UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2020 – OCTOBER 31, 2021

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | | | | | | | |

| | | | | AMG Funds October 31, 2021

AMG FQ Global Risk-Balanced Fund |

| | | | | |

| | | | | Class N: MMAVX | | Class I: MMASX | | Class Z: MMAFX |

| | |

| amgfunds.com | | 103121 AR014 |

| | |

| | | AMG Funds Annual Report — October 31, 2021 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULE OF PORTFOLIO INVESTMENTS | | | 4 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 12 | |

| | | |

| | | Balance sheet, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 14 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 15 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 16 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 19 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 26 | |

| | | |

| | | OTHER INFORMATION | | | 27 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 28 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 31 | |

| | | | | | | |

|

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended October 31, 2021, was marked by the continued extraordinary recovery amid an unprecedented global effort to stop the COVID-19 pandemic. Equities rallied to new record highs amid better-than-expected corporate earnings, colossal fiscal and monetary stimulus programs, and an improving economic backdrop. Since the market bottom on March 23, 2020, the S&P 500® Index has gained over 111%. Businesses and consumers contended with disrupted supply chains and rising prices on a wide range of goods such as lumber and gasoline, and outbreaks of coronavirus variants kept the world on edge. Volatility increased in September as investors grew more concerned about rising inflation and more hawkish global central bank policies, but equities were resilient and finished the fiscal year with a strong rally.

The S&P 500® gained 42.91% during the period and all sectors produced double-digit returns, but there was very wide dispersion in performance. Energy and financials led the market with returns of 111.38% and 72.14%, respectively. On the other hand, utilities and consumer staples lagged with returns of 10.64% and 19.02%, respectively. Value stocks edged out Growth stocks as the Russell 1000® Value Index returned 43.76% compared to the 43.21% return for the Russell 1000® Growth Index. Small cap stocks outperformed as the Russell 2000® Index experienced its best quarter (fourth quarter 2020) on record. Within small caps, the Value-Growth disparity was much more pronounced as the Russell 2000® Value Index returned 64.30% compared to 38.45% for the Russell 2000® Growth Index. Outside the U.S., foreign developed markets lagged their U.S. counterparts with a 34.18% return for the MSCI EAFE Index. A major regulatory crackdown in China shook investor confidence in Chinese equities and caused emerging markets to underperform with a 16.96% return for the MSCI Emerging Markets Index.

Interest rates lifted off from near-historic lows as the vaccine rollout initiated a return to normalcy and the economic outlook improved. The 10-year Treasury yield rose 69 basis points to 1.55% and ended the fiscal year not far off its post-pandemic high. The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, lost 0.48% over the period. Healthy risk appetite drove credit spreads tighter and helped investment-grade corporate bonds produce a modestly positive 2.18% return. The global search for yield helped high-yield bonds outperform the investment-grade market with a 10.53% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds benefited from a strong technical backdrop and drove a 2.64% return for the Bloomberg Municipal Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

| Average Annual Total Returns | | Periods ended

October 31, 2021* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 42.91 | % | | | 21.48% | | | | 18.93% | |

| | | | |

Small Cap | | (Russell 2000® Index) | | | 50.80 | % | | | 16.47% | | | | 15.52% | |

| | | | |

International | | (MSCI All Country World Index ex USA) | | | 29.66 | % | | | 12.00% | | | | 9.77% | |

| Bonds: | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | (0.48 | )% | | | 5.63% | | | | 3.10% | |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | 10.53 | % | | | 7.43% | | | | 6.40% | |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | 2.64 | % | | | 5.17% | | | | 3.41% | |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 0.11 | % | | | 1.37% | | | | 1.32% | |

*Source: FactSet. Past performance is no guarantee of future results.

2

|

About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

| | | | |

Six Months Ended October 31, 2021 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/21 | | Ending

Account

Value

10/31/21 | | Expenses

Paid

During

the Period* |

AMG FQ Global Risk-Balanced Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.29% | | $1,000 | | $1,038 | | $6.63 |

| | | | |

Class I | | 1.04% | | $1,000 | | $1,040 | | $5.35 |

| | | | |

Class Z | | 0.89% | | $1,000 | | $1,041 | | $4.58 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.29% | | $1,000 | | $1,019 | | $6.56 |

| | | | |

Class I | | 1.04% | | $1,000 | | $1,020 | | $5.30 |

| | | | |

Class Z | | 0.89% | | $1,000 | | $1,021 | | $4.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

|

AMG FQ Global Risk-Balanced Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

OVERVIEW For the fiscal year ended October 31, 2021, AMG FQ Global Risk-Balanced Fund’s (the “Fund”) Class N shares returned 16.52%, while the benchmark 60% MSCI World Index/40% FTSE World Government Bond Index - Hedged returned 21.86%. Risk assets performed well over the period, resulting in gains for the equity and commodity portfolios. The Fund’s bond portfolio modestly detracted. Nominal bonds fell as inflation and rate expectations rose. While the Fund also uses synthetic instruments such as futures contracts to gain exposure to the markets, this had no material impact on performance relative to holding physical securities MARKET OVERVIEW The fiscal year was a strong one for most risk assets. Markets priced in an optimistic growth scenario as vaccine trial results exceeded expectations and mass vaccinations began. Inflation expectations increased as supply chain bottlenecks limited the stock of available goods, but markets and central banks perceived most of the rise in price to be temporary. Toward the end of the fiscal year this started to change, as supply issues persisted and longer-term inflationary indicators began to rise. For most of the fiscal year the MRI1 was at 0.50, reflecting a tension across different indicators. The economic indicators were generally positive, with the manufacturing sector recovering as the economy reopened. Risk appetite, in contrast, was more mixed. Credit and bond markets signaled | | | | resilience, but implied volatility in crude and options markets remained high. The general advance in risk appetite may have masked longer-term uncertainty about the true health of the global economy. PERFORMANCE The Fund delivered positive returns, led by the equity portfolio. For most of the period, markets were growth-oriented as the global vaccination campaign began and parts of the economy reopened. Earnings and macro data were generally encouraging, consumer spending was strong, and labor markets were tight, outweighing concerns about potential inflation. The equity rally stalled a bit over the summer months as the Delta variant caused another crest in COVID-19 cases, but equities resumed their upward march in the fall. The reflationary trade supported inflation-linked assets, and Real Estate Investment Trust (REITs), Treasury Inflationary-Protected (TIP) securities, and commodities all finished the period up. The industrial commodities rallied as global manufacturing recovered and some travel resumed. Supply developments also supported prices, as ongoing bottlenecks limited the availability of most commodities. Precious metals were an exception to the general commodity advance, with gold falling back as demand for safe havens waned. Nominal bonds had mixed success over the period, reflecting the uncertainty around inflation and rates, but ultimately finished down. Most of the losses were realized in February 2021 and toward the end of the | | | | fiscal year-end. In February, sovereign bonds suffered their worst month in almost five years. The rise in yields was largely attributed to a rise in inflation expectations, though there is a contingent who believe the large influx of government bonds was also to blame. Nominal bonds started to recover in Q2 2021 but weakened again in September and October as markets priced in persistent inflation and more hawkish expectations for central banks. The Fund’s options hedge also detracted from overall results, given equity markets’ strong advance. OUTLOOK The MRI remained in a balanced market state (MRI of 0.50). Growth expectations remain positive, but risk appetite continues to be limited by the threat of persistent inflation and rising rates. We also may be observing a growing bubble mentality, based on activity in the cryptocurrency and SPAC (special-purpose acquisition company) markets. 1 The FQ Market Risk Indicator (“MRI”) is designed to indicate the current phase of the market cycle and the level of macro uncertainty, from resilience (MRI=0.00) to high fragility (MRI=1.00) in increments of 0.25 for a total of five levels. This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2021 and is not intended as a forecast or guarantee of future results, and is subject to change without notice. |

4

|

AMG FQ Global Risk-Balanced Fund Portfolio Manager’s Comments (continued) |

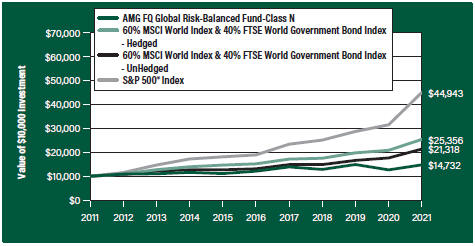

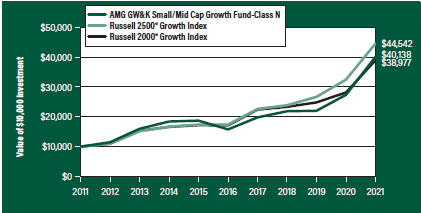

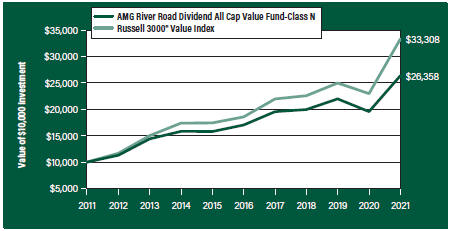

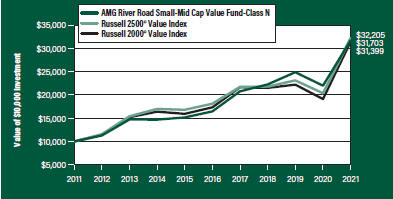

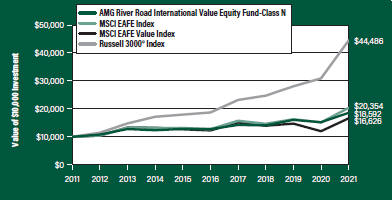

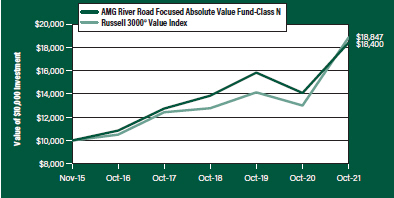

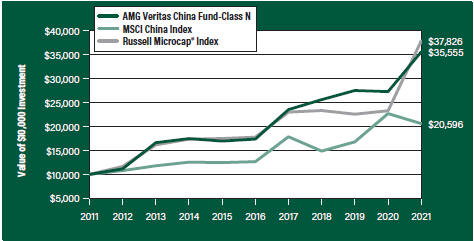

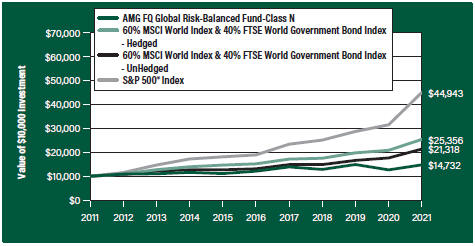

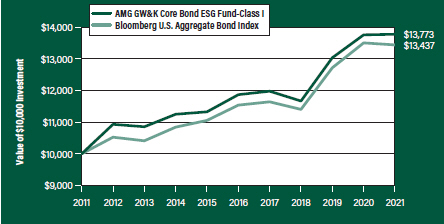

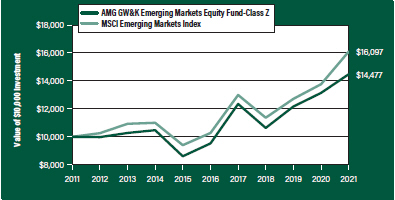

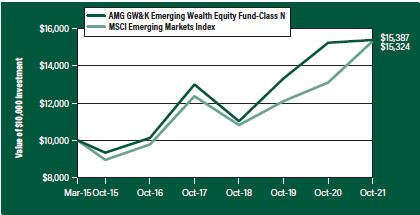

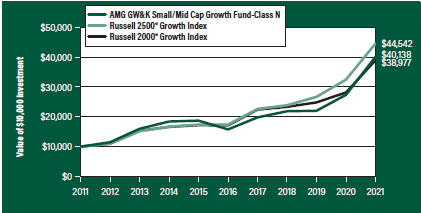

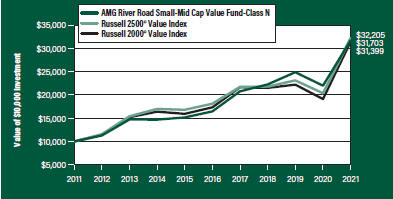

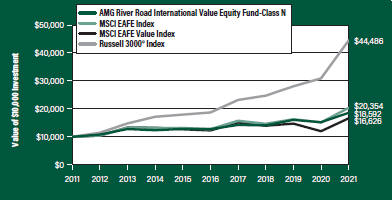

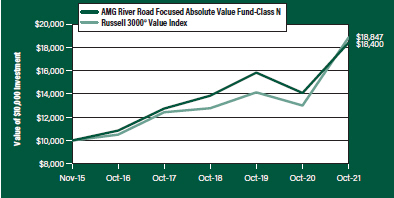

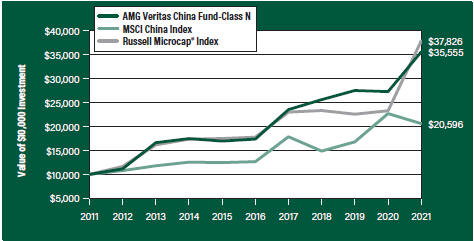

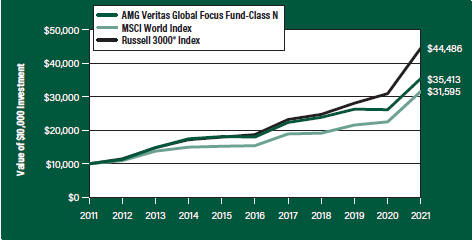

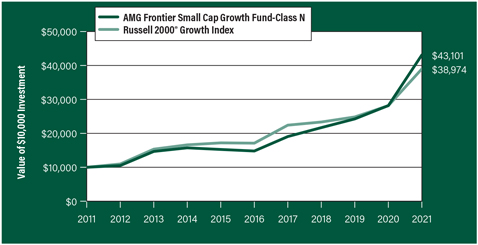

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Global Risk-Balanced Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG FQ Global Risk Balanced Fund’s Class N shares on October 31, 2011, to a $10,000 investment made in the 60% MSCI World Index & 40% FTSE World Government Bond Index-Hedged (“Composite Hedged Index”) and the 60% MSCI World Index & 40% FTSE World Government Bond Index-UnHedged (“Composite UnHedged Index”) and S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the indexes exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG FQ Global Risk-Balanced Fund and the AMG FQ Global Risk-Balanced Fund Composite Hedged and UnHedged Indexes and S&P 500® Index for the same time periods ended October 31, 2021.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | |

AMG FQ Global Risk-Balanced Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17 | |

| | | |

Class N | | | 16.52% | | | | 4.05% | | | | 3.95% | |

| | | |

Class I | | | 16.85% | | | | 4.35% | | | | 4.31% | |

| | | |

Class Z | | | 16.94% | | | | 4.47% | | | | 4.42% | |

| | | |

Composite Hedged Index18 | | | 21.86% | | | | 10.84% | | | | 9.75% | |

| | | |

Composite UnHedged Index18 | | | 21.02% | | | | 10.24% | | | | 7.87% | |

| | | |

S&P 500® Index19 | | | 42.91% | | | | 18.93% | | | | 16.21% | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

|

1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2021. All returns are in U.S. dollars ($). |

| |

2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| |

3 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| |

4 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. |

| |

5 The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

| |

6 Investments in commodities are subject to greater volatility than investments in traditional securities, such as stocks and bonds. Commodities are subject to risks, including but not limited to climate conditions, livestock disease, war, terrorism, political conflicts, interest rates, currency fluctuations, embargoes, tariffs and other regulatory developments. |

| |

7 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

| |

8 The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| |

9 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private |

5

|

AMG FQ Global Risk-Balanced Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

investment, possibly leading to nationalization or confiscation of investor assets. 10 Because exchange-traded funds (ETFs) incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. 11 In managing the Fund, the Fund’s Subadviser may rely heavily on one or more quantitative models (“Model”) and information and data supplied by third parties (“Data”). When a Model or Data used in managing the Fund contains an error, or is incorrect or incomplete, any investment decision made in reliance on the Model or Data may not produce the desired results and the Fund may realize losses. In addition, any hedging based on a faulty Model or Data may prove to be unsuccessful. 12 High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher-rated issuers. 13 The use of leverage in a Fund’s strategy, such as futures and forward commitment transactions, can magnify relatively small market movements into relatively larger losses for the Fund. 14 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. | | | | 16 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products. 17 Obligations of certain government agencies are not backed by the full faith and credit of the U.S. government. If one of these agencies defaulted on a loan, there is no guarantee that the U.S. government would provide financial support. Additionally, debt securities of the U.S. government may be affected by changing interest rates and subject to prepayment risk. 18 The benchmark is composed of 60% MSCI World Index and 40% FTSE World Government Bond Index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices. Please go to msci.com for most current list of countries represented by the index. The FTSE World Government Bond Index (FTSE) measures the performance of fixed-rate, local currency, investment grade sovereign bonds. The FTSE is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. Prior to July 31, 2018, the FTSE World Government Bond Index was known as the Citigroup World Government Bond Index. Unlike the Fund, the Composite Index is unmanaged, is not available for investment and does not incur fees. | | | | |

15 The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. | | | | 19 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the S&P 500® Index is unmanaged, is not available for investment and does not incur expenses. All MSCI data is provided ‘as is’. The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. The S&P 500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. Not FDIC insured, nor bank guaranteed. May lose value. | | | | |

6

|

AMG FQ Global Risk-Balanced Fund Schedule of Portfolio Investments October 31, 2021 |

| | | | | | | | |

| | | | | | | |

| | | Shares | | | Value | |

| |

Exchange Traded Funds - 53.1% | | | | | |

| | |

iShares Global Infrastructure ETF | | | 11,464 | | | | $547,635 | |

| | |

iShares iBoxx High Yield Corporate Bond ETF1,2 | | | 80,438 | | | | 6,992,475 | |

| | |

iShares TIPS Bond ETF | | | 52,521 | | | | 6,757,877 | |

| | |

Materials Select Sector SPDR Fund | | | 6,658 | | | | 566,729 | |

| | |

SPDR FTSE International Government Inflation-Protected Bond ETF2 | | | 24,923 | | | | 1,377,245 | |

| | |

VanEck Vectors Gold Miners ETF | | | 17,283 | | | | 548,044 | |

| | |

VanEck Vectors Natural Resource ETF | | | 11,469 | | | | 549,021 | |

| | |

Vanguard Global ex-U.S. Real Estate ETF | | | 3,311 | | | | 190,383 | |

| | |

Vanguard Real Estate ETF2 | | | 16,654 | | | | 1,815,952 | |

| |

Total Exchange Traded Funds | | | | | |

(Cost $18,154,308) | | | | | | | 19,345,361 | |

| | |

| | | Notes | | | | | |

| | | | | | | | |

| |

Exchange Traded Notes - 10.0% | | | | | |

| | |

Barclays PLC, iPath Bloomberg Commodity Index Total Return ETN, 06/12/36*,2 | | | 44,966 | | | | 1,359,322 | |

| | |

Deutsche Bank AG, DB Gold Double Long ETN, 02/15/38* | | | 19,814 | | | | 744,775 | |

| | |

Swedish Export Credit Corp., ELEMENTS Linked to the Rogers International Commodity Index Total Return, 10/24/22* | | | 217,804 | | | | 1,535,518 | |

| |

Total Exchange Traded Notes | | | | | |

(Cost $2,501,057) | | | | | | | 3,639,615 | |

| |

Purchased Options - 0.4% | | | | | |

| |

(See Open Exchange Traded Purchased Options schedule) | | | | | |

(Cost $363,254) | | | | | | | 145,210 | |

| | | Principal

Amount | | | | |

| |

Short-Term Investments - 47.6% | | | | | |

| |

Joint Repurchase Agreements - 9.8%3 | | | | | |

| | |

Bank of America Securities, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations, 1.500% - 5.000%, 09/01/28 - 01/01/59, totaling $1,020,000) | | | $1,000,000 | | | | 1,000,000 | |

| | |

Daiwa Capital Markets America, dated 10/29/21, due 11/01/21, 0.050% total to be received $565,954 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 6.500%, 11/01/21 - 11/01/51, totaling $577,271) | | | 565,952 | | | | 565,952 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Deutsche Bank Securities, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 8.000%, 11/04/21 - 08/15/51, totaling $1,020,000) | | | $1,000,000 | | | | $1,000,000 | |

| | |

RBC Dominion Securities, Inc., dated 10/29/21, due 11/01/21, 0.050% total to be received $1,000,004 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 6.000%, 11/01/21 - 07/20/51, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

| |

Total Joint Repurchase Agreements | | | | 3,565,952 | |

| |

U.S. Government Obligations - 22.0% | | | | | |

| | |

U.S. Treasury Bills, 0.035%, 01/13/221,4,5 | | | 2,500,000 | | | | 2,499,685 | |

| | |

U.S. Treasury Bills, 0.040%, 12/16/214,5 | | | 2,500,000 | | | | 2,499,875 | |

| | |

U.S. Treasury Bills, 0.043%, 11/18/215 | | | 3,000,000 | | | | 2,999,940 | |

| |

Total U.S. Government Obligations | | | | 7,999,500 | |

| | |

| | | Shares | | | | | |

| | | | | | | | |

| |

Other Investment Companies - 15.8% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%6 | | | 1,901,905 | | | | 1,901,905 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.01%6 | | | 1,901,905 | | | | 1,901,905 | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.03%6 | | | 1,959,538 | | | | 1,959,538 | |

| |

Total Other Investment Companies | | | | 5,763,348 | |

| | |

Total Short-Term Investments | | | | | | | | |

(Cost $17,328,938) | | | | | | | 17,328,800 | |

| | |

Total Investments - 111.1% | | | | | | | | |

(Cost $38,347,557) | | | | | | | 40,458,986 | |

| | |

Derivatives - (2.2)%7 | | | | | | | (815,667 | ) |

| |

Other Assets, less Liabilities - (8.9)% | | | | (3,242,217 | ) |

| | |

Net Assets - 100.0% | | | | | | | $36,401,102 | |

| * | Non-income producing security. |

| 1 | Some or all of these securities were held as collateral for written options as of October 31, 2021, amounting to $5,794,046 or 15.9% of net assets. |

| 2 | Some of these securities, amounting to $5,256,320 or 14.4% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

7

|

AMG FQ Global Risk-Balanced Fund Schedule of Portfolio Investments (continued) |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 4 | Some or all of this security is held as collateral for futures contracts. The market value of collateral at October 31, 2021, amounted to $2,799,784, or 7.7% of net assets. |

| 5 | Represents yield to maturity at October 31, 2021. |

| 6 | Yield shown represents the October 31, 2021, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 7 | Includes Exchange Traded Written Options and Futures Contracts. Please refer to the Open Exchange Traded Written Options and Open Futures Contracts tables for the details. |

| | |

ETF ETN SPDR TIPS | | Exchange Traded Fund Exchange Traded Notes Standard & Poor’s Depositary Receipt Treasury Inflation-Protected Securities |

| | | | | | | | | | | | | | | | | | | | | | | | |

Open Exchange Traded Purchased Options | | | | | | | | | | | | | | | | | | | | | | | | |

Description | | | Strike Price | | | | Expiration Date | | |

| Number of

Contracts |

| |

| Notional

Amount |

| | | Cost | | | | Value | |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,775 | | | | 11/19/21 | | | | 1 | | | | $37,750 | | | | $766 | | | $ | 53 | |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,825 | | | | 12/17/21 | | | | 16 | | | | 612,000 | | | | 12,790 | | | | 3,773 | |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,850 | | | | 01/21/22 | | | | 36 | | | | 1,386,000 | | | | 26,409 | | | | 18,103 | |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,900 | | | | 12/17/21 | | | | 20 | | | | 780,000 | | | | 10,354 | | | | 6,012 | |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,900 | | | | 11/19/21 | | | | 34 | | | | 1,326,000 | | | | 21,672 | | | | 2,869 | |

| | | | | | |

S&P 500 Index (Put) | | | 4,120 | | | | 11/19/21 | | | | 3 | | | | 1,236,000 | | | | 22,616 | | | | 1,410 | |

| | | | | | |

S&P 500 Index (Put) | | | 4,125 | | | | 12/17/21 | | | | 10 | | | | 4,125,000 | | | | 74,536 | | | | 21,450 | |

| | | | | | |

S&P 500 Index (Put) | | | 4,140 | | | | 01/21/22 | | | | 15 | | | | 6,210,000 | | | | 96,924 | | | | 71,100 | |

| | | | | | |

S&P 500 Index (Put) | | | 4,180 | | | | 11/19/21 | | | | 13 | | | | 5,434,000 | | | | 74,394 | | | | 7,475 | |

| | | | | | |

S&P 500 Index (Put) | | | 4,200 | | | | 12/17/21 | | | | 5 | | | | 2,100,000 | | | | 22,793 | | | | 12,965 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | Total | | | | $363,254 | | | $ | 145,210 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Open Exchange Traded Written Options | | | | | | | | | | | | | | | | | | | | | | | | |

Description | | | Strike Price | | | | Expiration Date | | |

| Number of

Contracts |

| |

| Notional

Amount |

| | | Premium | | | | Value | |

| | | | | | |

EURO STOXX 50 (Call) | | | 4,400 | | | | 12/17/21 | | | | 20 | | | | $880,000 | | | | $2,946 | | | $ | (4,277 | ) |

| | | | | | |

EURO STOXX 50 (Call) | | | 4,400 | | | | 11/19/21 | | | | 34 | | | | 1,496,000 | | | | 5,783 | | | | (1,415 | ) |

| | | | | | |

EURO STOXX 50 (Call) | | | 4,425 | | | | 11/19/21 | | | | 1 | | | | 44,250 | | | | 200 | | | | (25 | ) |

| | | | | | |

EURO STOXX 50 (Call) | | | 4,450 | | | | 12/17/21 | | | | 16 | | | | 712,000 | | | | 3,566 | | | | (1,794 | ) |

| | | | | | |

EURO STOXX 50 (Call) | | | 4,450 | | | | 01/21/22 | | | | 36 | | | | 1,602,000 | | | | 7,809 | | | | (11,819 | ) |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,625 | | | | 11/19/21 | | | | 1 | | | | 36,250 | | | | 555 | | | | (34 | ) |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,675 | | | | 12/17/21 | | | | 16 | | | | 588,000 | | | | 9,163 | | | | (2,405 | ) |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,700 | | | | 01/21/22 | | | | 36 | | | | 1,332,000 | | | | 18,045 | | | | (12,526 | ) |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,800 | | | | 12/17/21 | | | | 20 | | | | 760,000 | | | | 7,425 | | | | (4,370 | ) |

| | | | | | |

EURO STOXX 50 (Put) | | | 3,800 | | | | 11/19/21 | | | | 34 | | | | 1,292,000 | | | | 16,318 | | | | (1,965 | ) |

| | | | | | |

S&P 500 Index (Call) | | | 4,710 | | | | 11/19/21 | | | | 13 | | | | 6,123,000 | | | | 12,719 | | | | (9,945 | ) |

| | | | | | |

S&P 500 Index (Call) | | | 4,720 | | | | 12/17/21 | | | | 5 | | | | 2,360,000 | | | | 5,962 | | | | (14,950 | ) |

| | | | | | |

S&P 500 Index (Call) | | | 4,730 | | | | 11/19/21 | | | | 3 | | | | 1,419,000 | | | | 5,707 | | | | (1,395 | ) |

| | | | | | |

S&P 500 Index (Call) | | | 4,750 | | | | 12/17/21 | | | | 10 | | | | 4,750,000 | | | | 16,824 | | | | (22,000 | ) |

| | | | | | |

S&P 500 Index (Call) | | | 4,780 | | | | 01/21/22 | | | | 15 | | | | 7,170,000 | | | | 27,096 | | | | (57,615 | ) |

| | | | | | |

S&P 500 Index (Put) | | | 3,975 | | | | 11/19/21 | | | | 3 | | | | 1,192,500 | | | | 16,924 | | | | (960 | ) |

| | | | | | |

S&P 500 Index (Put) | | | 3,990 | | | | 01/21/22 | | | | 15 | | | | 5,985,000 | | | | 68,856 | | | | (51,450 | ) |

| | | | | | |

S&P 500 Index (Put) | | | 4,005 | | | | 12/17/21 | | | | 10 | | | | 4,005,000 | | | | 57,864 | | | | (14,500 | ) |

The accompanying notes are an integral part of these financial statements.

8

|

AMG FQ Global Risk-Balanced Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Strike Price | | | Expiration Date | | | Number of Contracts | | | Notional Amount | | | Premium | | | Value | |

| | | | | | |

S&P 500 Index (Put) | | | 4,085 | | | | 11/19/21 | | | | 13 | | | | $5,310,500 | | | | $58,362 | | | | $(6,110 | ) |

| | | | | | |

S&P 500 Index (Put) | | | 4,100 | | | | 12/17/21 | | | | 5 | | | | 2,050,000 | | | | 16,982 | | | | (9,750 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | Total | | | | $359,106 | | | | $(229,305 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Open Futures Contracts

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Currency | | | Number of Contracts | | | Position | | | Expiration Date | | | Current Notional Amount | | | Value and Unrealized Gain/(Loss) | |

| | | | | | |

CBOT U.S. Long Bond | | | USD | | | | 29 | | | | Long | | | | 12/21/21 | | | $ | 4,664,469 | | | $ | (44,656 | ) |

| | | | | | |

CME E-mini Russell 2000 Index | | | USD | | | | 36 | | | | Long | | | | 12/17/21 | | | | 4,131,540 | | | | 89,217 | |

| | | | | | |

Eurex 30 Year Euro BUXL | | | EUR | | | | 16 | | | | Long | | | | 12/08/21 | | | | 3,865,294 | | | | 92,791 | |

| | | | | | |

Eurex EURO STOXX 50 | | | EUR | | | | 87 | | | | Long | | | | 12/17/21 | | | | 4,261,236 | | | | 68,767 | |

| | | | | | |

FTSE 100 Index | | | GBP | | | | 11 | | | | Long | | | | 12/17/21 | | | | 1,087,504 | | | | 30,922 | |

| | | | | | |

ICE U.S. MSCI Emerging Markets EM Index | | | USD | | | | 51 | | | | Long | | | | 12/17/21 | | | | 3,218,100 | | | | (122,730 | ) |

| | | | | | |

Long Gilt | | | GBP | | | | 37 | | | | Long | | | | 12/29/21 | | | | 6,325,493 | | | | (199,563 | ) |

| | | | | | |

Micro E-mini S&P 500 | | | USD | | | | 62 | | | | Long | | | | 12/17/21 | | | | 1,425,070 | | | | 23,998 | |

| | | | | | |

Mini Hang Seng Index | | | HKD | | | | 23 | | | | Long | | | | 11/29/21 | | | | 748,014 | | | | (18,803 | ) |

| | | | | | |

Montreal Exchange 10 Year Canadian Bond | | | CAD | | | | 42 | | | | Long | | | | 12/20/21 | | | | 4,783,371 | | | | (164,691 | ) |

| | | | | | |

Montreal Exchange S&P/TSX 60 Index | | | CAD | | | | 6 | | | | Long | | | | 12/16/21 | | | | 1,222,204 | | | | 33,583 | |

| | | | | | |

SFE 10 Year Australian Bond | | | AUD | | | | 46 | | | | Long | | | | 12/15/21 | | | | 4,666,330 | | | | (333,500 | ) |

| | | | | | |

SFE S&P ASX Share Price Index 200 | | | AUD | | | | 12 | | | | Long | | | | 12/16/21 | | | | 1,642,914 | | | | (27,572 | ) |

| | | | | | |

TSE Mini Topix | | | JPY | | | | 58 | | | | Long | | | | 12/09/21 | | | | 1,013,950 | | | | (14,125 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | Total | | | $ | (586,362 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

CURRENCY ABBREVIATIONS:

| | |

| AUD | | Australian Dollar |

| CAD | | Canadian Dollar |

| EUR | | Euro Dollar |

| GBP | | British Pound |

| HKD | | Hong Kong Dollar |

| JPY | | Japanese Yen |

| USD | | U.S. Dollar |

The accompanying notes are an integral part of these financial statements.

9

|

AMG FQ Global Risk-Balanced Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Exchange Traded Funds† | | | $19,345,361 | | | | – | | | | – | | | | $19,345,361 | |

| | | | |

Exchange Traded Notes† | | | 3,639,615 | | | | – | | | | – | | | | 3,639,615 | |

| | | | |

Purchased Options | | | | | | | | | | | | | | | | |

| | | | |

Equity Contracts | | | 145,210 | | | | – | | | | – | | | | 145,210 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | – | | | | $3,565,952 | | | | – | | | | 3,565,952 | |

| | | | |

U.S. Government Obligations | | | – | | | | 7,999,500 | | | | – | | | | 7,999,500 | |

| | | | |

Other Investment Companies | | | 5,763,348 | | | | – | | | | – | | | | 5,763,348 | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | | $28,893,534 | | | | $11,565,452 | | | | – | | | | $40,458,986 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financial Derivative Instruments - Assets | | | | | | | | | | | | | | | | |

| | | | |

Equity Futures Contracts | | | $246,487 | | | | – | | | | – | | | | $246,487 | |

| | | | |

Interest Rate Futures Contracts | | | 92,791 | | | | – | | | | – | | | | 92,791 | |

| | | | |

Financial Derivative Instruments - Liabilities | | | | | | | | | | | | | | | | |

| | | | |

Equity Futures Contracts | | | (183,230 | ) | | | – | | | | – | | | | (183,230 | ) |

| | | | |

Equity Written Options | | | (229,305 | ) | | | – | | | | – | | | | (229,305 | ) |

| | | | |

Interest Rate Futures Contracts | | | (742,410 | ) | | | – | | | | – | | | | (742,410 | ) |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Financial Derivative Instruments | | | $(815,667 | ) | | | – | | | | – | | | | $(815,667 | ) |

| | | | | | | | | | | | | | | | |

| † | All exchange traded funds and exchange traded notes held in the Fund are level 1 securities. For a detailed listing of these securities, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2021, there were no transfers in or out of Level 3.

The following schedule shows the value of derivative instruments at October 31, 2021:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

| | | | |

Derivatives not accounted for as hedging instruments | | Statement of Assets and Liabilities Location | | Fair Value | | | Statement of Assets and Liabilities Location | | Fair Value | |

| | | | |

Equity contracts | | Options purchased1 | | | $145,210 | | | Options written | | | $229,305 | |

| | | | |

Equity contracts | | Receivable for variation margin2 | | | 23,241 | | | Payable for variation margin2 | | | 85,510 | |

| | | | |

Interest rate contracts | | Receivable for variation margin2 | | | 9,969 | | | Payable for variation margin2 | | | 137,321 | |

| | | | | | | | | | | | |

| | | | |

| | Totals | | | $178,420 | | | | | | $452,136 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

10

|

AMG FQ Global Risk-Balanced Fund Schedule of Portfolio Investments (continued) |

For the fiscal year ended October 31, 2021, the effect of derivative instruments on the Statement of Operations for the Fund and the amount of realized gain/loss and unrealized appreciation/depreciation on derivatives recognized in income was as follows:

| | | | | | | | | | | | | | |

| | | Realized Gain/(Loss) | | | Change in Unrealized Appreciation/Depreciation | |

| | | | |

Derivatives not accounted for as hedging instruments | | Statement of Operations Location | | Realized

Gain/(Loss) | | | Statement of Operations Location | | | Change in

Unrealized

Appreciation/

Depreciation | |

| | | | |

Equity contracts | | Net realized loss on options purchased1 | | | $(2,040,378 | ) | |

| Net change in unrealized appreciation/

depreciation on options purchased1 |

| | | $(384,320 | ) |

| | | | |

Equity contracts | | Net realized gain on options written | | | 764,886 | | |

| Net change in unrealized appreciation/

depreciation on options written |

| | | 46,276 | |

| | | | |

Interest rate contracts | | Net realized loss on futures contracts | | | (1,243,360 | ) | |

| Net change in unrealized appreciation/

depreciation on futures contracts |

| | | (496,495 | ) |

| | | | |

Equity contracts | | Net realized gain on futures contracts | | | 5,490,725 | | |

| Net change in unrealized appreciation/

depreciation on futures contracts |

| | | 668,977 | |

| | | | | | | | | | | | | | |

| | | | |

| | Totals | | | $2,971,873 | | | | | | | | $(165,562 | ) |

| | | | | | | | | | | | | | |

1 Options purchased are included in investments at value on the Statement of Assets and Liabilities. Net realized gain/(loss) on options purchased and net change in unrealized appreciation/depreciation on options purchased are included in the net realized gain/(loss) on investments and net change in unrealized appreciation/depreciation of investments, respectively, on the Statement of Operations.

2 Only current day’s variation margin is reported within the Statement of Assets and Liabilities. The variation margin is included in the open futures cumulative depreciation of $(586,362).

The accompanying notes are an integral part of these financial statements.

11

|

Statement of Assets and Liabilities October 31, 2021 |

| | | | |

| | | AMG

FQ Global

Risk-Balanced Fund | |

Assets: | | | | |

Investments at value1 (including securities on loan valued at $5,256,320) | | | $40,458,986 | |

Dividend and interest receivables | | | 101 | |

Securities lending income receivable | | | 3,063 | |

Receivable for Fund shares sold | | | 355 | |

Receivable from affiliate | | | 9,100 | |

Receivable for variation margin | | | 33,210 | |

Prepaid expenses and other assets | | | 4,461 | |

Total assets | | | 40,509,276 | |

Liabilities: | | | | |

Payable upon return of securities loaned | | | 3,565,952 | |

Payable for Fund shares repurchased | | | 8,757 | |

Written options2 | | | 229,305 | |

Payable for variation margin | | | 222,831 | |

Accrued expenses: | | | | |

Investment advisory and management fees | | | 18,521 | |

Administrative fees | | | 4,630 | |

Distribution fees | | | 248 | |

Shareholder service fees | | | 376 | |

Other | | | 57,554 | |

| |

Total liabilities | | | 4,108,174 | |

| |

| | | | |

| |

Net Assets | | | $36,401,102 | |

1 Investments at cost | | | $38,347,557 | |

2 Premiums received | | | $359,106 | |

The accompanying notes are an integral part of these financial statements.

12

|

Statement of Assets and Liabilities (continued) |

| | | | |

| | | AMG

FQ Global

Risk-Balanced Fund | |

| |

Net Assets Represent: | | | | |

Paid-in capital | | | $37,650,998 | |

Total distributable loss | | | (1,249,896 | ) |

Net Assets | | | $36,401,102 | |

| |

Class N: | | | | |

Net Assets | | | $1,175,430 | |

Shares outstanding | | | 74,569 | |

| |

Net asset value, offering and redemption price per share | | | $15.76 | |

Class I: | | | | |

Net Assets | | | $1,694,854 | |

Shares outstanding | | | 106,966 | |

| |

Net asset value, offering and redemption price per share | | | $15.84 | |

Class Z: | | | | |

Net Assets | | | $33,530,818 | |

Shares outstanding | | | 2,115,553 | |

| |

Net asset value, offering and redemption price per share | | | $15.85 | |

The accompanying notes are an integral part of these financial statements.

13

|

Statement of Operations For the fiscal year ended October 31, 2021 |

| | | | |

| | | AMG

FQ Global

Risk-Balanced Fund | |

Investment Income: | | | | |

Dividend income | | | $747,642 | |

Interest income | | | 2,516 | |

Securities lending income | | | 47,441 | |

Total investment income | | | 797,599 | |

Expenses: | | | | |

Investment advisory and management fees | | | 235,589 | |

Administrative fees | | | 58,897 | |

Distribution fees - Class N | | | 3,018 | |

Shareholder servicing fees - Class N | | | 1,811 | |

Shareholder servicing fees - Class I | | | 2,607 | |

Professional fees | | | 42,137 | |

Custodian fees | | | 19,254 | |

Registration fees | | | 18,999 | |

Transfer agent fees | | | 11,583 | |

Reports to shareholders | | | 10,807 | |

Trustee fees and expenses | | | 2,837 | |

Miscellaneous | | | 3,301 | |

Total expenses before offsets | | | 410,840 | |

Expense reimbursements | | | (53,948 | ) |

Expense reductions | | | (1,481 | ) |

Net expenses | | | 355,411 | |

| |

| | | | |

Net investment income | | | 442,188 | |

Net Realized and Unrealized Gain: | | | | |

Net realized loss on investments | | | (1,522,644 | ) |

Net realized gain on futures contracts | | | 4,247,365 | |

Net realized gain on written options | | | 764,886 | |

Net realized loss on foreign currency transactions | | | (17,222 | ) |

| |

Net change in unrealized appreciation/depreciation on investments | | | 2,146,421 | |

| |

Net change in unrealized appreciation/depreciation on futures contracts | | | 172,482 | |

| |

Net change in unrealized appreciation/depreciation on written options | | | 46,276 | |

| |

Net change in unrealized appreciation/depreciation on foreign currency translations | | | (1,416 | ) |

Net realized and unrealized gain | | | 5,836,148 | |

| |

| | | | |

Net increase in net assets resulting from

operations | | | $6,278,336 | |

The accompanying notes are an integral part of these financial statements.

14

|

Statements of Changes in Net Assets For the fiscal years ended October 31, |

| | | | | | | | |

| | | AMG

FQ Global

Risk-Balanced Fund | |

| | | 2021 | | | 2020 | |

| | |

Increase (Decrease) in Net Assets Resulting From Operations: | | | | | | | | |

Net investment income | | | $442,188 | | | | $245,432 | |

Net realized gain (loss) on investments | | | 3,472,385 | | | | (6,013,420 | ) |

Net change in unrealized appreciation/depreciation on investments | | | 2,363,763 | | | | (1,730,052 | ) |

| | |

Net increase (decrease) in net assets resulting from operations | | | 6,278,336 | | | | (7,498,040 | ) |

Distributions to Shareholders: | | | | | | | | |

Class N | | | (3,955 | ) | | | (81,284 | ) |

Class I | | | (10,887 | ) | | | (81,571 | ) |

Class Z | | | (298,407 | ) | | | (1,851,649 | ) |

Total distributions to shareholders | | | (313,249 | ) | | | (2,014,504 | ) |

Capital Share Transactions:1 | | | | | | | | |

| | |

Net decrease from capital share transactions | | | (8,394,212 | ) | | | (5,341,377 | ) |

| | | | | | | | |

| | |

Total decrease in net assets | | | (2,429,125 | ) | | | (14,853,921 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 38,830,227 | | | | 53,684,148 | |

End of year | | | $36,401,102 | | | | $38,830,227 | |

| 1 | See Note 1(g) of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

15

|

AMG FQ Global Risk-Balanced Fund Financial Highlights For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended October 31, | |

| | | | | |

| Class N | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Net Asset Value, Beginning of Year | | | $13.57 | | | | $16.54 | | | | $14.56 | | | | $15.77 | | | | $13.89 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.11 | | | | 0.02 | | | | 0.21 | | | | 0.26 | | | | 0.11 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.13 | | | | (2.41 | ) | | | 2.06 | | | | (1.43 | ) | | | 1.91 | |

Total income (loss) from investment operations | | | 2.24 | | | | (2.39 | ) | | | 2.27 | | | | (1.17 | ) | | | 2.02 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.58 | ) | | | (0.29 | ) | | | (0.04 | ) | | | (0.14 | ) |

Net Asset Value, End of Year | | | $15.76 | | | | $13.57 | | | | $16.54 | | | | $14.56 | | | | $15.77 | |

Total Return2,3 | | | 16.52 | % | | | (15.01 | )% | | | 15.98 | % | | | (7.43 | )% | | | 14.69 | % |

Ratio of net expenses to average net assets | | | 1.29 | %4 | | | 1.28 | %4 | | | 1.29 | % | | | 1.29 | % | | | 1.33 | % |

Ratio of gross expenses to average net assets5 | | | 1.43 | % | | | 1.45 | % | | | 1.41 | % | | | 1.37 | % | | | 1.39 | % |

| | | | | |

Ratio of net investment income to average net assets2 | | | 0.75 | % | | | 0.17 | % | | | 1.38 | % | | | 1.67 | % | | | 0.76 | % |

Portfolio turnover | | | 35 | % | | | 193 | % | | | 15 | % | | | 27 | % | | | 26 | % |

Net assets end of year (000’s) omitted | | | $1,175 | | | | $1,110 | | | | $2,340 | | | | $1,870 | | | | $2,200 | |

| | | | | | | | | | | | | | | | | | | | | |

16

|

AMG FQ Global Risk-Balanced Fund Financial Highlights For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended October 31, | |

| | | | | |

| Class I | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Net Asset Value, Beginning of Year | | | $13.65 | | | | $16.62 | | | | $14.64 | | | | $15.83 | | | | $13.97 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.15 | | | | 0.06 | | | | 0.25 | | | | 0.30 | | | | 0.16 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.13 | | | | (2.42 | ) | | | 2.06 | | | | (1.44 | ) | | | 1.92 | |

Total income (loss) from investment operations | | | 2.28 | | | | (2.36 | ) | | | 2.31 | | | | (1.14 | ) | | | 2.08 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.09 | ) | | | (0.61 | ) | | | (0.33 | ) | | | (0.05 | ) | | | (0.22 | ) |

Net Asset Value, End of Year | | | $15.84 | | | | $13.65 | | | | $16.62 | | | | $14.64 | | | | $15.83 | |

Total Return2,3 | | | 16.85 | % | | | (14.75 | )% | | | 16.23 | % | | | (7.20 | )% | | | 15.14 | % |

Ratio of net expenses to average net assets | | | 1.04 | %4 | | | 1.03 | %4 | | | 1.04 | % | | | 1.04 | % | | | 0.99 | % |

Ratio of gross expenses to average net assets5 | | | 1.18 | % | | | 1.20 | % | | | 1.16 | % | | | 1.12 | % | | | 1.05 | % |

| | | | | |

Ratio of net investment income to average net assets2 | | | 1.00 | % | | | 0.42 | % | | | 1.63 | % | | | 1.92 | % | | | 1.09 | % |

Portfolio turnover | | | 35 | % | | | 193 | % | | | 15 | % | | | 27 | % | | | 26 | % |

Net assets end of year (000’s) omitted | | | $1,695 | | | | $1,528 | | | | $2,182 | | | | $1,484 | | | | $1,420 | |

| | | | | | | | | | | | | | | | | | | | | |

17

|

AMG FQ Global Risk-Balanced Fund Financial Highlights For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended October 31, | |

| | | | | |

| Class Z | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Net Asset Value, Beginning of Year | | | $13.66 | | | | $16.62 | | | | $14.64 | | | | $15.87 | | | | $14.00 | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.18 | | | | 0.08 | | | | 0.28 | | | | 0.32 | | | | 0.18 | |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.13 | | | | (2.40 | ) | | | 2.05 | | | | (1.44 | ) | | | 1.92 | |

Total income (loss) from investment operations | | | 2.31 | | | | (2.32 | ) | | | 2.33 | | | | (1.12 | ) | | | 2.10 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.12 | ) | | | (0.64 | ) | | | (0.35 | ) | | | (0.11 | ) | | | (0.23 | ) |

Net Asset Value, End of Year | | | $15.85 | | | | $13.66 | | | | $16.62 | | | | $14.64 | | | | $15.87 | |

Total Return2,3 | | | 16.94 | % | | | (14.57 | )% | | | 16.43 | % | | | (7.13 | )% | | | 15.23 | % |

Ratio of net expenses to average net assets | | | 0.89 | %4 | | | 0.88 | %4 | | | 0.89 | % | | | 0.89 | % | | | 0.89 | % |

Ratio of gross expenses to average net assets5 | | | 1.03 | % | | | 1.05 | % | | | 1.01 | % | | | 0.97 | % | | | 0.95 | % |

| | | | | |

Ratio of net investment income to average net assets2 | | | 1.15 | % | | | 0.57 | % | | | 1.78 | % | | | 2.07 | % | | | 1.19 | % |

Portfolio turnover | | | 35 | % | | | 193 | % | | | 15 | % | | | 27 | % | | | 26 | % |

Net assets end of year (000’s) omitted | | | $33,531 | | | | $36,192 | | | | $49,163 | | | | $50,058 | | | | $59,712 | |

| | | | | | | | | | | | | | | | | | | | | |

| 1 | Per share numbers have been calculated using average shares. |

| 2 | Total returns and net investment income would have been lower had certain expenses not been offset. |

| 3 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 4 | Includes reduction from broker recapture amounting to less than 0.01% and 0.01% for the fiscal years ended 2021 and 2020. |

| 5 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

18

|

Notes to Financial Statements October 31, 2021 |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds I (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report is AMG FQ Global Risk-Balanced Fund (the “Fund”).

The Fund offers Class N, Class I and Class Z shares. Each class represents an interest in the same assets of the Fund. Although all share classes generally have identical voting rights, each share class votes separately when required by law. Different share classes may have different net asset values per share to the extent the share classes pay different distribution amounts and/or the expenses of such share classes differ. Each share class has its own expense structure. Please refer to a current prospectus for additional information on each share class.

Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to the long-term implications. Such disruptions can adversely affect assets of the Fund and thus Fund performance.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

a. VALUATION OF INVESTMENTS

Equity securities, including option contracts, traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last quoted mean between the last quoted bid and ask prices (the “mean price”). Equity securities traded in the over-the-counter market (other than NMS securities) are valued at the mean price. Foreign equity securities (securities principally traded in markets other than U.S. markets) are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price. Effective October 1, 2021, equity securities lacking any sales or traded in the over-the-counter market (other than NMS securities) are valued at the bid price. There was no impact to the Fund relating to the change in valuation policy.

Fixed income securities purchased with a remaining maturity exceeding 60 days are valued at the evaluated mean price provided by an authorized pricing service or, if an evaluated price is not available, by reference to other securities which are considered comparable in credit rating, interest rate, due date and other features (generally referred to as “matrix pricing”) or other similar pricing methodologies. Effective October 1, 2021, fixed income securities purchased with a remaining maturity exceeding 60 days are valued at the evaluated bid price provided by an

authorized pricing service. There was no impact to the Fund relating to the change in valuation policy.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of amortized cost. Investments in other open-end registered investment companies are valued at their end of day net asset value per share.

Futures contracts for which market quotations are readily available are valued at the settlement price as of the close of the futures exchange.

The Fund’s portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based valuations provided by third party pricing services approved by the Board of Trustees of the Trust (the “Board”). Under certain circumstances, the value of certain Fund portfolio investments (including derivatives) may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Valuation Committee, which is comprised of the Independent Trustees of the Board, and the Pricing Committee, which is comprised of representatives from AMG Funds LLC (the “Investment Manager”) are the committees appointed by the Board to make fair value determinations. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is not readily available or otherwise not determinable pursuant to the Board’s valuation procedures, if the Investment Manager or the Pricing Committee believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Pricing Committee and, if required under the Trust’s securities valuation procedures, the Valuation Committee, seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with a quarterly report showing as of the most recent quarter end, all outstanding securities fair valued by the Fund, including a comparison with the prior quarter end and the percentage of the Fund that the security represents at each quarter end.

With respect to foreign equity securities and certain foreign fixed income securities, the Board has adopted a policy that securities held in the Fund that can be fair valued by the applicable fair value pricing service are fair valued on each business day provided that each individual price exceeds a pre-established confidence level.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the

19

|

Notes to Financial Statements (continued) |

transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies, futures contracts, options contracts)

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign currency exchange contracts, swaps, foreign securities utilizing international fair value pricing, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments.

b. SECURITY TRANSACTIONS

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

c. INVESTMENT INCOME AND EXPENSES

Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Dividend and interest income on foreign securities is recorded gross of any withholding tax. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to the Fund are apportioned among the funds in the Trust and other trusts or funds within the AMG Funds Family of Funds (collectively the “AMG Funds Family”) based upon their relative average net assets or number of shareholders. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

The Fund had certain portfolio trades directed to various brokers under a brokerage recapture program. Credits received from the brokerage recapture program are earned and paid on a monthly basis, and are recorded as expense

offsets, which serve to reduce the Fund’s overall expense ratio. For the fiscal year ended October 31, 2021, the impact on the expenses and expense ratios was $1,481 or less than 0.01%.

d. DIVIDENDS AND DISTRIBUTIONS

Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually in December. Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. There were no permanent differences during the year. Temporary differences are due to wash sale loss deferrals and mark-to-market of futures and option contracts.

The tax character of distributions paid during the fiscal years ended October 31, 2021 and October 31, 2020 were as follows:

| | | | | | | | |

| Distributions paid from: | | 2021 | | | 2020 | |

| | |

Ordinary income * | | | $313,249 | | | | $2,014,504 | |

| | | | | | | | |

| | | $313,249 | | | | $2,014,504 | |

| | | | | | | | |

| * | For tax purposes, short-term capital gain distributions, if any, are considered ordinary income distributions. |

As of October 31, 2021, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | | | |

| Capital loss carryforward | | $2,593,868 | |

| |

Undistributed ordinary income | | | 59,412 | |

At October 31, 2021, the cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax purposes were as follows:

| | | | | | | | | | | | |

| Cost | | Appreciation | | | Depreciation | | | Net Appreciation | |

| | | |

$38,648,110 | | | $2,647,397 | | | | $(1,362,837 | ) | | | $1,284,560 | |

e. FEDERAL TAXES

The Fund currently qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

20

|

Notes to Financial Statements (continued) |

Management has analyzed the Fund’s tax positions taken on federal income tax returns as of October 31, 2021, and for all open tax years (generally, the three prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, Management is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

f. CAPITAL LOSS CARRYOVERS AND DEFERRALS

As of October 31, 2021, the Fund had capital loss carryovers for federal income tax purposes as shown in the following chart. These amounts may be used to offset future realized capital gains indefinitely, and retain their character as short-term and/or long-term.

| | | | | | | | | | | | | | |

Capital Loss Carryover Amounts | | | | | | | |

| | |

| Short-Term | | | Long-Term | | | Total | |

| | | |

| | $1,551,487 | | | | $1,042,381 | | | | $2,593,868 | | | | | |

For the fiscal year ended October 31, 2021, the Fund utilized capital loss carryovers in the amount of:

| | | | | | |

| Capital Loss Carryover Utilized |

| | | |

| | | Short-Term | | Long-Term | | |

| | | |

| | $2,442,363 | | $1,505,859 | | |

g. CAPITAL STOCK

The Trust’s Declaration of Trust authorizes for the Fund the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date.

For the fiscal years ended October 31, 2021 and October 31, 2020, the capital stock transactions by class for the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | October 31, 2021 | | | October 31, 2020 | |

| | | | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | |

Class N: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 749 | | | | $11,582 | | | | 9,833 | | | | $156,768 | |

| | | | |

Reinvestment of distributions | | | 266 | | | | 3,954 | | | | 5,052 | | | | 81,284 | |

| | | | |

Cost of shares repurchased | | | (8,209) | | | | (126,970) | | | | (74,612) | | | | (1,131,549) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (7,194) | | | | $(111,434) | | | | (59,727) | | | | $(893,497) | |

| | | | | | | | | | | | | | | | |

| | | | |

Class I: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 31,539 | | | | $481,176 | | | | 12,337 | | | | $196,102 | |

| | | | |

Reinvestment of distributions | | | 731 | | | | 10,887 | | | | 5,010 | | | | 80,875 | |

| | | | |

Cost of shares repurchased | | | (37,246) | | | | (575,454) | | | | (36,648) | | | | (554,743) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (4,976) | | | | $(83,391) | | | | (19,301) | | | | $(277,766) | |

| | | | | | | | | | | | | | | | |

| | | | |

Class Z: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 32,766 | | | | $489,806 | | | | 60,251 | | | | $825,289 | |

| | | | |

Reinvestment of distributions | | | 19,957 | | | | 296,758 | | | | 114,271 | | | | 1,843,200 | |

| | | | |

Cost of shares repurchased | | | (587,465) | | | | (8,985,951) | | | | (481,439) | | | | (6,838,603) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (534,742) | | | | $(8,199,387) | | | | (306,917) | | | | $(4,170,114) | |

| | | | | | | | | | | | | | | | |

h. REPURCHASE AGREEMENTS AND JOINT REPURCHASE AGREEMENTS

The Fund may enter into third-party repurchase agreements for temporary cash management purposes and third-party or bilateral joint repurchase agreements for reinvestment of cash collateral on securities lending transactions under the securities lending program offered by The Bank of New York Mellon (“BNYM”) (the “Program”) (collectively, “Repurchase Agreements”). The value of the underlying collateral, including accrued interest, must equal or exceed the value of the Repurchase Agreements during the term of the agreement. For joint repurchase agreements, the Fund participates on a pro rata basis with other clients of BNYM

in its share of the underlying collateral under such joint repurchase agreements and in its share of proceeds from any repurchase or other disposition of the underlying collateral. The underlying collateral for all Repurchase Agreements is held in safekeeping by the Fund’s custodian or at the Federal Reserve Bank. If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. Pursuant to the Program, the Fund is indemnified for such losses by BNYM on joint repurchase agreements.

21

|