UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06563

CALVERT WORLD VALUES FUND, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2018

Date of Reporting Period

____________________________________________________________________________________

Item 1. Reports to Stockholders

Calvert International Equity Fund

Calvert Mid-Cap Fund

Calvert International Opportunities Fund

Calvert Emerging Markets Equity Fund

|

| | |

| | |

| | | |

Calvert International Equity Fund

| | |

| | | |

| | |

|

| |

Annual Report September 30, 2018 E-Delivery Sign-Up — Details Inside | |

|

|

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund and its adviser have claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser is subject to CFTC regulation. |

Choose Planet-friendly E-delivery! Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs. Just go to www.calvert.com. If you already have an online account with the Calvert funds, click on Login to access your Account and select the documents you would like to receive via e-mail. If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps. Note: If your shares are not held directly with the Calvert funds but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm. |

|

| | | | |

| | TABLE OF CONTENTS |

| | | | | |

| | | | | Management’s Discussion of Fund Performance |

| | | | | Performance |

| | | | | Fund Profile |

| | | | | Endnotes and Additional Disclosures |

| | | | | Fund Expenses |

| | | | | Financial Statements |

| | | | | Report of Independent Registered Public Accounting Firm |

| | | | | Federal Tax Information |

| | | | | Management and Organization |

| | | | | Important Notices |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE1 Economic and Market Conditions

Led by higher U.S. stocks, most global stock indexes advanced during the 12-month period ended September 30, 2018.

U.S. stocks opened the period on the upswing as investors anticipated, and then cheered passage of the Republican tax reform package in December 2017. Sharp cuts in corporate taxes - a key element of the bill - raised corporate-profit expectations. Stocks also got a boost from positive U.S. economic data, including the unemployment rate, which fell to a 17-year low.

Early in the period, global stocks followed U.S. stocks sharply higher. European stocks got a boost from growing economies and rising corporate profits across the region. Key equity indexes in the Asia-Pacific region also rose despite tensions with North Korea. China’s stock market advanced behind an accelerating housing market, rising retail sales, and strong foreign trade.

U.S. stocks pulled back in February 2018 amid fears that rising rates would spur inflation and boost the appeal of fixed-income investments at the expense of stocks. After a brief rebound, equity markets weakened in the spring of 2018, as investors confronted the prospect of a global trade war due to President Trump’s imposition of broad new tariffs. The protectionist move drew retaliatory action from impacted countries including China, Canada, and certain countries in the European Union.

European stocks also pulled back even more substantially amid mounting trade war concerns, before a partial recovery in the final months of the period. In China, signs of a slowing economy compounded trade war concerns, sending Chinese stocks into a prolonged slump that reached bear market territory in late June 2018.

U.S. stocks bounced back strongly in the final three months of the period. Technology stocks led the advance, overcoming an earlier setback from a wave of data-privacy scandals. U.S. economic indicators remained largely positive throughout the period, prompting the U.S. Federal Reserve to raise its benchmark interest rate three times over the 12-month span.

For the 12-month period ended September 30, 2018, the MSCI World Index,2 a proxy for global equities, advanced 11.24%. The MSCI EAFE Index of developed-market international equities rose 2.74%, while the MSCI Emerging Markets Index declined fractionally. In the U.S., the blue-chip Dow Jones Industrial Average® advanced 20.76%, while the broader U.S. equity market, as represented by the S&P 500® Index, gained 17.91%.

Fund Performance

For the 12-month period ended September 30, 2018, Calvert International Equity Fund (the Fund) returned 4.02% for Class A shares at net asset value (NAV), outperforming the MSCI EAFE Index (the Index), which returned 2.74%. Stock selection was the

major contributor to outperformance during the period. Sector allocation detracted from relative performance. The Fund, rather than making strategic sector allocations, uses a bottom-up, stock selection strategy that focuses on the strengths of each prospective investment. Looking at sector attribution, however, the leading contributors during the period were largely in the information technology, health care, and consumer sectors. Over the 12 months, the Fund increased the proportion of its investments in these sectors relative to the benchmark.

Calvert’s environmental, social, and governance (ESG) mandate means the Fund is limited to what it may hold in the energy and materials sectors. During the period, when oil prices rebounded strongly, the Fund’s underweight in the energy sector was the largest detractor from relative performance.

The largest individual contributor, Don Quijote Holdings Co. Ltd. (Don Quijote), continued to be one of the best managed Japanese retail companies. The acquisition of 20% of Uny, another Japanese retailer, produced positive results that surprised the market and led to the belief that Don Quijote may increase its ownership position in the future.

Lonza Group AG (Lonza), in the health care sector, was another leading contributor. Calvert initiated a position in Lonza in early 2018 following a drop in the company’s stock price. Lonza’s long-term strategy appears very promising. Calvert believes the company’s use of capital and new investments in cell, viral, and antibody therapies may help increase value.

Kering SA, a French luxury goods company that owns Gucci, further contributed to returns during the period. The strength of the rejuvenation of the Gucci brand surprised the market and led to unexpectedly strong earnings.

ING Groep NV (ING), a Dutch bank, was a detractor during the period as European banks performed poorly in general. In addition, ING agreed to a settlement with Dutch authorities over money-laundering charges that entailed a fine and management changes, including the replacement of its chief financial officer.

Continental AG, a German automotive supplier, also detracted from Fund performance. The company surprised the market with a warning in August 2018 that its profits would be significantly lower than anticipated as a result of increasingly weak auto markets and internal operational issues.

ConvaTec Group plc (ConvaTec), a medical products and technologies company that the Fund bought in hopes of a turnaround, was a major detractor. Calvert sold its position in ConvaTec during the period because of ongoing operational and management problems. Those assets were reallocated to buy Coloplast A/S., a significantly higher-performing competitor in the past.

|

|

See Endnotes and Additional Disclosures in this report. Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to www.calvert.com. |

2 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (Unaudited)

PERFORMANCE

|

| | | | | | | | | | | | | | |

Performance2,3 | | | | | | | | | |

Portfolio Managers Christopher M. Dyer, CFA and Ian Kirwan, each of Eaton Vance Advisers International Ltd. |

| | | | | | | | | | |

| % Average Annual Total Returns | Class Inception Date |

| | Performance Inception Date |

| | One Year |

| | Five Years |

| | Ten Years |

|

| Class A at NAV | 07/02/1992 |

| | 07/02/1992 |

| | 4.02 | % | | 2.57 | % | | 2.68 | % |

| Class A with 4.75% Maximum Sales Charge | — |

| | — |

| | -0.91 |

| | 1.57 |

| | 2.18 |

|

| Class C at NAV | 03/01/1994 |

| | 07/02/1992 |

| | 3.23 |

| | 1.75 |

| | 1.81 |

|

| Class C with 1% Maximum Sales Charge | — |

| | — |

| | 2.23 |

| | 1.75 |

| | 1.81 |

|

| Class I at NAV | 02/26/1999 |

| | 07/02/1992 |

| | 4.37 |

| | 3.05 |

| | 3.31 |

|

| | | | | | | | | | |

| | | | | | | | | | |

| MSCI EAFE Index | — |

| | — |

| | 2.74 | % | | 4.41 | % | | 5.38 | % |

| | | | | | | | | | |

% Total Annual Operating Expense Ratios4 | | | | | Class A |

| | Class C |

| | Class I |

|

| Gross | | | | | 1.60 | % | | 2.56 | % | | 1.08 | % |

| Net | | | | | 1.34 |

| | 2.09 |

| | 0.97 |

|

|

|

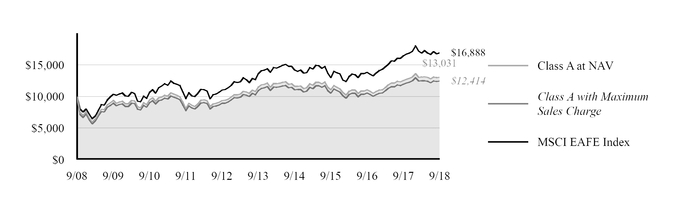

| Growth of $10,000 |

| This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index. |

|

| | | | | | | | |

| Growth of Investment | Amount Invested |

| Period Beginning | At NAV |

| With Maximum Sales Charge |

| Class C |

| $10,000 |

| 09/30/2008 |

| $11,972 |

| N.A. |

| Class I |

| $250,000 |

| 09/30/2008 |

| $346,362 |

| N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to www.calvert.com.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (Unaudited) 3

FUND PROFILE

|

| | | | | | | |

| |

| | | | | |

| | SECTOR ALLOCATION (% of total investments)5 | | | TEN LARGEST HOLDINGS (% of net assets)6 |

| | | | | | |

| | Industrials | 19.3 | % | | Nestle SA | 3.9 | % |

| | Financials | 19.3 | % | | Unilever plc | 3.2 | % |

| | Health Care | 14.1 | % | | adidas AG | 2.8 | % |

| | Consumer Staples | 13.5 | % | | Kao Corp. | 2.7 | % |

| | Consumer Discretionary | 12.8 | % | | ASML Holding NV | 2.7 | % |

| | Information Technology | 6.9 | % | | Lonza Group AG | 2.6 | % |

| | Materials | 5.9 | % | | Prudential plc | 2.5 | % |

| | Utilities | 2.5 | % | | Iberdrola SA | 2.5 | % |

| | High Social Impact Investments | 2.5 | % | | Melrose Industries plc | 2.4 | % |

| | Communication Services | 1.4 | % | | Ecolab, Inc. | 2.4 | % |

| | Energy | 1.0 | % | | Total | 27.7 | % |

| | Venture Capital Limited Partnership Interest | 0.7 | % | | | |

| | Venture Capital | 0.1 | % | | | |

| | Total | 100.0 | % | | | |

See Endnotes and Additional Disclosures in this report.

4 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (Unaudited)

|

| | |

| Endnotes and Additional Disclosures | | |

1 The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated on the cover. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission.

| |

2 | MSCI World Index is an unmanaged index of equity securities in the developed markets. MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Dow Jones Industrial Average® is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| |

3 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

Effective December 31, 2016, Calvert Research and Management became the investment adviser to the Fund and performance reflected prior to such date is that of the Fund’s former investment adviser, Calvert Investment Management, Inc.

4 Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/19. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report.

5 Does not include Short Term Investment of Cash Collateral for Securities Loaned.

6 Excludes cash and cash equivalents.

Fund profile subject to change due to active management.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (Unaudited) 5

FUND EXPENSES

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2018 to September 30, 2018).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

|

| | | | |

| | BEGINNING

ACCOUNT VALUE

(4/1/18) | ENDING

ACCOUNT VALUE

(9/30/18) | EXPENSES PAID

DURING PERIOD*

(4/1/18 - 9/30/18) | ANNUALIZED

EXPENSE RATIO |

| Actual | | | | |

| Class A | $1,000.00 | $996.60 | $6.61** | 1.32% |

| Class C | $1,000.00 | $992.70 | $10.34** | 2.07% |

| Class I | $1,000.00 | $998.40 | $4.76** | 0.95% |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,018.45 | $6.68** | 1.32% |

| Class C | $1,000.00 | $1,014.69 | $10.45** | 2.07% |

| Class I | $1,000.00 | $1,020.31 | $4.81** | 0.95% |

| | | | | |

| * Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2018. |

| ** Absent a waiver and/or reimbursement of expenses by affiliates, expenses would be higher. |

6 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT (Unaudited)

CALVERT INTERNATIONAL EQUITY FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2018

|

| | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - 96.2% | | |

| Australia - 3.3% | | |

| Challenger Ltd. | 379,279 | 3,068,893 |

| CSL Ltd. | 21,570 | 3,134,107 |

| | | 6,203,000 |

| | | |

| Canada - 1.9% | | |

| CAE, Inc. | 178,366 | 3,620,761 |

| | | |

| Denmark - 3.9% | | |

| Coloplast A/S, Class B | 37,223 | 3,802,531 |

| Novo Nordisk A/S, Class B | 78,885 | 3,712,727 |

| | | 7,515,258 |

| | | |

| France - 3.8% | | |

| Kering SA | 6,431 | 3,449,300 |

| Legrand SA | 53,127 | 3,873,818 |

| | | 7,323,118 |

| | | |

| Germany - 6.2% | | |

| adidas AG | 21,533 | 5,266,099 |

| Continental AG | 16,007 | 2,781,131 |

| SAP SE | 31,414 | 3,862,777 |

| | | 11,910,007 |

| | | |

| Hong Kong - 2.4% | | |

| AIA Group Ltd. | 505,537 | 4,507,830 |

| | | |

| Ireland - 1.6% | | |

| Kerry Group plc, Class A | 27,887 | 3,084,006 |

| | | |

| Japan - 20.2% | | |

| Don Quijote Holdings Co. Ltd. | 87,000 | 4,402,517 |

| FP Corp. (1) | 57,900 | 3,521,449 |

| Japan Lifeline Co. Ltd. (1) | 127,800 | 2,701,613 |

| Kao Corp. | 63,741 | 5,148,857 |

| Komatsu Ltd. | 117,702 | 3,581,778 |

| MISUMI Group, Inc. | 106,335 | 2,751,363 |

| Mitsubishi UFJ Financial Group, Inc. | 678,043 | 4,212,470 |

| ORIX Corp. (1) | 250,200 | 4,051,143 |

| Santen Pharmaceutical Co. Ltd. | 266,492 | 4,225,450 |

| Seven & I Holdings Co. Ltd. | 86,917 | 3,875,187 |

| | | 38,471,827 |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 7

|

| | | |

| | SHARES | VALUE ($) |

| COMMON STOCKS - CONT’D | | |

| Netherlands - 4.7% | | |

| ASML Holding NV | 27,161 | 5,099,602 |

|

| ING Groep NV | 303,770 | 3,942,660 |

|

| | | 9,042,262 |

|

| | | |

| Singapore - 1.8% | | |

| DBS Group Holdings Ltd. | 182,428 | 3,480,205 |

|

| | | |

| South Africa - 1.4% | | |

| Naspers Ltd., Class N | 12,472 | 2,685,831 |

|

| | | |

| Spain - 4.6% | | |

| Iberdrola SA | 653,844 | 4,802,387 |

|

| Industria de Diseno Textil SA | 130,398 | 3,939,528 |

|

| | | 8,741,915 |

|

| | | |

| Sweden - 8.1% | | |

| Assa Abloy AB, Class B | 209,363 | 4,196,447 |

|

| Atlas Copco AB, Class A | 102,305 | 2,942,105 |

|

| Indutrade AB | 148,245 | 4,008,470 |

|

| Swedbank AB, Class A | 171,601 | 4,244,062 |

|

| | | 15,391,084 |

|

| | | |

| Switzerland - 8.2% | | |

| Lonza Group AG | 14,710 | 5,032,252 |

|

| Nestle SA | 88,783 | 7,389,991 |

|

| Sika AG | 22,028 | 3,205,503 |

|

| | | 15,627,746 |

|

| | | |

| Taiwan - 2.2% | | |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 94,362 | 4,167,026 |

|

| | | |

| United Kingdom - 16.5% | | |

| Aviva plc | 660,588 | 4,214,861 |

|

| Compass Group plc | 203,048 | 4,514,431 |

|

| GlaxoSmithKline plc | 204,665 | 4,104,497 |

|

| Melrose Industries plc | 1,736,821 | 4,520,918 |

|

| Prudential plc | 212,854 | 4,880,328 |

|

| Unilever plc | 112,206 | 6,163,936 |

|

| Weir Group plc (The) | 137,474 | 3,153,906 |

|

| | | 31,552,877 |

|

| | | |

8 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

|

| | | |

| United States - 5.4% | | |

| Ecolab, Inc. | 28,826 | 4,519,340 |

|

| Oceaneering International, Inc. (2) | 67,275 | 1,856,790 |

|

| Xylem, Inc. | 49,499 | 3,953,485 |

|

| | | 10,329,615 |

|

| | | |

| Total Common Stocks (Cost $162,178,795) | | 183,654,368 |

|

| | | |

| | | |

| PREFERRED STOCKS - 0.1% | | |

| Venture Capital - 0.1% | | |

| Bioceptive, Inc.: | | |

| Series A (2)(3)(4) | 582,574 | — |

|

| Series B (2)(3)(4) | 40,523 | — |

|

| FINAE, Series D (2)(3)(4) | 2,597,442 | 184,599 |

|

| | | 184,599 |

|

| | | |

| Total Preferred Stocks (Cost $491,304) | | 184,599 |

|

| | | |

| | | |

| | | VALUE ($) |

|

| VENTURE CAPITAL LIMITED PARTNERSHIP INTERESTS - 0.7% | | |

| Africa Renewable Energy Fund LP (2)(3)(4) | | 891,286 |

|

| Blackstone Clean Technology Partners LP (2)(3)(4) | | 11,560 |

|

| China Environment Fund 2004 LP (2)(3)(4) | | 3,779 |

|

| Emerald Sustainability Fund I LP (2)(3)(4) | | 85,580 |

|

| gNet Defta Development Holding LLC (2)(3)(4)(5) | | 257,618 |

|

| SEAF Central and Eastern European Growth Fund LLC (2)(3)(4)(5) | | 39,099 |

|

| SEAF India International Growth Fund LP (2)(3)(4) | | 26,763 |

|

| | | |

| Total Venture Capital Limited Partnership Interests (Cost $2,119,560) | | 1,315,685 |

|

| | | |

| | | |

| | PRINCIPAL AMOUNT ($) | VALUE ($) |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.0% | | |

| Windhorse International-Spring Health Water Ltd., 1.00%, 3/15/19 (3)(4)(6) | 70,000 | — |

|

| | | |

| Total Venture Capital Debt Obligations (Cost $70,000) | | — |

|

| | | |

| | | |

| HIGH SOCIAL IMPACT INVESTMENTS - 2.5% | | |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/19 (3)(5) | 4,431,583 | 4,264,734 |

|

| ImpactAssets Inc., Global Sustainable Agriculture Notes, 2.50%, 11/3/20 (3)(4)(7) | 220,000 | 206,580 |

|

| ImpactAssets Inc., Microfinance Plus Notes, 2.40%, 11/3/20 (3)(4)(7) | 283,000 | 258,945 |

|

| | | |

| Total High Social Impact Investments (Cost $4,934,583) | | 4,730,259 |

|

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 9

|

| | |

| | SHARES | VALUE ($) |

| SHORT TERM INVESTMENT OF CASH COLLATERAL FOR SECURITIES LOANED - 0.9% | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 2.16% | 1,696,404 | 1,696,404 |

| | | |

| Total Short Term Investment of Cash Collateral for Securities Loaned (Cost $1,696,404) | | 1,696,404 |

| | | |

| | | |

| TOTAL INVESTMENTS (Cost $171,490,646) - 100.4% | | 191,581,315 |

| Other assets and liabilities, net - (0.4%) | | (778,525) |

NET ASSETS - 100.0% | | 190,802,790 |

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| (1) All or a portion of this security was on loan at September 30, 2018. The aggregate market value of securities on loan at September 30, 2018 was $9,609,101. |

| (2) Non-income producing security. |

| (3) Restricted security. Total market value of restricted securities amounts to $6,230,543, which represents 3.3% of the net assets of the Fund as of September 30, 2018. |

| (4) For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 1A). |

| (5) Affiliated company (see Note 7). |

| (6) Security defaulted as to principal and interest in March 2013. It has been restructured at a 9% rate maturing on March 15, 2019 with 1% to be paid annually and the remaining interest due at maturity. As of September 30, 2018, security is in default with respect to its annual 1% interest payment. |

| (7) Notes carry an interest rate that varies by period and is contingent on the performance of the underlying portfolio of loans to borrowers. The coupon rate shown represents the rate in effect at September 30, 2018. |

| |

| Abbreviations: |

| ADR: | American Depositary Receipt | |

At September 30, 2018, the concentration of the Fund’s investments in the various sectors, determined as a percentage of total investments, was as follows:

|

| | |

| ECONOMIC SECTORS | (% OF TOTAL INVESTMENTS)* |

| Industrials | 19.3 | % |

| Financials | 19.3 | % |

| Health Care | 14.1 | % |

| Consumer Staples | 13.5 | % |

| Consumer Discretionary | 12.8 | % |

| Information Technology | 6.9 | % |

| Materials | 5.9 | % |

| Utilities | 2.5 | % |

| High Social Impact Investments | 2.5 | % |

| Communication Services | 1.4 | % |

| Energy | 1.0 | % |

| Venture Capital Limited Partnership Interests | 0.7 | % |

| Venture Capital | 0.1 | % |

| Total | 100.0 | % |

| * Does not include Short Term Investment of Cash Collateral for Securities Loaned. | |

10 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

|

| | | |

| RESTRICTED SECURITIES | ACQUISITION

DATES | COST ($) |

| Africa Renewable Energy Fund LP | 4/17/14-8/24/18 | 879,466 |

|

| Bioceptive, Inc., Series A | 10/26/12-12/18/13 | 252,445 |

|

| Bioceptive, Inc., Series B | 1/7/16 | 16,250 |

|

| Blackstone Clean Technology Partners LP | 7/29/10-6/25/15 | 78,853 |

|

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/19 | 12/15/16 | 4,431,583 |

|

| China Environment Fund 2004 LP | 9/15/05-4/1/09 | — |

|

| Emerald Sustainability Fund I LP | 7/19/01-5/17/11 | 395,432 |

|

| FINAE, Series D | 2/28/11-11/16/15 | 222,609 |

|

| gNet Defta Development Holding LLC | 8/30/05 | 400,000 |

|

| ImpactAssets Inc., Global Sustainable Agriculture Notes, 2.50%, 11/3/20 | 11/13/15 | 220,000 |

|

| ImpactAssets Inc., Microfinance Plus Notes, 2.40%, 11/3/20 | 11/13/15 | 283,000 |

|

| SEAF Central and Eastern European Growth Fund LLC | 8/10/00-8/26/11 | 155,418 |

|

| SEAF India International Growth Fund LP | 3/22/05-5/24/10 | 210,391 |

|

| Windhorse International-Spring Health Water Ltd., 1.00%, 3/15/19 | 2/12/14 | 70,000 |

|

| See notes to financial statements. | |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 11

CALVERT INTERNATIONAL EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2018

|

| | | |

| ASSETS | |

Investments in securities of unaffiliated issuers, at value (identified cost $166,503,645) - including $9,609,101 of securities on loan |

| $187,019,864 |

|

| Investments in securities of affiliated issuers, at value (identified cost $4,987,001) | 4,561,451 |

|

| Cash | 652,191 |

|

| Cash denominated in foreign currency, at value (cost $30,738) | 30,595 |

|

| Receivable for capital shares sold | 185,862 |

|

| Dividends and interest receivable | 354,730 |

|

| Interest receivable - affiliated | 52,810 |

|

| Securities lending income receivable | 2,058 |

|

| Tax reclaims receivable | 366,083 |

|

| Receivable from affiliates | 28,225 |

|

| Directors’ deferred compensation plan | 104,262 |

|

| Other assets | 4,237 |

|

| Total assets | 193,362,368 |

|

| | |

| LIABILITIES | |

| Payable for capital shares redeemed | 416,395 |

|

| Deposits for securities loaned | 1,696,404 |

|

| Payable to affiliates: | |

| Investment advisory fee | 117,625 |

|

| Administrative fee | 18,820 |

|

| Distribution and service fees | 32,963 |

|

| Sub-transfer agency fee | 12,799 |

|

| Directors’ deferred compensation plan | 104,262 |

|

| Accrued expenses | 160,310 |

|

| Total liabilities | 2,559,578 |

|

| Commitments and contingent liabilities (see Note 10) | |

| NET ASSETS |

| $190,802,790 |

|

| | |

| NET ASSETS CONSIST OF: | |

| Paid-in capital applicable to common stock | |

| (75,000,000 shares per class of $0.01 par value authorized) |

| $200,931,318 |

|

| Accumulated loss | (10,128,528) |

|

| Total |

| $190,802,790 |

|

| | |

| NET ASSET VALUE PER SHARE | |

| Class A (based on net assets of $114,914,646 and 6,555,362 shares outstanding) |

| $17.53 |

|

| Class C (based on net assets of $11,148,780 and 743,225 shares outstanding) |

| $15.00 |

|

| Class I (based on net assets of $64,739,364 and 3,457,894 shares outstanding) |

| $18.72 |

|

| | |

| OFFERING PRICE PER SHARE* | |

| Class A (100/95.25 of net asset value per share) |

| $18.40 |

|

| * On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| See notes to financial statements. |

12 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

CALVERT INTERNATIONAL EQUITY FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2018

|

| | | |

| INVESTMENT INCOME | |

| Dividend income (net of foreign taxes withheld of $446,185) |

| $4,649,520 |

|

| Interest income | 129,001 |

|

| Interest income - affiliated issuers | 84,077 |

|

| Securities lending income, net | 54,210 |

|

| Total investment income | 4,916,808 |

|

| | |

| EXPENSES | |

| Investment advisory fee | 1,553,639 |

|

| Administrative fee | 248,493 |

|

| Distribution and service fees: | |

| Class A | 308,764 |

|

| Class C | 120,488 |

|

| Directors’ fees and expenses | 10,148 |

|

| Custodian fees | 77,646 |

|

| Transfer agency fees and expenses | 370,848 |

|

| Accounting fees | 54,401 |

|

| Professional fees | 74,050 |

|

| Registration fees | 77,015 |

|

| Reports to shareholders | 35,305 |

|

| Miscellaneous | 33,786 |

|

| Total expenses | 2,964,583 |

|

| Waiver and/or reimbursement of expenses by affiliates | (388,563) |

|

| Reimbursement of expenses-other | (4,237) |

|

| Net expenses | 2,571,783 |

|

| Net investment income | 2,345,025 |

|

| | |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Investment securities - unaffiliated issuers | 7,788,657 |

|

| Foreign currency transactions | (26,658) |

|

| | 7,761,999 |

|

| | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investment securities - unaffiliated issuers | (1,191,786) |

|

| Investment securities - affiliated issuers | 13,625 |

|

| Foreign currency | (9,111) |

|

| | (1,187,272) |

|

| | |

| Net realized and unrealized gain | 6,574,727 |

|

| | |

| Net increase in net assets resulting from operations |

| $8,919,752 |

|

| See notes to financial statements. |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 13

CALVERT INTERNATIONAL EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | Year Ended

September 30, 2018 | | Year Ended

September 30, 2017 |

| Operations: | | | |

| Net investment income |

| $2,345,025 |

| |

| $2,944,365 |

|

| Net realized gain | 7,761,999 |

| | 14,229,386 |

|

| Net change in unrealized appreciation (depreciation) | (1,187,272) |

| | 10,933,290 |

|

| Net increase in net assets resulting from operations | 8,919,752 |

| | 28,107,041 |

|

| | | | |

Distributions to shareholders:(1) | | | |

| Class A shares | (1,876,125) |

| | (3,452,931) |

|

| Class C shares | (125,794) |

| | (255,867) |

|

| Class I shares | (1,292,207) |

| | (4,232,336) |

|

| Class Y shares | — |

| | (513,395) |

|

| Total distributions to shareholders | (3,294,126) |

| | (8,454,529) |

|

| | | | |

| Capital share transactions: | | | |

| Class A shares | (14,993,614) |

| | (41,965,309) |

|

| Class C shares | (1,124,533) |

| | (2,798,431) |

|

| Class I shares | (9,224,705) |

| | (72,272,764) |

|

Class Y shares (2) | (25,569,482) |

| | (558,951) |

|

| Net decrease in net assets from capital share transactions | (50,912,334) |

| | (117,595,455) |

|

| | | | |

| TOTAL DECREASE IN NET ASSETS | (45,286,708) |

| | (97,942,943) |

|

| | | | |

| | | | |

| NET ASSETS | | | |

| Beginning of year | 236,089,498 |

| | 334,032,441 |

|

| End of year |

| $190,802,790 |

| | $236,089,498 (3) |

|

| | | | |

| | | | |

(1) For the year ended September 30, 2017, the source of distributions was from net investment income. |

(2) Effective December 8, 2017, Class Y shares of the Fund converted to Class I shares at net asset value. Thereafter, Class Y shares were terminated. |

(3) Includes accumulated undistributed net investment income of $3,010,704 at September 30, 2017. The requirement to disclose the corresponding amount as of September 30, 2018 was eliminated. |

| See notes to financial statements. | | |

14 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

CALVERT INTERNATIONAL EQUITY FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | |

| | Year Ended September 30, |

| CLASS A SHARES | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | |

| Net asset value, beginning | $17.10 | | $15.49 | | $15.62 | | $16.51 | | $16.44 | |

| Income from investment operations: | | | | | | | | | | |

Net investment income (1) | 0.19 |

| | 0.17 |

| | 0.34 |

| (2) | 0.18 |

| | 0.15 |

| |

| Net realized and unrealized gain (loss) | 0.50 |

| | 1.84 |

| | (0.33) |

| | (0.97) |

| | 0.02 |

| |

| Total from investment operations | 0.69 |

| | 2.01 |

| | 0.01 |

| | (0.79) |

| | 0.17 |

| |

| Distributions from: | | | | | | | | | | |

| Net investment income | (0.26) |

| | (0.40) |

| | (0.14) |

| | (0.10) |

| | (0.10) |

| |

| Total distributions | (0.26) |

| | (0.40) |

| | (0.14) |

| | (0.10) |

| | (0.10) |

| |

| Total increase (decrease) in net asset value | 0.43 |

| | 1.61 |

| | (0.13) |

| | (0.89) |

| | 0.07 |

| |

| Net asset value, ending | $17.53 | | $17.10 | | $15.49 | | $15.62 | | $16.51 | |

Total return (3) | 4.02 | % | | 13.43 | % | | 0.04 | % | | (4.78 | %) | | 0.99 | % | |

Ratios to average net assets: (4) | | | | | | | | | | |

| Total expenses | 1.47 | % | | 1.58 | % | | 1.62 | % | | 1.67 | % | | 1.66 | % | |

| Net expenses | 1.32 | % | | 1.35 | % | | 1.38 | % | | 1.54 | % | | 1.66 | % | |

| Net investment income | 1.09 | % | | 1.08 | % | | 2.20 | % | (2) | 1.08 | % | | 0.88 | % | |

| Portfolio turnover | 48 | % | | 138 | % | | 94 | % | | 97 | % | | 82 | % | |

| Net assets, ending (in thousands) | $114,915 | | $126,669 | | $156,757 | | $167,225 | | $263,718 | |

| | | | | | | | | | | |

(1) Computed using average shares outstanding. |

(2) Amount includes a non-recurring refund for overbilling of prior years’ custody out-of-pocket fees. This amounted to $0.013 per share and 0.08% of average net assets. |

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

(4) Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| See notes to financial statements. |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 15

CALVERT INTERNATIONAL EQUITY FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | |

| | Year Ended September 30, |

| CLASS C SHARES | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | |

| Net asset value, beginning | $14.68 | | $13.31 | | $13.47 | | $14.27 | | $14.26 | |

| Income from investment operations: | | | | | | | | | | |

Net investment income (loss) (1) | 0.06 |

| | 0.05 |

| | 0.19 |

| (2) | 0.04 |

| | (0.01) |

| |

| Net realized and unrealized gain (loss) | 0.42 |

| | 1.59 |

| | (0.28) |

| | (0.84) |

| | 0.02 |

| |

| Total from investment operations | 0.48 |

| | 1.64 |

| | (0.09) |

| | (0.80) |

| | 0.01 |

| |

| Distributions from: | | | | | | | | | | |

| Net investment income | (0.16) |

| | (0.27) |

| | (0.07) |

| | — |

| | — |

| |

| Total distributions | (0.16) |

| | (0.27) |

| | (0.07) |

| | — |

| | — |

| |

| Total increase (decrease) in net asset value | 0.32 |

| | 1.37 |

| | (0.16) |

| | (0.80) |

| | 0.01 |

| |

| Net asset value, ending | $15.00 | | $14.68 | | $13.31 | | $13.47 | | $14.27 | |

Total return (3) | 3.23 | % | | 12.60 | % | | (0.68 | %) | | (5.61 | %) | | 0.07 | % | |

Ratios to average net assets: (4) | | | | | | | | | | |

| Total expenses | 2.22 | % | | 2.54 | % | | 2.55 | % | | 2.58 | % | | 2.57 | % | |

| Net expenses | 2.07 | % | | 2.10 | % | | 2.14 | % | | 2.37 | % | | 2.57 | % | |

| Net investment income (loss) | 0.39 | % | | 0.35 | % | | 1.42 | % | (2) | 0.31 | % | | (0.06 | %) | |

| Portfolio turnover | 48 | % | | 138 | % | | 94 | % | | 97 | % | | 82 | % | |

| Net assets, ending (in thousands) | $11,149 | | $12,013 | | $13,613 | | $15,997 | | $17,173 | |

| | | | | | | | | | | |

(1) Computed using average shares outstanding. |

(2) Amount includes a non-recurring refund for overbilling of prior years’ custody out-of-pocket fees. This amounted to $0.011 per share and 0.08% of average net assets. |

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

(4) Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| See notes to financial statements. |

16 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

CALVERT INTERNATIONAL EQUITY FUND

FINANCIAL HIGHLIGHTS

|

| | | | | | | | | | | | | | | |

| | Year Ended September 30, |

| CLASS I SHARES | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | |

| Net asset value, beginning | $18.24 | | $16.53 | | $16.73 | | $17.68 | | $17.69 | |

| Income from investment operations: | | | | | | | | | | |

Net investment income (1) | 0.27 |

| | 0.21 |

| | 0.44 |

| (2) | 0.30 |

| | 0.28 |

| |

| Net realized and unrealized gain (loss) | 0.53 |

| | 2.01 |

| | (0.36) |

| | (1.05) |

| | 0.02 |

| |

| Total from investment operations | 0.80 |

| | 2.22 |

| | 0.08 |

| | (0.75) |

| | 0.30 |

| |

| Distributions from: | | | | | | | | | | |

| Net investment income | (0.32) |

| | (0.51) |

| | (0.28) |

| | (0.20) |

| | (0.31) |

| |

| Total distributions | (0.32) |

| | (0.51) |

| | (0.28) |

| | (0.20) |

| | (0.31) |

| |

| Total increase (decrease) in net asset value | 0.48 |

| | 1.71 |

| | (0.20) |

| | (0.95) |

| | (0.01) |

| |

| Net asset value, ending | $18.72 | | $18.24 | | $16.53 | | $16.73 | | $17.68 | |

Total return (3) | 4.37 | % | | 13.89 | % | | 0.41 | % | | (4.27 | %) | | 1.64 | % | |

Ratios to average net assets: (4) | | | | | | | | | | |

| Total expenses | 1.22 | % | | 1.06 | % | | 1.04 | % | | 1.03 | % | | 1.02 | % | |

| Net expenses | 0.95 | % | | 0.96 | % | | 0.95 | % | | 0.98 | % | | 1.02 | % | |

| Net investment income | 1.44 | % | | 1.28 | % | | 2.67 | % | (2) | 1.68 | % | | 1.53 | % | |

| Portfolio turnover | 48 | % | | 138 | % | | 94 | % | | 97 | % | | 82 | % | |

| Net assets, ending (in thousands) | $64,739 | | $72,503 | | $140,129 | | $147,614 | | $92,318 | |

| | | | | | | | | | | |

(1) Computed using average shares outstanding. |

(2) Amount includes a non-recurring refund for overbilling of prior years’ custody out-of-pocket fees. This amounted to $0.014 per share and 0.09% of average net assets. |

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

(4) Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| See notes to financial statements. |

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 17

NOTES TO FINANCIAL STATEMENTS

NOTE 1 — SIGNIFICANT ACCOUNTING POLICIES

Calvert International Equity Fund (the Fund) is a diversified series of Calvert World Values Fund, Inc. (the Corporation). The Corporation is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The investment objective of the Fund is to seek to provide a high total return consistent with reasonable risk by investing primarily in a diversified portfolio of stocks. The Fund invests primarily in equity securities of foreign companies.

The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. A contingent deferred sales charge of 0.80% may apply to certain redemptions of Class A shares for accounts for which no sales charge was paid, if redeemed within one year of purchase. Class C shares are sold without a front-end sales charge, and with certain exceptions, are charged a contingent deferred sales charge of 1% on shares redeemed within one year of purchase. Class C shares are only available for purchase through a financial intermediary. Class I shares are sold at net asset value, are not subject to a sales charge and are sold only to certain eligible investors. The Fund previously offered Class Y shares. At the close of business on December 8, 2017, Class Y shares were converted to Class I shares. Each class represents a pro rata interest in the Fund, but votes separately on class-specific matters and is subject to different expenses.

The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946). Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

A. Investment Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (the Board) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

U.S. generally accepted accounting principles (U.S. GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Valuation techniques used to value the Fund’s investments by major category are as follows:

Equity Securities. Equity securities (including warrants and rights) listed on a U.S. securities exchange generally are valued at the last sale or closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Equity securities listed on the NASDAQ Global or Global Select Market are valued at the NASDAQ official closing price and are categorized as Level 1 in the hierarchy. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices and are categorized as Level 2 in the hierarchy. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Fund’s Board has approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities. Such securities are categorized as Level 2 in the hierarchy.

Debt Securities. Debt securities are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. Accordingly, debt securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities of sufficient credit quality purchased with remaining maturities of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

18 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

Venture Capital Securities. Venture capital securities for which market quotations are not readily available are generally categorized as Level 3 in the hierarchy. Venture capital equity securities are generally valued using the most appropriate and applicable method to measure fair value in light of each company’s situation. Methods may include market, income, options-pricing or cost approaches with discounts as appropriate based on assumptions of liquidation or exit risk. Examples of the market approach are subsequent rounds of financing, comparable transactions, and revenue times an industry multiple. An example of the income approach is the discounted cash flow model. Examples of the cost approach are replacement cost, salvage value, or net asset value. The options-pricing method treats common stock and preferred stock as call options on the enterprise value with strike price based on the preferred stock liquidation preference. Venture capital limited partnership interests are valued at the fair value reported by the general partner of the partnership, adjusted as necessary to reflect subsequent capital calls and distributions and any other available information. In some cases, adjustments may be made to account for daily pricing of material public holdings within the partnership.

Other Securities. Investments in registered investment companies (including money market funds) that do not trade on an exchange are valued at the net asset value per share on the valuation day and are categorized as Level 1 in the hierarchy.

Fair Valuation. If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Fund’s adviser, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by or at the direction of the Board in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material.

The following table summarizes the market value of the Fund’s holdings as of September 30, 2018, based on the inputs used to value them:

|

| | | | | | | | | | | | | |

| Assets | Level 1 | Level 2 | | Level 3(1) | Total |

| Common Stocks | | | | | |

| Canada | $ | 3,620,761 |

| $ | — |

| | $ | — |

| $ | 3,620,761 |

|

| Taiwan | 4,167,026 |

| — |

| | — |

| 4,167,026 |

|

| United States | 10,329,615 |

| — |

| | — |

| 10,329,615 |

|

Other Countries(2) | — |

| 165,536,966 |

| | — |

| 165,536,966 |

|

| Total Common Stocks | $ | 18,117,402 |

| $ | 165,536,966 |

| (3) | $ | — |

| $ | 183,654,368 |

|

| Preferred Stocks - Venture Capital | — |

| — |

| | 184,599 |

| 184,599 |

|

| Venture Capital Limited Partnership Interests | — |

| — |

| | 1,315,685 |

| 1,315,685 |

|

| Venture Capital Debt Obligations | — |

| — |

| | — |

| — |

|

| High Social Impact Investments | — |

| 4,264,734 |

| | 465,525 |

| 4,730,259 |

|

| Short Term Investment of Cash Collateral for Securities Loaned | 1,696,404 |

| — |

| | — |

| 1,696,404 |

|

| Total | $ | 19,813,806 |

| $ | 169,801,700 |

| | $ | 1,965,809 |

| $ | 191,581,315 |

|

| | | | | | |

(1) None of the unobservable inputs for Level 3 assets, individually or collectively, had a material impact on the Fund. |

(2) For further breakdown of equity securities by country, please refer to the Schedule of Investments. |

(3) Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of trading in their applicable foreign markets. |

Level 3 investments at the beginning and/or end of the period in relation to net assets were not significant and accordingly, a reconciliation of Level 3 assets for the year ended September 30, 2018 is not presented.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 19

B. Investment Transactions and Income: Investment transactions for financial statement purposes are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Non-cash dividends are recorded at the fair value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. In consideration of recent decisions rendered by European courts, the Fund has filed additional tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings within these countries. Due to the uncertainty as to the ultimate resolution of these proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment, no amounts are reflected in the financial statements for such outstanding reclaims. Distributions received that represent a return of capital are recorded as a reduction of cost of investments. Distributions received that represent a capital gain are recorded as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned.

C. Share Class Accounting: Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based upon the relative net assets of each class to the total net assets of the Fund. Expenses arising in connection with a specific class are charged directly to that class.

D. Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income, and expenses are translated at the prevailing rate of exchange on the date of the event. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

E. Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities (excluding Rule 144A securities) is included at the end of the Schedule of Investments.

F. Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from U.S. GAAP; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

G. Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

H. Indemnifications: The Corporation’s By-Laws provide for indemnification for Directors or officers of the Corporation and certain other parties, to the fullest extent permitted by Maryland law and the 1940 Act, provided certain conditions are met. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I. Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

NOTE 2 — RELATED PARTY TRANSACTIONS

The investment advisory fee is earned by Calvert Research and Management (CRM), a subsidiary of Eaton Vance Management (EVM), as compensation for investment advisory services rendered to the Fund. Pursuant to the investment advisory agreement, CRM receives a fee, payable monthly, at the following annual rates of the Fund’s average daily net assets: 0.75% on the first $250 million, 0.725% on the next $250 million and 0.675% on the excess of $500 million. For the year ended September 30, 2018, the investment advisory fee amounted to $1,553,639 or 0.75% of the Fund’s average daily net assets.

Eaton Vance Advisers International Ltd. (EVAIL), an indirect, wholly-owned subsidiary of Eaton Vance Corp., provides sub-advisory services to the Fund pursuant to a sub-advisory agreement with CRM. Sub-advisory fees are paid by CRM from its

20 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

investment advisory fee. Prior to November 1, 2017, Eaton Vance Management (International) Limited (EVMI), an indirect, wholly-owned subsidiary of Eaton Vance Corp., served as sub-adviser to the Fund.

CRM and EVAIL (EVMI prior to November 1, 2017) have agreed to reimburse the Fund’s operating expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only and excluding expenses such as brokerage commissions, acquired fund fees and expenses of unaffiliated funds, interest expense, taxes or litigation expenses) exceed 1.32%, 2.07% and 0.95% for Class A, Class C and Class I, respectively, and prior to the close of business on December 8, 2017, 1.08% for Class Y, of such class’ average daily net assets. The expense reimbursement agreement may be changed or terminated after January 31, 2019. For the year ended September 30, 2018, CRM, EVAIL and EVMI waived or reimbursed expenses of $388,563.

The administrative fee is earned by CRM as compensation for administrative services rendered to the Fund. The fee is computed at an annual rate of 0.12% of the Fund’s average daily net assets attributable to Class A, Class C and Class I (and Class Y prior to the close of business on December 8, 2017) and is payable monthly. For the year ended September 30, 2018, CRM was paid administrative fees of $248,493.

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays Eaton Vance Distributors, Inc. (EVD), an affiliate of CRM and the Fund’s principal underwriter, a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. The Fund also has in effect a distribution plan for Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class C Plan, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class C shares for providing ongoing distribution services and facilities to the Fund. In addition, pursuant to the Class C Plan, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued for the year ended September 30, 2018 amounted to $308,764 and $120,488 for Class A shares and Class C shares, respectively.

The Fund was informed that EVD received $18,902 as its portion of the sales charge on sales of Class A shares and $758 of contingent deferred sales charges paid by Fund shareholders for the year ended September 30, 2018.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended September 30, 2018, sub-transfer agency fees and expenses incurred to EVM amounted to $71,269 and are included in transfer agency fees and expenses on the Statement of Operations.

Each Director of the Fund who is not an employee of CRM or its affiliates receives a fee of $3,000 for each Board meeting attended in person and $2,000 for each Board meeting attended by phone plus an annual fee of $52,000, and $1,500 for each Committee meeting attended in person and $1,000 for each Committee meeting attended by phone plus an annual Committee fee of $2,500. The Board chair receives an additional $10,000 annual retainer and Committee chairs receive an additional $6,000 annual retainer. Eligible Directors may participate in a Deferred Compensation Plan (the Plan). Amounts deferred under the Plan are treated as though equal dollar amounts had been invested in shares of the Fund or other Calvert funds selected by the Directors. The Fund purchases shares of the funds selected equal to the dollar amounts deferred under the Plan, resulting in an asset equal to the deferred compensation liability. Obligations of the Plan are paid solely from the Fund’s assets. Directors’ fees are allocated to each of the Calvert funds served. Salaries and fees of officers and Directors of the Fund who are employees of CRM or its affiliates are paid by CRM. In addition, an advisory council was established to aid the Board and CRM in advancing the cause of responsible investing through original scholarship and thought leadership. The advisory council consists of CRM’s Chief Executive Officer and four additional members. Each member (other than CRM’s Chief Executive Officer) receives annual compensation of $75,000, which is being reimbursed by Calvert Investment Management, Inc. (CIM), the Calvert funds’ former investment adviser and Ameritas Holding Company, CIM’s parent company, through the end of 2019. For the year ended September 30, 2018, the Fund’s allocated portion of such expense and reimbursement was $4,237, which are included in miscellaneous expense and reimbursement of expenses-other, respectively, on the Statement of Operations.

NOTE 3 — INVESTMENT ACTIVITY

During the year ended September 30, 2018, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $98,538,556 and $147,564,483, respectively.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 21

NOTE 4 — DISTRIBUTIONS TO SHAREHOLDERS AND INCOME TAX INFORMATION

The tax character of distributions declared for the years ended September 30, 2018 and September 30, 2017 was as follows:

|

| | | | | | |

| | Year Ended

September 30, |

| | 2018 | 2017 |

| Ordinary income |

| $3,294,126 |

|

| $8,454,529 |

|

During the year ended September 30, 2018, accumulated loss was decreased by $105,942,269 and paid-in capital was decreased by $105,942,269 due to expired capital loss carryforwards. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of September 30, 2018, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

|

| | | |

| Undistributed ordinary income |

| $2,103,841 |

|

| Capital loss carryforwards and deferred capital losses |

| ($32,019,365 | ) |

| Net unrealized appreciation (depreciation) |

| $19,786,996 |

|

At September 30, 2018, the Fund, for federal income tax purposes, had capital loss carryforwards of $10,386,632 and deferred capital losses of $21,632,733 which would reduce the Fund’s taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus would reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. The capital loss carryforwards will expire on September 30, 2019 ($10,386,632) and their character is short-term. The deferred capital losses are treated as arising on the first day of the Fund’s next taxable year and retain the same short-term or long-term character as when originally deferred. Of the deferred capital losses at September 30, 2018, $9,129,251 are short-term and $12,503,482 are long term.

Under tax regulations, capital losses incurred in taxable years beginning after December 2010 can be carried forward to offset future capital gains for an unlimited period. These losses are required to be used prior to capital loss carryforwards, which carry an expiration date. As a result of this ordering rule, capital loss carryforwards may be more likely to expire unused.

The cost and unrealized appreciation (depreciation) of investments of the Fund at September 30, 2018, as determined on a federal income tax basis, were as follows:

|

| | | |

| Aggregate cost |

| $171,792,488 |

|

| Gross unrealized appreciation |

| $25,081,971 |

|

| Gross unrealized depreciation | (5,293,144) |

|

| Net unrealized appreciation (depreciation) |

| $19,788,827 |

|

NOTE 5 — SECURITIES LENDING

To generate additional income, the Fund may lend its securities pursuant to a securities lending agency agreement with State Street Bank and Trust Company (SSB), the securities lending agent. Security loans are subject to termination by the Fund at any time and, therefore, are not considered illiquid investments. The Fund requires that the loan be continuously collateralized by either cash or securities as collateral equal at all times to at least 102% of the market value of the domestic securities loaned and 105% of the market value of the international securities loaned (if applicable). The market value of securities loaned is determined daily and any additional required collateral is delivered to the Fund on the next business day. Cash collateral is generally invested in a money market fund registered under the 1940 Act that is managed by an affiliate of SSB. Any gain or loss in the market price of the loaned securities that might occur and any interest earned or dividends declared during the term of the loan would accrue to the account of the Fund. Income earned on the investment of collateral, net of broker rebates and other expenses incurred by the securities lending agent, is split between the Fund and the securities lending agent on the basis of agreed upon contractual terms. Non-cash collateral, if any, is held by the lending agent on behalf of the Fund and cannot be sold or re-pledged by the Fund; accordingly, such collateral is not reflected in the Statement of Assets and Liabilities.

The risks associated with lending portfolio securities include, but are not limited to, possible delays in receiving additional collateral or in the recovery of the loaned securities, possible loss of rights to the collateral should the borrower fail financially, as well as risk of loss in the value of the collateral or the value of the investments made with the collateral. The securities lending agent shall indemnify the Fund in the case of default of any securities borrower.

22 www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT

At September 30, 2018, the total value of securities on loan was $9,609,101 and the total value of collateral received was $10,069,359, comprised of cash of $1,696,404 and U.S. Government and/or agencies securities of $8,372,955.

The following table provides a breakdown of securities lending transactions accounted for as secured borrowings, the obligations by class of collateral pledged, and the remaining contractual maturity of those transactions as of September 30, 2018.

|

| | | | | | | | | | | | | | | |

| | Remaining Contractual Maturity of the Transactions |

| | Overnight and

Continuous | <30 days | 30 to 90 days | >90 days | Total |

| Securities Lending Transactions |

| Common Stocks |

| $10,069,359 |

|

| $— |

|

| $— |

|

| $— |

|

| $10,069,359 |

|

The carrying amount of the liability for deposits for securities loaned at September 30, 2018 approximated its fair value. If measured at fair value, such liability would have been considered as Level 2 in the fair value hierarchy (see Note 1A) at September 30, 2018.

NOTE 6 — LINE OF CREDIT

The Fund participates with other funds managed by CRM in a $62.5 million committed ($25 million committed and $25 million uncommitted prior to August 7, 2018) unsecured line of credit agreement with SSB, which is in effect through August 6, 2019. Borrowings may be made for temporary or emergency purposes only. Borrowings bear interest at the higher of the One-Month London Interbank Offered Rate (LIBOR) in effect that day or the overnight Federal Funds Rate, plus 1.00% (1.25% prior to August 7, 2018) per annum. A commitment fee of 0.20% (0.25% prior to August 7, 2018) per annum is incurred on the unused portion of the committed facility. An administrative fee of $37,500 was incurred in connection with the renewal of the facility in August 2018. These fees are allocated to all participating funds. Because the line of credit is not available exclusively to the Fund, it may be unable to borrow some or all of its requested amounts at any particular time. The Fund had no borrowings outstanding pursuant to this line of credit at September 30, 2018. The Fund did not have any significant borrowings or allocated fees during the year ended September 30, 2018.

NOTE 7 — AFFILIATED COMPANIES

The Fund has invested a portion of its assets designated for high social impact investments in notes (the “Notes”) issued by Calvert Impact Capital, Inc. (CIC), formerly the Calvert Social Investment Foundation, pursuant to an exemptive order granted by the U.S. Securities and Exchange Commission (the SEC) in 1998 (the Exemptive Order). The Fund obtained the Exemptive Order because at that time there was a significant overlap of Fund Board members and CIC Board members as well as certain other affiliations between CIC and affiliates of the Fund’s investment adviser. CIC may be considered an affiliated person of the Fund based on the overlap between CIC’s Board of Directors and the Calvert funds’ Directors/Trustees and other potential affiliations. CIC has licensed use of the Calvert name from CRM, and currently two Fund Board members (one of whom is CRM’s President and Chief Executive Officer), two members of the Advisory Council to the Calvert Fund Board of Directors/Trustees, and an additional CRM officer serve on CIC’s Board. CIC is not owned or otherwise controlled by CRM or its affiliates. The Fund intends to request a new exemptive order from the SEC to permit additional investment in the Notes.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND ANNUAL REPORT 23

In addition to the Notes, a Fund may also invest in companies that are considered affiliated companies because the Fund has direct or indirect ownership of, control of, or voting power of 5 percent or more of the outstanding voting shares of the company, or the company is under common ownership or control with the Fund. At September 30, 2018, the value of the Fund’s investment in the Notes and affiliated companies was $4,561,451, which represents 2.39% of the Fund’s net assets. Transactions in the Notes and affiliated companies by the Fund for the year ended September 30, 2018 were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Issuer | Principal Amount, beginning of period | Gross Additions | Gross Reductions | Principal Amount, end of period | Value, end of period | Interest Income | Net Realized Gain (Loss) | Capital Gain Distributions Received | Change in Unrealized Appreciation (Depreciation) |

| High Social Impact Investments | | | | | | | | | |