UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06526 | | |

| | |

| | |

| | | The Coventry Group | | |

|

| | | | (Exact name of registrant as specified in charter) | | |

| | | | | | |

| 3435 Stelzer Road | | Columbus, OH | | 43219 |

|

| | | | (Address of principal executive offices) | | (Zip code) |

| | | | | | |

| 3435 Stelzer Road | | Columbus, OH | | 43219 |

|

| | | | (Name and address of agent for service) | | |

| Registrant’s telephone number, including area code: | 1-800-282-8782 | | |

| | |

| | |

| | | | | | |

| Date of fiscal year end: | | March 31, 2009 | | |

| | |

| | |

| | | | | | |

| Date of reporting period: | | March 31, 2009 | | |

| | |

| | |

| | | |

| Item 1. | | Reports to Stockholders. |

| | | |

| | | |

| |

| |

| |

| |

|

| |

| Boston Trust Balanced Fund |

| Boston Trust Equity Fund |

| Boston Trust Small Cap Fund |

| Boston Trust Midcap Fund |

| |

| Walden Social Balanced Fund |

| Walden Social Equity Fund |

| Walden Small Cap Innovations Fund |

| |

| |

|

| |

| |

| |

| |

| |

| |

| | ANNUAL REPORT |

| |

| | March 31, 2009 |

| |

| |

| |

| |

Boston Trust Investment Management, Inc., a subsidiary of Boston Trust & Investment Management Company (BTIM) and an affiliate of Walden Asset Management (Walden) serves as investment adviser (the Adviser) to the Boston Trust and Walden Funds and receives a fee for its services. Walden, a division of BTIM, performs shareholder advocacy, proxy voting, screening services, and other social initiatives for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by Boston Trust & Investment Management Company or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by Foreside Distribution Services, L.P., Columbus, Ohio.

The foregoing information and opinions are for general information only. Boston Trust Funds and Boston Trust Investment Management, Inc. do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

Economic and Market

Summary (unaudited) | Boston Trust Balanced Fund

Boston Trust Equity Fund

Manager Commentary by Domenic Colasacco |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of these Funds will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Market and Performance Summary

Sadly, actual events during the first quarter of 2009 only confirmed widespread, broadly pessimistic near-term economic views. Early in January, it became clear that the sharp decline in Gross Domestic Product1 that began last September would persist through the winter months, with continued steep drops in consumer spending for durable goods such as automobiles, furniture and appliances. Business capital expenditures across a broad range of industries also fell. Not surprisingly, employment trends were especially weak, as businesses struggled to reduce expenses given the sudden fall in revenue. In just three months, roughly two million jobs were lost, and the unemployment rate jumped to 8.5%, the highest level in nearly 30 years. Economic news from Japan and across key European countries was also at the low end of negative forecasts.

One had to look hard for positive economic news during the past few months, but there was good progress on several fronts. Most importantly, the variety of programs initiated by the Federal Reserve (the “Fed”) since last fall to help stabilize credit markets began to be effective. On the fiscal side, the new Obama administration quickly passed an economic stimulus bill, and in March, the Treasury Department finally detailed a long-awaited plan to remove some problem, or so-called toxic, assets from bank balance sheets. Even though we suspect both of these fiscal programs will have to be enhanced and revised in the months ahead, they are essential, positive steps that help fill the economic void left by broad declines in private sector activity. Independent of these new government programs, toward quarter-end a few economic reports suggested that the rate of decline in consumer spending had begun to moderate. Positive news, however minor, is always welcome amid the deluge of adverse reports.

Despite our lack of confidence at year-end 2008 for an early resolution of the economic mess, we thought there was a reasonable prospect that the decline in aggregate stock prices already seen fully reflected the further deterioration in business conditions we anticipated. After all, from the peak reached in October 2007, the S&P 500 Index2 had already declined more than 40%. That prospect did not prove to be the case. From the first week of January through early March, the S&P 500 declined another 25%. About one-half of this fresh drop was recouped through the final few weeks of the first quarter of 2009. High day-to-day volatility and price advances that last for months (false starts that are called, in Wall Street parlance, bear market rallies) are typical in extended bear markets. Not until well after stock prices trough and economic activity improves is it possible to have full confidence that the worst has passed.

Economic Summary & Outlook

We generally dislike periods when the economy captures newspaper headlines or becomes the lead story in broadcast news. For economic events to rise to such levels of general interest has usually required dire developments. That has certainly been the case since last fall when Federal Reserve and Treasury Department intervention was required to prevent an implosion of our financial system. We will not repeat how we

|

| 1 | The Gross Domestic Product (GDP) is the measure of the market value of the goods and services produced by labor and property in the United States. |

| 2 | The Standard & Poor’s 500 Index (“S&P 500”) is an unmanaged index that is regarded as a gauge of the U.S. equities market, this index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. |

|

1

Economic and Market

Summary (unaudited)(cont.) | Boston Trust Balanced Fund

Boston Trust Equity Fund

Manager Commentary by Domenic Colasacco |

|

came to that point. Suffice to note that we are now in the midst of a severe global recession unlike any we have experienced since World War II. The essential difference from prior recessionary periods, in our view, is the near collapse of our largest financials institutions and the consequent sharp and deep drop in private sector economic activity. These developments required government intervention unprecedented in scale. We share the view that without such support, more banks would have failed and the current economic decline would be much worse.

Will these massive levels of monetary and fiscal stimulus succeed? Recent surveys have confirmed that most economic forecasters expect GDP trends to stabilize by summer and begin to rise prior to year-end 2009. Other economists are not as sanguine and have expressed concern that more government support will be required to effect a positive turn in GDP. Frankly, all economic forecasts in the current fragile financial environment come with a high degree of risk. Which (if any) prove prescient as time passes no one knows for sure. We do know that we are not yet in the type of sustainable, balanced economic environment that supported attractive investment returns through most of the 1980’s and 1990’s. Until we get there, financial markets will remain volatile. Stated differently, the transition toward a revised financial order, with more government involvement, is unlikely to be smooth.

Investment Strategy

For the 12-month period ended March 31, 2009, the Boston Trust Balanced Fund returned -18.68%, and the Boston Trust Equity Fund returned -32.73%. For the same period, the S&P 500 Index1, the Barclays Capital U.S. Government/Credit Index2 and the Citigroup 90-day U.S. Treasury Bill Index3 posted a -38.09%, 1.78% and 1.13% total return, respectively.

The Boston Trust Balanced Fund’s net asset value fell by 5.55% during the first quarter of 2009. That is clearly not pleasant in absolute terms but, as was the case in 2008, above the returns posted by most balanced mutual funds. Our decision to reduce the Fund’s equity allocation over the past 18 months from above 70% to just below 50% at year-end helped cushion the first quarter decline. At fiscal period end, stocks comprised roughly 45% of the Fund’s total value, the lowest level in over a decade.

We decided to reduce equity exposure further over the past few months in light of the lack of clarity in both the timing and strength of an economic recovery. Where does the Fund go from here? And when will this excruciating bear market end? Our thoughts on these questions are summarized below.†

Asset Allocation: Our policy and practice has been to keep the Balanced Fund’s equity allocation within an approximate range of 45% to 75% of total assets.† Two primary factors drive our allocation decision process: comparative equity valuations and prospective economic conditions. When both are favorable, we tend to keep stock exposure near maximum, while the opposite is true during periods of high stock prices and weak economics. Gradations in either or both factors lead us to some middle ground.†

At roughly 45%, the Balanced Fund’s current equity allocation is at the low end of its usual range. On the surface, such a low allocation implies that we have a bearish outlook for stocks. Yet that is not the reason we have chosen to de-emphasize equities at this time. By nearly all traditional valuation metrics stocks, in the aggregate, are now either fairly priced or simply bargains. If the more bullish economists prove correct, we would not be surprised to see the primary stock indices rise by 25% or so in just a few months. In that environment, we would look back with regret at not having purchased more stocks at today’s levels.†

Our continued cautious equity allocation primarily reflects the unusually high level of economic uncertainty. Stocks could just as easily decline 25% in the second quarter, rather than rise, if the economy fails to respond positively in the months ahead to recent government stimulus programs. We have always preferred to invest when economic trends are more settled and definitive. Among the things we would like to see prior to increasing significantly the Fund’s equity allocation are more evidence of a trough in home values, a moderation in job losses, lower credit spreads in fixed income markets and more confidence that the worst is behind us with respect to the health of our major banks and insurance companies. Stock prices may very well move higher as these issues clarify, but investment risks will be lower. We believe there will be many opportunities to generate attractive returns (with less risk) within an already improved economic environment.

|

| 1 | The Standard & Poor’s 500 Index (“S&P 500”) is an unmanaged index that is regarded as a gauge of the U.S. equities market, this index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. |

| 2 | The Barclays Capital U.S. Government/Credit Bond Index is a non-securitized component of the Barclays U.S. Aggregate Index and was the first macro index launched by Lehman Brothers. The U.S. Government/Credit Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), Government-Related issues (i.e., agency, sovereign, supranational, and local authority debt), and USD Corporates. |

| 3 | The Citigroup 90-Day U.S. Treasury Bills are represented by the U.S. Treasury Bill Total Return Index. Treasury bills are government guaranteed and offer a fixed rate of return. Return and principal of stocks and bonds will vary with market conditions. |

| † | Portfolio composition is subject to change. |

|

2

Economic and Market

Summary (unaudited)(cont.) | Boston Trust Balanced Fund

Boston Trust Equity Fund

Manager Commentary by Domenic Colasacco |

|

On behalf of all of us at Boston Trust & Investment Management Company, we thank you for your continued confidence in our services. Please feel free to contact us at (617) 726-7252 should you have any questions about our investment views or your account.

Domenic Colasacco

Portfolio Manager and President

Boston Trust Investment Management, Inc.

3

| Investment Performance (unaudited) | Boston Trust Balanced Fund

March 31, 2009 |

|

| Fund Net Asset Value: $23.33 | | | | | | | | | | | | |

| Gross Expense Ratio1: 1.09% | | Annualized |

| | |

|

| | | 1 Year Ended | | 5 Years Ended | | 10 Years Ended |

| | | 3/31/09 | | 3/31/09 | | 3/31/09 |

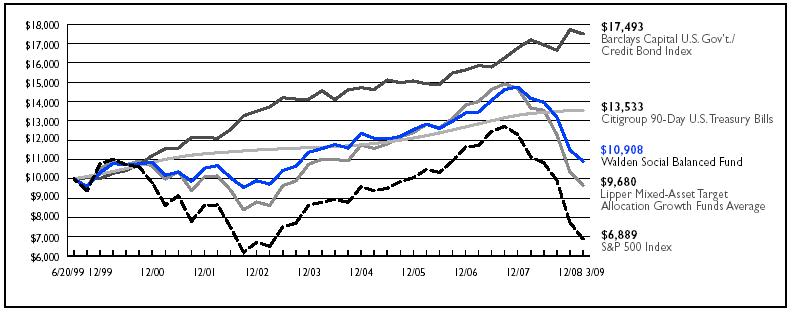

Boston Trust Balanced Fund | | | -18.68% | | | | 0.89% | | | | 2.24% | |

Lipper Mixed-Asset Target Allocation Growth Funds Average | | | -29.69% | | | | -2.45% | | | | 0.01% | |

S&P 500 Index | | | -38.09% | | | | -4.76% | | | | -3.00% | |

Barclays Capital U.S. Government/Credit Bond Index | | | 1.78% | | | | 3.74% | | | | 5.64% | |

Citigroup 90-Day U.S. Treasury Bill | | | 1.13% | | | | 3.06% | | | | 3.19% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2008. Additional information pertaining to the Fund’s expense ratios as of March 31, 2009 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occured, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2008, the Total Fund Operating Expenses would be 1.08% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

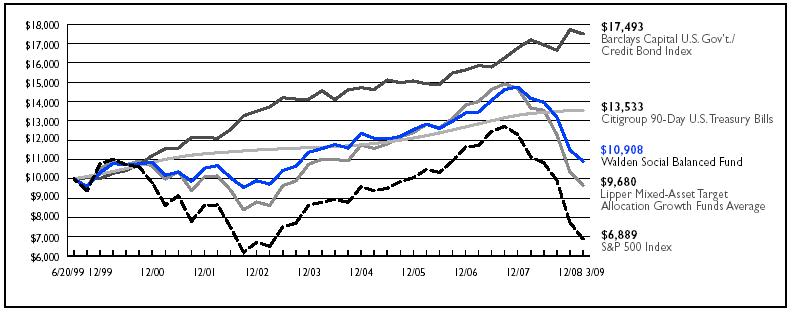

The chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Balanced Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of Fund shares.

The Boston Trust Balanced Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Government/Credit Bond Index is a non-securitized component of the Barclays U.S. Aggregate Index and was the first macro index launched by Lehman Brothers. The U.S. Government/Credit Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), Government-Related issues (i.e., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Citigroup 90-Day U.S. Treasury Bills are represented by the U.S. Treasury Bill Total Return Index. Treasury bills are government guaranteed and offer a fixed rate of return. Return and principal of stocks and bonds will vary with market conditions. The indices’ performance is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. The Lipper Average is an equally weighted index of the largest managed mutual funds within their respective investment objectives, adjusted for the reinvestment of capital gains distributions and income dividends. Investors cannot invest directly in an index.

The Lipper Mixed-Asset Target Allocation Growth Funds Average is an average of managed mutual funds whose primary objective is to maintain a mix of between 60%-80% equity securities with the remainder invested in bonds, cash and cash equivalents.

4

| Investment Performance (unaudited) | Boston Trust Equity Fund

March 31, 2009 |

|

| Fund Net Asset Value: $8.77 | | | | | | | | | | | | | | | | |

| Gross Expense Ratio1: 1.10% | | Annualized |

| | |

|

| | | 1 Year Ended | | 3 Years Ended | | 5 Years Ended | | Since Inception |

| | | 3/31/09 | | 3/31/09 | | 3/31/09 | | 10/1/03 |

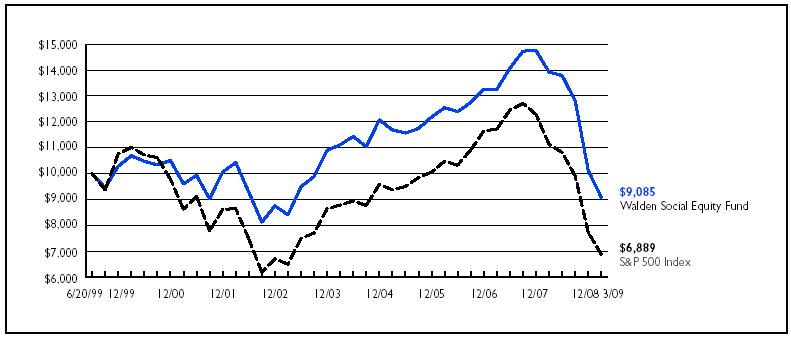

Boston Trust Equity Fund | | | -32.73% | | | | -9.00% | | | | -2.81% | | | | -0.87% | |

S&P 500 Index | | | -38.09% | | | | -13.06% | | | | -4.76% | | | | -2.42% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2008. Additional information pertaining to the Fund’s expense ratios as of March 31, 2009 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occured, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2008, the Total Fund Operating Expenses would be 1.10% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

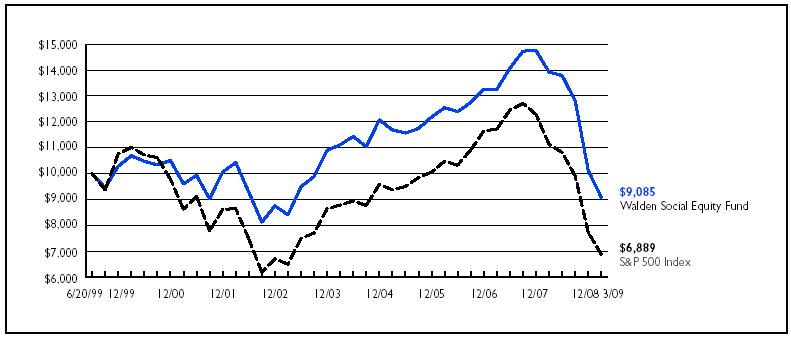

The chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Equity Fund from October 1, 2003 to March 31, 2009, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of Fund shares.

The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is an unmanaged index that is regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

5

Economic and Market

Summary (unaudited) | Boston Trust Small Cap Fund

Manager Commentary by Kenneth P. Scott |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Small-capitalization stocks typically carry additional risk, since smaller companies generally have higher risk of failure and, historically, their stocks have experienced a greater degree of volatility.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Economic and Market Summary

In the first quarter 2009, when equity markets continued to decline, the Boston Trust Small Cap Fund outperformed the Russell 2000® Index1 by approximately one and a half percent. For the trailing one, three, five, and 10 year periods ended March 31, 2009, the Boston Trust Small Cap Fund has outperformed the benchmark, while experiencing less volatility.

We focus our small cap research analysis on companies we judge to be more innovative, of higher quality and leveraged to investment themes offering significant benefits to their customers and the potential for long-term growth. During our period under review, firms with superior profitability, as indicated by returns on invested capital, performed comparatively well. Similarly, our investment in faster growing firms with less financial leverage also contributed to better relative small cap performance.

While we continue to aim for sector and market cap comparability, our underweight in stocks with market capitalizations below $100 million contributed positively to performance during the quarter. If small cap market indices remain at depressed levels, we believe this is likely to increase the benchmark tracking error of the Fund. In the current environment, identifying higher quality financial services firms remains a challenge. Still we narrowed our modest underweight in this sector, which had a small positive performance impact in the last three calendar months of the Fund’s fiscal period.†

We established new positions in four stocks in the Boston Trust Small Cap Fund during the period under review. Commerce Bancshares (1.07%) is a Midwest bank with a less stressed balance sheet and lower exposure to real estate. Another new holding, Computer Programs & Systems (0.52%), designs electronic medical record systems, which are expected to see continued growth, driven in part by regulatory reform efforts aiming to reduce medical errors. Gen-Probe (1.02%) makes human blood analysis equipment that detects disease, such as infectious microorganisms, TB, strep, pneumonia and fungal infections. Investment Technology Group (0.90%) manages the POSIT investment trading platform, which allows buyers and sellers to post, anonymously, large blocks to be matched on a periodic basis.†

Conversely, we sold the full positions of six stocks from the Fund during the period under review: Gaiam, Healthways, Interface, Kadant, School Specialty and SunOpta. We believe these firms are more likely than peers to experience continued deterioration in their fundamental performance; some of these firms, in our judgment, have near-term liquidity issues relative to existing debt obligations. The net result of this portfolio management and securities research activity was a turnover rate in line with our historical average.†

We recognize that strong relative returns may be cold comfort when the overall equity markets have declined so severely. Extraordinary market volatility is likely to linger, and significant risks and challenges remain, in small cap as well as large cap funds. However, the current valuation of small cap stocks is below historical averages leading us to expect better than average returns as the economy recovers, particularly for shares of companies whose growth prospects are uniquely leveraged to the fastest growing segments of the economy. In the meantime, we expect that the market’s lower appetite for risk will support demand for the shares of higher quality companies, especially when they are more reasonably valued than their peers. Our efforts to identify higher quality, innovative small cap companies at attractive prices continue.

The equities of the companies in bold-face in the commentary were holdings of the Boston Trust Small Cap Fund as of March 31, 2009.

Kenneth P. Scott, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

|

| 1 | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. |

| † | Portfolio composition is subject to change. |

|

6

| Investment Performance (unaudited) | Boston Trust Small Cap Fund

March 31, 2009 |

|

| Fund Net Asset Value: $7.21 | | | | | | | | | | | | |

| Gross Expense Ratio1: 1.15% | | Annualized |

| | |

|

| | | 1 Year Ended | | 5 Years Ended | | 10 Years Ended |

| | | 3/31/09 | | 3/31/09 | | 3/31/09 |

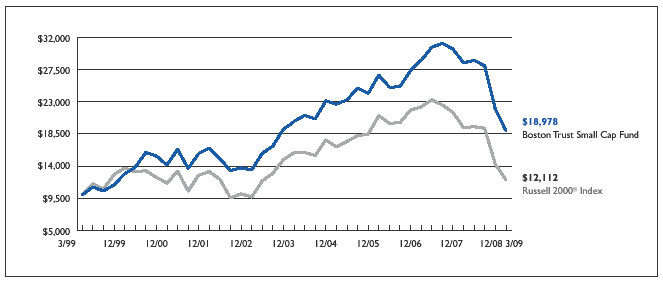

Boston Trust Small Cap Fund* | | | -33.24% | | | | -1.28% | | | | 6.62% | |

Russell 2000® Index | | | -37.50% | | | | -5.24% | | | | 1.93% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| * | The quoted performance for the Fund reflects the performance of a collective investment fund that was previously managed with full investment authority by the parent company of the Fund’s Adviser prior to the establishment of the Fund on December 16, 2005. The performance of the collective fund has been restated to reflect the net expenses of the Fund after all expenses at an annual rate of 1.25%, the Adviser’s expense limitation, for its initial year of investment operations. The performance of the collective investment fund was restated to reflect the expenses associated with the Mutual Fund. The collective investment fund was not registered with the Securities and Exchange Commission and, therefore, was not subject to the investment restrictions imposed by law on registered mutual funds. If the collective investment fund had been registered, the collective investment fund’s performance may have been adversely affected. |

| | |

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2008. Additional information pertaining to the Fund’s expense ratios as of March 31, 2009 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occured, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2008, the Total Fund Operating Expenses would be 1.14% and the Net Fund Operating Expenses would be 1.14% excluding the indirect costs of investing in Acquired Funds. |

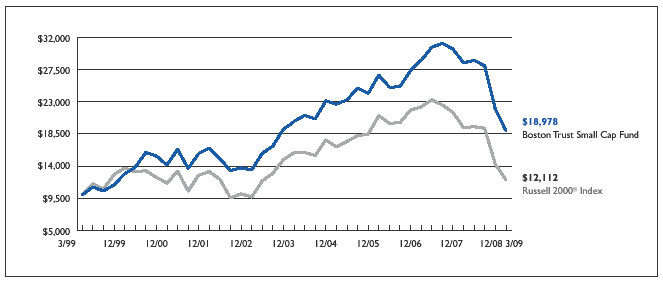

The chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Small Cap Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of Fund shares.

The Boston Trust Small Cap Fund is measured against the Russell 2000® Index, which is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

7

Economic and Market

Summary (unaudited) | Boston Trust Midcap Fund

Manager Commentary by Stephen J. Amyouny |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Small-capitalization stocks typically carry additional risk, since smaller companies generally have higher risk of failure and, historically, their stocks have experienced a greater degree of volatility.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Market Summary

In the first quarter of 2009, investors were harshly reminded of the long road to financial and economic recovery ahead. The historic election of President Obama initially brought widespread hope that a new administration would aggressively address the economic issues that continue to plague the nation. However, this hope quickly dissolved as investors once again began to recognize and fear the deep troubles affecting our financial system. As a result, stocks sold off sharply in January and February, extending a stock market decline that began in October of 2007. High volatility remained prevalent in the first quarter as investors continued to evaluate the short term and long term outlook for the global economy. Yet, March brought renewed optimism that the economy might be nearing a bottom. For the first time in several months, there were bits of encouraging economic news that investors hoped might signal the beginning stages of a recovery. It is too early to tell if we have indeed reached a bottom, both in terms of the economy and the financial markets, but we remain optimistic that the massive fiscal and monetary stimuli that have been placed in motion will eventually put the economy back on track.

Portfolio Review

The Boston Trust Midcap Fund returned -33.03% for the year ended March 31, 2009 versus the benchmark Russell Midcap® Index1 return of -40.81%. Once again, stocks within the financial sector led the decline due to continued concerns over the health of the global financial system. Although the government continues to enact programs aimed at stabilizing the financial system and enhancing the flow of credit, investors remain skeptical of the uncertain future for financial companies. Fortunately, the Fund’s limited exposure to financial services companies helped to moderate the impact of this sector’s sharp sell-off. However, the Fund was not so fortunate in its positioning within the Industrial Products and Services sector, which also performed quite poorly during the period. As economic conditions continue to deteriorate across the globe, demand for industrial products and services has fallen sharply. Industrial companies with exposure to global infrastructure, autos, trucks, residential construction, and transportation services were among the hardest hit. Despite these short-term losses, we expect the Fund’s industrial product holdings to perform very well when economic activity begins to reaccelerate. On a positive note, the Fund’s technology holdings collectively posted a positive return while losses within the healthcare and energy sectors were quite modest.†

During the period, the Fund established new positions in Gen-Probe (1.0%), a diagnostic test manufacturer with a pristine balance sheet, solid growth prospects, and an attractive valuation, and Time Warner Cable (1.5%). We also decided to liquidate the Fund’s positions in IMS Health, Investment Technology Group, Terex, Northern Trust, Wilmington Trust, Lincoln Electric, and Cablevision. These stocks were generally sold in order to reduce our exposure to financial companies or due to increased uncertainty regarding their growth outlook or financial stability.†

Portfolio Strategy

Over the last 12 months, the Fund has benefited from our relatively defensive portfolio composition. During this period, we have maintained an above-average allocation to companies in defensive sectors, e.g. healthcare and consumer staples, and a below-average allocation to the financial services and consumer discretionary sectors. The uncertain outlook for financial companies and our continued concerns over the financial health of consumers will most likely keep us on the defensive in these areas. In fact, we believe that unemployment

|

| 1 | The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. |

| † | Portfolio composition is subject to change. |

|

8

Economic and Market

Summary (unaudited)(cont.) | Boston Trust Midcap Fund

Manager Commentary by Stephen J. Amyouny |

|

will continue to rise, bankruptcies will continue to escalate, the housing market has not yet reached bottom, and consumer confidence will remain at low levels over the next few months—all of which will continue to negatively impact discretionary spending among consumers. Yet, we are also optimistic that the massive amounts of monetary and fiscal stimuli provided by the government will stabilize the economy and position it for a reacceleration of growth over the next 12 to 18 months. As such, we continue to maintain a healthy exposure to industrial products and technology companies that stand to benefit from the eventual recovery in economic activity. Once we have increased confidence that a sustainable economic recovery is under way, we are likely to reduce our exposure in the more defensive sectors; however, at this time, the Fund maintains a delicate balance between defensive and economically sensitive sectors.†

Lastly, we should note that our research team remains focused on the balance sheets and general financial health of each of the Fund’s companies. Our long-standing approach of investing in higher-quality companies with sustainable business models and attractive growth prospects has served us well over the years. In this environment, it has paid to own these higher-quality companies with below-average financial leverage and solid free cash flow generation. We have also identified a number of potential portfolio candidates that have strong financial profiles, attractive growth prospects, and now sell at reasonable valuations, and we are likely to invest in several of these companies over the remainder of the year.†

The equities of the companies in bold-face in the commentary were holdings of the Boston Trust Midcap Fund as of March 31, 2009.

Stephen J. Amyouny, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

|

| † | Portfolio composition is subject to change. |

|

9

| Investment Performance (unaudited) | Boston Trust Midcap Fund

March 31, 2009 |

|

| Fund Net Asset Value: $6.08 | | | | | | | | |

| Gross Expense Ratio1: 1.58% | | Annualized |

| | |

|

| | | 1 Year Ended | | Since Inception |

| | | 3/31/09 | | 9/24/07 |

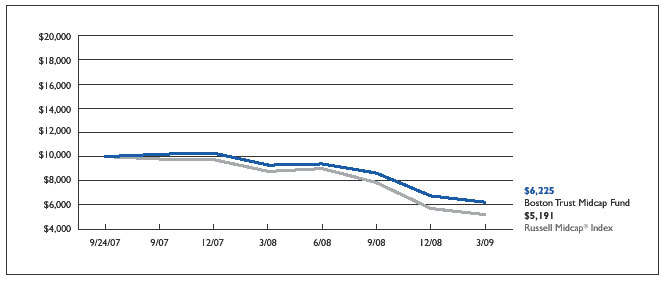

Boston Trust Midcap Fund | | | -33.03% | | | | -26.82% | |

Russell Midcap® Index | | | -40.81% | | | | -35.09% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2008. Additional information pertaining to the Fund’s expense ratios as of March 31, 2009 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occured, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2008, the Total Fund Operating Expenses would be 1.58% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

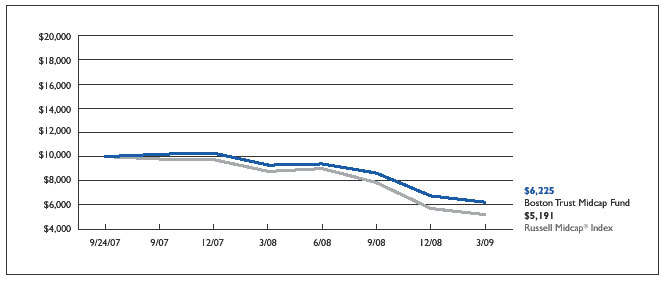

The chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Midcap Fund from September 24, 2007 to March 31, 2009, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap® Index, which is an unmanaged index that measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

10

| Schedule of Portfolio Investments | | Boston Trust Balanced Fund

March 31, 2009 |

|

| | | | | | |

COMMON STOCkS (42.7%) | | | | | |

| Security Description | | Shares | | Value ($) |

| |

| |

|

| Consumer Discretionary (3.8%) | | | | | |

| Comcast Corp., Class A | | 70,000 | | | 954,800 |

| Johnson Controls, Inc. | | 40,000 | | | 480,000 |

| NIKE, Inc., Class B | | 17,000 | | | 797,130 |

| Omnicom Group, Inc. | | 50,000 | | | 1,170,000 |

| Staples, Inc. | | 50,000 | | | 905,500 |

| Target Corp. | | 40,000 | | | 1,375,600 |

| | | | |

|

| | | | | | 5,683,030 |

| | | | |

|

| Consumer Products (5.4%) | | | | | |

| Costco Wholesale Corp. | | 30,000 | | | 1,389,600 |

| Diageo PLC, ADR | | 25,000 | | | 1,118,750 |

| PepsiCo, Inc. | | 25,000 | | | 1,287,000 |

| Procter & Gamble Co. | | 60,000 | | | 2,825,400 |

| Sysco Corp. | | 60,000 | | | 1,368,000 |

| | | | |

|

| | | | | | 7,988,750 |

| | | | |

|

| Energy (6.3%) | | | | | |

| Apache Corp. | | 20,000 | | | 1,281,800 |

| Chevron Corp. | | 28,000 | | | 1,882,720 |

| Exxon Mobil Corp. | | 65,000 | | | 4,426,500 |

| Schlumberger Ltd. | | 15,000 | | | 609,300 |

| XTO Energy, Inc. | | 35,000 | | | 1,071,700 |

| | | | |

|

| | | | | | 9,272,020 |

| | | | |

|

| Financial Services (3.1%) | | | | | |

| Chubb Corp. | | 30,000 | | | 1,269,600 |

| Cincinnati Financial Corp. | | 50,000 | | | 1,143,500 |

| State Street Corp. | | 15,000 | | | 461,700 |

| T. Rowe Price Group, Inc. | | 60,000 | | | 1,731,600 |

| | | | |

|

| | | | | | 4,606,400 |

| | | | |

|

| Health Care (7.5%) | | | | | |

| Becton, Dickinson & Co. | | 35,000 | | | 2,353,400 |

| C.R. Bard, Inc. | | 25,000 | | | 1,993,000 |

| DENTSPLY International, Inc. | | 60,000 | | | 1,611,000 |

| Johnson & Johnson, Inc. | | 30,000 | | | 1,578,000 |

| Medtronic, Inc. | | 30,000 | | | 884,100 |

| Saint Jude Medical, Inc.(a) | | 35,000 | | | 1,271,550 |

| Stryker Corp. | | 30,000 | | | 1,021,200 |

| Varian Medical Systems, Inc.(a) | | 15,000 | | | 456,600 |

| | | | |

|

| | | | | | 11,168,850 |

| | | | |

|

| Industrial Materials (2.3%) | | | | | |

| Air Products & Chemicals, Inc. | | 15,000 | | | 843,750 |

| AptarGroup, Inc. | | 17,500 | | | 544,950 |

| Ecolab, Inc. | | 25,000 | | | 868,250 |

| Sigma-Aldrich Corp. | | 30,000 | | | 1,133,700 |

| | | | |

|

| | | | | | 3,390,650 |

| | | | |

|

| Industrial Products & Services (7.6%) | | | | | |

| Donaldson Co., Inc. | | 75,000 | | | 2,013,000 |

| Emerson Electric Co. | | 60,000 | | | 1,714,800 |

| Illinois Tool Works, Inc. | | 60,000 | | | 1,851,000 |

| Parker Hannifin Corp. | | 20,000 | | | 679,600 |

| Precision Castparts Corp. | | 30,000 | | | 1,797,000 |

| United Parcel Service, Inc., Class B | | 30,000 | | | 1,476,600 |

| W.W. Grainger, Inc. | | 25,000 | | | 1,754,500 |

| | | | |

|

| | | | | | 11,286,500 |

| | | | |

|

| Information Technology (6.7%) | | | | | |

| Accenture Ltd., Class A | | 35,000 | | | 962,150 |

| Automatic Data Processing, Inc. | | 20,000 | | | 703,200 |

| Cisco Systems, Inc.(a) | | 100,000 | | | 1,677,000 |

| EMC Corp.(a) | | 100,000 | | | 1,140,000 |

| International Business Machines Corp. | | 10,000 | | | 968,900 |

| Microsoft Corp. | | 125,000 | | | 2,296,250 |

| Oracle Corp.(a) | | 120,000 | | | 2,168,400 |

| | | | |

|

| | | | | | 9,915,900 |

| | | | |

|

| TOTAL COMMON STOCKS (Cost $55,202,821) | | | | | 63,312,100 |

| | | | |

|

CORPORATE BONDS (3.2%) | | | | | |

| | | Principal | | | |

| Security Description | | Amount ($) | | | Value ($) |

| |

| |

|

| Basic Materials (0.2%) | | | | | |

| Weyerhaeuser Co., 7.25%, 7/1/13 | | 300,000 | | | 277,365 |

| | | | |

|

| Communication Services (0.3%) | | | | | |

| AT&T, Inc., 5.63%, 6/15/16 | | 500,000 | | | 501,831 |

| | | | |

|

| Consumer Products (0.4%) | | | | | |

| Diageo Capital PLC, 5.50%, 9/30/16 | | 500,000 | | | 506,397 |

| | | | |

|

| Financial Services (1.5%) | | | | | |

| American Express Co., 7.00%, 3/19/18 | | 250,000 | | | 220,887 |

| American Express Credit Co., | | | | | |

Series C, 5.88%, 5/2/13 | | 600,000 | | | 527,246 |

| John Deere Capital Corp., | | | | | |

Series D, 5.35%, 4/3/18 | | 1,000,000 | | | 929,289 |

| National Rural Utilities Cooperative | | | | | |

Finance Corp., 10.38%, 11/1/18 | | 500,000 | | | 579,765 |

| | | | |

|

| | | | | | 2,257,187 |

| | | | |

|

| Industrial Products & Services (0.3%) | | | | | |

| Emerson Electric Co., 5.13%, 12/1/16 | | 300,000 | | | 309,205 |

| Weyerhaeuser Co., 6.75%, 3/15/12 | | 100,000 | | | 96,252 |

| | | | |

|

| | | | | | 405,457 |

| | | | |

|

| Information Technology (0.5%) | | | | | |

| Oracle Corp., 5.75%, 4/15/18 | | 750,000 | | | 784,093 |

| | | | |

|

| TOTAL CORPORATE BONDS (Cost $4,897,253) | | | | | 4,732,330 |

| | | | |

|

MUNICIPAL BONDS (5.8%) | | | | | |

| Connecticut (0.7%) | | | | | |

| Connecticut State, Series E, GO, 5.00%, | | | | | |

12/15/20, Callable 12/15/16 @ 100 | | 1,000,000 | | | 1,103,270 |

| | | | |

|

| Florida (0.7%) | | | | | |

| Florida State Board of Education, Series D, | | | | | |

GO, 5.00%, 6/1/21, Callable 6/1/17 @ 101 | | 1,000,000 | | | 1,061,040 |

| | | | |

|

| Georgia (0.2%) | | | | | |

| Georgia State, Series B, GO, 5.00%, 3/1/20, | | | | | |

Callable 3/1/16 @ 100 | | 300,000 | | | 330,888 |

| | | | |

|

| Illinois (1.0%) | | | | | |

| Illinois State, Series A, GO, 5.00%, 3/1/22, | | | | | |

Callable 3/1/14 @ 100 | | 750,000 | | | 777,360 |

| Illinois State, GO, 5.00%, 4/1/24, | | | | | |

Callable 4/1/17 @ 100 | | 500,000 | | | 516,290 |

| Illinois State, Series A, GO, 5.00%, 6/1/29, | | | | | |

Callable 12/1/16 @ 100 | | 250,000 | | | 247,790 |

| | | | |

|

| | | | | | 1,541,440 |

| | | | |

|

| Massachusetts (1.2%) | | | | | |

| Massachusetts State, Series A, GO, 5.25%, 8/1/20 | | 500,000 | | | 572,155 |

| Massachusetts State, Series C, GO, | | | | | |

5.50%, 12/1/22, FSA | | 1,000,000 | | | 1,160,080 |

| | | | |

|

| | | | | | 1,732,235 |

| | | | |

|

| Ohio (0.4%) | | | | | |

| Ohio State, Series D, GO, 4.50%, 9/15/22, MBIA, | | | | | |

Callable 3/15/16 @ 100 | | 500,000 | | | 512,585 |

| | | | |

|

| Washington (0.9%) | | | | | |

| Washington State, Series A, GO, 5.00%, 7/1/20, | | | | | |

FSA, Callable 7/1/14 @ 100 | | 1,000,000 | | | 1,062,380 |

| Washington State, Series C, GO, 5.00%, 2/1/26, | | | | | |

Callable 2/1/19 @ 100 | | 250,000 | | | 257,222 |

| | | | |

|

| | | | | | 1,319,602 |

| | | | |

|

| See Notes to Financial Statements |

|

| |

| 11 |

| Schedule of Portfolio Investments (cont.) | | Boston Trust Balanced Fund

March 31, 2009 |

|

MUNICIPAL BONDS, CONTINUED | | | | | |

| | | | | | |

| | | Shares or | | | |

| | | Principal | | | |

| Security Description | | Amount ($) | | Value ($) |

| |

| |

|

| Wisconsin (0.7%) | | | | | |

| Wisconsin State, Series C, GO, 5.00%, 5/1/25, | | | | | |

Callable 5/1/18 @ 100 | | 200,000 | | | 206,624 |

| Wisconsin State, Series D, GO, 5.50%, 5/1/26, | | | | | |

Callable 5/1/18 @ 100 | | 750,000 | | | 799,605 |

| | | | |

|

| | | | | | 1,006,229 |

| | | | |

|

| TOTAL MUNICIPAL BONDS (Cost $8,414,483) | | | | | 8,607,289 |

| | | | |

|

U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (45.5%) | | | | | |

| Federal Farm Credit Bank | | | | | |

4.75%, 12/7/09 | | 5,000,000 | | | 5,130,700 |

6.30%, 12/20/10 | | 1,500,000 | | | 1,627,874 |

| Federal Home Loan Bank | | | | | |

2.25%, 4/13/12 | | 7,500,000 | | | 7,557,262 |

4.88%, 12/14/12 | | 13,000,000 | | | 14,259,414 |

5.00%, 10/13/11 | | 3,000,000 | | | 3,242,682 |

5.25%, 9/11/09 | | 5,000,000 | | | 5,099,525 |

5.25%, 6/11/10 | | 5,000,000 | | | 5,249,195 |

5.25%, 6/10/11 | | 3,000,000 | | | 3,238,938 |

5.25%, 9/13/13 | | 5,000,000 | | | 5,595,225 |

5.38%, 6/8/12 | | 5,000,000 | | | 5,517,520 |

| Government National Mortgage Association, | | | | | |

6.00%, 10/15/36 | | 2,708,732 | | | 2,834,306 |

U.S. Treasury Bills, 0.87%, 11/19/09(b) | | 5,000,000 | | | 4,984,210 |

| U.S. Treasury Inflation Protected Bonds, | | | | | |

3.50%, 1/15/11 | | 3,032,450 | | | 3,185,771 |

| | | | |

|

| TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT | | | | | |

AGENCY OBLIGATIONS (Cost $64,551,736) | | | | | 67,522,622 |

| | | | |

|

INVESTMENT COMPANIES (7.5%) | | | | | |

| Cavanal Hill U.S. Treasury Fund, 0.01%(c) | | 3,746,542 | | | 3,746,542 |

| Victory Federal Money Market, | | | | | |

Investor Shares, 0.45%(c) | | 7,417,756 | | | 7,417,756 |

| | | | |

|

| TOTAL INVESTMENT COMPANIES | | | | | |

(Cost $11,164,298) | | | | | 11,164,298 |

| | | | |

|

| Total Investments (Cost $144,230,591) — 104.7% | | | | | 155,338,639 |

| Liabilities in excess of other assets — (4.7)% | | | | | (6,938,107) |

| | | | |

|

| NET ASSETS — 100.0% | | | | $ | 148,400,532 |

| | | | |

|

|

| (a) | | Non-income producing security. |

| (b) | | Rate represents the effective yield at purchase. |

| (c) | | Rate disclosed is the seven day yield as of March 31, 2009. |

| ADR | | American Depositary Receipt |

| FSA | | Insured by Financial Security Assurance |

| GO | | General Obligation |

| MBIA | | Insured by Municipal Bond Insurance Association |

| PLC | | Public Limited Company |

| See Notes to Financial Statements |

|

| |

| 12 |

| Financial Statements | | Boston Trust Balanced Fund |

|

STATEMENT OF ASSETS AND LIABILITIES | | | |

| March 31, 2009 | | | |

| | | | |

| Assets: | | | |

| Investments, at value (cost $144,230,591) | | $ | 155,338,639 |

| Interest and dividends receivable | | | 976,218 |

| Receivable for capital shares issued | | | 18,060 |

| Prepaid expenses and other assets | | | 27,656 |

| | |

|

Total Assets | | | 156,360,573 |

| | |

|

| Liabilities: | | | |

| Payable for investments purchased | | | 7,774,728 |

| Payable for capital shares redeemed | | | 9,687 |

| Accrued expenses and other liabilities: | | | |

Investment adviser | | | 93,979 |

Chief compliance officer | | | 1,127 |

Administration and accounting | | | 4,174 |

Custodian | | | 5,241 |

Transfer agent | | | 2,946 |

Other | | | 68,159 |

| | |

|

Total Liabilities | | | 7,960,041 |

| | |

|

| | | | |

| Net Assets | | $ | 148,400,532 |

| | |

|

| | | | |

| Composition of Net Assets: | | | |

| Capital | | $ | 140,054,792 |

| Accumulated net investment income | | | 759,251 |

| Accumulated net realized losses from | | | |

investment transactions | | | (3,521,559) |

| Net unrealized appreciation from investments | | | 11,108,048 |

| | |

|

| | | | |

| Net Assets | | $ | 148,400,532 |

| | |

|

| | | | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 6,360,840 |

| | |

|

| Net Asset Value, Offering Price and Redemption Price per share | | $ | 23.33 |

| | |

|

STATEMENT OF OPERATIONS | | | |

| For the year ended March 31, 2009 | | | |

| | | | |

| Investment Income: | | | |

| Interest | | $ | 2,942,711 |

| Dividends | | | 1,738,754 |

| Less: Foreign tax withholding | | | (3,129) |

| | |

|

Total Investment Income | | | 4,678,336 |

| | |

|

| Expenses: | | | |

Investment adviser | | | 1,250,601 |

Administration and accounting | | | 338,602 |

Trustee | | | 18,653 |

Custodian | | | 32,404 |

Transfer agency | | | 17,946 |

Chief compliance officer | | | 13,775 |

Other | | | 130,653 |

| | |

|

Total expenses before fee reductions | | | 1,802,634 |

Fees voluntarily reduced by the administrator | | | (92,923) |

Fees contractually reduced by the investment adviser | | | (39,648) |

| | |

|

| Net Expenses | | | 1,670,063 |

| | |

|

| | | | |

| Net Investment Income | | | 3,008,273 |

| | |

|

| | | | |

| Net Realized/Unrealized Losses from Investments: | | | |

| Net realized losses from investment transactions | | | (2,892,802) |

| Change in unrealized appreciation/depreciation from investments | | | (34,137,628) |

| | |

|

| Net realized/unrealized losses from investments | | | (37,030,430) |

| | |

|

| | | | |

| Change in Net Assets Resulting from Operations | | $ | (34,022,157) |

| | |

|

| See Notes to Financial Statements |

|

| |

| 13 |

| Financial Statements | | Boston Trust Balanced Fund |

|

STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | For the year ended | | | For the year ended |

| | | March 31, 2009 | | | March 31, 2008 |

| | |

| | |

|

| Investment Activities: | | | | | | | |

| Operations: | | | | | | | |

Net investment income | | $ | 3,008,273 | | | $ | 2,671,776 |

Net realized gains (losses) from investment transactions | | | (2,892,802) | | | | 7,314,461 |

Change in unrealized appreciation/depreciation from investments | | | (34,137,628) | | | | 332,647 |

| | |

| | |

|

| Change in net assets resulting from operations | | | (34,022,157) | | | | 10,318,884 |

| | |

| | |

|

| Dividends: | | | | | | | |

Net investment income | | | (3,026,472) | | | | (2,580,508) |

Net realized gains from investment transactions | | | (4,856,029) | | | | (5,624,715) |

| | |

| | |

|

| Change in net assets from shareholder dividends | | | (7,882,501) | | | | (8,205,223) |

| | |

| | |

|

| Capital Share Transactions: | | | | | | | |

Proceeds from shares issued | | | 20,285,450 | | | | 16,074,101 |

Dividends reinvested | | | 7,558,953 | | | | 7,856,581 |

Cost of shares redeemed | | | (20,852,763) | | | | (13,037,872) |

| | |

| | |

|

| Change in net assets from capital share transactions | | | 6,991,640 | | | | 10,892,810 |

| | |

| | |

|

| | | | | | | | |

| Change in net assets | | | (34,913,018) | | | | 13,006,471 |

| | | | | | | | |

| Net Assets: | | | | | | | |

Beginning of period | | | 183,313,550 | | | | 170,307,079 |

| | |

| | |

|

End of period | | $ | 148,400,532 | | | $ | 183,313,550 |

| | |

| | |

|

| Share Transactions: | | | | | | | |

Issued | | | 795,051 | | | | 510,696 |

Reinvested | | | 313,910 | | | | 246,829 |

Redeemed | | | (795,578) | | | | (411,351) |

| | |

| | |

|

| Change in shares | | | 313,383 | | | | 346,174 |

| | |

| | |

|

| Accumulated net investment income | | $ | 759,251 | | | $ | 777,451 |

| | |

| | |

|

| See Notes to Financial Statements |

|

| |

| 14 |

| Financial Statements | | Boston Trust Balanced Fund |

|

FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout the years indicated. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the year | | | For the year | | | For the year | | | For the year | | | For the year |

| | | ended | | | ended | | | ended | | | ended | | | ended |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 |

| | |

| | |

| | |

| | |

| | |

|

| Net Asset Value, Beginning of Period | | $ | 30.31 | | | $ | 29.87 | | | $ | 29.11 | | | $ | 28.77 | | | $ | 27.63 |

| | |

| | | |

| | |

| | |

| | |

|

| Investment Activities: | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.49 | (a) | | | 0.46 | | | | 0.46 | | | | 0.53 | | | | 0.50 |

Net realized and unrealized gains (losses) from | | | | | | | | | | | | | | | | | | | |

investment transactions | | | (6.11) | | | | 1.42 | | | | 2.13 | | | | 0.88 | | | | 1.15 |

| | |

| | | |

| | |

| | |

| | |

|

| Total from investment activities | | | (5.62) | | | | 1.88 | | | | 2.59 | | | | 1.41 | | | | 1.65 |

| | |

| | | |

| | |

| | |

| | |

|

| Dividends: | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.52) | | | | (0.45) | | | | (0.43) | | | | (0.52) | | | | (0.50) |

Net realized gains from investments | | | (0.84) | | | | (0.99) | | | | (1.40) | | | | (0.55) | | | | (0.01) |

| | |

| | | |

| | |

| | |

| | |

|

| Total dividends | | | (1.36) | | | | (1.44) | | | | (1.83) | | | | (1.07) | | | | (0.51) |

| | |

| | | |

| | |

| | |

| | |

|

| | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 23.33 | | | $ | 30.31 | | | $ | 29.87 | | | $ | 29.11 | | | $ | 28.77 |

| | |

| | | |

| | |

| | |

| | |

|

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (18.68)% | | | | 6.06% | | | | 8.98% | | | | 4.97% | | | | 5.96% |

| | |

| | | |

| | |

| | |

| | |

|

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | $ | 148,401 | | | $ | 183,314 | | | $ | 170,307 | | | $ | 164,475 | | | $ | 172,218 |

| Ratio of net expenses to average net assets | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% |

| Ratio of net investment income to average net assets | | | 1.80% | | | | 1.46% | | | | 1.50% | | | | 1.76% | | | | 1.75% |

| Ratio of expenses (before fee reductions) to average | | | | | | | | | | | | | | | | | | | |

net assets(b) | | | 1.08% | | | | 1.08% | | | | 1.07% | | | | 1.08% | | | | 1.09% |

| Portfolio turnover | | | 21.30% | | | | 33.49% | | | | 37.24% | | | | 29.77% | | | | 10.38% |

|

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced and total fund expenses are capped at 1.00%. If such expense caps had not been in place, the ratio would have been as indicated. |

| See Notes to Financial Statements |

|

| |

| 15 |

| Schedule of Portfolio Investments | | Boston Trust Equity Fund

March 31, 2009 |

|

COMMON STOCKS (94.5%) | | | | | |

| Security Description | | Shares | | Value ($) |

| |

| |

|

| Consumer Discretionary (10.4%) | | | | | |

| Comcast Corp., Class A | | 60,000 | | | 818,400 |

| Johnson Controls, Inc. | | 25,000 | | | 300,000 |

| NIKE, Inc., Class B | | 10,000 | | | 468,900 |

| Omnicom Group, Inc. | | 40,000 | | | 936,000 |

| Staples, Inc. | | 25,000 | | | 452,750 |

| Target Corp. | | 30,000 | | | 1,031,700 |

| | | | |

|

| | | | | | 4,007,750 |

| | | | |

|

| Consumer Products (10.9%) | | | | | |

| Costco Wholesale Corp. | | 15,000 | | | 694,800 |

| Diageo PLC, ADR | | 17,500 | | | 783,125 |

| PepsiCo, Inc. | | 15,000 | | | 772,200 |

| Procter & Gamble Co. | | 20,000 | | | 941,800 |

| Sysco Corp. | | 45,000 | | | 1,026,000 |

| | | | |

|

| | | | | | 4,217,925 |

| | | | |

|

| Energy (12.8%) | | | | | |

| Apache Corp. | | 12,000 | | | 769,080 |

| Chevron Corp. | | 15,000 | | | 1,008,600 |

| Exxon Mobil Corp. | | 30,000 | | | 2,043,000 |

| Schlumberger Ltd. | | 15,000 | | | 609,300 |

| XTO Energy, Inc. | | 17,000 | | | 520,540 |

| | | | |

|

| | | | | | 4,950,520 |

| | | | |

|

| Financial Services (8.2%) | | | | | |

| Chubb Corp. | | 25,000 | | | 1,058,000 |

| Cincinnati Financial Corp. | | 35,000 | | | 800,450 |

| State Street Corp. | | 10,000 | | | 307,800 |

| T. Rowe Price Group, Inc. | | 35,000 | | | 1,010,100 |

| | | | |

|

| | | | | | 3,176,350 |

| | | | |

|

| Health Care (14.5%) | | | | | |

| Becton, Dickinson & Co. | | 17,500 | | | 1,176,700 |

| C.R. Bard, Inc. | | 12,500 | | | 996,500 |

| DENTSPLY International, Inc. | | 30,000 | | | 805,500 |

| Johnson & Johnson, Inc. | | 12,000 | | | 631,200 |

| Medtronic, Inc. | | 25,000 | | | 736,750 |

| Saint Jude Medical, Inc.(a) | | 15,000 | | | 544,950 |

| Stryker Corp. | | 12,500 | | | 425,500 |

| Varian Medical Systems, Inc.(a) | | 10,000 | | | 304,400 |

| | | | |

|

| | | | | | 5,621,500 |

| | | | |

|

| Industrial Materials (6.3%) | | | | | |

| Air Products & Chemicals, Inc. | | 14,000 | | | 787,500 |

| AptarGroup, Inc. | | 12,500 | | | 389,250 |

| Ecolab, Inc. | | 15,000 | | | 520,950 |

| Sigma-Aldrich Corp. | | 20,000 | | | 755,800 |

| | | | |

|

| | | | | | 2,453,500 |

| | | | |

|

| Industrial Products & Services (17.9%) | | | | | |

| Donaldson Co., Inc. | | 30,000 | | | 805,200 |

| Emerson Electric Co. | | 37,500 | | | 1,071,750 |

| Illinois Tool Works, Inc. | | 35,000 | | | 1,079,750 |

| Parker Hannifin Corp. | | 15,000 | | | 509,700 |

| Precision Castparts Corp. | | 22,500 | | | 1,347,750 |

| Rockwell Collins, Inc. | | 10,000 | | | 326,400 |

| United Parcel Service, Inc., Class B | | 15,000 | | | 738,300 |

| W.W. Grainger, Inc. | | 15,000 | | | 1,052,700 |

| | | | |

|

| | | | | | 6,931,550 |

| | | | |

|

| Information Technology (13.5%) | | | | | |

| Accenture Ltd., Class A | | 25,000 | | | 687,250 |

| Automatic Data Processing, Inc. | | 20,000 | | | 703,200 |

| Cisco Systems, Inc.(a) | | 55,000 | | | 922,350 |

| EMC Corp.(a) | | 70,000 | | | 798,000 |

| Microsoft Corp. | | 65,000 | | | 1,194,050 |

| Oracle Corp.(a) | | 50,000 | | | 903,500 |

| | | | |

|

| | | | | | 5,208,350 |

| | | | |

|

| TOTAL COMMON STOCKS (Cost $34,586,512) | | | | | 36,567,445 |

| | | | |

|

INVESTMENT COMPANIES (5.7%) | | | | | |

| | | | | | |

| Cavanal Hill U.S. Treasury Fund, 0.01%(b) | | 254,024 | | | 254,024 |

| Victory Federal Money Market, Investor | | | | | |

Shares, 0.45%(b) | | 1,935,879 | | | 1,935,879 |

| | | | |

|

| TOTAL INVESTMENT COMPANIES | | | | | |

(Cost $2,189,903) | | | | | 2,189,903 |

| | | | |

|

| Total Investments (Cost $36,776,415) — 100.2% | | | | | 38,757,348 |

| Liabilities in excess of other assets — (0.2)% | | | | | (58,624) |

| | | | |

|

| NET ASSETS — 100.0% | | | | $ | 38,698,724 |

| | | | |

|

|

| (a) | | Non-income producing security. |

| (b) | | Rate disclosed is the seven day yield as of March 31, 2009. |

| ADR | | American Depositary Receipt |

| PLC | | Public Limited Company |

| See Notes to Financial Statements |

|

| |

| 16 |

| Financial Statements | | Boston Trust Equity Fund |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2009 |

| Assets: | | | | |

| Investments, at value (cost $36,776,415) | | $ | 38,757,348 | |

| Interest and dividends receivable | | | 93,928 | |

| Prepaid expenses and other assets | | | 7,333 | |

| | |

| |

Total Assets | | | 38,858,609 | |

| | |

| |

| | | | | |

| Liabilities: | | | | |

| Payable for capital shares redeemed | | | 108,233 | |

| Accrued expenses and other liabilities: | | | | |

Investment adviser | | | 25,286 | |

Chief compliance officer | | | 329 | |

Administration and accounting | | | 1,194 | |

Custodian | | | 2,120 | |

Transfer agent | | | 2,946 | |

Other | | | 19,777 | |

| | |

| |

Total Liabilities | | | 159,885 | |

| | |

| |

| | | | | |

| Net Assets | | $ | 38,698,724 | |

| | |

| |

| | | | | |

| Composition of Net Assets: | | | | |

| Capital | | $ | 40,672,418 | |

| Accumulated net investment income | | | 111,490 | |

| Accumulated net realized losses from | | | | |

investment transactions | | | (4,066,117) | |

| Net unrealized appreciation from investments | | | 1,980,933 | |

| | |

| |

| | | | | |

| Net Assets | | $ | 38,698,724 | |

| | |

| |

| | | | | |

| Shares outstanding (par value $0.01, unlimited number of | | | | |

shares authorized) | | | 4,412,718 | |

| | |

| |

| | | | | |

| Net Asset Value, Offering Price and Redemption Price per | | | | |

share | | $ | 8.77 | |

| | |

| |

| For the year ended March 31, 2009 | | �� | | |

| | | | | |

| Investment Income: | | | | |

| Interest | | $ | 5 | |

| Dividends | | | 1,028,842 | |

| Less: Foreign tax withholding | | | (2,503) | |

| | |

| |

Total Investment Income | | | 1,026,344 | |

| | |

| |

| | | | | |

| Expenses: | | | | |

Investment adviser | | | 413,488 | |

Administration and accounting | | | 113,309 | |

Trustee | | | 3,758 | |

Custodian | | | 12,620 | |

Transfer agency | | | 17,946 | |

Chief compliance officer | | | 4,146 | |

Other | | | 40,812 | |

| | |

| |

Total expenses before fee reductions | | | 606,079 | |

Fees voluntarily reduced by the administrator | | | (30,688) | |

Fees contractually reduced by the investment adviser | | | (23,578) | |

| | |

| |

| Net Expenses | | | 551,813 | |

| | |

| |

| | | | | |

| Net Investment Income | | | 474,531 | |

| | |

| |

| | | | | |

| Net Realized/Unrealized Losses from Investments: | | | | |

| Net realized losses from investment transactions | | | (4,042,987) | |

| Change in unrealized appreciation/depreciation from | | | | |

investments | | | (17,791,854) | |

| | |

| |

| Net realized/unrealized losses from investments | | | (21,834,841) | |

| | |

| |

| | | | | |

| Change in Net Assets Resulting from Operations | | $ | (21,360,310) | |

| | |

| |

See Notes to Financial Statements

17

| Financial Statements | | Boston Trust Equity Fund |

|

| STATEMENTS OF CHANGES IN NET ASSETS |

| | For the year ended | | For the year ended |

| | March 31, 2009 | | March 31, 2008 |

| |

| |

|

| Investment Activities: | | | | | | | | | |

| Operations: | | | | | | | | | |

| Net investment income | | $ | 474,531 | | | | $ | 365,451 | |

| Net realized gains (losses) from investment transactions | | | (4,042,987) | | | | | 727,583 | |

| Change in unrealized appreciation/depreciation from investments | | | (17,791,854) | | | | | 474,087 | |

| | |

| | | |

| |

| Change in net assets resulting from operations | | | (21,360,310) | | | | | 1,567,121 | |

| | |

| | | |

| |

| Dividends: | | | | | | | | | |

Net investment income | | | (482,096) | | | | | (369,648) | |

Net realized gains from investment transactions | | | — | | | | | (1,405,851) | |

| | |

| | | |

| |

| Change in net assets from shareholder dividends | | | (482,096) | | | | | (1,775,499) | |

| | |

| | | |

| |

| Capital Share Transactions: | | | | | | | | | |

Proceeds from shares issued | | | 4,500,020 | | | | | 6,359,787 | |

Dividends reinvested | | | 437,230 | | | | | 1,650,276 | |

Cost of shares redeemed | | | (9,445,789) | | | | | (2,636,040) | |

| | |

| | | |

| |

| Change in net assets from capital share transactions | | | (4,508,539) | | | | | 5,374,023 | |

| | |

| | | |

| |

| | | | | | | | | | |

| Change in net assets | | | (26,350,945) | | | | | 5,165,645 | |

Net Assets: | | | | | | | | | |

Beginning of period | | | 65,049,669 | | | | | 59,884,024 | |

| | |

| | | |

| |

End of period | | $ | 38,698,724 | | | | $ | 65,049,669 | |

| | |

| | | |

| |

| | | | | | | | | | |

| Share Transactions: | | | | | | | | | |

Issued | | | 389,563 | | | | | 464,496 | |

Reinvested | | | 45,892 | | | | | 113,812 | |

Redeemed | | | (960,879) | | | | | (187,820) | |

| | |

| | | |

| |

| Change in shares | | | (525,424) | | | | | 390,488 | |

| | |

| | | |

| |

| | | | | | | | | | |

| Accumulated net investment income | | $ | 111,490 | | | | $ | 119,054 | |

| | |

| | | |

| |

See Notes to Financial Statements

18

| Financial Statements | | Boston Trust Equity Fund |

|

Selected data for a share outstanding throughout the years indicated.

| | | | For the year | | | | For the year | | | | For the year | | | | For the year | | | | For the year | |

| | | | ended | | | | ended | | | | ended | | | | ended | | | | ended | |

| | | | March 31, | | | | March 31, | | | | March 31, | | | | March 31, | | | | March 31, | |

| | | | 2009 | | | | 2008 | | | | 2007 | | | | 2006 | | | | 2005 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Asset Value, Beginning of Period | | $ | 13.17 | | | $ | 13.17 | | | $ | 12.39 | | | $ | 11.86 | | | $ | 11.19 | |

| | |

| | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.10 | (a) | | | 0.08 | | | | 0.09 | | | | 0.09 | | | | 0.10 | |

Net realized and unrealized gains (losses) from | | | | | | | | | | | | | | | | | | | | |

investment transactions | | | (4.40) | | | | 0.30 | | | | 1.04 | | | | 0.65 | | | | 0.84 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total from investment activities | | | (4.30) | | | | 0.38 | | | | 1.13 | | | | 0.74 | | | | 0.94 | |

| | |

| | |

| | |

| | |

| | |

| |

| Dividends: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10) | | | | (0.08) | | | | (0.08) | | | | (0.09) | | | | (0.09) | |

Net realized gains from investments | | | — | | | | (0.30) | | | | (0.27) | | | | (0.12) | | | | (0.18) | |

| | |

| | |

| | |

| | |

| | |

| |

| Total dividends | | | (0.10) | | | | (0.38) | | | | (0.35) | | | | (0.21) | | | | (0.27) | |

| | |

| | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 8.77 | | | $ | 13.17 | | | $ | 13.17 | | | $ | 12.39 | | | $ | 11.86 | |

| | |

| | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (32.73)% | | | | 2.59% | | | | 9.20% | | | | 6.23% | | | | 8.34% | |

| | |

| | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | $ | 38,699 | | | $ | 65,050 | | | $ | 59,884 | | | $ | 48,574 | | | $ | 41,175 | |

| Ratio of net expenses to average net assets | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Ratio of net investment income to average net assets | | | 0.86% | | | | 0.55% | | | | 0.71% | | | | 0.73% | | | | 0.84% | |

| Ratio of expenses (before fee reductions) to average | | | | | | | | | | | | | | | | | | | | |

net assets(b) | | | 1.10% | | | | 1.10% | | | | 1.11% | | | | 1.11% | | | | 1.14% | |

| Portfolio turnover | | | 28.85% | | | | 23.53% | | | | 21.48% | | | | 20.44% | | | | 12.05% | |

|

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced and total fund expenses are capped at 1.00%. If such expense caps had not been in place, the ratio would have been as indicated. |

See Notes to Financial Statements

19

| Schedule of Portfolio Investments | | Boston Trust Small Cap Fund

March 31, 2009 |

|

| Security Description | | Shares | | | Value ($) | |

| |

| | |

| |

| Consumer Discretionary (12.0%) | | | | | | | | |

| Ambassadors Group, Inc. | | | 7,300 | | | | 59,276 | |

| Capella Education Co.(a) | | | 5,050 | | | | 267,650 | |

| Gentex Corp. | | | 48,000 | | | | 478,080 | |

| Hibbett Sports, Inc.(a) | | | 8,600 | | | | 165,292 | |

| John Wiley & Sons, Inc., Class A | | | 16,600 | | | | 494,348 | |

| LKQ Corp.(a) | | | 29,000 | | | | 413,830 | |

| Pre-Paid Legal Services, Inc.(a) | | | 3,800 | | | | 110,314 | |

| Scholastic Corp. | | | 7,500 | | | | 113,025 | |

| Strayer Education, Inc. | | | 3,850 | | | | 692,499 | |

| Timberland Co., Class A(a) | | | 13,000 | | | | 155,220 | |

| Under Armour, Inc., Class A(a) | | | 6,500 | | | | 106,795 | |

| | | | | | |

| |

| | | | | | | | 3,056,329 | |

| | | | | | |

| |

| Consumer Products (6.6%) | | | | | | | | |

| Diamond Foods, Inc. | | | 13,500 | | | | 377,055 | |

| Green Mountain Coffee Roasters, Inc.(a) | | | 8,600 | | | | 412,800 | |

| Hain Celestial Group, Inc.(a) | | | 12,000 | | | | 170,880 | |

| Lifeway Foods, Inc.(a) | | | 20,000 | | | | 160,000 | |

| United Natural Foods, Inc.(a) | | | 16,000 | | | | 303,520 | |

| Whole Foods Market, Inc. | | | 15,200 | | | | 255,360 | |

| | | | | | |

| |

| | | | | | | | 1,679,615 | |

| | | | | | |

| |

| Energy (3.9%) | | | | | | | | |

| CARBO Ceramics, Inc. | | | 10,000 | | | | 284,400 | |

| CREDO Petroleum Corp.(a) | | | 12,400 | | | | 92,628 | |

| Dawson Geophysical Co.(a) | | | 5,200 | | | | 70,200 | |

| Encore Acquisition Co.(a) | | | 19,000 | | | | 442,130 | |

| NATCO Group, Inc., Class A(a) | | | 6,000 | | | | 113,580 | |

| | | | | | |

| |

| | | | | | | | 1,002,938 | |

| | | | | | |

| |

| Financial Services (16.6%) | | | | | | | | |

| Assured Guaranty Ltd. | | | 45,525 | | | | 308,204 | |

| Bank of Hawaii Corp. | | | 14,500 | | | | 478,210 | |

| Commerce Bancshares, Inc. | | | 7,500 | | | | 272,250 | |

| Corporate Office Properties | | | 14,500 | | | | 360,035 | |

| Digital Realty Trust, Inc. | | | 14,100 | | | | 467,838 | |

| Dime Community Bancshares | | | 55,225 | | | | 518,010 | |

| eHealth, Inc.(a) | | | 25,000 | | | | 400,250 | |

| Independent Bank Corp. | | | 10,200 | | | | 150,450 | |

| Investment Technology Group, Inc.(a) | | | 9,000 | | | | 229,680 | |

| Jones Lang LaSalle, Inc. | | | 11,000 | | | | 255,860 | |

| Parkway Properties, Inc. | | | 10,125 | | | | 104,288 | |

| Southside Bancshares, Inc. | | | 9,200 | | | | 173,880 | |

| Umpqua Holdings Corp. | | | 15,500 | | | | 140,430 | |