and First Puerto Rico Funds appeared on their behalf at the May 17th hearing to represent their interests with respect to their COFINA holdings.

On June 30, 2016, President Obama signed PROMESA, a bipartisan congressional effort that created the independent, seven-member Oversight Board. The board, appointed by the House of Representatives, Senate and President Obama, has fiscal oversight over Puerto Rico’s finances for an initial term of five years and its term will expire once Puerto Rico has posted four structurally balanced budgets in a row and is deemed to have “adequate access… at reasonable interest rates” to the capital markets. The board has the power to approve or reject the general government’s proposed budgets until the board is satisfied that the budgets are structurally responsible and based on reasonable expectations and accounting standards.

Additionally, Title III of PROMESA provides Puerto Rico with a path for restructuring its debts following a process based on Chapter 9 of the U.S. Bankruptcy Code, with some important protections and safeguards that are not available to creditors in a Chapter 9 proceeding. This is important as the U.S. Supreme Court affirmed in June 2016 that neither Puerto Rico nor its municipalities or agencies can file for bankruptcy under Chapter 9. Title III is available to Puerto Rico and its related issuers only if negotiations under Title VI of PROMESA do not result in consensual agreements with creditors following good faith efforts to reach a consensual restructuring.

On Monday, March 13, 2017, the Oversight Board certified a 10-year Fiscal Plan for Puerto Rico, as required by PROMESA.

As part of the Puerto Rico Electric Power Authority (PREPA) forbearing creditor group (Ad Hoc Group), we have been participating in discussions related to the PREPA bonds owned by our managed funds and accounts.

After months of negotiation, PREPA and more than 70% of its creditors signed an Amended and Restated Restructuring Support Agreement (RSA) that would provide, among other things, for a restructuring of some of PREPA’s outstanding debt at 85 cents on the dollar. In our view, the implementation of the RSA would provide the basis for PREPA to provide more reliable and lower-cost service, fund its capital needs for the medium term, help ensure environmental compliance, diversify generation resources to include more natural gas, and provide jobs.

The new RSA sets forth numerous milestones, including approval from the Oversight Board, and is scheduled to expire September 1, 2017, the date on which the exchange is expected to take place.

COFINA, the Spanish name for debt secured by a dedicated portion of the sales and use tax, has through May 2017 made all principal and interest payments on time and in full. Several creditors have alleged that an event of default has occurred which could, under certain circumstances, result in acceleration. Because Judge Swain could not hear the matter prior to June 1, 2017, when a small debt service payment was due, she ordered the payment, which is on deposit with the trustee, be put in escrow for benefit of bondholders until the matter is heard in the next few months.

On July 1, 2016, Puerto Rico defaulted on the entire payment due on its General Obligation (GO) Bonds, making it the first state or territory-level issuer to do so since the Great Depression. The government has continued to default on GO bonds as of this writing; however, Puerto Rico Governor Ricardo Roselló Nevares did authorize the March 1, 2017, debt service payment of $1.4 million.

On November 22, 2016, certain Franklin Municipal Bond Funds that own COFINA bonds joined other bondholders in filing a Motion to Intervene in a lawsuit in Puerto Rico between a group of GO hedge fund bondholders and the government, in an effort to uphold the validity of the COFINA bond structure. The motion was granted on February 17, 2017. On April 4, 2017, the First Circuit Court of Appeals, in a related motion, stayed all aspects of the lawsuit until May 1, 2017. The Title III filing discussed above has further stayed this lawsuit and other litigation related to Puerto Rico’s GO and COFINA debt.

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income, while seeking value in the municipal bond market.

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2017, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of

| | | | |

| 4 | | Annual Report | | franklintempleton.com |

fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 5 | |

Franklin California High Yield Municipal Fund

This annual report for Franklin California High Yield Municipal Fund covers the fiscal year ended May 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to provide a high level of income exempt from federal and California personal income taxes by investing at least 80% of its net assets in municipal securities in any rating category, including higher yielding, lower rated securities, that pay interest free from such taxes.1 Its secondary goal is capital appreciation to the extent possible and consistent with its principal goal.

Credit Quality Composition*

5/31/17

| | | | |

| Ratings | | % of Total

Investments | |

| AAA | | | 1.71% | |

| AA | | | 23.72% | |

| A | | | 19.07% | |

| BBB | | | 16.09% | |

| Below Investment Grade | | | 9.60% | |

| Refunded | | | 9.82% | |

| Not Rated | | | 19.99% | |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this composition.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.10 on May 31, 2016, to $10.89 on May 31, 2017. The Fund’s Class A shares paid dividends totaling 39.34 cents per share for the reporting period.2 The Performance Summary beginning on page 9 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate

was 3.60% based on an annualization of May’s 3.41 cent per share dividend and the maximum offering price of $11.37 on May 31, 2017. An investor in the 2017 maximum combined effective federal and California personal income tax bracket of 50.83% (including 3.8% Medicare tax) would need to earn a distribution rate of 7.32% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For other performance data, please see the Performance Summary.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

| | | | | | | | | | | | |

| Dividend Distributions* | |

| 6/1/16–5/31/17 | |

| | | Dividend per Share (cents) | |

| Month | | Class A | | | Class C | | | Advisor Class | |

| June | | | 3.30 | | | | 2.79 | | | | 3.39 | |

| July | | | 3.25 | | | | 2.74 | | | | 3.34 | |

| August | | | 3.20 | | | | 2.69 | | | | 3.29 | |

| September | | | 3.16 | | | | 2.63 | | | | 3.25 | |

| October | | | 3.16 | | | | 2.63 | | | | 3.25 | |

| November | | | 3.16 | | | | 2.63 | | | | 3.25 | |

| December | | | 3.21 | | | | 2.69 | | | | 3.30 | |

| January | | | 3.31 | | | | 2.79 | | | | 3.40 | |

| February | | | 3.36 | | | | 2.84 | | | | 3.45 | |

| March | | | 3.41 | | | | 2.92 | | | | 3.49 | |

| April | | | 3.41 | | | | 2.92 | | | | 3.49 | |

| May | | | 3.41 | | | | 2.92 | | | | 3.49 | |

| Total | | | 39.34 | | | | 33.19 | | | | 40.39 | |

*The distribution amount is the sum of all net investment income distributions for the period shown. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

State Update

California’s large and diverse economy continued to expand during the past 12 months under review. Universities and

1. The Fund may invest up to 100% of its assets in bonds whose interest payments are subject to federal alternative minimum tax. All or a significant portion of the income on these obligations may be subject to such tax. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of all net investment income distributions for the period shown. Assumes shares were purchased and held for the entire accrual period.

Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 23.

| | | | |

| | | |

| 6 | | Annual Report | | franklintempleton.com |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

innovative businesses supported the state’s expansion. Job growth in the state outpaced that of the nation, positioning its economy for faster overall economic growth and pushing revenues higher. Unemployment declined from 5.5% in May 2016 to 4.7% at period-end, yet remained above the 4.3% national rate.3 Sales of California homes declined during the period as housing prices generally increased.

According to independent credit rating agency Standard & Poor’s (S&P), several years of improving California’s fiscal condition have enabled the state to significantly increase funding for education, establish anti-poverty programs, retire debts and build budgetary reserves. However, recent state spending growth and slower revenue collections throughout fiscal year 2017 have marginally tipped California’s general fund into an operating deficit. The governor’s new fiscal year 2017 budget proposal anticipates slower revenue growth ahead and recommends corrective action to close the budget gap.

California’s net tax-supported debt was $2,217 per capita and 4.2% of personal income, compared with the $1,006 and 2.5% national medians, respectively.4 During the period under review, S&P assigned its rating of California’s general obligations bonds at AA- with a stable outlook.5 The rating reflected S&P’s view on the state’s expanding economy, increasing budgetary reserve levels, strong overall liquidity and declining debt ratios. In contrast, S&P cited several challenges to the state including high housing costs, a volatile revenue structure, retirement benefit liabilities and a large backlog of deferred maintenance and infrastructure. Nevertheless, the stable outlook reflected S&P’s view that California has brought its finances into structural alignment and generated modest operating surpluses that could translate to larger projected budget reserves.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders while balancing risk and return within the Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets.

| | | | |

| Portfolio Composition | | | | |

| 5/31/17 | | | | |

| | | % of Total

Investments* | |

| Tax-Supported | | | 22.6% | |

| General Obligation | | | 13.4% | |

| Transportation | | | 13.2% | |

| Hospital & Health Care | | | 12.0% | |

| Refunded** | | | 11.5% | |

| Utilities | | | 7.8% | |

| Other Revenue | | | 7.1% | |

| Higher Education | | | 4.9% | |

| Subject to Government Appropriations | | | 3.5% | |

| Housing | | | 2.9% | |

| Corporate-Backed | | | 1.1% | |

*Does not include cash and cash equivalents.

**Includes all refunded bonds; the percentage may differ from that in the Credit Quality Composition.

Manager’s Discussion

Consistent with our strategy, we sought to remain invested in bonds that maintain an average weighted maturity of 15 to 30 years with good call features. Based on the combination of our value-oriented philosophy of investing primarily for income and a positively sloping municipal yield curve, in which interest rates for longer term bonds are higher than those for shorter term bonds, we favored the use of longer term bonds. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The Fund holds a small portion of its assets in Puerto Rico bonds, which decreased in price over the period. Additionally, Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which we discussed in the Municipal Bond Market Overview on page 3. We continue to closely monitor developments in Puerto Rico; however, the municipal bond market’s overall fundamentals, such as general creditworthiness and low default rates, remained stable.

Thank you for your continued participation in Franklin California High Yield Municipal Fund. We look forward to serving your future investment needs.

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, State Government - US: Medians - Total State Debt Remains Essentially Flat in 2017, 5/3/17.

5. This does not indicate S&P’s rating of the Fund.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 7 |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2017, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| 8 | | Annual Report | | franklintempleton.com |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

Performance Summary as of May 31, 2017

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/17

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 4.25% and the minimum is 0%. Class A: 4.25% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| Share Class | | Cumulative

Total Return1

| | | Average Annual

Total Return2 | |

| | |

A | | | | | | | | |

1-Year | | | +1.71% | | | | -2.59% | |

5-Year | | | +28.71% | | | | +4.27% | |

10-Year | | | +67.72% | | | | +4.85% | |

| | |

Advisor | | | | | | | | |

1-Year | | | +1.80% | | | | +1.80% | |

5-Year | | | +29.42% | | | | +5.29% | |

| 10-Year | | | +69.42% | | | | +5.41% | |

| | | | | | | | | | | | | | | | |

| Share Class | | Distribution

Rate3 | | | Taxable Equivalent

Distribution Rate4 | | | 30-Day

Standardized Yield5 | | | Taxable Equivalent 30-Day

Standardized Yield4 | |

A | | | 3.60% | | | | 7.32% | | | | 2.67% | | | | 5.43% | |

Advisor | | | 3.84% | | | | 7.81% | | | | 2.89% | | | | 5.88% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 11 for Performance Summary footnotes.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 9 | |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

PERFORMANCE SUMMARY

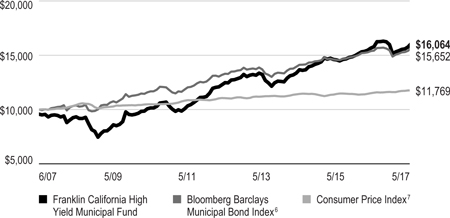

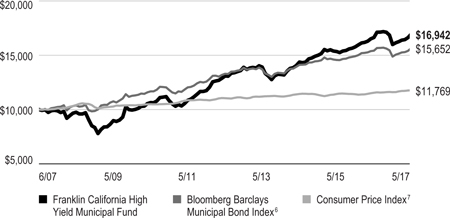

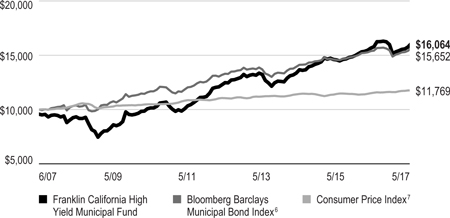

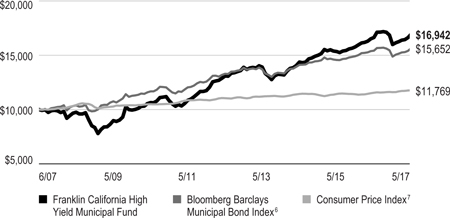

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (6/1/07–5/31/17)

Advisor Class (6/1/07–5/31/17)

See page 11 for Performance Summary footnotes.

| | | | |

| 10 | | Annual Report | | franklintempleton.com |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

PERFORMANCE SUMMARY

Net Asset Value

| | | | | | | | | | | | |

| Share Class (Symbol) | | 5/31/17 | | | 5/31/16 | | | Change | |

A (FCAMX) | | | $10.89 | | | | $11.10 | | | | -$0.21 | |

C (FCAHX) | | | $10.97 | | | | $11.17 | | | | -$0.20 | |

Advisor (FVCAX) | | | $10.91 | | | | $11.12 | | | | -$0.21 | |

|

Distributions (6/1/16–5/31/17) | |

| Share Class | | Net Investment

Income | | | | | | | |

A | | | $0.3934 | | | | | | | | | |

C | | | $0.3319 | | | | | | | | | |

Advisor | | | $0.4039 | | | | | | | | | |

|

| Total Annual Operating Expenses8 | |

| Share Class | | | | | | | | | |

A | | | 0.65% | | | | | | | | | |

Advisor | | | 0.55% | | | | | | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest-rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. Investments in lower rated bonds include higher risk of default and loss of principal. The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, there by increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Distribution rate is based on an annualization of the respective class’s May dividend and the maximum offering price (NAV for Advisor Class) per share on 5/31/17.

4. Taxable equivalent distribution rate and yield assume the published rates as of 12/19/16 for the maximum combined effective federal and California state personal income tax rate of 50.83%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

5. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

6. Source: Morningstar. The Bloomberg Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, S&P and Fitch.

7. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 11 | |

FRANKLIN CALIFORNIA HIGH YIELD MUNICIPAL FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | |

Share Class | | Beginning

Account

Value 12/1/16 | | | | Ending

Account

Value 5/31/17 | | Expenses Paid During

Period 12/1/16–5/31/171 | | | | Ending

Account

Value 5/31/17 | | Expenses Paid During

Period 12/1/16–5/31/171 | | | | Annualized

Expense

Ratio |

A | | $1,000 | | | | $1,059.90 | | $3.34 | | | | $1,021.69 | | $3.28 | | | | 0.65% |

C | | $1,000 | | | | $1,056.40 | | $6.15 | | | | $1,018.95 | | $6.04 | | | | 1.20% |

Advisor | | $1,000 | | | | $1,059.20 | | $2.82 | | | | $1,022.19 | | $2.77 | | | | 0.55% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

| | | | |

| 12 | | Annual Report | | franklintempleton.com |

Franklin Tennessee Municipal Bond Fund

This annual report for Franklin Tennessee Municipal Bond Fund covers the fiscal year ended May 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to maximize income exempt from federal and Tennessee personal income taxes, consistent with prudent investing and the preservation of capital, by investing at least 80% of its net assets in investment grade municipal securities that pay interest free from such taxes.1

Credit Quality Composition*

5/31/17

| | | | |

| Ratings | | % of Total

Investments | |

| AA | | | 55.52% | |

| A | | | 16.45% | |

| BBB | | | 3.32% | |

| Below Investment Grade | | | 2.27% | |

| Refunded | | | 20.18% | |

| Not Rated | | | 2.26% | |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this composition.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.44 on May 31, 2016, to $11.11 on May 31, 2017. The Fund’s Class A shares paid dividends totaling 37.50 cents per share for the reporting period.2 The Performance Summary beginning on page 16 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 3.21% based on an annualization of May’s 3.10 cent per share dividend and the maximum offering price of $11.60 on May 31, 2017. An investor in the 2017 maximum combined

effective federal and Tennessee personal income tax bracket of 46.42% (including 3.8% Medicare tax) would need to earn a distribution rate of 5.99% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For other performance data, please see the Performance Summary.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

| | | | | | | | |

| Dividend Distributions* | |

| 6/1/16–5/31/17 | |

| | | Dividend per Share (cents) | |

| Month | | Class A | | | Advisor Class** | |

| June | | | 3.20 | | | | — | |

| July | | | 3.10 | | | | — | |

| August | | | 3.10 | | | | — | |

| September | | | 3.10 | | | | 1.59 | |

| October | | | 3.10 | | | | 3.19 | |

| November | | | 3.10 | | | | 3.19 | |

| December | | | 3.10 | | | | 3.19 | |

| January | | | 3.15 | | | | 3.24 | |

| February | | | 3.15 | | | | 3.24 | |

| March | | | 3.15 | | | | 3.24 | |

| April | | | 3.15 | | | | 3.24 | |

| May | | | 3.10 | | | | 3.19 | |

| Total | | | 37.50 | | | | 27.31 | |

*The distribution amount is the sum of all net investment income distributions for the period shown. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**Effective 9/15/16, the Fund began offering Advisor Class shares. See the prospectus for details.

State Update

Over the 12 months under review, Tennessee’s diverse economy grew. The state is a distribution and manufacturing hub partly due to its access to the Mississippi River,

1. The Fund may invest up to 100% of its assets in bonds whose interest payments are subject to federal alternative minimum tax. All or a significant portion of the income on these obligations may be subject to such tax. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of all net investment income distributions for the period shown. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 40.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 13 | |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

transportation network and abundant supply of land. These factors contributed to its strong–yet cyclical–trade and manufacturing businesses. Tennessee’s unemployment rate declined from 4.6% in May 2016 to 4.0% at period-end, below the nation’s 4.3% average.3

Tennessee’s fiscal year 2016 budget ended the period with better-than-budgeted revenue performance and supported the enacted fiscal year 2017 budget surplus, which includes additional funding for K-12 education, teacher pay and rural development. The state’s enacted 2016 and 2017 budgets are structurally balanced and aim to continue building rainy day reserves.

Tennessee’s net tax-supported debt was relatively low at $322 per capita and 0.8% of personal income, compared with the $1,006 and 2.5% national medians, respectively.4 During the period under review, independent credit rating agency Standard & Poor’s (S&P) assigned the state’s general obligations bonds AAA with a stable outlook.5 In S&P’s view, the rating reflected the state’s strong growth, improving rainy day reserves, strong financial management practices and performance, long-standing funding of the state’s retirement obligations and low debt burden. The outlook also reflected S&P’s view of Tennessee’s excellent management of its long-term liabilities and that the state could continue to exhibit economic growth, supported by its growing employment.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders while balancing risk and return within the Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets.

Manager’s Discussion

Consistent with our strategy, we sought to remain invested in bonds that maintain an average weighted maturity of 15 to 30 years with good call features. Based on the combination of our value-oriented philosophy of investing primarily for income and a positively sloping municipal yield curve, in which interest rates for longer term bonds are higher than those

Portfolio Composition

5/31/17

| | | | |

| | | % of Total

Investments* | |

| Utilities | | | 26.1% | |

| Refunded** | | | 24.7% | |

| Hospital & Health Care | | | 17.2% | |

| Higher Education | | | 8.9% | |

| General Obligation | | | 7.6% | |

| Transportation | | | 6.6% | |

| Other Revenue | | | 4.3% | |

| Housing | | | 3.0% | |

| Tax-Supported | | | 1.1% | |

| Subject to Government Appropriations | | | 0.5% | |

*Does not include cash and cash equivalents.

**Includes all refunded bonds; the percentage may differ from that in the Credit Quality Composition.

for shorter term bonds, we favored the use of longer term bonds. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The Fund holds a small portion of its assets in Puerto Rico bonds, which decreased in price over the period. The price decline of COFINA bonds outweighed an increase in price for the PREPA bond in the Fund. Additionally, Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which we discussed in the Municipal Bond Market Overview on page 3. We continue to closely monitor developments in Puerto Rico; however, the municipal bond market’s overall fundamentals, such as general creditwor-thiness and low default rates, remained stable.

Thank you for your continued participation in Franklin Tennessee Municipal Bond Fund. We look forward to serving your future investment needs.

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, State Government - US: Medians - Total State Debt Remains Essentially Flat in 2017, 5/3/17.

5. This does not indicate S&P’s rating of the Fund.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| 14 | | Annual Report | | franklintempleton.com |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2017, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 15 | |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

Performance Summary as of May 31, 2017

The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/17

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 4.25% and the minimum is 0%. Class A: 4.25% maximum initial sales charge; Advisor Class: no sales charges.

| | | | | | | | |

| Share Class | | Cumulative Total Return1 | | | Average Annual

Total Return2 | |

| | |

A | | | | | | | | |

1-Year | | | +0.40% | | | | -3.89% | |

5-Year | | | +10.91% | | | | +1.21% | |

10-Year | | | +44.73% | | | | +3.31% | |

| | |

Advisor3 | | | | | | | | |

1-Year | | | +0.56% | | | | +0.56% | |

5-Year | | | +11.08% | | | | +2.12% | |

10-Year | | | +44.96% | | | | +3.78% | |

| | | | | | | | | | | | | | | | |

| Share Class | | Distribution

Rate4 | | | Taxable Equivalent

Distribution Rate5 | | | 30-Day

Standardized Yield6 | | | Taxable Equivalent 30-Day

Standardized Yield5 | |

A | | | 3.21% | | | | 5.99% | | | | 1.74% | | | | 3.25% | |

Advisor | | | 3.44% | | | | 6.42% | | | | 1.92% | | | | 3.58% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 18 for Performance Summary footnotes.

| | | | |

| | | |

| 16 | | Annual Report | | franklintempleton.com |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

PERFORMANCE SUMMARY

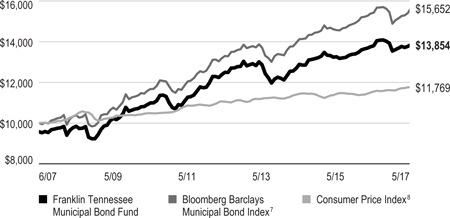

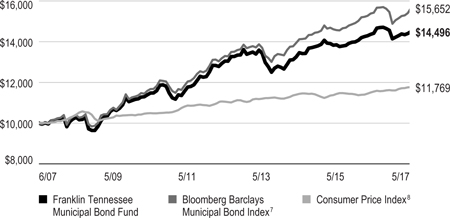

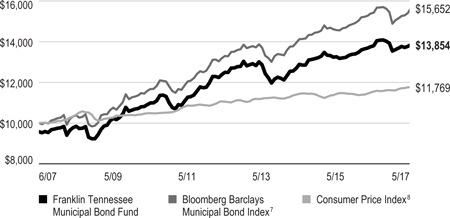

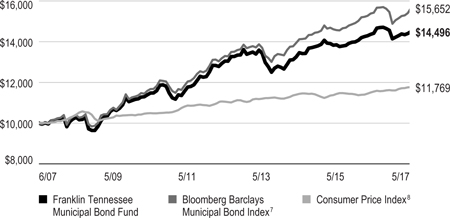

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Class A (6/1/07–5/31/17)

Advisor Class (6/1/07–5/31/17)3

See page 18 for Performance Summary footnotes.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 17 | |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

PERFORMANCE SUMMARY

Net Asset Value

| | | | | | | | | | | | | | | | |

| Share Class (Symbol) | | 5/31/17 | | | 9/15/16 | | | 5/31/16 | | | Change | |

A (FRTIX) | | | $11.11 | | | | N/A | | | | $11.44 | | | | - $0.33 | |

Advisor (FTMZX) | | | $11.12 | | | | $11.50 | | | | N/A | | | | - $0.38 | |

|

Distributions (6/1/16–5/31/17) | |

| Share Class | | Net Investment

Income | | | | | | | | | | |

A | | | $0.3750 | | | | | | | | | | | | | |

Advisor (9/15/16–5/31/17) | | | $0.2731 | | | | | | | | | | | | | |

|

Total Annual Operating Expenses9 | |

| | | | |

| Share Class | | | | | | | | | | | | |

A | | | 0.72% | | | | | | | | | | | | | |

Advisor | | | 0.62% | | | | | | | | | | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest-rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Effective 9/15/16, the Fund began offering Advisor class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 9/15/16, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 9/15/16, actual Advisor class performance is used reflecting all charges and fees applicable to that class. Since 9/15/16 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were -0.91% and -0.91%.

4. Distribution rate is based on an annualization of the respective class’s May dividend and the maximum offering price (NAV for Advisor Class) per share on 5/31/17.

5. Taxable equivalent distribution rate and yield assume the published rates as of 12/19/16 for the maximum combined effective federal and Tennessee state personal income tax rate of 46.42%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: Morningstar. The Bloomberg Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, S&P and Fitch.

8. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

9. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| 18 | | Annual Report | | franklintempleton.com |

FRANKLIN TENNESSEE MUNICIPAL BOND FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | |

Share Class | | Beginning

Account

Value 12/1/16 | | | | Ending

Account

Value 5/31/17 | | Expenses Paid During

Period 12/1/16–5/31/171 | | | | Ending

Account

Value 5/31/17 | | Expenses Paid During Period 12/1/16–5/31/171 | | | | Annualized

Expense

Ratio |

A | | $1,000 | | | | $1,023.50 | | $3.83 | | | | $1,021.14 | | $3.83 | | | | 0.76% |

Advisor | | $1,000 | | | | $1,024.90 | | $3.33 | | | | $1,021.64 | | $3.33 | | | | 0.66% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

| | | | | | |

| franklintempleton.com | | Annual Report | | | 19 | |

FRANKLIN MUNICIPAL SECURITIES TRUST

Financial Highlights

Franklin California High Yield Municipal Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Class A | | | | | | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $11.10 | | | | $10.65 | | | | $10.42 | | | | $10.59 | | | | $10.40 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.40 | | | | 0.41 | | | | 0.44 | | | | 0.49 | | | | 0.46 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.22 | ) | | | 0.46 | | | | 0.24 | | | | (0.18 | ) | | | 0.17 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.18 | | | | 0.87 | | | | 0.68 | | | | 0.31 | | | | 0.63 | |

| | | | |

| | | | | |

| Less distributions from net investment income | | | (0.39 | ) | | | (0.42 | ) | | | (0.45 | ) | | | (0.48 | ) | | | (0.44) | |

| | | | |

| | | | | |

Net asset value, end of year | | | $10.89 | | | | $11.10 | | | | $10.65 | | | | $10.42 | | | | $10.59 | |

| | | | |

| | | | | |

Total returnc | | | 1.71% | | | | 8.37% | | | | 6.63% | | | | 3.22% | | | | 6.10% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 0.63% | | | | 0.65% | | | | 0.63% | | | | 0.63% | | | | 0.61% | |

| | | | | |

Net investment income | | | 3.66% | | | | 3.83% | | | | 4.17% | | | | 4.95% | | | | 4.31% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $1,377,514 | | | | $1,442,703 | | | | $1,294,192 | | | | $1,203,532 | | | | $1,330,444 | |

| | | | | |

Portfolio turnover rate | | | 19.73% | | | | 12.23% | | | | 11.98% | | | | 22.26% | | | | 5.47% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

| | | | |

| 20 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN MUNICIPAL SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin California High Yield Municipal Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Class C | | | | | | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $11.17 | | | | $10.72 | | | | $10.49 | | | | $10.65 | | | | $10.46 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.34 | | | | 0.36 | | | | 0.39 | | | | 0.44 | | | | 0.40 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.21 | ) | | | 0.45 | | | | 0.23 | | | | (0.18 | ) | | | 0.17 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.13 | | | | 0.81 | | | | 0.62 | | | | 0.26 | | | | 0.57 | |

| | | | |

| | | | | |

| Less distributions from net investment income | | | (0.33 | ) | | | (0.36 | ) | | | (0.39 | ) | | | (0.42 | ) | | | (0.38) | |

| | | | |

| | | | | |

Net asset value, end of year | | | $10.97 | | | | $11.17 | | | | $10.72 | | | | $10.49 | | | | $10.65 | |

| | | | |

| | | | | |

Total returnc | | | 1.22% | | | | 7.73% | | | | 6.01% | | | | 2.74% | | | | 5.48% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 1.18% | | | | 1.20% | | | | 1.18% | | | | 1.18% | | | | 1.16% | |

| | | | | |

Net investment income | | | 3.11% | | | | 3.28% | | | | 3.62% | | | | 4.40% | | | | 3.76% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $358,308 | | | | $377,550 | | | | $326,456 | | | | $278,775 | | | | $322,824 | |

| | | | | |

Portfolio turnover rate | | | 19.73% | | | | 12.23% | | | | 11.98% | | | | 22.26% | | | | 5.47% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

| | | | | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 21 | |

FRANKLIN MUNICIPAL SECURITIES TRUST

FINANCIAL HIGHLIGHTS

Franklin California High Yield Municipal Fund (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended May 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Advisor Class | | | | | | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $11.12 | | | | $10.67 | | | | $10.44 | | | | $10.61 | | | | $10.41 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.41 | | | | 0.43 | | | | 0.45 | | | | 0.50 | | | | 0.47 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.22 | ) | | | 0.45 | | | | 0.24 | | | | (0.18 | ) | | | 0.18 | |

| | | | |

| | | | | |

Total from investment operations | | | 0.19 | | | | 0.88 | | | | 0.69 | | | | 0.32 | | | | 0.65 | |

| | | | |

| | | | | |

| Less distributions from net investment income | | | (0.40 | ) | | | (0.43 | ) | | | (0.46 | ) | | | (0.49 | ) | | | (0.45) | |

| | | | |

| | | | | |

Net asset value, end of year | | | $10.91 | | | | $11.12 | | | | $10.67 | | | | $10.44 | | | | $10.61 | |

| | | | |

| | | | | |

Total return | | | 1.80% | | | | 8.46% | | | | 6.73% | | | | 3.32% | | | | 6.30% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 0.53% | | | | 0.55% | | | | 0.53% | | | | 0.53% | | | | 0.51% | |

| | | | | |

Net investment income | | | 3.76% | | | | 3.93% | | | | 4.27% | | | | 5.05% | | | | 4.41% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $720,890 | | | | $635,463 | | | | $474,392 | | | | $315,131 | | | | $303,904 | |

| | | | | |

Portfolio turnover rate | | | 19.73% | | | | 12.23% | | | | 11.98% | | | | 22.26% | | | | 5.47% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

| | | | |

| 22 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN MUNICIPAL SECURITIES TRUST

Statement of Investments, May 31, 2017

Franklin California High Yield Municipal Fund

| | | | | | | | | | |

| | | | | Units | | | Value | |

| |

| | Common Stocks and Other Equity Interests (Cost $611,327) 0.0%† | |

| | Consumer Discretionary 0.0%† | | | | | | | | |

| a,b 1155 Island Avenue LLC, LP | | | 7,830,849 | | | $ | 611,323 | |

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount | | | | |

| | Corporate Bonds (Cost $3,893,328) 0.1% | | | | | | | | |

| | Consumer Discretionary 0.1% | | | | | | | | |

c,d 1155 Island Avenue LLC, PIK, 10.00%, 12/11/24 | | $ | 3,893,328 | | | | 3,896,991 | |

| | | | | | | | | | |

| | Municipal Bonds 93.1% | |

| | California 88.8% | | | | | | | | |

| | ABAG Finance Authority for Nonprofit Corps. Revenue, Episcopal Senior Communities, Refunding, 6.125%, 7/01/41 | | | 7,500,000 | | | | 8,285,925 | |

| | Alameda Corridor Transportation Authority Revenue, second sub. lien, Refunding, Series B, AGMC Insured, 4.00%, 10/01/35 | | | 3,250,000 | | | | 3,415,165 | |

| | Alameda Special Tax, CFD No. 13-1, Alameda Landing Public Improvements, 5.00%, 9/01/46 | | | 1,400,000 | | | | 1,539,818 | |

| | Artesia RDA Tax Allocation, | | | | | | | | |

| | Artesia Redevelopment Project Area, 5.50%, 6/01/42 | | | 6,355,000 | | | | 6,356,716 | |

| | Artesia Redevelopment Project Area, 5.70%, 6/01/42 | | | 2,920,000 | | | | 2,921,314 | |

| | Housing Set-Aside, Artesia Redevelopment Project Area, 7.70%, 6/01/46 | | | 3,215,000 | | | | 3,463,873 | |

| | Azusa Special Tax, | | | | | | | | |

| | CFD No. 2005-1, Rosedale, Improvement Area No. 1, 5.00%, 9/01/27 | | | 1,970,000 | | | | 1,981,505 | |

| | CFD No. 2005-1, Rosedale, Improvement Area No. 1, 5.00%, 9/01/37 | | | 1,630,000 | | | | 1,638,085 | |

| | Baldwin Park USD, | | | | | | | | |

| | GO, Los Angeles County, Capital Appreciation, Election of 2006, AGMC Insured, Pre-Refunded, zero cpn., 8/01/31 | | | 5,735,000 | | | | 2,619,175 | |

| | GO, Los Angeles County, Capital Appreciation, Election of 2006, Refunding, BAM Insured, zero cpn., 8/01/42 | | | 10,000,000 | | | | 2,306,900 | |

| | Bay Area Toll Authority Toll Bridge Revenue, San Francisco Bay Area, Subordinate, Series S-4, 5.25%, 4/01/53 | | | 15,000,000 | | | | 17,099,400 | |

| | Beaumont Financing Authority Local Agency Revenue, | | | | | | | | |

| | Series C, 5.45%, 9/01/27 | | | 6,435,000 | | | | 6,436,802 | |

| | Series C, 5.50%, 9/01/29 | | | 855,000 | | | | 855,898 | |

| | Series C, 5.50%, 9/01/35 | | | 1,035,000 | | | | 1,035,859 | |

| | Series C, 5.50%, 9/01/35 | | | 3,995,000 | | | | 4,008,463 | |

| | Beaumont USD, GO, Election of 2008, Series C, AGMC Insured, 6.00%, 8/01/41 | | | 1,925,000 | | | | 2,264,166 | |

| | Buena Park Community RDA Tax Allocation, Consolidated Redevelopment Project, 6.25%, 9/01/35 | | | 5,000,000 | | | | 5,301,150 | |

| | California County Tobacco Securitization Agency Tobacco Settlement Revenue, Asset-Backed, Los Angeles County Securitization Corp., 5.70%, 6/01/46 | | | 3,000,000 | | | | 3,018,210 | |

| | California Municipal Finance Authority Revenue, | | | | | | | | |

| | American Heritage Education Foundation Project, Refunding, Series A, 5.00%, 6/01/36 | | | 1,000,000 | | | | 1,087,470 | |

| | American Heritage Education Foundation Project, Refunding, Series A, 5.00%, 6/01/46 | | | 1,750,000 | | | | 1,879,675 | |

| | California PFAR, | | | | | | | | |

| | University Housing, NCCD Claremont Properties LLC, Claremont Colleges Project, Series A, 5.00%, 7/01/27 | | | 1,125,000 | | | | 1,290,848 | |

| | University Housing, NCCD Claremont Properties LLC, Claremont Colleges Project, Series A, 5.00%, 7/01/32 | | | 825,000 | | | | 914,587 | |

| | University Housing, NCCD Claremont Properties LLC, Claremont Colleges Project, Series A, 5.00%, 7/01/37 | | | 1,325,000 | | | | 1,438,500 | |

| | University Housing, NCCD Claremont Properties LLC, Claremont Colleges Project, Series A, 5.00%, 7/01/47 | | | 1,950,000 | | | | 2,098,571 | |

| | | | | | |

| franklintempleton.com | | Annual Report | | | 23 | |

FRANKLIN MUNICIPAL SECURITIES TRUST

STATEMENT OF INVESTMENTS

Franklin California High Yield Municipal Fund (continued)

| | | | | | | | | | |

| | | | | Principal

Amount | | | Value | |

| |

| | Municipal Bonds (continued) | |

| | California (continued) | | | | | | | | |

| | California Public Finance Authority Revenue, | | | | | | | | |

| | Henry Mayo Newhall Hospital, Refunding, 5.00%, 10/15/37 | | $ | 1,100,000 | | | $ | 1,209,483 | |

| | Henry Mayo Newhall Hospital, Refunding, 5.00%, 10/15/47 | | | 5,000,000 | | | | 5,419,500 | |

| | California School Finance Authority Charter School Revenue, | | | | | | | | |

| | Aspire Public Schools-Obligated Group, Refunding, 5.00%, 8/01/36 | | | 3,200,000 | | | | 3,456,576 | |

| | Aspire Public Schools-Obligated Group, Refunding, 5.00%, 8/01/46 | | | 2,500,000 | | | | 2,636,775 | |

| | Aspire Public Schools-Obligated Group, Refunding, Series B, 5.00%, 8/01/35 | | | 1,000,000 | | | | 1,083,300 | |

| | Aspire Public Schools-Obligated Group, Refunding, Series B, 5.00%, 8/01/45 | | | 1,100,000 | | | | 1,161,732 | |

| | Rocketship Education Obligated Group, Series A, 5.00%, 6/01/34 | | | 1,000,000 | | | | 1,019,580 | |

| | Rocketship Education Obligated Group, Series A, 5.125%, 6/01/47 | | | 1,100,000 | | | | 1,113,827 | |

| | Rocketship Education Obligated Group, Series A, 5.25%, 6/01/52 | | | 1,200,000 | | | | 1,217,160 | |

| | California School Finance Authority School Facility Revenue, | | | | | | | | |

| | Alliance College, Ready Public Schools Project, Series C, 5.00%, 7/01/46 | | | 10,000,000 | | | | 10,434,700 | |

| | Green Dot Public School Project, Series A, 5.00%, 8/01/35 | | | 2,525,000 | | | | 2,722,809 | |

| | Green Dot Public School Project, Series A, 5.00%, 8/01/45 | | | 3,500,000 | | | | 3,718,820 | |

| | Kipp LA Projects, Series A, 5.00%, 7/01/35 | | | 1,200,000 | | | | 1,276,092 | |

| | Kipp LA Projects, Series A, 5.00%, 7/01/45 | | | 1,675,000 | | | | 1,792,736 | |

| | California State Educational Facilities Authority Revenue, | | | | | | | | |

| | Chapman University, 5.00%, 4/01/40 | | | 5,000,000 | | | | 5,636,650 | |

| | Loma Linda University, Refunding, Series A, 5.00%, 4/01/42 | | | 8,500,000 | | | | 9,657,615 | |

| | University of the Pacific, Refunding, 5.00%, 11/01/36 | | | 3,000,000 | | | | 3,449,970 | |

| | University of San Francisco, 6.125%, 10/01/36 | | | 2,000,000 | | | | 2,370,000 | |

| | California State GO, | | | | | | | | |

| | Various Purpose, 6.00%, 11/01/39 | | | 13,000,000 | | | | 14,550,900 | |

| | Various Purpose, FGIC Insured, 6.00%, 8/01/19 | | | 30,000 | | | | 30,237 | |

| | Various Purpose, Refunding, 5.00%, 3/01/45 | | | 5,000,000 | | | | 5,752,900 | |

| | California State Health Facilities Financing Authority Revenue, | | | | | | | | |

| | Adventist Health System/West, Refunding, Series A, 4.00%, 3/01/39 | | | 9,000,000 | | | | 9,312,930 | |

| | California-Nevada Methodist Homes, Refunding, California Mortgage Insured, 5.00%, 7/01/45 | | | 4,500,000 | | | | 5,133,960 | |

| | eChildren’s Hospital Los Angeles, Refunding, Series A, 4.00%, 8/15/49 | | | 3,375,000 | | | | 3,383,404 | |

| | El Camino Hospital, 4.00%, 2/01/42 | | | 6,500,000 | | | | 6,720,935 | |

| | El Camino Hospital, 5.00%, 2/01/42 | | | 5,000,000 | | | | 5,640,400 | |

| | Kaiser Permanente, Refunding, Series A, Subseries A-2, 4.00%, 11/01/38 | | | 10,000,000 | | | | 10,459,300 | |

| | Kaiser Permanente, Series A, Subseries A-2, 4.00%, 11/01/51 | | | 25,000,000 | | | | 25,425,750 | |

| | Lucile Salter Packard Children’s Hospital at Stanford, Series A, 5.00%, 8/15/43 | | | 7,160,000 | | | | 8,134,691 | |

| | Providence Health and Services, Series C, Pre-Refunded, 6.50%, 10/01/33 | | | 4,000,000 | | | | 4,297,000 | |

| | Sutter Health, Refunding, Series B, 5.00%, 11/15/46 | | | 26,925,000 | | | | 30,847,972 | |

| | California State Infrastructure and Economic Development Bank Revenue, Goodwill Industries of Sacramento Valley and Northern Nevada Project, Series A, 5.00%, 1/01/47 | | | 10,360,000 | | | | 10,264,792 | |

| | California State Municipal Finance Authority Charter School Lease Revenue, | | | | | | | | |

| | Santa Rosa Academy Project, 5.125%, 7/01/35 | | | 450,000 | | | | 467,919 | |

| | Santa Rosa Academy Project, 5.375%, 7/01/45 | | | 1,400,000 | | | | 1,446,676 | |

| | California State Municipal Finance Authority Charter School Revenue, | | | | | | | | |

| | King Chavez Academy of Excellence Project, Refunding, Series A, 5.00%, 5/01/36 | | | 2,675,000 | | | | 2,816,267 | |

| | King Chavez Academy of Excellence Project, Refunding, Series A, 5.00%, 5/01/46 | | | 2,775,000 | | | | 2,873,707 | |

| | Palmdale Aerospace Academy Project, 5.00%, 7/01/31 | | | 1,000,000 | | | | 1,045,210 | |

| | Palmdale Aerospace Academy Project, 5.00%, 7/01/36 | | | 2,750,000 | | | | 2,793,313 | |

| | Palmdale Aerospace Academy Project, 5.00%, 7/01/41 | | | 1,750,000 | | | | 1,758,803 | |