UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06637

The UBS Funds

(Exact name of registrant as specified in charter)

One North Wacker Drive, Chicago, IL 60606-2807

(Address of principal executive offices) (Zip code)

Keith A. Weller, Esq.

UBS Asset Management

One North Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Copy to:

Jana L. Cresswell, Esq.

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103-7098

Registrant’s telephone number, including area code: 888-793 8637

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| | (a) | Copy of the report transmitted to shareholders: |

TABLE OF CONTENTS

0000886244ubs:UBSIndexFTSEWorldGovernmentBondIndexHedgedinUSD19579AdditionalIndexMember2024-02-290000886244ubs:UBSIndexMSCIACWIexMinusUSIndex19581AdditionalIndexMember2014-07-012024-06-300000886244ubs:UBSIndexRussell3000IndexTRUSD19558AdditionalIndexMember2019-09-30

Annual Shareholder Report

June 30, 2024

UBS Engage For Impact Fund

This annual shareholder report contains important information about UBS Engage For Impact Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $94 | 0.88% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Stock selection in Consumer Staples and Energy contributed positively to performance.

• The individual stock positions that contributed to performance the most were:

• Micron rose on continued positive sentiment regarding rising demand for High Bandwidth Memory, which is increasingly of interest in the artificial intelligence boom.

• Sprouts Farmers Market shares rallied on strong first quarter operating results with double-digit growth in gross profit dollars, and an upward revision in full year guidance reflecting a positive outlook.

• Galp Energia shares traded well following the completion of its first phase of Mopane exploration campaign in Namibia; as the discovery surprised investors to the upside, with maximum flows achieved during well tests.

What didn’t work:

• Stock selection in Consumer Discretionary and Information Technology contributed negatively to performance

• The individual stock positions that negatively impacted performance the most were:

• Not owning NVIDIA detracted from relative performance as shares rallied on strong revenue, bullish forward guidance and a liquidity-raising stock split. Data centre revenue was up 427% year on year, driven by strong demand for their graphics processing units.

• Spectris shares were weighed by a recent downgrade in guidance to the bottom end of the expected range, which management attributed to weakness in China and the healthcare sector. We believe the stock is more attractively valued than US peers, therefore giving us conviction in the potential upside in share price.

• JTOWER shares fell on news competitors KDDI and Softbank are in talks to broaden the scope of their 5G cellular network partnership, which investors interpretated as a sharp close to JTower’s tower co-sharing expansion potential. We believe the infrastructure growth potential to be significant still.

The Fund did not invest in derivatives during the reporting period.

UBS Engage For Impact Fund

| Class P | MSCI All Country World Index (net) |

|---|

| 10/31/2018 | $10,050 | $10,154 |

| 11/30/2018 | $10,170 | $10,302 |

| 12/31/2018 | $9,316 | $9,577 |

| 1/31/2019 | $10,167 | $10,333 |

| 2/28/2019 | $10,547 | $10,609 |

| 3/31/2019 | $10,657 | $10,743 |

| 4/30/2019 | $10,957 | $11,105 |

| 5/31/2019 | $10,067 | $10,447 |

| 6/30/2019 | $10,827 | $11,131 |

| 7/31/2019 | $10,587 | $11,163 |

| 8/31/2019 | $10,367 | $10,899 |

| 9/30/2019 | $10,527 | $11,128 |

| 10/31/2019 | $10,827 | $11,432 |

| 11/30/2019 | $11,177 | $11,712 |

| 12/31/2019 | $11,519 | $12,124 |

| 1/31/2020 | $11,108 | $11,990 |

| 2/29/2020 | $10,347 | $11,022 |

| 3/31/2020 | $8,580 | $9,534 |

| 4/30/2020 | $9,669 | $10,555 |

| 5/31/2020 | $10,224 | $11,014 |

| 6/30/2020 | $10,419 | $11,366 |

| 7/31/2020 | $10,841 | $11,967 |

| 8/31/2020 | $11,416 | $12,699 |

| 9/30/2020 | $11,180 | $12,290 |

| 10/31/2020 | $11,087 | $11,991 |

| 11/30/2020 | $12,752 | $13,469 |

| 12/31/2020 | $13,470 | $14,095 |

| 1/31/2021 | $13,574 | $14,031 |

| 2/28/2021 | $13,895 | $14,356 |

| 3/31/2021 | $14,237 | $14,739 |

| 4/30/2021 | $14,609 | $15,383 |

| 5/31/2021 | $14,827 | $15,623 |

| 6/30/2021 | $14,765 | $15,829 |

| 7/31/2021 | $14,796 | $15,938 |

| 8/31/2021 | $15,417 | $16,337 |

| 9/30/2021 | $14,816 | $15,662 |

| 10/31/2021 | $15,562 | $16,461 |

| 11/30/2021 | $15,096 | $16,065 |

| 12/31/2021 | $15,657 | $16,707 |

| 1/31/2022 | $14,223 | $15,887 |

| 2/28/2022 | $13,698 | $15,477 |

| 3/31/2022 | $13,896 | $15,812 |

| 4/30/2022 | $13,010 | $14,546 |

| 5/31/2022 | $13,104 | $14,563 |

| 6/30/2022 | $11,623 | $13,336 |

| 7/31/2022 | $12,369 | $14,267 |

| 8/31/2022 | $11,903 | $13,742 |

| 9/30/2022 | $10,912 | $12,426 |

| 10/31/2022 | $11,728 | $13,176 |

| 11/30/2022 | $12,731 | $14,198 |

| 12/31/2022 | $12,158 | $13,639 |

| 1/31/2023 | $12,982 | $14,617 |

| 2/28/2023 | $12,617 | $14,198 |

| 3/31/2023 | $12,617 | $14,636 |

| 4/30/2023 | $12,723 | $14,846 |

| 5/31/2023 | $12,381 | $14,687 |

| 6/30/2023 | $13,123 | $15,540 |

| 7/31/2023 | $13,841 | $16,109 |

| 8/31/2023 | $13,546 | $15,659 |

| 9/30/2023 | $12,993 | $15,011 |

| 10/31/2023 | $12,264 | $14,560 |

| 11/30/2023 | $13,240 | $15,904 |

| 12/31/2023 | $14,159 | $16,667 |

| 1/31/2024 | $13,874 | $16,765 |

| 2/29/2024 | $14,656 | $17,485 |

| 3/31/2024 | $15,107 | $18,034 |

| 4/30/2024 | $14,609 | $17,439 |

| 5/31/2024 | $15,035 | $18,147 |

| 6/30/2024 | $14,917 | $18,551 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 10/24/18 |

|---|

| Class P | 13.67% | 6.62% | 7.29% |

| MSCI All Country World Index (net) | 19.38% | 10.76% | 11.49% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $51,747,265 |

| # of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 28% |

| Total Advisory Fees Paid | $0 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

Top 5 Holdings (% of Net Assets)

| Broadcom, Inc. | 4.5% |

| AstraZeneca PLC (United Kingdom) | 4.2 |

| Micron Technology, Inc. | 4.2 |

| Alcon, Inc. (Switzerland) | 4.0 |

| Danone SA (France) | 3.9 |

UBS Engage For Impact Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 27.4% |

| Health Care | 16.4% |

| Industrials | 13.3% |

| Consumer Staples | 9.8% |

| Financials | 9.4% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Engage For Impact Fund

Annual Shareholder Report

June 30, 2024

UBS Engage For Impact Fund

This annual shareholder report contains important information about UBS Engage For Impact Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

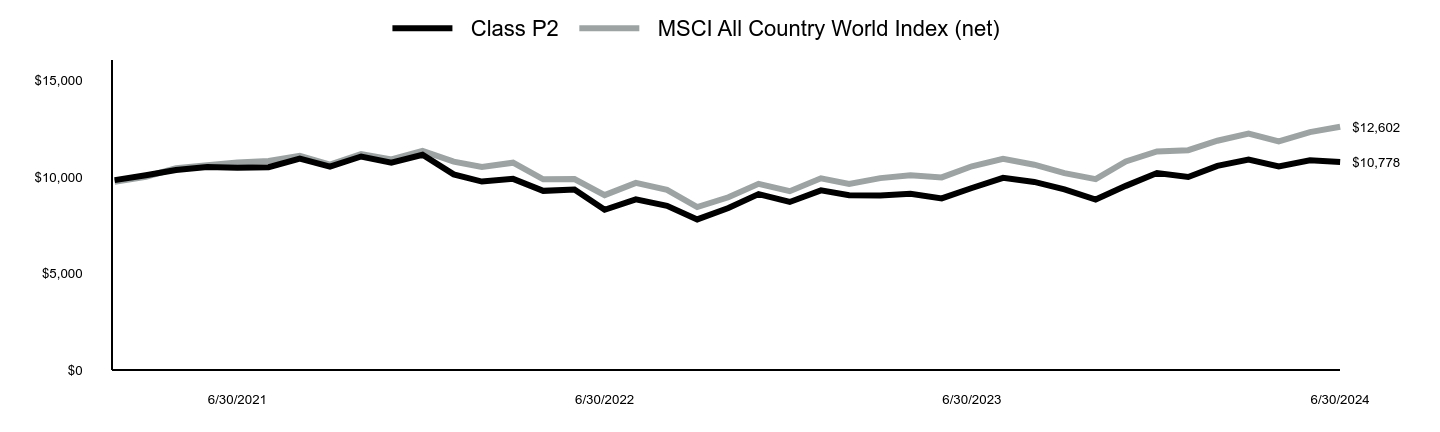

| Class P2 | $30 | 0.28% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Stock selection in Consumer Staples and Energy contributed positively to performance.

• The individual stock positions that contributed to performance the most were:

• Micron rose on continued positive sentiment regarding rising demand for High Bandwidth Memory, which is increasingly of interest in the artificial intelligence boom.

• Sprouts Farmers Market shares rallied on strong first quarter operating results with double-digit growth in gross profit dollars, and an upward revision in full year guidance reflecting a positive outlook.

• Galp Energia shares traded well following the completion of its first phase of Mopane exploration campaign in Namibia; as the discovery surprised investors to the upside, with maximum flows achieved during well tests.

What didn’t work:

• Stock selection in Consumer Discretionary and Information Technology contributed negatively to performance

• The individual stock positions that negatively impacted performance the most were:

• Not owning NVIDIA detracted from relative performance as shares rallied on strong revenue, bullish forward guidance and a liquidity-raising stock split. Data centre revenue was up 427% year on year, driven by strong demand for their graphics processing units.

• Spectris shares were weighed by a recent downgrade in guidance to the bottom end of the expected range, which management attributed to weakness in China and the healthcare sector. We believe the stock is more attractively valued than US peers, therefore giving us conviction in the potential upside in share price.

• JTOWER shares fell on news competitors KDDI and Softbank are in talks to broaden the scope of their 5G cellular network partnership, which investors interpretated as a sharp close to JTower’s tower co-sharing expansion potential. We believe the infrastructure growth potential to be significant still.

The Fund did not invest in derivatives during the reporting period.

UBS Engage For Impact Fund

| Class P2 | MSCI All Country World Index (net) |

|---|

| 2/28/2021 | $9,839 | $9,752 |

| 3/31/2021 | $10,088 | $10,012 |

| 4/30/2021 | $10,359 | $10,450 |

| 5/31/2021 | $10,521 | $10,613 |

| 6/30/2021 | $10,477 | $10,753 |

| 7/31/2021 | $10,506 | $10,827 |

| 8/31/2021 | $10,953 | $11,098 |

| 9/30/2021 | $10,535 | $10,639 |

| 10/31/2021 | $11,063 | $11,182 |

| 11/30/2021 | $10,740 | $10,913 |

| 12/31/2021 | $11,150 | $11,350 |

| 1/31/2022 | $10,137 | $10,792 |

| 2/28/2022 | $9,763 | $10,514 |

| 3/31/2022 | $9,904 | $10,741 |

| 4/30/2022 | $9,281 | $9,881 |

| 5/31/2022 | $9,356 | $9,893 |

| 6/30/2022 | $8,301 | $9,059 |

| 7/31/2022 | $8,841 | $9,692 |

| 8/31/2022 | $8,508 | $9,335 |

| 9/30/2022 | $7,802 | $8,441 |

| 10/31/2022 | $8,392 | $8,951 |

| 11/30/2022 | $9,115 | $9,645 |

| 12/31/2022 | $8,706 | $9,265 |

| 1/31/2023 | $9,305 | $9,930 |

| 2/28/2023 | $9,052 | $9,645 |

| 3/31/2023 | $9,043 | $9,942 |

| 4/30/2023 | $9,128 | $10,085 |

| 5/31/2023 | $8,892 | $9,977 |

| 6/30/2023 | $9,431 | $10,556 |

| 7/31/2023 | $9,954 | $10,943 |

| 8/31/2023 | $9,743 | $10,637 |

| 9/30/2023 | $9,355 | $10,197 |

| 10/31/2023 | $8,833 | $9,891 |

| 11/30/2023 | $9,541 | $10,804 |

| 12/31/2023 | $10,205 | $11,323 |

| 1/31/2024 | $9,999 | $11,389 |

| 2/29/2024 | $10,573 | $11,878 |

| 3/31/2024 | $10,907 | $12,251 |

| 4/30/2024 | $10,547 | $11,846 |

| 5/31/2024 | $10,864 | $12,327 |

| 6/30/2024 | $10,778 | $12,602 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 2/23/21 |

|---|

| Class P2 | 14.29% | 2.26% |

| MSCI All Country World Index (net) | 19.38% | 7.15% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $51,747,265 |

| # of Portfolio Holdings | 48 |

| Portfolio Turnover Rate | 28% |

| Total Advisory Fees Paid | $0 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

Top 5 Holdings (% of Net Assets)

| Broadcom, Inc. | 4.5% |

| AstraZeneca PLC (United Kingdom) | 4.2 |

| Micron Technology, Inc. | 4.2 |

| Alcon, Inc. (Switzerland) | 4.0 |

| Danone SA (France) | 3.9 |

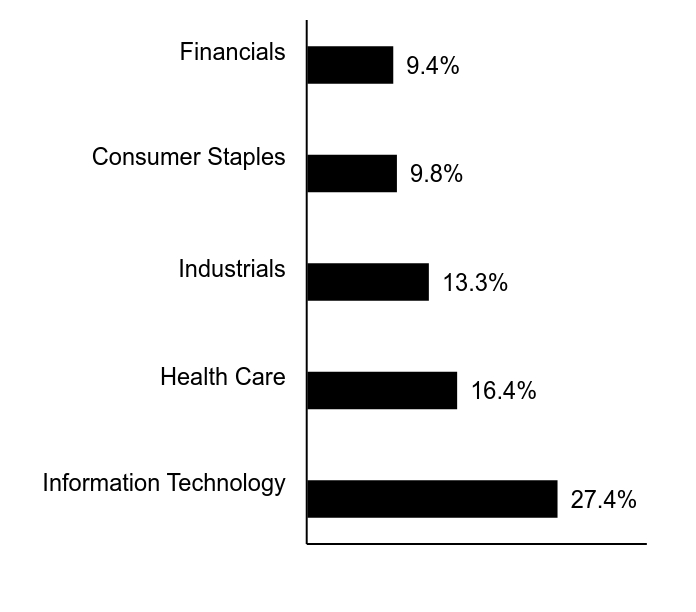

UBS Engage For Impact Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 27.4% |

| Health Care | 16.4% |

| Industrials | 13.3% |

| Consumer Staples | 9.8% |

| Financials | 9.4% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Engage For Impact Fund

Annual Shareholder Report

June 30, 2024

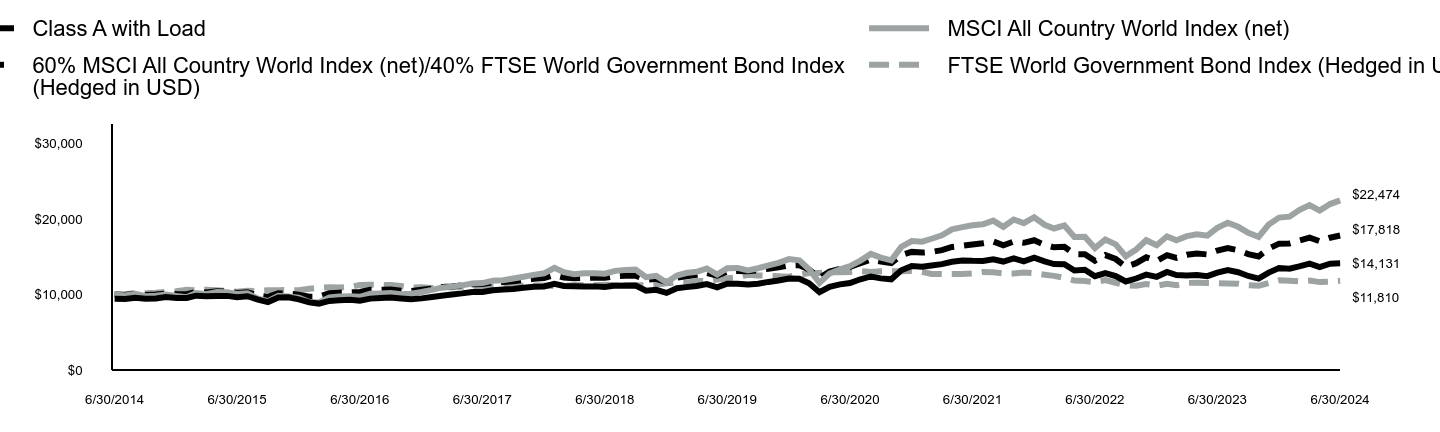

UBS Global Allocation Fund

This annual shareholder report contains important information about UBS Global Allocation Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $127 | 1.21% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

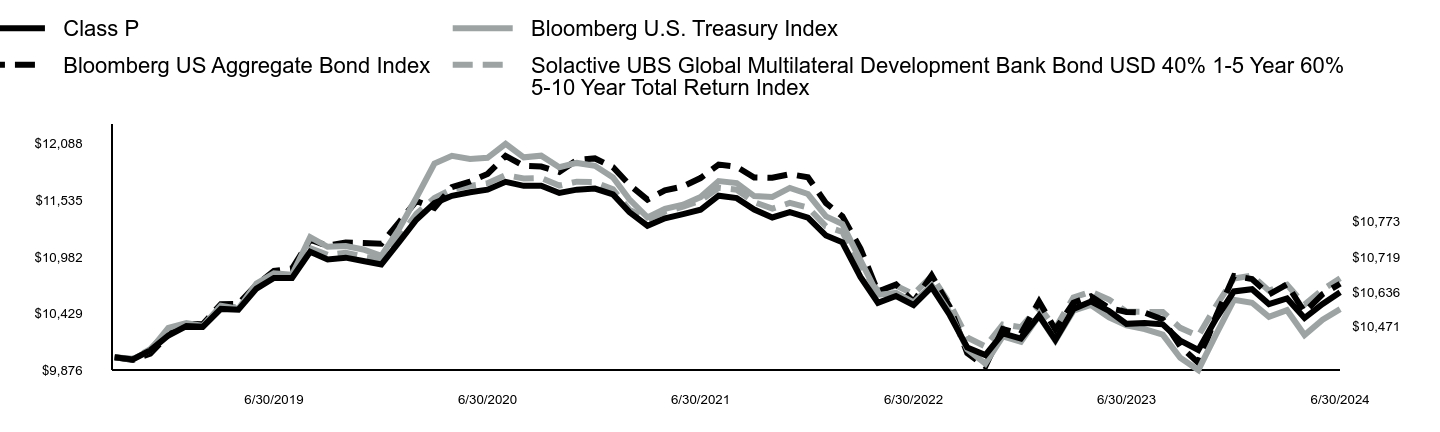

Asset allocation:

• In October 2023, the yield on 10-year US Treasury bonds reached 5%, but by the end of the reporting period, yields had declined about 1%. As a result, the fund’s slight underweight duration relative to the Fund’s secondary benchmark index, a blend of 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD), hurt performance.

• From an asset class perspective, the largest detractor has been in foreign currency exposure. Our overweight positions in Japanese yen and Brazilian real were our largest detractors to performance. Additionally, within US equities our positioning has detracted from overall performance due to opportunistic positions in US small-cap and mid-cap stocks which underperformed large-cap equities.

• With respect to our tactical asset allocation decisions, an overweight in the EURO STOXX Banks sector was the largest contributor.

Bottom-up security selection:

Security selection in US large-cap value, emerging markets equity, international equity, China equity, and US securitized fixed income strategies detracted from performance. Meanwhile, security selection within US large-cap growth, intermediate investment grade fixed income, global government fixed income, and below-investment grade fixed income contributed to performance.

We use derivatives extensively for capital management, risk management, and expressing asset allocation views. We utilize various futures which include equity regional, equity style, fixed income regional in both government and corporate credit. Futures are sometimes used to manage overall regional exposure while increasing exposure to active managers. We also utilize futures to gain exposure to asset classes when limited by our max allocation to external ETFs by SEC rules.

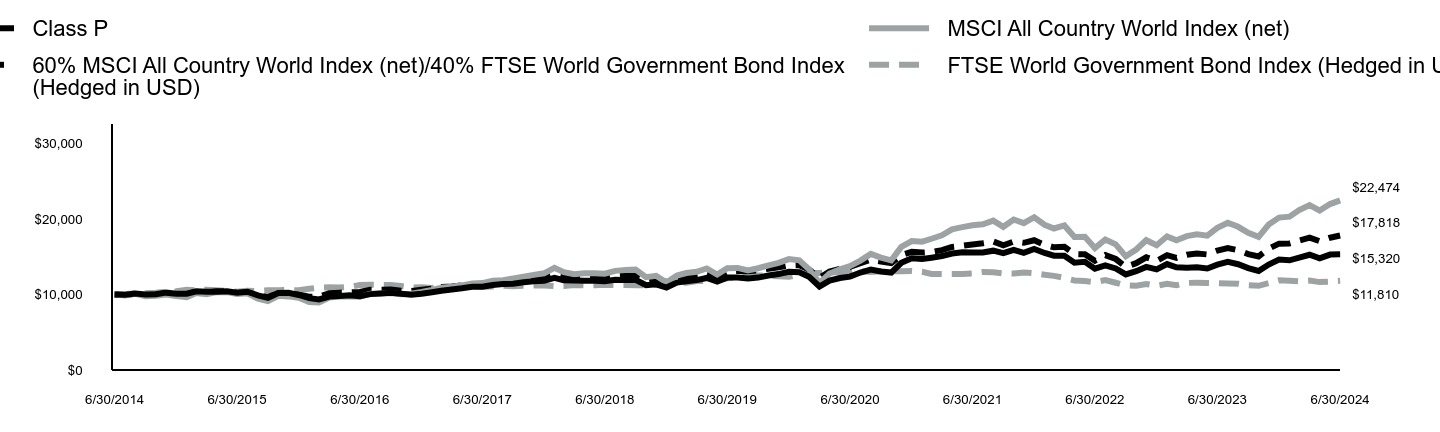

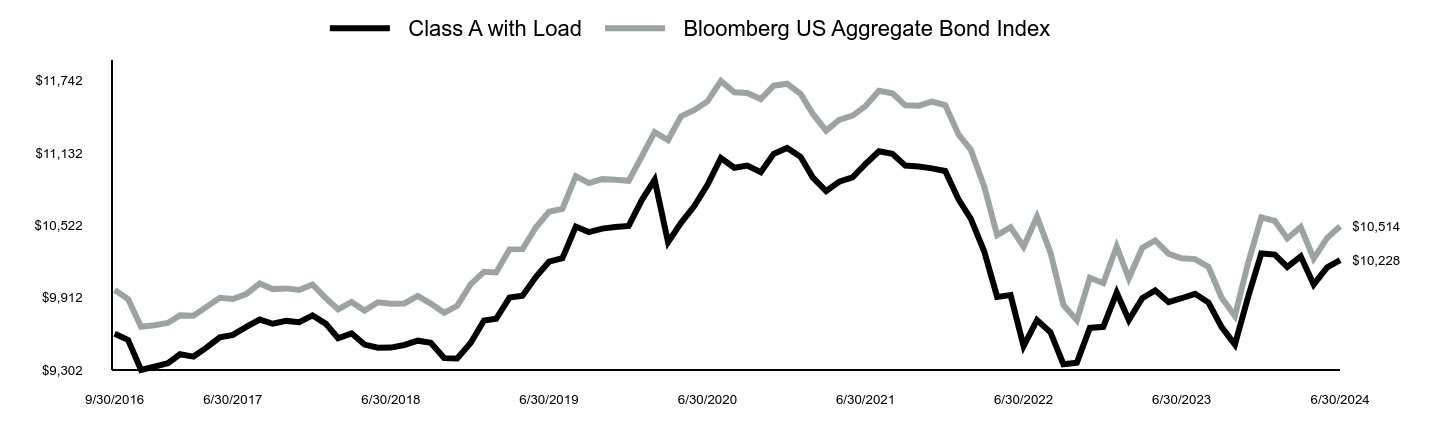

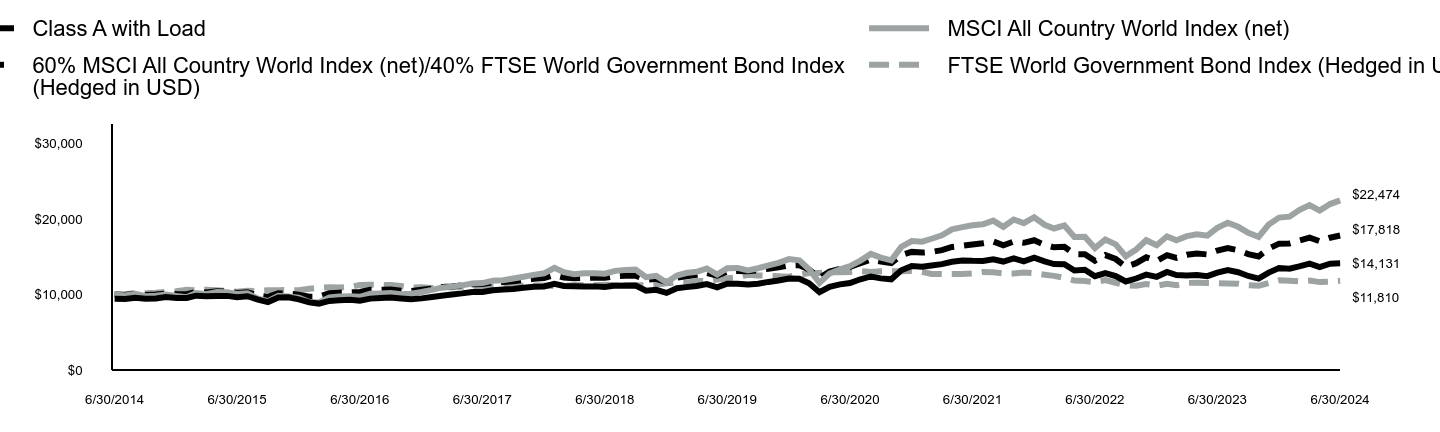

UBS Global Allocation Fund

| Class A with Load | MSCI All Country World Index (net) | 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD) | FTSE World Government Bond Index (Hedged in USD) |

|---|

| 6/30/2014 | $9,452 | $10,000 | $10,000 | $10,000 |

| 7/31/2014 | $9,409 | $9,879 | $9,943 | $10,040 |

| 8/31/2014 | $9,572 | $10,097 | $10,128 | $10,173 |

| 9/30/2014 | $9,443 | $9,770 | $9,923 | $10,153 |

| 10/31/2014 | $9,486 | $9,838 | $9,991 | $10,221 |

| 11/30/2014 | $9,675 | $10,003 | $10,137 | $10,338 |

| 12/31/2014 | $9,546 | $9,810 | $10,054 | $10,426 |

| 1/31/2015 | $9,538 | $9,656 | $10,042 | $10,638 |

| 2/28/2015 | $9,846 | $10,194 | $10,347 | $10,558 |

| 3/31/2015 | $9,769 | $10,036 | $10,282 | $10,638 |

| 4/30/2015 | $9,795 | $10,327 | $10,430 | $10,556 |

| 5/31/2015 | $9,820 | $10,314 | $10,395 | $10,490 |

| 6/30/2015 | $9,649 | $10,071 | $10,195 | $10,354 |

| 7/31/2015 | $9,769 | $10,158 | $10,300 | $10,486 |

| 8/31/2015 | $9,315 | $9,462 | $9,869 | $10,468 |

| 9/30/2015 | $8,998 | $9,119 | $9,686 | $10,553 |

| 10/31/2015 | $9,606 | $9,835 | $10,153 | $10,581 |

| 11/30/2015 | $9,632 | $9,754 | $10,105 | $10,586 |

| 12/31/2015 | $9,360 | $9,578 | $9,986 | $10,561 |

| 1/31/2016 | $8,956 | $9,000 | $9,705 | $10,774 |

| 2/29/2016 | $8,798 | $8,938 | $9,713 | $10,907 |

| 3/31/2016 | $9,149 | $9,601 | $10,165 | $10,964 |

| 4/30/2016 | $9,228 | $9,742 | $10,248 | $10,945 |

| 5/31/2016 | $9,299 | $9,755 | $10,280 | $11,010 |

| 6/30/2016 | $9,185 | $9,696 | $10,340 | $11,270 |

| 7/31/2016 | $9,457 | $10,114 | $10,622 | $11,310 |

| 8/31/2016 | $9,527 | $10,148 | $10,629 | $11,273 |

| 9/30/2016 | $9,606 | $10,210 | $10,666 | $11,266 |

| 10/31/2016 | $9,483 | $10,036 | $10,502 | $11,120 |

| 11/30/2016 | $9,378 | $10,113 | $10,480 | $10,935 |

| 12/31/2016 | $9,490 | $10,331 | $10,624 | $10,957 |

| 1/31/2017 | $9,670 | $10,614 | $10,766 | $10,874 |

| 2/28/2017 | $9,849 | $10,911 | $10,985 | $10,970 |

| 3/31/2017 | $10,010 | $11,045 | $11,061 | $10,957 |

| 4/30/2017 | $10,154 | $11,217 | $11,194 | $11,029 |

| 5/31/2017 | $10,342 | $11,465 | $11,365 | $11,086 |

| 6/30/2017 | $10,333 | $11,517 | $11,379 | $11,045 |

| 7/31/2017 | $10,558 | $11,839 | $11,579 | $11,068 |

| 8/31/2017 | $10,674 | $11,884 | $11,653 | $11,180 |

| 9/30/2017 | $10,728 | $12,114 | $11,759 | $11,110 |

| 10/31/2017 | $10,890 | $12,365 | $11,926 | $11,160 |

| 11/30/2017 | $11,024 | $12,605 | $12,077 | $11,187 |

| 12/31/2017 | $11,070 | $12,808 | $12,195 | $11,192 |

| 1/31/2018 | $11,425 | $13,530 | $12,575 | $11,115 |

| 2/28/2018 | $11,134 | $12,962 | $12,260 | $11,121 |

| 3/31/2018 | $11,098 | $12,685 | $12,163 | $11,258 |

| 4/30/2018 | $11,070 | $12,806 | $12,214 | $11,213 |

| 5/31/2018 | $11,079 | $12,822 | $12,233 | $11,236 |

| 6/30/2018 | $10,988 | $12,752 | $12,212 | $11,279 |

| 7/31/2018 | $11,179 | $13,137 | $12,422 | $11,254 |

| 8/31/2018 | $11,152 | $13,240 | $12,486 | $11,267 |

| 9/30/2018 | $11,179 | $13,298 | $12,496 | $11,216 |

| 10/31/2018 | $10,497 | $12,301 | $11,934 | $11,216 |

| 11/30/2018 | $10,615 | $12,481 | $12,072 | $11,293 |

| 12/31/2018 | $10,215 | $11,602 | $11,643 | $11,483 |

| 1/31/2019 | $10,834 | $12,518 | $12,236 | $11,585 |

| 2/28/2019 | $10,979 | $12,853 | $12,428 | $11,576 |

| 3/31/2019 | $11,125 | $13,015 | $12,617 | $11,797 |

| 4/30/2019 | $11,389 | $13,454 | $12,864 | $11,777 |

| 5/31/2019 | $10,952 | $12,656 | $12,499 | $11,989 |

| 6/30/2019 | $11,425 | $13,485 | $13,062 | $12,161 |

| 7/31/2019 | $11,425 | $13,524 | $13,126 | $12,256 |

| 8/31/2019 | $11,325 | $13,203 | $13,090 | $12,610 |

| 9/30/2019 | $11,425 | $13,481 | $13,224 | $12,535 |

| 10/31/2019 | $11,671 | $13,850 | $13,419 | $12,481 |

| 11/30/2019 | $11,853 | $14,188 | $13,594 | $12,431 |

| 12/31/2019 | $12,129 | $14,688 | $13,848 | $12,355 |

| 1/31/2020 | $12,080 | $14,526 | $13,881 | $12,634 |

| 2/29/2020 | $11,496 | $13,352 | $13,297 | $12,836 |

| 3/31/2020 | $10,307 | $11,550 | $12,224 | $12,845 |

| 4/30/2020 | $11,028 | $12,787 | $13,054 | $12,961 |

| 5/31/2020 | $11,350 | $13,343 | $13,387 | $12,944 |

| 6/30/2020 | $11,515 | $13,769 | $13,660 | $12,982 |

| 7/31/2020 | $12,022 | $14,498 | $14,148 | $13,111 |

| 8/31/2020 | $12,392 | $15,385 | $14,610 | $12,977 |

| 9/30/2020 | $12,139 | $14,889 | $14,371 | $13,075 |

| 10/31/2020 | $12,012 | $14,527 | $14,158 | $13,067 |

| 11/30/2020 | $13,210 | $16,318 | $15,215 | $13,092 |

| 12/31/2020 | $13,778 | $17,075 | $15,648 | $13,109 |

| 1/31/2021 | $13,679 | $16,998 | $15,558 | $13,012 |

| 2/28/2021 | $13,847 | $17,391 | $15,640 | $12,730 |

| 3/31/2021 | $14,026 | $17,856 | $15,878 | $12,706 |

| 4/30/2021 | $14,342 | $18,637 | $16,296 | $12,707 |

| 5/31/2021 | $14,501 | $18,927 | $16,460 | $12,730 |

| 6/30/2021 | $14,461 | $19,176 | $16,626 | $12,800 |

| 7/31/2021 | $14,451 | $19,308 | $16,794 | $12,991 |

| 8/31/2021 | $14,679 | $19,791 | $17,026 | $12,952 |

| 9/30/2021 | $14,372 | $18,974 | $16,523 | $12,798 |

| 10/31/2021 | $14,778 | $19,942 | $17,017 | $12,774 |

| 11/30/2021 | $14,402 | $19,462 | $16,852 | $12,926 |

| 12/31/2021 | $14,872 | $20,241 | $17,195 | $12,809 |

| 1/31/2022 | $14,386 | $19,247 | $16,587 | $12,619 |

| 2/28/2022 | $14,042 | $18,749 | $16,253 | $12,473 |

| 3/31/2022 | $14,018 | $19,156 | $16,319 | $12,195 |

| 4/30/2022 | $13,188 | $17,622 | $15,359 | $11,865 |

| 5/31/2022 | $13,283 | $17,643 | $15,328 | $11,785 |

| 6/30/2022 | $12,429 | $16,156 | $14,480 | $11,646 |

| 7/31/2022 | $12,844 | $17,284 | $15,223 | $11,919 |

| 8/31/2022 | $12,453 | $16,648 | $14,704 | $11,561 |

| 9/30/2022 | $11,729 | $15,054 | $13,675 | $11,199 |

| 10/31/2022 | $12,121 | $15,962 | $14,151 | $11,159 |

| 11/30/2022 | $12,642 | $17,200 | $14,930 | $11,398 |

| 12/31/2022 | $12,345 | $16,524 | $14,454 | $11,161 |

| 1/31/2023 | $12,991 | $17,708 | $15,206 | $11,413 |

| 2/28/2023 | $12,581 | $17,200 | $14,848 | $11,232 |

| 3/31/2023 | $12,531 | $17,731 | $15,283 | $11,535 |

| 4/30/2023 | $12,581 | $17,986 | $15,436 | $11,575 |

| 5/31/2023 | $12,432 | $17,793 | $15,309 | $11,523 |

| 6/30/2023 | $12,904 | $18,826 | $15,826 | $11,493 |

| 7/31/2023 | $13,240 | $19,515 | $16,154 | $11,457 |

| 8/31/2023 | $12,954 | $18,970 | $15,873 | $11,439 |

| 9/30/2023 | $12,456 | $18,186 | $15,361 | $11,226 |

| 10/31/2023 | $12,108 | $17,639 | $15,047 | $11,159 |

| 11/30/2023 | $12,904 | $19,267 | $16,072 | $11,514 |

| 12/31/2023 | $13,508 | $20,192 | $16,738 | $11,878 |

| 1/31/2024 | $13,419 | $20,311 | $16,775 | $11,839 |

| 2/29/2024 | $13,724 | $21,182 | $17,158 | $11,752 |

| 3/31/2024 | $14,093 | $21,847 | $17,534 | $11,842 |

| 4/30/2024 | $13,635 | $21,126 | $17,071 | $11,647 |

| 5/31/2024 | $14,093 | $21,984 | $17,527 | $11,715 |

| 6/30/2024 | $14,131 | $22,474 | $17,818 | $11,810 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 9.51% | 4.34% | 4.10% |

| Class A with Load | 3.52% | 3.17% | 3.52% |

| MSCI All Country World Index (net) | 19.38% | 10.76% | 8.43% |

| 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD) | 12.58% | 6.41% | 5.95% |

| FTSE World Government Bond Index (Hedged in USD) | 2.75% | (0.58%) | 1.68% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $153,472,343 |

| # of Portfolio Holdings | 330 |

| Portfolio Turnover Rate | 82% |

| Total Advisory Fees Paid | $758,956 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

| PACE International Equity Investments, Class P2 | 9.4% |

| UBS Emerging Markets Equity Opportunity Fund, Class P2 | 6.4 |

| PACE International Emerging Markets Equity Investments, Class P2 | 6.4 |

| PACE High Yield Investments, Class P2 | 5.9 |

| SPDR Portfolio High Yield Bond ETF | 4.6 |

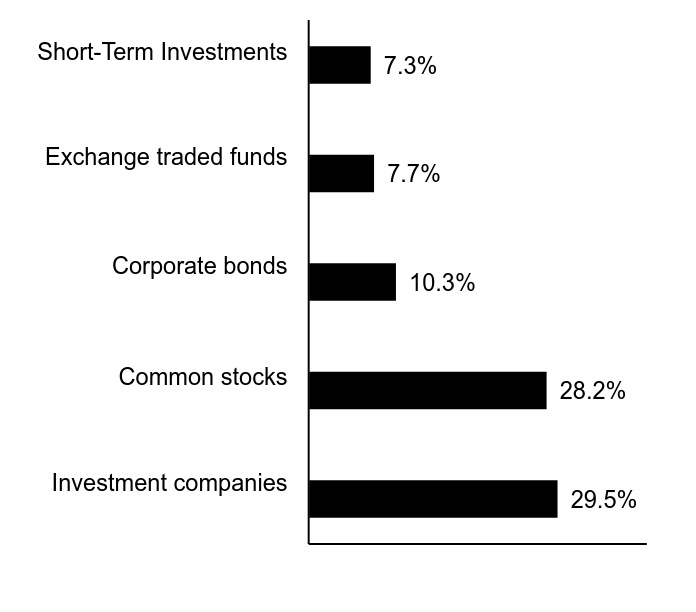

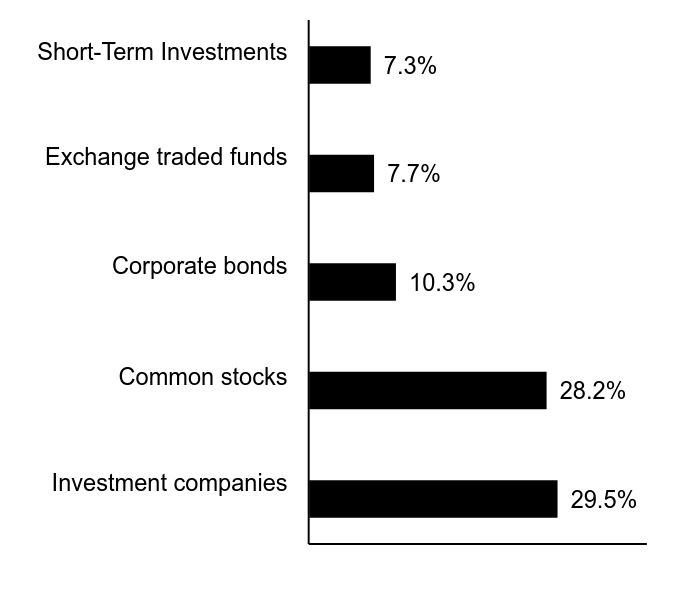

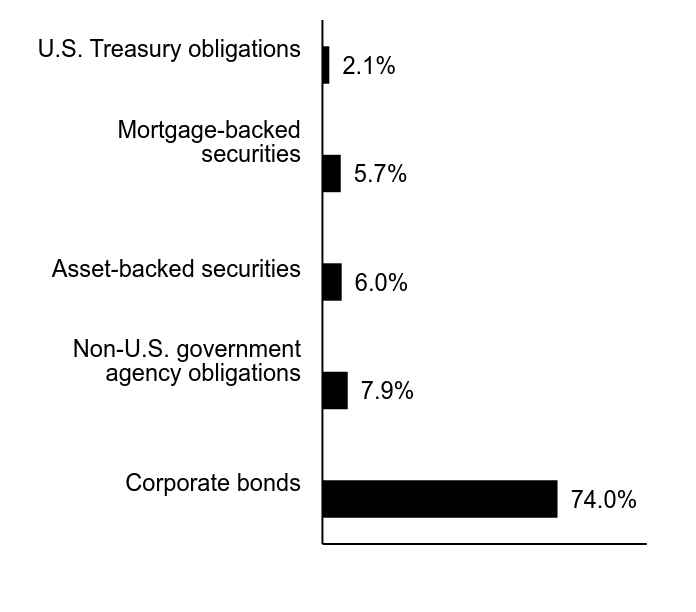

UBS Global Allocation Fund

| Value | Value |

|---|

| Investment companies | 29.5% |

| Common stocks | 28.2% |

| Corporate bonds | 10.3% |

| Exchange traded funds | 7.7% |

| Short-Term Investments | 7.3% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Global Allocation Fund

Annual Shareholder Report

June 30, 2024

UBS Global Allocation Fund

This annual shareholder report contains important information about UBS Global Allocation Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $101 | 0.96% |

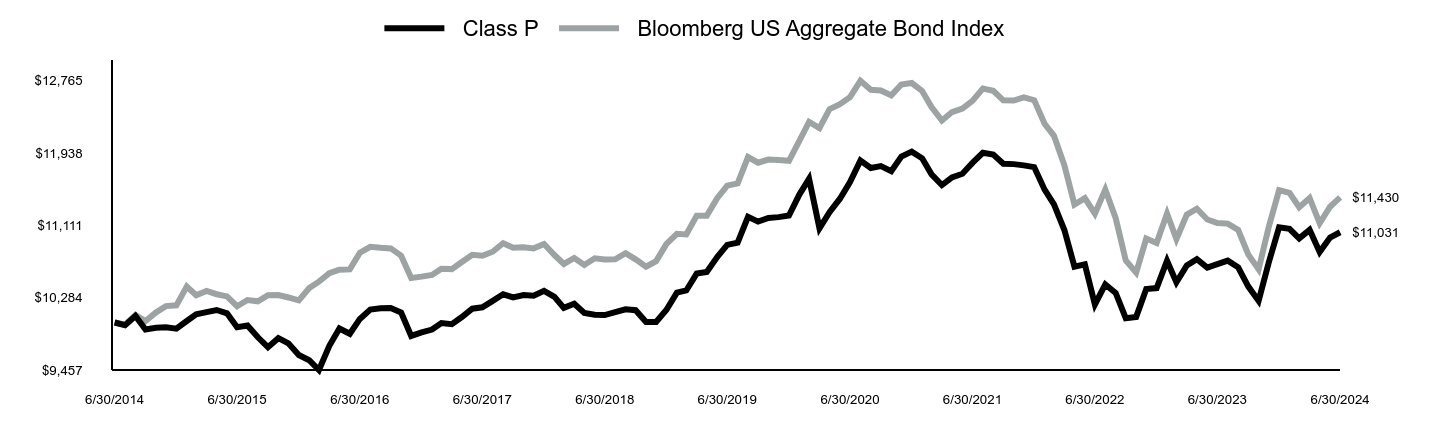

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

Asset allocation:

• In October 2023, the yield on 10-year US Treasury bonds reached 5%, but by the end of the reporting period, yields had declined about 1%. As a result, the fund’s slight underweight duration relative to the Fund’s secondary benchmark index, a blend of 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD), hurt performance.

• From an asset class perspective, the largest detractor has been in foreign currency exposure. Our overweight positions in Japanese yen and Brazilian real were our largest detractors to performance. Additionally, within US equities our positioning has detracted from overall performance due to opportunistic positions in US small-cap and mid-cap stocks which underperformed large-cap equities.

• With respect to our tactical asset allocation decisions, an overweight in the EURO STOXX Banks sector was the largest contributor.

Bottom-up security selection:

Security selection in US large-cap value, emerging markets equity, international equity, China equity, and US securitized fixed income strategies detracted from performance. Meanwhile, security selection within US large-cap growth, intermediate investment grade fixed income, global government fixed income, and below-investment grade fixed income contributed to performance.

We use derivatives extensively for capital management, risk management, and expressing asset allocation views. We utilize various futures which include equity regional, equity style, fixed income regional in both government and corporate credit. Futures are sometimes used to manage overall regional exposure while increasing exposure to active managers. We also utilize futures to gain exposure to asset classes when limited by our max allocation to external ETFs by SEC rules.

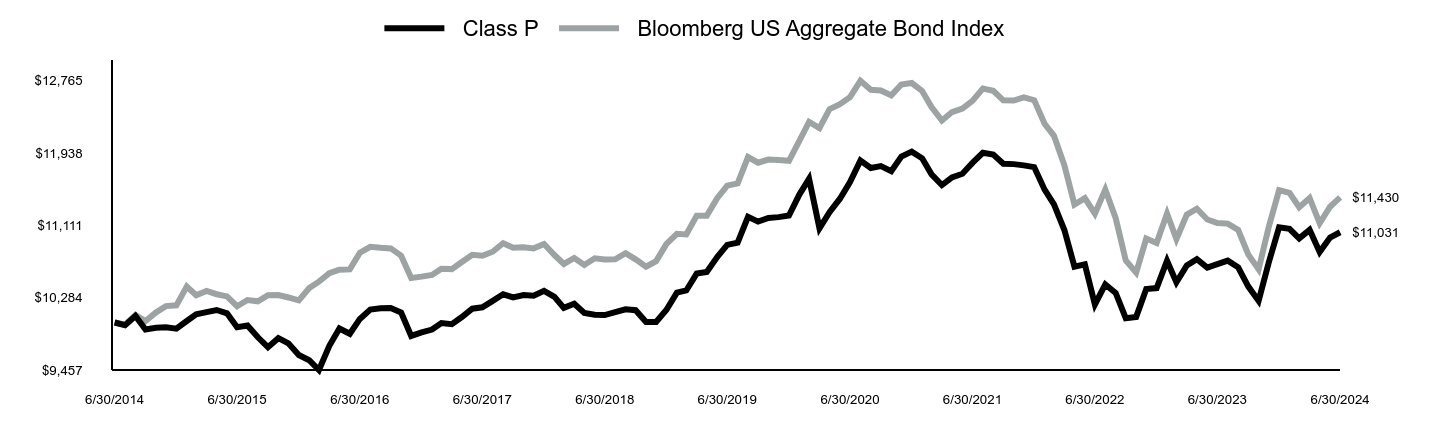

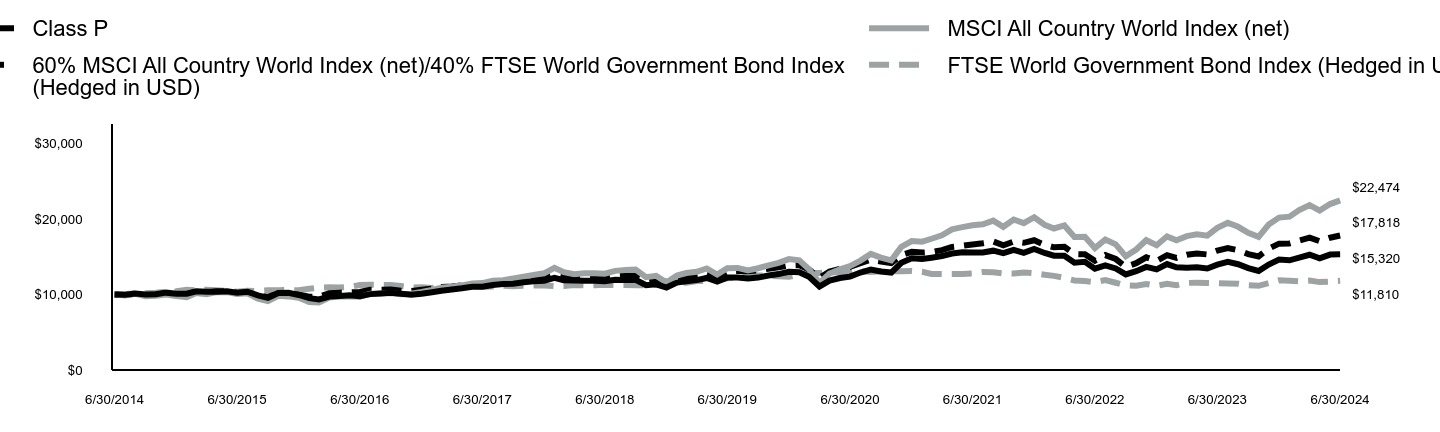

UBS Global Allocation Fund

| Class P | MSCI All Country World Index (net) | 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD) | FTSE World Government Bond Index (Hedged in USD) |

|---|

| 6/30/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 7/31/2014 | $9,956 | $9,879 | $9,943 | $10,040 |

| 8/31/2014 | $10,124 | $10,097 | $10,128 | $10,173 |

| 9/30/2014 | $10,000 | $9,770 | $9,923 | $10,153 |

| 10/31/2014 | $10,044 | $9,838 | $9,991 | $10,221 |

| 11/30/2014 | $10,249 | $10,003 | $10,137 | $10,338 |

| 12/31/2014 | $10,116 | $9,810 | $10,054 | $10,426 |

| 1/31/2015 | $10,107 | $9,656 | $10,042 | $10,638 |

| 2/28/2015 | $10,436 | $10,194 | $10,347 | $10,558 |

| 3/31/2015 | $10,356 | $10,036 | $10,282 | $10,638 |

| 4/30/2015 | $10,382 | $10,327 | $10,430 | $10,556 |

| 5/31/2015 | $10,418 | $10,314 | $10,395 | $10,490 |

| 6/30/2015 | $10,231 | $10,071 | $10,195 | $10,354 |

| 7/31/2015 | $10,364 | $10,158 | $10,300 | $10,486 |

| 8/31/2015 | $9,884 | $9,462 | $9,869 | $10,468 |

| 9/30/2015 | $9,556 | $9,119 | $9,686 | $10,553 |

| 10/31/2015 | $10,204 | $9,835 | $10,153 | $10,581 |

| 11/30/2015 | $10,231 | $9,754 | $10,105 | $10,586 |

| 12/31/2015 | $9,944 | $9,578 | $9,986 | $10,561 |

| 1/31/2016 | $9,524 | $9,000 | $9,705 | $10,774 |

| 2/29/2016 | $9,350 | $8,938 | $9,713 | $10,907 |

| 3/31/2016 | $9,725 | $9,601 | $10,165 | $10,964 |

| 4/30/2016 | $9,807 | $9,742 | $10,248 | $10,945 |

| 5/31/2016 | $9,889 | $9,755 | $10,280 | $11,010 |

| 6/30/2016 | $9,770 | $9,696 | $10,340 | $11,270 |

| 7/31/2016 | $10,054 | $10,114 | $10,622 | $11,310 |

| 8/31/2016 | $10,136 | $10,148 | $10,629 | $11,273 |

| 9/30/2016 | $10,227 | $10,210 | $10,666 | $11,266 |

| 10/31/2016 | $10,090 | $10,036 | $10,502 | $11,120 |

| 11/30/2016 | $9,981 | $10,113 | $10,480 | $10,935 |

| 12/31/2016 | $10,100 | $10,331 | $10,624 | $10,957 |

| 1/31/2017 | $10,296 | $10,614 | $10,766 | $10,874 |

| 2/28/2017 | $10,493 | $10,911 | $10,985 | $10,970 |

| 3/31/2017 | $10,661 | $11,045 | $11,061 | $10,957 |

| 4/30/2017 | $10,820 | $11,217 | $11,194 | $11,029 |

| 5/31/2017 | $11,026 | $11,465 | $11,365 | $11,086 |

| 6/30/2017 | $11,026 | $11,517 | $11,379 | $11,045 |

| 7/31/2017 | $11,260 | $11,839 | $11,579 | $11,068 |

| 8/31/2017 | $11,382 | $11,884 | $11,653 | $11,180 |

| 9/30/2017 | $11,438 | $12,114 | $11,759 | $11,110 |

| 10/31/2017 | $11,625 | $12,365 | $11,926 | $11,160 |

| 11/30/2017 | $11,766 | $12,605 | $12,077 | $11,187 |

| 12/31/2017 | $11,826 | $12,808 | $12,195 | $11,192 |

| 1/31/2018 | $12,206 | $13,530 | $12,575 | $11,115 |

| 2/28/2018 | $11,892 | $12,962 | $12,260 | $11,121 |

| 3/31/2018 | $11,854 | $12,685 | $12,163 | $11,258 |

| 4/30/2018 | $11,826 | $12,806 | $12,214 | $11,213 |

| 5/31/2018 | $11,835 | $12,822 | $12,233 | $11,236 |

| 6/30/2018 | $11,750 | $12,752 | $12,212 | $11,279 |

| 7/31/2018 | $11,959 | $13,137 | $12,422 | $11,254 |

| 8/31/2018 | $11,921 | $13,240 | $12,486 | $11,267 |

| 9/30/2018 | $11,959 | $13,298 | $12,496 | $11,216 |

| 10/31/2018 | $11,236 | $12,301 | $11,934 | $11,216 |

| 11/30/2018 | $11,359 | $12,481 | $12,072 | $11,293 |

| 12/31/2018 | $10,931 | $11,602 | $11,643 | $11,483 |

| 1/31/2019 | $11,588 | $12,518 | $12,236 | $11,585 |

| 2/28/2019 | $11,759 | $12,853 | $12,428 | $11,576 |

| 3/31/2019 | $11,911 | $13,015 | $12,617 | $11,797 |

| 4/30/2019 | $12,197 | $13,454 | $12,864 | $11,777 |

| 5/31/2019 | $11,731 | $12,656 | $12,499 | $11,989 |

| 6/30/2019 | $12,244 | $13,485 | $13,062 | $12,161 |

| 7/31/2019 | $12,244 | $13,524 | $13,126 | $12,256 |

| 8/31/2019 | $12,140 | $13,203 | $13,090 | $12,610 |

| 9/30/2019 | $12,244 | $13,481 | $13,224 | $12,535 |

| 10/31/2019 | $12,511 | $13,850 | $13,419 | $12,481 |

| 11/30/2019 | $12,710 | $14,188 | $13,594 | $12,431 |

| 12/31/2019 | $13,012 | $14,688 | $13,848 | $12,355 |

| 1/31/2020 | $12,961 | $14,526 | $13,881 | $12,634 |

| 2/29/2020 | $12,339 | $13,352 | $13,297 | $12,836 |

| 3/31/2020 | $11,064 | $11,550 | $12,224 | $12,845 |

| 4/30/2020 | $11,839 | $12,787 | $13,054 | $12,961 |

| 5/31/2020 | $12,186 | $13,343 | $13,387 | $12,944 |

| 6/30/2020 | $12,369 | $13,769 | $13,660 | $12,982 |

| 7/31/2020 | $12,910 | $14,498 | $14,148 | $13,111 |

| 8/31/2020 | $13,307 | $15,385 | $14,610 | $12,977 |

| 9/30/2020 | $13,042 | $14,889 | $14,371 | $13,075 |

| 10/31/2020 | $12,910 | $14,527 | $14,158 | $13,067 |

| 11/30/2020 | $14,195 | $16,318 | $15,215 | $13,092 |

| 12/31/2020 | $14,813 | $17,075 | $15,648 | $13,109 |

| 1/31/2021 | $14,709 | $16,998 | $15,558 | $13,012 |

| 2/28/2021 | $14,885 | $17,391 | $15,640 | $12,730 |

| 3/31/2021 | $15,093 | $17,856 | $15,878 | $12,706 |

| 4/30/2021 | $15,435 | $18,637 | $16,296 | $12,707 |

| 5/31/2021 | $15,601 | $18,927 | $16,460 | $12,730 |

| 6/30/2021 | $15,570 | $19,176 | $16,626 | $12,800 |

| 7/31/2021 | $15,560 | $19,308 | $16,794 | $12,991 |

| 8/31/2021 | $15,809 | $19,791 | $17,026 | $12,952 |

| 9/30/2021 | $15,477 | $18,974 | $16,523 | $12,798 |

| 10/31/2021 | $15,923 | $19,942 | $17,017 | $12,774 |

| 11/30/2021 | $15,518 | $19,462 | $16,852 | $12,926 |

| 12/31/2021 | $16,031 | $20,241 | $17,195 | $12,809 |

| 1/31/2022 | $15,510 | $19,247 | $16,587 | $12,619 |

| 2/28/2022 | $15,138 | $18,749 | $16,253 | $12,473 |

| 3/31/2022 | $15,125 | $19,156 | $16,319 | $12,195 |

| 4/30/2022 | $14,219 | $17,622 | $15,359 | $11,865 |

| 5/31/2022 | $14,331 | $17,643 | $15,328 | $11,785 |

| 6/30/2022 | $13,425 | $16,156 | $14,480 | $11,646 |

| 7/31/2022 | $13,872 | $17,284 | $15,223 | $11,919 |

| 8/31/2022 | $13,450 | $16,648 | $14,704 | $11,561 |

| 9/30/2022 | $12,668 | $15,054 | $13,675 | $11,199 |

| 10/31/2022 | $13,090 | $15,962 | $14,151 | $11,159 |

| 11/30/2022 | $13,661 | $17,200 | $14,930 | $11,398 |

| 12/31/2022 | $13,337 | $16,524 | $14,454 | $11,161 |

| 1/31/2023 | $14,038 | $17,708 | $15,206 | $11,413 |

| 2/28/2023 | $13,610 | $17,200 | $14,848 | $11,232 |

| 3/31/2023 | $13,545 | $17,731 | $15,283 | $11,535 |

| 4/30/2023 | $13,597 | $17,986 | $15,436 | $11,575 |

| 5/31/2023 | $13,441 | $17,793 | $15,309 | $11,523 |

| 6/30/2023 | $13,960 | $18,826 | $15,826 | $11,493 |

| 7/31/2023 | $14,324 | $19,515 | $16,154 | $11,457 |

| 8/31/2023 | $14,012 | $18,970 | $15,873 | $11,439 |

| 9/30/2023 | $13,493 | $18,186 | $15,361 | $11,226 |

| 10/31/2023 | $13,116 | $17,639 | $15,047 | $11,159 |

| 11/30/2023 | $13,973 | $19,267 | $16,072 | $11,514 |

| 12/31/2023 | $14,629 | $20,192 | $16,738 | $11,878 |

| 1/31/2024 | $14,536 | $20,311 | $16,775 | $11,839 |

| 2/29/2024 | $14,881 | $21,182 | $17,158 | $11,752 |

| 3/31/2024 | $15,267 | $21,847 | $17,534 | $11,842 |

| 4/30/2024 | $14,788 | $21,126 | $17,071 | $11,647 |

| 5/31/2024 | $15,294 | $21,984 | $17,527 | $11,715 |

| 6/30/2024 | $15,320 | $22,474 | $17,818 | $11,810 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class P | 9.74% | 4.58% | 4.36% |

| MSCI All Country World Index (net) | 19.38% | 10.76% | 8.43% |

| 60% MSCI All Country World Index (net)/40% FTSE World Government Bond Index (Hedged in USD) | 12.58% | 6.41% | 5.95% |

| FTSE World Government Bond Index (Hedged in USD) | 2.75% | (0.58%) | 1.68% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $153,472,343 |

| # of Portfolio Holdings | 330 |

| Portfolio Turnover Rate | 82% |

| Total Advisory Fees Paid | $758,956 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

| PACE International Equity Investments, Class P2 | 9.4% |

| UBS Emerging Markets Equity Opportunity Fund, Class P2 | 6.4 |

| PACE International Emerging Markets Equity Investments, Class P2 | 6.4 |

| PACE High Yield Investments, Class P2 | 5.9 |

| SPDR Portfolio High Yield Bond ETF | 4.6 |

UBS Global Allocation Fund

| Value | Value |

|---|

| Investment companies | 29.5% |

| Common stocks | 28.2% |

| Corporate bonds | 10.3% |

| Exchange traded funds | 7.7% |

| Short-Term Investments | 7.3% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Global Allocation Fund

Annual Shareholder Report

June 30, 2024

UBS US Dividend Ruler Fund

This annual shareholder report contains important information about UBS US Dividend Ruler Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $55 | 0.51% |

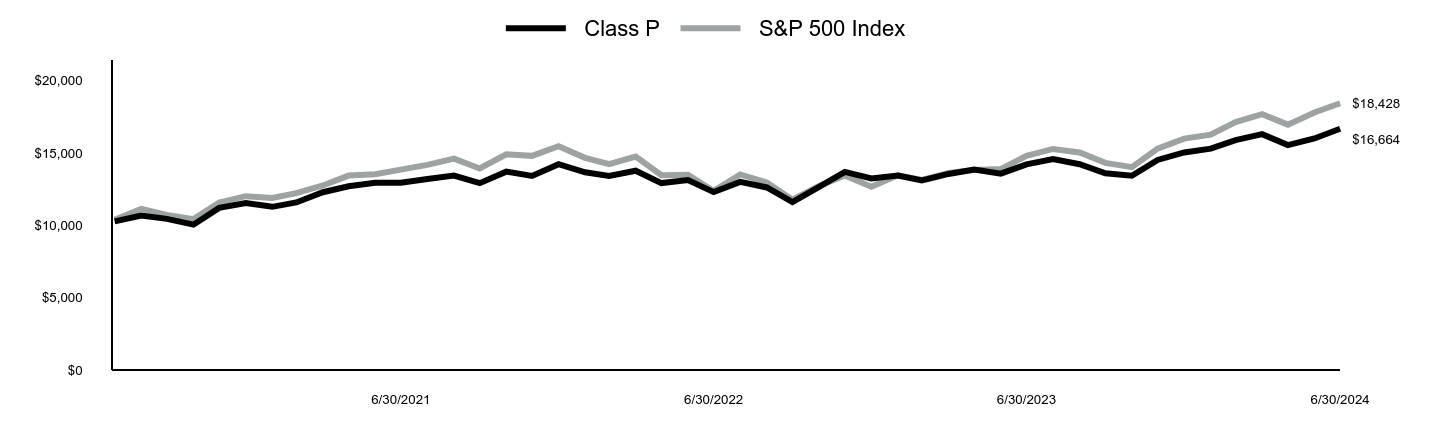

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Stock selection within the financials, materials, and energy sectors were additive to performance

• Within sectors, the portfolio’s overweight to technology and underweight to consumer discretionary were positive performance contributors.

• Several holdings were beneficial for absolute performance, including:

• Broadcom’s shares rallied given its growing exposure to artificial intelligence infrastructure

• While artificial intelligence adoption remains in its early days, Microsoft appears to be a leader in monetizing its vast amount of data across its Office platform and leading Azure cloud offering.

• Shares of Taiwan Semiconductor ADR rallied amid robust artificial intelligence datacenter demand from key customers such as NVIDIA.

What didn't work:

• Stock selection within industrials and consumer discretionary were the largest relative detractors.

• Within sectors, the portfolio’s underweight to communication services was the largest detractor.

• Several holdings weighed on absolute performance, including:

• Shares of RTX slid amid issues with its geared turbofan engines. The associated cost of grounding the impacted planes, including actual repairs and remediation to customers, led management to cut its free cash flow guidance for 2024.

• Starbucks shares fell due to declining same stores sales. The company blamed softer “occasional visitor” traffic and social media disinformation tied to its stance on the Middle East conflict.

• Shares of UPS lagged due to weak parcel volumes and elevated labor costs. Looking forward, volumes appear to be near trough levels. Margins should also begin to rebound driven by greater mix of more profitable segments such as healthcare and small and medium-sized businesses, and lessening labor costs headwinds.

The Fund did not invest in derivatives during the reporting period.

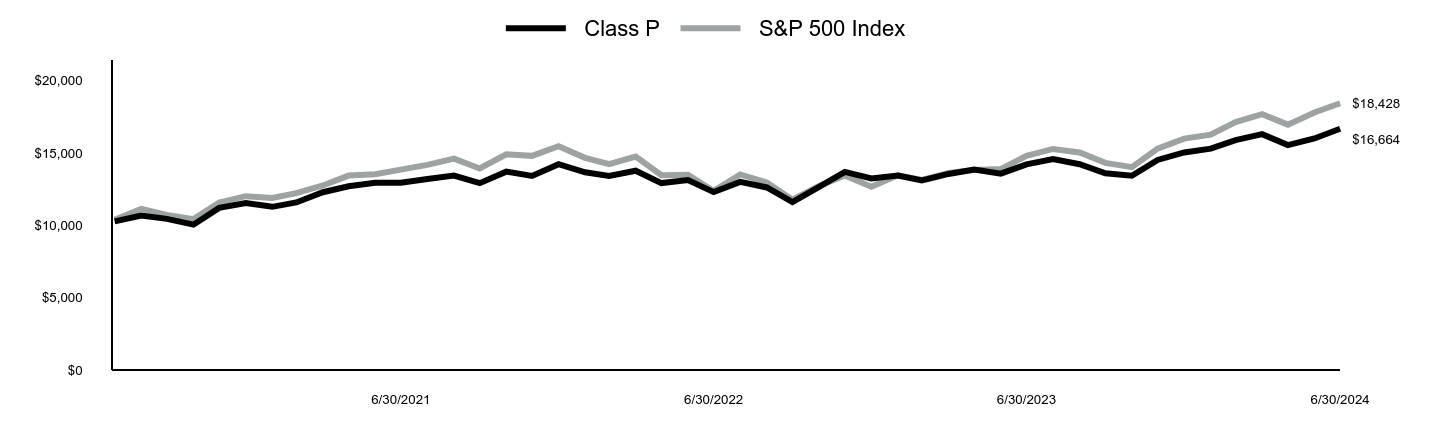

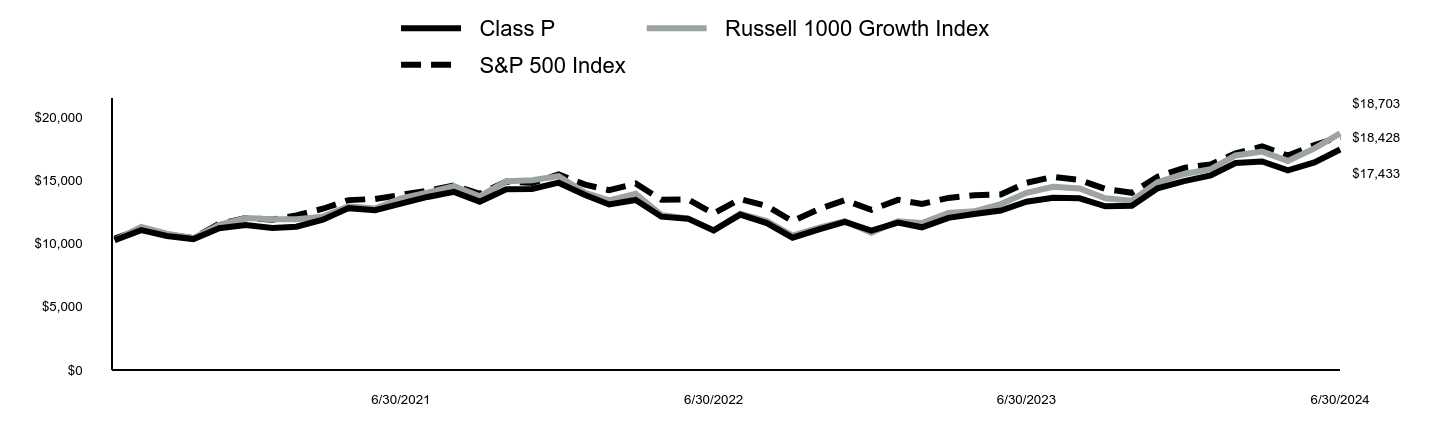

UBS US Dividend Ruler Fund

| Class P | S&P 500 Index |

|---|

| 7/31/2020 | $10,270 | $10,385 |

| 8/31/2020 | $10,670 | $11,131 |

| 9/30/2020 | $10,440 | $10,708 |

| 10/31/2020 | $10,040 | $10,423 |

| 11/30/2020 | $11,200 | $11,564 |

| 12/31/2020 | $11,534 | $12,009 |

| 1/31/2021 | $11,272 | $11,888 |

| 2/28/2021 | $11,574 | $12,215 |

| 3/31/2021 | $12,281 | $12,750 |

| 4/30/2021 | $12,694 | $13,431 |

| 5/31/2021 | $12,937 | $13,525 |

| 6/30/2021 | $12,937 | $13,840 |

| 7/31/2021 | $13,189 | $14,169 |

| 8/31/2021 | $13,431 | $14,600 |

| 9/30/2021 | $12,906 | $13,921 |

| 10/31/2021 | $13,703 | $14,896 |

| 11/30/2021 | $13,401 | $14,793 |

| 12/31/2021 | $14,221 | $15,456 |

| 1/31/2022 | $13,660 | $14,656 |

| 2/28/2022 | $13,400 | $14,218 |

| 3/31/2022 | $13,764 | $14,745 |

| 4/30/2022 | $12,912 | $13,460 |

| 5/31/2022 | $13,120 | $13,484 |

| 6/30/2022 | $12,289 | $12,371 |

| 7/31/2022 | $12,995 | $13,512 |

| 8/31/2022 | $12,611 | $12,961 |

| 9/30/2022 | $11,603 | $11,767 |

| 10/31/2022 | $12,652 | $12,720 |

| 11/30/2022 | $13,681 | $13,431 |

| 12/31/2022 | $13,236 | $12,657 |

| 1/31/2023 | $13,439 | $13,452 |

| 2/28/2023 | $13,098 | $13,124 |

| 3/31/2023 | $13,545 | $13,606 |

| 4/30/2023 | $13,843 | $13,818 |

| 5/31/2023 | $13,566 | $13,878 |

| 6/30/2023 | $14,205 | $14,795 |

| 7/31/2023 | $14,578 | $15,271 |

| 8/31/2023 | $14,216 | $15,027 |

| 9/30/2023 | $13,588 | $14,311 |

| 10/31/2023 | $13,417 | $14,010 |

| 11/30/2023 | $14,514 | $15,289 |

| 12/31/2023 | $15,031 | $15,984 |

| 1/31/2024 | $15,294 | $16,253 |

| 2/29/2024 | $15,886 | $17,121 |

| 3/31/2024 | $16,291 | $17,671 |

| 4/30/2024 | $15,535 | $16,950 |

| 5/31/2024 | $15,995 | $17,790 |

| 6/30/2024 | $16,664 | $18,428 |

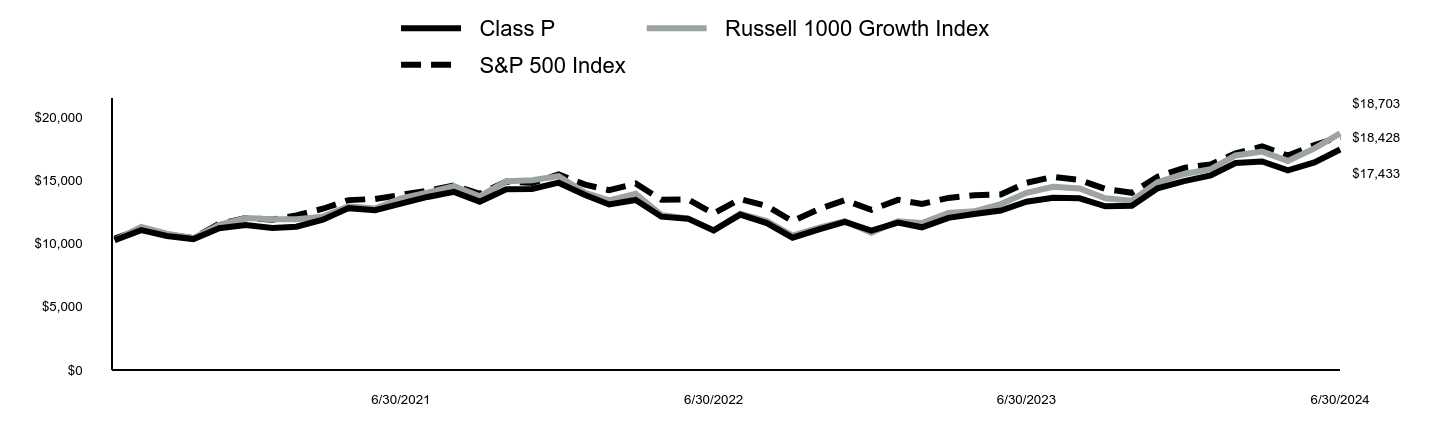

Average Annual Total Returns (%)

| 1 Year | Since Inception 7/9/20 |

|---|

| Class P | 17.31% | 13.71% |

| S&P 500 Index | 24.56% | 16.62% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $199,336,082 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 26% |

| Total Advisory Fees Paid | $183,794 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

Top 5 Holdings (% of Net Assets)

| Microsoft Corp. | 11.9% |

| Broadcom, Inc. | 5.7 |

| Oracle Corp. | 5.1 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 4.5 |

| JPMorgan Chase & Co. | 4.4 |

UBS US Dividend Ruler Fund

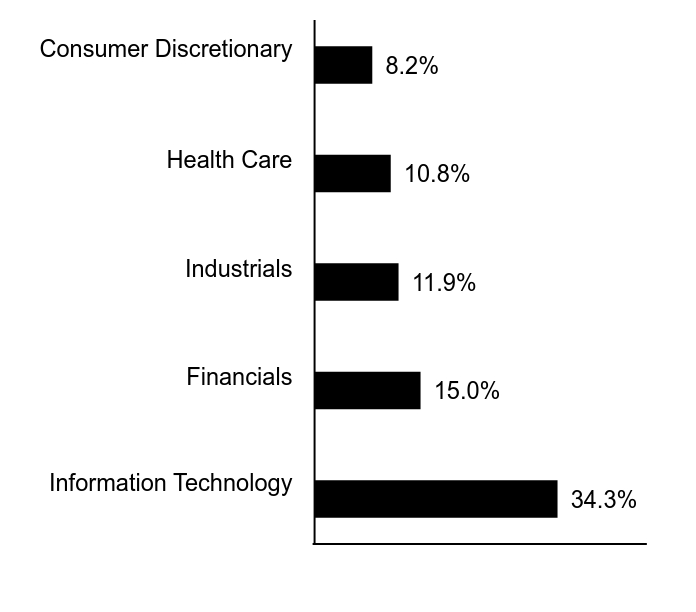

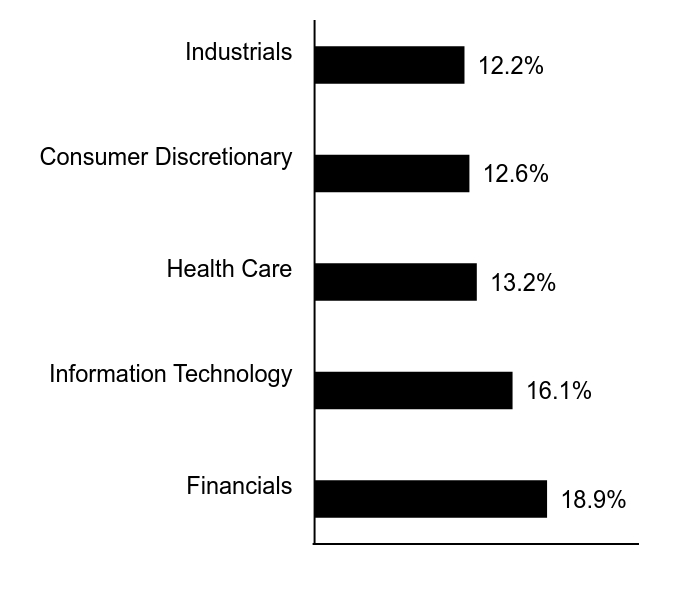

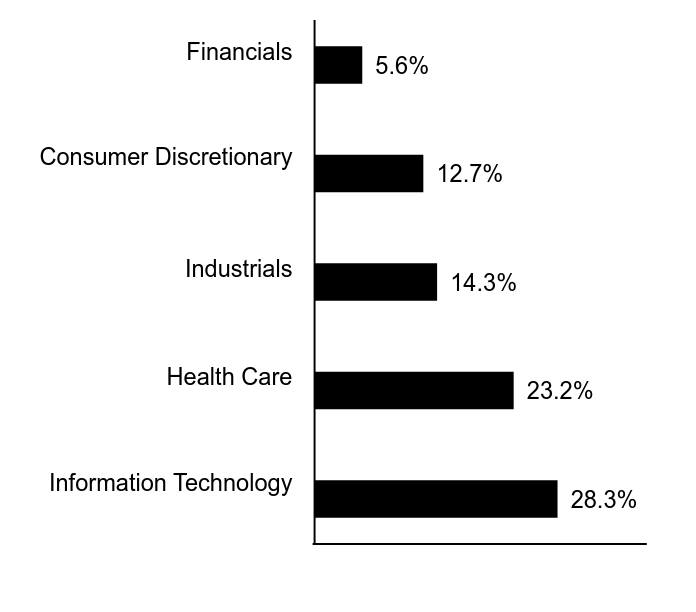

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 34.3% |

| Financials | 15.0% |

| Industrials | 11.9% |

| Health Care | 10.8% |

| Consumer Discretionary | 8.2% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS US Dividend Ruler Fund

Annual Shareholder Report

June 30, 2024

UBS US Dividend Ruler Fund

This annual shareholder report contains important information about UBS US Dividend Ruler Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P2 | $17 | 0.16% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Stock selection within the financials, materials, and energy sectors were additive to performance

• Within sectors, the portfolio’s overweight to technology and underweight to consumer discretionary were positive performance contributors.

• Several holdings were beneficial for absolute performance, including:

• Broadcom’s shares rallied given its growing exposure to artificial intelligence infrastructure

• While artificial intelligence adoption remains in its early days, Microsoft appears to be a leader in monetizing its vast amount of data across its Office platform and leading Azure cloud offering.

• Shares of Taiwan Semiconductor ADR rallied amid robust artificial intelligence datacenter demand from key customers such as NVIDIA.

What didn't work:

• Stock selection within industrials and consumer discretionary were the largest relative detractors.

• Within sectors, the portfolio’s underweight to communication services was the largest detractor.

• Several holdings weighed on absolute performance, including:

• Shares of RTX slid amid issues with its geared turbofan engines. The associated cost of grounding the impacted planes, including actual repairs and remediation to customers, led management to cut its free cash flow guidance for 2024.

• Starbucks shares fell due to declining same stores sales. The company blamed softer “occasional visitor” traffic and social media disinformation tied to its stance on the Middle East conflict.

• Shares of UPS lagged due to weak parcel volumes and elevated labor costs. Looking forward, volumes appear to be near trough levels. Margins should also begin to rebound driven by greater mix of more profitable segments such as healthcare and small and medium-sized businesses, and lessening labor costs headwinds.

The Fund did not invest in derivatives during the reporting period.

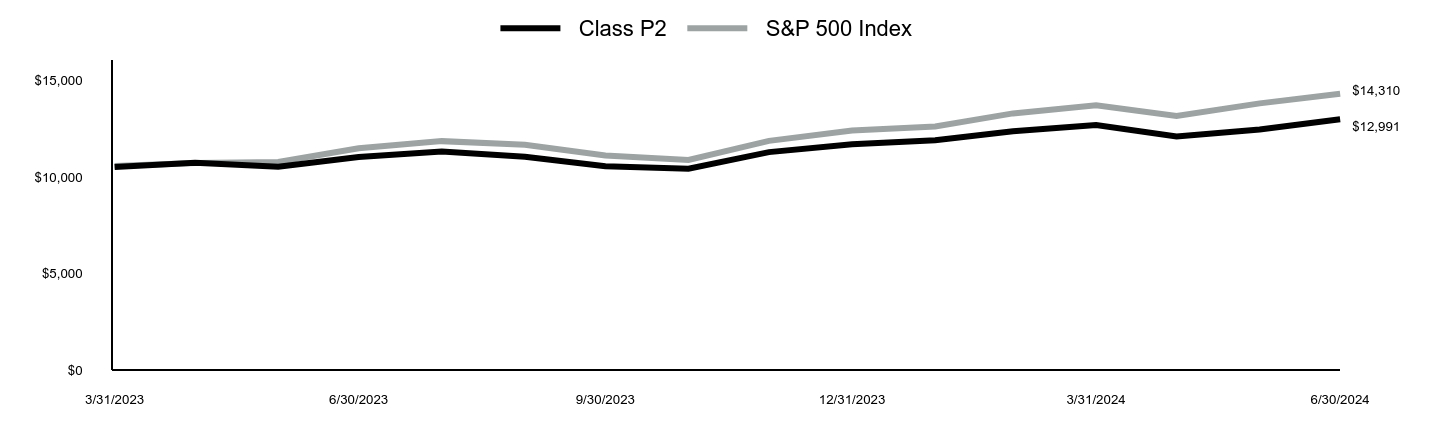

UBS US Dividend Ruler Fund

| Class P2 | S&P 500 Index |

|---|

| 3/31/2023 | $10,512 | $10,565 |

| 4/30/2023 | $10,744 | $10,730 |

| 5/31/2023 | $10,529 | $10,777 |

| 6/30/2023 | $11,033 | $11,489 |

| 7/31/2023 | $11,322 | $11,858 |

| 8/31/2023 | $11,050 | $11,669 |

| 9/30/2023 | $10,562 | $11,113 |

| 10/31/2023 | $10,430 | $10,879 |

| 11/30/2023 | $11,289 | $11,872 |

| 12/31/2023 | $11,691 | $12,412 |

| 1/31/2024 | $11,905 | $12,620 |

| 2/29/2024 | $12,366 | $13,294 |

| 3/31/2024 | $12,691 | $13,722 |

| 4/30/2024 | $12,101 | $13,162 |

| 5/31/2024 | $12,460 | $13,814 |

| 6/30/2024 | $12,991 | $14,310 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 3/15/23 |

|---|

| Class P2 | 17.74% | 22.43% |

| S&P 500 Index | 24.56% | 31.93% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $199,336,082 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 26% |

| Total Advisory Fees Paid | $183,794 |

What is the Fund’s investment objective?

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

Top 5 Holdings (% of Net Assets)

| Microsoft Corp. | 11.9% |

| Broadcom, Inc. | 5.7 |

| Oracle Corp. | 5.1 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 4.5 |

| JPMorgan Chase & Co. | 4.4 |

UBS US Dividend Ruler Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 34.3% |

| Financials | 15.0% |

| Industrials | 11.9% |

| Health Care | 10.8% |

| Consumer Discretionary | 8.2% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS US Dividend Ruler Fund

Annual Shareholder Report

June 30, 2024

UBS All China Equity Fund

This annual shareholder report contains important information about UBS All China Equity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $161 | 1.70% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Security selection within the consumer staples sector was additive to performance.

• An overweight in the communication services sector and an underweight in the information technology sector was also positive for performance.

• With respect to specific securities, our positioning in China Merchants Bank, NetEase and TAL Education were the main contributors.

What didn’t work:

• Security selection within the financials sector detracted from performance.

• An overweight in the consumer staples and health care sectors also dragged on performance.

• With respect to specific securities, underweighting PDD and overweighting JOINN Laboratories and Yunnan Energy hindered performance.

The Fund did not invest in derivatives during the reporting period.

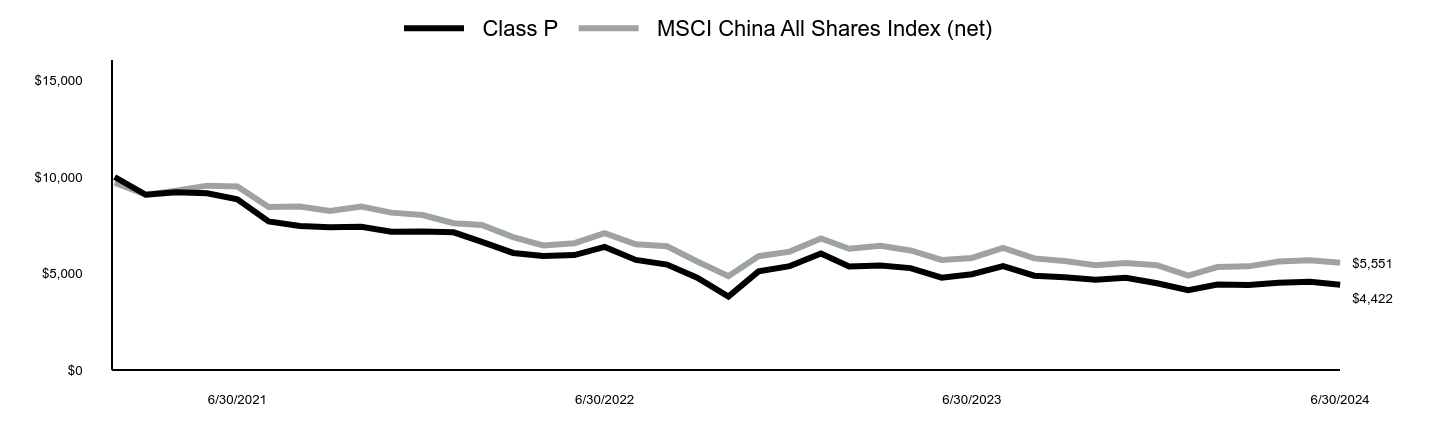

UBS All China Equity Fund

| Class P | MSCI China All Shares Index (net) |

|---|

| 2/28/2021 | $10,000 | $9,698 |

| 3/31/2021 | $9,080 | $9,082 |

| 4/30/2021 | $9,210 | $9,292 |

| 5/31/2021 | $9,160 | $9,552 |

| 6/30/2021 | $8,840 | $9,507 |

| 7/31/2021 | $7,700 | $8,449 |

| 8/31/2021 | $7,460 | $8,467 |

| 9/30/2021 | $7,390 | $8,238 |

| 10/31/2021 | $7,420 | $8,467 |

| 11/30/2021 | $7,160 | $8,154 |

| 12/31/2021 | $7,173 | $8,030 |

| 1/31/2022 | $7,133 | $7,602 |

| 2/28/2022 | $6,639 | $7,509 |

| 3/31/2022 | $6,065 | $6,885 |

| 4/30/2022 | $5,903 | $6,453 |

| 5/31/2022 | $5,954 | $6,570 |

| 6/30/2022 | $6,377 | $7,085 |

| 7/31/2022 | $5,702 | $6,513 |

| 8/31/2022 | $5,460 | $6,408 |

| 9/30/2022 | $4,785 | $5,622 |

| 10/31/2022 | $3,808 | $4,862 |

| 11/30/2022 | $5,108 | $5,897 |

| 12/31/2022 | $5,382 | $6,134 |

| 1/31/2023 | $6,033 | $6,812 |

| 2/28/2023 | $5,362 | $6,279 |

| 3/31/2023 | $5,413 | $6,441 |

| 4/30/2023 | $5,280 | $6,192 |

| 5/31/2023 | $4,782 | $5,700 |

| 6/30/2023 | $4,965 | $5,806 |

| 7/31/2023 | $5,382 | $6,328 |

| 8/31/2023 | $4,884 | $5,783 |

| 9/30/2023 | $4,802 | $5,642 |

| 10/31/2023 | $4,680 | $5,428 |

| 11/30/2023 | $4,782 | $5,537 |

| 12/31/2023 | $4,495 | $5,427 |

| 1/31/2024 | $4,131 | $4,887 |

| 2/29/2024 | $4,433 | $5,335 |

| 3/31/2024 | $4,402 | $5,370 |

| 4/30/2024 | $4,526 | $5,625 |

| 5/31/2024 | $4,568 | $5,691 |

| 6/30/2024 | $4,422 | $5,551 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 2/24/21 |

|---|

| Class P | (10.93%) | (21.64%) |

| MSCI China All Shares Index (net) | (4.39%) | (16.14%) |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $2,765,410 |

| # of Portfolio Holdings | 39 |

| Portfolio Turnover Rate | 6% |

| Total Advisory Fees Paid | $0 |

What is the Fund’s investment objective?

The Fund seeks to maximize capital appreciation.

Top 5 Holdings (% of Net Assets)

| NetEase, Inc. (China) | 14.5% |

| Tencent Holdings Ltd. (China) | 11.7 |

| Kweichow Moutai Co. Ltd., Class A (China) | 9.5 |

| China Merchants Bank Co. Ltd., Class H (China) | 9.1 |

| Hong Kong Exchanges & Clearing Ltd. (Hong Kong) | 4.4 |

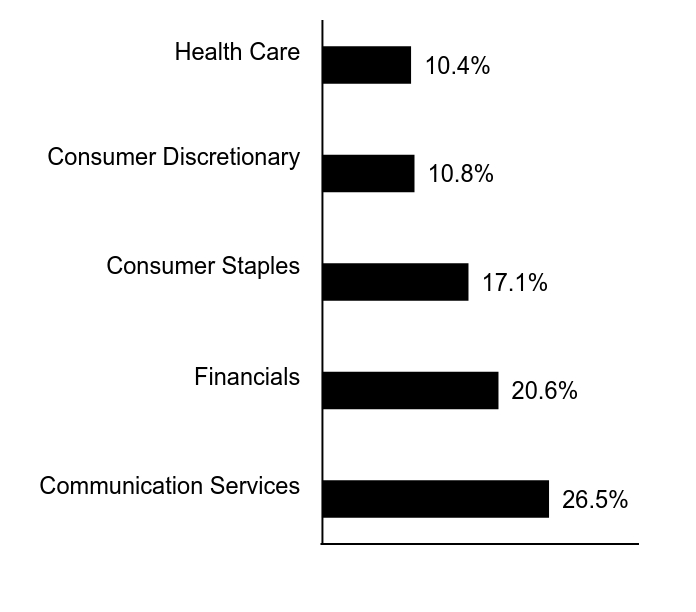

UBS All China Equity Fund

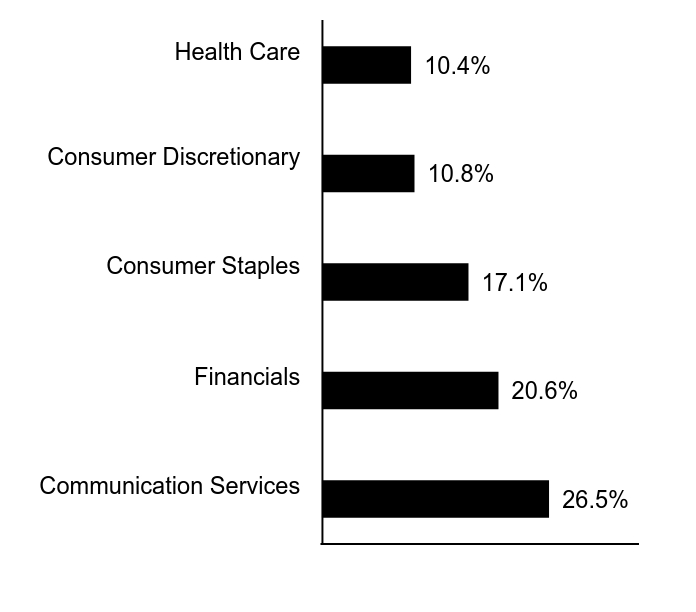

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Communication Services | 26.5% |

| Financials | 20.6% |

| Consumer Staples | 17.1% |

| Consumer Discretionary | 10.8% |

| Health Care | 10.4% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS All China Equity Fund

Annual Shareholder Report

June 30, 2024

UBS All China Equity Fund

This annual shareholder report contains important information about UBS All China Equity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P2 | $86 | 0.91% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Security selection within the consumer staples sector was additive to performance.

• An overweight in the communication services sector and an underweight in the information technology sector was also positive for performance.

• With respect to specific securities, our positioning in China Merchants Bank, NetEase and TAL Education were the main contributors.

What didn’t work:

• Security selection within the financials sector detracted from performance.

• An overweight in the consumer staples and health care sectors also dragged on performance.

• With respect to specific securities, underweighting PDD and overweighting JOINN Laboratories and Yunnan Energy hindered performance.

The Fund did not invest in derivatives during the reporting period.

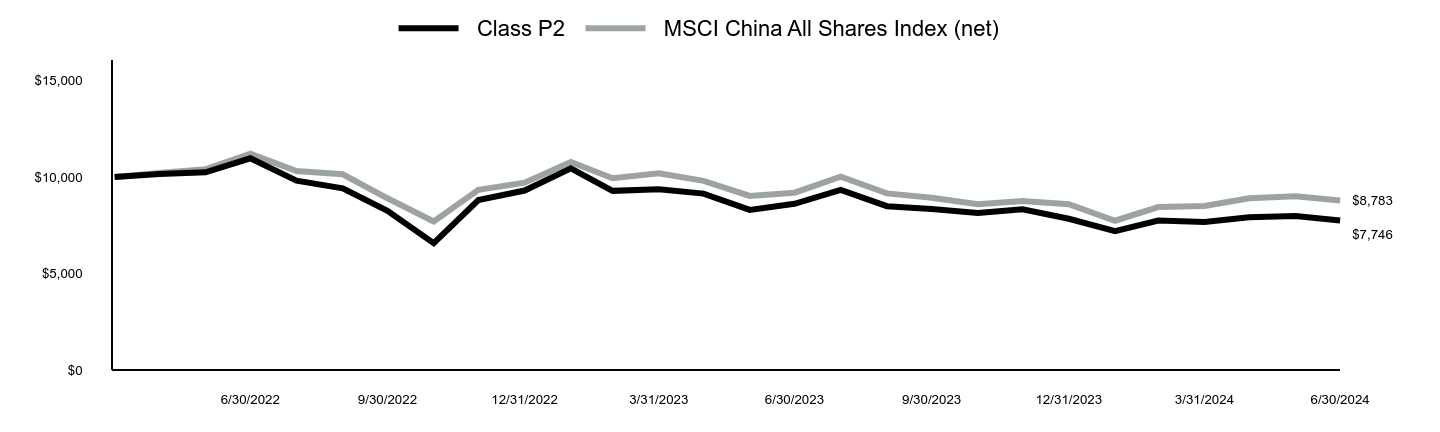

UBS All China Equity Fund

| Class P2 | MSCI China All Shares Index (net) |

|---|

| 3/31/2022 | $10,000 | $10,000 |

| 4/30/2022 | $10,156 | $10,211 |

| 5/31/2022 | $10,242 | $10,397 |

| 6/30/2022 | $10,969 | $11,210 |

| 7/31/2022 | $9,810 | $10,305 |

| 8/31/2022 | $9,412 | $10,139 |

| 9/30/2022 | $8,253 | $8,896 |

| 10/31/2022 | $6,574 | $7,693 |

| 11/30/2022 | $8,806 | $9,332 |

| 12/31/2022 | $9,299 | $9,707 |

| 1/31/2023 | $10,446 | $10,780 |

| 2/28/2023 | $9,281 | $9,936 |

| 3/31/2023 | $9,369 | $10,192 |

| 4/30/2023 | $9,140 | $9,798 |

| 5/31/2023 | $8,293 | $9,019 |

| 6/30/2023 | $8,611 | $9,186 |

| 7/31/2023 | $9,334 | $10,012 |

| 8/31/2023 | $8,487 | $9,150 |

| 9/30/2023 | $8,346 | $8,928 |

| 10/31/2023 | $8,134 | $8,588 |

| 11/30/2023 | $8,328 | $8,761 |

| 12/31/2023 | $7,837 | $8,587 |

| 1/31/2024 | $7,199 | $7,734 |

| 2/29/2024 | $7,746 | $8,442 |

| 3/31/2024 | $7,673 | $8,497 |

| 4/30/2024 | $7,910 | $8,901 |

| 5/31/2024 | $7,983 | $9,005 |

| 6/30/2024 | $7,746 | $8,783 |

Average Annual Total Returns (%)

| 1 Year | Since Inception 4/21/22 |

|---|

| Class P2 | (10.04%) | (11.54%) |

| MSCI China All Shares Index (net) | (4.39%) | (6.93%) |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $2,765,410 |

| # of Portfolio Holdings | 39 |

| Portfolio Turnover Rate | 6% |

| Total Advisory Fees Paid | $0 |

What is the Fund’s investment objective?

The Fund seeks to maximize capital appreciation.

Top 5 Holdings (% of Net Assets)

| NetEase, Inc. (China) | 14.5% |

| Tencent Holdings Ltd. (China) | 11.7 |

| Kweichow Moutai Co. Ltd., Class A (China) | 9.5 |

| China Merchants Bank Co. Ltd., Class H (China) | 9.1 |

| Hong Kong Exchanges & Clearing Ltd. (Hong Kong) | 4.4 |

UBS All China Equity Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Communication Services | 26.5% |

| Financials | 20.6% |

| Consumer Staples | 17.1% |

| Consumer Discretionary | 10.8% |

| Health Care | 10.4% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS All China Equity Fund

Annual Shareholder Report

June 30, 2024

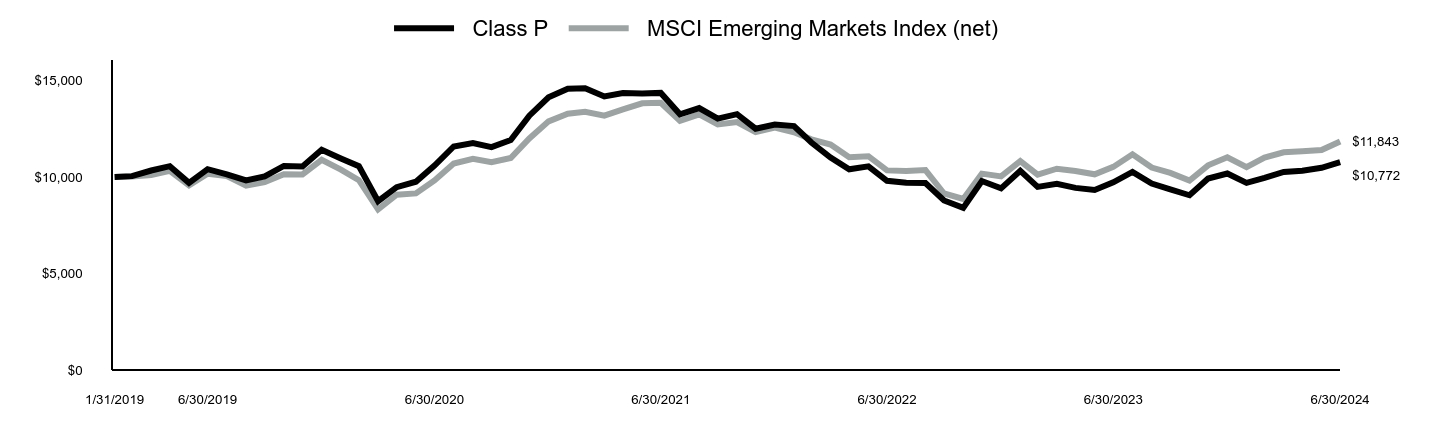

UBS Emerging Markets Equity Opportunity Fund

This annual shareholder report contains important information about UBS Emerging Markets Equity Opportunity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P | $105 | 1.00% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• On a sector level, stock selection within Consumer Discretionary and Information Technology added value

• On a stock level PDD, SK Hynix, and Mediatek were among the top contributors

• The Fund's holding in PDD (China, Consumer Discretionary) was the top contributor to results over the reporting period. PDD has been reporting better-than-expected results for the past few quarters. The company has been seeing strong revenue growth underpinned by higher market share gain, as well as improvement in profitability.

• The Fund’s position in SK Hynix (South Korea, Information Technology) was also additive for returns. SK Hynix outperformed with strong demand expectations for High Bandwidth Memory, spurred by Nvidia’s strong guidance that reflected robust demand for artificial intelligence.

What didn’t work:

• On a sector level, stock selection within Financials and Consumer Staples detracted

• On a stock level China Mengniu, Samsung SDI and Ping An Insurance were among the main detractors

• The Fund’s position in China Mengniu (China, Consumer Discretionary) was a headwind for returns. The stock underperformed amid concerns about weak consumption and dairy demand. In addition, weakening raw milk prices added to pricing pressure and raised risks of milk powder inventory write-down. The unexpected change in CEO also caused concerns on the company’s strategy.

• The Fund's position in Samsung SDI (Korea, Materials) also contributed negatively to performance. The stock underperformed on concerns about slowdown in electric vehicle demand and its effect on the supply chain.

The Fund did not invest in derivatives during the reporting period.

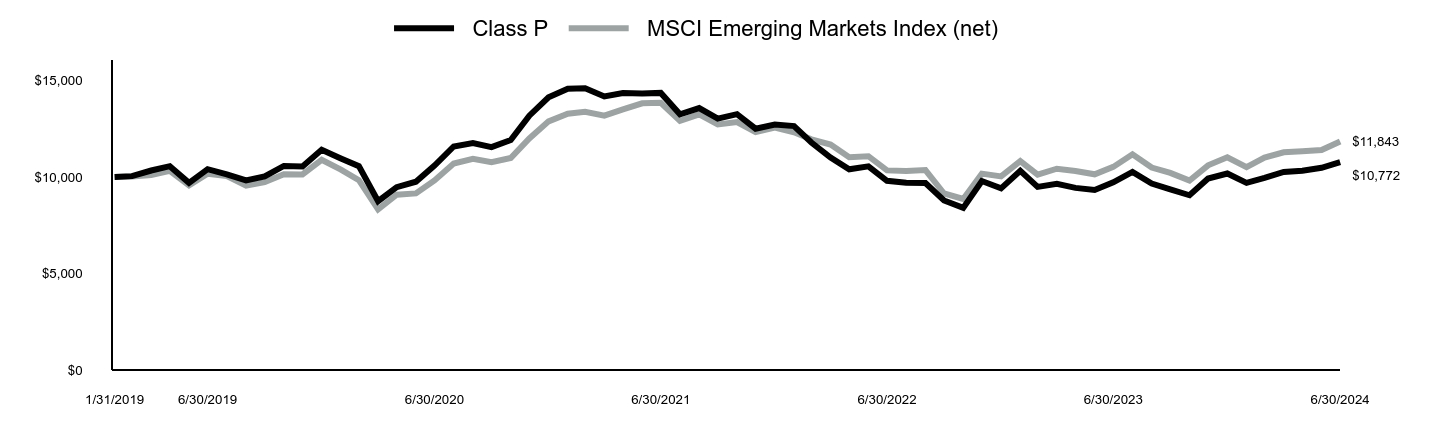

UBS Emerging Markets Equity Opportunity Fund

| Class P | MSCI Emerging Markets Index (net) |

|---|

| 1/31/2019 | $10,000 | $10,000 |

| 2/28/2019 | $10,045 | $10,022 |

| 3/31/2019 | $10,336 | $10,107 |

| 4/30/2019 | $10,561 | $10,319 |

| 5/31/2019 | $9,697 | $9,571 |

| 6/30/2019 | $10,404 | $10,168 |

| 7/31/2019 | $10,135 | $10,044 |

| 8/31/2019 | $9,821 | $9,554 |

| 9/30/2019 | $10,034 | $9,736 |

| 10/31/2019 | $10,572 | $10,147 |

| 11/30/2019 | $10,549 | $10,133 |

| 12/31/2019 | $11,410 | $10,889 |

| 1/31/2020 | $10,963 | $10,381 |

| 2/29/2020 | $10,561 | $9,834 |

| 3/31/2020 | $8,747 | $8,319 |

| 4/30/2020 | $9,470 | $9,081 |

| 5/31/2020 | $9,757 | $9,151 |

| 6/30/2020 | $10,595 | $9,823 |

| 7/31/2020 | $11,582 | $10,701 |

| 8/31/2020 | $11,755 | $10,938 |

| 9/30/2020 | $11,548 | $10,762 |

| 10/31/2020 | $11,915 | $10,984 |

| 11/30/2020 | $13,178 | $12,000 |

| 12/31/2020 | $14,125 | $12,882 |

| 1/31/2021 | $14,577 | $13,277 |

| 2/28/2021 | $14,601 | $13,379 |

| 3/31/2021 | $14,172 | $13,177 |

| 4/30/2021 | $14,346 | $13,505 |

| 5/31/2021 | $14,322 | $13,818 |

| 6/30/2021 | $14,357 | $13,842 |

| 7/31/2021 | $13,245 | $12,910 |

| 8/31/2021 | $13,569 | $13,248 |

| 9/30/2021 | $13,025 | $12,722 |

| 10/31/2021 | $13,256 | $12,847 |

| 11/30/2021 | $12,503 | $12,323 |

| 12/31/2021 | $12,716 | $12,555 |

| 1/31/2022 | $12,638 | $12,317 |

| 2/28/2022 | $11,788 | $11,949 |

| 3/31/2022 | $11,002 | $11,679 |

| 4/30/2022 | $10,397 | $11,029 |

| 5/31/2022 | $10,551 | $11,078 |

| 6/30/2022 | $9,804 | $10,342 |

| 7/31/2022 | $9,701 | $10,316 |

| 8/31/2022 | $9,688 | $10,359 |

| 9/30/2022 | $8,786 | $9,145 |

| 10/31/2022 | $8,400 | $8,861 |

| 11/30/2022 | $9,791 | $10,175 |

| 12/31/2022 | $9,409 | $10,032 |

| 1/31/2023 | $10,319 | $10,824 |

| 2/28/2023 | $9,489 | $10,123 |

| 3/31/2023 | $9,647 | $10,429 |

| 4/30/2023 | $9,436 | $10,311 |

| 5/31/2023 | $9,330 | $10,138 |

| 6/30/2023 | $9,726 | $10,523 |

| 7/31/2023 | $10,266 | $11,178 |

| 8/31/2023 | $9,660 | $10,489 |

| 9/30/2023 | $9,357 | $10,215 |

| 10/31/2023 | $9,054 | $9,818 |

| 11/30/2023 | $9,923 | $10,604 |

| 12/31/2023 | $10,179 | $11,018 |

| 1/31/2024 | $9,693 | $10,507 |

| 2/29/2024 | $9,950 | $11,006 |

| 3/31/2024 | $10,260 | $11,279 |

| 4/30/2024 | $10,327 | $11,330 |

| 5/31/2024 | $10,475 | $11,394 |

| 6/30/2024 | $10,772 | $11,843 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 1/31/19 |

|---|

| Class P | 10.76% | 0.70% | 1.38% |

| MSCI Emerging Markets Index (net) | 12.55% | 3.10% | 3.18% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $459,208,131 |

| # of Portfolio Holdings | 37 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $652,074 |

What is the Fund’s investment objective?

The Fund seeks to maximize capital appreciation.

Top 5 Holdings (% of Net Assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 10.1% |

| Samsung Electronics Co. Ltd. (South Korea) | 7.6 |

| Tencent Holdings Ltd. (China) | 6.9 |

| Reliance Industries Ltd. (India) | 4.8 |

| HDFC Bank Ltd. (India) | 4.4 |

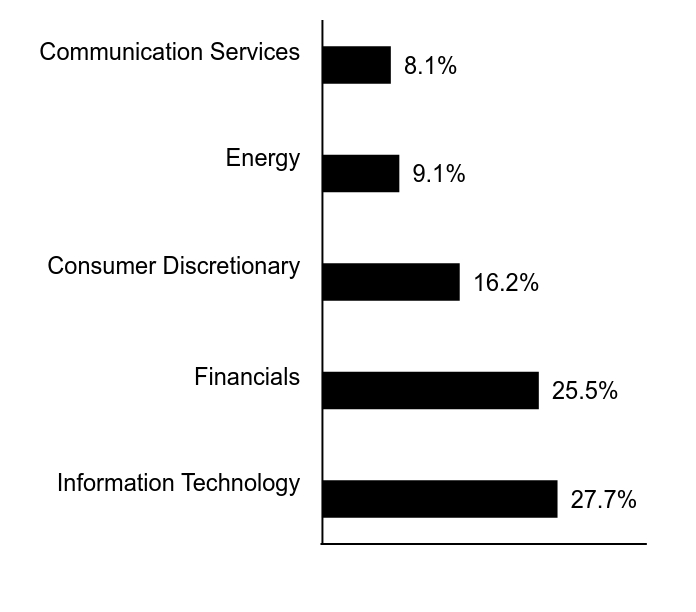

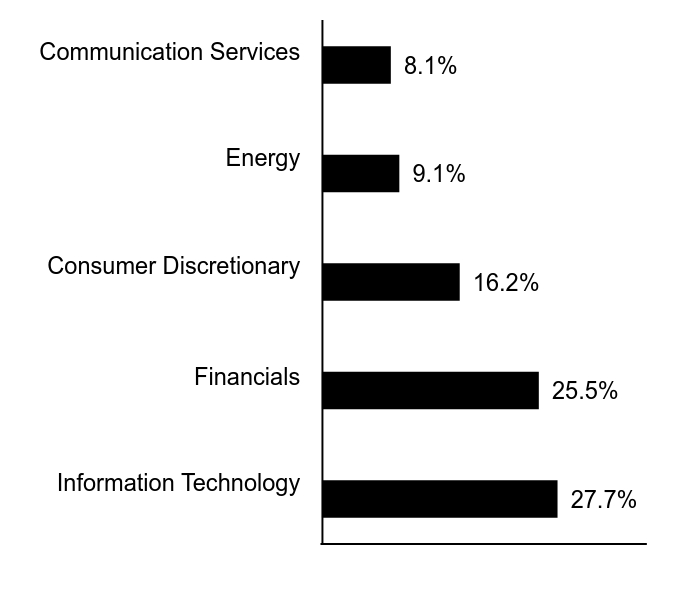

UBS Emerging Markets Equity Opportunity Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 27.7% |

| Financials | 25.5% |

| Consumer Discretionary | 16.2% |

| Energy | 9.1% |

| Communication Services | 8.1% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Emerging Markets Equity Opportunity Fund

Annual Shareholder Report

June 30, 2024

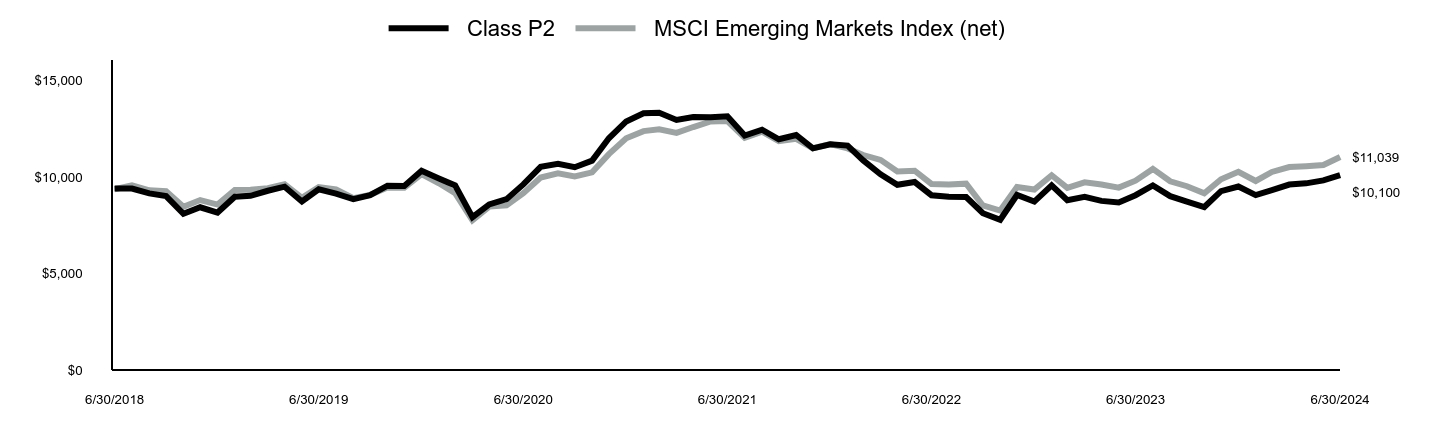

UBS Emerging Markets Equity Opportunity Fund

This annual shareholder report contains important information about UBS Emerging Markets Equity Opportunity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class P2 | $26 | 0.25% |

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• On a sector level, stock selection within Consumer Discretionary and Information Technology added value

• On a stock level PDD, SK Hynix, and Mediatek were among the top contributors

• The Fund's holding in PDD (China, Consumer Discretionary) was the top contributor to results over the reporting period. PDD has been reporting better-than-expected results for the past few quarters. The company has been seeing strong revenue growth underpinned by higher market share gain, as well as improvement in profitability.

• The Fund’s position in SK Hynix (South Korea, Information Technology) was also additive for returns. SK Hynix outperformed with strong demand expectations for High Bandwidth Memory, spurred by Nvidia’s strong guidance that reflected robust demand for artificial intelligence.

What didn’t work:

• On a sector level, stock selection within Financials and Consumer Staples detracted

• On a stock level China Mengniu, Samsung SDI and Ping An Insurance were among the main detractors

• The Fund’s position in China Mengniu (China, Consumer Discretionary) was a headwind for returns. The stock underperformed amid concerns about weak consumption and dairy demand. In addition, weakening raw milk prices added to pricing pressure and raised risks of milk powder inventory write-down. The unexpected change in CEO also caused concerns on the company’s strategy.

• The Fund's position in Samsung SDI (Korea, Materials) also contributed negatively to performance. The stock underperformed on concerns about slowdown in electric vehicle demand and its effect on the supply chain.

The Fund did not invest in derivatives during the reporting period.

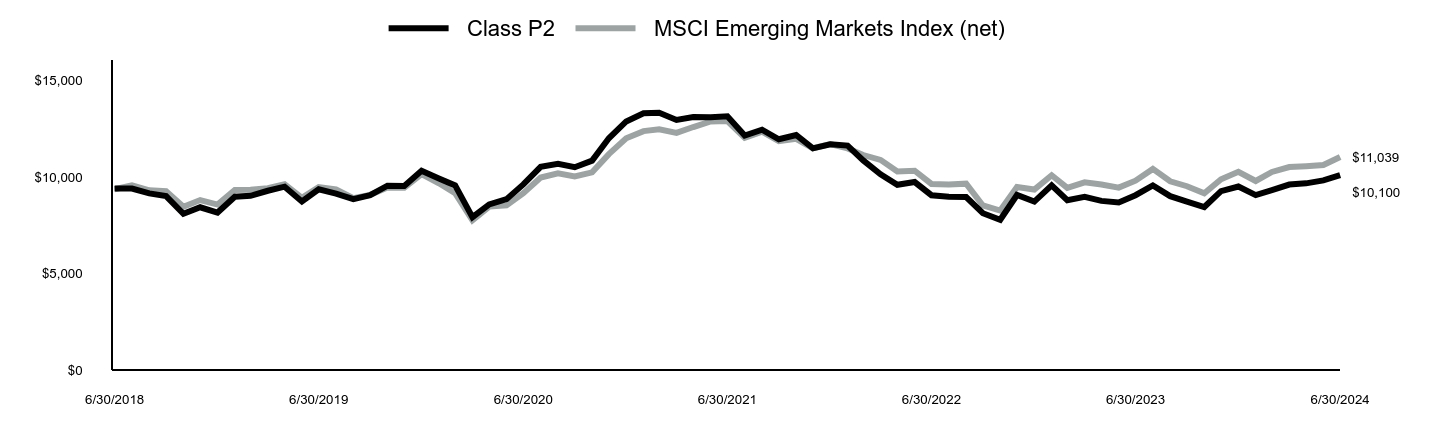

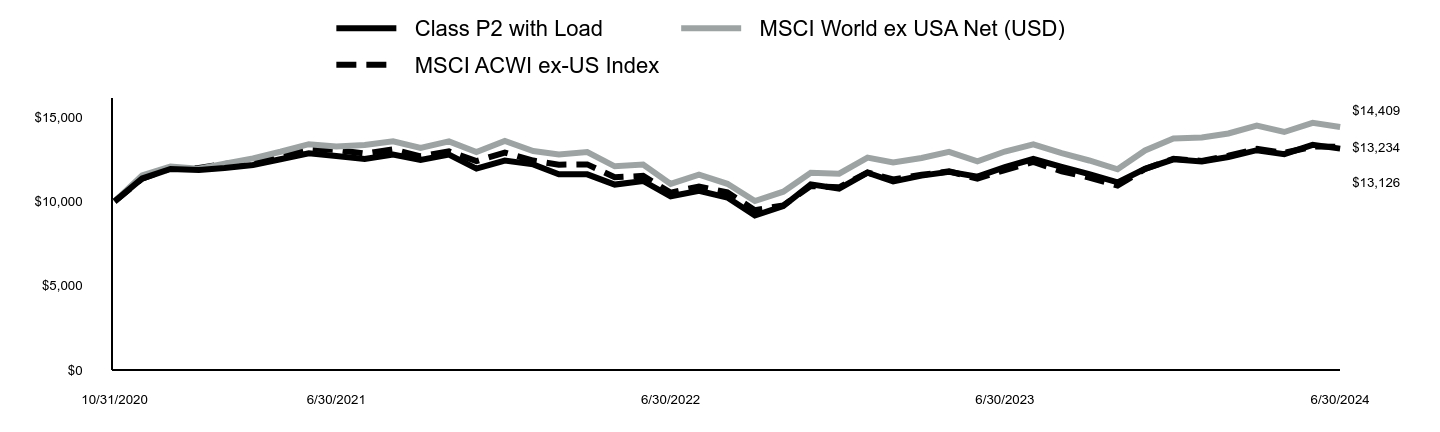

UBS Emerging Markets Equity Opportunity Fund

| Class P2 | MSCI Emerging Markets Index (net) |

|---|

| 6/30/2018 | $9,410 | $9,365 |

| 7/31/2018 | $9,400 | $9,570 |

| 8/31/2018 | $9,150 | $9,312 |

| 9/30/2018 | $9,010 | $9,262 |

| 10/31/2018 | $8,090 | $8,456 |

| 11/30/2018 | $8,430 | $8,804 |

| 12/31/2018 | $8,159 | $8,571 |

| 1/31/2019 | $8,974 | $9,321 |

| 2/28/2019 | $9,024 | $9,342 |

| 3/31/2019 | $9,286 | $9,421 |

| 4/30/2019 | $9,497 | $9,619 |

| 5/31/2019 | $8,733 | $8,921 |

| 6/30/2019 | $9,366 | $9,478 |

| 7/31/2019 | $9,135 | $9,362 |

| 8/31/2019 | $8,853 | $8,906 |

| 9/30/2019 | $9,055 | $9,076 |

| 10/31/2019 | $9,548 | $9,458 |

| 11/30/2019 | $9,538 | $9,445 |

| 12/31/2019 | $10,319 | $10,150 |

| 1/31/2020 | $9,926 | $9,677 |

| 2/29/2020 | $9,564 | $9,166 |

| 3/31/2020 | $7,920 | $7,755 |

| 4/30/2020 | $8,582 | $8,465 |

| 5/31/2020 | $8,851 | $8,530 |

| 6/30/2020 | $9,616 | $9,157 |

| 7/31/2020 | $10,526 | $9,975 |

| 8/31/2020 | $10,681 | $10,195 |

| 9/30/2020 | $10,505 | $10,032 |

| 10/31/2020 | $10,846 | $10,239 |

| 11/30/2020 | $12,005 | $11,186 |

| 12/31/2020 | $12,879 | $12,008 |

| 1/31/2021 | $13,299 | $12,376 |

| 2/28/2021 | $13,331 | $12,471 |

| 3/31/2021 | $12,953 | $12,282 |

| 4/30/2021 | $13,110 | $12,588 |

| 5/31/2021 | $13,100 | $12,880 |

| 6/30/2021 | $13,142 | $12,902 |

| 7/31/2021 | $12,144 | $12,034 |

| 8/31/2021 | $12,449 | $12,349 |

| 9/30/2021 | $11,956 | $11,858 |

| 10/31/2021 | $12,176 | $11,975 |

| 11/30/2021 | $11,483 | $11,487 |

| 12/31/2021 | $11,696 | $11,703 |

| 1/31/2022 | $11,625 | $11,481 |

| 2/28/2022 | $10,859 | $11,138 |

| 3/31/2022 | $10,140 | $10,886 |

| 4/30/2022 | $9,598 | $10,281 |

| 5/31/2022 | $9,739 | $10,326 |

| 6/30/2022 | $9,055 | $9,640 |

| 7/31/2022 | $8,973 | $9,616 |

| 8/31/2022 | $8,961 | $9,656 |

| 9/30/2022 | $8,124 | $8,524 |

| 10/31/2022 | $7,782 | $8,260 |

| 11/30/2022 | $9,067 | $9,485 |

| 12/31/2022 | $8,727 | $9,351 |

| 1/31/2023 | $9,571 | $10,090 |

| 2/28/2023 | $8,800 | $9,436 |

| 3/31/2023 | $8,971 | $9,721 |

| 4/30/2023 | $8,763 | $9,611 |

| 5/31/2023 | $8,678 | $9,450 |

| 6/30/2023 | $9,057 | $9,809 |

| 7/31/2023 | $9,559 | $10,419 |

| 8/31/2023 | $9,008 | $9,777 |

| 9/30/2023 | $8,727 | $9,522 |

| 10/31/2023 | $8,445 | $9,152 |

| 11/30/2023 | $9,265 | $9,884 |

| 12/31/2023 | $9,506 | $10,271 |

| 1/31/2024 | $9,063 | $9,794 |

| 2/29/2024 | $9,316 | $10,260 |

| 3/31/2024 | $9,607 | $10,514 |

| 4/30/2024 | $9,670 | $10,561 |

| 5/31/2024 | $9,822 | $10,620 |

| 6/30/2024 | $10,100 | $11,039 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 6/4/18 |

|---|

| Class P2 | 11.51% | 1.52% | 0.16% |

| MSCI Emerging Markets Index (net) | 12.55% | 3.10% | 1.64% |

Performance data represents past performance, which does not guarantee future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or a redemption of Fund shares.

| FUND STATISTICS | |

|---|

| Total Net Assets | $459,208,131 |

| # of Portfolio Holdings | 37 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $652,074 |

What is the Fund’s investment objective?

The Fund seeks to maximize capital appreciation.

Top 5 Holdings (% of Net Assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 10.1% |

| Samsung Electronics Co. Ltd. (South Korea) | 7.6 |

| Tencent Holdings Ltd. (China) | 6.9 |

| Reliance Industries Ltd. (India) | 4.8 |

| HDFC Bank Ltd. (India) | 4.4 |

UBS Emerging Markets Equity Opportunity Fund

Top 5 Sectors (% of Net Assets)

| Value | Value |

|---|

| Information Technology | 27.7% |

| Financials | 25.5% |

| Consumer Discretionary | 16.2% |

| Energy | 9.1% |

| Communication Services | 8.1% |

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit http://www.ubs.com/port-info .

UBS Emerging Markets Equity Opportunity Fund

Annual Shareholder Report

June 30, 2024

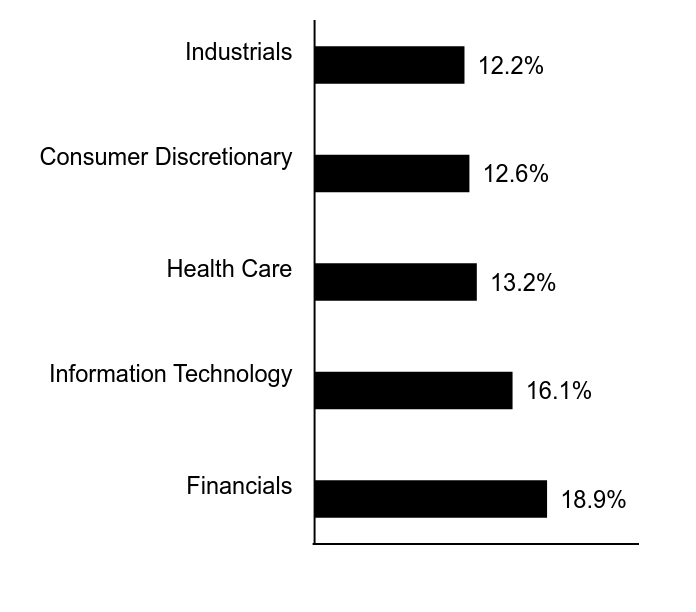

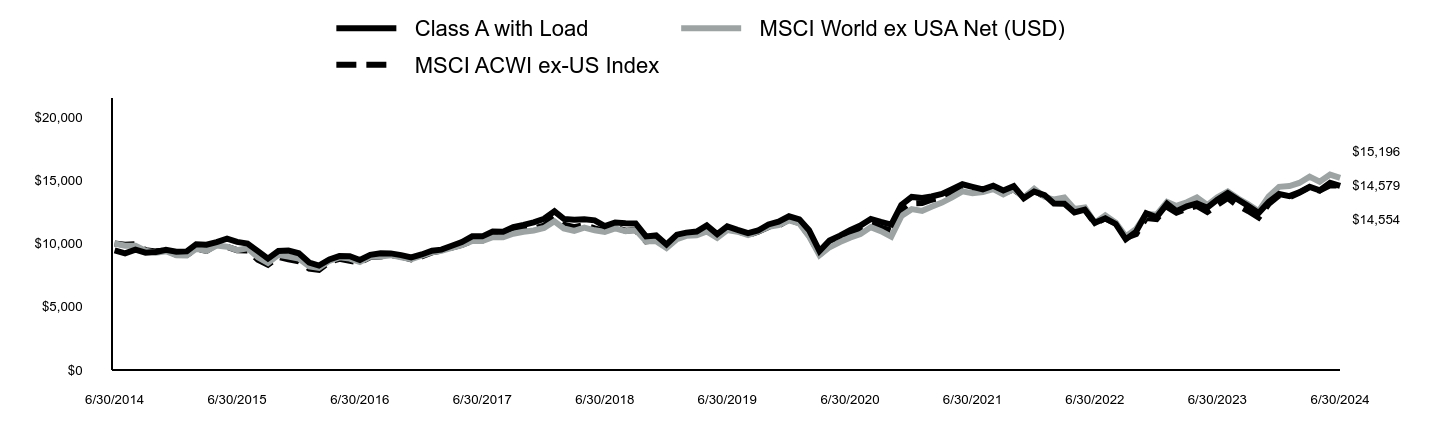

UBS International Sustainable Equity Fund

This annual shareholder report contains important information about UBS International Sustainable Equity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at http://www.ubs.com/port-info . You can also request this information by contacting us at 1-800-647-1568.

What were the Fund costs for the last year?

Annual Fund Operating Expenses

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $131 | 1.26% |

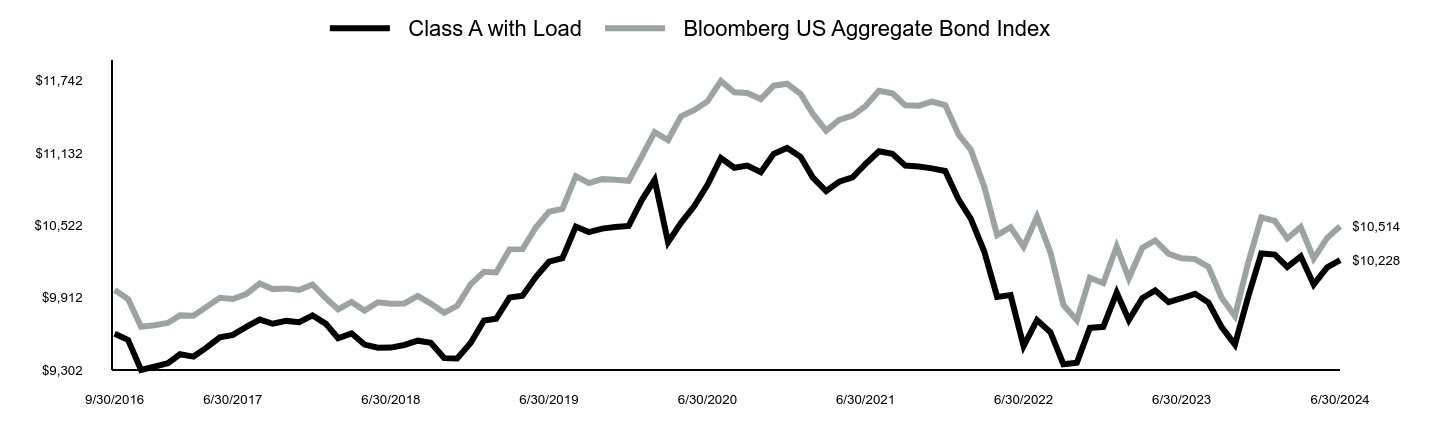

How did the Fund perform last year and what affected its performance?

Portfolio performance summary

What worked:

• Stock selection in Information Technology and Consumer Staples contributed positively to performance over the reporting period.

• Several individual stock positions were positive for performance during the 12-month period. The largest contributors were:

• Taiwan Semiconductor Manufacturing shares climbed after the company surprised to the upside on net profits due to strong growth in shipments for their high-performance computing chips used to power generative artificial intelligence.

• Banco Sabadell shares jumped after reporting strong net profit in the first quarter on the back of higher-than-expected interest rates. The company is now forecasting continued growth in lending income for the remainder of 2024.

• SK Hynix shares rallied after the company posted its fastest pace of revenue growth since 2010 and announced plans to expand the capacity of its highly differentiated chips.

What didn’t work:

• Stock selection in Materials and Energy contributed negatively to performance over the reporting period.

• The individual stock positions that negatively impacted performance the most were:

• Not owning Novo Nordisk contributed negatively to relative performance after the company reported a 37% year-over-year increase in sales, of which 55% were from diabetes and weight loss drugs. The company also bounced after an early-stage drug trial found that an oral version of amycretic can lead to significant weight loss.

• Spectris shares were weighed by a recent downgrade in guidance to the bottom end of the expected range, which management attributed to weakness in China and the healthcare sector. We believe the stock is more attractively valued than US peers, therefore giving us conviction in the potential upside in share price.

• Nippon Telegraph share price declined on the back of dissapointing quarterly results and a guide down in net profit and operating income for the fiscal year 2024.

The Fund did not invest in derivatives during the reporting period.

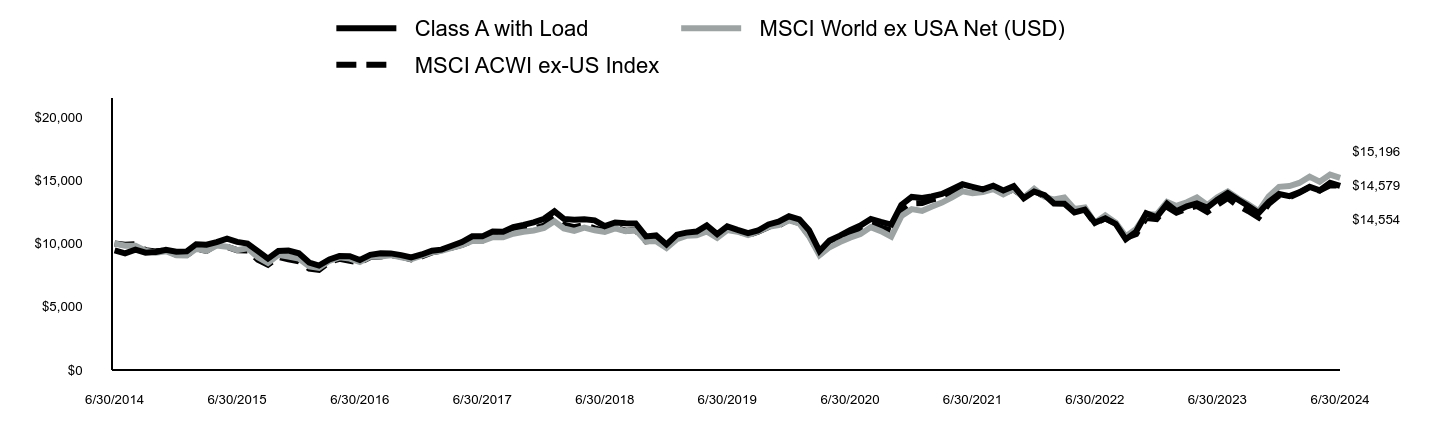

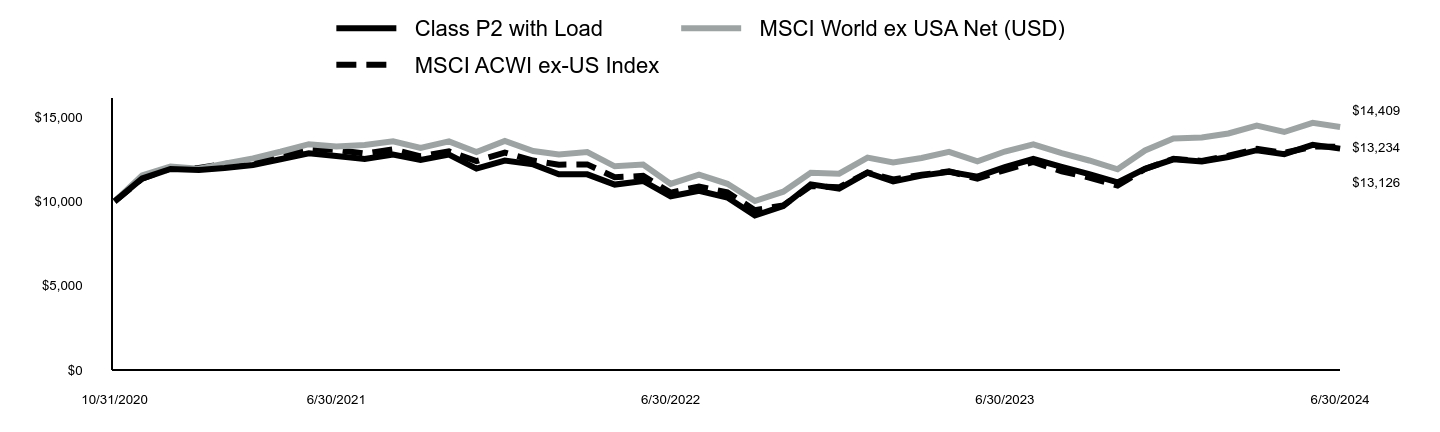

UBS International Sustainable Equity Fund

| Class A with Load | MSCI World ex USA Net (USD) | MSCI ACWI ex-US Index |

|---|

| 6/30/2014 | $9,451 | $10,000 | $10,000 |

| 7/31/2014 | $9,219 | $9,822 | $9,901 |

| 8/31/2014 | $9,514 | $9,829 | $9,956 |

| 9/30/2014 | $9,271 | $9,426 | $9,473 |

| 10/31/2014 | $9,335 | $9,276 | $9,380 |

| 11/30/2014 | $9,504 | $9,390 | $9,447 |

| 12/31/2014 | $9,356 | $9,078 | $9,107 |

| 1/31/2015 | $9,377 | $9,046 | $9,093 |

| 2/28/2015 | $9,944 | $9,586 | $9,580 |

| 3/31/2015 | $9,901 | $9,426 | $9,425 |

| 4/30/2015 | $10,115 | $9,834 | $9,901 |

| 5/31/2015 | $10,383 | $9,749 | $9,746 |

| 6/30/2015 | $10,126 | $9,472 | $9,474 |

| 7/31/2015 | $9,998 | $9,622 | $9,448 |

| 8/31/2015 | $9,399 | $8,921 | $8,726 |

| 9/30/2015 | $8,811 | $8,471 | $8,321 |

| 10/31/2015 | $9,410 | $9,108 | $8,941 |

| 11/30/2015 | $9,442 | $8,963 | $8,756 |

| 12/31/2015 | $9,231 | $8,802 | $8,591 |

| 1/31/2016 | $8,496 | $8,196 | $8,007 |

| 2/29/2016 | $8,258 | $8,082 | $7,915 |

| 3/31/2016 | $8,744 | $8,630 | $8,559 |

| 4/30/2016 | $9,004 | $8,908 | $8,784 |

| 5/31/2016 | $8,993 | $8,807 | $8,636 |

| 6/30/2016 | $8,701 | $8,540 | $8,504 |

| 7/31/2016 | $9,101 | $8,960 | $8,924 |

| 8/31/2016 | $9,231 | $8,968 | $8,981 |

| 9/30/2016 | $9,220 | $9,077 | $9,091 |

| 10/31/2016 | $9,079 | $8,901 | $8,961 |

| 11/30/2016 | $8,896 | $8,758 | $8,753 |

| 12/31/2016 | $9,131 | $9,044 | $8,977 |

| 1/31/2017 | $9,429 | $9,313 | $9,295 |

| 2/28/2017 | $9,517 | $9,421 | $9,444 |

| 3/31/2017 | $9,826 | $9,660 | $9,683 |

| 4/30/2017 | $10,113 | $9,865 | $9,890 |

| 5/31/2017 | $10,565 | $10,194 | $10,211 |

| 6/30/2017 | $10,565 | $10,204 | $10,243 |

| 7/31/2017 | $10,951 | $10,507 | $10,621 |

| 8/31/2017 | $10,940 | $10,505 | $10,676 |

| 9/30/2017 | $11,293 | $10,777 | $10,874 |

| 10/31/2017 | $11,469 | $10,925 | $11,079 |

| 11/30/2017 | $11,679 | $11,035 | $11,169 |

| 12/31/2017 | $11,955 | $11,233 | $11,419 |

| 1/31/2018 | $12,546 | $11,757 | $12,054 |

| 2/28/2018 | $11,944 | $11,198 | $11,486 |

| 3/31/2018 | $11,877 | $11,004 | $11,283 |

| 4/30/2018 | $11,922 | $11,257 | $11,464 |

| 5/31/2018 | $11,833 | $11,044 | $11,199 |

| 6/30/2018 | $11,375 | $10,922 | $10,988 |

| 7/31/2018 | $11,665 | $11,191 | $11,251 |

| 8/31/2018 | $11,610 | $10,979 | $11,016 |

| 9/30/2018 | $11,587 | $11,065 | $11,066 |

| 10/31/2018 | $10,561 | $10,186 | $10,166 |

| 11/30/2018 | $10,639 | $10,177 | $10,262 |

| 12/31/2018 | $9,930 | $9,651 | $9,798 |

| 1/31/2019 | $10,701 | $10,339 | $10,538 |

| 2/28/2019 | $10,860 | $10,605 | $10,744 |

| 3/31/2019 | $10,951 | $10,659 | $10,808 |

| 4/30/2019 | $11,428 | $10,961 | $11,093 |

| 5/31/2019 | $10,747 | $10,442 | $10,498 |

| 6/30/2019 | $11,360 | $11,063 | $11,130 |

| 7/31/2019 | $11,076 | $10,930 | $10,995 |

| 8/31/2019 | $10,826 | $10,661 | $10,656 |

| 9/30/2019 | $11,030 | $10,960 | $10,930 |

| 10/31/2019 | $11,507 | $11,314 | $11,311 |

| 11/30/2019 | $11,734 | $11,456 | $11,411 |

| 12/31/2019 | $12,152 | $11,821 | $11,905 |

| 1/31/2020 | $11,911 | $11,592 | $11,585 |

| 2/29/2020 | $11,049 | $10,563 | $10,670 |

| 3/31/2020 | $9,395 | $9,071 | $9,125 |

| 4/30/2020 | $10,234 | $9,704 | $9,816 |

| 5/31/2020 | $10,624 | $10,117 | $10,137 |

| 6/30/2020 | $11,049 | $10,463 | $10,596 |

| 7/31/2020 | $11,417 | $10,742 | $11,068 |

| 8/31/2020 | $11,945 | $11,296 | $11,542 |

| 9/30/2020 | $11,704 | $10,978 | $11,258 |

| 10/31/2020 | $11,497 | $10,546 | $11,016 |

| 11/30/2020 | $13,048 | $12,165 | $12,498 |

| 12/31/2020 | $13,684 | $12,718 | $13,173 |

| 1/31/2021 | $13,603 | $12,582 | $13,202 |