UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

Ivy Wafford Duke, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2015

Item 1. Report to Stockholders.

|

| | |

| | |

| | | |

Calvert International Equity Fund

| | |

| | | |

| | |

|

| |

Annual Report September 30, 2015 E-Delivery Sign-Up — Details Inside | |

|

|

| |

Choose Planet-friendly E-delivery! Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs. Just go to calvert.com. If you already have an online account at Calvert, click on Login, to access your Account, and select the documents you would like to receive via e-mail. If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm. |

|

| | | |

| | | TABLE OF CONTENTS |

| | | | |

| | | | President’s Letter |

| | | | Portfolio Management Discussion |

| | | | Understanding Your Fund’s Expenses |

| | | | Report of Independent Registered Public Accounting Firm |

| | | | Statement of Net Assets |

| | | | Restricted Securities |

| | | | Statement of Operations |

| | | | Statements of Changes in Net Assets |

| | | | Notes to Financial Statements |

| | | | Financial Highlights |

| | | | Explanation of Financial Tables |

| | | | Proxy Voting |

| | | | Availability of Quarterly Portfolio Holdings |

| | | | Director and Officer Information Tables |

|

| |

| John Streur President and Chief Executive Officer, Calvert Investments, Inc. |

Dear Shareholders,

Global economic growth is vital to the improvement of the lives of all people, especially so to those of the ultra-poor. However, how that growth is achieved is critical to the long-term health and sustainability of our collective societies. Business activity that does not show consideration for environmental and social impacts may have calamitous consequences, many of which we are witnessing now, including political and social unrest, unjust wealth distribution and diminished bio-diversity.

The returns of the markets (chart below) reflect the impact of the uncertainty created by a legacy of unsustainable development and the current lack of positive economic growth trends. The steep decline in the emerging market equities index (reflective of the flight of capital and currency weakness) is particularly impactful as these regions include some of the largest populations of individuals most in need of sustainable and inclusive economic development.

|

| | | | |

| MARKET BENCHMARKS | Total Returns for the period ended 9/30/2015 |

| 6 Months | Year-to-Date | 1 Year | 5 Year |

| S&P 500 | -6.18% | -5.29% | -0.61% | 13.34% |

| Russell 1000 | -6.72% | -5.24% | -0.61% | 13.42% |

| Russell 3000 | -7.12% | -5.45% | -0.49% | 13.28% |

| MSCI World ex USA | -9.88% | -6.32% | -9.73% | 3.92% |

| MSCI Emerging Markets | -17.11% | -15.22% | -18.98% | -3.25% |

| Barclays U.S. Aggregate Bond | -0.47% | 1.13% | 2.94% | 3.10% |

| Barclays Global Aggregate | -0.34% | -2.25% | -3.26% | 0.81% |

| Returns for periods greater than one year have been annualized. |

In an effort to mitigate this issue and foster the long term sustainability and justice of our global economic system, many of the world’s leaders participated with the United Nations (“UN”) to design and implement a 15-year plan to create the kind of economic development (http://www.calvert.com/media-relations/press-releases/calvert-ceo-participates-in-the-un-sustainable-development-summit) that should benefit the poorest people in the world, preserve opportunities for future generations, and provide stewardship to the environment. This effort, which kicked-off at the UN Summit earlier this month, involves bringing together private enterprise, governments, NGOs, development banks and people of all walks of life to achieve the “Sustainable Development Goals 2015” (SDGs). These goals include: eliminating extreme poverty, eliminating extreme hunger, fostering good health for all, promoting gender equality, and creating environmental sustainability and peace and stability throughout the world. The SDGs impact residents of every country in some manner, but no one more acutely than the denizens of the developing and emerging nations.

It was my privilege, as Calvert’s CEO, to be invited to the Summit, as one of 350 global leaders asked to participate in the development of this critical 15-year sustainability plan. During the course of this event, I announced that Calvert Investments would lead a project (http://www.calvert.com/perspective/social-impact/calvert-un-sustainable-development-goals) to map the Sustainable Development Goals to standards that companies can be measured by, and that investors may look to in order to

4 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED)

understand which companies are helping to create sustainable, responsible growth. It is integral to the success and achievement of the goals, that the largest holders of capital, i.e., corporations, help drive these initiatives.

The crucial role that corporations now play in creating social and environmental outcomes was highlighted at the UN sessions by the presence of CEOs and sustainability officers from around the world, and the vital role of investors and the capital markets was reflected by our presence and contribution. In addition to representing your interests at the UN event, Calvert has contributed to the understanding of the role that corporations and investors play in driving social and environmental conditions through our most recent research, “The Role of the Corporation in Society”, available to you on our website, (see http://www.calvert.com/perspective/governance/calvert-serafeim-series-report).

Despite the fact that the past year has not brought the financial returns that you or I would have wished for as investors, I believe that when we look back on 2015 several years from now we are likely to see it as a transformative year in terms of our economic and social systems. Individuals and organizations of all types — corporate, government, NGO, religious — are coming together due to the realization that we need a more sustainable and just system to serve the needs of all stakeholders. As a shareholder of Calvert Funds, you are very much part of this mission, as together we are a leader and innovator in connecting capital to mission, with the dual purpose of driving competitive investment returns with just and sustainable economic progress.

On behalf of all of us at Calvert Investments, thank you for the confidence you have placed in our management of your funds and the ongoing privilege to serve you. We appreciate the opportunity to work with you as we strive to meet your financial needs while also helping to render the world a better place for all people.

Respectfully,

John Streur

October 2015

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 5

|

| |

| PORTFOLIO MANAGEMENT DISCUSSION |

|

| |

| Joshua Linder, CFA Portfolio Manager |

|

| |

| Christopher Madden, CFA Portfolio Manager |

Performance

For the year ended September 30, 2015, Calvert International Equity Fund outperformed its benchmark, the MSCI EAFE Investable Market Index (IMI), by 238 basis points. The Fund declined 4.78%, while the benchmark declined 7.16%.

Investment Process

Our investment process focuses on sustainable businesses with attractive valuations and environmental, social, and governance (ESG) characteristics, generous dividend yields, reasonable growth prospects, and stable quality of earnings and cash flows. The Fund invests primarily in the stocks of large-cap, non-U.S. companies from the constituent countries of the MSCI EAFE IMI, but may also invest in other countries, including emerging market stocks. Effective October 1, 2015, the Fund (“Funds” for the Social Book) adopted The Calvert Principles for Responsible Investment. The Principles may be found at http://www.calvert.com/approach/how-we-invest/the-calvert-principles.

Market Review

Improving economic conditions in the United States compared with a stagnating or deteriorating growth outlook in much of the rest of the world helped domestic equities outperform international equity markets over the 12-month reporting period. Despite an initial positive reaction by European financial markets following the quantitative easing announcement by the European Central Bank (ECB), there are already signs the eurozone economic recovery may have a hard time accelerating. Further signs of an economic slowdown in China and concerns about the ability of the Chinese government to engineer a soft economic landing weighed on emerging market stocks throughout the period and contributed to the broader sell-off in equities at the end of the third quarter of 2015.

For the 12-month period ended September 30, 2015, the S&P 500 and Russell 1000 both declined 0.61% while the MSCI EAFE IMI and MSCI Emerging Markets Index declined 7.16% and 18.98%, respectively. The Russell 2000 Fund Class A shares (at NAV) returned 1.25%. The Barclays U.S. Credit Index returned 1.50%.

A wide range of U.S. macroeconomic data improved over the year. Most importantly, the job market was relatively healthy for most of the 12-month period, adding an average of 237,000 jobs per month. This helped push the unemployment rate down to 5.1%, though this was driven in part by a declining labor force participation rate and has not yet been accompanied by meaningful wage growth.

The price of crude oil declined by 50% during the period. With lower commodity prices, a stronger dollar, and little wage growth, inflation in the U.S. remained below the U.S. Federal Reserve’s 2% target. The Fed decided to delay interest rate hikes given the continued low inflation and slowing global growth, but is still considering raising rates before the end of the calendar year.

Slowing growth in China helped push down commodity prices and contributed to weakness in other emerging market economies that rely heavily on Chinese commodity consumption. The low level of inflation provides the Chinese government with room for additional accommodative monetary and fiscal policy, which we saw with the devaluing of the yuan.

6 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED)

|

| | | | |

| | | | |

| | CALVERT INTERNATIONAL EQUITY FUND |

| | SEPTEMBER 30, 2015 | |

| | | | |

| | ECONOMIC SECTORS | % OF TOTAL INVESTMENTS | |

| | Consumer Discretionary | 7.8 | % | |

| | Consumer Staples | 10.4 | % | |

| | Energy | 2.4 | % | |

| | Financials | 26.9 | % | |

| | Health Care | 16.0 | % | |

| | High Social Impact Investment | 1.1 | % | |

| | Industrials | 8.9 | % | |

| | Information Technology | 1.3 | % | |

| | Limited Partnership Interest | 0.5 | % | |

| | Materials | 0.4 | % | |

| | Short-Term Investments | 12.3 | % | |

| | Telecommunication Services | 7.1 | % | |

| | Utilities | 4.6 | % | |

| | Venture Capital | 0.3 | % | |

| | Total | 100 | % | |

| | | | |

Portfolio Strategy

Earlier this year, we transitioned the Fund to being managed entirely by Calvert Investments. We manage this Fund as a core portfolio with a valuation bias.

Our quantitative models performed well and drove stock selection during the period. In particular, the drivers that focus on market sentiment and earnings as well as profitability positively contributed to results.

The Fund is underweight materials and industrials, given both macroeconomic concerns and ESG issues. Materials companies also tend to be poor businesses, with limited differentiation and low barriers to entry.

Over the past year, we have decreased exposure to those sectors and to the consumer discretionary sector. We exited consumer electronics and media giant Sony, after it had strong price appreciation. We believe the market already understands and properly values the positive changes occurring at the company.

The Fund’s largest geographical underweight is to the Asia-Pacific region, excluding Japan. Almost all of that underweight is due to not owning Australian companies. Many of Australia’s largest companies are materials or energy firms with large Chinese customer bases and significant exposure to the commodity supercycle, a part of the market we have been negative on for some time.

The Fund is overweighted in financial services and health care stocks, where we have focused on pharmaceutical companies. Over the last year, we have added to holdings in each group, including insurer Swiss Re. Swiss Re has significant excess capital, which should result in higher

|

| | | | | | |

| | | | | |

| | CALVERT INTERNATIONAL EQUITY FUND | |

| | SEPTEMBER 30, 2015 | |

| | | | | |

| | INVESTMENT PERFORMANCE | |

| | (TOTAL RETURN AT NAV) | |

| | | 6 MONTHS ENDED 9/30/15 | 12 MONTHS ENDED 9/30/15 | |

| | Class A | -6.24 | % | -4.78 | % | |

| | Class C | -6.65 | % | -5.67 | % | |

| | Class I | -6.06 | % | -4.27 | % | |

| | Class Y | -6.13 | % | -4.52 | % | |

| | MSCI EAFE Investable Market Index | -8.56 | % | -7.16 | % | |

| | Lipper International Multi-Cap Growth Funds Average | -8.16 | % | -5.79 | % | |

| | | | | |

| | Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charge. | |

| | | | | |

| | TEN LARGEST STOCK HOLDINGS | % OF NET ASSETS | |

| | Sanofi SA (ADR) | 2.9 | % | |

| | Banco Bilbao Vizcaya Argentaria SA | 2.7 | % | |

| | Atlas Copco AB (ADR), Shares A | 2.5 | % | |

| | Nippon Telegraph & Telephone Corp. | 2.5 | % | |

| | Unilever NV (CVA) | 2.4 | % | |

| | Novartis AG (ADR) | 2.4 | % | |

| | Nissan Motor Co. Ltd. | 2.4 | % | |

| | Roche Holding AG | 2.4 | % | |

| | Toyota Motor Corp. | 2.3 | % | |

| | Allianz SE | 2.2 | % | |

| | Total | 24.7 | % | |

| | | | | |

dividends or more stock bought back near book value. Total yield, including buybacks, is expected to be 12% in 2016 and 9% in 2017. Swiss Re has improved its life insurance underwriting and has exhibited price discipline through the cycle for property and casualty insurance. It also has improved asset management, avoiding major problems during the European sovereign debt crisis. Reinsurance industry pricing is cyclically weak, allowing investors to buy a top-notch company at a bargain price.

Access to western medicines in emerging markets is one of the themes in this portfolio. We added to Novartis, which makes branded pharmaceuticals, eye care products, and generic drugs. Novartis’ broad range of pharmaceuticals has limited patent expiration over the next few years, and the company has several promising drugs in late stages of research and development, focusing on oncology and cardiology. Novartis’ management believes that Entresto, its new drug to treat heart failure, could be its biggest drug ever.

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 7

We believe Novartis’ multiple does not reflect its relatively low patent risk or its strong pipeline. From an ESG perspective, Novartis is a leader in helping emerging markets (25% of sales) gain access to top-notch medicines through a broad suite of products that address diseases disproportionately affecting the poor, and through pricing programs based on affordability.

Sector allocation and stock selection each contributed positively to Fund performance. Our ESG approach underweights materials and energy sectors, two of the worst performing sectors during the period.

Stock selection was positive in the financial services sector. Within financial services, French insurer Axa was a positive contributor. We still consider the stock undervalued. Axa is a leader in incorporating ESG risks into its asset management business, and it has a strong structure to protect data security.

Stock selection in health care was detrimental to performance. Sanofi, a French pharmaceutical manufacturer with a promising drug pipeline, dropped 14% during the period as the market over-reacted to slower sales in one key drug, Lantus.1 The company’s valuation is lower than that of most of its peers. From an ESG perspective, Sanofi has very strong initiatives to improve access to healthcare in emerging market countries.

Outlook

Central banks around the globe have engaged in a concurrent, unprecedented effort to keep interest rates low in hopes of boosting economic activity. As a result, risky assets have appeared more attractive to investors and benefited from an expansion in earnings multiples over the last several years. Although valuations are far from extreme levels, they are well above historical long-term averages, making markets more vulnerable to shocks from some of the negative catalysts currently in the global economy. These include continued economic deceleration in China — a scenario that began to unfold in the third quarter of 2015.

We are worried that concurrent quantitative easing (QE) across multiple global economies could be less potent than that implemented in the U.S. after the financial crisis if these efforts effectively cancel each other out. Market enthusiasm for global QE may wane if robust economic recovery doesn’t follow, hindered by underlying structural economic and fiscal challenges in many economies, including Europe and Japan.

______________________________

1All returns reflect the period a holding was in the Fund.

In our view, the probability of a hard economic landing for China is increasing. If this process occurs in a disorderly fashion, it may have a significant negative impact on both market sentiment and the global economy since China is the world’s second-largest economy and has a meaningful impact on corporate earnings streams globally.

We believe the U.S. economy can continue to grow, although the tough first quarter of 2015 caused by severe weather will have a negative impact on growth numbers for the year. The positive impact of lower oil prices should provide additional support to the economy. Despite our positive outlook on the U.S. economy in the medium-to-long run, we continue to be concerned about potential market jitters in the short term given recent data indicating softness globally. Large-cap stocks with relatively high percentages of profits exposed to foreign markets will most likely be more volatile in the next 12-month period as European and Asian economies continue to work through challenging growth environments, soft demand, and the impacts of a high dollar.

Note: for information on a recent portfolio manager change in the Fund and other changes, please see the supplement to the prospectus included at the end of this report.

Joshua Linder, CFA

Christopher Madden

Calvert Investment Management, Inc.

October 2015

As of September 30, 2015, the following companies represented the following percentages of net assets: Sony 0.00%; Swiss Re 1.91%, ADR 0.26%; Novartis 1.83%, ADR 2.37%; Axa ADR 1.88%; and Sanofi 0.97%, ADR 2.94%. Holdings are subject to change.

8 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED)

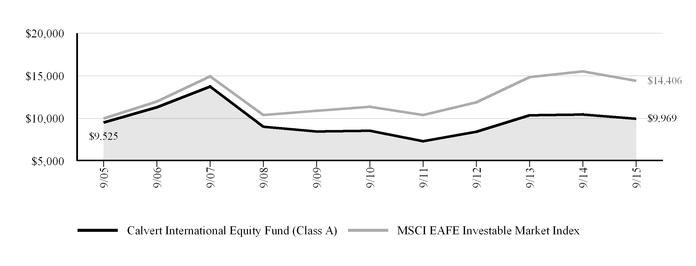

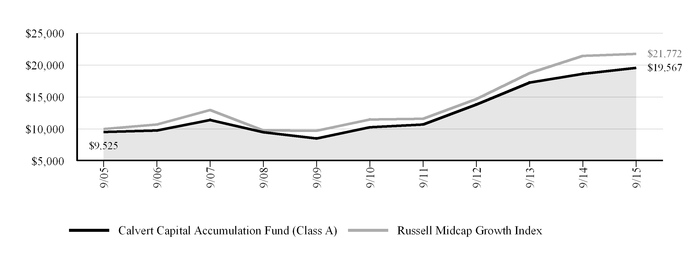

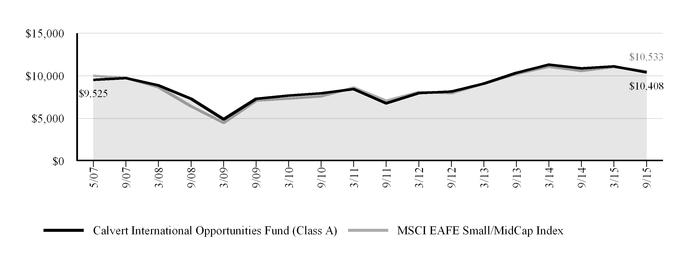

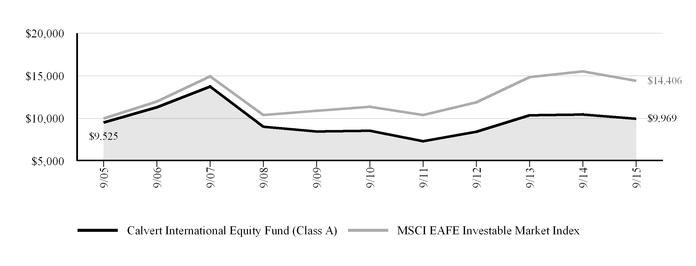

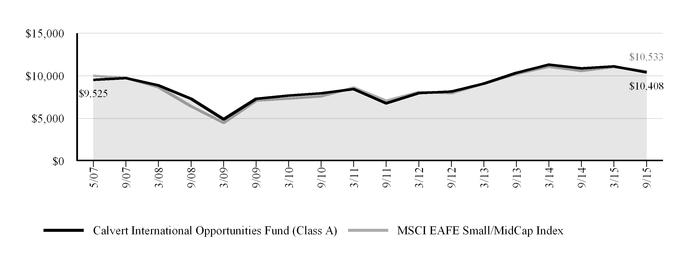

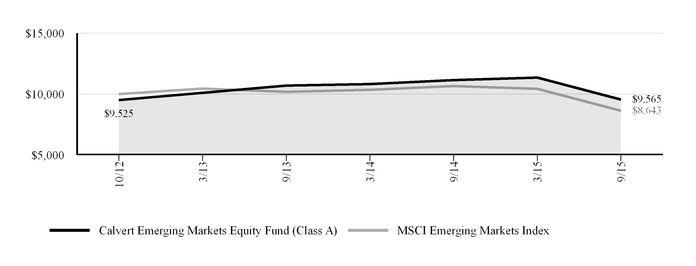

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Class A shares, reflect the deduction of the maximum front-end Class A sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with a broad based market index. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The value of an investment in a different share class would be different.

|

| | | | | | | |

| CALVERT INTERNATIONAL EQUITY FUND |

| SEPTEMBER 30, 2015 |

| AVERAGE ANNUAL TOTAL RETURNS | Ticker Symbol | 1 Year | 5 Year | 10 Year |

| Class A (with max. load) | CWVGX | -9.29 | % | 2.14 | % | -0.03 | % |

| Class C (with max. load) | CWVCX | -6.62 | % | 2.20 | % | -0.41 | % |

| Class I | CWVIX | -4.27 | % | 3.83 | % | 1.15 | % |

| Class Y | CWEYX | -4.52 | % | 3.51 | % | 0.73 | % |

| MSCI EAFE Investable Market Index | | -7.16 | % | 4.84 | % | 3.72 | % |

| Lipper International Multi-Cap Growth Funds Average | | -5.79 | % | 3.85 | % | 3.19 | % |

| | | | | |

| Calvert International Equity Fund first offered Class Y shares on October 31, 2008. Performance prior to that date reflects the performance of Class A shares at net asset value (NAV). Actual Class Y share performance would have been different. |

| | | | | |

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions, and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data, including most recent month-end, visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.68%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED) 9

UNDERSTANDING YOUR FUND'S EXPENSES

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in this mutual fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by the fund's investors during the period. The actual and hypothetical information presented in the examples is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2015 to September 30, 2015).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. |

| | | | |

| | ANNUALIZED

EXPENSE RATIO | BEGINNING

ACCOUNT VALUE

4/1/15 | ENDING

ACCOUNT VALUE

9/30/15 | EXPENSES PAID

DURING PERIOD*

4/1/15 - 9/30/15 |

| Class A | | | | |

| Actual | 1.38% | $1,000.00 | $937.60 | $6.70 |

| Hypothetical (5% return per year before expenses) | 1.38% | $1,000.00 | $1,018.15 | $6.98 |

| Class C | | | | |

| Actual | 2.14% | $1,000.00 | $933.50 | $10.37 |

| Hypothetical (5% return per year before expenses) | 2.14% | $1,000.00 | $1,014.34 | $10.81 |

| Class I | | | | |

| Actual | 0.95% | $1,000.00 | $939.40 | $4.62 |

| Hypothetical (5% return per year before expenses) | 0.95% | $1,000.00 | $1,020.31 | $4.81 |

| Class Y | | | | |

| Actual | 1.13% | $1,000.00 | $938.70 | $5.49 |

| Hypothetical (5% return per year before expenses) | 1.13% | $1,000.00 | $1,019.40 | $5.72 |

| | | | | |

| * Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). Expense ratios shown in the Financial Highlights represent the actual expenses incurred for the fiscal year. |

10 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (UNAUDITED)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors of Calvert World Values Fund, Inc. and Shareholders of Calvert International Equity Fund:

We have audited the accompanying statement of net assets of the Calvert International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., as of September 30, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2015 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert International Equity Fund as of September 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

November 25, 2015

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 11

CALVERT INTERNATIONAL EQUITY FUND

STATEMENT OF NET ASSETS

SEPTEMBER 30, 2015

|

| | |

| | SHARES | VALUE ($) |

| EQUITY SECURITIES - 91.2% | | |

| | | |

| Belgium - 0.6% | | |

Ageas (ADR) | 49,904 | 2,042,072 |

| | | |

| France - 12.9% | | |

| AXA SA (ADR) | 271,355 | 6,602,067 |

| BNP Paribas SA | 47,113 | 2,771,305 |

| BNP Paribas SA (ADR) | 162,367 | 4,802,816 |

| Credit Agricole SA (ADR) | 214,378 | 1,217,667 |

| Ipsen SA (ADR) | 118,735 | 1,824,957 |

| Orange SA | 253,725 | 3,832,990 |

| Orange SA (ADR) | 217,395 | 3,287,012 |

| Sanofi SA | 35,864 | 3,412,938 |

| Sanofi SA (ADR) | 217,706 | 10,334,504 |

| Suez Environnement Co. | 298,495 | 5,363,179 |

| Suez Environnement Co. (ADR) | 37,117 | 332,940 |

| Valeo SA (ADR) | 24,671 | 1,667,019 |

| | | 45,449,394 |

| | | |

| Germany - 6.6% | | |

| Allianz SE | 48,317 | 7,564,850 |

| Allianz SE (ADR) | 390,467 | 6,102,999 |

| Deutsche Post AG | 164,873 | 4,558,220 |

| Deutsche Post AG (ADR) | 174,622 | 4,840,522 |

| | | 23,066,591 |

| | | |

| Hong Kong - 0.8% | | |

BOC Hong Kong Holdings Ltd. (ADR) | 46,638 | 2,763,768 |

| | | |

| Japan - 19.2% | | |

| Mizuho Financial Group, Inc. | 3,131,400 | 5,890,236 |

| Mizuho Financial Group, Inc. (ADR) | 1,134,770 | 4,209,997 |

| MS&AD Insurance Group Holdings, Inc. (ADR) | 155,752 | 2,088,634 |

| Nippon Telegraph & Telephone Corp. | 250,800 | 8,820,525 |

| Nippon Telegraph & Telephone Corp. (ADR) | 170,981 | 6,037,339 |

| Nissan Motor Co. Ltd. | 901,336 | 8,314,410 |

| Nissan Motor Co. Ltd. (ADR) | 266,570 | 4,950,205 |

| Nomura Holdings, Inc. | 1,281,243 | 7,444,604 |

| Nomura Holdings, Inc. (ADR) | 963,766 | 5,609,118 |

|

| | |

| | SHARES | VALUE ($) |

| Toyota Motor Corp.(t) | 135,137 | 7,959,273 |

| Toyota Motor Corp. (ADR) | 53,368 | 6,258,999 |

| | | 67,583,340 |

| | | |

| Netherlands - 8.0% | | |

| Koninklijke Ahold NV (ADR) | 249,710 | 4,866,848 |

| Koninklijke Ahold NV, Amsterdam Stock Exchange | 311,105 | 6,065,442 |

| Koninklijke Philips NV: | | |

| Common | 61,768 | 1,454,910 |

| NY Shares | 110,944 | 2,602,746 |

| Unilever NV (CVA) | 213,120 | 8,567,650 |

| Unilever NV, NY Shares | 109,014 | 4,382,363 |

| | | 27,939,959 |

| | | |

| New Zealand - 0.5% | | |

| Spark New Zealand Ltd. | 428,639 | 816,576 |

| Spark New Zealand Ltd. (ADR) | 93,967 | 894,566 |

| | | 1,711,142 |

| | | |

| Norway - 2.9% | | |

| Statoil ASA | 276,311 | 4,022,782 |

| Statoil ASA (ADR) | 330,453 | 4,811,396 |

| Yara International ASA (ADR) | 37,046 | 1,485,915 |

| | | 10,320,093 |

| | | |

| Singapore - 0.5% | | |

Singapore Telecommunications Ltd. (ADR) | 75,343 | 1,900,904 |

| | | |

| South Africa - 1.0% | | |

| Aspen Pharmacare Holdings Ltd.* | 122,151 | 2,604,193 |

| MTN Group Ltd. (ADR) | 77,381 | 990,477 |

| | | 3,594,670 |

| | | |

| Spain - 3.8% | | |

| Banco Bilbao Vizcaya Argentaria SA | 1,133,449 | 9,603,256 |

| Banco Bilbao Vizcaya Argentaria SA (ADR) | 446,445 | 3,736,745 |

| | | 13,340,001 |

| | | |

12 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

|

| | | | |

| | SHARES | VALUE ($) |

| Sweden - 3.6% | | |

| Atlas Copco AB (ADR): | | |

| A Shares | 108,608 | 2,619,625 |

|

| B Shares | 45,265 | 1,012,035 |

|

| Atlas Copco AB, A Shares | 371,126 | 8,922,426 |

|

| | | 12,554,086 |

|

| | | |

| Switzerland - 9.8% | | |

| Novartis AG | 70,135 | 6,442,949 |

|

| Novartis AG (ADR) | 90,608 | 8,328,687 |

|

| Roche Holding AG | 31,383 | 8,273,725 |

|

| Roche Holding AG (ADR) | 47,060 | 1,550,627 |

|

| Swiss Re AG | 78,186 | 6,702,593 |

|

| Swiss Re AG (ADR) | 42,500 | 913,750 |

|

Zurich Insurance Group AG (ADR)* | 94,607 | 2,323,548 |

|

| | | 34,535,879 |

|

| | | |

| United Kingdom - 17.4% | | |

| AstraZeneca plc | 55,335 | 3,508,613 |

|

| AstraZeneca plc (ADR) | 163,515 | 5,203,047 |

|

| Barclays plc | 1,963,031 | 7,250,957 |

|

| Barclays plc (ADR) | 286,993 | 4,241,757 |

|

| GlaxoSmithKline plc | 195,720 | 3,748,551 |

|

| GlaxoSmithKline plc (ADR) | 112,096 | 4,310,091 |

|

| J Sainsbury plc | 1,364,910 | 5,397,189 |

|

| J Sainsbury plc (ADR) | 300,535 | 4,748,453 |

|

| SSE plc | 231,575 | 5,247,107 |

|

| SSE plc (ADR) | 279,454 | 6,371,551 |

|

| Standard Chartered plc | 659,315 | 6,404,076 |

|

| Unilever plc | 10,526 | 428,400 |

|

| Unilever plc (ADR) | 104,800 | 4,273,744 |

|

| | | 61,133,536 |

|

| | | |

| United States - 3.4% | | |

| Apple, Inc. | 43,996 | 4,852,759 |

|

| Applied Industrial Technologies, Inc. | 186,061 | 7,098,227 |

|

| | | 11,950,986 |

|

| | | |

| Venture Capital - 0.2% | | |

Bioceptive, Inc., Series A, Preferred (a)(b)(i)* | 582,574 | 299,967 |

|

| FINAE, Series D, Preferred (b)(i)* | 2,597,442 | 203,960 |

|

| Powerspan Corp., Contingent Deferred Distribution (b)(i)* | 1 | — |

|

| | | 503,927 |

|

| | | |

|

| | | | |

| | SHARES | VALUE ($) |

Total Equity Securities (Cost $345,302,129) | | 320,390,348 |

|

| | | |

| | | |

| | ADJUSTED BASIS ($) | VALUE ($) |

|

VENTURE CAPITAL LIMITED PARTNERSHIP INTEREST - 0.5% | | |

| Africa Renewable Energy Fund LP (b)(i)* | 344,664 | 301,316 |

|

| BFSE Holding, BV LP (b)(i)* | 481,870 | 338,409 |

|

| Blackstone Clean Technology Partners LP (b)(i)* | 78,853 | 27,058 |

|

| China Environment Fund 2004 LP (b)(i)* | 462,236 | 123,854 |

|

| Emerald Sustainability Fund I LP (b)(i)* | 1,246,310 | 272,189 |

|

| gNet Defta Development Holdings LLC, LP (a)(b)(i)* | 400,000 | 313,541 |

|

| Mainstream Brazil Impact Investing Fund LP (b)(i)* | 18,422 | — |

|

| SEAF Central and Eastern European Growth Fund LLC, LP (a)(b)(i)* | 1,060,000 | 316,913 |

|

| SEAF India International Growth Fund LP (b)(i)* | 482,500 | 83,614 |

|

| Terra Capital (b)(i)* | 469,590 | 1 |

|

| | | |

Total Venture Capital Limited Partnership Interest (Cost $2,896,431) | | 1,776,895 |

|

| | | |

| | | |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.2% | PRINCIPAL

AMOUNT ($) | |

| AFIG LLC, 6.00%, 10/17/17 (b)(i) | 450,953 | 450,953 |

|

| FINAE: | | |

| Note I, 6.50%, 12/1/15 (b)(i) | 62,500 | 62,500 |

|

| Note II, 6.50%, 12/1/15 (b)(i) | 125,000 | 125,000 |

|

Windhorse International-Spring Health Water Ltd., 1.00%, 3/14/18 (b)(i)(u) | 70,000 | 52,500 |

|

| | | |

| Total Venture Capital Debt Obligations (Cost $708,452) | | 690,953 |

|

| | | |

| | | |

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 13

|

| | | | |

| HIGH SOCIAL IMPACT INVESTMENTS - 1.2% | SHARES | VALUE ($) |

Calvert Social Investment Foundation Notes, 0.25%, 7/1/17 (b)(i)(r) | 4,431,583 | 4,293,415 |

|

| | | |

| Total High Social Impact Investments (Cost $4,431,583) | | 4,293,415 |

|

| TIME DEPOSIT - 13.0% | | |

| State Street Bank Time Deposit, 0.088%, 10/1/15 | 45,772,457 | 45,772,457 |

|

| | | |

Total Time Deposit (Cost $45,772,457) | | 45,772,457 |

|

| | | |

| | | |

| TOTAL INVESTMENTS (Cost $399,111,052) - 106.1% | | 372,924,068 |

|

| Other assets and liabilities, net - (6.1%) | | (21,597,297) |

|

NET ASSETS - 100.0% | |

| $351,326,771 |

|

|

| | | |

| NET ASSETS CONSIST OF: | |

| Paid-in capital applicable to the following shares of common stock, with 250,000,000 shares of $0.01 par value shares authorized: | |

| Class A: 10,706,550 shares outstanding |

| $264,692,076 |

|

| Class C: 1,187,167 shares outstanding | 31,480,478 |

|

| Class I: 8,824,625 shares outstanding | 193,481,605 |

|

| Class Y: 1,238,872 shares outstanding | 20,255,665 |

|

| Undistributed net investment income | 4,124,476 |

|

| Accumulated net realized gain (loss) on investments and foreign currency transactions | (136,513,607) |

|

| Net unrealized appreciation (depreciation) on investments and assets and liabilities denominated in foreign currencies | (26,193,922) |

|

| | |

| NET ASSETS |

| $351,326,771 |

|

| | |

| NET ASSET VALUE PER SHARE | |

| Class A (based on net assets of $167,224,905) |

| $15.62 |

|

| Class C (based on net assets of $15,997,034) |

| $13.47 |

|

| Class I (based on net assets of $147,613,901) |

| $16.73 |

|

| Class Y (based on net assets of $20,490,931) |

| $16.54 |

|

|

| |

| NOTES TO STATEMENT OF NET ASSETS |

| (a) | Affiliated company. |

| (b) | This security was valued under the direction of the Board of Directors. See Note A. |

| (i) | Restricted securities represent 2.1% of the net assets of the Fund. |

| (r) | The coupon rate shown on floating or adjustable rate securities represents the rate in effect on September 30, 2015. |

| (t) | 90,000 shares of Toyota Motor Corp. have been soft segregated in order to cover outstanding commitments to certain limited partnerships investments within the Fund. There are no restrictions on the trading of this security. |

| (u) | Security defaulted as to principal and interest in March 2013. It has been restructured at a 9% rate maturing on March 14, 2018 with 1% to be paid annually and the remaining interest due at maturity. This security is currently accruing at 1%. |

| * | Non-income producing security. |

| Abbreviations: |

| ADR: | American Depositary Receipt |

| CVA: | Certificaten Van Aandelen |

| LLC: | Limited Liability Corporation |

| LP: | Limited Partnership |

| Ltd.: | Limited |

| plc: | Public Limited Company |

| See notes to financial statements. |

14 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

|

| | | |

| RESTRICTED SECURITIES | ACQUISITON DATES | COST ($) |

| AFIG LLC | 10/11/12-10/15/12 | 450,953 |

|

| Africa Renewable Energy Fund LP | 4/17/14 - 7/2/15 | 344,664 |

|

| BFSE Holding, BV LP | 1/12/06 - 6/11/14 | 604,246 |

|

| Bioceptive, Inc., Series A, Preferred | 10/26/12 - 12/18/13 | 252,445 |

|

| Blackstone Clean Technology Partners LP | 7/29/10 - 6/25/15 | 78,853 |

|

| Calvert Social Investment Foundation Notes, 0.25%, 7/1/17 | 7/1/14 | 4,431,583 |

|

| China Environment Fund 2004 LP | 9/15/05 - 4/1/09 | — |

|

| Emerald Sustainability Fund I LP | 7/19/01 - 5/17/11 | 425,186 |

|

| FINAE, Series D, Preferred | 2/28/11 | 252,686 |

|

| FINAE, Note I, 6.50%, 12/1/15 | 12/10/10 | 62,500 |

|

| FINAE, Note II, 6.50%, 12/1/15 | 2/24/11 | 125,000 |

|

| gNet Defta Development Holdings LLC, LP | 8/30/05 | 400,000 |

|

| Mainstream Brazil Impact Investing Fund LP | 12/12/14 - 3/25/15 | 18,422 |

|

| Powerspan Corp., Contingent Deferred Distribution | 7/11/14 | — |

|

| SEAF Central and Eastern European Growth Fund LLC, LP | 8/10/00 - 8/26/11 | 317,335 |

|

| SEAF India International Growth Fund LP | 3/22/05 - 5/24/10 | 238,135 |

|

| Terra Capital LP | 11/23/98 - 3/14/06 | 469,590 |

|

| Windhorse International-Spring Health Water Ltd., 1.00%, 3/14/18 | 2/12/14 | 70,000 |

|

| See notes to financial statements. |

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 15

CALVERT INTERNATIONAL EQUITY FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMPER 30, 2015

|

| | | | | |

| NET INVESTMENT INCOME | | |

| Investment Income: | | |

| Dividend income (net of foreign taxes withheld of $944,579) | |

| $9,989,278 |

|

| Interest income | | 54,258 |

|

| Total investment income | | 10,043,536 |

|

| | | |

| Expenses: | | |

| Investment advisory fee | | 2,822,908 |

|

| Administrative fees | | 1,120,384 |

|

| Transfer agency fees and expenses | | 565,599 |

|

| Distribution Plan expenses: | | |

| Class A | | 592,604 |

|

| Class B (a) | | 9,510 |

|

| Class C | | 170,741 |

|

| Directors' fees and expenses | | 36,300 |

|

| Accounting fees | | 38,363 |

|

| Custodian fees | | 164,729 |

|

| Professional fees | | 44,689 |

|

| Registration fees | | 71,913 |

|

| Reports to shareholders | | 39,260 |

|

| Miscellaneous | | 112,648 |

|

| Total expenses | | 5,789,648 |

|

| Reimbursement from Advisor: | | |

| Class A | | (305,073) |

|

| Class B (a) | | (7,560) |

|

| Class C | | (36,507) |

|

| Class I | | (46,574) |

|

| Class Y | | (31,244) |

|

| Net expenses | | 5,362,690 |

|

| | | |

| NET INVESTMENT INCOME | | 4,680,846 |

|

| | | |

| REALIZED AND UNREALIZED GAIN (LOSS) | | |

| Net realized gain (loss) on: | | |

| Investments | | 26,700,045 |

|

| Foreign currency transactions | | (721,042) |

|

| | | 25,979,003 |

|

| | | |

| Change in unrealized appreciation (depreciation) on: | | |

| Investments in unaffiliated securities | | (46,510,373) |

|

| Investments in affiliated securities | | (54,006) |

|

| Assets and liabilities denominated in foreign currencies | | 26,209 |

|

| | | (46,538,170) |

|

| | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | (20,559,167) |

|

| | | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | |

| ($15,878,321 | ) |

| (a) | Class B shares were converted into Class A shares at the close of business on April 20, 2015. | | |

| See notes to financial statements. |

16 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

CALVERT INTERNATIONAL EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

| | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | YEAR ENDED

SEPTEMBER 30, 2015 | | YEAR ENDED

SEPTEMBER 30, 2014 |

| Operations: | | | |

| Net investment income |

| $4,680,846 |

| |

| $3,856,887 |

|

| Net realized gain (loss) | 25,979,003 |

| | 38,182,047 |

|

| Change in unrealized appreciation (depreciation) | (46,538,170) |

| | (39,050,285) |

|

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | (15,878,321) |

| | 2,988,649 |

|

| | | | |

| Distributions to shareholders from: | | | |

| Net investment income: | | | |

| Class A shares | (1,631,419) |

| | (1,441,168) |

|

| Class I shares | (1,067,547) |

| | (1,465,772) |

|

| Class Y shares | (128,897) |

| | (125,098) |

|

| Total distributions | (2,827,863) |

| | (3,032,038) |

|

| | | | |

| Capital share transactions: | | | |

| Shares sold: | | | |

| Class A shares (b) | 66,145,855 |

| | 58,755,990 |

|

| Class B shares (a) | 16,461 |

| | 22,810 |

|

| Class C shares | 2,588,056 |

| | 2,254,459 |

|

| Class I shares | 87,412,574 |

| | 15,405,740 |

|

| Class Y shares | 8,115,882 |

| | 9,173,420 |

|

| Reinvestment of distributions: | | | |

| Class A shares | 1,180,433 |

| | 1,068,320 |

|

| Class I shares | 878,598 |

| | 1,195,493 |

|

| Class Y shares | 88,086 |

| | 72,616 |

|

| Redemption fees: | | | |

| Class A shares | 442 |

| | 3,602 |

|

| Class C shares | 22 |

| | 227 |

|

| Shares redeemed: | | | |

| Class A shares | (157,566,212) |

| | (38,938,256) |

|

| Class B shares (a)(b) | (2,086,695) |

| | (1,205,154) |

|

| Class C shares | (2,791,010) |

| | (2,857,013) |

|

| Class I shares | (22,631,854) |

| | (6,486,688) |

|

| Class Y shares | (4,015,663) |

| | (1,959,045) |

|

| Total capital share transactions | (22,665,025) |

| | 36,506,521 |

|

| | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (41,371,209) |

| | 36,463,132 |

|

| See notes to financial statements. |

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 17

|

| | | | | | | | |

| NET ASSETS | YEAR ENDED

SEPTEMBER 30, 2015 | | YEAR ENDED

SEPTEMBER 30, 2014 |

| Beginning of year |

| $392,697,980 |

| |

| $356,234,848 |

|

| End of year (including undistributed net investment income of $4,124,476 and $2,266,246, respectively) |

| $351,326,771 |

| |

| $392,697,980 |

|

| | | | |

| CAPITAL SHARE ACTIVITY | | | |

| Shares sold: | | | |

| Class A shares (c) | 3,961,337 |

| | 3,451,461 |

|

| Class B shares (a) | 1,117 |

| | 1,517 |

|

| Class C shares | 178,700 |

| | 152,718 |

|

| Class I shares | 4,800,946 |

| | 846,818 |

|

| Class Y shares | 461,877 |

| | 510,073 |

|

| Reinvestment of distributions: | | | |

| Class A shares | 73,137 |

| | 62,658 |

|

| Class I shares | 51,022 |

| | 65,795 |

|

| Class Y shares | 5,163 |

| | 4,041 |

|

| Shares redeemed: | | | |

| Class A shares | (9,300,506) |

| | (2,290,221) |

|

| Class B shares (a)(c) | (140,247) |

| | (80,280) |

|

| Class C shares | (194,622) |

| | (193,947) |

|

| Class I shares | (1,248,932) |

| | (355,259) |

|

| Class Y shares | (230,027) |

| | (108,621) |

|

| Total capital share activity | (1,581,035) |

| | 2,066,753 |

|

| | | | |

| (a) | Class B shares were converted into Class A shares at the close of business on April 20, 2015. |

| (b) | Amounts include $1,452,680 of share transactions that were redeemed from Class B shares and converted into Class A shares at the close of business on April 20, 2015. |

| (c) | Amount includes 96,332 shares redeemed from Class B shares and 84,213 shares purchased into Class A shares at the close of business on April 20,2015. |

| See notes to financial statements. |

18 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert International Equity Fund (the "Fund"), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert World Values Fund, Inc. is comprised of four separate series. The operations of each series are accounted for separately. The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946).

The Fund offers four classes of shares of capital stock - Classes A, C, I, and Y. The Fund also offered Class B shares; however, all existing Class B shares of the Fund were automatically converted to Class A shares of the Fund at the close of business on April 20, 2015, without the imposition of the applicable Class A sales load or the Class B contingent deferred sales charge. Class B shares were closed at that time and are no longer available. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived in certain other instances where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries, foundations, and endowments that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each class has different: (a) dividend rates due to differences in Distribution Plan expenses and other class specific expenses, (b) exchange privileges and (c) class specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. U.S. generally accepted accounting principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the year. Transfers in and/or out of levels are determined based on the fair value of such securities at the end of the year. Valuation techniques used to value the Fund’s investments by major category are as follows:

Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 19

principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account and are categorized as Level 2 in the hierarchy. The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters. Such securities would be categorized as Level 2 in the hierarchy in these circumstances. Utilizing this technique may result in transfers between Level 1 and Level 2. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are generally categorized as Level 3 in the hierarchy. Venture capital direct equity securities are generally valued using the most appropriate and applicable method to measure fair value in light of each company’s situation. Methods may include market, income or cost approaches with discounts as appropriate based on assumptions of liquidation or exit risk. Examples of the market approach are subsequent rounds of financing, comparable transactions, and revenue times an industry multiple. An example of the income approach is the discounted cash flow. Examples of the cost approach are replacement cost, salvage value, or net asset percentage. Venture capital limited partnership (“LP”) securities are valued at the fair value reported by the general partner of the partnership adjusted as necessary to reflect subsequent capital calls and distributions and any other available information, as a practical expedient. In the absence of a reported LP unit value, fair value may be estimated based on the Fund’s percentage equity in the partnership and/or other balance sheet information and portfolio value for the most recently available period reported by the general partner. In some cases adjustments may be made to account for daily pricing of material public holdings within the partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, other than Venture capital debt securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the Fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At September 30, 2015, securities valued at $7,265,190, or 2.1% of net assets, were fair valued in good faith under the direction of the Board.

20 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

The following table summarizes the market value of the Fund's holdings as of September 30, 2015, based on the inputs used to value them:

|

| | | | | | | | | | | | | |

| VALUATION INPUTS |

| INVESTMENT IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Equity Securities* |

| $158,492,496 |

| $161,393,925** |

| $— |

|

| $319,886,421 |

|

| Equity Securities - Venture Capital | — |

| — |

| 503,927 |

| 503,927 |

|

| Venture Capital Limited Partnership | | | | |

| Interest | — |

| — |

| 1,776,895 |

| 1,776,895 |

|

| Venture Capital Debt Obligations | — |

| — |

| 690,953 |

| 690,953 |

|

| High Social Impact Investments | — |

| 4,293,415 |

| — |

| 4,293,415 |

|

| Time Deposit | — |

| 45,772,457 |

| — |

| 45,772,457 |

|

| TOTAL |

| $158,492,496 |

|

| $211,459,797 |

| $2,971,775*** |

|

| $372,924,068 |

|

| | | | | | |

| * | For a further breakdown of equity securities by country, please refer to the Statement of Net Assets. |

| ** | Includes certain securities trading primarily outside the U.S. whose value was adjusted as a result of significant market movements following the close of local trading. On September 30, 2015, price movements exceeded specified parameters and the third party fair value pricing service quantitatively fair valued the affected securities. |

| *** | Level 3 securities represent 0.8% of net assets. |

On September 30, 2015, price movements exceeded specified parameters and the third party fair value pricing service quantitatively fair valued the affected securities. As a result, $161,393,925 transferred out of Level 1 into Level 2. The amount of this transfer was determined based on the fair value of the securities at the end of the year.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Statement of Net Assets.

The Fund may invest in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from Calvert and its subsidiaries. The Fund has received an exemptive order from the Securities and Exchange Commission permitting the Fund to make investments in these notes under certain conditions.

Security Transactions and Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income, and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on investments and assets and liabilities denominated in foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from U.S. generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 21

Redemption Fees: The Fund charged a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase (within seven days for Class I shares). The redemption fee was accounted for as an addition to paid-in capital. This fee was eliminated effective February 2, 2015.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund's tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund's financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly, on the following rates of the Fund’s average daily net assets: .75% on the first $250 million, .725% on the next $250 million, and .675% on the excess of $500 million. Under the terms of the agreement, $215,433 was payable at year end.

The Advisor has contractually agreed to limit net annual Fund operating expenses through January 31, 2017. The contractual expense caps are 1.38%, 2.14%, .95%, and 1.13% for Class A, Class C, Class I, and Class Y, respectively. Prior to April 1, 2015, the contractual expense class was 1.10% and 1.39%, for Class I and Class Y, respectively. For the purpose of this expense limit, operating expenses do not include interest expense, brokerage commissions, taxes and extraordinary expenses. This expense limitation does not limit acquired fund fees and expenses, if any. Under the terms of the agreement, $12,285 was receivable at year end. The Advisor voluntarily reimbursed Class B shares for expenses of $7,560 for the year ended September 30, 2015.

Calvert Investment Administrative Services, Inc., an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .35% for Class A, C and Y shares and .15% for Class I shares, based on their average daily net assets. Under the terms of the agreement, $77,498 was payable at year end.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted a Distribution Plan that permits the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .35% and 1.00% annually of average daily net assets of Class A and C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly, of .25% and 1.00% of the Fund’s average daily net assets of Class A and C shares, respectively. Class I and Class Y shares do not have Distribution Plan expenses. Under the terms of the agreement, $48,267 was payable at year end.

CID received $43,455 as its portion of commissions charged on sales of the Fund’s Class A shares for the year ended September 30, 2015.

Calvert Investment Services, Inc. (“CIS”), an affiliate of the Advisor, acts as shareholder servicing agent for the Fund. For its services, CIS received a fee of $94,500 for the year ended September 30, 2015. Under the terms of the agreement, $7,793 was payable at year end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

Each Director of the Fund who is not an employee of the Advisor or its affiliates receives an annual retainer of $52,000 ($48,000 prior to January 1, 2015) plus a meeting fee of up to $3,000 for each Board meeting attended. Additional fees of $6,000 ($5,000 prior to January 1, 2015) annually may be paid to the Committee chairs ($10,000 for the Board Chair and the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Eligible Directors may participate in a Deferred Compensation Plan (the “Plan”). Obligations of the Plan will be paid solely out of the Fund’s assets. As of September 30, 2015, approximately $234,600 was deferred under the Plan. Directors’ fees are allocated to each of the funds served.

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the year, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $352,845,677 and $385,921,803, respectively.

The Fund may purchase securities, typically short-term variable rate demand notes, from or sell to other funds managed by the Advisor. These interportfolio transactions are primarily used for cash management purposes and are made pursuant to Rule 17a-7 of the Investment Company Act of 1940. For the year ended September 30, 2015, such sales transactions were $201,633. The realized loss on sales transactions was $92,252.

22 calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

|

| | | |

| Capital Loss Carryforward | |

| EXPIRATION DATE | |

| 2017 |

| ($19,653,860 | ) |

| 2018 |

| ($105,942,268 | ) |

| 2019 |

| ($10,386,632 | ) |

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred in taxable years beginning after December 22, 2010 can be carried forward to offset future capital gains for an unlimited period. These losses are required to be utilized prior to the losses incurred in pre-enactment taxable years and will retain their character as either long-term or short-term. Losses incurred in pre-enactment taxable years can be utilized until expiration. The Fund's use of net capital losses acquired from reorganizations may be limited under certain tax provisions.

The tax character of dividends and distributions paid during the year ended September 30, 2015 and September 30, 2014 was as follows:

|

| | | | | | | |

| DISTRIBUTIONS PAID FROM: | 2015 |

| | 2014 |

|

| Ordinary income |

| $2,827,863 |

| |

| $3,032,038 |

|

| Total |

| $2,827,863 |

| |

| $3,032,038 |

|

As of September 30, 2015, the tax basis components of distributable earnings/(accumulated losses) and the federal tax cost were as follows:

|

| | | |

| Unrealized appreciation |

| $4,073,038 |

|

| Unrealized (depreciation) | (30,790,869) |

|

| Net unrealized appreciation (depreciation) |

| ($26,717,831 | ) |

| | |

| Undistributed ordinary income |

| $4,124,476 |

|

| Capital loss carryforward |

| ($135,982,760 | ) |

| | |

| Federal income tax cost of investments |

| $399,641,899 |

|

The differences between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Net Assets are primarily due to temporary book-tax differences that will reverse in a subsequent period. These differences are mainly due to wash sales and partnerships.

Reclassifications, as shown in the table below, have been made to the Fund's components of net assets to reflect income and gains available for distribution (or available capital loss carryovers, as applicable) under income tax law and regulations. These reclassifications are due to permanent book-tax differences and have no impact on net assets. The primary permanent differences causing such reclassifications for the Fund are due to foreign currency transactions, partnerships, and passive foreign investment companies.

|

| | | |

| Undistributed net investment income |

| $5,247 |

|

| Accumulated net realized gain (loss) |

| ($5,247 | ) |

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .20% per annum is incurred on the unused portion of the committed facility. An administrative fee of $25,000 was paid in connection with the uncommitted facility. These fees are allocated to all participating funds. The Fund had no borrowings under the agreement during the year ended September 30, 2015.

calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 23

NOTE E — AFFILIATED COMPANIES

An affiliated company is a company in which the Fund has a direct or indirect ownership of, control of, or voting power of 5 percent or more of the outstanding voting shares. Affiliated companies of the Fund as of September 30, 2015 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | |

| Name of Affiliated Issuer | Market Value 9/30/14 | Purchases at Cost | Proceeds from Sales | Net Realized Gain (Loss) | Net Change in Unrealized Gain (Loss) | Market Value 9/30/15 | Dividend Income |

| Bioceptive, Inc., Series A, Preferred |

| $299,967 |

|

| $— |

|

| $— |

|

| $— |

|

| $— |

|

| $299,967 |

|

| $— |

|

| gNet Defta Development Holdings LLC, LP | 319,014 |

| — |

| — |

| — |

| (5,473 | ) | 313,541 |

| — |

|

| SEAF Central and Eastern European Growth Fund LLC, LP | 379,035 |

| — |

| (13,589 | ) | — |

| (48,533 | ) | 316,913 |

| — |

|

| Total |

| $998,016 |

|

| $— |

|

| ($13,589 | ) |

| $— |

|

| ($54,006 | ) |

| $930,421 |

|

| $— |

|

NOTE F — CAPITAL COMMITMENTS

In connection with certain venture capital investments, the Fund is committed to future capital calls, which will increase the Fund’s investment in these securities. The aggregate amount of the future capital commitments totals $1,219,773 at September 30, 2015.

NOTE G — LIMITED PARTNERSHIP INVESTMENT

The Fund executed agreements to invest in the following limited partnerships:

|

| | | | | | |

| Name of Partnership | Total Capital Commitment | Unfunded Commitment at 9/30/15 |

| Africa Renewable Energy Fund, LP |

| $1,000,000 |

|

| $655,336 |

|

| BFSE Holding, BV, LP |

| $494,429 |

|

| $14,178 |

|

| Blackstone Clean Technology Partners, LP |

| $79,361 |

|

| $508 |

|

| China Environment Fund 2004, LP |

| $500,000 |

|

| $37,764 |

|

| Emerald Sustainability Fund I, LP |

| $1,246,310 |

|

| $— |

|

| Mainstream Brazil Impact Investing Fund, LP |

| $500,000 |

|

| $481,578 |

|

| SEAF Central and Eastern European Growth Fund LLC, LP |

| $1,060,000 |

|

| $— |

|

| SEAF India International Growth Fund, LP |

| $482,500 |

|

| $— |

|

| Terra Capital |

| $500,000 |

|

| $30,410 |

|

NOTE H — SUBSEQUENT EVENTS