UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2019 – OCTOBER 31, 2020

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | | | | | | | |

| | | | | AMG Funds October 31, 2020

AMG GW&K Core Bond ESG Fund |

| | | | | |

| | | | | Class N: MBGVX | | Class I: MBDFX | | Class Z: MBDLX |

| | | | | AMG GW&K Emerging Wealth Equity Fund (formerly AMG GW&K Trilogy Emerging Wealth Equity Fund) |

| | | | | |

| | | | | Class N: TYWVX | | Class I: TYWSX | | Class Z: TYWIX |

| | | | | AMG GW&K Emerging Markets Equity Fund (formerly AMG GW&K Trilogy Emerging Markets Equity Fund) |

| | | | | |

| | | | | Class N: TLEVX | | Class I: TLESX | | Class Z: TLEIX |

| | | | | |

| | | | | | | | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary or, if you invest directly with the Funds, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1.800.548.4539 to inform the Funds that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Funds.

| | |

| amgfunds.com | | 103120 AR069 |

| | |

| | | AMG Funds Annual Report — October 31, 2020 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG GW&K Core Bond ESG Fund | | | 4 | |

| | | |

| | | AMG GW&K Emerging Wealth Equity Fund | | | 12 | |

| | | |

| | | AMG GW&K Emerging Markets Equity Fund | | | 18 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 25 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations

and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 27 | |

| | | |

| | | Detail of sources of income, expenses, and realized and

unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 28 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 29 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income

and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 38 | |

| | | |

| | | Accounting and distribution policies, details of agreements and

transactions with Fund management and affiliates, and descriptions of

certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 46 | |

| | | |

| | | OTHER INFORMATION | | | 47 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 48 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 50 | |

| | | | | | | |

|

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ending October 31, 2020, was a volatile period for financial markets marked by a dramatic selloff and extraordinary rebound amid the unprecedented global effort to stop the COVID-19 pandemic. During the first half of the fiscal year, equities achieved new record highs against the backdrop of a healthy economy and strong investor sentiment. However, a broad-based selloff occurred amid a global flight to quality as investors assessed the scope of the unfolding COVID-19 health care crisis, a deteriorating economy, and skyrocketing unemployment. An oil price war initiated between Saudi Arabia and Russia only made matters worse. From its peak in mid-February 2020, the S&P 500® Index declined (33.79)% over the span of a few weeks, bringing the eleven-year bull market to an abrupt end. In response to the crisis, global central banks and governments were quick to flood the market with massive fiscal and monetary stimulus which helped to stabilize the market and led to an impressive recovery in risk assets, albeit a very uneven one. So despite the volatility, the S&P 500® Index still achieved a 9.71% return for the fiscal year.

During the year there was very wide dispersion in performance across sectors, with information technology and consumer discretionary sectors leading the market with returns of 34.47% and 24.69%, respectively. On the other hand, companies in the energy sector fell (45.24)%, and financials, real estate, and industrials also produced negative returns. Growth stocks significantly outperformed value stocks for the period with returns of 29.22% and (7.57)% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. Large caps also outperformed small caps as measured by the 9.71% return for the S&P 500® Index compared to (0.14)% for the Russell 2000® Index. Outside the U.S., emerging markets outperformed developed markets with the 8.25% return for the MSCI Emerging Markets Index compared to the (6.86)% return for the MSCI EAFE Index.

Interest rates fell dramatically and led to strong returns for bond investors as the U.S. Federal Reserve slashed short-term rates in response to the slowing economy. The 10-year Treasury yield ended the year near a historic low yield of 0.88%. The Bloomberg Barclays U.S. Aggregate Bond Index®, a broad measure of U.S. bond market performance, returned 6.19% over the period. Riskier high yield bonds lagged the broader bond market with a 3.49% return as measured by the return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index®.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds

provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

| Average Annual Total Returns | | Periods ended

October 31, 2020* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 9.71 | % | | | 10.42% | | | | 11.71% | |

| | | | |

Small Cap | | (Russell 2000® Index) | | | (0.14 | )% | | | 2.19% | | | | 7.27% | |

| | | | |

International | | (MSCI All Country World Index ex USA) | | | (2.61 | )% | | | (0.19)% | | | | 4.26% | |

| Bonds: | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 6.19 | % | | | 5.06% | | | | 4.08% | |

| | | | |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | | | 3.49 | % | | | 4.24% | | | | 6.32% | |

| | | | |

Tax-exempt | | (Bloomberg Barclays

Municipal Bond Index) | | | 3.59 | % | | | 4.09% | | | | 3.70% | |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month

Treasury Bill Index) | | | 1.30 | % | | | 1.89% | | | | 1.43% | |

*Source: FactSet. Past performance is no guarantee of future results.

2

|

About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

| | | | |

Six Months Ended October 31, 2020 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/20 | | Ending

Account

Value

10/31/20 | | Expenses

Paid

During

the Period* |

AMG GW&K Core Bond ESG Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $1,021 | | $4.47 |

| | | | |

Class I | | 0.55% | | $1,000 | | $1,023 | | $2.80 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $1,023 | | $2.44 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $1,021 | | $4.47 |

| | | | |

Class I | | 0.55% | | $1,000 | | $1,022 | | $2.80 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $1,023 | | $2.44 |

AMG GW&K Emerging Wealth Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.26% | | $1,000 | | $1,225 | | $7.05 |

| | | | |

Class I | | 0.97% | | $1,000 | | $1,226 | | $5.43 |

| | | | |

Class Z | | 0.86% | | $1,000 | | $1,227 | | $4.81 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.26% | | $1,000 | | $1,019 | | $6.39 |

| | | | |

Class I | | 0.97% | | $1,000 | | $1,020 | | $4.93 |

| | | | |

Class Z | | 0.86% | | $1,000 | | $1,021 | | $4.37 |

| | | | | | | | |

| | | | |

Six Months Ended October 31, 2020 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/20 | | Ending

Account

Value

10/31/20 | | Expenses

Paid

During

the Period* |

AMG GW&K Emerging Markets Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.36% | | $1,000 | | $1,232 | | $7.63 |

| | | | |

Class I | | 1.00% | | $1,000 | | $1,234 | | $5.62 |

| | | | |

Class Z | | 0.93% | | $1,000 | | $1,236 | | $5.23 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.36% | | $1,000 | | $1,018 | | $6.90 |

| | | | |

Class I | | 1.00% | | $1,000 | | $1,020 | | $5.08 |

| | | | |

Class Z | | 0.93% | | $1,000 | | $1,020 | | $4.72 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 366. |

3

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

For the 12 months ending October 31, 2020, AMG GW&K Core Bond ESG Fund’s (the “Fund)” Class I shares returned 5.55%, compared to the return of 6.19% for the Bloomberg Barclays U.S. Aggregate Bond Index® (the “Index”). OVERVIEW GW&K Investment Management, LLC (“GWK”) believes that responsible corporate behavior with respect to ESG (environmental, social, and governance) factors can lead to positive and sustainable long-term financial performance and aligns with our pursuit of quality investments. GW&K has been incorporating ESG factors into our equity and fixed income analysis process for several years, and as a signatory of the UN Principals for Responsible Investment, we are committed to incorporating the assessment of ESG issues into our fundamental research process. We believe ESG investing adds value to our investment process by improving our assessment of risk and enhancing our ability to identify high quality credits; aids our up-in-quality bias by improving identification of credits with less long-term volatility; limits our exposure to credit ratings downgrades and negative events that are difficult to quantify; and deepens our fundamental credit analysis and leads to better outcomes by providing a more nuanced and complete picture. ESG considerations have long informed our process. We focus on business and credit fundamentals, relative valuation, and technical considerations. We believe ESG factors are important considerations in analyzing a company’s business and financial policy and that they highlight non-financial risks that can significantly affect a company’s financial health over the long term. Just as with credit risks, investors require additional compensation for ESG risks, leading to potential inefficiencies in valuation. MARKET OVERVIEW The end of 2019 saw a sharp turn in sentiment across fixed income markets that led to a selloff in interest rates and further tightening in credit spreads. The primary catalyst for the reversal was the completion of a “phase one” trade agreement between the U.S. and China, though positive signs from the labor market and evidence of stability in global manufacturing lifted sentiment as well. Additionally, the U.S. Federal Reserve (the “Fed”) made it clear that tightening was effectively out of the question until the committee sees meaningful evidence of inflation, suggesting monetary policy is likely to remain accommodative indefinitely. By year-end, | | | | worries of a trade-war-inspired global slowdown or a central bank induced liquidity crisis had been replaced with talk of green shoots, inflection points, and the recession that never was. At the start of 2020, fixed income markets experienced an extraordinarily volatile quarter as COVID-19 evolved into a global pandemic and investors aggressively shed risk assets amid a massive, system-wide deleveraging. Measures enacted to slow the spread of the virus effectively shut down entire segments of the world economy, and the implications for growth, liquidity, and inflation were profound. Expectations for second quarter 2020 pointed to declines of as much as a third of Gross Domestic Product (GDP). Companies began hoarding cash by drawing down lines of credit, and break-evens fell to their lowest level in two decades. Adding to the tumult was the start of a crude price war between Russia and Saudi Arabia, which exacerbated the selloff inspired by an already dire outlook for demand and lead oil to post its worst quarter on record. Sentiment was similarly dismal, as investors struggled to handicap the ultimate duration and severity of the slowdown. They pulled record amounts of cash from investment grade mutual funds and caused dislocations in even the safest corners of the fixed income market, desperate to raise cash by selling anything they could. Fiscal and monetary authorities took significant steps to mitigate the fallout from the virus, but given the unprecedented nature of the threat it posed, the long-term efficacy of these efforts remained an open question. Fixed income markets made gains in the second quarter of 2020, benefiting from ongoing support from the Fed and renewed investor optimism amid the country’s gradual reopening. Data suggested the bottom was likely in, as green shoots across the economy drove the recovery narrative. The consumer proved remarkably resilient, with a V-shaped rebound unfolding in the retail, housing, and auto sectors. Business activity also bounced, as manufacturing sentiment and new orders pointed to a steady pace of progress in returning to pre-pandemic levels. Adding to the turnaround’s momentum were expectations of additional fiscal stimulus, which would not only provide an obvious boost to the economy but also, more importantly, narrow the range of potential adverse outcomes. Despite the unprecedented size and scope of the Fed’s intervention, however, alarming news of rising case counts, renewed lockdowns across the country, and uncertain progress on the development of treatments and vaccines tempered the rally in the | | | | closing weeks. The potential for a significant second wave in the fall loomed as well, and posed a serious threat to investor optimism. On the one hand, the Fed’s relatively downbeat economic outlook ensures that it is likely to provide necessary support for the indefinite future. On the other hand, it paints a challenging picture for the nation’s recovery. The key question fixed income markets faced was which of these two forces would prevail in the coming quarters. Fixed income markets were remarkably subdued in the third quarter, trading in an extremely narrow range despite major economic advances and significant developments epidemiologically and politically. For much of the period, this calm was striking for its apparent insensitivity to the steady progress of the U.S. recovery. The consumer continued to display astonishing resilience, the housing sector soared, and the labor market made major strides in its path back to normalcy. Encouraging results in the hunt for a COVID-19 vaccine and improved outcomes for those infected also seemed to have little impact. Toward the end of the quarter, this muted trading was all the more notable, considering the looming uncertainty investors face heading into year end. Signs had already begun to emerge that the “second wave” was forming, negotiators remained far apart in their efforts to agree on a second round of stimulus, and there was increasing concern that a protracted vote count could result in a weeks-long delay in determining the outcome of the election. Yet the bond market exited the quarter essentially where it started. Of course, the cause of this apparent tranquility is no mystery: The Fed remains absolutely dominant across all corners of the fixed income market. And as its influence continues to overwhelm fundamentals and distort pricing mechanisms, it has become increasingly challenging and all the more important for investors to be discerning in their yield curve positioning and sector allocation. Interest rates rose in October, particularly at the long end, as the market priced in growing odds of a Democratic sweep in the election. While the yield on the 10-year Treasury never broke out of its 0.50%–0.90% post-March trading range, the 2s-to-10s curve spread steepened to its highest level since 2018. For much of the month, the focus was on the prospects for a Phase 4 stimulus package out of Washington, with on-again/off-again negotiations reflected in volatile market swings. Meanwhile, behind the scenes, economic data remained encouraging, as housing stayed strong, consumer spending held up, and labor markets continued to |

4

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

heal. We learned that third quarter GDP rebounded sharply, regaining almost two-thirds of lost output from the first half of 2020, leaving the economy only (3.5)% smaller than where it began the year. And yet, over the final week of October, risk aversion once again took center stage, routing oil prices and sending stocks tumbling. Several factors were responsible, from renewed coronavirus-related restrictions in Europe and the United States to jitters over the possibility of a contested U.S. election to changing timetables on the availability of COVID-19 vaccines. For the month, two-year Treasury yields edged up 3 bps while five-, 10-, and 30-year yields rose 11 bps, 19 bps, and 21 bps, respectively. FUND REVIEW The Fund underperformed in the first part of its fiscal year due to its overweight to spread product during the onset of the COVID-19 pandemic. The above-benchmark allocation to investment grade corporate bonds and taxable municipals detracted from returns. Treasuries, on the other hand, outperformed, and the Fund was underweighted. Partially offsetting these headwinds was an overweight to agency mortgage backed securities (“MBS”), which we took advantage of during the market’s indiscriminate selloff in part of March. Subsequently, markets grasped a risk-on tone toward the end of March, as the Fed and fiscal policy backstopped the economy. The Fund’s overweight to investment-grade corporates and taxable municipals served as strong tailwinds during this period. Corporate security selection for the full year was a modest detractor, the majority of which came from the technology sector. Selection in financials also hurt. Partially compensating for these was good selection within consumer cyclicals. Additionally, selection within agency MBS was a positive due to our preference for conventional and specified pools. The yield curve effect was negative. The Fund gained | | | | from its underweight to the long end of the yield curve, which experienced the smallest decrease in rates. However, the Fund’s duration positioning weighed on relative performance at times throughout the year, especially being short duration in March. The Fund’s ESG focus resulted in repositioning in the corporate bond sector during the period. Listed below are examples of trades conducted over the period where ESG factors had a key influence in our decision making process. Purchases throughout the period included: a green bond from stable-business Sysco Corp.; The Ford Foundation for its attractive valuation and favorable ESG characteristics; Xylem Inc. due to its strong ESG profile and solid fundamentals; Equinix Inc. as an opportunity to add a green bond with good fundamentals; National Rural Utilities Cooperative Finance Corp. to add ESG exposure with a newly issued sustainable bond in a defensive utility credit; and The Korea Development Bank to add high quality green bond exposure. Sales during the period included Exelon Inc. for its lower ESG score and Citigroup Inc. because of ESG concerns related to recent operational miscues. OUTLOOK The desultory tone of the rates market highlights the extent to which the Treasury sector has become a policy tool rather than a useful means of price discovery—particularly at the front end, where the effects of the Fed’s intervention are most apparent. The signal farther out is a little clearer and there is some evidence that inflation concerns have begun to influence trading at the long end, but the overall level and shape of the curve nevertheless reflect broad-based skepticism around the 2% target. In light of this tension between an economy with significant excess slack and the Fed’s stated goal, | | | | we are neutral duration across the Fund. But we are expressing this view by underweighting the long end in favor of intermediate maturities. The belly of the curve not only offers relatively attractive carry and roll, it is also less susceptible to an uptick in inflation in the event the Fed is successful sooner than expected. Rates have risen recently, mostly on the long end. Spreads have continued to tighten. As the recovery continues to unfold, we remain constructive on credit relative to Treasuries. The duration of the Treasury market reached yet another record length while its yield continues to sit near a record low. We believe this combination remains an unattractive value proposition and consequently the Fund has minimal exposure to the sector. Credit, meanwhile, is well positioned to benefit from both constructive fundamentals and Fed largesse, while spreads continue to sit wide of recent lows. The Fund remains overweighted in corporate credit, given its superior carry, potential for spread compression, and insulation against rising rates. Within the space, we continue to find high-quality franchises in COVID-19-exposed sectors that we expect to survive the slowdown and be in a strong competitive position on the other side. The Fund has also maintained an out-of-benchmark exposure to fixed-to-floating hybrid preferred bank securities, given their attractive yields and conservatively capitalized balance sheets. Our securitized exposure is neutral, in light of heightened prepayment uncertainty, though within the space we prefer higher-coupon, seasoned pools with more attractive convexity profiles. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2020, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

5

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

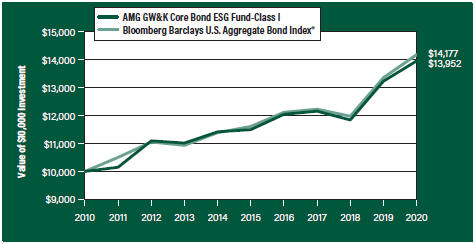

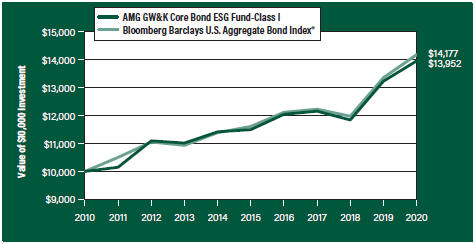

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Core Bond ESG Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Core Bond ESG Fund’s Class I shares on October 31, 2010 to a $10,000 investment made in the Bloomberg Barclays U.S. Aggregate Bond Index® for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Core Bond ESG Fund and the Bloomberg Barclays U.S. Aggregate Bond Index® for the same time periods ended October 31, 2020.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG GW&K Core Bond ESG Fund2, 3, 4, 5, 6, 7, 8, 9 | |

| | | | | |

Class N | | | 5.31% | | | | 3.64% | | | | — | | | | 3.17% | | | | 05/08/15 | |

| | | | | |

Class I | | | 5.55% | | | | 3.96% | | | | 3.39% | | | | 5.84% | | | | 04/30/93 | |

| | | | | |

Class Z | | | 5.73% | | | | 4.06% | | | | — | | | | 3.59% | | | | 05/08/15 | |

| | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index®10 | | | 6.19% | | | | 4.08% | | | | 3.55% | | | | 5.34% | | | | 04/30/93† | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2020. All returns are in U.S. dollars ($). 2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 To the extent that the Fund invests in asset-backed or mortgage-backed securities, its exposure to prepayment and extension risks may be greater than investments in other fixed income securities. 4 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 5 The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. 6 The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

7 Many bonds have call provisions which allow the debtors to pay them back before maturity. This is especially true with mortgage securities, which can be paid back anytime. Typically debtors prepay their debt when it is to their advantage (when interest rates drop making a new loan at current rates more attractive), and thus likely to the disadvantage of bondholders, who may have to reinvest prepayment proceeds in securities with lower yields. Prepayment risk will vary depending on the provisions of the security and current interest rates relative to the interest rate of the debt. |

8 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 9 Applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than performance, and the Fund may underperform funds that do not utilize an ESG investment strategy. The application of this strategy may affect the Fund’s exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the |

6

|

AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

Subadviser will reflect the beliefs or values of any particular investor. 10 The Bloomberg Barclays U.S. Aggregate Bond Index® is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. Unlike the Fund, the Bloomberg Barclays U.S. Aggregate Bond Index® is unmanaged, is not available for investment, and does not incur expenses. | | | | Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy | | | | or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. Not FDIC insured, nor bank guaranteed. May lose value. |

7

|

AMG GW&K Core Bond ESG Fund Fund Snapshots (unaudited) October 31, 2020 |

PORTFOLIO BREAKDOWN

| | |

| Category | | % of Net Assets |

| | |

Corporate Bonds and Notes | | 48.8 |

| | |

U.S. Government and Agency Obligations | | 40.0 |

| | |

Municipal Bonds | | 8.5 |

| | |

Foreign Government Obligations | | 0.7 |

| | |

Other Assets Less Liabilities | | 2.0 |

| |

| Rating | | % of Market Value1 |

| | |

U.S. Government and Agency Obligations | | 40.9 |

| | |

Aaa/AAA | | 3.3 |

| | |

Aa/AA | | 14.9 |

| | |

A | | 16.4 |

| | |

Baa/BBB | | 24.5 |

| 1 | Includes market value of long-term fixed-income securities only. |

TOP TEN HOLDINGS

| | |

| Security Name | | % of

Net Assets |

| | |

United States Treasury Notes, 4.500%, 02/15/36 | | 4.4 |

| | |

FHLMC, 2.500%, 10/01/34 | | 2.3 |

| | |

FNMA, 4.500%, 06/01/41 | | 2.3 |

| | |

FNMA, 4.500%, 04/01/39 | | 2.0 |

| | |

California State General Obligation, School Improvements, 7.550%, 04/01/39 | | 2.0 |

| | |

Oracle Corp., 2.500%, 04/01/25 | | 2.0 |

| | |

FNMA, 4.500%, 04/01/39 | | 2.0 |

| | |

FHLMC, 2.500%, 08/01/50 | | 2.0 |

| | |

Verizon Communications, Inc., 3.875%, 02/08/29 | | 2.0 |

| | |

Campbell Soup Co., 4.150%, 03/15/28 | | 2.0 |

| | | |

| | |

Top Ten as a Group | | 23.0 |

| | |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by any of the rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments October 31, 2020 |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Corporate Bonds and Notes - 48.8% | | | | | |

| | |

Financials - 12.1% | | | | | | | | |

| | |

Bank of America Corp. | | | | | | | | |

Series MM, (4.300% to 01/28/25 then 3 month LIBOR + 2.664%), 4.300%, 01/28/251,2,3 | | | $2,129,000 | | | | $2,079,777 | |

| | |

The Bank of New York Mellon Corp. | | | | | | | | |

MTN, 2.450%, 08/17/26 | | | 987,000 | | | | 1,074,440 | |

| | |

Boston Properties, LP | | | | | | | | |

3.400%, 06/21/29 | | | 1,945,000 | | | | 2,111,821 | |

| | |

The Charles Schwab Corp. | | | | | | | | |

Series G, (5.375% to 06/01/25 then U.S. Treasury Yield Curve CMT 5 year + 4.971%), 5.375%, 06/01/251,2,3 | | | 2,926,000 | | | | 3,209,237 | |

| | |

Crown Castle International Corp. | | | | | | | | |

4.000%, 03/01/27 | | | 1,840,000 | | | | 2,080,642 | |

| | |

Equinix, Inc. | | | | | | | | |

1.000%, 09/15/25 | | | 1,050,000 | | | | 1,046,779 | |

| | |

The Goldman Sachs Group, Inc. | | | | | | | | |

3.500%, 11/16/26 | | | 2,794,000 | | | | 3,095,518 | |

| | |

JPMorgan Chase & Co. | | | | | | | | |

Series FF, (5.000% to 08/01/24 then SOFRRATE + 3.380%), 5.000%, 08/01/241,2,3 | | | 2,059,000 | | | | 2,060,740 | |

| | |

MetLife, Inc. | | | | | | | | |

Series G, (3.850% to 09/15/25 then U.S. Treasury Yield Curve CMT 5 year + 3.576%), 3.850%, 09/15/251,2,3 | | | 2,109,000 | | | | 2,120,304 | |

| | |

Morgan Stanley, GMTN | | | | | | | | |

(4.431% to 01/23/29 then 3 month LIBOR + 1.628%), 4.431%, 01/23/301,3 | | | 1,725,000 | | | | 2,068,584 | |

| | |

Truist Financial Corp. | | | | | | | | |

Series N, (4.800% to 09/01/24 then U.S. Treasury Yield Curve CMT 5 year + 3.003%), 4.800%, 09/01/241,2,3 | | | 1,036,000 | | | | 1,045,349 | |

| | |

Visa, Inc. | | | | | | | | |

3.150%, 12/14/25 | | | 2,753,000 | | | | 3,064,450 | |

| | |

Total Financials | | | | | | | 25,057,641 | |

| | |

Industrials - 35.7% | | | | | | | | |

| | |

Apple, Inc. | | | | | | | | |

2.900%, 09/12/27 | | | 1,868,000 | | | | 2,082,756 | |

| | |

AT&T, Inc. | | | | | | | | |

4.250%, 03/01/27 | | | 1,826,000 | | | | 2,101,796 | |

| | |

Automatic Data Processing, Inc. | | | | | | | | |

3.375%, 09/15/25 | | | 2,771,000 | | | | 3,122,660 | |

| | |

BorgWarner, Inc. | | | | | | | | |

2.650%, 07/01/27 | | | 2,044,000 | | | | 2,148,244 | |

| | |

Campbell Soup Co. | | | | | | | | |

4.150%, 03/15/28 | | | 3,516,000 | | | | 4,074,702 | |

| | |

Comcast Corp. | | | | | | | | |

4.150%, 10/15/28 | | | 1,761,000 | | | | 2,096,400 | |

| | |

CommonSpirit Health | | | | | | | | |

3.347%, 10/01/29 | | | 2,394,000 | | | | 2,503,937 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Costco Wholesale Corp. | | | | | | | | |

1.600%, 04/20/30 | | | $2,049,000 | | | | $2,073,366 | |

| | |

CVS Health Corp. | | | | | | | | |

5.125%, 07/20/45 | | | 1,785,000 | | | | 2,262,745 | |

| | |

Fiserv, Inc. | | | | | | | | |

4.200%, 10/01/28 | | | 1,785,000 | | | | 2,100,249 | |

| | |

The Ford Foundation | | | | | | | | |

Series 2020, 2.415%, 06/01/50 | | | 2,357,000 | | | | 2,314,094 | |

| | |

The George Washington University | | | | | | | | |

Series 2018, 4.126%, 09/15/48 | | | 2,726,000 | | | | 3,223,972 | |

| | |

Georgia-Pacific LLC | | | | | | | | |

8.000%, 01/15/24 | | | 1,583,000 | | | | 1,939,515 | |

| | |

Johnson Controls International plc/Tyco Fire & Security Finance SCA (Ireland) | | | | | | | | |

1.750%, 09/15/30 | | | 2,100,000 | | | | 2,092,550 | |

| | |

Kaiser Foundation Hospitals | | | | | | | | |

3.150%, 05/01/27 | | | 1,915,000 | | | | 2,114,066 | |

| | |

Lear Corp. | | | | | | | | |

3.800%, 09/15/27 | | | 1,991,000 | | | | 2,136,191 | |

| | |

Lowe’s Cos., Inc. | | | | | | | | |

4.000%, 04/15/25 | | | 1,852,000 | | | | 2,100,141 | |

| | |

Magna International, Inc. (Canada) | | | | | | | | |

2.450%, 06/15/30 | | | 2,037,000 | | | | 2,141,572 | |

| | |

McDonald’s Corp., MTN | | | | | | | | |

3.700%, 01/30/26 | | | 2,301,000 | | | | 2,598,968 | |

| | |

Microsoft Corp. | | | | | | | | |

2.525%, 06/01/50 | | | 2,263,000 | | | | 2,315,892 | |

| | |

Oracle Corp. | | | | | | | | |

2.500%, 04/01/25 | | | 3,933,000 | | | | 4,211,516 | |

| | |

Parker-Hannifin Corp. | | | | | | | | |

3.250%, 06/14/29 | | | 1,914,000 | | | | 2,151,957 | |

| | |

Precision Castparts Corp. | | | | | | | | |

3.250%, 06/15/25 | | | 1,866,000 | | | | 2,063,755 | |

| | |

RELX Capital, Inc. | | | | | | | | |

4.000%, 03/18/29 | | | 1,881,000 | | | | 2,183,558 | |

| | |

ServiceNow, Inc. | | | | | | | | |

1.400%, 09/01/30 | | | 2,130,000 | | | | 2,061,423 | |

| | |

Sysco Corp. | | | | | | | | |

2.400%, 02/15/30 | | | 2,424,000 | | | | 2,468,732 | |

| | |

T-Mobile USA, Inc. | | | | | | | | |

3.500%, 04/15/254 | | | 1,000,000 | | | | 1,096,610 | |

| | |

TWDC Enterprises 18 Corp., MTN | | | | | | | | |

1.850%, 07/30/26 | | | 2,007,000 | | | | 2,104,314 | |

| | |

Verizon Communications, Inc. | | | | | | | | |

3.875%, 02/08/29 | | | 3,527,000 | | | | 4,133,623 | |

| | |

VF Corp. | | | | | | | | |

2.800%, 04/23/27 | | | 2,023,000 | | | | 2,185,793 | |

| | |

Xylem, Inc. | | | | | | | | |

2.250%, 01/30/31 | | | 2,064,000 | | | | 2,161,388 | |

| | |

Total Industrials | | | | | | | 74,366,485 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

9

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Utilities - 1.0% | | | | | | | | |

| | |

National Rural Utilities Cooperative Finance Corp. | | | | | | | | |

1.350%, 03/15/31 | | | $2,086,000 | | | | $2,052,336 | |

| | |

Total Corporate Bonds and Notes | | | | | | | | |

(Cost $95,490,877) | | | | | | | 101,476,462 | |

| | |

Municipal Bonds - 8.5% | | | | | | | | |

| | |

California State General Obligation, School Improvements | | | | | | | | |

7.550%, 04/01/39 | | | 2,475,000 | | | | 4,256,950 | |

| | |

JobsOhio Beverage System | | | | | | | | |

Series B, 4.532%, 01/01/35 | | | 1,735,000 | | | | 2,199,928 | |

| | |

Los Angeles Unified School District, School Improvements | | | | | | | | |

5.750%, 07/01/34 | | | 2,685,000 | | | | 3,643,438 | |

| | |

Massachusetts School Building Authority | | | | | | | | |

Series B, 1.753%, 08/15/30 | | | 2,142,000 | | | | 2,125,999 | |

| | |

Metropolitan Transportation Authority | | | | | | | | |

6.687%, 11/15/40 | | | 1,825,000 | | | | 2,168,301 | |

| | |

University of California, University & College Improvements | | | | | | | | |

Series BD, 3.349%, 07/01/29 | | | 2,985,000 | | | | 3,356,632 | |

| | |

Total Municipal Bonds | | | | | | | | |

(Cost $16,413,392) | | | | | | | 17,751,248 | |

| | |

| U.S. Government and Agency Obligations - 40.0% | | | | | | | | |

| | |

Fannie Mae - 21.0% | | | | | | | | |

| | |

FNMA | | | | | | | | |

2.000%, 08/01/50 to 09/01/50 | | | 2,721,283 | | | | 2,808,513 | |

3.500%, 03/01/30 to 03/01/48 | | | 10,131,909 | | | | 11,081,970 | |

4.000%, 03/01/44 to 07/01/49 | | | 9,789,094 | | | | 10,835,347 | |

4.500%, 04/01/39 to 06/01/41 | | | 13,834,394 | | | | 15,506,509 | |

5.000%, 08/01/40 | | | 3,082,645 | | | | 3,556,130 | |

| | |

Total Fannie Mae | | | | | | | 43,788,469 | |

| | |

Freddie Mac - 11.7% | | | | | | | | |

| | |

FHLMC | | | | | | | | |

1.500%, 11/01/50 | | | 819,000 | | | | 826,118 | |

2.000%, 09/01/50 | | | 1,667,857 | | | | 1,721,319 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

FHLMC | | | | | | | | |

2.500%, 10/01/34 to 08/01/50 | | | $8,394,727 | | | | $8,893,949 | |

5.000%, 07/01/44 | | | 2,449,011 | | | | 2,823,664 | |

| | |

FHLMC Gold Pool | | | | | | | | |

3.500%, 07/01/32 to 05/01/44 | | | 2,231,881 | | | | 2,461,494 | |

4.000%, 05/01/26 | | | 115,158 | | | | 122,243 | |

| | |

FHLMC Multifamily Structured Pass Through Certificates | | | | | | | | |

Series K054, Class A2 2.745%, 01/25/26 | | | 1,472,000 | | | | 1,612,189 | |

Series K058, Class A2 2.653%, 08/25/26 | | | 191,000 | | | | 210,513 | |

Series K062, Class A2 3.413%, 12/25/26 | | | 513,000 | | | | 587,673 | |

Series K063, Class A2 3.430%, 01/25/273 | | | 2,544,000 | | | | 2,912,857 | |

Series K071, Class A2 3.286%, 11/25/27 | | | 1,912,000 | | | | 2,205,394 | |

| | |

Total Freddie Mac | | | | | | | 24,377,413 | |

| |

U.S. Treasury Obligations - 7.3% | | | | | |

| | |

United States Treasury Bonds | | | | | | | | |

4.500%, 02/15/36 | | | 6,137,000 | | | | 9,075,089 | |

| | |

United States Treasury Notes | | | | | | | | |

2.000%, 11/30/22 | | | 3,863,000 | | | | 4,010,579 | |

6.250%, 08/15/23 | | | 1,785,000 | | | | 2,086,288 | |

| | |

Total U.S. Treasury Obligations | | | | | | | 15,171,956 | |

| | |

Total U.S. Government and Agency Obligations | | | | | | | | |

(Cost $78,738,432) | | | | | | | 83,337,838 | |

| |

Foreign Government Obligation - 0.7% | | | | | |

| | |

The Korea Development Bank (South Korea) | | | | | | | | |

0.500%, 10/27/23 | | | | | | | | |

(Cost $1,381,526) | | | 1,385,000 | | | | 1,386,083 | |

| | |

Total Foreign Government Obligation | | | | | | | | |

(Cost $1,381,526) | | | | | | | 1,386,083 | |

| | |

Total Investments - 98.0% | | | | | | | | |

(Cost $192,024,227) | | | | | | | 203,951,631 | |

| |

Other Assets, less Liabilities - 2.0% | | | | 4,127,896 | |

| | |

Net Assets - 100.0% | | | | | | | $208,079,527 | |

| | | | | | | | |

| 1 | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at October 31, 2020. Rate will reset at a future date. |

| 2 | Perpetuity Bond. The date shown represents the next call date. |

| 3 | Variable rate security. The rate shown is based on the latest available information as of October 31, 2020. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| 4 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2020, the value of these securities amounted to $1,096,610 or 0.5% of net assets. |

| | |

CMT FHLMC FNMA GMTN LIBOR MTN SOFRRATE | | Constant Maturity Treasury Freddie Mac Fannie Mae Global Medium-Term Notes London Interbank Offered Rate Medium-Term Note Secured Overnight Financing Rate |

The accompanying notes are an integral part of these financial statements.

10

|

AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2020:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Corporate Bonds and Notes† | | | | — | | | | | $101,476,462 | | | | | — | | | | | $101,476,462 | |

Municipal Bonds | | | | — | | | | | 17,751,248 | | | | | — | | | | | 17,751,248 | |

U.S. Government and Agency Obligations† | | | | — | | | | | 83,337,838 | | | | | — | | | | | 83,337,838 | |

Foreign Government Obligation | | | | — | | | | | 1,386,083 | | | | | — | | | | | 1,386,083 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | | — | | | | | $203,951,631 | | | | | — | | | | | $203,951,631 | |

| | | | | | | | | | | | | | | | | | | | |

| † | All corporate bonds and notes and U.S. government and agency obligations held in the Fund are Level 2 securities. For a detailed breakout of corporate bonds and notes and U.S. government and agency obligations by major industry or agency classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

11

|

AMG GW&K Emerging Wealth Equity Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

MARKET OVERVIEW Despite the economic impact of pandemic containment measures, emerging markets delivered respectable performance for the year ended October 2020; the MSCI Emerging Markets Index (“MSCI EM”) advanced 8.25%. The headline result does not tell the whole story, however, as returns varied markedly across regions. Thanks to the size, scale, and exceptional performance of China, Taiwan, and South Korea, Asia more than offset negative results in Latin America and Europe, Middle East and Africa (“EMEA”). North Asia’s economic activity quickly returned to normal thanks to robust public health measures. China and Taiwan are among the few major countries in the world to report positive year-on-year GDP growth in the third quarter of 2020, with gains of 4.9% and 3.3%, respectively. In addition, favorable exposure to information technology demand, particularly semiconductors, supported business activity in Taiwan and South Korea. As a result, the MSCI Asia Index returned 20.1% for the period. In contrast, Latin America and EMEA have fared poorly in terms of both public health and economic performance, as noted in the performance of their equity markets. The MSCI EM Latin America Index declined (33.1%), while the MSCI EMEA Index fell (18.0%). Weak oil prices have been an issue for both regions, as the price of Brent crude oil declined sharply over the past year. On a sector level, consumer discretionary 47.6%, information technology 35.3%, communication services 33.3%, and health care 32.0% were the strongest performing sectors while energy (29.9%), utilities (21.0%), and financials (20.5%) were down the most. | | | | FUND REVIEW AMG GW&K Emerging Wealth Equity Fund’s (the “Fund”) Class N shares returned 14.37%, compared to an 8.25% return for its benchmark, the MSCI EM for the fiscal year ended October 31, 2020. Much lower exposure to Latin America and EMEA had a positive impact on relative performance, as did the Fund’s developed market holdings, led by Infineon Technologies AG and QUALCOMM, Inc. Looking at performance on a sector basis, less exposure to the traditional banking industry in financials was a large contributor to performance, as was the Fund’s underweight allocation to the hard hit energy sector. Positive stock selection in the consumer staples sector was also additive as China’s leading baijiu spirits producer, Wuliangye Yibin Co., Ltd. performed well throughout the year, despite a challenging environment. Both an overweight allocation and stock selection in the health care sector also added significant value to fiscal year performance. Ping An Healthcare and Technology Co., Ltd., China’s leading online doctor consultation service, rallied on an increase in online consultations due to COVID-19. Finally, underweight allocations to the utilities, real estate, and industrials sectors helped relative performance. While the Fund’s overweight allocation to the consumer discretionary sector had a positive effect, this was offset by stock selection, and the sector ultimately detracted. Travel-related stocks, such as Macau based Sands China, Ltd, remain under pressure due to the negative impact of virus containment measures. Maruti Suzuki India, Ltd. also declined amid tough economic conditions in India. | | | | OUTLOOK AND PORTFOLIO POSITIONING As an efficacious COVID-19 vaccine becomes a closer reality, we are confident that a coordinated global economic recovery will unfold over the next several years. The U.S. dollar will likely remain benign or possibly decline versus a range of currencies as the country works to finance deficits at historically low interest rates. If history is any guide, EM equities should benefit from both economic recovery and potential dollar weakness. Relative equity valuations also remain a plus for EM, with the Shiller price/earnings ratio for the MSCI EM trading at 13.5x compared to 16.2x for the MSCI EAFE Index and 26.5x for the S&P 500® Index. With respect to the Fund’s structure, trading and market activity during the fiscal year resulted in increased exposure to the consumer discretionary and health care sectors while our weights in financials, industrials, communication services, information technology, materials, and consumer staples decreased. At the close of the period, the Fund had overweight positions in the consumer discretionary, health care, and financials sectors and underweight positions in the information technology, communication services, materials, energy, industrials sectors, real estate, utilities and consumer staples relative to the benchmark. Geographically, the portfolio finished the fiscal year with exposures of 75% in EM Asia, 20% in developed markets, and 5% in EM Latin America. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2020, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

12

|

AMG GW&K Emerging Wealth Equity Fund Portfolio Manager’s Comments (continued) |

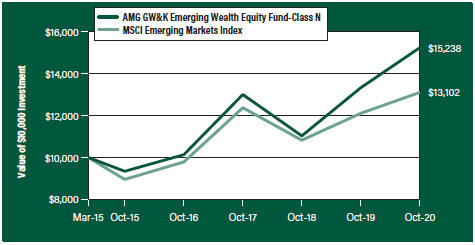

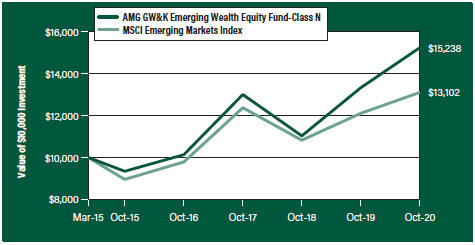

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Emerging Wealth Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Emerging Wealth Equity Fund’s Class N shares on March 19, 2015 (inception date), to a $10,000 investment made in the MSCI Emerging Markets Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Emerging Wealth Equity Fund and the MSCI Emerging Markets Index for the same time periods ended October 31, 2020.

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Since

Inception | | | Inception

Date | |

AMG GW&K Emerging Wealth Equity Fund2, 3, 4, 5, 6, 7, 8, 9 | | | | | | | | | |

| | | | |

Class N | | | 14.37 | % | | | 10.29 | % | | | 7.78 | % | | | 03/19/15 | |

| | | | |

Class I | | | 14.63 | % | | | 10.60 | % | | | 8.06 | % | | | 03/19/15 | |

| | | | |

Class Z | | | 14.75 | % | | | 10.70 | % | | | 8.17 | % | | | 03/19/15 | |

| | | | |

MSCI Emerging Markets Index10 | | | 8.25 | % | | | 7.92 | % | | | 4.92 | % | | | 03/19/15 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2020. All returns are in U.S. dollars ($). 2 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 3 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. 4 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. 5 The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. 6 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 7 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

8 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 9 Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 10 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Please go to msci.com for most current list of countries represented by the index. Unlike the Fund, the MSCI Emerging Markets Index is unmanaged, is not available for investment and does not incur expenses. |

13

|

AMG GW&K Emerging Wealth Equity Fund Portfolio Manager’s Comments (continued) |

| | | | | | | | |

All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data | | | | provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. | | | | Not FIDC insured, not bank guaranteed. May lose value. |

14

|

AMG GW&K Emerging Wealth Equity Fund Fund Snapshots (unaudited) October 31, 2020 |

PORTFOLIO BREAKDOWN

| | |

| Sector | | % of

Net Assets |

| | |

Consumer Discretionary | | 44.3 |

| | |

Financials | | 20.0 |

| | |

Information Technology | | 9.6 |

| | |

Health Care | | 7.8 |

| | |

Communication Services | | 6.1 |

| | |

Consumer Staples | | 5.1 |

| | |

Materials | | 2.4 |

| | |

Other Assets Less Liabilities | | 4.7 |

TOP TEN HOLDINGS

| | |

| Security Name | | % of

Net Assets |

Alibaba Group Holding, Ltd., Sponsored ADR (China) | | 10.0 |

| | |

Sands China, Ltd. (Macau) | | 5.4 |

| | |

QUALCOMM, Inc. | | 4.9 |

| | |

HDFC Bank, Ltd., ADR (India) | | 4.7 |

| | |

Trip.com Group, Ltd., ADR (China) | | 4.5 |

| | |

Yum China Holdings, Inc. (China) | | 4.2 |

| | |

Infineon Technologies AG (Germany) | | 4.0 |

| | |

Kotak Mahindra (India) | | 3.5 |

| | |

AIA Group, Ltd. (Hong Kong) | | 3.4 |

| | |

Ping An Insurance Group Co. of China, Ltd., Class H (China) | | 3.4 |

| | | |

| | |

Top Ten as a Group | | 48.0 |

| | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

15

|

AMG GW&K Emerging Wealth Equity Fund Schedule of Portfolio Investments October 31, 2020 |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 95.3% | | | | | | | | |

| | |

Communication Services - 6.1% | | | | | | | | |

| | |

Tencent Holdings, Ltd. (China) | | | 56,390 | | | | $4,308,515 | |

| | |

Tencent Music Entertainment Group, ADR (China)* | | | 426,059 | | | | 6,339,758 | |

| | |

The Walt Disney Co. (United States) | | | 18,318 | | | | 2,221,057 | |

| | |

Total Communication Services | | | | | | | 12,869,330 | |

| | |

Consumer Discretionary - 44.3% | | | | | | | | |

| | |

Alibaba Group Holding, Ltd., Sponsored ADR (China)* | | | 68,731 | | | | 20,941,648 | |

| | |

Booking Holdings, Inc. (United States)* | | | 1,248 | | | | 2,024,880 | |

| | |

Eicher Motors, Ltd. (India) | | | 102,980 | | | | 2,898,156 | |

| | |

Haidilao International Holding, Ltd. (China)1,2 | | | 236,000 | | | | 1,563,217 | |

| | |

Hermes International (France) | | | 2,119 | | | | 1,972,995 | |

| | |

Huazhu Group, Ltd., ADR (China)2 | | | 130,109 | | | | 5,156,220 | |

| | |

Jubilant Foodworks, Ltd. (India) | | | 132,038 | | | | 3,872,393 | |

| | |

LVMH Moet Hennessy Louis Vuitton SE (France) | | | 6,375 | | | | 2,988,256 | |

| | |

MakeMyTrip, Ltd. (India)*,2 | | | 253,700 | | | | 4,761,949 | |

| | |

Maruti Suzuki India, Ltd. (India) | | | 22,275 | | | | 2,092,153 | |

| | |

Moncler SpA (Italy)* | | | 83,683 | | | | 3,348,289 | |

| | |

New Oriental Education & Technology Group, Inc., Sponsored ADR (China)* | | | 11,303 | | | | 1,812,775 | |

| | |

NIKE, Inc., Class B (United States) | | | 17,539 | | | | 2,106,083 | |

| | |

Sands China, Ltd. (Macau) | | | 3,251,600 | | | | 11,411,828 | |

| | |

Starbucks Corp. (United States) | | | 19,326 | | | | 1,680,589 | |

| | |

TAL Education Group, ADR (China)* | | | 56,530 | | | | 3,756,984 | |

| | |

Titan Co., Ltd. (India) | | | 151,280 | | | | 2,381,024 | |

| | |

Trip.com Group, Ltd., ADR (China)* | | | 332,492 | | | | 9,562,470 | |

| | |

Yum China Holdings, Inc. (China) | | | 164,988 | | | | 8,782,311 | |

| | |

Total Consumer Discretionary | | | | | | | 93,114,220 | |

| | |

Consumer Staples - 5.1% | | | | | | | | |

| | |

The Estee Lauder Cos., Inc., Class A (United States) | | | 5,510 | | | | 1,210,327 | |

| | |

Foshan Haitian Flavouring & Food Co., Ltd., Class A (China) | | | 19,400 | | | | 464,312 | |

| | |

LG Household & Health Care, Ltd. (South Korea) | | | 3,314 | | | | 4,393,965 | |

| | |

Wal-Mart de Mexico, S.A.B. de CV (Mexico) | | | 760,570 | | | | 1,841,590 | |

| | |

Wuliangye Yibin Co., Ltd., Class A (China) | | | 77,103 | | | | 2,819,071 | |

| | |

Total Consumer Staples | | | | | | | 10,729,265 | |

| | |

Financials - 20.0% | | | | | | | | |

| | |

AIA Group, Ltd. (Hong Kong) | | | 759,100 | | | | 7,224,489 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

China International Capital Corp., Ltd., Class H (China)*,1 | | | 1,063,600 | | | | $2,485,196 | |

| | |

Credicorp, Ltd. (Peru) | | | 17,688 | | | | 2,028,460 | |

| | |

Grupo Financiero Banorte, S.A.B de CV, Class O (Mexico)* | | | 1,121,804 | | | | 5,003,072 | |

| | |

HDFC Bank, Ltd., ADR (India)* | | | 173,283 | | | | 9,953,375 | |

| | |

Hong Kong Exchanges & Clearing, Ltd. (Hong Kong) | | | 20,300 | | | | 972,750 | |

| | |

Kotak Mahindra (India)* | | | 349,686 | | | | 7,297,439 | |

| | |

Ping An Insurance Group Co. of China, Ltd., Class H (China) | | | 681,250 | | | | 7,043,903 | |

| | |

Total Financials | | | | | | | 42,008,684 | |

| | |

Health Care - 7.8% | | | | | | | | |

| | |

Alibaba Health Information Technology, Ltd. (Hong Kong)* | | | 165,602 | | | | 434,280 | |

| | |

China Resources Sanjiu Medical & Pharmaceutical Co., Ltd., Class A (China) | | | 1,116,381 | | | | 4,520,825 | |

| | |

CSPC Pharmaceutical Group, Ltd. (China) | | | 329,600 | | | | 350,011 | |

| | |

Jiangsu Hengrui Medicine Co., Ltd., Class A (China) | | | 94,184 | | | | 1,252,697 | |

| | |

Meinian Onehealth Healthcare Holdings Co., Ltd., Class A (China)* | | | 1,440,748 | | | | 3,676,303 | |

| | |

Novo Nordisk A/S, Class B (Denmark) | | | 48,024 | | | | 3,062,282 | |

| | |

Ping An Healthcare and Technology Co., Ltd. (China)*,1 | | | 250,110 | | | | 3,227,337 | |

| | |

Total Health Care | | | | | | | 16,523,735 | |

| | |

Information Technology - 9.6% | | | | | | | | |

| | |

Infineon Technologies AG (Germany) | | | 302,435 | | | | 8,420,119 | |

| | |

Mastercard, Inc., Class A (United States) | | | 4,935 | | | | 1,424,438 | |

| | |

QUALCOMM, Inc. (United States) | | | 83,124 | | | | 10,254,177 | |

| | |

Total Information Technology | | | | | | | 20,098,734 | |

| | |

Materials - 2.4% | | | | | | | | |

| | |

Asian Paints, Ltd. (India) | | | 147,898 | | | | 4,411,335 | |

| | |

Chr Hansen Holding A/S (Denmark) | | | 7,423 | | | | 749,054 | |

| | |

Total Materials | | | | | | | 5,160,389 | |

| | |

Total Common Stocks | | | | | | | | |

(Cost $165,261,054) | | | | | | | 200,504,357 | |

| | |

Total Investments - 95.3% | | | | | | | | |

(Cost $165,261,054) | | | | | | | 200,504,357 | |

| | |

Other Assets, less Liabilities - 4.7% | | | | | | | 9,779,715 | |

| | |

Net Assets - 100.0% | | | | | | | $210,284,072 | |

The accompanying notes are an integral part of these financial statements.

16

|

AMG GW&K Emerging Wealth Equity Fund Schedule of Portfolio Investments (continued) |

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2020, the value of these securities amounted to $7,275,750 or 3.5% of net assets. |

| 2 | Some of these securities, amounting to $7,345,204 or 3.5% of net assets, were out on loan to various borrowers and are collateralized by various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| ADR | American Depositary Receipt |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2020:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 21 | | Level 3 | | Total |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | | | | | |

Consumer Discretionary | | | | $63,484,065 | | | | | $29,630,155 | | | | | — | | | | | $93,114,220 | |

Financials | | | | 16,984,907 | | | | | 25,023,777 | | | | | — | | | | | 42,008,684 | |

Information Technology | | | | 11,678,615 | | | | | 8,420,119 | | | | | — | | | | | 20,098,734 | |

Health Care | | | | — | | | | | 16,523,735 | | | | | — | | | | | 16,523,735 | |

Communication Services | | | | 8,560,815 | | | | | 4,308,515 | | | | | — | | | | | 12,869,330 | |

Consumer Staples | | | | 3,051,917 | | | | | 7,677,348 | | | | | — | | | | | 10,729,265 | |

Materials | | | | — | | | | | 5,160,389 | | | | | — | | | | | 5,160,389 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | | $103,760,319 | | | | | $96,744,038 | | | | | — | | | | | $200,504,357 | |

| | | | | | | | | | | | | | | | | | | | |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended October 31, 2020, there were no transfers in or out of Level 3.

The country allocation in the Schedule of Portfolio Investments at October 31, 2020, was as follows:

| | |

| Country | | % of Long-Term

Investments |

China | | 43.9 |

Denmark | | 1.9 |

France | | 2.5 |

Germany | | 4.2 |

Hong Kong | | 4.3 |

India | | 18.8 |

Italy | | 1.7 |

Macau | | 5.7 |

Mexico | | 3.4 |

Peru | | 1.0 |

South Korea | | 2.2 |

United States | | 10.4 |

| | |

| | 100.0 |

| | |

The accompanying notes are an integral part of these financial statements.

17

|

AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (unaudited) |

| | | | |

MARKET OVERVIEW Despite the economic impact of pandemic containment measures, emerging markets delivered respectable performance for the year ended October 2020; the MSCI Emerging Markets Index (“MSCI EM”) advanced 8.25%. The headline result does not tell the entire story, however, as returns varied markedly across regions. Thanks to the size, scale, and exceptional performance of China, Taiwan, and South Korea, Asia more than offset negative results in Latin America and Europe, Middle East and Africa (“EMEA”). North Asia’s economic activity quickly returned to normal thanks to robust public health measures. China and Taiwan are among the few major countries in the world to report positive year-on-year GDP growth in the third quarter of 2020, with gains of 4.9% and 3.3%, respectively. In addition, favorable exposure to information technology demand, particularly semiconductors, supported business activity in Taiwan and South Korea. As a result, the MSCI Asia Index returned 20.1% for the period. In contrast, Latin America and EMEA have fared poorly in terms of both public health and economic performance, as noted in the performance of their equity markets. The MSCI EM Latin America Index declined (33.1%), while the MSCI EMEA Index fell (18.0%). Weak oil prices have been an issue for both regions, as the price of Brent crude oil declined sharply over the past year. On a sector level, consumer discretionary 47.6%, information technology 35.3%, communication services 33.3%, and health care 32.0% were the strongest performing sectors while energy (29.9%), utilities (21.0%), and financials (20.5%) were down the most. | | FUND REVIEW AMG GW&K Emerging Markets Equity Fund’s (the “Fund”) Class Z shares returned 8.01%, compared to an 8.25% return for its benchmark, the MSCI EM, for the fiscal year ended October 31, 2020. Regional allocation was a key factor in the performance shortfall due to the portfolio’s higher exposure to struggling Latin American markets. In addition, the portfolio’s bank holdings, particularly Brazil’s Banco Bradesco S.A. and Itau Unibanco Holding S.A., came under pressure over credit quality concerns in the wake of the pandemic. Recent company updates have been encouraging and both stocks have recovered from mid fiscal year lows. Notwithstanding the portfolio’s strong consumer discretionary performance, not owning all the Chinese internet service companies detracted from the sector’s relative results. Stock selection in the health care sector detracted from performance due to the portfolio’s lack of exposure to Indian and Chinese pharmaceutical companies. Positive sector highlights include an underweight position and strong stock selection in energy, thanks to standout performance from Indian oil marketing company Reliance Industries. Stock selection in consumer staples was also positive, as China’s leading baijiu spirits producer, Wuliangye Yibin Co., Ltd. delivered strong sales throughout the year. Taiwan Semiconductor Manufacturing Co., Ltd reported earnings well ahead of estimates and took the lead in the portfolio’s information technology sector, which also outperformed the Index. Less exposure to the weaker performing utilities and real estate sectors helped on a relative basis. | | OUTLOOK AND PORTFOLIO POSITIONING As an efficacious COVID-19 vaccine becomes a closer reality, we are confident that a coordinated global economic recovery will unfold over the next several years. The U.S. dollar will likely remain benign or possibly decline versus a range of currencies as the country works to finance deficits at historically low interest rates. If history is any guide, EM equities should benefit from both economic recovery and potential dollar weakness. Relative equity valuations also remain a plus for EM, with the Shiller price/earnings ratio for the MSCI EM trading at 13.5x compared to 16.2x for the MSCI EAFE Index and 26.5x for the S&P 500® Index. With respect to the Fund’s structure, trading and market activity during the fiscal year resulted in increased exposures to the information technology, consumer discretionary, and communication services sectors while our weights in financials, industrials, energy, real estate, and consumer staples decreased. At the close of the period, the Fund had overweight positions in the consumer discretionary, information technology, financials, consumer staples, and communication services sectors and underweight positions in the materials, energy, real estate, industrials, utilities, and health care sectors relative to the benchmark. Geographically, the portfolio finished the fiscal year with 79% in Asia, 9% in Latin America, and 8% in the EMEA region, including a small cash balance. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2020, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

18

|

AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (continued) |

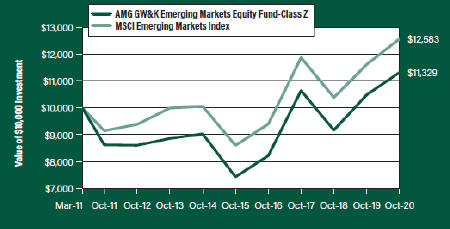

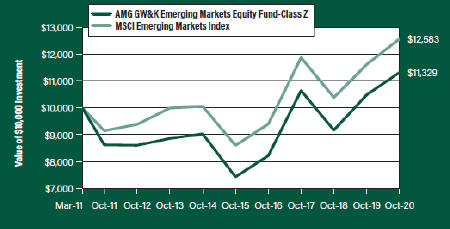

CUMULATIVE TOTAL RETURN PERFORMANCE