UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06526 | | |

| | | The Coventry Group | | |

| | | | (Exact name of registrant as specified in charter) | | |

| | | | | | |

| 3435 Stelzer Rd. | | Columbus, OH | | 43219 |

| | | | (Address of principal executive offices) | | (Zip code) |

| | | | | | |

| 3435 Stelzer Rd. | | Columbus, OH | | 43219 |

| | | | (Name and address of agent for service) | | |

| Registrant’s telephone number, including area code: | 1-800-282-8782 | | |

| | | | | | |

| Date of fiscal year end: | | March 31 | | |

| | | | | | |

| Date of reporting period: | | March 31, 2011 | | |

Item 1. Reports to Stockholders.

Annual Report

March 31, 2011

Boston Trust Investment Management, Inc., a subsidiary of Boston Trust & Investment Management Company (BTIM) and an affiliate of Walden Asset Management (Walden) serves as investment adviser (the Adviser) to the Boston Trust and Walden Funds and receives a fee for its services. Walden, a division of BTIM, performs shareholder advocacy, proxy voting, screening services, and other environmental, social and governance initiatives for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by Boston Trust & Investment Management Company or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by Foreside Distribution Services, L.P., Portland, ME.

The foregoing information and opinions are for general information only. Boston Trust Funds and Boston Trust Investment Management, Inc. do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

The recent appreciation in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

| Photography credits: |

| • | Cover: Bruce Field |

| • | Pages 1 and 7: Jim Gallagher |

| • | Pages 5 and 33: Rebecca Monette |

| • | Pages 9 and 31: Janet C. Dygert |

1

This page intentionally left blank.

2

Economic and Market

Summary (Unaudited) |  |

Domenic Colasacco, CFA

Portfolio Manager and President

Boston Trust Investment Management, Inc.

Stock prices, over longer time-periods, reflect economic conditions generally and trends in corporate profits in particular. Shorter-term price movements, however, are driven most often by the perceived impact that political and business related events will have on longer-term economic health. Through the first few months of 2011, investors had to assess a series of political revolutions in the Middle East and the devastating earthquake in Japan. Neither of these has yet to be fully resolved. In the Middle East, revolutions could spread and threaten additional key oil producing regions; while in Japan the full extent of radiation damage—particularly its impact on the world’s third largest economy—remains subject to conflicting reports and opinions.

Initially, investors reacted negatively to both news reports, depressing equity markets around the globe. In the United States, the S&P 500 Index1 fell by roughly 7% during the latter weeks of February and the first part of March. By quarter end, though, nearly all of the price declines had been recouped. Indeed, the S&P 500 ended the first quarter of 2011 roughly 15% above levels of a year ago and about 30% higher than the market lows reached last summer. At least for the moment, investors have concluded that neither the turmoil in the Middle East nor the catastrophe in Japan is likely to pose a meaningful threat to the gradual, yet widespread, business recovery that is underway in most developed and emerging economies. Yet, for prices to continue upward, we believe it is imperative that key economic metrics such as employment, total income, capital spending and corporate profits continue to improve.

Our Economic Outlook

We expect 2011 to be another year of modest growth in Gross Domestic Product2, with comparatively low reported inflation and further gains in corporate profits. Stock prices tend to rise in such an environment far more often than not. While most of the headline news in recent months was ominous, nearly all of the key economic reports have been at the better end of expectations, in particular the key employment statistics. Our economy added roughly 600,000 new private sector jobs in the first quarter of 2011, the best period since the financial crisis began. Recent gains were sufficient to bring the unemployment rate below 9% for the first time in nearly two years.

Paradoxically, despite all the political rhetoric, the divergent views of Democrats and Republicans led to a more stimulative budget for this fiscal year than we were likely to receive exclusively from either side. Democrats held firm for more spending, while Republicans demanded lower taxes. The creative, breakthrough compromise for the fiscal 2011 budget was to do both.

Lower taxes with more government spending, however, is not a sustainable option. At some point, our trade and budget deficits need to be reduced, as must those in other developed economies. In managing the Fund, we will seek to balance such longer-term domestic and global economic challenges with what still currently remains an equity friendly investment environment.

|

| 1 | The Standard & Poor’s 500 Index (“S&P 500”), an unmanaged index that is widely regarded as a gauge of the U.S. equities market.This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. |

| | |

| 2 | The Gross Domestic Product (“GDP”) is the measure of the market value of the goods and services produced by labor and property in the United States. |

3

| |

Boston Trust Balanced Fund

Boston Trust Equity Fund | |

| | March 31, 2011 | |

| |

Domenic Colasacco, CFA | |

| | Portfolio Manager and President Boston Trust Investment Management, Inc. | |

| |

Balanced Fund Objective | |

| | The Fund seeks long-term capital growth and income through an actively managed portfolio of stocks, bonds and money market instruments. | |

| |

Equity Fund Objective | |

| | The Fund seeks long-term capital growth through an actively managed portfolio of stocks. | |

| |

Investment Concerns | |

| | Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Intermediate-term, higher quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

Cash equivalents offer low risk and low return potential. | |

| | | |

| | | |

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Portfolio Review

The Boston Trust Balanced Fund was well positioned to participate in the favorable stock market trend over the past twelve months. Our constructive views about the sustainability of the current economic recovery—despite the frequent ominous headlines—led us to retain the Fund’s equity allocation near 70% for most of the past year. While the Fund’s performance benefited from the above average equity exposure (the usual range is 45% to 75%), the Fund’s performance modestly trailed its Morningstar peer group average for the 12-month period. We are pleased that during this period of sharply rising markets the Fund’s emphasis on high quality, lower risk equity investments did not significantly constrain results. In contrast, the Fund’s bond segment performance fell short of the Barclays Capital U.S. Government/Credit Bond Index as longer maturity, and lower credit quality issues led the market higher. Given today’s low starting yields, we believe total returns for the fixed income segment in the year ahead are likely to be modest, and that the risks of extending maturities or increasing credit risk are substantial. We therefore have focused our efforts to achieve attractive total returns on the equity segment. As outlined on the performance chart on page 5, however, the Fund’s long term results remain attractive.

The Boston Trust Equity Fund returned 15.48% for 12-month period ended March 31, 2011 compared to the 15.65% for the S&P 500 Index. The very modest underperformance of the Fund resulted from the comparison to an unmanaged benchmark that reflects no deduction for fees and expenses; the Funds’ expense ratio is 1%. We are pleased to report strong, absolute returns during a period when more volatile, riskier stocks such as those of commodities and energy companies were in favor. As is the case with the Balanced Fund, performance is above average for longer term periods that include a complete market and economic cycle.

Our Investment Strategy

In our view, stocks remain fairly priced by past standards, and are attractive compared to the low yields available in both money market instruments and bonds. Unless there is a significant change in the economic trend or a sharp rise in prices, we expect to keep the Balanced Fund’s equity exposure at the upper end of the range in the months ahead. We believe equity values will continue to be supported by a combination of the ample corporate cash flow and the continued profit growth we anticipate for the remainder of 2011 and into 2012.*

Within the Balanced Fund’s equity segment, and in the Boston Trust Equity Fund, we have emphasized stocks of companies that we believe will benefit comparatively from the broad global economic recovery that is underway. These include stocks in the industrial, energy, and financial industries. We also continued to emphasize stocks of higher quality companies. In our view higher quality stocks are not likely to decline as much as stocks generally if the pace of economic recovery decelerates unexpectedly. We also believe they remain attractively priced compared to equity securities of most risky, less proven companies.*

Our investment position within the fixed income segment is also unchanged; the Boston Trust Balanced Fund continues to prefer investment-grade issues with comparatively short maturities. From a total return perspective, the incremental yield available in longer-maturity or higher credit risk bonds is insufficient in our view to compensate for the potential loss in principal value if interest rates rise or credit conditions deteriorate.*

* Portfolio composition is subject to change.

4

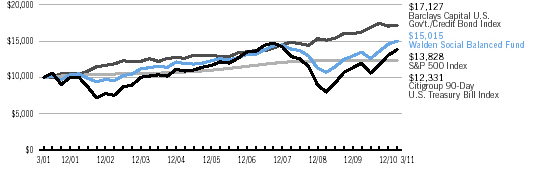

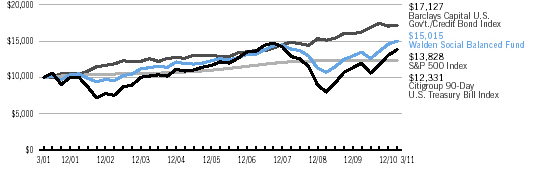

| Investment Performance (Unaudited) | Boston Trust Balanced Fund

Boston Trust Equity Fund

March 31, 2011 |

| | | Annualized |

| | | 1 Year | | 5 Years | | 10 Years | | Since |

| | | Ended | | Ended | | Ended | | Inception |

| | | 3/31/11 | | 3/31/11 | | 3/31/11 | | 10/1/03 |

| Boston Trust Balanced Fund1 | | 11.65 | % | | 5.59 | % | | 5.78 | % | | — | |

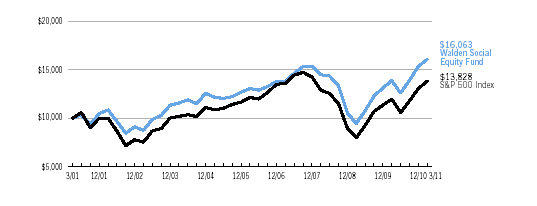

| Boston Trust Equity Fund11 | | 15.48 | % | | 4.78 | % | | — | | | 6.44 | % |

| S&P 500 Index | | 15.65 | % | | 2.62 | % | | 3.29 | % | | 5.69 | % |

|

| Barclays Capital U.S. Government/Credit Bond Index | | 5.26 | % | | 5.83 | % | | 5.53 | % | | — | |

|

| Citigroup 90-Day U.S. Treasury Bill Index | | 0.15 | % | | 2.10 | % | | 2.12 | % | | — | |

|

| Morningstar U.S. Open-End Moderate Allocation Funds Avg. | | 11.97 | % | | 3.55 | % | | 4.36 | % | | — | |

|

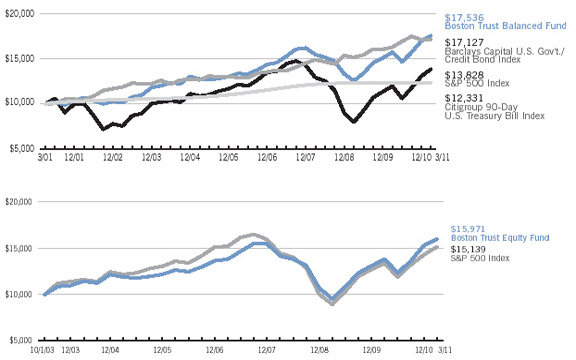

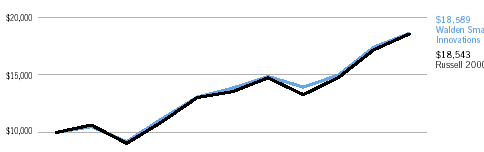

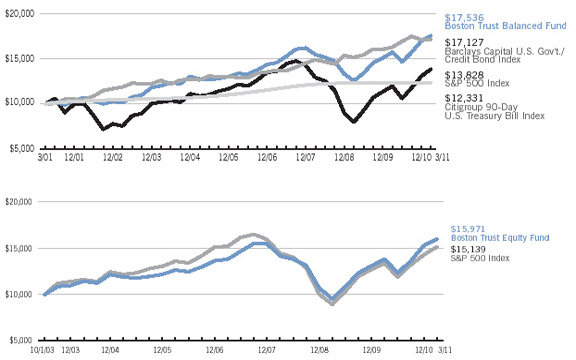

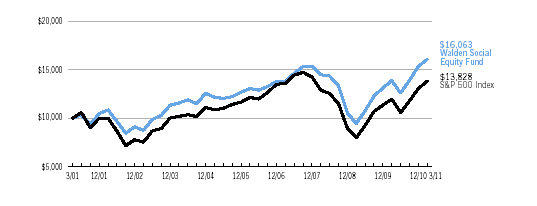

Hypothetical Growth of a $10,000 Investment

The top chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Balanced Fund. The bottom chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Equity Fund from October 1, 2003 to March 31, 2011. Both charts represent the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graphs do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Balanced Fund is measured against a combination of equity and fixed income indices. The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”) which is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also widely viewed as a proxy for the total market. The Barclays Capital U.S. Government/Credit Bond Index is a component of the Barclays U.S. Aggregate Index. The Barclays Capital U.S. Government/Credit Bond Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), Government-Related issues (i.e., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Citigroup 90-Day U.S. Treasury Bill Index reflects monthly return equivalents of yield averages that are not marked to the market. The Index is an average of the last three-month treasury bill issues. The three-month treasury bills are the short-term debt obligations of the U.S. Government. The Morningstar U.S. Open-End Moderate Allocation Funds Average represents performance of portfolios that seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. These portfolios tend to hold larger positions in stocks than conservative-allocation portfolios. These portfolios typically have 50% to 70% of assets in equities and the remainder in fixed income and cash. The indices are unmanaged and their performance does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Balanced Fund

| Fund Net Asset Value: | $31.56 |

| Gross Expense Ratio1: | 1.09% |

Equity Fund

| Fund Net Asset Value: | $14.46 |

| Gross Expense Ratio1: | 1.12% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2010. The Gross Expense Ratio excludes the impact of any voluntary or contractual fee waivers. After giving effect to such fee waivers, the Balanced Fund’s Net Expense Ratio would be 1.01%, and the Equity Fund’s Net Expense Ratio would be 1.00%, including the indirect expenses of investing in acquired funds. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of March 31, 2011 can be found in the financial highlights. The investment performance reflects voluntary and contractual fee waivers. If such fee reductions had not occurred, the quoted performance would have been lower. The voluntary fee waivers may be discontinued at any time. The contractual fee waiver continues through August 1, 2012 and may be terminated thereafter. |

5

| |

Boston Trust Midcap Fund | |

| | March 31, 2011 | |

| |

Stephen J. Amyouny, CFA | |

| | Portfolio Manager Boston Trust Investment Management, Inc. | |

| |

Fund Objective | |

| | The Fund seeks long-term capital growth through an actively managed portfolio of stocks of middle capitalization (“midcap”) companies. | |

| |

Investment Concerns | |

| | Equity securities (stocks) are more volatile and carry more risk and return potential than other forms investments, including investments in high-grade fixed income securities.

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure. | |

| | | |

| | | |

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Portfolio Review

The Boston Trust Midcap Fund posted a return of 29.32% for the year ended March 31, 2011. Although performance among sectors was broad-based and generally quite good, the Fund achieved particularly strong results within its more economically-sensitive industries, such as the industrial products & services, information technology, and consumer discretionary sectors. Security selection within the information technology sector also contributed significantly to performance as several of the Fund’s larger positions within this sector appreciated sharply during this period. Additionally, energy stocks benefited from the sharp increase in oil prices. Fund holdings within the more defensive, less economically-sensitive sectors, such as utilities and telecommunications, generally performed poorly relative to the broader market.

During the most recent quarter, two distinct and visible trends proved a headwind to the Fund: 1) investors’ appetite for risk was evident by the strong performance of stocks with high betas1 (i.e. volatility); and 2) the stocks of companies with significant leverage to commodity prices, especially within the energy and materials sectors, performed very well. With the exception of the brief period in which stocks came under selling pressure—primarily related to the Libyan uprising and the Japanese tsunami—investors rewarded the riskier stocks in the market. The Fund, which contains high-quality companies that favor steady and predictable earnings, did not benefit from these trends. Partially offsetting this headwind was our sector allocation decisions, which had a modestly positive impact. Although our portfolios are well-diversified with representation across all sectors, our modest overweight in healthcare and our underweight in financials provided positive contributions.*

Portfolio Strategy:

Equities have rebounded substantially from the market bottom reached approximately two years ago, yet we believe that further gains are likely if corporate earnings and healthy free cash flows materialize as expected. Should these gains continue we believe that our high quality investment discipline is well positioned to reap these benefits. Providing some level of support to equity prices is the substantial cash balances and financial strength of our companies. Measures of balance sheet strength look remarkably robust and bode well for future capital growth, rising acquisition activity, and greater shareholder returns.*

The Fund remains well-diversified with an emphasis on multi-national companies with significant growth opportunities in developing regions of the world (e.g. technology and industrial product companies). This tilt toward economically-sensitive global industries and companies has provided positive benefits over the last 18 months; yet, we continue to assess the risk and reward potential of each Fund holding. If an external event disrupts the favorable trends that we anticipate, we believe the quality of our selections may, as in the past, provide a measure of protection.

| 1 | Beta is a means of measuring the volatility of a security or portfolio of securities in comparison with the market as a whole. A Beta of 1 indicates that the security will move with the market, greater than 1 indicates that it’s more volatile than the market, and less than 1 indicates that it’s less volatile than the market. |

| * | Portfolio composition is subject to change. |

6

| Investment Performance (Unaudited) | Boston Trust Midcap Fund

March 31, 2011 |

| | | Annualized |

| | | 1 Year | | Since |

| | | Ended | | Inception |

| | | 3/31/11 | | 9/24/07 |

| Boston Trust Midcap Fund1 | | 29.32 | % | | 6.63 | % |

| Russell Midcap® Index | | 24.27 | % | | 2.27 | % |

|

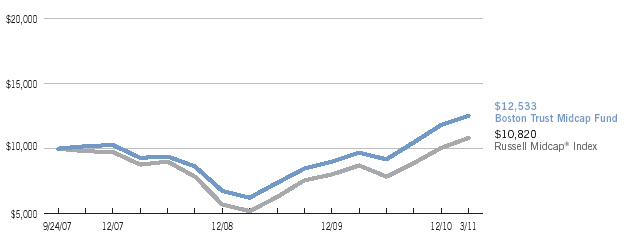

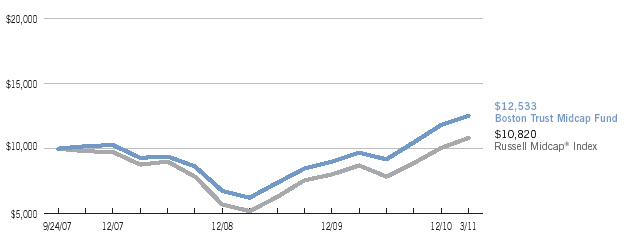

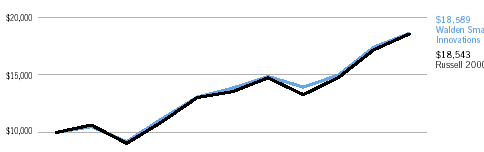

Hypothetical Growth of a $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Midcap Fund from September 24, 2007 to March 31, 2011, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap® Index, which is an unmanaged index that measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000 companies. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

| Fund Net Asset Value: | $11.96 |

| Gross Expense Ratio1: | 1.33% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2010. The Gross Expense Ratio excludes the impact of any voluntary or contractual fee waivers. After giving effect to such fee waivers, the Fund’s Net Expense Ratio would be 1.01%, including the indirect expenses of investing in acquired funds. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of March 31, 2011 can be found in the financial highlights. The investment performance reflects voluntary and contractual fee waivers. If such fee reductions had not occurred, the quoted performance would have been lower. The voluntary fee waivers may be discontinued at any time. The contractual fee waiver continues through August 1, 2012 and may be terminated thereafter. |

7

| |

Boston Trust Small Cap Fund | |

| | March 31, 2011 | |

| |

Kenneth P. Scott, CFA | |

| | Portfolio Manager Boston Trust Investment Management, Inc. | |

| |

Fund Objective | |

| | The Fund is to seeks long-term capital growth through an actively managed portfolio of stocks of small capitalization companies. | |

| |

Investment Concerns | |

| | Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average. | |

| | | |

| | | |

Manager Commentary (Unaudited)

Management Discussion of Fund Performance

Portfolio Review

The Boston Trust Small Cap Fund, which focuses on higher quality, innovative companies, rose 25.78% for the year ended March 31, 2011, in-line with the robust performance of the Russell 2000® Index. For the trailing three-year, five-year, and ten-year periods ended March 31, 2011, the Fund outperformed the benchmark with less volatility.

Contributors and Detractors to Performance

Overall, the Fund participated, albeit not fully, in the strong market rise of most quarters this fiscal year, while avoiding some of the downturn last spring. This performance pattern is consistent, in our view, with the Fund’s focus on higher quality, innovative companies. Generally speaking, higher quality firms underperform in a period of sharply rising stock prices. And, by certain measures of financial quality, such as returns on capital, and the stability of profitability, it appears that higher quality small cap firms did modestly underperform the small cap market during the past year, especially during the summer months. The Fund’s higher quality profile benefited from the market’s volatility this past year, in our view, while the acquisition of four Fund holdings in late 2010 also contributed positively. As noted previously, we aim to maintain Fund sector weights comparable to those of the overall market. Thus, our sector composition generally has no significant impact on overall performance.*

The best-performing Fund holdings through the full year period were CARBO Ceramics, Inc. (CRR), which represented 3.13% of the Fund at March 31, 2011, Hain Celestial Group, Inc. (HAIN)(0.61%), Lindsay Manufacturing Co. (LNN)(1.23%), and Under Armour, Inc. (UA)(1.71%). Conversely, the Fund laggards for the full year period were eHealth, Inc. (EHTH)(0.88%), Itron, Inc. (ITRI)(0.30%), Net 1 UEPS Technologies, Inc. (UEPS)(0.46%), and NutriSystem, Inc. (NTRI)(0.32%).*

Changes in Fund Positions

We sold the entire position of 17 small-cap stocks during the year. Five firms, including Lululemon Athletica (LULU), grew over Boston Trust’s upper market cap threshold. Four firms, including Baldor Electric (BEZ), were acquired. We sold 8 firms from the Fund due to concerns about the sustainability of future profitability or deteriorating fundamentals. These included Pre-Paid Legal Services (PPD) and Timberland (TBL).*

Conversely, we established new positions in 27 higher quality, innovative small cap company stocks during the fiscal year. Examples include East West Bancorp, Inc. (EWBC) (1.58%), Hub Group, Inc. (HUBG)(0.48%), InterDigital, Inc. (IDCC)(1.06%), NIC, Inc. (EGOV)(0.64%), and OYO Geospace Corp. (OYOG)(0.49%).

Fund Manager Outlook

With a trailing Price-to-Earnings1 ratio of 39x at March 31, 2011, the valuation of the Russell 2000® implies a continued, strong recovery in small cap company earnings. The market may have an overly optimistic outlook for small cap firms overall, and a shortfall in sales and earnings may prove disappointing. However, if the economy continues to improve, and small cap stocks live up to market expectations for growth, then these stocks may continue to perform well. In either case, we continue to believe that our focus on innovative, higher quality, more reasonably valued stocks leveraged to more sustainable elements of economic growth, may continue to provide value to clients’ overall portfolios over time.

| 1 | The Price-to-Earnings Ratio (“P/E Ratio”) is a valuation ratio of a company’s current share price to its per-share earnings. A high P/E means high projected earnings in the future. |

| * | Portfolio composition is subject to change. |

8

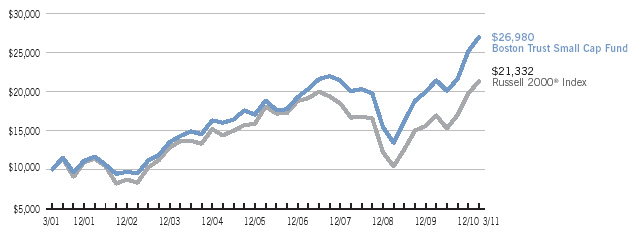

| Investment Performance (Unaudited) | Boston Trust Small Cap Fund

March 31, 2011 |

| | | Annualized |

| | | 1 Year | | 5 Years | | 10 Years |

| | | Ended | | Ended | | Ended |

| | | 3/31/11 | | 3/31/11 | | 3/31/11 |

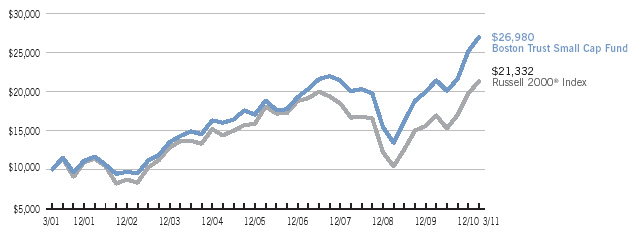

| Boston Trust Small Cap Fund1,* | | 25.78 | % | | 7.42 | % | | 10.43 | % |

| Russell 2000® Index | | 25.79 | % | | 3.35 | % | | 7.87 | % |

|

Hypothetical Growth of a $10,000 Investment

The chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Small Cap Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | The quoted performance for the Fund reflects the performance of a collective investment fund that was previously managed with full investment authority by the parent company of the Fund’s Adviser prior to the establishment of the Fund on December 16, 2005. The performance of the collective investment fund has been restated to reflect the net expenses of the Fund after all expenses at an annual rate of 1.25%, the Adviser’s expense limitation for its initial year of investment operations. The performance of the collective investment fund was restated to reflect the expenses associated with the mutual fund. The collective investment fund was not registered with the Securities and Exchange Commission and, therefore, was not subject to the investment restrictions imposed by law on registered mutual funds. If the collective investment fund had been registered, the collective investment fund’s performance may have been adversely affected. |

The Boston Trust Small Cap Fund is measured against the Russell 2000® Index, which is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

| Fund Net Asset Value: | $14.00 |

| Gross Expense Ratio1: | 1.16% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from the Fund’s most recent prospectus, dated August 1, 2010. The Gross Expense Ratio excludes the impact of any voluntary or contractual fee waivers. After giving effect to such fee waivers, the Fund’s Net Expense Ratio would be 1.02%, including the indirect expenses of investing in acquired funds. Please see the Fund’s most recent prospectus for details. Additional information pertaining to the Fund’s expense ratio as of March 31, 2011 can be found in the financial highlights. The investment performance reflects voluntary and contractual fee waivers. If such fee reductions had not occurred, the quoted performance would have been lower. The voluntary fee waivers may be discontinued at any time. The contractual fee waiver continues through August 1, 2012 and may be terminated thereafter. |

9

| |

| |

| Schedule of Portfolio Investments | | Boston Trust Balanced Fund

March 31, 2011 |

|

| COMMON STOCKS (72.6%) | | | | | | |

| Security Description | | | | Shares | | | Fair Value ($) |

| |

| Consumer Discretionary (5.8%) | | | | | | |

| Comcast Corp., Class A | | | 100,000 | | | 2,472,000 |

| Johnson Controls, Inc. | | | 30,000 | | | 1,247,100 |

| NIKE, Inc., Class B | | | 40,000 | | | 3,028,000 |

| Omnicom Group, Inc. | | | 50,000 | | | 2,453,000 |

| Ross Stores, Inc. | | | 50,000 | | | 3,556,000 |

| Target Corp. | | | 15,000 | | | 750,150 |

| | | | | | | | 13,506,250 |

| Consumer Products (10.0%) | | | | | | |

| Church & Dwight Co., Inc. | | | 15,000 | | | 1,190,100 |

| Costco Wholesale Corp. | | | 35,000 | | | 2,566,200 |

| Diageo PLC, Sponsored ADR | | | 25,000 | | | 1,905,500 |

| Kellogg Co. | | | 25,000 | | | 1,349,500 |

| McCormick & Co., Inc. | | | 60,000 | | | 2,869,800 |

| McDonald’s Corp. | | | 12,500 | | | 951,125 |

| Nestle SA, Sponsored ADR | | | 15,000 | | | 862,200 |

| PepsiCo, Inc. | | | 40,000 | | | 2,576,400 |

| Procter & Gamble Co. | | | 40,000 | | | 2,464,000 |

| SYSCO Corp. | | | 125,000 | | | 3,462,500 |

| Walgreen Co. | | | 80,000 | | | 3,211,200 |

| | | | | | | | 23,408,525 |

| Energy (11.9%) | | | | | | |

| Apache Corp. | | | 25,000 | | | 3,273,000 |

| Chevron Corp. | | | 50,000 | | | 5,371,500 |

| ConocoPhillips | | | 50,000 | | | 3,993,000 |

| Denbury Resources, Inc.(a) | | | 40,000 | | | 976,000 |

| Devon Energy Corp. | | | 10,000 | | | 917,700 |

| Exxon Mobil Corp. | | | 100,000 | | | 8,413,000 |

| Schlumberger Ltd. | | | 50,000 | | | 4,663,000 |

| | | | | | | | 27,607,200 |

| Financial Services (9.1%) | | | | | | |

| BB&T Corp. | | | 25,000 | | | 686,250 |

| Chubb Corp. | | | 60,000 | | | 3,678,600 |

| Cincinnati Financial Corp. | | | 125,000 | | | 4,100,000 |

| Comerica, Inc. | | | 45,000 | | | 1,652,400 |

| JPMorgan Chase & Co. | | | 35,000 | | | 1,613,500 |

| M&T Bank Corp. | | | 10,000 | | | 884,700 |

| Northern Trust Corp. | | | 25,000 | | | 1,268,750 |

| PNC Financial Services Group, Inc. | | | 25,000 | | | 1,574,750 |

| State Street Corp. | | | 25,000 | | | 1,123,500 |

| SunTrust Banks, Inc. | | | 25,000 | | | 721,000 |

| T. Rowe Price Group, Inc. | | | 60,000 | | | 3,985,200 |

| | | | | | | | 21,288,650 |

| Health Care (7.2%) | | | | | | |

| Becton, Dickinson & Co. | | | 40,000 | | | 3,184,800 |

| C.R. Bard, Inc. | | | 32,500 | | | 3,227,575 |

| DENTSPLY International, Inc. | | | 60,000 | | | 2,219,400 |

| Johnson & Johnson, Inc. | | | 25,000 | | | 1,481,250 |

| Medtronic, Inc. | | | 40,000 | | | 1,574,000 |

| Saint Jude Medical, Inc. | | | 35,000 | | | 1,794,100 |

| Stryker Corp. | | | 25,000 | | | 1,520,000 |

| Varian Medical Systems, Inc.(a) | | | 25,000 | | | 1,691,000 |

| | | | | | | | 16,692,125 |

| Industrial Materials (3.3%) | | | | | | |

| Air Products & Chemicals, Inc. | | | 25,000 | | | 2,254,500 |

| AptarGroup, Inc. | | | 40,000 | | | 2,005,200 |

| Ecolab, Inc. | | | 25,000 | | | 1,275,500 |

| Sigma-Aldrich Corp. | | | 35,000 | | | 2,227,400 |

| | | | | | | | 7,762,600 |

| | | | | | | |

| | | | | Shares or | | | |

| | | | | Principal | | | |

| Security Description | | | | Amount ($) | | | Fair Value ($) |

| |

| Industrial Products & Services (13.4%) | | | | | | |

| 3M Co. | | | 20,000 | | | 1,870,000 |

| Donaldson Co., Inc. | | | 75,000 | | | 4,596,750 |

| Emerson Electric Co. | | | 75,000 | | | 4,382,250 |

| Hubbell, Inc., Class B | | | 40,000 | | | 2,841,200 |

| Illinois Tool Works, Inc. | | | 65,000 | | | 3,491,800 |

| Precision Castparts Corp. | | | 30,000 | | | 4,415,400 |

| Rockwell Collins, Inc. | | | 50,000 | | | 3,241,500 |

| United Parcel Service, Inc., Class B | | | 40,000 | | | 2,972,800 |

| W.W. Grainger, Inc. | | | 25,000 | | | 3,442,000 |

| | | | | | | | 31,253,700 |

| Information Technology (11.9%) | | | | | | |

| Accenture PLC, Class A | | | 75,000 | | | 4,122,750 |

| Apple, Inc.(a) | | | 5,000 | | | 1,742,250 |

| Automatic Data Processing, Inc. | | | 75,000 | | | 3,848,250 |

| Cisco Systems, Inc. | | | 25,000 | | | 428,750 |

| EMC Corp.(a) | | | 150,000 | | | 3,982,500 |

| Hewlett-Packard Co. | | | 5,000 | | | 204,850 |

| Intel Corp. | | | 50,000 | | | 1,008,500 |

| International Business Machines Corp. | | | 27,500 | | | 4,484,425 |

| Microsoft Corp. | | | 125,000 | | | 3,170,000 |

| Oracle Corp. | | | 140,000 | | | 4,671,800 |

| | | | | | | | 27,664,075 |

| TOTAL COMMON STOCKS (Cost $106,590,194) | | | | | | 169,183,125 |

| |

| CORPORATE BONDS (3.6%) | | | | | | |

| Basic Materials (0.1%) | | | | | | |

| Weyerhaeuser Co., 7.25%, 7/1/13 | | | 300,000 | | | 314,862 |

| Consumer Products (0.2%) | | | | | | |

| Diageo Capital PLC, 5.50%, 9/30/16 | | | 500,000 | | | 557,541 |

| Financial Services (2.5%) | | | | | | |

| American Express Bank FSB, BKNT, 6.00%, | | | | | | |

9/13/17 | | | | 200,000 | | | 221,905 |

| American Express Co. | | | | | | |

7.00%, 3/19/18 | | | | 1,500,000 | | | 1,755,553 |

8.13%, 5/20/19 | | | | 1,675,000 | | | 2,093,097 |

| John Deere Capital Corp., Series D, 5.35%, | | | | | | |

4/3/18 | | | | 1,000,000 | | | 1,102,891 |

| National Rural Utilities Cooperative Finance Corp., | | | | | | |

10.38%, 11/1/18 | | | | 500,000 | | | 683,650 |

| | | | | | | | 5,857,096 |

| Industrial Products & Services (0.2%) | | | | | | |

| Emerson Electric Co., 5.13%, 12/1/16 | | | 300,000 | | | 334,618 |

| Information Technology (0.4%) | | | | | | |

| Oracle Corp., 5.75%, 4/15/18 | | | 750,000 | | | 841,066 |

| Telecommunications (0.2%) | | | | | | |

| AT&T, Inc., 5.63%, 6/15/16 | | | 500,000 | | | 559,965 |

| TOTAL CORPORATE BONDS (Cost $7,355,600) | | | | | | 8,465,148 |

| 10 | | See Notes to Financial Statements |

| |

| |

| Schedule of Portfolio Investments (cont.) | | Boston Trust Balanced Fund

March 31, 2011 |

|

| MUNICIPAL BONDS (2.9%) | | | | | | |

| | | | | Shares or | | | |

| | | | | Principal | | | |

| Security Description | | | | Amount ($) | | | Fair Value ($) |

| |

| Florida (0.6%) | | | | | | |

| Florida State Board of Education, Series A, GO, | | | | | | |

4.75%, 1/1/20, Callable 1/1/12 @ 101 | | | 300,000 | | | 312,747 |

| Florida State Board of Education, Series D, GO, | | | | | | |

5.00%, 6/1/21, Callable 6/1/17 @ 101 | | | 1,000,000 | | | 1,088,130 |

| | | | | | | | 1,400,877 |

| Illinois (0.6%) | | | | | | |

| Illinois State, GO, 5.00%, 4/1/24, Callable 4/1/17 | | | | | | |

@ 100 | | | | 500,000 | | | 478,110 |

| Illinois State, Series A | | | | | | |

5.00%, 3/1/22, Callable 3/1/14 @ 100 | | | 750,000 | | | 731,505 |

5.00%, 6/1/29, Callable 12/1/16 @ 100 | | | 250,000 | | | 228,105 |

| | | | | | | | 1,437,720 |

| Massachusetts (0.9%) | | | | | | |

| Massachusetts State Development Finance Agency | | | | | | |

Revenue, Series R-2, 5.00%, 7/1/28, Callable | | | | | | |

7/1/20 @ 100 | | | | 460,000 | | | 475,442 |

| Massachusetts State Health & Educational | | | | | | |

Facilities Authority Revenue, Series A, 5.00%, | | | | | | |

12/15/26, GO of Institution, Callable 12/15/19 | | | | | | |

@ 100 | | | | 1,500,000 | | | 1,619,445 |

| | | | | | | | 2,094,887 |

| Ohio (0.2%) | | | | | | |

| Ohio State, Series D, GO, 4.50%, 9/15/22, | | | | | | |

NATL-RE, Callable 3/15/16 @ 100 | | | 500,000 | | | 512,005 |

| Washington (0.1%) | | | | | | |

| Washington State, Series C, GO, 5.00%, 2/1/26, | | | | | | |

Callable 2/1/19 @ 100 | | | 250,000 | | | 262,183 |

| Wisconsin (0.5%) | | | | | | |

| Wisconsin State, Series C, GO, 5.00%, 5/1/25, | | | | | | |

Callable 5/1/18 @ 100 | | | 200,000 | | | 210,572 |

| Wisconsin State, Series D, GO, 5.50%, 5/1/26, | | | | | | |

Callable 5/1/18 @ 100 | | | 750,000 | | | 816,757 |

| | | | | | | | 1,027,329 |

| TOTAL MUNICIPAL BONDS (Cost $6,888,054) | | | | | | 6,735,001 |

| | | | | | | | |

| U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (19.3%) | | | | | | |

| | | | | Shares or | | | |

| | | | | Principal | | | |

| Security Description | | | | Amount ($) | | | Fair Value ($) |

| |

| Federal Home Loan Bank | | | | | | |

2.25%, 4/13/12 | | | 7,500,000 | | | 7,645,650 |

4.88%, 12/14/12 | | | 12,000,000 | | | 12,830,172 |

5.25%, 9/13/13 | | | 5,000,000 | | | 5,490,620 |

5.25%, 12/9/22 | | | 1,000,000 | | | 1,099,905 |

5.38%, 6/8/12 | | | 5,000,000 | | | 5,291,055 |

| Government National Mortgage Association | | | | | | |

6.00%, 10/15/36 | | | 1,222,236 | | | 1,346,434 |

| U.S. Treasury Bills(a)(b) | | | | | | |

0.11%, 6/9/11 | | | 1,500,000 | | | 1,499,827 |

0.13%, 4/21/11 | | | 3,500,000 | | | 3,499,864 |

| U.S. Treasury Inflation Protected Bonds | | | | | | |

1.25%, 7/15/20 | | | 6,057,900 | | | 6,265,653 |

| TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY | | | | | | |

OBLIGATIONS (Cost $43,326,884) | | | | | | 44,969,180 |

| | | | | | | | |

| INVESTMENT COMPANIES (1.6%) | | | | | | |

| Victory Federal Money Market, Investor Shares, | | | | | | |

0.01% (c) | | | 3,818,329 | | | 3,818,329 |

| Total Investment Companies (Cost $3,818,329) | | | | | | 3,818,329 |

| Total Investments (Cost $167,979,061) (d) — 100.0% | | | | | | 233,170,783 |

| Other assets in excess of liabilities — 0.0% | | | | | | 57,378 |

| NET ASSETS — 100.0% | | | | | $ | 233,228,161 |

|

| (a) | | Non-income producing security. |

| (b) | | Rate represents the effective yield at purchase. |

| (c) | | Rate disclosed is the seven day yield as of March 31, 2011. |

| (d) | | See Federal Tax Information listed in the Notes to Financial Statements. |

| ADR | | American Depositary Receipt |

| BKNT | | Bank Note |

| FSB | | Federal Savings Bank |

| GO | | General Obligation |

| NATL-RE | | Reinsured by National Public Finance Guarantee Corporation |

| PLC | | Public Limited Company |

| | See Notes to Financial Statements | 11 |

| |

| |

| Financial Statements | | Boston Trust Balanced Fund |

| |

| STATEMENT OF ASSETS AND LIABILITIES | | | | |

| March 31, 2011 | | | | |

| | | | | |

| Assets: | | | | |

| Investments, at fair value (cost $167,979,061) | | $ | 233,170,783 | |

| Interest and dividends receivable | | | 915,289 | |

| Receivable for investments sold | | | 934,249 | |

| Receivable for capital shares issued | | | 84 | |

| Prepaid expenses and other assets | | 18,668 | |

Total Assets | | 235,039,073 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 1,562,734 | |

| Payable for capital shares redeemed | | | 23,600 | |

| Accrued expenses and other liabilities: | | | | |

Investment adviser | | | 162,938 | |

Administration and accounting | | | 5,809 | |

Custodian | | | 4,173 | |

Transfer agent | | | 1,861 | |

Trustee | | | 738 | |

Other | | 49,059 | |

Total Liabilities | | 1,810,912 | |

| Net Assets | | $ | 233,228,161 | |

| Composition of Net Assets: | | | | |

| Capital | | $ | 169,532,580 | |

| Accumulated net investment income | | | 792,716 | |

| Accumulated net realized losses from investment transactions | | | (2,288,857 | ) |

| Net unrealized appreciation from investments | | 65,191,722 | |

| Net Assets | | $ | 233,228,161 | |

Shares Outstanding (par value $0.01, unlimited number of shares authorized) | | 7,390,865 | |

Net Asset Value, Offering Price and Redemption Price per share | | $ | 31.56 | |

| STATEMENT OF OPERATIONS | | | | |

| For the year ended March 31, 2011 | | | | |

| | | | | |

| Investment Income: | | | | |

| Interest | | $ | 2,331,457 | |

| Dividends | | 2,857,910 | |

Total Investment Income | | 5,189,367 | |

| Expenses: | | | | |

Investment adviser | | | 1,558,874 | |

Administration and accounting | | | 422,609 | |

Trustee | | | 14,925 | |

Custodian | | | 40,977 | |

Transfer agency | | | 19,541 | |

Chief compliance officer | | | 11,148 | |

Recoupment of prior expenses reimbursed by the investment adviser | | | 17,016 | |

Other | | 130,871 | |

Total expenses before fee reductions | | | 2,215,961 | |

Fees voluntarily reduced by the administrator | | (136,554 | ) |

| Net Expenses | | 2,079,407 | |

| Net Investment Income | | 3,109,960 | |

| Net Realized/Unrealized Gains from Investments: | | | | |

Net realized gains from investment transactions | | | 286,430 | |

Change in unrealized appreciation from investments | | 20,040,206 | |

| Net realized/unrealized gains from investments | | 20,326,636 | |

| Change in Net Assets Resulting from Operations | | $ | 23,436,596 | |

| 12 | | See Notes to Financial Statements |

| |

| |

| Financial Statements | | Boston Trust Balanced Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | | |

| | | For the year ended | | For the year ended |

| | | March 31, | | March 31, |

| | | 2011 | | 2010 |

| | | | | | | | | |

| | | | | | | | | |

| Investment Activities: | | | | | | | | |

| Operations: | | | | | | | | |

Net investment income | | $ | 3,109,960 | | | $ | 3,221,977 | |

Net realized gains from investment transactions | | | 286,430 | | | | 946,272 | |

Change in unrealized appreciation/depreciation from investments | | 20,040,206 | | | 34,043,468 | |

| Change in Net Assets Resulting from Operations | | 23,436,596 | | | 38,211,717 | |

| Dividends: | | | | | | | | |

Net investment income | | (3,144,788) | | | (3,153,684) | |

| Change in Net Assets Resulting from Shareholder Dividends | | (3,144,788) | | | (3,153,684) | |

| Capital Share Transactions: | | | | | | | | |

Proceeds from shares issued | | | 26,295,763 | | | | 26,227,435 | |

Dividends reinvested | | | 2,969,891 | | | | 3,011,645 | |

Cost of shares redeemed | | (16,640,819) | | | (12,386,127) | |

| Change in Net Assets Resulting from Capital Share Transactions | | 12,624,835 | | | 16,852,953 | |

| Change in Net Assets | | | 32,916,643 | | | | 51,910,986 | |

| Net Assets: | | | | | | | | |

Beginning of period | | 200,311,518 | | | 148,400,532 | |

End of period | | $ | 233,228,161 | | | $ | 200,311,518 | |

| Share Transactions: | | | | | | | | |

Issued | | | 877,206 | | | | 973,787 | |

Reinvested | | | 99,062 | | | | 109,834 | |

Redeemed | | (568,537) | | | (461,327) | |

| Change in Shares | | | 407,731 | | | | 622,294 | |

Accumulated net investment income | | $ | 792,716 | | | $ | 827,544 | |

See Notes to Financial Statements | | 13 |

| |

| |

| Financial Highlights | | Boston Trust Balanced Fund |

| |

| FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout the years indicated. | |

| | | | | | | | | | | | | | | | | | | | | |

| | | For the year | | | For the year | | | For the year | | | For the year | | | For the year | |

| | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 28.69 | | | $ | 23.33 | | | $ | 30.31 | | | $ | 29.87 | | | $ | 29.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.44 | | | | 0.47 | | | | 0.49(a) | | | | 0.46 | | | | 0.46 | |

Net realized and unrealized gains (losses) from investment transactions | | 2.88 | | | 5.36 | | | (6.11) | | | 1.42 | | | 2.13 | |

| Total from Investment Activities | | 3.32 | | | 5.83 | | | (5.62) | | | 1.88 | | | 2.59 | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividends: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | (0.45) | | | (0.47) | | | (0.52) | | | (0.45) | | | (0.43) | |

Net realized gains from investments | | — | | | — | | | (0.84) | | | (0.99) | | | (1.40) | |

| Total Dividends | | (0.45) | | | (0.47) | | | (1.36) | | | (1.44) | | | (1.83) | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 31.56 | | | $ | 28.69 | | | $ | 23.33 | | | $ | 30.31 | | | $ | 29.87 | |

| Total Return | | 11.65% | | | 25.08% | | | (18.68)% | | | 6.06% | | | 8.98% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | $ | 233,228 | | | $ | 200,312 | | | $ | 148,401 | | | $ | 183,314 | | | $ | 170,307 | |

| Ratio of net expenses to average net assets | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

Ratio of net investment income to average net assets | | | 1.50% | | | | 1.84% | | | | 1.80% | | | | 1.46% | | | | 1.50% | |

Ratio of expenses (before fee reductions) to average net assets(b) | | | 1.07% | | | | 1.08% | | | | 1.08% | | | | 1.08% | | | | 1.07% | |

| Portfolio Turnover Rate | | | 15.76% | | | | 12.90% | | | | 21.30% | | | | 33.49% | | | | 37.24% | |

|

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| 14 | | See Notes to Financial Statements |

| |

| |

| Schedule of Portfolio Investments | | Boston Trust Equity Fund

March 31, 2011 |

|

| COMMON STOCKS (99.6%) |

| Security Description | | | | Shares | | | Fair Value ($) |

| | | | | | | | |

| Consumer Discretionary (7.4%) | | | | | | | |

| Comcast Corp., Class A | | | 40,000 | | | | 988,800 |

| Johnson Controls, Inc. | | | 18,000 | | | | 748,260 |

| NIKE, Inc., Class B | | | 7,500 | | | | 567,750 |

| Omnicom Group, Inc. | | | 25,000 | | | | 1,226,500 |

| Ross Stores, Inc. | | | 12,500 | | | | 889,000 |

| Target Corp. | | | 5,000 | | | | 250,050 |

| | | | | | | | 4,670,360 |

| Consumer Products (12.2%) | | | | | | | |

| Church & Dwight Co., Inc. | | | 7,500 | | | | 595,050 |

| Costco Wholesale Corp. | | | 15,000 | | | | 1,099,800 |

| Diageo PLC, Sponsored ADR | | | 12,500 | | | | 952,750 |

| Kellogg Co. | | | 5,000 | | | | 269,900 |

| McCormick & Co., Inc. | | | 15,000 | | | | 717,450 |

| McDonald’s Corp. | | | 2,500 | | | | 190,225 |

| PepsiCo, Inc. | | | 12,500 | | | | 805,125 |

| Procter & Gamble Co. | | | 12,500 | | | | 770,000 |

| SYSCO Corp. | | | 40,000 | | | | 1,108,000 |

| Walgreen Co. | | | 30,000 | | | | 1,204,200 |

| | | | | | | | 7,712,500 |

| Energy (16.4%) | | | | | | | |

| Apache Corp. | | | 12,000 | | | | 1,571,040 |

| Chevron Corp. | | | 16,000 | | | | 1,718,880 |

| ConocoPhillips | | | 20,000 | | | | 1,597,200 |

| Denbury Resources, Inc.(a) | | | 10,000 | | | | 244,000 |

| Devon Energy Corp. | | | 5,000 | | | | 458,850 |

| Exxon Mobil Corp. | | | 35,000 | | | | 2,944,550 |

| Schlumberger Ltd. | | | 20,000 | | | | 1,865,200 |

| | | | | | | | 10,399,720 |

| Financial Services (12.9%) | | | | | | | |

| Chubb Corp. | | | 22,000 | | | | 1,348,820 |

| Cincinnati Financial Corp. | | | 40,000 | | | | 1,312,000 |

| Comerica, Inc. | | | 17,500 | | | | 642,600 |

| JPMorgan Chase & Co. | | | 10,000 | | | | 461,000 |

| M&T Bank Corp. | | | 5,000 | | | | 442,350 |

| Northern Trust Corp. | | | 7,500 | | | | 380,625 |

| PNC Financial Services Group, Inc. | | | 12,500 | | | | 787,375 |

| State Street Corp. | | | 12,500 | | | | 561,750 |

| SunTrust Banks, Inc. | | | 10,000 | | | | 288,400 |

| T. Rowe Price Group, Inc. | | | 30,000 | | | | 1,992,600 |

| | | | | | | | 8,217,520 |

| Health Care (10.2%) | | | | | | | |

| Becton, Dickinson & Co. | | | 15,000 | | | | 1,194,300 |

| C.R. Bard, Inc. | | | 12,500 | | | | 1,241,375 |

| DENTSPLY International, Inc. | | | 30,000 | | | | 1,109,700 |

| Johnson & Johnson, Inc. | | | 3,500 | | | | 207,375 |

| Medtronic, Inc. | | | 20,000 | | | | 787,000 |

| Saint Jude Medical, Inc. | | | 10,000 | | | | 512,600 |

| Stryker Corp. | | | 12,500 | | | | 760,000 |

| Varian Medical Systems, Inc.(a) | | | 10,000 | | | | 676,400 |

| | | | | | | | 6,488,750 |

| Industrial Materials (5.8%) | | | | | | | |

| Air Products & Chemicals, Inc. | | | 10,000 | | | | 901,800 |

| AptarGroup, Inc. | | | 15,000 | | | | 751,950 |

| Ecolab, Inc. | | | 15,000 | | | | 765,300 |

| Sigma-Aldrich Corp. | | | 20,000 | | | | 1,272,800 |

| | | | | | | | 3,691,850 |

| Industrial Products & Services (18.2%) | | | | | | | |

| 3M Co. | | | 5,000 | | | | 467,500 |

| Donaldson Co., Inc. | | | 25,000 | | | | 1,532,250 |

| Emerson Electric Co. | | | 35,000 | | | | 2,045,050 |

| Hubbell, Inc., Class B | | | 10,000 | | | | 710,300 |

| Illinois Tool Works, Inc. | | | 25,000 | | | | 1,343,000 |

| Precision Castparts Corp. | | | 15,000 | | | | 2,207,700 |

| Rockwell Collins, Inc. | | | 15,000 | | | | 972,450 |

| United Parcel Service, Inc., Class B | | | 9,000 | | | | 668,880 |

| W.W. Grainger, Inc. | | | 11,500 | | | | 1,583,320 |

| | | | | | | | 11,530,450 |

| Information Technology (16.5%) | | | | | | | |

| Accenture PLC, Class A | | | 25,000 | | | | 1,374,250 |

| Apple, Inc.(a) | | | 1,250 | | | | 435,563 |

| Automatic Data Processing, Inc. | | | 25,000 | | | | 1,282,750 |

| Cisco Systems, Inc. | | | 17,500 | | | | 300,125 |

| EMC Corp.(a) | | | 65,000 | | | | 1,725,750 |

| Hewlett-Packard Co. | | | 5,000 | | | | 204,850 |

| Intel Corp. | | | 20,000 | | | | 403,400 |

| International Business Machines Corp. | | | 10,000 | | | | 1,630,700 |

| Microsoft Corp. | | | 50,000 | | | | 1,268,000 |

| Oracle Corp. | | | 55,000 | | | | 1,835,350 |

| | | | | | | | 10,460,738 |

| TOTAL COMMON STOCKS (Cost $37,444,865) | | | | | | | 63,171,888 |

| | |

| INVESTMENT COMPANIES (0.3%) | |

Victory Federal Money Market, Investor Shares,

0.01% (b) | | | 214,061 | | | | 214,061 |

| Total Investment Companies (Cost $214,061) | | | | | | | 214,061 |

| Total Investments (Cost $37,658,926) (c) — 99.9% | | | | | | | 63,385,949 |

| Other assets in excess of liabilities — 0.1% | | | | | | | 77,491 |

| | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 63,463,440 |

|

| (a) | | Non-income producing security. |

| (b) | | Rate disclosed is the seven day yield as of March 31, 2011. |

| (c) | | See Federal Tax Information listed in the Notes to Financial Statements. |

| ADR | | American Depositary Receipt |

| PLC | | Public Limited Company |

See Notes to Financial Statements | | 15 |

| |

| |

| Financial Statements | | Boston Trust Equity Fund |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2011 | | | | | |

| | | | | | |

| Assets: | | | | | |

| Investments, at fair value (cost $37,658,926) | | | $ | 63,385,949 | |

| Dividends receivable | | | | 108,110 | |

| Receivable for investments sold | | | | 483,878 | |

| Prepaid expenses and other assets | | | | 4,678 | |

Total Assets | | | | 63,982,615 | |

| Liabilities: | | | | | |

| Payable for investments purchased | | | | 459,304 | |

| Accrued expenses and other liabilities: | | | | | |

Investment adviser | | | | 39,558 | |

Administration and accounting | | | | 1,595 | |

Custodian | | | | 1,578 | |

Transfer agent | | | | 2,066 | |

Trustee | | | | 227 | |

Other | | | | 14,847 | |

Total Liabilities | | | | 519,175 | |

| Net Assets | | | $ | 63,463,440 | |

| Composition of Net Assets: | | | | | |

| Capital | | | $ | 40,653,132 | |

| Accumulated net investment income | | | | 131,770 | |

| Accumulated net realized losses from investment transactions | | | | (3,048,485) | |

| Net unrealized appreciation from investments | | | | 25,727,023 | |

| Net Assets | | | $ | 63,463,440 | |

Shares Outstanding (par value $0.01, unlimited number of shares authorized) | | | | 4,388,108 | |

Net Asset Value, Offering Price and Redemption Price per share | | | $ | 14.46 | |

| STATEMENT OF OPERATIONS |

| For the year ended March 31, 2011 | | | | | |

| | | | | | |

| Investment Income: | | | | | |

| Dividends | | | $ | 1,026,926 | |

Total Investment Income | | | | 1,026,926 | |

| Expenses: | | | | | |

Investment adviser | | | | 415,918 | |

Administration and accounting | | | | 115,179 | |

Trustee | | | | 3,986 | |

Custodian | | | | 12,966 | |

Transfer agency | | | | 19,563 | |

Chief compliance officer | | | | 2,966 | |

Other | | | | 34,579 | |

Total expenses before fee reductions | | | | 605,157 | |

Fees voluntarily reduced by the administrator | | | | (36,462) | |

Fees contractually reduced by the investment adviser | | | | (13,866) | |

| Net Expenses | | | | 554,829 | |

| Net Investment Income | | | | 472,097 | |

| Net Realized/Unrealized Gains from Investments: | | | | | |

Net realized gains from investment transactions | | | | 242,815 | |

Change in unrealized appreciation from investments | | | | 7,726,327 | |

| Net realized/unrealized gains from investments | | | | 7,969,142 | |

| Change in Net Assets Resulting from Operations | | | $ | 8,441,239 | |

| 16 | | See Notes to Financial Statements |

| |

| |

| Financial Statements | | Boston Trust Equity Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | | For the year ended | | | | For the year ended | |

| | | | March 31, | | | | March 31, | |

| | | | 2011 | | | | 2010 | |

| | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | |

| Operations: | | | | | | | | | | |

Net investment income | | | $ | 472,097 | | | | $ | 440,449 | |

Net realized gains from investment transactions | | | | 242,815 | | | | | 774,817 | |

Change in unrealized appreciation from investments | | | | 7,726,327 | | | | | 16,019,763 | |

| Change in Net Assets Resulting from Operations | | | | 8,441,239 | | | | | 17,235,029 | |

| Dividends: | | | | | | | | | | |

Net investment income | | | | (457,037) | | | | | (435,641) | |

| Change in Net Assets Resulting from Shareholder Dividends | | | | (457,037) | | | | | (435,641) | |

| Capital Share Transactions: | | | | | | | | | | |

Proceeds from shares issued | | | | 3,647,169 | | | | | 2,198,669 | |

Dividends reinvested | | | | 404,313 | | | | | 393,025 | |

Cost of shares redeemed | | | | (2,155,592) | | | | | (4,506,458) | |

| Change in Net Assets Resulting from Capital Share Transactions | | | | 1,895,890 | | | | | (1,914,764) | |

| Change in Net Assets | | | | 9,880,092 | | | | | 14,884,624 | |

| Net Assets: | | | | | | | | | | |

Beginning of period | | | | 53,583,348 | | | | | 38,698,724 | |

End of period | | | $ | 63,463,440 | | | | $ | 53,583,348 | |

| Share Transactions: | | | | | | | | | | |

Issued | | | | 282,284 | | | | | 200,783 | |

Reinvested | | | | 29,971 | | | | | 33,279 | |

Redeemed | | | | (168,962) | | | | | (401,965) | |

| Change in Shares | | | | 143,293 | | | | | (167,903) | |

| Accumulated net investment income | | | $ | 131,770 | | | | $ | 116,710 | |

See Notes to Financial Statements | | 17 |

| |

| |

| Financial Statements | | Boston Trust Equity Fund |

| |

| FINANCIAL HIGHLIGHTS |

| Selected data for a share outstanding throughout the years indicated. |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | For the year | | | For the year | | | For the year | | | For the year | | | For the year | |

| | | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | $ | 12.62 | | | $ | 8.77 | | | $ | 13.17 | | | $ | 13.17 | | | $ | 12.39 | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | 0.11 | | | | 0.10 | | | | 0.10(a) | | | | 0.08 | | | | 0.09 | |

Net realized and unrealized gains (losses) from investment transactions | | | | 1.84 | | | | 3.85 | | | | (4.40) | | | | 0.30 | | | | 1.04 | |

| Total from Investment Activities | | | | 1.95 | | | | 3.95 | | | | (4.30) | | | | 0.38 | | | | 1.13 | |

| Dividends: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | (0.11) | | | | (0.10) | | | | (0.10) | | | | (0.08) | | | | (0.08) | |

Net realized gains from investments | | | | — | | | | — | | | | — | | | | (0.30) | | | | (0.27) | |

| Total Dividends | | | | (0.11) | | | | (0.10) | | | | (0.10) | | | | (0.38) | | | | (0.35) | |

| Net Asset Value, End of Period | | | $ | 14.46 | | | $ | 12.62 | | | $ | 8.77 | | | $ | 13.17 | | | $ | 13.17 | |

| Total Return | | | | 15.48% | | | | 45.13% | | | | (32.73)% | | | | 2.59% | | | | 9.20% | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | | $ | 63,463 | | | $ | 53,583 | | | $ | 38,699 | | | $ | 65,050 | | | $ | 59,884 | |

| Ratio of net expenses to average net assets | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Ratio of net investment income to average net assets | | | | 0.85% | | | | 0.92% | | | | 0.86% | | | | 0.55% | | | | 0.71% | |

Ratio of expenses (before fee reductions) to average net assets(b) | | | | 1.09% | | | | 1.11% | | | | 1.10% | | | | 1.10% | | | | 1.11% | |

| Portfolio Turnover Rate | | | | 14.31% | | | | 19.90% | | | | 28.85% | | | | 23.53% | | | | 21.48% | |

| |

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| 18 | | See Notes to Financial Statements |

| |

| |

| Schedule of Portfolio Investments | | Boston Trust Midcap Fund

March 31, 2011 |

|

| COMMON STOCKS (97.5%) |

| Security Description | | | | Shares | | | Fair Value ($) |

| Consumer Discretionary (12.9%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | 4,850 | | | | 318,257 |

| Autoliv, Inc. | | | | 5,830 | | | | 432,761 |

| Cablevision Systems Corp., Class A | | | | 10,500 | | | | 363,405 |

| Family Dollar Stores, Inc. | | | | 6,000 | | | | 307,920 |

| Gentex Corp. | | | | 9,050 | | | | 273,762 |

| Guess?, Inc. | | | | 7,500 | | | | 295,125 |

| John Wiley & Sons, Inc., Class A | | | | 2,600 | | | | 132,184 |

| O’Reilly Automotive, Inc.(a) | | | | 6,700 | | | | 384,982 |

| Omnicom Group, Inc. | | | | 7,750 | | | | 380,215 |

| Ross Stores, Inc. | | | | 8,700 | | | | 618,744 |

| | | | | | | | | 3,507,355 |

| Consumer Products (8.0%) | | | | | | | | |

| Brown-Forman Corp., Class B | | | | 6,375 | | | | 435,413 |

| Church & Dwight Co., Inc. | | | | 8,250 | | | | 654,555 |

| Clorox Co. | | | | 3,000 | | | | 210,210 |

| Hasbro, Inc. | | | | 7,250 | | | | 339,590 |

| McCormick & Co., Inc. | | | | 11,300 | | | | 540,479 |

| | | | | | | | | 2,180,247 |

| Energy (9.2%) | | | | | | | | |

| Cabot Oil & Gas Corp. | | | | 7,500 | | | | 397,275 |

| Core Laboratories NV | | | | 4,000 | | | | 408,680 |

| Denbury Resources, Inc.(a) | | | | 21,425 | | | | 522,770 |

| FMC Technologies, Inc.(a) | | | | 5,325 | | | | 503,106 |

| Murphy Oil Corp. | | | | 6,500 | | | | 477,230 |

| QEP Resources, Inc. | | | | 4,750 | | | | 192,565 |

| | | | | | | | | 2,501,626 |

| Financial Services (15.2%) | | | | | | | | |

| Bank of Hawaii Corp. | | | | 4,200 | | | | 200,844 |

| Cincinnati Financial Corp. | | | | 14,905 | | | | 488,884 |

| Comerica, Inc. | | | | 10,275 | | | | 377,298 |

| Commerce Bancshares, Inc. | | | | 6,893 | | | | 278,753 |

| Corporate Office Properties Trust | | | | 6,500 | | | | 234,910 |

| Digital Realty Trust, Inc. | | | | 4,300 | | | | 250,002 |

| East West Bancorp, Inc. | | | | 10,000 | | | | 219,600 |

| IntercontinentalExchange, Inc.(a) | | | | 2,500 | | | | 308,850 |

| Jones Lang LaSalle, Inc. | | | | 1,675 | | | | 167,065 |

| M&T Bank Corp. | | | | 3,650 | | | | 322,915 |

| Morningstar, Inc. | | | | 5,875 | | | | 342,982 |

| SEI Investments Co. | | | | 14,000 | | | | 334,320 |

| T. Rowe Price Group, Inc. | | | | 6,000 | | | | 398,520 |

| TD Ameritrade Holding Corp. | | | | 10,025 | | | | 209,222 |

| | | | | | | | | 4,134,165 |

| Health Care (11.2%) | | | | | | | | |

| C.R. Bard, Inc. | | | | 5,850 | | | | 580,963 |

| DENTSPLY International, Inc. | | | | 11,500 | | | | 425,385 |

| Gen-Probe, Inc.(a) | | | | 4,200 | | | | 278,670 |

| IDEXX Laboratories, Inc.(a) | | | | 2,650 | | | | 204,633 |

| Patterson Cos., Inc. | | | | 7,650 | | | | 246,254 |

| Pharmaceutical Product Development, Inc. | | | | 5,875 | | | | 162,796 |

| ResMed, Inc.(a) | | | | 8,100 | | | | 243,000 |

| Techne Corp. | | | | 2,700 | | | | 193,320 |

| Varian Medical Systems, Inc.(a) | | | | 4,200 | | | | 284,088 |

| Waters Corp.(a) | | | | 5,000 | | | | 434,500 |

| | | | | | | | | 3,053,609 |

| Industrial Materials (5.1%) | | | | | | | | |

| AptarGroup, Inc. | | | | 9,600 | | | | 481,248 |

| Ecolab, Inc. | | | | 6,225 | | | | 317,600 |

| Sigma-Aldrich Corp. | | | | 9,275 | | | | 590,261 |

| | | | | | | | | 1,389,109 |

| | | | | | | | | |

| Industrial Products & Services (16.1%) | | | | | | | | |

| AMETEK, Inc. | | | | 11,750 | | | | 515,472 |

| C.H. Robinson Worldwide, Inc. | | | | 4,150 | | | | 307,640 |

| CLARCOR, Inc. | | | | 6,950 | | | | 312,263 |

| Donaldson Co., Inc. | | | | 9,000 | | | | 551,610 |

| Expeditors International of Washington, Inc. | | | | 5,200 | | | | 260,728 |

| L-3 Communications Holdings, Inc. | | | | 3,000 | | | | 234,930 |

| Lincoln Electric Holdings, Inc. | | | | 7,500 | | | | 569,400 |

| Mettler-Toledo International, Inc.(a) | | | | 2,800 | | | | 481,600 |

| Rockwell Collins, Inc. | | | | 9,000 | | | | 583,470 |

| W.W. Grainger, Inc. | | | | 4,225 | | | | 581,698 |

| | | | | | | | | 4,398,811 |

| Information Technology (15.1%) | | | | | | | | |

| Amdocs Ltd.(a) | | | | 12,000 | | | | 346,200 |

| BMC Software, Inc.(a) | | | | 12,200 | | | | 606,828 |

| Check Point Software Technologies Ltd.(a) | | | | 10,900 | | | | 556,445 |

| Citrix Systems, Inc.(a) | | | | 5,225 | | | | 383,828 |

| F5 Networks, Inc.(a) | | | | 3,200 | | | | 328,224 |

| FactSet Research Systems, Inc. | | | | 2,600 | | | | 272,298 |

| Fiserv, Inc.(a) | | | | 3,250 | | | | 203,840 |

| Paychex, Inc. | | | | 5,700 | | | | 178,752 |

| Polycom, Inc.(a) | | | | 5,500 | | | | 285,175 |

| Skyworks Solutions, Inc.(a) | | | | 9,250 | | | | 299,885 |

| Teradata Corp.(a) | | | | 13,000 | | | | 659,100 |

| | | | | | | | | 4,120,575 |

| Telecommunications (1.2%) | | | | | | | | |

| NII Holdings, Inc.(a) | | | | 8,050 | | | | 335,444 |

| | | | | | | | | |

| Utilities (3.5%) | | | | | | | | |

| AGL Resources, Inc. | | | | 5,150 | | | | 205,176 |

| Energen Corp. | | | | 4,500 | | | | 284,040 |

| NSTAR | | | | 4,700 | | | | 217,469 |

| Questar Corp. | | | | 15,000 | | | | 261,750 |

| | | | | | | | | 968,435 |

| TOTAL COMMON STOCKS (Cost $18,731,790) | | | | | | | | 26,589,376 |

| | | | | | | | | | |

| INVESTMENT COMPANIES (2.4%) |

Victory Federal Money Market, Investor Shares,

0.01% (b) | | | | 665,515 | | | | 665,515 |

| Total Investment Companies (Cost $665,515) | | | | | | | | 665,515 |

| Total Investments (Cost $19,397,305) (c) — 99.9% | | | | | | | | 27,254,891 |

| Other assets in excess of liabilities — 0.1% | | | | | | | | 20,628 |

| NET ASSETS — 100.0% | | | | | | | $ | 27,275,519 |

| |

| (a) | | Non-income producing security. |

| (b) | | Rate disclosed is the seven day yield as of March 31, 2011. |

| (c) | | See Federal Tax Information listed in the Notes to Financial Statements. |

See Notes to Financial Statements | | 19 |

| |

| |

| Financial Statements | | Boston Trust Midcap Fund |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2011 | | | | | |

| Assets: | | | | | |

| Investments, at fair value (cost $19,397,305) | | | $ | 27,254,891 | |

| Dividends receivable | | | | 21,841 | |

| Receivable for capital shares issued | | | | 17,940 | |

| Prepaid expenses and other assets | | | | 3,365 | |

Total Assets | | | | 27,298,037 | |

| Liabilities: | | | | | |

| Accrued expenses and other liabilities: | | | | | |

Investment adviser | | | | 15,909 | |

Administration and accounting | | | | 673 | |

Custodian | | | | 584 | |

Transfer agent | | | | 2,006 | |

Trustee | | | | 45 | |

Other | | | | 3,301 | |

Total Liabilities | | | | 22,518 | |

| Net Assets | | | $ | 27,275,519 | |

| Composition of Net Assets: | | | | | |

| Capital | | | $ | 18,920,771 | |

| Accumulated net investment income | | | | 10,330 | |

| Accumulated net realized gains from investment transactions | | | | 486,832 | |

| Net unrealized appreciation from investments | | | | 7,857,586 | |

| Net Assets | | | $ | 27,275,519 | |

| Shares Outstanding (par value $0.01, unlimited number of shares authorized) | | | | 2,279,625 | |

| Net Asset Value, Offering Price and Redemption Price per share | | | $ | 11.96 | |

| STATEMENT OF OPERATIONS | | | | | |

| For the year ended March 31, 2011 | | | | | |

| Investment Income: | | | | | |

| Dividends | | | $ | 252,939 | |

| Less: Foreign tax withholding | | | | (421) | |

Total Investment Income | | | | 252,518 | |

| Expenses: | | | | | |

Investment adviser | | | | 151,132 | |

Administration and accounting | | | | 44,410 | |

Trustee | | | | 1,280 | |

Custodian | | | | 8,410 | |

Transfer agency | | | | 20,080 | |

Chief compliance officer | | | | 927 | |

Other | | | | 16,560 | |

Total expenses before fee reductions | | | | 242,799 | |

Fees voluntarily reduced by the administrator | | | | (13,302) | |

Fees contractually reduced by the investment adviser | | | | (27,687) | |

| Net Expenses | | | | 201,810 | |

| Net Investment Income | | | | 50,708 | |

| Net Realized/Unrealized Gains from Investments: | | | | | |

Net realized gains from investment transactions | | | | 1,174,341 | |

Change in unrealized appreciation from investments | | | | 4,206,917 | |

| Net realized/unrealized gains from investments | | | | 5,381,258 | |

| Change in Net Assets Resulting from Operations | | | $ | 5,431,966 | |

| 20 | | See Notes to Financial Statements |

| |

| |

| Financial Statements | | Boston Trust Midcap Fund |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | | For the year ended | | | | For the year ended | |

| | | | March 31, | | | | March 31, | |

| | | | 2011 | | | | 2010 | |

| Investment Activities: | | | | | | | | | | |

| Operations: | | | | | | | | | | |

Net investment income | | | $ | 50,708 | | | | $ | 29,258 | |

Net realized gains from investment transactions | | | | 1,174,341 | | | | | 74,712 | |

Change in unrealized appreciation from investments | | | | 4,206,917 | | | | | 4,650,605 | |

| Change in Net Assets Resulting from Operations | | | | 5,431,966 | | | | | 4,754,575 | |

| Dividends: | | | | | | | | | | |

Net investment income | | | | (43,671) | | | | | (33,641) | |

Net realized gains from investment transactions | | | | (407,930) | | | | | — | |

| Change in Net Assets Resulting from Shareholder Dividends | | | | (451,601) | | | | | (33,641) | |

| Capital Share Transactions: | | | | | | | | | | |

Proceeds from shares issued | | | | 5,926,173 | | | | | 4,098,321 | |

Dividends reinvested | | | | 394,901 | | | | | 31,914 | |

Cost of shares redeemed | | | | (334,592) | | | | | (561,325) | |

| Change in Net Assets Resulting from Capital Share Transactions | | | | 5,986,482 | | | | | 3,568,910 | |

| Change in Net Assets | | | | 10,966,847 | | | | | 8,289,844 | |

| Net Assets: | | | | | | | | | | |

Beginning of period | | | | 16,308,672 | | | | | 8,018,828 | |

End of period | | | $ | 27,275,519 | | | | $ | 16,308,672 | |

| Share Transactions: | | | | | | | | | | |

Issued | | | | 549,194 | | | | | 474,162 | |

Reinvested | | | | 35,545 | | | | | 3,714 | |

Redeemed | | | | (32,572) | | | | | (69,958) | |

| Change in Shares | | | | 552,167 | | | | | 407,918 | |

| Accumulated net investment income | | | $ | 10,330 | | | | $ | 3,293 | |

See Notes to Financial Statements | | 21 |

| |

| |

| Financial Highlights | | Boston Trust Midcap Fund |

| |

| FINANCIAL HIGHLIGHTS |

| Selected data for a share outstanding throughout the periods indicated. |

| | | For the year | | | For the year | | | For the year | | | For the period | |

| | | ended | | | ended | | | ended | | | ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008(a) | |

| Net Asset Value, Beginning of Period | | $ | 9.44 | | | $ | 6.08 | | | $ | 9.23 | | | $ | 10.00 | |

| Investment Activities: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.02 | | | | 0.02(b) | | | | 0.01 | |

Net realized and unrealized gains (losses) from investment transactions | | | 2.73 | | | | 3.36 | | | | (3.07) | | | | (0.71) | |

| Total from Investment Activities | | | 2.75 | | | | 3.38 | | | | (3.05) | | | | (0.70) | |

| Dividends: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02) | | | | (0.02) | | | | (0.02) | | | | —(c) | |

Net realized gains from investments | | | (0.21) | | | | — | | | | (0.08) | | | | (0.07) | |

| Total Dividends | | | (0.23) | | | | (0.02) | | | | (0.10) | | | | (0.07) | |

| Net Asset Value, End of Period | | $ | 11.96 | | | $ | 9.44 | | | $ | 6.08 | | | $ | 9.23 | |

| Total Return(d) | | | 29.32% | | | | 55.68% | | | | (33.03)% | | | | (7.05)% | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | $ | 27,276 | | | $ | 16,309 | | | $ | 8,019 | | | $ | 13,433 | |

| Ratio of net expenses to average net assets(e) | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Ratio of net investment income to average net assets(e) | | | 0.25% | | | | 0.26% | | | | 0.24% | | | | 0.29% | |

| Ratio of expenses (before fee reductions) to average net assets(e)(f) | | | 1.20% | | | | 1.32% | | | | 1.48% | | | | 1.58% | |

| Portfolio Turnover Rate(d) | | | 18.58% | | | | 26.44% | | | | 22.93% | | | | 17.87% | |

| |

| (a) | | Commenced operations on September 24, 2007. |

| (b) | | Calculated using the average shares method. |

| (c) | | Less than $0.005 per share. |

| (d) | | Not annualized for periods less than one year. |

| (e) | | Annualized for periods less than one year. |

| (f) | | During the period, certain fees were reduced. If such fee reductions had not occurred, the ratio would have been as indicated. |

| 22 | | See Notes to Financial Statements |

| |

| |

| Schedule of Portfolio Investments | | Boston Trust Small Cap Fund

March 31, 2011 |

| |

| COMMON STOCKS (99.5%) |

| Security Description | | | Shares | | Fair Value ($) |

| Consumer Discretionary (12.5%) | | | | | | |

| Ambassadors Group, Inc. | | | 55,000 | | | 602,250 |

| Amerigon, Inc.(a) | | | 89,700 | | | 1,369,719 |

| Capella Education Co.(a) | | | 48,500 | | | 2,414,815 |

| Fuel Systems Solutions, Inc.(a) | | | 76,400 | | | 2,305,752 |

| Hibbett Sports, Inc.(a) | | | 78,300 | | | 2,803,923 |

| John Wiley & Sons, Inc., Class A | | | 112,200 | | | 5,704,248 |

| K12, Inc.(a) | | | 57,550 | | | 1,939,435 |

| LKQ Corp.(a) | | | 155,000 | | | 3,735,500 |

| NutriSystem, Inc. | | | 59,500 | | | 862,155 |

| Select Comfort Corp.(a) | | | 114,100 | | | 1,376,046 |

| Tempur-Pedic International, Inc.(a) | | | 65,300 | | | 3,308,098 |

| The Men’s Wearhouse, Inc. | | | 49,385 | | | 1,336,358 |

| Under Armour, Inc., Class A(a) | | | 67,300 | | | 4,579,765 |

| Universal Technical Institute, Inc. | | | 64,300 | | | 1,250,635 |

| | | | | | | 33,588,699 |

| Consumer Products (3.1%) | | | | | | |