UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2014

Item 1. Report to Stockholders.

[Calvert International Equity Fund Annual Report]

and

[Calvert Capital Accumulation Fund Annual Report]

and

[Calvert International Opportunities Fund Annual Report]

and

[Calvert Emerging Markets Equity Fund Annual Report]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

TABLE OF CONTENTS

| 5 | President’s Letter |

| 7 | SRI Update |

| 9 | Portfolio Management Discussion |

| 15 | Shareholder Expense Example |

| 17 | Report of Independent Registered Public Accounting Firm |

| 18 | Statement of Net Assets |

| 27 | Statement of Operations |

| 28 | Statements of Changes in Net Assets |

| 30 | Notes to Financial Statements |

| 38 | Financial Highlights |

| 44 | Explanation of Financial Tables |

| 45 | Proxy Voting |

| 46 | Availability of Quarterly Portfolio Holdings |

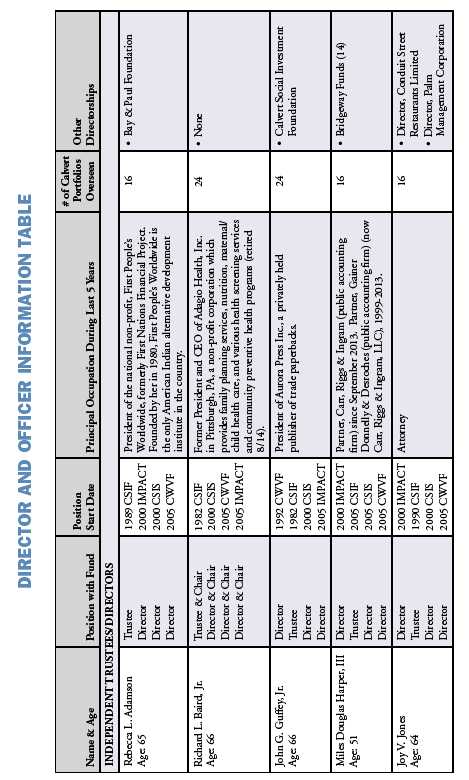

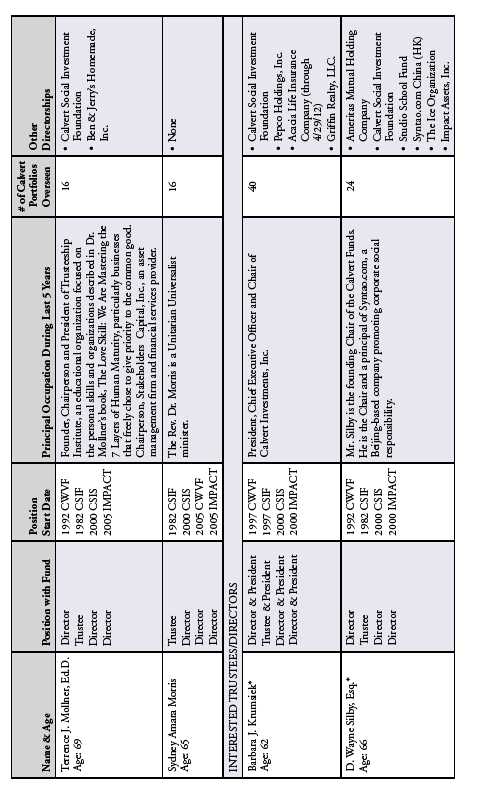

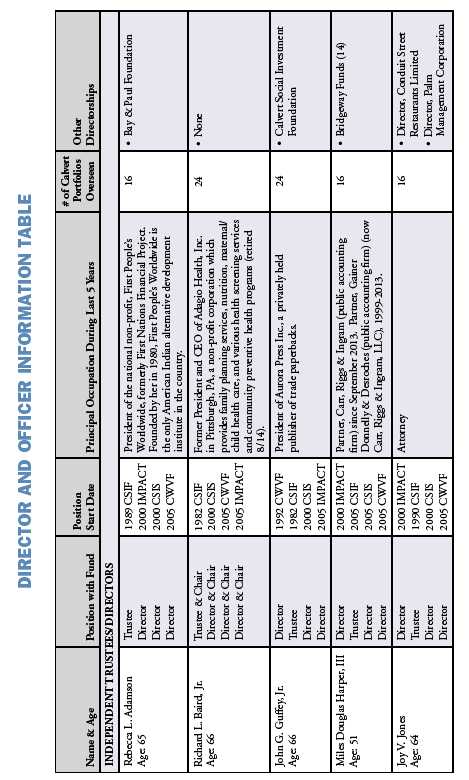

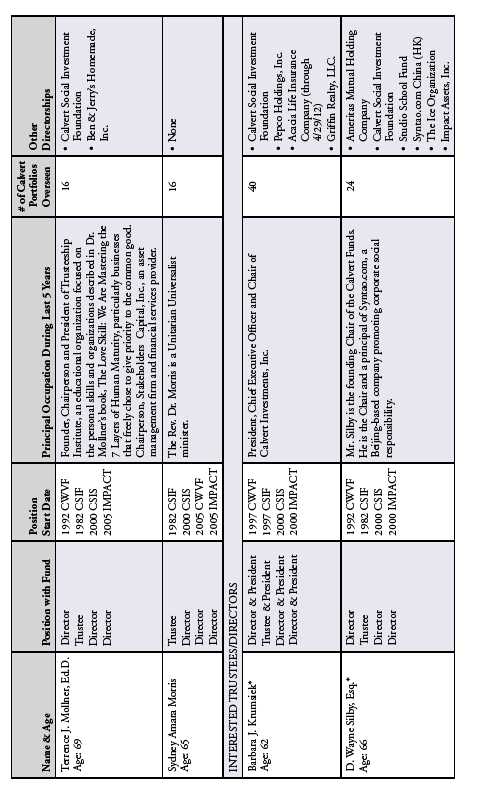

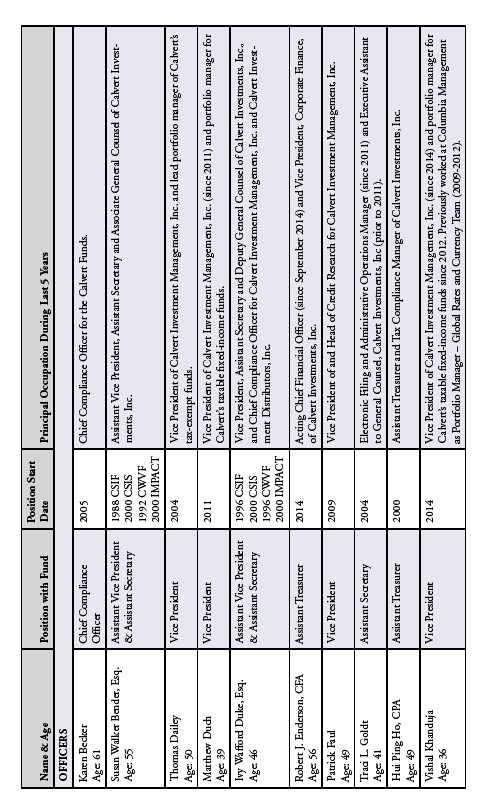

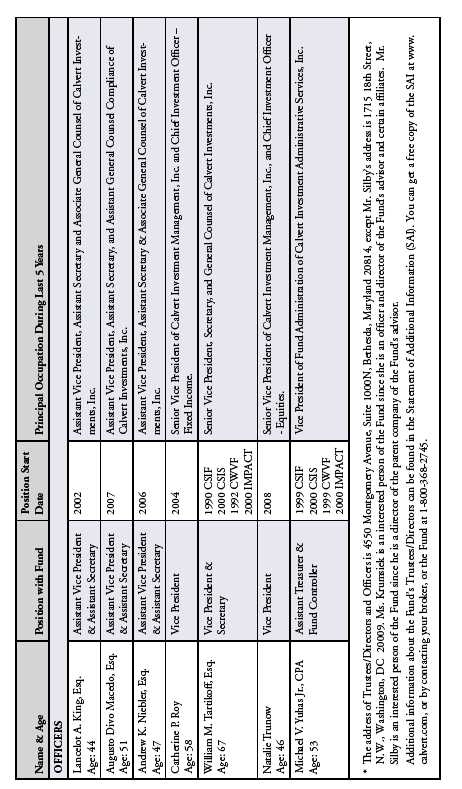

| 47 | Director and Officer Information Table |

This page intentionally left blank.

Barbara Krumsiek

President and CEO of Calvert Investments, Inc.

Dear Calvert Shareholder,

For the 12 months ended September 30, 2014, the U.S. economy continued to improve. It has largely recovered, is going into an expansion phase, and is expected to continue to grow through the end of 2014 and into 2015. After recovering from a weak first-quarter caused by severe weather across the country, trends in the U.S. economy included a continued low interest-rate environment and declines in the unemployment rate. Economic growth was slower in Europe, Japan, and China, which were weighed down by further deterioration of macroeconomic data from Europe and growing concerns that China’s economic slowdown could negatively impact global economic growth. Global disruptions, including geopolitical conflicts, have been largely ignored to date by investors, while renewed investor and consumer confidence is high due to robust economic data and earnings data in the U.S. and supported by the U.S. Federal Reserve (the Fed) and central banks around the world continuing to maintain accommodative monetary policies.

While interest rates will likely remain low or rise very gradually over the near term, the Fed tapering with accompanying higher interest rates and continued accommodative language, an improving U.S. economy, and healthy earning and sales growth are expected to favor stocks over bonds over the long term. Overall, investors have become more risk tolerant assisted by accommodative global monetary policy. Volatility remained low throughout the year, but we did see an uptick at the end of the third quarter on fears that a global economic slowdown could also impact the U.S. recovery.

Calvert Women’s Principles® (CWP)

December 20, 2014, officially marks the 10-year anniversary of the Calvert Women’s Principles®, an important milestone in Calvert’s leadership in the women and investing space. In November, we will release our findings in the Women Investors Survey, the release of the latest Diversity Report, and a new article for CWP’s anniversary including a history, a look back at its implementation through Women’s Empowerment Principles (United Nations) and Gender Equality Principles (City of San Francisco), and the future of the program. Information about all our CWP events are available on Calvert’s website.

Calvert Global Water Fund

The Calvert Global Water Fund continues to garner attention and results, and its Class Y Shares recently won a Lipper Award1 for 2014 (Best Performing Fund among 105 funds in the Global Natural Resources Funds classification for the 3-year period ended December 31, 2013). We launched the Water fund in 2008 to give investors access to a broad array of companies around the world whose primary focus is on water. The Fund’s holdings span every sub-sector of the water cycle, including the collection, treatment, and distribution of water and includes sector holdings in water infrastructure, utilities, and technologies. I would encourage you visit the Calvert Water Website, www.calvert.com/water, where you can find the Water: Be a Part of the Solution video, the H2Alpha webinar, and the Water Investing app. This Fund is an example of our commitment to environmental, social, and governance (ESG) integration within our Funds.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 5

Moving Forward

The end of 2014 will see my retirement as president and CEO of Calvert Investments. As CEO for more than 17 years, I have seen our business grow from primarily money market assets to a firm that has over $13.5 billion in Assets Under Management (AUM) in mutual funds that address many social issues. My plan moving forward is to become the Founding Chair of the forthcoming, soon to be launched Calvert institute, which will promote the growth of sustainable and responsible investing (SRI) through research, advocacy, and fostering innovation in the field of sustainable investing. In addition, I will continue serving on the Board of Calvert and as chair until May 2015. John Streur joined the Calvert family as CEO-Elect in late October and will take the reins full-time as CEO on January 1, 2015.

Stay Informed in the Months Ahead

Maintaining a well-diversified mix of U.S. and international stocks, bonds, and cash—appropriate for your goals and risk tolerance—is one of the best ways to mitigate the effects of an uneven recovery in the economy and markets. Of course, we recommend consulting your financial advisor if you have questions or concerns about your investments. We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals.

As always, we thank you for investing with Calvert.

Barbara Krumsiek

President and CEO of Calvert Investments, Inc.

October 2014

For more information on any Calvert fund, please contact Calvert at 800.368.2748 for a free summary prospectus and/or prospectus. An investor should consider the investment objectives, risks, charges, and expenses of an investment carefully before investing. The summary prospectus and prospectus contain this and other information. Read them carefully before you invest or send money.

Calvert mutual funds are underwritten and distributed by Calvert Investment Distributors, Inc., member, FINRA, and subsidiary of Calvert Investments, Inc.

1. Lipper Fund Awards are granted annually to the funds in each Lipper classification that achieve the highest score for Consistent Return, a measure of funds’ historical risk-adjusted returns, relative to peers. Scores for Consistent Return are computed for all Lipper global classifications with ten or more distinct portfolios. The scores are subject to change every month and are calculated over 36, 60, and 120 month periods. The highest 20% of funds in each classification are named Lipper Leaders for Consistent Return. The highest Lipper Leader for Consistent Return within each eligible classification determines the fund classification winner over three, five, or ten years.

Source: Lipper, a Thomson Reuters company.

| 6 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

As always, Calvert continues to work hard to ensure you have a say in the responsible management of environmental, social, and governance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Shareholder Advocacy

Calvert filed 31 shareholder proposals for the 2014 proxy season on a variety of issues, including board diversity, greenhouse gas (GHG) emissions reductions, and sustainability reporting. Calvert shareholder proposals filed during the 2013/2014 season resulted in the following company commitments:

• PACCAR, a designer and manufacturer of trucks, committed to report to the Carbon Disclosure Project and set goals for reducing the GHG emissions from its trucks and manufacturing operations.

• Polaris, a maker of motorcycles, off-road vehicles, and small electric vehicles, agreed to produce a sustainability plan and strategy for goal-defined company-wide emissions reductions.

• Capital One, the well-known diversified bank, has said it will reduce its GHG emissions 25% by 2020, and increase its environmentally-preferred paper use to 70% by the end of 2014.

Public Policy Initiatives

Power Forward 2.0

Calvert, in conjunction with Ceres, the World Wildlife Federation, and David Gardiner & Associates, published Power Forward 2.0: How American Companies Are Setting Clean Energy Targets and Capturing Greater Business Value, which found that 215 of the companies in the Fortune 500 (43%) have set climate and/or clean energy targets. Other key findings include that 53 Fortune 100 companies report savings of $1.1 billion annually through energy efficiency and renewable energy. These companies are reducing emissions equivalent to taking 15 coal plants offline.

The initial 2012 Power Forward report showed that a majority of Fortune 100 companies had set commitments to renewable energy, GHG emissions reductions, or both. The report attracted press coverage by USA Today, The Huffington Post, Bloomberg, and was referenced in testimony to the Senate Budget Committee. The Guardian listed the report as one of the “10 reasons to be hopeful that we will overcome climate change.”

UN Climate Summit

In September, Calvert joined global leaders from 160 countries to participate in the UN Climate Summit, calling on policymakers, business leaders, and other investors to take immediate steps to address the material financial risks created by climate change. The

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 7

Summit was the start of a critical 15-month period of international negotiations leading up to the UNFCCC Conference of Parties in Paris, December 2015, which will strive for a global agreement between governments that establishes major cuts to GHG emissions.

ESG Integration and Fixed Income

The United Nations-supported Principles for Responsible Investment (PRI) is an international network of investors working toward incorporating ESG issues into investment practices across asset classes. The PRI published the Fixed Income Investor Guide, highlighting examples of strategies to incorporate ESG integration and engagement in fixed-income asset classes. Material is sourced from the PRI’s Reporting Framework, extensive research, and interviews with signatories, including Calvert Investments. Chief Investment Officer Cathy Roy and Senior Credit Analyst Kim Nguyen-Taylor are among the experts who are quoted and provided material input, including a case study.

Conflict Minerals Due Diligence Reporting

Investors and consumers are increasingly calling on companies to identify and mitigate human rights-related risks in their supply chains. A major step forward in this continuing effort was companies’ filing of more than 1,300 conflict minerals due diligence reports to the Securities and Exchange Commission in June 2014. Several Calvert holdings, including Advanced Micro Devices, Apple, General Electric, Hewlett-Packard, Intel, and Microsoft, demonstrated exemplary approaches to this due diligence reporting. In filing the disclosures, companies complied with an SEC rule developed according to Dodd-Frank Section 1502. This law requires disclosure by companies that use gold, tin, tantalum, and tungsten in their products to determine whether such metals originate from particular mines in the Democratic Republic of the Congo (DRC) or adjoining countries that have been used to fuel a nearly two-decade long war in the region.

The reporting rule allows investors to evaluate the efforts of companies in industries, ranging from electronics and auto parts to retailers and jewelers, to identify and eliminate the use of conflict minerals in their supply chains. Most importantly, the rule has diminished the use of conflict minerals and in turn could help end the conflict in the DRC. Calvert was an early supporter of this legislation and played a leading role in the SEC rule-making process as part of a multi-stakeholder coalition.

Calvert’s Signature® criteria examine corporate performance across seven broad areas of concern: Governance and Ethics, Environment, Workplace, Product Safety and Impact, International Operations and Human Rights, Indigenous Peoples’ Rights, and Community Relations. For a company to be eligible for inclusion in a Calvert Signature portfolio, it must meet the criteria in all seven categories.

As of September 30, 2014, the following companies represented the following percentages of Portfolio net assets: PACCAR 0.15% of Calvert Social Index Fund; Polaris 0.15% of Calvert Social Index Fund, 3.30% of Calvert Capital Accumulation Fund; Capital One 0.90% of Calvert Social Index Fund, 0.28% of Calvert Balanced Portfolio, 3.51% of Calvert Large Cap Core Portfolio; Advanced Mirco Devices 0.20% of Calvert Social Index Fund; Apple 4.09% of Calvert Balanced Portfolio, 6.58% of Calvert Large Cap Core Portfolio, 4.69% of Calvert Equity Portfolio, 0.47% of Calvert Bond Portfolio, 4.50% of Calvert Social Index Fund; General Electric 0%; Hewlett-Packard 0.49% of Calvert Social Index Fund; Intel 0.41% of Calvert Balanced Portfolio, 0.20% of Calvert Bond Portfolio, 1.29% of Calvert Social Index Fund; and Microsoft 0.78% of Calvert Balanced Portfolio, 4.69% of Calvert Equity Portfolio, 0.29% of Calvert Bond Portfolio, 2.85% of Calvert Social Index Fund. Holdings are subject to change.

| 8 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

Investment Performance

For the one-year period ended September 30, 2014, Calvert International Equity Fund Class A shares (at NAV) returned 0.99% compared to its benchmark, the MSCI EAFE IMI Index, which returned 4.53% for the period. Stock selection and sector allocation both contributed to the Fund’s relative underperformance.

Investment Climate

The divergence between economic conditions in the United States and the rest of the world continued over the 12-month reporting period, and was reflected in global equity market performance. Macroeconomic data showed the U.S. economy regained its footing after a weather-induced, disappointing first quarter. In contrast, concerns about economic growth in emerging markets, especially China, and anemic economic activity in Europe, highlighted risks abroad. The 12-month period was also marked by rising geopolitical tensions across multiple regions, but the equity markets proved resilient, with most major global indices finishing in positive territory.

For the year ended September 30, 2014, the Standard and Poor’s (S&P) 500, Russell 1000, Russell 2000, MSCI EAFE, and MSCI Emerging Markets Indices returned 19.73%, 19.01%, 3.93%, 4.70%, and 4.66%, respectively.

From an investment-style perspective, growth stocks slightly outpaced value stocks, while large-capitalization stocks significantly outperformed small-cap stocks. With increases in interest rates looming in the next 6-18 months, combined with lofty asset valuations entering into 2014, it was understandable that the performance of small-cap stocks was less than stellar. Looking at sector performance, Health Care, Information Technology, and Materials were the top performers within the Russell 1000 Index, while the Consumer Discretionary, Energy, and Telecommunication Services sectors lagged.

Accelerating Economic Recovery in the U.S.

A wide range of positive U.S. macroeconomic data pointed toward a broader-based recovery over the year, led by an improving labor market. The Purchasing Managers’ Index (PMI) showed expansion in the manufacturing sector, consumer confidence rose, and corporate earnings were strong. While the housing recovery has slowed, we believe it remains on a long-term, upward trajectory, with the slowdown in price appreciation leading to more affordable prices and acting as a potential tailwind for new home buyers. The Fed continued tapering throughout the year, but signaled that short-term interest rates would likely remain low for an extended period, even after the bond-buying program winds down.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 9

| | |

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| September 30, 2014 |

| |

| Investment Performance | |

| (total return at NAV*) | |

| | 6 Months | 12 Months |

| | Ended | Ended |

| | 9/30/14 | 9/30/14 |

| Class A | -3.56% | 0.99% |

| Class B | -4.24% | -0.28% |

| Class C | -3.97% | 0.07% |

| Class I | -3.28% | 1.64% |

| Class Y | -3.38% | 1.41% |

| |

| MSCI EAFE | | |

| Investable | | |

| Market Index | | |

| (IMI) | -2.24% | 4.53% |

| |

| Lipper | | |

| International | | |

| Multi-Cap | | |

| Growth Funds | | |

| Average | -2.63% | 3.07% |

| |

| Ten Largest | % of Net |

| Stock Holdings | Assets |

| Roche Holding AG | 2.4% |

| Toyota Motor Corp. | 2.2% |

| Sanofi SA | 1.6% |

| Unilever NV (CVA) | 1.6% |

| AIA Group Ltd. | 1.6% |

| HSBC Holdings plc, London | |

| Exchange | 1.5% |

| Softbank Corp. | 1.5% |

| Isuzu Motors Ltd. | 1.4% |

| BG Group plc | 1.4% |

| Intesa Sanpaolo SpA, Milano | |

| Stock Exchange | 1.4% |

| Total | 16.6% |

* Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

| |

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| September 30, 2014 |

| |

| | % of Total |

| Economic Sectors | Investments |

| Consumer Discretionary | 17.1% |

| Consumer Staples | 8.4% |

| Energy | 4.6% |

| Financials | 24.8% |

| Health Care | 11.9% |

| Industrials | 11.0% |

| Information Technology | 4.8% |

| Limited Partnership Interest | 0.4% |

| Materials | 5.6% |

| Short-Term Investments | 2.6% |

| Telecommunication Services | 5.6% |

| Utilities | 2.8% |

| Venture Capital | 0.4% |

| Total | 100% |

Geopolitical Turmoil Intensifies

Geopolitical turmoil dominated headlines for much of the year with ongoing conflict in the Ukraine and escalating tensions in the Middle East that spurred the U.S. and partners to confront ISIS militarily. Protests in Hong Kong and uncertainty around China’s response briefly roiled the equity markets. Bucking historical trends, oil prices continued to decline despite conflict in the Middle East, Ukraine, and Russia as a combination of growing oil supply from North America and weaker global demand helped push oil prices down.

Weak Economic Growth Abroad

Business and consumer confidence in the eurozone continued to fall over the reporting period. Inflation remained dangerously low with several countries, including Greece, Spain, and Italy, expe-

| 10 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

riencing deflation. The region’s economic woes spread to core euro economies as well, particularly evident in France’s stagnating economy. Even Germany’s relatively stable economy showed signs of strain as Germany’s Manufacturing PMI slipped into contraction territory.

Although European equities benefited from the European Central Bank’s pledge to add further stimulus and likely initiate an asset purchase program, the positive market reaction was short-lived. Eurozone countries have thus far proved either unwilling or unable to enact meaningful structural economic reforms.

The global implications of slower growth in China troubled investors throughout the year, as Chinese home prices fell, GDP growth slowed, and the specter of a property-bubble burst remained a concern. Although China’s Manufacturing PMI hovered in expansion territory at the end of the period, we continue to watch for further signs of stress as China transitions from an investment-driven economy to a more consumer-oriented one.

Portfolio Strategy

The equity markets of developed, overseas countries finished the 12-month reporting period in positive territory. The Fund was up for the period, but underperformed its benchmark largely because of adverse stock selection, particularly in the Financials, Information Technology, and Consumer Discretionary sectors.

The Fund’s investment management team is comprised of three investment managers: Thornburg Investment Management (13% of assets), Martin Currie (65% of assets), and Calvert Investment Management (22% of assets).

The Fund’s overweight position in Consumer Discretionary, which was one of the worst-performing Index sectors, was the largest detractor from performance during the period. From a geographic perspective, our allocation of just under 5% to emerging markets (primarily Russia), during the period, also hurt relative performance.

In the Financials sector, banking companies struggled with a variety of issues. Japanese financial stocks were hurt by disappointment in the government’s progress on reforms. Japanese banks, Mizuho Financial Group, and Sumitomo Mitsui Trust Holdings were the weakest performers. Enthusiasm for megabanks waned in Japan as investors questioned their ability to sustain earnings growth in a low interest-rate environment. The Fund’s exposure to Sberbank, one of Russia’s oldest and largest banks, hurt performance. The bank’s performance was affected by sanctions imposed in response to Russia’s activities in Ukraine. We sold our position in the company.

Geopolitical uncertainty also affected Russian Internet search provider Yandex, which fell 17%1 during the reporting period. We sold this holding as well. While there is evidence that the company’s Internet media business model remains intact, its potential was obscured by geopolitical concerns.

Canadian athletic company Lululemon Athletica also detracted from performance, falling 43% during the period after suffering some senior-level management changes, not all of which were expected, and a high-profile product recall. The recall drew attention to the need for improved quality-control processes and supply-chain adjustments, which delayed product delivery. Lululemon lowered revenue and earnings guidance and struggled to restore sales growth.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 11

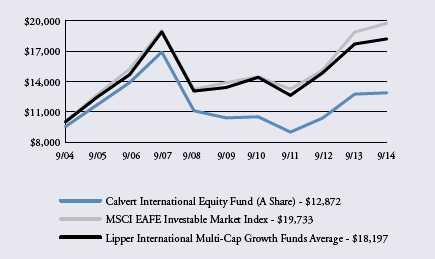

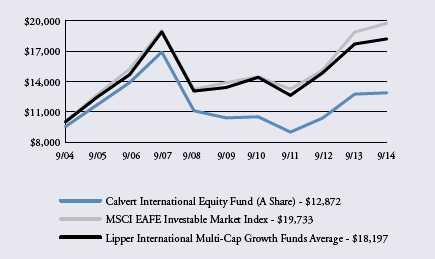

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Class A shares and reflect the deduction of the maximum front-end sales charge of 4.75% and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.78%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

| 12 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

| |

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| September 30, 2014 |

| |

| Average Annual Total Returns |

| |

| Class A Shares | (with max. load) |

| One year | -3.80% |

| Five year | 3.35% |

| Ten year | 2.56% |

| |

| Class B Shares | (with max. load) |

| One year | -5.26% |

| Five year | 2.93% |

| Ten year | 1.91% |

| |

| Class C Shares | (with max. load) |

| One year | -0.86% |

| Five year | 3.44% |

| Ten year | 2.17% |

| |

| Class I Shares | |

| One year | 1.64% |

| Five year | 5.11% |

| Ten year | 3.80% |

| |

| Class Y Shares* | |

| One year | 1.41% |

| Five year | 4.79% |

| Ten year | 3.31% |

* Calvert International Equity Fund first offered Class Y shares on October 31, 2008.

Performance prior to that date reflects the performance of Class A shares at net asset value (NAV). Actual Class Y share performance would have been different.

Stock selection in Consumer Staples helped performance during the period. Retailer CVS Health Corporation, an out-of-benchmark U.S. holding, returned more than 41% for the year, as investors recognized the benefits of the company’s joint venture with Cardinal Healthcare. The company’s earnings exceeded estimates and confirmed our positive outlook for CVS.

Outlook

If U.S. macroeconomic data remains positive, we could see a pick-up in economic activity, increases in GDP growth, and further positive earnings news. The housing market remains a key driver of economic recovery. While we don’t anticipate institutional buyer demand returning to previous levels, we believe individual U.S. homebuyers can ultimately fill the gap, and we remain optimistic about recovery for the U.S. housing market.

In the United States, the end of quantitative easing and the prospect of increased interest rates have investors worried the Fed may tighten too early and derail economic recovery, but with the Fed’s policies dependent on economic data—and little inflation pressure at the moment—there is flexibility to delay tightening. If stronger economic data adjusts market expectations, we could see a temporary spike in market volatility.

As investors get more clarity on the timing, magnitude, and the clip of interest-rate increases, we believe small-cap stocks could outperform large-caps. Small-cap earnings have shown better growth and their business models are more leveraged to U.S. recovery. Our long-term outlook for large-cap stocks, although more modest, is also positive.

We expect the dollar to continue to strengthen, which may favor U.S. securities overall. The stronger U.S. dollar and fears of economic slowdown in China could create near-term headwinds for emerging markets. One positive byproduct of China’s economic transition has been the winding down of the commodities super-cycle, which should make input costs cheaper and help keep inflation low.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 13

Lower hydrocarbon-based energy prices could provide support for global economic growth and help keep inflation low. This could challenge the alternative energy industry in the near-term, but we view the transition from fossil fuels to alternative energy as inevitable, which reinforces our environmental, social, and governance (ESG) positioning with respect to the alternative energy sector.

We closely monitor extreme climate events as they may affect the growth and performance dynamics of entire regions and countries. In the U.S., extreme weather conditions erased about 1% of GDP in the first quarter of 2014. If this is a long-term trend, global markets may be in for a rude awakening.

Overall, we believe global economic growth will continue to move ahead, led by the United States, which will continue to favor the U.S. equity markets.

Calvert Investment Management, Inc.

October 2014

1. Returns reflect the period securities were held by the portfolio.

As of September 30, 2014, the following companies represented the following percentages of Fund net assets: Mizuho Financial Group 1.60%, Sumitomo Mitsui Trust Holdings, Inc. 0.30%, Sberbank 0%, Yandex 0%, Lululemon Athletica 0.20%, CVS Health Corporation 0.80%, and Cardinal Healthcare 0%. Holdings are subject to change.

| 14 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2014 to September 30, 2014).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 15

| | | |

| | BEGINNING | ENDING | EXPENSES PAID |

| | ACCOUNT

VALUE | ACCOUNT

VALUE | DURING

PERIOD* |

| | 4/1/14 | 9/30/14 | 4/1/14 - 9/30/14 |

| CLASS A | | | |

| Actual | $1,000.00 | $964.37 | $8.05 |

| Hypothetical | $1,000.00 | $1,016.87 | $8.26 |

| (5% return per year before expenses) | | | |

| |

| CLASS B | | | |

| Actual | $1,000.00 | $957.59 | $14.57 |

| Hypothetical | $1,000.00 | $1,010.18 | $14.97 |

| (5% return per year before expenses) | | | |

| |

| CLASS C | | | |

| Actual | $1,000.00 | $960.32 | $12.53 |

| Hypothetical | $1,000.00 | $1,012.28 | $12.87 |

| (5% return per year before expenses) | | | |

| |

| CLASS I | | | |

| Actual | $1,000.00 | $967.18 | $4.91 |

| Hypothetical | $1,000.00 | $1,020.07 | $5.04 |

| (5% return per year before expenses) | | | |

| |

| CLASS Y | | | |

| Actual | $1,000.00 | $966.22 | $6.34 |

| Hypothetical | $1,000.00 | $1,018.62 | $6.50 |

| (5% return per year before expenses) | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.63%, 2.97%, 2.55%, 1.00%, and 1.29% for Class A, Class B, Class C, Class I, and Class Y, respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| 16 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors of Calvert World Values Fund, Inc. and Shareholders of Calvert International Equity Fund: We have audited the accompanying statement of net assets of the Calvert International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., as of September 30, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2014, by correspondence with the custodian and brokers or by performing other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert International Equity Fund as of September 30, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 17

| | |

| STATEMENT OF NET ASSETS |

| SEPTEMBER 30, 2014 |

| |

| EQUITY SECURITIES - 94.9% | SHARES | VALUE |

| Australia - 2.9% | | |

| ALS Ltd. | 170,559 | $785,187 |

| Aurizon Holdings Ltd. | 503,605 | 1,992,857 |

| Australia & New Zealand Banking Group Ltd. (ADR) | 31,305 | 847,270 |

| Macquarie Group Ltd. | 36,560 | 1,839,251 |

| Westpac Banking Corp. (ADR) | 73,994 | 2,079,971 |

| Woolworths Ltd. | 128,731 | 3,850,390 |

| | | 11,394,926 |

| |

| Austria - 1.0% | | |

| OMV AG (ADR) | 705 | 23,702 |

| Voestalpine AG | 97,015 | 3,834,275 |

| | | 3,857,977 |

| |

| Belgium - 0.1% | | |

| Ageas (ADR) | 16,137 | 530,988 |

| |

| Canada - 1.3% | | |

| Dollarama, Inc. | 6,411 | 543,378 |

| Intact Financial Corp. | 4,350 | 281,410 |

| Lululemon Athletica, Inc.* | 21,884 | 919,347 |

| Suncor Energy, Inc. Toronto Exchange | 97,100 | 3,511,141 |

| | | 5,255,276 |

| |

| China - 0.4% | | |

| Alibaba Group Holding Ltd. (ADR)* | 8,610 | 764,998 |

| BOC Hong Kong Holdings Ltd. (ADR) | 14,621 | 927,702 |

| | | 1,692,700 |

| |

| Denmark - 0.3% | | |

| H Lundbeck A/S (ADR) | 4,947 | 109,841 |

| Novo Nordisk A/S, Series B | 21,162 | 1,012,295 |

| | | 1,122,136 |

| |

| Finland - 0.1% | | |

| Metso Oyj (ADR) | 594 | 20,986 |

| Sampo Oyj (ADR) | 9,749 | 235,341 |

| | | 256,327 |

| |

| France - 7.3% | | |

| Air Liquide SA | 38,639 | 4,711,597 |

| AXA SA (ADR) | 88,664 | 2,182,908 |

| BNP Paribas SA (ADR) | 51,009 | 1,679,216 |

| Casino Guichard Perrachon SA (ADR) | 361 | 7,689 |

| Credit Agricole SA (ADR) | 70,467 | 525,331 |

| Eutelsat Communications SA | 108,352 | 3,497,702 |

| 18 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| France - Cont’d | | |

| Kering SA | 23,121 | $4,660,962 |

| Numericable Group SA* | 15,083 | 804,664 |

| Orange SA (ADR) | 30,438 | 448,656 |

| Sanofi SA | 56,578 | 6,398,258 |

| Sanofi SA (ADR) | 29,211 | 1,648,377 |

| Suez Environnement Co. (ADR) | 12,087 | 101,410 |

| Valeo SA (ADR) | 7,857 | 436,064 |

| Vallourec SA | 22,437 | 1,031,539 |

| Veolia Environnement SA (ADR) | 31,318 | 549,631 |

| | | 28,684,004 |

| |

| Germany - 5.8% | | |

| Allianz SE (ADR) | 126,350 | 2,036,762 |

| Brenntag AG | 67,856 | 3,333,877 |

| Celesio AG (ADR) | 2,078 | 13,549 |

| Commerzbank AG (ADR)* | 1 | 15 |

| Continental AG | 17,200 | 3,271,882 |

| Continental AG (ADR) | 74 | 2,802 |

| Deutsche Post AG | 141,953 | 4,551,005 |

| Deutsche Post AG (ADR) | 66,303 | 2,123,354 |

| Dialog Semiconductor plc* | 95,131 | 2,672,111 |

| ElringKlinger AG | 28,887 | 854,988 |

| Hugo Boss AG | 28,000 | 3,498,789 |

| K+S AG (ADR) | 2,216 | 31,068 |

| Merck KGaA (ADR) | 4,105 | 125,777 |

| Muenchener Rueckversicherungs AG (ADR) | 18,233 | 360,284 |

| | | 22,876,263 |

| |

| Hong Kong - 2.8% | | |

| AIA Group Ltd | 1,189,427 | 6,150,135 |

| Bank of East Asia Ltd. (ADR) | 7,631 | 30,348 |

| Hang Seng Bank Ltd. (ADR) | 52,462 | 835,982 |

| PCCW Ltd. (ADR) | 3,746 | 23,038 |

| Samsonite International SA* | 1,157,100 | 3,717,943 |

| Shenguan Holdings Group Ltd. | 1,190,148 | 398,507 |

| | | 11,155,953 |

| |

| India - 0.7% | | |

| Wipro Ltd. (ADR) | 236,200 | 2,872,192 |

| |

| Ireland - 0.9% | | |

| Kerry Group plc | 52,418 | 3,694,625 |

| |

| Israel - 1.2% | | |

| Check Point Software Technologies Ltd.* | 65,600 | 4,542,144 |

| |

| Italy - 3.5% | | |

| GTECH SpA (ADR) | 1,107 | 26,081 |

| Intesa Sanpaolo SpA, Milano Stock Exchange | 1,747,363 | 5,308,585 |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 19

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| Italy - Cont’d | | |

| Intesa Sanpaolo SpA (ADR) | 15,502 | $280,044 |

| Mediobanca SpA* | 501,526 | 4,312,614 |

| Pirelli & C. SpA | 58,879 | 814,838 |

| Prysmian SpA | 161,645 | 3,002,445 |

| Snam SpA (ADR) | 4,529 | 49,321 |

| Terna Rete Elettrica Nazionale SpA (ADR) | 3,785 | 56,832 |

| | | 13,850,760 |

| |

| Japan - 16.8% | | |

| Astellas Pharma, Inc. | 346,000 | 5,151,748 |

| Coca-Cola East Japan Co. Ltd | 47,000 | 932,929 |

| Eisai Co. Ltd. (ADR) | 424 | 17,135 |

| FANUC Corp. | 4,551 | 822,022 |

| Isuzu Motors Ltd | 383,000 | 5,412,811 |

| JSR Corp | 147,700 | 2,576,249 |

| Kubota Corp. | 24,026 | 379,531 |

| Mitsui Fudosan Co. Ltd. | 154,256 | 4,725,079 |

| Mizuho Financial Group, Inc. | 2,696,200 | 4,815,916 |

| Mizuho Financial Group, Inc. (ADR) | 465,494 | 1,661,814 |

| MS&AD Insurance Group Holdings (ADR) | 50,456 | 548,204 |

| Nippon Telegraph & Telephone Corp. | 16,802 | 1,044,964 |

| Nippon Telegraph & Telephone Corp. (ADR) | 101,457 | 3,156,327 |

| Nissan Motor Co. Ltd | 379,400 | 3,698,004 |

| Nissan Motor Co. Ltd. (ADR) | 73,438 | 1,422,127 |

| Nomura Holdings, Inc. (ADR) | 209,151 | 1,236,082 |

| Olympus Corp.* | 17,850 | 640,435 |

| ORIX Corp | 360,400 | 4,971,828 |

| Softbank Corp | 83,533 | 5,856,259 |

| Sony Corp | 29,400 | 533,717 |

| Sony Corp. (ADR) | 48,901 | 882,174 |

| Sumitomo Mitsui Trust Holdings, Inc | 327,287 | 1,362,266 |

| Takeda Pharmaceutical Co. Ltd. (ADR) | 14,428 | 313,665 |

| Tokyo Gas Co. Ltd | 621,118 | 3,491,400 |

| Toyota Motor Corp. (t) | 149,782 | 8,826,451 |

| Toyota Motor Corp. (ADR) | 12,657 | 1,487,577 |

| | | 65,966,714 |

| |

| Luxembourg - 1.0% | | |

| Ipsen SA (ADR) | 46,295 | 564,336 |

| ProSiebenSat.1 Media AG | 84,472 | 3,365,210 |

| | | 3,929,546 |

| |

| Mexico - 0.1% | | |

| FINAE, Series D, Preferred (b)(i)* | 1,962,553 | 298,139 |

| |

| Netherlands - 4.3% | | |

| Aegon NV | 105,641 | 868,369 |

| Akzo Nobel NV | 15,663 | 1,072,938 |

| ING Groep NV (CVA)* | 112,183 | 1,602,100 |

| 20 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| Netherlands - Cont’d | | |

| Koninklijke Ahold NV (ADR) | 68,291 | $1,104,265 |

| Koninklijke Philips NV, NY Shares | 70,084 | 2,222,364 |

| Unilever NV, NY Shares | 85,657 | 3,398,870 |

| Unilever NV (CVA) | 157,749 | 6,280,448 |

| Wolters Kluwer NV (ADR) | 14,483 | 385,248 |

| | | 16,934,602 |

| |

| New Zealand - 0.1% | | |

| Spark New Zealand Ltd. (ADR) | 27,311 | 317,354 |

| |

| Norway - 2.6% | | |

| DnB ASA | 242,707 | 4,542,720 |

| DNB ASA (ADR) | 368 | 68,525 |

| Orkla ASA | 77,215 | 697,985 |

| Prosafe SE | 135,456 | 791,996 |

| Statoil ASA (ADR) | 132,882 | 3,609,075 |

| Yara International ASA (ADR) | 11,859 | 595,678 |

| | | 10,305,979 |

| |

| Philippines - 0.7% | | |

| Philippine Long Distance Telephone Co. (ADR) | 40,905 | 2,821,627 |

| |

| Portugal - 0.0% | | |

| Portugal Telecom SGPS SA (ADR) | 42,236 | 88,273 |

| |

| Singapore - 0.2% | | |

| Singapore Telecommunications Ltd. (ADR) | 28,833 | 861,530 |

| |

| South Africa - 2.3% | | |

| Aspen Pharmacare Holdings Ltd. | 149,057 | 4,435,985 |

| Clicks Group Ltd. | 92,584 | 548,610 |

| MTN Group Ltd. (ADR) | 30,742 | 654,190 |

| Naspers Ltd | 26,867 | 2,958,293 |

| Nedbank Group Ltd. (ADR) | 5,734 | 110,437 |

| Tiger Brands Ltd. (ADR) | 2,875 | 80,471 |

| | | 8,787,986 |

| |

| South Korea - 0.2% | | |

| SK Hynix, Inc.* | 18,435 | 816,713 |

| |

| Spain - 2.5% | | |

| Amadeus IT Holding SA | 24,181 | 904,398 |

| Banco Bilbao Vizcaya Argentaria SA: | | |

| Common | 86,035 | 1,037,586 |

| Rights* | 86,035 | 8,582 |

| Banco Bilbao Vizcaya Argentaria SA (ADR) | 147,331 | 1,767,972 |

| Banco Santander SA (ADR) | 183,572 | 1,743,934 |

| Distribuidora Internacional de Alimentacion SA | 62,798 | 450,713 |

| Enagas SA (ADR) | 2,558 | 41,005 |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 21

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| Spain - Cont’d | | |

| Ferrovial SA (ADR) | 430 | $8,097 |

| Inditex SA | 136,945 | 3,782,634 |

| | | 9,744,921 |

| |

| Sweden - 2.5% | | |

| Assa Abloy AB, Series B | 98,653 | 5,092,526 |

| Atlas Copco AB (ADR): | | |

| A Shares | 41,252 | 1,178,570 |

| B Shares | 15,213 | 392,031 |

| Sandvik AB (ADR) | 5,419 | 60,801 |

| SKF AB (ADR) | 960 | 20,054 |

| Svenska Cellulosa AB SCA, Series B | 72,385 | 1,725,876 |

| Svenska Handelsbanken AB (ADR) | 12,513 | 293,430 |

| Swedbank AB (ADR) | 14,551 | 365,085 |

| Tele2 AB (ADR) | 118,277 | 704,931 |

| | | 9,833,304 |

| |

| Switzerland - 8.5% | | |

| Aryzta AG* | 45,265 | 3,900,971 |

| Clariant AG* | 264,132 | 4,522,212 |

| Credit Suisse Group AG* | 142,039 | 3,934,668 |

| Novartis AG | 18,789 | 1,772,621 |

| Novartis AG (ADR) | 31,575 | 2,972,155 |

| Roche Holding AG | 31,860 | 9,439,136 |

| Roche Holding AG (ADR) | 111,462 | 4,122,979 |

| Swiss Re AG (ADR) | 3,389 | 270,612 |

| UBS AG* | 77,892 | 1,358,046 |

| Zurich Insurance Group AG (ADR)* | 29,695 | 885,178 |

| | | 33,178,578 |

| |

| Taiwan - 0.9% | | |

| MediaTek, Inc. | 201,000 | 2,976,725 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (ADR) | 23,847 | 481,232 |

| | | 3,457,957 |

| |

| United Kingdom - 19.8% | | |

| Admiral Group plc (ADR) | 3,403 | 71,157 |

| Aon plc | 13,595 | 1,191,874 |

| ARM Holdings plc | 25,502 | 374,725 |

| Ashtead Group plc | 231,863 | 3,922,169 |

| AstraZeneca plc (ADR) | 23,008 | 1,643,692 |

| Aviva plc | 145,562 | 1,235,877 |

| Barclays plc | 963,232 | 3,553,263 |

| Barclays plc (ADR) | 28,407 | 420,708 |

| BG Group plc | 288,162 | 5,327,852 |

| BT Group plc | 121,477 | 747,878 |

| BT Group plc (ADR) | 38,898 | 2,391,449 |

| Bunzl plc (ADR) | 20,992 | 544,428 |

| Capita plc | 232,001 | 4,379,791 |

| 22 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| United Kingdom - Cont’d | | |

| Catlin Group Ltd. (ADR) | 2,173 | $36,611 |

| Compass Group plc | 65,463 | 1,057,995 |

| easyJet plc | 20,051 | 462,755 |

| Foxtons Group plc | 202,200 | 705,067 |

| GlaxoSmithKline plc | 63,804 | 1,462,179 |

| GlaxoSmithKline plc (ADR) | 36,664 | 1,685,444 |

| Howden Joinery Group plc | 469,348 | 2,581,269 |

| HSBC Holdings plc: | | |

| Hong Kong Exchange | 227,314 | 2,330,240 |

| London Exchange | 596,061 | 6,052,642 |

| HSBC Holdings plc (ADR) | 38,065 | 1,936,747 |

| Inmarsat plc | 226,574 | 2,575,957 |

| Intertek Group plc | 12,202 | 518,691 |

| J Sainsbury plc (ADR) | 10,892 | 178,901 |

| Johnson Matthey plc | 54,055 | 2,559,060 |

| Legal & General Group plc (ADR) | 884 | 16,266 |

| Liberty Global plc, Series C* | 33,621 | 1,378,965 |

| Man Group plc (ADR) | 54,532 | 101,975 |

| Meggitt plc | 504,745 | 3,693,615 |

| Old Mutual plc (ADR) | 1,311 | 30,894 |

| Pearson plc | 47,825 | 961,805 |

| Persimmon plc* | 190,136 | 4,113,682 |

| Prudential plc | 233,225 | 5,204,801 |

| Reckitt Benckiser Group plc | 6,332 | 549,421 |

| Reckitt Benckiser Group plc (ADR) | 25,909 | 450,558 |

| Sage Group plc (ADR) | 89 | 2,099 |

| SSE plc | 155,983 | 3,913,615 |

| SSE plc (ADR) | 87,511 | 2,208,778 |

| The British Land Co. plc (ADR) | 5,516 | 63,020 |

| Unilever plc | 19,045 | 798,458 |

| Unilever plc (ADR) | 82,324 | 3,449,376 |

| United Utilities Group plc (ADR) | 25,809 | 673,615 |

| | | 77,559,364 |

| |

| United States - 4.1% | | |

| Accenture plc | 13,830 | 1,124,656 |

| Applied Industrial Technologies, Inc | 13,552 | 618,649 |

| Applied Materials, Inc. | 26,662 | 576,166 |

| Bioceptive, Inc., Series A, Preferred (a)(b)(i)* | 582,574 | 299,967 |

| Bristol-Myers Squibb Co | 34,395 | 1,760,336 |

| CNO Financial Group, Inc. | 35,839 | 607,829 |

| CVS Health Corp. | 41,400 | 3,295,026 |

| EOG Resources, Inc | 36,900 | 3,653,838 |

| MasterCard, Inc. | 9,701 | 717,098 |

| Nielsen NV | 25,914 | 1,148,768 |

| Perrigo Co. plc | 5,930 | 890,627 |

| Powerspan Corp., Contingent Deferred Distribution (b)(i)* | 1 | — |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 23

| | |

| EQUITY SECURITIES - CONT’D | SHARES | VALUE |

| United States - Cont’d | | |

| Unit Corp.* | 16,873 | $989,601 |

| Wynn Resorts Ltd. | 1,621 | 303,257 |

| | | 15,985,818 |

| |

| Total Equity Securities (Cost $351,099,897) | | 372,674,676 |

| |

| | ADJUSTED | |

| VENTURE CAPITAL LIMITED PARTNERSHIP INTEREST - 0.4% | BASIS | |

| BFSE Holding, B.V. (b)(i)* | $612,966 | 310,115 |

| Africa Renewable Energy Fund (b)(i)* | 52,626 | 21,098 |

| Blackstone Clean Technology Partners (b)(i)* | 75,424 | 46,037 |

| China Environment Fund 2004 (b)(i)* | — | 130,273 |

| Emerald Sustainability Fund I (b)(i)* | 433,916 | 229,476 |

| gNet Defta Development Holdings LLC (a)(b)(i)* | 400,000 | 319,014 |

| SEAF Central and Eastern European Growth Fund LLC (a)(b)(i)* | 330,924 | 379,035 |

| SEAF India International Growth Fund (b)(i)* | 281,749 | 127,228 |

| ShoreCap International LLC (b)(i)* | — | 115,129 |

| Terra Capital (b)(i)* | 469,590 | 1 |

| |

| Total Venture Capital Limited Partnership Interest | | |

| (Cost $2,657,194) | | 1,677,406 |

| |

| | PRINCIPAL | |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.3% | AMOUNT | |

| AFIG LLC, 6.00%, 10/17/17 (b)(i) | 450,953 | 338,214 |

| FINAE: | | |

| Note I, 6.50%, 12/1/15 (b)(i) | 250,000 | 250,000 |

| Note II, 6.50%, 12/1/15 (b)(i) | 500,000 | 500,000 |

| Windhorse International-Spring Health Water Ltd., 1.00%, | | |

| 3/14/18 (b)(i) | 70,000 | 52,500 |

| |

| Total Venture Capital Debt Obligations (Cost $1,270,953) | | 1,140,714 |

| |

| HIGH SOCIAL IMPACT INVESTMENTS - 1.1% | | |

| Calvert Social Investment Foundation Notes, 0.25%, 7/1/17 (b)(i) | 4,431,583 | 4,344,226 |

| |

| Total High Social Impact Investments (Cost $4,431,583) | | 4,344,226 |

| |

| TIME DEPOSIT - 2.6% | | |

| State Street Bank Time Deposit, 0.069%, 10/1/14 | 10,059,906 | 10,059,906 |

| |

| Total Time Deposit (Cost $10,059,906) | | 10,059,906 |

| |

| |

| TOTAL INVESTMENTS (Cost $369,519,533) - 99.3% | | 389,896,928 |

| Other assets and liabilities, net - 0.7% | | 2,801,052 |

| NET ASSETS - 100% | | $392,697,980 |

| |

| See notes to financial statements. | | |

| 24 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

| |

| NET ASSETS CONSIST OF: | |

| Paid-in capital applicable to the following shares of common stock with | |

| 250,000,000 shares of $0.01 par value shares authorized: | |

| Class A: 15,972,582 shares outstanding | $348,631,999 |

| Class B: 139,130 shares outstanding | 8,369,793 |

| Class C: 1,203,089 shares outstanding | 31,683,410 |

| Class I: 5,221,589 shares outstanding | 127,822,287 |

| Class Y: 1,001,859 shares outstanding | 16,067,360 |

| Undistributed net investment income | 2,266,246 |

| Accumulated net realized gain (loss) on investments and foreign | |

| currency transactions | (162,487,363) |

| Net unrealized appreciation (depreciation) on investments, foreign currencies, | |

| and assets and liabilities denominated in foreign currencies | 20,344,248 |

| |

| NET ASSETS | $392,697,980 |

| |

| NET ASSET VALUE PER SHARE | |

| Class A (based on net assets of $263,718,541) | $16.51 |

| Class B (based on net assets of $2,009,982) | $14.45 |

| Class C (based on net assets of $17,172,793) | $14.27 |

| Class I (based on net assets of $92,317,454) | $17.68 |

| Class Y (based on net assets of $17,479,210) | $17.45 |

See notes to financial statements.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 25

| | |

| RESTRICTED SECURITIES | ACQUISITION DATES | COST |

| AFIG LLC, 6.00%, 10/17/17 | 10/11/12 | $450,953 |

| Africa Renewable Energy Fund LP | 4/17/14 | 52,626 |

| BFSE Holding, B.V | 1/12/06 - 6/11/14 | 612,966 |

| Bioceptive, Inc., Series A, Preferred | 10/26/12 - 12/18/13 | 252,445 |

| Blackstone Clean Technology Partners LP | 7/29/10 - 2/21/14 | 75,424 |

| Calvert Social Investment Foundation Notes, | | |

| 0.25%, 7/1/17 | 7/1/14 | 4,431,583 |

| China Environment Fund 2004 LP | 9/15/05 - 4/1/09 | — |

| Emerald Sustainability Fund I LP | 7/19/01 - 5/17/11 | 433,916 |

| FINAE: | | |

| Series D, Preferred | 2/28/11 | 252,686 |

| Note I, 6.50%, 12/1/15 | 12/10/10 | 250,000 |

| Note II, 6.50%, 12/1/15 | 2/24/11 | 500,000 |

| gNet Defta Development Holdings LLC, LP | 8/30/05 | 400,000 |

| Powerspan Corp., Contingent Deferred Distribution | 8/20/97 - 7/11/14 | — |

| SEAF Central and Eastern European Growth | | |

| Fund LLC, LP | 8/10/00 - 8/26/11 | 330,924 |

| SEAF India International Growth Fund LP | 3/22/05 - 5/24/10 | 281,749 |

| ShoreCap International LLC, LP | 8/12/04 - 12/15/08 | — |

| Terra Capital LP | 11/23/98 - 3/14/06 | 469,590 |

| Windhorse International-Spring Health Water Ltd., | | |

| 9.00%, 3/14/18 | 2/12/14 | 70,000 |

| (a) | Affiliated company. |

| (b) | This security was valued under the direction of the Board of Directors. See Note A. |

| (i) | Restricted securities represent 2.0% of net assets of the Fund. |

| (t) | 75,000 shares of Toyota Motor Corp. have been soft segregated in order to cover outstanding commitments to certain limited partnerships investments within the Fund. There are no restrictions on the trading of this security. |

| * | Non-income producing security. |

Abbreviations:

ADR: American Depositary Receipts

CVA: Certificaten Van Aandelen

LLC: Limited Liability Corporation

LP: Limited Partnership

plc: Public Limited Company

See notes to financial statements.

| 26 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

| |

| STATEMENT OF OPERATIONS |

| YEAR ENDED SEPTEMBER 30, 2014 |

| |

| NET INVESTMENT INCOME | |

| Investment Income: | |

| Dividend income (net of foreign taxes withheld of $860,790) | $9,751,002 |

| Interest income | 114,363 |

| Total investment income | 9,865,365 |

| |

| Expenses: | |

| Investment advisory fee | 2,878,134 |

| Transfer agency fees and expenses | 696,136 |

| Administrative fees | 1,178,211 |

| Distribution Plan expenses: | |

| Class A | 658,680 |

| Class B | 27,175 |

| Class C | 179,516 |

| Directors' fees and expenses | 36,653 |

| Custodian fees | 141,971 |

| Registration fees | 51,127 |

| Reports to shareholders | 47,544 |

| Professional fees | 87,881 |

| Miscellaneous | 31,476 |

| Total expenses | 6,014,504 |

| Reimbursement from Advisor: | |

| Class B | (6,026) |

| Net expenses | 6,008,478 |

| |

| NET INVESTMENT INCOME | 3,856,887 |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Investments | 38,676,895 |

| Foreign currency transactions | (494,848) |

| | 38,182,047 |

| |

| Change in unrealized appreciation (depreciation) on: | |

| Investments and foreign currencies | (39,006,845) |

| Assets and liabilities denominated in foreign currencies | (43,440) |

| | (39,050,285) |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | (868,238) |

| |

| INCREASE (DECREASE) IN NET ASSETS | |

| RESULTING FROM OPERATIONS | $2,988,649 |

See notes to financial statements.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 27

| | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | Year Ended | Year Ended |

| | September 30, | September 30, |

| Increase (Decrease) in Net Assets | 2014 | 2013 |

| Operations: | | |

| Net investment income | $3,856,887 | $1,991,350 |

| Net realized gain (loss) | 38,182,047 | 21,909,482 |

| Change in unrealized appreciation (depreciation) | (39,050,285) | 43,140,368 |

| |

| Increase (Decrease) in Net Assets | | |

| Resulting From Operations | 2,988,649 | 67,041,200 |

| |

| Distributions to shareholders from: | | |

| Net investment income: | | |

| Class A shares | (1,441,168) | (1,472,525) |

| Class I shares . | (1,465,772) | (1,480,867) |

| Class Y shares . | (125,098) | (86,752) |

| Total distributions . | (3,032,038) | (3,040,144) |

| |

| Capital share transactions: | | |

| Shares sold: | | |

| Class A shares | 58,755,990 | 50,683,210 |

| Class B shares | 22,810 | 12,163 |

| Class C shares | 2,254,459 | 1,438,125 |

| Class I shares . | 15,405,740 | 11,987,612 |

| Class Y shares . | 9,173,420 | 4,137,041 |

| Reinvestment of distributions: | | |

| Class A shares | 1,068,320 | 1,204,726 |

| Class I shares . | 1,195,493 | 1,307,560 |

| Class Y shares . | 72,616 | 42,132 |

| Redemption fees: | | |

| Class A shares | 3,602 | 804 |

| Class C shares | 227 | 52 |

| Class I shares . | — | 1 |

| Shares redeemed: | | |

| Class A shares | (38,938,256) | (34,384,564) |

| Class B shares | (1,205,154) | (1,104,033) |

| Class C shares | (2,857,013) | (2,851,196) |

| Class I shares . | (6,486,688) | (48,952,897) |

| Class Y shares . | (1,959,045) | (3,141,545) |

| Total capital share transactions . | 36,506,521 | (19,620,809) |

| |

| Total Increase (Decrease) in Net Assets | 36,463,132 | 44,380,247 |

| |

| Net Assets | | |

| Beginning of year | 356,234,848 | 311,854,601 |

| End of year (including undistributed net investment income of | | |

| $2,266,246 and $1,765,051, respectively) | $392,697,980 | $356,234,848 |

See notes to financial statements.

28 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

| | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | Year Ended | Year Ended |

| | September 30, | September 30, |

| Capital Share Activity | 2014 | 2013 |

| Shares sold: | | |

| Class A shares | 3,451,461 | 3,392,867 |

| Class B shares | 1,517 | 864 |

| Class C shares | 152,718 | 108,793 |

| Class I shares . | 846,818 | 739,068 |

| Class Y shares . | 510,073 | 264,708 |

| Reinvestment of distributions: | | |

| Class A shares | 62,658 | 85,381 |

| Class I shares . | 65,795 | 86,594 |

| Class Y shares . | 4,041 | 2,831 |

| Shares redeemed: | | |

| Class A shares | (2,290,221) | (2,343,110) |

| Class B shares | (80,280) | (85,072) |

| Class C shares | (193,947) | (223,872) |

| Class I shares . | (355,259) | (3,131,479) |

| Class Y shares . | (108,621) | (200,003) |

| Total capital share activity | 2,066,753 | (1,302,430) |

See notes to financial statements.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 29

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert World Values Fund, Inc. is comprised of four separate series. The operations of each series are accounted for separately. The Fund offers five classes of shares of capital stock - Classes A, B, C, I, and Y. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Class B shares are no longer offered for purchase, except through reinvestment of dividends and/ or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived for certain other institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries, foundations, and endowments that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund, except Special Equities investments, to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties. Special Equities investments, as described in the Fund’s prospectus and statement of additional information, are fair valued by the Board’s Special Equities Committee.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation

| 30 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. There were no such transfers during the period. Valuation techniques used to value the Funds’ investments by major category are as follows: Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy.

In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters. Such securities would be categorized as Level 2 in the hierarchy in these circumstances. Utilizing this technique may result in transfers between Level 1 and Level 2. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are fair valued by the Fund’s Board of Directors and are categorized as Level 3 in the hierarchy. Venture capital direct equity securities are generally valued using the most appropriate and applicable method to measure fair value in light of each company’s situation. Methods may include market, income or cost approaches with discounts as appropri-

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 31

ate based on assumptions of liquidation or exit risk. Examples of the market approach are subsequent rounds of financing, comparable transactions, and revenue times an industry multiple. An example of the income approach is the discounted cash flow. Examples of the cost approach are replacement cost, salvage value, or net asset percentage. Venture capital limited partnership (“LP”) securities are valued at the fair value reported by the general partner of the partnership adjusted as necessary to reflect subsequent capital calls and distributions and any other available information, as a practical expedient. In the absence of a reported LP unit value, fair value may be estimated based on the Fund’s percentage equity in the partnership and/or other balance sheet information and portfolio value for the most recently available period reported by the general partner. In some cases adjustments may be made to account for daily pricing of material public holdings within the partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee or with respect to Special Equities investments, by the Special Equities Committee using the venture capital methodologies described above.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based

| 32 | www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT |

on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At September 30, 2014, securities valued at $7,760,452, or 2.0% of net assets, were fair valued in good faith under the direction of the Board.

The following table summarizes the market value of the Fund’s holdings as of September 30, 2014, based on the inputs used to value them:

| | | VALUATION INPUTS | |

| INVESTMENTS IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Equity securities* | $372,076,570 | — | — | $372,076,570** |

| Other debt obligations | — | $14,404,132 | — | 14,404,132 |

| Venture capital | — | — | $3,416,226 | 3,416,226 |

| TOTAL | $372,076,570 | $14,404,132 | $3,416,226*** | $389,896,928 |

| * | For further breakdown of equity securities by country, please refer to the Statement of Net Assets. |

| ** | Exclusive of $598,106 venture capital equity shown in venture capital heading. |

| *** | Level 3 securities represent 0.9% of net assets. |

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 33

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund (within seven days for Class I shares). The redemption fee is accounted for as an addition to paid-in capital and is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

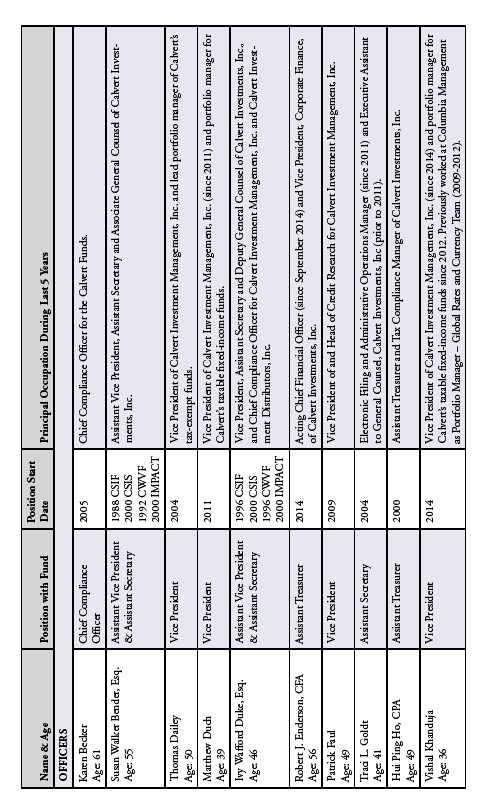

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives a monthly fee based on the following annual rates of average daily net assets: .75% on the first $250 million, .725% on the next $250 million, and .675% on the excess of $500 million. At year end, $246,859 was payable.