UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG FUNDS I

(Exact name of registrant as specified in charter)

680 Washington Blvd., Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Blvd., Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: September 30

Date of reporting period: OCTOBER 1, 2021 – SEPTEMBER 30, 2022

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | |

| | | AMG Funds September 30, 2022 |

| | |

|

| | |

| | | AMG Boston Common Global Impact Fund |

| | | Class I: BRWIX |

| | | |

| | | |

| | | |

| | | |

| | | | |

| amgfunds.com | | | | 093022 AR074 |

| | |

| | | AMG Funds Annual Report — September 30, 2022 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULE OF PORTFOLIO INVESTMENTS | | | 4 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 12 | |

| | | |

| | | Balance sheet, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 13 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 14 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 15 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 16 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 21 | |

| | | |

| | | OTHER INFORMATION | | | 22 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 23 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 25 | |

| | | | | | | |

|

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended September 30, 2022, was a volatile period for risk assets as uncertainties mounted about high inflation, monetary policy, and the Russian invasion of Ukraine. Global equity and bond markets fell in tandem amid sharply higher interest rates and eroding investor confidence as worries of an impending recession loomed over markets. A global commodity shock caused by the war in Ukraine only made matters worse. The S&P 500® Index slipped into a bear market with the Index falling more than (24)% from its peak earlier in the year. The abrupt shift in markets this year has reset expectations around future growth as stubbornly high inflation has necessitated the U.S. Federal Reserve and other global central banks to take more aggressive policy action in bringing down inflation. While the outlook is uncertain given the recent negative returns across many asset classes, one silver lining is that stock and bond valuations are now more attractive than where they were at the start of the year.

There was very wide dispersion in sector performance. Energy significantly outperformed all other sectors with a gain of 45.70% as the price of oil surged during the period. Defensive-oriented sectors also outperformed with a 5.55% return from utilities and a nearly flat (0.09)% return from consumer staples. All other sectors experienced negative returns, led by high growth technology and mega cap internet-related companies underperforming during the period. Communications services fell the most with a (39.07)% return during the fiscal year, followed by declines of (20.89)% for consumer discretionary and (19.96)% for information technology. Value stocks outperformed growth stocks as the Russell 1000® Value Index returned (11.36)% compared to the (22.59)% return for the Russell 1000® Growth Index. Small cap stocks struggled as the Russell 2000® Index lost (23.50)%. Outside the U.S., foreign developed markets lagged their U.S. counterparts as the U.S. dollar surged and the MSCI EAFE Index fell (25.13)%. Emerging Markets underperformed with a (28.11)% return for the MSCI Emerging Markets Index.

The 10-year Treasury yield more than doubled during the period, surging past the 3% threshold for the first time in the post-pandemic era. Rapidly rising rates from a very low base led to historically bad performance for bonds as the Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, lost (14.60)% over the period. Investment-grade corporate bonds underperformed, returning (18.53)% for the year. High yield bonds held up slightly better with a (14.14)% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds were slightly better with a (11.50)% return for the Bloomberg Municipal Bond Index. Non-U.S. bonds delivered weak performance and were also impacted by the stronger dollar as the Bloomberg Global Aggregate ex U.S. fell (24.77)%.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

|

Respectfully, |

|

| Keitha Kinne |

| President |

| AMG Funds |

| | | | | | | | | | | | | | |

| | | | | Periods ended | |

| Average Annual Total Returns | | September 30, 2022* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | (15.47 | )% | | | 8.16 | % | | | 9.24 | % |

| | | | |

Small Cap | | (Russell 2000® Index) | | | (23.50 | )% | | | 4.29 | % | | | 3.55 | % |

| | | | |

International | | (MSCI ACWI ex USA) | | | (25.17 | )% | | | (1.52 | )% | | | (0.81 | )% |

| | | | |

Bonds: | | | | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | (14.60 | )% | | | (3.26 | )% | | | (0.27 | )% |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | (14.14 | )% | | | (0.45 | )% | | | 1.57 | % |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | (11.50 | )% | | | (1.85 | )% | | | 0.59 | % |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 0.39 | % | | | 0.68 | % | | | 1.25 | % |

*Source: FactSet. Past performance is no guarantee of future results.

2

| | |

| | | About Your Fund’s Expenses |

| | | |

| | | |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

Six Months Ended

September 30, 2022 | | Expense

Ratio for

the Period | | Beginning

Account

Value

04/01/22 | | Ending

Account

Value

09/30/22 | | Expenses

Paid

During

the Period* |

AMG Boston Common Global Impact Fund |

|

Based on Actual Fund Return |

| | | | |

Class I | | 0.93% | | $1,000 | | $781 | | $4.15 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 0.93% | | $1,000 | | $1,020 | | $4.71 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

3

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | | | | | |

AMG Boston Common Global Impact Fund (the “Fund”) returned (29.90)% during the year ended September 30, 2022, compared to the (20.66)% return for the MSCI ACWI Index (the “Index”). Market Overview The year under review was marked by numerous cross currents. Geopolitical tensions, especially Russia’s war in Ukraine, soaring energy and food prices pushing up inflation & interest rates globally, hawkish central banks, China’s COVID lockdowns, and slowing global growth have all weighed on investor sentiment during the period. Encouragingly, supply chains seem to be unsnarling, with positive implications for near-term demand-supply imbalances and inflationary forces. Within the Index, Japan, Emerging Markets, and European equities declined most, while the U.K. and North American equities held up better relative to the Index. The traditional energy sector outperformed most, benefiting from elevated energy and gas prices, which have begun to roll over. Investor preference for defensive positions aided utilities and consumer staples, which also outperformed. Lagging most were communication services, especially media and entertainment stocks, and consumer discretionary and technology sectors, as higher interest rates, rising costs, and slowing demand pressured stock performance. Portfolio Review The difficult market environment impacted the portfolio, which underperformed the Index during the fiscal year. Stock selection was the primary driver of the underperformance. Detracting most was the selection in materials, especially in our green chemical holdings in Europe and the U.K., including Koninklijke DSM NV and Croda International PLC, as well as Norwegian manufacturer of petrochemical substitutes Borregaard A.S.A. and Belgian metal recycler & electric vehicle battery supplier Umicore, S.A.. Concerns regarding input costs and demand dynamics in a slowing growth environment have weighed on these positions. The industrials sector also lagged, as European holdings Schneider Electric SE, TOMRA Systems A.S.A., and Spirax-Sarco Engineering PLC declined with concerns around slowing economic activity, while wind turbine maker Vestas Wind Systems A/S was hurt by rising steel and freight costs. In the U.S., The AZEK Co., Inc. (“AZEK”), a leading manufacturer of recycled deck materials, and Carrier Global Corp., a global provider of safe and sustainable refrigeration and air conditioning appliances, declined amid concerns of | | | | a slowdown in residential and commercial real estate investment. Within healthcare, vaccine developer BioNTech SE, ADR (“BioNTech”), traditional Chinese medicine supplier China Traditional Chinese Medicine Holdings Co., Ltd., and Swiss hearing aid specialist Sonova Holding AG detracted value. Our lack of exposure to the lagging communication services sector proved most beneficial from an allocation perspective, while the underweight allocation to and selection within technology was also positive. Within technology, Enphase Energy, Inc. (“Enphase”) and First Solar, Inc., both U.S.-based renewable energy solutions providers, topped returns on resilient demand and conducive policy environment. Financials contributed during the period, led by Indonesian microfinance lender Bank Rakyat Indonesia Persero Tbk PT, ADR, which was positively correlated with commodities and benefits from an improving economy as mobility picks up. On a regional basis, our holdings in Europe, North America, and the U.K. detracted most, while those in Asia Pacific ex Japan and Emerging Markets were slightly positive. Outlook and Positioning The Russian war against Ukraine and the related European energy crisis are geopolitical threats that hinder global economic recovery. However, Europe looks rather well prepared to manage the winter of 2022 without Russian natural gas, having taken steps to collectively reduce energy demand, increase gas storage, and ensure fiscal support to lessen impact on consumers and small & medium-sized enterprises. China’s reluctance to abandon its “zero-COVID” policy is also stymying global growth. In this uncertain and higher interest rate market environment, we are increasingly cautious regarding stocks with elevated valuation levels. We have gradually moved the portfolio to more defensive positioning, decreasing our cyclical exposure in Europe and Japan while adding to positions within our more defensively tilted impact themes of Access to Health and Water Management. While short-term policy interest rates are poised to rise further, we see disinflationary trends on the horizon. Commodity-related inflation appears to be easing as corporations right-size supply chains and consumer demand moderates. Corporate executives of many holdings continue to display optimism about future revenue growth capabilities, especially as many companies stand to benefit from the electrification and renewable power energy transition. The recently passed Inflation Reduction Act (“IRA”) in the U.S. contains $369 billion in climate | | | | spending, including clean electricity tax credits, clean energy incentives, building efficiency, and electrification. This should help to drive U.S. climate action forward and help to rebuild the U.S.’ credibility on the international climate stage. Our Fund’s investment strategy is very well aligned with such policy measures. Portfolio Activity Over the period, we used the market selloff to initiate positions in a select number of predominantly U.S.-based, technology-oriented solutions names. In early 2022 we bought Enphase, a pure-play solutions company and leading provider of microinverter systems for the solar industry. Enphase is the market leader in this niche category, which helps support the provision of green, affordable, and reliable energy. Its technology approach brings solar energy generation, storage, control, and management into an all-in-one intelligent platform. We also purchased online payment platform PayPal Holdings, Inc. (“PayPal”), a dominant player in the payment industry, which facilitates online retailing for both large and small enterprises across more than two hundred markets. We regard PayPal as a solutions company within our Inclusive & Sustainable Finance impact theme. We also purchased salesforce.com, Inc., a cloud-based solutions provider of customer relationship management (“CRM”) systems to businesses of all sizes and industries worldwide. Within the eco-efficiency impact theme, we bought Infineon Technologies AG, a German/U.S. semiconductor manufacturer focused on structural trends like renewable energy adoption and e-mobility infrastructure, including EV charging. Other new positions during the period include U.S.-based AZEK and LKQ Corp (“LKQ”). AZEK is a manufacturer of high-quality recycled deck material, displaying strong organic growth in the attractive market for remodeling outdoor residential space. Increasing its products’ use of recycled content should help bolster margin expansion, bringing it closer to the industry’s market leader TREX. LKQ is a global leader within the auto recycling industry and thus part of our Recycling and Efficiency impact investment theme. Cars are the most recycled product on the planet, and 95% of car materials can be repurposed (like steel, copper, and aluminum). The auto recycling industry reclaims more than 750 million tons of scrap each month from wrecked or abandoned vehicles, and LKQ has been a consolidator in this highly fragmented market. LKQ gathers an average of 140 recycled and refurbished high-quality parts from each salvaged or total loss |

4

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

vehicle. The company has made important strides in repairing its balance sheet, which should allow for significant share buybacks. As we tilted into the more defensive impact themes, we bought Regeneron Pharmaceuticals, Inc. and BioNTech, both solutions names in our Access to Health impact theme. In terms of exits, we sold Cummins, Inc., a name we like for its long-term hydrogen potential, but which remains largely dependent on heavy diesel engine manufacturing. We also sold paper & packaging company DS Smith PLC, whose investment thesis appeared challenged during a period of decelerating economic growth, as well as Mohawk Industries, Inc., | | | | whose high free cash flow yield was expected to be impacted by higher energy & materials input prices. Cerner Corp. received a take-out offer from Oracle. Overall, on a sector basis, we raised our allocation to technology and financials, while reducing industrials and materials. The Fund remains focused on product solutions companies within our nine impact investment themes whose revenues stand to benefit from economic expansion, regulatory directives, and the long-term pathway to achieve carbon-neutral transformation. Our integrated ESG & Impact research process leads us to a portfolio of 40-60 companies that we believe are best positioned for | | | | this sustainable transition. At the end of the period, the largest impact investment themes in which we were invested were Recycling & Eco-Efficiency, Organic/Healthier Products, Sustainable & Inclusive Finance, and Access to Health. This commentary reflects the viewpoints of the portfolio manager, Boston Common Asset Management, as of September 30, 2022, is not intended as a forecast or guarantee of future results, and is subject to change without notice. |

5

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

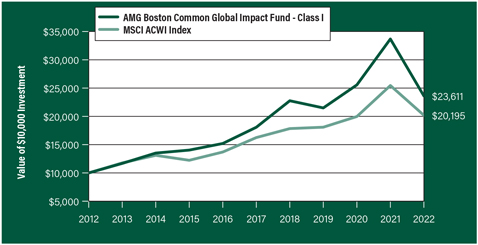

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Boston Common Global Impact Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Boston Common Global Impact Fund’s Class I shares on September 30, 2012, to a $10,000 investment made in the MSCI ACWI Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Boston Common Global Impact Fund and the MSCI ACWI for the same time periods ended September 30, 2022.

| | | | | | |

| | | One | | Five | | Ten |

| Average Annual Total Returns1 | | Year | | Years | | Years |

|

AMG Boston Common Global Impact Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15 |

| | | |

Class I | | (29.90%) | | 5.49% | | 8.97% |

| | | |

MSCI ACWI Index16 | | (20.66%) | | 4.44% | | 7.28% |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2022. All returns are in U.S. Dollars ($). |

| 2 | As of March 19, 2021, the Fund’s Subadviser was changed to Boston Common Asset Management, LLC. Prior to March 19, 2021, the Fund was known as the AMG Managers Brandywine Fund, and had different principal investment strategies and corresponding risks. Performance shown for periods prior to March 19, 2021, reflects |

|

the performance and investment strategies of the Fund’s previous Subadvisers, Friess Associates, LLC and Friess Associates of Delaware, LLC. The Fund’s past performance would have been different if the Fund were managed by the current Subadviser and strategy, and the Fund’s prior performance record might be less pertinent for investors considering whether to purchase shares of the fund. 3 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 4 The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. 5 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 6 Companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 7 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. 8 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. 9 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 10 Changes in the general political and social environment of a country can have substantial effects on the value of investments exposed to that country. 11 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. |

6

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

12 Applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than performance, and the Fund may underperform funds that do not utilize an ESG investment strategy. The application of this strategy may affect the Fund’s exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the Subadviser will reflect the beliefs or values of any particular investor. | | | | 13 The Fund may not be able to dispose of particular investments, such as illiquid securities, readily at favorable times or prices or the Fund may have to sell them at a loss. 14 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 15 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. 16 The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of | | | | developed and emerging markets. Please go to msci.com for the most current list of countries represented by the index. Unlike the Fund, the MSCI ACWI Index is unmanaged, is not available for investment and does not incur expenses. All MSCI data is provided ‘as is’. The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. Not FDIC insured, nor bank guaranteed. May lose value. |

7

| | |

| | | AMG Boston Common Global Impact Fund Fund Snapshots (unaudited) September 30, 2022 |

| | | |

| | | |

PORTFOLIO BREAKDOWN

| | | | | |

| Sector | | % of Net Assets |

| | |

Information Technology | | | | 20.7 | |

| | |

Industrials | | | | 17.8 | |

| | |

Health Care | | | | 14.5 | |

| | |

Consumer Discretionary | | | | 13.3 | |

| | |

Financials | | | | 10.2 | |

| | |

Materials | | | | 10.1 | |

| | |

Consumer Staples | | | | 6.1 | |

| | |

Utilities | | | | 3.4 | |

| | |

Real Estate | | | | 2.4 | |

| | |

Short-Term Investments | | | | 3.9 | |

| | |

Other Assets, Less Liabilities | | | | (2.4 | ) |

TOP TEN HOLDINGS

| | | | | |

| Security Name | | % of

Net Assets |

| | |

Xylem, Inc. (United States) | | | | 2.9 | |

| | |

PayPal Holdings, Inc. (United States) | | | | 2.8 | |

| | |

Bank Rakyat Indonesia Persero Tbk PT, ADR (Indonesia) | | | | 2.8 | |

| | |

Enphase Energy, Inc. (United States) | | | | 2.5 | |

| | |

Sprouts Farmers Market, Inc. (United States) | | | | 2.5 | |

| | |

TopBuild Corp. (United States) | | | | 2.5 | |

| | |

Carrier Global Corp. (United States) | | | | 2.5 | |

| | |

Intuit, Inc. (United States) | | | | 2.4 | |

| | |

ORIX Corp. (Japan) | | | | 2.4 | |

| | |

Shimano, Inc. (Japan) | | | | 2.4 | |

| | | | | | |

| | |

Top Ten as a Group | | | | 25.7 | |

| | | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments September 30, 2022 |

| | | |

| | | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| | |

Common Stocks - 98.5% | | | | | | | | |

| |

Consumer Discretionary - 13.3% | | | | | |

| | |

Barratt Developments PLC (United Kingdom) | | | 1,957,955 | | | | $7,399,935 | |

| | |

BYD Co., Ltd., Class H (China) | | | 430,500 | | | | 10,605,610 | |

| | |

KB Home (United States) | | | 487,206 | | | | 12,628,379 | |

| | |

LKQ Corp. (United States) | | | 195,560 | | | | 9,220,654 | |

| | |

Shimano, Inc. (Japan) | | | 82,100 | | | | 12,845,784 | |

| | |

TopBuild Corp. (United States)* | | | 83,825 | | | | 13,812,683 | |

| | |

Yamaha Corp. (Japan) | | | 155,400 | | | | 5,522,043 | |

| | |

Total Consumer Discretionary | | | | | | | 72,035,088 | |

| | |

Consumer Staples - 6.1% | | | | | | | | |

| | |

Kerry Group PLC, Class A (Ireland) | | | 109,783 | | | | 9,785,215 | |

| | |

McCormick & Co., Inc., Non-Voting Shares (United States) | | | 135,280 | | | | 9,641,405 | |

| | |

Sprouts Farmers Market, Inc. (United States)*,1 | | | 497,825 | | | | 13,814,644 | |

| | |

Total Consumer Staples | | | | | | | 33,241,264 | |

| | |

Financials - 10.2% | | | | | | | | |

| | |

Bank Rakyat Indonesia Persero Tbk PT, ADR (Indonesia)1 | | | 1,077,959 | | | | 15,123,765 | |

| | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc., REIT (United States)1 | | | 325,320 | | | | 9,736,827 | |

| | |

HDFC Bank, Ltd., ADR (India) | | | 160,149 | | | | 9,355,904 | |

| | |

ORIX Corp. (Japan) | | | 938,900 | | | | 13,153,101 | |

| | |

Ping An Insurance Group Co. of China, Ltd., Class H (China) | | | 1,581,000 | | | | 7,887,285 | |

| | |

Total Financials | | | | | | | 55,256,882 | |

| | |

Health Care - 14.5% | | | | | | | | |

| | |

Biogen, Inc. (United States)* | | | 29,649 | | | | 7,916,283 | |

| | |

BioNTech SE, ADR (Germany)1 | | | 59,780 | | | | 8,063,126 | |

| | |

China Traditional Chinese Medicine Holdings Co., Ltd. (Hong Kong) | | | 28,004,000 | | | | 9,742,437 | |

| | |

CSL, Ltd. (Australia) | | | 52,382 | | | | 9,526,565 | |

| | |

Gilead Sciences, Inc. (United States) | | | 201,610 | | | | 12,437,321 | |

| | |

Hoya Corp. (Japan) | | | 82,200 | | | | 7,920,678 | |

| | |

Illumina, Inc. (United States)* | | | 26,543 | | | | 5,064,139 | |

| | |

Regeneron Pharmaceuticals, Inc. (United States)* | | | 14,985 | | | | 10,322,717 | |

| | |

Sonova Holding AG (Switzerland) | | | 34,645 | | | | 7,624,013 | |

| | |

Total Health Care | | | | | | | 78,617,279 | |

| | |

Industrials - 17.8% | | | | | | | | |

| | |

The AZEK Co., Inc. (United States)* | | | 407,700 | | | | 6,775,974 | |

| | |

Carrier Global Corp. (United States) | | | 383,347 | | | | 13,631,819 | |

| | |

Daikin Industries, Ltd. (Japan) | | | 59,400 | | | | 9,139,823 | |

| | |

Kurita Water Industries, Ltd. (Japan) | | | 324,400 | | | | 11,517,239 | |

| | |

Schneider Electric SE (France) | | | 107,624 | | | | 12,156,215 | |

| | | | | | | | |

| | |

| | | Shares | | | Value | |

| | |

Spirax-Sarco Engineering PLC (United Kingdom) | | | 68,025 | | | | $7,819,689 | |

| | |

TOMRA Systems A.S.A. (Norway) | | | 409,410 | | | | 7,223,407 | |

| | |

Vestas Wind Systems A/S (Denmark) | | | 305,659 | | | | 5,628,057 | |

| | |

Westinghouse Air Brake Technologies Corp. (United States) | | | 84,754 | | | | 6,894,738 | |

| | |

Xylem, Inc. (United States) | | | 180,325 | | | | 15,753,192 | |

| | |

Total Industrials | | | | | | | 96,540,153 | |

| | |

Information Technology - 20.7% | | | | | | | | |

| | |

Adobe, Inc. (United States)* | | | 34,476 | | | | 9,487,795 | |

| | |

Applied Materials, Inc. (United States) | | | 107,156 | | | | 8,779,291 | |

| | |

Ciena Corp. (United States)* | | | 147,480 | | | | 5,962,616 | |

| | |

Enphase Energy, Inc. (United States)* | | | 49,820 | | | | 13,823,555 | |

| | |

First Solar, Inc. (United States)* | | | 73,278 | | | | 9,692,481 | |

| | |

Infineon Technologies AG (Germany) | | | 350,770 | | | | 7,676,263 | |

| | |

Intuit, Inc. (United States) | | | 34,209 | | | | 13,249,830 | |

| | |

Pagseguro Digital, Ltd., Class A (Brazil)* | | | 603,915 | | | | 7,989,796 | |

| | |

PayPal Holdings, Inc. (United States)* | | | 177,175 | | | | 15,249,452 | |

| | |

salesforce.com, Inc. (United States)* | | | 86,270 | | | | 12,409,077 | |

| | |

Xinyi Solar Holdings, Ltd. (China) | | | 7,800,000 | | | | 8,191,064 | |

| | |

Total Information Technology | | | | | | | 112,511,220 | |

| | |

Materials - 10.1% | | | | | | | | |

| | |

Borregaard A.S.A. (Norway) | | | 729,166 | | | | 8,611,907 | |

| | |

Croda International PLC (United Kingdom) | | | 84,089 | | | | 6,005,975 | |

| | |

Ecolab, Inc. (United States) | | | 67,265 | | | | 9,714,412 | |

| | |

Koninklijke DSM NV (Netherlands)1 | | | 76,812 | | | | 8,740,480 | |

| | |

Novozymes A/S, Class B (Denmark) | | | 156,888 | | | | 7,883,955 | |

| | |

Sociedad Quimica y Minera de Chile, S.A., ADR (Chile) | | | 94,035 | | | | 8,533,676 | |

| | |

Umicore, S.A. (Belgium) | | | 172,383 | | | | 5,060,697 | |

| | |

Total Materials | | | | | | | 54,551,102 | |

| | |

Real Estate - 2.4% | | | | | | | | |

| | |

Vonovia SE (Germany) | | | 249,428 | | | | 5,383,101 | |

| | |

Weyerhaeuser Co., REIT (United States) | | | 267,365 | | | | 7,635,944 | |

| | |

Total Real Estate | | | | | | | 13,019,045 | |

| | |

Utilities - 3.4% | | | | | | | | |

| | |

American Water Works Co., Inc. (United States) | | | 76,293 | | | | 9,930,297 | |

| | |

Orsted A.S. (Denmark)2 | | | 109,013 | | | | 8,688,420 | |

| | |

Total Utilities | | | | | | | 18,618,717 | |

| | |

Total Common Stocks | | | | | | | | |

(Cost $726,381,192) | | | | | | | 534,390,750 | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| |

Short-Term Investments - 3.9% | | | | | |

| | |

Joint Repurchase

Agreements - 2.6%3 | | | | | | | | |

| | |

Amherst Pierpont Securities LLC, dated 09/30/22, due 10/03/22, 3.140% total to be received $3,291,524 (collateralized by various U.S. Government Agency Obligations, 0.000% - 5.000%, 03/31/23 - 11/20/69, totaling $3,356,476) | | | $3,290,663 | | | | $3,290,663 | |

| | |

Cantor Fitzgerald Securities, Inc., dated 09/30/22, due 10/03/22, 3.050% total to be received $3,072,320 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 9.000%, 11/01/22 - 08/20/72, totaling $3,132,970) | | | 3,071,539 | | | | 3,071,539 | |

| | |

Mirae Asset Securities USA, Inc., dated 09/30/22, due 10/03/22, 3.180% total to be received $3,291,535 (collateralized by various U.S. Government Agency Obligations, 0.400% - 7.500%, 10/15/23 - 05/15/61, totaling $3,357,366) | | | 3,290,663 | | | | 3,290,663 | |

| | |

MUFG Securities America, Inc., dated 09/30/22, due 10/03/22, 3.050% total to be received $1,949,088 (collateralized by various U.S. Government Agency Obligations, 2.000% - 5.000%, 09/01/28 - 09/01/52, totaling $1,987,565) | | | 1,948,593 | | | | 1,948,593 | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $18,411,134 or 3.4% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2022, the value of this security amounted to $8,688,420 or 1.6% of net assets. |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| | |

State of Wisconsin Investment Board, dated 09/30/22, due 10/03/22, 3.040% total to be received $2,253,232 (collateralized by various U.S. Treasuries, 0.125% - 3.875%, 10/15/24 - 02/15/51, totaling $2,297,770) | | | $2,252,661 | | | | $2,252,661 | |

| | |

Total Joint Repurchase Agreements | | | | | | | 13,854,119 | |

| | |

| | | Shares | | | | |

| |

Other Investment Companies - 1.3% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 2.75%4 | | | 4,552,992 | | | | 4,552,992 | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 2.75%4 | | | 2,732,701 | | | | 2,732,701 | |

| | |

Total Other Investment Companies | | | | | | | 7,285,693 | |

| | |

Total Short-Term Investments

(Cost $21,139,812) | | | | | | | 21,139,812 | |

| | |

Total Investments - 102.4%

(Cost $747,521,004) | | | | | | | 555,530,562 | |

| |

Other Assets, less Liabilities - (2.4)% | | | | (13,207,237 | ) |

| | |

Net Assets - 100.0% | | | | | | $ | 542,323,325 | |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 4 | Yield shown represents the September 30, 2022, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

REIT Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

10

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of September 30, 2022:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 21 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks | | | | | | | | | | | | | | | | |

| | | | |

Information Technology | | | $96,643,893 | | | | $15,867,327 | | | | — | | | | $112,511,220 | |

| | | | |

Industrials | | | 43,055,723 | | | | 53,484,430 | | | | — | | | | 96,540,153 | |

| | | | |

Health Care | | | 43,803,586 | | | | 34,813,693 | | | | — | | | | 78,617,279 | |

| | | | |

Consumer Discretionary | | | 35,661,716 | | | | 36,373,372 | | | | — | | | | 72,035,088 | |

| | | | |

Financials | | | 34,216,496 | | | | 21,040,386 | | | | — | | | | 55,256,882 | |

| | | | |

Materials | | | 26,859,995 | | | | 27,691,107 | | | | — | | | | 54,551,102 | |

| | | | |

Consumer Staples | | | 23,456,049 | | | | 9,785,215 | | | | — | | | | 33,241,264 | |

| | | | |

Utilities | | | 9,930,297 | | | | 8,688,420 | | | | — | | | | 18,618,717 | |

| | | | |

Real Estate | | | 7,635,944 | | | | 5,383,101 | | | | — | | | | 13,019,045 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | | 13,854,119 | | | | — | | | | 13,854,119 | |

| | | | |

Other Investment Companies | | | 7,285,693 | | | | — | | | | — | | | | 7,285,693 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 328,549,392 | | | $ | 226,981,170 | | | | — | | | $ | 555,530,562 | |

| | | | | | | | | | | | | | | | |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended September 30, 2022, there were no transfers in or out of Level 3.

The country allocation in the Schedule of Portfolio Investments at September 30, 2022, was as follows:

| | |

| Country | | % of Long-Term

Investments |

| |

Australia | | 1.8 |

| |

Belgium | | 0.9 |

| |

Brazil | | 1.5 |

| |

Chile | | 1.6 |

| |

China | | 5.0 |

| |

Denmark | | 4.2 |

| |

France | | 2.3 |

| |

Germany | | 4.0 |

| |

Hong Kong | | 1.8 |

| |

India | | 1.8 |

| | |

| Country | | % of Long-Term

Investments |

| |

Indonesia | | 2.8 |

| |

Ireland | | 1.8 |

| |

Japan | | 11.2 |

| |

Netherlands | | 1.6 |

| |

Norway | | 3.0 |

| |

Switzerland | | 1.4 |

| |

United Kingdom | | 4.0 |

| |

United States | | 49.3 |

| | |

| |

| | | 100.0 |

| | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| | | Statement of Assets and Liabilities September 30, 2022 |

| | | |

| | | |

| | | | |

| | | AMG

Boston Common

Global Impact

Fund | |

| |

Assets: | | | | |

| |

Investments at value1 (including securities on loan valued at $18,411,134) | | | $555,530,562 | |

| |

Dividend and interest receivables | | | 1,895,980 | |

| |

Securities lending income receivable | | | 3,406 | |

| |

Receivable for Fund shares sold | | | 357 | |

| |

Prepaid expenses and other assets | | | 16,541 | |

| |

Total assets | | | 557,446,846 | |

| |

Liabilities: | | | | |

| |

Payable upon return of securities loaned | | | 13,854,119 | |

| |

Payable for Fund shares repurchased | | | 653,913 | |

| |

Payable to Affiliate | | | 21,842 | |

| |

Accrued expenses: | | | | |

| |

Investment advisory and management fees | | | 353,756 | |

| |

Administrative fees | | | 72,690 | |

| |

Other | | | 167,201 | |

| |

Total liabilities | | | 15,123,521 | |

| | | | |

| |

Net Assets | | | $542,323,325 | |

| |

1 Investments at cost | | | $747,521,004 | |

| |

Net Assets Represent: | | | | |

| |

Paid-in capital | | | $740,488,552 | |

| |

Total distributable loss | | | (198,165,227 | ) |

| |

Net Assets | | | $542,323,325 | |

| |

Class I: | | | | |

| |

Net Assets | | | $542,323,325 | |

| |

Shares outstanding | | | 17,893,665 | |

| |

Net asset value, offering and redemption price per share | | | $30.31 | |

The accompanying notes are an integral part of these financial statements.

12

| | |

| | | Statement of Operations For the fiscal year ended September 30, 2022 |

| | | |

| | | |

| | | | |

| | | AMG

Boston Common

Global Impact

Fund | |

| |

Investment Income: | | | | |

| |

Dividend income | | | $13,018,154 | 1 |

| |

Securities lending income | | | 190,574 | |

| |

Foreign withholding tax | | | (864,080 | ) |

| |

Total investment income | | | 12,344,648 | |

| |

Expenses: | | | | |

| |

Investment advisory and management fees | | | 5,448,783 | |

| |

Administrative fees | | | 1,119,613 | |

| |

Custodian fees | | | 181,165 | |

| |

Professional fees | | | 93,735 | |

| |

Transfer agent fees | | | 82,186 | |

| |

Trustee fees and expenses | | | 49,731 | |

| |

Registration fees | | | 36,641 | |

| |

Reports to shareholders | | | 9,346 | |

| |

Interest expense | | | 773 | |

| |

Miscellaneous | | | 29,265 | |

| |

Repayment of prior reimbursements | | | 24,851 | |

| |

Total expenses before offsets | | | 7,076,089 | |

| |

Expense reimbursements | | | (133,716 | ) |

| |

Total expenses | | | 6,942,373 | |

| | | | |

| |

Net investment income | | | 5,402,275 | |

| |

Net Realized and Unrealized Loss: | | | | |

| |

Net realized loss on investments | | | (7,766,350 | ) |

| |

Net realized loss on foreign currency transactions | | | (237,672 | ) |

| |

Net change in unrealized appreciation/depreciation on investments | | | (242,107,534 | ) |

| |

Net change in unrealized appreciation/depreciation on foreign currency translations | | | (33,692 | ) |

| |

Net realized and unrealized loss | | | (250,145,248 | ) |

| | | | |

| |

Net decrease in net assets resulting from operations | | | $(244,742,973 | ) |

1 Includes non-recurring dividends of $2,335,932.

The accompanying notes are an integral part of these financial statements.

13

| | |

| | | Statements of Changes in Net Assets For the fiscal years ended September 30, |

| | | |

| | | |

| | | | | | | | |

| | | AMG

Boston Common

Global Impact

Fund |

| | |

| | | 2022 | | 2021 |

| | |

Increase (Decrease) in Net Assets Resulting From Operations: | | | | | | | | |

| | |

Net investment income | | | $5,402,275 | | | | $356,733 | |

| | |

Net realized gain (loss) on investments | | | (8,004,022 | ) | | | 341,638,350 | |

| | |

Net change in unrealized appreciation/depreciation on investments | | | (242,141,226 | ) | | | (86,333,640 | ) |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | (244,742,973 | ) | | | 255,661,443 | |

| | |

Distributions to Shareholders: | | | | | | | | |

| | |

Class I | | | (5,876,761 | ) | | | (451,891,718 | ) |

| | |

Capital Share Transactions:1 | | | | | | | | |

| | |

Net increase (decrease) from capital share transactions | | | (111,352,185 | ) | | | 265,468,347 | |

| | | | | | | | |

| | |

Total increase (decrease) in net assets | | | (361,971,919 | ) | | | 69,238,072 | |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 904,295,244 | | | | 835,057,172 | |

| | | | | | | | |

| | |

End of year | | | $542,323,325 | | | | $904,295,244 | |

1 See Note 1(g) of the Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements.

14

| | |

| | | AMG Boston Common Global Impact Fund Financial Highlights For a share outstanding throughout each fiscal year |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, |

| | | | | |

Class I | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| | | | | |

Net Asset Value, Beginning of Year | | | $43.52 | | | | $56.96 | | | | $52.89 | | | | $56.01 | | | | $44.48 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)1 | | | 0.28 | 2,3 | | | 0.02 | 3 | | | (0.27 | ) | | | (0.13 | ) | | | (0.21 | )3 |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | (13.19 | ) | | | 15.47 | | | | 9.70 | | | | (2.99 | ) | | | 11.74 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total income (loss) from investment operations | | | (12.91 | ) | | | 15.49 | | | | 9.43 | | | | (3.12 | ) | | | 11.53 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | |

Net realized gain on investments | | | (0.20 | ) | | | (28.93 | ) | | | (5.36 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions to shareholders | | | (0.30 | ) | | | (28.93 | ) | | | (5.36 | ) | | | — | | | | — | |

| | | | | |

Net Asset Value, End of Year | | | $30.31 | | | | $43.52 | | | | $56.96 | | | | $52.89 | | | | $56.01 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return4 | | | (29.90 | )%3 | | | 31.75 | %3 | | | 18.95 | % | | | (5.57 | )% | | | 25.92 | %3 |

| | | | | |

Ratio of net expenses to average net assets | | | 0.93 | % | | | 1.03 | % | | | 1.11 | % | | | 1.10 | % | | | 1.10 | % |

| | | | | |

Ratio of gross expenses to average net assets | | | 0.95 | %5 | | | 1.03 | %5 | | | 1.11 | % | | | 1.10 | % | | | 1.10 | %5 |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.72 | %3 | | | 0.04 | %3 | | | (0.51 | )% | | | (0.26 | )% | | | (0.43 | )%3 |

| | | | | |

Portfolio turnover | | | 25 | % | | | 202 | % | | | 221 | % | | | 145 | % | | | 138 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $542,323 | | | | $904,295 | | | | $835,057 | | | | $786,149 | | | | $893,301 | |

| 1 | Per share numbers have been calculated using average shares. |

| 2 | Includes non-recurring dividends. Without these dividends, net investment income per share would have been $0.16. |

| 3 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 4 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 5 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

15

| | |

| | | Notes to Financial Statements September 30, 2022 |

| | | |

| | | |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds I (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report is AMG Boston Common Global Impact Fund (the “Fund”).

Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to the long-term implications. Such disruptions can adversely affect assets of the Fund and thus Fund performance.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last quoted bid price. Equity securities held by the Fund that are traded in the over-the-counter market (other than NMS securities) are valued at the bid price. Foreign equity securities (securities principally traded in markets other than U.S. markets) held by the Fund are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of amortized cost. Investments in other open-end registered investment companies are valued at their end of day net asset value per share.

The Fund’s portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based valuations provided by third party pricing services approved by the Board of Trustees of the Trust (the “Board”). Under certain circumstances, the value of certain Fund portfolio investments may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Valuation Committee, which is comprised of the Independent Trustees of the Board, and the Pricing Committee, which is comprised of representatives from AMG Funds LLC (the “Investment Manager”) are the committees appointed by the Board to make fair value determinations. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is

not readily available or otherwise not determinable pursuant to the Board’s valuation procedures, if the Investment Manager or the Pricing Committee believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Pricing Committee and, if required under the Trust’s securities valuation procedures, the Valuation Committee, seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with a quarterly report showing as of the most recent quarter end, all outstanding securities fair valued by the Fund, including a comparison with the prior quarter end and the percentage of the Fund that the security represents at each quarter end.

With respect to foreign equity securities and certain foreign fixed income securities, the Board has adopted a policy that securities held in the Fund that can be fair valued by the applicable fair value pricing service are fair valued on each business day provided that each individual price exceeds a pre-established confidence level.

Effective September 8, 2022, the Fund adopted the requirements of Rule 2a-5 under the 1940 Act (“Rule 2a-5”), which the Fund’s Board designated the Fund’s Investment Manager as the Fund’s Valuation Designee to perform the Fund’s fair value determinations. Such determinations are subject to Board oversight and certain reporting and other requirements intended to ensure that the Board receives the information it needs to oversee the Investment Manager’s fair value determinations. The Fund’s adoption of Rule 2-a5 did not impact how the Fund determines fair value or the carrying amount of investments held in the Fund.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)

16

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments.

b. SECURITY TRANSACTIONS

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

c. INVESTMENT INCOME AND EXPENSES

Dividend income is recorded on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, and if after the fact, as soon as the Fund becomes aware of the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Dividend and interest income on foreign securities is recorded gross of any withholding tax. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to the Fund are apportioned among the funds in the Trust and other trusts or funds within the AMG Funds Family of Funds (collectively the “AMG Funds Family”) based upon their relative average net assets or number of shareholders.

d. DIVIDENDS AND DISTRIBUTIONS

Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually in December. Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. There were no permanent differences. Temporary differences are primarily due to wash sale loss deferrals.

The tax character of distributions paid during the fiscal years ended September 30, 2022 and September 30, 2021 were as follows:

| | | | | | | | |

| | |

Distributions paid from: | | | 2022 | | | | 2021 | |

| | |

Ordinary income * | | | $1,897,407 | | | | $266,048,264 | |

| | |

Long-term capital gains | | | 3,979,354 | | | | 185,843,454 | |

| | | | | | | | |

| | |

| | | $5,876,761 | | | | $451,891,718 | |

| | | | | | | | |

| * | For tax purposes, short-term capital gain distributions, if any, are considered ordinary income distributions. |

As of September 30, 2022, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | | | |

| |

Capital loss carryforward | | $ | 8,223,386 | |

| |

Undistributed ordinary income | | | 2,787,995 | |

At September 30, 2022, the cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax purposes were as follows:

| | | | | | | | | | | | |

| Cost | | Appreciation | | | Depreciation | | | Net Depreciation | |

| | | |

| $748,218,257 | | | $15,342,156 | | | | $(208,071,992 | ) | | | $(192,729,836 | ) |

e. FEDERAL TAXES

The Fund currently qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

Management has analyzed the Fund’s tax positions taken on federal income tax returns as of September 30, 2022, and for all open tax years (generally, the three prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, Management is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

f. CAPITAL LOSS CARRYOVERS AND DEFERRALS

As of September 30, 2022, the Fund had capital loss carryovers for federal income tax purposes as shown in the following chart. These amounts may be used to offset future realized capital gains indefinitely, and retain their character as short-term and/or long-term.

| | | | | | | | | | |

| Short-Term | | | Long-Term | | | Total | |

| | |

| | — | | | | $8,223,386 | | | | $8,223,386 | |

17

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

g. CAPITAL STOCK

The Trust’s Declaration of Trust authorizes for the Fund the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date.

For the fiscal years ended September 30, 2022 and September 30, 2021, the capital stock transactions by class for the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | September 30, 2022 | | | September 30, 2021 | |

| | | | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | | | | |

| | | | |

Class I: | | | | | | | | | | | | | | | | |

| | | | |

Shares sold | | | 80,180 | | | | $3,054,181 | | | | 176,870 | | | | $8,489,156 | |

| | | | |

Shares issued in reinvestment of distributions | | | 123,799 | | | | 5,507,819 | | | | 9,562,894 | | | | 422,177,212 | |

| | | | |

Shares redeemed | | | (3,088,646 | ) | | | (119,914,185 | ) | | | (3,622,135 | ) | | | (165,198,021 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Net increase (decrease) | | | (2,884,667 | ) | | | $(111,352,185 | ) | | | 6,117,629 | | | | $265,468,347 | |

| | | | | | | | | | | | | | | | |

h. REPURCHASE AGREEMENTS AND JOINT REPURCHASE AGREEMENTS

The Fund may enter into third-party and bilateral repurchase agreements for temporary cash management purposes and third-party or bilateral joint repurchase agreements for reinvestment of cash collateral on securities lending transactions under the securities lending program offered by The Bank of New York Mellon (“BNYM”) (the “Program”) (collectively, “Repurchase Agreements”). The value of the underlying collateral, including accrued interest, must equal or exceed the value of the Repurchase Agreements during the term of the agreement. For joint repurchase agreements, the Fund participates on a pro rata basis with other clients of BNYM in its share of the underlying collateral under such joint repurchase agreements and in its share of proceeds from any repurchase or other disposition of the underlying collateral. The underlying collateral for all Repurchase Agreements is held in safekeeping by the Fund’s custodian or at the Federal Reserve Bank. If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. Pursuant to the Program, the Fund is indemnified for such losses by BNYM on joint repurchase agreements.

At September 30, 2022, the market value of Repurchase Agreements outstanding was $13,854,119.

i. FOREIGN CURRENCY TRANSLATION

The books and records of the Fund are maintained in U.S. Dollars. The value of investments, assets and liabilities denominated in currencies other than U.S. Dollars are translated into U.S. Dollars based upon current foreign exchange rates. Purchases and sales of foreign investments, income and expenses are converted into U.S. Dollars based on currency exchange rates prevailing on the respective dates of such transactions. Net realized and unrealized gain (loss) on foreign currency transactions represent: (1) foreign exchange gains and losses from the sale and holdings of foreign currencies; (2) gains and losses between trade date and settlement date on investment securities transactions and foreign currency exchange contracts; and (3) gains and losses from the difference between amounts of interest and dividends recorded and the amounts actually received.

The Fund does not isolate the net realized and unrealized gain or loss resulting from changes in exchange rates from the fluctuations in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

2. AGREEMENTS AND TRANSACTIONS WITH AFFILIATES

The Trust has entered into an investment advisory agreement under which the Investment Manager, a subsidiary and the U.S. retail distribution arm of Affiliated Managers Group, Inc. (“AMG”), serves as investment manager to the Fund and is responsible for the Fund’s overall administration and operations. The Investment Manager selects one or more subadvisers for the Fund (subject to Board approval) and monitors each subadviser’s investment performance, security holdings and investment strategies. The Fund’s investment portfolio is managed by Boston Common Asset Management, LLC (“Boston Common”) who serves pursuant to a subadvisory agreement with the Investment Manager. AMG owns a minority equity interest in Boston Common.

Investment management fees are paid directly by the Fund to the Investment Manager based on average daily net assets. For the fiscal year ended September 30, 2022, the Fund paid an investment management fee at the annual rate of 0.73% of the average daily net assets of the Fund. The fee paid to Boston Common for its services as subadviser is paid out of the fee the Investment Manager receives from the Fund and does not increase the expenses of the Fund. Prior to May 19, 2021, the annual rate for the investment management fees was 0.88% of the Fund’s average daily net assets.

The Investment Manager has contractually agreed, through at least February 1, 2023, to waive management fees and/or pay or reimburse fund expenses in order to limit total annual Fund operating expenses after fee waiver and expense reimbursements (exclusive of taxes, interest (including interest incurred in connection with bank and custody overdrafts, and in connection with securities sold short), shareholder servicing fees, distribution and service (12b-1) fees, brokerage commissions and other transaction costs, dividends payable with respect to securities sold short, acquired fund fees and expenses and extraordinary expenses) of the Fund to the annual rate of 0.93% of the Fund’s average daily net assets (this annual rate or such other annual rate that may be in effect from time to time, the “Expense Cap”), subject to later reimbursement by the

18

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

Fund in certain circumstances. Prior to May 19, 2021, the Fund did not have an expense limitation.

In general, for a period of up to 36 months after the date any amounts are paid, waived or reimbursed by the Investment Manager, the Investment Manager may recover such amounts from the Fund, provided that such repayment would not cause the Fund’s total annual operating expenses after fee waiver and expense reimbursements (exclusive of the items noted in the parenthetical above) to exceed either (i) the Expense Cap in effect at the time such amounts were paid, waived or reimbursed, or (ii) the Expense Cap in effect at the time of such repayment by the Fund.

The contractual expense limitation may only be terminated in the event the Investment Manager or a successor ceases to be the investment manager of the Fund or a successor fund, by mutual agreement between the Investment Manager and the Board, or in the event of the Fund’s liquidation unless the Fund is reorganized or is a party to a merger in which the surviving entity is successor to the accounting and performance information of the Fund.

At September 30, 2022, the Fund’s expiration of reimbursements subject to recoupment is as follows:

| | |

Expiration Period | | |

| |

2-3 years | | $130,405* |

* As of September 30, 2022, the Fund owed the Investment Advisor $21,842 for recoupment of previously reimbursed expenses, which is reflected in the Statement of Assets and Liabilities under Payable to affiliate.

The Trust, on behalf of the Fund, has entered into an amended and restated Administration Agreement under which the Investment Manager serves as the Fund’s administrator (the “Administrator”) and is responsible for all non-portfolio management aspects of managing the Fund’s operations, including administration and shareholder services to the Fund. The Fund pays a fee to the Administrator at the rate of 0.15% per annum of the Fund’s average daily net assets for this service.

The Fund is distributed by AMG Distributors, Inc. (the “Distributor”), a wholly-owned subsidiary of the Investment Manager. The Distributor serves as the distributor and underwriter for the Fund and is a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Shares of the Fund will be continuously offered and will be sold directly to prospective purchasers and through brokers, dealers or other financial intermediaries who have executed selling agreements with the Distributor. Generally the Distributor bears all or a portion of the expenses of providing services pursuant to the distribution agreement, including the payment of the expenses relating to the distribution of prospectuses for sales purposes and any advertising or sales literature.

The Board provides supervision of the affairs of the Trust and other trusts within the AMG Funds Family. The Trustees of the Trust who are not affiliated with the Investment Manager receive an annual retainer and per meeting fees for regular, special and telephonic meetings, and they are reimbursed for out-of-pocket expenses incurred while carrying out their duties as Board members. The Chairman of the Board and the Audit Committee Chair receive additional annual retainers. Certain Trustees and Officers of the Fund are Officers and/or Directors of the Investment Manager, AMG and/or the Distributor.

The Securities and Exchange Commission (the “SEC”) granted an exemptive order that permits certain eligible funds in the AMG Funds Family to lend and borrow money for certain temporary purposes directly to and from other eligible funds in

the AMG Funds Family. Participation in this interfund lending program is voluntary for both the borrowing and lending funds, and an interfund loan is only made if it benefits each participating fund. The Administrator manages the program according to procedures approved by the Board, and the Board monitors the operation of the program. An interfund loan must comply with certain conditions set out in the exemptive order, which are designed to assure fairness and protect all participating funds. The interest earned and interest paid on interfund loans are included on the Statement of Operations as interest income and interest expense, respectively. At September 30, 2022, the Fund had no interfund loans outstanding.

The Fund utilized the interfund loan program during the fiscal year ended September 30, 2022 as follows:

| | | | | | | | | | | | | | |

| | | Average Borrowed | | Number

of Days | | | Interest

Paid | | | Average

Interest Rate | |

| | | | |

| | $3,204,006 | | | 6 | | | | $773 | | | | 1.468% | |

3. PURCHASES AND SALES OF SECURITIES

Purchases and sales of securities (excluding short-term securities and U.S. Government Obligations) for the fiscal year ended September 30, 2022, were $182,398,920 and $297,105,843, respectively.