UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: September 30

Date of reporting period: OCTOBER 1, 2017 – MARCH 31, 2018

(Semi-Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | SEMI-ANNUAL REPORT |

|

AMG Funds |

March 31, 2018  |

AMG Managers Brandywine Fund Class I: BRWIX |

AMG Managers Brandywine Blue Fund Class I: BLUEX |

| | |

amgfunds.com | | |

| | 033118 SAR073 |

|

| |

| AMG Funds |

| Semi-Annual Report — March 31, 2018 (unaudited) |

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

FUND PERFORMANCE | | | 4 | |

| |

FUND SNAPSHOTS, ROSES AND THORNS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG Managers Brandywine Fund | | | 5 | |

| |

AMG Managers Brandywine Blue Fund | | | 10 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 14 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 15 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal period | | | | |

| |

Statements of Changes in Net Assets | | | 16 | |

Detail of changes in assets for the past two fiscal periods | | | | |

| |

Financial Highlights | | | 17 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Statements | | | 19 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | |

| | AMG Managers Brandywine Fund |

| | AMG Managers Brandywine Blue Fund |

DEAR FELLOW SHAREHOLDER:

The stock market’s extended period of calm came to an end during the March quarter, with major market indexes correcting for the first time in two years. While stocks regained all or most of their lost ground by the end of the period, volatility persisted as the key issues credited with sparking the decline remained unresolved.

AMG Managers Brandywine Fund returned 2.40 percent in the three months through March, comparing favorably with a 0.64 percent decline in the Russell 3000® Index and a 1.48 percent gain in the Russell 3000® Growth Index.

AMG Managers Brandywine Blue Fund’s 3.51 percent return in the period outpaced a 1.42 percent gain in the Russell 1000® Growth Index. The S&P 500® and Russell 1000® Indexes declined 0.76 and 0.69 percent, respectively.

The Federal Reserve (the Fed) kept rates unchanged at its January 31 meeting, but its post-meeting statement regarding inflation expectations seemed to raise the market’s sensitivity toward the topic. Two days later, the Labor Department reported a rise in average hourly wages. After notching its best January in 21 years, the S&P 500 Index was 10 percent below its high a little more than a week into February.

Volatility, virtually absent in 2017, spiked to its highest level since the summer of 2015 when China unexpectedly devalued the yuan. Newfound skittishness was on display as investors were forced to digest a series of unusual events against a backdrop of everything-is-great valuations.

News of Facebook user data poaching spurred calls for new tech-sector regulations. Amazon.com, which among many things is a government contractor trusted to store classified information for U.S. spy agencies, was targeted for official scorn via tweet. New tariffs raised fears about the possibility that the U.S. and China, the world’s two largest economies, could be on the verge of a trade war. The Fed ended up raising rates at its March 21 meeting.

As dramatic as it all might sound, final March-quarter returns showed an encouraging amount of resilience. Brandywine generated positive returns in four of the eight economic sectors represented in the Fund’s portfolio during the quarter. The Fund outperformed the same sectors in the Russell 3000® Growth Index in five out of eight sectors. Brandywine Blue enjoyed positive returns in five out of seven sectors and outperformed the sectors within the Russell 1000® Growth Index at the same rate.

Technology holdings were the most prominent contributors to absolute performance for both Funds. Comprising the largest position in each Fund, technology holdings were the most responsible for Brandywine’s performance advantage over the Russell 3000® Growth Index and the second-most responsible for Brandywine Blue’s relative edge over the Russell 1000® Growth Index.

Semiconductors and software drove technology performance, with holdings from both areas reporting significant, expectation-beating results. Micron Technology and Nvidia Corp., held in both Funds, led semiconductor returns. Micron tripled earnings in its most recently reported quarter on 58 percent revenue growth, while Nvidia grew earnings 59 percent on 34 percent revenue growth. ServiceNow was a mutually held standout in software. The company grew December-quarter earnings 46 percent as revenue climbed 41 percent.

Consumer discretionary holdings, which represented the second largest position in each Fund, were the second greatest contributors to total returns. They trailed only technology as relative performance contributors in Brandywine and earned the top relative performance spot in Brandywine Blue.

Investor enthusiasm for technology (and earnings strength) reached into the consumer discretionary sector, where the top contributors operate internet-based business models. Netflix enjoyed its strongest quarter of subscriber growth ever in the three months through December even as it raised prices, helping the company earn $0.41 per share versus $0.15 the year before as it boosted revenue by one-third. Amazon.com grew December-quarter earnings 40 percent on 38 percent revenue growth. Both companies, held by both Funds, exceeded consensus earnings expectations.

Industrial holdings were the biggest absolute and relative performance detractors in both Funds. Both Funds held Oshkosh Corp., which reported robust December-quarter earnings growth, exceeded expectations and raised guidance for its fiscal year ending in September. Still, shares declined amid the emergence of steel tariffs – the company makes commercial specialty vehicles – and what appeared to be waning prospects for broad infrastructure spending in the near term. REV Group (Brandywine only), which also makes specialty vehicles, and Cummins (both Funds), which makes engines, fared similarly.

The only other noteworthy performance detractor was energy, where Halliburton Co. modestly weighed on performance in both Funds. Energy’s negative influence was more pronounced in Brandywine because it held Halcon Resources, an oil and gas production company that disappointed investors with a higher-than-expected 2018 capital expenditure forecast.

Amid concerns about inflation and trade tension, we expect the heightened volatility that emerged in the early months of the year to persist. We plan to be vigilant regarding valuations, as the market’s tempered risk tolerance could prompt some level of repricing, particularly among long-tenured leadership groups. We also plan to capitalize on volatility with a goal to optimize entry and exit points as the Funds evolve with the earnings landscape.

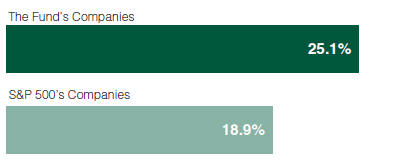

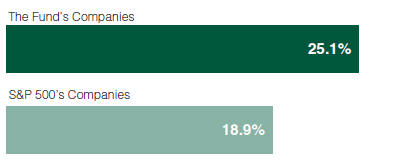

That said, the earnings environment appears strong enough to stand out despite the noise. Based on consensus estimates, the average 2018 earnings growth rates of the Brandywine and Brandywine Blue portfolio companies are 33.7 and 26.9 percent, respectively.

Thanks for your support. We’re committed to building on recent results on your behalf.

|

|

| Scott Gates |

| Chief Investment Officer |

| Friess Associates, LLC |

2

| | |

| | | |

| | | |

| About Your Fund’s Expenses (unaudited) | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and

actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s

actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended March 31, 2018 | | Expense

Ratio for

the Period | | | Beginning

Account

Value

10/01/17 | | | Ending

Account

Value

03/31/18 | | | Expenses

Paid

During

the Period* | |

AMG Managers Brandywine Fund | |

Based on Actual Fund Return | |

Class I | | | 1.10 | % | | $ | 1,000 | | | $ | 1,074 | | | $ | 5.69 | |

|

Based on Hypothetical 5% Annual Return | |

Class I | | | 1.10 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.54 | |

|

AMG Managers Brandywine Blue Fund | |

Based on Actual Fund Return | |

Class I | | | 1.18 | % | | $ | 1,000 | | | $ | 1,085 | | | $ | 6.13 | |

Based on Hypothetical 5% Annual Return | |

Class I | | | 1.18 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.94 | |

|

* Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. | |

|

| |

| Fund Performance (unaudited) |

| Periods ended March 31, 2018 |

|

The table below shows the average annual total returns for the periods indicated for each Fund, as well as each Fund’s relative index for the same time periods ended March 31, 2018.

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | Six

Months* | | | One Year | | | Five

Years | | | Ten Years | |

AMG Managers Brandywine Fund2, 3, 4, 5, 6, 7 | | | | | | | | | | | | | | | | |

Class I | | | 7.37 | % | | | 19.04 | % | | | 12.93 | % | | | 4.34 | % |

Russell 3000® Growth Index9 | | | 9.20 | % | | | 21.06 | % | | | 15.32 | % | | | 11.31 | % |

Russell 3000® Index10 | | | 5.65 | % | | | 13.81 | % | | | 13.03 | % | | | 9.62 | % |

S&P 500 Index11 | | | 5.84 | % | | | 13.99 | % | | | 13.31 | % | | | 9.49 | % |

AMG Managers Brandywine Blue Fund2, 3, 5, 6, 8 | | | | | | | | | | | | | | | | |

Class I | | | 8.45 | % | | | 22.26 | % | | | 12.93 | % | | | 4.87 | % |

Russell 1000® Growth Index12 | | | 9.39 | % | | | 21.25 | % | | | 15.53 | % | | | 11.34 | % |

Russell 1000® Index13 | | | 5.85 | % | | | 13.98 | % | | | 13.17 | % | | | 9.61 | % |

S&P 500 Index11 | | | 5.84 | % | | | 13.99 | % | | | 13.31 | % | | | 9.49 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Funds and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Funds are net of expenses and based on the published NAV as of March 31, 2018. All returns are in U.S. dollars ($). |

| 2 | The Fund inception dates and returns for all periods prior to October 1, 2013, reflect performance of the predecessor Funds, Brandywine Fund and Brandywine Blue Fund, which were managed by Friess Associates, LLC with the same investment objective and substantially similar investment policies. |

| 3 | Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. |

| 4 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. |

| 5 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. |

| 6 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 7 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 8 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 9 | The Russell 3000® Growth Index measures the performance of those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 3000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

| 10 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 11 | The S&P 500 Index is capitalization-weighted index of 500 stocks. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the S&P 500 Index is unmanaged, is not available for investment, and does not incur expenses. |

| 12 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

| 13 | The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the U.S. market. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment, and does not incur expenses. |

The Russell Indices are trademarks of the London Stock Exchange Group companies.

The S&P 500 Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc.

Not FDIC insured, nor bank guaranteed. May lose value.

4

|

| AMG Managers Brandywine Fund |

| Fund Snapshots (unaudited) |

| March 31, 2018 |

|

PORTFOLIO BREAKDOWN

| | | | | | | | | | | | | | | | |

| Industry (Top Ten) | | AMG

Managers Brandywine Fund* | | | Russell

3000®

Growth

Index* | | | Russell

3000®

Index* | | | S&P 500

Index* | |

Internet & Direct Marketing Retail | | | 8.8 | % | | | 6.0 | % | | | 3.1 | % | | | 3.7 | % |

Internet Software & Services | | | 8.1 | % | | | 7.9 | % | | | 4.4 | % | | | 4.7 | % |

Semiconductors | | | 7.8 | % | | | 4.0 | % | | | 3.5 | % | | | 3.7 | % |

Data Processing & Outsourced Services | | | 4.8 | % | | | 5.4 | % | | | 2.9 | % | | | 2.9 | % |

Pharmaceuticals | | | 4.7 | % | | | 2.0 | % | | | 4.0 | % | | | 4.6 | % |

Application Software | | | 4.6 | % | | | 3.1 | % | | | 1.7 | % | | | 1.4 | % |

Home Entertainment Software | | | 4.4 | % | | | 0.7 | % | | | 0.4 | % | | | 0.4 | % |

Footwear | | | 4.4 | % | | | 0.7 | % | | | 0.4 | % | | | 0.4 | % |

Systems Software | | | 3.9 | % | | | 5.8 | % | | | 3.5 | % | | | 4.0 | % |

Trading Companies & Distributors | | | 3.7 | % | | | 0.5 | % | | | 0.4 | % | | | 0.2 | % |

Other Common Stock | | | 42.0 | % | | | 63.9 | % | | | 75.7 | % | | | 74.0 | % |

Short-Term Investments1 | | | 4.3 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

Other Assets Less Liabilities2 | | | (1.5 | )% | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

| * | As a percentage of net assets. |

| 1 | Includes reinvestment of cash collateral into joint repurchase agreements on security lending transactions. |

| 2 | Includes repayment of cash collateral on security lending transactions. |

|

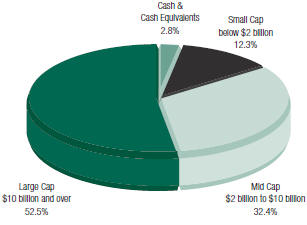

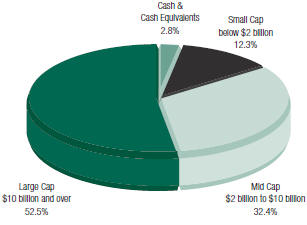

PORTFOLIO MARKET CAPITALIZATION |

|

|

| | | | | | | | |

TOP TEN HOLDINGS | |

Security Name | | % of

Net Assets | | | % Change from

Book Cost | |

Amazon.com, Inc. | | | 4.2 | | | | 126.4 | |

Netflix, Inc. | | | 3.0 | | | | 183.9 | |

Micron Technology, Inc. | | | 2.3 | | | | 60.4 | |

Alphabet, Inc., Class A | | | 2.3 | | | | 50.9 | |

Zoetis, Inc. | | | 2.1 | | | | 55.8 | |

Salesforce.com, Inc. | | | 2.1 | | | | 53.5 | |

Broadcom, Ltd. | | | 2.0 | | | | 184.4 | |

Bio-Techne Corp. | | | 2.0 | | | | 31.1 | |

NVIDIA Corp. | | | 2.0 | | | | 163.1 | |

Global Payments, Inc. | | | 2.0 | | | | 55.5 | |

| | | | | | | | |

Top Ten as a Group | | | 24.0 | | | | | |

| | | | | | | | |

|

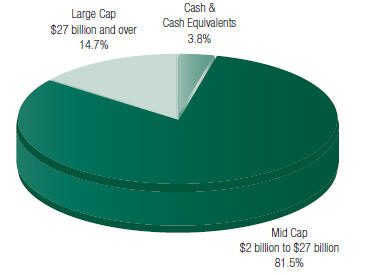

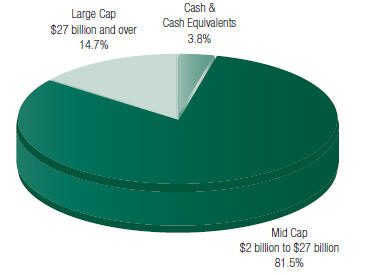

| ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS |

|

Forecasted Increase in Earnings Per Share 2018 vs 2017 |

|

Source: Consensus estimates from FactSet Research Systems Inc. |

|

| This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

5

|

| AMG Managers Brandywine Fund |

| Roses and Thorns (unaudited) |

| Quarter Ending March 31, 2018 |

|

| | | | | | | | |

$ Gain (in millions) | | | % Gain | | | Biggest $ Winners Reason for Move |

| $ | 8.3 | | | | 53.9 | % | | Netflix Inc. (NFLX) The provider of internet subscription services reported December-quarter earnings of $0.41 per share, up from $0.15 per share the year before and ahead of the consensus estimate. Revenue increased 33 percent on strong subscriber growth. |

| | |

| $ | 6.3 | | | | 23.8 | % | | Amazon.com Inc. (AMZN) The provider of online retail shopping services grew December-quarter earnings 40 percent, topping the consensus estimate. Revenue grew 38 percent. The company’s better-than-expected revenue growth was driven by newly acquired Whole Foods, Amazon Web Services and a strong holiday season. |

| | |

| $ | 3.9 | | | | 33.9 | % | | Proofpoint Inc. (PFPT) The provider of cloud-based security and compliance solutions increased revenue 36 percent in the December quarter. The company increased market share through organic growth and acquisition. We sold Proofpoint when it hit our price target. |

| | |

| $ | 3.8 | | | | 26.8 | % | | Micron Technology Inc. (MU) Earnings for the company, which makes semiconductor memory and storage technologies, more than tripled to $2.82 per share in the February quarter, beating the consensus estimate. Revenue increased 58 percent. |

| | |

| $ | 3.2 | | | | 26.9 | % | | ServiceNow Inc. (NOW) The provider of cloud-based services that automate enterprise technology operations grew December-quarter earnings 46 percent. Revenue rose 41 percent. Growth in renewal rates and new subscriptions helped drive results. The company also raised 2018 revenue guidance. |

| | |

$ Loss (in millions) | | | % Loss | | | Biggest $ Losers Reason for Move |

| $ | 3.3 | | | | 30.9 | % | | Halcon Resources Corp. (HK) The onshore oil and natural gas exploration and production company’s shares declined after reduced production and increased costs led to disappointing December-quarter results. We sold Halcon Resources to fund a new opportunity with better visibility. |

| | |

| $ | 3.2 | | | | 12.4 | % | | Facebook Inc. (FEB) The social networking service and website saw its share price decline when it was revealed that a for-profit data analytics firm harvested private information from more than 50 million users. The announcement raised concerns about Facebook’s data privacy policies and the potential for regulatory oversight in the wake of the controversy. We sold Facebook to fund a holding with greater visibility. |

| | |

| $ | 3.0 | | | | 21.7 | % | | Winnebago Industries Inc. (WGO) The manufacturer of motorized and towable recreational vehicles grew earnings 44 percent in the February-quarter, exceeding the consensus estimate. Shares traded lower with concerns surrounding dealer inventory and order backlog in the towable segment. We sold Winnebago to fund a new opportunity. |

| | |

| $ | 2.4 | | | | 15.0 | % | | Oshkosh Corp. (OSK) The manufacturer of commercial specialty vehicles reported December-quarter earnings of $0.84 per share versus $0.26 the year before, exceeding the consensus estimate. The company also raised fiscal year earnings and revenue guidance. Shares came under pressure amid concerns about steel tariffs and dimming prospects for widespread infrastructure spending. |

| | |

| $ | 1.8 | | | | 22.8 | % | | Heska Corp. (HSKA) Excluding a one-time charge, the maker of diagnostic veterinary products grew earnings 37 percent in the December quarter. Modest 2018 revenue guidance disappointed investors, whose forecasts showed more pronounced optimism for new products that the company is scheduled to introduce. We sold Heska to fund a new opportunity with a more promising earnings outlook. |

All gains/losses are calculated on an average cost basis from December 31, 2017 through March 31, 2018.

This commentary reflects the viewpoints of Friess Associates, LLC as of March 31, 2018 and is not intended as a forecast or guarantee of future results.

6

|

| AMG Managers Brandywine Fund |

| Schedule of Portfolio Investments (unaudited) |

| March 31, 2018 |

|

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | Common Stocks - 97.2% | | | | | | | | |

| | Consumer Discretionary | | | | | | | | |

| | | | Apparel Retail - 1.6% | |

| | 445,954 | | | American Eagle Outfitters, Inc. | | $ | 5,982,694 | | | $ | 8,887,863 | |

| | 30,525 | | | The Children’s Place, Inc. | | | 3,010,388 | | | | 4,128,506 | |

| | | | Auto Parts & Equipment - 0.4% | |

| | 144,871 | | | Modine Manufacturing Co.* | | | 2,295,986 | | | | 3,064,022 | |

| | | | Cable & Satellite - 1.3% | |

| | 34,276 | | | Charter Communications, Inc., Class A* | | | 7,957,387 | | | | 10,667,377 | |

| | | | Footwear - 4.4% | | | | | | | | |

| | 164,935 | | | Deckers Outdoor Corp.* | | | 11,280,031 | | | | 14,849,098 | |

| | 228,215 | | | Skechers U.S.A., Inc., Class A* | | | 9,107,896 | | | | 8,875,281 | |

| | 370,564 | | | Wolverine World Wide, Inc. | | | 10,364,578 | | | | 10,709,300 | |

| | | | General Merchandise Stores - 3.3% | |

| | 128,635 | | | Dollar Tree, Inc.* | | | 9,099,730 | | | | 12,207,462 | |

| | 226,345 | | | Ollie’s Bargain Outlet Holdings, Inc.*,1 | | | 9,914,790 | | | | 13,648,603 | |

| | | | Homebuilding - 0.8% | | | | | | | | |

| | 146,055 | | | D.R. Horton, Inc. | | | 6,424,288 | | | | 6,403,051 | |

| | | | Hotels, Resorts & Cruise Lines - 0.9% | |

| | 129,470 | | | Norwegian Cruise Line Holdings, Ltd.* | | | 6,854,019 | | | | 6,858,026 | |

| | | | Internet & Direct Marketing Retail - 8.8% | | | | | |

| | 22,755 | | | Amazon.com, Inc.* | | | 14,549,120 | | | | 32,934,222 | |

| | 6,396 | | | Booking Holdings, Inc.* | | | 12,131,988 | | | | 13,306,174 | |

| | 80,409 | | | Netflix, Inc.* | | | 8,364,077 | | | | 23,748,798 | |

| | | | Leisure Facilities - 1.5% | | | | | |

| | 54,527 | | | Vail Resorts, Inc. | | | 12,051,311 | | | | 12,088,636 | |

| | | | Movies & Entertainment - 2.7% | |

| | 314,660 | | | Liberty Media Corp.-Liberty Formula One, Class C* | | | 11,276,573 | | | | 9,707,261 | |

| | 274,955 | | | Live Nation Entertainment, Inc.* | | | 11,819,990 | | | | 11,586,604 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 152,484,846 | | | | 203,670,284 | |

| | | | This sector is 33.6% above your Fund’s cost. | | | | | |

| | Consumer Staples | | | | | | | | |

| | | | Packaged Foods & Meats - 1.3% | |

| | 17,060 | | | Calavo Growers, Inc.1 | | | 855,811 | | | | 1,572,932 | |

| | 535,730 | | | Nomad Foods, Ltd. (United Kingdom)* | | | 7,724,786 | | | | 8,432,390 | |

| | | | | | | | | | | | |

| | Total Consumer Staples | | | 8,580,597 | | | | 10,005,322 | |

| | | | This sector is 16.6% above your Fund’s cost. | | | | | |

| | Financials | | | | | | | | |

| | | | Financial Exchanges & Data - 1.9% | |

| | 93,140 | | | CME Group, Inc. | | | 8,750,461 | | | | 15,064,464 | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | | | Regional Banks - 1.0% | |

| | 189,407 | | | Pacific Premier Bancorp, Inc.* | | $ | 8,013,600 | | | $ | 7,614,161 | |

| | | | | | | | | | | | |

| | Total Financials | | | 16,764,061 | | | | 22,678,625 | |

| | | | This sector is 35.3% above your Fund’s cost. | | | | | |

| | Health Care | | | | | | | | |

| | | | Biotechnology - 0.5% | | | | | | | | |

| | 44,869 | | | Incyte Corp.* | | | 4,273,449 | | | | 3,738,934 | |

| | | | Health Care Equipment - 1.5% | | | | | |

| | 205,465 | | | Abbott Laboratories | | | 12,225,583 | | | | 12,311,463 | |

| | | | Health Care Technology - 1.0% | | | | | |

| | 444,915 | | | HMS Holdings Corp.* | | | 7,683,597 | | | | 7,492,368 | |

| | 15,405 | | | Tabula Rasa HealthCare, Inc.* | | | 423,637 | | | | 597,714 | |

| | | | Life Sciences Tools & Services - 3.1% | |

| | 105,319 | | | Bio-Techne Corp. | | | 12,129,213 | | | | 15,907,382 | |

| | 40,385 | | | Thermo Fisher Scientific, Inc. | | | 5,305,297 | | | | 8,337,887 | |

| | | | Pharmaceuticals - 4.7% | | | | | | | | |

| | 187,954 | | | Bristol-Myers Squibb Co. | | | 12,313,496 | | | | 11,888,091 | |

| | 218,270 | | | Intersect ENT, Inc.* | | | 8,506,981 | | | | 8,578,011 | |

| | 199,975 | | | Zoetis, Inc. | | | 10,716,542 | | | | 16,699,912 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 73,577,795 | | | | 85,551,762 | |

| | | | This sector is 16.3% above your Fund’s cost. | |

| | Industrials | | | | | | | | |

| | | | Aerospace & Defense - 1.3% | | | | | | | | |

| | 203,500 | | | Mercury Systems, Inc.* | | | 8,635,350 | | | | 9,833,120 | |

| | | | Agricultural & Farm Machinery - 0.7% | |

| | 417,245 | | | CNH Industrial N.V. (United Kingdom) | | | 6,266,920 | | | | 5,173,838 | |

| | | | Air Freight & Logistics - 1.5% | | | | | | | | |

| | 118,993 | | | XPO Logistics, Inc.* | | | 12,047,660 | | | | 12,114,677 | |

| | | | Construction & Engineering - 3.3% | |

| | 115,795 | | | Jacobs Engineering Group, Inc. | | | 7,205,921 | | | | 6,849,274 | |

| | 251,895 | | | MasTec, Inc.* | | | 10,115,328 | | | | 11,851,660 | |

| | 223,995 | | | Quanta Services, Inc.* | | | 7,809,104 | | | | 7,694,228 | |

| | | | Construction Machinery & Heavy Trucks - 3.1% | |

| | 68,386 | | | Cummins, Inc. | | | 11,960,863 | | | | 11,084,687 | |

| | 175,040 | | | Oshkosh Corp. | | | 12,643,047 | | | | 13,525,341 | |

| | | | Electrical Components & Equipment - 1.1% | | | | | |

| | 50,306 | | | Rockwell Automation, Inc. | | | 9,393,866 | | | | 8,763,305 | |

| | | | Human Resource & Employment Services - 1.3% | |

| | 89,630 | | | ManpowerGroup, Inc. | | | 12,022,547 | | | | 10,316,413 | |

| | | | Industrial Machinery - 0.7% | | | | | | | | |

| | 268,987 | | | Harsco Corp.* | | | 4,784,608 | | | | 5,554,582 | |

| | | | Trading Companies & Distributors - 3.7% | | | | | |

| | 82,743 | | | GMS, Inc.* | | | 1,857,781 | | | | 2,528,626 | |

7

|

| AMG Managers Brandywine Fund |

| Schedule of Portfolio Investments (continued) |

|

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | Industrials (continued) | | | | | | | | |

| | | | Trading Companies & Distributors - 3.7% (continued) | | | | | |

| | 146,501 | | | Herc Holdings, Inc.* | | $ | 8,051,674 | | | $ | 9,515,240 | |

| | 107,450 | | | Rush Enterprises, Inc., Class A* | | | 4,470,713 | | | | 4,565,550 | |

| | 71,523 | | | United Rentals, Inc.* | | | 8,865,986 | | | | 12,354,168 | |

| | | | Trucking - 1.5% | | | | | | | | |

| | 263,550 | | | Knight-Swift Transportation Holdings, Inc. | | | 12,011,604 | | | | 12,125,936 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 138,142,972 | | | | 143,850,645 | |

| | | | This sector is 4.1% above your Fund’s cost. | |

| | Information Technology | | | | | | | | |

| | | | Application Software - 4.6% | |

| | 208,680 | | | Atlassian Corp. PLC, Class A (Australia)* | | | 5,231,753 | | | | 11,252,026 | |

| | 82,920 | | | Blackbaud, Inc. | | | 7,543,736 | | | | 8,442,085 | |

| | 142,880 | | | Salesforce.com, Inc.* | | | 10,821,895 | | | | 16,616,944 | |

| | | | Communications Equipment - 3.0% | |

| | 439,236 | | | ARRIS International PLC* | | | 11,566,072 | | | | 11,670,500 | |

| | 462,901 | | | Ciena Corp.* | | | 11,788,626 | | | | 11,989,136 | |

| | | | Data Processing & Outsourced Services - 4.8% | |

| | 176,960 | | | Black Knight, Inc.* | | | 4,502,085 | | | | 8,334,816 | |

| | 139,960 | | | Global Payments, Inc. | | | 10,039,962 | | | | 15,608,339 | |

| | 119,890 | | | Visa, Inc., Class A | | | 8,635,439 | | | | 14,341,242 | |

| | | | Electronic Manufacturing Services - 1.0% | |

| | 249,730 | | | Fabrinet (Thailand)* | | | 8,208,224 | | | | 7,836,527 | |

| | | | Home Entertainment Software - 4.4% | |

| | 207,755 | | | Activision Blizzard, Inc. | | | 11,084,769 | | | | 14,015,152 | |

| | 86,540 | | | Electronic Arts, Inc.* | | | 8,324,154 | | | | 10,492,110 | |

| | 101,900 | | | Take-Two Interactive Software, Inc.* | | | 10,511,063 | | | | 9,963,782 | |

| | | | Internet Software & Services - 8.1% | |

| | 17,429 | | | Alphabet, Inc., Class A* | | | 11,980,700 | | | | 18,076,313 | |

| | 294,161 | | | Dropbox, Inc., Class A*,1 | | | 8,845,404 | | | | 9,192,531 | |

| | 303,159 | | | Five9, Inc.* | | | 7,155,957 | | | | 9,031,107 | |

| | 1,888,010 | | | Limelight Networks, Inc.* | | | 8,335,267 | | | | 7,759,721 | |

| | 106,551 | | | LogMeIn, Inc. | | | 12,058,991 | | | | 12,311,968 | |

| | 160,662 | | | The Trade Desk, Inc., Class A*,1 | | | 7,554,141 | | | | 7,972,048 | |

| | | | Semiconductors - 7.8% | |

| | 69,190 | | | Broadcom, Ltd. | | | 5,733,996 | | | | 16,304,624 | |

| | 347,485 | | | Micron Technology, Inc.* | | | 11,293,923 | | | | 18,117,868 | |

| | 67,631 | | | NVIDIA Corp. | | | 5,953,664 | | | | 15,662,663 | |

| | 162,400 | | | Xilinx, Inc. | | | 10,984,940 | | | | 11,731,776 | |

| | | | Systems Software - 3.9% | |

| | 169,255 | | | Microsoft Corp. | | | 10,853,934 | | | | 15,447,904 | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | 91,815 | | | ServiceNow, Inc.* | | $ | 7,306,472 | | | $ | 15,190,793 | |

| | | | | | | | | | | | |

| | Total Information Technology | | | 216,315,167 | | | | 297,361,975 | |

| | | | This sector is 37.5% above your Fund’s cost. | |

| | Materials | | | | | | | | |

| | | | Commodity Chemicals - 0.5% | |

| | 127,946 | | | AdvanSix, Inc.* | | | 5,139,309 | | | | 4,449,962 | |

| | | | This sector is 13.4% below your Fund’s cost. | |

| | Utilities | | | | | | | | |

| | | | Water Utilities - 0.2% | |

| | 67,319 | | | Evoqua Water Technologies Corp.* | | | 1,279,421 | | | | 1,433,221 | |

| | | | This sector is 12.0% above your Fund’s cost. | |

| | Total Common Stocks | | | 612,284,168 | | | | 769,001,796 | |

| | | |

Principal Amount | | | | | | | | | |

| | Short-Term Investments - 4.3% | | | | | | | | |

| | Commercial Paper - 3.3% | | | | | | | | |

| $ | 26,489,000 | | | Energy Transfer LP, 2.65%, 04/02/182 | | | 26,487,050 | | | | 26,487,050 | |

| | Joint Repurchase Agreements - 1.0%3 | |

| | 383,723 | | | BNP Paribas S.A., dated 03/29/18, due 04/02/18, 1.800% total to be received $383,800 (collateralized by various U.S. Government Agency Obligations, 0.000% - 2.375%, 02/15/23 - 09/09/49, totaling $391,397) | | | 383,723 | | | | 383,723 | |

| | 1,823,329 | | | Daiwa Capital Markets Americas, dated 03/29/18, due 04/02/18, 1.810% total to be received $1,823,696 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.500%, 04/30/18 - 12/01/51, totaling $1,859,796) | | | 1,823,329 | | | | 1,823,329 | |

| | 1,823,329 | | | HSBC Securities, Inc., dated 03/29/18, due 04/02/18, 1.780% total to be received $1,823,690 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.250%, 05/15/18 - 01/15/37, totaling $1,866,444) | | | 1,823,329 | | | | 1,823,329 | |

| | 1,823,329 | | | Jefferies LLC, dated 03/29/18, due 04/02/18, 1.820% total to be received $1,823,698 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.250%, 04/17/18 - 07/15/32, totaling $1,859,804) | | | 1,823,329 | | | | 1,823,329 | |

8

|

| AMG Managers Brandywine Fund |

| Schedule of Portfolio Investments (continued) |

|

| | | | | | | | | | |

Principal Amount | | | | Cost | | | Value | |

| $1,823,329 | | Nomura Securities International, Inc., dated 03/29/18, due 04/02/18, 1.820% total to be received $1,823,698 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.500%, 04/02/18 - 02/20/68, totaling $1,859,796) | | $ | 1,823,329 | | | $ | 1,823,329 | |

| | | | | | | | | | |

| | Total Joint Repurchase Agreements | | | 7,677,039 | | | | 7,677,039 | |

| | | | | | | | | | |

Shares | | | | Cost | | | Value | |

| | Other Investment Companies - 0.0%# | |

| 108,308 | | Dreyfus Government Cash Management Fund, Institutional Class Shares, 1.54%4 | | $ | 108,308 | | | $ | 108,308 | |

| | | | | | | | | | |

| | Total Short-Term Investments | | | 34,272,397 | | | | 34,272,397 | |

Total Investments - 101.5% | | $ | 646,556,565 | | | | 803,274,193 | |

Other Assets, less Liabilities - (1.5%) | | | | (12,251,744 | ) |

Total Net Assets - 100.0% | | | | | | $ | 791,022,449 | |

| | | | | | | | | | |

| * | Non-income producing security. |

| 1 | Some or all of these securities, amounting to $7,399,789 or 0.9% of net assets, were out on loan to various brokers. |

| 2 | Represents yield to maturity at March 31, 2018. |

| 3 | Collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| 4 | Yield shown represents the March 31, 2018, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of March 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 769,001,796 | | | | — | | | | — | | | $ | 769,001,796 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Commercial Paper | | | — | | | $ | 26,487,050 | | | | — | | | | 26,487,050 | |

Joint Repurchase Agreements | | | — | | | | 7,677,039 | | | | — | | | | 7,677,039 | |

Other Investment Companies | | | 108,308 | | | | — | | | | — | | | | 108,308 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 769,110,104 | | | $ | 34,164,089 | | | | — | | | $ | 803,274,193 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

As of March 31, 2018, the Fund had no transfers between levels from the beginning of the reporting period.

9

|

| AMG Managers Brandywine Blue Fund |

| Fund Snapshots (unaudited) |

| March 31, 2018 |

|

PORTFOLIO BREAKDOWN

| | | | | | | | | | | | | | | | |

| | | AMG | | | Russell | | | | | | | |

| | | Managers | | | 1000® | | | Russell | | | | |

| | | Brandywine | | | Growth | | | 1000® | | | S&P 500 | |

Industry (Top Ten) | | Blue Fund* | | | Index* | | | Index* | | | Index* | |

Internet & Direct Marketing Retail | | | 11.3 | % | | | 6.4 | % | | | 3.4 | % | | | 3.7 | % |

Semiconductors | | | 10.8 | % | | | 4.2 | % | | | 3.7 | % | | | 3.7 | % |

Data Processing & Outsourced Services | | | 9.0 | % | | | 5.8 | % | | | 3.1 | % | | | 2.9 | % |

Systems Software | | | 8.1 | % | | | 6.2 | % | | | 3.8 | % | | | 4.0 | % |

Home Entertainment Software | | | 6.4 | % | | | 0.8 | % | | | 0.4 | % | | | 0.4 | % |

Internet Software & Services | | | 4.8 | % | | | 8.1 | % | | | 4.5 | % | | | 4.7 | % |

Pharmaceuticals | | | 4.8 | % | | | 1.8 | % | | | 4.1 | % | | | 4.6 | % |

Life Sciences Tools & Services | | | 4.4 | % | | | 1.0 | % | | | 0.9 | % | | | 0.9 | % |

Health Care Equipment | | | 3.5 | % | | | 2.4 | % | | | 2.6 | % | | | 2.7 | % |

Application Software | | | 2.7 | % | | | 2.9 | % | | | 1.6 | % | | | 1.4 | % |

Other Common Stock | | | 32.8 | % | | | 60.4 | % | | | 71.9 | % | | | 71.0 | % |

Short-Term Investments | | | 1.9 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

Other Assets Less Liabilities | | | (0.5 | )% | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

| * | As a percentage of net assets. |

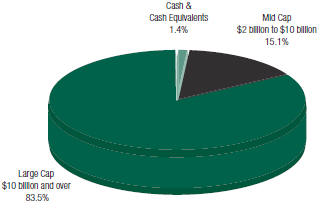

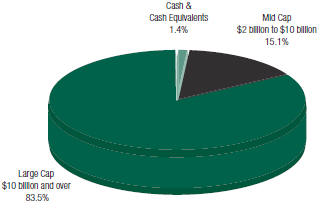

PORTFOLIO MARKET CAPITALIZATION

TOP TEN HOLDINGS

| | | | | | | | |

| | | %of | | | % Change from | |

Security Name | | Net Assets | | | Book Cost | |

Microsoft Corp. | | | 4.9 | | | | 42.8 | |

Amazon.com, Inc. | | | 4.5 | | | | 80.5 | |

Netflix, Inc. | | | 4.5 | | | | 178.3 | |

ServiceNow, Inc. | | | 3.2 | | | | 100.8 | |

Micron Technology, Inc. | | | 3.2 | | | | 61.1 | |

Zoetis, Inc. | | | 2.8 | | | | 55.3 | |

Alphabet, Inc., Class A | | | 2.8 | | | | 50.7 | |

Broadcom, Ltd. | | | 2.7 | | | | 186.5 | |

Salesforce.com, Inc. | | | 2.7 | | | | 49.8 | |

NVIDIA Corp. | | | 2.7 | | | | 167.3 | |

| | | | | | | | |

Top Ten as a Group | | | 34.0 | | | | | |

| | | | | | | | |

ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS

Forecasted Increase in Earnings Per Share 2018 vs 2017

Source: Consensus estimates from FactSet Research Systems Inc.

This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

10

|

| AMG Managers Brandywine Blue Fund |

| Roses and Thorns (unaudited) |

| Quarter Ending March 31, 2018 |

|

| | | | | | | | |

$ Gain (in millions) | | | % Gain | | | Biggest $ Winners Reason for Move |

| $ | 2.8 | | | | 53.9 | % | | Netflix Inc. (NFLX) The provider of internet subscription services reported December-quarter earnings of $0.41 per share, up from $0.15 per share the year before and ahead of the consensus estimate. Revenue increased 33 percent on strong subscriber growth. |

| | |

| $ | 1.9 | | | | 23.6 | % | | Amazon.com Inc. (AMZN) The provider of online retail shopping services grew December-quarter earnings 40 percent, topping the consensus estimate. Revenue grew 38 percent. The company’s better-than-expected revenue growth was driven by newly acquired Whole Foods, Amazon Web Services and a strong holiday season. |

| | |

| $ | 1.2 | | | | 26.9 | % | | ServiceNow Inc. (NOW) The provider of cloud-based services that automate enterprise technology operations grew December-quarter earnings 46 percent. Revenue rose 41 percent. Growth in renewal rates and new subscriptions helped drive results. The company also raised 2018 revenue guidance. |

| | |

| $ | 1.2 | | | | 26.8 | % | | Micron Technology Inc. (MU) Earnings for the company, which makes semiconductor memory and storage technologies, more than tripled to $2.82 per share in the February quarter, beating the consensus estimate. Revenue increased 58 percent. |

| | |

| $ | 0.8 | | | | 19.7 | % | | Nvidia Corp. (NVDA) The developer of computer graphics processors, chipsets and related software grew January-quarter earnings 59 percent, beating the consensus estimate by 35 percent. Revenue increased 34 percent. The company’s data center and gaming businesses were standout contributors to results. |

| | |

$ Loss (in millions) | | | % Loss | | | Biggest $ Losers Reason for Move |

| $ | 0.8 | | | | 12.5 | % | | Facebook Inc. (FB) The social networking service and website saw its share price decline when it was revealed that a for-profit data analytics firm harvested private information from more than 50 million users. The announcement raised concerns about Facebook’s data privacy policies and the potential for regulatory oversight in the wake of the controversy. We sold Facebook to fund a holding with greater visibility. |

| | |

| $ | 0.5 | | | | 15.0 | % | | Oshkosh Corp. (OSK) The manufacturer of commercial specialty vehicles reported December-quarter earnings of $0.84 per share versus $0.26 the year before, exceeding the consensus estimate. The company also raised fiscal year earnings and revenue guidance. Shares came under pressure amid concerns about steel tariffs and dimming prospects for widespread infrastructure spending. |

| | |

| $ | 0.5 | | | | 17.7 | % | | CNH Industrial NV (CNHI) The manufacturer of agricultural equipment and commercial vehicles grew December-quarter revenue 16 percent to $8.1 billion, topping forecasts. Shares came under pressure amid announced steel tariffs and potential for trade disruptions with China. |

| | |

| $ | 0.5 | | | | 13.9 | % | | Manpower Group Inc. (MAN) The provider of workforce solutions and services grew December-quarter earnings 13 percent, topping the consensus estimate. The company continued to experience strong demand in Europe, where it generates two-thirds of revenue. Shares traded lower after management guided investors to expect flat operating profit margins, an outlook that was slightly below expectations. |

| | |

| $ | 0.5 | | | | 13.4 | % | | Biogen Inc. (BIIB) The biotechnology company focused on neurological and autoimmune disorders grew December-quarter earnings to $5.26 per share. Shares declined due to concerns regarding the status of its Alzheimer’s treatment that arose after the company added participants to its phase III clinical trial. The company noted that the increase was to maintain statistical standards and does not reflect on the treatment’s efficacy or the trial’s timing. |

All gains/losses are calculated on an average cost basis from December 31, 2017 through March 31, 2018.

This commentary reflects the viewpoints of Friess Associates, LLC as of March 31, 2018 and is not intended as a forecast or guarantee of future results.

11

|

| AMG Managers Brandywine Blue Fund |

| Schedule of Portfolio Investments (unaudited) |

| March 31, 2018 |

|

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | Common Stocks - 98.6% | | | | | | | | |

| | Consumer Discretionary | | | | | | | | |

| | | | Cable & Satellite - 2.0% | | | | | | | | |

| | 11,325 | | | Charter Communications, Inc., Class A* | | $ | 2,865,263 | | | $ | 3,524,567 | |

| | | | Footwear - 2.0% | | | | | | | | |

| | 93,300 | | | Skechers U.S.A., Inc., Class A* | | | 3,841,504 | | | | 3,628,437 | |

| | | | General Merchandise Stores - 2.0% | | | | | | | | |

| | 38,035 | | | Dollar Tree, Inc.* | | | 2,772,103 | | | | 3,609,521 | |

| | | | Homebuilding - 0.9% | | | | | | | | |

| | 36,200 | | | D.R. Horton, Inc. | | | 1,597,154 | | | | 1,587,008 | |

| | | | Hotels, Resorts & Cruise Lines - 0.7% | | | | | | | | |

| | 25,100 | | | Norwegian Cruise Line Holdings, Ltd.* | | | 1,331,434 | | | | 1,329,547 | |

| | | | Internet & Direct Marketing Retail - 11.3% | | | | | |

| | 5,583 | | | Amazon.com, Inc.* | | | 4,476,567 | | | | 8,080,499 | |

| | 1,955 | | | Booking Holdings, Inc.* | | | 3,712,497 | | | | 4,067,163 | |

| | 26,980 | | | Netflix, Inc.* | | | 2,862,795 | | | | 7,968,543 | |

| | | | Leisure Facilities - 2.0% | | | | | | | | |

| | 15,928 | | | Vail Resorts, Inc. | | | 3,479,722 | | | | 3,531,238 | |

| | | | Movies & Entertainment - 1.9% | | | | | | | | |

| | 81,745 | | | Live Nation Entertainment, Inc.* | | | 3,511,112 | | | | 3,444,734 | |

| | | | | | | | | | | | |

| | Total Consumer Discretionary | | | 30,450,151 | | | | 40,771,257 | |

| | | | This sector is 33.9% above your Fund’s cost. | | | | | | |

| | Consumer Staples | | | | | | | | |

| | | | Packaged Foods & Meats - 2.0% | | | | | | | | |

| | 28,500 | | | The JM Smucker Co. | | | 3,545,970 | | | | 3,534,285 | |

| | | | This sector is 0.3% below your Fund’s cost. | | | | | | |

| | Financials | | | | | | | | |

| | | | Financial Exchanges & Data - 2.4% | | | | | | | | |

| | 27,025 | | | CME Group, Inc. | | | 2,538,802 | | | | 4,371,023 | |

| | | | This sector is 72.2% above your Fund’s cost. | | | | | | |

| | Health Care | | | | | | | | |

| | | | Biotechnology - 2.2% | | | | | | | | |

| | 11,200 | | | Biogen, Inc.* | | | 3,539,756 | | | | 3,066,784 | |

| | 10,140 | | | Incyte Corp.* | | | 965,762 | | | | 844,966 | |

| | | | Health Care Equipment - 3.5% | | | | | | | | |

| | 62,300 | | | Abbott Laboratories | | | 3,825,105 | | | | 3,733,016 | |

| | 17,165 | | | Edwards Lifesciences Corp.* | | | 2,158,929 | | | | 2,394,861 | |

| | | | Life Sciences Tools & Services - 4.4% | | | | | |

| | 60,540 | | | Agilent Technologies, Inc. | | | 4,098,197 | | | | 4,050,126 | |

| | 18,700 | | | Thermo Fisher Scientific, Inc. | | | 2,890,097 | | | | 3,860,802 | |

| | | | Pharmaceuticals - 4.8% | | | | | | | | |

| | 56,100 | | | Bristol-Myers Squibb Co. | | | 3,707,486 | | | | 3,548,325 | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| | 60,060 | | | Zoetis, Inc. | | $ | 3,229,832 | | | $ | 5,015,611 | |

| | | | | | | | | | | | |

| | Total Health Care | | | 24,415,164 | | | | 26,514,491 | |

| | | | This sector is 8.6% above your Fund’s cost. | | | | | | |

| | Industrials | | | | | | | | |

| | | | Agricultural & Farm Machinery - 1.4% | | | | | |

| | 202,600 | | | CNH Industrial N.V. (United Kingdom) | | | 3,050,627 | | | | 2,512,240 | |

| | | | Air Freight & Logistics - 2.1% | | | | | | | | |

| | 36,000 | | | XPO Logistics, Inc.* | | | 3,638,753 | | | | 3,665,160 | |

| | | | Construction & Engineering - 1.6% | | | | | | | | |

| | 46,700 | | | Jacobs Engineering Group, Inc. | | | 2,815,061 | | | | 2,762,305 | |

| | | | Construction Machinery & Heavy Trucks - 1.7% | | | | | |

| | 39,915 | | | Oshkosh Corp. | | | 3,399,189 | | | | 3,084,232 | |

| | | | Electrical Components & Equipment - 1.9% | | | | | |

| | 19,515 | | | Rockwell Automation, Inc. | | | 3,682,308 | | | | 3,399,513 | |

| | | | Human Resource & Employment Services - 1.8% | | | | | |

| | 28,212 | | | ManpowerGroup, Inc. | | | 3,770,853 | | | | 3,247,201 | |

| | | | Trading Companies & Distributors - 2.1% | | | | | |

| | 21,655 | | | United Rentals, Inc.* | | | 2,682,209 | | | | 3,740,468 | |

| | | | Trucking - 2.1% | | | | | | | | |

| 81,865 | | | Knight-Swift Transportation Holdings, Inc. | | 3,695,124 | | | 3,766,609 | |

| | | | | | | | | | | | |

| | Total Industrials | | | 26,734,124 | | | | 26,177,728 | |

| | | | This sector is 2.1% below your Fund’s cost. | | | | | | |

| | Information Technology | | | | | | | | |

| | | | Application Software - 2.7% | | | | | | | | |

| | 41,060 | | | Salesforce.com, Inc.* | | | 3,187,380 | | | | 4,775,278 | |

| | | | Data Processing & Outsourced Services - 9.0% | | | | | |

| | 37,520 | | | Global Payments, Inc. | | | 2,696,027 | | | | 4,184,230 | |

| | 20,700 | | | Mastercard, Inc., Class A | | | 3,608,354 | | | | 3,625,812 | |

| | 34,550 | | | Visa, Inc., Class A | | | 2,485,668 | | | | 4,132,871 | |

| | 51,000 | | | Worldpay, Inc., Class A* | | | 2,339,257 | | | | 4,194,240 | |

| | | | Home Entertainment Software - 6.4% | | | | | | | | |

| | 61,045 | | | Activision Blizzard, Inc. | | | 3,265,429 | | | | 4,118,096 | |

| | 35,315 | | | Electronic Arts, Inc.* | | | 3,657,040 | | | | 4,281,590 | |

| | 30,800 | | | Take-Two Interactive Software, Inc.* | | | 2,911,926 | | | | 3,011,624 | |

| | | | Internet Software & Services - 4.8% | | | | | | | | |

| | 4,807 | | | Alphabet, Inc., Class A* | | | 3,308,126 | | | | 4,985,532 | |

| | 31,200 | | | LogMeIn, Inc. | | | 3,819,127 | | | | 3,605,160 | |

| | | | Semiconductors - 10.8% | | | | | | | | |

| | 20,865 | | | Broadcom, Ltd. | | | 1,716,293 | | | | 4,916,837 | |

| | 109,460 | | | Micron Technology, Inc.* | | | 3,543,029 | | | | 5,707,245 | |

| | 20,507 | | | NVIDIA Corp. | | | 1,776,598 | | | | 4,749,216 | |

| | 53,645 | | | Xilinx, Inc. | | | 3,683,219 | | | | 3,875,315 | |

12

|

| |

| AMG Managers Brandywine Blue Fund |

| Schedule of Portfolio Investments (continued) |

|

| | | | | | | | |

Shares | | | | Cost | | | Value |

Information Technology (continued) | | | | | | |

| | Systems Software - 8.1% | | | | | | |

95,800 | | Microsoft Corp. | | $ | 6,123,044 | | | $8,743,666 |

34,800 | | ServiceNow, Inc.* | | | 2,867,873 | | | 5,757,660 |

| | | | | | | | |

Total Information Technology | | | 50,988,390 | | | 74,664,372 |

| | This sector is 46.4% above your Fund’s cost. | | | |

Total Common Stocks | | | 138,672,601 | | | 176,033,156 |

| | | |

Principal Amount | | | | | | | |

Short-Term Investments - 1.9% | | | | | | |

Commercial Paper - 1.9% | | | | | | |

$3,351,000 | | Energy Transfer LP, 2.65%, 04/02/181 | | | 3,350,754 | | | 3,350,754 |

| * | Non-income producing security. |

| 1 | Represents yield to maturity at March 31, 2018. |

| | | | | | | | | | |

Shares | | | | Cost | | | Value | |

Other Investment Companies - 0.0%# | | | | | | | | |

| 101,255 | | Dreyfus Government Cash Management Fund, Institutional Class Shares, 1.54%2 | | $ | 101,255 | | | $ | 101,255 | |

| | | | | | | | | | |

Total Short-Term Investments | | | 3,452,009 | | | | 3,452,009 | |

Total Investments - 100.5% | | $ | 142,124,610 | | | | 179,485,165 | |

Other Assets, less Liabilities - (0.5%) | | | | | | | (970,598 | ) |

Total Net Assets - 100.0% | | | | | | | $178,514,567 | |

| | | | | | | | | | |

| 2 | Yield shown represents the March 31, 2018, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of March 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 176,033,156 | | | | — | | | | — | | | $ | 176,033,156 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Commercial Paper | | | — | | | $ | 3,350,754 | | | | — | | | | 3,350,754 | |

Other Investment Companies | | | 101,255 | | | | — | | | | — | | | | 101,255 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 176,134,411 | | | $ | 3,350,754 | | | | — | | | $ | 179,485,165 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

As of March 31, 2018, the Fund had no transfers between levels from the beginning of the reporting period.

13

|

| |

| Statement of Assets and Liabilities (unaudited) |

| March 31, 2018 |

|

| | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | | AMG

Managers

Brandywine

Blue Fund | |

Assets: | | | | | | | | |

Investments at Value* (including securities on loan valued at $7,399,789, and $0, respectively) | | $ | 803,274,193 | | | $ | 179,485,165 | |

Cash | | | 1,398 | | | | 376 | |

Receivable for investments sold | | | 9,132,421 | | | | 1,185,941 | |

Dividend, interest and other receivables | | | 207,911 | | | | 50,796 | |

Receivable for Fund shares sold | | | 8,106 | | | | 1,234 | |

Receivable from affiliate | | | 2,787 | | | | — | |

Prepaid expenses | | | 21,712 | | | | 12,957 | |

Total assets | | | 812,648,528 | | | | 180,736,469 | |

Liabilities: | | | | | | | | |

Payable upon return of securities loaned | | | 7,677,039 | | | | — | |

Payable for investments purchased | | | 12,635,182 | | | | 1,856,212 | |

Payable for Fund shares repurchased | | | 403,513 | | | | 103,222 | |

Accrued expenses: | | | | | | | | |

Investment advisory and management fees | | | 613,124 | | | | 138,375 | |

Administrative fees | | | 104,510 | | | | 23,587 | |

Shareholder service fees | | | 13,935 | | | | 7,862 | |

Professional fees | | | 55,848 | | | | 30,816 | |

Other | | | 122,928 | | | | 61,828 | |

Total liabilities | | | 21,626,079 | | | | 2,221,902 | |

Net Assets | | $ | 791,022,449 | | | $ | 178,514,567 | |

* Investments at cost | | $ | 646,556,565 | | | $ | 142,124,610 | |

Net Assets Represent: | | | | | | | | |

Paid-in capital | | $ | 1,052,190,976 | | | $ | 324,897,721 | |

Accumulated net investment loss | | | (4,351,065 | ) | | | (822,767 | ) |

Accumulated net realized loss from investments | | | (413,535,090 | ) | | | (182,920,942 | ) |

Net unrealized appreciation on investments | | | 156,717,628 | | | | 37,360,555 | |

Net Assets | | $ | 791,022,449 | | | $ | 178,514,567 | |

| | |

Class I: | | | | | | | | |

Net Assets | | $ | 791,022,449 | | | $ | 178,514,567 | |

Shares outstanding | | | 16,563,008 | | | | 3,602,779 | |

Net asset value, offering and redemption price per share | | $ | 47.76 | | | $ | 49.55 | |

The accompanying notes are an integral part of these financial statements.

14

|

| |

| Statement of Operations (unaudited) |

| For the six months ended March 31, 2018 |

|

| | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | | AMG

Managers

Brandywine

Blue Fund | |

Investment Income: | | | | | | | | |

Dividend income | | $ | 2,418,898 | 1 | | $ | 621,466 | 2 |

Interest income | | | 187,877 | | | | 68,283 | |

Securities lending income | | | 56,256 | | | | 4,264 | |

Total investment income | | | 2,663,031 | | | | 694,013 | |

Expenses: | | | | | | | | |

Investment advisory and management fees | | | 3,515,709 | | | | 793,432 | |

Administrative fees | | | 599,268 | | | | 135,244 | |

Shareholder servicing fees - Class I | | | 79,902 | | | | 45,082 | |

Transfer agent fees | | | 50,518 | | | | 7,433 | |

Professional fees | | | 47,534 | | | | 25,597 | |

Reports to shareholders | | | 38,591 | | | | 29,608 | |

Trustee fees and expenses | | | 26,675 | | | | 6,012 | |

Custodian fees | | | 25,350 | | | | 6,985 | |

Registration fees | | | 14,728 | | | | 13,163 | |

Miscellaneous | | | 9,415 | | | | 2,409 | |

Total expenses before offsets | | | 4,407,690 | | | | 1,064,965 | |

Fee waivers | | | (15,980 | ) | | | — | |

Net expenses | | | 4,391,710 | | | | 1,064,965 | |

Net investment loss | | | (1,728,679 | ) | | | (370,952 | ) |

Net Realized and Unrealized Gain: | | | | | | | | |

Net realized gain on investments | | | 48,631,953 | | | | 13,079,963 | |

Net change in unrealized appreciation/depreciation on investments | | | 9,572,481 | | | | 1,765,856 | |

Net realized and unrealized gain | | | 58,204,434 | | | | 14,845,819 | |

Net increase in net assets resulting from operations | | $ | 56,475,755 | | | $ | 14,474,867 | |

| 1 | Includes non-recurring dividends of $325,990. |

| 2 | Includes non-recurring dividends of $94,588. |

The accompanying notes are an integral part of these financial statements.

15

|

| |

| Statements of Changes in Net Assets |

| For the six months ended March 31, 2018 (unaudited) and the fiscal year ended September 30, 2017 |

|

| | | | | | | | | | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | | AMG

Managers

Brandywine Blue Fund | |

| | | March 31, 2018 | | | September 30, 20171 | | | March 31, 2018 | | | September 30, 20171 | |

Increase in Net Assets Resulting From Operations: | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (1,728,679 | ) | | $ | (3,167,941 | ) | | $ | (370,952 | ) | | $ | (469,725 | ) |

Net realized gain on investments | | | 48,631,953 | | | | 79,635,473 | | | | 13,079,963 | | | | 19,449,670 | |

Net change in unrealized appreciation/depreciation on investments | | | 9,572,481 | | | | 50,520,064 | | | | 1,765,856 | | | | 15,658,514 | |

Net increase in net assets resulting from operations | | | 56,475,755 | | | | 126,987,596 | | | | 14,474,867 | | | | 34,638,459 | |

Capital Share Transactions:2 | | | | | | | | | | | | | | | | |

Net decrease from capital share transactions | | | (36,927,252 | ) | | | (76,279,999 | ) | | | (8,414,076 | ) | | | (19,137,433 | ) |

Total increase in net assets | | | 19,548,503 | | | | 50,707,597 | | | | 6,060,791 | | | | 15,501,026 | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of period | | | 771,473,946 | | | | 720,766,349 | | | | 172,453,776 | | | | 156,952,750 | |

End of period | | $ | 791,022,449 | | | $ | 771,473,946 | | | $ | 178,514,567 | | | $ | 172,453,776 | |

End of period accumulated net investment loss | | $ | (4,351,065 | ) | | $ | (2,622,386 | ) | | $ | (822,767 | ) | | $ | (451,815 | ) |

| | | | | | | | | | | | | | | | |

| 1 | Effective February 27, 2017, the Funds’ shares were renamed as described in Note 1 of the Notes to the Financial Statements. |

| 2 | See Note 1(g) of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

16

|

| AMG Managers Brandywine Fund |

| Financial Highlights |

| For a share outstanding throughout each fiscal period |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the six months ended March 31, 2018

(unaudited) | | | | |

| | | | For the fiscal year ended September 30, | |

| Class I | | | 20171 | | | 2016 | | | 2015 | | | 20142 | | | 2013 | |

Net Asset Value, Beginning of Period | | $ | 44.48 | | | $ | 37.42 | | | $ | 34.54 | | | $ | 33.25 | | | $ | 28.75 | | | $ | 24.62 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)3,4 | | | (0.10 | )5 | | | (0.17 | )6 | | | (0.08 | )7 | | | 0.04 | 8 | | | (0.12 | ) | | | (0.03 | ) |

Net realized and unrealized gain on investments | | | 3.38 | | | | 7.23 | | | | 2.96 | | | | 1.25 | | | | 4.62 | | | | 4.16 | |

Total income from investment operations | | | 3.28 | | | | 7.06 | | | | 2.88 | | | | 1.29 | | | | 4.50 | | | | 4.13 | |

Net Asset Value, End of Period | | $ | 47.76 | | | $ | 44.48 | | | $ | 37.42 | | | $ | 34.54 | | | $ | 33.25 | | | $ | 28.75 | |

Total Return4,9 | | | 7.37 | %10 | | | 18.87 | % | | | 8.34 | % | | | 3.88 | % | | | 15.65 | % | | | 16.77 | % |

Ratio of net expenses to average net assets | | | 1.10 | %11 | | | 1.11 | % | | | 1.11 | % | | | 1.10 | % | | | 1.10 | % | | | 1.11 | %12 |

Ratio of gross expenses to average net assets4,13 | | | 1.10 | %11 | | | 1.12 | % | | | 1.11 | % | | | 1.10 | % | | | 1.10 | % | | | 1.11 | % |

Ratio of net investment income (loss) to average net assets | | | (0.43 | )%11 | | | (0.43 | )% | | | (0.24 | )% | | | 0.10 | % | | | (0.37 | )% | | | (0.12 | )% |

Portfolio turnover | | | 72 | %10 | | | 187 | % | | | 185 | % | | | 190 | % | | | 219 | % | | | 214 | % |

Net assets end of period (000’s) omitted | | $ | 791,022 | | | $ | 771,474 | | | $ | 720,766 | | | $ | 759,185 | | | $ | 799,045 | | | $ | 816,222 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Effective February 27, 2017, the Fund’s Class S shares were renamed to Class I shares. |

| 2 | At the start of business October 1, 2013, the Fund was reorganized into a fund of AMG Funds I. |

| 3 | Per share numbers have been calculated using average shares. |

| 4 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 5 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.12). |

| 6 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.22). |

| 7 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.10). |

| 8 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.07). |

| 9 | The total return is calculated using the published Net Asset Value as of fiscal period end. |

| 12 | Interest expense is less than 0.005% of average net assets. |

| 13 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

17

|

| AMG Managers Brandywine Blue Fund |

| Financial Highlights |

| For a share outstanding throughout each fiscal period |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the six months ended March 31, 2018 (unaudited) | | | | |

| | | | For the fiscal year ended September 30, | |

| Class I | | | 20171 | | | 2016 | | | 2015 | | | 20142 | | | 2013 | |

Net Asset Value, Beginning of Period | | $ | 45.69 | | | $ | 36.87 | | | $ | 33.95 | | | $ | 33.51 | | | $ | 30.01 | | | $ | 25.00 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)3 | | | (0.10 | )4 | | | (0.12 | )5 | | | (0.02 | )6 | | | 0.10 | 7 | | | (0.03 | ) | | | 0.12 | |

Net realized and unrealized gain on investments | | | 3.96 | | | | 8.94 | | | | 3.02 | | | | 0.34 | | | | 3.53 | | | | 4.89 | |

Total income from investment operations | | | 3.86 | | | | 8.82 | | | | 3.00 | | | | 0.44 | | | | 3.50 | | | | 5.01 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | (0.08 | ) | | | — | | | | — | | | | — | |

Net Asset Value, End of Period | | $ | 49.55 | | | $ | 45.69 | | | $ | 36.87 | | | $ | 33.95 | | | $ | 33.51 | | | $ | 30.01 | |

Total Return8 | | | 8.45 | %9 | | | 23.92 | % | | | 8.86 | % | | | 1.31 | % | | | 11.66 | % | | | 20.04 | % |

Ratio of net expenses to average net assets | | | 1.18 | %10 | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.19 | % | | | 1.22 | % |

Ratio of net investment income (loss) to average net assets | | | (0.41 | )%10 | | | (0.29 | )% | | | (0.05 | )% | | | 0.29 | % | | | (0.11 | )% | | | 0.45 | % |

Portfolio turnover | | | 70 | %9 | | | 167 | % | | | 139 | % | | | 156 | % | | | 182 | % | | | 202 | % |

Net assets end of period (000’s) omitted | | $ | 178,515 | | | $ | 172,454 | | | $ | 156,953 | | | $ | 169,180 | | | $ | 215,941 | | | $ | 278,620 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Effective February 27, 2017, the Fund’s Class S shares were renamed to Class I shares. |

| 2 | At the start of business October 1, 2013, the Fund was reorganized into a fund of AMG Funds I. |

| 3 | Per share numbers have been calculated using average shares. |

| 4 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.13). |

| 5 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.18). |

| 6 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.04). |

| 7 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.08). |

| 8 | The total return is calculated using the published Net Asset Value as of fiscal period end. |

18

|

| |

| Notes to Financial Statements (unaudited) |

| March 31, 2018 |

|

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds I (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report are AMG Managers Brandywine Fund (“Brandywine”) and AMG Managers Brandywine Blue Fund (“Brandywine Blue”), each a “Fund” and collectively, the “Funds.”

A significant portion of the Brandywine Blue’s holdings may be focused in a relatively small number of securities, which may make the Fund more volatile and subject to greater risk than a more diversified fund.

Effective February 27, 2017, each Fund’s Class S shares were renamed to Class I shares. Please refer to a current prospectus for additional information.

The Funds’ financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last quoted bid price or the mean between the last quoted bid and ask prices (the “exchange mean price”). Equity securities traded in the over-the-counter market (other than NMS securities) are valued at the exchange mean price. Foreign equity securities (securities principally traded in markets other than U.S. markets) are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of amortized cost. Investments in other open-end regulated investment companies are valued at their end of day net asset value per share.

The Funds’ portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based valuations provided by third party pricing services approved by the Board of Trustees of the Trust (the “Board”). Under certain circumstances, the value of certain Fund portfolio investments may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Valuation Committee, which is comprised of the Independent Trustees of the Board, and the Pricing Committee, which is comprised of representatives from AMG Funds LLC (the “Investment Manager”) are the committees appointed by the Board to make fair value determinations. Each Fund may use the fair value of a

portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is not readily available or otherwise not determinable pursuant to the Board’s valuation procedures, if the Investment Manager or the Pricing Committee believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Pricing Committee and, if required under the Trust’s securities valuation procedures, the Valuation Committee, seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with a quarterly report showing as of the most recent quarter end, all outstanding securities fair valued by the Fund, including a comparison with the prior quarter end and the percentage of the Fund that the security represents at each quarter end.

With respect to foreign equity securities and certain foreign fixed income securities, the Board has adopted a policy that securities held in a Fund that can be fair valued by the applicable fair value pricing service are fair valued on each business day provided that each individual price exceeds a pre-established confidence level.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Funds. Unobservable inputs reflect the Funds’ own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)