UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06526 | | |

| | | The Coventry Group | | |

| | | | (Exact name of registrant as specified in charter) | | |

| | | | | | |

| 3435 Stelzer Rd. | | Columbus, OH | | 43219 |

| | | | (Address of principal executive offices) | | (Zip code) |

| | | | | | |

| 3435 Stelzer Rd. | | Columbus, OH | | 43219 |

| | | | (Name and address of agent for service) | | |

| Registrant’s telephone number, including area code: | 1-800-282-8782 | | |

| | | | | | |

| Date of fiscal year end: | | March 31 | | |

| | | | | | |

| Date of reporting period: | | March 31, 2010 | | |

Item 1. Reports to Stockholders.

| | | |

| |

| |

| |

| |

|

| |

| Boston Trust Balanced Fund |

| Boston Trust Equity Fund |

| Boston Trust Midcap Fund |

| Boston Trust Small Cap Fund |

| |

| Walden Social Balanced Fund |

| Walden Social Equity Fund |

| Walden Small Cap Innovations Fund |

| |

| |

|

| |

| |

| |

| |

| |

| |

| | ANNUAL REPORT |

| |

| | March 31, 2010 |

| |

| |

| |

| |

Boston Trust Investment Management, Inc., a subsidiary of Boston Trust & Investment Management Company (BTIM) and an affiliate of Walden Asset Management (Walden) serves as investment adviser (the Adviser) to the Boston Trust and Walden Funds and receives a fee for its services. Walden, a division of BTIM, performs shareholder advocacy, proxy voting, screening services, and other social initiatives for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by Boston Trust & Investment Management Company or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by Foreside Distribution Services, L.P., Gahanna, OH.

The foregoing information and opinions are for general information only. Boston Trust Funds and Boston Trust Investment Management, Inc. do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

Economic and Market

Summary (unaudited) | Boston Trust Balanced Fund

Boston Trust Equity Fund

Manager Commentary by Domenic Colasacco |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of these Funds will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Many of the primary stock indices reached new recovery highs during the final quarter of the Funds’ fiscal year. As a welcome change, price gains were achieved without the volatility and fanfare that accompanied financial market trends over the past several years. Nearly all the media headlines were captured by the historic political battle in Washington over health care legislation and the equally contentious struggle in Europe to address Greece’s severe debt and budget problems. The latter, which has yet to be fully resolved, brought to light the inherent structural weaknesses in the European monetary union. Stock investors mostly looked past these headlines and were pleased with reports of further progress toward economic stabilization and recovery. Not only have consumer spending and business capital investment continued to improve, but corporate profits and cash flows have been at the upper end of expectations, particularly for non-financial companies. Additionally, a few nascent signs emerged that a modest reversal in the severe employment downturn is underway. Indeed, just after quarter-end, the Labor Department reported the first substantive monthly increase in private sector jobs since the financial crisis began.

As outlined in the statistical table, the Boston Trust Balanced Fund’s return for the past 12 months was slightly below the composite benchmark. The shortfall primarily reflects the underperformance of the Fund’s equity segment during a period of sharply rising stock prices - the S&P 500 Index1 was up by nearly 50% in the past year. Such relative price trends are typical given the equity segments’ focus on stocks of companies that have comparatively stable business models, with less financial and operating leverage. Performance is above average over all longer-term periods. The Boston Trust Equity Fund returned 45.13% for the 12-month period ended March 31, 2010 compared to 49.77% for the S&P 500. As with the Boston Trust Balanced Fund, the shortfall reflects the focus on stocks of companies with comparatively stable business models, and with less financial and operating leverage.†

We are especially pleased that an investment in the Fund is now within 3% of the record, quarter-end high that was reached on December 31, 2007. By comparison, a portfolio invested entirely in the S&P 500 would have to rise by another 25% or so to return to peak 2007 values. Will the Fund recoup the balance of the loss in the months ahead? Or have stock prices risen too far (up roughly 50% in just one year), too fast in light of the improved yet still problematic economic environment? The future is never certain, but we think the current upward trend will continue. Our views in this regard are summarized in more detail in the Economic Outlook and Investment Strategy.†

Economic Summary & Outlook

Current economic conditions are far from ideal. The list of problem areas remain long and include the following: a structural trade imbalance; budget deficits and debt levels, at all levels of government, that are at their highest ratios to gross domestic product since World War II; the highest unemployment in nearly 30 years; impaired household balance sheets; an energy policy, which still relies on imported oil; and wages, after inflation adjustments,

|

| 1 | The Standard & Poor’s 500 Index (“S&P 500”), an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. |

| † | Portfolio composition is subject to change. |

|

1

Economic and Market

Summary (unaudited)(cont.) | Boston Trust Balanced Fund

Boston Trust Equity Fund

Manager Commentary by Domenic Colasacco |

|

wages that in over a decade have made little progress. Moreover, economic conditions in Japan and most of Europe are not much better than our own. Little wonder that consumer confidence is close to the lowest level in several generations.

Yet these economic problems are not new. As we have seen over both the past quarter and year, an increase in stock prices is not dependent on an ideal economic environment. That is especially true in times, such as now, when stock valuations relative to sales, earnings, cash flows and prevailing interest rates are reasonable. In our view, the essential ingredient needed to sustain an upward trend in stock prices going forward is further aggregate improvement, however modest, in the myriad of economic problems that exist. There is little question that, as bad as the economic situation may appear today, matters were worse 3, 6 and especially 12 months ago. Last spring, much of our financial system was in crisis, we were shedding hundreds of thousands of jobs every month, and house prices, along with corporate profits and cash flows, were in a virtual free-fall. None of these is the case today. The government’s monetary and fiscal policy initiatives merit much of the credit for the recent economic improvement. Such policies remain firmly in place and, in our opinion, are likely to lead to further gains in business activity-and stock prices-in the year ahead. We believe stock market returns may become especially attractive if, as intended, the policy initiatives lead to more substantive increases in private sector confidence and spending.

Asset Allocation: Our policy and practice has been to keep the Boston Trust Balanced Fund’s equity allocation within an approximate range of 45% to 75% of total assets. Two primary factors drive our equity allocation decision process: comparative stock/bond valuations and prospective economic conditions. When both are favorable, we tend to keep stock exposure near maximum, while the opposite is true during periods of high stock prices and weak economics. Gradations in either or both factors lead us to some middle ground.†

At fiscal year-end, the Boston Trust Balanced Fund’s equity allocation was nearly 70% of total assets. That compares with just under 65% at 12/31/09 and 53% at 6/30/09. As outlined in my prior reports, we have been of the opinion that stocks became attractively priced relative to most valuation metrics over a year ago. Our typical conservatism, however, led us to increase stock exposure only as our confidence in the economic foundation strengthened. We expect to follow a similar path in the months ahead and may increase the Fund’s equity allocation by several additional percentage points, provided the economic news, on the margin, remains positive. There is also no question that our preference for stocks is influenced by the close to zero return available in money market instruments and the low absolute yield levels of longer term bonds. Stock prices do not have to rise much in the year ahead to perform better than fixed income instruments generally.†

Equity and Fixed Income Component: Equity performance in the Boston Trust Equity Fund and the equity component of the Boston Trust Balanced Fund was aided by the steps we took beginning in late summer of 2009 to increase exposure to stocks in cyclical sectors that would benefit comparatively from improvement in economic activity. These included a number of industrial capital equipment companies, as well as those firms that manufacture and sell discretionary products directly to consumers. In addition, our decision to purchase stocks in a handful of well-positioned regional banks and insurance companies also contributed significantly to recent positive equity results.†

Given current low absolute bond yields, and our view that interest rates are more likely to rise than fall in the months ahead, we do not expect to revise our year-long decision to emphasize shorter term bonds. For more detail on Fund holdings, please refer to the Fund’s financial statements.†

Thank you for your continued confidence in our services. Please feel free to contact us directly at 617-726-7250 should you have any questions about our investment views or your account.

Domenic Colasacco

Portfolio Manager and President

Boston Trust Investment Management, Inc.

|

| † | Portfolio composition is subject to change. |

|

2

| Investment Performance (unaudited) | Boston Trust Balanced Fund

March 31, 2010 |

|

| Fund Net Asset Value: $28.69 | | |

| Gross Expense Ratio1: 1.09% | | |

| | | Annualized | |

| |

|

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | Ended | | | Ended | | | Ended | |

| | | 3/31/10 | | | 3/31/10 | | | 3/31/10 | |

| Boston Trust Balanced Fund | | 25.08 | % | | | 4.30 | % | | | 4.08 | % | |

| Lipper Mixed-Asset Target Allocation Growth Funds Average | | 40.02 | % | | | 2.96 | % | | | 1.92 | % | |

| S&P 500 Index | | 49.77 | % | | | 1.92 | % | | | -0.65 | % | |

| Barclays Capital U.S. Government/Credit Bond Index | | 7.51 | % | | | 5.17 | % | | | 6.22 | % | |

| Citigroup 90-Day U.S. Treasury Bill Index | | 0.13 | % | | | 2.76 | % | | | 2.70 | % | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2009. Additional information pertaining to the Fund’s expense ratios as of March 31, 2010 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2009, the Total Fund Operating Expenses would be 1.08% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

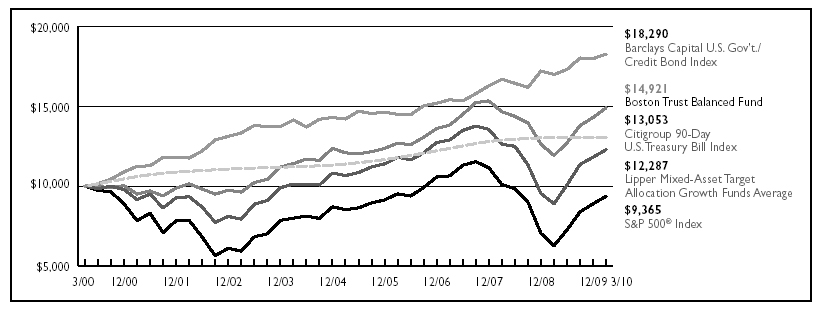

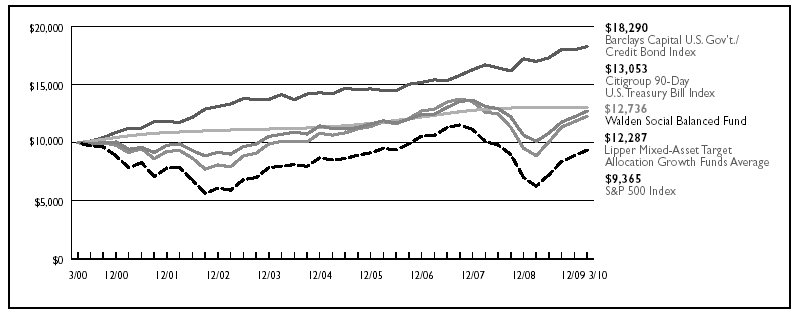

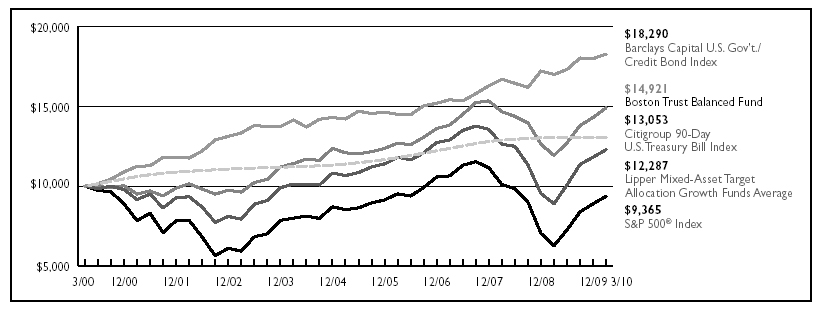

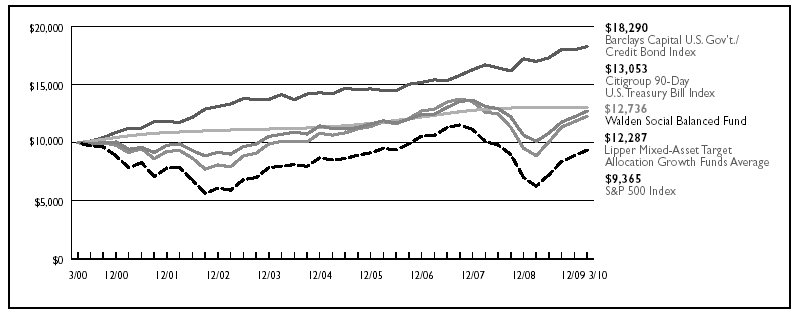

The chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Balanced Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Balanced Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Government/Credit Bond Index is a non-securitized component of the Barclays U.S. Aggregate Index and was the first macro index launched by Lehman Brothers. The Barclays Capital U.S. Government/Credit Bond Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), Government-Related issues (i.e., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Citigroup 90-Day U.S. Treasury Bill Index reflects monthly return equivalents of yield averages that are not marked to the market. The Index is an average of the last three-month treasury bill issues. The three-month treasury bills are the short-term debt obligations of the U.S. Government. The indices’ performance is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services.

The Lipper Mixed-Asset Target Allocation Growth Funds Average (“Lipper Average”) is an average of managed mutual funds whose primary objective is to maintain a mix of between 60%-80% equity securities with the remainder invested in bonds, cash and cash equivalents. The Lipper Average is an equally weighted index of the largest managed mutual funds within their respective investment objectives, adjusted for the reinvestment of capital gains distributions and income dividends and net of all fund expenses. Investors cannot invest directly in an index.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

3

| Investment Performance (unaudited) | Boston Trust Equity Fund

March 31, 2010 |

|

| Fund Net Asset Value: $12.62 | | |

| Gross Expense Ratio1: 1.12% | | |

| | Annualized | |

| |

|

| | | 1 Year | | | 5 Years | | | Since | |

| | | Ended | | | Ended | | | Inception | |

| | | 3/31/10 | | | 3/31/10 | | | 10/1/03 | |

| Boston Trust Equity Fund | | 45.13 | % | | | 3.05 | % | | | 5.12 | % | |

| S&P 500 Index | | 49.77 | % | | | 1.92 | % | | | 4.23 | % | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2009. Additional information pertaining to the Fund’s expense ratios as of March 31, 2010 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2009, the Total Fund Operating Expenses would be 1.10% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

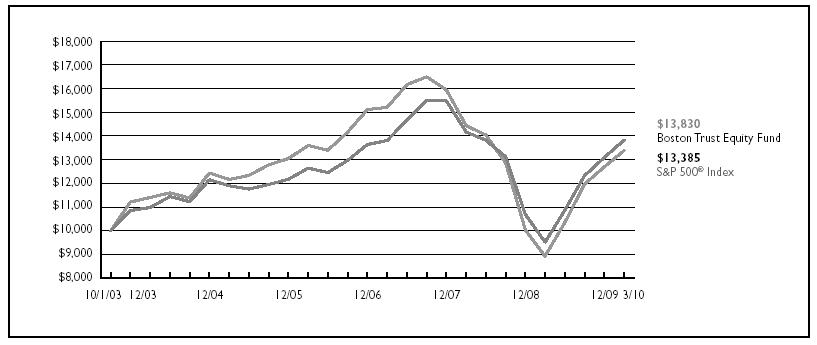

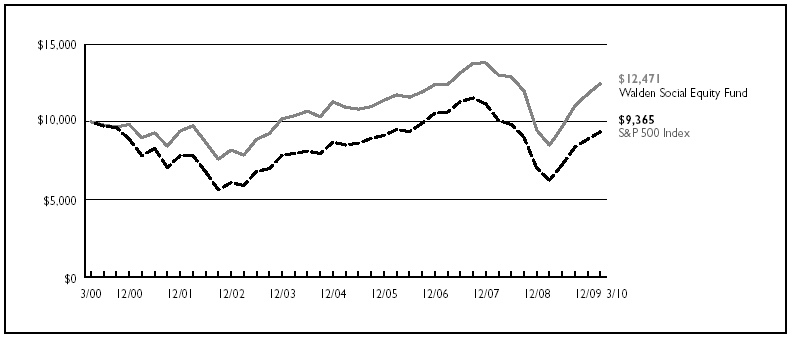

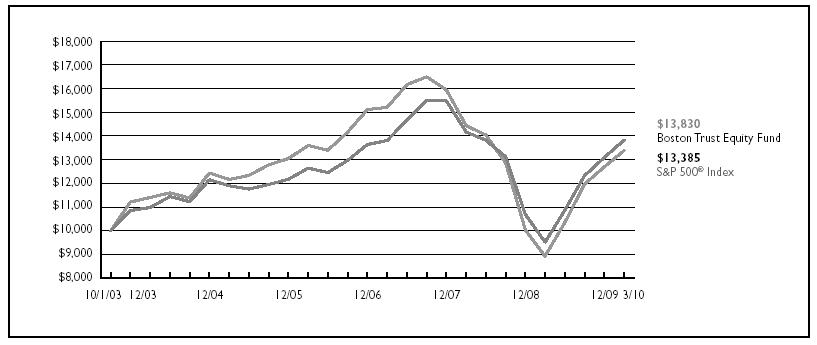

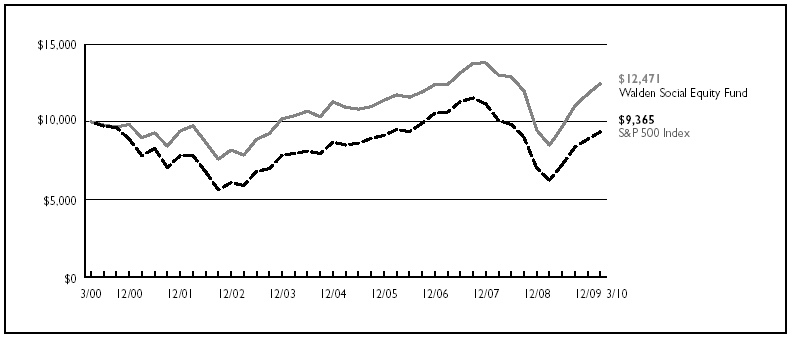

The chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Equity Fund from October 1, 2003 to March 31, 2010, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Index (“S&P 500”), which is an unmanaged index that is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

4

Economic and Market

Summary (unaudited) | Boston Trust Midcap Fund

Manager Commentary by Stephen J. Amyouny |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Mid-capitalization stocks typically carry additional risk, since smaller companies companies generally have higher risk of failure and, historically, their stocks have experienced a greater degree of volatility.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Market Summary

The equity markets continued their upward rise during the first quarter of 2010 as economic activity gained momentum and further signs of financial stabilization appeared. Price gains were achieved without the significant volatility that has been prevalent over the last few years. Not only have consumer spending and business capital investment continued to improve, but corporate profits and cash flows have been at the upper end of expectations, particularly for non-financial companies. Credit markets have stabilized substantially as evidenced by the significant reduction in corporate bond yield spreads relative to U.S. treasuries. This improvement has provided companies with increased access to capital, lower costs of capital, and enhanced liquidity, which are critical components to future growth. Additionally, a few nascent signs emerged that a modest reversal in the severe employment downturn is underway. Indeed, just after quarter-end, the Labor Department reported the first substantive monthly increase in private sector jobs since the financial crisis began.

Midcap stocks, as measured by the benchmark Russell Midcap® Index1, posted strong results for the quarter (8.67%) and exceptionally strong results over the last 12 months (67.71%). Despite this incredible price recovery, the Russell Midcap® Index remains approximately 10% below its price at the beginning of 2008.

Portfolio Review

The Boston Trust Midcap Fund posted a return of 55.68% over the most recent 12 months. Although performance among sectors was broad-based and generally quite good, the Fund achieved particularly strong results within its more economically sensitive industries, such as the Industrial Products & Services, Financial Services, and Consumer Discretionary sectors. Within these groups, retailers Abercrombie & Fitch (0.7%) and Ross Stores (2.4%), auto supplier Autoliv (1.5%), regional banks Comerica (1.8%) and M&T Bank (1.8%), and aerospace suppliers Precision Castparts (1.6%) and Rockwell Collins (1.9%), posted strong performances for the period ended March 31, 2010. Solid gains were achieved among many technology, industrial materials, and energy companies. Fund holdings within the more defensive, less economically-sensitive sectors, such as utilities and consumer staples, generally performed poorly relative to the broader market.†

Over the last 12 months, lower quality stocks performed exceptionally well relative to stocks of higher quality companies. These lower quality stocks, which generally possess below average financial strength, higher than average financial leverage, and poor sales and earnings consistency, recovered sharply following their dismal performance in 2008 and early 2009. For this reason, the performance of the Fund, which concentrates its investments in the securities of higher quality companies, has trailed the benchmark over the last year; however, the Fund still posted an exceptionally high absolute return for the 12 months ended March 31, 2010, and the Fund’s annualized return since inception remains superior to the index.

We established new positions in several companies, including Teradata (1.2%), Check Point Software (1.1%), FMC Technologies (1.7%), Strayer Education (0.9%), and Morningstar (1.0%). We also liquidated positions in Energizer, GameStop, Nordstrom, Juniper Networks, Airgas, and Smith International—the latter two positions due to acquisitions by larger companies.†

| 1 | | The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000 companies. |

| | | |

| † | | Portfolio composition is subject to change. |

5

Economic and Market

Summary (unaudited)(cont.) | Boston Trust Midcap Fund

Manager Commentary by Stephen J. Amyouny |

|

Portfolio Strategy

We believe that the Fund remains very well diversified with broad-based exposure across economic sectors and a wide range of industries. We will continue to increase, selectively, the Fund’s portfolio allocation to allow exposure to economically sensitive industries, such as industrial products and technology companies that stand to benefit from accelerating global economic activity. Many of the companies held in the Fund have significant exposure to developing regions of the world, such as Brazil, China and India, where economic growth could very likely be robust in comparison to developed regions.†

We also remain acutely aware of the rising earnings expectations for most companies and the related potential for disappointments if earnings growth does not materialize as investors anticipate. For this reason, we continue to look to reduce or eliminate Fund positions in those companies where earnings expectations appear overly optimistic relative to our internal projections. Companies have generally reduced costs aggressively during the downcycle and are now positioned to achieve significant profit margin expansion over the next few quarters. We believe the combination of accelerating sales growth and margin expansion should lead to higher earnings for most companies this year. Our Fund’s long-term focus on high-quality companies with sustainable business models, attractive growth prospects, and reasonable valuations may produce attractive investment returns in this type of economic environment.†

The equities of the companies in bold-face in the commentary were holdings of the Boston Trust Midcap Fund as of March 31, 2010.

Stephen J. Amyouny, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

† Portfolio composition is subject to change.

6

| Investment Performance (unaudited) | Boston Trust Midcap Fund

March 31, 2010 |

|

| Fund Net Asset Value: $9.44 | | |

| Gross Expense Ratio1: 1.50% | | |

| | | Annualized | |

| |

|

| | | 1 Year | | | Since | |

| | | Ended | | | Inception | |

| | | 3/31/10 | | | 9/24/07 | |

| Boston Trust Midcap Fund | | 55.68 | % | | | -1.24 | % | |

| Russell Midcap® Index | | 67.71 | % | | | -5.35 | % | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2009. Additional information pertaining to the Fund’s expense ratios as of March 31, 2010 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2009, the Total Fund Operating Expenses would be 1.48% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

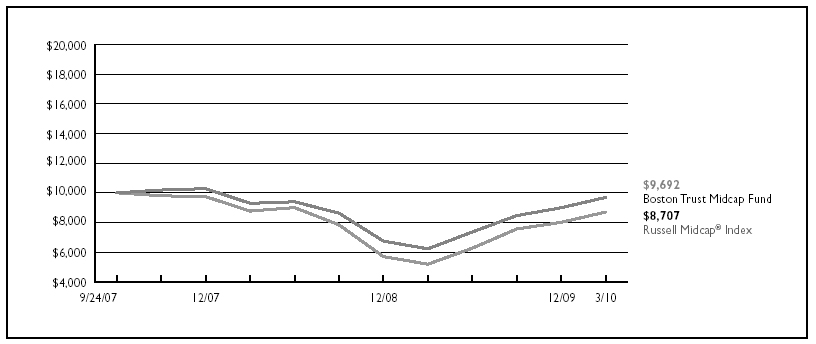

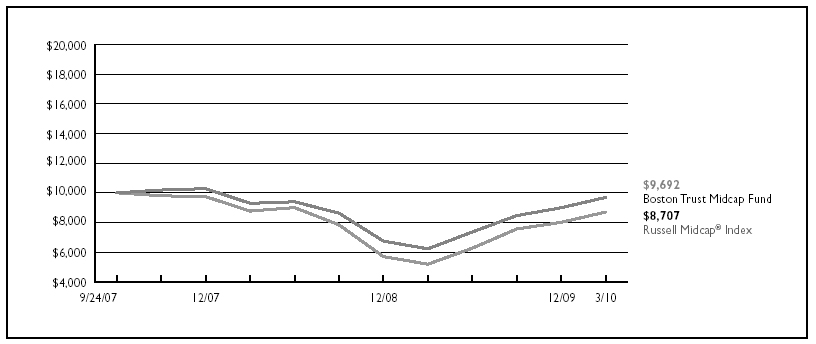

The chart represents historical performance of a hypothetical investment of $10,000 in the Boston Trust Midcap Fund from September 24, 2007 to March 31, 2010, and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap® Index, which is an unmanaged index that measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000 companies. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

7

Economic and Market

Summary (unaudited) | Boston Trust Small Cap Fund

Manager Commentary by Kenneth P. Scott |

|

Investment Concerns:

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Small-capitalization stocks typically carry additional risk, since smaller companies generally have higher risk of failure and, historically, their stocks have experienced a greater degree of volatility.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call us at 1.800.282.8782 ext. 7050.

Market Summary

Generally speaking, a sharp rebound in stock prices, like the one we have experienced over the past quarter, and year, favors lower quality companies—those less equipped to withstand economic hardship—whose share price suffered most during the preceding bear market. This can create a headwind for managers investing in higher quality companies. This appears to have been the case in the first quarter of 2010 and over the past year. While the Boston Trust Small Cap Fund’s absolute performance was positive, two key elements related to quality appear to be associated with lower relative returns for the quarter: firms with higher returns on invested capital, and those with more consistent returns on invested capital—both factors we favor—underperformed their less profitable and more volatile peers during the quarter.

Portfolio Review

After a market hiccup in January, small cap equity prices continued their rebound, as most economic fundamentals continued to improve during the first quarter of 2010. Boston Trust Small Cap Fund, which focuses on higher quality, innovative companies, underperformed the strong absolute performance of the Russell 2000® Index1 by more than one percent for the calendar quarter and for the one-year period ended March 31, 2010. For the five-year and ten-year periods ended March 31, 2010, the Boston Trust Small Cap Fund has outperformed the benchmark, with less volatility.†

As noted previously, we aim to maintain Fund sector weights comparable to those of the overall market. Thus, our sector composition generally has no significant impact on overall performance. That said, our stock performance within sectors generally reflects our high-quality bias. For example, our consumer discretionary picks did not keep up fully with the exceptional, double-digit performance of the small cap consumer discretionary sector, while our tech selections outperformed this market-lagging sector. Individually, Baldor Electric (2.3%), Lululemon (2.1%) and Polycom (2.4%) contributed most to first quarter performance, while Nutrisystem (0.5%), Investment Technology Group (1.0%) and Carbo Ceramics (1.5%) detracted most.†

During the first quarter 2010, we established new positions in Cantel Medical (CMN) (0.5%) which is a leading provider of infection prevention and control products in the healthcare market. Nutraceutical International (NUTR) (0.3%) is a leading manufacturer of branded nutritional supplements and natural products. Orrstown Financial (ORRF) (0.5%) and UMB Financial (UMBF) (0.5%) are community banks with conservative lending standards operating primarily in two areas less affected by the housing crisis—south-central Pennsylvania and Kansas City, Missouri, respectively. We sold stakes in Commerce Bancshares, Green Mountain Coffee Roasters and Idexx Laboratories from the Fund during the quarter because stock price appreciation moved them outside small cap market capitalization range. We also completed the sale of Encore Acquisition from the Fund, given its acquisition by Denbury Resources.†

Portfolio Strategy

We continue to believe that our focus on innovative, higher quality, more reasonably valued stocks leveraged to more sustainable elements of economic growth will continue to provide substantial value to client portfolios over time. We appreciate your continued confidence in our services.

The equities of the companies in bold-face in the commentary were holdings of the Boston Trust Small Cap Fund as of March 31, 2010.

Kenneth P. Scott, CFA

Portfolio Manager

Boston Trust Investment Management, Inc.

| 1 | | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. |

| † | | Portfolio composition is subject to change. |

8

| Investment Performance (unaudited) | Boston Trust Small Cap Fund

March 31, 2010 |

|

| Fund Net Asset Value: $11.52 | | |

| Gross Expense Ratio1: 1.20% | | |

| | | Annualized | |

| |

|

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | Ended | | | Ended | | | Ended | |

| | | 3/31/10 | | | 3/31/10 | | | 3/31/10 | |

| Boston Trust Small Cap Fund* | | 60.01 | % | | | 6.03 | % | | | 8.92 | % | |

| Russell 2000® Index | | 62.76 | % | | | 3.36 | % | | | 3.68 | % | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | | The above Gross Expense ratio is from the Fund’s prospectus dated August 1, 2009. Additional information pertaining to the Fund’s expense ratios as of March 31, 2010 can be found in the financial highlights. The investment performance reflects voluntary fee waivers which may be discontinued at any time and a contractual fee waiver which shall continue in effect from year to year only upon mutual agreement of the Fund and the Adviser. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Based on the Fund’s prospectus dated August 1, 2009, the Total Fund Operating Expenses would be 1.18% and the Net Fund Operating Expenses would be 1.00% excluding the indirect costs of investing in Acquired Funds. |

| |

| * | | The quoted performance for the Fund reflects the performance of a collective investment fund that was previously managed with full investment authority by the parent company of the Fund’s Adviser prior to the establishment of the Fund on December 16, 2005. The performance of the collective investment fund has been restated to reflect the net expenses of the Fund after all expenses at an annual rate of 1.25%, the Adviser’s expense limitation for its initial year of investment operations. The performance of the collective investment fund was restated to reflect the expenses associated with the mutual fund. The collective investment fund was not registered with the Securities and Exchange Commission and, therefore, was not subject to the investment restrictions imposed by law on registered mutual funds. If the collective investment fund had been registered, the collective investment fund’s performance may have been adversely affected. |

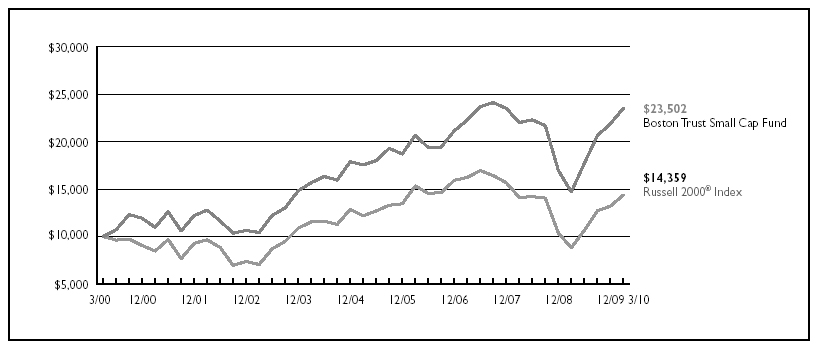

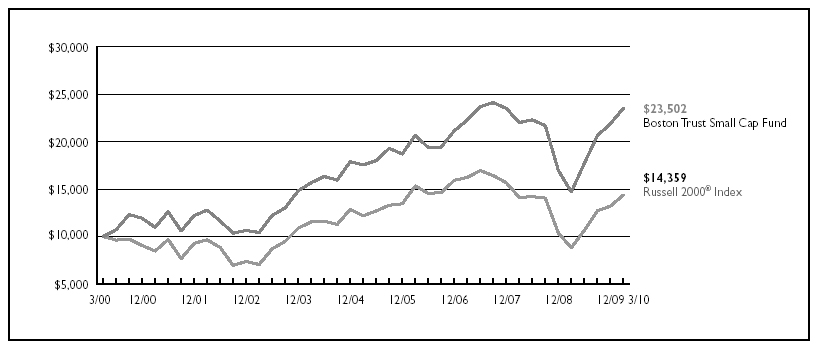

The chart represents historical 10-year performance of a hypothetical investment of $10,000 in the Boston Trust Small Cap Fund and represents the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Small Cap Fund is measured against the Russell 2000® Index, which is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

9

|

| Schedule of Portfolio Investments | | Boston Trust Balanced Fund

March 31, 2010 |

| COMMON STOCKS (67.9%) | | | | | | | |

| Security Description | | | | | Shares | | | Value ($) |

| |

| Consumer Discretionary (6.1%) | | | | | | | |

| Comcast Corp., Class A | | | | 80,000 | | | 1,505,600 |

| Johnson Controls, Inc. | | | | 30,000 | | | 989,700 |

| NIKE, Inc., Class B | | | | 25,000 | | | 1,837,500 |

| Omnicom Group, Inc. | | | | 60,000 | | | 2,328,600 |

| Ross Stores, Inc. | | | | 25,000 | | | 1,336,750 |

| Staples, Inc. | | | | 65,000 | | | 1,520,350 |

| Target Corp. | | | | 50,000 | | | 2,630,000 |

| | | | | | | | 12,148,500 |

| Consumer Products (9.9%) | | | | | | | |

| Costco Wholesale Corp. | | | | 35,000 | | | 2,089,850 |

| Diageo PLC, Sponsored ADR | | | | 35,000 | | | 2,360,750 |

| Kellogg Co. | | | | 50,000 | | | 2,671,500 |

| McCormick & Co., Inc. | | | | 75,000 | | | 2,877,000 |

| PepsiCo, Inc. | | | | 35,000 | | | 2,315,600 |

| Procter & Gamble Co. | | | | 60,000 | | | 3,796,200 |

| SYSCO Corp. | | | | 125,000 | | | 3,687,500 |

| | | | | | | | 19,798,400 |

| Energy (8.1%) | | | | | | | |

| Apache Corp. | | | | 20,000 | | | 2,030,000 |

| Chevron Corp. | | | | 40,000 | | | 3,033,200 |

| ConocoPhillips | | | | 45,000 | | | 2,302,650 |

| Exxon Mobil Corp. | | | | 65,000 | | | 4,353,700 |

| Schlumberger Ltd. | | | | 45,000 | | | 2,855,700 |

| XTO Energy, Inc. | | | | 35,000 | | | 1,651,300 |

| | | | | | | | 16,226,550 |

| Financial Services (9.9%) | | | | | | | |

| Bank of America Corp. | | | | 80,000 | | | 1,428,000 |

| Chubb Corp. | | | | 50,000 | | | 2,592,500 |

| Cincinnati Financial Corp. | | | | 125,000 | | | 3,612,500 |

| Comerica, Inc. | | | | 50,000 | | | 1,902,000 |

| JPMorgan Chase & Co. | | | | 25,000 | | | 1,118,750 |

| M&T Bank Corp. | | | | 20,000 | | | 1,587,600 |

| PNC Financial Services Group, Inc. | | | | 25,000 | | | 1,492,500 |

| State Street Corp. | | | | 30,000 | | | 1,354,200 |

| SunTrust Banks, Inc. | | | | 55,000 | | | 1,473,450 |

| T. Rowe Price Group, Inc. | | | | 60,000 | | | 3,295,800 |

| | | | | | | | 19,857,300 |

| Health Care (8.1%) | | | | | | | |

| Becton, Dickinson & Co. | | | | 35,000 | | | 2,755,550 |

| C.R. Bard, Inc. | | | | 30,000 | | | 2,598,600 |

| DENTSPLY International, Inc. | | | | 60,000 | | | 2,091,000 |

| Johnson & Johnson, Inc. | | | | 30,000 | | | 1,956,000 |

| Medtronic, Inc. | | | | 40,000 | | | 1,801,200 |

| Saint Jude Medical, Inc.(a) | | | | 35,000 | | | 1,436,750 |

| Stryker Corp. | | | | 30,000 | | | 1,716,600 |

| Varian Medical Systems, Inc.(a) | | | | 35,000 | | | 1,936,550 |

| | | | | | | | 16,292,250 |

| Industrial Materials (3.2%) | | | | | | | |

| Air Products & Chemicals, Inc. | | | | 25,000 | | | 1,848,750 |

| AptarGroup, Inc. | | | | 40,000 | | | 1,574,000 |

| Ecolab, Inc. | | | | 30,000 | | | 1,318,500 |

| Sigma-Aldrich Corp. | | | | 30,000 | | | 1,609,800 |

| | | | | | | | 6,351,050 |

| Industrial Products & Services (11.9%) | | | | | | | |

| ABB Ltd., Sponsored ADR(a) | | | | 75,000 | | | 1,638,000 |

| Donaldson Co., Inc. | | | | 75,000 | | | 3,384,000 |

| Emerson Electric Co. | | | | 85,000 | | | 4,278,900 |

| Hubbell, Inc., Class B | | | | 15,000 | | | 756,450 |

| Illinois Tool Works, Inc. | | | | 60,000 | | | 2,841,600 |

| Precision Castparts Corp. | | | | 30,000 | | | 3,801,300 |

| | | | |

Shares or

Principal

Amount ($) | | | Value ($) |

| Rockwell Collins, Inc. | | | | 40,000 | | | 2,503,600 |

| United Parcel Service, Inc., Class B | | | | 30,000 | | | 1,932,300 |

| W.W. Grainger, Inc. | | | | 25,000 | | | 2,703,000 |

| | | | | | | | 23,839,150 |

| Information Technology (10.7%) | | | | | | | |

| Accenture PLC, Class A | | | | 60,000 | | | 2,517,000 |

| Automatic Data Processing, Inc. | | | | 65,000 | | | 2,890,550 |

| Cisco Systems, Inc.(a) | | | | 120,000 | | | 3,123,600 |

| EMC Corp.(a) | | | | 160,000 | | | 2,886,400 |

| International Business Machines Corp. | | | | 20,000 | | | 2,565,000 |

| Microsoft Corp. | | | | 125,000 | | | 3,658,750 |

| Nokia Corp., Sponsored ADR | | | | 50,000 | | | 777,000 |

| Oracle Corp. | | | | 120,000 | | | 3,082,800 |

| | | | | | | | 21,501,100 |

| TOTAL COMMON STOCKS (Cost $94,103,631) | | | | | | | 136,014,300 |

| |

| CORPORATE BONDS (4.2%) | | | | | | | |

| Basic Materials (0.2%) | | | | | | | |

| Weyerhaeuser Co. | | | | | | | |

6.75%, 3/15/12 | | | | 100,000 | | | 106,697 |

7.25%, 7/1/13 | | | | 300,000 | | | 322,511 |

| | | | | | | | 429,208 |

| Consumer Products (0.3%) | | | | | | | |

| Diageo Capital PLC, 5.50%, 9/30/16 | | | | 500,000 | | | 543,620 |

| |

| Financial Services (2.8%) | | | | | | | |

| American Express Bank FSB, BKNT, | | | | | | | |

6.00%, 9/13/17 | | | | 200,000 | | | 214,973 |

| American Express Co., | | | | | | | |

7.00%, 3/19/18 | | | | 1,500,000 | | | 1,706,331 |

8.13%, 5/20/19 | | | | 1,675,000 | | | 2,032,159 |

| John Deere Capital Corp., Series D, | | | | | | | |

5.35%, 4/3/18 | | | | 1,000,000 | | | 1,065,817 |

National Rural Utilities Cooperative Finance Corp., 10.38%, 11/1/18 | | | | 500,000 | | | 666,048 |

| | | | | | | | 5,685,328 |

| Industrial Products & Services (0.2%) | | | | | | | |

| Emerson Electric Co., 5.13%, 12/1/16 | | | | 300,000 | | | 322,669 |

| |

| Information Technology (0.4%) | | | | | | | |

| Oracle Corp., 5.75%, 4/15/18 | | | | 750,000 | | | 823,940 |

| |

| Telecommunications (0.3%) | | | | | | | |

| AT&T, Inc., 5.63%, 6/15/16 | | | | 500,000 | | | 548,882 |

| TOTAL CORPORATE BONDS (Cost $7,460,767) | | | | | | | 8,353,647 |

| |

| MUNICIPAL BONDS (2.2%) | | | | | | | |

| Florida (0.5%) | | | | | | | |

| Florida State Board of Education, Series D, GO, | | | | | | | |

5.00%, 6/1/21, Callable 6/1/17 @ 101 | | | | 1,000,000 | | | 1,093,970 |

| |

| Illinois (0.8%) | | | | | | | |

| Illinois State, GO, 5.00%, 4/1/24, Callable 4/1/17 @ 100 | | | | 500,000 | | | 512,130 |

| Illinois State, Series A, | | | | | | | |

5.00%, 3/1/22, Callable 3/1/14 @ 100 | | | | 750,000 | | | 773,812 |

5.00%, 6/1/29, Callable 3/1/14 @ 100 | | | | 250,000 | | | 252,378 |

| | | | | | | | 1,538,320 |

| See Notes to Financial Statements |

|

| |

| 10 |

|

| Schedule of Portfolio Investments | Boston Trust Balanced Fund

March 31, 2010 |

| MUNICIPAL BONDS, CONTINUED | | | | | | | |

| Security Description | | | | | Shares or

Principal

Amount ($) | | | Value ($) |

| Ohio (0.3%) | | | | | | | |

Ohio State, Series D, GO, 4.50%, 9/15/22, NATL-RE, Callable 3/15/16 @ 100 | | | | 500,000 | | | 519,255 |

| |

| Washington (0.1%) | | | | | | | |

Washington State, Series C, GO, 5.00%, 2/1/26, Callable 2/1/19 @ 100 | | | | 250,000 | | | 270,343 |

| |

| Wisconsin (0.5%) | | | | | | | |

Wisconsin State, Series C, GO, 5.00%, 5/1/25, Callable 5/1/18 @ 100 | | | | 200,000 | | | 215,100 |

Wisconsin State, Series D, GO, 5.50%, 5/1/26, Callable 5/1/18 @ 100 | | | | 750,000 | | | 835,117 |

| | | | | | | | 1,050,217 |

| TOTAL MUNICIPAL BONDS (Cost $4,342,749) | | | | | | | 4,472,105 |

| |

U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (23.7%) | | | | | | | |

| Federal Home Loan Bank | | | | | | | |

2.25%, 4/13/12 | | | | 7,500,000 | | | 7,662,367 |

4.88%, 12/14/12 | | | | 13,000,000 | | | 14,120,119 |

5.00%, 10/13/11 | | | | 1,500,000 | | | 1,594,454 |

5.25%, 6/11/10 | | | | 5,000,000 | | | 5,048,800 |

5.25%, 6/10/11 | | | | 2,000,000 | | | 2,104,252 |

5.25%, 9/13/13 | | | | 5,000,000 | | | 5,531,715 |

5.25%, 12/9/22 | | | | 1,000,000 | | | 1,055,550 |

5.38%, 6/8/12 | | | | 5,000,000 | | | 5,440,980 |

| Government National Mortgage Association, | | | | | | | |

6.00%, 10/15/36 | | | | 1,634,339 | | | 1,748,602 |

| U.S. Treasury Inflation Protected Bonds, | | | | | | | |

3.50%, 1/15/11 | | | | 3,112,500 | | | 3,224,600 |

TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $45,312,828) | | | | | | | 47,531,439 |

| |

| INVESTMENT COMPANIES (1.6%) | | | | | | | |

Victory Federal Money Market, Investor Shares, 0.01% (b) (Cost $3,120,208) | | | | 3,120,208 | | | 3,120,208 |

| Total Investments (Cost $154,340,183) — 99.6% | | | | | | | 199,491,699 |

| Other assets in excess of liabilities — 0.4% | | | | | | | 819,819 |

| |

| NET ASSETS — 100.0% | | | | | | | $200,311,518 |

|

| (a) | | Non-income producing security. |

| (b) | | Rate disclosed is the seven day yield as of March 31, 2010. |

| ADR | | American Depositary Receipt |

| BKNT | | Bank Note |

| FSB | | Federal Savings Bank |

| GO | | General Obligation |

| NATL-RE | | Reinsured by National Public Finance Guarantee Corporation |

| PLC | | Public Limited Company |

| See Notes to Financial Statements |

|

| |

| 11 |

| Financial Statements | | Boston Trust Balanced Fund |

| STATEMENT OF ASSETS AND LIABILITIES | | | | |

| March 31, 2010 | | | | |

| | | | | |

| Assets: | | | | |

| Investments, at value (cost $154,340,183) | | $ | 199,491,699 | |

| Interest and dividends receivable | | | 1,003,432 | |

| Receivable for capital shares issued | | | 22,000 | |

| Prepaid expenses and other assets | | | 3,504 | |

Total Assets | | | 200,520,635 | |

| | | | | |

| Liabilities: | | | | |

| Payable for capital shares redeemed | | | 14,000 | |

| Accrued expenses and other liabilities: | | | | |

Investment adviser | | | 123,186 | |

Chief compliance officer | | | 862 | |

Administration and accounting | | | 5,999 | |

Custodian | | | 8,059 | |

Transfer agent | | | 4,245 | |

Trustee | | | 3,920 | |

Other | | | 48,846 | |

Total Liabilities | | | 209,117 | |

| | | | | |

| Net Assets | | $ | 200,311,518 | |

| | | | | |

| Composition of Net Assets: | | | | |

| Capital | | $ | 156,907,745 | |

| Accumulated net investment income | | | 827,544 | |

| Accumulated net realized losses from investment transactions | | | (2,575,287 | ) |

| Net unrealized appreciation from investments | | | 45,151,516 | |

| | | | | |

| Net Assets | | $ | 200,311,518 | |

| | | | | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 6,983,134 | |

| | | | | |

| Net Asset Value, Offering Price and Redemption Price per share | | $ | 28.69 | |

| | | | | |

| STATEMENT OF OPERATIONS | | | | |

| For the year ended March 31, 2010 | | | | |

| | | | | |

| Investment Income: | | | | |

| Interest | | $ | 2,875,717 | |

| Dividends | | | 2,101,424 | |

Total Investment Income | | | 4,977,141 | |

| Expenses: | | | | |

Investment adviser | | | 1,315,294 | |

Administration and accounting | | | 357,090 | |

Trustee | | | 17,597 | |

Custodian | | | 33,394 | |

Transfer agency | | | 17,971 | |

Chief compliance officer | | | 12,510 | |

Printing | | | 29,081 | |

Professional | | | 74,224 | |

Other | | | 45,032 | |

Total expenses before fee reductions | | | 1,902,193 | |

Fees voluntarily reduced by the administrator | | | (102,094) | |

Fees contractually reduced by the investment adviser | | | (44,935) | |

| Net Expenses | | | 1,755,164 | |

| | | | | |

| Net Investment Income | | | 3,221,977 | |

| Net Realized/Unrealized Gains from Investments: | | | | |

| Net realized gains from investment transactions | | | 946,272 | |

| Change in unrealized appreciation/depreciation from investments | | | 34,043,468 | |

| Net realized/unrealized gains from investments | | | 34,989,740 | |

| | | | | |

| Change in Net Assets Resulting from Operations | | $ | 38,211,717 | |

| See Notes to Financial Statements |

|

| |

| 12 |

| Financial Statements | | Boston Trust Balanced Fund |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | | | | |

| | | | | | | | | | | |

| | | | For the year ended | | | | For the year ended | |

| | | | March 31, 2010 | | | | March 31, 2009 | |

| Investment Activities: | | | | | | | | | | |

| Operations: | | | | | | | | | | |

Net investment income | | | $ | 3,221,977 | | | | $ | 3,008,273 | |

Net realized gains (losses) from investment transactions | | | | 946,272 | | | | | (2,892,802) | |

Change in unrealized appreciation/depreciation from investments | | | | 34,043,468 | | | | | (34,137,628) | |

| Change in net assets resulting from operations | | | | 38,211,717 | | | | | (34,022,157) | |

| | | | | | | | | | | |

| Dividends: | | | | | | | | | | |

Net investment income | | | | (3,153,684) | | | | | (3,026,472) | |

Net realized gains from investment transactions | | | | — | | | | | (4,856,029) | |

| Change in net assets resulting from shareholder dividends | | | | (3,153,684) | | | | | (7,882,501) | |

| | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | | | | |

Proceeds from shares issued | | | | 26,227,435 | | | | | 20,285,450 | |

Dividends reinvested | | | | 3,011,645 | | | | | 7,558,953 | |

Cost of shares redeemed | | | | (12,386,127) | | | | | (20,852,763) | |

| Change in net assets resulting from capital share transactions | | | | 16,852,953 | | | | | 6,991,640 | |

| | | | | | | | | | | |

| Change in net assets | | | | 51,910,986 | | | | | (34,913,018) | |

| | | | | | | | | | | |

| Net Assets: | | | | | | | | | | |

Beginning of period | | | | 148,400,532 | | | | | 183,313,550 | |

End of period | | | $ | 200,311,518 | | | | $ | 148,400,532 | |

| | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | |

Issued | | | | 973,787 | | | | | 795,051 | |

Reinvested | | | | 109,834 | | | | | 313,910 | |

Redeemed | | | | (461,327) | | | | | (795,578) | |

| Change in shares | | | | 622,294 | | | | | 313,383 | |

| | | | | | | | | | | |

| Accumulated net investment income | | | $ | 827,544 | | | | $ | 759,251 | |

| See Notes to Financial Statements |

|

| |

| 13 |

| Financial Statements | | Boston Trust Balanced Fund |

| FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout the years indicated. | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | For the year | | | For the year | | | For the year | | | For the year | | | For the year | |

| | | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net Asset Value, Beginning of Period | | | $ | 23.33 | | | $ | 30.31 | | | $ | 29.87 | | | $ | 29.11 | | | $ | 28.77 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | 0.47 | | | | 0.49 | (a) | | | 0.46 | | | | 0.46 | | | | 0.53 | |

Net realized and unrealized gains (losses) from investment transactions | | | | 5.36 | | | | (6.11) | | | | 1.42 | | | | 2.13 | | | | 0.88 | |

| Total from investment activities | | | | 5.83 | | | | (5.62) | | | | 1.88 | | | | 2.59 | | | | 1.41 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Dividends: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | (0.47) | | | | (0.52) | | | | (0.45) | | | | (0.43) | | | | (0.52) | |

Net realized gains from investments | | | | — | | | | (0.84) | | | | (0.99) | | | | (1.40) | | | | (0.55) | |

| Total dividends | | | | (0.47) | | | | 1.36) | | | | (1.44) | | | | (1.83) | | | | (1.07) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | | $ | 28.69 | | | $ | 23.33 | | | $ | 30.31 | | | $ | 29.87 | | | $ | 29.11 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | | 25.08% | | | | (18.68)% | | | | 6.06% | | | | 8.98% | | | | 4.97% | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | | $ | 200,312 | | | $ | 148,401 | | | $ | 183,314 | | | $ | 170,307 | | | $ | 164,475 | |

| Ratio of net expenses to average net assets | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Ratio of net investment income to average net assets | | | | 1.84% | | | | 1.80% | | | | 1.46% | | | | 1.50% | | | | 1.76% | |

Ratio of expenses (before fee reductions) to average net assets(b) | | | | 1.08% | | | | 1.08% | | | | 1.08% | | | | 1.07% | | | | 1.08% | |

| Portfolio turnover rate | | | | 12.90% | | | | 21.30% | | | | 33.49% | | | | 37.24% | | | | 29.77% | |

|

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced and total fund expenses were capped at 1.00%. If such expense caps had not been in place, the ratio would have been as indicated. |

| See Notes to Financial Statements |

|

| |

| 14 |

| Schedule of Portfolio Investments | | Boston Trust Equity Fund

March 31, 2010 |

|

| COMMON STOCKS (99.7%) | | | | | | | | |

| Security Description | | | | | | | Shares | | Value ($) |

| |

| Consumer Discretionary (7.7%) | | | | | | | | |

| Comcast Corp., Class A | | | | | | 35,000 | | 658,700 |

| Johnson Controls, Inc. | | | | | | 18,000 | | 593,820 |

| NIKE, Inc., Class B | | | | | | 5,000 | | 367,500 |

| Omnicom Group, Inc. | | | | | | 25,000 | | 970,250 |

| Ross Stores, Inc. | | | | | | 1,000 | | 53,470 |

| Staples, Inc. | | | | | | 30,000 | | 701,700 |

| Target Corp. | | | | | | 15,000 | | 789,000 |

| | | | | | | | | 4,134,440 |

| Consumer Products (12.5%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | 15,000 | | 895,650 |

| Diageo PLC, Sponsored ADR | | | | | | 15,000 | | 1,011,750 |

| Kellogg Co. | | | | | | 7,500 | | 400,725 |

| McCormick & Co., Inc. | | | | | | 25,000 | | 959,000 |

| PepsiCo, Inc. | | | | | | 15,000 | | 992,400 |

| Procter & Gamble Co. | | | | | | 15,000 | | 949,050 |

| SYSCO Corp. | | | | | | 50,000 | | 1,475,000 |

| | | | | | | | | 6,683,575 |

| Energy (11.4%) | | | | | | | | |

| Apache Corp. | | | | | | 12,000 | | 1,218,000 |

| Chevron Corp. | | | | | | 12,500 | | 947,875 |

| ConocoPhillips | | | | | | 10,000 | | 511,700 |

| Exxon Mobil Corp. | | | | | | 32,500 | | 2,176,850 |

| Schlumberger Ltd. | | | | | | 20,000 | | 1,269,200 |

| | | | | | | | | 6,123,625 |

| Financial Services (16.3%) | | | | | | | | |

| Bank of America Corp. | | | | | | 35,000 | | 624,750 |

| Chubb Corp. | | | | | | 20,000 | | 1,037,000 |

| Cincinnati Financial Corp. | | | | | | 45,000 | | 1,300,500 |

| Comerica, Inc. | | | | | | 20,000 | | 760,800 |

| JPMorgan Chase & Co. | | | | | | 10,000 | | 447,500 |

| M&T Bank Corp. | | | | | | 10,000 | | 793,800 |

| PNC Financial Services Group, Inc. | | | | | | 12,500 | | 746,250 |

| State Street Corp. | | | | | | 15,000 | | 677,100 |

| SunTrust Banks, Inc. | | | | | | 25,000 | | 669,750 |

| T. Rowe Price Group, Inc. | | | | | | 30,000 | | 1,647,900 |

| | | | | | | | | 8,705,350 |

| Health Care (13.3%) | | | | | | | | |

| Becton, Dickinson & Co. | | | | | | 15,000 | | 1,180,950 |

| C.R. Bard, Inc. | | | | | | 12,500 | | 1,082,750 |

| DENTSPLY International, Inc. | | | | | | 30,000 | | 1,045,500 |

| Johnson & Johnson, Inc. | | | | | | 10,000 | | 652,000 |

| Medtronic, Inc. | | | | | | 25,000 | | 1,125,750 |

| Merck & Co., Inc. | | | | | | 2,500 | | 93,375 |

| Saint Jude Medical, Inc.(a) | | | | | | 10,000 | | 410,500 |

| Stryker Corp. | | | | | | 12,500 | | 715,250 |

| Varian Medical Systems, Inc.(a) | | | | | | 15,000 | | 829,950 |

| | | | | | | | | 7,136,025 |

| Industrial Materials (5.7%) | | | | | | | | |

| Air Products & Chemicals, Inc. | | | | | | 10,000 | | 739,500 |

| AptarGroup, Inc. | | | | | | 15,000 | | 590,250 |

| Ecolab, Inc. | | | | | | 15,000 | | 659,250 |

| Sigma-Aldrich Corp. | | | | | | 20,000 | | 1,073,200 |

| | | | | | | | | 3,062,200 |

| Industrial Products & Services (17.1%) | | | | | | | | |

| ABB Ltd., Sponsored ADR | | | | | | 35,000 | | 764,400 |

| Donaldson Co., Inc. | | | | | | 25,000 | | 1,128,000 |

| Emerson Electric Co. | | | | | | 37,500 | | 1,887,750 |

| Illinois Tool Works, Inc. | | | | | | 25,000 | | 1,184,000 |

| Precision Castparts Corp. | | | | | | 15,000 | | 1,900,650 |

| Rockwell Collins, Inc. | | | | | | 15,000 | | 938,850 |

| W.W. Grainger, Inc. | | | | | | 12,500 | | 1,351,500 |

| | | | | | | | | 9,155,150 |

| Information Technology (15.7%) | | | | | | | | |

| Accenture PLC, Class A | | | | | | 25,000 | | 1,048,750 |

| Automatic Data Processing, Inc. | | | | | | 25,000 | | 1,111,750 |

| Cisco Systems, Inc.(a) | | | | | | 55,000 | | 1,431,650 |

| EMC Corp.(a) | | | | | | 80,000 | | 1,443,200 |

| International Business Machines Corp. | | | | | | 5,000 | | 641,250 |

| Microsoft Corp. | | | | | | 50,000 | | 1,463,500 |

| Oracle Corp. | | | | | | 50,000 | | 1,284,500 |

| | | | | | | | | 8,424,600 |

| TOTAL COMMON STOCKS (Cost $35,424,269) | | | | | | | | 53,424,965 |

| |

| INVESTMENT COMPANIES (0.2%) | | | | | | | | |

Victory Federal Money Market, Investor Shares, 0.01% (b) (Cost $117,678) | | | | | | 117,678 | | 117,678 |

| Total Investments (Cost $35,541,947) — 99.9% | | | | | | | | 53,542,643 |

| Other assets in excess of liabilities — 0.1% | | | | | | | | 40,705 |

| NET ASSETS — 100.0% | | | | | | | | $53,583,348 |

|

| (a) | | Non-income producing security. |

| (b) | | Rate disclosed is the seven day yield as of March 31, 2010. |

| ADR | | American Depositary Receipt |

| PLC | | Public Limited Company |

See Notes to Financial Statements

15

| Financial Statements | | Boston Trust Equity Fund |

|

| STATEMENT OF ASSETS AND LIABILITIES | | | |

| March 31, 2010 | | | |

| | | | |

| Assets: | | | |

| Investments, at value (cost $35,541,947) | | $ | 53,542,643 |

| Dividends receivable | | | 95,957 |

| Prepaid expenses and other assets | | | 106 |

Total Assets | | | 53,638,706 |

| Liabilities: | | | |

| Accrued expenses and other liabilities: | | | |

Investment adviser | | | 32,203 |

Chief compliance officer | | | 237 |

Administration and accounting | | | 1,776 |

Custodian | | | 2,584 |

Transfer agent | | | 4,370 |

Trustee | | | 1,080 |

Other | | | 13,108 |

Total Liabilities | | | 55,358 |

| | | | |

| Net Assets | | $ | 53,583,348 |

| Composition of Net Assets: | | | |

| Capital | | $ | 38,757,242 |

| Accumulated net investment income | | | 116,710 |

| Accumulated net realized losses from investment transactions | | | (3,291,300) |

| Net unrealized appreciation from investments | | | 18,000,696 |

| | | | |

| Net Assets | | $ | 53,583,348 |

| | | | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 4,244,815 |

| | | | |

| Net Asset Value, Offering Price and Redemption Price per share | | $ | 12.62 |

| | | | |

| STATEMENT OF OPERATIONS | | | |

| For the year ended March 31, 2010 | | | |

| | | | |

| Investment Income: | | | |

| Dividends | | $ | 920,931 |

Total Investment Income | | | 920,931 |

| Expenses: | | | |

Investment adviser | | | 360,054 |

Administration and accounting | | | 99,456 |

Trustee | | | 4,683 |

Custodian | | | 10,467 |

Transfer agency | | | 17,507 |

Chief compliance officer | | | 3,382 |

Printing | | | 7,659 |

Professional | | | 19,662 |

Other | | | 11,723 |

Total expenses before fee reductions | | | 534,593 |

Fees voluntarily reduced by the administrator | | | (28,005) |

Fees contractually reduced by the investment adviser | | | (26,106) |

| Net Expenses | | | 480,482 |

| | | | |

| Net Investment Income | | | 440,449 |

| Net Realized/Unrealized Gains from Investments: | | | |

| Net realized gains from investment transactions | | | 774,817 |

| Change in unrealized appreciation/depreciation from investments | | | 16,019,763 |

| Net realized/unrealized gains from investments | | | 16,794,580 |

| | | | |

| Change in Net Assets Resulting from Operations | | $ | 17,235,029 |

See Notes to Financial Statements

16

| Financial Statements | | Boston Trust Equity Fund |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | | | | | |

| | | | | | | | | | | |

| | | | For the year ended | | | | For the year ended | |

| | | | March 31, 2010 | | | | March 31, 2009 | |

| Investment Activities: | | | | | | | | | | |

| Operations: | | | | | | | | | | |

Net investment income | | | $ | 440,449 | | | | $ | 474,531 | |

Net realized gains (losses) from investment transactions | | | | 774,817 | | | | | (4,042,987) | |

Change in unrealized appreciation/depreciation from investments | | | | 16,019,763 | | | | | (17,791,854) | |

| Change in net assets resulting from operations | | | | 17,235,029 | | | | | (21,360,310) | |

| | | | | | | | | | | |

| Dividends: | | | | | | | | | | |

Net investment income | | | | (435,641) | | | | | (482,096) | |

| Change in net assets resulting from shareholder dividends | | | | (435,641) | | | | | (482,096) | |

| | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | | | | |

Proceeds from shares issued | | | | 2,198,669 | | | | | 4,500,020 | |

Dividends reinvested | | | | 393,025 | | | | | 437,230 | |

Cost of shares redeemed | | | | (4,506,458) | | | | | (9,445,789) | |

| Change in net assets resulting from capital share transactions | | | | (1,914,764) | | | | | (4,508,539) | |

| | | | | | | | | | | |

| Change in net assets | | | | 14,884,624 | | | | | (26,350,945) | |

| | | | | | | | | | | |

| Net Assets: | | | | | | | | | | |

Beginning of period | | | | 38,698,724 | | | | | 65,049,669 | |

End of period | | | $ | 53,583,348 | | | | $ | 38,698,724 | |

| | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | |

Issued | | | | 200,783 | | | | | 389,563 | |

Reinvested | | | | 33,279 | | | | | 45,892 | |

Redeemed | | | | (401,965) | | | | | (960,879) | |

| Change in shares | | | | 167,903) | | | | | (525,424) | |

| | | | | | | | | | | |

| Accumulated net investment income | | | $ | 116,710 | | | | $ | 111,490 | |

See Notes to Financial Statements

17

| Financial Statements | | Boston Trust Equity Fund |

|

| |

| FINANCIAL HIGHLIGHTS |

| Selected data for a share outstanding throughout the years indicated. | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | For the year | | | For the year | | | For the year | | | For the year | | | For the year | |

| | | | ended | | | ended | | | ended | | | ended | | | ended | |

| | | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | | $ | 8.77 | | | $ | 13.17 | | | $ | 13.17 | | | $ | 12.39 | | | $ | 11.86 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | 0.10 | | | | 0.10 | (a) | | | 0.08 | | | | 0.09 | | | | 0.09 | |

Net realized and unrealized gains (losses) from investment transactions | | | | 3.85 | | | | (4.40) | | | | 0.30 | | | | 1.04 | | | | 0.65 | |

| Total from investment activities | | | | 3.95 | | | | (4.30) | | | | 0.38 | | | | 1.13 | | | | 0.74 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Dividends: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | (0.10) | | | | (0.10) | | | | (0.08) | | | | (0.08) | | | | (0.09) | |

Net realized gains from investments | | | | — | | | | — | | | | (0.30) | | | | (0.27) | | | | (0.12) | |

| Total dividends | | | | (0.10) | | | | (0.10) | | | | (0.38) | | | | (0.35) | | | | (0.21) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | | $ | 12.62 | | | $ | 8.77 | | | $ | 13.17 | | | $ | 13.17 | | | $ | 12.39 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | | 45.13% | | | | (32.73)% | | | | 2.59% | | | | 9.20% | | | | 6.23% | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at end of period (000’s) | | | $ | 53,583 | | | $ | 38,699 | | | $ | 65,050 | | | $ | 59,884 | | | $ | 48,574 | |

| Ratio of net expenses to average net assets | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Ratio of net investment income to average net assets | | | | 0.92% | | | | 0.86% | | | | 0.55% | | | | 0.71% | | | | 0.73% | |

| Ratio of expenses (before fee reductions) to average net assets(b) | | | | 1.11% | | | | 1.10% | | | | 1.10% | | | | 1.11% | | | | 1.11% | |

| Portfolio turnover rate | | | | 19.90% | | | | 28.85% | | | | 23.53% | | | | 21.48% | | | | 20.44% | |

|

| (a) | | Calculated using the average shares method. |

| (b) | | During the period, certain fees were reduced and total fund expenses were capped at 1.00%. If such expense caps had not been in place, the ratio would have been as indicated. |

See Notes to Financial Statements

18

| Schedule of Portfolio Investments | | Boston Trust Midcap Fund

March 31, 2010 |

|

COMMON STOCkS (96.6%) | | | | | |

| Security Description | | | Shares | | | Value ($) |

| |

| Consumer Discretionary (13.1%) | | | | | |

| Abercrombie & Fitch Co., Class A | | 2,600 | | | 118,664 |

| Advance Auto Parts, Inc. | | 4,500 | | | 188,640 |

| Autoliv, Inc.(a) | | 4,830 | | | 248,890 |

| Coach, Inc. | | 4,500 | | | 177,840 |

| Guess?, Inc. | | 4,150 | | | 194,967 |

| John Wiley & Sons, Inc., Class A | | 2,600 | | | 112,528 |

| O’Reilly Automotive, Inc.(a) | | 6,200 | | | 258,602 |

| Omnicom Group, Inc. | | 7,750 | | | 300,777 |

| Ross Stores, Inc. | | 7,300 | | | 390,331 |

| Strayer Education, Inc. | | 575 | | | 140,024 |

| | | | | | 2,131,263 |

| Consumer Products (6.8%) | | | | | |

| Alberto-Culver Co. | | 10,000 | | | 261,500 |

| Brown-Forman Corp., Class B | | 3,125 | | | 185,781 |

| Church & Dwight Co., Inc. | | 3,500 | | | 234,325 |

| Clorox Co. | | 2,500 | | | 160,350 |

| McCormick & Co., Inc. | | 7,050 | | | 270,438 |

| | | | | | 1,112,394 |

| Energy (6.3%) | | | | | |

| Cabot Oil & Gas Corp. | | 8,200 | | | 301,760 |

| Core Laboratories NV | | 1,300 | | | 170,040 |

| FMC Technologies, Inc.(a) | | 4,325 | | | 279,525 |

| Murphy Oil Corp. | | 5,000 | | | 280,950 |

| | | | | | 1,032,275 |

| Financial Services (16.3%) | | | | | |

| Bank of Hawaii Corp. | | 3,900 | | | 175,305 |

| Cincinnati Financial Corp. | | 10,405 | | | 300,704 |

| Comerica, Inc. | | 7,525 | | | 286,251 |

| Commerce Bancshares, Inc. | | 4,375 | | | 179,988 |

| Digital Realty Trust, Inc. | | 2,600 | | | 140,920 |

| IntercontinentalExchange, Inc.(a) | | 975 | | | 109,376 |

| Jones Lang LaSalle, Inc. | | 1,675 | | | 122,091 |

| M&T Bank Corp. | | 3,650 | | | 289,737 |

| Morningstar, Inc.(a) | | 3,325 | | | 159,899 |

| SEI Investments Co. | | 11,250 | | | 247,162 |

| T. Rowe Price Group, Inc. | | 6,750 | | | 370,777 |

| TD Ameritrade Holding Corp.(a) | | 8,525 | | | 162,487 |

| The NASDAQ OMX Group, Inc.(a) | | 5,400 | | | 114,048 |

| | | | | | 2,658,745 |

| Health Care (12.2%) | | | | | |

| C.R. Bard, Inc. | | 3,650 | | | 316,163 |

| DENTSPLY International, Inc. | | 7,275 | | | 253,534 |

| Gen-Probe, Inc.(a) | | 3,950 | | | 197,500 |

| IDEXX Laboratories, Inc.(a) | | 2,650 | | | 152,508 |

| Patterson Cos., Inc. | | 5,650 | | | 175,432 |

| Pharmaceutical Product Development, Inc. | | 5,875 | | | 139,531 |

| ResMed, Inc.(a) | | 2,300 | | | 146,395 |

| Techne Corp. | | 1,900 | | | 121,011 |

| Varian Medical Systems, Inc.(a) | | 4,200 | | | 232,386 |

| Waters Corp.(a) | | 3,700 | | | 249,898 |

| | | | | | 1,984,358 |

| Industrial Materials (5.6%) | | | | | |

| AptarGroup, Inc. | | 7,300 | | | 287,255 |

| Ecolab, Inc. | | 5,725 | | | 251,614 |

| Sigma-Aldrich Corp. | | 7,025 | | | 376,961 |

| | | | | | 915,830 |

| Industrial Products & Services (15.6%) | | | | | |

| AMETEK, Inc. | | 6,500 | | | 269,490 |

| C.H. Robinson Worldwide, Inc. | | 4,150 | | | 231,777 |

| CLARCOR, Inc. | | 4,950 | | | 170,726 |

| Donaldson Co., Inc. | | 7,800 | | | 351,936 |

| Expeditors International of Washington, Inc. | | 5,200 | | | 191,984 |

| L-3 Communications Holdings, Inc. | | 1,250 | | | 114,538 |

| Mettler-Toledo International, Inc.(a) | | 2,800 | | | 305,760 |

| Precision Castparts Corp. | | 2,100 | | | 266,091 |

| Rockwell Collins, Inc. | | 4,950 | | | 309,820 |

| W.W. Grainger, Inc. | | 3,125 | | | 337,875 |

| | | | | | 2,549,997 |

| Information Technology (15.9%) | | | | | |

| Amdocs Ltd.(a) | | 7,000 | | | 210,770 |

| BMC Software, Inc.(a) | | 6,000 | | | 228,000 |

| Check Point Software Technologies Ltd.(a) | | 5,250 | | | 184,065 |

| Citrix Systems, Inc.(a) | | 7,350 | | | 348,904 |

| Cognizant Technology Solutions Corp. Class A(a) | | 4,500 | | | 229,410 |

| F5 Networks, Inc.(a) | | 2,600 | | | 159,926 |

| FactSet Research Systems, Inc. | | 3,650 | | | 267,800 |

| Fiserv, Inc.(a) | | 2,250 | | | 114,210 |

| Intuit, Inc.(a) | | 4,750 | | | 163,115 |

| NetApp, Inc.(a) | | 10,400 | | | 338,624 |

| Paychex, Inc. | | 4,700 | | | 144,290 |

| Teradata Corp.(a) | | 6,750 | | | 195,008 |

| | | | | | 2,584,122 |

| Telecommunications (0.8%) | | | | | |

| NII Holdings, Inc.(a) | | 3,150 | | | 131,229 |

| | | | | | |

| Utilities (4.0%) | | | | | |

| AGL Resources, Inc. | | 2,650 | | | 102,423 |

| Energen Corp. | | 3,500 | | | 162,855 |

| NSTAR | | 3,200 | | | 113,344 |

| Questar Corp. | | 6,250 | | | 270,000 |

| | | | | | 648,622 |

| TOTAL COMMON STOCKS (Cost $12,098,166) | | | | | 15,748,835 |

| | | | | | |

| INVESTMENT COMPANIES (3.1%) | | | | | |

| Victory Federal Money Market, Investor Shares, 0.01%(b) (Cost $503,577) | | 503,577 | | | 503,577 |

| Total Investments (Cost $12,601,743) — 99.7% | | | | | 16,252,412 |

| Other assets in excess of liabilities — 0.3% | | | | | 56,260 |

| NET ASSETS — 100.0% | | | | $ | 16,308,672 |

|

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day yield as of March 31, 2010. |

| NV | Naamloze Venootschap (Dutch Corporation) |

See Notes to Financial Statements

19

| Financial Statements | | Boston Trust Midcap Fund |

|

| STATEMENT OF ASSETS AND LIABILITIES | | | |

| March 31, 2010 | | | |

| | | | |

| Assets: | | | |

| Investments, at value (cost $12,601,743) | | $ | 16,252,412 |

| Dividends receivable | | | 10,834 |

| Receivable for capital shares issued | | | 61,000 |

| Prepaid expenses and other assets | | | 1,110 |

Total Assets | | | 16,325,356 |

| | | | |

| Liabilities: | | | |

| Accrued expenses and other liabilities: | | | |

Investment adviser | | | 6,467 |

Chief compliance officer | | | 65 |

Administration and accounting | | | 742 |

Custodian | | | 1,384 |

Transfer agent | | | 4,015 |

Trustee | | | 296 |

Other | | | 3,715 |

Total Liabilities | | | 16,684 |

| | | | |

| Net Assets | | $ | 16,308,672 |

| | | | |

| Composition of Net Assets: | | | |

| Capital | | $ | 12,934,289 |

| Accumulated net investment income | | | 3,293 |

Accumulated net realized losses from investment transactions | | | (279,579) |

Net unrealized appreciation from investments | | | 3,650,669 |

| | | | |

Net Assets | | $ | 16,308,672 |

| | | | |

Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 1,727,458 |