UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG FUNDS I

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

| | |

| Date of fiscal year end: September 30 |

|

Date of reporting period: OCTOBER 1, 2019 – SEPTEMBER 30, 2020 (Annual Shareholder Report) |

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | |

| | | AMG Funds September 30, 2020 |

| | |

|

| | |

| | | AMG Managers Brandywine Fund |

| | | Class I: BRWIX |

| | |

| | | AMG Managers Brandywine Blue Fund |

| | | Class I: BLUEX |

| | | |

| | | |

| | | |

| | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary or, if you invest directly with the Funds, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1.800.548.4539 to inform the Funds that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Funds.

| | | | |

| amgfunds.com | | | | 093020 AR073 |

|

AMG Funds Annual Report — September 30, 2020 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 4 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 5 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, ROSES AND THORNS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG Managers Brandywine Fund | | | 10 | |

| | | |

| | | AMG Managers Brandywine Blue Fund | | | 13 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 20 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 21 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 22 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 23 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 25 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 30 | |

| | | |

| | | OTHER INFORMATION | | | 31 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 32 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 34 | |

| | | | | | | |

|

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

DEAR FELLOW SHAREHOLDER:

Stocks extended their climb in the September quarter, continuing a dramatic rise from the Covid-crisis depths reached in March. Mirroring the market’s response in the spring, investor confidence in the recovery outweighed concerns about lingering risks posed by the ongoing pandemic.

AMG Managers Brandywine Fund (“Brandywine”) rose 9.16 percent in the three months through September. The Russell 3000® and Russell 3000® Growth Indexes gained 9.21 and 12.86 percent. AMG Managers Brandywine Blue Fund (“Brandywine Blue”) increased 13.37 percent in the quarter as the S&P 500®, Russell 1000® and Russell 1000® Growth Indexes added 8.93, 9.47 and 13.22 percent.

The recent run of enthusiasm left stocks in positive territory through the first nine months of 2020. AMG Managers Brandywine Fund finished September with a 9.48 percent year-to-date return, while the Russell 3000® and Russell 3000® Growth Indexes gained 5.41 and 23.00 percent. AMG Managers Brandywine Blue Fund returned 17.59 percent in the same period. The S&P 500®, Russell 1000® and Russell 1000® Growth Indexes increased 5.57, 6.40 and 24.33 percent.

Investors saw reason for optimism in the first couple months of the September quarter, including better-than-expected job gains and optimism that Congress would provide additional economic stimulus. Second-quarter earnings results appeared to contribute to confidence, with more than two-thirds of the companies in the S&P 500® Index reporting earnings above the mean estimate.

Technology played a central role in keeping the wheels of commerce turning despite the limitations related to the outbreak. Housing also emerged as a significant bright spot, with low rates spurring robust increases in housing starts and existing home sales. Excitement surrounding these trends helped propel major indexes to record highs in August. It turned out to be the best August for the S&P 500® Index in more than three decades.

Things changed in September. Lacking evidence of any tangible progress, investors viewed the prospect of an agreement being reached regarding a new round of stimulus for the economy before upcoming elections as increasingly dim. Volatility rose as the market changed direction. Leaders to the upside, namely technology companies, led the market lower as investors challenged their previous assumptions.

Despite the drama late in the period, the three months through September represented a broadly positive period for stocks. Every economic sector represented in the Brandywine portfolio, save a small decline in consumer staples, gained ground. All sectors in the Brandywine Blue portfolio posted positive absolute returns.

Technology holdings comprised the largest percentage of assets in Brandywine and Brandywine Blue and contributed the most to total gains in both Funds. Semiconductor holdings were top performers amid expectation-beating earnings results.

Enphase Energy, which makes microinverter systems used in solar energy applications, exceeded June-quarter estimates by 23 percent. The company also announced that it initiated shipments of a new battery storage system product. Advanced Micro Devices beat June-quarter expectations with earnings per share of

$0.18, up from $0.08 in the year-ago period. Results showed that the company captured market share in processors used in the desktop, notebook and server markets. Both companies were held by both Funds.

Other standout performers from the technology sector held by both Funds included Corning, Salesforce.com and The Trade Desk. Despite sharing some holdings, the Funds experienced different outcomes in terms of relative performance. Technology was the biggest detractor from Brandywine’s performance relative to the Russell 3000® Growth Index, while the sector was the second biggest contributor to Brandywine Blue’s performance versus the Russell 1000® Growth Index.

Consumer discretionary holdings, including Amazon (both Funds) and Chewy (Brandywine only), were the second biggest contributors to Brandywine’s absolute return. Both companies thrived as their online business models proved to be well-suited for pandemic conditions. Revenue for Amazon and Chewy grew 40 and 47 percent, respectively, in their most recently reported quarters. As a group, however, consumer discretionary holdings trailed the sector within the benchmark, making it Brandywine’s second biggest relative performance detractor.

Industrial holdings were the second biggest contributors to Brandywine Blue’s absolute performance and the most pronounced positive influence on relative results. Generac Holdings was a notable contributor as the work-from-home trend helped drive a 30 percent increase in sales of the company’s residential standby generators. Reservations early in the pandemic about the outlook for turf equipment prompted analysts to be overly conservative regarding Toro Co., which exceeded June-quarter estimates by 50 percent on strength driven by rises in golf course usage and residential lawncare. Both companies were held by both Funds.

There were fewer holdings that declined than usual in the mostly positive environment of the September quarter, and most declines were relatively modest. Sabre Corp. (Brandywine) and Ciena Corp. (both Funds) were exceptions.

June-quarter results for Sabre, which provides various technology solutions to the travel industry, showed that it was too early to take fledgling signs of improvement in tourism as evidence of a broader trend. As for Ciena, a networking infrastructure provider, solid results in its July-quarter earnings report didn’t signify full emergence from pandemic-related problems. The company reported conservative spending trends among customers and restrictions in India were likely to fuel uncertainty in coming quarters.

For more information on holdings that influenced September-quarter results, please see Roses & Thorns on page 7 for Brandywine and page 14 for Brandywine Blue.

Thanks for your long-term focus and continued confidence. We’re encouraged by recent results and working hard to build on them.

Scott Gates

Chief Investment Officer

Friess Associates, LLC

2

|

About Your Fund’s Expenses |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

Six Months Ended September 30, 2020 | | Expense

Ratio for

the Period | | Beginning

Account

Value

04/01/20 | | Ending

Account

Value

09/30/20 | | Expenses

Paid

During

the Period* |

AMG Managers Brandywine Fund |

|

Based on Actual Fund Return |

| | | | |

Class I | | 1.11% | | $1,000 | | $1,351 | | $6.52 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 1.11% | | $1,000 | | $1,019 | | $5.60 |

AMG Managers Brandywine Blue Fund |

|

Based on Actual Fund Return |

| | | | |

Class I | | 1.17% | | $1,000 | | $1,386 | | $6.98 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 1.17% | | $1,000 | | $1,019 | | $5.91 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

3

|

AMG Managers Brandywine Fund Portfolio Manager’s Comments (unaudited) |

| | | | | | | | |

Early optimism abruptly gave way to widespread fear that was soon overcome by a new bout of enthusiasm, leaving stocks with healthy gains in a fiscal year that featured a bear market induced by a global health crisis. Despite an economic recession and a continuing pandemic, investors found ample reason for optimism in the 12 months through September 30, 2020. AMG Managers Brandywine Fund (the “Fund”) employs an investment strategy that is based on the premise that company-specific fundamentals, with a particular emphasis on earnings, drive stock prices. While conceding that broader trends influence stocks as a group during certain periods, this approach considers such periods to be finite, with investors ultimately returning to judge each company on its individual merits over time. Macro factors played a significant role in defining market sentiment during the fiscal year, with the government’s aggressive response to an economic shock rising above other forces to promote confidence amid trying conditions. The sentiment resulting from the applied stimulus fueled some disparity between stock prices and fundamentals in certain areas, though the environment was generally good for our approach. The Fund rose 18.95 percent in its fiscal year. The fiscal year began on a positive note, with volatility stemming from U.S.-China trade relations abating throughout the final three months of 2019 as the world’s two largest economies approached and eventually agreed to a “phase one” trade deal. Late-quarter confidence regarding trade was a continuation of an upbeat attitude evident in | | | | October, when investors anticipated, then celebrated the U.S. Federal Reserve Bank’s (the Fed) third interest rate reduction for the calendar year. Throughout the period, the most pronounced threat to stocks all year, the risk of recession highlighted by an inversion of the yield curve in August, retreated as a stream of comforting economic data flowed. The Fund participated in the positive market environment that marked the December quarter, with seven of nine economic sectors represented in its portfolio posting positive absolute returns. Technology and health care holdings, its two biggest concentrations of assets at the time, drove performance. The emergence of the Covid-19 pandemic sparked widespread fear that ultimately pushed major market indexes into bear market territory during the three months through March. The March quarter ended up being the worst quarter since the waning months of the 2008 financial crisis for the S&P 500® Index and the worst quarter since 1987 for the Dow Jones Industrial Average. The Fund participated in the double-digit market downturn, with holdings perceived to be among the most economically sensitive leading the way. Holdings from the technology and consumer discretionary sectors, representing the largest and third largest portfolio positions, respectively, detracted the most from performance. Stocks staged a comeback of historic proportions in the three months through June as aggressive action taken by the government emboldened investors to look beyond near-term economic trouble. From direct payments to individuals from the U.S. Treasury to rock-bottom rates courtesy of the Fed, optimism | | | | stemmed from the government’s various forms of intervention designed to support commerce and market integrity. Portfolio holdings rebounded with the rest of the market. Illustrating the market’s mood reversal, the holdings that led the Fund’s decline in the previous quarter, technology and consumer discretionary holdings, drove the Fund to a double-digit gain in the June quarter. Upbeat sentiment carried into the September quarter, running through July and August. Major market indexes reached new highs in mid-August, bringing an end to the shortest bear market in history. Better-than-expected job gains, housing strength and hope for another round of stimulus maintained the positive mood. The market showed few signs of weakness until September, when negotiations regarding new stimulus appeared at a standstill. Still, the final quarter of the fiscal year was positive in aggregate. Every economic sector represented in the Fund’s portfolio, except for an isolated decline in consumer staples, posted positive absolute returns. Technology and consumer discretionary holdings, which at the time represented the Fund’s largest portfolio positions, contributed the most to the Fund’s return. This commentary reflects the viewpoints of Friess Associates, LLC as of September 30, 2020 and is not intended as a forecast or guarantee of future results. |

4

|

AMG Managers Brandwine Fund Portfolio Manager’s Comments (continued) |

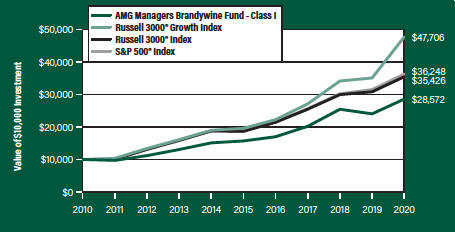

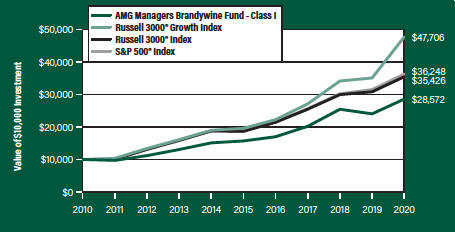

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Managers Brandywine Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Managers Brandywine Fund’s Class I shares on September 30, 2010, to a $10,000 investment made in the Russell 3000® Growth Index, Russell 3000® Index and S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Brandywine Fund and the Russell 3000® Growth Index, Russell 3000® Index and S&P 500® Index for the same time periods ended September 30, 2020.

| | | | | | | | | | | | |

Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

|

AMG Managers Brandywine Fund2, 3, 4, 5, 6, 7, 8, 9 | |

| | | |

Class I | | | 18.95% | | | | 12.74 | % | | | 11.07% | |

| | | |

Russell 3000® Growth Index10, 13 | | | 36.12% | | | | 19.51 | % | | | 16.91% | |

| | | |

Russell 3000® Index11, 13 | | | 15.00% | | | | 13.69 | % | | | 13.48% | |

| | | |

S&P 500® Index12, 13 | | | 15.15% | | | | 14.15 | % | | | 13.74% | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2020. All returns are in U.S. dollars ($). |

| | |

| | | 2 The Fund returns for all periods prior to October 1, 2013, reflect performance of the predecessor fund, Brandywine Fund, and was managed by Friess Associates, LLC with the same investment objective and substantially similar investment policies. 3 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 4 The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. 5 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 6 Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 7 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. 8 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 9 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 10 The Russell 3000® Growth Index measures the performance of those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. 11 The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. 12 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. 13 Unlike the Fund, indices are unmanaged, are not available for investment and do not incur expenses. The Russell Indices are trademarks of the London Stock Exchange Group companies. The S&P500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved. Not FDIC insured, nor bank guaranteed. May lose value. |

5

|

AMG Managers Brandywine Fund Fund Snapshots (unaudited) September 30, 2020 |

PORTFOLIO BREAKDOWN

| | | | | | | | |

Industry (Top Ten) | | AMG Managers Brandywine Fund1 | | | Russell 3000® Growth Index | |

| | | |

Application Software | | | 10.3% | | | | 6.9% | |

| | | |

Interactive Media & Services | | | 6.7% | | | | 7.8% | |

| | | |

Semiconductors | | | 6.4% | | | | 4.8% | |

| | | |

Building Products | | | 5.3% | | | | 0.3% | |

| | | |

Health Care Equipment | | | 4.9% | | | | 2.7% | |

| | | |

Internet & Direct Marketing Retail | | | 4.7% | | | | 8.5% | |

| | | |

Semiconductor Equipment | | | 4.5% | | | | 1.1% | |

| | | |

Interactive Home Entertainment | | | 4.2% | | | | 0.3% | |

| | | |

Electronic Components | | | 3.6% | | | | 0.1% | |

| | | |

Life Sciences Tools & Services | | | 3.4% | | | | 1.5% | |

| | | |

Other Common Stock | | | 43.5% | | | | 66.0% | |

| | | |

Short-Term Investments | | | 4.1% | | | | 0.0% | |

| | | |

Other Assets | | | (1.6)% | | | | 0.0% | |

| 1 | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | | | | | |

Security Name | | % of Net Assets | | | % Change from Book Cost | |

| | | |

Tandem Diabetes Care, Inc. | | | 4.9 | | | | 126.4 | |

| | | |

Amazon.com, Inc. | | | 4.7 | | | | 69.1 | |

| | | |

Facebook, Inc., Class A | | | 2.9 | | | | (5.2) | |

| | | |

Adobe, Inc. | | | 2.6 | | | | 96.3 | |

| | | |

Generac Holdings, Inc. | | | 2.4 | | | | 69.6 | |

| | | |

Enphase Energy, Inc. | | | 2.4 | | | | 78.2 | |

| | | |

salesforce.com, Inc. | | | 2.3 | | | | 60.9 | |

| | | |

SVMK, Inc. | | | 2.3 | | | | 10.1 | |

| | | |

Corning, Inc. | | | 2.2 | | | | 16.6 | |

| | | |

Activision Blizzard, Inc. | | | 2.2 | | | | 33.6 | |

| | | | | | | | | |

| | | |

Top Ten as a Group | | | 28.9 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

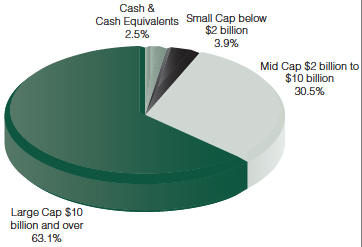

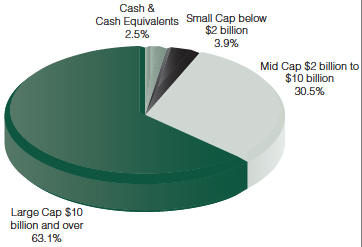

PORTFOLIO MARKET CAPITALIZATION

ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS

Forecasted Increase in Earnings Per Share 2021 vs 2020

Source: Consensus estimates from FactSet Research Systems Inc.

This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

|

AMG Managers Brandywine Fund Roses and Thorns (unaudited) Quarter Ending September 30, 2020 |

| | | | | | |

$ Gain (in millions) | | % Gain | | | Biggest $ Winners Reason for Move |

| | |

| $8.3 | | | 73.6% | | | Enphase Energy Inc. (ENPH) |

| | |

| | | | | | | The maker of microinverter systems used in solar photovoltaics reported June-quarter earnings of $0.17 per share, exceeding the consensus estimate. Enphase benefitted from strong demand for residential solar installations. The company also began North American shipments of a new battery storage system product. |

| | |

| $7.5 | | | 61.8% | | | Advanced Micro Devices Inc. (AMD) |

| | |

| | | | | | | The semiconductor manufacturer earned $0.18 per share in the June quarter, up from $0.08 in the year-ago period and ahead of the consensus estimate. Market-share gains and strong personal computer and server demand drove results. The company also raised its full-year guidance. |

| | |

| $7.3 | | | 58.8% | | | Generac Holdings Inc. (GNRC) |

| | |

| | | | | | | The company, which makes power generation equipment, grew June-quarter earnings 17 percent, exceeding the consensus estimate. With more people spending more time at home, sales of residential standby generators increased 30 percent. The company raised guidance for the remainder of the year. |

| | |

| $6.1 | | | 49.4% | | | Chewy Inc. (CHWY) |

| | |

| | | | | | | The online retailer of pet-related products exceeded June-quarter expectations with 47 percent revenue growth. Customers viewed the company’s e-commerce fulfillment of pet foods and other products as a favorable alternative to in-person shopping amid pandemic restrictions and risks. Auto-ship sales, a source of recurring revenue, rose 50 percent during the quarter. |

| | |

| $5.5 | | | 49.4% | | | Twitter Inc. (TWTR) |

| | |

| | | | | | | Shares of Twitter, a microblogging and social networking service, increased amid enthusiasm for rebounding advertising trends. The three months through June represented the company’s sixth consecutive quarter of growth in monetizable daily active usage, meaning the audience for advertising on Twitter continued to expand. |

| | |

$Loss

(in millions) | | % Loss | | | Biggest $ Losers Reason for Move |

| | |

| $3.2 | | | 22.3% | | | Ciena Corp. (CIEN) |

| | |

| | | | | | | The provider of network and communications infrastructure grew July-quarter earnings 49 percent, exceeding the consensus estimate by 28 percent. Revenue growth also topped expectations. Shares declined when Ciena reduced near-term sales guidance, citing customer efforts to conserve cash amid macro headwinds and tight Covid-19 restrictions in India as impediments to growth in coming quarters. |

| | |

| $3.1 | | | 20.1% | | | Advanced Energy Industries Inc. (AEIS) |

| | |

| | | | | | | The company, which provides products used in semiconductor manufacturing and thin film plasma processes, earned $1.18 per share in the June quarter, up from $0.45 in the year-ago period and ahead of the consensus estimate. Purchased in August, shares declined as semiconductor capital equipment stocks joined other technology stocks in leading the market lower in September as investors grew anxious regarding a lack of progress in negotiations for economic stimulus. |

| | |

| $2.8 | | | 23.8% | | | Sabre Corp. (SABR) |

| | |

| | | | | | | While early signs of recovery in the travel space emerged incrementally, results for the technology solutions provider for the global travel and tourism industry showed that it was premature to expect a broader rebound in the three months through June. Bookings stabilized in the middle of the quarter, but a high level of cancellations early in the period resulted in disappointing overall results. |

| | |

| $2.5 | | | 17.0% | | | Calix Inc. (CALX) |

| | |

| | | | | | | The maker of telecommunications network equipment performed well in the summer months as results showed that increased internet usage spurred demand for its broadband access systems. The company earned $1.70 per share in the June quarter, far exceeding the consensus estimate of $0.06. Shares declined in September as Calix joined other technology stocks in leading the market lower as investors grew anxious regarding a lack of progress in negotiations for economic stimulus. |

| | |

| $2.3 | | | 33.2% | | | GoHealth Inc. (GOCO) |

| | |

| | | | | | | The internet-based health insurance marketplace operator reported solid June-quarter results, its first quarterly report since becoming a public company. Several lawsuits filed in relation to the company’s initial public offering raised investor concerns and weighed on GoHealth’s stock price. |

All gains/losses are calculated on an average cost basis from June 30, 2020 through September 30, 2020. Companies still held at the end of the period appear in the accompanying Schedule of Portfolio Investments.

This commentary reflects the viewpoints of Friess Associates, LLC as of September 30, 2020, and is not intended as a forecast or guarantee of future results.

7

|

AMG Managers Brandywine Fund Schedule of Portfolio Investments September 30, 2020 |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Common Stocks - 97.5% | | | | | |

| |

| | Communication Services | | | | | |

| | |

| | | | Interactive Home Entertainment - 4.2% | | | | | |

| | | |

| | 229,786 | | | Activision Blizzard, Inc. | | | $13,922,090 | | | | $18,601,177 | |

| | | |

| | 124,311 | | | Electronic Arts, Inc.* | | | 12,057,369 | | | | 16,211,397 | |

| | |

| | | | Interactive Media & Services - 6.7% | | | | | |

| | | |

| | 91,150 | | | Facebook, Inc., Class A* | | | 25,172,850 | | | | 23,872,185 | |

| | | |

| | 592,433 | | | Snap, Inc., Class A* | | | 14,239,696 | | | | 15,468,426 | |

| | | |

| | 373,239 | | | Twitter, Inc. * | | | 12,258,691 | | | | 16,609,135 | |

| | |

| | | | Movies & Entertainment - 2.2% | | | | | |

| | | |

| | 27,338 | | | Netflix, Inc.* | | | 9,694,441 | | | | 13,669,820 | |

| | | |

| | 183,303 | | | Warner Music Group Corp., Class A | | | 5,486,217 | | | | 5,268,129 | |

| | | | | | | | | | | | |

| | |

| | Total Communication Services | | | 92,831,354 | | | | 109,700,269 | |

| | |

| | | | This sector is 18.2% above your Fund’s cost. | | | | |

| | |

| | Consumer Discretionary | | | | | | | | |

| | |

| | | | Apparel, Accessories & Luxury Goods - 1.7% | | | | | |

| | | |

| | 205,184 | | | VF Corp. | | | 15,462,074 | | | | 14,414,176 | |

| | |

| | | | Automotive Retail - 0.8% | | | | | |

| | | |

| | 137,292 | | | Penske Automotive Group, Inc. | | | 6,505,173 | | | | 6,543,337 | |

| | |

| | | | Education Services - 1.4% | | | | | |

| | | |

| | 166,526 | | | Chegg, Inc.*,1 | | | 6,085,780 | | | | 11,896,617 | |

| | |

| | | | Footwear - 2.0% | | | | | |

| | | |

| | 382,009 | | | Crocs, Inc.* | | | 10,461,251 | | | | 16,323,245 | |

| | |

| | | | Home Improvement Retail - 2.5% | | | | | |

| | | |

| | 155,270 | | | Floor & Decor Holdings, Inc., Class A* | | | 10,872,018 | | | | 11,614,196 | |

| | | |

| | 596,546 | | | GrowGeneration Corp.*,1 | | | 9,544,259 | | | | 9,532,805 | |

| | |

| | | | Internet & Direct Marketing Retail - 4.7% | | | | | |

| | | |

| | 12,382 | | | Amazon.com, Inc.* | | | 23,060,330 | | | | 38,987,575 | |

| | |

| | | | Leisure Products - 1.5% | | | | | |

| | | |

| | 273,842 | | | YETI Holdings, Inc.* | | | 11,670,738 | | | | 12,410,519 | |

| | |

| | | | Specialty Stores - 1.7% | | | | | |

| | | |

| | 98,696 | | | Tractor Supply Co. | | | 14,752,314 | | | | 14,147,085 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Discretionary | | | 108,413,937 | | | | 135,869,555 | |

| | |

| | | | This sector is 25.3% above your Fund’s cost. | | | | |

| |

| | Financials | | | | | |

| | |

| | | | Property & Casualty Insurance - 1.7% | | | | | |

| | | |

| | 283,069 | | | First American Financial Corp. | | | 14,979,736 | | | | 14,411,043 | |

| | |

| | | | This sector is 3.8% below your Fund’s cost. | | | | |

| | |

| | Health Care | | | | | | | | |

| | |

| | | | Health Care Equipment - 4.9% | | | | | |

| | | |

| | 360,874 | | | Tandem Diabetes Care, Inc.* | | | 18,088,286 | | | | 40,959,199 | |

| | |

| | | | Health Care Technology - 0.2% | | | | | |

| | | |

| | 32,380 | | | GoodRx Holdings, Inc., Class A* | | | 1,490,775 | | | | 1,800,328 | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| | |

| | | | Life Sciences Tools & Services - 3.4% | | | | | |

| | | |

| | 96,313 | | | Repligen Corp.* | | | $14,543,337 | | | | $14,210,020 | |

| | | |

| | 32,617 | | | Thermo Fisher Scientific, Inc. | | | 5,572,949 | | | | 14,401,058 | |

| | |

| | | | Pharmaceuticals - 1.8% | | | | | |

| | | |

| | 88,809 | | | Zoetis, Inc. | | | 12,146,650 | | | | 14,686,344 | |

| | | | | | | | | | | | |

| | |

| | Total Health Care | | | 51,841,997 | | | | 86,056,949 | |

| | |

| | | | This sector is 66.0% above your Fund’s cost. | | | | |

| | |

| | Industrials | | | | | | | | |

| | |

| | | | Aerospace & Defense - 1.7% | | | | | |

| | | |

| | 30,094 | | | TransDigm Group, Inc. | | | 15,371,503 | | | | 14,298,261 | |

| | |

| | | | Agricultural & Farm Machinery - 1.4% | | | | | |

| | | |

| | 145,204 | | | The Toro Co. | | | 10,043,392 | | | | 12,189,876 | |

| | |

| | | | Building Products - 5.3% | | | | | |

| | | |

| | 265,122 | | | Masco Corp. | | | 15,176,870 | | | | 14,616,176 | |

| | | |

| | 230,006 | | | Owens Corning | | | 15,354,684 | | | | 15,826,713 | |

| | | |

| | 243,170 | | | UFP Industries, Inc. | | | 11,713,862 | | | | 13,741,536 | |

| | |

| | | | Electrical Components & Equipment - 2.4% | | | | | |

| | | |

| | 102,380 | | | Generac Holdings, Inc.* | | | 11,689,458 | | | | 19,824,863 | |

| | |

| | | | Railroads - 1.7% | | | | | |

| | | |

| | 179,277 | | | CSX Corp. | | | 14,268,153 | | | | 13,924,445 | |

| | |

| | | | Research & Consulting Services - 1.9% | | | | | |

| | | |

| | 509,235 | | | Clarivate PLC (Jersey)* | | | 15,108,180 | | | | 15,781,193 | |

| | |

| | | | Trucking - 1.4% | | | | | |

| | | |

| | 287,155 | | | Knight-Swift Transportation Holdings, Inc. | | | 12,178,746 | | | | 11,687,208 | |

| | | | | | | | | | | | |

| | |

| | Total Industrials | | | 120,904,848 | | | | 131,890,271 | |

| | |

| | | | This sector is 9.1% above your Fund’s cost. | | | | |

| |

| | Information Technology | | | | | |

| | |

| | | | Application Software - 10.3% | | | | | |

| | | |

| | 45,070 | | | Adobe, Inc.* | | | 11,261,231 | | | | 22,103,680 | |

| | | |

| | 75,800 | | | salesforce.com, Inc.* | | | 11,837,726 | | | | 19,050,056 | |

| | | |

| | 849,968 | | | SVMK, Inc.* | | | 17,062,354 | | | | 18,792,792 | |

| | | |

| | 34,337 | | | The Trade Desk, Inc., Class A* | | | 14,965,795 | | | | 17,813,349 | |

| | | |

| | | | Zoom Video Communications, Inc., | | | | | | | | |

| | | |

| | 17,751 | | | Class A* | | | 8,019,973 | | | | 8,344,923 | |

| | |

| | | | Communications Equipment - 2.0% | | | | | |

| | | |

| | 689,296 | | | Calix, Inc.* | | | 14,769,842 | | | | 12,255,683 | |

| | | |

| | 60,267 | | | Lumentum Holdings, Inc.* | | | 3,040,880 | | | | 4,527,860 | |

| | |

| | | | Data Processing & Outsourced Services - 3.3% | | | | | |

| | | |

| | 62,400 | | | Global Payments, Inc. | | | 11,300,463 | | | | 11,080,992 | |

| | | |

| | 49,387 | | | Mastercard, Inc., Class A | | | 9,582,574 | | | | 16,701,202 | |

| | |

| | | | Electronic Components - 3.6% | | | | | |

| | | |

| | 579,626 | | | Corning, Inc. | | | 16,104,370 | | | | 18,785,679 | |

The accompanying notes are an integral part of these financial statements.

8

|

AMG Managers Brandywine Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| |

| | Information Technology (continued) | | | | | |

| | |

| | | | Electronic Components - 3.6% (continued) | | | | | |

| | | |

| | 747,046 | | | Knowles Corp.* | | | $11,969,602 | | | | $11,130,985 | |

| | |

| | | | Internet Services & Infrastructure - 1.9% | | | | | |

| | | |

| | 8,147 | | | Snowflake, Inc., Class A*,1 | | | 1,996,341 | | | | 2,044,897 | |

| | | |

| | 56,969 | | | Twilio, Inc., Class A* | | | 15,040,269 | | | | 14,076,470 | |

| | |

| | | | Semiconductor Equipment - 4.5% | | | | | |

| | | |

| | 192,584 | | | Advanced Energy Industries, Inc.* | | | 15,173,630 | | | | 12,121,237 | |

| | | |

| | 238,152 | | | Enphase Energy, Inc.*,1 | | | 11,034,600 | | | | 19,668,973 | |

| | | |

| | 65,945 | | | Teradyne, Inc. | | | 5,749,751 | | | | 5,239,990 | |

| | | |

| | | | Semiconductors - 6.4% | | | | | | | | |

| | | |

| | 118,735 | | | Inphi Corp.* | | | 14,987,541 | | | | 13,328,004 | |

| | | |

| 86,651 | | | NXP Semiconductors, N.V.

(Netherlands) | | | 11,113,944 | | | | 10,814,911 | |

| | | |

| | 99,931 | | | Skyworks Solutions, Inc. | | | 14,752,046 | | | | 14,539,961 | |

| | | |

| | 81,330 | | | Universal Display Corp.1 | | | 15,058,449 | | | | 14,699,584 | |

| | | |

| | | | Systems Software - 1.9% | | | | | | | | |

| | | |

| | 114,150 | | | Zscaler, Inc.* | | | 7,671,479 | | | | 16,059,763 | |

| | |

| | | | Technology Hardware, Storage & Peripherals - 2.1% | | | | | |

| | | |

| | 151,428 | | | Apple, Inc. | | | 10,893,427 | | | | 17,536,877 | |

| | | | | | | | | | | | |

| | |

| | Total Information Technology | | | 253,386,287 | | | | 300,717,868 | |

| | |

| | | | This sector is 18.7% above your Fund’s cost. | | | | |

| | |

| | Materials | | | | | | | | |

| | | |

| | | | Metal & Glass Containers - 1.1% | | | | | | | | |

| | | |

| | 115,486 | | | Crown Holdings, Inc.* | | | 8,760,872 | | | | 8,876,254 | |

| | |

| | | | This sector is 1.3% above your Fund’s cost. | | | | |

| | |

| | Real Estate | | | | | | | | |

| | | |

| | | | Residential REITs - 1.5% | | | | | | | | |

| | | |

| | 88,552 | | | Sun Communities, Inc. | | | 12,560,351 | | | | 12,451,297 | |

| | | |

| | | | Specialized REITs - 1.7% | | | | | | | | |

| | | |

| | 44,619 | | | SBA Communications Corp. | | | 14,062,100 | | | | 14,210,259 | |

| | | | | | | | | | | | |

| | |

| | Total Real Estate | | | 26,622,451 | | | | 26,661,556 | |

| | |

| | | | This sector is 0.1% above your Fund’s cost. | | | | |

| | |

| | Total Common Stocks | | | 677,741,482 | | | | 814,183,765 | |

| | | |

Principal Amount | | | | | | | | | |

| |

| | Short-Term Investments - 4.1% | | | | | |

| |

| | Joint Repurchase Agreements - 1.4%2 | | | | | |

| | $446,605 | | | Bank of America Securities, Inc., dated 09/30/20, due 10/01/20, 0.060% total to be received $446,606 (collateralized by various U.S. Treasuries, 1.250% - 2.375%, 10/31/21 - 05/15/29, totaling $455,537) | | | 446,605 | | | | 446,605 | |

| | | | | | | | | | | | |

Principal Amount | | | | | Cost | | | Value | |

| | | |

| | $1,280,801 | | | Cantor Fitzgerald Securities, Inc., dated 09/30/20, due 10/01/20, 0.100% total to be received $1,280,805 (collateralized by various U.S. Government Agency Obligations, 0.415% - 9.000%, 10/25/20 - 06/20/69, totaling $1,306,417) | | | $1,280,801 | | | | $1,280,801 | |

| | | |

| 1,594,698 | | | Citadel Securities LLC, dated 09/30/20, due 10/01/20, 0.120% total to be received $1,594,703 (collateralized by various U.S. Treasuries, 0.000% - 7.500%, 10/08/20 - 08/15/50, totaling $1,626,599) | | | 1,594,698 | | | | 1,594,698 | |

| | | |

| 2,744,369 | | | Citigroup Global Markets, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $2,744,375 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 4.625%, 11/27/20 - 11/01/59, totaling $2,799,257) | | | 2,744,369 | | | | 2,744,369 | |

| | | |

| 2,744,369 | | | MUFG Securities America, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $2,744,375 (collateralized by various U.S. Government Agency Obligations, 2.000% - 5.000%, 08/01/35 - 09/01/50, totaling $2,799,256) | | | 2,744,369 | | | | 2,744,369 | |

| | | |

| 2,744,369 | | | RBC Dominion Securities, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $2,744,375 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 5.500%, 10/27/20 - 07/15/61, totaling $2,799,256) | | | 2,744,369 | | | | 2,744,369 | |

| | | | | | | | | | | | |

| | | |

| | | | Total Joint Repurchase Agreements | | | 11,555,211 | | | | 11,555,211 | |

| | | |

| Shares | | | | | | | | | |

| | Other Investment Companies - 2.7% | | | | | |

| | | |

| | 7,353,450 | | | Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%3 | | | 7,353,450 | | | | 7,353,450 | |

| | | |

| 7,353,450 | | | Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%3 | | | 7,353,450 | | | | 7,353,450 | |

| | | |

| 7,576,282 | | | JPMorgan U.S. Government Money Market Fund, IM Shares, 0.06%3 | | | 7,576,282 | | | | 7,576,282 | |

| | | |

| | | | Total Other Investment Companies | | | 22,283,182 | | | | 22,283,182 | |

| | | | | | | | | | | | |

| | |

| | Total Short-Term Investments | | | 33,838,393 | | | | 33,838,393 | |

| | |

| | Total Investments - 101.6% | | | 711,579,875 | | | | 848,022,158 | |

| | |

| | Other Assets, less Liabilities - (1.6%) | | | | | | | (12,964,986 | ) |

| | Total Net Assets - 100.0% | | | | | | | $835,057,172 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

9

|

AMG Managers Brandywine Fund Schedule of Portfolio Investments (continued) |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $19,656,225 or 2.4% of net assets, were out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the September 30, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

REITs Real Estate Investment Trusts

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of September 30, 2020:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks† | | | $814,183,765 | | | | — | | | | — | | | $ | 814,183,765 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | $ | 11,555,211 | | | | — | | | | 11,555,211 | |

| | | | |

Other Investment Companies | | | 22,283,182 | | | | — | | | | — | | | | 22,283,182 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | | $836,466,947 | | | $ | 11,555,211 | | | | — | | | $ | 848,022,158 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended September 30, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

10

|

AMG Managers Brandywine Blue Fund Portfolio Manager’s Comments (unaudited) |

| | | | |

The 12 months through September included exceptional extremes, beginning with the stock market’s upward progress being dramatically disrupted by the emergence of a global pandemic. Investors quickly accepted the near-term economic consequences and chose to view the prospects for recovery with enthusiasm, resulting in solid gains in large-cap benchmarks. AMG Managers Brandywine Blue Fund (the “Fund”) employs an investment strategy designed to capitalize on the relationship between operational performance and share prices by isolating companies with superior earnings profiles. While recognizing that broad factors can influence stocks for fleeting periods, this approach is based on the premise that individual-company fundamentals determine stock prices over the long haul. Given the far-reaching impact of the health crisis, macro factors were a significant market influence for much of the fiscal year. Still, the government’s swift and sizable response to the pandemic appeared to be the most pronounced macro influence, contributing to positive investor sentiment. The Fund’s earnings-driven investment strategy was generally effective in this climate. The Fund rose 27.84 percent in the fiscal year. The fiscal year began with some relief in October as investors applauded a third interest rate reduction by the U.S. Federal Reserve Bank. Volatility picked up as economic uncertainty resurfaced later in the final quarter of 2019 due to heightened trade tensions between the U.S. and China. The market’s mood became decidedly positive toward the end of the | | December quarter as the two countries reached a partial agreement. Fund holdings generated positive absolute returns in six of the nine economic sectors represented in the portfolio during the December quarter. Technology holdings, which comprised the Fund’s largest portfolio position, contributed the most to performance. Health care holdings, which represented the second largest portfolio position, were the second biggest contributors to results. Marred by the emergence of the Covid-19 crisis, the March quarter, spanning the first three months of 2020, was the worst quarter for the S&P 500® Index since the 2008 financial crisis. As fighting the pandemic prompted shutdowns, shelter-in-place orders and resource realignment, investors fled cyclical economic sectors. Record jobless claims further dampened expectations for companies in any way reliant on discretionary spending on the part of business or consumer customers. Performance trends reversed in the bear-market conditions of the March quarter. Every economic sector represented in the Fund declined. Technology and health care holdings, the Fund’s two largest portfolio positions at the time, went from being the biggest positive performance influences in the December quarter to the biggest performance detractors in the March quarter. There was no shortage of developments with potential to rattle investors during the three months through June, including the continuing pandemic, dismal economic data points and mass protests across the country. Still, investors bet on the promise | | of an unprecedented $1.6 trillion stimulus package above all else. With very few exceptions, investor sentiment was overtly positive in the June quarter. Technology holdings, which still represented the largest portfolio position, contributed the most to performance amid the market’s upbeat mood. Holdings from the consumer discretionary and health care sectors contributed to June-quarter performance as well. While the pace slowed some, the market maintained its upward bias in the final quarter of the fiscal year. Hope among investors that the government would provide additional economic stimulus fueled optimism through the first couple months of the September quarter. The S&P 500® reached a new all-time high in mid-August, ending the bear-market recovery in record time. Volatility picked up in September as stimulus negotiations stalled, but stocks still managed to preserve healthy gains for the quarter. Holdings from every economic sector represented in the Fund portfolio posted positive absolute returns. Technology holdings, led by semiconductor-related companies, were again top performance contributors. Holdings from the industrial, communication services and consumer discretionary sectors were also material performance contributors. This commentary reflects the viewpoints of Friess Associates, LLC as of September 30, 2020 and is not intended as a forecast or guarantee of future results. |

11

|

AMG Managers Brandywine Blue Fund Portfolio Manager’s Comments (unaudited) |

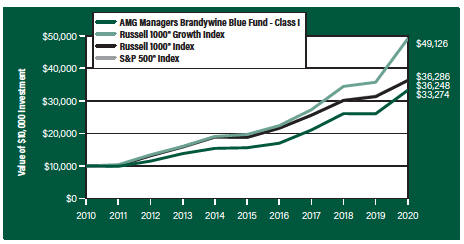

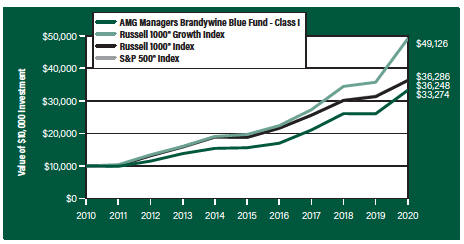

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Managers Brandywine Blue Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Managers Brandywine Blue Fund’s Class I shares on September 30, 2010, to a $10,000 investment made in the Russell 1000® Growth Index, Russell 1000® Index and S&P 500® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses.

The table below shows the average annual total returns for the AMG Managers Brandywine Blue Fund and the Russell 1000® Growth Index, Russell 1000® Index and S&P 500® Index for the same time periods ended September 30, 2020.

| | | | | | |

Average Annual Total Returns1 | | One Year | | Five Years | | Ten Years |

|

AMG Managers Brandywine Blue Fund2, 3, 4, 5, 6, 7, 8, 9 |

Class I | | 27.84% | | 16.37% | | 12.77% |

Russell 1000® Growth Index10, 13 | | 37.53% | | 20.10% | | 17.25% |

Russell 1000® Index11, 13 | | 16.01% | | 14.09% | | 13.76% |

S&P 500® Index12, 13 | | 15.15% | | 14.15% | | 13.74% |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of September 30, 2020. All returns are in U.S. dollars ($). |

| | |

| | | 2 The Fund returns for all periods prior to October 1, 2013, reflect performance of the predecessor fund, Brandywine Blue Fund, and was managed by Friess Associates, LLC with the same investment objective and substantially similar investment policies. 3 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. 4 A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. 5 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. 6 Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 7 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. 8 The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. 9 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 10 The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. 11 The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market. 12 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. 13 Unlike the Fund, indices are unmanaged, are not available for investment and do not incur expenses. The Russell Indices are trademarks of the London Stock Exchange Group companies. The S&P 500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved. Not FDIC insured, nor bank guaranteed. May lose value. |

12

|

AMG Managers Brandywine Blue Fund Fund Snapshots (unaudited) Septemer 30, 2020 |

PORTFOLIO BREAKDOWN

| | | | | | | | |

| Industry (Top Ten) | | AMG Managers Brandywine Blue Fund1 | | | Russell 1000® Growth Index | |

| | | |

Application Software | | | 10.5 | % | | | 6.9 | % |

| | | |

Interactive Media & Services | | | 8.9 | % | | | 8.2 | % |

| | | |

Semiconductors | | | 7.3 | % | | | 5.0 | % |

| | | |

Interactive Home Entertainment | | | 5.7 | % | | | 0.3 | % |

| | | |

Internet & Direct Marketing Retail | | | 5.4 | % | | | 8.9 | % |

| | | |

Building Products | | | 4.9 | % | | | 0.2 | % |

| | | |

Data Processing & Outsourced Services | | | 4.8 | % | | | 6.6 | % |

| | | |

Life Sciences Tools & Services | | | 4.8 | % | | | 1.5 | % |

| | | |

Technology Hardware, Storage & Peripherals | | | 3.2 | % | | | 11.4 | % |

| | | |

Internet Services & Infrastructure | | | 3.2 | % | | | 0.7 | % |

| | | |

Other Common Stock | | | 39.6 | % | | | 50.3 | % |

| | | |

Short-Term Investments | | | 4.0 | % | | | 0.0 | % |

| | | |

Other Assets | | | (2.3 | )% | | | 0.0 | % |

| 1 | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

| Security Name | | % of Net Assets | | % Change from Book Cost |

| | | |

Amazon.com, Inc. | | 5.4 | | 71.0 |

| | | |

salesforce.com, Inc. | | 3.6 | | 58.4 |

| | | |

The Trade Desk, Inc., Class A | | 3.3 | | 16.8 |

| | | |

Apple, Inc. | | 3.2 | | 57.5 |

| | | |

Snap, Inc. | | 3.2 | | 7.9 |

| | | |

Netflix, Inc. | | 3.1 | | 34.7 |

| | | |

Corning, Inc. | | 3.0 | | 15.1 |

| | | |

Facebook, Inc., Class A | | 3.0 | | (4.1) |

| | | |

Skyworks Solutions, Inc. | | 3.0 | | (1.6) |

| | | |

Thermo Fisher Scientific, Inc. | | 3.0 | | 130.4 |

| | | | | |

| | | |

Top Ten as a Group | | 33.8 | | |

| | | | | |

| | | | | |

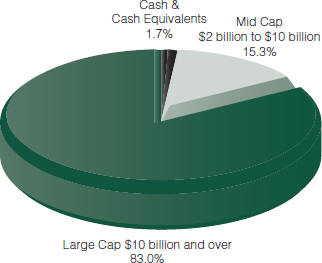

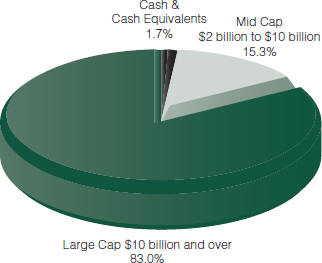

PORTFOLIO MARKET CAPITALIZATION

ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS

Forecasted Increase in Earnings Per Share 2021 vs 2020

Source: Consensus estimates from FactSet Research Systems Inc.

This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

13

|

AMG Managers Brandywine Blue Fund Roses and Thorns (unaudited) Quarter Ending September 30, 2020 |

| | | | | | |

$ Gain (in millions) | | % Gain | | Biggest $ Winners Reason for Move |

| $2.5 | | 61.8% | | Advanced Micro Devices Inc. (AMD) |

| | | | | The semiconductor manufacturer earned $0.18 per share in the June quarter, up from $0.08 in the year-ago period and ahead of the consensus estimate. Market-share gains and strong personal computer and server demand drove results. The company also raised its full-year guidance. |

| $2.3 | | 73.6% | | Enphase Energy Inc. (ENPH) |

| | | | | The maker of microinverter systems used in solar photovoltaics reported June-quarter earnings of $0.17 per share, exceeding the consensus estimate. Enphase benefitted from strong demand for residential solar installations. The company also began North American shipments of a new battery storage system product. |

| $2.2 | | 57.0% | | Generac Holdings Inc. (GNRC) |

| | | | | The company, which makes power generation equipment, grew June-quarter earnings 17 percent, exceeding the consensus estimate. With more people spending more time at home, sales of residential standby generators increased 30 percent. The company raised guidance for the remainder of the year. |

| $2.0 | | 33.9% | | Salesforce.com (CRM) |

| | | | | The company, which offers cloud-based enterprise software for customer relationship management, earned $1.44 per share in the July quarter, up from $0.66 in the year-ago period and more than double the consensus estimate. Revenue increased 29 percent. New customer wins and subscription-and-support revenue were highlights. |

| $1.7 | | 49.4% | | Twitter Inc. (TWTR) |

| | | | | Shares of Twitter, a microblogging and social networking service, increased amid enthusiasm for rebounding advertising trends. The three months through June represented the company’s sixth consecutive quarter of growth in monetizable daily active usage, meaning the audience for advertising on Twitter continued to expand. |

| | |

$ Loss

(in millions) | | % Loss | | Biggest $ Losers Reason for Move |

| $1.2 | | 22.7% | | Ciena Corp. (CIEN) |

| | | | | The provider of network and communications infrastructure grew July-quarter earnings 49 percent, exceeding the consensus estimate by 28 percent. Revenue growth also topped expectations. Shares declined when Ciena reduced near-term sales guidance, citing customer efforts to conserve cash amid macro headwinds and tight Covid-19 restrictions in India as impediments to growth in coming quarters. |

| $0.5 | | 14.5% | | Exact Sciences Corp. (EXAS) |

| | | | | The diagnostics company focused on the detection of colorectal cancer grew June-quarter revenue 35 percent. Results showed some disruption to sales of the company’s flagship Cologuard testing kits. Also, Illumina, which makes tools used in life sciences research, acquired Grail, a private maker of blood-based diagnostics tests, resulting in a combined entity that some view as a competitive threat to Exact Sciences. |

| $0.4 | | 6.4% | | Twilio Inc. (TWLO) |

| | | | | Purchased in late August, Twilio shares declined with other cloud-based software makers that were previously solid performers. We were not aware of any material news that affected the stock. Technology stocks led the market lower in September as investors grew anxious regarding a lack of progress in negotiations for economic stimulus. |

| $0.3 | | 6.6% | | VF Corp. (VFC) |

| | | | | Although the apparel and footwear company reported top- and bottom-line results for the June quarter that were modestly better than expected, investors expressed concern regarding profit margin pressure brought on by increased promotional activity. |

| $0.3 | | 4.5% | | Tractor Supply Co. (TSCO) |

| | | | | The operator of retail farm and ranch stores reported June-quarter earnings of $2.90 per share, 61 percent above the year-ago period and ahead of the consensus estimate. Shares declined in September as investors grew anxious regarding a lack of progress in negotiations for economic stimulus. We were not aware of any material news that affected the stock. |

All gains/losses are calculated on an average cost basis from June 30, 2020 through September 30, 2020. Companies still held at the end of the period appear in the accompanying Schedule of Portfolio Investments.

This commentary reflects the viewpoints of Friess Associates, LLC as of September 30, 2020, and is not intended as a forecast or guarantee of future results.

14

|

AMG Managers Brandywine Blue Fund Schedule of Portfolio Investments September 30, 2020 |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| | Common Stocks—98.3% | | | | | | | | |

| | Communication Services | | | | | | | | |

| | | | Interactive Home Entertainment - 5.7% | | | | | | | | |

| | 69,478 | | | Activision Blizzard, Inc. | | $ | 4,268,049 | | | $ | 5,624,244 | |

| | 41,976 | | | Electronic Arts, Inc.* | | | 4,200,631 | | | | 5,474,090 | |

| | | | Interactive Media &

Services - 8.9% | | | | | | |

| | 22,000 | | | Facebook, Inc., Class A* | | | 6,005,199 | | | | 5,761,800 | |

| | 238,971 | | | Snap, Inc., Class A* | | | 5,781,970 | | | | 6,239,533 | |

| | 118,282 | | | Twitter, Inc. * | | | 3,889,246 | | | | 5,263,549 | |

| | | | Movies &

Entertainment - 3.1% | | | | | | |

| | 12,060 | | | Netflix, Inc.* | | | 4,476,244 | | | | 6,030,362 | |

| | | | | | | | | | | | |

| | |

| | Total Communication Services | | | 28,621,339 | | | | 34,393,578 | |

| | |

| | | | This sector is 20.2% below your Fund’s cost. | | | | |

| | |

| | Consumer Discretionary | | | | | | | | |

| | |

| | | | Apparel, Accessories & Luxury Goods - 2.3% | | | | | |

| | 63,576 | | | VF Corp. | | | 4,781,052 | | | | 4,466,214 | |

| | |

| | | | Home Improvement Retail - 2.1% | | | | | |

| | 54,709 | | | Floor & Decor Holdings, Inc., Class A* | | | 3,834,863 | | | | 4,092,233 | * |

| | |

| | | | Internet & Direct Marketing Retail—5.4% | | | | | |

| | 3,350 | | | Amazon.com, Inc.* | | | 6,169,587 | | | | 10,548,246 | |

| | |

| | | | Specialty Stores—2.9% | | | | | |

| | 38,691 | | | Tractor Supply Co. | | | 5,805,155 | | | | 5,545,968 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Discretionary | | | 20,590,657 | | | | 24,652,661 | |

| | |

| | | | This sector is 19.7% above your Fund’s cost. | | | | |

| | |

| | Financials | | | | | | | | |

| | |

| | | | Property & Casualty Insurance - 2.4% | | | | | |

| | 94,200 | | | First American Financial Corp. | | | 4,998,657 | | | | 4,795,722 | |

| | | | | | | | | | | | |

| | |

| | | | This sector is 4.1% below your Fund’s cost. | | | | |

| | |

| | Health Care | | | | | | | | |

| | |

| | | | Life Sciences Tools & Services - 4.8% | | | | | |

| | 23,547 | | | Repligen Corp.* | | | 3,560,717 | | | | 3,474,125 | |

| | 13,010 | | | Thermo Fisher Scientific, Inc. | | | 2,492,945 | | | | 5,744,175 | |

| | |

| | | | Pharmaceuticals - 2.3% | | | | | |

| | 27,444 | | | Zoetis, Inc. | | | 3,756,326 | | | | 4,538,414 | |

| | | | | | | | | | | | |

| | |

| | Total Health Care | | | 9,809,988 | | | | 13,756,714 | |

| | |

| | | | This sector is 40.2% above your Fund’s cost. | | | | |

| | |

| | Industrials | | | | | | | | |

| | |

| | | | Aerospace & Defense - 1.6% | | | | | |

| | 6,532 | | | TransDigm Group, Inc. | | | 3,334,921 | | | | 3,103,484 | |

| | |

| | | | Agricultural & Farm Machinery - 2.0% | | | | | |

| | 46,032 | | | The Toro Co. | | | 3,227,008 | | | | 3,864,386 | |

| | |

| | | | Building Products - 4.9% | | | | | |

| | 85,300 | | | Masco Corp. | | | 4,880,001 | | | | 4,702,589 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| | 70,564 | | | Owens Corning | | $ | 4,728,738 | | | $ | 4,855,509 | |

| | |

| | | | Electrical Components & Equipment - 2.6% | | | | | |

| | | |

| | 26,245 | | | Generac Holdings, Inc.* | | | 3,009,935 | | | | 5,082,082 | |

| | |

| | | | Railroads - 2.1% | | | | | |

| | | |

| | 52,680 | | | CSX Corp. | | | 4,197,003 | | | | 4,091,655 | |

| | |

| | | | Research & Consulting Services - 2.7% | | | | | |

| | | |

| | 167,912 | | | Clarivate PLC (Jersey)* | | | 4,959,516 | | | | 5,203,593 | |

| | |

| | | | Trucking - 1.4% | | | | | |

| | | |

| | 66,796 | | | Knight-Swift Transportation Holdings, Inc. | | | 2,831,440 | | | | 2,718,597 | |

| | | | | | | | | | | | |

| | |

| | Total Industrials | | | 31,168,562 | | | | 33,621,895 | |

| | |

| | | | This sector is 7.9% above your Fund’s cost. | | | | |

| |

| | Information Technology | | | | | |

| | |

| | | | Application Software - 10.5% | | | | | |

| | | |

| | 10,121 | | | Adobe, Inc.* | | | 2,520,236 | | | | 4,963,642 | |

| | | |

| | 28,150 | | | salesforce.com, Inc.* | | | 4,466,693 | | | | 7,074,658 | |

| | | |

| | 12,262 | | | The Trade Desk, Inc., Class A* | | | 5,447,311 | | | | 6,361,281 | |

| | | |

| | 4,147 | | | Zoom Video Communications, Inc., Class A | | | 1,873,631 | | | | 1,949,546 | |

| | |

| | | | Data Processing & Outsourced Services - 4.8% | | | | | |

| | | |

| | 29,100 | | | Global Payments, Inc. | | | 5,310,350 | | | | 5,167,578 | |

| | | |

| | 12,374 | | | Mastercard, Inc., Class A | | | 2,164,570 | | | | 4,184,516 | |

| | |

| | | | Electronic Components - 3.0% | | | | | |

| | | |

| | 180,374 | | | Corning, Inc. | | | 5,078,755 | | | | 5,845,921 | |

| | |

| | | | Internet Services & Infrastructure - 3.2% | | | | | |

| | | |

| | 1,905 | | | Snowflake, Inc., Class A*,1 | | | 454,297 | | | | 478,155 | |

| | | |

| | 23,000 | | | Twilio, Inc., Class A* | | | 6,069,095 | | | | 5,683,070 | |

| | |

| | | | Semiconductor Equipment - 2.8% | | | | | |

| | | |

| | 65,311 | | | Enphase Energy, Inc.*,1 | | | 3,015,915 | | | | 5,394,035 | |

| | |

| | | | Semiconductors - 7.3% | | | | | |

| | | |

| | 22,779 | | | NXP Semiconductors, N.V. (Netherlands) | | | 2,917,162 | | | | 2,843,047 | |

| | | |

| | 39,492 | | | Skyworks Solutions, Inc. | | | 5,836,831 | | | | 5,746,086 | |

| | | |

| | 31,200 | | | Universal Display Corp. | | | 5,789,174 | | | | 5,639,088 | |

| | |

| | | | Systems Software - 2.4% | | | | | |

| | | |

| | 33,700 | | | Zscaler, Inc.* | | | 2,226,310 | | | | 4,741,253 | |

| | |

| | | | Technology Hardware, Storage & Peripherals - 3.2% | | | | | |

| | | |

| | 54,610 | | | Apple, Inc. | | | 4,016,184 | | | | 6,324,384 | |

| | | | | | | | | | | | |

| | |

| | Total Information Technology | | | 57,186,514 | | | | 72,396,260 | |

| | |

| | | | This sector is 26.6% above your Fund’s cost. | | | | |

| | |

| | Materials | | | | | | | | |

| | |

| | | | Metal & Glass Containers - 1.0% | | | | | |

| | | |

| | 26,864 | | | Crown Holdings, Inc.* | | | 2,038,750 | | | | 2,064,767 | |

| | |

| | | | This sector is 1.3% above your Fund’s cost. | | | | |

The accompanying notes are an integral part of these financial statements.

15

|

AMG Managers Brandywine Blue Fund Schedule of Portfolio Investments (continued) |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| |

| | Real Estate | | | | | |

| | |

| | | | Specialized REITs - 2.9% | | | | | |

| | | |

| | 17,600 | | | SBA Communications Corp. | | | $5,537,137 | | | | $5,605,248 | |

| | |

| | | | This sector is 1.2% above your Fund’s cost. | | | | |

| | |

| | Total Common Stocks | | | 159,951,604 | | | | 191,286,845 | |

| Principal

Amount |

| | | | | | | | | | |

| |

| | Short-Term Investments - 4.0% | | | | | |

| |

| | Joint Repurchase Agreements - 3.0%2 | | | | | |

| | | |

| | $1,385,273 | | | Citigroup Global Markets, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $1,385,276 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 4.625%, 11/27/20 - 11/01/59, totaling $1,412,979) | | | 1,385,273 | | | | 1,385,273 | |

| | | |

| | 1,385,273 | | | HSBC Securities USA, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $1,385,276 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 5.000%, 11/01/26 - 08/01/50, totaling $1,412,978) | | | 1,385,273 | | | | 1,385,273 | |

| | | |

| | 291,623 | | | JP Morgan Securities LLC, dated 09/30/20, due 10/01/20, 0.060% total to be received $291,623 (collateralized by various U.S. Treasuries, 0.000% - 1.750%, 11/19/20 - 08/31/24, totaling $297,456) | | | 291,623 | | | | 291,623 | |

| | | |

| | 1,385,273 | | | MUFG Securities America, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $1,385,276 (collateralized by various U.S. Government Agency Obligations, 2.000% - 5.000%, 08/01/35 - 09/01/50, totaling $1,412,978) | | | 1,385,273 | | | | 1,385,273 | |

| | | | | | | | | | | | |

Principal

Amount | | | | | Cost | | | Value | |

| | | |

| | $1,385,273 | | | RBC Dominion Securities, Inc., dated 09/30/20, due 10/01/20, 0.080% total to be received $1,385,276 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 5.500%, 10/27/20 - 07/15/61, totaling $1,412,978) | | $ | 1,385,273 | | | $ | 1,385,273 | |

| | | | | | | | | | | | |

| | | | Total Joint Repurchase Agreements | | | 5,832,715 | | | | 5,832,715 | |

| | Shares | | | | | | | | | | | |

| |

| | Other Investment Companies - 1.0% | | | | | |

| | | |

| | 640,627 | | | Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%3 | | | 640,627 | | | | 640,627 | |

| | | |

| | 640,627 | | | Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%3 | | | 640,627 | | | | 640,627 | |

| | | |

| | 660,040 | | | JPMorgan U.S. Government Money Market Fund, IM Shares, 0.06%3 | | | 660,040 | | | | 660,040 | |

| | | | Total Other Investment Companies | | | 1,941,294 | | | | 1,941,294 | |

| | | | | | | | | | | | |

| | |

| | Total Short-Term Investments | | | 7,774,009 | | | | 7,774,009 | |

| | |

| | Total Investments - 102.3% | | | 167,725,613 | | | | 199,060,854 | |

| |

| | Other Assets, less Liabilities - (2.3%) | | | | (4,413,488 | ) |

| |

| | Total Net Assets - 100.0% | | | $ | 194,647,366 | |

| | | | | | | | | | | | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $5,813,157 or 3.0% of net assets, were out on loan to various borrowers and are collateralized by cash. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the September 30, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| REITs Real | Estate Investment Trusts |

The accompanying notes are an integral part of these financial statements.