UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 01136

Guggenheim Funds Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Funds Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: September 30

Date of reporting period: October 1, 2021 - March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

3.31.2022

Guggenheim Funds Semi-Annual Report

Guggenheim Funds Trust-Equity |

Guggenheim Alpha Opportunity Fund | | |

Guggenheim Large Cap Value Fund | | |

Guggenheim Market Neutral Real Estate Fund | | |

Guggenheim Risk Managed Real Estate Fund | | |

Guggenheim Small Cap Value Fund | | |

Guggenheim StylePlus—Large Core Fund | | |

Guggenheim StylePlus—Mid Growth Fund | | |

Guggenheim World Equity Income Fund | | |

GuggenheimInvestments.com | SBE-SEMI-0322x0922 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 7 |

ALPHA OPPORTUNITY FUND | 10 |

LARGE CAP VALUE FUND | 28 |

MARKET NEUTRAL REAL ESTATE FUND | 37 |

RISK MANAGED REAL ESTATE FUND | 47 |

SMALL CAP VALUE FUND | 62 |

STYLEPLUS—LARGE CORE FUND | 71 |

STYLEPLUS—MID GROWTH FUND | 81 |

WORLD EQUITY INCOME FUND | 92 |

NOTES TO FINANCIAL STATEMENTS | 102 |

OTHER INFORMATION | 116 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 117 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 123 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management, LLC (the “Investment Advisers”) are pleased to present the shareholder report for a selection of our Funds (the “Funds”) for the semi-annual period ended March 31, 2022.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC,

Guggenheim Partners Investment Management, LLC,

April 30, 2022

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/ or legal professional regarding your specific situation.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

COVID-19 and Other Market Risks. The outbreak of COVID-19 and the recovery response has caused and continues to cause at times reduced consumer demand and economic output, supply chain disruptions, and market closures, travel restrictions, quarantines, and disparate global vaccine distributions. As with other serious economic disruptions, governmental authorities and regulators have responded in recent years to this situation with significant fiscal and monetary policy changes. These included providing direct capital infusions into companies, introducing new monetary programs, and lowering interest rates. In some cases, these responses resulted in high inflation, low interest rates, and negative interest rates. Recently, the United States and other governments have also made investments and engaged in infrastructure modernization projects that have also increased public debt and spending. These actions, including their reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, continue to cause higher inflation, heighten investor uncertainty, and adversely affect the value of the Funds’ investments and the performance of the Funds. These actions also contribute to a risk that asset prices have a high degree of correlation across markets and asset classes. The duration and extent of COVID-19 over the long term cannot be reasonably estimated at this time. The ultimate impact of COVID-19 and the extent to which COVID-19 impacts the Funds will depend on future developments, which are highly uncertain and difficult to predict.

The value of, or income generated by, the investments held by a Fund are subject to the possibility of rapid and unpredictable fluctuation, and loss. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailing interest rates, changes in inflation rates or expectations about inflation rates (which are currently elevated relative to normal conditions), adverse investor confidence or sentiment, changing economic, political, social or financial market conditions, increased instability or general uncertainty, environmental disasters, governmental actions, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics), debt crises, actual or threatened wars or other armed conflicts (such as the current Russia-Ukraine conflict and its risk of expansion or collateral economic and other effects) or ratings downgrades, and other similar events, each of which may be temporary or last for extended periods. Changing economic, political, geopolitical, social, or financial market or other conditions in one country or geographic region could adversely affect the value, yield and return of the investments held by a Fund in a different country or geographic region and economies, markets and issuers generally because of the increasingly interconnected global economies and financial markets.

Alpha Opportunity Fund is subject to a number of risks and is not suitable for all investors. ● Investments in securities and derivatives, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the Fund may lose money. There can be no guarantee the Fund will achieve it investment objective. ●The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● Certain of the derivative instruments, such as swaps and structured notes, are also subject to the risks of counterparty default and adverse tax treatment. ●The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs, including paying more for a security than it received from its sale and the risk of unlimited losses. ●In certain circumstances the Fund may be subject to liquidity risk and it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ●In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ●The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Large Cap Value Fund may not be suitable for all investors. ● An investment in the Fund will fluctuate and is subject to investment risks, which means an investor could lose money. ● The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. The Fund is subject to risk that large-capitalization stocks may underperform other segments of the equity market or the equity markets as a whole. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Market Neutral Real Estate Fund may not be suitable for all investors. ● Investing involves risk, including the possible loss of principal. ● There are no assurances that any fund will achieve its objective and/or strategy. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s use of derivatives such as futures, options, and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs. The Fund risks paying more for a security than it received from its sale. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political, or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Investing in sector funds is more volatile than investing in broadly diversified funds, as there is a greater risk due to the concentration of the funds’ holdings in issuers of the same or similar offerings. ● This Fund is considered non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single security could cause greater fluctuations in the value of fund shares than would occur in a more diversified fund. ● Short selling involves increased risks and costs. You risk paying more for a security than you received from its sale. This strategy may not be suitable for all investors. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Risk Managed Real Estate Fund may not be suitable for all investors. ● Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time ● Investing involves risk, including the possible loss of principal. ● There are no assurances that any fund will achieve its objective and/or strategy. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs. The Fund risks paying more for a security than it received from its sale. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Investing in sector funds is more volatile than investing in broadly diversified funds, as there is a greater risk due to the concentration of the funds’ holdings in issuers of the same or similar offerings. ● As a result, changes in the market value of a single security could cause greater fluctuations in the value of fund shares than would occur in a more diversified fund. ● Short selling involves increased risks and costs. You risk paying more for a security than you received from its sale. This strategy may not be suitable for all investors. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell you shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

Small Cap Value Fund may not be suitable for all investors. ● An investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. ● The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. ● Investing in securities of small-capitalization companies may involve a greater risk of loss and more abrupt fluctuations in market price than investments in larger-capitalization companies. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

StylePlus—Large Core Fund may not be suitable for all investors. ● Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. ● The Fund may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

StylePlus—Mid Growth Fund may not be suitable for all investors. ● Investments in mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions, among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. ● The Fund may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

World Equity Income Fund may not be suitable for all investors. ●Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. ●The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risk). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar. ● The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. ●The Fund’s use of leverage, through instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ●The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ●The Fund may have significant exposure to securities in a particular capitalization range e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-denominate capitalization range may underperform other segments of the equity market or the equity market as a whole. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | March 31, 2022 |

In the six months ended March 31, 2022, most major U.S. equity indexes rose slightly amid market volatility resulting from Russia’s attack on Ukraine, COVID-19 shutdowns in China, and the commencement of rate hikes by the Federal Reserve (the “Fed”).

Nevertheless, the U.S. economy appears to remain on a strong footing. The Institute of Supply Management’s March Services Purchasing Managers’ Index showed a continued recovery in the services sector with business activity, employment, and new orders all rising. The March consumer price index (“CPI”) report was encouraging, with core CPI coming in lower than expected at 0.32% month over month, slightly below expectations of 0.5%.

Economic strength continues to embolden the Fed to move aggressively as it attempts to rein in inflation by raising interest rates and shrinking its balance sheet. The Fed is increasingly concerned about inflation and will act aggressively to get monetary policy to what they view is a more appropriate stance. In a recent speech, Lael Brainard, one of the Federal Open Market Committee’s (“FOMC”) traditionally more dovish members, referenced a “rapid pace” of balance sheet reduction and an “expeditious increase” in the fed funds rate, which caused market expectations for the degree of monetary tightening to ramp up.

Brainard’s shift in tone was echoed in the release of the minutes from the March FOMC meeting. The minutes were highly focused on elevated inflation and risks that inflation could stay well above target, as well mentions of an extremely tight labor market. The minutes repeated the phrase that monetary policy would move expeditiously, and contained a section that mentioned many participants would have voted for a 50-basis-point rate hike in March if it weren’t for the uncertainty resulting from the outbreak of war in Ukraine. Given this language, the 50-basis-point move at the May meeting and Fed Chair Jerome Powell’s telegraphing of further 50-basis point hikes came as no surprise. One basis point is equal to 0.01%. The Fed’s strategy at this point is to get rates back to a neutral level as fast as possible, and then see how far into restrictive territory they need to go based on how the economic and financial market data evolve.

A hawkish Fed has historically paved the way for a bullish approach to bonds. Indeed, we believe many fixed-income sectors are now pricing at compelling levels after enduring a first quarter marked by sharply rising yields, a flattening of the Treasury yield curve, and widening spreads. As the Fed races to raise rates during a period of U.S. economic strength and in the face of several global challenges, we remain diligent in our search for attractive entry points exposed by recent market volatility.

For the six-month period ended March 31, 2022, the S&P 500® Index* returned 5.92%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned -3.38%. The return of the MSCI Emerging Markets Index* was -8.20%.

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a -5.92% return for the six-month period, while the Bloomberg U.S. Corporate High Yield Index* returned -4.16%. The return of the ICE Bank of America (“BofA”) 3-Month U.S. Treasury Bill Index* was 0.05% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | March 31, 2022 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

FTSE NAREIT Equity REITs Total Return Index (“FNRE”) is one of the FTSE NAREIT U.S. Real Estate Index Series that contains all Equity REITs not designated as Timber REITs or Infrastructure REITs. FTSE NAREIT U.S. Real Estate Index Series is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the U.S. economy. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes provide the facility to concentrate commercial real estate exposure in more selected markets. The National Association of Real Estate Investment Trusts (NAREIT) is the trade association for REITs and publicly traded real estate companies with an interest in the U.S. property and investment markets.

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Morningstar Long/Short Equity Category Average is the average return of funds Morningstar places in a given category based on their portfolio statistics and compositions over the past three years. Long-short portfolios hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. At least 75% of the assets are in equity securities or derivatives, and funds in the category will typically have beta values to relevant benchmarks of between 0.3 and 0.8 over a three-year period.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index (Net) is calculated with net dividends reinvested. It is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

Russell 1000® Value Index is a measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap Growth® Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning September 30, 2021 and ending March 31, 2022.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

September 30, 2021 | Ending

Account Value

March 31, 2022 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 | | | | | |

Alpha Opportunity Fund | | | | | |

A-Class | 1.76% | 1.39% | $ 1,000.00 | $ 1,013.90 | $ 8.84 |

C-Class | 2.51% | 1.02% | 1,000.00 | 1,010.20 | 12.58 |

P-Class | 1.76% | 1.38% | 1,000.00 | 1,013.80 | 8.84 |

Institutional Class | 1.51% | 1.50% | 1,000.00 | 1,015.00 | 7.59 |

Large Cap Value Fund | | | | | |

A-Class | 1.14% | 11.43% | 1,000.00 | 1,114.30 | 6.01 |

C-Class | 1.89% | 11.01% | 1,000.00 | 1,110.10 | 9.94 |

P-Class | 1.14% | 11.43% | 1,000.00 | 1,114.30 | 6.01 |

Institutional Class | 0.89% | 11.56% | 1,000.00 | 1,115.60 | 4.69 |

Market Neutral Real Estate Fund | | | | | |

A-Class | 1.64% | (0.29%) | 1,000.00 | 997.10 | 8.17 |

C-Class | 2.39% | (0.68%) | 1,000.00 | 993.20 | 11.88 |

P-Class | 1.64% | (0.30%) | 1,000.00 | 997.00 | 8.17 |

Institutional Class | 1.39% | (0.21%) | 1,000.00 | 997.90 | 6.92 |

Risk Managed Real Estate Fund | | | | | |

A-Class | 1.21% | 9.74% | 1,000.00 | 1,097.40 | 6.33 |

C-Class | 1.94% | 9.32% | 1,000.00 | 1,093.20 | 10.12 |

P-Class | 1.29% | 9.69% | 1,000.00 | 1,096.90 | 6.74 |

Institutional Class | 0.91% | 9.88% | 1,000.00 | 1,098.80 | 4.76 |

Small Cap Value Fund | | | | | |

A-Class | 1.30% | 5.91% | 1,000.00 | 1,059.10 | 6.67 |

C-Class | 2.05% | 5.57% | 1,000.00 | 1,055.70 | 10.51 |

P-Class | 1.31% | 5.93% | 1,000.00 | 1,059.30 | 6.73 |

Institutional Class | 1.05% | 6.08% | 1,000.00 | 1,060.80 | 5.39 |

StylePlus—Large Core Fund | | | | | |

A-Class | 1.14% | 4.25% | 1,000.00 | 1,042.50 | 5.81 |

C-Class | 2.09% | 3.76% | 1,000.00 | 1,037.60 | 10.62 |

P-Class | 1.24% | 4.18% | 1,000.00 | 1,041.80 | 6.31 |

Institutional Class | 0.92% | 4.37% | 1,000.00 | 1,043.70 | 4.69 |

StylePlus—Mid Growth Fund | | | | | |

A-Class | 1.29% | (9.84%) | 1,000.00 | 901.60 | 6.12 |

C-Class | 2.25% | (10.27%) | 1,000.00 | 897.30 | 10.64 |

P-Class | 1.42% | (9.89%) | 1,000.00 | 901.10 | 6.73 |

Institutional Class | 1.07% | (9.75%) | 1,000.00 | 902.50 | 5.08 |

World Equity Income Fund | | | | | |

A-Class | 1.21% | 4.53% | 1,000.00 | 1,045.30 | 6.17 |

C-Class | 1.96% | 4.10% | 1,000.00 | 1,041.00 | 9.97 |

P-Class | 1.21% | 4.48% | 1,000.00 | 1,044.80 | 6.17 |

Institutional Class | 0.96% | 4.68% | 1,000.00 | 1,046.80 | 4.90 |

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

September 30, 2021 | Ending

Account Value

March 31, 2022 | Expenses

Paid During

Period2 |

Table 2. Based on hypothetical 5% return (before expenses) | | | | |

Alpha Opportunity Fund | | | | | |

A-Class | 1.76% | 5.00% | $ 1,000.00 | $ 1,016.16 | $ 8.85 |

C-Class | 2.51% | 5.00% | 1,000.00 | 1,012.42 | 12.59 |

P-Class | 1.76% | 5.00% | 1,000.00 | 1,016.16 | 8.85 |

Institutional Class | 1.51% | 5.00% | 1,000.00 | 1,017.40 | 7.59 |

Large Cap Value Fund | | | | | |

A-Class | 1.14% | 5.00% | 1,000.00 | 1,019.25 | 5.74 |

C-Class | 1.89% | 5.00% | 1,000.00 | 1,015.51 | 9.50 |

P-Class | 1.14% | 5.00% | 1,000.00 | 1,019.25 | 5.74 |

Institutional Class | 0.89% | 5.00% | 1,000.00 | 1,020.49 | 4.48 |

Market Neutral Real Estate Fund | | | | | |

A-Class | 1.64% | 5.00% | 1,000.00 | 1,016.75 | 8.25 |

C-Class | 2.39% | 5.00% | 1,000.00 | 1,013.01 | 11.99 |

P-Class | 1.64% | 5.00% | 1,000.00 | 1,016.75 | 8.25 |

Institutional Class | 1.39% | 5.00% | 1,000.00 | 1,018.00 | 6.99 |

Risk Managed Real Estate Fund | | | | | |

A-Class | 1.21% | 5.00% | 1,000.00 | 1,018.90 | 6.09 |

C-Class | 1.94% | 5.00% | 1,000.00 | 1,015.26 | 9.75 |

P-Class | 1.29% | 5.00% | 1,000.00 | 1,018.50 | 6.49 |

Institutional Class | 0.91% | 5.00% | 1,000.00 | 1,020.39 | 4.58 |

Small Cap Value Fund | | | | | |

A-Class | 1.30% | 5.00% | 1,000.00 | 1,018.45 | 6.54 |

C-Class | 2.05% | 5.00% | 1,000.00 | 1,014.71 | 10.30 |

P-Class | 1.31% | 5.00% | 1,000.00 | 1,018.40 | 6.59 |

Institutional Class | 1.05% | 5.00% | 1,000.00 | 1,019.70 | 5.29 |

StylePlus—Large Core Fund | | | | | |

A-Class | 1.14% | 5.00% | 1,000.00 | 1,019.25 | 5.74 |

C-Class | 2.09% | 5.00% | 1,000.00 | 1,014.51 | 10.50 |

P-Class | 1.24% | 5.00% | 1,000.00 | 1,018.75 | 6.24 |

Institutional Class | 0.92% | 5.00% | 1,000.00 | 1,020.34 | 4.63 |

StylePlus—Mid Growth Fund | | | | | |

A-Class | 1.29% | 5.00% | 1,000.00 | 1,018.50 | 6.49 |

C-Class | 2.25% | 5.00% | 1,000.00 | 1,013.71 | 11.30 |

P-Class | 1.42% | 5.00% | 1,000.00 | 1,017.85 | 7.14 |

Institutional Class | 1.07% | 5.00% | 1,000.00 | 1,019.60 | 5.39 |

World Equity Income Fund | | | | | |

A-Class | 1.21% | 5.00% | 1,000.00 | 1,018.90 | 6.09 |

C-Class | 1.96% | 5.00% | 1,000.00 | 1,015.16 | 9.85 |

P-Class | 1.21% | 5.00% | 1,000.00 | 1,018.90 | 6.09 |

Institutional Class | 0.96% | 5.00% | 1,000.00 | 1,020.14 | 4.84 |

1 | This ratio represents annualized net expenses, which may include short dividend and interest expense. Excluding these expenses, the operating expense ratio for the Risk Managed Real Estate Fund would be 1.20%, 1.93%, 1.28% and 0.91% for the A-Class, C-Class, P-Class and Institutional Class, respectively. Excludes expenses of the underlying funds in which the Funds invest, if any. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period September 30, 2021 to March 31, 2022. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | March 31, 2022 |

ALPHA OPPORTUNITY FUND

OBJECTIVE: Seeks long-term growth of capital.

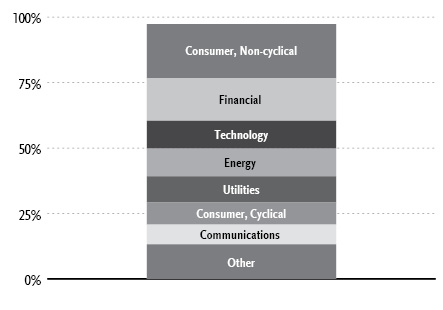

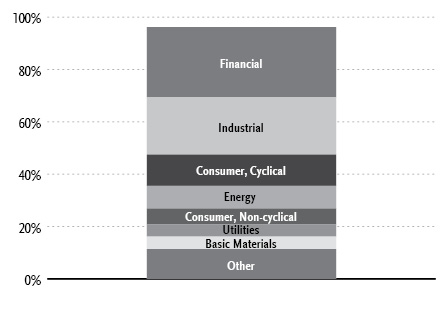

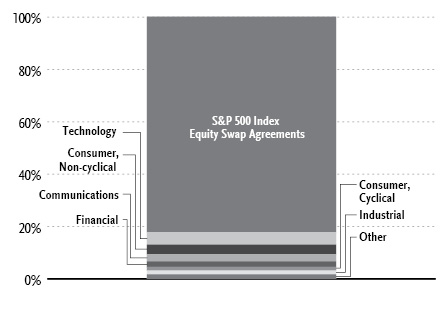

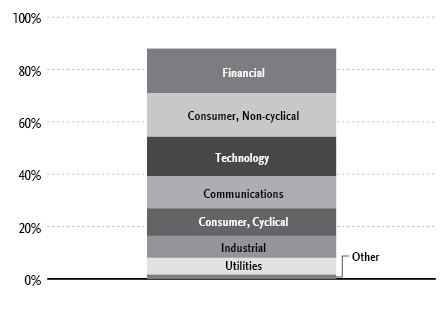

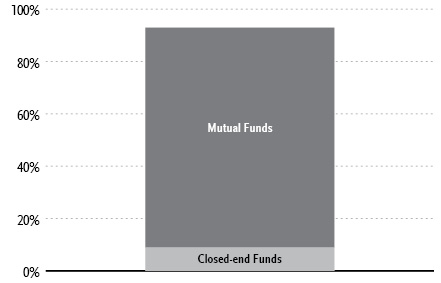

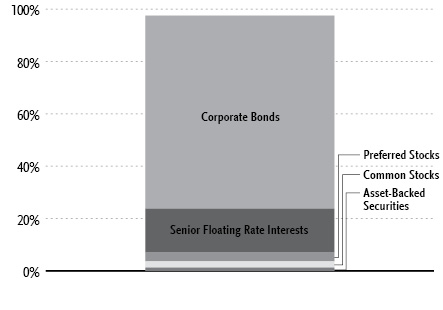

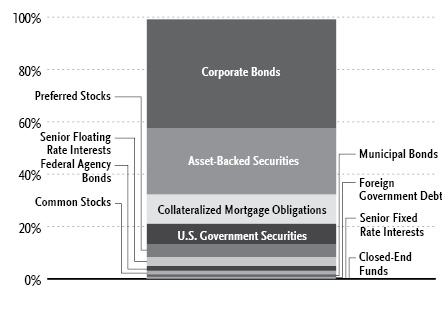

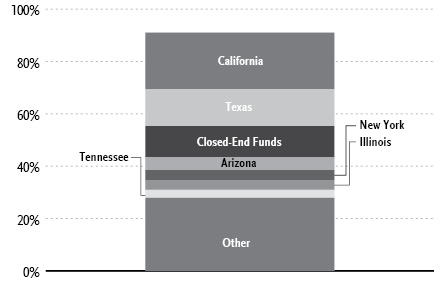

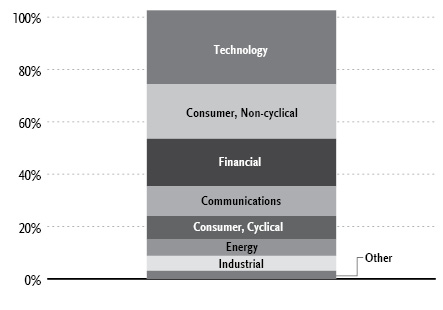

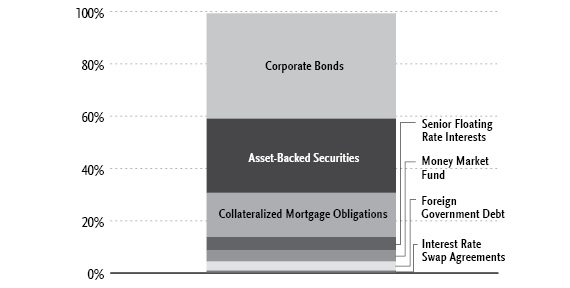

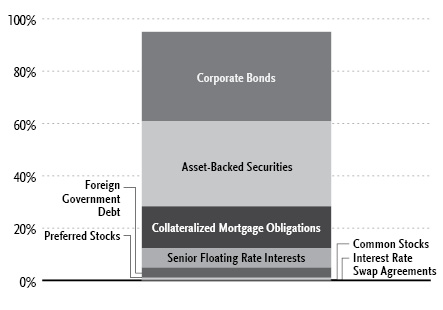

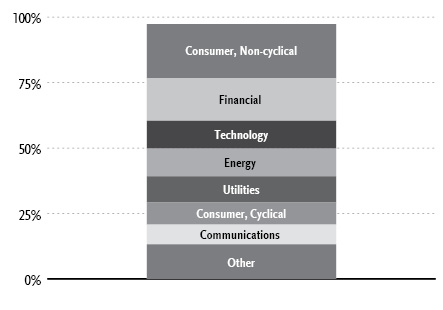

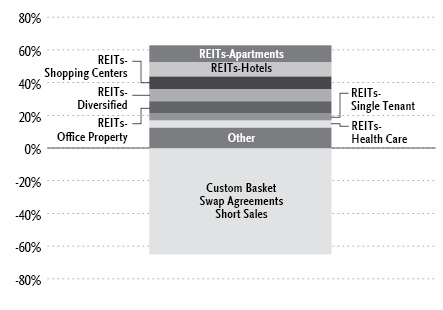

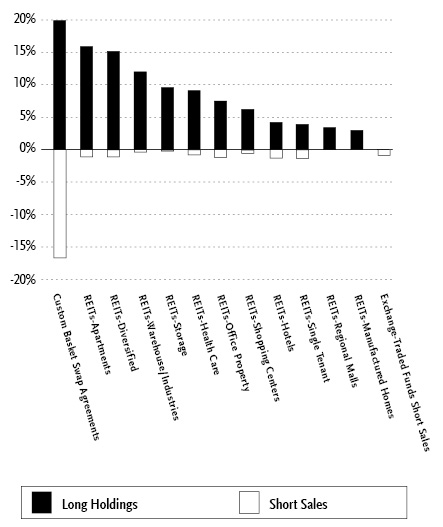

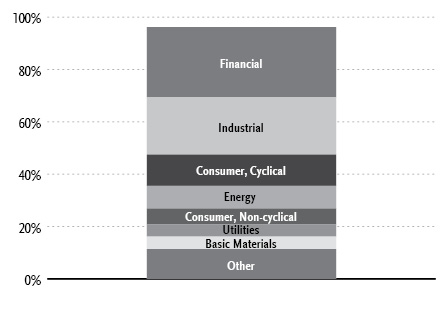

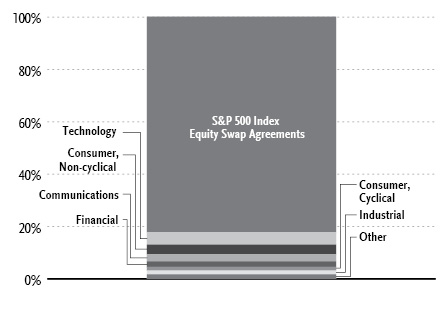

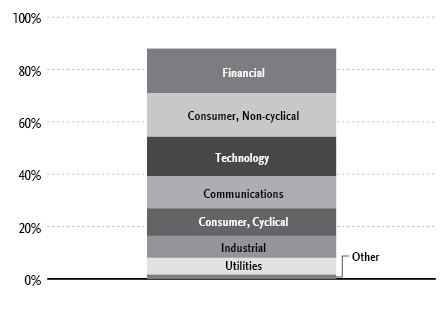

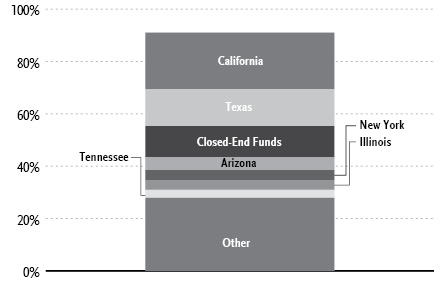

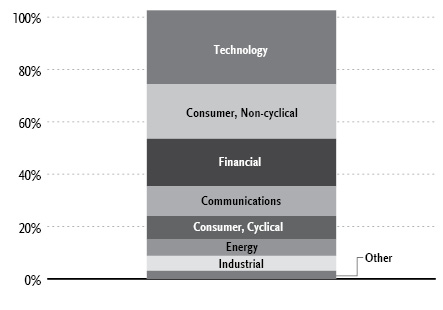

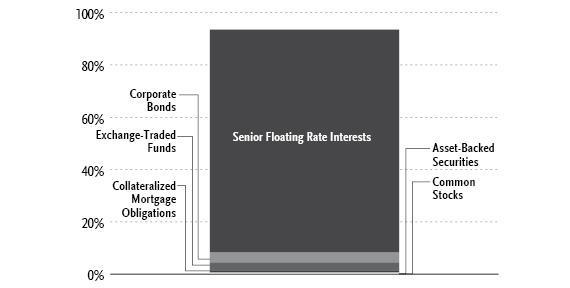

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | July 7, 2003 |

C-Class | July 7, 2003 |

P-Class | May 1, 2015 |

Institutional Class | November 7, 2008 |

Ten Largest Holdings | % of Total Net Assets |

Safety Insurance Group, Inc. | 1.1% |

MGE Energy, Inc. | 1.1% |

CMS Energy Corp. | 1.1% |

AutoZone, Inc. | 1.1% |

Bristol-Myers Squibb Co. | 1.1% |

Johnson & Johnson | 1.1% |

National Fuel Gas Co. | 1.1% |

Arch Capital Group Ltd. | 1.1% |

Vishay Intertechnology, Inc. | 1.1% |

Mercury General Corp. | 1.1% |

Top Ten Total | 11.0% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | March 31, 2022 |

Average Annual Returns*

Periods Ended March 31, 2022

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 1.39% | (2.56%) | (0.81%) | 4.54% |

A-Class Shares with sales charge‡ | (3.43%) | (7.20%) | (1.77%) | 4.03% |

C-Class Shares | 1.02% | (3.28%) | (1.58%) | 3.74% |

C-Class Shares with CDSC§ | 0.02% | (4.24%) | (1.58%) | 3.74% |

Institutional Class Shares | 1.50% | (2.31%) | (0.45%) | 4.96% |

Morningstar Long/Short Equity Category Average | 2.16% | 4.80% | 4.72% | 4.43% |

S&P 500 Index | 5.92% | 15.65% | 15.99% | 14.64% |

S&P 500 Index Blended** | 0.05% | 0.06% | 1.13% | 7.09% |

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.05% | 0.06% | 1.13% | 0.63% |

| 6 Month† | 1 Year | 5 Year | Since

Inception

(05/01/15) |

P-Class Shares | 1.38% | (2.58%) | (0.79%) | 0.90% |

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.05% | 0.06% | 1.13% | 0.88% |

Morningstar Long/Short Equity Category Average | 2.16% | 4.80% | 4.72% | 3.39% |

S&P 500 Index | 5.92% | 15.65% | 15.99% | 13.85% |

S&P 500 Index Blended** | 0.05% | 0.06% | 1.13% | 9.16% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, S&P 500 Index, and the Morningstar Long/Short Equity Category Average are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported returns. The graph is based on A-Class shares only; performance for C-Class, P-Class and Institutional Class will vary due to differences in fee structures. |

** | Effective March 13, 2017, the Fund changed its principal investment strategy. As a result of the investment strategy change, the Fund’s new benchmark is the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The Fund’s performance was previously compared to the S&P 500 Index. The S&P 500 Index-Blended uses performance data for the S&P 500 Index from 09/30/11 to 03/12/17, and the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill index from 03/13/17 to 03/31/22. |

† | 6 month returns are not annualized. |

‡ | Fund returns are calculated using the maximum sales charge of 4.75%. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS (Unaudited) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 96.5% |

| | | | | | | | | |

Financial - 23.0% |

Safety Insurance Group, Inc.1 | | | 4,171 | | | $ | 378,935 | |

Arch Capital Group Ltd.*,1 | | | 7,471 | | | | 361,746 | |

Mercury General Corp.1 | | | 6,459 | | | | 355,245 | |

National Bank Holdings Corp. — Class A | | | 8,120 | | | | 327,074 | |

Enstar Group Ltd.* | | | 1,249 | | | | 326,176 | |

Old Republic International Corp.1 | | | 11,223 | | | | 290,339 | |

Travelers Companies, Inc. | | | 1,559 | | | | 284,876 | |

Stewart Information Services Corp. | | | 4,447 | | | | 269,533 | |

Preferred Bank/Los Angeles CA | | | 3,631 | | | | 269,021 | |

Radian Group, Inc. | | | 11,465 | | | | 254,638 | |

AMERISAFE, Inc.1 | | | 4,964 | | | | 246,562 | |

Fulton Financial Corp. | | | 14,633 | | | | 243,200 | |

United Bankshares, Inc. | | | 6,901 | | | | 240,707 | |

MGIC Investment Corp. | | | 17,215 | | | | 233,263 | |

Evercore, Inc. — Class A1 | | | 1,932 | | | | 215,070 | |

PS Business Parks, Inc. REIT | | | 1,253 | | | | 210,604 | |

Everest Re Group Ltd. | | | 698 | | | | 210,363 | |

BankUnited, Inc. | | | 4,771 | | | | 209,733 | |

Fidelity National Financial, Inc. | | | 4,209 | | | | 205,568 | |

HomeStreet, Inc. | | | 4,171 | | | | 197,622 | |

Interactive Brokers Group, Inc. — Class A | | | 2,959 | | | | 195,028 | |

Piper Sandler Cos. | | | 1,453 | | | | 190,706 | |

Markel Corp.* | | | 128 | | | | 188,831 | |

Raymond James Financial, Inc. | | | 1,707 | | | | 187,561 | |

Essent Group Ltd.1 | | | 4,496 | | | | 185,280 | |

Equity Commonwealth REIT*,1 | | | 6,361 | | | | 179,444 | |

Hilltop Holdings, Inc. | | | 5,972 | | | | 175,577 | |

OneMain Holdings, Inc. | | | 3,571 | | | | 169,301 | |

Meta Financial Group, Inc. | | | 2,873 | | | | 157,785 | |

Janus Henderson Group plc | | | 3,903 | | | | 136,683 | |

First American Financial Corp. | | | 2,034 | | | | 131,844 | |

Western Union Co. | | | 6,886 | | | | 129,044 | |

PotlatchDeltic Corp. REIT | | | 2,167 | | | | 114,266 | |

Easterly Government Properties, Inc. REIT | | | 5,274 | | | | 111,492 | |

Citigroup, Inc. | | | 2,019 | | | | 107,815 | |

WP Carey, Inc. REIT | | | 913 | | | | 73,807 | |

Total Financial | | | | | | | 7,764,739 | |

| | | | | | | | | |

Consumer, Non-cyclical - 18.8% |

Bristol-Myers Squibb Co.1 | | | 5,058 | | | | 369,386 | |

Johnson & Johnson1 | | | 2,072 | | | | 367,221 | |

John B Sanfilippo & Son, Inc.1 | | | 4,096 | | | | 341,770 | |

Gilead Sciences, Inc.1 | | | 5,666 | | | | 336,844 | |

Amgen, Inc.1 | | | 1,264 | | | | 305,660 | |

AbbVie, Inc.1 | | | 1,857 | | | | 301,038 | |

Hologic, Inc.*,1 | | | 3,850 | | | | 295,757 | |

Innoviva, Inc.* | | | 13,636 | | | | 263,857 | |

Perdoceo Education Corp.* | | | 22,829 | | | | 262,077 | |

Regeneron Pharmaceuticals, Inc.*,1 | | | 362 | | | | 252,828 | |

Amphastar Pharmaceuticals, Inc.* | | | 6,731 | | | | 241,643 | |

Incyte Corp.*,1 | | | 2,680 | | | | 212,846 | |

Eagle Pharmaceuticals, Inc.*,1 | | | 4,281 | | | | 211,867 | |

Bio-Rad Laboratories, Inc. — Class A* | | | 358 | | | | 201,636 | |

Vertex Pharmaceuticals, Inc.* | | | 709 | | | | 185,028 | |

USANA Health Sciences, Inc.*,1 | | | 2,321 | | | | 184,403 | |

Prestige Consumer Healthcare, Inc.*,1 | | | 3,107 | | | | 164,485 | |

Quest Diagnostics, Inc. | | | 1,162 | | | | 159,032 | |

Molson Coors Beverage Co. — Class B1 | | | 2,972 | | | | 158,645 | |

EVERTEC, Inc. | | | 3,865 | | | | 158,194 | |

Abbott Laboratories | | | 1,283 | | | | 151,856 | |

Merck & Company, Inc.1 | | | 1,770 | | | | 145,228 | |

Vanda Pharmaceuticals, Inc.* | | | 11,926 | | | | 134,883 | |

Royalty Pharma plc — Class A | | | 3,393 | | | | 132,191 | |

Waters Corp.* | | | 403 | | | | 125,087 | |

United Therapeutics Corp.*,1 | | | 664 | | | | 119,128 | |

Pfizer, Inc. | | | 2,133 | | | | 110,425 | |

Exelixis, Inc.* | | | 4,828 | | | | 109,451 | |

Laboratory Corporation of America Holdings* | | | 411 | | | | 108,364 | |

Halozyme Therapeutics, Inc.* | | | 2,227 | | | | 88,813 | |

Corteva, Inc.1 | | | 1,438 | | | | 82,656 | |

Premier, Inc. — Class A | | | 1,906 | | | | 67,835 | |

Total Consumer, Non-cyclical | | | | | | | 6,350,134 | |

| | | | | | | | | |

Industrial - 14.1% |

Vishay Intertechnology, Inc.1 | | | 18,283 | | | | 358,347 | |

3M Co.1 | | | 2,355 | | | | 350,613 | |

Knowles Corp.* | | | 16,192 | | | | 348,614 | |

Garmin Ltd. | | | 2,842 | | | | 337,089 | |

Mueller Industries, Inc. | | | 6,070 | | | | 328,812 | |

Snap-on, Inc.1 | | | 1,415 | | | | 290,754 | |

Sanmina Corp.* | | | 7,033 | | | | 284,274 | |

Sturm Ruger & Company, Inc.1 | | | 4,073 | | | | 283,562 | |

Packaging Corporation of America | | | 1,615 | | | | 252,118 | |

TTM Technologies, Inc.* | | | 16,773 | | | | 248,576 | |

Hillenbrand, Inc.1 | | | 4,458 | | | | 196,910 | |

OSI Systems, Inc.*,1 | | | 2,117 | | | | 180,199 | |

Crane Co.1 | | | 1,634 | | | | 176,929 | |

Eagle Materials, Inc.1 | | | 1,223 | | | | 156,984 | |

Encore Wire Corp.1 | | | 1,257 | | | | 143,386 | |

Louisiana-Pacific Corp. | | | 1,751 | | | | 108,772 | |

Owens Corning1 | | | 1,170 | | | | 107,055 | |

Vontier Corp. | | | 4,092 | | | | 103,896 | |

Albany International Corp. — Class A1 | | | 1,219 | | | | 102,786 | |

Dorian LPG Ltd. | | | 6,587 | | | | 95,446 | |

UFP Industries, Inc. | | | 1,091 | | | | 84,182 | |

Insteel Industries, Inc. | | | 2,167 | | | | 80,157 | |

Keysight Technologies, Inc.* | | | 449 | | | | 70,928 | |

Arrow Electronics, Inc.* | | | 573 | | | | 67,975 | |

Total Industrial | | | | | | | 4,758,364 | |

| | | | | | | | | |

Consumer, Cyclical - 11.1% |

AutoZone, Inc.* | | | 181 | | | | 370,069 | |

Gentex Corp.1 | | | 11,899 | | | | 347,094 | |

Whirlpool Corp.1 | | | 1,668 | | | | 288,197 | |

NVR, Inc.* | | | 60 | | | | 268,036 | |

Cummins, Inc.1 | | | 1,147 | | | | 235,261 | |

Allison Transmission Holdings, Inc.1 | | | 5,693 | | | | 223,507 | |

Dolby Laboratories, Inc. — Class A1 | | | 2,669 | | | | 208,769 | |

Ethan Allen Interiors, Inc. | | | 6,565 | | | | 171,150 | |

Acushnet Holdings Corp.1 | | | 3,869 | | | | 155,766 | |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Value | |

Columbia Sportswear Co. | | | 1,566 | | | $ | 141,770 | |

Tri Pointe Homes, Inc.* | | | 6,546 | | | | 131,444 | |

Brunswick Corp.1 | | | 1,536 | | | | 124,247 | |

Methode Electronics, Inc. | | | 2,597 | | | | 112,320 | |

LKQ Corp. | | | 2,302 | | | | 104,534 | |

PulteGroup, Inc. | | | 2,314 | | | | 96,956 | |

AutoNation, Inc.*,1 | | | 947 | | | | 94,302 | |

Tapestry, Inc. | | | 2,510 | | | | 93,246 | |

Jack in the Box, Inc. | | | 974 | | | | 90,981 | |

Zumiez, Inc.* | | | 2,238 | | | | 85,514 | |

Toll Brothers, Inc. | | | 1,789 | | | | 84,119 | |

Autoliv, Inc. | | | 1,094 | | | | 83,626 | |

Shoe Carnival, Inc. | | | 2,412 | | | | 70,334 | |

MarineMax, Inc.* | | | 1,676 | | | | 67,476 | |

Haverty Furniture Companies, Inc. | | | 2,404 | | | | 65,918 | |

Buckle, Inc.1 | | | 1,568 | | | | 51,807 | |

Total Consumer, Cyclical | | | | | | | 3,766,443 | |

| | | | | | | | | |

Utilities - 10.1% |

MGE Energy, Inc.1 | | | 4,734 | | | | 377,726 | |

CMS Energy Corp. | | | 5,357 | | | | 374,669 | |

National Fuel Gas Co. | | | 5,342 | | | | 366,996 | |

Duke Energy Corp.1 | | | 3,141 | | | | 350,724 | |

IDACORP, Inc.1 | | | 3,007 | | | | 346,887 | |

Portland General Electric Co. | | | 6,118 | | | | 337,408 | |

Chesapeake Utilities Corp.1 | | | 2,291 | | | | 315,608 | |

Otter Tail Corp. | | | 3,095 | | | | 193,437 | |

PPL Corp. | | | 6,720 | | | | 191,923 | |

Southern Co.1 | | | 2,476 | | | | 179,535 | |

American States Water Co.1 | | | 1,662 | | | | 147,951 | |

WEC Energy Group, Inc. | | | 1,374 | | | | 137,139 | |

California Water Service Group | | | 1,619 | | | | 95,974 | |

Total Utilities | | | | | | | 3,415,977 | |

| | | | | | | | | |

Communications - 7.8% |

Verizon Communications, Inc.1 | | | 6,395 | | | | 325,761 | |

Meta Platforms, Inc. — Class A* | | | 1,455 | | | | 323,534 | |

Comcast Corp. — Class A | | | 6,750 | | | | 316,035 | |

Cisco Systems, Inc.1 | | | 3,386 | | | | 188,803 | |

Yelp, Inc. — Class A*,1 | | | 5,530 | | | | 188,628 | |

Viavi Solutions, Inc.*,1 | | | 11,288 | | | | 181,511 | |

Nexstar Media Group, Inc. — Class A | | | 868 | | | | 163,601 | |

Interpublic Group of Companies, Inc. | | | 4,526 | | | | 160,447 | |

Shenandoah Telecommunications Co. | | | 6,017 | | | | 141,881 | |

Omnicom Group, Inc.1 | | | 1,649 | | | | 139,967 | |

Alphabet, Inc. — Class C* | | | 49 | | | | 136,856 | |

InterDigital, Inc. | | | 2,034 | | | | 129,769 | |

Juniper Networks, Inc.1 | | | 2,555 | | | | 94,944 | |

F5, Inc.* | | | 343 | | | | 71,670 | |

NETGEAR, Inc.* | | | 2,589 | | | | 63,897 | |

Total Communications | | | | | | | 2,627,304 | |

| | | | | | | | | |

Technology - 6.1% |

CSG Systems International, Inc. | | | 5,587 | | | | 355,166 | |

Rambus, Inc.*,1 | | | 7,622 | | | | 243,066 | |

NetApp, Inc.1 | | | 2,027 | | | | 168,241 | |

Xperi Holding Corp. | | | 8,003 | | | | 138,612 | |

Intel Corp. | | | 2,688 | | | | 133,217 | |

Progress Software Corp. | | | 2,676 | | | | 126,013 | |

Akamai Technologies, Inc.* | | | 909 | | | | 108,525 | |

ExlService Holdings, Inc.* | | | 724 | | | | 103,728 | |

Lumentum Holdings, Inc.* | | | 996 | | | | 97,210 | |

Ziff Davis, Inc.* | | | 947 | | | | 91,651 | |

Dropbox, Inc. — Class A* | | | 3,152 | | | | 73,284 | |

NetScout Systems, Inc.* | | | 2,276 | | | | 73,014 | |

CommVault Systems, Inc.*,1 | | | 1,075 | | | | 71,326 | |

Genpact Ltd. | | | 1,638 | | | | 71,269 | |

SS&C Technologies Holdings, Inc. | | | 913 | | | | 68,493 | |

Skyworks Solutions, Inc. | | | 509 | | | | 67,839 | |

Qorvo, Inc.* | | | 528 | | | | 65,525 | |

Total Technology | | | | | | | 2,056,179 | |

| | | | | | | | | |

Basic Materials - 4.6% |

Dow, Inc.1 | | | 4,413 | | | | 281,196 | |

LyondellBasell Industries N.V. — Class A | | | 2,680 | | | | 275,558 | |

Westlake Corp. | | | 2,012 | | | | 248,281 | |

International Paper Co.1 | | | 5,066 | | | | 233,796 | |

Minerals Technologies, Inc. | | | 2,295 | | | | 151,814 | |

AdvanSix, Inc. | | | 2,586 | | | | 132,119 | |

Reliance Steel & Aluminum Co. | | | 705 | | | | 129,261 | |

NewMarket Corp. | | | 279 | | | | 90,502 | |

Total Basic Materials | | | | | | | 1,542,527 | |

| | | | | | | | | |

Energy - 0.9% |

Kinder Morgan, Inc. | | | 10,163 | | | | 192,182 | |

Exxon Mobil Corp. | | | 1,438 | | | | 118,765 | |

Total Energy | | | | | | | 310,947 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $32,290,073) | | | | | | | 32,592,614 | |

| | | | | | | | | |

MONEY MARKET FUND† - 4.4% |

Goldman Sachs Financial Square Treasury Instruments Fund — Institutional Shares, 0.16%2 | | | 1,469,927 | | | | 1,469,927 | |

Total Money Market Fund | | | | |

(Cost $1,469,927) | | | | | | | 1,469,927 | |

| | | | | | | | | |

Total Investments - 100.9% | | | | |

(Cost $33,760,000) | | $ | 34,062,541 | |

Other Assets & Liabilities, net - (0.9)% | | | (293,126 | ) |

Total Net Assets - 100.0% | | $ | 33,769,415 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

Custom Basket Swap Agreements |

Counterparty | Reference Obligation | Type | | Financing Rate | | Payment

Frequency | | | Maturity

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

OTC Custom Basket Swap Agreements†† |

Morgan Stanley Capital Services LLC | MS Equity Custom Basket | Pay | | 0.73% (Federal Funds Rate + 0.40%) | At Maturity | 02/01/24 | | $ | 7,635,350 | | | $ | 200,766 | |

Goldman Sachs International | GS Equity Custom Basket | Pay | | 0.78% (Federal Funds Rate + 0.45%) | At Maturity | 05/06/24 | | | 7,635,293 | | | | 198,180 | |

| | | | | | | | | | | | | | | $ | 15,270,643 | | | $ | 398,946 | |

OTC Custom Basket Swap Agreements Sold Short†† |

Morgan Stanley Capital Services LLC | MS Equity Custom Basket | Receive | | 0.03% (Federal Funds Rate - 0.30%) | At Maturity | 02/01/24 | | $ | 14,657,845 | | | $ | (449,476 | ) |

Goldman Sachs International | GS Equity Custom Basket | Receive | | 0.03% (Federal Funds Rate - 0.20%) | At Maturity | 05/06/24 | | | 14,483,552 | | | | (450,876 | ) |

| | | | | | | | | | | | | | | $ | 29,141,397 | | | $ | (900,352 | ) |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

MS EQUITY LONG CUSTOM BASKET | | | | | | | | |

Consumer, Non-cyclical | | | | | | | | | | | | |

Amphastar Pharmaceuticals, Inc. | | | 1,583 | | | | 0.71 | % | | $ | 25,249 | |

AbbVie, Inc. | | | 437 | | | | 0.93 | % | | | 19,318 | |

Innoviva, Inc. | | | 3,208 | | | | 0.81 | % | | | 19,163 | |

Bristol-Myers Squibb Co. | | | 1,190 | | | | 1.14 | % | | | 12,041 | |

Regeneron Pharmaceuticals, Inc. | | | 85 | | | | 0.78 | % | | | 12,034 | |

Vertex Pharmaceuticals, Inc. | | | 167 | | | | 0.57 | % | | | 11,806 | |

Molson Coors Beverage Co. — Class B | | | 1,028 | | | | 0.72 | % | | | 9,317 | |

Amgen, Inc. | | | 297 | | | | 0.94 | % | | | 7,792 | |

Johnson & Johnson | | | 487 | | | | 1.13 | % | | | 7,717 | |

Eagle Pharmaceuticals, Inc. | | | 1,007 | | | | 0.65 | % | | | 6,085 | |

United Therapeutics Corp. | | | 156 | | | | 0.37 | % | | | 4,661 | |

Hologic, Inc. | | | 906 | | | | 0.91 | % | | | 4,608 | |

Exelixis, Inc. | | | 1,136 | | | | 0.34 | % | | | 4,106 | |

Merck & Company, Inc. | | | 416 | | | | 0.45 | % | | | 3,891 | |

Incyte Corp. | | | 630 | | | | 0.66 | % | | | 3,099 | |

Perdoceo Education Corp. | | | 5,371 | | | | 0.81 | % | | | 2,909 | |

Corteva, Inc. | | | 338 | | | | 0.25 | % | | | 2,853 | |

Prestige Consumer Healthcare, Inc. | | | 731 | | | | 0.51 | % | | | 2,628 | |

Quest Diagnostics, Inc. | | | 273 | | | | 0.49 | % | | | 2,028 | |

Halozyme Therapeutics, Inc. | | | 524 | | | | 0.27 | % | | | 1,064 | |

Royalty Pharma plc — Class A | | | 798 | | | | 0.41 | % | | | 225 | |

Premier, Inc. — Class A | | | 448 | | | | 0.21 | % | | | (800 | ) |

Waters Corp. | | | 95 | | | | 0.39 | % | | | (909 | ) |

Abbott Laboratories | | | 302 | | | | 0.47 | % | | | (927 | ) |

John B Sanfilippo & Son, Inc. | | | 963 | | | | 1.05 | % | | | (1,565 | ) |

Laboratory Corporation of America Holdings | | | 96 | | | | 0.33 | % | | | (1,698 | ) |

Pfizer, Inc. | | | 501 | | | | 0.34 | % | | | (3,063 | ) |

EVERTEC, Inc. | | | 909 | | | | 0.49 | % | | | (4,406 | ) |

USANA Health Sciences, Inc. | | | 546 | | | | 0.57 | % | | | (10,343 | ) |

Gilead Sciences, Inc. | | | 1,333 | | | | 1.04 | % | | | (10,868 | ) |

Bio-Rad Laboratories, Inc. — Class A | | | 84 | | | | 0.62 | % | | | (12,019 | ) |

Vanda Pharmaceuticals, Inc. | | | 2,806 | | | | 0.42 | % | | | (14,912 | ) |

Total Consumer, Non-cyclical | | | | | | | | | | | 101,084 | |

| | | | | | | | | | | | | |

Consumer, Cyclical | | | | | | | | | | | | |

AutoZone, Inc. | | | 42 | | | | 1.12 | % | | | 20,312 | |

AutoNation, Inc. | | | 222 | | | | 0.29 | % | | | 4,442 | |

Ethan Allen Interiors, Inc. | | | 1,544 | | | | 0.53 | % | | | 3,192 | |

Allison Transmission Holdings, Inc. | | | 1,339 | | | | 0.69 | % | | | 2,558 | |

Methode Electronics, Inc. | | | 611 | | | | 0.35 | % | | | 524 | |

Tapestry, Inc. | | | 590 | | | | 0.29 | % | | | (18 | ) |

Columbia Sportswear Co. | | | 368 | | | | 0.44 | % | | | (33 | ) |

Zumiez, Inc. | | | 526 | | | | 0.26 | % | | | (1,244 | ) |

Autoliv, Inc. | | | 257 | | | | 0.26 | % | | | (2,635 | ) |

Brunswick Corp. | | | 361 | | | | 0.38 | % | | | (2,794 | ) |

MarineMax, Inc. | | | 394 | | | | 0.21 | % | | | (3,379 | ) |

Jack in the Box, Inc. | | | 229 | | | | 0.28 | % | | | (3,513 | ) |

Haverty Furniture Companies, Inc. | | | 565 | | | | 0.20 | % | | | (3,531 | ) |

Cummins, Inc. | | | 270 | | | | 0.73 | % | | | (3,696 | ) |

Tri Pointe Homes, Inc. | | | 1,540 | | | | 0.40 | % | | | (4,323 | ) |

Shoe Carnival, Inc. | | | 567 | | | | 0.22 | % | | | (4,532 | ) |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Buckle, Inc. | | | 703 | | | | 0.30 | % | | $ | (4,643 | ) |

LKQ Corp. | | | 541 | | | | 0.32 | % | | | (5,806 | ) |

PulteGroup, Inc. | | | 544 | | | | 0.30 | % | | | (6,163 | ) |

Gentex Corp. | | | 2,799 | | | | 1.07 | % | | | (7,344 | ) |

NVR, Inc. | | | 14 | | | | 0.82 | % | | | (7,503 | ) |

Toll Brothers, Inc. | | | 421 | | | | 0.26 | % | | | (8,564 | ) |

Acushnet Holdings Corp. | | | 910 | | | | 0.48 | % | | | (8,813 | ) |

Dolby Laboratories, Inc. — Class A | | | 628 | | | | 0.64 | % | | | (9,288 | ) |

Whirlpool Corp. | | | 392 | | | | 0.89 | % | | | (17,871 | ) |

Total Consumer, Cyclical | | | | | | | | | | | (74,665 | ) |

| | | | | | | | | | | | | |

Basic Materials | | | | | | | | | | | | |

Westlake Corp. | | | 473 | | | | 0.76 | % | | | 14,625 | |

LyondellBasell Industries N.V. — Class A | | | 630 | | | | 0.85 | % | | | 7,930 | |

Dow, Inc. | | | 1,038 | | | | 0.87 | % | | | 7,719 | |

AdvanSix, Inc. | | | 608 | | | | 0.41 | % | | | 4,511 | |

NewMarket Corp. | | | 65 | | | | 0.28 | % | | | 770 | |

Reliance Steel & Aluminum Co. | | | 166 | | | | 0.40 | % | | | (631 | ) |

Minerals Technologies, Inc. | | | 540 | | | | 0.47 | % | | | (1,897 | ) |

International Paper Co. | | | 1,192 | | | | 0.72 | % | | | (2,075 | ) |

Total Basic Materials | | | | | | | | | | | 30,952 | |

| | | | | | | | | | | | | |

Technology | | | | | | | | | | | | |

CSG Systems International, Inc. | | | 1,314 | | | | 1.09 | % | | | 24,278 | |

Rambus, Inc. | | | 1,793 | | | | 0.75 | % | | | 18,299 | |

ExlService Holdings, Inc. | | | 170 | | | | 0.32 | % | | | 6,494 | |

NetApp, Inc. | | | 477 | | | | 0.52 | % | | | 6,063 | |

Lumentum Holdings, Inc. | | | 234 | | | | 0.30 | % | | | 3,780 | |

Akamai Technologies, Inc. | | | 214 | | | | 0.33 | % | | | 1,434 | |

Dropbox, Inc. — Class A | | | 741 | | | | 0.23 | % | | | 1,053 | |

Genpact Ltd. | | | 385 | | | | 0.22 | % | | | 648 | |

NetScout Systems, Inc. | | | 535 | | | | 0.22 | % | | | 338 | |

Progress Software Corp. | | | 629 | | | | 0.39 | % | | | 303 | |

SS&C Technologies Holdings, Inc. | | | 214 | | | | 0.21 | % | | | (169 | ) |

Skyworks Solutions, Inc. | | | 119 | | | | 0.21 | % | | | (219 | ) |

Ziff Davis, Inc. | | | 222 | | | | 0.28 | % | | | (361 | ) |

Intel Corp. | | | 632 | | | | 0.41 | % | | | (626 | ) |

Qorvo, Inc. | | | 124 | | | | 0.20 | % | | | (976 | ) |

CommVault Systems, Inc. | | | 253 | | | | 0.22 | % | | | (2,853 | ) |

Xperi Holding Corp. | | | 1,883 | | | | 0.43 | % | | | (5,187 | ) |

Total Technology | | | | | | | | | | | 52,299 | |

| | | | | | | | | | | | | |

Industrial | | | | | | | | | | | | |

Mueller Industries, Inc. | | | 1,428 | | | | 1.01 | % | | | 13,791 | |

Packaging Corporation of America | | | 380 | | | | 0.78 | % | | | 8,852 | |

Knowles Corp. | | | 3,809 | | | | 1.07 | % | | | 8,788 | |

Crane Co. | | | 384 | | | | 0.54 | % | | | 5,211 | |

Owens Corning | | | 275 | | | | 0.33 | % | | | 4,661 | |

Encore Wire Corp. | | | 295 | | | | 0.44 | % | | | 4,400 | |

TTM Technologies, Inc. | | | 3,946 | | | | 0.77 | % | | | 3,725 | |

Dorian LPG Ltd. | | | 1,550 | | | | 0.29 | % | | | 2,854 | |

Albany International Corp. — Class A | | | 286 | | | | 0.32 | % | | | 1,986 | |

Sanmina Corp. | | | 1,654 | | | | 0.88 | % | | | 1,615 | |

Keysight Technologies, Inc. | | | 105 | | | | 0.22 | % | | | 678 | |

Snap-on, Inc. | | | 333 | | | | 0.90 | % | | | 306 | |

Louisiana-Pacific Corp. | | | 412 | | | | 0.34 | % | | | (76 | ) |

Insteel Industries, Inc. | | | 509 | | | | 0.25 | % | | | (1,053 | ) |

Arrow Electronics, Inc. | | | 135 | | | | 0.21 | % | | | (1,291 | ) |

Hillenbrand, Inc. | | | 1,049 | | | | 0.61 | % | | | (1,431 | ) |

Sturm Ruger & Company, Inc. | | | 958 | | | | 0.87 | % | | | (2,263 | ) |

UFP Industries, Inc. | | | 256 | | | | 0.26 | % | | | (2,563 | ) |

Vishay Intertechnology, Inc. | | | 4,302 | | | | 1.10 | % | | | (3,935 | ) |

Eagle Materials, Inc. | | | 287 | | | | 0.48 | % | | | (5,093 | ) |

OSI Systems, Inc. | | | 498 | | | | 0.56 | % | | | (5,491 | ) |

Vontier Corp. | | | 962 | | | | 0.32 | % | | | (7,256 | ) |

3M Co. | | | 554 | | | | 1.08 | % | | | (10,981 | ) |

Garmin Ltd. | | | 668 | | | | 1.04 | % | | | (11,478 | ) |

Total Industrial | | | | | | | | | | | 3,956 | |

| | | | | | | | | | | | | |

Communications | | | | | | | | | | | | |

Juniper Networks, Inc. | | | 601 | | | | 0.29 | % | | | 8,824 | |

Cisco Systems, Inc. | | | 796 | | | | 0.58 | % | | | 8,011 | |

Omnicom Group, Inc. | | | 388 | | | | 0.43 | % | | | 6,211 | |

Viavi Solutions, Inc. | | | 2,656 | | | | 0.56 | % | | | 3,061 | |

F5, Inc. | | | 80 | | | | 0.22 | % | | | 1,309 | |

Interpublic Group of Companies, Inc. | | | 1,065 | | | | 0.49 | % | | | 1,148 | |

Nexstar Media Group, Inc. — Class A | | | 204 | | | | 0.50 | % | | | 1,144 | |

Alphabet, Inc. — Class C | | | 11 | | | | 0.40 | % | | | (261 | ) |

Comcast Corp. — Class A | | | 1,588 | | | | 0.97 | % | | | (692 | ) |

Meta Platforms, Inc. — Class A | | | 342 | | | | 1.00 | % | | | (920 | ) |

Shenandoah Telecommunications Co. | | | 1,415 | | | | 0.44 | % | | | (945 | ) |

NETGEAR, Inc. | | | 609 | | | | 0.20 | % | | | (2,158 | ) |

InterDigital, Inc. | | | 478 | | | | 0.40 | % | | | (2,237 | ) |

Yelp, Inc. — Class A | | | 1,301 | | | | 0.58 | % | | | (2,389 | ) |

Verizon Communications, Inc. | | | 1,504 | | | | 1.00 | % | | | (4,133 | ) |

Total Communications | | | | | | | | | | | 15,973 | |

| | | | | | | | | | | | | |

Utilities | | | | | | | | | | | | |

National Fuel Gas Co. | | | 1,256 | | | | 1.13 | % | | | 20,415 | |

IDACORP, Inc. | | | 647 | | | | 0.98 | % | | | 11,962 | |

Chesapeake Utilities Corp. | | | 539 | | | | 0.97 | % | | | 9,362 | |

Southern Co. | | | 582 | | | | 0.55 | % | | | 8,069 | |

Portland General Electric Co. | | | 1,314 | | | | 0.95 | % | | | 6,843 | |

Duke Energy Corp. | | | 675 | | | | 0.99 | % | | | 5,367 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

CMS Energy Corp. | | | 1,260 | | | | 1.15 | % | | $ | 3,947 | |

MGE Energy, Inc. | | | 1,113 | | | | 1.16 | % | | | 3,659 | |

WEC Energy Group, Inc. | | | 323 | | | | 0.42 | % | | | 1,828 | |

California Water Service Group | | | 381 | | | | 0.30 | % | | | 506 | |

American States Water Co. | | | 23 | | | | 0.03 | % | | | (141 | ) |

Otter Tail Corp. | | | 728 | | | | 0.60 | % | | | (221 | ) |

PPL Corp. | | | 1,581 | | | | 0.59 | % | | | (1,757 | ) |

Total Utilities | | | | | | | | | | | 69,839 | |

| | | | | | | | | | | | | |

Financial | | | | | | | | | | | | |

Arch Capital Group Ltd. | | | 1,757 | | | | 1.08 | % | | | 13,913 | |

Safety Insurance Group, Inc. | | | 981 | | | | 1.17 | % | | | 11,504 | |

Enstar Group Ltd. | | | 294 | | | | 1.01 | % | | | 9,415 | |

Raymond James Financial, Inc. | | | 401 | | | | 0.58 | % | | | 9,123 | |

Markel Corp. | | | 30 | | | | 0.58 | % | | | 7,612 | |

Preferred Bank/Los Angeles CA | | | 854 | | | | 0.83 | % | | | 5,504 | |

Everest Re Group Ltd. | | | 164 | | | | 0.65 | % | | | 5,289 | |

Travelers Companies, Inc. | | | 366 | | | | 0.88 | % | | | 3,671 | |

Equity Commonwealth | | | 1,496 | | | | 0.55 | % | | | 3,226 | |

BankUnited, Inc. | | | 1,122 | | | | 0.65 | % | | | 2,888 | |

Old Republic International Corp. | | | 2,640 | | | | 0.89 | % | | | 2,102 | |

PS Business Parks, Inc. | | | 294 | | | | 0.65 | % | | | 1,986 | |

Western Union Co. | | | 1,620 | | | | 0.40 | % | | | 1,386 | |

WP Carey, Inc. | | | 214 | | | | 0.23 | % | | | 788 | |

Easterly Government Properties, Inc. | | | 1,240 | | | | 0.34 | % | | | 525 | |

United Bankshares, Inc. | | | 1,623 | | | | 0.74 | % | | | 177 | |

Radian Group, Inc. | | | 2,697 | | | | 0.78 | % | | | (140 | ) |

Stewart Information Services Corp. | | | 1,046 | | | | 0.83 | % | | | (589 | ) |

Fulton Financial Corp. | | | 3,443 | | | | 0.75 | % | | | (812 | ) |

Janus Henderson Group plc | | | 918 | | | | 0.42 | % | | | (1,611 | ) |

First American Financial Corp. | | | 478 | | | | 0.41 | % | | | (1,638 | ) |

Interactive Brokers Group, Inc. — Class A | | | 696 | | | | 0.60 | % | | | (1,724 | ) |

HomeStreet, Inc. | | | 981 | | | | 0.61 | % | | | (1,906 | ) |

Fidelity National Financial, Inc. | | | 990 | | | | 0.63 | % | | | (2,175 | ) |

Citigroup, Inc. | | | 475 | | | | 0.33 | % | | | (2,822 | ) |

PotlatchDeltic Corp. | | | 509 | | | | 0.35 | % | | | (2,966 | ) |

OneMain Holdings, Inc. | | | 840 | | | | 0.52 | % | | | (3,991 | ) |

Essent Group Ltd. | | | 1,057 | | | | 0.57 | % | | | (4,091 | ) |

MGIC Investment Corp. | | | 4,050 | | | | 0.72 | % | | | (4,262 | ) |

Piper Sandler Cos. | | | 341 | | | | 0.59 | % | | | (4,314 | ) |

Mercury General Corp. | | | 1,519 | | | | 1.09 | % | | | (4,681 | ) |

National Bank Holdings Corp. — Class A | | | 1,910 | | | | 1.01 | % | | | (5,683 | ) |

Meta Financial Group, Inc. | | | 676 | | | | 0.49 | % | | | (5,737 | ) |

AMERISAFE, Inc. | | | 1,168 | | | | 0.76 | % | | | (7,353 | ) |

Hilltop Holdings, Inc. | | | 1,405 | | | | 0.54 | % | | | (10,172 | ) |

Evercore, Inc. — Class A | | | 454 | | | | 0.66 | % | | | (11,981 | ) |

Total Financial | | | | | | | | | | | 461 | |

| | | | | | | | | | | | | |

Energy | | | | | | | | | | | | |

Kinder Morgan, Inc. | | | 2,391 | | | | 0.59 | % | | | 823 | |

Exxon Mobil Corp. | | | 338 | | | | 0.37 | % | | | 44 | |

Total Energy | | | | | | | | | | | 867 | |

Total MS Equity Long Custom Basket | | | | | | $ | 200,766 | |

| | | | | | | | | |

MS EQUITY SHORT CUSTOM BASKET | | | | | | | | |

Consumer, Non-cyclical | | | | | | | | | | | | |

Guardant Health, Inc. | | | 1,297 | | | | (0.59 | )% | | | 71,299 | |

CoStar Group, Inc. | | | 2,313 | | | | (1.05 | )% | | | 47,402 | |

Viad Corp. | | | 3,262 | | | | (0.79 | )% | | | 30,061 | |

Equifax, Inc. | | | 633 | | | | (1.02 | )% | | | 19,663 | |

Driven Brands Holdings, Inc. | | | 6,627 | | | | (1.19 | )% | | | 16,462 | |

TransUnion | | | 1,111 | | | | (0.78 | )% | | | 10,524 | |

ASGN, Inc. | | | 1,000 | | | | (0.80 | )% | | | 8,634 | |

Dun & Bradstreet Holdings, Inc. | | | 4,745 | | | | (0.57 | )% | | | 8,483 | |

Natera, Inc. | | | 420 | | | | (0.12 | )% | | | 6,969 | |

Cooper Companies, Inc. | | | 125 | | | | (0.36 | )% | | | 1,378 | |

Verisk Analytics, Inc. — Class A | | | 811 | | | | (1.19 | )% | | | 767 | |

Intellia Therapeutics, Inc. | | | 288 | | | | (0.14 | )% | | | (233 | ) |

Booz Allen Hamilton Holding Corp. | | | 1,053 | | | | (0.63 | )% | | | (1,782 | ) |

Cintas Corp. | | | 664 | | | | (1.93 | )% | | | (3,571 | ) |

UnitedHealth Group, Inc. | | | 142 | | | | (0.49 | )% | | | (3,632 | ) |

Rollins, Inc. | | | 3,906 | | | | (0.93 | )% | | | (7,928 | ) |

Sysco Corp. | | | 1,544 | | | | (0.86 | )% | | | (9,623 | ) |

Bunge Ltd. | | | 1,128 | | | | (0.85 | )% | | | (12,886 | ) |

Quanta Services, Inc. | | | 678 | | | | (0.61 | )% | | | (15,464 | ) |

Total Consumer, Non-cyclical | | | | | | | | | | | 166,523 | |

| | | | | | | | | | | | | |

Communications | | | | | | | | | | | | |

Lyft, Inc. — Class A | | | 3,215 | | | | (0.84 | )% | | | 13,960 | |

Okta, Inc. | | | 156 | | | | (0.16 | )% | | | 7,366 | |

Airbnb, Inc. — Class A | | | 173 | | | | (0.20 | )% | | | 3,613 | |

Trade Desk, Inc. — Class A | | | 519 | | | | (0.25 | )% | | | (1,225 | ) |

Palo Alto Networks, Inc. | | | 49 | | | | (0.21 | )% | | | (2,371 | ) |

DoorDash, Inc. — Class A | | | 483 | | | | (0.39 | )% | | | (9,092 | ) |

Total Communications | | | | | | | | | | | 12,251 | |

| | | | | | | | | | | | | |

Consumer, Cyclical | | | | | | | | | | | | |

United Airlines Holdings, Inc. | | | 3,207 | | | | (1.01 | )% | | | 31,926 | |

Delta Air Lines, Inc. | | | 3,779 | | | | (1.02 | )% | | | 23,433 | |

MillerKnoll, Inc. | | | 6,310 | | | | (1.49 | )% | | | 16,819 | |

IAA, Inc. | | | 1,599 | | | | (0.42 | )% | | | 16,636 | |

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(continued) | March 31, 2022 |

ALPHA OPPORTUNITY FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Freshpet, Inc. | | | 533 | | | | (0.37 | )% | | $ | 14,972 | |

MGM Resorts International | | | 1,525 | | | | (0.44 | )% | | | 2,336 | |

Copart, Inc. | | | 1,730 | | | | (1.48 | )% | | | 710 | |

American Airlines Group, Inc. | | | 10,552 | | | | (1.31 | )% | | | 527 | |

Southwest Airlines Co. | | | 2,066 | | | | (0.65 | )% | | | (395 | ) |

JetBlue Airways Corp. | | | 3,748 | | | | (0.38 | )% | | | (1,501 | ) |

Royal Caribbean Cruises Ltd. | | | 628 | | | | (0.36 | )% | | | (2,249 | ) |

Hilton Worldwide Holdings, Inc. | | | 450 | | | | (0.47 | )% | | | (3,118 | ) |

Carnival Corp. | | | 2,330 | | | | (0.32 | )% | | | (4,476 | ) |

Lululemon Athletica, Inc. | | | 170 | | | | (0.42 | )% | | | (8,872 | ) |

Total Consumer, Cyclical | | | | | | | | | | | 86,748 | |

| | | | | | | | | | | | | |

Financial | | | | | | | | | | | | |

Western Alliance Bancorporation | | | 1,630 | | | | (0.92 | )% | | | 33,540 | |

Americold Realty Trust | | | 3,162 | | | | (0.60 | )% | | | 28,117 | |

SVB Financial Group | | | 170 | | | | (0.65 | )% | | | 20,680 | |

Sun Communities, Inc. | | | 1,069 | | | | (1.28 | )% | | | 16,401 | |

Equinix, Inc. | | | 245 | | | | (1.24 | )% | | | 12,999 | |

Bank of New York Mellon Corp. | | | 1,011 | | | | (0.34 | )% | | | 12,091 | |

Invitation Homes, Inc. | | | 4,659 | | | | (1.28 | )% | | | 10,217 | |

Equitable Holdings, Inc. | | | 6,535 | | | | (1.38 | )% | | | 7,229 | |

Regions Financial Corp. | | | 2,985 | | | | (0.45 | )% | | | 4,247 | |

RLJ Lodging Trust | | | 15,107 | | | | (1.45 | )% | | | 2,765 | |

Northern Trust Corp. | | | 1,355 | | | | (1.08 | )% | | | 2,217 | |

Signature Bank | | | 364 | | | | (0.73 | )% | | | 2,207 | |

First Republic Bank | | | 475 | | | | (0.53 | )% | | | 1,205 | |

Safehold, Inc. | | | 1,180 | | | | (0.45 | )% | | | 991 | |

UDR, Inc. | | | 1,408 | | | | (0.55 | )% | | | 338 | |

Sunstone Hotel Investors, Inc. | | | 11,590 | | | | (0.93 | )% | | | (216 | ) |

Park Hotels & Resorts, Inc. | | | 10,011 | | | | (1.33 | )% | | �� | (336 | ) |

Wells Fargo & Co. | | | 2,263 | | | | (0.75 | )% | | | (596 | ) |

Bank of America Corp. | | | 1,602 | | | | (0.45 | )% | | | (676 | ) |

Zions Bancorp North America | | | 2,438 | | | | (1.09 | )% | | | (1,126 | ) |

Digital Realty Trust, Inc. | | | 472 | | | | (0.46 | )% | | | (1,250 | ) |

CBRE Group, Inc. — Class A | | | 955 | | | | (0.60 | )% | | | (1,403 | ) |

Goldman Sachs Group, Inc. | | | 528 | | | | (1.19 | )% | | | (1,404 | ) |

State Street Corp. | | | 2,396 | | | | (1.42 | )% | | | (1,834 | ) |

Crown Castle International Corp. | | | 880 | | | | (1.11 | )% | | | (2,696 | ) |

Lincoln National Corp. | | | 903 | | | | (0.40 | )% | | | (3,052 | ) |