UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2010

Item 1. Report to Stockholders.

Calvert World Values International Equity

Fund

Annual Report

September 30, 2010

E-Delivery Sign-Up —

Details Inside

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to account access, you’ll be prompted to set up a personal identification number for your account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps.

TABLE

OF CONTENTS

4 President’s Letter

7 SRI Update

9 Portfolio Management Discussion

14 Shareholder Expense Example

16 Report of Independent Registered Public Accounting Firm

17 Statement of Net Assets

28 Statement of Operations

29 Statements of Changes in Net Assets

31 Notes to Financial Statements

39 Financial Highlights

44 Explanation of Financial Tables

46 Proxy Voting and Availability of Quarterly Portfolio Holdings

48 Director and Officer Information Table

Dear Shareholder:

Over the 12-month reporting period, the U.S. financial markets and economy continued to recover, in fits and starts, from the “Great Recession.” As economic data vacillated between good and bad news on employment, housing trends, business strength, and consumer confidence, market volatility and investor sentiment also see-sawed.

During the winter, investors became less risk averse, pouring money into higher-yielding areas of the bond market as well as stocks, which reached 18-month highs in March. Later in the spring, however, investor sentiment took an abrupt turn as confidence in the global economic recovery waned and fears of a double-dip recession grew. Following a dismal August for the stock market, September saw a surge in stock prices lifted by strong corporate earnings reports and renewed investor interest in bargain-priced stocks. In the bond market, Treasury yields moved lower over the 12-month reporting period and corporate bonds generally performed well.

Economic Recovery Slow But on Track

Looking ahead, the pace of economic recovery has clearly slowed, causing Federal Reserve (Fed) Chairman Ben Bernanke to say that the Fed stands ready to use all of the tools at its disposal to reinvigorate the U.S. economy. In our view, while the country faces sobering challenges related to the unemployment rate, high levels of government debt, and the stumbling housing market, we also see encouraging signs of economic recovery. Overall, companies have strong balance sheets and cash positions, have reported stronger-than-expected corporate earnings, and are investing in their businesses. Consumers are generally “deleveraging” by saving more and paying down their debt. Financial reform is under way in the U.S. that may help reassure investors and stabilize the markets. Globally, central banks around the world are continuing to pursue extremely accommodative mone tary policies to encourage economic recovery.

In this transitional environment, we believe that both the equity and fixed-income markets are likely to continue to be somewhat volatile. In our view, investment strategies that include sustainability criteria may be better positioned to weather these uncertainties and provide long-term value.

Markets Challenged, But Gain Ground

Despite the volatility over the course of the 12-month reporting period, domestic and international stocks had moved solidly ahead by the end of the period. U.S. stock indexes reported 12-month gains across all styles, strategies, and capitalization ranges. The large-cap Russell 1000 Index and the Standard & Poor’s 500 Index returned 10.75% and 10.16%, respectively. Mid-cap stocks were the top-performing category, with the Russell Midcap Index up 17.54%, while the small-cap Russell 2000 Index rose 13.35%. In terms of style, growth stocks moderately outpaced value stocks. On the international front, the MSCI EAFE Investable Market Index (IMI), a benchmark for international stocks, edged up 4.23%, and the MSCI Emerging Markets IMI was up 21.97%.

In the fixed-income markets, the Barclays Capital U.S. Credit Index, a market barometer for investment-grade bonds, was up 11.67%. In line with the Fed’s federal funds rate target of 0% to 0.25%, money market returns remained very low.

The Gulf of Mexico Oil Spill and the Extractives Industry

In the wake of the April 20 oil spill in the Gulf of Mexico, Americans have continued to grapple with the devastation caused by the spill and its long-term environmental, societal, and economic implications. Calvert shares the concern and the frustration felt by the millions of people affected by this tragedy.

Following the spill, Calvert met with BP officials, urging BP not only to clean up the current spill, but also to implement stronger safety and process management standards for its contractors. We are also evaluating how our advocacy objectives with deepwater oil-drilling companies may help prevent such disasters in the future.

In terms of extraction methodologies, Calvert has long recognized that as readily accessible supplies of oil and gas dry up, companies may be forced to seek mineral resources in countries with poor governance, weak rule of law, and high levels of corruption. Accordingly, over the past two years, we have been a leading advocate for transparency requirements for extractive industries. In July, the U.S. Congress passed legislation requiring companies to disclose payments that they make to the U.S. or foreign governments for the purpose of commercial development of oil, natural gas, or minerals. We believe this legislation is a milestone toward helping advance environmental sustainability in this industry.

In our view, the oil spill also underlines the urgency for expanded investment—with greater federal incentives—in alternative energy sources.

Financial Reform Under Way

Looking ahead, long-awaited financial reform is under way with Congressional passage of the largest financial reform bill since the Great Depression. The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) is designed to address inadequate regulation of Wall Street firms and the type of unrestrained environment that contributed to the credit crisis of 2008 and the ensuing global market meltdown. The Dodd-Frank Act seeks to establish strong consumer protections, shield taxpayers from future corporate bailouts, shine a light on the “shadow markets” and derivatives trading, and expand the role of shareholders in corporate governance. While these goals are laudable, the impact of the Dodd-Frank Act on the financial industry—and ultimately its ability to prevent another financial crisis—must stand the test of time.

As the Obama administration and Congress work to implement key financial reforms, we believe that over time these efforts may work to redress some systemic imbalances in the financial system and provide additional stability to the economy and markets.

Review Your Portfolio Allocations

In our view, the financial markets are likely to be in transition for some time as the government tackles financial reform, the global economy continues to recover, and political elections in the U.S. impact a variety of government policies. Now may be an opportune time to review your overall investment strategy and portfolio allocations with your financial advisor. Check to ensure that your target mix of U.S. and international stocks, bonds, and cash is well-diversified and appropriate given your investment goals, stage of life, and attitude toward risk.

For up-to-date economic and market commentary from Calvert professionals, along with information on current Calvert sustainability initiatives, please visit our website,

www.calvert.com.

As always, we appreciate your investing with Calvert.

Sincerely,

Barbara J. Krumsiek

President and CEO

Calvert Group, Ltd.

October 2010

sri

Update

from the Calvert Sustainability Research Department

As the fallout from the financial crisis continues to prove, responsible management of environmental, social, and governance (ESG) factors isn’t just “nice to do”—it’s essential to keeping our companies and our economy healthy and strong. Therefore, Calvert continues to work hard to ensure that you have a say in charting new paths to a more prosperous future.

Shareholder Advocacy

For the 2010 proxy season, Calvert filed a record 45 resolutions—including 30 as the lead filer. Issues covered by the resolutions focused on climate change, board and employee diversity, executive compensation, sustainability reporting, and political contributions. Thus far, we have negotiated 31 successful withdrawals after the companies have agreed to address our objectives.

The resolutions featured two new issues this year—climate change adaptation and board chair independence. Our resolutions on the first topic asked Kroger and Dover Corporation to report on how each plans to assess and manage the business impacts of climate change. Dover management agreed, so the resolution was successfully withdrawn. At Kroger, the resolution received strong support with 40% of shareholders voting in favor of it.

The second new issue recommended that Chesapeake Energy and Eaton Corporation separate the Board of Directors Chair and CEO positions to strengthen the Board’s oversight of company management and accountability to shareholders (which is emerging as a corporate governance best practice). Both resolutions were successfully withdrawn after management agreed to appoint a Lead Independent Director.

Community Investments

Many of our Funds participate in Calvert’s High Social Impact Investing program, which is administered through the Calvert Social Investment Foundation. This community investment program may allocate a small percentage of Fund assets at below-market interest rates to investments that provide economic opportunity for struggling populations.1

The Foundation recently launched its Green Strategies to Fight Poverty™ investment initiative, which allows investors to target their Community Investment Note investments to organizations and projects that both fight poverty and protect the environment.

Special Equities

A modest but important portion of certain funds is allocated to small private companies that are developing products or services that address important sustainability or environmental issues. CSIF Equity Portfolio has invested in Marrone Bio Innovations, which uses bio-based systems to control pests and weeds and recently received emergency-use approval from the EPA to sell its new invasive mussel control system in certain areas of the western U.S. The company also submitted a second organic herbicide product, for use on both organic and industrial farms, for approval to the EPA.

Calvert Large Cap Growth Fund invested in the Berkeley Renewable Energy Asia Fund, which brings power to areas of the world without access to a central power grid. Led by a management team with a long history in the industry, Berkeley mitigates construction risk by helping communities build the plants and then selling them to a service provider once they’re up and running.2

1 As of September 30, 2010, Calvert Social Investment Foundation Community Investment Notes represented the following percentages of Fund net assets: Calvert Social Investment Fund (CSIF) Balanced Portfolio 0.94%, CSIF Bond Portfolio 0.34%, CSIF Equity Portfolio 0.52%, Calvert Capital Accumulation Fund 1.29%, Calvert World Values International Equity Fund 1.19%, Calvert New Vision Small Cap Fund 0.78%, and Calvert Large Cap Growth Fund 0.56%. The Calvert Social Investment Foundation is a 501(c)(3) nonprofit organization. The Foundation’s Community Investment Note Program is not a mutual fund and should not be confused with any Calvert Group-sponsored investment product.

2 As of September 30, 2010, Marrone Bio Innovations represented 0.05% of CSIF Equity Portfolio; Berkeley Renewable Energy Asia Fund represented 0.002% of Calvert Large Cap Growth Fund. All holdings are subject to change without notice.

As of September 30, 2010, the following companies represented the following percentages of Fund net assets:

Kroger represented 0% of all Calvert SRI funds. Dover Corporation represented 0.15% of Calvert Social Index

Fund. Chesapeake Energy represented 0.22% of CSIF Balanced Portfolio, 0.79% of CSIF Bond Portfolio,

and 0.22% of Calvert Social Index Fund. Eaton Corporation represented 0.52% of CSIF Enhanced Equity

Portfolio and 0.20% of Calvert Social Index Fund. All holdings are subject to change without notice.

Portfolio Management Discussion

Natalie A. Trunow

Senior Vice President, Chief Investment Officer - Equities

Calvert Asset Management Company

Performance

Calvert World Values International Equity Fund Class A shares (at NAV) returned 1.08% for the 12-month period ended September 30, 2010, underperforming the benchmark Morgan Stanley Capital International Europe Australasia Far East Investable Market Index (MSCI EAFE IMI), which returned 4.23%. The bulk of the Fund’s underperformance was due to stock selection in the fourth quarter of 2009.

New Subadvisor

At the end of 2009, Calvert made extensive changes to the management structure of the Fund. On December 8, 2009, the Board of Directors replaced Acadian Asset Management as the subadvisor to the Fund with a multi-manager structure consisting of Thornburg Investment Management, Martin Currie, and Calvert Asset Management Company (CAMCO) as the subadvisors. The multi-manager, investment style-balanced approach offers more upside opportunity in different market environments as well as enhanced opportunity for risk control and diversification. The three managers have

calvert world

values

international

equity fund

September 30, 2010

Investment Performance

(total return at NAV*)

| 6 Months | 12 Months |

| ended | ended |

| 9/30/10 | 9/30/10 |

Class A | 1.09% | 1.08% |

Class B | 0.49% | 0.00% |

Class C | 0.75% | 0.25% |

Class I | 1.51% | 1.91% |

Class Y | 1.40% | 1.73% |

MSCI EAFE Investable Market Index | 0.95% | 4.23% |

Lipper International Multi-Cap Core Funds Average | 2.35% | 6.50% |

Ten Largest | | |

Stock Holdings | | % of Net Assets |

Pearson plc | | 1.9% |

Canadian National Railway Co. | | 1.9% |

Novo Nordisk A/S, Series B | | 1.6% |

BNP Paribas | | 1.6% |

Potash Corporation of Saskatchewan, Inc. | | 1.5% |

Standard Chartered plc | | 1.4% |

ING Groep NV (CVA) | | 1.3% |

Tesco plc | | 1.3% |

SAP AG | | 1.3% |

Reckitt Benckiser Group plc | | 1.2% |

Total | | 15.0% |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

complementary investment styles that we believe will help maximize returns, while enabling the CAMCO Equity Team to better control risk in the fund. Calvert managed this transition with all of the new portfolios in place by December 31, 2009.

Investment Climate

After a year of uncertainty about global economic recovery, markets worldwide ended the reporting period in positive territory. In the U.S., the Standard & Poor’s 500 Index returned 10.16% and in emerging markets, the Morgan Stanley Capital International Emerging Markets Index gained 20.54%.

Overall, markets have largely built on the rally that started in early March 2009 as investors fluctuated between optimism and uncertainty about the sustainability of an economic recovery, including fears of a double-dip recession. However, we saw some sharp sell-offs in the second quarter of 2010 as the uncertainty escalated, causing the re-pricing of risk in both equity and fixed-income assets.

Dramatic downgrades in the sovereign creditworthiness of Greece, Spain, and Dubai rattled global financial markets in the spring of 2010--leading many to question the overall strength of the euro-zone’s economic recovery. In response, several European Union countries implemented austerity programs to slash their budget deficits and slow economic growth, and a new set of rules to toughen European banks’ capital and liquidity requirements was introduced.

China had some success with its attempt to engineer a soft landing for its overheated economy, which should improve global growth prospects--especially since it is now the world’s second-largest economy, eclipsing Japan in the second quarter of 2010, according to gross domestic product (GDP) data.

In the U.S., economic news throughout the period suggested a slow and sometimes uneven recovery was underway. GDP growth in the fourth quarter of 2009 turned positive for the first time since the second quarter of 2008, largely due to government stimulus efforts designed to increase consumer spending and inventory rebuilding. However, economic recovery in the second half of 2010 has been slower than most original forecasts, with early estimates of 2.4% for the second quarter of 2010 lowered to 1.7%.

Portfolio Review

Due to the management changes, discussion of the Fund’s performance is divided into two parts: performance under Acadian’s

calvert world

values

international

equity fund

September 30, 2010

Economic Sectors | % of Total Investments |

Consumer Discretionary | 18.6% |

Consumer Staples | 6.6% |

Energy | 6.6% |

Financials | 25.4% |

Government | 2.8% |

Health Care | 11.0% |

Industrials | 9.1% |

Information Technology | 6.7% |

Limited Partnership Interest | 0.8% |

Materials | 3.4% |

Telecommunication Services | 5.7% |

Utilities | 2.6% |

Venture Capital | 0.7% |

Total | 100% |

management and transition (fourth quarter of 2009), and performance under the current multi-manager structure (January 1 through September 30, 2010).

Fourth Quarter 2009

The Fund underperformed its benchmark by 3.12 percentage points for the quarter, primarily due to stock selection in the Materials and Energy sectors. Relative returns were hurt by not owning several of the top performers--such as Rio Tinto, BHP Billiton, and BP--which do not meet Calvert’s environmental, social, and governance (ESG) criteria. Country selection helped offset some of the underperformance, although sector selection contributed a little as well. An underweight to Financials and strong stock selection within that sector were also beneficial.

2010 Year-to-Date Performance

After the change to the multi-manager structure, performance improved significantly. For 2010 through September 30, the Fund performed approximately in line with the benchmark, returning 2.29% versus 2.33%. Stock selection helped relative returns the most.

As of September 30, 2010, the allocation among the three managers was as follows: 37.9% of total Fund assets with Thornburg, 36.8% of total Fund assets with Martin Currie, and 25.3% of total Fund assets with CAMCO. These allocations are all within target ranges.

Stock selection was strongest in the Energy, Financials, and Utilities sectors. Avoiding investment in BP, Total, E.On, and RWE benefited relative performance by more than 1.20 percentage points. In Financials, Bank Mandiri, BanColombia, DnB NOR, Banco Santander-Chile, and Hang Lung Properties were all top contributors.

On the negative side, stock selection struggled in Consumer Staples and Telecommunication as a lack of exposure to Nestle, British American Tobacco, and Vodafone hurt relative performance. Mobile operator NTT DoCoMo also detracted from returns.

Overall, sector allocation had a neutral impact on the Fund. An underweight to Industrials detracted the most, but was offset by an underweight to Utilities.

Outlook

We believe that, given relative valuations and capital flows, the sharp outperformance of bonds versus equities of the past several months is bound to reverse and equities will outperform bonds over the next six to 18 months. The economy has slowed, but sustained economic recovery continues. The equity markets seem to present an attractive buying opportunity relative to other asset classes. In September, equities looked more attractive relative to bonds than they have since 1993 (except for the market bottom in March of 2009), with 10-year Treasuries yielding 2.51% versus the Dow Jones Industrial Average’s dividend yield of 2.6% and an attractive forward price/earnings multiple of 12.2.

As we have commented in the past, we don’t believe that negative GDP growth, which would constitute a double-dip recession, is likely. While we anticipate a somewhat more challenged earnings environment later this year, we believe that the strength in the corporate sector is likely to persist and continue to support the overall economic recovery. Our outlook continues to call for a slow, gradual pace to economic recovery and a generally positive environment for stock picking, barring any major geopolitical calamities.

October 2010

As of September 30, 2010, the following companies represented the following percentages of Fund net assets: Toyo Seikan Kaisha 0%, Rio Tinto 0%, BHP Billiton 0%, Santos 0.65%, BP 0%, Total 0%, Barclays 1.04%, UBS 0%, Lloyds Banking Group 0%, Nissan Motor 0.6%, Aisin Seiki 0%, E.On 0%, RWE 0%, Bank Mandiri 0.56%, BanColombia 0.84%, DnB NOR 0.97%, Banco Santander-Chile 0.51%, Hang Lung Properties 1.56%, Nestle 0%, British American Tobacco 0%, Vodafone 0.24%, and NTT DoCoMo 0%. All holdings are subject to change without notice.

calvert world

values

international

equity fund

September 30, 2010

Average Annual Total Returns

Class A Shares | (with max. load) |

One year | -3.80% |

Five year | -3.10% |

Ten year | -1.33% |

| |

| |

Class B Shares | (with max. load) |

One year | -5.15% |

Five year | -3.37% |

Ten year | -2.00% |

| |

| |

Class C Shares | (with max. load) |

One year | -0.83% |

Five year | -2.96% |

Ten year | -1.74% |

| |

Class I Shares | |

One year | 1.91% |

Five year | -1.45% |

Ten year | -0.05% |

| |

| |

| |

Class Y Shares** | |

One year | 1.73% |

Five year | -1.97% |

Ten year | -0.76% |

**Calvert World Values International Equity Fund first offered Class Y Shares on October 31, 2008. Performance prior to that date reflects the performance of Class A Shares at net asset value (NAV). Actual Class Y Share performance would have been different.

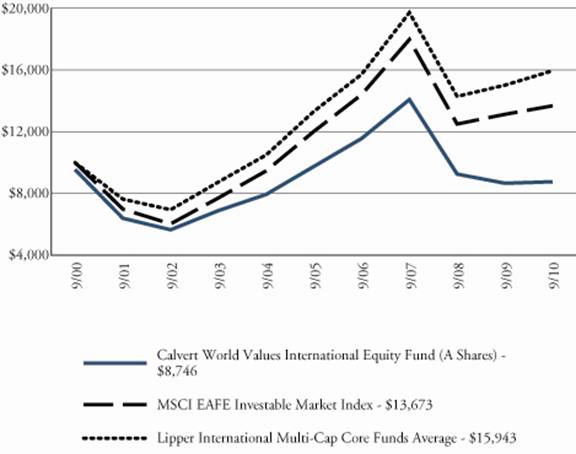

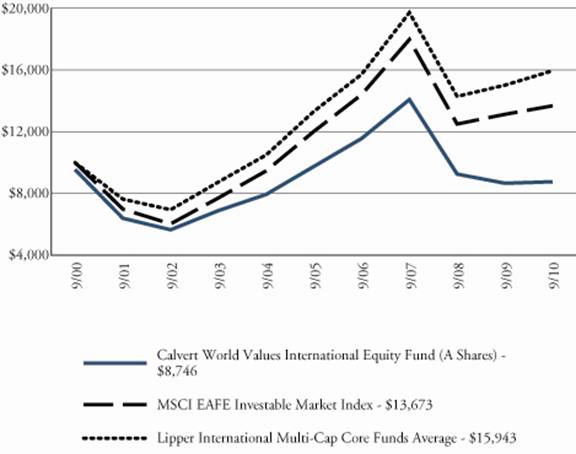

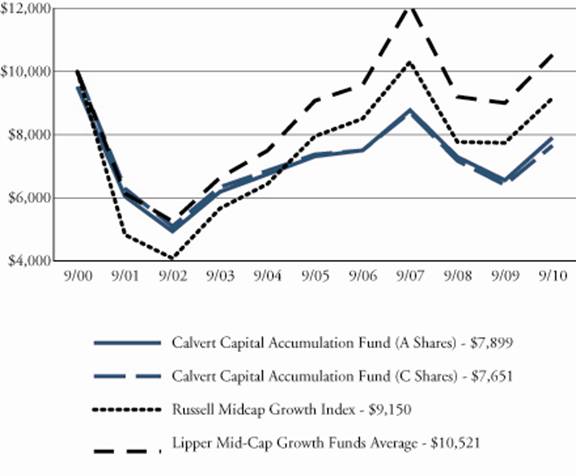

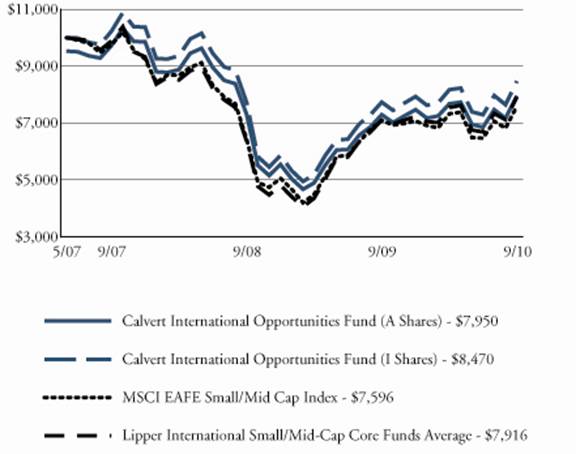

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds without 10-year records). The results shown are for Classes A shares and reflect the deduction of the maximum front-end sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s/Portfolio’s distributions or the redemption of the Fund/Portfolio shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.87%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a differe nt time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s/Portfolio’s operating expenses.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2010 to September 30, 2010).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending Account | Expenses Paid |

| Account Value | Value | During Period* |

| 4/1/10 | 9/30/10 | 4/1/10 - 9/30/10 |

Class A | | | |

Actual | $1,000.00 | $1,010.90 | $9.07 |

Hypothetical | $1,000.00 | $1,016.04 | $9.10 |

(5% return per | | | |

year before expenses) | | | |

Class B | | | |

Actual | $1,000.00 | $1,004.90 | $14.93 |

Hypothetical | $1,000.00 | $1,010.18 | $14.97 |

(5% return per | | | |

year before expenses) | | | |

Class C | | | |

Actual | $1,000.00 | $1,007.50 | $13.54 |

Hypothetical | $1,000.00 | $1,011.58 | $13.56 |

(5% return per | | | |

year before expenses) | | | |

Class I | | | |

Actual | $1,000.00 | $1,015.10 | $5.35 |

Hypothetical | $1,000.00 | $1,019.75 | $5.37 |

(5% return per | | | |

year before expenses) | | | |

| | | |

Class Y | | | |

Actual | $1,000.00 | $1,014.00 | $7.02 |

Hypothetical | $1,000.00 | $1,018.10 | $7.03 |

(5% return per | | | |

year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.80%, 2.97%, 2.69%, 1.06% and 1.39% for Class A, Class B, Class C, Class I and Class Y, respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

report of independent registered public accounting firm

The Board of Directors of Calvert World Values Fund, Inc. and Shareholders of Calvert World Values International Equity Fund:

We have audited the accompanying statement of net assets of Calvert World Values International Equity Fund (the Fund), a series of the Calvert World Values Fund, Inc., as of September 30, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2010, by correspondence with custodians and brokers or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert World Values International Equity Fund as of September 30, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

/s/KPMG LLP

Philadelphia, Pennsylvania

November 24, 2010

STATEMENT OF NET ASSETS

september 30, 2010

Equity Securities - 93.7% | | Shares | Value | |

Australia - 2.0% | | | | |

Amcor Ltd. (ADR) | | 7,398 | $185,394 | |

Australia & New Zealand Banking Group Ltd. (ADR) | | 11,353 | 260,438 | |

Computershare Ltd. (ADR) | | 936 | 8,789 | |

CSL Ltd. (ADR) | | 3,301 | 52,552 | |

Lend Lease Group (ADR) | | 1,126 | 8,220 | |

National Australia Bank Ltd. (ADR) | | 27,348 | 671,120 | |

Santos Ltd. | | 190,373 | 2,350,642 | |

Sims Metal Management Ltd. (ADR) | | 34,931 | 593,827 | |

Telstra Corp Ltd. (ADR) | | 40,833 | 518,171 | |

Westpac Banking Corp. | | 94,479 | 2,116,427 | |

Westpac Banking Corp. (ADR) | | 4,723 | 530,393 | |

Woodside Petroleum Ltd. (ADR) | | 1,536 | 64,911 | |

| | | 7,360,884 | |

| | | | |

Belgium - 0.2% | | | | |

Ageas (ADR) | | 14,865 | 41,771 | |

Delhaize Group SA (ADR) | | 9,185 | 664,627 | |

| | | 706,398 | |

| | | | |

Bermuda - 0.2% | | | | |

Signet Jewelers Ltd.* | | 26,441 | 839,238 | |

| | | | |

Brazil - 1.8% | | | | |

Banco do Brasil SA | | 111,300 | 2,107,040 | |

BM&F Bovespa SA | | 243,793 | 2,032,566 | |

Natura Cosmeticos SA | | 94,099 | 2,522,687 | |

Tractebel Energia SA (ADR) | | 794 | 11,751 | |

| | | 6,674,044 | |

| | | | |

Canada - 6.0% | | | | |

Brookfield Properties Corp. | | 49,278 | 764,795 | |

Canadian National Railway Co. | | 109,824 | 7,019,689 | |

EnCana Corp. | | 68,816 | 2,078,284 | |

Loblaw Co.’s Ltd. | | 62,500 | 2,475,230 | |

Potash Corporation of Saskatchewan, Inc. | | 36,875 | 5,311,475 | |

Suncor Energy, Inc. | | 68,000 | 2,212,832 | |

Thomson Reuters Corp. | | 53,000 | 1,991,393 | |

| | | 21,853,698 | |

| | | | |

Chile - 0.5% | | | | |

Banco Santander Chile (ADR) | | 19,079 | 1,842,077 | |

| | | | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

China - 2.0% | | | | |

China Merchants Bank Co. Ltd. | | 446,915 | $1,151,769 | |

China Southern Airlines Co. Ltd. (ADR)* | | 7,311 | 212,165 | |

CNinsure, Inc. (ADR) | | 75,100 | 1,755,087 | |

Ctrip.com International Ltd. (ADR)* | | 55,500 | 2,650,125 | |

Mindray Medical International Ltd. (ADR) | | 55,700 | 1,647,049 | |

| | | 7,416,195 | |

| | | | |

Colombia - 0.8% | | | | |

BanColombia SA (ADR) | | 46,230 | 3,034,075 | |

| | | | |

Denmark - 2.6% | | | | |

Danske Bank A/S (ADR)* | | 4,955 | 58,717 | |

H Lundbeck A/S (ADR) | | 1,549 | 27,169 | |

Novo Nordisk A/S, Series B | | 58,893 | 5,830,671 | |

Novo Nordisk A/S (ADR) | | 9,731 | 957,920 | |

Novozymes A/S (ADR) | | 353 | 44,972 | |

Torm A/S (ADR)* | | 4,783 | 35,059 | |

Vestas Wind Systems A/S* | | 56,071 | 2,107,952 | |

Vestas Wind Systems A/S (ADR)* | | 37,928 | 472,583 | |

| | | 9,535,043 | |

| | | | |

Finland - 0.1% | | | | |

Metso Oyj (ADR) | | 827 | 37,893 | |

Stora Enso Oyj (ADR) | | 18,824 | 184,852 | |

| | | 222,745 | |

| | | | |

France - 10.0% | | | | |

Air France-KLM (ADR)* | | 4,168 | 63,937 | |

Air Liquide SA | | 21,862 | 2,660,746 | |

Air Liquide SA (ADR) | | 7,463 | 182,620 | |

AXA SA (ADR) | | 120,417 | 2,092,847 | |

BNP Paribas | | 80,560 | 5,715,830 | |

BNP Paribas (ADR) | | 14,023 | 496,975 | |

Carrefour SA (ADR) | | 42,586 | 454,818 | |

Cie Generale d’Optique Essilor International SA (ADR) | | 632 | 21,677 | |

Compagnie Generale des Etablissements Michelin (ADR) | | 609 | 9,531 | |

Credit Agricole SA (ADR) | | 6,518 | 50,710 | |

Dassault Systemes SA | | 38,521 | 2,826,887 | |

France Telecom SA (ADR) | | 52,244 | 1,124,813 | |

Gemalto NV | | 50,931 | 2,085,258 | |

Groupe Danone | | 47,866 | 2,856,165 | |

Lafarge SA | | 46,064 | 2,631,176 | |

Lafarge SA (ADR) | | 4,098 | 58,561 | |

L’Oreal SA (ADR) | | 15,703 | 353,003 | |

Publicis Groupe | | 57,100 | 2,705,535 | |

Publicis Groupe SA (ADR) | | 7,307 | 172,884 | |

Sanofi-Aventis SA (s) | | 47,723 | 3,172,148 | |

Sanofi-Aventis SA (ADR) | | 72,818 | 2,421,199 | |

Schneider Electric SA | | 26,409 | 3,340,570 | |

Schneider Electric SA (ADR) | | 3,246 | 41,386 | |

SCOR SE (ADR) | | 3,777 | 8,687 | |

Veolia Environnement (ADR) | | 36,814 | 970,417 | |

| | | 36,518,380 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

Germany - 3.8% | | | | |

Adidas AG | | 48,540 | $2,997,714 | |

Adidas AG (ADR) | | 2,356 | 72,848 | |

Allianz SE (ADR) | | 104,297 | 1,178,556 | |

Deutsche Bank AG | | 26,426 | 1,442,786 | |

Deutsche Post AG (ADR) | | 1,449 | 26,444 | |

Merck KGaA (ADR) | | 2,116 | 59,121 | |

SAP AG | | 92,848 | 4,581,827 | |

Volkswagen AG, Preferred | | 27,142 | 3,267,919 | |

Volkswagen AG (ADR): | | | | |

Common | | 5,591 | 123,561 | |

Preferred | | 1,001 | 24,114 | |

| | | 13,774,890 | |

| | | | |

Greece - 0.0% | | | | |

Alpha Bank AE (ADR)* | | 5,632 | 8,673 | |

National Bank of Greece SA (ADR)* | | 23,179 | 52,616 | |

| | | 61,289 | |

| | | | |

Guernsey - 0.8% | | | | |

Amdocs Ltd.* | | 103,397 | 2,963,358 | |

| | | | |

Hong Kong - 3.2% | | | | |

Bank of East Asia Ltd. (ADR) | | 19,507 | 82,710 | |

China Merchants Holdings International Co. Ltd. | | 298,000 | 1,082,868 | |

Hang Lung Properties Ltd. | | 515,989 | 2,509,965 | |

Hang Lung Properties Ltd. (ADR) | | 124,877 | 3,060,735 | |

Hang Seng Bank Ltd. (ADR) | | 3,888 | 56,843 | |

Hengdeli Holdings Ltd. | | 3,472,000 | 1,615,092 | |

Hong Kong Exchanges and Clearing Ltd. | | 155,446 | 3,060,647 | |

Hong Kong Exchanges and Clearing Ltd. (ADR) | | 2,677 | 52,496 | |

MTR Corp. (ADR) | | 276 | 10,378 | |

| | | 11,531,734 | |

| | | | |

India - 0.4% | | | | |

HDFC Bank Ltd. (ADR) | | 1,036 | 191,007 | |

Infosys Technologies Ltd. (ADR) | | 19,935 | 1,341,825 | |

Patni Computer Systems Ltd. (ADR) | | 3,285 | 60,115 | |

| | | 1,592,947 | |

| | | | |

Indonesia - 0.6% | | | | |

Bank Mandiri Tbk PT | | 2,479,000 | 1,999,866 | |

Indosat Tbk PT (ADR) | | 3,059 | 93,177 | |

| | | 2,093,043 | |

| | | | |

Ireland - 0.1% | | | | |

Allied Irish Banks plc (ADR)* | | 243,050 | 345,131 | |

Experian plc (ADR) | | 8,569 | 92,973 | |

| | | 438,104 | |

| | | | |

Israel - 0.5% | | | | |

Bezeq Israeli Telecommunication Corp Ltd. | | 769,270 | 1,921,112 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

Italy - 0.9% | | | | |

Intesa Sanpaolo SpA | | 696,404 | $2,256,489 | |

Luxottica Group SpA (ADR) | | 26,971 | 735,769 | |

Telecom Italia SpA (ADR) | | 15,109 | 210,468 | |

| | | 3,202,726 | |

| | | | |

Japan - 11.8% | | | | |

ACom Co. Ltd. (ADR) | | 2,655 | 9,930 | |

Aeon Co. Ltd. (ADR) | | 5,925 | 63,279 | |

Asahi Glass Co. Ltd. (ADR) | | 993 | 10,129 | |

Brother Industries Ltd. (ADR) | | 84 | 10,333 | |

Canon, Inc. | | 44,943 | 2,095,439 | |

Central Japan Railway Co. (ADR) | | 1,375 | 9,996 | |

Dai Nippon Printing Co. Ltd. (ADR) | | 48,653 | 601,351 | |

Dai-ichi Life Insurance Co. Ltd. | | 2,031 | 2,450,620 | |

Daiwa House Industry Co. Ltd. (ADR) | | 710 | 71,405 | |

Denso Corp. (ADR) | | 472 | 55,583 | |

East Japan Railway Co. (ADR) | | 5,201 | 52,218 | |

Eisai Co. Ltd. (ADR) | | 250 | 8,700 | |

Fanuc Ltd. | | 14,495 | 1,844,408 | |

Fujitsu Ltd. (ADR) | | 877 | 31,037 | |

Honda Motor Co. Ltd. (ADR) | | 61,950 | 2,204,800 | |

Kao Corp. (ADR) | | 20,767 | 505,469 | |

Kobe Steel Ltd. (ADR) | | 1,005 | 11,728 | |

Konami Corp. (ADR) | | 553 | 9,727 | |

Kubota Corp. (ADR) | | 8,451 | 389,338 | |

Minebea Co. Ltd. (ADR) | | 928 | 9,475 | |

Mitsubishi Estate Co. Ltd. (ADR) | | 871 | 141,973 | |

Mitsui Fudosan Co. Ltd. | | 102,256 | 1,723,443 | |

Mizuho Financial Group, Inc. (ADR) | | 168,689 | 484,137 | |

MS&AD Insurance Group Holdings (ADR) | | 17,351 | 199,189 | |

Nikon Corp. (ADR) | | 46 | 8,646 | |

Nintendo Co. Ltd. (ADR) | | 64,443 | 2,010,622 | |

Nippon Telegraph & Telephone Corp. (ADR) | | 115,773 | 2,537,744 | |

Nippon Yusen Kabushiki Kaisha | | 588,000 | 2,407,182 | |

Nippon Yusen KK (ADR) | | 42,425 | 345,340 | |

Nissan Motor Co. Ltd. (ADR)* | | 12,635 | 220,860 | |

Nitto Denko Corp. (ADR) | | 100 | 39,623 | |

NSK Ltd. (ADR) | | 374 | 25,275 | |

NTT DoCoMo, Inc. | | 1,607 | 2,673,845 | |

NTT DoCoMo, Inc. (ADR) | | 58,388 | 976,248 | |

ORIX Corp. (ADR) | | 6,337 | 242,453 | |

Panasonic Corp. | | 188,716 | 2,554,917 | |

Panasonic Corp. (ADR) | | 52,365 | 711,117 | |

Ricoh Co. Ltd. | | 141,000 | 1,986,557 | |

Ricoh Co. Ltd. (ADR) | | 1,197 | 83,910 | |

Secom Co. Ltd. (ADR) | | 580 | 52,925 | |

Sega Sammy Holdings, Inc. (ADR) | | 24,208 | 96,348 | |

Sekisui House Ltd. | | 193,000 | 1,732,703 | |

Sekisui House Ltd. (ADR) | | 26,991 | 244,268 | |

Sharp Corp. (ADR) | | 4,458 | 44,535 | |

Shiseido Co. Ltd. (ADR) | | 7,326 | 165,055 | |

Sony Corp. (ADR) | | 54,216 | 1,676,359 | |

Sumitomo Trust & Banking Co. Ltd. (ADR) | | 68,219 | 345,870 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

Japan - Cont’d | | | | |

Teijin Ltd. (ADR) | | 277 | $9,127 | |

Tokyo Gas Co. Ltd. | | 698,118 | 3,167,186 | |

Toray Industries, Inc. (ADR) | | 505 | 28,022 | |

TOTO Ltd. (ADR) | | 292 | 19,955 | |

Toyota Motor Corp. | | 92,082 | 3,304,547 | |

Toyota Motor Corp. (ADR) | | 28,402 | 2,033,015 | |

Trend Micro, Inc. (ADR) | | 483 | 14,451 | |

| | | 42,752,412 | |

| | | | |

Luxembourg - 0.7% | | | | |

SES SA (FDR) | | 109,876 | 2,635,222 | |

| | | | |

Mexico - 0.6% | | | | |

America Movil SAB de CV (ADR), Series L | | 25,043 | 1,335,543 | |

Gruma SAB de CV (ADR)* | | 6,269 | 35,545 | |

Grupo Televisa SA (ADR) | | 44,215 | 836,548 | |

| | | 2,207,636 | |

| | | | |

Netherlands - 5.0% | | | | |

AEGON NV, NY Shares* | | 71,800 | 430,082 | |

ASML Holding NV | | 50,070 | 1,491,966 | |

ING Groep NV (ADR)* | | 170,885 | 1,758,406 | |

ING Groep NV (CVA)* | | 449,654 | 4,653,740 | |

Koninklijke KPN NV | | 53,400 | 823,920 | |

Koninklijke Philips Electronics NV: | | | | |

Common | | 105,593 | 3,310,848 | |

NY Shares | | 99,709 | 3,122,886 | |

Reed Elsevier NV (ADR) | | 40,058 | 1,009,061 | |

TNT NV (ADR) | | 10,284 | 276,640 | |

Unilever NV, NY Shares | | 33,107 | 989,237 | |

Wolters Kluwer NV (ADR) | | 7,536 | 158,030 | |

| | | 18,024,816 | |

| | | | |

Norway - 2.3% | | | | |

DnB NOR ASA | | 257,967 | 3,502,270 | |

Petroleum Geo-Services ASA* | | 192,737 | 2,191,735 | |

Petroleum Geo-Services ASA (ADR)* | | 7,400 | 84,360 | |

Statoil ASA (ADR) | | 114,342 | 2,398,895 | |

Tomra Systems ASA (ADR) | | 2,030 | 11,896 | |

Yara International ASA (ADR) | | 4,589 | 207,331 | |

| | | 8,396,487 | |

| | | | |

Singapore - 0.6% | | | | |

City Developments Ltd. (ADR) | | 2,287 | 22,001 | |

Oversea-Chinese Banking Corp. Ltd. | | 310,830 | 2,089,673 | |

| | | 2,111,674 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

South Africa - 1.5% | | | | |

African Bank Investments Ltd. (ADR) | | 492 | $12,472 | |

Aspen Pharmacare Holdings Ltd.* | | 250,669 | 3,366,127 | |

Nedbank Group Ltd. (ADR) | | 1,165 | 49,384 | |

Telkom SA Ltd. (ADR) | | 528 | 11,484 | |

Tiger Brands Ltd. (ADR) | | 1,673 | 45,824 | |

Truworths International Ltd. | | 181,300 | 1,813,000 | |

| | | 5,298,291 | |

| | | | |

South Korea - 0.6% | | | | |

KT Corp. (ADR) | | 108,967 | 2,229,465 | |

| | | | |

Spain - 2.4% | | | | |

Banco Santander SA (ADR) | | 158,692 | 2,009,041 | |

Inditex SA | | 35,023 | 2,775,475 | |

Telefonica SA | | 155,046 | 3,830,319 | |

| | | 8,614,835 | |

| | | | |

Sweden - 2.5% | | | | |

Atlas Copco AB, Series B | | 144,543 | 2,533,013 | |

Atlas Copco AB (ADR) | | 6,427 | 124,105 | |

Hennes & Mauritz AB, B Shares | | 124,054 | 4,474,394 | |

Hennes & Mauritz AB (ADR) | | 18,528 | 134,513 | |

Husqvarna AB, Series B | | 190,600 | 1,405,333 | |

Sandvik AB (ADR) | | 2,326 | 35,844 | |

SKF AB (ADR) | | 1,101 | 25,400 | |

Telefonaktiebolaget LM Ericsson (ADR) | | 31,339 | 343,789 | |

| | | 9,076,391 | |

| | | | |

Switzerland - 6.5% | | | | |

Credit Suisse Group AG | | 44,963 | 1,925,316 | |

Credit Suisse Group AG (ADR) | | 28,037 | 1,193,255 | |

Julius Baer Group Ltd. | | 42,873 | 1,563,508 | |

Logitech International SA* | | 119,234 | 2,081,140 | |

Novartis AG | | 74,412 | 4,274,982 | |

Novartis AG (ADR) | | 53,457 | 3,082,865 | |

Roche Holding AG | | 26,495 | 3,625,049 | |

Roche Holding AG (ADR) | | 67,225 | 2,294,389 | |

Swiss Reinsurance (ADR) | | 3,510 | 153,738 | |

Zurich Financial Services AG | | 11,038 | 2,591,682 | |

Zurich Financial Services AG (ADR) | | 33,662 | 786,008 | |

| | | 23,571,932 | |

| | | | |

Taiwan - 0.3% | | | | |

Chunghwa TeleCom Co. Ltd. (ADR) | | 49,267 | 1,104,566 | |

| | | | |

Turkey - 1.1% | | | | |

Turkiye Garanti Bankasi AS | | 679,918 | 3,935,578 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

United Kingdom - 19.3% | | | | |

Amlin plc | | 234,585 | $1,480,712 | |

Barclays plc | | 547,117 | 2,578,240 | |

Barclays plc (ADR) | | 62,420 | 1,176,617 | |

BG Group plc | | 223,246 | 3,927,544 | |

BG Group plc (ADR) | | 31,795 | 2,810,996 | |

British Airways plc (ADR)* | | 1,226 | 23,196 | |

British Land Co. plc (ADR) | | 1,257 | 9,327 | |

Bunzl plc (ADR) | | 347 | 20,959 | |

Cairn Energy plc* | | 190,971 | 1,362,517 | |

Capita Group plc | | 216,239 | 2,673,363 | |

Centrica plc | | 665,581 | 3,386,699 | |

Centrica plc (ADR) | | 48,104 | 978,916 | |

Compass Group plc | | 322,548 | 2,691,418 | |

Compass Group plc (ADR) | | 10,209 | 86,776 | |

GlaxoSmithKline plc | | 202,324 | 3,992,265 | |

GlaxoSmithKline plc (ADR) | | 35,131 | 1,388,377 | |

HSBC Holdings plc (ADR) | | 40,183 | 2,032,858 | |

Inchcape plc* | | 441,527 | 2,165,383 | |

International Power plc (ADR) | | 1,318 | 80,398 | |

J Sainsbury plc (ADR) | | 4,951 | 121,448 | |

Johnson Matthey plc (ADR) | | 193 | 10,702 | |

Kingfisher plc | | 1,216,487 | 4,481,214 | |

Kingfisher plc (ADR) | | 21,054 | 154,115 | |

Legal & General Group plc (ADR) | | 1,518 | 12,190 | |

Man Group plc (ADR) | | 1,878 | 6,423 | |

Marks & Spencer Group plc (ADR) | | 44,751 | 541,935 | |

Old Mutual plc (ADR) | | 694 | 12,076 | |

Pearson plc | | 455,949 | 7,067,637 | |

Pearson plc (ADR) | | 22,433 | 348,160 | |

Persimmon plc* | | 212,629 | 1,335,771 | |

Prudential plc (ADR) | | 42,225 | 842,389 | |

Reckitt Benckiser Group plc | | 82,117 | 4,521,958 | |

Reckitt Benckiser Group plc (ADR) | | 15,013 | 165,743 | |

Reed Elsevier plc (ADR) | | 9,242 | 311,918 | |

Sage Group plc (ADR) | | 9,153 | 160,361 | |

Scottish & Southern Energy plc (ADR) | | 2,525 | 44,465 | |

Smith & Nephew plc | | 285,157 | 2,603,680 | |

Smith & Nephew plc (ADR) | | 13,032 | 591,653 | |

Standard Chartered plc | | 175,435 | 5,038,698 | |

Tate & Lyle plc (ADR) | | 336 | 9,828 | |

Tesco plc | | 694,278 | 4,630,209 | |

Tesco plc (ADR) | | 27,527 | 554,669 | |

Unilever plc (ADR) | | 89,541 | 2,605,643 | |

Vodafone Group plc (ADR) | | 35,009 | 868,573 | |

Wolseley plc (ADR)* | | 37,345 | 92,242 | |

| | | 70,000,261 | |

| | | | |

United States - 2.0% | | | | |

Atmos Energy Corp. | | 6,260 | 183,105 | |

Cimarex Energy Co. | | 9,599 | 635,262 | |

Distributed Energy Systems Corp.* | | 308,138 | 1,233 | |

Evergreen Solar, Inc.* | | 1,400 | 1,028 | |

Portland General Electric Co. | | 20,427 | 414,260 | |

| | | | |

Equity Securities - Cont’d | | Shares | Value | |

United States - Cont’d | | | | |

Powerspan Corp.: | | | | |

Series A, Convertible Preferred (b)(i)* | | 45,455 | $385,655 | |

Series B, Convertible Preferred (b)(i)* | | 20,000 | 203,548 | |

Series C, Convertible Preferred (b)(i)* | | 239,764 | 824,788 | |

Series D, Convertible Preferred (b)(i)* | | 45,928 | 157,992 | |

Series D, Preferred Warrants (strike price $3.44/share, | | | | |

expires 12/31/12) (b)(i)* | | 2,347 | - | |

RF Technology, Inc. Contingent Deferred Distribution (b)(i)* | | 365,374 | 3,654 | |

SEACOR Holdings, Inc.* | | 18,765 | 1,598,027 | |

SmarThinking, Inc.: | | | | |

Series 1-A, Convertible Preferred (b)(i) | | 104,297 | 318,794 | |

Series 1-B, Convertible Preferred (b)(i) | | 163,588 | 168,370 | |

Series 1-B, Preferred Warrants (strike price $0.01/share, | | | | |

expires 5/26/15) (b)(i)* | | 11,920 | 12,149 | |

Series 1-B, Preferred Warrants (strike price $1.53/share, | | | | |

expires 6/1/15) (b)(i)* | | 32,726 | - | |

Tidewater, Inc. | | 39,557 | 1,772,549 | |

Tutor Perini Corp.* | | 10,000 | 200,900 | |

| | | 6,881,314 | |

| | | | |

Total Equity Securities (Cost $325,269,963) | | | 340,422,860 | |

| | | | |

| | | | |

| | Adjusted | | |

Limited Partnership Interest - 0.8% | | Basis | | |

Blackstone Cleantech Venture Partners (b)(i)* | | $30,000 | 30,000 | |

Balkan Financial Sector Equity Fund CV (b)(i)* | | 563,779 | 450,172 | |

China Environment Fund 2004 (b)(i)* | | - | 185,968 | |

Emerald Cleantech Fund I (b)(i)* | | 954,421 | 465,393 | |

gNet Defta Development Holdings LLC (a)(b)(i)* | | 400,000 | 389,241 | |

SEAF Central and Eastern European Growth Fund LLC (a)(b)(i)* | | 347,466 | 535,931 | |

SEAF India International Growth Fund (b)(i)* | | 481,432 | 388,137 | |

ShoreCap International LLC (b)(i)* | | - | 436,472 | |

Terra Capital (b)(i)* | | 469,590 | 1 | |

| | | | |

Total Limited Partnership Interest (Cost $3,246,688) | | | 2,881,315 | |

| | | | |

| | Principal | | |

Certificates of Deposit - 0.1% | | Amount | | |

Self Help Credit Union, 1.80%, 2/23/11 (b)(k) | | 250,000 | 249,625 | |

| | | | |

Total Certificates of Deposit (Cost $250,000) | | | 249,625 | |

| | | | |

| | | | |

| | Principal | | |

Venture Capital Debt Obligations - 0.1% | | Amount | Value | |

Access Bank plc, 8.477%, 8/29/12 (b)(i) | | $500,000 | $520,442 | |

Mayer Laboratories, Inc., 6.00%, 12/31/01 (b)(i)(w) | | 47,922 | 11,980 | |

| | | | |

Total Venture Capital Debt Obligations (Cost $547,922) | | | 532,422 | |

| | | | |

High Social Impact Investments - 1.2% | | | | |

Calvert Social Investment Foundation Notes, 1.17%, 7/1/11 (b)(i)(r) | | 4,431,583 | 4,283,081 | |

| | | | |

Total High Social Impact Investments (Cost $4,431,583) | | | 4,283,081 | |

| | | | |

U.S. Government Agencies | | | | |

and Instrumentalities - 2.8% | | | | |

Federal Home Loan Bank Discount Notes, 10/1/10 | | 10,200,000 | 10,200,000 | |

| | | | |

Total U.S. Government Agencies and Instrumentalities | | | | |

(Cost $10,200,000) | | | 10,200,000 | |

| | | | |

TOTAL INVESTMENTS (Cost $343,946,156) - 98.7% | | | 358,569,303 | |

Other assets and liabilities, net - 1.3% | | | 4,796,652 | |

Net Assets - 100% | | | $363,365,955 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital applicable to the following shares of common stock with | | | | |

250,000,000 shares of $0.01 par value shares authorized: | | | | |

Class A: 17,669,216 shares outstanding | | | $365,500,370 | |

Class B: 552,541 shares outstanding | | | 13,654,250 | |

Class C: 1,813,107 shares outstanding | | | 39,087,341 | |

Class I: 5,829,375 shares outstanding | | | 137,024,156 | |

Class Y: 192,072 shares outstanding | | | 2,420,944 | |

Undistributed net investment income | | | 1,184,550 | |

Accumulated net realized gain (loss) on investments | | | | |

and foreign currency transactions | | | (210,102,713) | |

Net unrealized appreciation (depreciation) on investments, foreign | | | | |

currencies, and assets and liabilities denominated in foreign currencies | | | 14,597,057 | |

| | | | |

Net Assets | | | $363,365,955 | |

See notes to financial statements.

Net Asset Value Per Share | | | |

Class A (based on net assets of $245,308,866) | | $13.88 | |

Class B (based on net assets of $6,850,379) | | $12.40 | |

Class C (based on net assets of $21,941,911) | | $12.10 | |

Class I (based on net assets of $86,474,878) | | $14.83 | |

Class Y (based on net assets of $2,789,921) | | $14.53 | |

Restricted Securities | | Acquisition Dates | Cost |

Access Bank plc, 8.477%, 8/29/12 | | 8/29/07 | $500,000 |

Balkan Financial Sector Equity Fund CV LP | | 1/12/06 - 9/24/10 | 563,779 |

Blackstone Cleantech Venture Partners LP | | 7/29/10 | 30,000 |

Calvert Social Investment Foundation Notes, 1.17%, 7/1/11 | | 7/1/08 | 4,431,583 |

China Environment Fund 2004 LP | | 9/15/05 - 4/1/09 | - |

Emerald Cleantech Fund I LP | | 7/19/01 - 9/21/10 | 954,421 |

gNet Defta Development Holdings LLC, LP | | 8/30/05 | 400,000 |

Mayer Laboratories, Inc., 6.00%, 12/31/01 | | 12/31/96 | 47,922 |

Powerspan Corp.: | | | |

Series A, Convertible Preferred | | 8/20/97 | 250,000 |

Series B, Convertible Preferred | | 10/5/99 | 200,000 |

Series C, Convertible Preferred | | 12/21/04 - 6/12/08 | 273,331 |

Series D, Convertible Preferred | | 6/20/08 | 157,996 |

Series D, Preferred Warrants | | | |

(strike price $3.44/share, expires 12/31/12) | | 12/5/07 - 6/20/08 | - |

RF Technology, Inc. Contingent Deferred Distribution | | 7/17/06 | 104,368 |

SEAF Central and Eastern European Growth Fund LLC, LP | | 8/10/00 - 7/16/10 | 347,466 |

SEAF India International Growth Fund LP | | 3/22/05 - 5/24/10 | 481,432 |

ShoreCap International LLC, LP | | 8/12/04 - 12/15/08 | - |

SmarThinking, Inc.: | | | |

Series 1-A, Convertible Preferred | | 4/22/03 - 5/27/05 | 159,398 |

Series 1-B, Convertible Preferred | | 6/10/03 | 250,000 |

Series 1-B, Convertible Preferred Warrants | | | |

(strike price $0.01/share, expires 5/26/15) | | 5/27/05 | - |

Series 1-B, Convertible Preferred Warrants | | | |

(strike price $1.53/share, expires 6/1/15) | | 9/19/00 | - |

Terra Capital LP | | 11/23/98 - 3/14/06 | 469,590 |

(a) Affiliated company.

(b) This security was valued by the Board of Directors. See Note A.

(i) Restricted securities represent 2.7% of net assets of the Fund.

(k) These certificates of deposit are fully insured by agencies of the federal government.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

(s) 45,000 shares of Sanofi-Aventis SA have been soft segregated in order to cover outstanding commitments to certain limited partnership investments with the Fund. There are no restrictions on the trading of this security.

(w) Mayer Laboratories, Inc. is in default for principal and interest. Past due accrued interest as of September 30, 2010 totaled $2,310.

* Non-income producing security.

Abbreviations:

ADR: American Depositary Receipts

CVA: Certificaten Van Aandelen

FDR: Fiduciary Depositary Receipts

LLC: Limited Liability Corporation

LP: Limited Partnership

See notes to financial statements.

Statement of Operations

year ended september 30, 2010

Net Investment Income | | | |

Investment Income: | | | |

Dividend income (net of foreign taxes withheld of $854,988) | | $8,275,052 | |

Interest income | | 121,054 | |

Total investment income | | 8,396,106 | |

| | | |

Expenses: | | | |

Investment advisory fee | | 2,764,351 | |

Transfer agency fees and expenses | | 895,409 | |

Administrative fees | | 1,119,486 | |

Distribution Plan expenses: | | | |

Class A | | 621,735 | |

Class B | | 77,095 | |

Class C | | 223,571 | |

Directors’ fees and expenses | | 45,006 | |

Custodian fees | | 285,640 | |

Registration fees | | 67,400 | |

Reports to shareholders | | 209,963 | |

Professional fees | | 47,261 | |

Miscellaneous | | 63,157 | |

Total expenses | | 6,420,074 | |

Reimbursement from Advisor: | | | |

Class A | | (59,041) | |

Class B | | (4,238) | |

Class C | | (4,786) | |

Class I | | (19,110) | |

Class Y | | (11,069) | |

Fees waived | | (13,724) | |

Fees paid indirectly | | (917) | |

Net expenses | | 6,307,189 | |

| | | |

Net Investment Income | | 2,088,917 | |

| | | |

Realized and Unrealized Gain (Loss) | | | |

Net realized gain (loss) on: | | | |

Investments (net of foreign taxes of $99,594) | | 2,343,380 | |

Foreign currency transactions | | (747,721) | |

| | 1,595,659 | |

Change in unrealized appreciation (depreciation) on: | | | |

Investments and foreign currencies | | (509,221) | |

Assets and liabilities denominated in foreign currencies | | (22,841) | |

| | (532,062) | |

| | | |

Net Realized and Unrealized Gain (Loss) | | 1,063,597 | |

| | | |

Increase (Decrease) in Net Assets | | | |

Resulting From Operations | | $3,152,514 | |

See notes to financial statements.

Statements of Changes in Net Assets

| | Year Ended | Year Ended | |

| | September 30, | September 30, | |

Increase (Decrease) in Net Assets | | 2010 | 2009 | |

Operations: | | | | |

Net investment income | | $2,088,917 | $3,896,152 | |

Net realized gain (loss) | | 1,595,659 | (185,255,630) | |

Change in unrealized appreciation (depreciation) | | (532,062) | 141,828,817 | |

| | | | |

Increase (Decrease) in Net Assets | | | | |

Resulting From Operations | | 3,152,514 | (39,530,661) | |

| | | | |

Distributions to shareholders from: | | | | |

Net investment income: | | | | |

Class A shares | | (1,877,571) | (7,682,721) | |

Class B shares | | — | (148,212) | |

Class C shares | | — | (420,523) | |

Class I shares | | (1,650,864) | (3,518,021) | |

Class Y shares | | (5,626) | (1) | |

Net realized gain: | | | | |

Class A shares | | — | (634,873) | |

Class B shares | | — | (25,817) | |

Class C shares | | — | (67,464) | |

Class I shares | | — | (222,338) | |

Class Y shares | | — | (3.00) | |

Total distributions | | (3,534,061) | (12,719,973) | |

| | | | |

Capital share transactions: | | | | |

Shares sold: | | | | |

Class A shares | | 37,402,286 | 46,807,216 | |

Class B shares | | 269,456 | 518,403 | |

Class C shares | | 2,587,664 | 2,179,011 | |

Class I shares | | 13,046,519 | 22,384,629 | |

Class Y shares | | 3,391,938 | 595,466 | |

Reinvestment of distributions: | | | | |

Class A shares | | 1,712,839 | 7,616,106 | |

Class B shares | | — | 153,830 | |

Class C shares | | — | 380,058 | |

Class I shares | | 1,379,546 | 3,486,897 | |

Class Y shares | | 2,622 | 4 | |

Redemption fees: | | | | |

Class A shares | | 1,376 | 7,071 | |

Class B shares | | 6 | 47 | |

Class C shares | | 59 | 134 | |

Class I shares | | — | 59 | |

Class Y shares | | 1,837 | 3 | |

See notes to financial statements.

Statements of Changes in Net Assets

| | Year Ended | Year Ended |

| | September 30, | September 30, |

Increase (Decrease) in Net Assets - (Cont’d) | | 2010 | 2009 |

Capital share transactions (Cont’d): | | | |

Shares redeemed: | | | |

Class A shares | | ($64,598,217) | ($71,757,677) |

Class B shares | | (2,328,107) | (2,569,260) |

Class C shares | | (4,676,204) | (6,216,320) |

Class I shares | | (35,107,420) | (25,214,435) |

Class Y shares | | (1,497,086) | (73,687) |

Total capital share transactions | | (48,410,886) | (21,702,445) |

| | | |

| | | |

Total Increase (Decrease) in Net Assets | | (48,792,433) | (73,953,079) |

| | | |

| | | |

Net Assets | | | |

Beginning of year | | 412,158,388 | 486,111,467 |

End of year (including undistributed net investment | | | |

income of $1,184,550 and $3,453,338, respectively) | | $363,365,955 | $412,158,388 |

| | | |

| | | |

Capital Share Activity | | | |

Shares sold: | | | |

Class A shares | | 2,802,787 | 4,194,520 |

Class B shares | | 22,231 | 48,508 |

Class C shares | | 220,010 | 226,686 |

Class I shares | | 924,635 | 1,846,796 |

Class Y shares | | 248,819 | 54,292 |

Reinvestment of distributions: | | | |

Class A shares | | 125,851 | 715,552 |

Class B shares | | — | 16,008 |

Class C shares | | — | 40,709 |

Class I shares | | 95,470 | 307,732 |

Class Y shares | | 185 | — |

Shares redeemed: | | | |

Class A shares | | (4,854,110) | (6,481,230) |

Class B shares | | (194,930) | (253,088) |

Class C shares | | (404,192) | (634,154) |

Class I shares | | (2,456,887) | (2,100,701) |

Class Y shares | | (105,845) | (5,379) |

Total capital share activity | | (3,575,976) | (2,023,749) |

See notes to financial statements.

Notes to Financial Statements

Note A — Significant Accounting Policies

General: The Calvert World Values International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The operation of each series is accounted for separately. The Fund offers five classes of shares of capital stock. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Effective March 1, 2010, Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or d istributions and through certain exchanges. Class C shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment may be waived for certain institutional accounts, where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Effective October 31, 2008, the Fund began to offer Class Y shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors to value its investments wherever possible. Securities for which market quotations are available are valued at last sale price or official closing price on the primary market or exchange in which they trade. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the Fund’s net asset value is determined, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. Short-term notes are stated at amortized cost, which approximates fair value. The Fund may invest in securities whose resale is subject to restrictions. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Directors.

The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters.

In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At September 30, 2010, securities valued at $10,021,393 or 2.8% of net assets, were fair valued in good faith under the direction of the Board of Directors.

The Fund utilizes various methods to measure the fair value of its investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the year. For additional information on the Fund’s policy regarding valuation of investments, please refer to the Fund’s most recent prospectus.

The following is a summary of the inputs used to value the Fund’s net assets as of September 30, 2010:

| Valuation Inputs |

Investments in Securities | Level 1 | Level 2 | Level 3 | Total |

Equity securities* | $338,347,910 | — | $2,074,950 | $340,422,860 |

Limited partnership interest | — | — | 2,881,315 | 2,881,315 |

Other debt obligations | — | $10,200,000 | 5,065,128 | 15,265,128 |

TOTAL | $338,347,910 | $10,200,000 | $10,021,393 ** | $358,569,303 |

* For further breakdown of equity securities by country, please refer to the Statement of Net Assets.

**Level 3 securities represent 2.8% of net assets.

Repurchase Agreements: The Fund may enter into repurchase agreements with recognized financial institutions or registered broker/dealers and, in all instances, holds underlying securities with a value exceeding the total repurchase price, including accrued interest. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate clas ses of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund (within seven days for Class I shares). The redemption fee is paid to the Class of the Fund from which the redemption is made, and is accounted for as an addition to paid-in capital. The fee is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Expense Offset Arrangement: The Fund has an arrangement with its custodian bank whereby the custodian’s fees may be paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits are used to reduce the Fund’s expenses. Such a deposit arrangement may be an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

New Accounting Pronouncements: In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements”. ASU 2010-06 will require reporting entities to make new disclosures about amount and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements and input and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3, and information on purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measures. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2009 except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measures, which are effective for fiscal years beginning after December 15, 2010. At this time, management is evaluating the implications of ASU No. 2010-06 disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measures and its impact on the financial statements has not been determined.

Note B — Related Party Transactions

Calvert Asset Management Company, Inc. (the “Advisor”) is wholly-owned by Calvert Group, Ltd. (“Calvert”), which is indirectly wholly owned by UNIFI Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives a monthly fee based on the following annual rates of average daily net assets: .75% on the first $250 million, .725% on the next $250 million and .675% on the excess of $500 million. Under the terms of the agreement, $217,189 was payable at year end. In addition, $104,936 was payable at year end for operating expenses paid by the Advisor during September 2010. For the year ended September 30, 2010, the Advisor waived $13,724 of its fee.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2011 for Class I and Class Y. The contractual expense cap is 1.10% and 1.39%, respectively. For the purposes of this expense limit, operating expenses do not include interest expense, brokerage commissions, taxes, and extraordinary expenses. This expense limitation does not limit any acquired fund fees and expenses. To the extent any expense offset credits are earned, the Advisor’s obligation under the contractual limitation may be reduced and the Advisor may benefit from the expense offset arrangement. The Advisor voluntarily reimbursed Class Y shares for expenses of $11,069 for the year ended September 30, 2010.

Calvert Administrative Services Company, an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .35% for Classes A, B, C and Y, and .15% for Class I, based on their average daily net assets. Under the terms of the agreement, $88,494 was payable at year end.

Calvert Distributors, Inc., an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Distribution Plans, adopted by Class A, Class B and Class C shares, allow the Fund to pay the Distributor for expenses and services associated with distribution of shares. The expenses paid may not exceed .35%, 1.00% and 1.00% annually of average daily net assets of each Class A, Class B and Class C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly of .25%, 1.00% and 1.00% of the Fund’s average daily net assets of Class A, Class B and Class C, respectively. Class I and Class Y shares do not have Distribution Plan expenses. Under the terms of agreement, $72,695 was payable at year end.

The Distributor received $43,053 as its portion of commissions charged on sales of the Fund’s Class A shares for the year ended September 30, 2010.

Calvert Shareholder Services, Inc. (“CSSI”), an affiliate of the Advisor, is the shareholder servicing agent for the Fund. For its services, CSSI received a fee of $191,183 for the year ended September 30, 2010. Under the terms of the agreement, $15,332 was payable at year end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

The Fund invests in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from the Calvert Group, Ltd. and its subsidiaries. The Fund has received from the Securities and Exchange Commission an exemptive order permitting the Fund to make investments in these notes under certain conditions.

Each Director of the Funds who is not an employee of the Advisor or its affiliates receives an annual retainer of $44,000 plus a meeting fee of $2,000 for each Board meeting attended. Additional fees of up to $5,000 annually may be paid to the Board chair and Committee chairs ($10,000 for the Special Equities Committee chair) and $2,500 annually may be paid to committee members, plus a committee meeting fee of $500 for each committee meeting attended. Director’s fees are allocated to each of the Funds served.

Note C — Investment Activity

During the year, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $478,995,400 and $539,653,412, respectively.

Capital Loss Carryforwards

Expiration Date | |

30-Sep-17 | $90,728,857 |

30-Sep-18 | 105,942,268 |

Capital losses may be utilized to offset future capital gains until expiration.