UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 01136

Guggenheim Funds Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Funds Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: September 30

Date of reporting period: October 1, 2020 - March 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

3.31.2021

Guggenheim Funds Semi-Annual Report

Guggenheim Funds Trust-Equity |

Guggenheim Alpha Opportunity Fund | | |

Guggenheim Large Cap Value Fund | | |

Guggenheim Market Neutral Real Estate Fund | | |

Guggenheim Risk Managed Real Estate Fund | | |

Guggenheim Small Cap Value Fund | | |

Guggenheim StylePlus—Large Core Fund | | |

Guggenheim StylePlus—Mid Growth Fund | | |

Guggenheim World Equity Income Fund | | |

GuggenheimInvestments.com | SBE-SEMI-0321x0921 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 7 |

ALPHA OPPORTUNITY FUND | 10 |

LARGE CAP VALUE FUND | 29 |

MARKET NEUTRAL REAL ESTATE FUND | 38 |

RISK MANAGED REAL ESTATE FUND | 49 |

SMALL CAP VALUE FUND | 65 |

STYLEPLUS—LARGE CORE FUND | 74 |

STYLEPLUS—MID GROWTH FUND | 86 |

WORLD EQUITY INCOME FUND | 98 |

NOTES TO FINANCIAL STATEMENTS | 109 |

OTHER INFORMATION | 122 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 123 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 128 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management, LLC (“GPIM”) (together, “Investment Advisers”), are pleased to present the shareholder report for eight equity funds (the “Fund” or “Funds”). The report covers the semi-annual period ended March 31, 2021.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, (“Guggenheim”) a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC

Guggenheim Partners Investment Management, LLC

April 30, 2021

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

COVID-19. The global ongoing crisis caused by the outbreak of COVID-19 and the current recovery underway is causing disruption to consumer demand and economic output and supply chains. There are still travel restrictions and quarantines, and adverse impacts on local and global economies. Investors should be aware that in light of the current uncertainty, volatility and distress in economies, the financial markets, and labor and public health conditions around the world, the Funds’ investments and a shareholder’s investment in a Fund are subject to investment risk, including the possible loss of the entire principal amount invested. Firms through which investors invest with the Funds, the Funds, their service providers, the markets in which they invest and market intermediaries are also impacted by quarantines and similar measures intended to respond to and contain the ongoing pandemic, which can obstruct their functioning and subject them to heightened operational and other risks.

Alpha Opportunity Fund is subject to a number of risks and may not suitable for all investors. ● Investments in securities and derivatives, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the Fund may lose money. There can be no guarantee the Fund will achieve it investment objective. ● The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● Certain of the derivative instruments, such as swaps and structured notes, are also subject to the risks of counterparty default and adverse tax treatment. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs, including paying more for a security than it received from its sale and the risk of unlimited losses. ● In certain circumstances the Fund may be subject to liquidity risk and it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ● In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ● The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. ● Please read the prospectus for more detailed information regarding these and other risks.

Large Cap Value Fund may not be suitable for all investors. ● An investment in the Fund will fluctuate and is subject to investment risks, which means an investor could lose money. ● The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. The Fund is subject to risk that large-capitalization stocks may underperform other segments of the equity market or the equity markets as a whole. ● Please read the prospectus for more detailed information regarding these and other risks.

Market Neutral Real Estate Fund may not be suitable for all investors. ● Investing involves risk, including the possible loss of principal. ● There are no assurances that any fund will achieve its objective and/or strategy. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s use of derivatives such as futures, options, and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs. The Fund risks paying more for a security than it received from its sale. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political, or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Investing in sector funds is more volatile than investing in broadly diversified funds, as there is a greater risk due to the concentration of the funds’ holdings in issuers of the same or similar offerings. ● This Fund is considered non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single security could cause greater fluctuations in the value of fund shares than would occur in a more diversified fund. ● Short selling involves increased risks and costs. You risk paying more for a security than you received from its sale. This strategy may not be suitable for all investors. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Risk Managed Real Estate Fund may not be suitable for all investors. ● Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time ● Investing involves risk, including the possible loss of principal. ● There are no assurances that any fund will achieve its objective and/or strategy. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs. The Fund risks paying more for a security than it received from its sale. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Investing in sector funds is more volatile than investing in broadly diversified funds, as there is a greater risk due to the concentration of the funds’ holdings in issuers of the same or similar offerings. ● Short selling involves increased risks and costs. You risk paying more for a security than you received from its sale. This strategy may not be suitable for all investors. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell you shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Small Cap Value Fund may not be suitable for all investors. ● An investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. ● The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. ● Investing in securities of small-capitalization companies may involve a greater risk of loss and more abrupt fluctuations in market price than investments in larger-capitalization companies. ● Please read the prospectus for more detailed information regarding these and other risks.

StylePlus—Large Core Fund may not be suitable for all investors. ● Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. ● The Fund may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

StylePlus—Mid Growth Fund may not be suitable for all investors. ● Investments in mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions, among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. ● The Fund may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

World Equity Income Fund may not be suitable for all investors. ● Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risk). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar. ● The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. ● The Fund’s use of leverage, through instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund may have significant exposure to securities in a particular capitalization range e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-denominate capitalization range may underperform other segments of the equity market or the equity market as a whole. ● Please read the prospectus for more detailed information regarding these and other risks.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | March 31, 2021 |

For the six-month period ended March 31, 2021, the Standard & Poor’s 500® (“S&P 500®”) Index returned 19.07% as the equity market continued to climb after the sharp selloff following the outbreak of COVID-19 in March 2020. This increase was in spite of ongoing personal and economic hardships imposed by COVID-19, highlighting the crucial role of policy support in the form of monetary and fiscal stimulus, which has succeeded in averting a lengthy recession in the U.S. These policy initiatives, particularly on the monetary side, increased market liquidity and lowered borrowing rates, reassuring equity investors that the Federal Reserve (the “Fed”) would do everything in its power to maintain market stability.

Our 2021 U.S. economic growth forecast increased during the first quarter of 2021 from an annualized 5.5% to over 7%, factoring in more fiscal stimulus than previously anticipated. This forecast captures the effect of stimulus representing roughly 11% of 2020–2021 gross domestic product (“GDP”), versus the previous calculation of about 8%. We see strength in the consumer sector and in housing activity. In addition, U.S. vaccinations for COVID-19 continue to accelerate, nearing 3 million doses per day by the end of the first quarter. More than 213 million doses have been administered in the U.S. so far, and about 35% of the U.S. population has been fully vaccinated. The U.S. is seeing the best-case scenario unfold in its vaccine rollout, but other countries have not been as fortunate.

Europe’s vaccine rollout hit a major speedbump during the first quarter when questions surrounding the safety of the AstraZeneca vaccine led several major European countries to temporarily suspend distribution. Safety concerns, coupled with supply constraints, meant that less than 10% of the populations of Germany, France, and Italy had been vaccinated by the end of the first quarter, well under the pace needed to reach 70% inoculated by summer. Any delay in ending the pandemic on a global scale has implications for other countries too, including the U.S., where travel and hospitality workers represent a large share of the unemployed.

Despite vaccination delays in Europe and its implications abroad, we saw meaningful improvement in the domestic labor market during the first quarter as states moved forward with business re-openings. Seasonally adjusted initial jobless claims fell by 97,000 to 684,000 in the week ending March 20, 2021, the lowest level since the pandemic began, before seeing an uptick the following week to 719,000. We saw more positive news across the board in the March payroll report with 916,000 jobs added, and with 156,000 more from revisions. Standing in the way of additional labor market gains are local government restrictions on certain sectors, although easing of these restrictions is expected by summer.

Economic developments drove a sharp increase in U.S. Treasury yields. The market pulled forward expectations of the next Fed rate hike from December 2023 to December 2022, while repricing the long-run terminal Fed funds rate estimate to 2.25% from just 0.55% last August. We do not expect the Fed to raise interest rates as early as the market is anticipating, even though we expect strong GDP growth in coming years.

Year-over-year inflation measures will rise over the next several months due to base effects, which may be compounded by supply chain disruptions in the goods sector and potential capacity constraints for certain services. However, these factors could prove to be short-lived, with base effects set to dampen inflation starting in the summer months. Moreover, the Fed is focused on generating sustainably higher inflation. Even if core inflation rises above the Fed’s 2% target in 2021, the Fed’s focus is on a long-term average of 2%. With years of shortfalls to make up, and the Fed now targeting labor market disparities as part of an expanded definition of full employment, we expect policymakers to remain resolutely patient. Any tapering of asset purchases will likely be deferred until later in 2022, with the first rate hike likely to come sometime after that.

Easy financial conditions and low rates will likely support credit over the next few years. With market optimism pulling forward rate hike expectations and causing bond yields to rise, we view this as an opportunity to add incremental yield to portfolios.

For the six-month period ended March 31, 2021, the S&P 500® Index* returned, as noted, 19.07%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned 20.08%. The return of the MSCI Emerging Markets Index* was 22.43%.

In the bond market, the Bloomberg Barclays U.S. Aggregate Bond Index* posted a -2.73% return for the six-month period, while the Bloomberg Barclays U.S. Corporate High Yield Index* returned 7.36%. The return of the ICE Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.06% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | March 31, 2021 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be denominated in U.S. dollars and must be fixed rate and nonconvertible. The 1-3 Month U.S. Treasury Bill Index is market capitalization weighted and the securities in the index are updated on the last business day of each month.

FTSE NAREIT Equity REITs Total Return Index (“FNRE”) is one of the FTSE NAREIT U.S. Real Estate Index Series that contains all Equity REITs not designated as Timber REITs or Infrastructure REITs. FTSE NAREIT U.S. Real Estate Index Series is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the U.S. economy. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes provide the facility to concentrate commercial real estate exposure in more selected markets. The National Association of Real Estate Investment Trusts (NAREIT) is the trade association for REITs and publicly traded real estate companies with an interest in the U.S. property and investment markets.

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Morningstar Long/Short Equity Category Average is the average return of funds Morningstar places in a given category based on their portfolio statistics and compositions over the past three years. Long-short portfolios hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. At least 75% of the assets are in equity securities or derivatives, and funds in the category will typically have beta values to relevant benchmarks of between 0.3 and 0.8 over a three-year period.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index (Net) is calculated with net dividends reinvested. It is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

Russell 1000® Value Index is a measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 3000® Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market.

Russell Midcap Growth® Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning September 30, 2020 and ending March 31, 2021.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

September 30, 2020 | Ending

Account Value

March 31, 2021 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 | | | | | |

Alpha Opportunity Fund | | | | | |

A-Class | 1.76% | 12.54% | $ 1,000.00 | $ 1,125.40 | $ 9.33 |

C-Class | 2.51% | 12.14% | 1,000.00 | 1,121.40 | 13.28 |

P-Class | 1.76% | 12.57% | 1,000.00 | 1,125.70 | 9.33 |

Institutional Class | 1.49% | 12.68% | 1,000.00 | 1,126.80 | 7.90 |

Large Cap Value Fund | | | | | |

A-Class | 1.15% | 35.54% | 1,000.00 | 1,355.40 | 6.75 |

C-Class | 1.90% | 35.03% | 1,000.00 | 1,350.30 | 11.13 |

P-Class | 1.15% | 35.53% | 1,000.00 | 1,355.30 | 6.75 |

Institutional Class | 0.90% | 35.71% | 1,000.00 | 1,357.10 | 5.29 |

Market Neutral Real Estate Fund | | | | | |

A-Class | 1.64% | (1.39%) | 1,000.00 | 986.10 | 8.12 |

C-Class | 2.39% | (1.74%) | 1,000.00 | 982.60 | 11.81 |

P-Class | 1.64% | (1.43%) | 1,000.00 | 985.70 | 8.12 |

Institutional Class | 1.39% | (1.27%) | 1,000.00 | 987.30 | 6.89 |

Risk Managed Real Estate Fund | | | | | |

A-Class | 1.31% | 17.64% | 1,000.00 | 1,176.40 | 7.11 |

C-Class | 2.12% | 17.17% | 1,000.00 | 1,171.70 | 11.48 |

P-Class | 1.37% | 17.60% | 1,000.00 | 1,176.00 | 7.43 |

Institutional Class | 1.04% | 17.81% | 1,000.00 | 1,178.10 | 5.65 |

Small Cap Value Fund | | | | | |

A-Class | 1.30% | 50.91% | 1,000.00 | 1,509.10 | 8.13 |

C-Class | 2.05% | 50.36% | 1,000.00 | 1,503.60 | 12.80 |

P-Class | 1.30% | 50.89% | 1,000.00 | 1,508.90 | 8.13 |

Institutional Class | 1.05% | 51.04% | 1,000.00 | 1,510.40 | 6.57 |

StylePlus—Large Core Fund | | | | | |

A-Class | 1.19% | 19.60% | 1,000.00 | 1,196.00 | 6.52 |

C-Class | 2.10% | 19.05% | 1,000.00 | 1,190.50 | 11.47 |

P-Class | 1.32% | 19.58% | 1,000.00 | 1,195.80 | 7.23 |

Institutional Class | 1.06% | 19.70% | 1,000.00 | 1,197.00 | 5.81 |

StylePlus—Mid Growth Fund | | | | | |

A-Class | 1.30% | 21.22% | 1,000.00 | 1,212.20 | 7.17 |

C-Class | 2.18% | 20.68% | 1,000.00 | 1,206.80 | 11.99 |

P-Class | 1.39% | 21.17% | 1,000.00 | 1,211.70 | 7.66 |

Institutional Class | 1.10% | 21.35% | 1,000.00 | 1,213.50 | 6.07 |

World Equity Income Fund | | | | | |

A-Class | 1.21% | 24.11% | 1,000.00 | 1,241.10 | 6.76 |

C-Class | 1.96% | 23.58% | 1,000.00 | 1,235.80 | 10.93 |

P-Class | 1.21% | 24.06% | 1,000.00 | 1,240.60 | 6.76 |

Institutional Class | 0.96% | 24.19% | 1,000.00 | 1,241.90 | 5.37 |

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

September 30, 2020 | Ending

Account Value

March 31, 2021 | Expenses

Paid During

Period2 |

Table 2. Based on hypothetical 5% return (before expenses) | | | | |

Alpha Opportunity Fund | | | | | |

A-Class | 1.76% | 5.00% | $ 1,000.00 | $ 1,016.16 | $ 8.85 |

C-Class | 2.51% | 5.00% | 1,000.00 | 1,012.42 | 12.59 |

P-Class | 1.76% | 5.00% | 1,000.00 | 1,016.16 | 8.85 |

Institutional Class | 1.49% | 5.00% | 1,000.00 | 1,017.50 | 7.49 |

Large Cap Value Fund | | | | | |

A-Class | 1.15% | 5.00% | 1,000.00 | 1,019.20 | 5.79 |

C-Class | 1.90% | 5.00% | 1,000.00 | 1,015.46 | 9.55 |

P-Class | 1.15% | 5.00% | 1,000.00 | 1,019.20 | 5.79 |

Institutional Class | 0.90% | 5.00% | 1,000.00 | 1,020.44 | 4.53 |

Market Neutral Real Estate Fund | | | | | |

A-Class | 1.64% | 5.00% | 1,000.00 | 1,016.75 | 8.25 |

C-Class | 2.39% | 5.00% | 1,000.00 | 1,013.01 | 11.99 |

P-Class | 1.64% | 5.00% | 1,000.00 | 1,016.75 | 8.25 |

Institutional Class | 1.39% | 5.00% | 1,000.00 | 1,018.00 | 6.99 |

Risk Managed Real Estate Fund | | | | | |

A-Class | 1.31% | 5.00% | 1,000.00 | 1,018.40 | 6.59 |

C-Class | 2.12% | 5.00% | 1,000.00 | 1,014.36 | 10.65 |

P-Class | 1.37% | 5.00% | 1,000.00 | 1,018.10 | 6.89 |

Institutional Class | 1.04% | 5.00% | 1,000.00 | 1,019.75 | 5.24 |

Small Cap Value Fund | | | | | |

A-Class | 1.30% | 5.00% | 1,000.00 | 1,018.45 | 6.54 |

C-Class | 2.05% | 5.00% | 1,000.00 | 1,014.71 | 10.30 |

P-Class | 1.30% | 5.00% | 1,000.00 | 1,018.45 | 6.54 |

Institutional Class | 1.05% | 5.00% | 1,000.00 | 1,019.70 | 5.29 |

StylePlus—Large Core Fund | | | | | |

A-Class | 1.19% | 5.00% | 1,000.00 | 1,019.00 | 5.99 |

C-Class | 2.10% | 5.00% | 1,000.00 | 1,014.46 | 10.55 |

P-Class | 1.32% | 5.00% | 1,000.00 | 1,018.35 | 6.64 |

Institutional Class | 1.06% | 5.00% | 1,000.00 | 1,019.65 | 5.34 |

StylePlus—Mid Growth Fund | | | | | |

A-Class | 1.30% | 5.00% | 1,000.00 | 1,018.45 | 6.54 |

C-Class | 2.18% | 5.00% | 1,000.00 | 1,014.06 | 10.95 |

P-Class | 1.39% | 5.00% | 1,000.00 | 1,018.00 | 6.99 |

Institutional Class | 1.10% | 5.00% | 1,000.00 | 1,019.45 | 5.54 |

World Equity Income Fund | | | | | |

A-Class | 1.21% | 5.00% | 1,000.00 | 1,018.90 | 6.09 |

C-Class | 1.96% | 5.00% | 1,000.00 | 1,015.16 | 9.85 |

P-Class | 1.21% | 5.00% | 1,000.00 | 1,018.90 | 6.09 |

Institutional Class | 0.96% | 5.00% | 1,000.00 | 1,020.14 | 4.84 |

1 | This ratio represents annualized net expenses, which may include short dividend and interest expense. Excluding these expenses, the operating expense ratios for the Risk Managed Real Estate Fund would be 1.22%, 2.03%, 1.29% and 0.95% for the A-Class, C-Class, P-Class and Institutional Class, respectively. Excludes expenses of the underlying funds in which the Funds invest, if any. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period September 30, 2020 to March 31, 2021. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | March 31, 2021 |

ALPHA OPPORTUNITY FUND

OBJECTIVE: Seeks long-term growth of capital.

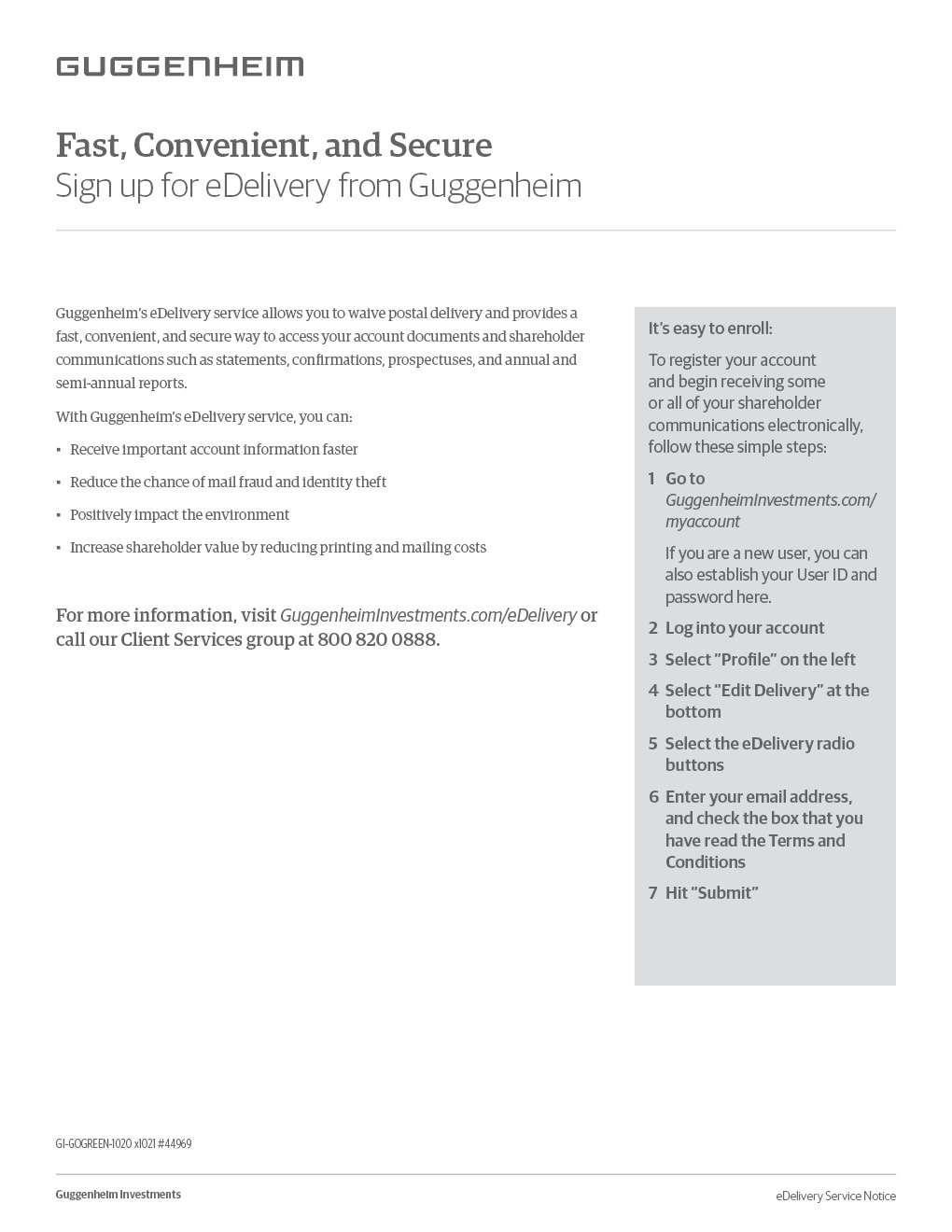

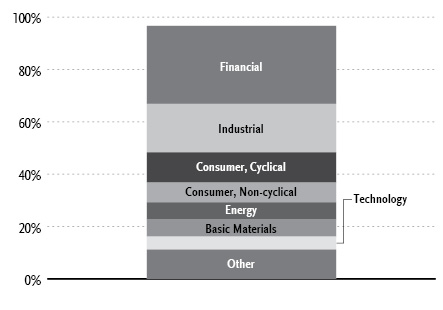

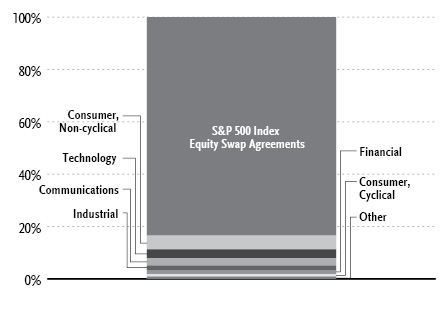

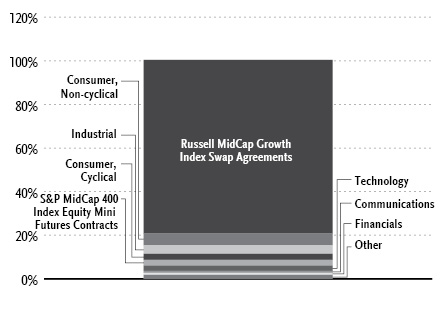

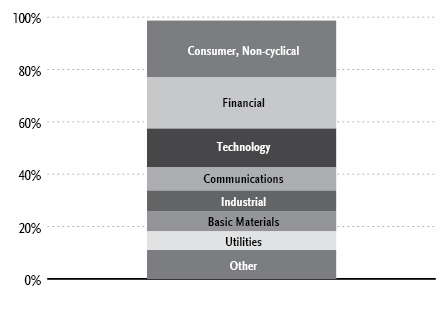

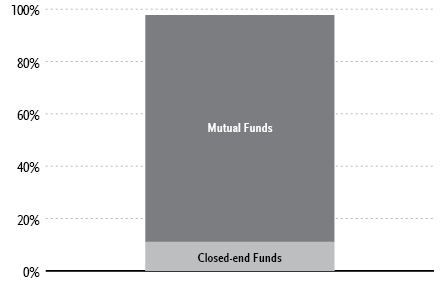

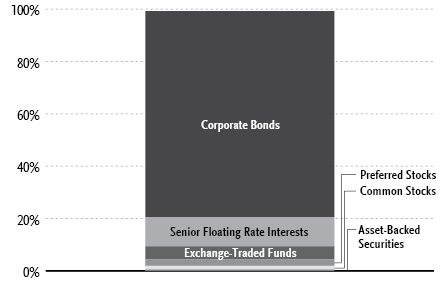

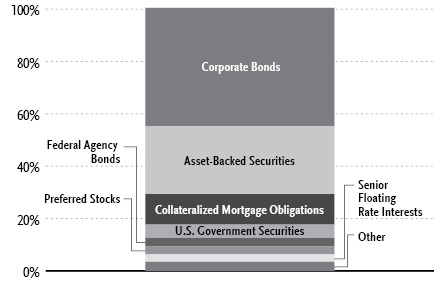

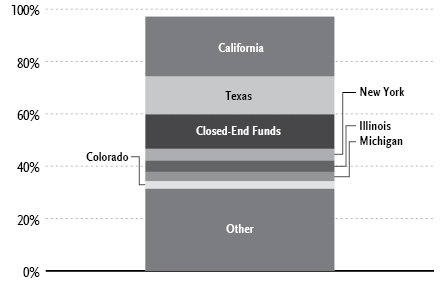

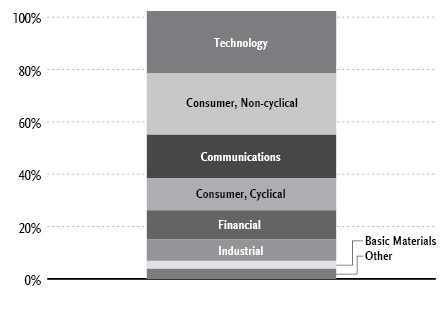

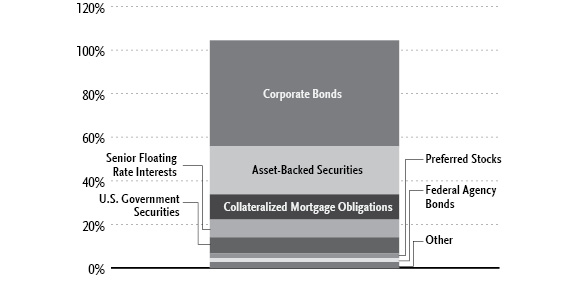

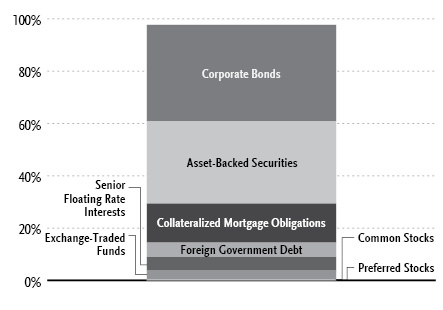

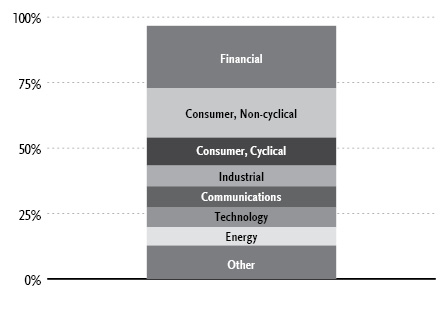

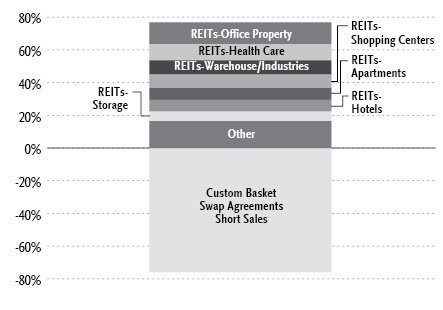

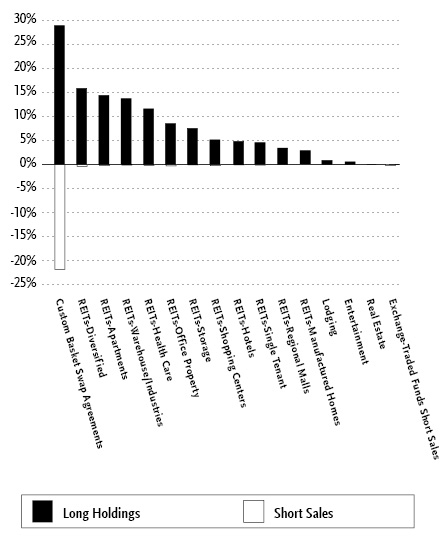

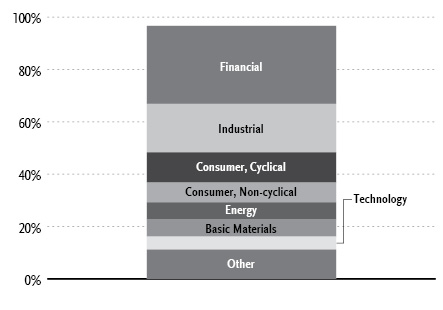

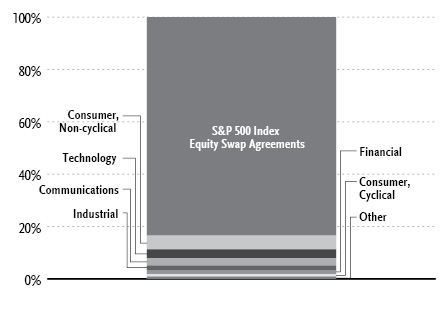

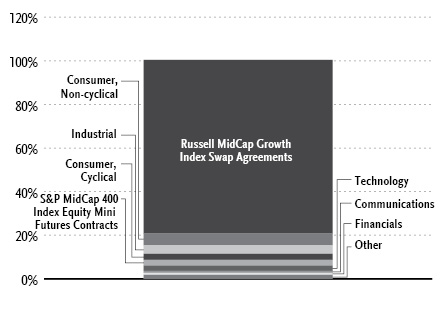

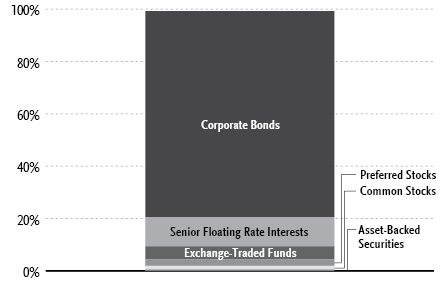

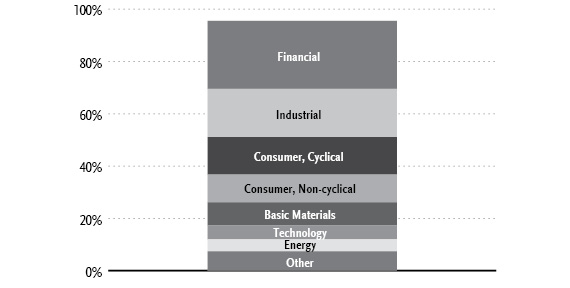

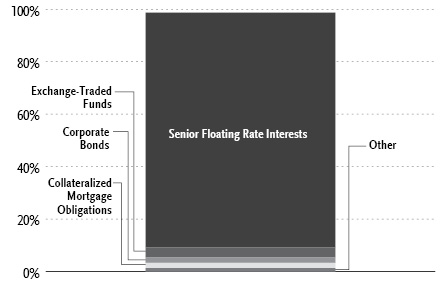

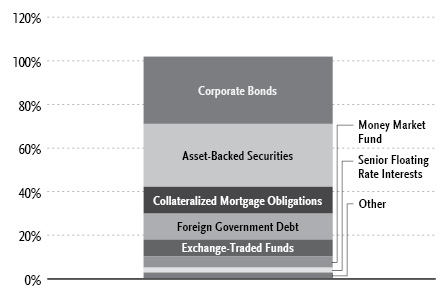

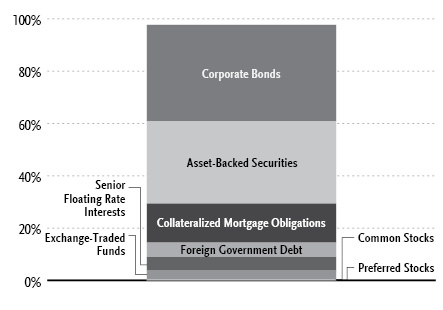

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | July 7, 2003 |

C-Class | July 7, 2003 |

P-Class | May 1, 2015 |

Institutional Class | November 7, 2008 |

Ten Largest Holdings (% of Total Net Assets) |

McKesson Corp. | 1.3% |

International Business Machines Corp. | 1.3% |

SS&C Technologies Holdings, Inc. | 1.3% |

Verizon Communications, Inc. | 1.3% |

Molson Coors Beverage Co. — Class B | 1.3% |

MetLife, Inc. | 1.2% |

General Dynamics Corp. | 1.2% |

Amgen, Inc. | 1.2% |

Cisco Systems, Inc. | 1.1% |

Evergy, Inc. | 1.1% |

Top Ten Total | 12.3% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | March 31, 2021 |

Average Annual Returns*

Periods Ended March 31, 2021

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 12.54% | 18.58% | 1.32% | 5.25% |

A-Class Shares with sales charge‡ | 7.21% | 12.94% | 0.34% | 4.74% |

C-Class Shares | 12.14% | 17.74% | 0.53% | 4.45% |

C-Class Shares with CDSC§ | 11.14% | 16.74% | 0.53% | 4.45% |

Institutional Class Shares | 12.68% | 18.96% | 1.77% | 5.68% |

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.06% | 0.12% | 1.19% | 0.63% |

S&P 500 Index | 19.07% | 56.35% | 16.29% | 13.91% |

S&P 500 Index Blended** | 0.06% | 0.12% | 4.46% | 7.96% |

Morningstar Long/Short Equity Category Average | 12.72% | 24.72% | 4.90% | 4.17% |

| 6 Month† | 1 Year | 5 Year | Since

Inception

(05/01/15) |

P-Class Shares | 12.57% | 18.69% | 1.40% | 1.50% |

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.06% | 0.12% | 1.19% | 1.02% |

S&P 500 Index | 19.07% | 56.35% | 16.29% | 13.55% |

S&P 500 Index Blended** | 0.06% | 0.12% | 4.46% | 3.71% |

Morningstar Long/Short Equity Category Average | 12.72% | 24.72% | 4.90% | 3.15% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, S&P 500 Index, and the Morningstar Long/Short Equity Category Average are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported return. |

** | Effective March 13, 2017, the Fund changed its principal investment strategy. As a result of the investment strategy change, the Fund’s new benchmark is the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The Fund’s performance was previously compared to the S&P 500 Index. The S&P 500 Index-Blended uses performance data for the S&P 500 Index from 03/31/11 to 03/12/17, and the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill index from 03/13/17 to 03/31/21. |

† | 6 month returns are not annualized. |

‡ | Fund returns are calculated using the maximum sales charge of 4.75%. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS (Unaudited) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 104.3% |

| | | | | | | | | |

Consumer, Non-cyclical - 34.4% |

McKesson Corp.1 | | | 2,433 | | | $ | 474,532 | |

Molson Coors Beverage Co. — Class B*,1 | | | 9,061 | | | | 463,470 | |

Amgen, Inc.1 | | | 1,684 | | | | 418,996 | |

J M Smucker Co.1 | | | 3,179 | | | | 402,239 | |

Merck & Company, Inc. | | | 5,183 | | | | 399,558 | |

Bristol-Myers Squibb Co.1 | | | 6,324 | | | | 399,234 | |

General Mills, Inc.1 | | | 6,415 | | | | 393,368 | |

Altria Group, Inc.1 | | | 7,573 | | | | 387,435 | |

Philip Morris International, Inc.1 | | | 4,211 | | | | 373,684 | |

Johnson & Johnson1 | | | 2,264 | | | | 372,088 | |

Colgate-Palmolive Co.1 | | | 4,718 | | | | 371,920 | |

Cardinal Health, Inc.1 | | | 5,998 | | | | 364,379 | |

Campbell Soup Co. | | | 7,062 | | | | 355,007 | |

Humana, Inc. | | | 833 | | | | 349,235 | |

Conagra Brands, Inc. | | | 8,825 | | | | 331,820 | |

Procter & Gamble Co.1 | | | 2,318 | | | | 313,927 | |

Kraft Heinz Co. | | | 7,809 | | | | 312,360 | |

United Rentals, Inc.*,1 | | | 944 | | | | 310,869 | |

Kellogg Co. | | | 4,654 | | | | 294,598 | |

Kimberly-Clark Corp.1 | | | 2,004 | | | | 278,656 | |

Gilead Sciences, Inc. | | | 4,103 | | | | 265,177 | |

United Therapeutics Corp.* | | | 1,522 | | | | 254,585 | |

Pfizer, Inc.1 | | | 6,483 | | | | 234,879 | |

Tyson Foods, Inc. — Class A | | | 2,878 | | | | 213,835 | |

Quanta Services, Inc. | | | 2,335 | | | | 205,433 | |

DaVita, Inc.* | | | 1,842 | | | | 198,513 | |

Ingredion, Inc. | | | 2,078 | | | | 186,854 | |

John B Sanfilippo & Son, Inc. | | | 2,051 | | | | 185,349 | |

Quest Diagnostics, Inc. | | | 1,420 | | | | 182,243 | |

Regeneron Pharmaceuticals, Inc.* | | | 381 | | | | 180,266 | |

Sprouts Farmers Market, Inc.* | | | 6,682 | | | | 177,875 | |

Kroger Co. | | | 4,934 | | | | 177,575 | |

Cigna Corp.1 | | | 728 | | | | 175,987 | |

H&R Block, Inc.1 | | | 7,823 | | | | 170,542 | |

Post Holdings, Inc.* | | | 1,491 | | | | 157,628 | |

Laboratory Corporation of America Holdings* | | | 577 | | | | 147,152 | |

Incyte Corp.* | | | 1,765 | | | | 143,442 | |

Coca-Cola Co. | | | 2,689 | | | | 141,737 | |

Hologic, Inc.* | | | 1,856 | | | | 138,049 | |

CVS Health Corp. | | | 1,758 | | | | 132,254 | |

Vector Group Ltd. | | | 9,136 | | | | 127,447 | |

Hill-Rom Holdings, Inc.1 | | | 1,056 | | | | 116,667 | |

Ionis Pharmaceuticals, Inc.*,1 | | | 2,578 | | | | 115,907 | |

Becton Dickinson and Co. | | | 465 | | | | 113,065 | |

Innoviva, Inc.* | | | 8,859 | | | | 105,865 | |

Prestige Consumer Healthcare, Inc.* | | | 2,278 | | | | 100,414 | |

Hershey Co. | | | 593 | | | | 93,789 | |

Perrigo Company plc | | | 2,247 | | | | 90,936 | |

Abbott Laboratories | | | 749 | | | | 89,760 | |

Medtronic plc1 | | | 755 | | | | 89,188 | |

Constellation Brands, Inc. — Class A1 | | | 391 | | | | 89,148 | |

Encompass Health Corp. | | | 1,079 | | | | 88,370 | |

USANA Health Sciences, Inc.* | | | 894 | | | | 87,254 | |

Boston Scientific Corp.* | | | 2,247 | | | | 86,847 | |

FleetCor Technologies, Inc.* | | | 310 | | | | 83,275 | |

Total Consumer, Non-cyclical | | | | | | | 12,514,682 | |

| | | | | | | | | |

Industrial - 17.9% |

General Dynamics Corp. | | | 2,382 | | | | 432,476 | |

Parker-Hannifin Corp. | | | 1,029 | | | | 324,577 | |

Lockheed Martin Corp. | | | 816 | | | | 301,512 | |

3M Co. | | | 1,535 | | | | 295,764 | |

Vishay Intertechnology, Inc. | | | 12,159 | | | | 292,789 | |

Acuity Brands, Inc. | | | 1,542 | | | | 254,430 | |

Oshkosh Corp. | | | 1,920 | | | | 227,827 | |

Arrow Electronics, Inc.*,1 | | | 1,967 | | | | 217,983 | |

Owens Corning | | | 2,362 | | | | 217,516 | |

Union Pacific Corp. | | | 911 | | | | 200,794 | |

Masco Corp.1 | | | 3,344 | | | | 200,306 | |

Trane Technologies plc1 | | | 1,191 | | | | 197,182 | |

CSX Corp. | | | 1,977 | | | | 190,622 | |

Fortive Corp. | | | 2,615 | | | | 184,724 | |

AGCO Corp.1 | | | 1,245 | | | | 178,844 | |

Snap-on, Inc.1 | | | 755 | | | | 174,208 | |

Northrop Grumman Corp. | | | 536 | | | | 173,471 | |

Caterpillar, Inc.1 | | | 745 | | | | 172,743 | |

Timken Co. | | | 2,085 | | | | 169,239 | |

Agilent Technologies, Inc. | | | 1,329 | | | | 168,969 | |

Hubbell, Inc.1 | | | 833 | | | | 155,679 | |

Norfolk Southern Corp. | | | 546 | | | | 146,612 | |

Energizer Holdings, Inc. | | | 2,973 | | | | 141,099 | |

Westinghouse Air Brake Technologies Corp. | | | 1,704 | | | | 134,889 | |

Hillenbrand, Inc. | | | 2,642 | | | | 126,050 | |

Lincoln Electric Holdings, Inc.1 | | | 988 | | | | 121,465 | |

Eaton Corporation plc1 | | | 870 | | | | 120,304 | |

Sanmina Corp.* | | | 2,882 | | | | 119,257 | |

Lennox International, Inc. | | | 374 | | | | 116,535 | |

Waters Corp.*,1 | | | 408 | | | | 115,941 | |

AECOM* | | | 1,626 | | | | 104,243 | |

O-I Glass, Inc.* | | | 7,070 | | | | 104,212 | |

Mettler-Toledo International, Inc.* | | | 87 | | | | 100,545 | |

Berry Global Group, Inc.*,1 | | | 1,481 | | | | 90,933 | |

TE Connectivity Ltd. | | | 695 | | | | 89,732 | |

Westrock Co.1 | | | 1,704 | | | | 88,693 | |

Donaldson Company, Inc. | | | 1,495 | | | | 86,949 | |

Total Industrial | | | | | | | 6,539,114 | |

| | | | | | | | | |

Utilities - 13.8% |

Evergy, Inc. | | | 6,928 | | | | 412,424 | |

PPL Corp.1 | | | 14,151 | | | | 408,115 | |

Public Service Enterprise Group, Inc.1 | | | 6,722 | | | | 404,732 | |

Southern Co. | | | 6,027 | | | | 374,638 | |

UGI Corp. | | | 8,602 | | | | 352,768 | |

Duke Energy Corp. | | | 3,381 | | | | 326,368 | |

Exelon Corp.1 | | | 7,283 | | | | 318,558 | |

IDACORP, Inc. | | | 3,155 | | | | 315,405 | |

Consolidated Edison, Inc. | | | 3,941 | | | | 294,787 | |

ONE Gas, Inc. | | | 3,715 | | | | 285,721 | |

NiSource, Inc. | | | 11,214 | | | | 270,370 | |

OGE Energy Corp.1 | | | 8,329 | | | | 269,526 | |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Value | |

Southwest Gas Holdings, Inc. | | | 3,192 | | | $ | 219,322 | |

Pinnacle West Capital Corp. | | | 2,585 | | | | 210,290 | |

CenterPoint Energy, Inc. | | | 8,130 | | | | 184,145 | |

DTE Energy Co. | | | 1,360 | | | | 181,070 | |

Sempra Energy | | | 742 | | | | 98,374 | |

AES Corp. | | | 3,253 | | | | 87,213 | |

Total Utilities | | | | | | | 5,013,826 | |

| | | | | | | | | |

Technology - 12.3% |

International Business Machines Corp.1 | | | 3,547 | | | | 472,673 | |

SS&C Technologies Holdings, Inc.1 | | | 6,685 | | | | 467,081 | |

Cerner Corp. | | | 4,313 | | | | 310,018 | |

Seagate Technology plc | | | 4,026 | | | | 308,995 | |

Dell Technologies, Inc. — Class C* | | | 2,666 | | | | 235,008 | |

CDK Global, Inc.1 | | | 4,178 | | | | 225,863 | |

HP, Inc. | | | 6,112 | | | | 194,056 | |

Kulicke & Soffa Industries, Inc. | | | 3,584 | | | | 176,010 | |

Intel Corp.1 | | | 2,733 | | | | 174,912 | |

Dropbox, Inc. — Class A* | | | 5,933 | | | | 158,174 | |

NetApp, Inc. | | | 2,051 | | | | 149,046 | |

Qorvo, Inc.* | | | 708 | | | | 129,351 | |

Bandwidth, Inc. — Class A* | | | 982 | | | | 124,459 | |

Cirrus Logic, Inc.* | | | 1,454 | | | | 123,285 | |

Texas Instruments, Inc. | | | 637 | | | | 120,387 | |

VMware, Inc. — Class A* | | | 789 | | | | 118,705 | |

Cognizant Technology Solutions Corp. — Class A | | | 1,505 | | | | 117,571 | |

Oracle Corp.1 | | | 1,589 | | | | 111,500 | |

KLA Corp. | | | 317 | | | | 104,737 | |

Skyworks Solutions, Inc. | | | 526 | | | | 96,510 | |

Accenture plc — Class A | | | 347 | | | | 95,859 | |

Microchip Technology, Inc.1 | | | 617 | | | | 95,771 | |

CSG Systems International, Inc. | | | 2,082 | | | | 93,461 | |

Fiserv, Inc.* | | | 782 | | | | 93,089 | |

Paychex, Inc.1 | | | 941 | | | | 92,237 | |

Western Digital Corp. | | | 1,295 | | | | 86,441 | |

Total Technology | | | | | | | 4,475,199 | |

| | | | | | | | | |

Consumer, Cyclical - 9.4% |

Gentex Corp.1 | | | 8,170 | | | | 291,424 | |

Allison Transmission Holdings, Inc.1 | | | 6,911 | | | | 282,176 | |

AutoZone, Inc.*,1 | | | 195 | | | | 273,838 | |

Genuine Parts Co. | | | 2,328 | | | | 269,094 | |

Gentherm, Inc.* | | | 3,256 | | | | 241,302 | |

Best Buy Company, Inc.1 | | | 2,095 | | | | 240,527 | |

AutoNation, Inc.*,1 | | | 2,497 | | | | 232,770 | |

Lowe’s Companies, Inc. | | | 1,009 | | | | 191,892 | |

MSC Industrial Direct Company, Inc. — Class A | | | 2,116 | | | | 190,842 | |

Lear Corp. | | | 1,052 | | | | 190,675 | |

Cummins, Inc. | | | 715 | | | | 185,264 | |

Lennar Corp. — Class A | | | 1,572 | | | | 159,134 | |

PACCAR, Inc. | | | 1,707 | | | | 158,614 | |

PulteGroup, Inc. | | | 2,791 | | | | 146,360 | |

Brunswick Corp.1 | | | 1,414 | | | | 134,853 | |

O’Reilly Automotive, Inc.* | | | 263 | | | | 133,407 | |

Dolby Laboratories, Inc. — Class A1 | | | 1,002 | | | | 98,917 | |

Total Consumer, Cyclical | | | | | | | 3,421,089 | |

| | | | | | | | | |

Communications - 9.1% |

Verizon Communications, Inc.1 | | | 8,006 | | | | 465,549 | |

Cisco Systems, Inc.1 | | | 8,012 | | | | 414,300 | |

Viavi Solutions, Inc.* | | | 20,698 | | | | 324,958 | |

Juniper Networks, Inc.1 | | | 10,290 | | | | 260,646 | |

T-Mobile US, Inc.* | | | 1,761 | | | | 220,636 | |

VeriSign, Inc.* | | | 1,049 | | | | 208,499 | |

Ciena Corp.* | | | 3,651 | | | | 199,783 | |

Charter Communications, Inc. — Class A* | | | 307 | | | | 189,425 | |

Cogent Communications Holdings, Inc. | | | 2,494 | | | | 171,488 | |

Sirius XM Holdings, Inc. | | | 24,866 | | | | 151,434 | |

Omnicom Group, Inc.1 | | | 1,957 | | | | 145,112 | |

Motorola Solutions, Inc. | | | 735 | | | | 138,217 | |

InterDigital, Inc. | | | 2,028 | | | | 128,676 | |

AT&T, Inc.1 | | | 3,955 | | | | 119,718 | |

Vonage Holdings Corp.* | | | 10,000 | | | | 118,200 | |

Facebook, Inc. — Class A* | | | 144 | | | | 42,412 | |

Discovery, Inc. — Class A* | | | 644 | | | | 27,988 | |

Total Communications | | | | | | | 3,327,041 | |

| | | | | | | | | |

Financial - 7.2% |

MetLife, Inc.1 | | | 7,448 | | | | 452,764 | |

Allstate Corp.1 | | | 2,774 | | | | 318,733 | |

Highwoods Properties, Inc. REIT | | | 7,259 | | | | 311,701 | |

Prudential Financial, Inc. | | | 2,669 | | | | 243,146 | |

Travelers Companies, Inc. | | | 1,522 | | | | 228,909 | |

Berkshire Hathaway, Inc. — Class B*,1 | | | 884 | | | | 225,835 | |

Brandywine Realty Trust REIT1 | | | 14,036 | | | | 181,205 | |

Aflac, Inc.1 | | | 3,398 | | | | 173,910 | |

Hartford Financial Services Group, Inc. | | | 2,369 | | | | 158,225 | |

Synchrony Financial | | | 3,233 | | | | 131,454 | |

Western Union Co.1 | | | 4,009 | | | | 98,862 | |

Sabra Health Care REIT, Inc. | | | 5,042 | | | | 87,529 | |

Total Financial | | | | | | | 2,612,273 | |

| | | | | | | | | |

Basic Materials - 0.2% |

International Paper Co. | | | 1,606 | | | | 86,837 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $33,155,236) | | | | | | | 37,990,061 | |

| | | | | | | | | |

MONEY MARKET FUND† - 4.7% |

Goldman Sachs Financial Square Treasury Instruments Fund — Institutional Shares, 0.01%2 | | | 1,715,994 | | | | 1,715,994 | |

Total Money Market Fund | | | | |

(Cost $1,715,994) | | | | | | | 1,715,994 | |

| | | | | | | | | |

Total Investments - 109.0% | | | | |

(Cost $34,871,230) | | $ | 39,706,055 | |

Other Assets & Liabilities, net - (9.0)% | | | (3,279,105 | ) |

Total Net Assets - 100.0% | | $ | 36,426,950 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

Custom Basket Swap Agreements |

Counterparty | Reference Obligation | Financing Rate

Pay (Receive) | Payment

Frequency | | Maturity

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

OTC Custom Basket Swap Agreements†† |

Morgan Stanley Capital Services LLC | MS Equity Custom Basket | 0.47% (Federal Funds Rate + 0.40%) | At Maturity | | | 02/01/24 | | | $ | 3,235,092 | | | $ | 340,231 | |

Goldman Sachs International | GS Equity Custom Basket | 0.52% (Federal Funds Rate + 0.45%) | At Maturity | | | 05/06/24 | | | | 3,235,098 | | | | 339,251 | |

| | | | | | | | | | $ | 6,470,190 | | | $ | 679,482 | |

OTC Custom Basket Swap Agreements Sold Short†† |

Goldman Sachs International | GS Equity Custom Basket | (0.13)% (Federal Funds Rate - 0.20%) | At Maturity | | | 05/06/24 | | | $ | 13,320,112 | | | $ | (1,561,868 | ) |

Morgan Stanley Capital Services LLC | MS Equity Custom Basket | (0.23)% (Federal Funds Rate - 0.30%) | At Maturity | | | 02/01/24 | | | | 13,214,069 | | | | (1,591,166 | ) |

| | | | | | | | | | $ | 26,534,181 | | | $ | (3,153,034 | ) |

| | Shares | | | Percentage

Notional

Amount | | |

Value and

Unrealized

Appreciation

(Depreciation)

| |

MS EQUITY LONG CUSTOM BASKET | | | | | | | | |

Industrial | | | | | | | | | | | | |

Snap-on, Inc. | | | 63 | | | | 0.47 | % | | $ | 6,863 | |

AGCO Corp. | | | 103 | | | | 0.46 | % | | | 6,508 | |

Acuity Brands, Inc. | | | 128 | | | | 0.65 | % | | | 6,144 | |

Oshkosh Corp. | | | 160 | | | | 0.59 | % | | | 4,433 | |

Owens Corning | | | 196 | | | | 0.56 | % | | | 4,419 | |

Caterpillar, Inc. | | | 62 | | | | 0.44 | % | | | 4,305 | |

Vishay Intertechnology, Inc. | | | 1,013 | | | | 0.75 | % | | | 3,958 | |

General Dynamics Corp. | | | 198 | | | | 1.11 | % | | | 3,730 | |

TE Connectivity Ltd. | | | 57 | | | | 0.23 | % | | | 3,538 | |

Hubbell, Inc. | | | 69 | | | | 0.40 | % | | | 3,480 | |

Arrow Electronics, Inc. | | | 164 | | | | 0.56 | % | | | 3,285 | |

Timken Co. | | | 173 | | | | 0.43 | % | | | 2,572 | |

Lincoln Electric Holdings, Inc. | | | 82 | | | | 0.31 | % | | | 2,288 | |

Waters Corp. | | | 34 | | | | 0.30 | % | | | 2,205 | |

3M Co. | | | 128 | | | | 0.76 | % | | | 1,743 | |

Parker-Hannifin Corp. | | | 85 | | | | 0.83 | % | | | 1,432 | |

Eaton Corporation plc | | | 72 | | | | 0.31 | % | | | 1,368 | |

Trane Technologies plc | | | 99 | | | | 0.51 | % | | | 1,258 | |

Masco Corp. | | | 278 | | | | 0.51 | % | | | 1,187 | |

O-I Glass, Inc. | | | 589 | | | | 0.27 | % | | | 1,112 | |

Energizer Holdings, Inc. | | | 247 | | | | 0.36 | % | | | 1,009 | |

Northrop Grumman Corp. | | | 44 | | | | 0.44 | % | | | 983 | |

Lennox International, Inc. | | | 31 | | | | 0.30 | % | | | 877 | |

Lockheed Martin Corp. | | | 68 | | | | 0.78 | % | | | 859 | |

Westinghouse Air Brake Technologies Corp. | | | 142 | | | | 0.35 | % | | | 737 | |

Agilent Technologies, Inc. | | | 110 | | | | 0.43 | % | | | 715 | |

Mettler-Toledo International, Inc. | | | 7 | | | | 0.25 | % | | | 684 | |

AECOM | | | 135 | | | | 0.27 | % | | | 607 | |

Berry Global Group, Inc. | | | 123 | | | | 0.23 | % | | | 575 | |

CSX Corp. | | | 164 | | | | 0.49 | % | | | 507 | |

Union Pacific Corp. | | | 75 | | | | 0.51 | % | | | 498 | |

Sanmina Corp. | | | 240 | | | | 0.31 | % | | | 429 | |

Norfolk Southern Corp. | | | 45 | | | | 0.37 | % | | | 275 | |

Westrock Co. | | | 142 | | | | 0.23 | % | | | 274 | |

Fortive Corp. | | | 218 | | | | 0.48 | % | | | 141 | |

Donaldson Company, Inc. | | | 124 | | | | 0.22 | % | | | (152 | ) |

Hillenbrand, Inc. | | | 220 | | | | 0.32 | % | | | (533 | ) |

Total Industrial | | | | | | | | | | | 74,313 | |

| | | | | | | | | | | | | |

Consumer, Non-cyclical | | | | | | | | | | | | |

United Rentals, Inc. | | | 79 | | | | 0.79 | % | | | 9,362 | |

Cardinal Health, Inc. | | | 457 | | | | 0.86 | % | | | 8,099 | |

Molson Coors Beverage Co. — Class B | | | 755 | | | | 1.19 | % | | | 7,485 | |

McKesson Corp. | | | 202 | | | | 1.22 | % | | | 7,111 | |

Amgen, Inc. | | | 140 | | | | 1.08 | % | | | 4,719 | |

Altria Group, Inc. | | | 631 | | | | 1.00 | % | | | 4,681 | |

Quanta Services, Inc. | | | 194 | | | | 0.53 | % | | | 4,491 | |

Kraft Heinz Co. | | | 651 | | | | 0.80 | % | | | 4,373 | |

United Therapeutics Corp. | | | 126 | | | | 0.65 | % | | | 3,930 | |

Johnson & Johnson | | | 188 | | | | 0.96 | % | | | 3,506 | |

J M Smucker Co. | | | 265 | | | | 1.04 | % | | | 3,498 | |

Campbell Soup Co. | | | 718 | | | | 1.12 | % | | | 2,640 | |

Philip Morris International, Inc. | | | 351 | | | | 0.96 | % | | | 2,425 | |

Sprouts Farmers Market, Inc. | | | 557 | | | | 0.46 | % | | | 2,336 | |

H&R Block, Inc. | | | 652 | | | | 0.44 | % | | | 2,219 | |

Procter & Gamble Co. | | | 193 | | | | 0.81 | % | | | 2,192 | |

Tyson Foods, Inc. — Class A | | | 239 | | | | 0.55 | % | | | 1,993 | |

Cigna Corp. | | | 60 | | | | 0.45 | % | | | 1,980 | |

Laboratory Corporation of America Holdings | | | 48 | | | | 0.38 | % | | | 1,860 | |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

General Mills, Inc. | | | 534 | | | | 1.01 | % | | $ | 1,757 | |

DaVita, Inc. | | | 153 | | | | 0.51 | % | | | 1,751 | |

Vector Group Ltd. | | | 761 | | | | 0.33 | % | | | 1,703 | |

Colgate-Palmolive Co. | | | 393 | | | | 0.96 | % | | | 1,655 | |

Kellogg Co. | | | 387 | | | | 0.76 | % | | | 1,466 | |

Conagra Brands, Inc. | | | 735 | | | | 0.85 | % | | | 1,398 | |

Hill-Rom Holdings, Inc. | | | 88 | | | | 0.30 | % | | | 1,322 | |

Kroger Co. | | | 411 | | | | 0.46 | % | | | 1,283 | |

Pfizer, Inc. | | | 540 | | | | 0.60 | % | | | 1,244 | |

Post Holdings, Inc. | | �� | 124 | | | | 0.41 | % | | | 1,234 | |

Bristol-Myers Squibb Co. | | | 527 | | | | 1.03 | % | | | 1,101 | |

John B Sanfilippo & Son, Inc. | | | 171 | | | | 0.48 | % | | | 1,008 | |

Humana, Inc. | | | 69 | | | | 0.89 | % | | | 966 | |

USANA Health Sciences, Inc. | | | 74 | | | | 0.22 | % | | | 951 | |

Quest Diagnostics, Inc. | | | 118 | | | | 0.47 | % | | | 903 | |

CVS Health Corp. | | | 146 | | | | 0.34 | % | | | 797 | |

Medtronic plc | | | 63 | | | | 0.23 | % | | | 758 | |

Ingredion, Inc. | | | 173 | | | | 0.48 | % | | | 671 | |

Prestige Consumer Healthcare, Inc. | | | 189 | | | | 0.26 | % | | | 567 | |

Constellation Brands, Inc. — Class A | | | 32 | | | | 0.23 | % | | | 554 | |

Kimberly-Clark Corp. | | | 167 | | | | 0.72 | % | | | 465 | |

Innoviva, Inc. | | | 738 | | | | 0.27 | % | | | 456 | |

Abbott Laboratories | | | 62 | | | | 0.23 | % | | | 443 | |

Coca-Cola Co. | | | 224 | | | | 0.36 | % | | | 346 | |

Hershey Co. | | | 49 | | | | 0.24 | % | | | 330 | |

Hologic, Inc. | | | 154 | | | | 0.35 | % | | | 322 | |

Incyte Corp. | | | 147 | | | | 0.37 | % | | | 252 | |

Merck & Company, Inc. | | | 432 | | | | 1.03 | % | | | 207 | |

Encompass Health Corp. | | | 90 | | | | 0.23 | % | | | 6 | |

Becton Dickinson and Co. | | | 38 | | | | 0.29 | % | | | (9 | ) |

Regeneron Pharmaceuticals, Inc. | | | 31 | | | | 0.45 | % | | | (142 | ) |

Perrigo Company plc | | | 187 | | | | 0.23 | % | | | (175 | ) |

Boston Scientific Corp. | | | 187 | | | | 0.22 | % | | | (243 | ) |

Gilead Sciences, Inc. | | | 342 | | | | 0.68 | % | | | (312 | ) |

FleetCor Technologies, Inc. | | | 25 | | | | 0.21 | % | | | (430 | ) |

Ionis Pharmaceuticals, Inc. | | | 214 | | | | 0.30 | % | | | (1,512 | ) |

Total Consumer, Non-cyclical | | | | | | | | | | | 101,993 | |

| | | | | | | | | | | | | |

Financial | | | | | | | | | | | | |

MetLife, Inc. | | | 621 | | | | 1.17 | % | | | 6,812 | |

Hartford Financial Services Group, Inc. | | | 197 | | | | 0.41 | % | | | 4,032 | |

Allstate Corp. | | | 231 | | | | 0.82 | % | | | 2,842 | |

Travelers Companies, Inc. | | | 126 | | | | 0.59 | % | | | 2,040 | |

Aflac, Inc. | | | 283 | | | | 0.45 | % | | | 1,941 | |

Synchrony Financial | | | 269 | | | | 0.34 | % | | | 1,936 | |

Highwoods Properties, Inc. | | | 605 | | | | 0.80 | % | | | 1,837 | |

Western Union Co. | | | 334 | | | | 0.25 | % | | | 1,652 | |

Berkshire Hathaway, Inc. — Class B | | | 73 | | | | 0.58 | % | | | 1,240 | |

Sabra Health Care REIT, Inc. | | | 420 | | | | 0.23 | % | | | (201 | ) |

Prudential Financial, Inc. | | | 222 | | | | 0.63 | % | | | (256 | ) |

Brandywine Realty Trust | | | 1,170 | | | | 0.47 | % | | | (595 | ) |

Total Financial | | | | | | | | | | | 23,280 | |

| | | | | | | | | | | | | |

Utilities | | | | | | | | | | | | |

Evergy, Inc. | | | 577 | | | | 1.06 | % | | | 3,072 | |

Exelon Corp. | | | 607 | | | | 0.82 | % | | | 2,994 | |

UGI Corp. | | | 717 | | | | 0.91 | % | | | 2,824 | |

Public Service Enterprise Group, Inc. | | | 560 | | | | 1.04 | % | | | 2,467 | |

IDACORP, Inc. | | | 263 | | | | 0.81 | % | | | 2,341 | |

PPL Corp. | | | 1,179 | | | | 1.05 | % | | | 2,122 | |

Southern Co. | | | 502 | | | | 0.96 | % | | | 2,067 | |

NiSource, Inc. | | | 934 | | | | 0.70 | % | | | 1,860 | |

CenterPoint Energy, Inc. | | | 677 | | | | 0.47 | % | | | 1,654 | |

ONE Gas, Inc. | | | 309 | | | | 0.73 | % | | | 1,407 | |

Duke Energy Corp. | | | 281 | | | | 0.84 | % | | | 1,062 | |

DTE Energy Co. | | | 113 | | | | 0.47 | % | | | 979 | |

OGE Energy Corp. | | | 694 | | | | 0.69 | % | | | 786 | |

Pinnacle West Capital Corp. | | | 215 | | | | 0.54 | % | | | 777 | |

Consolidated Edison, Inc. | | | 328 | | | | 0.76 | % | | | 706 | |

Sempra Energy | | | 61 | | | | 0.25 | % | | | 572 | |

Southwest Gas Holdings, Inc. | | | 266 | | | | 0.56 | % | | | (157 | ) |

AES Corp. | | | 271 | | | | 0.22 | % | | | (238 | ) |

Total Utilities | | | | | | | | | | | 27,295 | |

| | | | | | | | | | | | | |

Technology | | | | | | | | | | | | |

Seagate Technology plc | | | 335 | | | | 0.79 | % | | | 6,204 | |

HP, Inc. | | | 509 | | | | 0.50 | % | | | 5,842 | |

Texas Instruments, Inc. | | | 53 | | | | 0.31 | % | | | 4,008 | |

Kulicke & Soffa Industries, Inc. | | | 298 | | | | 0.45 | % | | | 3,970 | |

NetApp, Inc. | | | 171 | | | | 0.38 | % | | | 3,750 | |

CDK Global, Inc. | | | 348 | | | | 0.58 | % | | | 3,347 | |

International Business Machines Corp. | | | 295 | | | | 1.22 | % | | | 3,009 | |

SS&C Technologies Holdings, Inc. | | | 557 | | | | 1.20 | % | | | 2,902 | |

Intel Corp. | | | 227 | | | | 0.45 | % | | | 2,530 | |

KLA Corp. | | | 26 | | | | 0.27 | % | | | 2,490 | |

Dell Technologies, Inc. — Class C | | | 222 | | | | 0.60 | % | | | 2,066 | |

Oracle Corp. | | | 132 | | | | 0.29 | % | | | 1,713 | |

Cirrus Logic, Inc. | | | 121 | | | | 0.32 | % | | | 1,668 | |

Microchip Technology, Inc. | | | 51 | | | | 0.24 | % | | | 1,458 | |

Skyworks Solutions, Inc. | | | 43 | | | | 0.24 | % | | | 1,323 | |

Dropbox, Inc. — Class A | | | 494 | | | | 0.41 | % | | | 984 | |

Cerner Corp. | | | 359 | | | | 0.80 | % | | | 760 | |

Qorvo, Inc. | | | 59 | | | | 0.33 | % | | | 710 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Accenture plc — Class A | | | 28 | | | | 0.24 | % | | $ | 535 | |

Cognizant Technology Solutions Corp. — Class A | | | 125 | | | | 0.30 | % | | | 397 | |

VMware, Inc. — Class A | | | 65 | | | | 0.30 | % | | | 371 | |

Paychex, Inc. | | | 78 | | | | 0.24 | % | | | 279 | |

Fiserv, Inc. | | | 65 | | | | 0.24 | % | | | 116 | |

Western Digital Corp. | | | 108 | | | | 0.22 | % | | | (337 | ) |

CSG Systems International, Inc. | | | 173 | | | | 0.24 | % | | | (422 | ) |

Bandwidth, Inc. — Class A | | | 81 | | | | 0.32 | % | | | (3,462 | ) |

Total Technology | | | | | | | | | | | 46,211 | |

| | | | | | | | | | | | | |

Communications | | | | | | | | | | | | |

Facebook, Inc. — Class A | | | 189 | | | | 1.72 | % | | | 6,245 | |

Cisco Systems, Inc. | | | 667 | | | | 1.07 | % | | | 5,702 | |

Viavi Solutions, Inc. | | | 1,725 | | | | 0.84 | % | | | 2,622 | |

Ciena Corp. | | | 304 | | | | 0.51 | % | | | 2,555 | |

Discovery, Inc. — Class A | | | 686 | | | | 0.92 | % | | | 2,256 | |

Juniper Networks, Inc. | | | 857 | | | | 0.67 | % | | | 1,985 | |

Cogent Communications Holdings, Inc. | | | 207 | | | | 0.44 | % | | | 1,642 | |

Omnicom Group, Inc. | | | 163 | | | | 0.37 | % | | | 1,577 | |

Verizon Communications, Inc. | | | 579 | | | | 1.04 | % | | | 1,522 | |

Motorola Solutions, Inc. | | | 61 | | | | 0.35 | % | | | 1,280 | |

T-Mobile US, Inc. | | | 146 | | | | 0.57 | % | | | 786 | |

VeriSign, Inc. | | | 87 | | | | 0.53 | % | | | 564 | |

Sirius XM Holdings, Inc. | | | 2,072 | | | | 0.39 | % | | | 448 | |

Charter Communications, Inc. — Class A | | | 25 | | | | 0.48 | % | | | (27 | ) |

InterDigital, Inc. | | | 169 | | | | 0.33 | % | | | (217 | ) |

Vonage Holdings Corp. | | | 833 | | | | 0.30 | % | | | (747 | ) |

AT&T, Inc. | | | 329 | | | | 0.31 | % | | | (2,233 | ) |

Total Communications | | | | | | | | | | | 25,960 | |

| | | | | | | | | | | | | |

Consumer, Cyclical | | | | | | | | | | | | |

Gentherm, Inc. | | | 271 | | | | 0.62 | % | | | 5,930 | |

Lear Corp. | | | 87 | | | | 0.49 | % | | | 3,835 | |

AutoZone, Inc. | | | 16 | | | | 0.69 | % | | | 3,543 | |

AutoNation, Inc. | | | 208 | | | | 0.60 | % | | | 3,391 | |

Gentex Corp. | | | 681 | | | | 0.75 | % | | | 2,726 | |

Cummins, Inc. | | | 59 | | | | 0.47 | % | | | 2,677 | |

Brunswick Corp. | | | 117 | | | | 0.34 | % | | | 2,568 | |

Lennar Corp. — Class A | | | 131 | | | | 0.41 | % | | | 2,398 | |

Genuine Parts Co. | | | 194 | | | | 0.69 | % | | | 2,127 | |

MSC Industrial Direct Company, Inc. — Class A | | | 176 | | | | 0.49 | % | | | 1,991 | |

Lowe’s Companies, Inc. | | | 84 | | | | 0.49 | % | | | 1,940 | |

PACCAR, Inc. | | | 142 | | | | 0.41 | % | | | 1,787 | |

PulteGroup, Inc. | | | 232 | | | | 0.38 | % | | | 1,534 | |

Allison Transmission Holdings, Inc. | | | 576 | | | | 0.73 | % | | | 1,382 | |

Best Buy Company, Inc. | | | 174 | | | | 0.62 | % | | | 1,267 | |

Dolby Laboratories, Inc. — Class A | | | 83 | | | | 0.25 | % | | | 1,123 | |

O’Reilly Automotive, Inc. | | | 21 | | | | 0.33 | % | | | 846 | |

Total Consumer, Cyclical | | | | | | | | | | | 41,065 | |

| | | | | | | | | | | | | |

Basic Materials | | | | | | | | | | | | |

International Paper Co. | | | 133 | | | | 0.22 | % | | | 114 | |

| | | | | | | | | | | | | |

Total MS Equity Long Custom Basket | | | | | | $ | 340,231 | |

| | | | | | | | | |

MS EQUITY SHORT CUSTOM BASKET | | | | | | | | |

Basic Materials | | | | | | | | | | | | |

Southern Copper Corp. | | | 1,310 | | | | (0.70 | )% | | $ | 3,686 | |

LyondellBasell Industries N.V. — Class A | | | 686 | | | | (0.56 | )% | | | 2,717 | |

Royal Gold, Inc. | | | 499 | | | | (0.41 | )% | | | (653 | ) |

Westlake Chemical Corp. | | | 613 | | | | (0.41 | )% | | | (756 | ) |

PPG Industries, Inc. | | | 975 | | | | (1.11 | )% | | | (2,591 | ) |

Steel Dynamics, Inc. | | | 1,851 | | | | (0.71 | )% | | | (5,621 | ) |

Huntsman Corp. | | | 3,537 | | | | (0.77 | )% | | | (9,631 | ) |

Axalta Coating Systems Ltd. | | | 2,958 | | | | (0.66 | )% | | | (11,143 | ) |

RPM International, Inc. | | | 764 | | | | (0.53 | )% | | | (13,696 | ) |

Nucor Corp. | | | 1,263 | | | | (0.77 | )% | | | (17,673 | ) |

United States Steel Corp. | | | 3,538 | | | | (0.70 | )% | | | (18,242 | ) |

Air Products and Chemicals, Inc. | | | 883 | | | | (1.88 | )% | | | (19,334 | ) |

Quaker Chemical Corp. | | | 499 | | | | (0.92 | )% | | | (31,577 | ) |

Balchem Corp. | | | 1,074 | | | | (1.02 | )% | | | (33,448 | ) |

Freeport-McMoRan, Inc. | | | 2,566 | | | | (0.64 | )% | | | (39,173 | ) |

Celanese Corp. — Class A | | | 940 | | | | (1.07 | )% | | | (41,024 | ) |

Albemarle Corp. | | | 611 | | | | (0.68 | )% | | | (42,579 | ) |

Linde plc | | | 871 | | | | (1.85 | )% | | | (49,231 | ) |

Total Basic Materials | | | | | | | | | | | (329,969 | ) |

| | | | | | | | | | | | | |

Utilities | | | | | | | | | | | | |

ALLETE, Inc. | | | 806 | | | | (0.41 | )% | | | (1,221 | ) |

California Water Service Group | | | 1,320 | | | | (0.56 | )% | | | (3,911 | ) |

Total Utilities | | | | | | | | | | | (5,132 | ) |

| | | | | | | | | | | | | |

Financial | | | | | | | | | | | | |

Realty Income Corp. | | | 3,976 | | | | (1.91 | )% | | | 14,475 | |

UDR, Inc. | | | 1,509 | | | | (0.50 | )% | | | 6,044 | |

Global Net Lease, Inc. | | | 4,111 | | | | (0.56 | )% | | | 5,541 | |

Goldman Sachs Group, Inc. | | | 686 | | | | (1.70 | )% | | | 5,269 | |

JBG SMITH Properties | | | 3,355 | | | | (0.81 | )% | | | 5,224 | |

CyrusOne, Inc. | | | 1,040 | | | | (0.53 | )% | | | 4,751 | |

Federal Realty Investment Trust | | | 688 | | | | (0.53 | )% | | | 3,719 | |

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2021 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

QTS Realty Trust, Inc. — Class A | | | 1,081 | | | | (0.51 | )% | | $ | 2,822 | |

Kilroy Realty Corp. | | | 1,217 | | | | (0.60 | )% | | | 2,277 | |

Nasdaq, Inc. | | | 699 | | | | (0.78 | )% | | | (208 | ) |

CubeSmart | | | 1,959 | | | | (0.56 | )% | | | (1,295 | ) |

Host Hotels & Resorts, Inc. | | | 5,135 | | | | (0.65 | )% | | | (1,297 | ) |

Life Storage, Inc. | | | 902 | | | | (0.59 | )% | | | (1,375 | ) |

Intercontinental Exchange, Inc. | | | 997 | | | | (0.84 | )% | | | (1,813 | ) |

Agree Realty Corp. | | | 3,363 | | | | (1.71 | )% | | | (1,878 | ) |

KKR & Company, Inc. — Class A | | | 1,607 | | | | (0.59 | )% | | | (2,352 | ) |

Digital Realty Trust, Inc. | | | 546 | | | | (0.58 | )% | | | (2,931 | ) |

CME Group, Inc. — Class A | | | 591 | | | | (0.91 | )% | | | (3,505 | ) |

Equity LifeStyle Properties, Inc. | | | 1,499 | | | | (0.72 | )% | | | (3,759 | ) |

Americold Realty Trust | | | 2,749 | | | | (0.80 | )% | | | (4,220 | ) |

Duke Realty Corp. | | | 1,959 | | | | (0.62 | )% | | | (6,818 | ) |

Medical Properties Trust, Inc. | | | 5,925 | | | | (0.95 | )% | | | (8,327 | ) |

Healthpeak Properties, Inc. | | | 3,483 | | | | (0.84 | )% | | | (9,459 | ) |

Prologis, Inc. | | | 1,264 | | | | (1.01 | )% | | | (9,979 | ) |

Equinix, Inc. | | | 168 | | | | (0.86 | )% | | | (11,259 | ) |

Camden Property Trust | | | 1,282 | | | | (1.07 | )% | | | (11,940 | ) |

S&T Bancorp, Inc. | | | 2,202 | | | | (0.56 | )% | | | (13,006 | ) |

Rayonier, Inc. | | | 2,607 | | | | (0.64 | )% | | | (13,017 | ) |

TFS Financial Corp. | | | 3,678 | | | | (0.57 | )% | | | (15,184 | ) |

Southside Bancshares, Inc. | | | 2,050 | | | | (0.60 | )% | | | (16,891 | ) |

Alleghany Corp. | | | 294 | | | | (1.39 | )% | | | (16,929 | ) |

First Midwest Bancorp, Inc. | | | 2,692 | | | | (0.45 | )% | | | (17,585 | ) |

EastGroup Properties, Inc. | | | 751 | | | | (0.81 | )% | | | (18,518 | ) |

First Industrial Realty Trust, Inc. | | | 4,942 | | | | (1.71 | )% | | | (19,218 | ) |

Howard Hughes Corp. | | | 993 | | | | (0.71 | )% | | | (19,385 | ) |

Ares Management Corp. — Class A | | | 2,028 | | | | (0.86 | )% | | | (19,457 | ) |

Loews Corp. | | | 1,841 | | | | (0.71 | )% | | | (23,633 | ) |

Terreno Realty Corp. | | | 1,520 | | | | (0.66 | )% | | | (23,811 | ) |

American Tower Corp. — Class A | | | 701 | | | | (1.27 | )% | | | (25,001 | ) |

Brookline Bancorp, Inc. | | | 6,702 | | | | (0.76 | )% | | | (29,890 | ) |

Sun Communities, Inc. | | | 1,091 | | | | (1.24 | )% | | | (31,195 | ) |

First Financial Bankshares, Inc. | | | 2,863 | | | | (1.01 | )% | | | (38,706 | ) |

Rexford Industrial Realty, Inc. | | | 3,328 | | | | (1.27 | )% | | | (42,190 | ) |

First Republic Bank | | | 1,079 | | | | (1.36 | )% | | | (65,143 | ) |

Total Financial | | | | | | | | | | | (481,052 | ) |

| | | | | | | | | | | | | |

Consumer, Non-cyclical | | | | | | | | | | | | |