| | OMB APPROVAL |

| | OMB Number: 3235-0570 |

| | Expires: November 30, 2005 |

| | Estimated average burden

hours per response. . . . 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6640

American Strategic Income Portfolio Inc. II

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

| AMERICAN STRATEGIC | |

| INCOME PORTFOLIO INC. | |

| ASP | |

| | |

| | |

| AMERICAN STRATEGIC | |

| INCOME PORTFOLIO INC. II | |

| BSP | |

| | |

| | |

| AMERICAN STRATEGIC | |

| INCOME PORTFOLIO INC. III | |

| CSP | |

| | |

| | |

| AMERICAN SELECT | |

| PORTFOLIO INC. | |

| SLA | |

| | |

| | August 31, 2005 |

| | ANNUAL REPORT |

FIRST AMERICAN MORTGAGE FUNDS

Primary Investments

American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, American Strategic Income Portfolio Inc. III, and American Select Portfolio Inc. (“First American Mortgage Funds” or the “funds”) invest in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. The funds may also invest in U.S. government securities, corporate debt securities, preferred stock issued by real estate investment trusts, and mortgage servicing rights. The funds borrow through the use of reverse repurchase agreements and revolving credit facilities. Use of borrowing and certain other investments and investment techniques may cause the funds’ net asset value (“NAV”) to fluctuate to a greater extent than would be expected from interest-rate movements alone.

Fund Objectives

Each fund’s primary objective is to achieve high levels of current income. Each fund’s secondary objective is to seek capital appreciation. As with other investment companies, there can be no assurance these funds will achieve their objectives.

| | Table of Contents |

| | |

5 | | Fund Overviews |

| | |

19 | | Financial Statements |

| | |

26 | | Notes to Financial Statements |

| | |

37 | | Schedule of Investments |

| | |

51 | | Report of Independent Registered Public Accounting Firm |

| | |

52 | | Notice to Shareholders |

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

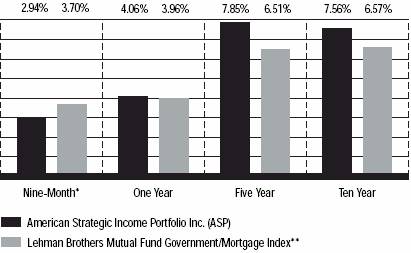

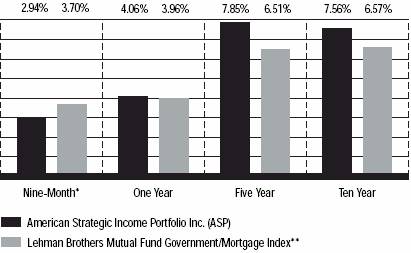

Average Annual Total Returns – ASP

Based on NAV for the period ended August 31, 2005

*Total return has not been annualized.

**The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Developed by Lehman Brothers for comparative use by the mutual fund industry, this index is unmanaged and does not include any fees or expenses in its total return calculations.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the nine-month, one-year, five-year, and ten-year periods ended August 31, 2005, were -0.14%, -2.78%, 8.63%, and 8.32%, respectively. Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price. • Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell. • The fund uses the Lehman Brothers Mutual Fund Government/Mortgage Index as a benchmark. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans. This limits the ability of the fund to respond quickly to market changes.

1

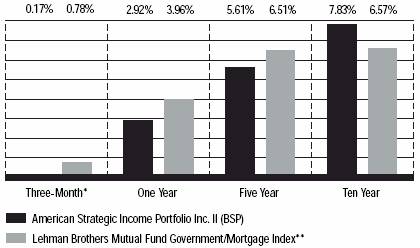

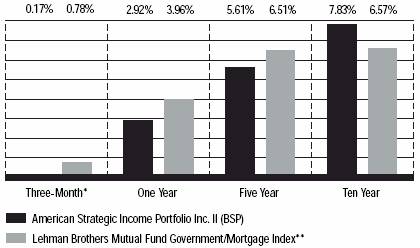

Average Annual Total Returns – BSP

Based on NAV for the period ended August 31, 2005

*Total return has not been annualized.

**The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Developed by Lehman Brothers for comparative use by the mutual fund industry, this index is unmanaged and does not include any fees or expenses in its total return calculations.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the three-month, one-year, five-year, and ten-year periods ended August 31, 2005, were -1.59%, -3.78%, 9.33%, and 10.05%, respectively. Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price. • Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell. • The fund uses the Lehman Brothers Mutual Fund Government/Mortgage Index as a benchmark. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans. This limits the ability of the fund to respond quickly to market changes.

2

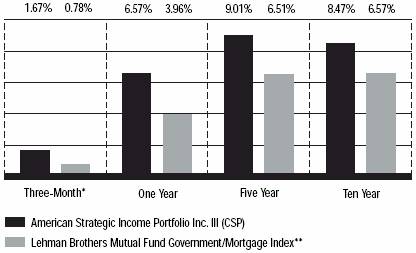

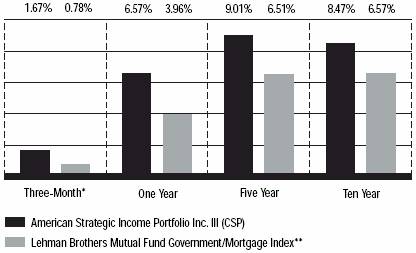

Average Annual Total Returns – CSP

Based on NAV for the period ended August 31, 2005

*Total return has not been annualized.

**The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Developed by Lehman Brothers for comparative use by the mutual fund industry, this index is unmanaged and does not include any fees or expenses in its total return calculations.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the three-month, one-year, five-year, and ten-year periods ended August 31, 2005, were -4.09%, -1.79%, 9.23%, and 10.03%, respectively. Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price. • Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell. • The fund uses the Lehman Brothers Mutual Fund Government/Mortgage Index as a benchmark. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans. This limits the ability of the fund to respond quickly to market changes.

3

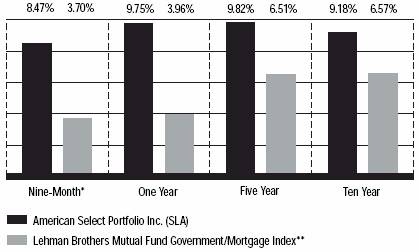

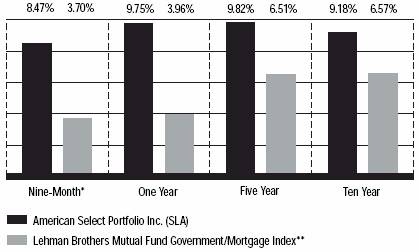

Average Annual Total Returns – SLA

Based on NAV for the period ended August 31, 2005

*Total return has not been annualized.

**The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Developed by Lehman Brothers for comparative use by the mutual fund industry, this index is unmanaged and does not include any fees or expenses in its total return calculations.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the nine-month, one-year, five-year, and ten-year periods ended August 31, 2005, were 2.61%, 1.11%, 10.22%, and 10.70%, respectively. Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price. • Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell. • The fund uses the Lehman Brothers Mutual Fund Government/Mortgage Index as a benchmark. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans. This limits the ability of the fund to respond quickly to market changes.

4

Fund OVERVIEW – ASP

Fund Management

John Wenker is primarily responsible for the management of the fund. He has 22 years of financial experience.

Chris Neuharth, CFA, is responsible for the management of the mortgage-backed securities portion of the fund. He has 24 years of financial experience.

Russ Kappenman, CPA, is responsible for the acquisition and management of the whole loans portion of the fund. He has 19 years of financial experience.

American Strategic Income Portfolio’s fiscal year-end has changed from November 30 to August 31, effective with the nine months ended August 31, 2005. In this report, we will discuss the economy and the fund’s performance during this nine-month period. For the fiscal period ended August 31, 2005, the fund had a total return of 2.94%, based on its NAV. The fund’s benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 3.70% during the period. The underperformance of the fund relative to its benchmark is due to several factors, including modest deterioration in the credit profile of the fund’s mortgage portfolio and higher interest expense.

The interest-rate environment was particularly challenging. The 10-year Treasury yield during the reporting period dropped from 4.36% to 4.01%. For some time we have been hesitant to add long-term, fixed-rate loans to the portfolio given the low long-term rate environment. If the yield on the 10-year Treasury were to rise substantially, the value of long-term, fixed-rate loans would deteriorate substantially. As an alternative we have added adjustable rate loans, generally of shorter duration, to the portfolio. The adjustable rate loans typically use the one-month London Interbank Offering Rate (“LIBOR”) as their base rate. During the reporting period, the one-month LIBOR increased from 2.31% to 3.70%.

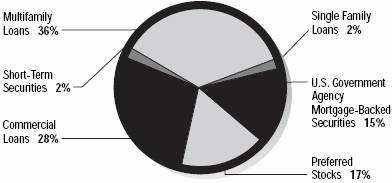

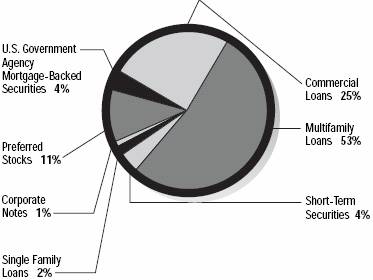

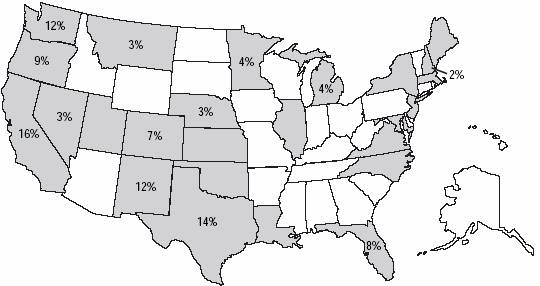

Portfolio Allocation

As a percentage of total assets on August 31, 2005

5

While the increase in the LIBOR increased the fund’s income from its adjustable rate loans, it also increased the fund’s interest expense. The fund continued to use leverage, or borrowing, during the period. The one-month LIBOR is the base rate for the borrowing used by the fund. As the one-month LIBOR increased, the interest expense of the fund increased. Keep in mind that the use of leverage increases interest-rate risk in the fund and will increase the volatility of the fund’s NAV and market price.

During the reporting period, one loan paid off with an unpaid principal balance of $1.2 million and a weighted average coupon of 8.15%, and four loans were purchased with an original principal balance of $9.9 million and a weighted average coupon of 6.08%. As of August 31, 2005, there were no loans in default. Prepayment penalties from loans that paid off during the reporting period amounted to $36,307.

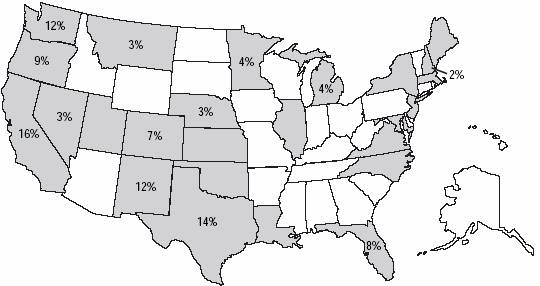

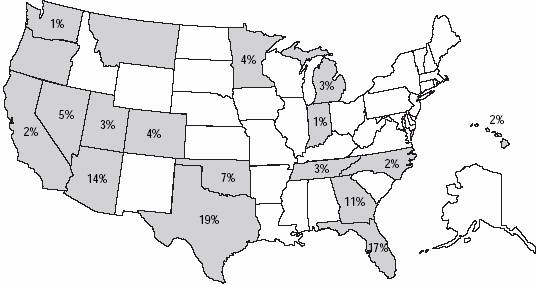

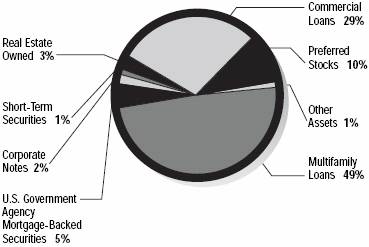

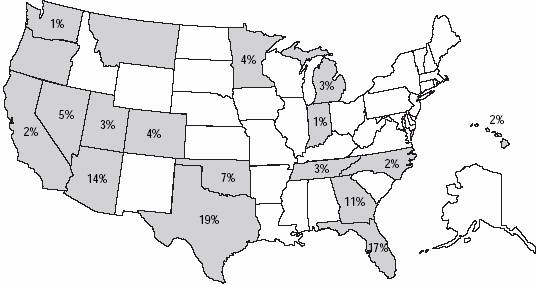

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2005. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

6

During the reporting period, the fund paid 64.2 cents per share in dividends resulting in an annualized distribution yield of 8.49% based on the August 31, 2005, market price. This included a 2.7 cents per share special dividend paid on January 7, 2005. As of August 31, 2005, distributions in excess of net investment income were 0.5 cents per share. The fund decreased its dividend from 7.3 cents per share to 6.5 cents per share in April 2005.

Delinquent Loan Profile

The tables below show the percentages of single family loans and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2005, based on the value outstanding.

Single family loans

Current | | 92.6 | % |

30 Days | | 7.4 | % |

60 Day | | 0.0 | % |

90 Day | | 0.0 | % |

120+ Day | | 0.0 | % |

Multifamily and commercial loans

Current | | 100.0 | % |

30 Day | | 0.0 | % |

60 Day | | 0.0 | % |

90 Day | | 0.0 | % |

120+ Day | | 0.0 | % |

7

Fund OVERVIEW – BSP

Fund Management

John Wenker is primarily responsible for the management of the fund. He has 22 years of financial experience.

Chris Neuharth, CFA, is responsible for the management of the mortgage-backed securities portion of the fund. He has 24 years of financial experience.

Russ Kappenman, CPA, is responsible for the acquisition and management of the whole loans portion of the fund. He has 19 years of financial experience.

American Strategic Income Portfolio II’s fiscal year-end has changed from May 31 to August 31, effective with the three months ended August 31, 2005. In this report, we will discuss the economy and the fund’s performance during this three-month period. For the fiscal period ended August 31, 2005, the fund had a total return of 0.17%, based on its NAV. The fund’s benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 0.78% during the period. The underperformance of the fund relative to its benchmark is due to several factors, including modest deterioration in the credit profile of the fund’s mortgage portfolio and higher interest expense.

The interest-rate environment was particularly challenging. The 10-year Treasury yield during the reporting period was fairly flat moving from 3.98% to 4.01%. For some time we have been hesitant to add long-term, fixed-rate loans to the portfolio given the low long-term rate environment. If the yield on the 10-year Treasury were to rise substantially, the value of long-term, fixed-rate loans would deteriorate substantially. As an alternative we have added adjustable rate loans, generally of shorter duration, to the portfolio. The adjustable rate loans typically use the one-month London Interbank Offering Rate (“LIBOR”) as their base rate. During the reporting period, the one-month LIBOR increased from 3.13% to 3.70%.

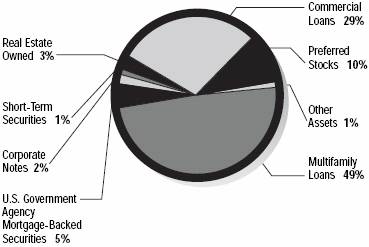

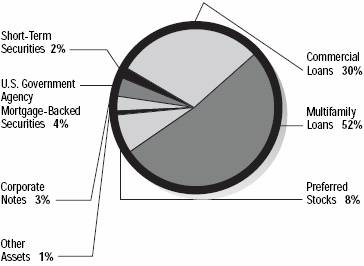

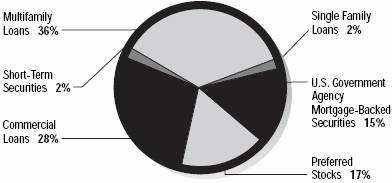

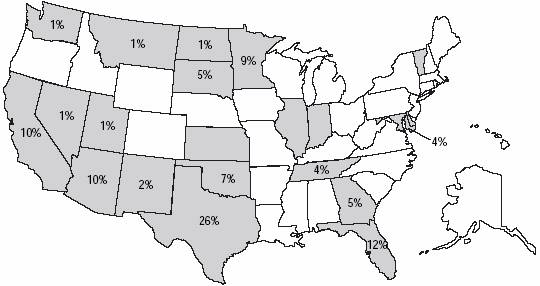

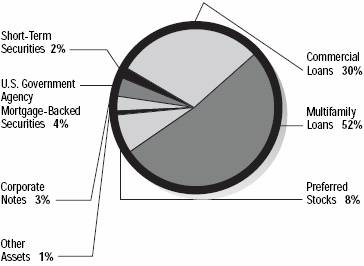

Portfolio Allocation

As a percentage of total assets on August 31, 2005

8

While the increase in the LIBOR increased the fund’s income from its adjustable rate loans, it also increased the fund’s interest expense. The fund continued to use leverage, or borrowing, during the period. The one-month LIBOR is the base rate for the borrowing used by the fund. As the one-month LIBOR increased, the interest expense of the fund increased. Keep in mind that the use of leverage increases interest-rate risk in the fund and will increase the volatility of the fund’s NAV and market price.

During the reporting period, three loans paid off with an unpaid principal balance of $15.5 million and a weighted average coupon of 6.51%, and three loans were purchased with an original principal balance of $25.1 million and a weighted average coupon of 6.56%. During the reporting period, the fund took possession of a multifamily property that had been in default. The value of the property represents 4.3% of the fund’s net assets. Management is working to stabilize the property and sell it. Prepayment penalties from loans that paid off during the reporting period amounted to $32,000.

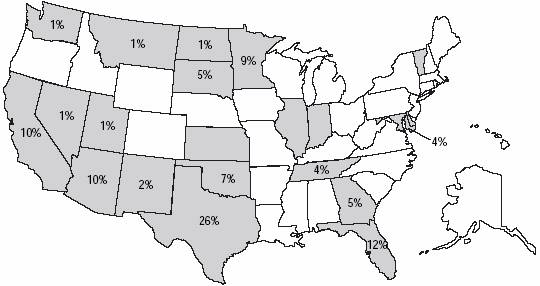

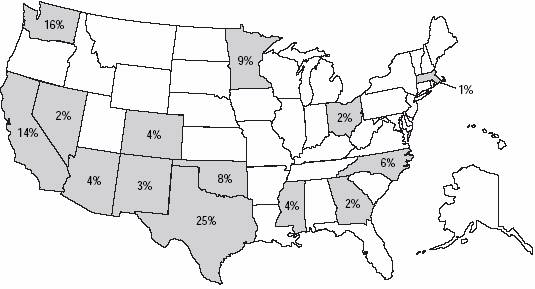

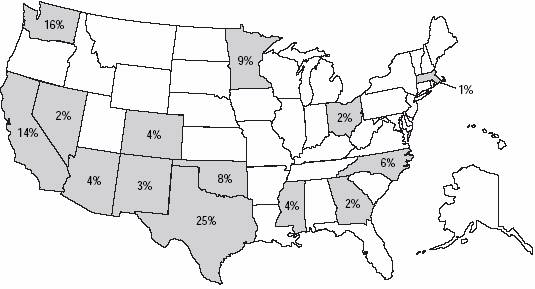

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2005. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

9

During the reporting period, the fund paid 24.0 cents per share in dividends resulting in an annualized distribution yield of 8.30% based on the August 31, 2005, market price. As of August 31, 2005, undistributed net investment income was 8.3 cents per share.

Delinquent Loan Profile

The tables below show the percentages of single family loans and a private mortgage-backed security and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2005, based on the value outstanding.

Single family loans and a private mortgage-backed security

Current | | 74.5 | % |

30 Day | | 4.9 | % |

60 Day | | 0.0 | % |

90 Day | | 0.0 | % |

120+ Day | | 20.6 | % |

Multifamily and commercial loans

Current | | 100.0 | % |

30 Day | | 0.0 | % |

60 Day | | 0.0 | % |

90 Day | | 0.0 | % |

120+ Day | | 0.0 | % |

10

Fund OVERVIEW – CSP

Fund Management

John Wenker is primarily responsible for the management of the fund. He has 22 years of financial experience.

Chris Neuharth, CFA, is responsible for the management of the mortgage-backed securities portion of the fund. He has 24 years of financial experience.

Russ Kappenman, CPA, is responsible for the acquisition and management of the whole loans portion of the fund. He has 19 years of financial experience.

American Strategic Income Portfolio III’s fiscal year-end has changed from May 31 to August 31, effective with the three months ended August 31, 2005. In this report, we will discuss the economy and the fund’s performance during this three-month period. For the fiscal period ended August 31, 2005, the fund had a total return of 1.67%, based on its NAV. The fund’s benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 0.78% during the period. The outperformance of the fund relative to its benchmark is due to several factors, including the stable credit profile of the fund’s mortgage portfolio and the positive effects of prepayment penalties.

The fund outperformed its benchmark despite a challenging interest-rate environment. The 10-year Treasury yield during the reporting period was fairly flat moving from 3.98% to 4.01%. For some time we have been hesitant to add long-term, fixed-rate loans to the portfolio given the low long-term rate environment. If the yield on the 10-year Treasury were to rise substantially, the value of long-term, fixed-rate loans would deteriorate substantially. As an alternative we have added adjustable rate loans, generally of shorter duration, to the portfolio. The adjustable rate loans typically use the one-month London Interbank Offering Rate (“LIBOR”) as their base rate. During the reporting period, the one-month LIBOR increased from 3.13% to 3.70%.

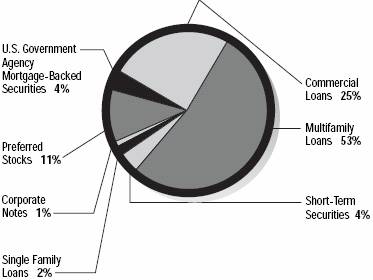

Portfolio Allocation

As a percentage of total assets on August 31, 2005

11

While the increase in the LIBOR increased the fund’s income from its adjustable rate loans, it also increased the fund’s interest expense. The fund continued to use leverage, or borrowing, during the period. The one-month LIBOR is the base rate for the borrowing used by the fund. As the one-month LIBOR increased, the interest expense of the fund increased. Keep in mind that the use of leverage increases interest-rate risk in the fund and will increase the volatility of the fund’s NAV and market price.

During the reporting period, seven loans paid off with an unpaid principal balance of $42.2 million and a weighted average coupon of 7.69%, and five loans were purchased with an original principal balance of $31.6 million and a weighted average coupon of 8.17%. As of August 31, 2005, there was one multifamily loan in default. The unpaid principal balance of this loan is $6,790,000 or 2.14% of assets. Prepayment penalties from loans that paid off during the reporting period amounted to $558,192.

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2005. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

12

During the reporting period, the fund paid 21.0 cents per share in dividends resulting in an annualized distribution yield of 7.57% based on the August 31, 2005, market price. As of August 31, 2005, undistributed net investment income was 3.4 cents per share.

Delinquent Loan Profile

The tables below show the percentages of single family loans and a private mortgage-backed security and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2005, based on the value outstanding.

Single family loans and a security private mortgage-backed

Current | | 100.0 | % |

30 Days | | 0.0 | % |

60 Days | | 0.0 | % |

90 Days | | 0.0 | % |

120+ Days | | 0.0 | % |

Multifamily and commercial loans

Current | | 97.7 | % |

30 Days | | 0.0 | % |

60 Days | | 0.0 | % |

90 Days | | 0.0 | % |

120+ Days | | 2.3 | % |

13

Fund OVERVIEW – SLA

Fund Management

John Wenker is primarily responsible for the management of the fund. He has 22 years of financial experience.

Chris Neuharth, CFA, is responsible for the management of the mortgage-backed securities portion of the fund. He has 24 years of financial experience.

Russ Kappenman, CPA, is responsible for the acquisition and management of the whole loans portion of the fund. He has 19 years of financial experience.

American Select Portfolio’s fiscal year-end has changed from November 30 to August 31, effective with the nine months ended August 31, 2005. In this report, we will discuss the economy and the fund’s performance during this nine-month period. For the fiscal period ended August 31, 2005, the fund had a total return of 8.47%, based on its NAV. The fund’s benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 3.70% during the period. The outperformance of the fund relative to its benchmark is due to several factors, including the positive effects of prepayment penalties, attractive interest income from two participating loans that paid off, and an improving credit profile for the mortgage portfolio.

The fund outperformed its benchmark despite a challenging interest-rate environment. The 10-year Treasury yield during the reporting period dropped from 4.36% to 4.01%. For some time we have been hesitant to add long-term, fixed-rate loans to the portfolio given the low long-term rate environment. If the yield on the 10-year Treasury were to rise substantially, the value of long-term, fixed-rate loans would deteriorate substantially. As an alternative we have added adjustable rate loans, generally of shorter duration, to the portfolio. The adjustable rate loans typically use the one-month London Interbank Offering Rate (“LIBOR”) as their base rate. During the reporting period, the one-month LIBOR increased from 2.31% to 3.70%.

Portfolio Allocation

As a percentage of total assets on August 31, 2005

14

While the increase in the LIBOR increased the fund’s income from its adjustable rate loans, it also increased the fund’s interest expense. The fund continued to use leverage, or borrowing, during the period. The one-month LIBOR is the base rate for the borrowing used by the fund. As the one-month LIBOR increased, the interest expense of the fund increased. Keep in mind that the use of leverage increases interest-rate risk in the fund and will increase the volatility of the fund’s NAV and market price.

During the reporting period, 19 loans paid off with an unpaid principal balance of $66.1 million and a weighted average coupon of 7.16%, and 12 loans were purchased with an original principal balance of $50.9 million and a weighted average coupon of 6.10%. As of August 31, 2005, there are no multifamily or commercial loans in default. Prepayment penalties from loans that paid off during the reporting period amounted to $1,521,983.

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2005. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

15

During the reporting period, the fund paid 65.0 cents per share in dividends resulting in an annualized distribution yield of 7.83% based on the August 31, 2005, market price. The fund decreased its monthly dividend from 8.0 cents per share to 7.0 cents per share in February 2005. As of August 31, 2005, undistributed net investment income was 33.4 cents per share. This was the result of increased earnings in early July related to nonrecurring events. The fund declared a special dividend of 24.0 cents per share with an ex-dividend date of September 1, 2005.

Delinquent Loan Profile

The tables below show the percentages of multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2005, based on the value outstanding.

Multifamily and commercial loans

Current | | 100.0 | % |

30 Days | | 0.0 | % |

60 Days | | 0.0 | % |

90 Days | | 0.0 | % |

120+ Days | | 0.0 | % |

16

CONCLUSION for ASP, BSP, CSP, SLA

As of this writing, the commercial real estate markets appear to have stabilized with occupancy levels increasing moderately over the past several months. However, rental income has not begun to improve in most markets. Sustained job growth at a level able to push occupancies substantially higher and foster rental growth has not occurred. An abundance of capital in the real estate debt markets makes the accumulation of appropriate loan products a challenge. In addition, the weaker real estate markets could lead to increased levels of default. We will continue to diligently manage the credit risk in the funds and feel that their current credit profiles are acceptable. We believe that as the U.S. economy improves there should be increased demand for space and that occupancy levels should rise. Furthermore, as occupancy levels rise there should be an increased ability to push rental rates higher.

As you are probably aware, the funds’ board of directors, in consultation with U.S. Bancorp Asset Management (“USBAM”), has decided not to pursue the previously proposed reorganization of the First American Mortgage Funds into the First American Strategic Real Estate Portfolio Inc., a specialty finance company that would elect to be taxed as a REIT. The board and USBAM are currently exploring other options, including the possibility of combining the First American Mortgage Funds.

Thank you for your investment in the funds and your continued trust as we navigate the investment landscape. If you have any questions about the funds, please call us at 800.677.FUND.

Sincerely,

Mark Jordahl

Chief Investment Officer

U.S. Bancorp Asset Management, Inc.

John Wenker

Managing Director, Head of Real Estate

U.S. Bancorp Asset Management, Inc.

17

Valuation of Investments

The fund’s investments in whole loans (single family, multifamily, and commercial), participation mortgages, and mortgage servicing rights are generally not traded in any organized market; therefore, market quotations are not readily available. These investments are valued at “fair value” according to procedures adopted by the fund’s board of directors. Pursuant to these procedures, whole loan, participation mortgage, and mortgage servicing rights investments are initially valued at cost and their values are subsequently monitored and adjusted pursuant to a pricing model designed by U.S. Bancorp Asset Management (“USBAM”) to incorporate, among other things, the present value of the projected stream of cash flows on such investments. The pricing model takes into account a number of relevant factors including the projected rate of prepayments, the delinquency profile, the historical payment record, the expected yield at purchase, changes in prevailing interest rates, and changes in the real or perceived liquidity of whole loans, participation mortgages, and mortgage servicing rights, as the case may be. The results of the pricing model may be further subject to price ceilings due to the illiquid nature of the investments. Changes in prevailing interest rates, real or perceived liquidity, yield spreads, and creditworthiness are factored into the pricing model each week. Certain mortgage loan information is received on a monthly basis and includes, but is not limited to, the projected rate of prepayments, projected rate and severity of defaults, the delinquency profile, and the historical payment record. Valuations of whole loans, participation mortgages, and mortgage servicing rights are determined no less frequently than weekly.

18

Financial STATEMENTS

Statements of Assets and Liabilities August 31, 2005

| | | American

Strategic

Income

Portfolio | | American

Strategic

Income

Portfolio II | | American

Strategic

Income

Portfolio III | | American

Select

Portfolio | |

| Assets: | |

Investments in unaffiliated securities, at value (cost: $58,995,698, $249,987,479, $314,096,572,

$170,948,175) (note 2) | | $ | 59,295,415 | | | $ | 241,826,199 | | | $ | 308,804,728 | | | $ | 171,797,800 | | |

Investment in affiliated money market fund, at value (cost: $944,201,$3,389,005, $11,092,832,

$2,496,551) (note 3) | | | 944,201 | | | | 3,389,005 | | | | 11,092,832 | | | | 2,496,551 | | |

| Real estate owned (cost: $0, $13,225,000, $0, $0) (note 2) | | | - | | | | 8,430,270 | | | | - | | | | - | | |

| Cash | | | - | | | | 957,667 | | | | 243,378 | | | | - | | |

| Receivable for accrued interest | | | 274,805 | | | | 349,451 | | | | 756,006 | | | | 842,334 | | |

| Prepaid expenses | | | 23,264 | | | | 142,380 | | | | 188,396 | | | | 68,564 | | |

| Other assets | | | 16,371 | | | | 360,038 | | | | 198,850 | | | | 16,862 | | |

| Total assets | | | 60,554,056 | | | | 255,455,010 | | | | 321,284,190 | | | | 175,222,111 | | |

| Liabilities: | |

| Payable for reverse repurchase agreements (note 2) | | | 8,026,702 | | | | 60,529,932 | | | | 62,488,970 | | | | 30,064,820 | | |

| Payable for investment advisory fees (note 3) | | | 25,077 | | | | 102,525 | | | | 143,685 | | | | 63,226 | | |

| Bank overdraft | | | 47,796 | | | | - | | | | - | | | | 110,128 | | |

| Payable for administrative fees (note 3) | | | 11,054 | | | | 41,083 | | | | 54,526 | | | | 30,582 | | |

| Payable for interest expense | | | 16,762 | | | | 205,315 | | | | 217,269 | | | | 102,071 | | |

| Payable for reorganization expenses (note 3) | | | 45,275 | | | | 181,452 | | | | 229,841 | | | | 138,376 | | |

| Payable for professional fees | | | 28,211 | | | | 44,573 | | | | 50,156 | | | | 28,145 | | |

| Payable for other expenses | | | 70,115 | | | | 79,679 | | | | 54,780 | | | | 42,530 | | |

| Total liabilities | | | 8,270,992 | | | | 61,184,559 | | | | 63,239,227 | | | | 30,579,878 | | |

| Net assets applicable to outstanding capital stock | | $ | 52,283,064 | | | $ | 194,270,451 | | | $ | 258,044,963 | | | $ | 144,642,233 | | |

| Composition of net assets: | |

| Capital stock and additional paid-in capital | | $ | 54,221,146 | | | $ | 207,236,709 | | | $ | 263,968,796 | | | $ | 139,930,119 | | |

| Undistributed net investment income | | | 3,093 | | | | 1,333,868 | | | | 730,825 | | | | 3,494,687 | | |

| Accumulated net realized gain (loss) on investments | | | (2,240,892 | ) | | | (1,344,116 | ) | | | (1,362,814 | ) | | | 367,802 | | |

| Unrealized appreciation or depreciation of investments | | | 299,717 | | | | (12,956,010 | ) | | | (5,291,844 | ) | | | 849,625 | | |

| Total–representing net assets applicable to capital stock | | $ | 52,283,064 | | | $ | 194,270,451 | | | $ | 258,044,963 | | | $ | 144,642,233 | | |

| Net asset value and market price of capital stock: | |

| Net assets outstanding | | $ | 52,283,064 | | | $ | 194,270,451 | | | $ | 258,044,963 | | | $ | 144,642,233 | | |

| Shares outstanding (authorized 1 billion shares for each fund of $0.01 par value) | | | 4,231,331 | | | | 15,985,741 | | | | 21,356,023 | | | | 10,662,195 | | |

| Net asset value per share | | $ | 12.36 | | | $ | 12.15 | | | $ | 12.08 | | | $ | 13.57 | | |

| Market price per share | | $ | 11.35 | | | $ | 11.57 | | | $ | 11.10 | | | $ | 12.45 | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

19

Financial STATEMENTS continued

Statements of Operations

| | | American Strategic

Income Portfolio | | American Strategic

Income Portfolio II | |

| | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | |

| Investment income: | | | |

| Interest from unaffiliated securities | | $ | 2,379,794 | | | $ | 4,398,012 | | | $ | 4,333,559 | | | $ | 20,004,949 | | |

| Dividends from unaffiliated securities | | | 473,784 | | | | 317,939 | | | | 384,802 | | | | 378,504 | | |

| Dividends from affiliated money market fund | | | 93,070 | | | | 40,739 | | | | 26,271 | | | | 95,344 | | |

| Total investment income | | | 2,946,648 | | | | 4,756,690 | | | | 4,744,632 | | | | 20,478,797 | | |

| Expenses (note 3): | | | |

| Investment advisory fees | | | 203,511 | | | | 305,839 | | | | 268,221 | | | | 1,222,501 | | |

| Interest expense | | | 164,989 | | | | 147,139 | | | | 596,459 | | | | 1,306,396 | | |

| Administrative fees | | | 98,926 | | | | 133,782 | | | | 123,045 | | | | 502,759 | | |

| Custodian fees | | | 7,970 | | | | 10,702 | | | | 9,844 | | | | 40,430 | | |

| Transfer agent fees | | | 16,783 | | | | 24,418 | | | | 6,607 | | | | 34,018 | | |

| Listing fees | | | 17,854 | | | | 19,444 | | | | 2,984 | | | | 38,100 | | |

| Postage and printing fees | | | 21,383 | | | | 31,563 | | | | 19,613 | | | | 58,878 | | |

| Mortgage servicing fees | | | 38,185 | | | | 46,075 | | | | 43,832 | | | | 179,061 | | |

| Directors' fees | | | 6,264 | | | | 8,825 | | | | 8,265 | | | | 11,689 | | |

| Professional fees | | | 43,120 | | | | 34,622 | | | | 39,114 | | | | 113,550 | | |

| Other expenses | | | 10,748 | | | | 9,869 | | | | 2,316 | | | | 80,597 | | |

| Total expenses | | | 629,733 | | | | 772,278 | | | | 1,120,300 | | | | 3,587,979 | | |

| Net investment income | | | 2,316,915 | | | | 3,984,412 | | | | 3,624,332 | | | | 16,890,818 | | |

| Net realized and unrealized gains (losses) on investments (note 4): | | | |

| Net realized gain on investments | | | 58,003 | | | | 295,555 | | | | 26,208 | | | | 1,229,106 | | |

| Net change in unrealized appreciation or depreciation of investments | | | (874,358 | ) | | | (704,969 | ) | | | (3,990,486 | ) | | | (10,543,368 | ) | |

| Net gain (loss) on investments | | | (816,355 | ) | | | (409,414 | ) | | | (3,964,278 | ) | | | (9,314,262 | ) | |

| Net increase (decrease) in net assets resulting from operations | | $ | 1,500,560 | | | $ | 3,574,998 | | | $ | (339,946 | ) | | $ | 7,576,556 | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

20

| | | American Strategic

Income Portfolio III | | American

Select Portfolio | |

| | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | |

| Investment income: | |

| Interest from unaffiliated securities | | $ | 5,601,349 | | | $ | 25,090,472 | | | $ | 12,342,656 | | | $ | 13,612,656 | | |

| Dividends from unaffiliated securities | | | 609,200 | | | | 539,054 | | | | 226,828 | | | | 6,948 | | |

| Dividends from affiliated money market fund | | | 61,322 | | | | 144,910 | | | | 99,831 | | | | 27,123 | | |

| Total investment income | | | 6,271,871 | | | | 25,774,436 | | | | 12,669,315 | | | | 13,646,727 | | |

| Expenses (note 3): | |

| Investment advisory fees | | | 355,676 | | | | 1,535,313 | | | | 525,732 | | | | 708,240 | | |

| Interest expense | | | 743,866 | | | | 2,079,148 | | | | 1,355,641 | | | | 1,142,241 | | |

| Administrative fees | | | 161,713 | | | | 649,745 | | | | 262,866 | | | | 354,120 | | |

| Custodian fees | | | 12,937 | | | | 52,475 | | | | 21,175 | | | | 28,329 | | |

| Transfer agent fees | | | 8,952 | | | | 30,441 | | | | 21,098 | | | | 29,193 | | |

| Listing fees | | | 3,016 | | | | 39,026 | | | | 25,926 | | | | 28,180 | | |

| Postage and printing fees | | | 21,388 | | | | 78,617 | | | | 36,738 | | | | 46,073 | | |

| Mortgage servicing fees | | | 55,029 | | | | 248,577 | | | | 108,654 | | | | 146,054 | | |

| Directors' fees | | | 3,982 | | | | 14,686 | | | | 18,454 | | | | 25,466 | | |

| Professional fees | | | 41,268 | | | | 145,329 | | | | 37,262 | | | | 97,252 | | |

| Other expenses | | | 19,294 | | | | 69,175 | | | | 16,074 | | | | 32,058 | | |

| Total expenses | | | 1,427,121 | | | | 4,942,532 | | | | 2,429,620 | | | | 2,637,206 | | |

| Net investment income | | | 4,844,750 | | | $ | 20,831,904 | | | | 10,239,695 | | | | 11,009,521 | | |

| Net realized and unrealized gains (losses) on investments (note 4): | |

| Net realized gain on investments | | | 514,206 | | | | 1,856,772 | | | | 1,518,160 | | | | 331,712 | | |

| Net change in unrealized appreciation or depreciation of investments | | | (2,099,636 | ) | | | (6,889,418 | ) | | | (246,923 | ) | | | (3,180,143 | ) | |

| Net gain (loss) on investments | | | (1,585,430 | ) | | | (5,032,646 | ) | | | 1,271,237 | | | | (2,848,431 | ) | |

| Net increase (decrease) in net assets resulting from operations | | $ | 3,259,320 | | | $ | 15,799,258 | | | $ | 11,510,932 | | | $ | 8,161,090 | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

21

Financial STATEMENTS continued

Statements of Cash Flows

| | | American Strategic

Income Portfolio | | American Strategic

Income Portfolio II | |

| | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | |

| Cash flows from operating activities: | | | |

| Net increase/decrease in net assets resulting from operations | | $ | 1,500,560 | | | $ | 3,574,998 | | | $ | (339,946 | ) | | $ | 7,576,556 | | |

Adjustments to reconcile net increase/decrease in net assets resulting from operations to net cash

provided by (used in) operating activities: | | | |

| Purchases of investments | | | (14,274,968 | ) | | | (15,307,598) | | | | (28,819,810 | ) | | | (107,084,164 | ) | |

| Proceeds from paydowns and sales of investments | | | 5,270,684 | | | | 31,216,613 | | | | 19,623,613 | | | | 119,925,310 | | |

| Net purchases/sales of short-term securities | | | 8,271,691 | | | | (7,686,186 | ) | | | (1,701,401 | ) | | | 1,319,191 | | |

| Net amortization/accretion of bond discount and premium | | | (6,823 | ) | | | 319 | | | | 1,744 | | | | 6,778 | | |

| Net change in unrealized appreciation or depreciation of investments | | | 874,358 | | | | 704,969 | | | | 3,990,486 | | | | 10,543,368 | | |

| Net realized gain/loss on investments | | | (58,003 | ) | | | (295,555 | ) | | | (26,208 | ) | | | (1,229,106 | ) | |

| Increase/decrease in accrued interest receivable | | | (26,321 | ) | | | 87,405 | | | | (74,109 | ) | | | 377,181 | | |

| Increase/decrease in prepaid expenses | | | (23,264 | ) | | | - | | | | 25,075 | | | | - | | |

| Increase/decrease in other assets | | | (7,037 | ) | | | 3,731 | | | | 8,479 | | | | 151,678 | | |

| Increase/decrease in accrued fees and expenses | | | 57,669 | | | | (11,405 | ) | | | 77,268 | | | | 26,899 | | |

| Net cash provided by (used in) operating activities | | | 1,578,546 | | | | 12,287,291 | | | | (7,234,809 | ) | | | 31,613,691 | | |

| Cash flows from financing activities: | | | |

| Net payments from/proceeds for reverse repurchase agreements | | | 1,096,065 | | | | (8,674,363 | ) | | | 11,163,374 | | | | (13,679,828 | ) | |

| Distributions paid to shareholders | | | (2,718,250 | ) | | | (3,667,671 | ) | | | (3,836,578 | ) | | | (16,545,245 | ) | |

| Net cash provided by (used in) in financing activities | | | (1,622,185 | ) | | | (12,342,034 | ) | | | 7,326,796 | | | | (30,225,073 | ) | |

| Net increase/decrease in cash | | | (43,639 | ) | | | (54,743 | ) | | | 91,987 | | | | 1,388,618 | | |

| Cash or bank overdraft at beginning of period | | | (4,157 | ) | | | 50,586 | | | | 865,680 | | | | (522,938 | ) | |

| Cash or bank overdraft at end of period | | $ | (47,796 | ) | | $ | (4,157 | ) | | $ | 957,667 | | | $ | 865,680 | | |

Supplemental disclosure of cash flow information:

Cash paid for interest | | $ | 147,611 | | | $ | 148,981 | | | $ | 523,074 | | | $ | 1,241,101 | | |

| Noncash financing activities resulting from reinvested dividends | | $ | - | | | $ | 13,287 | | | $ | - | | | $ | - | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

22

| | | American Strategic

Income Portfolio III | | American

Select Portfolio | |

| | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | |

| Cash flows from operating activities: | |

| Net increase/decrease in net assets resulting from operations | | $ | 3,259,320 | | | $ | 15,799,258 | | | $ | 11,510,932 | | | $ | 8,161,090 | | |

Adjustments to reconcile net increase/decrease in net assets resulting from operations to net cash

provided by (used in) operating activities: | |

| Purchases of investments | | | (42,918,780 | ) | | | (154,018,920 | ) | | | (64,191,377 | ) | | | (25,297,558 | ) | |

| Proceeds from paydowns and sales of investments | | | 47,572,058 | | | | 169,798,056 | | | | 72,752,975 | | | | 32,976,750 | | |

| Net purchases/sales of short-term securities | | | (9,920,270 | ) | | | 1,049,675 | | | | (852,296 | ) | | | (297,060 | ) | |

| Net amortization/accretion of bond discount and premium | | | 16,387 | | | | 21,411 | | | | (59,830 | ) | | | 5,363 | | |

| Net change in unrealized appreciation or depreciation of investments | | | 2,099,636 | | | | 6,889,418 | | | | 246,923 | | | | 3,180,143 | | |

| Net realized gain/loss on investments | | | (514,206 | ) | | | (1,856,772 | ) | | | (1,518,160 | ) | | | (331,712 | ) | |

| Increase/decrease in accrued interest receivable | | | (376,394 | ) | | | 649,994 | | | | 4,166 | | | | 169,476 | | |

| Increase/decrease in prepaid expenses | | | 22,166 | | | | - | | | | (68,564 | ) | | | - | | |

| Increase/decrease in other assets | | | 171,270 | | | | 155,367 | | | | 32,719 | | | | (18,177 | ) | |

| Increase/decrease in accrued fees and expenses | | | 95,979 | | | | (11,361 | ) | | | 103,048 | | | | 71,478 | | |

| Net cash provided by (used in) operating activities | | | (492,834 | ) | | | 38,476,126 | | | | 17,960,536 | | | | 18,619,793 | | |

| Cash flows from financing activities: | |

| Net payments from/proceeds for reverse repurchase agreements | | | 3,931,132 | | | | (16,819,043 | ) | | | (11,217,281 | ) | | | (7,387,289 | ) | |

| Distributions paid to shareholders | | | (4,484,766 | ) | | | (21,302,633 | ) | | | (6,930,427 | ) | | | (11,115,340 | ) | |

| Net cash provided by (used in) in financing activities | | | (553,634 | ) | | | (38,121,676 | ) | | | (18,147,708 | ) | | | (18,502,629 | ) | |

| Net increase/decrease in cash | | | (1,046,468 | ) | | | 354,450 | | | | (187,172 | ) | | | 117,164 | | |

| Cash or bank overdraft at beginning of period | | | 1,289,846 | | | | 935,396 | | | | 77,044 | | | | (40,120 | ) | |

| Cash or bank overdraft at end of period | | $ | 243,378 | | | $ | 1,289,846 | | | $ | (110,128 | ) | | $ | 77,044 | | |

Supplemental disclosure of cash flow information:

Cash paid for interest | | $ | 679,785 | | | $ | 1,952,420 | | | $ | 1,236,534 | | | $ | 1,130,043 | | |

| Noncash financing activities resulting from reinvested dividends | | $ | - | | | $ | - | | | $ | - | | | $ | - | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

23

Financial STATEMENTS continued

Statements of Changes in Net Assets

| | | American Strategic Income Portfolio | | American Strategic Income Portfolio II | |

| | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Year Ended

11/30/03 | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Year Ended

5/31/04 | |

| Operations: | |

| Net investment income | | $ | 2,316,915 | | | $ | 3,984,412 | | | $ | 3,761,772 | | | $ | 3,624,332 | | | $ | 16,890,818 | | | $ | 17,882,331 | | |

| Net realized gain on investments | | | 58,003 | | | | 295,555 | | | | 279,776 | | | | 26,208 | | | | 1,229,106 | | | | 806,361 | | |

| Net change in unrealized appreciation or depreciation of investments | | | (874,358 | ) | | | (704,969 | ) | | | (119,911 | ) | | | (3,990,486 | ) | | | (10,543,368 | ) | | | (2,836,227 | ) | |

| Net increase (decrease) in net assets resulting from operations | | | 1,500,560 | | | | 3,574,998 | | | | 3,921,637 | | | | (339,946 | ) | | | 7,576,556 | | | | 15,852,465 | | |

| Distributions to shareholders (note 2): | |

| From net investment income | | | (2,648,649 | ) | | | (3,680,958 | ) | | | (3,680,357 | ) | | | (3,836,578 | ) | | | (16,545,245 | ) | | | (18,204,555 | ) | |

| From return of capital | | | (69,601 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | |

| Total distributions | | | (2,718,250 | ) | | | (3,680,958 | ) | | | (3,680,357 | ) | | | (3,836,578 | ) | | | (16,545,245 | ) | | | (18,204,555 | ) | |

| Capital share transactions (note 2): | |

| Proceeds from shares issued from reinvested dividends | | | - | | | | 13,287 | (1) | | | - | | | | - | | | | - | | | | 378,262 | (2) | |

| Total increase (decrease) in net assets | | | (1,217,690 | ) | | | (92,673 | ) | | | 241,280 | | | | (4,176,524 | ) | | | (8,968,689 | ) | | | (1,973,828 | ) | |

| Net assets at beginning of period | | | 53,500,754 | | | | 53,593,427 | | | | 53,352,147 | | | | 198,446,975 | | | | 207,415,664 | | | | 209,389,492 | | |

| Net assets at end of period | | $ | 52,283,064 | | | $ | 53,500,754 | | | $ | 53,593,427 | | | $ | 194,270,451 | | | $ | 198,446,975 | | | $ | 207,415,664 | | |

| Undistributed net investment income | | $ | 3,093 | | | $ | 373,566 | | | $ | 90,382 | | | $ | 1,333,868 | | | $ | 1,546,114 | | | $ | 1,272,973 | | |

(1) 1,037 shares issued from reinvested dividends.

(2) 28,452 shares issued from reinvested dividends.

(3) 12,731 shares issued from reinvested dividends.

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

24

| | | American Strategic Income Portfolio III | | American Select Portfolio | |

| | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Year Ended

5/31/04 | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Year Ended

11/30/03 | |

| Operations: | |

| Net investment income | | $ | 4,844,750 | | | $ | 20,831,904 | | | $ | 22,150,828 | | | $ | 10,239,695 | | | $ | 11,009,521 | | | $ | 11,167,206 | | |

| Net realized gain on investments | | | 514,206 | | | | 1,856,772 | | | | 1,064,894 | | | | 1,518,160 | | | | 331,712 | | | | 1,158,848 | | |

| Net change in unrealized appreciation or depreciation of investments | | | (2,099,636 | ) | | | (6,889,418 | ) | | | (1,875,575 | ) | | | (246,923 | ) | | | (3,180,143 | ) | | | (1,546,288 | ) | |

| Net increase (decrease) in net assets resulting from operations | | | 3,259,320 | | | | 15,799,258 | | | | 21,340,147 | | | | 11,510,932 | | | | 8,161,090 | | | | 10,779,766 | | |

| Distributions to shareholders (note 2): | |

| From net investment income | | | (4,484,766 | ) | | | (21,302,633 | ) | | | (23,960,300 | ) | | | (6,930,427 | ) | | | (11,115,340 | ) | | | (11,461,860 | ) | |

| From return of capital | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | |

| Total distributions | | | (4,484,766 | ) | | | (21,302,633 | ) | | | (23,960,300 | ) | | | (6,930,427 | ) | | | (11,115,340 | ) | | | (11,461,860 | ) | |

| Capital share transactions (note 2): | |

| Proceeds from shares issued from reinvested dividends | | | - | | | | - | | | | 160,455 | (3) | | | - | | | | - | | | | - | | |

| Total increase (decrease) in net assets | | | (1,225,446 | ) | | | (5,503,375 | ) | | | (2,459,698 | ) | | | 4,580,505 | | | | (2,954,250 | ) | | | (682,094 | ) | |

| Net assets at beginning of period | | | 259,270,409 | | | | 264,773,784 | | | | 267,233,482 | | | | 140,061,728 | | | | 143,015,978 | | | | 143,698,072 | | |

| Net assets at end of period | | $ | 258,044,963 | | | $ | 259,270,409 | | | $ | 264,773,784 | | | $ | 144,642,233 | | | $ | 140,061,728 | | | $ | 143,015,978 | | |

| Undistributed net investment income | | $ | 730,825 | | | $ | 370,841 | | | $ | 946,558 | | | $ | 3,494,687 | | | $ | 185,419 | | | $ | 291,238 | | |

See accompanying Notes to Financial Statements.

2005 Annual Report

First American Mortgage Funds

25

Notes to Financial STATEMENTS

| (1) Organization | | American Strategic Income Portfolio Inc. ("ASP"), American Strategic Income Portfolio Inc. II ("BSP"), American Strategic Income Portfolio Inc. III ("CSP"), and American Select Portfolio Inc. ("SLA") (the "funds") are registered under the Investment Company Act of 1940 (as amended) as div ersified, closed-end management investment companies. The funds emphasize investments in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. They may also invest in U.S. government securities, corporate debt securities, preferred stock issued by real estate investment trusts, and mortgage servicing rights. In addition, the funds may borrow using reverse repurchase agreements and revolving credit facilities. Fund shares are listed on the New York Sto ck Exchange under the symbols ASP, BSP, CSP, and SLA, respectively. | |

|

| | | On June 22, 2005 the funds' board of directors approved a change in the funds' fiscal year-ends from May 31 to August 31 for BSP and CSP, and from November 30 to August 31 for ASP and SLA, effective with the fiscal period ended August 31, 2005 (the "fiscal period"). | |

|

| (2) Summary of Significant Accounting Policies | | Security Valuations | |

|

| | | Security valuations for the funds' investments (other than whole loans, participation mortgages, and mortgage servicing rights) are furnished by one or more independent pricing services that have been approved by the funds' board of directors. Investments in equity securities that are traded on a national securities exchange are stated at the last quoted sales price if readily available for such securities on each business day. For securities traded on the Nasdaq national market system, the funds utilize the Nasdaq Official Closing Price which compares the last trade to the bid/ask price of a security. If the last trade falls within the bid/ask range, then that price will be the closing price. If the last trade is outside the bid/ask range, and falls above the ask, the ask price will be the closing price. If the last trade is below the bid, the bid will be the closing price. Other equity securities traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. When market quotations are not readily available, securities are valued at fair value as determined in good faith by procedures established and approved by the funds' board of directors. Some of the factors which may be considered in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securities of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the security is purchased or sold. If events occur that materially affect the value of securities (including non-U.S. securities) between the close of trading in those secur ities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost which approximates market value. Security valuations are performed once a week and at the end of each month. | |

|

| | | The funds' investments in whole loans (single family, multifamily, and commercial), participation mortgages, and mortgage servicing rights are generally not traded in any organized market and | |

|

2005 Annual Report

First American Mortgage Funds

26

| | | therefore, market quotations are not readily available. These investments are valued at fair value according to procedures adopted by the funds' board of directors. Pursuant to these procedures, whole loan investments are initially valued at cost and their values are subsequently monitored and adjusted using a U.S. Bancorp Asset Management, Inc. ("USBAM") pricing model designed to incorporate, among other things, the present value of the projected stream of cash flows on such investments. The pricing model takes into account a number of relevant factors including the projected rate of prepayments, the delinquency profile, the historical payment record, the expected yield at purchase, changes in prevailing interest rates, and changes in the real or perceived liquidity of whole loans, participation mortgages or mortgage servicing rights, as the case may be. The results of the pricing model may be further subject to price ceilings due to the illiquid nature of the loans. Changes in prevailing interest rates, real or perceived liquidity, yield spreads, and creditworthiness are factored into the pricing model each week. | |

|

| | | Certain mortgage loan information is received once a month. This information includes, but is not limited to, the projected rate of prepayments, projected rate and severity of defaults, the delinquency profile, and the historical payment record. Valuations of whole loans, participation mortgages and mortgage servicing rights are determined no less frequently than weekly. Although USBAM believes the pricing model to be reasonable and appropriate, the actual values that may be realized upon the sale of whole loans, participation mortgages, and mortgage servicing rights can only be determined in negotiations between the funds and third parties. | |

|

| | | As of August 31, 2005, ASP, BSP, CSP, and SLA had fair valued securities with values of $40,124,864, $205,437,930, $259,565,915, and $151,169,679, respectively, or 76.7%, 105.7%, 100.6%, and 104.5% of net assets, respectively. | |

|

| | | Security Transactions and Investment Income | |

|

| | | For financial statement purposes, the funds record security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of bond premiums, is recorded on the accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. | |

|

| | | Whole Loans and Participation Mortgages | |

|

| | | Whole loans and participation mortgages may bear a greater risk of loss arising from a default on the part of the borrower of the underlying loans than do traditional mortgage-backed securities. This is because whole loans and participation mortgages, unlike most mortgage-backed securities, generally are not backed by any government guarantee or private credit enhancement. Such risk may be greater during a period of declining or stagnant real estate values. In addition, the individual loans underlying whole loans and participation mortgages may be larger than the loans underlying mortgage-backed securities. With respect to participation mortgages, the funds generally will not be able to unilaterally enforce their rights i n the event of a default, but rather will be dependent on the cooperation of the other participation holders. | |

|

| | | The funds do not record past due interest as income until received. The funds may incur certain costs and delays in the event of a foreclosure. Also, there is no assurance that the subsequent sale of the property will produce an amount equal to the sum of the unpaid principal balance of the loan as of the date the borrower went into default, the accrued unpaid interest, and all of the foreclosure expenses. In this case, the funds may suffer a loss. | |

|

2005 Annual Report

First American Mortgage Funds

27

Notes to Financial STATEMENTS continued

| | | At August 31, BSP had one loan representing 0.1% of net assets that was 120 or more days delinquent as to the timely monthly payment of principal and interest. This deliquency relates solely to a single family whole loan and represents 20.6% of the total single family loans and private mortgage-backed security's value outstanding at August 31, 2005. At August 31, 2005, no multifamily or commercial loans were delinquent. | |

|

| | | At August 31, 2005, CSP had one loan representing 1.8% of net assets that was 120 or more days delinquent as to the timely monthly payment of principal and interest. This delinquency relates solely to a multifamily whole loan and represents 2.3% of total multifamily and commercial loans outstanding at August 31, 2005. At August 31, 2005, no single family or commercial loans were delinquent. | |

|

| | | At August 31, 2005, no loans were 120 or more days delinquent in ASP or SLA. | |

|

| | | Real estate acquired through foreclosure, if any, is recorded at estimated fair value. The funds may receive rental or other income as a result of holding real estate. In addition, the fund may incur expenses associated with maintaining any real estate owned. On August 31, 2005, BSP owned one apartment building with a value of $8,430,270, for a total of 4.3% of the fund's net assets. BSP did not receive any rental income or incur any expenses during the fiscal period. BSP did not hold any other real estate owned properties during the fiscal period ended August 31, 2005. BSP did not recognize any net realized gains (losses) during this same period. | |

|

| | | On August 31, 2005, ASP, CSP, and SLA owned no real estate. | |

|

| | | Reverse Repurchase Agreements | |

|

| | | Reverse repurchase agreements involve the sale of portfolio-eligible securities by the funds, coupled with an agreement to repurchase the securities at a specified date and price. Reverse repurchase agreements may increase volatility of the funds' net asset values and involve the risk that interest costs on money borrowed may exceed the return on securities purchased with that borrowed money. Reverse repurchase agreements are considered t o be borrowings by the funds, and are subject to the funds' overall restriction on borrowing under which each fund must maintain asset coverage of at least 300%. For the fiscal period ended August 31, 2005, the weighted average borrowings outstanding for ASP, BSP, CSP, and SLA were $7,286,559, $55,809,066, $70,190,737, and $48,826,599, respectively, and the weighted average interest rates paid by the funds on such borrowings were 2.82%, 4.18%, 4.29%, and 3.79 %, respectively. | |

|

| | | Securities Purchased on a When-Issued Basis | |

|

| | | Delivery and payment for securities that have been purchased by the funds on a when-issued or forward-commitment basis can take place a month or more after the transaction date. During this period, such securities do not earn interest, are subject to market fluctuation and may increase or decrease in value prior to their delivery. Each fund segregates, with its custodian, assets with a market value equal to the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of a fund's net asset value if the fund makes such purchases while remaining substantially fully invested. As of August 31, 2005, the funds had no outstanding when-issued or forward-commitment securities. | |

|

| | | Federal Taxes | |

|

| | | The funds intend to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and not be subject to federal income tax. Therefore, no income tax provision is required. The funds also intend to distribute their taxable net investment income and realized gains, if any, to avoid the payment of any federal excise taxes. | |

|

2005 Annual Report

First American Mortgage Funds

28

| | | Net investment income and net realized gains (losses) may differ for financial statement and tax purposes because of temporary or permanent book-to-tax differences. These differences are primarily due to the timing of recognition of income on certain collateralized mortgage-backed securities, post-October losses and investments in REITs. | |

|

| | | On the statements of assets and liabilities, as a result of permanent book-to-tax differences related to investments in REITs and expiring capital loss carryovers, undistributed (distributions in excess of) net investment income and accumulated net realized gains (losses) have been increased (decreased), resulting in a net reclassification adjustment to paid-in capital by the following: | |

|

| | | American Strategic

Income Portfolio | | American Strategic

Income Portfolio II | |

| Undistributed net investment income | | $ | 30,862 | | | $ | - | | |

| Accumulated net realized gains (losses) | | | 38,739 | | | | 1,266,343 | | |

| Paid-in capital reduction | | | (69,601 | ) | | | (1,266,343 | ) | |

| | | The character of distributions made during the period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal period in which amounts are distributed may differ from the period that the income or realized gains or losses were recorded by the funds. | |

|

| | | The tax character of distributions paid during the fiscal period ended August 31, 2005 and the fiscal years ended November 30, 2004 and 2003 were as follows: | |

|

| | | American Strategic

Income Portfolio | | American Select

Portfolio | |

| | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Year Ended

11/30/03 | | Nine-Month

Period Ended

8/31/05 | | Year Ended

11/30/04 | | Year Ended

11/30/03 | |

| Distributions paid from ordinary income | | $ | 2,648,649 | | | $ | 3,680,958 | | | $ | 3,680,357 | | | $ | 6,930,427 | | | $ | 11,115,340 | | | $ | 11,461,860 | | |

| Return of capital | | | 69,601 | | | | - | | | | - | | | | - | | | | - | | | | - | | |

| Total | | | 2,718,250 | | | | 3,680,958 | | | | 3,680,357 | | | | 6,930,427 | | | | 11,115,340 | | | | 11,461,860 | | |

| | | The tax character of distributions paid during the fiscal period ended August 31, 2005 and the fiscal years ended May 31, 2005 and 2004 were as follows: | |

|

| | | American Strategic

Income Portfolio II | | American Strategic

Income Portfolio III | |

| | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Year Ended

5/31/04 | | Three-Month

Period Ended

8/31/05 | | Year Ended

5/31/05 | | Year Ended

5/31/04 | |

| Distributions paid from ordinary income | | $ | 3,836,578 | | | $ | 16,545,245 | | | $ | 18,204,555 | | | $ | 4,484,766 | | | $ | 21,302,633 | | | $ | 23,960,300 | | |

| | | At August 31, 2005, the components of accumulated earnings (deficit) on a tax basis were as follows: | |

|

| | | American Strategic

Income Portfolio | | American Strategic

Income Portfolio II | | American Strategic

Income Portfolio III | | American Select

Portfolio | |

| Undistributed ordinary income | | $ | - | | | $ | 1,333,868 | | | $ | 730,772 | | | $ | 3,494,687 | | |

| Accumulated capital gains (losses) | | | (1,943,334 | ) | | | (811,879 | ) | | | (286,617 | ) | | | 1,356,052 | | |

| Unrealized appreciation (depreciation) | | | 5,253 | | | | (13,488,247 | ) | | | (6,367,988 | ) | | | (138,625 | ) | |

| Accumulated earnings (deficit) | | $ | (1,938,081 | ) | | $ | (12,966,258 | ) | | $ | (5,923,833 | ) | | $ | 4,712,114 | | |

2005 Annual Report

First American Mortgage Funds

29

Notes to Financial STATEMENTS continued

| | | The difference between book basis and tax basis unrealized appreciation (depreciation) and accumulated realized gains (losses) at August 31, 2005, is attributable to a one-time tax election whereby the funds marked appreciated securities to market creating capital gains that were used to reduce capital loss carryovers and increase tax cost basis. | |

|

| | | Distributions to Shareholders | |

|

| | | Distributions from net investment income are declared and paid on a monthly basis. Any net realized capital gains on sales of securities for the funds are distributed to shareholders at least annually. These distributions are recorded as of the close of business on the ex-dividend date. Such distributions are payable in cash or, pursuant to the funds' dividend reinvestment plans, reinvested in additional shares of the funds' capital stock. Under each fund's plan, fund shares will be purchased in the open market unless the market price plus commissions exceeds the net asset value by 5% or more. If, at the close of business on the dividend payment date, the shares purchased in the open market are insufficient to satisfy the divi dend reinvestment requirement, the funds will issue new shares at a discount of up to 5% from the current market price. | |

|

| | | Repurchase Agreements and Other Short-Term Securities | |

|

| | | For repurchase agreements entered into with certain broker-dealers, the funds, along with other affiliated registered investment companies, may transfer uninvested cash balances into a joint trading account, the daily aggregate of which is invested in repurchase agreements secured by U.S. government or agency obligations. Securities pledged as collateral for all individual and joint repurchase agreements are held by the funds' custodian bank until maturity of the repurchase agreement. All agreements require that the daily market value of the collateral be in excess of the repurchase amount, including accrued interest, to protect the funds in the event of a default. | |

|

| | | Deferred Compensation Plan | |

|

| | | Under a Deferred Compensation Plan (the "Plan"), non-interested directors of the First American Fund family may participate and elect to defer receipt of their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of selected open-end First American Funds as designated by the board of directors. All amounts in the Plan are 100% vested and accounts under the Plan are obligations of the funds. Deferred amounts remain in the funds until distributed in accordance with the Plan. | |

|

| | | Use of Estimates in Preparation of Financial Statements | |

|

| | | The preparation of financial statements, in conformity with U.S. generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the results of operations during the reporting period. Actual results could differ from these estimates. | |

|

| | | Reclassifications | |

|

| | | Certain amounts in the 2004 financial statements have been reclassified to conform to the 2005 presentation. | |

|

| | (3 | ) Expenses | | Investment Advisory Fees | |

|

| | | Pursuant to investment advisory agreements with each fund (each an "Agreement"), USBAM, a subsidiary of U.S. Bank National Association ("U.S. Bank"), manages the funds' assets and | |

|

2005 Annual Report

First American Mortgage Funds

30

| | | furnishes related office facilities, equipment, research, and personnel. For ASP, BSP, and CSP, the Agreement provides USBAM with a monthly investment advisory fee in an amount equal to an annualized rate of 0.20% of the respective fund's average weekly net assets and 4.50% of the daily gross income accrued by such fund during the month (i.e., investment income, including accretion of bond discounts and amortization of premiums, other than gains from the sale of securities or gains from options and futures contracts less interest on money borrowed by the funds). The monthly investment advisory fee shall not exceed, in the agg regate, 1/12 of 0.725% of the respective fund's average weekly net assets during the month (approximately 0.725% on an annual basis). For SLA, the Agreement provides USBAM with a monthly investment advisory fee in an amount equal to an annualized rate of 0.50% of the fund's average weekly net assets. For its fees, USBAM provides investment advice and, in general, conducts the management and investment activities of the funds. | |

|

| | | The funds may invest in money market funds that are a series of First American Funds, Inc. ("FAF"), subject to certain limitations. In order to avoid the payment of duplicative investment advisory fees to USBAM, which acts as the investment advisor to these funds and the related money market funds, USBAM will reimburse to each fund an amount equal to the investment advisory fees received from the related money market funds that are attributable to the assets of that fund . For financial statement purposes, this reimbursement is recorded as investment income. | |

|

| | | Administrative Fees | |

|

| | | USBAM serves as the funds' administrator pursuant to administration agreements between USBAM and each fund. Under these agreements, USBAM receives a monthly administrative fee from each fund in an amount equal to 0.25% of the fund's average weekly net assets. For its fee, USBAM provides numerous services to the funds including, but not limited to, handling the general business affairs, financial and regulatory reporting, and various other services. | |

|

| | | Custodian Fees | |

|

| | | U.S. Bank serves as each fund's custodian pursuant to a custodian agreement with the funds. The custodian fee charged to each fund is equal to an annual rate of 0.02% of such fund's average weekly net assets. These fees are computed weekly and paid monthly. | |

|

| | | Mortgage Servicing Fees | |

|

| | | The funds may enter into mortgage servicing agreements with mortgage servicers for whole loans and participation mortgages. For a fee, mortgage servicers maintain loan records, such as insurance and taxes and the proper allocation of payments between principal and interest. | |

|

| | | Proposed Reorganization Expenses | |

|

| | | The funds previously filed a proxy statement/registration statement and took certain other steps in connection with a proposed reorganization of the funds into First American Strategic Real Estate Portfolio Inc., a specialty real estate finance company that would be taxed as a real estate investment trust. The Board of Directors, in consultation with USBAM, has decided not to pursue this proposed reorganization. As set forth below, certain costs and expenses incurred in connection with the proposed reorganization of the funds (including, but not limited to, the preparation of all necessary registration statements, proxy materials and other documents, preparation for and attendance at board and committee, shareholder, planning, organizational, and other meetings, and costs and expenses of accountants, attorneys, financial advisors, and other experts engaged in connection with the reorganization) were borne by ASP, BSP, CSP, and SLA (collectively, the | |

|

2005 Annual Report

First American Mortgage Funds

31

Notes to Financial STATEMENTS continued