UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2011

<PAGE>

Item 1. Report to Stockholders.

INFORMATION REGARDING CALVERT OPERATING COMPANY

NAME CHANGES

Effective on April 30, 2011, the following Calvert operating companies changed their names as indicated:

| | |

| Old Name | New Name | Company Description |

| |

| Calvert Group, Ltd. | Calvert Investments, Inc. | Corporate parent of |

| | | each operating company |

| | | listed below |

| |

| Calvert Asset Management | Calvert Investment | Investment advisor to |

| Company, Inc. | Management, Inc. | the Calvert Funds |

| |

| Calvert Distributors, Inc. | Calvert Investment Distributors, | Principal underwriter |

| | Inc. | and distributor for the |

| | | Calvert Funds |

| |

| Calvert Administrative | Calvert Investment | Administrative services |

| Services Company | Administrative Services, Inc. | provider for the Calvert |

| | | Funds |

| |

| Calvert Shareholder | Calvert Investment Services, | Shareholder servicing |

| Services, Inc. | Inc. | provider for the Calvert |

| | | Funds |

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

TABLE

OF CONTENTS

4 President’s Letter

7 SRI Update

10 Portfolio Management Discussion

15 Shareholder Expense Example

17 Report of Independent Registered Public Accounting Firm

18 Statement of Net Assets

28 Statement of Operations

29 Statements of Changes in Net Assets

31 Notes to Financial Statements

40 Financial Highlights

45 Explanation of Financial Tables

47 Proxy Voting and Availability of Quarterly Portfolio Holdings

48 Director and Officer Information Table

Dear Shareholder:

After a strong finish to 2010 and start of the new year, the U.S. economy lost its footing in the summer of 2011. Hope for a second-half rebound gave way to concerns we were heading into another recession as consumer insecurity, a weak job market, the looming sovereign debt crisis in Europe, and uncertainty about the direction of U.S. and European policy weighed on economic growth and turned markets into a roller coaster.

The final months of the reporting period were particularly difficult for equities amid significant market volatility in the financial markets. After U.S. government debt lost its Standard & Poor’s triple A rating for the first time in history, already anxious investors flocked to the relative safety of cash and Treasuries, despite very low short-term yields. In the end, third-quarter market turmoil more than erased stock market gains made through the first six months of 2011. In fact, the -13.87% third-quarter return for the Standard & Poor’s 500 Index was the biggest quarterly drop for that index since the financial meltdown in the fourth quarter of 2008.

The 2008-2009 Financial Crisis -- Where Are We Now?

There have been many media comparisons to the third quarter of 2008 recently, so I think it’s worth noting some key differences. Despite third-quarter events, equity markets are still generally ahead of where they were in the depths of the financial crisis, as the S&P 500 Index and Russell Mid-Cap Index returned an annualized 1.23% and 3.96% for the three-year period ended September 30, 2011. Also, unlike 2008, the stock market seems to be rebounding quickly, having regained much of the lost ground in the first two weeks of October.

While still high, the unemployment rate has decreased a full percentage point from its recession peak. And in a direct month-to-month comparison, the United States added 103,000 jobs in September 2011 (58,000 if you exclude the return of striking Verizon workers) versus losing 434,000 jobs in September 2008.1 In housing, builder confidence in the current market for new single-family homes as measured by the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) rose four points to 18 for October 2011--a sign that pockets of recovery in housing may be starting to emerge across the country. The HMI index is also four points higher than it was in October 2008.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 4 |

Energy prices have fallen, too--after soaring to $150 a barrel, crude oil hovered around $80 a barrel at the end of September 2011. While prices at the pump did not decrease proportionately, they are lower, which is good for consumers’ wallets and oil-dependent industries. In fact, reports show retail sales have notched up in recent weeks--a sign that consumers are starting to spend a bit more freely now. And although household debt still exceeds consumers’ after-tax income, it fell 12% between its record high in September 2007 and June of this year.2 The bottom line is that economic recovery may continue to be more two-steps-forward-one-step-back rather than the straight line progress we’d all prefer, but the recovery is happening. In the meantime, the expertise of your Calvert fund managers will help guide your investments through the ups and downs that may lie ahead.

Board Diversity and Company Competitiveness

As always, we filed several shareholder resolutions this year asking companies to consider diverse candidates during their board selection. Most were successfully withdrawn after the companies agreed to add specific considerations of race, gender and ethnicity to their selection process. However, Urban Outfitters was one of two companies that opposed the resolution that we filed.

Unlike its five biggest apparel-industry competitors, Urban Outfitters doesn’t have any women or minorities on its board. This is particularly disconcerting since 53% of its North American net retail store sales in fiscal 2011 came from its Anthropologie and Free People stores for women. Of course, the Urban Outfitters flagship store heavily caters to women too. Smart companies understand the importance of having management that reflects their target audiences and Urban Outfitters is certainly missing the mark.

We pressed on and 22% of shareholders voted in favor of the resolution. The battle received a good deal of attention in the press, although it remains to be seen if the company will heed the call of its shareholders.

Your Financial Advisor Is Always Available

It’s easy to be a long-term investor when markets are strong. The challenge is to remain one when markets are going through a protracted period of uncertainty. While it may take longer than we’d like, markets have always recovered in the past and I am confident they will do so again. These cycles are simply the nature of the market.

In times like these, it’s best to stay the course, maintaining a well-diversified mix of U.S. and international stocks, bonds, and cash appropriate for your goals and risk tolerance. However, if you think your financial needs or risk tolerance have changed, your financial advisor is always available to discuss your concerns.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 5 |

We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals. As always, we thank you for entrusting your investments to Calvert.

Sincerely,

Barbara J. Krumsiek

President and CEO

Calvert Investments, Inc.

October 2011

1 Bureau of Labor Statistics

2 Center for American Progress, Economic Snapshot for September 2011

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 6 |

As always, Calvert continues to work hard to ensure you have a say in the responsible man- agement of environmental, social, and gover- nance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Climate ChangeAs the impacts of climate change become increasingly apparent, the consequences on vulnerable, impoverished communities around the world cannot be ignored. Even with aggressive mitigation efforts, many will still experience dire effects from more severe weather-related disasters, increased food and water insecurity, increased scarcity of natural resources, and negative health effects. While many communities have begun to prepare, businesses can contribute to--and benefit from--preparation as well.

To that end, Calvert has joined with leading companies such as Entergy, Green Mountain Coffee Roasters, Levi Strauss, Limited Brands, Starbucks, and Swiss Re to launch the Partnership for Resilience and Environmental Preparedness (PREP) to promote business practices that help companies and communities gear up for the impact of climate change. It also advocates for public policies to mitigate climate variability, weather extremes, and other consequences of a changing climate.

Overall Shareholder Advocacy Efforts

Calvert filed 38 resolutions in the 2011 proxy season, 28 of which were successfully withdrawn after companies agreed to the terms of the resolution. The most popular topics were sustainability reporting, climate change risks, and climate principles.

Majority Vote in Director Elections

Shareholders’ role in electing a board of directors is a fundamental part of ensuring accountability. Unfortunately, many companies weaken this role by conducting elections under a plurality rather than a majority standard—which essentially means a director nominee can be elected with only his or her own affirmative vote.

Calvert filed four shareholder proposals calling for companies to adopt majority voting this year. Those at Plains Exploration and Production, Global Payments, and Agco were withdrawn after the companies agreed to the requested changes. Hansen Natural responded with minor improvements to their election process. But we felt they were insufficient, so we kept the resolution on the ballot and 48% of shareholders voted in favor of it.

Update on Board Diversity

Persuading companies to make their boards more representative of their customers, employees, and other target audiences continues to be an important initiative. In August, Calvert Senior Sustainability Analyst Aditi Mohapatra published an article in Forbes

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 7 |

magazine, “Are There Really Boards With No Women?” The article highlighted the fact that women still hold only 18% of corporate board posts at S&P 100 companies, despite a growing body of evidence proving the business case for diverse boards.

Also, five resolutions seeking a proactive commitment to include women and minorities as part of every board director search were filed this year. Three were successfully withdrawn before the annual meeting. The remaining two—at Urban Outfitters and American Financial Group—received strong support with 22% and 27% of shareholders votes.

First U.S. Automaker Added to Calvert Social Index

Another notable event was Ford Motor becoming the first U.S. automaker to qualify for Calvert Signature Funds and be added to the Calvert Social Index. Ford has emerged in recent years as the fuel efficiency leader among the big three U.S. auto manufacturers. A review of Ford’s key industry impacts, as well as our engagement with the company over the past four years, ensured that it met our environment, social, and governance (ESG) criteria for investment.

While we remain concerned about the overall impact of automobile companies on issues such as greenhouse emissions, we believe Ford and the foreign automakers Calvert invests in are taking meaningful steps to reduce the negative environmental impacts of their products. Of course, we will continue to seek improvement on key issues by working with senior management of all these companies.

Community Investments

Many of our Funds participate in Calvert’s High Social Impact Investing program, which is administered through the Calvert Foundation. This community investment program may allocate a small percentage of Fund assets at below-market interest rates to investments that provide economic opportunity for struggling populations.1 One such company receiving funding through the Foundation is Seedco Financial Services, which supports small businesses in under-served communities and those owned by women and minorities such as Telecom Transport Services in Birmingham, Alabama. Last year, owner Sue Watkins landed a large contract to transport costly telecommunication equipment that required the company to move to a new warehouse, lease new equipment, and hire additional staff. A $25,000 microloan from Seedco allowed her to make the necessary investments. Now the company enjoys continued growth and is creating jobs in her community.

Special Equities

A modest but important portion of certain funds is allocated to small private companies that aim to provide market-rate returns while developing products or services that address important sustainability or environmental issues.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 8 |

One recent investment was PresenceLearning, a firm that provides live, online speech therapy to students via web-based video conference technology.2 A national shortage of speech therapists prevents many students with severe communication disorders from receiving therapy. Now, the company’s distributed network technology enables specialists to serve more students in a more cost-efficient manner.

Another investment was DBL Equity Fund–BAEF II, L.P.2 DBL is a women-led firm with a “Double Bottom Line” strategy to invest in companies that aim to deliver top-tier venture capital returns while working with these companies to create social, environmental, and economic improvement in the regions where they operate.

1 As of September 30, 2011, Calvert Social Investment Foundation (“Calvert Foundation” or “Foundation”) Community Investment Notes represented the following percentages of Fund net assets: Calvert Capital Accumulation Fund 0.79%, Calvert International Equity Fund 1.48%, and Calvert Small Cap Fund 0.57%. The Calvert Foundation is a 501(c)(3) nonprofit organization. The Foundation’s Community Investment Note Program is not a mutual fund and should not be confused with any Calvert Investment-sponsored investment product.

2 As of September 30, 2011, PresenceLearning and DBL Equity Fund represented 0.01% and 0.02% of Calvert Equity Portfolio. All holdings are subject to change without notice.

As of September 30, 2011, the following companies represented the following percentages of net assets: Entergy 0% of all funds, Green Mountain Coffee Roasters 0.17% of Calvert Social Index Fund, Levi Strauss 0% of all funds, Limited 0.15% of Calvert Social Index Fund, Starbucks 0.41% of Calvert Social Index Fund, Swiss Re 0% of all funds, Plains Exploration 0.05% of Calvert Social Index Fund, Global Payments 0.05% of Calvert Social Index Fund, Agco 0.05% of Calvert Social Index Fund, Hansen Natural 0.09% of Calvert Social Index Fund, Urban Outfitters 0% of all funds and American Financial Group 0.04% of Calvert Social Index Fund, and Ford 0.53% of Calvert Social Index Fund. All holdings are subject to change without notice.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 9 |

PORTFOLIO MANAGEMENT DISCUSSION

Natalie A. Trunow

Senior Vice President, Chief Investment Officer - Equities Calvert Investment Management, Inc.

Investment Performance

For the 12-month period ended September 30, 2011, Calvert International Equity Fund Class A shares (at NAV) returned -14.47%, underperforming the -8.51% return of the MSCI EAFE Investable Market Index due to weak stock selection.

Investment Climate

A strong performance by equity markets in the fourth quarter of 2010 and modest gains in the first half of 2011 were largely erased by stocks’ dismal performance in the third quarter of 2011. Despite healthy earnings from U.S. companies, macroeconomic troubles became the focus of attention and weighed on investor sentiment. Over the past four quarters, the Standard & Poor’s (S&P) 500 Index of U.S. stocks returned 1.14%. International stocks fared considerably worse as the MSCI EAFE IMI and MSCI Emerging Markets IMI Index, for example, returned -8.51% and -16.46%, respectively.

In general, U.S. companies, led by those in the Technology and Health Care sectors, continued to show financial strength and to

CALVERT INTERNATIONAL EQUITY FUND

September 30, 2011

Investment Performance

(Total Return at NAV*)

| | 6 months | | 12 months | |

| | ended | | ended | |

| | 9/30/11 | | 9/30/11 | |

| Class A | -19.35 | % | -14.47 | % |

| Class B | -19.75 | % | -15.48 | % |

| Class C | -19.66 | % | -15.21 | % |

| Class I | -19.06 | % | -13.84 | % |

| Class Y | -19.16 | % | -14.20 | % |

| |

| MSCI EAFE Investable | | | |

| Market Index | -17.50 | % | -8.51 | % |

| |

| Lipper International | | | | |

| Large-Cap Core | | | | |

| Funds Average | -19.21 | % | -10.77 | % |

| |

| |

| Ten Largest | | | % of | |

| Stock Holdings | | | Net Assets | |

| BG Group plc | | | 2.3 | % |

| Canadian National Railway Co. | | | |

| - Toronto Exchange | | | 2.3 | % |

| Novartis AG | | | 2.3 | % |

| Pearson plc | | | 2.2 | % |

| Canon, Inc. | | | 1.8 | % |

| Telefonica SA | | | 1.8 | % |

| Toyota Motor Corp. | | | 1.7 | % |

| SAP AG | | | 1.5 | % |

| Adidas AG | | | 1.5 | % |

| Kingfisher plc | | | 1.5 | % |

| Total | | | 18.9 | % |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 10 |

rely on their healthy balance sheets and impressive cash reserves for mergers and acquisitions.

The eurozone crisis continued to unfold, weighed down by struggling peripheral economies. Although leaders attempted to assure investors that the proposed long-term solutions to the debt crisis were viable, the fear of contagion intensified. Germany and France braced for a Greek default by taking steps to insulate their financial institutions from large losses. While we don’t see a high probability of a Greek default driving the United States into recession, the possibility still seemed to drive market sentiment.

European bank stocks continued to be among those most adversely impacted by the eurozone debt crisis, driven by longer-term funding stress, as well as by U.S. money market funds’ further reductions in their exposure to these banks.

The S&P downgrade of U.S. government debt on August 5 was another blow to investor confidence, contributing to a global equity market sell-off and pushing U.S. Treasury yields down as risk aversion in the markets increased. The resulting equity market volatility was also fed by concerns about the political stalemate in Washington, the European sovereign debt issues, and a significant slowdown in U.S. economic growth—or, more ominously, the possibility of a double-dip recession in the United States.

After the completion of QE2 in June, the Federal Reserve (Fed) supplemented its accommodative policy with the well-timed September 21 announcement of “operation twist,” a plan to sell $400 billion in short-term Treasuries while purchasing the same amount of longer-term Treasuries. This could boost investment and refinanc-ing in the United States by reducing long-

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| September 30, 2011 |

| |

| | % of Total | |

| Economic Sectors | Investments | |

| Consumer Discretionary | 19.2 | % |

| Consumer Staples | 8.5 | % |

| Energy | 6.2 | % |

| Financials | 19.6 | % |

| Health Care | 9.0 | % |

| Industrials | 10.0 | % |

| Information Technology | 9.2 | % |

| Limited Partnership Interest | 0.9 | % |

| Materials | 5.1 | % |

| Telecommunication Services | 7.4 | % |

| Time Deposit | 1.6 | % |

| Utilities | 2.6 | % |

| Venture Capital | 0.7 | % |

| Total | 100 | % |

term interest rates. The Fed also promised to keep interest rates low for the next two years. However, the announcement was accompanied by alarming statements about U.S. economic weakness, which further unsettled markets.

In fact, worries about anemic global economic growth intensified over the last 12 months, with U.S. gross domestic product (GDP) growth numbers revised down for the first half of the year to less than a 1% average annual growth rate, according to the Bureau of Economic Analysis.

The most recent release of employment figures by the Bureau of Labor Statistics showed that the unemployment rate remained at 9.1% in August. Jobs data is likely to be a lagging indicator of economic activity in this economic cycle and may not improve until other economic indicators are more firmly in positive territory.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 11 |

Although the secular upward trend in commodity prices may persist in the long term, decreasing commodity prices are a positive for global economic growth in the near term. A continued price break should reduce risks to top-line inflation, lift the drag on economic growth, and provide additional stability to the Fed’s actions.

In China, the threat of inflation still looms and may make it difficult for that country and other emerging-market economies to implement more accommodative monetary policy in the near term. However, recent industrial production numbers in China were positive and although manufacturing data was slightly contractionary, it was not at hard landing levels.

One of the stronger headwinds to U.S. economic growth, the housing market, seems to be stabilizing, helped by historically low mortgage rates and home prices, and can provide a considerable boost to consumer confidence. The U.S. manufacturing sector continued to be strong, with the Chicago PMI and ISM Manufacturing PMI both better than expected in September.

Portfolio Strategy

The Fund is based upon a multi-manager approach with allocations managed by each of the two sub-advisors, Thornburg Investment Management and Martin Currie Inc., as well as the advisor, Calvert Investment Management, Inc., with the latter also overseeing the general strategy and overall allocations to the managers.

Stock selection in the Fund suffered, primarily in Financials. All three managers had significant struggles in their respective portfolios in this sector, specifically within the commercial banks industry due to the negative impact of the European debt crisis. Barclays, Turikye Garanti Bankasi, BNP Paribas, and Standard Chartered

CALVERT INTERNATIONAL EQUITY FUND

September 30, 2011

Average Annual Total Returns

| Class A Shares | (with max. load) | |

| One year | -18.41 | % |

| Five year | -9.20 | % |

| Ten year | 1.11 | % |

| |

| Class B Shares | (with max. load) | |

| One year | -19.58 | % |

| Five year | -9.49 | % |

| Ten year | 0.44 | % |

| |

| Class C Shares | (with max. load) | |

| One year | -15.99 | % |

| Five year | -9.09 | % |

| Ten year | 0.70 | % |

| |

| Class I Shares | | |

| One year | -13.84 | % |

| Five year | -7.65 | % |

| Ten year | 2.39 | % |

| |

| Class Y Shares* | | |

| One year | -14.20 | % |

| Five year | -8.08 | % |

| Ten year | 1.74 | % |

* Calvert International Equity Fund first offered Class Y Shares on October 31, 2008.

Performance prior to that date reflects the performance of Class A Shares at net asset value (NAV). Actual Class Y Share perfor- mance would have been different.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 12 |

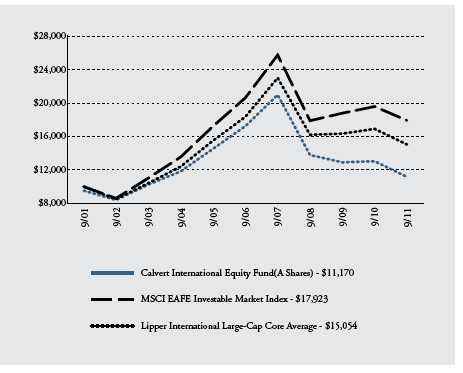

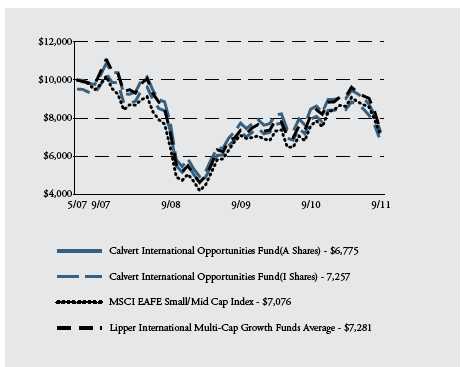

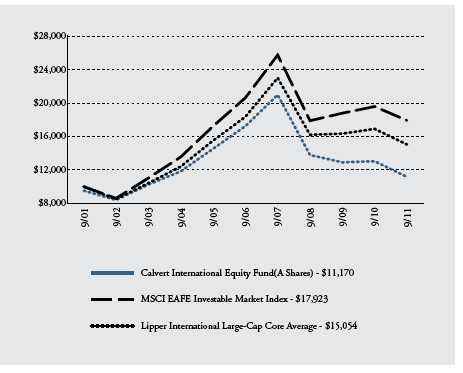

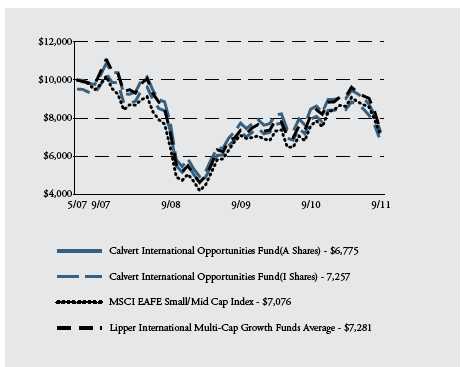

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods. The results shown are for Classes A shares and reflect the deduction of the maximum front-end sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.90%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 13 |

all weighed on performance. The Fund also experienced stock selection weakness within Diversified Financials, specifically as a result of its Hong Kong Exchanges & Clearinghouse and BM&F Bovespa holdings. Areas within Industrials and Consumer Staples detracted as well, but to a much lesser extent.

Sector allocation had an slight negative impact on the overall active return. Country allocation was a positive contributor to active return, driven by the Fund’s overweight position in North American equities.

Outlook

While we may see further volatility in the equity markets, those who step in to buy the dips in a time of uncertainty could have the potential for greater returns. Combined with generally positive U.S. economic data and attractive equity valuations--the 12-month forward price/earnings ratio for the S&P 500 Index was 10.61 after market close on September 30--as well as signs that China’s growth momentum has not stalled, we continue to believe the market can see a healthy recovery in the next few months. We remain cautiously optimistic on U.S. economic growth, albeit less so on European and global growth.

We also believe the U.S. earnings season that started in October is likely to provide positive earnings surprises and serve as a positive catalyst for the U.S. and possibly global equity markets, especially given current valuation levels, which may present some of the best buying opportunities in the equity markets.

October 2011

The following companies represented the following percentages of Portfolio net assets as of September 30, 2011: Barclays 0.13%, Turikye Garanti Bankasi 0.43%, BNP Paribas 0.57%, Standard Chartered 1.17%, Hong Kong Exchanges 0.80%, and BM&F Bovespa 0.40%. Holdings are subject to change without notice.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 14 |

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2011 to September 30, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 15 |

| | BEGINNING | ENDING | EXPENSES PAID |

| | ACCOUNT VALUE | ACCOUNT VALUE | DURING PERIOD* |

| | 4/1/11 | 9/30/11 | 4/1/11 - 9/30/11 |

| Class A | | | |

| Actual | $1,000.00 | $806.50 | $8.20 |

| Hypothetical | $1,000.00 | $1,015.99 | $9.15 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| Class B | | | |

| Actual | $1,000.00 | $802.50 | $13.42 |

| Hypothetical | $1,000.00 | $1,010.18 | $14.97 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| Class C | | | |

| Actual | $1,000.00 | $803.40 | $12.07 |

| Hypothetical | $1,000.00 | $1,011.68 | $13.47 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| Class I | | | |

| Actual | $1,000.00 | $809.40 | $4.81 |

| Hypothetical | $1,000.00 | $1,019.75 | $5.37 |

| (5% return per | | | |

| year before expenses) | | | |

| |

| Class Y | | | |

| Actual | $1,000.00 | $808.40 | $6.30 |

| Hypothetical | $1,000.00 | $1,018.10 | $7.03 |

| (5% return per | | | |

| year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.81%, 2.97%, 2.67%, 1.06% and 1.39% for Class A, Class B, Class C, Class I and Class Y, respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 16 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors of Calvert World Values Fund, Inc. and Shareholders of Calvert World Values International Equity Fund:

We have audited the accompanying statement of net assets of Calvert World Values International Equity Fund (the Fund), a series of Calvert World Values Fund, Inc., as of September 30, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2011, by correspondence with the custodian and brokers or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert World Values International Equity Fund as of September 30, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

November 28, 2011

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 17 |

| | | |

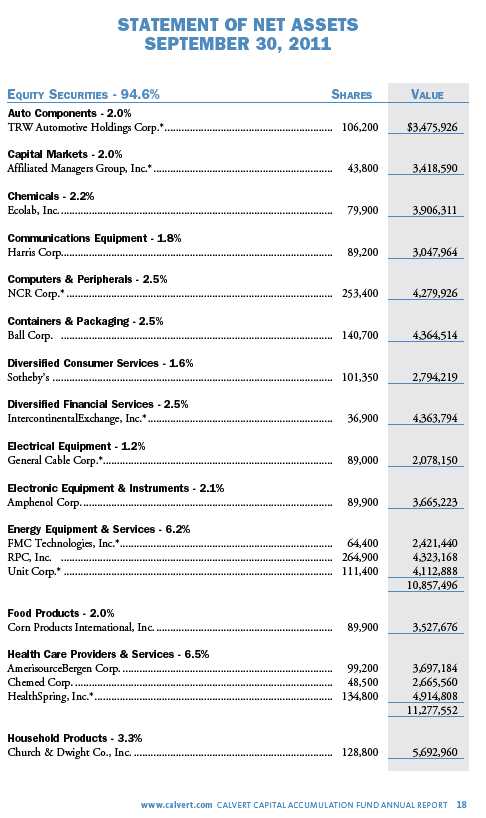

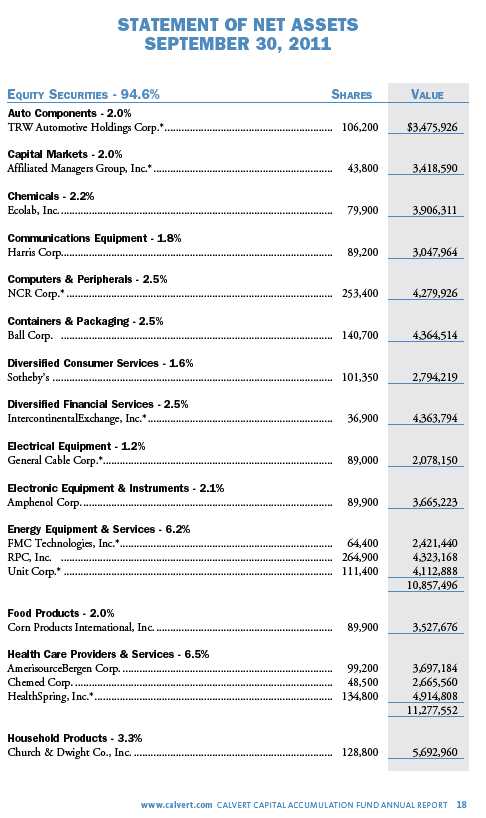

| STATEMENT OF NET ASSETS |

| SEPTEMBER 30, 2011 |

| |

| |

| |

| EQUITY SECURITIES - 94.3% | SHARES | | VALUE |

| Australia - 1.4% | | | |

| Amcor Ltd. (ADR) | 5,959 | $ | 160,238 |

| Santos Ltd. | 184,133 | | 2,004,956 |

| Sims Metal Management Ltd | 101,410 | | 1,212,562 |

| Sims Metal Management Ltd. (ADR) | 62,686 | | 742,202 |

| | | | 4,119,958 |

| |

| Austria - 0.1% | | | |

| Erste Group Bank AG (ADR) | 10,863 | | 141,762 |

| Telekom Austria AG (ADR) | 546 | | 10,980 |

| Verbund AG (ADR) | 1,033 | | 6,012 |

| | | | 158,754 |

| |

| Belgium - 0.1% | | | |

| Ageas (ADR) | 4,263 | | 7,673 |

| Delhaize Group SA (ADR) | 4,333 | | 253,221 |

| | | | 260,894 |

| |

| Brazil - 1.8% | | | |

| BM&FBOVESPA SA | 243,793 | | 1,158,190 |

| Natura Cosmeticos SA | 109,999 | | 1,902,428 |

| Porto Seguro SA | 101,000 | | 955,276 |

| Tim Participacoes SA (ADR) | 57,446 | | 1,353,428 |

| | | | 5,369,322 |

| |

| Canada - 5.7% | | | |

| Canadian National Railway Co.: | | | |

| New York Exchange | 32,251 | | 2,147,272 |

| Toronto Exchange | 99,824 | | 6,728,272 |

| Cenovus Energy, Inc. | 45,200 | | 1,403,854 |

| EnCana Corp.: | | | |

| New York Exchange | 58,265 | | 1,119,271 |

| Toronto Exchange | 68,616 | | 1,332,035 |

| Potash Corporation of Saskatchewan, Inc. | 41,701 | | 1,802,317 |

| Suncor Energy, Inc.: | | | |

| New York Exchange | 13,430 | | 341,659 |

| Toronto Exchange | 65,800 | | 1,694,714 |

| | | | 16,569,394 |

| |

| China - 1.0% | | | |

| China Merchants Bank Co. Ltd | 1,051,915 | | 1,593,672 |

| Mindray Medical International Ltd. (ADR) | 53,900 | | 1,272,579 |

| | | | 2,866,251 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 18 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Denmark - 1.4% | | | |

| Danske Bank A/S (ADR)* | 28,748 | $ | 202,961 |

| H Lundbeck A/S (ADR) | 6,680 | | 127,187 |

| Novo Nordisk A/S, Series B | 37,322 | | 3,724,673 |

| Novozymes A/S (ADR) | 765 | | 109,196 |

| | | | 4,164,017 |

| |

| Finland - 0.5% | | | |

| Metso Oyj (ADR) | 871 | | 25,451 |

| Nokia Oyj (ADR) | 16,522 | | 93,515 |

| Outotec OYJ | 32,865 | | 1,173,171 |

| Sampo Oyj (ADR) | 13,053 | | 166,034 |

| | | | 1,458,171 |

| |

| France - 8.8% | | | |

| Air France-KLM (ADR)* | 5,218 | | 39,239 |

| Air Liquide SA | 36,144 | | 4,242,806 |

| Air Liquide SA (ADR) | 15,637 | | 365,280 |

| AXA SA (ADR) | 37,817 | | 497,294 |

| BNP Paribas SA | 33,371 | | 1,325,980 |

| BNP Paribas SA (ADR) | 16,289 | | 320,893 |

| Cap Gemini SA (ADR) | 424 | | 7,089 |

| Carrefour SA (ADR) | 56,261 | | 248,674 |

| Cie Generale d’Optique Essilor International SA (ADR) | 2,595 | | 92,643 |

| Credit Agricole SA (ADR) | 61,249 | | 207,634 |

| Danone (ADR) | 51,495 | | 639,568 |

| Dassault Systemes SA | 38,521 | | 2,730,406 |

| Groupe Danone | 47,866 | | 2,957,055 |

| L’Oreal SA (ADR) | 8,390 | | 163,605 |

| Publicis Groupe | 65,000 | | 2,731,799 |

| Sanofi SA | 42,497 | | 2,801,038 |

| Sanofi SA (ADR) | 23,058 | | 756,302 |

| Schneider Electric SA (s) | 46,070 | | 2,489,875 |

| Schneider Electric SA (ADR) | 23,452 | | 254,220 |

| Suez Environnement Co. (ADR) | 3,272 | | 22,544 |

| Suez Environnement SA | 89,193 | | 1,247,920 |

| Valeo SA (ADR) | 11,425 | | 241,182 |

| Vallourec SA | 10,700 | | 615,642 |

| Veolia Environnement SA (ADR) | 40,141 | | 584,453 |

| | | | 25,583,141 |

| |

| Germany - 7.8% | | | |

| Adidas AG | 72,474 | | 4,389,622 |

| Aixtron SE (ADR) | 40,468 | | 587,595 |

| Allianz SE | 16,400 | | 1,549,184 |

| Allianz SE (ADR) | 134,018 | | 1,251,728 |

| Brenntag AG | 12,089 | | 1,055,236 |

| Celesio AG (ADR) | 1,954 | | 5,022 |

| Commerzbank AG (ADR)* | 2,056 | | 5,243 |

| Continental AG* | 28,178 | | 1,625,492 |

| Continental AG (ADR)* | 124 | | 7,218 |

| Deutsche Post AG (ADR) | 15,587 | | 201,072 |

| Henkel AG & Co. KGaA | 34,013 | | 1,494,026 |

| K+S AG (ADR) | 3,026 | | 81,097 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 19 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Germany - Cont’d | | | |

| Kabel Deutschland Holding AG* | 24,400 | $ | 1,320,329 |

| Merck KGaA (ADR) | 714 | | 19,471 |

| SAP AG | 87,248 | | 4,464,583 |

| SAP AG (ADR) | 32,107 | | 1,625,256 |

| Volkswagen AG, Preferred | 20,307 | | 2,696,939 |

| Volkswagen AG (ADR), Preferred | 17,431 | | 466,105 |

| | | | 22,845,218 |

| |

| Greece - 0.1% | | | |

| National Bank of Greece SA (ADR)* | 417,598 | | 325,685 |

| |

| Hong Kong - 4.0% | | | |

| AIA Group Ltd. | 540,000 | | 1,535,892 |

| Bank of East Asia Ltd. (ADR) | 6,813 | | 21,052 |

| China Merchants Holdings International Co. Ltd. | 924,000 | | 2,488,375 |

| City Telecom HK Ltd. (ADR) | 99,061 | | 936,127 |

| Esprit Holdings Ltd. (ADR) | 113,562 | | 265,735 |

| Hang Lung Properties Ltd. | 498,989 | | 1,475,818 |

| Hang Lung Properties Ltd. (ADR) | 88,320 | | 1,302,720 |

| Hang Seng Bank Ltd. (ADR) | 2,300 | | 27,071 |

| Hong Kong Exchanges and Clearing Ltd. | 152,646 | | 2,191,274 |

| Hong Kong Exchanges and Clearing Ltd. (ADR) | 7,030 | | 102,005 |

| Johnson Electric Holdings Ltd. (ADR) | 2,229 | | 10,944 |

| Li & Fung Ltd. (ADR) | 45,817 | | 155,320 |

| PCCW Ltd. (ADR) | 4,548 | | 16,691 |

| SJM Holdings Ltd. | 602,000 | | 1,048,312 |

| | | | 11,577,336 |

| |

| Indonesia - 0.6% | | | |

| Bank Mandiri Tbk PT | 2,397,500 | | 1,674,290 |

| |

| Ireland - 0.1% | | | |

| Experian plc (ADR) | 21,200 | | 235,744 |

| WPP plc (ADR) | 1,384 | | 63,733 |

| | | | 299,477 |

| |

| Israel - 1.2% | | | |

| Check Point Software Technologies Ltd.* | 67,000 | | 3,534,920 |

| |

| Italy - 0.1% | | | |

| Intesa Sanpaolo SpA (ADR) | 22,663 | | 215,299 |

| |

| Japan - 15.4% | | | |

| Advantest Corp. (ADR) | 8,403 | | 89,744 |

| Aeon Co. Ltd. (ADR) | 6,110 | | 81,385 |

| Asahi Glass Co. Ltd. (ADR) | 50,819 | | 491,420 |

| Canon, Inc | 117,243 | | 5,314,032 |

| Canon, Inc. (ADR) | 50,119 | | 2,268,386 |

| Dai Nippon Printing Co. Ltd. (ADR) | 46,114 | | 469,440 |

| Dai-ichi Life Insurance Co. Ltd. | 855 | | 884,375 |

| Daiwa House Industry Co. Ltd. (ADR) | 1,001 | | 128,779 |

| Denso Corp. (ADR) | 12,105 | | 194,285 |

| Eisai Co. Ltd. (ADR) | 527 | | 21,038 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 20 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Japan - Cont’d | | | |

| Fanuc Ltd. | 17,361 | $ | 2,393,033 |

| Fujitsu Ltd. (ADR) | 21,109 | | 493,106 |

| Honda Motor Co. Ltd. (ADR) | 66,906 | | 1,950,310 |

| KDDI Corp. | 312 | | 2,145,345 |

| Konami Corp. (ADR) | 3,970 | | 133,829 |

| Kubota Corp. (ADR) | 12,812 | | 511,455 |

| Mitsui Fudosan Co. Ltd | 102,256 | | 1,620,316 |

| Mizuho Financial Group, Inc. (ADR) | 393,007 | | 1,120,070 |

| MS&AD Insurance Group Holdings (ADR) | 70,455 | | 759,505 |

| Nippon Yusen KK (ADR) | 162,228 | | 856,564 |

| Nissan Motor Co. Ltd. (ADR)* | 99,011 | | 1,737,643 |

| Nitto Denko Corp. (ADR) | 15,501 | | 607,019 |

| Nomura Holdings, Inc. (ADR) | 280,694 | | 999,271 |

| NSK Ltd. (ADR) | 3,145 | | 46,546 |

| NTT DoCoMo, Inc | 1,554 | | 2,836,096 |

| ORIX Corp. (ADR) | 12,681 | | 491,135 |

| Panasonic Corp. (ADR) | 130,902 | | 1,246,187 |

| Sega Sammy Holdings, Inc. (ADR) | 12,209 | | 70,812 |

| Seiko Epson Corp. (ADR) | 18,760 | | 116,687 |

| Sekisui House Ltd. | 193,000 | | 1,821,159 |

| Sharp Corp. (ADR) | 49,666 | | 413,718 |

| Sony Corp. | 71,800 | | 1,379,545 |

| Sony Corp. (ADR) | 66,389 | | 1,261,391 |

| Sumitomo Mitsui Trust Holdings, Inc. (ADR) | 84,468 | | 277,900 |

| Tokyo Gas Co. Ltd. | 507,118 | | 2,364,934 |

| Toyota Motor Corp. | 148,182 | | 5,071,436 |

| Toyota Motor Corp. (ADR) | 31,311 | | 2,137,289 |

| | | | 44,805,185 |

| |

| Luxembourg - 0.8% | | | |

| SES SA (FDR) | 93,998 | | 2,291,205 |

| |

| Mexico - 0.1% | | | |

| FINAE, Series D, Preferred (b)(i)* | 1,962,553 | | 221,998 |

| |

| Netherlands - 2.6% | | | |

| ASML Holding NV | 5,123 | | 176,949 |

| BE Semiconductor Industries NV | 7,456 | | 44,363 |

| Gemalto NV | 49,261 | | 2,357,483 |

| ING Groep NV (CVA)* | 380,288 | | 2,686,759 |

| Koninklijke Philips Electronics NV | 79,111 | | 1,419,251 |

| PostNL NV (ADR) | 27,939 | | 123,211 |

| TNT Express NV (ADR) | 27,212 | | 185,042 |

| Yandex NV* | 30,500 | | 622,505 |

| | | | 7,615,563 |

| |

| Norway - 1.2% | | | |

| DnB NOR ASA | 141,767 | | 1,423,306 |

| Petroleum Geo-Services ASA* | 145,537 | | 1,475,394 |

| Yara International ASA (ADR) | 15,886 | | 614,788 |

| | | | 3,513,488 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 21 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Philippines - 0.8% | | | |

| Philippine Long Distance Telephone Co. (ADR) | 49,285 | $ | 2,441,086 |

| |

| Portugal - 0.1% | | | |

| Portugal Telecom SGPS SA (ADR) | 51,404 | | 372,679 |

| |

| Russia - 0.3% | | | �� |

| X5 Retail Group NV (GDR) (e)* | 36,900 | | 1,022,130 |

| |

| Singapore - 0.8% | | | |

| City Developments Ltd. (ADR) | 976 | | 7,281 |

| Oversea-Chinese Banking Corp. Ltd | 300,830 | | 1,860,789 |

| Singapore Telecommunications Ltd. (ADR) | 21,282 | | 513,875 |

| | | | 2,381,945 |

| |

| South Africa - 1.6% | | | |

| African Bank Investments Ltd. (ADR) | 338 | | 6,817 |

| Aspen Pharmacare Holdings Ltd.* | 174,055 | | 1,976,496 |

| Clicks Group Ltd.* | 379,200 | | 1,770,705 |

| MTN Group Ltd. (ADR) | 41,692 | | 683,749 |

| Nedbank Group Ltd. (ADR) | 7,142 | | 119,057 |

| Tiger Brands Ltd. (ADR) | 3,922 | | 100,795 |

| | | | 4,657,619 |

| |

| Spain - 2.4% | | | |

| Banco Bilbao Vizcaya Argentaria SA (ADR) | 72,956 | | 593,132 |

| Banco Santander SA (ADR) | 134,789 | | 1,083,704 |

| International Consolidated Airlines Group SA (ADR)* | 1,318 | | 15,447 |

| Telefonica SA | 270,057 | | 5,197,245 |

| | | | 6,889,528 |

| |

| Sweden - 1.9% | | | |

| Assa Abloy AB, Series B | 107,900 | | 2,234,438 |

| Atlas Copco AB (ADR) | 4,854 | | 85,916 |

| Hennes & Mauritz AB, B Shares | 101,754 | | 3,057,465 |

| SKF AB (ADR) | 1,348 | | 25,545 |

| Svenska Cellulosa AB (ADR) | 7,423 | | 90,189 |

| | | | 5,493,553 |

| |

| Switzerland - 6.1% | | | |

| Adecco SA (ADR) | 571 | | 11,271 |

| Compagnie Financiere Richemont SA | 34,023 | | 1,512,642 |

| Credit Suisse Group AG* | 64,700 | | 1,681,509 |

| Credit Suisse Group AG (ADR) | 62,481 | | 1,639,501 |

| Julius Baer Group Ltd.* | 42,873 | | 1,430,935 |

| Nobel Biocare Holding AG (ADR) | 1,013 | | 5,146 |

| Novartis AG | 119,679 | | 6,689,564 |

| Roche Holding AG (ADR) | 81,168 | | 3,264,577 |

| STMicroelectronics NV | 30,202 | | 196,313 |

| Swatch Group AG, Bearer Shares | 1,800 | | 590,803 |

| Zurich Financial Services AG (ADR)* | 35,686 | | 749,049 |

| | | | 17,771,310 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 22 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Thailand - 0.4% | | | |

| Kasikornbank PCL | 313,500 | $ | 1,177,455 |

| |

| Turkey - 0.4% | | | |

| Turkiye Garanti Bankasi AS | 322,700 | | 1,253,997 |

| |

| United Kingdom - 22.8% | | | |

| ARM Holdings plc | 163,700 | | 1,403,707 |

| Aviva plc (ADR) | 31,069 | | 290,495 |

| Barclays plc (ADR) | 39,751 | | 388,765 |

| BG Group plc | 355,178 | | 6,775,980 |

| BG Group plc (ADR) | 17,016 | | 1,623,326 |

| British Land Co. plc (ADR) | 1,126 | | 8,163 |

| BT Group plc (ADR) | 46,351 | | 1,234,791 |

| Bunzl plc (ADR) | 1,309 | | 79,587 |

| Capita Group plc | 209,151 | | 2,290,261 |

| Centrica plc | 435,574 | | 2,006,029 |

| Centrica plc (ADR) | 19,265 | | 355,054 |

| Compass Group plc | 183,072 | | 1,483,160 |

| GlaxoSmithKline plc | 118,477 | | 2,450,681 |

| HSBC Holdings plc | 360,539 | | 2,752,900 |

| HSBC Holdings plc (ADR) | 41,774 | | 1,589,083 |

| J Sainsbury plc (ADR) | 14,968 | | 252,360 |

| Johnson Matthey plc | 76,824 | | 1,883,944 |

| Johnson Matthey plc (ADR) | 288 | | 14,155 |

| Kingfisher plc | 1,129,487 | | 4,337,564 |

| Legal & General Group plc (ADR) | 1,263 | | 9,472 |

| Man Group plc (ADR) | 70,413 | | 176,737 |

| Old Mutual plc (ADR) | 1,864 | | 23,747 |

| Pearson plc | 370,337 | | 6,530,575 |

| Persimmon plc | 205,659 | | 1,455,482 |

| Prudential plc | 194,804 | | 1,670,463 |

| Prudential plc (ADR) | 101,675 | | 1,734,576 |

| Reckitt Benckiser Group plc | 82,117 | | 4,159,301 |

| Reckitt Benckiser Group plc (ADR) | 35,147 | | 354,633 |

| Sage Group plc (ADR) | 14,424 | | 228,620 |

| Scottish & Southern Energy plc (ADR) | 33,134 | | 666,987 |

| Smith & Nephew plc (ADR) | 27,153 | | 1,213,468 |

| Standard Chartered plc | 169,264 | | 3,384,686 |

| Tate & Lyle plc | 177,568 | | 1,721,035 |

| Tesco plc | 686,086 | | 4,020,688 |

| Tesco plc (ADR) | 84,429 | | 1,501,992 |

| Unilever plc (ADR) | 77,643 | | 2,421,685 |

| United Utilities Group plc (ADR) | 8,141 | | 158,831 |

| Vodafone Group plc | 930,743 | | 2,407,969 |

| Vodafone Group plc (ADR) | 46,181 | | 1,184,543 |

| | | | 66,245,495 |

| |

| United States - 1.9% | | | |

| Bristol-Myers Squibb Co. | 49,561 | | 1,555,224 |

| Distributed Energy Systems Corp.* | 308,138 | | - |

| MeadWestvaco Corp | 82,261 | | 2,020,330 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 23 |

| | | | |

| EQUITY SECURITIES - CONT’D | | SHARES | | VALUE |

| United States - Cont’d | | | | |

| Powerspan Corp.: | | | | |

| Series A, Convertible Preferred (b)(i)* | | 45,455 | | - |

| Series B, Convertible Preferred (b)(i)* | | 20,000 | | - |

| Series C, Convertible Preferred (b)(i)* | | 239,764 | | - |

| Series D, Convertible Preferred (b)(i)* | | 45,928 | | - |

| Series D, Preferred Warrants (strike price $3.44/share, | | | | |

| expires 12/31/12) (b)(i)* | | 2,347 | | - |

| Pricesmart, Inc. | | 17,928 | $ | 1,117,273 |

RF Technology, Inc. Contingent Deferred

Distribution (b)(i)* | | 365,374 | | 3,654 |

| Sealed Air Corp | | 47,994 | | 801,500 |

| SmarThinking, Inc. Contingent Deferred Distribution (b)(i)* | | 1 | | - |

| | | | | 5,497,981 |

| |

| |

| Total Equity Securities (Cost $314,511,435) | | | | 274,674,344 |

| |

| |

| VENTURE CAPITAL LIMITED | | ADJUSTED | | |

| PARTNERSHIP INTEREST - 1.1% | | BASIS | | |

| Balkan Financial Sector Equity Fund CV (b)(i)* | $ | 575,691 | | 512,092 |

| Blackstone Cleantech Venture Partners (b)(i)* | | 59,232 | | 45,705 |

| China Environment Fund 2004 (b)(i)* | | - | | 500,193 |

| Emerald Sustainability Fund I (b)(i)* | | 977,797 | | 676,719 |

| gNet Defta Development Holdings LLC (a)(b)(i)* | | 400,000 | | 354,319 |

| SEAF Central and Eastern European Growth Fund LLC (a)(b)(i)* | | 347,969 | | 633,608 |

| SEAF India International Growth Fund (b)(i)* | | 394,032 | | 403,585 |

| ShoreCap International LLC (b)(i)* | | - | | 205,227 |

| Terra Capital (b)(i)* | | 469,590 | | 1 |

| |

| Total Venture Capital Limited Partnership Interest (Cost $3,224,311) | | 3,331,449 |

| |

| |

| VENTURE CAPITAL DEBT | | PRINCIPAL | | |

| OBLIGATIONS - 0.4% | | AMOUNT | | |

| Access Bank plc, 8.477%, 8/29/12 (b)(i) | | 250,000 | | 257,109 |

| FINAE: | | | | |

| Note I, 6.50%, 12/10/15 (b)(i) | | 250,000 | | 250,000 |

| Note II, 6.50%, 2/29/16 (b)(i) | | 500,000 | | 500,000 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 (b)(i)(w) | | 33,848 | | 8,462 |

| Windhorse International-Spring Health Water Ltd., 8.00%, 3/13/13 (b)(i) 56,000 | | 56,000 |

| |

| Total Venture Capital Debt Obligations (Cost $1,089,848) | | | | 1,071,571 |

| |

| |

| HIGH SOCIAL IMPACT INVESTMENTS - 1.5% | | | | |

| Calvert Social Investment Foundation Notes, 0.94%, 7/1/14 (b)(i)(r) | | 4,431,583 | | 4,270,273 |

| |

| Total High Social Impact Investments (Cost $4,431,583) | | | | 4,270,273 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 24 |

| | | | | | |

| | | | PRINCIPAL | | | |

| TIME DEPOSIT - 1.6% | | AMOUNT | | VALUE | |

| State Street Time Deposit, 0.113%, 10/3/11 | $ | 4,570,376 | $ | 4,570,376 | |

| |

| Total Time Deposit (Cost $4,570,376) | | | | 4,570,376 | |

| |

| |

| |

| TOTAL INVESTMENTS (Cost $327,827,553) - 98.9% | | | | 287,918,013 | |

| Other assets and liabilities, net - 1.1% | | | | 3,259,867 | |

| NET ASSETS - 100% | | | $ | 291,177,880 | |

| |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares of common stock with | | | |

| 250,000,000 shares of $0.01 par value shares authorized: | | | | | |

| Class A: 14,687,878 shares outstanding | | | $ | 323,963,159 | |

| Class B: 429,978 shares outstanding | | | | 12,103,532 | |

| Class C: 1,578,439 shares outstanding | | | | 36,162,642 | |

| Class I: 7,017,378 shares outstanding | | | | 154,630,248 | |

| Class Y: 594,068 shares outstanding | | | | 8,597,765 | |

| Undistributed net investment income | | | | 3,608,275 | |

| Accumulated net realized gain (loss) on investments and foreign currency | | | |

| transactions | | | | (207,953,728 | ) |

| Net unrealized appreciation (depreciation) on investments, foreign currencies, | | | |

| and assets and liabilities denominated in foreign currencies | | | | (39,934,013 | ) |

| |

| NET ASSETS | | | $ | 291,177,880 | |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A | (based on net assets of $173,936,321) | | | $ | 11.84 | |

| Class B | (based on net assets of $4,505,815) | | | $ | 10.48 | |

| Class C | (based on net assets of $16,195,148 ) | | | $ | 10.26 | |

| Class I | (based on net assets of $89,142,274) | | | $ | 12.70 | |

| Class Y | (based on net assets of $7,398,322) | | | $ | 12.45 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 25 |

| | | |

| RESTRICTED SECURITIES | ACQUISITION DATES | | COST |

| Access Bank plc, 8.477%, 8/29/12 | 8/29/07 | $ | 250,000 |

| Balkan Financial Sector Equity Fund CV LP | 1/12/06 - 7/1/11 | | 575,691 |

| Blackstone Cleantech Venture Partners LP | 7/29/10 - 7/29/11 | | 59,232 |

| Calvert Social Investment Foundation Notes, 0.94%, 7/1/14 | 7/1/11 | | 4,431,583 |

| China Environment Fund 2004 LP | 9/15/05 - 4/1/09 | | - |

| Emerald Sustainability Fund I LP | 7/19/01 - 5/17/11 | | 977,797 |

| FINAE: | | | |

| Series D, Preferred | 2/28/11 | | 252,686 |

| Note I, 6.50%, 12/10/15 | 12/10/10 | | 250,000 |

| Note II, 6.50%, 2/29/16 | 2/24/11 | | 500,000 |

| gNet Defta Development Holdings LLC, LP | 8/30/05 | | 400,000 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 | 12/22/06 | | 33,848 |

| Powerspan Corp.: | | | |

| Series A, Convertible Preferred | 8/20/97 | | 250,000 |

| Series B, Convertible Preferred | 10/5/99 | | 200,000 |

| Series C, Convertible Preferred | 12/21/04 - 6/12/08 | | 273,331 |

| Series D, Convertible Preferred | 6/20/08 | | 157,996 |

| Series D, Preferred Warrants (strike price $3.44/share, | | | |

| expires 12/31/12) | 12/5/07 - 6/20/08 | | - |

| RF Technology, Inc. Contingent Deferred Distribution | 7/17/06 | | 104,368 |

| SEAF Central and Eastern European Growth Fund LLC, LP | 8/10/00 - 8/26/11 | | 347,969 |

| SEAF India International Growth Fund LP | 3/22/05 - 5/24/10 | | 394,032 |

| ShoreCap International LLC, LP | 8/12/04 - 12/15/08 | | - |

| SmarThinking, Inc. Contingent Deferred Distribution | 4/5/11 | | - |

| Terra Capital LP | 11/23/98 - 3/14/06 | | 469,590 |

| Windhorse International-Spring Health Water Ltd., 8.00%, 3/13/13 | 9/13/11 | | 56,000 |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 26 |

| (a) | Affiliated company. |

| (b) | This security was valued by the Board of Directors. See Note A. |

| (e) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (i) | Restricted securities represent 3.1% of net assets of the Fund. |

| (r) | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| (s) | 45,000 shares of Schneider Electric SA have been soft segregated in order to cover outstanding commitments to certain limited partnerships investments within the Fund. There are no restrictions on the trading of this security. |

| (w) | Mayer Laboratories, Inc. is in default for principal and interest. Past due accrued interest as of September 30, 2011 totaled $1,578. |

| * | Non-income producing security. |

Abbreviations:

ADR: American Depositary Receipts

CVA: Certificaten Van Aandelen

FDR: Fiduciary Depositary Receipts

GDR: Global Depositary Receipts

LLC: Limited Liability Corporation

LP: Limited Partnership

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 27 |

| | | |

| STATEMENT OF OPERATIONS |

| YEAR ENDED SEPTEMBER 30, 2011 |

| |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Dividend income (net of foreign taxes withheld of $906,992) | $ | 10,169,934 | |

| Interest income | | 131,909 | |

| Total investment income | | 10,301,843 | |

| |

| |

| Expenses: | | | |

| Investment advisory fee | | 2,713,839 | |

| Transfer agency fees and expenses | | 807,291 | |

| Administrative fees | | 1,094,489 | |

| Distribution Plan expenses: | | | |

| Class A | | 599,524 | |

| Class B | | 62,043 | |

| Class C | | 211,746 | |

| Directors’ fees and expenses | | 34,675 | |

| Custodian fees | | 298,535 | |

| Registration fees | | 67,389 | |

| Reports to shareholders | | 144,026 | |

| Professional fees | | 41,059 | |

| Miscellaneous | | 74,378 | |

| Total expenses | | 6,148,994 | |

| Reimbursement from Advisor: | | | |

| Class B | | (3,078 | ) |

| Class I | | (12,512 | ) |

| Class Y | | (6,915 | ) |

| Fees paid indirectly | | (2,434 | ) |

| Net expenses | | 6,124,055 | |

| |

| NET INVESTMENT INCOME | | 4,177,788 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | 1,926,268 | |

| Foreign currency transactions | | (328,902 | ) |

| | | 1,597,366 | |

| |

| Change in unrealized appreciation (depreciation) on: | | | |

| Investments and foreign currencies | | (54,532,898 | ) |

| Assets and liabilities denominated in foreign currencies | | 1,828 | |

| | | (54,531,070 | ) |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | (52,933,704 | ) |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | ($ | 48,755,916 | ) |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 28 |

STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | |

| | | | | | |

| | | Year ended | | | Year ended | |

| | | September

30, | | | September 30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2011 | | | 2010 | |

| Operations: | | | | | | |

| Net investment income | $ | 4,177,788 | | $ | 2,088,917 | |

| Net realized gain (loss) | | 1,597,366 | | | 1,595,659 | |

| Change in unrealized appreciation or (depreciation) | | (54,531,070 | ) | | (532,062 | ) |

| |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | (48,755,916 | ) | | 3,152,514 | |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (655,710 | ) | | (1,877,571 | ) |

| Class I shares | | (542,675 | ) | | (1,650,864 | ) |

| Class Y shares | | (3,993 | ) | | (5,626 | ) |

| Total distributions | | (1,202,378 | ) | | (3,534,061 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 37,038,781 | | | 37,402,286 | |

| Class B shares | | 95,958 | | | 269,456 | |

| Class C shares | | 1,483,373 | | | 2,587,664 | |

| Class I shares | | 31,388,444 | | | 13,046,519 | |

| Class Y shares | | 8,008,040 | | | 3,391,938 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 608,387 | | | 1,712,839 | |

| Class I shares | | 483,830 | | | 1,379,546 | |

| Class Y shares | | 419 | | | 2,622 | |

| Redemption fees: | | | | | | |

| Class A shares | | 4,506 | | | 1,376 | |

| Class B shares | | — | | | 6 | |

| Class C shares | | 249 | | | 59 | |

| Class I shares | | 669 | | | — | |

| Class Y shares | | 6 | | | 1,837 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (79,188,924 | ) | | (64,598,217 | ) |

| Class B shares | | (1,646,677 | ) | | (2,328,107 | ) |

| Class C shares | | (4,408,325 | ) | | (4,676,204 | ) |

| Class I shares | | (14,266,871 | ) | | (35,107,420 | ) |

| Class Y shares | | (1,831,646 | ) | | (1,497,086 | ) |

| Total capital share transactions | | (22,229,781 | ) | | (48,410,886 | ) |

| |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | (72,188,075 | ) | | (48,792,433 | ) |

| |

| |

| NET ASSETS | | | | | | |

| Beginning of year | | 363,365,955 | | | 412,158,388 | |

| End of year (including undistributed net investment | | | | | | |

| income of $3,608,275 and $1,184,550, respectively) | $ | 291,177,880 | | $ | 363,365,955 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 29 |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | | |

| | | | |

| | Year ended | | Year ended | |

| | September

30, | | September 30, | |

| CAPITAL SHARE ACTIVITY | 2011 | | 2010 | |

| Shares sold: | | | | |

| Class A shares | 2,582,076 | | 2,802,787 | |

| Class B shares | 7,466 | | 22,231 | |

| Class C shares | 119,086 | | 220,010 | |

| Class I shares | 2,086,100 | | 924,635 | |

| Class Y shares | 527,710 | | 248,819 | |

| Reinvestment of distributions: | | | | |

| Class A shares | 42,634 | | 125,851 | |

| Class I shares | 31,789 | | 95,470 | |

| Class Y shares | 28 | | 185 | |

| Shares redeemed: | | | | |

| Class A shares | (5,606,048 | ) | (4,854,110 | ) |

| Class B shares | (130,029 | ) | (194,930 | ) |

| Class C shares | (353,754 | ) | (404,192 | ) |

| Class I shares | (929,886 | ) | (2,456,887 | ) |

| Class Y shares | (125,742 | ) | (105,845 | ) |

| Total capital share activity | (1,748,570 | ) | (3,575,976 | ) |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 30 |

NOTES TO FINANCIAL STATEMENTS

NO

TE A — SIGNIFICANT ACCOUNTING POLICIESGeneral: The Calvert International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The operation of each series is accounted for separately. The Fund offers five classes of shares of capital stock. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Effective March 1, 2010, Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment may be waived for certain institutional accounts, where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Directors. In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At September 30, 2011, securities valued at $8,898,945 or 3.1% of net assets were fair valued in good faith under the direction of the Board of Directors.

The Fund utilizes various methods to measure the fair value of its investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 31 |

determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows.

Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters. Such securities would be categorized as Level 2 in the hierarchy in these circumstances. Utilizing this technique may result in transfers between Level 1 and Level 2. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are fair valued by the Fund’s Board of Directors and are categorized as Level 3 in the hierarchy. Venture capital direct equity securities are generally valued using the most appropriate and applicable method to measure fair value in light of each company’s situation. Methods may include market, income or cost approaches with discounts as appropriate based on assumptions of liquidation or exit risk. Examples of the market approach are subsequent rounds of financing, comparable transactions, and revenue times an industry multiple. An example of the income approach is the discounted cash flow. Examples of the cost approach are replacement cost, salvage value, or net asset percentage. Venture capital limited partnership (LP) securities are valued at the fair value reported by the general partner of the partnership adjusted as necessary to reflect subsequent capital calls and distributions and any other available information. In the absence of a reported LP unit value it may be estimated based on the Fund’s percentage equity in the partnership and/ or other balance sheet information and portfolio value for the most recently available period reported by the general partner. In some cases adjustments may be made to account for daily pricing of material public holdings within the partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term instruments of sufficient credit quality, with a maturity at issuance of 60 days or less, generally are valued at amortized cost, which approximates fair value; those for which quotations are not readily available are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 32 |

on the circumstances.

The following is a summary of the inputs used to value the Fund’s net assets as of September 30, 2011:

| | VALUATION INPUTS |

| Investments In Securities | Level 1 | Level 2 | | Level 3 | Total | |

| Equity securities* | $97,354,880 | $177,093,812 | ** | — | $274,448,692 | *** |

| Venture capital | — | — | | $4,628,672 | 4,628,672 | |

| Other debt obligations | — | 4,570,376 | | 4,270,273 | 8,840,649 | |

| TOTAL | $97,354,880 | $181,664,188 | | $8,898,945 | $287,918,013 | |

* For further breakdown of equity securities by country, please refer to the Statement of Net Assets.

** Includes certain securities trading primarily outside the U.S. whose value was adjusted as a result of significant market movements following the close of local trading.

*** Exclusive of $225,652 venture capital equity shown in the venture capital heading.

At September 30, 2011, a significant transfer out of Level 1 and into Level 2 occurred. On September 30, 2011, price movements exceeded specified parameters and the third party fair value pricing service quantitatively fair valued the affected securities.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | | | | VENTURE | |

| | | | | | CAPITAL | |

| Balance as of 9/30/10 | | | | $ | 5,488,687 | |

| Accrued discounts/premiums | | | | | - | |

| Realized gain (loss) | | | | | 134,089 | |

| Change in unrealized appreciation (depreciation) | | | | | (1,222,853 | ) |

| Purchases | | | | | 2,143,267 | |

| Sales | | | | | (1,914,518 | ) |

| Transfers in and/or out of Level 31 | | | | | - | |

| Balance as of 9/30/11 | | | | $ | 4,628,672 | |

| |

| | | OTHER DEBT | | | | |

| | | OBLIGATIONS | | | TOTAL | |

| Balance as of 9/30/10 | $ | 4,532,706 | | $ | 10,021,393 | |

| Accrued discounts/premiums | | - | | | - | |

| Realized gain (loss) | | - | | | 134,089 | |

| Change in unrealized appreciation (depreciation) | | (12,433 | ) | | (1,235,286 | ) |

| Purchases | | 4,431,583 | | | 6,574,850 | |

| Sales | | (4,681,583 | ) | | (6,596,101 | ) |

| Transfers in and/or out of Level 31 | | - | | | - | |

| Balance as of 9/30/11 | $ | 4,270,273 | | $ | 8,898,945 | |

1 The Fund’s policy is to recognize transfers into and transfers out of Level 3 as of the end of the reporting period.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 33 |

For the year ended September 30, 2011, total change in unrealized gain (loss) on Level 3 securities included in the change in net assets was ($1,235,286). Total unrealized gain (loss) for all securities (including Level 1 and Level 2) can be found on the accompanying Statement of Operations.

Repurchase Agreements: The Fund may enter into repurchase agreements with recognized financial institutions or registered broker/dealers and, in all instances, holds underlying securities with a value exceeding the total repurchase price, including accrued interest. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 34 |

capital accounts to reflect income and gains available for distribution under income tax regulations.