UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-03833

MAINSTAY VP FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Item 1. Reports to Stockholders.

MainStay VP Cornerstone Growth Portfolio

Message from the President and Semiannual Report

Unaudited | June 30, 2017

Sign up for electronic delivery of your shareholder reports. For full details on electronic delivery, including who can participate and what you

can receive via eDelivery, please log on to www.newyorklife.com/vsc

This page intentionally left blank

Message from the President

The six months ended June 30, 2017, brought positive results to many stock and bond investors. The year began with many investors hoping that Republican control of the White House, the Senate and the House of Representatives could bring an end to political gridlock; and while debate has continued on a number of issues, the U.S. stock market climbed relatively steadily throughout the first half of 2017.

According to FTSE-Russell U.S. market data, stocks at all capitalization levels tended to record positive total returns during the reporting period, with large-cap stocks generally outperforming stocks of smaller-capitalization companies. Growth stocks outpaced value stocks at every capitalization level by substantial margins—from more than six percentage points for micro-caps and mid-caps to more than 10 percentage points for the largest 200 U.S. companies by market capitalization.

Most sectors of the stock market advanced during the reporting period, with energy and telecommunication services being notable exceptions. Energy stocks declined as oil prices fell despite moves by the Organization of Petroleum Exporting Countries (OPEC) intended to limit oil production by its members. Telecommunication services stocks tended to decline as competition increased and rising interest rates made dividend payouts less appealing.

In March and June of 2017, the Federal Reserve announced successive increases in the target range for the federal funds rate, ultimately bringing the federal funds target range to 1.00% to 1.25%. While short-term U.S. Treasury yields rose in response, yields for U.S. Treasury securities with maturities of five years or longer declined. As the difference between short- and long-term yields narrowed, the advantages of higher-yielding long-term bonds became increasingly apparent.

Virtually all taxable and tax-exempt bond sectors provided positive total returns during the reporting period. Mortgage-backed

securities, though providing positive total returns, faced headwinds when the Federal Reserve announced plans to begin normalizing its balance sheet by reducing reinvestment of principal payments on mortgage-backed securities.

International stock and bond markets were also strong during the reporting period. International stocks provided double-digit total returns that were surpassed by emerging-market stocks as a whole. Global investment-grade bonds provided single-digit returns; and emerging-market debt was somewhat stronger.

Even during periods of favorable market performance and generally positive returns, MainStay believes that it is important to carefully monitor your investments. Your risk tolerance may

change over time, leading you to reevaluate which MainStay VP Portfolios are most appropriate for your long-term goals. Your goals themselves may also change, leading you to pursue investments with more or less risk. The portfolio managers of MainStay VP Portfolios seek to provide results consistent with the investment objectives of their respective Portfolios, to give you a wide range of choices suitable to various investment needs.

The report that follows provides more detailed information about the specific markets, securities and investment decisions that influenced your MainStay VP Portfolio during the six months ended June 30, 2017. We invite you to review the report carefully as part of your ongoing investment evaluation and review.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of the accompanying report and are subject to change. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Portfolio’s Summary Prospectus and/or Prospectus and consider the Portfolio’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Portfolio. You may obtain copies of the Portfolio’s Summary Prospectus and/or the Prospectus and the Statement of Additional Information free of charge, upon request, by calling toll-free 800-598-2019, by writing to New York Life Insurance and Annuity Corporation, 51 Madison Avenue, Room 251, New York, New York 10010 or by sending an email to MainStayShareholdersServices@nylim.com. These documents are also available at mainstayinvestments.com/vpdocuments. Please read the Summary Prospectus and/or Prospectus carefully before investing. MainStay VP Funds Trust portfolios are separate account options which are purchased through a variable insurance or variable annuity contract.

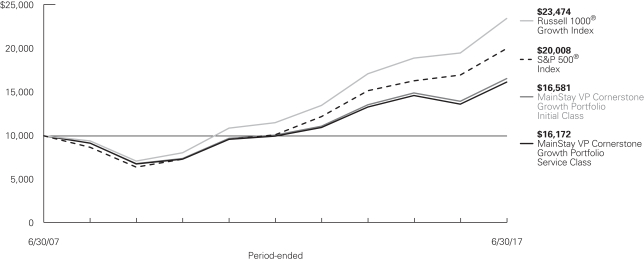

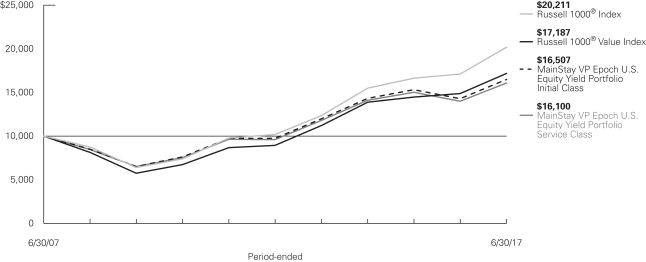

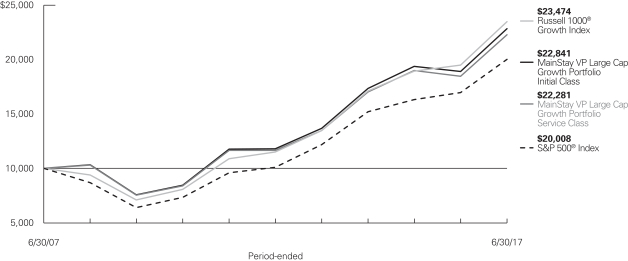

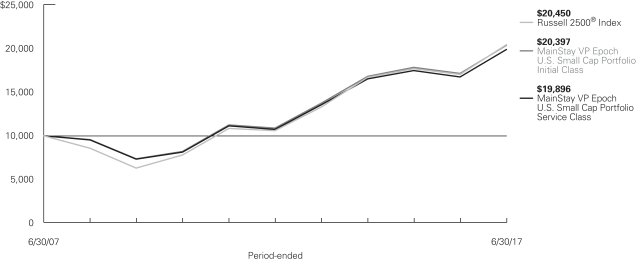

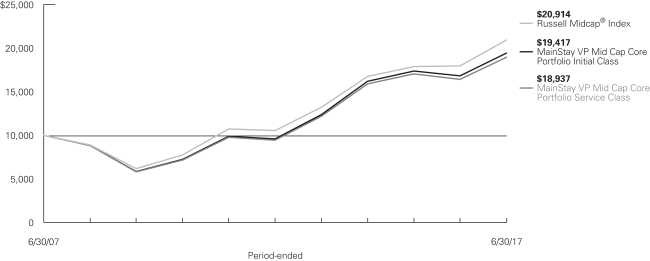

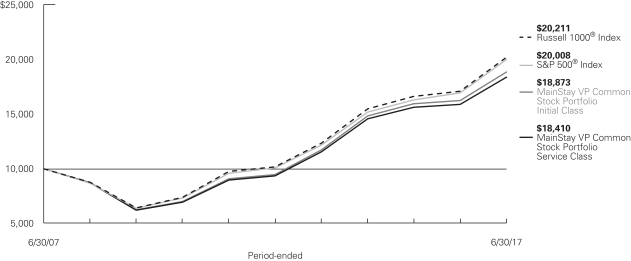

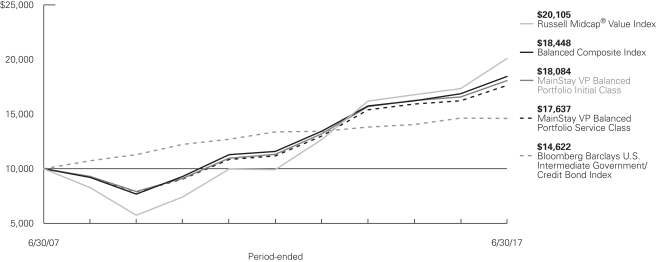

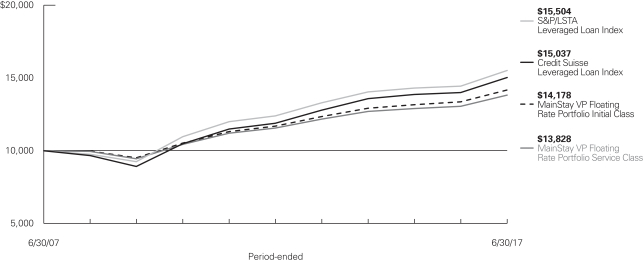

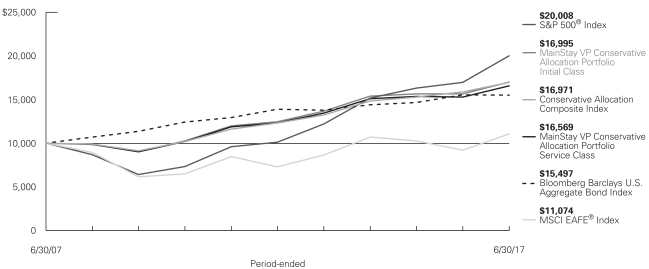

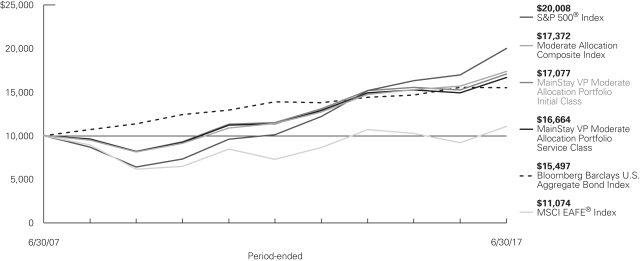

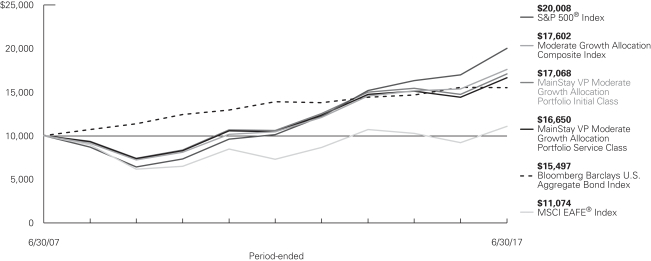

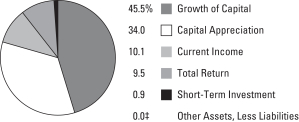

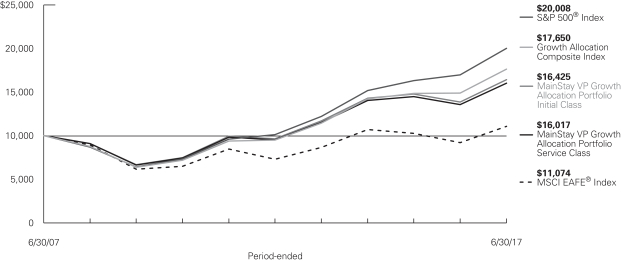

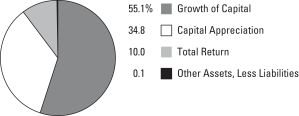

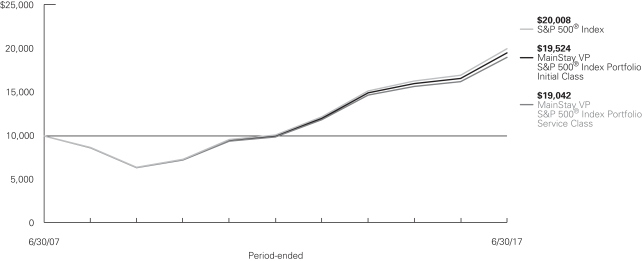

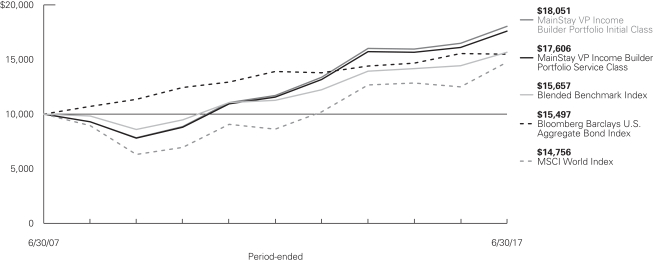

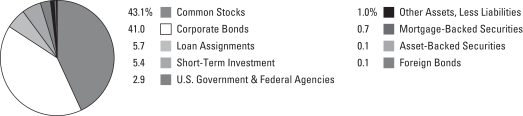

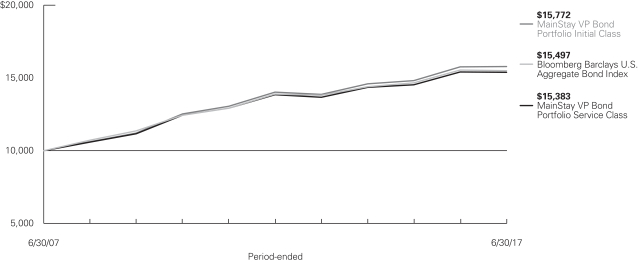

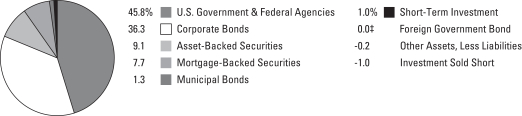

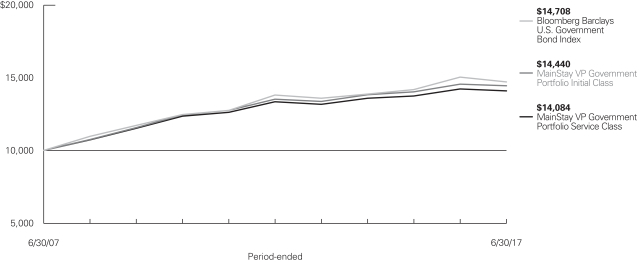

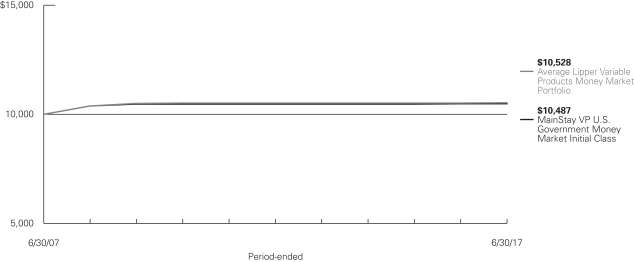

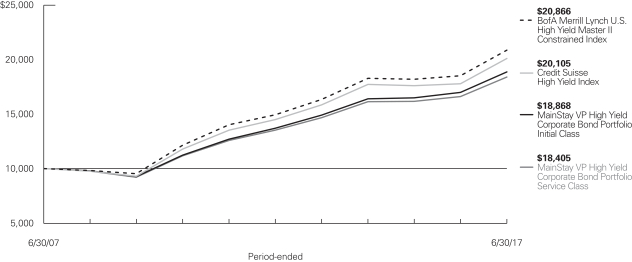

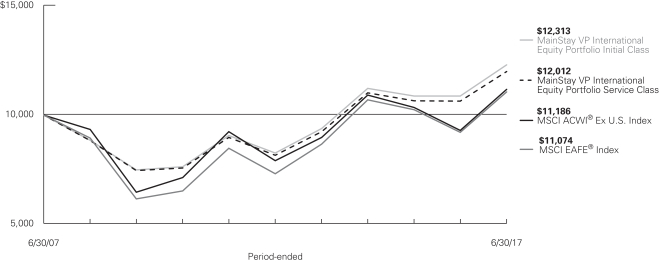

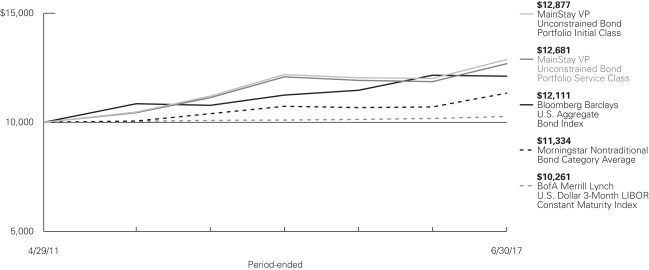

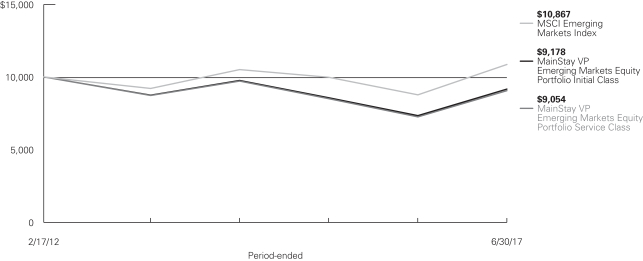

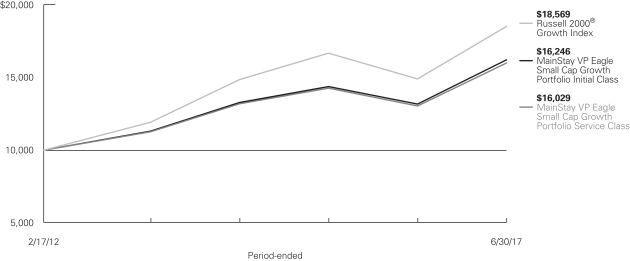

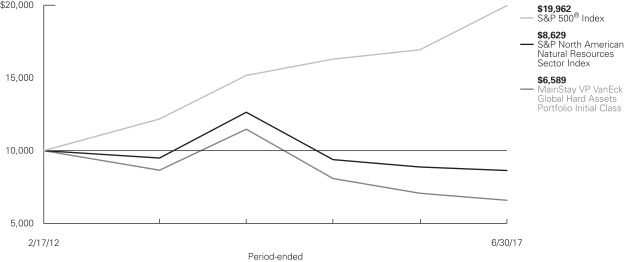

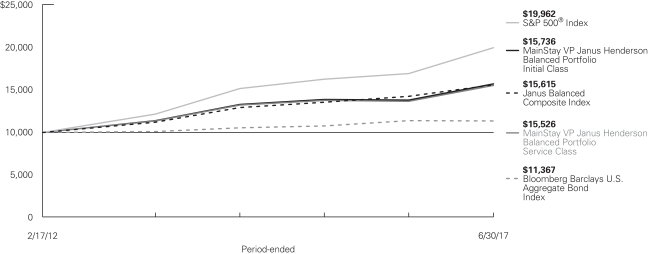

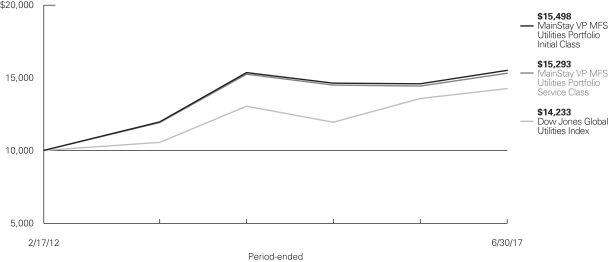

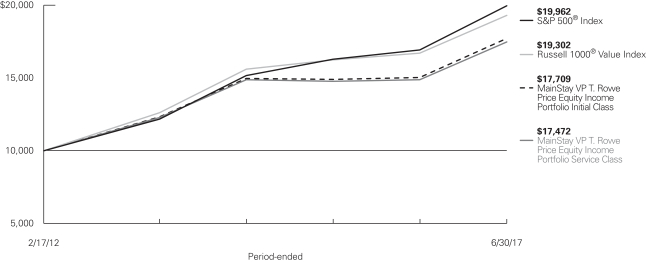

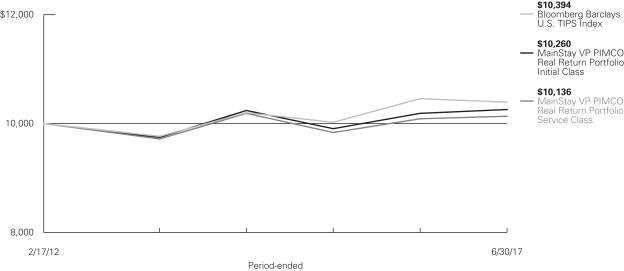

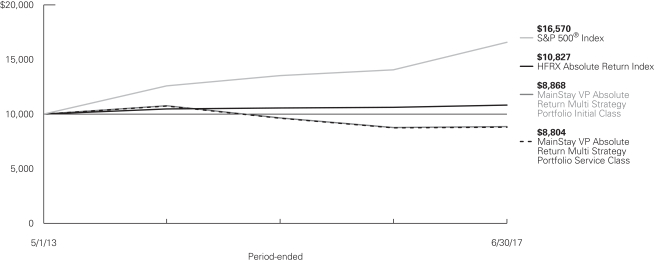

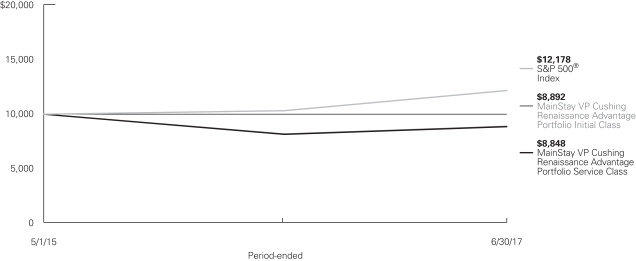

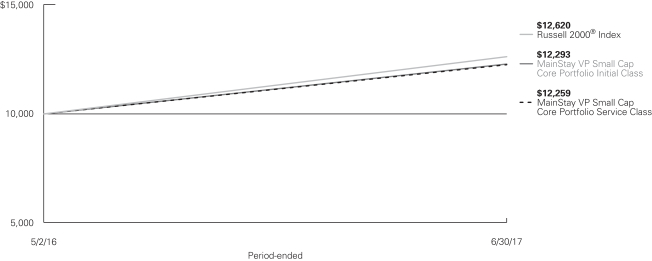

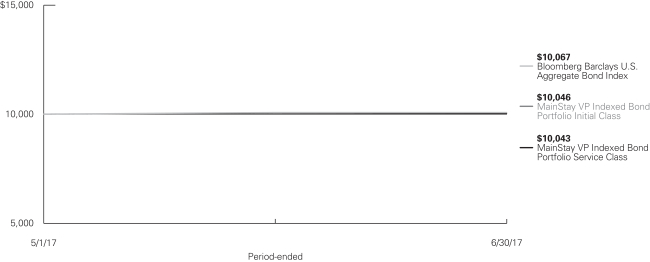

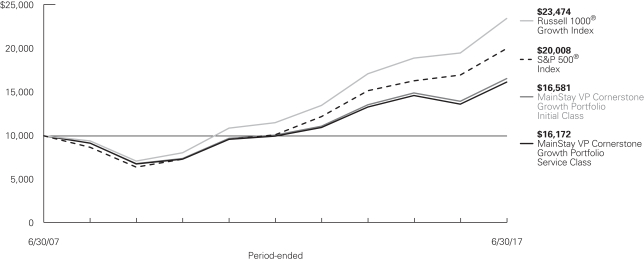

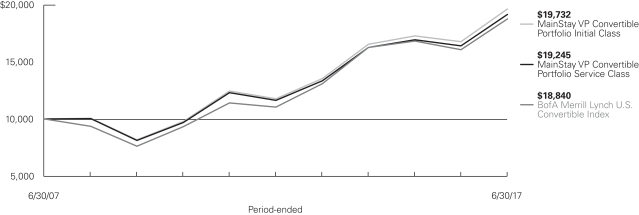

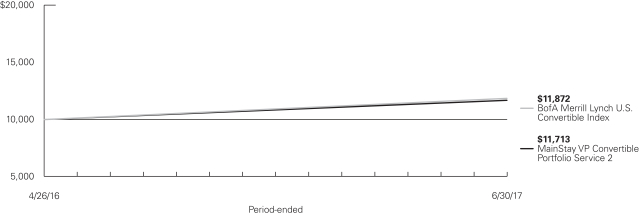

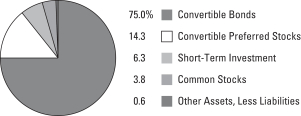

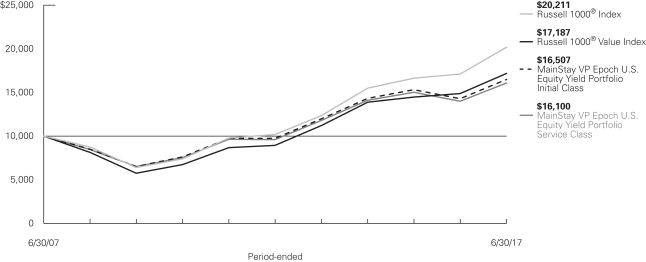

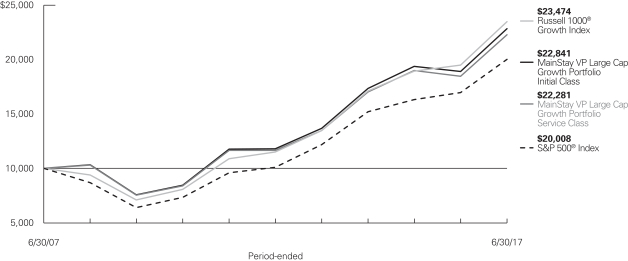

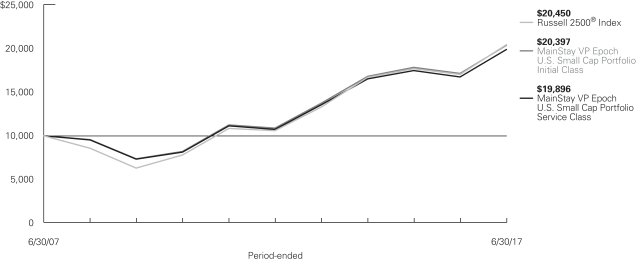

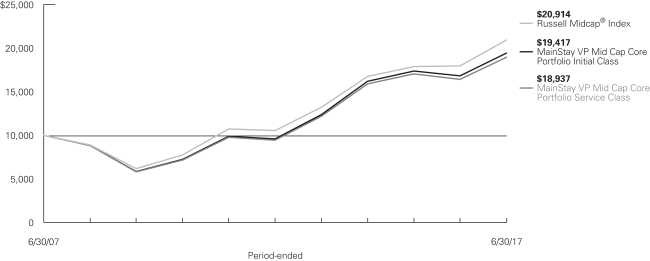

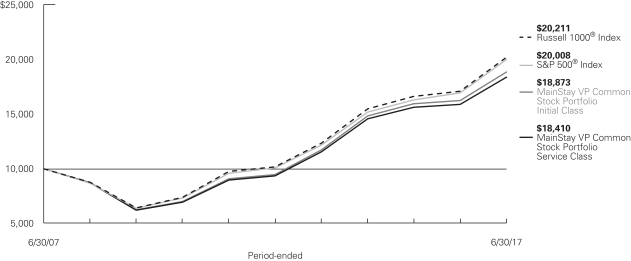

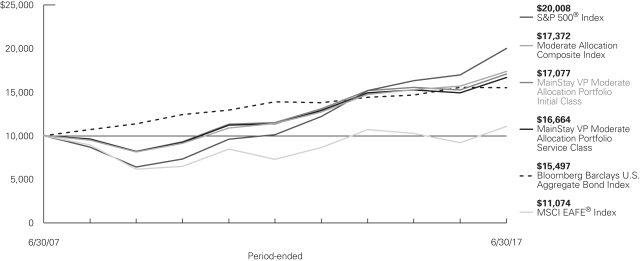

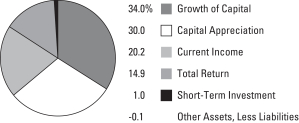

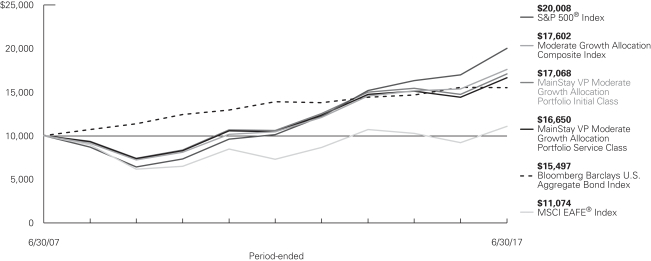

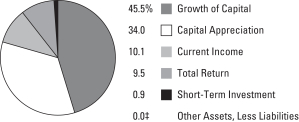

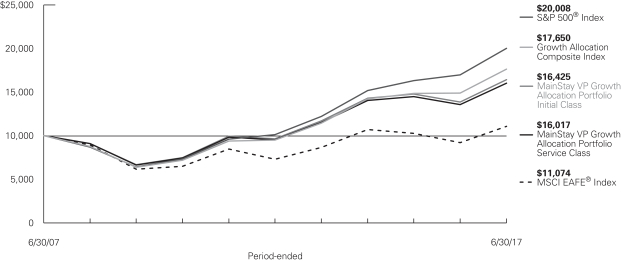

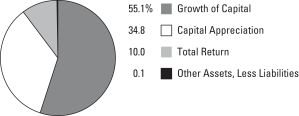

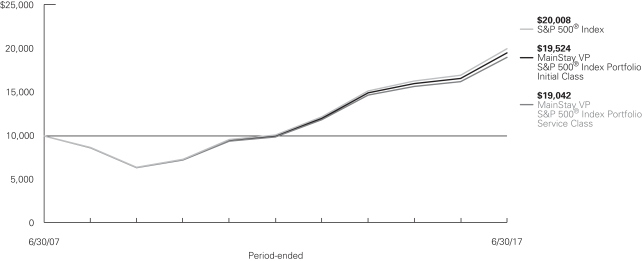

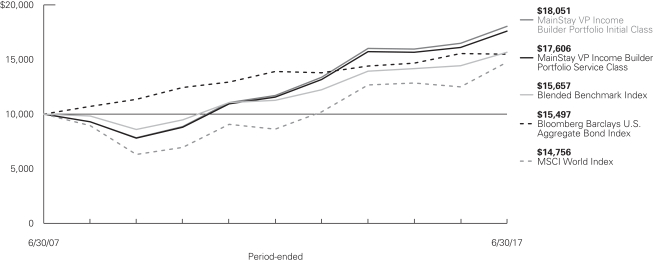

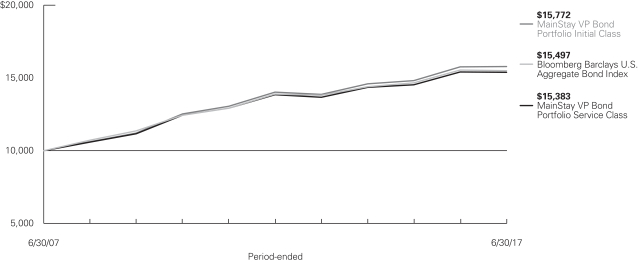

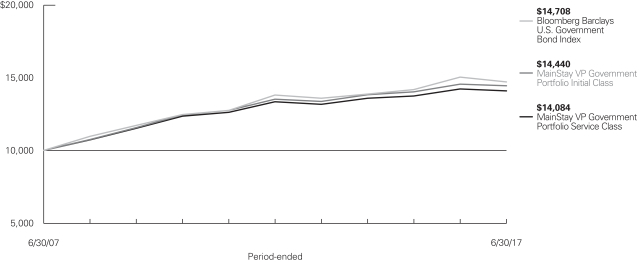

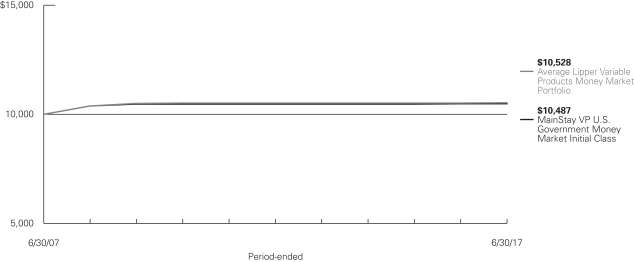

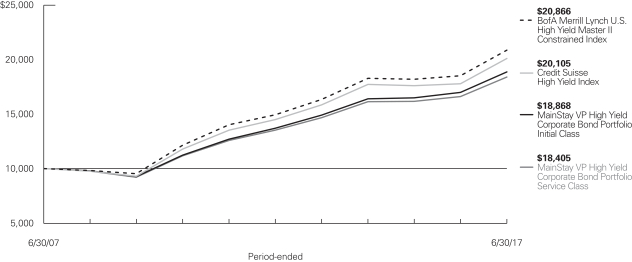

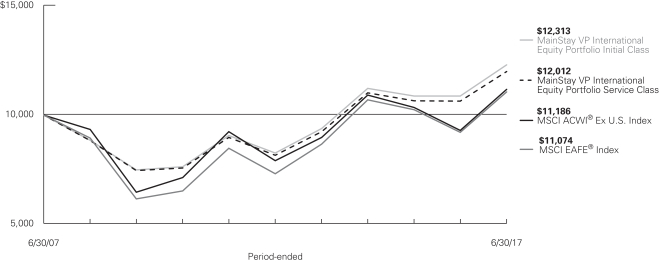

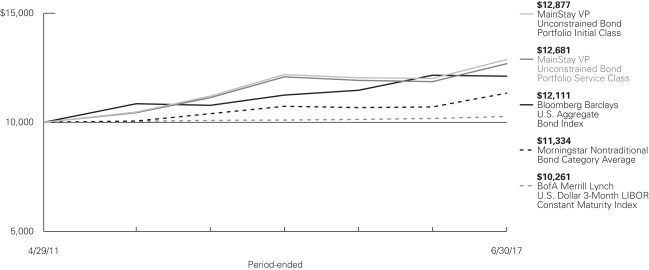

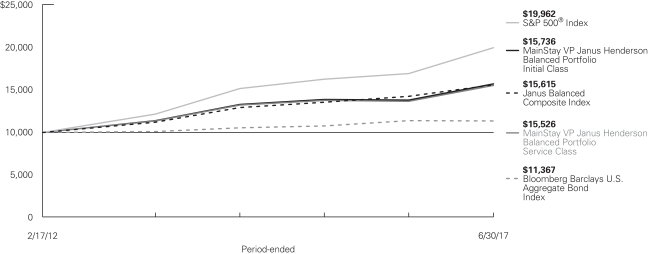

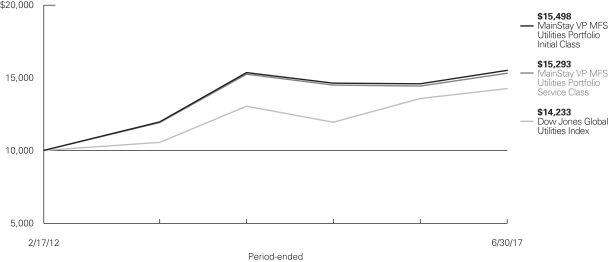

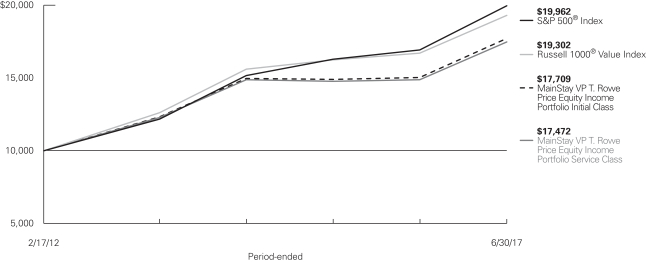

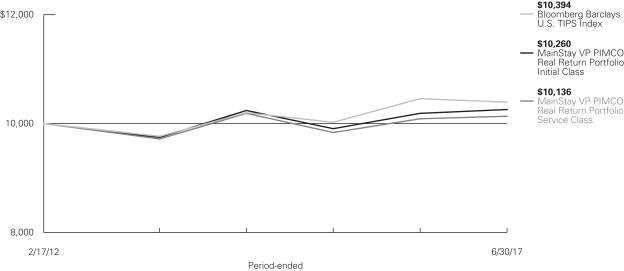

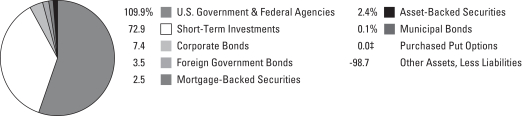

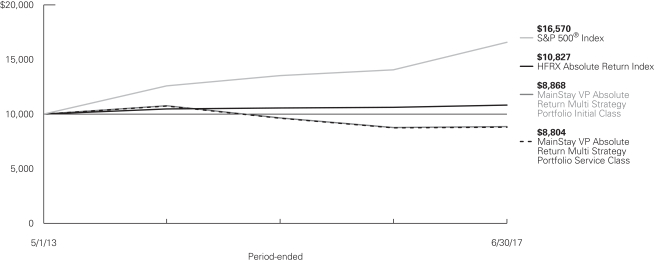

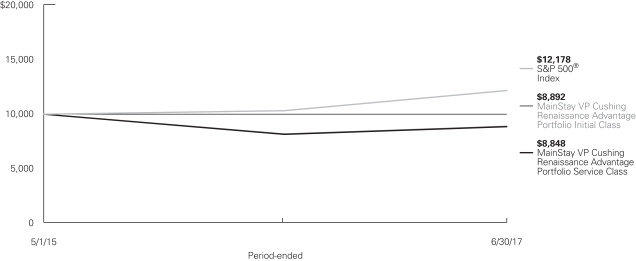

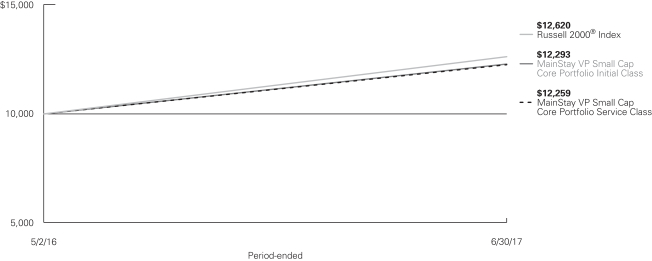

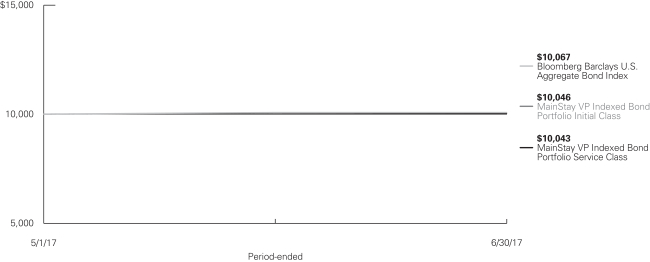

Investment and Performance Comparison (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The performance table and graph do not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. Please refer to the Performance Summary appropriate for your policy. For performance information current to the most recent month-end, please call 800-598-2019 or visit www.newyorklife.com.

Average Annual Total Returns for the Period Ended June 30, 2017

| | | | | | | | | | | | | | | | | | | | | | |

| Class | | Inception Date | | Six Months | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio1 | |

| Initial Class Shares | | 1/29/1993 | | | 12.44 | % | | | 18.81 | % | | | 10.46 | % | | | 5.19 | % | | | 0.77 | % |

| Service Class Shares | | 6/5/2003 | | | 12.30 | | | | 18.51 | | | | 10.18 | | | | 4.92 | | | | 1.02 | |

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One

Year | | | Five

Years | | | Ten

Years | |

Russell 1000® Growth Index2 | | | 13.99 | % | | | 20.42 | % | | | 15.30 | % | | | 8.91 | % |

S&P 500® Index3 | | | 9.34 | | | | 17.90 | | | | 14.63 | | | | 7.18 | |

Average Lipper Variable Products Multi-Cap Growth Portfolio4 | | | 15.32 | | | | 20.16 | | | | 13.39 | | | | 7.49 | |

| 1. | The gross expense ratios presented reflect the Portfolio’s “Total Annual Portfolio Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 2. | The Russell 1000® Growth Index is the Portfolio’s primary broad-based securities market index for comparison purposes. The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 3. | The S&P 500® Index is the Portfolio’s secondary benchmark. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is |

| | widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 4. | The Average Lipper Variable Products Multi-Cap Growth Portfolio is representative of portfolios that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap growth portfolios typically have above-average characteristics compared to the S&P SuperComposite 1500 Index. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar portfolios with all dividend and capital gain distributions reinvested. |

Cost in Dollars of a $1,000 Investment in MainStay VP Cornerstone Growth Portfolio (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from January 1, 2017 to June 30, 2017, and the impact of those costs on your investment.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2017 to June 30, 2017.

This example illustrates your Portfolio’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June 30, 2017. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Portfolio with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

1/1/17 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/17 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/17 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2 | |

| | | | | | |

| Initial Class Shares | | $ | 1,000.00 | | | $ | 1,124.40 | | | $ | 3.95 | | | $ | 1,021.10 | | | $ | 3.76 | | | | 0.75 | % |

| | | | | | |

| Service Class Shares | | $ | 1,000.00 | | | $ | 1,123.00 | | | $ | 5.26 | | | $ | 1,019.80 | | | $ | 5.01 | | | | 1.00 | % |

| 1. | Expenses are equal to the Portfolio’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 181 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| 2. | Expenses are equal to the Portfolio’s annualized expense ratio to reflect the six-month period. |

| | |

| 6 | | MainStay VP Cornerstone Growth Portfolio |

Industry Composition as of June 30, 2017 (Unaudited)

| | | | |

| Internet Software & Services | | | 9.0 | % |

| Technology Hardware, Storage & Peripherals | | | 8.0 | |

| Software | | | 7.7 | |

| Health Care Providers & Services | | | 6.4 | |

| Hotels, Restaurants & Leisure | | | 6.0 | |

| Biotechnology | | | 5.7 | |

| Internet & Direct Marketing Retail | | | 5.6 | |

| Semiconductors & Semiconductor Equipment | | | 5.4 | |

| IT Services | | | 5.2 | |

| Specialty Retail | | | 4.5 | |

| Media | | | 3.7 | |

| Equity Real Estate Investment Trusts (REITs) | | | 2.7 | |

| Tobacco | | | 2.5 | |

| Aerospace & Defense | | | 2.4 | |

| Beverages | | | 2.0 | |

| Capital Markets | | | 2.0 | |

| Industrial Conglomerates | | | 1.8 | |

| Health Care Equipment & Supplies | | | 1.6 | |

| Machinery | | | 1.5 | |

| Electronic Equipment, Instruments & Components | | | 1.4 | |

| Airlines | | | 1.2 | |

| Chemicals | | | 1.2 | |

| Food Products | | | 1.1 | |

| Insurance | | | 1.1 | |

| Containers & Packaging | | | 1.0 | |

| | | | |

| Banks | | | 0.9 | % |

| Household Durables | | | 0.9 | |

| Diversified Consumer Services | | | 0.6 | |

| Diversified Telecommunication Services | | | 0.6 | |

| Life Sciences Tools & Services | | | 0.6 | |

| Professional Services | | | 0.6 | |

| Textiles, Apparel & Luxury Goods | | | 0.6 | |

| Trading Companies & Distributors | | | 0.6 | |

| Oil, Gas & Consumable Fuels | | | 0.5 | |

| Pharmaceuticals | | | 0.5 | |

| Air Freight & Logistics | | | 0.4 | |

| Automobiles | | | 0.4 | |

| Commercial Services & Supplies | | | 0.4 | |

| Wireless Telecommunication Services | | | 0.4 | |

| Communications Equipment | | | 0.3 | |

| Health Care Technology | | | 0.3 | |

| Household Products | | | 0.3 | |

| Auto Components | | | 0.2 | |

| Food & Staples Retailing | | | 0.1 | |

| Road & Rail | | | 0.1 | |

| Personal Products | | | 0.0 | ‡ |

| Short-Term Investment | | | 0.0 | ‡ |

| Other Assets, Less Liabilities | | | 0.0 | ‡ |

| | | | |

| | | 100.0 | % |

| | | | |

See Portfolio of Investments beginning on page 10 for specific holdings within these categories.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings as of June 30, 2017 (excluding short-term investment) (Unaudited)

| 7. | UnitedHealth Group, Inc. |

Portfolio Management Discussion and Analysis (Unaudited)

Answers to the questions reflect the views of Andrew Ver Planck, CFA, and Migene Kim, CFA, of Cornerstone Capital Management Holdings LLC, the Portfolio’s subadvisor.

How did MainStay VP Cornerstone Growth Portfolio perform relative to its benchmarks and peers during the six months ended June 30, 2017?

For the six months ended June 30, 2017, MainStay VP Cornerstone Growth Portfolio returned 12.44% for Initial Class shares and 12.30% for Service Class shares. Over the same period, both share classes underperformed the 13.99% return of the Russell 1000® Growth Index,1 which is the Portfolio’s primary benchmark. Over the same period, both share classes outperformed the 9.34% return of the S&P 500® Index,1 which is a secondary benchmark of the Portfolio. Both share classes underperformed the 15.32% return of the Average Lipper2 Variable Products Multi-Cap Growth Portfolio for the six months ended June 30, 2017.

What factors affected the Portfolio’s relative performance during the reporting period?

Stock selection detracted from the Portfolio’s performance relative to the Russell 1000® Growth Index during the reporting period. Allocation effects—being overweight or underweight specific sectors as a result of the Portfolio’s bottom-up stock selection process—had a modestly negative impact on relative performance during the reporting period.

Which sectors were the strongest positive contributors to the Portfolio’s relative performance, and which sectors were particularly weak?

During the reporting period, the industrials, consumer discretionary and telecommunication services sectors made the strongest positive contributions to the Portfolio’s performance relative to the Russell 1000® Growth Index. (Contributions take weightings and total returns into account.) The contributions in these sectors were driven by favorable stock selection.

The weakest sector contributions to the Portfolio’s relative performance came from the health care, materials and energy sectors. Unfavorable stock selection detracted in health care and materials. An overweight position in the underperforming energy sector—and an underweight position in the outperforming health care sector—also detracted from the Portfolio’s relative performance.

During the reporting period, which individual stocks made the strongest positive contributions to the Portfolio’s absolute performance and which stocks detracted the most?

During the reporting period, the strongest positive contributor to absolute performance was technology company Apple. Best known for its iPhone, the company continued to deliver strong sales and earnings growth. E-commerce company Amazon.com also performed well, led by strong growth in its online retail platform and its web services business. The Portfolio’s position in social media company Facebook delivered strong absolute performance, aided by strong user adoption of the company’s platform and strong trends in advertising revenue.

On an absolute basis, the Portfolio’s weakest stock performer was steel producer United States Steel, which declined after reporting operating results well below expectations on continued weakness and supply concerns within the commodity segment. Akamai Technologies was another Portfolio holding that was weak on an absolute basis. The company optimizes and secures content and business applications over the Internet, and its stock fell on declining trends in the media segment of Akamai Technologies’ business. Brinker International, an owner and operator of casual-dining restaurants such as the Chili’s franchise, was also weak. The stock came under pressure because of slowing sales.

Did the Portfolio make any significant purchases or sales during the reporting period?

The Portfolio entered into new positions in health care distribution company McKesson and tobacco company Phillip Morris International, moving the Portfolio to overweight positions relative to the Russell 1000® Growth Index in these stocks. We believed that McKesson had exhibited attractive cash flow–based valuation and improving price and earnings trends. We believed that Phillip Morris International had maintained a reasonable valuation perspective and that the company had also exhibited strong earnings trends.

The Portfolio exited positions in defense contractor Northrop Grumman and in food services company Sysco. The Portfolio sold its position in Northrop Grumman because of what we considered to be an expensive valuation and a lack of earnings growth potential. Sysco was sold mainly because of poor cash flows and deteriorating industry trends.

How did the Portfolio’s sector weightings change during the reporting period?

During the reporting period, the Portfolio modestly increased its weightings relative to the Russell 1000® Growth Index in health care and real estate. Over the same period, the Portfolio

| 1. | See footnote on page 5 for more information on this index. |

| 2. | See footnote on page 5 for more information on Lipper Inc. |

| | |

| 8 | | MainStay VP Cornerstone Growth Portfolio |

modestly reduced its weightings relative to the Index in information technology and energy.

How was the Portfolio positioned at the end of the reporting period?

As of June 30, 2017, the Portfolio held modestly overweight positions relative to the Russell 1000® Growth Index in the consumer discretionary and health care sectors. As of the same date, the Portfolio held modestly underweight positions relative to the Index in industrials and materials.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

Portfolio of Investments June 30, 2017 (Unaudited)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks 99.4%† | |

Aerospace & Defense 2.4% | |

Boeing Co. | | | 37,090 | | | $ | 7,334,548 | |

Lockheed Martin Corp. | | | 9,835 | | | | 2,730,294 | |

Spirit AeroSystems Holdings, Inc. Class A | | | 25,861 | | | | 1,498,386 | |

| | | | | | | | |

| | | | | | | 11,563,228 | |

| | | | | | | | |

Air Freight & Logistics 0.4% | |

United Parcel Service, Inc. Class B | | | 3,762 | | | | 416,039 | |

XPO Logistics, Inc. (a) | | | 21,598 | | | | 1,395,879 | |

| | | | | | | | |

| | | | | | | 1,811,918 | |

| | | | | | | | |

Airlines 1.2% | |

Copa Holdings S.A. Class A | | | 10,932 | | | | 1,279,044 | |

Southwest Airlines Co. | | | 67,439 | | | | 4,190,659 | |

| | | | | | | | |

| | | | | | | 5,469,703 | |

| | | | | | | | |

Auto Components 0.2% | |

Lear Corp. | | | 7,802 | | | | 1,108,508 | |

| | | | | | | | |

|

Automobiles 0.4% | |

Tesla, Inc. (a) | | | 4,979 | | | | 1,800,456 | |

| | | | | | | | |

|

Banks 0.3% | |

Bank of America Corp. | | | 28,423 | | | | 689,542 | |

First Hawaiian, Inc. | | | 6,880 | | | | 210,666 | |

JPMorgan Chase & Co. | | | 4,569 | | | | 417,606 | |

| | | | | | | | |

| | | | | | | 1,317,814 | |

| | | | | | | | |

Beverages 2.0% | | | | | | | | |

Coca-Cola Co. | | | 59,133 | | | | 2,652,115 | |

Constellation Brands, Inc. Class A | | | 9,659 | | | | 1,871,238 | |

PepsiCo., Inc. | | | 41,461 | | | | 4,788,331 | |

| | | | | | | | |

| | | | | | | 9,311,684 | |

| | | | | | | | |

Biotechnology 5.7% | | | | | | | | |

¨AbbVie, Inc. | | | 102,506 | | | | 7,432,710 | |

Amgen, Inc. | | | 35,484 | | | | 6,111,409 | |

Biogen, Inc. (a) | | | 8,268 | | | | 2,243,605 | |

Celgene Corp. (a) | | | 27,524 | | | | 3,574,542 | |

Gilead Sciences, Inc. | | | 84,844 | | | | 6,005,258 | |

United Therapeutics Corp. (a) | | | 10,440 | | | | 1,354,381 | |

| | | | | | | | |

| | | | | | | 26,721,905 | |

| | | | | | | | |

Capital Markets 2.0% | | | | | | | | |

Lazard, Ltd. Class A | | | 56,628 | | | | 2,623,575 | |

LPL Financial Holdings, Inc. | | | 63,599 | | | | 2,700,414 | |

S&P Global, Inc. | | | 28,715 | | | | 4,192,103 | |

| | | | | | | | |

| | | | | | | 9,516,092 | |

| | | | | | | | |

Chemicals 1.2% | | | | | | | | |

Chemours Co. | | | 36,494 | | | | 1,383,852 | |

E.I. du Pont de Nemours & Co. | | | 20,196 | | | | 1,630,019 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Chemicals (continued) | | | | | | | | |

Huntsman Corp. | | | 51,602 | | | $ | 1,333,396 | |

Olin Corp. | | | 41,335 | | | | 1,251,624 | |

| | | | | | | | |

| | | | | | | 5,598,891 | |

| | | | | | | | |

Commercial Services & Supplies 0.4% | | | | | | | | |

Pitney Bowes, Inc. | | | 112,278 | | | | 1,695,398 | |

| | | | | | | | |

| | |

Communications Equipment 0.3% | | | | | | | | |

F5 Networks, Inc. (a) | | | 10,113 | | | | 1,284,958 | |

| | | | | | | | |

| | |

Containers & Packaging 1.0% | | | | | | | | |

Berry Plastics Group, Inc. (a) | | | 50,243 | | | | 2,864,353 | |

Owens-Illinois, Inc. (a) | | | 7,212 | | | | 172,511 | |

Silgan Holdings, Inc. | | | 59,387 | | | | 1,887,319 | |

| | | | | | | | |

| | | | | | | 4,924,183 | |

| | | | | | | | |

Diversified Consumer Services 0.6% | | | | | | | | |

H&R Block, Inc. | | | 92,016 | | | | 2,844,215 | |

| | | | | | | | |

|

Diversified Telecommunication Services 0.6% | |

SBA Communications Corp. (a) | | | 11,853 | | | | 1,598,970 | |

Verizon Communications, Inc. | | | 26,351 | | | | 1,176,835 | |

| | | | | | | | |

| | | | | | | 2,775,805 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components 1.4% | |

Corning, Inc. | | | 43,087 | | | | 1,294,764 | |

Jabil, Inc. | | | 89,445 | | | | 2,610,900 | |

Zebra Technologies Corp. Class A (a) | | | 24,838 | | | | 2,496,716 | |

| | | | | | | | |

| | | | | | | 6,402,380 | |

| | | | | | | | |

Equity Real Estate Investment Trusts (REITs) 2.7% | |

American Tower Corp. | | | 36,243 | | | | 4,795,674 | |

Digital Realty Trust, Inc. | | | 1,340 | | | | 151,353 | |

Gaming and Leisure Properties, Inc. | | | 34,634 | | | | 1,304,663 | |

Lamar Advertising Co. Class A | | | 38,859 | | | | 2,858,856 | |

Outfront Media, Inc. | | | 111,774 | | | | 2,584,215 | |

Public Storage | | | 3,468 | | | | 723,182 | |

Senior Housing Properties Trust | | | 9,509 | | | | 194,364 | |

| | | | | | | | |

| | | | | | | 12,612,307 | |

| | | | | | | | |

Food & Staples Retailing 0.1% | |

Costco Wholesale Corp. | | | 2,341 | | | | 374,396 | |

CVS Health Corp. | | | 4,278 | | | | 344,208 | |

| | | | | | | | |

| | | | | | | 718,604 | |

| | | | | | | | |

Food Products 1.1% | |

Conagra Brands, Inc. | | | 7,096 | | | | 253,753 | |

Flowers Foods, Inc. | | | 71,944 | | | | 1,245,351 | |

Pilgrim’s Pride Corp. (a) | | | 107,889 | | | | 2,364,927 | |

Tyson Foods, Inc. Class A | | | 23,839 | | | | 1,493,036 | |

| | | | | | | | |

| | | | | | | 5,357,067 | |

| | | | | | | | |

| † | Percentages indicated are based on Portfolio net assets. |

| ¨ | | Among the Portfolio’s 10 largest holdings, as of June 30, 2017, excluding short-term investment. May be subject to change daily. |

| | | | |

| 10 | | MainStay VP Cornerstone Growth Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | |

Health Care Equipment & Supplies 1.6% | |

Alere, Inc. (a) | | | 24,844 | | | $ | 1,246,920 | |

Baxter International, Inc. | | | 46,546 | | | | 2,817,895 | |

Becton Dickinson & Co. | | | 2,521 | | | | 491,872 | |

Cooper Cos., Inc. | | | 2,662 | | | | 637,336 | |

Danaher Corp. | | | 3,296 | | | | 278,149 | |

Hologic, Inc. (a) | | | 36,907 | | | | 1,674,840 | |

IDEXX Laboratories, Inc. (a) | | | 3,397 | | | | 548,344 | |

Medtronic PLC | | | 280 | | | | 24,850 | |

| | | | | | | | |

| | | | | | | 7,720,206 | |

| | | | | | | | |

Health Care Providers & Services 6.4% | |

Aetna, Inc. | | | 7,771 | | | | 1,179,871 | |

Anthem, Inc. | | | 11,220 | | | | 2,110,819 | |

Centene Corp. (a) | | | 36,440 | | | | 2,910,827 | |

Cigna Corp. | | | 21,591 | | | | 3,614,117 | |

Humana, Inc. | | | 16,651 | | | | 4,006,564 | |

McKesson Corp. | | | 21,340 | | | | 3,511,283 | |

¨UnitedHealth Group, Inc. | | | 52,983 | | | | 9,824,108 | |

WellCare Health Plans, Inc. (a) | | | 16,409 | | | | 2,946,400 | |

| | | | | | | | |

| | | | | | | 30,103,989 | |

| | | | | | | | |

Health Care Technology 0.3% | |

Cerner Corp. (a) | | | 24,345 | | | | 1,618,212 | |

| | | | | | | | |

|

Hotels, Restaurants & Leisure 6.0% | |

Aramark | | | 70,694 | | | | 2,897,040 | |

Brinker International, Inc. | | | 32,066 | | | | 1,221,715 | |

Carnival Corp. | | | 15,844 | | | | 1,038,891 | |

Choice Hotels International, Inc. | | | 716 | | | | 46,003 | |

Darden Restaurants, Inc. | | | 33,971 | | | | 3,072,337 | |

Extended Stay America, Inc. | | | 141,191 | | | | 2,733,458 | |

Las Vegas Sands Corp. | | | 56,577 | | | | 3,614,705 | |

McDonald’s Corp. | | | 38,623 | | | | 5,915,499 | |

Norwegian Cruise Line Holdings, Ltd. (a) | | | 8,631 | | | | 468,577 | |

Royal Caribbean Cruises, Ltd. | | | 6,236 | | | | 681,158 | |

Six Flags Entertainment Corp. | | | 22,925 | | | | 1,366,559 | |

Starbucks Corp. | | | 14,339 | | | | 836,107 | |

Wyndham Worldwide Corp. | | | 30,315 | | | | 3,043,929 | |

Wynn Resorts, Ltd. | | | 337 | | | | 45,198 | |

Yum China Holdings, Inc. (a) | | | 13,410 | | | | 528,756 | |

Yum! Brands, Inc. | | | 14,055 | | | | 1,036,697 | |

| | | | | | | | |

| | | | | | | 28,546,629 | |

| | | | | | | | |

Household Durables 0.9% | |

NVR, Inc. (a) | | | 1,246 | | | | 3,003,620 | |

Tempur Sealy International, Inc. (a) | | | 23,714 | | | | 1,266,091 | |

| | | | | | | | |

| | | | | | | 4,269,711 | |

| | | | | | | | |

Household Products 0.3% | |

Spectrum Brands Holdings, Inc. | | | 10,781 | | | | 1,348,056 | |

| | | | | | | | |

|

Industrial Conglomerates 1.8% | |

3M Co. | | | 30,085 | | | | 6,263,396 | |

| | | | | | | | |

| | |

Shares | | | Value | |

Industrial Conglomerates (continued) | |

Honeywell International, Inc. | | | 16,451 | | | $ | 2,192,754 | |

| | | | | | | | |

| | | | | | | 8,456,150 | |

| | | | | | | | |

Insurance 1.1% | |

Assurant, Inc. | | | 12,207 | | | | 1,265,744 | |

Athene Holding, Ltd. Class A (a) | | | 25,085 | | | | 1,244,467 | |

Lincoln National Corp. | | | 280 | | | | 18,922 | |

Progressive Corp. | | | 28,660 | | | | 1,263,620 | |

XL Group, Ltd. | | | 29,795 | | | | 1,305,021 | |

| | | | | | | | |

| | | | | | | 5,097,774 | |

| | | | | | | | |

Internet & Direct Marketing Retail 5.6% | |

¨Amazon.com, Inc. (a) | | | 18,521 | | | | 17,928,328 | |

Expedia, Inc. | | | 22,797 | | | | 3,395,613 | |

Liberty Interactive Corp. QVC Group Class A (a) | | | 118,127 | | | | 2,898,837 | |

Netflix, Inc. (a) | | | 135 | | | | 20,170 | |

Priceline Group, Inc. (a) | | | 1,129 | | | | 2,111,817 | |

| | | | | | | | |

| | | | | | | 26,354,765 | |

| | | | | | | | |

Internet Software & Services 9.0% | |

Akamai Technologies, Inc. (a) | | | 30,021 | | | | 1,495,346 | |

¨Alphabet, Inc.(a) | |

Class A | | | 11,413 | | | | 10,610,438 | |

Class C | | | 11,617 | | | | 10,556,716 | |

eBay, Inc. (a) | | | 59,872 | | | | 2,090,730 | |

¨Facebook, Inc. Class A (a) | | | 92,471 | | | | 13,961,272 | |

IAC / InterActiveCorp (a) | | | 13,495 | | | | 1,393,224 | |

VeriSign, Inc. (a) | | | 24,834 | | | | 2,308,569 | |

| | | | | | | | |

| | | | | | | 42,416,295 | |

| | | | | | | | |

IT Services 5.2% | |

Accenture PLC Class A | | | 4,278 | | | | 529,103 | |

Alliance Data Systems Corp. | | | 5,787 | | | | 1,485,465 | |

CoreLogic, Inc. (a) | | | 15,294 | | | | 663,454 | |

CSRA, Inc. | | | 37,299 | | | | 1,184,243 | |

DXC Technology Co. | | | 973 | | | | 74,649 | |

First Data Corp. Class A (a) | | | 156,723 | | | | 2,852,359 | |

International Business Machines Corp. | | | 12,767 | | | | 1,963,948 | |

Mastercard, Inc. Class A | | | 38,514 | | | | 4,677,525 | |

Total System Services, Inc. | | | 43,974 | | | | 2,561,485 | |

Visa, Inc. Class A | | | 75,859 | | | | 7,114,057 | |

Western Union Co. | | | 86,850 | | | | 1,654,492 | |

| | | | | | | | |

| | | | | | | 24,760,780 | |

| | | | | | | | |

Life Sciences Tools & Services 0.6% | |

Charles River Laboratories International, Inc. (a) | | | 6,753 | | | | 683,066 | |

VWR Corp. (a) | | | 28,986 | | | | 956,828 | |

Waters Corp. (a) | | | 7,456 | | | | 1,370,711 | |

| | | | | | | | |

| | | | | | | 3,010,605 | |

| | | | | | | | |

Machinery 1.5% | |

Caterpillar, Inc. | | | 24,447 | | | | 2,627,075 | |

Cummins, Inc. | | | 8,676 | | | | 1,407,421 | |

Deere & Co. | | | 16,185 | | | | 2,000,304 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of Investments June 30, 2017 (Unaudited) (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | |

Machinery (continued) | |

Fortive Corp. | | | 5,484 | | | $ | 347,411 | |

Toro Co. | | | 13,427 | | | | 930,357 | |

| | | | | | | | |

| | | | | | | 7,312,568 | |

| | | | | | | | |

Media 3.7% | |

Charter Communications, Inc. Class A (a) | | | 158 | | | | 53,222 | |

¨Comcast Corp. Class A | | | 212,766 | | | | 8,280,853 | |

DISH Network Corp. Class A (a) | | | 3,838 | | | | 240,873 | |

Lions Gate Entertainment Corp. Class A | | | 55,937 | | | | 1,578,542 | |

Live Nation Entertainment, Inc. (a) | | | 16,071 | | | | 560,074 | |

Scripps Networks Interactive, Inc. Class A | | | 15,450 | | | | 1,055,390 | |

Time Warner, Inc. | | | 3,917 | | | | 393,306 | |

Walt Disney Co. | | | 48,970 | | | | 5,203,062 | |

| | | | | | | | |

| | | | | | | 17,365,322 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels 0.5% | |

ONEOK, Inc. | | | 17,011 | | | | 887,294 | |

Williams Cos., Inc. | | | 46,392 | | | | 1,404,750 | |

| | | | | | | | |

| | | | | | | 2,292,044 | |

| | | | | | | | |

Personal Products 0.0%‡ | |

Nu Skin Enterprises, Inc., Class A | | | 390 | | | | 24,508 | |

| | | | | | | | |

|

Pharmaceuticals 0.5% | |

Bristol-Myers Squibb Co. | | | 10,320 | | | | 575,030 | |

Eli Lilly & Co. | | | 14,117 | | | | 1,161,829 | |

Johnson & Johnson | | | 3,130 | | | | 414,068 | |

| | | | | | | | |

| | | | | | | 2,150,927 | |

| | | | | | | | |

Professional Services 0.6% | |

Robert Half International, Inc. | | | 58,951 | | | | 2,825,521 | |

| | | | | | | | |

|

Road & Rail 0.1% | |

Union Pacific Corp. | | | 2,970 | | | | 323,463 | |

| | | | | | | | |

|

Semiconductors & Semiconductor Equipment 5.4% | |

Applied Materials, Inc. | | | 96,704 | | | | 3,994,842 | |

Broadcom, Ltd. | | | 10,246 | | | | 2,387,830 | |

Cree, Inc. (a) | | | 21,976 | | | | 541,709 | |

First Solar, Inc. (a) | | | 35,167 | | | | 1,402,460 | |

KLA-Tencor Corp. | | | 32,365 | | | | 2,961,721 | |

Lam Research Corp. | | | 22,995 | | | | 3,252,183 | |

Micron Technology, Inc. (a) | | | 75,061 | | | | 2,241,322 | |

NVIDIA Corp. | | | 12,563 | | | | 1,816,107 | |

ON Semiconductor Corp. (a) | | | 180,999 | | | | 2,541,226 | |

Qorvo, Inc. (a) | | | 12,747 | | | | 807,140 | |

Skyworks Solutions, Inc. | | | 32,423 | | | | 3,110,987 | |

Texas Instruments, Inc. | | | 8,653 | | | | 665,675 | |

| | | | | | | | |

| | | | | | | 25,723,202 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Software 7.7% | |

Activision Blizzard, Inc. | | | 70,601 | | | $ | 4,064,500 | |

Adobe Systems, Inc. (a) | | | 5,693 | | | | 805,218 | |

Cadence Design Systems, Inc. (a) | | | 88,171 | | | | 2,952,847 | |

Citrix Systems, Inc. (a) | | | 6,196 | | | | 493,078 | |

Dell Technologies, Inc. Class V (a) | | | 4,042 | | | | 247,007 | |

Electronic Arts, Inc. (a) | | | 15,732 | | | | 1,663,187 | |

¨Microsoft Corp. | | | 341,907 | | | | 23,567,649 | |

Nuance Communications, Inc. (a) | | | 19,417 | | | | 338,050 | |

Take-Two Interactive Software, Inc. (a) | | | 19,008 | | | | 1,394,807 | |

VMware, Inc. Class A (a) | | | 10,094 | | | | 882,518 | |

| | | | | | | | |

| | | | | | | 36,408,861 | |

| | | | | | | | |

Specialty Retail 4.5% | |

Best Buy Co., Inc. | | | 48,703 | | | | 2,792,143 | |

Burlington Stores, Inc. (a) | | | 2,033 | | | | 187,016 | |

GameStop Corp. Class A | | | 52,346 | | | | 1,131,197 | |

Gap, Inc. | | | 26,800 | | | | 589,332 | |

¨Home Depot, Inc. | | | 64,466 | | | | 9,889,084 | |

Lowe’s Cos., Inc. | | | 66,589 | | | | 5,162,645 | |

Signet Jewelers, Ltd. | | | 23,433 | | | | 1,481,903 | |

| | | | | | | | |

| | | | | | | 21,233,320 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals 8.0% | |

¨Apple, Inc. | | | 223,907 | | | | 32,247,086 | |

HP, Inc. | | | 68,115 | | | | 1,190,650 | |

NCR Corp. (a) | | | 45,095 | | | | 1,841,680 | |

Western Digital Corp. | | | 29,778 | | | | 2,638,331 | |

| | | | | | | | |

| | | | | | | 37,917,747 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods 0.6% | |

Michael Kors Holdings, Ltd. (a) | | | 75,826 | | | | 2,748,693 | |

NIKE, Inc. Class B | | | 4,743 | | | | 279,837 | |

| | | | | | | | |

| | | | 3,028,530 | |

| | | | | | | | |

Tobacco 2.5% | |

¨Altria Group, Inc. | | | 113,497 | | | | 8,452,122 | |

Philip Morris International, Inc. | | | 28,292 | | | | 3,322,895 | |

| | | | | | | | |

| | | | | | | 11,775,017 | |

| | | | | | | | |

Trading Companies & Distributors 0.6% | |

United Rentals, Inc. (a) | | | 27,057 | | | | 3,049,594 | |

| | | | | | | | |

|

Wireless Telecommunication Services 0.4% | |

T-Mobile U.S., Inc. (a) | | | 29,982 | | | | 1,817,509 | |

| | | | | | | | |

Total Common Stocks

(Cost $412,109,642) | | | | 469,786,421 | |

| | | | | | | | |

| | |

| Exchange-Traded Funds 0.6% (b) | | | | | | | | |

iShares Russell 1000 Growth ETF | | | 24,630 | | | | 2,931,463 | |

| | | | | | | | |

Total Exchange-Traded Funds

(Cost $2,893,716) | | | | | | | 2,931,463 | |

| | | | | | | | |

| | | | |

| 12 | | MainStay VP Cornerstone Growth Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Short-Term Investment 0.0%‡ | |

Repurchase Agreement 0.0% ‡ | |

Fixed Income Clearing Corp.

0.12%, dated 6/30/17

due 7/3/17

Proceeds at Maturity $166,278 (Collateralized by a United States Treasury Note with a rate of 2.00% and a maturity date of 8/31/21, with a Principal Amount of $170,000 and a Market Value of $172,849) | | $ | 166,276 | | | $ | 166,276 | |

| | | | | | | | |

Total Short-Term Investment

(Cost $166,276) | | | | | | | 166,276 | |

| | | | | | | | |

Total Investments

(Cost $415,169,634) (c) | | | 100.0 | % | | | 472,884,160 | |

Other Assets, Less Liabilities | | | (0.0 | )‡ | | | (234,857 | ) |

Net Assets | | | 100.0 | % | | $ | 472,649,303 | |

| ‡ | Less than one-tenth of a percent. |

| (a) | Non-income producing security. |

| (b) | Exchange-Traded Fund—An investment vehicle that represents a basket of securities that is traded on an exchange. |

| (c) | As of June 30, 2017, cost was $415,550,975 for federal income tax purposes and net unrealized appreciation was as follows: |

| | | | |

Gross unrealized appreciation | | $ | 63,269,611 | |

Gross unrealized depreciation | | | (5,936,426 | ) |

| | | | |

Net unrealized appreciation | | $ | 57,333,185 | |

| | | | |

The following abbreviation is used in the preceding pages:

ETF—Exchange-Traded Fund

The following is a summary of the fair valuations according to the inputs used as of June 30, 2017, for valuing the Portfolio’s assets.

Asset Valuation Inputs

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 469,786,421 | | | $ | — | | | $ | — | | | $ | 469,786,421 | |

| Exchange-Traded Funds Equity Funds | | | 2,931,463 | | | | — | | | | — | | | | 2,931,463 | |

Short-Term Investment

Repurchase Agreement | | | — | | | | 166,276 | | | | — | | | | 166,276 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | $ | 472,717,884 | | | $ | 166,276 | | | $ | — | | | $ | 472,884,160 | |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

The Portfolio recognizes transfers between the levels as of the beginning of the period.

For the period ended June 30, 2017, the Portfolio did not have any transfers among levels. (See Note 2)

As of June 30, 2017, the Portfolio did not hold any investments with significant unobservable inputs (Level 3). (See Note 2)

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Statement of Assets and Liabilities as of June 30, 2017 (Unaudited)

| | | | |

| Assets | | | | |

Investment in securities, at value

(identified cost $415,169,634) | | $ | 472,884,160 | |

Receivables: | | | | |

Dividends and interest | | | 303,186 | |

Fund shares sold | | | 18,067 | |

Other assets | | | 2,285 | |

| | | | |

Total assets | | | 473,207,698 | |

| | | | |

| |

| Liabilities | | | | |

Payables: | | | | |

Manager (See Note 3) | | | 275,489 | |

Fund shares redeemed | | | 188,798 | |

Shareholder communication | | | 49,415 | |

Professional fees | | | 23,921 | |

NYLIFE Distributors (See Note 3) | | | 13,013 | |

Custodian | | | 2,704 | |

Trustees | | | 724 | |

Accrued expenses | | | 4,331 | |

| | | | |

Total liabilities | | | 558,395 | |

| | | | |

Net assets | | $ | 472,649,303 | |

| | | | |

| |

| Composition of Net Assets | | | | |

Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | | $ | 17,622 | |

Additional paid-in capital | | | 398,907,406 | |

| | | | |

| | | 398,925,028 | |

Undistributed net investment income | | | 3,173,225 | |

Accumulated net realized gain (loss) on investments | | | 12,836,524 | |

Net unrealized appreciation (depreciation) on investments | | | 57,714,526 | |

| | | | |

Net assets | | $ | 472,649,303 | |

| | | | |

| | | | |

Initial Class | | | | |

Net assets applicable to outstanding shares | | $ | 409,906,559 | |

| | | | |

Shares of beneficial interest outstanding | | | 15,255,884 | |

| | | | |

Net asset value per share outstanding | | $ | 26.87 | |

| | | | |

Service Class | | | | |

Net assets applicable to outstanding shares | | $ | 62,742,744 | |

| | | | |

Shares of beneficial interest outstanding | | | 2,365,775 | |

| | | | |

Net asset value per share outstanding | | $ | 26.52 | |

| | | | |

| | | | |

| 14 | | MainStay VP Cornerstone Growth Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Operations for the six months ended June 30, 2017 (Unaudited)

| | | | |

| Investment Income (Loss) | |

Income | |

Dividends | | $ | 3,683,817 | |

Interest | | | 95 | |

| | | | |

Total income | | | 3,683,912 | |

| | | | |

Expenses | |

Manager (See Note 3) | | | 1,572,887 | |

Distribution/Service—Service Class (See Note 3) | | | 76,311 | |

Shareholder communication | | | 58,035 | |

Professional fees | | | 33,156 | |

Trustees | | | 5,262 | |

Custodian | | | 3,959 | |

Miscellaneous | | | 9,762 | |

| | | | |

Total expenses | | | 1,759,372 | |

| | | | |

Net investment income (loss) | | | 1,924,540 | |

| | | | |

|

| Realized and Unrealized Gain (Loss) on Investments | |

Net realized gain (loss) on investments | | | 9,512,515 | |

Net change in unrealized appreciation (depreciation) on investments | | | 40,093,841 | |

| | | | |

Net realized and unrealized gain (loss) on investments | | | 49,606,356 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 51,530,896 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Statements of Changes in Net Assets

for the six months ended June 30, 2017 (Unaudited) and the year ended December 31, 2016

| | | | | | | | |

| | | 2017 | | | 2016 | |

| Increase (Decrease) in Net Assets | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 1,924,540 | | | $ | 1,247,959 | |

Net realized gain (loss) on investments | | | 9,512,515 | | | | 5,334,451 | |

Net change in unrealized appreciation (depreciation) on investments | | | 40,093,841 | | | | (6,347,528 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 51,530,896 | | | | 234,882 | |

| | | | |

Dividends and distributions to shareholders: | | | | | | | | |

From net investment income: | | | | | | | | |

Initial Class | | | — | | | | (549,429 | ) |

| | | | |

From net realized gain on investments: | | | | | | | | |

Initial Class | | | — | | | | (29,462,402 | ) |

Service Class | | | — | | | | (5,192,207 | ) |

| | | | |

| | | — | | | | (34,654,609 | ) |

| | | | |

Total dividends and distributions to shareholders | | | — | | | | (35,204,038 | ) |

| | | | |

Capital share transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 52,963,742 | | | | 10,067,980 | |

Net asset value of shares issued to shareholders in reinvestment of dividends and distributions | | | — | | | | 35,204,038 | |

Cost of shares redeemed | | | (27,693,696 | ) | | | (48,979,279 | ) |

| | | | |

Increase (decrease) in net assets derived from capital share transactions | | | 25,270,046 | | | | (3,707,261 | ) |

| | | | |

Net increase (decrease) in net assets | | | 76,800,942 | | | | (38,676,417 | ) |

|

| Net Assets | |

Beginning of period | | | 395,848,361 | | | | 434,524,778 | |

| | | | |

End of period | | $ | 472,649,303 | | | $ | 395,848,361 | |

| | | | |

Undistributed net investment income at end of period | | $ | 3,173,225 | | | $ | 1,248,685 | |

| | | | |

| | | | |

| 16 | | MainStay VP Cornerstone Growth Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

June 30, | | | | | | Year ended December 31, | |

| Initial Class | | 2017* | | | | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value at beginning of period | | $ | 23.90 | | | | | | | $ | 26.09 | | | $ | 29.42 | | | $ | 34.19 | | | $ | 27.64 | | | $ | 24.14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.11 | (a) | | | | | | | 0.09 | (a) | | | 0.04 | (a) | | | 0.01 | (a) | | | 0.19 | (a) | | | 0.31 | |

Net realized and unrealized gain (loss) on investments | | | 2.86 | | | | | | | | (0.02 | ) | | | 0.58 | | | | 2.63 | | | | 6.62 | | | | 3.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.97 | | | | | | | | 0.07 | | | | 0.62 | | | | 2.64 | | | | 6.81 | | | | 3.61 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | | | | | (0.04 | ) | | | — | | | | (0.23 | ) | | | (0.26 | ) | | | (0.11 | ) |

From net realized gain on investments | | | — | | | | | | | | (2.22 | ) | | | (3.95 | ) | | | (7.18 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | | | | | (2.26 | ) | | | (3.95 | ) | | | (7.41 | ) | | | (0.26 | ) | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 26.87 | | | | | | | $ | 23.90 | | | $ | 26.09 | | | $ | 29.42 | | | $ | 34.19 | | | $ | 27.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return (b) | | | 12.43 | %(c) | | | | | | | 0.40 | % | | | 2.58 | % | | | 8.81 | % | | | 24.71 | % | | | 14.94 | % |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.89 | %†† | | | | | | | 0.35 | %(d) | | | 0.15 | % | | | 0.02 | % | | | 0.61 | % | | | 1.04 | % |

Net expenses | | | 0.75 | %†† | | | | | | | 0.76 | %(e) | | | 0.73 | % | | | 0.73 | % | | | 0.71 | % | | | 0.65 | % |

Portfolio turnover rate | | | 71 | % | | | | | | | 177 | % | | | 112 | % | | | 88 | % | | | 164 | % | | | 42 | % |

Net assets at end of period (in 000’s) | | $ | 409,907 | | | | | | | $ | 337,401 | | | $ | 370,679 | | | $ | 405,444 | | | $ | 522,795 | | | $ | 368,442 | |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | Without the custody fee reimbursement, net investment income (loss) would have been 0.34%. |

| (e) | Without the custody fee reimbursement, net expenses would have been 0.77%. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended June 30, | | | | | | Year ended December 31, | |

| Service Class | | 2017* | | | | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value at beginning of period | | $ | 23.62 | | | | | | | $ | 25.83 | | | $ | 29.24 | | | $ | 34.03 | | | $ | 27.52 | | | $ | 24.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.08 | (a) | | | | | | | 0.02 | (a) | | | (0.03 | )(a) | | | (0.08 | )(a) | | | 0.11 | (a) | | | 0.22 | |

Net realized and unrealized gain (loss) on investments | | | 2.82 | | | | | | | | (0.01 | ) | | | 0.57 | | | | 2.61 | | | | 6.59 | | | | 3.31 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.90 | | | | | | | | 0.01 | | | | 0.54 | | | | 2.53 | | | | 6.70 | | | | 3.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | | | | | — | | | | — | | | | (0.14 | ) | | | (0.19 | ) | | | (0.05 | ) |

From net realized gain on investments | | | — | | | | | | | | (2.22 | ) | | | (3.95 | ) | | | (7.18 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | | | | | (2.22 | ) | | | (3.95 | ) | | | (7.32 | ) | | | (0.19 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 26.52 | | | | | | | $ | 23.62 | | | $ | 25.83 | | | $ | 29.24 | | | $ | 34.03 | | | $ | 27.52 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return (b) | | | 12.28 | %(c) | | | | | | | 0.15 | % | | | 2.33 | % | | | 8.54 | % | | | 24.40 | % | | | 14.66 | % |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.63 | %†† | | | | | | | 0.10 | %(d) | | | (0.09 | %) | | | (0.23 | %) | | | 0.36 | % | | | 0.82 | % |

Net expenses | | | 1.00 | %†† | | | | | | | 1.01 | %(e) | | | 0.98 | % | | | 0.98 | % | | | 0.96 | % | | | 0.90 | % |

Portfolio turnover rate | | | 71 | % | | | | | | | 177 | % | | | 112 | % | | | 88 | % | | | 164 | % | | | 42 | % |

Net assets at end of period (in 000’s) | | $ | 62,743 | | | | | | | $ | 58,448 | | | $ | 63,846 | | | $ | 64,445 | | | $ | 63,898 | | | $ | 53,369 | |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | Without the custody fee reimbursement, net investment income (loss) would have been 0.09%. |

| (e) | Without the custody fee reimbursement, net expenses would have been 1.02%. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Notes to Financial Statements (Unaudited)

Note 1–Organization and Business

MainStay VP Funds Trust (the “Fund”) was organized as a Delaware statutory trust on February 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is comprised of thirty-two separate series (collectively referred to as the “Portfolios”). These financial statements and notes relate to the MainStay VP Cornerstone Growth Portfolio (the “Portfolio”), a “diversified” portfolio, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

Shares of the Portfolio are currently offered to certain separate accounts to fund variable annuity policies and variable universal life insurance policies issued by New York Life Insurance and Annuity Corporation (“NYLIAC”), a wholly-owned subsidiary of New York Life Insurance Company (“New York Life”). NYLIAC allocates shares of the Portfolios to, among others, NYLIAC Variable Annuity Separate Accounts-I, II, III and IV, VUL Separate Account-I and CSVUL Separate Account-I (collectively, the “Separate Accounts”). Shares of the Portfolio are also offered to the MainStay VP Conservative Allocation Portfolio, MainStay VP Moderate Allocation Portfolio, MainStay VP Moderate Growth Allocation Portfolio and MainStay VP Growth Allocation Portfolio, which operate as “funds-of-funds.”

The Portfolio currently offers two classes of shares. Initial Class shares commenced operations on January 29, 1993. Service Class shares commenced operations on June 5, 2003. Shares of the Portfolio are sold and are redeemed at a price equal to their respective net asset value (“NAV”) per share. No sales or redemption charge is applicable to the purchase or redemption of the Portfolio’s shares. Under the terms of the Fund’s multiple class plan adopted pursuant to Rule 18f-3 under the 1940 Act, the classes differ in that, among other things, Service Class shares pay a combined distribution and service fee of 0.25% of average daily net assets attributable to Service Class shares of the Portfolio to the Distributor (as defined in Note 3(B)) pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act. Contract owners of variable annuity contracts purchased after June 2, 2003, are permitted to invest only in the Service Class shares.

The Portfolio’s investment objective is to seek long-term growth of capital.

Note 2–Significant Accounting Policies

The Portfolio is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The Portfolio prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the “Exchange”) (usually 4:00 p.m. Eastern time) on each day the Portfolio is open for business (“valuation date”).

The Board of Trustees (the “Board”) of the Fund adopted procedures establishing methodologies for the valuation of the Portfolio’s securities and other assets and delegated the responsibility for valuation

determinations under those procedures to the Valuation Committee of the Fund (the “Valuation Committee”). The Board authorized the Valuation Committee to appoint a Valuation Sub-Committee (the “Sub-Committee”) to deal in the first instance with establishing the prices of securities for which market quotations are not readily available or the prices of which are not otherwise readily determinable under these procedures. The Sub-Committee meets (in person, via electronic mail or via teleconference) on an as-needed basis. Subsequently, the Valuation Committee meets to ensure that actions taken by the Sub-Committee were appropriate. The procedures recognize that, subject to the oversight of the Board and unless otherwise noted, the responsibility for the day-to-day valuation of portfolio assets (including fair value measurements for the Portfolio’s assets and liabilities) rests with New York Life Investment Management LLC (“New York Life Investments” or the “Manager”), aided to whatever extent necessary by the Subadvisor (as defined in Note 3(A)) to the Portfolio.

To assess the appropriateness of security valuations, the Manager, the Subadvisor or the Portfolio’s third party service provider, who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities and the sale prices to the prior and current day prices and challenges prices with changes exceeding certain tolerance levels with third party pricing services or broker sources. For those securities valued through either a standardized fair valuation methodology or a fair valuation measurement, the Sub-Committee deals in the first instance with such valuation and the Valuation Committee reviews and affirms, if appropriate, the reasonableness of the valuation based on such methodologies and measurements on a regular basis after considering all relevant information that is reasonably available. Any action taken by the Sub-Committee with respect to the valuation of a portfolio security or other asset is submitted by the Valuation Committee to the Board for its review and ratification, if appropriate, at its next regularly scheduled meeting.

“Fair value” is defined as the price the Portfolio would reasonably expect to receive upon selling an asset or liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the asset or liability. Fair value measurements are determined within a framework that establishes a three-tier hierarchy which maximizes the use of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. “Inputs” refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Portfolio. Unobservable inputs reflect the Portfolio’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing assets or liabilities may not be an indication of the risks associated with investing in those assets or liabilities. The three-tier hierarchy of inputs is summarized below.

| • | | Level 1—quoted prices in active markets for an identical asset or liability |

| | |

| 18 | | MainStay VP Cornerstone Growth Portfolio |

| • | | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

| • | | Level 3—significant unobservable inputs (including the Portfolio’s own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The level of an asset or liability within the fair value hierarchy is based on the lowest level of an input, both individually and in the aggregate, that is significant to the fair value measurement. As of June 30, 2017, the aggregate value by input level of the Portfolio’s assets and liabilities is included at the end of the Portfolio’s Portfolio of Investments.

The Portfolio may use third party vendor evaluations, whose prices may be derived from one or more of the following standard inputs, among others:

| | |

• Broker/dealer quotes | | • Benchmark securities |

• Two-sided markets | | • Reference data (corporate actions or material event notices) |

• Bids/offers | | • Monthly payment information |

• Industry and economic events | | • Reported trades |

An asset or liability for which market values cannot be measured using the methodologies described above is valued by methods deemed reasonable in good faith by the Valuation Committee, following the procedures established by the Board, to represent fair value. Under these procedures, the Portfolio generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information. The Portfolio may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to calculate fair value. Discounts may also be applied due to the nature and/or duration of any restrictions on the disposition of the asset or liability. Fair value represents a good faith approximation of the value of a security. Fair value determinations involve the consideration of a number of subjective factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Portfolio’s valuation procedures may differ from valuations for the same security determined by other funds using their own valuation procedures. Although the Portfolio’s valuation procedures are designed to value a security at the price the Portfolio may reasonably expect to receive upon the security’s sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Portfolio would actually realize upon the sale of the security or the price at which the security would trade if a reliable market price were readily available. During the six-month period ended June 30, 2017, there were no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been de-listed from a national exchange; (v) a security for which the market price is not readily available from a third party pricing source or, if so provided, does

not, in the opinion of the Manager or Subadvisor, reflect the security’s market value; (vi) a security subject to trading collars for which no or limited trading takes place; and (vii) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities for which market quotations or observable inputs are not readily available are generally categorized as Level 3 in the hierarchy. As of June 30, 2017, there were no securities held by the Portfolio that were fair valued in such a manner.

Equity securities and shares of Exchange-Traded Funds (“ETFs”) are valued at the last quoted sales prices as of the close of regular trading on the relevant exchange on each valuation date. Securities that are not traded on the valuation date are valued at the mean of the last quoted bid and ask prices. Prices are normally taken from the principal market in which each security trades. Investments in mutual funds, including money market funds, are valued at their respective NAVs as of the close of the Exchange on the valuation date. These securities are generally categorized as Level 1 in the hierarchy.

Temporary cash investments acquired in excess of 60 days to maturity at the time of purchase are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments which mature in 60 days or less at the time of purchase (“Short-Term Investments”) are valued using the amortized cost method of valuation, unless the use of such method would be inappropriate. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between such cost and the value on maturity date. Amortized cost approximates the current fair value of a security. Securities valued using the amortized cost method are not valued using quoted prices in an active market and are generally categorized as Level 2 in the hierarchy.

The information above is not intended to reflect an exhaustive list of the methodologies that may be used to value portfolio investments. The valuation procedures permit the use of a variety of valuation methodologies in connection with valuing portfolio investments. The methodology used for a specific type of investment may vary based on the market data available or other considerations. The methodologies summarized above may not represent the specific means by which portfolio investments are valued on any particular business day.

A Portfolio security or other asset may be determined to be illiquid under procedures approved by the Board. Illiquidity of a security might prevent the sale of such security at a time when the Manager or Subadvisor might wish to sell, and these securities could have the effect of decreasing the overall level of the Portfolio’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, requiring the Portfolio to rely on judgments that may be somewhat subjective in measuring value, which could vary materially from the amount that the Portfolio could realize upon disposition. Difficulty in selling illiquid securities may result in a loss or may be costly to the Portfolio. Under the supervision of the Board, the Manager or Subadvisor determines the liquidity of the Portfolio’s investments; in doing so, the Manager or Subadvisor may consider various factors, including (i) the frequency of trades and quotations, (ii) the number of dealers and prospective purchasers, (iii) dealer undertakings to make a

Notes to Financial Statements (Unaudited) (continued)

market, and (iv) the nature of the security and the market in which it trades (e.g., the time needed to dispose of the security, the method of soliciting offers and the mechanics of transfer). Illiquid securities are often valued in accordance with methods deemed by the Board in good faith to be reasonable and appropriate to accurately reflect their fair value. The liquidity of the Portfolio’s investments, as shown in the Portfolio of Investments and was determined as of June 30, 2017 and can change at any time in response to, among other relevant factors, market conditions or events or developments with respect to an individual issuer or instrument. As of June 30, 2017, the Portfolio did not hold any securities deemed to be illiquid under procedures approved by the Board.

(B) Income Taxes. The Portfolio’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute all of its taxable income to the shareholders of the Portfolio within the allowable time limits. Therefore, no federal, state and local income tax provisions are required.

Management evaluates the Portfolio’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is permitted only to the extent the position is “more likely than not” to be sustained assuming examination by taxing authorities. Management has analyzed the Portfolio’s tax positions taken on federal, state and local income tax returns for all open tax years (for up to three tax years), and has concluded that no provisions for federal, state and local income tax are required in the Portfolio’s financial statements. The Portfolio’s federal, state and local income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

(C) Dividends and Distributions to Shareholders. Dividends and distributions are recorded on the ex-dividend date. The Portfolio intend to declare and pay dividends from net investment income and distributions from net realized capital and currency gains, if any, at least annually. Unless the shareholder elects otherwise, all dividends and distributions are reinvested in the same class of shares of the Portfolio, at NAV. Dividends and distributions to shareholders are determined in accordance with federal income tax regulations and may differ from GAAP.

(D) Security Transactions and Investment Income. The Portfolio records security transactions on the trade date. Realized gains and losses on security transactions are determined using the identified cost method. Dividend income is recognized on the ex-dividend date; net of any foreign tax withheld at the source, and interest income is accrued as earned using the effective interest rate method. Discounts and premiums on Short-Term Investments are accreted and amortized, respectively, on the straight-line method. The straight-line method approximates the effective interest method for Short-Term Investments.

Investment income and realized and unrealized gains and losses on investments of the Portfolio are allocated pro rata to the separate classes of shares based upon their relative net assets on the date the income is earned or realized and unrealized gains and losses are incurred.

(E) Expenses. Expenses of the Fund are allocated to the individual Portfolios in proportion to the net assets of the respective Portfolios when the expenses are incurred, except where direct allocations of expenses can be made. Expenses (other than fees incurred under the distribution and service plans, further discussed in Note 3(B), which are charged directly to the Service Class shares) are allocated to separate classes of shares pro rata based upon their relative net assets on the date the expenses are incurred. The expenses borne by the Portfolio, including those of related parties to the Portfolio, are shown in the Statement of Operations. Additionally, the Portfolio may invest in shares of ETFs or mutual funds, which are subject to management fees and other fees that may increase their costs versus the costs of owning the underlying securities directly. These indirect expenses of ETFs or mutual funds are not included in the amounts shown as expenses on the Portfolio’s Statement of Operations or in the expense ratios included

in the financial highlights.

(F) Use of Estimates. In preparing financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

(G) Repurchase Agreements. The Portfolio may enter into repurchase agreements (i.e., buy a security from another party with the agreement that it be sold back in the future) to earn income. The Portfolio may enter into repurchase agreements only with counterparties, usually financial institutions, that are deemed by the Manager or Subadvisor to be creditworthy, pursuant to guidelines established by the Board. During the term of any repurchase agreement, the Manager or Subadvisor will continue to monitor the creditworthiness of the counterparty. Under the 1940 Act, repurchase agreements are considered to be collateralized loans by the Portfolio to the counterparty secured by the securities transferred to the Portfolio.

Repurchase agreements are subject to counterparty risk, meaning the Portfolio could lose money by the counterparty’s failure to perform under the terms of the agreement. The Portfolio mitigates this risk by ensuring the repurchase agreement is collateralized by cash, U.S. government securities, fixed income securities and/or other securities. The collateral is held by the Portfolio’s custodian valued daily on a mark to market basis to determine if the value, including accrued interest, exceeds the repurchase price. In the event of the counterparty’s default on the obligation to repurchase, the Portfolio has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, such as in the event of default or bankruptcy by the counterparty, realization and/or retention of the collateral may be limited or subject to delay, to legal proceedings and possible realized loss to the Portfolio.

(H) Securities Lending. In order to realize additional income, the Portfolio may engage in securities lending, subject to the limitations set forth in the 1940 Act and relevant guidance by the staff of the Securities and Exchange Commission (“SEC”). In the event the Portfolio does engage in securities lending, the Portfolio will lend through its custodian, State Street Bank and Trust Company (“State Street”). State Street will manage the Portfolio’s collateral in accordance with the lending agreement between the Portfolio and State Street, and indemnify the Portfolio against counterparty risk. The loans will be collateralized by U.S. Treasury securities at least equal at all times to the

| | |

| 20 | | MainStay VP Cornerstone Growth Portfolio |