UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG FUNDS I

(Exact name of registrant as specified in charter)

680 Washington Blvd., Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Blvd., Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: September 30

Date of reporting period: OCTOBER 1, 2020 – SEPTEMBER 30, 2021

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | |

| | | AMG Funds September 30, 2021 |

| | |

|

| | |

| | | AMG Boston Common Global Impact Fund |

| | | (formerly AMG Managers Brandywine Fund) |

| | |

| | | Class I: BRWIX |

| | | |

| | | |

| | | |

| | | |

| | | | |

| amgfunds.com | | | | 093021 AR074 |

| | |

| | | AMG Funds Annual Report — September 30, 2021 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULE OF PORTFOLIO INVESTMENTS | | | 4 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 13 | |

| | | |

| | | Balance sheet, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 14 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 15 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 16 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 17 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 23 | |

| | | |

| | | OTHER INFORMATION | | | 24 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 25 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 28 | |

| | | |

| | | FUNDS LIQUIDITY RISK MANAGEMENT PROGRAM | | | 30 | |

| |

| | Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended September 30, 2021, was marked by the continued extraordinary recovery amid the unprecedented global effort to stop the COVID-19 pandemic. Equities rallied to new record highs amid better-than-expected corporate earnings, colossal fiscal and monetary stimulus programs, and an improving economic backdrop. Since the market bottom on March 23, 2020, the S&P 500® Index has gained over 97%. Businesses and consumers contended with disrupted supply chains and rising prices on a wide range of goods such as lumber and gasoline, and outbreaks of the Delta variant kept the world on edge. The fiscal year ended with slightly elevated volatility as investors assessed rising inflation, more hawkish global central bank policies, and a major regulatory crackdown in China.

The S&P 500® gained 30.00% during the fiscal year and all sectors produced double-digit returns, but there was very wide dispersion in performance. Energy and financials led the market with returns of 83.05% and 59.13%, respectively. On the other hand, utilities and consumer staples lagged with returns of 10.97% and 11.34%, respectively. Value stocks returned to favor after a long stretch of underperformance compared to Growth stocks. The Russell 1000® Value Index returned 35.01% compared to the 27.32% return for the Russell 1000® Growth Index. Small cap stocks outperformed as the Russell 2000® Index experienced its best quarter (fourth quarter 2020) on record. Within small caps, the Value-Growth disparity was much more pronounced as the Russell 2000® Value Index returned 63.92% compared to 33.27% for the Russell 2000® Growth Index. Outside the U.S., foreign developed markets outpaced emerging markets with a 25.73% return for the MSCI EAFE Index compared to an 18.20% return for the MSCI Emerging Markets Index.

Interest rates climbed from near-historic lows as the vaccine rollout initiated a return to normalcy and the economic outlook improved. The 10-year Treasury yield rose 80 basis points to 1.48% and ended the fiscal year not far off its post-pandemic high. The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, lost -0.90% over the period. Healthy risk appetite drove credit spreads tighter and helped investment-grade corporate bonds produce a modestly positive 1.74% return. Riskier high-yield bonds outperformed the investment-grade market with an 11.28% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds benefited from a strong technical backdrop and drove a 2.63% return for the Bloomberg Municipal Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | | | | |

| | | | | Periods ended |

| Average Annual Total Returns | | September 30, 2021* |

| | | | |

| Stocks: | | | | 1 Year | | 3 Years | | 5 Years |

| | | | |

Large Cap | | (S&P 500® Index) | | | | 30.00 | % | | | | 15.99 | % | | | | 16.90 | % |

| | | | |

Small Cap | | (Russell 2000® Index) | | | | 47.68 | % | | | | 10.54 | % | | | | 13.45 | % |

| | | | |

International | | (MSCI All Country World Index ex USA) | | | | 23.92 | % | | | | 8.03 | % | | | | 8.94 | % |

Bonds: | | | | | | | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | | -0.90 | % | | | | 5.36 | % | | | | 2.94 | % |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | | 11.28 | % | | | | 6.91 | % | | | | 6.52 | % |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | | 2.63 | % | | | | 5.06 | % | | | | 3.26 | % |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | �� | | | 0.13 | % | | | | 1.43 | % | | | | 1.34 | % |

*Source: FactSet. Past performance is no guarantee of future results.

2

|

About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

Six Months Ended September 30, 2021 | | Expense

Ratio for

the Period | | Beginning

Account

Value

04/01/21 | | Ending

Account

Value

09/30/21 | | Expenses

Paid

During

the Period* |

AMG Boston Common Global Impact Fund |

Based on Actual Fund Return |

| | | | |

Class I | | 0.98% | | $1,000 | | $1,056 | | $5.05 |

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 0.98% | | $1,000 | | $1,020 | | $4.96 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

3

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | | | | | |

AMG Boston Common Global Impact Fund (the “Fund”) returned 31.75% during the year ended September 30, 2021, compared to the 27.44% return for the MSCI All Country World Index (the “MSCI Index”). The Fund’s legacy primary benchmark, the Russell 3000® Growth Index, returned 27.57% during the period. Effective March 19, 2021, the Fund’s subadviser changed from Friess Associates, LLC to Boston Common Asset Management, LLC (“Boston Common”). Also effective March 19, 2021, the Fund changed its name from AMG Managers Brandywine Fund to AMG Boston Common Global Impact Fund and changed its investment objective, benchmark, principal investment strategies, and principal risks. Performance Review For the period from October 1, 2020 through March 19, 2021, the Fund outperformed the legacy Russell 3000® Growth Index. The Fund’s outperformance was primarily attributable to stock selection in the consumer discretionary, information technology, and industrials sectors. The Fund’s sector allocations had a modestly negative contribution to returns, primarily from an underweight in financials and overweight in consumer discretionary. Following the Fund’s strategy change on March 19, 2021 through September 30, 2021, the Fund generated a positive return but lagged the MSCI Index. Investors navigated a dynamic set of factors during the period. Rising global vaccination rates and falling COVID infections helped create an outlook for a more normalized summer in most developed nations, boosting consumer confidence in many places to its highest level since the beginning of the pandemic. In contrast, lagging vaccination progress in developing nations caused factory closures in places such as Asia and broad-based logistical backlogs. In the meantime, alongside strong pent-up demand and widespread supply chain disruptions, inflationary pressures increased in several countries, raising investor concerns. By the third quarter of 2021, regulatory crackdowns and concerns about indebted property developers weighed on sentiment in China. Germany’s federal election ushered in a potential new coalition government, while Japan’s ruling party selected a new leader. While North American equities led global markets, European and UK equities held their ground. Asia Pacific and Emerging Market equities lagged, impeded by declines in China and Hong Kong. Soaring energy and gas prices pushed energy stocks | | | | higher on a sector basis, while IT and healthcare stocks also outperformed. Utilities and consumer discretionary stocks lagged the most, pressured by higher-than-expected input prices and snarled supply chains. On a relative basis, although the Fund’s regional allocation detracted from returns, stock selection added value over the period. The Fund benefited most from our overweight in eco-efficient industrials stocks. Contributing most in this sector were Carrier Global (U.S.), a manufacturer of highly efficient HVAC systems, and Tomra, a Norwegian provider of sensor-based recycling solutions. Others include Spirax-Sarco Engineering (UK), whose business involves the control and efficient management of steam and industrial fluids, and Xylem, an American water technology provider. Also adding value were materials and consumer discretionary holdings. Within the materials space, green chemical specialists Croda International (UK) and Koninklijke DSM (Netherlands) outperformed most metal and mining companies in the Index. While consumer discretionary stocks generally lagged at the Index level, the Fund’s holdings outperformed. Key contributors included Japanese companies Shimano (bike components) and Yamaha (musical instruments) amid growing demand for leisure products. BYD Company (China), a battery and electric vehicle manufacturer, also added value. Swiss hearing-aid specialist Sonova Holding was a strong outperformer in the healthcare sector. The Fund’s underweight to the financial sector, in addition to weak performance from emerging markets (EM) financial holdings, detracted most from performance. Weaker-than-expected earnings due to long-term beneficial restructuring of its insurance agencies as well as investor concern regarding exposure to leveraged real estate companies hurt Ping An Insurance Group (China) during the period. The COVID situation pressured other EM financials such as Bank Rakyat (Indonesia) and HDFC Bank (India), although improving vaccination progress should lift growth expectations. Stock selection in real estate also detracted as Hannon Armstrong (U.S.), a specialty finance company providing capital and advisory services to companies focused on renewable energy, energy efficiency, and sustainable infrastructure, declined. Neighborhood grocer Sprouts Farmers Market detracted most within consumer staples, which lagged the Index overall. | | | | Outlook and Positioning Record monetary and fiscal support and the lifting of COVID restrictions have buoyed economic growth in 2021 and created favorable conditions for global equities. Activity indicators have surged from last year’s low base and policymakers still seem largely keen to continue with the emergency relief measures. While the pandemic will likely have long-lasting effects, vibrant industrial and consumer activity suggest healthy prospects for corporate profits once production and logistics problems are overcome. COVID has caused shifts in demand, major shortfalls in production, and dramatic increases in backlogs as logistics challenges grew. These dislocations have lowered near-term growth and increased inflation. With over two-thirds of the populations of the U.S., European Union, UK, China, and Japan at least partially vaccinated, social and economic normalization should proceed as long as vaccines continue to protect against severe disease from new variants. Highly unequal vaccine distribution is a challenge for developing countries, yet Emerging Market valuations look attractive given our view that economies in Asia and elsewhere have dynamic long-term outlooks. The Fund’s strategy remains founded on our belief that highly innovative solutions companies addressing global sustainability challenges and opportunities will experience larger-than-expected demand for their products, thereby enabling the Fund to outperform the broader global equity market over a full market cycle. An increasing number of countries have announced goals toward achieving net-zero emissions by 2050. It is our opinion that such policy initiatives and regulatory directives across the globe will provide a long-term tailwind for the impact revenue-generating capabilities and future growth of many of our product solutions companies. Currently, the largest impact investment themes are eco-efficiency/recycling and access to health. Fund Activity Over the period we expanded upon our impact theme of access to health while slightly reducing our exposure to sustainable housing development. We added two U.S.-based healthcare companies, Illumina and Biogen. We see Illumina as a clear solutions provider, being the most advanced enterprise within the leading-edge technology of genetic testing and sequencing. We believe this technology will play an increasingly central role in shaping the medicine of the future, ranging from |

| | | | | | | | |

4

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

cancer treatment selection to wellness pre-screening to population-wide studies. Illumina is a high-multiple stock but has very attractive operating margins, high recurring revenue streams within an expanding total addressable market, and very clear societal benefits. We believe Biogen’s FDA-approved aducanumab (product name Aduhelm) is an innovative drug against Alzheimer’s disease that is likely to be prescribed to a select group of Alzheimer’s patients. This breakthrough solutions product is addressing a degenerative brain disorder that causes significant problems with memory, thinking, and behavior in patients. We also considered that Biogen has additional drugs in advanced clinical trials for Alzheimer’s and other high risk/high reward targets, including Parkinson’s and ALS. Within the impact theme of organic and healthier food, we bought McCormick, a leading global ingredient and flavor provider. Its focus on spices, seasonings, baking ingredients, and condiments positions the company in a superior growth category. We anticipate the company will deliver | | | | above-industry top-line growth, as it benefits from both secular trends in healthy in-home cuisine as well as rebounding restaurant dining. McCormick has strong sustainability and supply-chain monitoring practices and a solid track record of prudent capital allocation. We purchased Kurita Water Industries, a leading Japanese provider of equipment and chemicals that produce ultrapure water and help reclaim wastewater. Kurita provides products and services that contribute to water savings as well as reductions in CO2 emissions and waste. This company aims to save its customers 240 million cubic meters of water by 2023. In addition, we added to Koninklijke DSM, which is soon expected to introduce Bovaer, an innovative feed supplement that enables a reduction in the carbon footprint of cattle. Other promising solutions in the company’s pipeline include a sweetening alternative for sugar and an instant formula product closely resembling mother’s milk. To fund these purchases, we sold several stocks. Our conviction for Air Liquide diminished as momentum | | | | toward its long-term opportunity of green hydrogen weakened. Furthermore, we sold Taiwan Semiconductor but added to semiconductor equipment manufacturer Applied Materials, which we believe has a higher solutions exposure combined with strong growth prospects. Following strong performance and elevated valuation multiples, we trimmed our positions in Waters, Mohawk Industries, and Daikin Industries. We sold Grifols following an expensive acquisition and Swedish personal care company Essity following margin pressures within its consumer tissue segment, driven by continued volatility in pulp pricing. This commentary reflects the viewpoints of the portfolio manager, Boston Common Asset Management, LLC as of September 30, 2021 , is not intended as a forecast or guarantee of future results, and is subject to change without notice. |

| | | | | | | | |

5

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

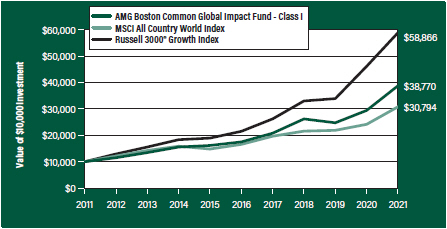

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Boston Common Global Impact Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Boston Common Global Impact Fund’s Class I shares on September 30, 2011, to a $10,000 investment made in the MSCI All Country World Index and Russell 3000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Boston Common Global Impact Fund and the MSCI All Country World Index and Russell 3000® Growth Index for the same time periods ended September 30, 2021.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | |

|

AMG Boston Common Global Impact Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15 | |

Class I | | | 31.75 | % | | | 17.24 | % | | | 14.51 | % |

MSCI All Country World Index16 | | | 27.44 | % | | | 13.20 | % | | | 11.90 | % |

| | | |

Russell 3000® Growth Index17 | | | 27.57 | % | | | 22.30 | % | | | 19.40 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2021. All returns are in U.S. dollars ($). |

| | |

| | | 2 As of March 19, 2021, the Fund’s Subadviser was changed to Boston Common Asset Management, LLC. Prior to March 19, 2021, the Fund was known as the AMG Managers Brandywine Fund, and had different principal investment strategies and corresponding risks. Performance shown for periods prior to March 19, 2021, reflects the performance and investment strategies of the Fund’s previous Subadviser, Friess Associates, LLC and Friess Associates of Delaware, LLC. The Fund’s past performance would have been different if the Fund were managed by the current Subadviser and strategy, and the Fund’s prior performance record might be less pertinent for investors considering whether to purchase shares of the fund. 3 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 4 The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. 5 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 6 Companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 7 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. 8 The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. 9 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 10 Changes in the general political and social environment of a country can have substantial effects on the value of investments exposed to that country. 11 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations |

| | | |

6

| | |

| | | AMG Boston Common Global Impact Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. 12 Applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than performance, and the Fund may underperform funds that do not utilize an ESG investment strategy. The application of this strategy may affect the Fund’s exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the Subadviser will reflect the beliefs or values of any particular investor. 13 The Fund may not be able to dispose of particular investments, such as illiquid securities, readily at | | | | favorable times or prices or the Fund may have to sell them at a loss. 14 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 15 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. 16 On March 19, 2021, the primary benchmark changed from the Russell 3000® Growth Index to the MSCI All Country World Index (ACWI). The MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Please go to msci.com for most current list of countries represented by the index. Unlike the Fund, the MSCI All Country World Index (ACWI) is unmanaged, is | | | | not available for investment and does not incur expenses. 17 The Russell 3000® Growth Index measures the performance of those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 3000® Growth Index is unmanaged, is not available for investment and does not incur expenses. All MSCI data is provided ‘as is’. The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. The Russell 3000® Growth Index is a trademark of the London Stock Exchange Group companies. Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | | | | | |

7

| | |

| | | AMG Boston Common Global Impact Fund Fund Snapshots (unaudited) September 30, 2021 |

| | | |

| | | |

PORTFOLIO BREAKDOWN

| | |

| Sector | | % of

Net Assets |

| | |

Industrials | | 20.6 |

| | |

Health Care | | 15.4 |

| | |

Consumer Discretionary | | 15.1 |

| | |

Information Technology | | 14.8 |

| | |

Materials | | 13.7 |

| | |

Financials | | 9.1 |

| | |

Consumer Staples | | 5.6 |

| | |

Utilities | | 3.9 |

| | |

Real Estate | | 1.4 |

| | |

Short-Term Investments | | 3.1 |

| | |

Other Assets Less Liabilities | | (2.7) |

TOP TEN HOLDINGS

| | |

| Security Name | | % of

Net Assets |

| | |

Carrier Global Corp. (United States) | | 3.0 |

| | |

Shimano, Inc. (Japan) | | 3.0 |

| | |

Borregaard A.S.A. (Norway) | | 2.6 |

| | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (United States) | | 2.5 |

| | |

Yamaha Corp. (Japan) | | 2.5 |

| | |

Xylem, Inc. (United States) | | 2.4 |

| | |

TopBuild Corp. (United States) | | 2.4 |

| | |

Sonova Holding AG (Switzerland) | | 2.4 |

| | |

Kerry Group PLC, Class A (Ireland) | | 2.3 |

| | |

TOMRA Systems A.S.A. (Norway) | | 2.3 |

| | |

Top Ten as a Group | | 25.4 |

| | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments September 30, 2021 |

| | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 99.6% | | | | | | | | |

| | |

Consumer Discretionary - 15.1% | | | | | | | | |

| | |

Barratt Developments PLC (United Kingdom) | | | 1,885,505 | | | | $16,667,463 | |

| | |

BYD Co., Ltd., Class H (China) | | | 521,000 | | | | 16,193,933 | |

| | |

KB Home (United States)1 | | | 506,456 | | | | 19,711,268 | |

| | |

Mohawk Industries, Inc. (United States)* | | | 70,369 | | | | 12,483,461 | |

| | |

Shimano, Inc. (Japan) | | | 93,100 | | | | 27,202,629 | |

| | |

TopBuild Corp. (United States)* | | | 104,985 | | | | 21,501,978 | |

| | |

Yamaha Corp. (Japan) | | | 360,100 | | | | 22,651,042 | |

| | |

Total Consumer Discretionary | | | | | | | 136,411,774 | |

| | |

Consumer Staples - 5.6% | | | | | | | | |

| | |

Kerry Group PLC, Class A (Ireland) | | | 158,088 | | | | 21,242,063 | |

| | |

McCormick & Co., Inc., Non-Voting Shares (United States) | | | 145,000 | | | | 11,749,350 | |

| | |

Sprouts Farmers Market, Inc. (United States)*,1 | | | 771,270 | | | | 17,870,326 | |

| | |

Total Consumer Staples | | | | | | | 50,861,739 | |

| | |

Financials - 9.1% | | | | | | | | |

| | |

Bank Rakyat Indonesia Persero Tbk PT, ADR (Indonesia)1 | | | 1,512,244 | | | | 20,657,253 | |

| | |

Hannon Armstrong Sustainable Infrastructure | | | | | | | | |

| | |

Capital, Inc., REIT (United States)1 | | | 426,985 | | | | 22,835,158 | |

| | |

HDFC Bank, Ltd., ADR (India) | | | 157,304 | | | | 11,497,349 | |

| | |

ORIX Corp. (Japan) | | | 978,900 | | | | 18,316,715 | |

| | |

Ping An Insurance Group Co. of China, Ltd., | | | | | | | | |

| | |

Class H (China) | | | 1,378,500 | | | | 9,428,082 | |

| | |

Total Financials | | | | | | | 82,734,557 | |

| | |

Health Care - 15.4% | | | | | | | | |

| | |

Biogen, Inc. (United States)* | | | 42,669 | | | | 12,074,900 | |

| | |

Cerner Corp. (United States) | | | 226,281 | | | | 15,957,336 | |

| | |

China Traditional Chinese Medicine | | | | | | | | |

| | |

Holdings Co., Ltd. (Hong Kong) | | | 28,682,000 | | | | 14,494,195 | |

| | |

CSL, Ltd. (Australia) | | | 52,382 | | | | 10,944,238 | |

| | |

Gilead Sciences, Inc. (United States) | | | 269,115 | | | | 18,797,683 | |

| | |

Grifols SA, ADR (Spain) | | | 276,558 | | | | 4,040,512 | |

| | |

Hoya Corp. (Japan) | | | 90,600 | | | | 14,135,305 | |

| | |

Illumina, Inc. (United States)* | | | 34,043 | | | | 13,808,181 | |

| | |

Sonova Holding AG (Switzerland) | | | 56,795 | | | | 21,463,299 | |

| | |

Waters Corp. (United States)* | | | 38,048 | | | | 13,594,551 | |

| | |

Total Health Care | | | | | | | 139,310,200 | |

| | |

Industrials - 20.6% | | | | | | | | |

| | |

Carrier Global Corp. (United States) | | | 532,612 | | | | 27,567,997 | |

| | |

Cummins, Inc. (United States) | | | 59,320 | | | | 13,320,899 | |

| | |

Daikin Industries, Ltd. (Japan) | | | 67,400 | | | | 14,695,792 | |

| | |

Kurita Water Industries, Ltd. (Japan) | | | 255,900 | | | | 12,313,478 | |

| | | | | | | | |

| | | Shares | | | Value | |

Schneider Electric SE (France) | | | 115,009 | | | | $19,155,213 | |

Spirax-Sarco Engineering PLC (United Kingdom) | | | 72,490 | | | | 14,585,411 | |

TOMRA Systems A.S.A. (Norway) | | | 403,920 | | | | 21,129,936 | |

Vestas Wind Systems A/S (Denmark) | | | 525,224 | | | | 21,066,227 | |

Westinghouse Air Brake Technologies Corp. (United States) | | | 234,274 | | | | 20,196,762 | |

Xylem, Inc. (United States) | | | 177,775 | | | | 21,987,212 | |

Total Industrials | | | | | | | 186,018,927 | |

Information Technology - 14.8% | | | | | | | | |

Adobe, Inc. (United States)* | | | 31,356 | | | | 18,052,276 | |

Applied Materials, Inc. (United States) | | | 117,191 | | | | 15,085,998 | |

Ciena Corp. (United States)* | | | 272,835 | | | | 14,010,077 | |

First Solar, Inc. (United States)* | | | 200,108 | | | | 19,102,310 | |

Intuit, Inc. (United States) | | | 37,034 | | | | 19,980,213 | |

Pagseguro Digital, Ltd., Class A (Brazil)*,1 | | | 282,525 | | | | 14,612,193 | |

VMware, Inc., Class A (United States)*,1 | | | 101,553 | | | | 15,100,931 | |

Xinyi Solar Holdings, Ltd. (China) | | | 8,692,000 | | | | 17,793,599 | |

Total Information Technology | | | | | | | 133,737,597 | |

Materials - 13.7% | | | | | | | | |

Borregaard A.S.A. (Norway) | | | 972,911 | | | | 23,600,728 | |

Croda International PLC (United Kingdom) | | | 142,554 | | | | 16,333,435 | |

DS Smith PLC (United Kingdom) | | | 3,561,666 | | | | 19,670,033 | |

Ecolab, Inc. (United States) | | | 67,835 | | | | 14,151,738 | |

Koninklijke DSM NV (Netherlands) | | | 76,812 | | | | 15,360,562 | |

Novozymes A/S, Class B (Denmark) | | | 221,878 | | | | 15,210,026 | |

Umicore, S.A. (Belgium) | | | 330,283 | | | | 19,539,416 | |

Total Materials | | | | | | | 123,865,938 | |

Real Estate - 1.4% | | | | | | | | |

Vonovia SE (Germany) | | | 212,808 | | | | 12,793,669 | |

Utilities - 3.9% | | | | | | | | |

American Water Works Co., Inc. (United States) | | | 118,758 | | | | 20,074,852 | |

Orsted A.S. (Denmark)2 | | | 113,903 | | | | 15,014,084 | |

Total Utilities | | | | | | | 35,088,936 | |

Total Common Stocks

(Cost $850,706,245) | | | | | | | 900,823,337 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 3.1% | | | | | | | | |

Joint Repurchase Agreements - 2.2%3 | | | | | | | | |

Bank of America Securities, Inc., dated 09/30/21, due 10/01/21, 0.050% total to be received $4,602,602 (collateralized by various U.S. Government Agency Obligations, 1.500% - 5.000%, 09/01/31 - 07/01/60, totaling $4,694,648) | | | $4,602,596 | | | | 4,602,596 | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Joint Repurchase Agreements - 2.2%3

(continued) | | | | | |

| | |

Cantor Fitzgerald Securities, Inc., dated 09/30/21, due 10/01/21, 0.050% total to be received $4,602,606 (collateralized by various U.S. Government Agency Obligations, 0.430% - 9.500%, 11/01/21 - 07/20/71, totaling $4,694,652) | | $ | 4,602,600 | | | | $4,602,600 | |

| | |

Daiwa Capital Markets America, dated 09/30/21, due 10/01/21, 0.050% total to be received $2,769,944 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 8.000%, 11/15/21 - 10/01/51, totaling $2,825,339) | | | 2,769,940 | | | | 2,769,940 | |

| | |

RBC Dominion Securities, Inc., dated 09/30/21, due 10/01/21, 0.050% total to be received $4,602,602 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 6.500%, 10/31/21 - 05/01/58, totaling $4,694,648) | | | 4,602,596 | | | | 4,602,596 | |

| | |

State of Wisconsin Investment Board, dated 09/30/21, due 10/01/21, 0.100% total to be received $2,801,567 (collateralized by various U.S. Treasuries, 0.125% - 3.875%, 07/15/23 - 02/15/48, totaling $2,857,673) | | | 2,801,559 | | | | 2,801,559 | |

| | |

Total Joint Repurchase Agreements | | | | | | | 19,379,291 | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $56,162,774 or 6.2% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2021, the value of these securities amounted to $15,014,084 or 1.7% of net assets. |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Other Investment Companies - 0.9% | | | | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%4 | | | 2,666,029 | | | | $2,666,029 | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.01%4 | | | 2,666,002 | | | | 2,666,002 | |

| | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.03%4 | | | 2,746,813 | | | | 2,746,813 | |

| | |

Total Other Investment Companies | | | | | | | 8,078,844 | |

| | |

Total Short-Term Investments

(Cost $27,458,135) | | | | | | | 27,458,135 | |

| | |

Total Investments - 102.7%

(Cost $878,164,380) | | | | | | | 928,281,472 | |

| | |

Other Assets, less Liabilities - (2.7)% | | | | | | | (23,986,228 | ) |

| | |

Net Assets - 100.0% | | | | | | $ | 904,295,244 | |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 4 | Yield shown represents the September 30, 2021, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

REIT Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

10

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of September 30, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 21 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Industrials | | | $125,269,033 | | | | $60,749,894 | | | | — | | | | $186,018,927 | |

Health Care | | | 78,273,163 | | | | 61,037,037 | | | | — | | | | 139,310,200 | |

Consumer Discretionary | | | 53,696,707 | | | | 82,715,067 | | | | — | | | | 136,411,774 | |

Information Technology | | | 115,943,998 | | | | 17,793,599 | | | | — | | | | 133,737,597 | |

Materials | | | 14,151,738 | | | | 109,714,200 | | | | — | | | | 123,865,938 | |

Financials | | | 54,989,760 | | | | 27,744,797 | | | | — | | | | 82,734,557 | |

Consumer Staples | | | 50,861,739 | | | | — | | | | — | | | | 50,861,739 | |

Utilities | | | 20,074,852 | | | | 15,014,084 | | | | — | | | | 35,088,936 | |

Real Estate | | | 12,793,669 | | | | — | | | | — | | | | 12,793,669 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Joint Repurchase Agreements | | | — | | | | 19,379,291 | | | | — | | | | 19,379,291 | |

Other Investment Companies | | | 8,078,844 | | | | — | | | | — | | | | 8,078,844 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | $534,133,503 | | | | $394,147,969 | | | | — | | | | $928,281,472 | |

| | | | | | | | | | | | | | | | |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the fiscal year ended September 30, 2021, there were no transfers in or out of Level 3.

For the fiscal year ended September 30, 2021, the effect of derivative instruments on the Statement of Operations for the Fund and the amount of realized gain/loss and unrealized appreciation/depreciation on derivatives recognized in income was as follows:

| | | | | | | | | | | | |

| | | Realized Gain/(Loss) | | | Change in Unrealized Appreciation/Depreciation | |

| | | | |

Derivatives not accounted for as hedging instruments | | Statement of Operations Location | | Realized

Gain/(Loss) | | | Statement of Operations Location | | Change in

Unrealized

Appreciation/

Depreciation | |

Equity contracts | | Net realized gain on futures contracts | | | $1,011,495 | | | Net change in unrealized appreciation/ depreciation on futures contracts | | | — | |

Foreign currency exchange contracts | | Net realized loss on forward contracts | | | (215,350 | ) | | Net change in unrealized appreciation/ depreciation on forward contracts | | | — | |

| | | | | | | | | | | | |

| | Totals | | | $796,145 | | | | | | — | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| | | AMG Boston Common Global Impact Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

The country allocation in the Schedule of Portfolio Investments at September 30, 2021, was as follows:

| | |

| Country | | % of Long-Term

Investments |

| |

Australia | | 1.2 |

| |

Belgium | | 2.2 |

| |

Brazil | | 1.6 |

| |

China | | 4.8 |

| |

Denmark | | 5.7 |

| |

France | | 2.1 |

| |

Germany | | 1.4 |

| |

Hong Kong | | 1.6 |

| |

India | | 1.3 |

| |

Indonesia | | 2.3 |

| |

Ireland | | 2.4 |

| |

Japan | | 12.1 |

| |

Netherlands | | 1.7 |

| |

Norway | | 5.0 |

| |

Spain | | 0.4 |

| |

Switzerland | | 2.4 |

| |

United Kingdom | | 7.5 |

| |

United States | | 44.3 |

| | |

| |

| | 100.0 |

| | |

The accompanying notes are an integral part of these financial statements.

12

| | |

| | | Statement of Assets and Liabilities September 30, 2021 |

| | | |

| | | |

| | | | |

| | | AMG

Boston Common

Global Impact

Fund | |

| |

Assets: | | | | |

| |

Investments at value1 (including securities on loan valued at $56,162,774) | | | $928,281,472 | |

| |

Receivable for investments sold | | | 1,384,423 | |

| |

Dividend and interest receivables | | | 2,144,661 | |

| |

Securities lending income receivable | | | 32,944 | |

| |

Receivable for Fund shares sold | | | 5,238 | |

| |

Receivable from affiliate | | | 21,540 | |

| |

Prepaid expenses and other assets | | | 20,833 | |

| |

Total assets | | | 931,891,111 | |

| |

Liabilities: | | | | |

| |

Payable upon return of securities loaned | | | 19,379,291 | |

| |

Payable for investments purchased | | | 7,129,354 | |

| |

Payable for Fund shares repurchased | | | 238,678 | |

| |

Accrued expenses: | | | | |

| |

Investment advisory and management fees | | | 576,593 | |

| |

Administrative fees | | | 118,478 | |

| |

Other | | | 153,473 | |

| |

Total liabilities | | | 27,595,867 | |

| | | | |

| |

Net Assets | | | $904,295,244 | |

| |

1 Investments at cost | | | $878,164,380 | |

| |

Net Assets Represent: | | | | |

| |

Paid-in capital | | | $851,840,737 | |

| |

Total distributable earnings | | | 52,454,507 | |

| |

Net Assets | | | $904,295,244 | |

| |

Class I: | | | | |

| |

Net Assets | | | $904,295,244 | |

| |

Shares outstanding | | | 20,778,332 | |

| |

Net asset value, offering and redemption price per share | | | $43.52 | |

The accompanying notes are an integral part of these financial statements.

13

| | |

| | | Statement of Operations For the fiscal year ended September 30, 2021 |

| | | |

| | | |

| | | | |

| | | AMG

Boston Common

Global Impact

Fund | |

| |

Investment Income: | | | | |

| |

Dividend income | | | $10,722,807 | |

| |

Securities lending income | | | 243,214 | |

| |

Foreign withholding tax | | | (763,631 | ) |

| |

Total investment income | | | 10,202,390 | |

| |

Expenses: | | | | |

| |

Investment advisory and management fees | | | 7,852,361 | |

| |

Administrative fees | | | 1,428,186 | |

| |

Shareholder servicing fees - Class I | | | 119,238 | |

| |

Transfer agent fees | | | 97,967 | |

| |

Custodian fees | | | 81,532 | |

| |

Reports to shareholders | | | 81,176 | |

| |

Professional fees | | | 69,516 | |

| |

Trustee fees and expenses | | | 64,511 | |

| |

Registration fees | | | 39,160 | |

| |

Miscellaneous | | | 33,550 | |

| |

Total expenses before offsets | | | 9,867,197 | |

| |

Expense reimbursements | | | (21,540 | ) |

| |

Total expenses | | | 9,845,657 | |

| | | | |

| |

Net investment income | | | 356,733 | |

| |

Net Realized and Unrealized Gain: | | | | |

| |

Net realized gain on investments | | | 341,239,023 | |

| |

Net realized loss on forwards contracts | | | (215,350 | ) |

| |

Net realized gain on futures contracts | | | 1,011,495 | |

| |

Net realized loss on foreign currency transactions | | | (396,818 | ) |

| |

Net change in unrealized appreciation/depreciation on investments | | | (86,325,191 | ) |

| |

Net change in unrealized appreciation/depreciation on foreign currency translations | | | (8,449 | ) |

| |

Net realized and unrealized gain | | | 255,304,710 | |

| | | | |

| |

Net increase in net assets resulting from operations | | | $255,661,443 | |

The accompanying notes are an integral part of these financial statements.

14

| | |

| | | Statements of Changes in Net Assets For the fiscal years ended September 30, |

| | | |

| | | |

| | | | | | | | |

| | | AMG

Boston Common

Global Impact

Fund |

| | |

| | | 2021 | | 2020 |

| | |

Increase in Net Assets Resulting From Operations: | | | | | | | | |

| | |

Net investment income (loss) | | | $356,733 | | | | $(4,020,608) | |

| | |

Net realized gain on investments | | | 341,638,350 | | | | 134,871,648 | |

| | |

Net change in unrealized appreciation/depreciation on investments | | | (86,333,640 | ) | | | 4,073,500 | |

| | |

Net increase in net assets resulting from operations | | | 255,661,443 | | | | 134,924,540 | |

| | |

Distributions to Shareholders: | | | | | | | | |

| | |

Class I | | | (451,891,718 | ) | | | (78,234,351 | ) |

| | |

Capital Share Transactions:1 | | | | | | | | |

| | |

Net increase (decrease) from capital share transactions | | | 265,468,347 | | | | (7,781,771 | ) |

| | |

| | | | | | | | |

| | |

Total increase in net assets | | | 69,238,072 | | | | 48,908,418 | |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 835,057,172 | | | | 786,148,754 | |

| | |

End of year | | | $904,295,244 | | | | $835,057,172 | |

| 1 | See Note 1(g) of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

15

|

AMG Boston Common Global Impact Fund Financial Highlights For a share outstanding throughout each fiscal year |

| | | | | | | | | | | | | | | | | | | | |

| | | For the fiscal years ended September 30, | |

| | | | | |

| Class I | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 20171 | |

| | | | | |

Net Asset Value, Beginning of Year | | | $56.96 | | | | $52.89 | | | | $56.01 | | | | $44.48 | | | | $37.42 | |

| | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)2 | | | 0.02 | 3 | | | (0.27 | ) | | | (0.13 | ) | | | (0.21 | )3 | | | (0.17 | )3,4 |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | 15.47 | | | | 9.70 | | | | (2.99 | ) | | | 11.74 | | | | 7.23 | |

| | | | | |

Total income (loss) from investment operations | | | 15.49 | | | | 9.43 | | | | (3.12 | ) | | | 11.53 | | | | 7.06 | |

| | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net realized gain on investments | | | (28.93 | ) | | | (5.36 | ) | | | — | | | | — | | | | — | |

| | | | | |

Net Asset Value, End of Year | | | $43.52 | | | | $56.96 | | | | $52.89 | | | | $56.01 | | | | $44.48 | |

| | | | | |

Total Return5 | | | 31.75 | %3 | | | 18.95 | % | | | (5.57 | )% | | | 25.92 | %3 | | | 18.87 | %3 |

| | | | | |

Ratio of net expenses to average net assets | | | 1.03 | % | | | 1.11 | % | | | 1.10 | % | | | 1.10 | % | | | 1.11 | % |

| | | | | |

Ratio of gross expenses to average net assets | | | 1.03 | %6 | | | 1.11 | % | | | 1.10 | % | | | 1.10 | %6 | | | 1.12 | %6 |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.04 | %3 | | | (0.51 | )% | | | (0.26 | )% | | | (0.43 | )%3 | | | (0.43 | )%3 |

| | | | | |

Portfolio turnover | | | 202 | % | | | 221 | % | | | 145 | % | | | 138 | % | | | 187 | % |

| | | | | |

Net assets end of year (000’s) omitted | | | $904,295 | | | | $835,057 | | | | $786,149 | | | | $893,301 | | | | $771,474 | |

| 1 | Effective February 27, 2017, the Fund’s Class S shares were renamed to Class I shares. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 4 | Includes non-recurring dividends. Without these dividends, net investment loss per share would have been $(0.22). |

| 5 | The total return is calculated using the published Net Asset Value as of fiscal year end. |

| 6 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

16

| | |

| | | Notes to Financial Statements September 30, 2021 |

| | | |

| | | |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds I (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report is AMG Boston Common Global Impact Fund (formerly AMG Managers Brandywine Fund) (the “Fund”).

On March 17-18, 2021, the Board of Trustees of the Trust (the “Board”) approved Boston Common Asset Management, LLC (“Boston Common”) as the subadviser to the Fund on an interim basis to replace Friess Associates, LLC (“Friess”) and Friess Associates of Delaware, LLC (“Friess of Delaware”), effective March 19, 2021, which was subsequently approved by the shareholders of the Fund on May 18, 2021. In conjunction with the subadviser change, the Fund seeks to achieve its investment objective by investing in a diversified portfolio of global equities. In conjunction with the changes in investment strategy for the Fund, the Fund sold substantially all open positions around the date of the subadviser change that increased the Fund’s portfolio turnover. Also, during the transition of the Fund’s portfolio, the Fund invested in futures contacts and forward foreign currency contracts to manage exposure to foreign markets. The Fund also declared a special capital gain distribution on March 24, 2021.

Market disruptions associated with the COVID-19 pandemic have had a global impact, and uncertainty exists as to the long-term implications. Such disruptions can adversely affect assets of the Fund and thus Fund performance.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last quoted bid price or the mean between the last quoted bid and ask prices (the “mean price”). Equity securities traded in the over-the-counter market (other than NMS securities) are valued at the mean price. Foreign equity securities (securities principally traded in markets other than U.S. markets) are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of

amortized cost. Investments in other open-end registered investment companies are valued at their end of day net asset value per share.

Futures contracts for which market quotations are readily available are valued at the settlement price as of the close of the futures exchange.

The Fund’s portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based valuations provided by third party pricing services approved by the Board. Under certain circumstances, the value of certain Fund portfolio investments may be based on an evaluation of fair value, pursuant to procedures established by and under the general supervision of the Board. The Valuation Committee, which is comprised of the Independent Trustees of the Board, and the Pricing Committee, which is comprised of representatives from AMG Funds LLC (the “Investment Manager”) are the committees appointed by the Board to make fair value determinations. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is not readily available or otherwise not determinable pursuant to the Board’s valuation procedures, if the Investment Manager or the Pricing Committee believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Pricing Committee and, if required under the Trust’s securities valuation procedures, the Valuation Committee, seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with a quarterly report showing as of the most recent quarter end, all outstanding securities fair valued by the Fund, including a comparison with the prior quarter end and the percentage of the Fund that the security represents at each quarter end.

With respect to foreign equity securities and certain foreign fixed income securities, the Board has adopted a policy that securities held in the Fund that can be fair valued by the applicable fair value pricing service are fair valued on each business day provided that each individual price exceeds a pre-established confidence level.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund.

Unobservable inputs reflect the Fund’s own assumptions about the assumptions

17

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign currency exchange contracts, swaps, foreign securities utilizing international fair value pricing, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments.

b. SECURITY TRANSACTIONS

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

c. INVESTMENT INCOME AND EXPENSES

Dividend income is recorded on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, and if after the fact, as soon as the Fund becomes aware of the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Dividend and interest income on foreign securities is recorded gross of any withholding tax. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Upon notification from issuers, distributions received from a real estate investment trust (REIT) may be redesignated as a reduction of cost of investments and/or realized gain. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to the Fund are apportioned among the funds in the Trust and other trusts or funds within the AMG Funds Family of Funds (collectively the “AMG Funds Family”) based upon their relative average net assets or number of shareholders.

d. DIVIDENDS AND DISTRIBUTIONS

Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually in December. Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the

financial statements to reflect their tax character. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. There were no permanent differences. Temporary differences are primarily due to mark to market of passive foreign investment companies and wash sale loss deferrals.

The tax character of distributions paid during the fiscal years ended September 30, 2021 and September 30, 2020 were as follows:

| | | | | | | | |

| Distributions paid from: | | 2021 | | | 2020 | |

| | |

Ordinary income * | | $ | 266,048,264 | | | | — | |

| | |

Long-term capital gains | | | 185,843,454 | | | $ | 78,234,351 | |

| | | | | | | | |

| | |

| | $ | 451,891,718 | | | $ | 78,234,351 | |

| | | | | | | | |

| * | For tax purposes, short-term capital gain distributions, if any, are considered ordinary income distributions. |

As of September 30, 2021, the components of distributable earnings (excluding unrealized appreciation/depreciation) on a tax basis consisted of:

| | | | |

| |

Undistributed long-term capital gains | | $ | 4,198,687 | |

At September 30, 2021, the cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax purposes were as follows:

| | | | | | | | | | | | |

| Cost | | Appreciation | | | Depreciation | | | Net Appreciation | |

| | | |

| $880,017,235 | | | $89,359,969 | | | | $(41,104,149) | | | | $48,255,820 | |

e. FEDERAL TAXES

The Fund currently qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for federal income or excise tax is included in the accompanying financial statements.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

Management has analyzed the Fund’s tax positions taken on federal income tax returns as of September 30, 2021, and for all open tax years (generally, the three prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, Management is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

f. CAPITAL LOSS CARRYOVERS AND DEFERRALS

As of September 30, 2021, the Fund had no capital loss carryovers for federal income tax purposes. Should the Fund incur net capital losses for the fiscal year

18

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

ended September 30, 2022, such amounts may be used to offset future realized capital gains indefinitely, and retain their character as short-term and/or long-term.

g. CAPITALSTOCK

The Trust’s Declaration of Trust authorizes for the Fund the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date.

For the fiscal years ended September 30, 2021 and September 30, 2020, the capital stock transactions by class for the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | September 30, 2021 | | | September 30, 2020 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | |

Class I: | | | | | | | | | | | | | | | | |

| | | | |

Proceeds from sale of shares | | | 176,870 | | | | $8,489,156 | | | | 46,057 | | | | $2,373,834 | |

| | | | |

Reinvestment of distributions | | | 9,562,894 | | | | 422,177,212 | | | | 1,413,629 | | | | 72,476,754 | |

| | | | |

Cost of shares repurchased | | | (3,622,135) | | | | (165,198,021) | | | | (1,661,560) | | | | (82,632,359) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net increase (decrease) | | | 6,117,629 | | | | $265,468,347 | | | | (201,874) | | | | $(7,781,771) | |

| | | | | | | | | | | | | | | | |

h. REPURCHASE AGREEMENTS AND JOINT REPURCHASE AGREEMENTS

The Fund may enter into third-party repurchase agreements for temporary cash management purposes and third-party or bilateral joint repurchase agreements for reinvestment of cash collateral on securities lending transactions under the securities lending program offered by The Bank of New York Mellon (“BNYM”) (the “Program”) (collectively, “Repurchase Agreements”). The value of the underlying collateral, including accrued interest, must equal or exceed the value of the Repurchase Agreements during the term of the agreement. For joint repurchase agreements, the Fund participates on a pro rata basis with other clients of BNYM in its share of the underlying collateral under such joint repurchase agreements and in its share of proceeds from any repurchase or other disposition of the underlying collateral. The underlying collateral for all Repurchase Agreements is held in safekeeping by the Fund’s custodian or at the Federal Reserve Bank. If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. Pursuant to the Program, the Fund is indemnified for such losses by BNYM on joint repurchase agreements.

At September 30, 2021, the market value of Repurchase Agreements outstanding was $19,379,291.

i. FOREIGN CURRENCY TRANSLATION

The books and records of the Fund are maintained in U.S. dollars. The value of investments, assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon current foreign exchange rates. Purchases and sales of foreign investments, income and expenses are converted into U.S. dollars based on currency exchange rates prevailing on the respective dates of such transactions. Net realized and unrealized gain (loss) on foreign currency transactions represent: (1) foreign exchange gains and losses from the sale and holdings of foreign currencies; (2) gains and losses between trade date and settlement date on investment securities transactions and foreign currency exchange contracts; and (3) gains and losses from the difference between amounts of interest and dividends recorded and the amounts actually received.

The Fund does not isolate the net realized and unrealized gain or loss resulting from changes in exchange rates from the fluctuations in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

2. AGREEMENTS AND TRANSACTIONS WITH AFFILIATES

The Trust has entered into an investment advisory agreement under which the Investment Manager, a subsidiary and the U.S. retail distribution arm of Affiliated Managers Group, Inc. (“AMG”), serves as investment manager to the Fund and is responsible for the Fund’s overall administration and operations. The Investment Manager selects one or more subadvisers for the Fund (subject to Board approval) and monitors each subadviser’s investment performance, security holdings and investment strategies. Effective March 19, 2021, the Fund’s investment portfolio is managed by Boston Common who serves pursuant to a subadvisory agreement with the Investment Manager. AMG owns a minority equity interest in Boston Common. Prior to March 19, 2021, the Fund’s investment portfolio was managed by Friess and Friess of Delaware.

Investment management fees are paid directly by the Fund to the Investment Manager based on average daily net assets. Effective May 19, 2021, the Fund paid an investment management fee at the annual rate of 0.73% of the average daily net assets of the Fund. Prior to May 19, 2021, the Fund paid an investment management fee at the annual rate of 0.88% of the average daily net assets of the Fund.

The Investment Manager has contractually agreed, through at least February 1, 2023, to waive management fees and/or pay or reimburse fund expenses in order to limit total annual Fund operating expenses after fee waiver and expense reimbursements (exclusive of taxes, interest (including interest incurred in connection with bank and custody overdrafts, and in connection with securities sold short), shareholder servicing fees, distribution and service (12b-1) fees, brokerage commissions and other transaction costs, dividends payable with respect to securities sold short, acquired fund fees and expenses and extraordinary expenses) of the Fund to the annual rate of 0.93% of the Fund’s

19

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

average daily net assets (this annual rate or such other annual rate that may be in effect from time to time, the “Expense Cap”), subject to later reimbursement by the Fund in certain circumstances. Prior to May 19, 2021, the Fund did not have an expense limitation.

In general, for a period of up to 36 months after the date any amounts are paid, waived or reimbursed by the Investment Manager, the Investment Manager may recover such amounts from the Fund, provided that such repayment would not cause the Fund’s total annual operating expenses after fee waiver and expense reimbursements (exclusive of the items noted in the parenthetical above) to exceed either (i) the Expense Cap in effect at the time such amounts were paid, waived or reimbursed, or (ii) the Expense Cap in effect at the time of such repayment by the Fund.

The contractual expense limitation may only be terminated in the event the Investment Manager or a successor ceases to be the investment manager of the Fund or a successor fund, by mutual agreement between the Investment Manager and the Board, or in the event of the Fund’s liquidation unless the Fund is reorganized or is a party to a merger in which the surviving entity is successor to the accounting and performance information of the Fund.

At September 30, 2021, the Fund’s expiration of reimbursements subject to recoupment is as follows:

| | | | |

Expiration Period | | | |

| |

2-3 years | | $ | 21,540 | |

| | | | |

| |

Total | | $ | 21,540 | |

| | | | |

The Trust, on behalf of the Fund, has entered into an amended and restated Administration Agreement under which the Investment Manager serves as the Fund’s administrator (the “Administrator”) and is responsible for all non-portfolio management aspects of managing the Fund’s operations, including administration and shareholder services to the Fund. The Fund pays a fee to the Administrator at the rate of 0.15% per annum of the Fund’s average daily net assets for this service.

The Fund is distributed by AMG Distributors, Inc. (the “Distributor”), a wholly-owned subsidiary of the Investment Manager. The Distributor serves as the distributor and underwriter for the Fund and is a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Shares of the Fund will be continuously offered and will be sold directly to prospective purchasers and through brokers, dealers or other financial intermediaries who have executed selling agreements with the Distributor. Generally the Distributor bears all or a portion of the expenses of providing services pursuant to the distribution agreement, including the payment of the expenses relating to the distribution of prospectuses for sales purposes and any advertising or sales literature.