| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-6665 |

|

| |

| T. Rowe Price Mid-Cap Growth Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: June 30, 2008 |

Item 1: Report to Shareholders| Mid-Cap Growth Fund | June 30, 2008 |

The views and opinions in this report were current as of June 30, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

As poorly as the stock market performed in the first half of 2008, the pervasive negative sentiment made it feel even worse. The market’s decline over the period—around 10% by its broadest measures—seems modest when compared to the outsized challenges that dogged the American economy and consumer. An unprecedented jump in the price of oil, rising food costs, increasing unemployment, and the worst housing collapse by some measures in more than 60 years resulted in a general feeling that the economy was in serious trouble. Your fund experienced a loss in this environment, but our mid-cap and growth focuses helped cushion the fund’s decline.

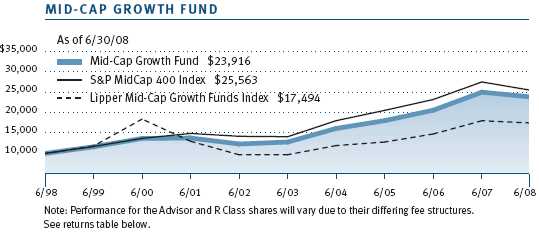

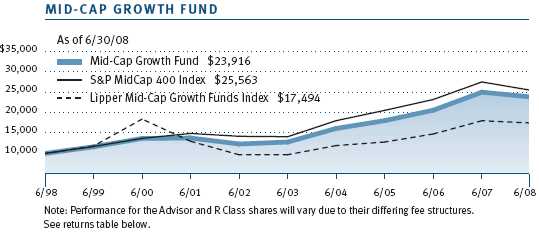

The Mid-Cap Growth Fund fell 6.64% during the six months ended June 30, 2008. (Returns for Advisor and R Class shares were lower due to their different fee structure.) The fund trailed the S&P MidCap 400 Index but modestly outperformed the Russell Midcap Growth Index over the period. The fund also outperformed its average peer and remained favorably ranked relative to its competitors over longer time periods. (Based on cumulative total return, Lipper ranked the Mid-Cap Growth Fund 260 out of 596, 156 out of 501, 91 out of 408, and 16 out of 181 funds in the category for the 1-, 3-, 5-, and 10-year periods ended June 30, 2008, respectively. Results will vary for other time periods. Past performance cannot guarantee future results.)

HIGHLIGHTS

• Skyrocketing oil prices, the ongoing housing slump, rising unemployment, and other factors resulted in poor stock market performance in the first half of 2008.

• The fund’s loss was mitigated by its focus on mid-cap and growth stocks, both of which were in favor over the period.

• Most of the fund’s top performers were in the energy sector, while financials and consumer shares detracted.

• While the economy faces significant challenges, we are mindful of the resilience of the U.S. economy, which has endured similar tests and emerged stronger.

MARKET ENVIRONMENT

Six months ago, we wrote to you of the cloud that had descended on the economy as consumers were struggling to adjust to $3 gasoline, the unemployment rate had crept up to 5.0%, and inflation had increased by 4.1% over the previous year. The skies have hardly gotten clearer. As we write, most drivers would be thrilled to find gas anywhere near $4 per gallon, unemployment stands at 5.5%, and prices have gone up 5.0% in the 12 months ending in June.

The economy has faced three major headwinds over the past six months, two of which have become subjects of almost-daily conversation. The rise of oil futures to over $140 per barrel by the last week of June and the alarming increase in the price of food have reacquainted many Americans with the phenomenon of inflation and the dire effect it can have on family budgets. Alarmingly for investors and economists, Americans have also begun to expect more inflation in the future—indeed, one measure suggested that inflationary expectations were at their highest level in nearly 30 years. Prices are rising at an even faster rate in emerging markets, threatening to undermine the economies that have driven much of the world’s growth over the past few years.

The second headwind, the continuing housing slump, is also widely recognized. Home prices and new construction continued to trend downward, with the declines most evident in formerly hot markets such as California and Florida. Prices have fallen quickly enough in many cities that millions of homeowners have found themselves “under water” on their loans, owing more than their homes are worth. When combined with the large number of adjustable-rate mortgages that are resetting to higher payments, the result has been a flood of foreclosures that has driven home prices down further. Congress and the administration have argued over solutions to the problem, but the government can do little more than modestly cushion the blow for those most affected.

The final headwind was also felt by all Americans, although its nature and source are more difficult to understand. As the mortgage crisis (which is no longer confined to subprime loans) continued to reverberate through the system, the economy began to deleverage. Stated differently, credit became more difficult to obtain, leading businesses and individuals to begin to reduce debt, in some cases involuntarily. As we have noted in past letters, this process was inevitable following years of easy credit and booming liquidity. Deleveraging can be highly dangerous if it proceeds too quickly, however. This was the case in March when the credit markets seized as banks and other institutions suddenly proved unwilling to take new loans onto their books, or to serve as “counterparties” on debt transactions. The situation became so dire that the Federal Reserve took the dramatic step of providing financial backing for the takeover of Bear Stearns, one of Wall Street’s most storied investment banks, averting bankruptcy and possible financial chaos.

While some criticized the Fed’s unprecedented action, it appeared that the normal policy responses were doing little to ease the strains of the credit crunch. Although the Fed aggressively lowered the federal funds rate from 4.25% to 2.00% over the period, mortgage rates remained elevated, and growing numbers of potential homebuyers found themselves unable to qualify for a loan. By June, it appeared that the housing slump was far from over—indeed, an argument could be made that prices and inventories had made roughly half the necessary adjustment.

The Fed’s intervention did appear to drive the U.S. dollar lower, however, which had the unfortunate effect of causing an increase in the price of imports, including oil. We worry that the Fed’s efforts to aid the economy through rate cuts are, in fact, counterproductive. As investors worldwide fret about the falling value of the dollar and the commitment of the Federal Reserve to fight inflation, commodities have come to be viewed as alternative stores of value, providing financial hedges against further dollar weakness for investors and speculators. In an unfortunate cycle, this phenomenon has, in turn, pushed up food and energy prices worldwide. Fed officials have recently begun to talk more openly about the threat of inflation, increasing speculation that the central bank will raise rates this fall even if the economy is not on track for recovery.

Certainly, rays of sunshine penetrated the gloom. The lower dollar has given a boost to U.S. exports, which may have helped the economy record a positive (albeit meager) annualized growth rate of 1.0% in the first quarter. The labor market contracted, but not as sharply as in past slowdowns, perhaps due to exceptionally cautious hiring on the part of employers over the past several years. And in spite of inflation worries, long-term interest rates stayed fairly low, due partly to continued strong interest from investors seeking a haven from the turbulent equity markets.

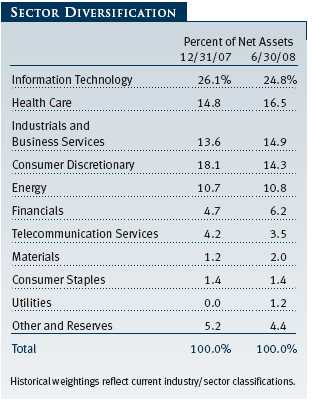

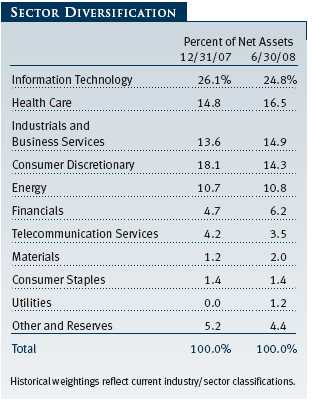

Mid-cap growth stocks fared much better than large-caps during the period, and growth shares handily outperformed value. These results were primarily attributable to an overrepresentation of the top-performing energy and materials groups among the mid-cap indices and an underrepresentation of the toxic financial stocks in growth indices relative to value indices.

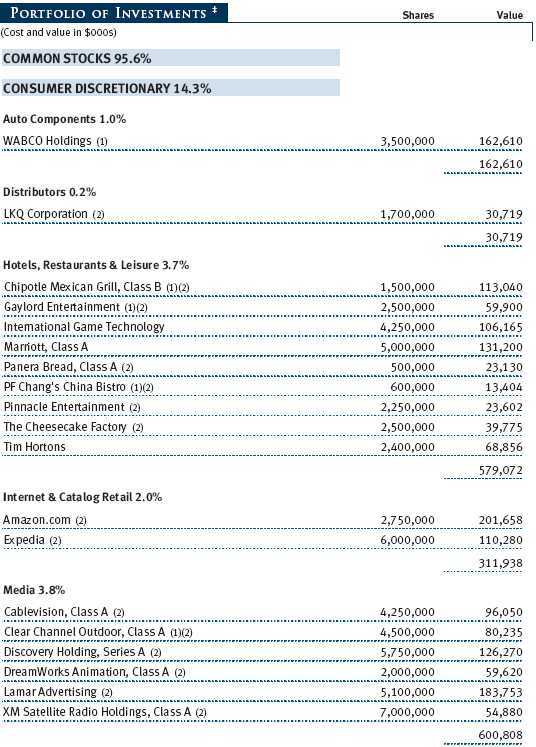

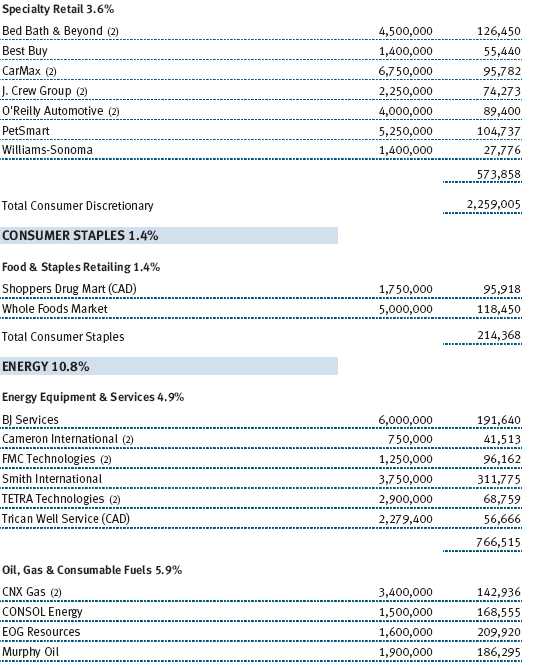

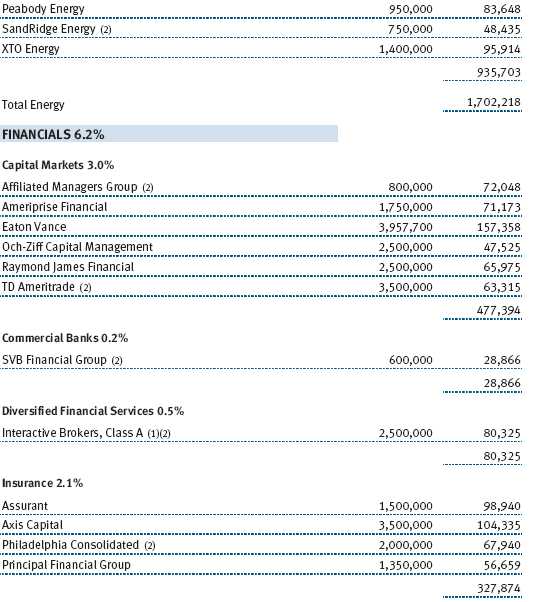

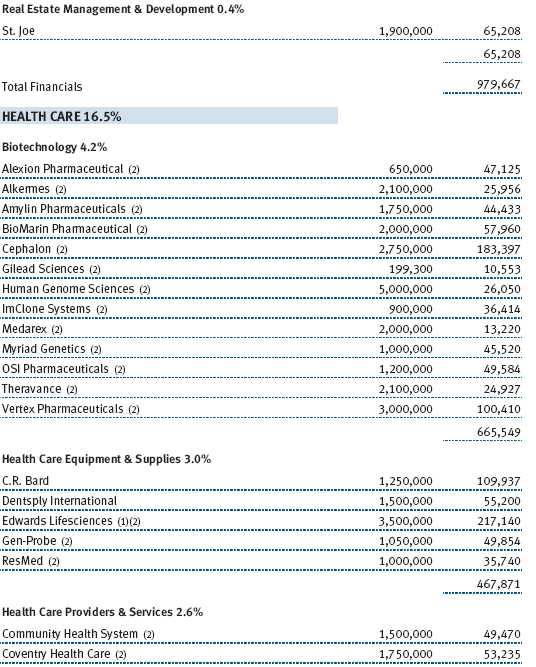

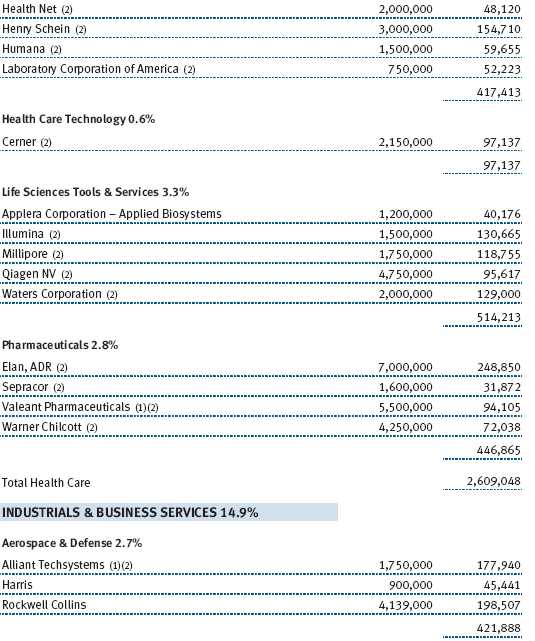

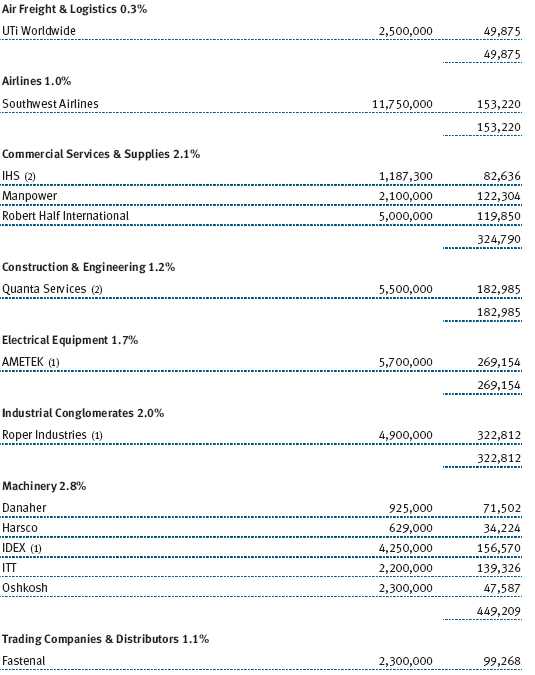

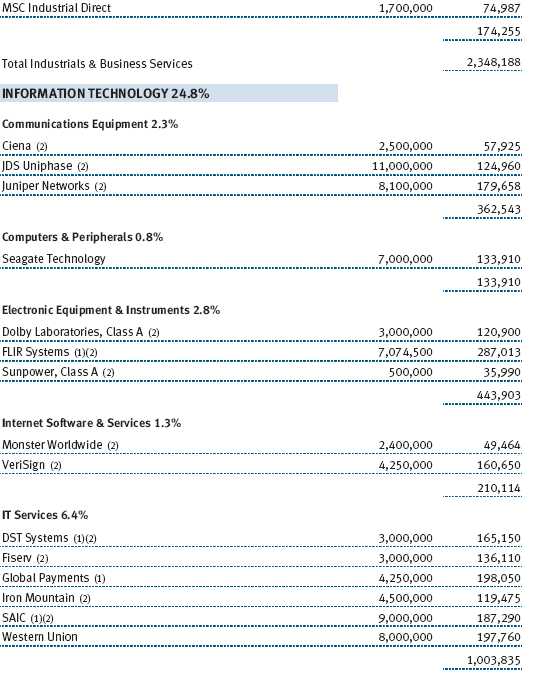

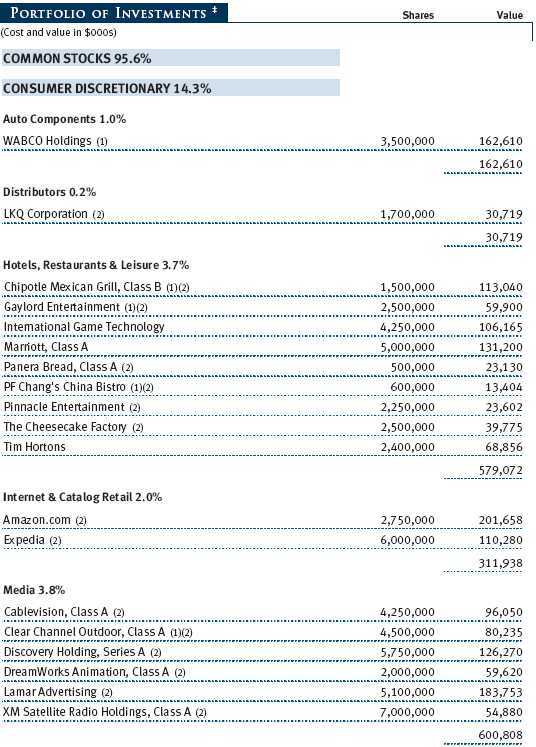

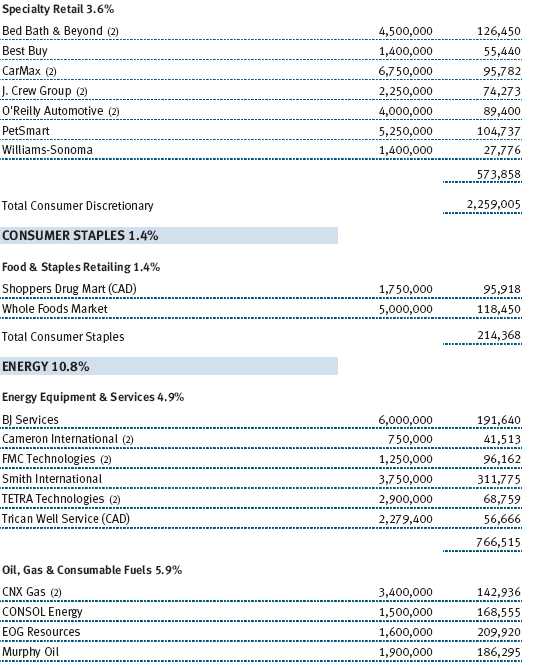

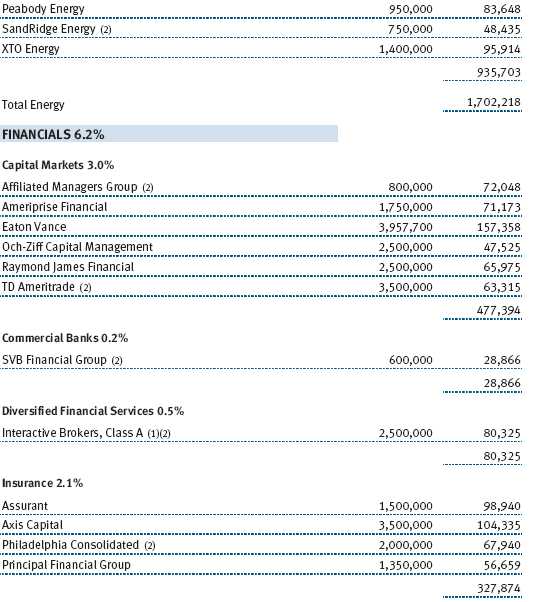

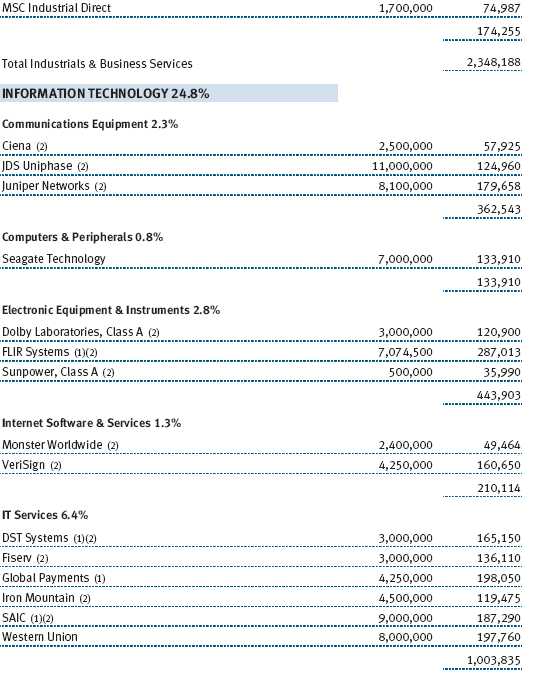

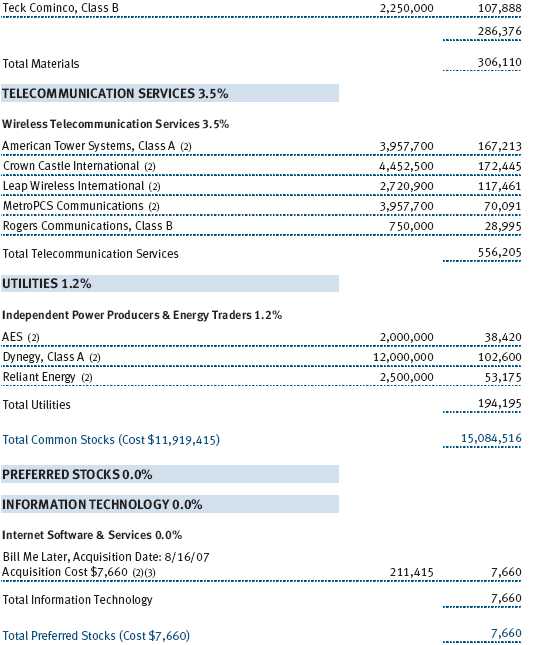

PORTFOLIO REVIEW

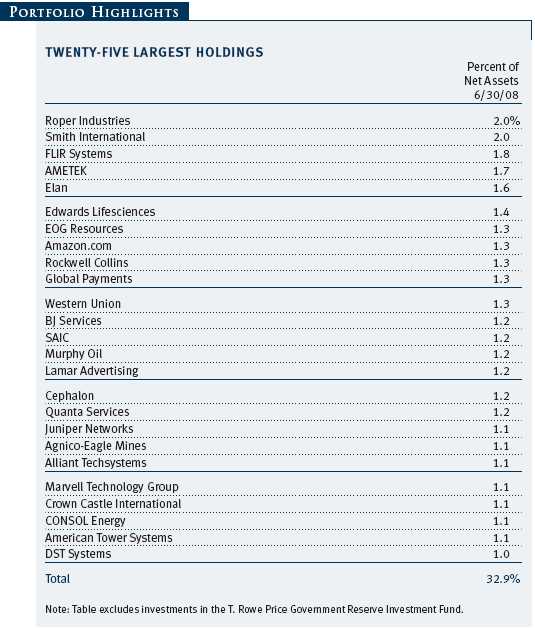

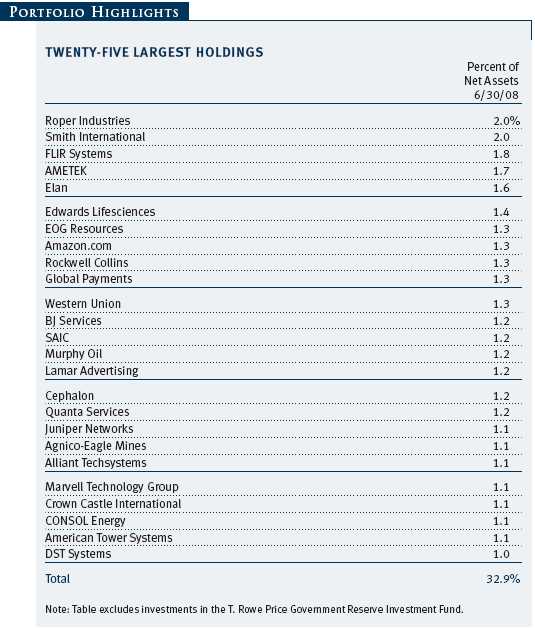

The stock market’s sectors never rise and fall in unison, but the gap between the haves and have-nots was substantial over the past six months. This pattern was reflected in the performance of our holdings. The parabolic rise in coal, oil, and natural gas prices over the past six months resulted in strong performance for our energy positions, led by oil and natural gas producer EOG Resources, coal producer CONSOL Energy, and energy services firm BJ Services. The rise in the price of oil was accompanied by a similar boom in other commodities. Gold miner Agnico-Eagle was a top contributor for the fund in the materials sector. Despite the boost they gave to our results, the energy and materials sectors hurt our relative results due to our below-benchmark weightings, which we will discuss in detail below. (Please refer to the portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

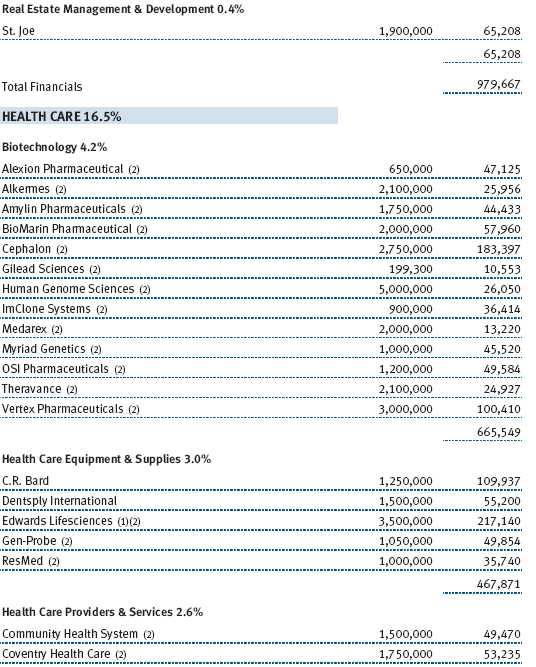

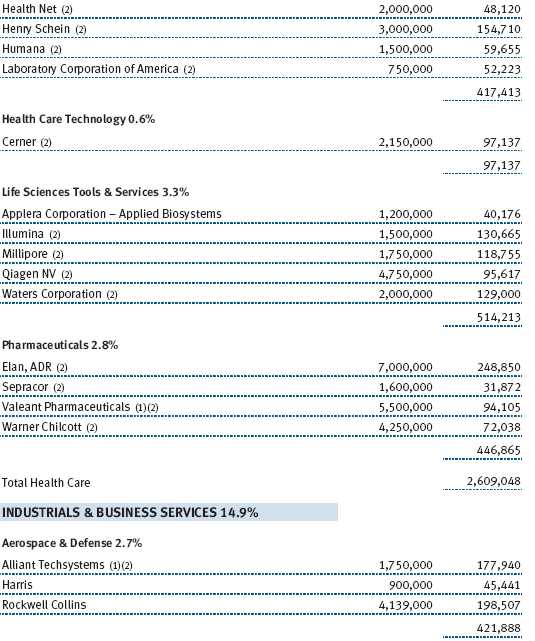

Health care, particularly biotechnology, has always been an emphasis of the fund given the forces that are feeding long-term growth trends in the sector: the aging population, growing demand from overseas, and drug innovations fueled by genetic research. Investing in the sector takes patience because companies often must endure many testing setbacks before scoring with an approved drug. Our results in the sector were mixed, but we experienced significant price appreciation from longtime holding Elan, which shot upward on hopeful results for the company’s Alzheimer’s treatment—a huge and largely unserved market. Elan’s approach blocks development of beta amyloid, which may be an important factor in the buildup of plaque in Alzheimer’s patients. Device maker Edwards Lifesciences also performed well as the company’s new noninvasive technique for heart valve implantation experienced a strong launch in Europe.

The fund’s detractors were mainly tied to the consumer, who seemed under pressure from all sides. Harman International was our largest detractor. The company’s high-end audio systems, many of which are deployed in upscale autos, found fewer buyers in these tightened times. We eliminated our position. A company’s product didn’t have to be expensive for it to be vulnerable, however. Chipotle Mexican Grill performed poorly after strong performance in 2007 as investors worried its strong sales growth would moderate. The same factor explains the poor results for Whole Foods Market. Online travel site Expedia felt the impact of scaled-back vacationing, as did International Game Technology, which experienced reduced demand for its gaming machines from cash-strapped casinos. Amazon.com fell when it lowered guidance for 2008.

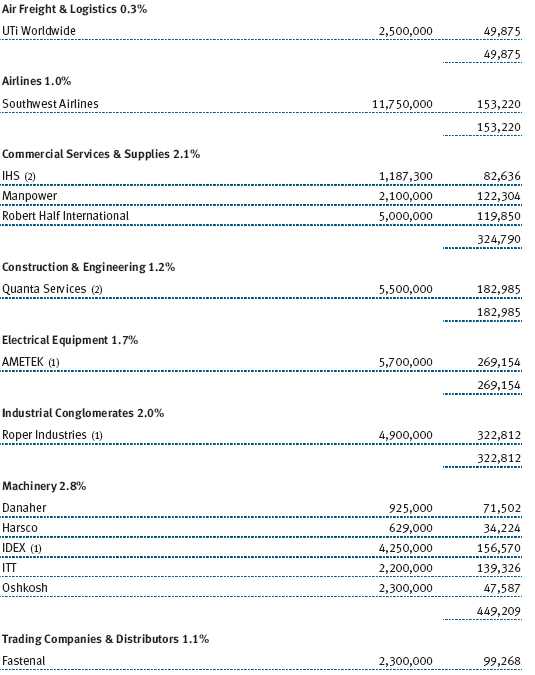

The remainder of our leading detractors were scattered across sectors and declined for company-specific reasons or, more often, as investors consolidated gains. Communications equipment maker Juniper Networks and IT services firm DST Systems declined after solid performances in early 2008. Although its profits and revenues remained strong, Rockwell Collins fell due to concerns about its commercial aviation end market. Specialty truck maker Oshkosh declined after lowering its guidance in response to a slowdown in nonresidential construction. Our financials holdings also weighed on the fund, but less so than in the broader indexes.

INVESTMENT STRATEGY AND OUTLOOK

The three separate headwinds facing the economy that we described earlier—high energy costs, slumping home prices, and credit contraction—are all attributable to the same source: too much easy money for too long. Ultimately, this was a function of a series of missteps by the Federal Reserve. While globalization and financial innovation have increased the forces that can affect how much money is coursing through the financial system, the Fed retains ultimate control over the U.S. monetary system. We are deeply concerned that the Fed has abrogated its role in maintaining a sound money policy. In particular, it seems clear that the Fed kept the federal funds rate at a historically low level (1%) for far too long after the last recession. These exceptionally low rates fostered too much investment in housing on the part of individuals and too much risk taking on the part of lending institutions and investors. The result was that the technology bubble of the late 1990s was followed in short order by a housing bubble driven by a drastic reduction in credit standards. In some respects, the housing bubble was worse than the Internet bubble because many Americans borrowed too much against inflated home values.

Pulling away the proverbial punch bowl and sending the partiers home is never popular. In fact, it’s certain to elicit a chorus of boos from Wall Street bankers, Washington politicians, and even Main Street, who would prefer to let the good times roll indefinitely. However, the checks and balances of a market economy require corrective periods where the excesses of the good times are extinguished. The Greenspan and Bernanke tenures at the Federal Reserve have been dedicated to perpetuating economic growth. While economic downturns are unpleasant, not allowing occasional corrections of excess to take place by pursuing excessively easy monetary policies can lead, ultimately, to a very traumatic period of adjustment. This is where we stand today.

Commodities Bubble Replaces Housing Bubble

The bubbles continue to blow, in our opinion. Even as the housing bubble began to deflate in 2006, a bubble in commodity prices began to emerge. While we share the view that growth in China and elsewhere is fostering a long-term rise in energy demand, this seems insufficient to explain how rapidly the price of oil has increased. Although there may be some truth to the theory that we have passed the peak in world oil production, other commodities without constrained supplies, such as coal, have risen equally as fast. Tellingly, the rise in oil prices has come hand-in-hand with a steep decline in the U.S. dollar. We suspect that oil has become the “anti-dollar,” its price rising alongside skepticism that the U.S. government is committed to maintaining the value of the currency.

When and how will this latest bubble burst? It’s very hard to know. Investor exuberance often persists for longer than one would surmise. Since this bubble is predicated on the notion of emerging market growth, particularly in China, it would not surprise us if an unanticipated slowdown in the Chinese economy pricked it. Inflation is currently running at alarming rates in China, where food and energy prices form a much larger part of consumer spending. Sometimes sudden and significant stock market declines can presage economic weakness; it is worth noting that the Chinese stock market has declined by roughly half this year.

A slowdown in China would have a major effect on U.S. stock valuations, although investors here appear not to have taken this possibility into account. Any security tied to China and its storied effect on the world economy has had a terrific runup in the past several years. This includes many energy and materials stocks, and the fund’s relative performance has suffered from not being as heavily invested in those sectors as our competitors. Indeed, we are reminded somewhat of our position in the late 1990s, when the technology stock party was raging and the Internet was going to change the world. It turns out that the Internet has changed the world, but not to the benefit of those who threw everything they had into overvalued tech stocks. Similarly, we have no doubt that China will exert a major impact on the world economy in the 21st century, but we doubt that this justifies the current relative valuations of many of the companies that are feeding Chinese growth.

Will a Slowing China Help the American Economy?

Indeed, a deceleration in China and other emerging markets, if it proceeds in an orderly fashion, might bode well for the U.S. economy in the months ahead. Slowing Chinese growth might be all it takes for oil prices to fall substantially, if not to the levels they were a few years ago.

It is also notable that high oil prices are resulting in demand destruction in the U.S., Japan, and Europe, where consumers are driving less and otherwise using energy more efficiently. A substantial drop in the price of oil would reduce inflation pressures in the U.S. and allow consumers and businesses to reduce debt levels relative to assets—the inevitable deleveraging process—in an orderly manner. A temporary respite in oil prices could also allow the U.S. more time to adjust to using alternative fuels.

Of course, much bleaker outcomes are possible as well, and they seem to be reflected in the country’s mood. Indeed, national pessimism is as extreme as we have seen it in the 16 years that we have been running this fund. We sense a growing skepticism toward institutions, which has undoubtedly been exacerbated by a lack of leadership from both Congress and the administration. This period seems to bear some similarities with the early 1980s, a time of widespread discontent.

This comparison may not be as dire as it appears at first glance. In 1980, striking Polish dockworkers founded the Solidarity movement, perhaps the first link in a chain of events that eventually led to the reintegration of most of the Communist world into the global economy. In 1981, IBM launched its first successful personal computer, laying the groundwork for the tremendous growth of the PC and software industries over the next two decades. In 1982, future biotechnology giant Genentech scored its first major success when the FDA approved the use of its synthetic human insulin.

Similar developments are undoubtedly at work today. We sense that tremendous opportunities exist in areas such as alternative fuels development, gene-based drug therapies, and digitization of consumer products. We are actively seeking out these new opportunities. While large-cap stocks appear more attractive than small- and mid-cap stocks at this point in the cycle, valuations are reasonable and growth stocks look very attractive relative to value stocks. In the meantime, we are confident that we can profit from our investments in companies that have found a way to adjust to current market conditions and prosper once the business cycle turns.

Above all, we are mindful that the U.S. economy retains great potential and has proven its resilience time and again. We urge shareholders to keep this potential in mind as the economy continues this period of adjustment.

Respectfully submitted,

Brian W.H. Berghuis

President of the fund and chairman of its Investment Advisory Committee

John F. Wakeman

Executive vice president of the fund

July 22, 2008

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

As with all stock and bond mutual funds, the fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. The financial markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. The stocks of mid-cap companies entail greater risk and are usually more volatile than the shares of larger companies. In addition, growth stocks can be volatile for several reasons. Since they usually reinvest a high proportion of earnings in their own businesses, they may lack the dividends usually associated with value stocks that can cushion their decline in a falling market. Also, since investors buy these stocks because of their expected superior earnings growth, earnings disappointments often result in sharp price declines.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

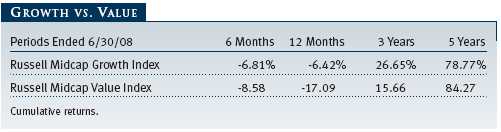

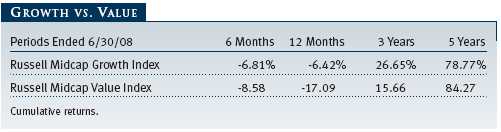

Russell Midcap Growth Index: An unmanaged index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

Russell Midcap Value Index: An unmanaged index that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

S&P MidCap 400 Index: An unmanaged index that tracks the stocks of 400 U.S. mid-cap companies.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

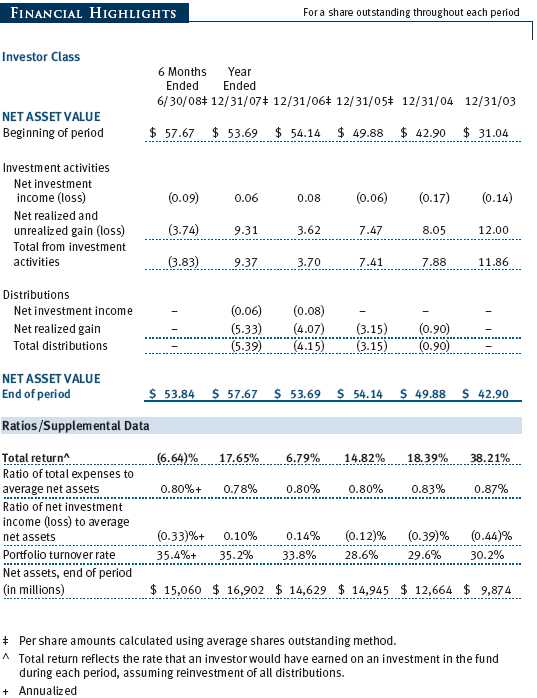

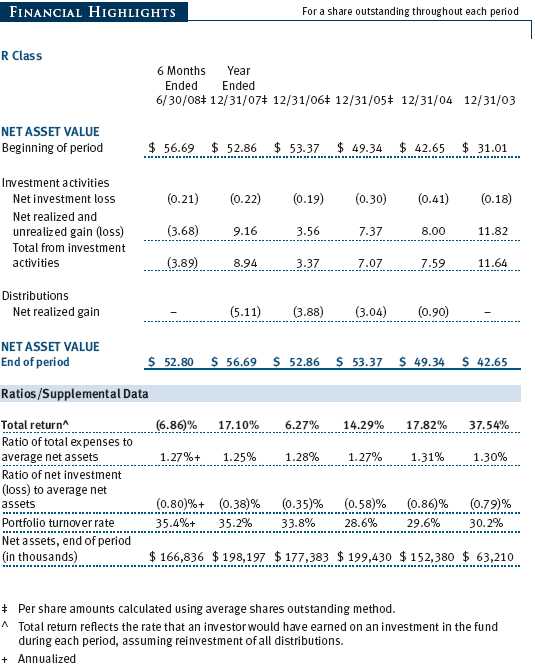

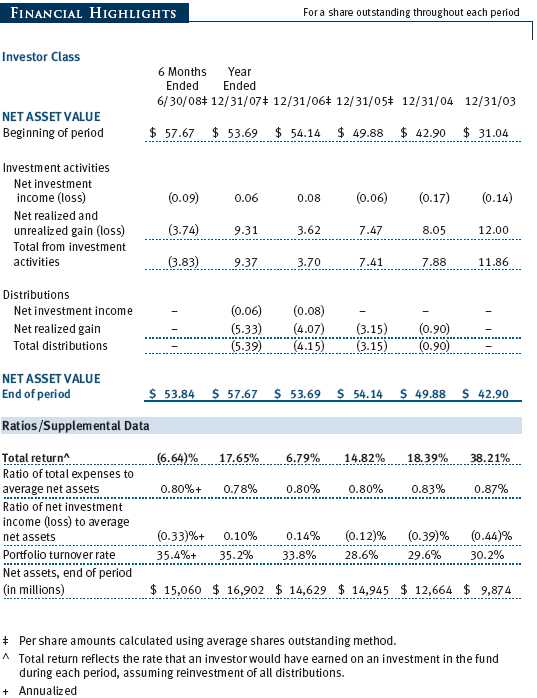

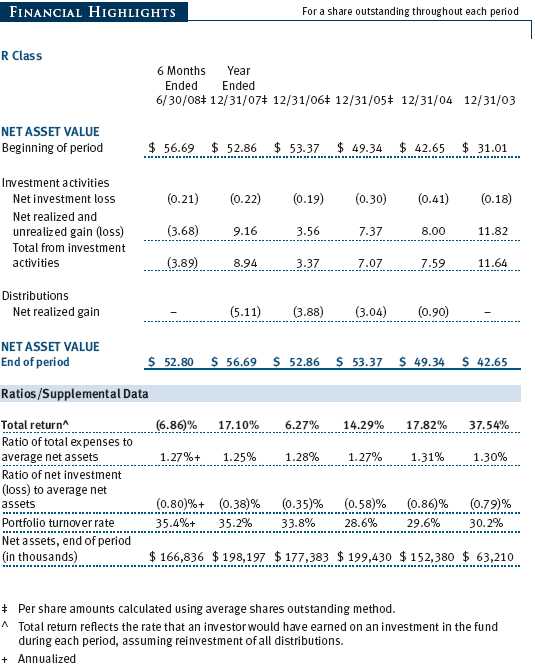

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns had been earned at a constant rate.

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has three share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee; Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee; and R Class shares are available to retirement plans serviced by intermediaries and charge a 0.50% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

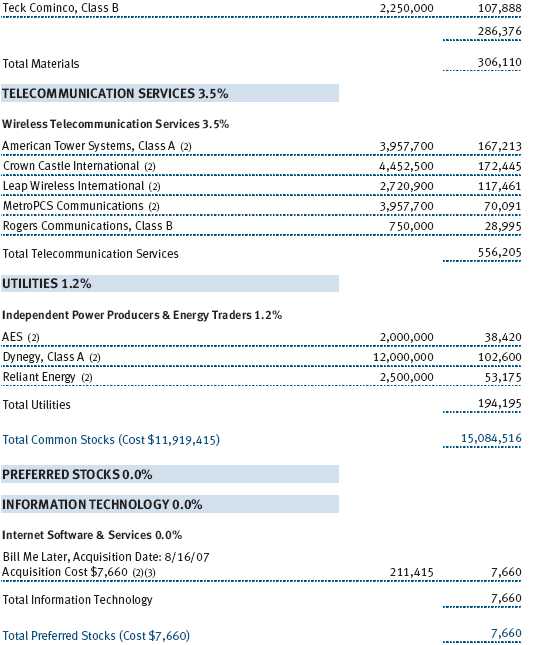

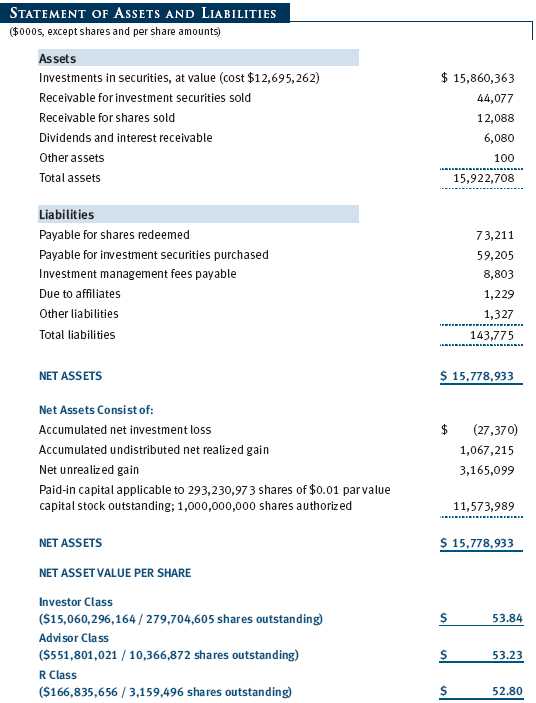

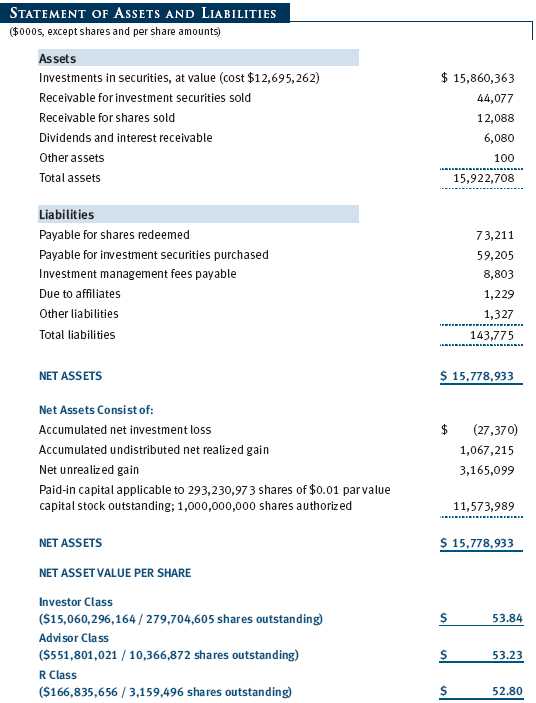

Unaudited

The accompanying notes are an integral part of these financial statements.

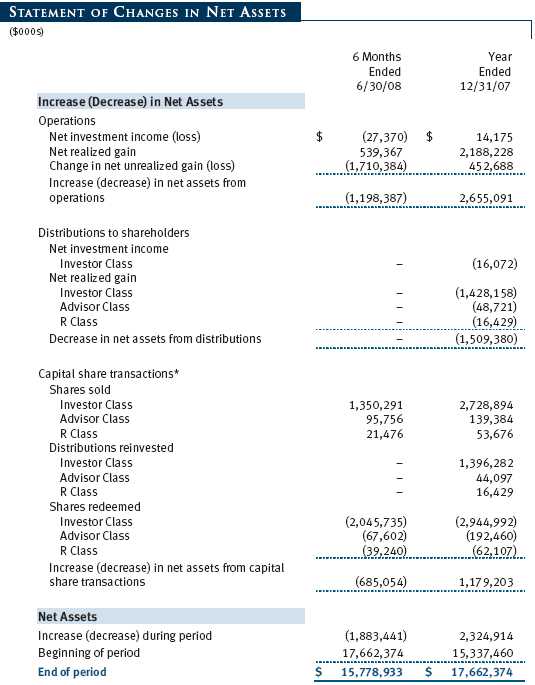

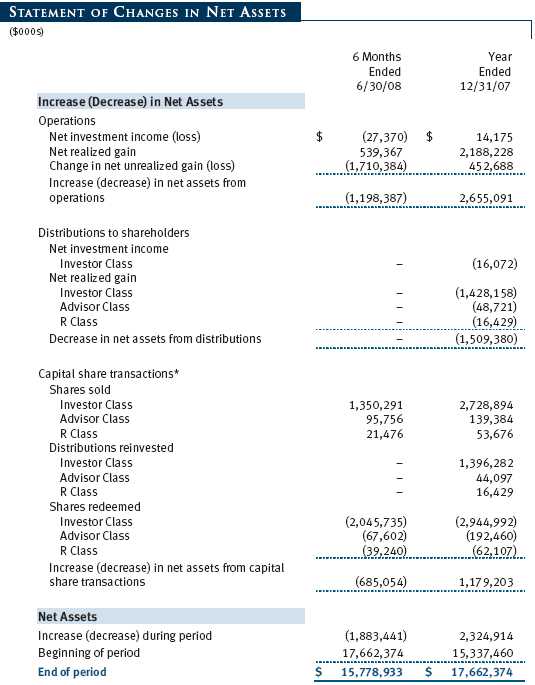

Unaudited

The accompanying notes are an integral part of these financial statements.

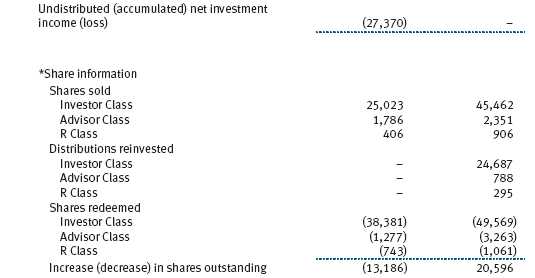

Unaudited

The accompanying notes are an integral part of these financial statements.

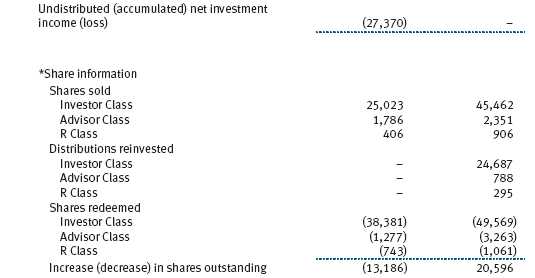

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Mid-Cap Growth Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. The fund has three classes of shares: the Mid-Cap Growth Fund original share class, referred to in this report as the Investor Class, offered since June 30, 1992; the Mid-Cap Growth Fund—Advisor Class (Advisor Class), offered since March 31, 2000; and the Mid-Cap Growth Fund—R Class (R Class), offered since September 30, 2002. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries, and R Class shares are available to retirement plans serviced by intermediaries. The Advisor Class and R Class each operate under separate Board-approved Rule 12b-1 plans, pursuant to which each class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services. Each class has exclusive voting rights on matters related solely to that class, separate voting rights on matters that relate to all classes, and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class on an annual basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class and R Class each pay distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% and 0.50%, respectively, of the class’s average daily net assets during the period ended June 30, 2008. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $269,000 for the six months ended June 30, 2008. Additionally, the fund earns credits on temporarily uninvested cash balances at the custodian that reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the six months ended June 30, 2008, the fund realized $191,796,000 of net gain on $429,207,000 of in-kind redemptions.

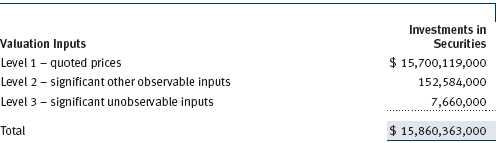

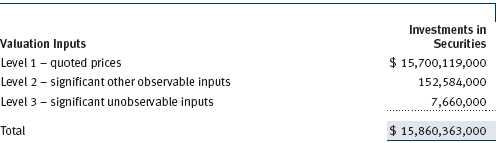

New Accounting Pronouncements On January 1, 2008, the fund adopted Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements. FAS 157 defines fair value, establishes the framework for measuring fair value, and expands the disclosures of fair value measurements in the financial statements. Adoption of FAS 157 did not have a material impact on the fund’s net assets or results of operations.

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”), which is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance and cash flows. Management is currently evaluating the impact the adoption of FAS 161 will have on the fund’s financial statements and related disclosures.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under FAS 157. The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

Valuation Inputs Various inputs are used to determine the value of the fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices, because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s investments, based on the inputs used to determine their values on June 30, 2008:

NOTE 3 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Other Purchases and sales of portfolio securities, other than short-term securities, aggregated $2,733,014,000 and $3,238,935,000, respectively, for the six months ended June 30, 2008.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions are determined in accordance with Federal income tax regulations, which differ from generally accepted accounting principles, and, therefore, may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of June 30, 2008.

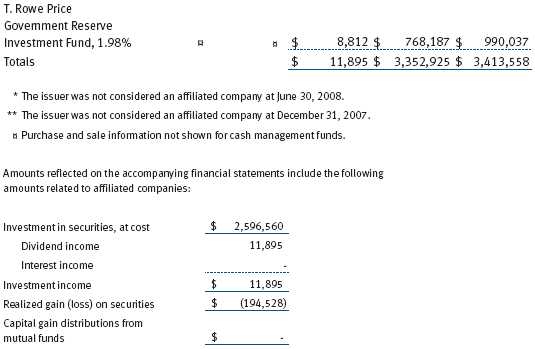

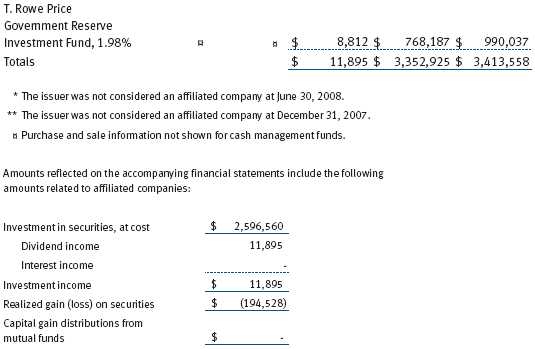

At June 30, 2008, the cost of investments for federal income tax purposes was $12,695,262,000. Net unrealized gain aggregated $3,165,099,000 at period-end, of which $4,261,296,000 related to appreciated investments and $1,096,196,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly.

The fee consists of an individual fund fee and a group fee. The individual fund fee is equal to 0.35% of the fund’s average daily net assets up to $15 billion and 0.30% of the fund’s average daily net assets in excess of $15 billion. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At June 30, 2008, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class and R Class. For the six months ended June 30, 2008, expenses incurred pursuant to these service agreements were $68,000 for Price Associates, $1,762,000 for T. Rowe Price Services, Inc., and $3,816,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the six months ended June 30, 2008, the fund was charged $114,000 for shareholder servicing costs related to the college savings plans, of which $99,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At June 30, 2008, approximately 1% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Retirement Funds (Retirement Funds) may invest. The Retirement Funds do not invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to a special servicing agreement, expenses associated with the operation of the Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Retirement Funds. Expenses allocated under this agreement are reflected as shareholder servicing expense in the accompanying financial statements. For the six months ended June 30, 2008, the fund was allocated $1,474,000 of Retirement Funds’ expenses, of which $1,118,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At June 30, 2008, approximately 9% of the outstanding shares of the Investor Class were held by the Retirement Funds.

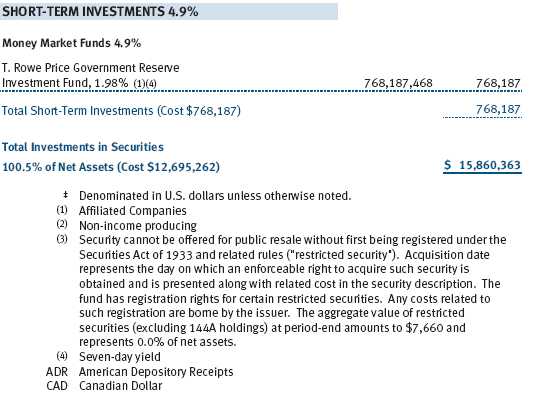

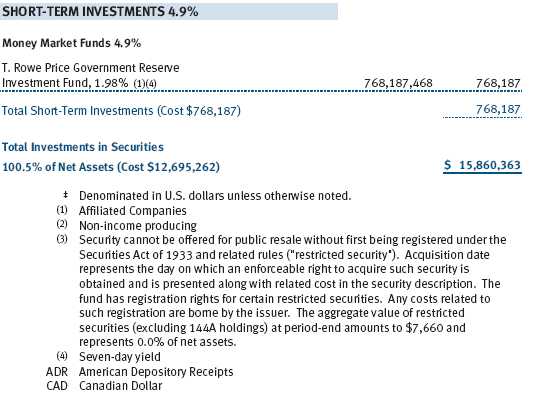

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of June 30, 2008, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 68,622 shares of the fund, representing less than 1% of the fund’s net assets.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 4, 2008, the fund’s Board of Directors (Board) unanimously approved the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Manager). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods as well as the fund’s year-by-year returns and compared these returns with previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board noted that soft dollars were not used to pay for third-party, non-broker research. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Manager’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. Under the Contract, the fund pays a fee to the Manager composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio (for the Investor Class, Advisor Class, and R Class) and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate for all three classes and expense ratio for the Investor Class and Advisor Class were at or below the median for comparable funds and that the expense ratio for the R Class was above the median for comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Mid-Cap Growth Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2008 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2008 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | August 20, 2008 |