UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number811-03833

MAINSTAY VP FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)576-7000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

| Item 1. | Reports to Stockholders. |

MainStay VP Balanced Portfolio

Message from the President and Semiannual Report

Unaudited | June 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the MainStay VP Portfolio annual and semi-annual shareholder reports may no longer be sent by mail, unless you specifically request paper copies of the reports from the insurance company that offers your policy. Instead, the reports will be made available online, and you will be notified by mail each time a report is posted and provided with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future shareholder reports in paper form free of charge. You can inform the insurance company that you wish to receive paper copies of reports by following the instructions provided by the insurance company. Your election to receive reports in paper form will apply to all portfolio companies available under your contract.

| | | | | | | | |

| | | | | |

| Not FDIC/NCUA Insured | | Not a Deposit | | May Lose Value | | No Bank Guarantee | | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Most equity and fixed-income markets in the United States and around the world advanced in the face of conflicting political and macroeconomic forces during thesix-month period ended June 30, 2019.

The reporting period began on the heels of tumultuous December 2018, during which equities and equity-sensitive bonds spiked sharply lower on concerns regarding the pace of economic growth, a U.S. government shutdown and the potential impact of trade disputes between the United States and other nations, particularly China. Markets recovered quickly in early 2019 as trade tensions eased, the government reopened and the U.S. Federal Reserve Board (Fed) adopted a more patient tone regarding the future direction of interest rates. Markets moved broadly higher from January through April, supported by encouraging economic data and generally strong corporate earnings.

During the first four months of the reporting period, the improving economic environment encouraged investors to favor areas of the market viewed as offering greater return potential along with higher risks. Among U.S. stocks, cyclical, growth-oriented sectors tended to outperform more defensive, value-oriented sectors, whilelarge-cap stocks outperformed theirsmaller-cap counterparts. Within the S&P 500® Index, the information technology sector led the market’s advance, followed by communication services, consumer discretionary and consumer staples. Industrials, utilities, financials, materials, real estate and energy produced more modest gains. While some international equity markets outperformed or underperformed the U.S. market, on average international stocks mirrored the performance of their U.S. counterparts. Fixed-income securities gained ground as well, albeit along a more gradual trajectory. Among U.S. fixed-income instruments, corporate issues generally outperformed government bonds, with lower credit quality, higher yielding securities leading the sector’s advance. Long-term U.S. Treasury bond yields proved particularly weak, with

10-year yields dipping at times below3-month yields, reflecting investors’ continued concerns about domestic economic growth.

May 2019 saw a return of uncertainty and volatility. Trade discussions between the United States and China faltered, driving global equity prices lower. Government bond prices rose as investors sought safe havens. June brought yet anotherU-turn as equity prices climbed again after comments from the Fed raised hopes of an interest rate cut in response to weak economic data. Stock and bond prices rose, with U.S. equity markets ending the reporting period in record territory.

We are pleased to see renewed signs of strength in broad areas of the financial market. At the same time, we remained sharply focused on providing you, as a MainStay VP investor, with the experienced and disciplined fund management that we believe underpins an effective, long-term investment strategy. Whatever tomorrow’s investment environment brings, you can rely on our portfolio managers to pursue the objectives of their individual Portfolios as outlined in the prospectus with the energy and dedication you have come to expect.

The report that follows contains additional information on the market events, investment decisions and specific securities that shaped your VP Portfolio’s performance during the six months ended June 30, 2019. We encourage you to read the report carefully and use it to evaluate your Portfolio’s performance in light of your long-range financial plan.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Portfolio’s Summary Prospectus and/or Prospectus and consider the Portfolio’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Portfolio. You may obtain copies of the Portfolio’s Summary Prospectus and/or the Prospectus and the Statement of Additional Information free of charge, upon request, by calling toll-free 800-598-2019, by writing to New York Life Insurance and Annuity Corporation, 51 Madison Avenue, Room 251, New York, New York 10010 or by sending an email to MainStayShareholdersServices@nylim.com. These documents are also available at nylinvestments.com/vpdocuments. Please read the Summary Prospectus and/or Prospectus carefully before investing. MainStay VP Funds Trust portfolios are separate account options which are purchased through a variable insurance or variable annuity contract.

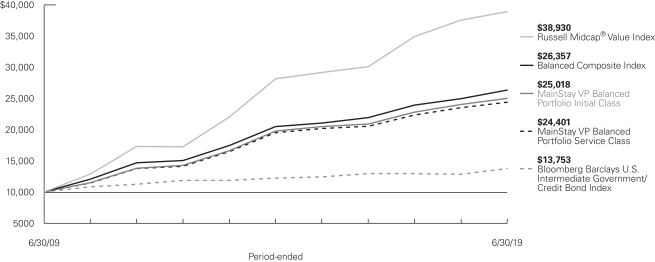

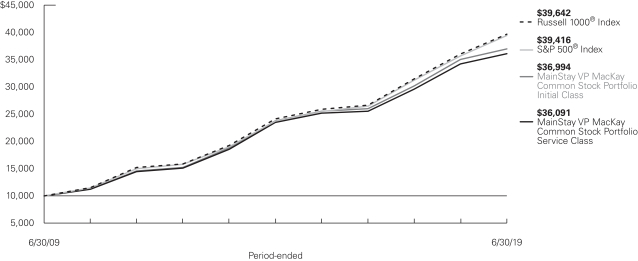

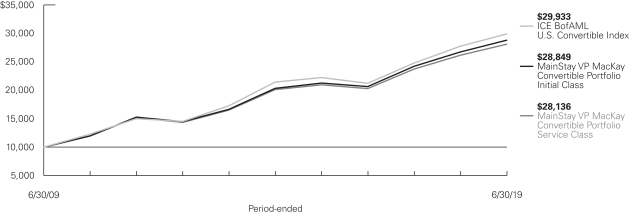

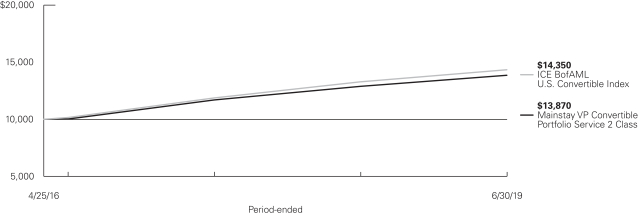

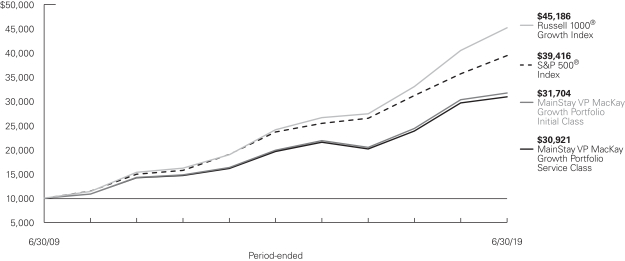

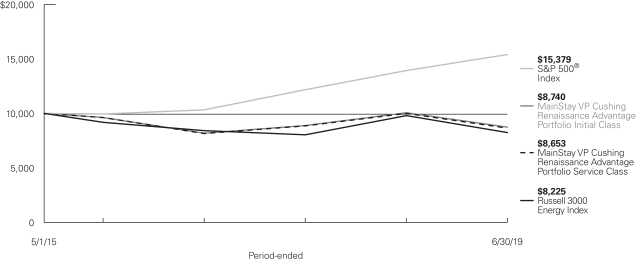

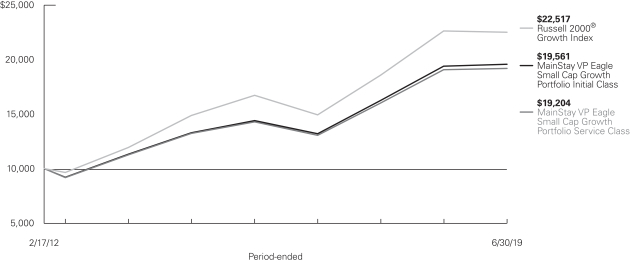

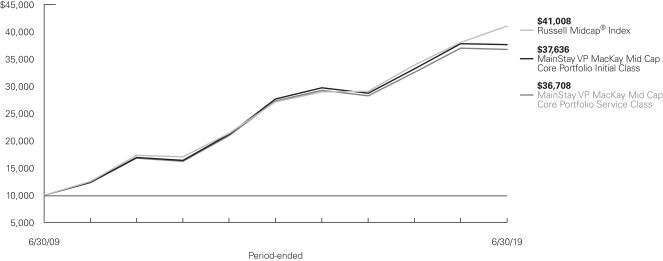

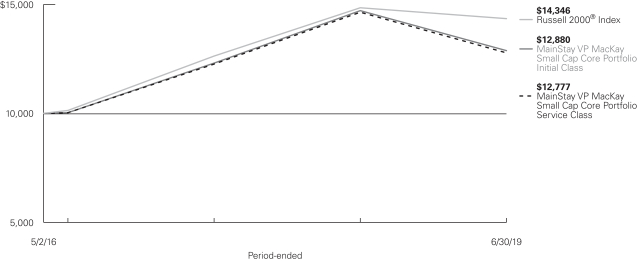

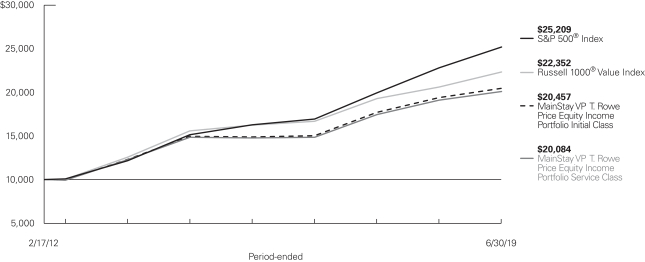

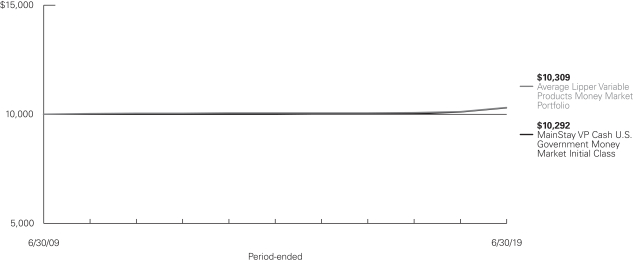

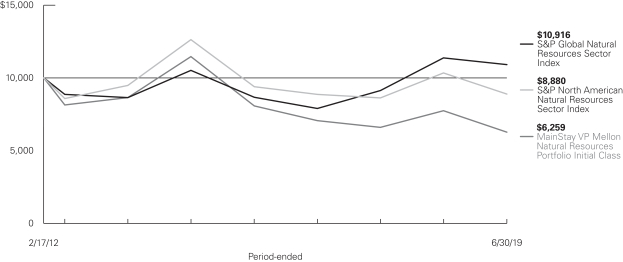

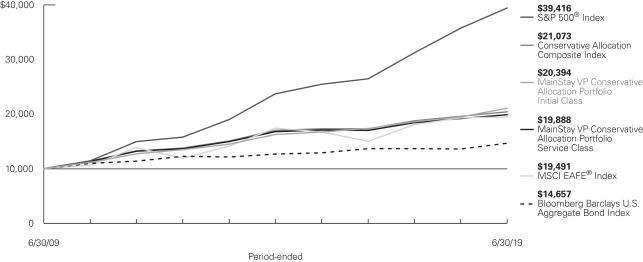

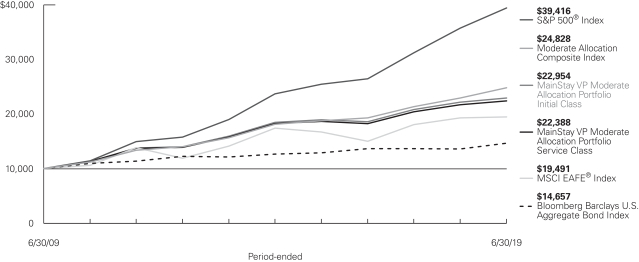

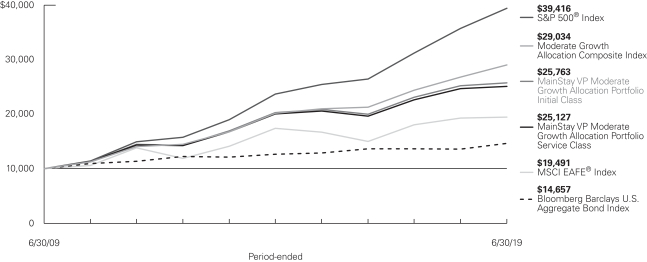

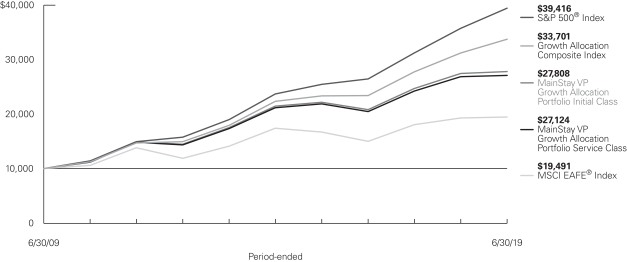

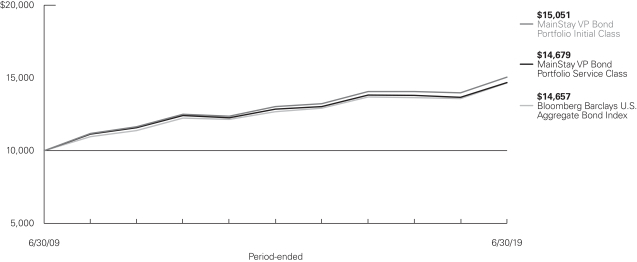

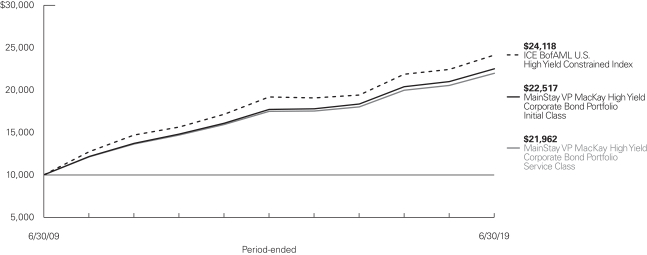

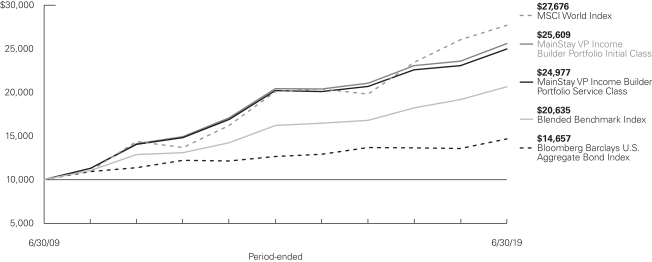

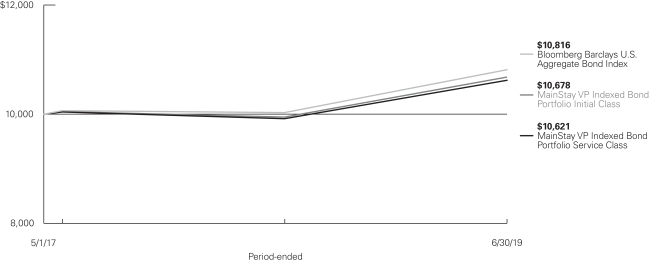

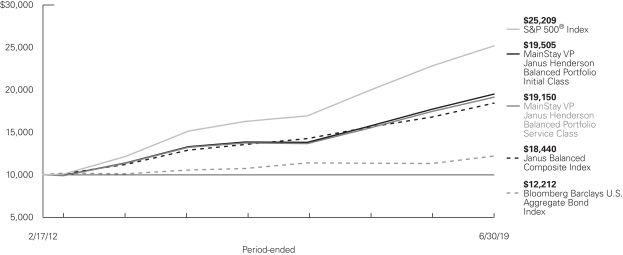

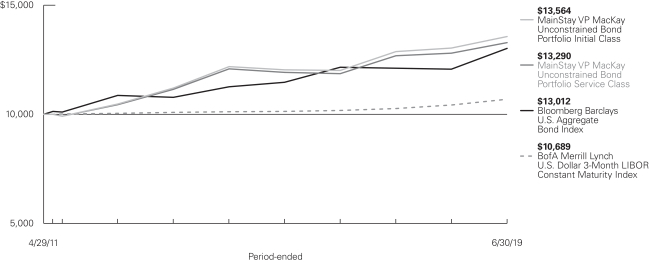

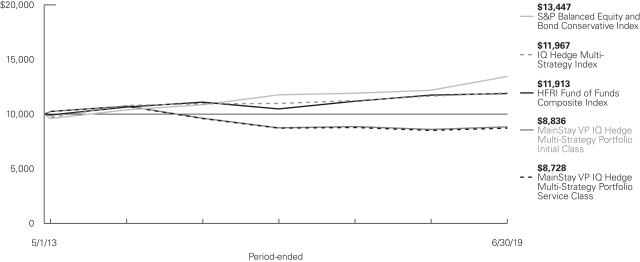

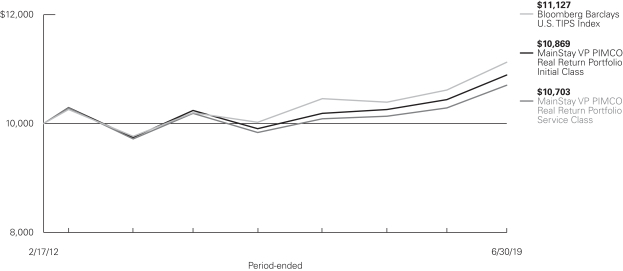

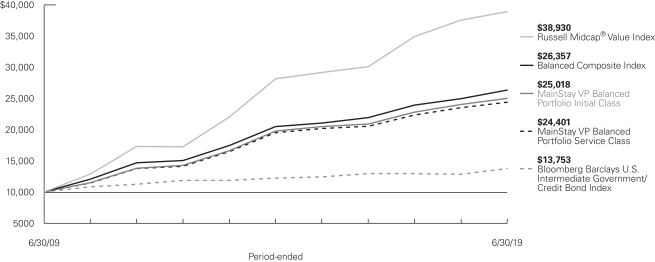

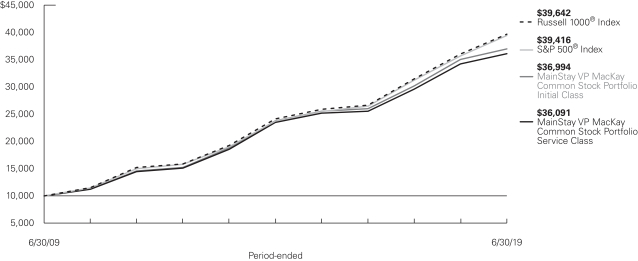

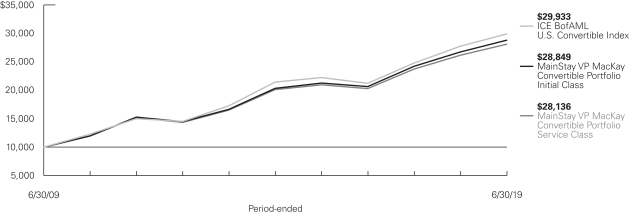

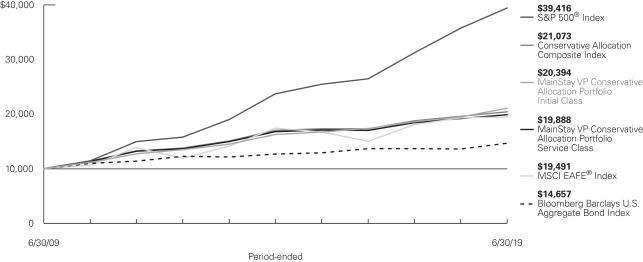

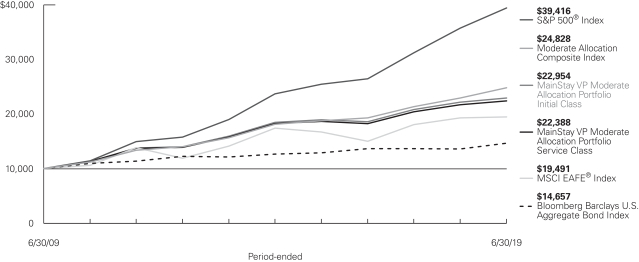

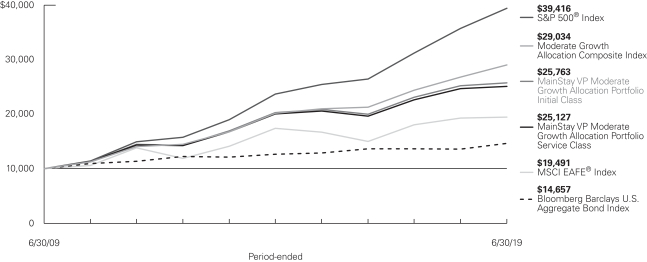

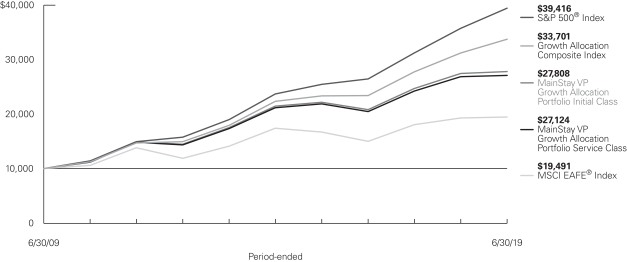

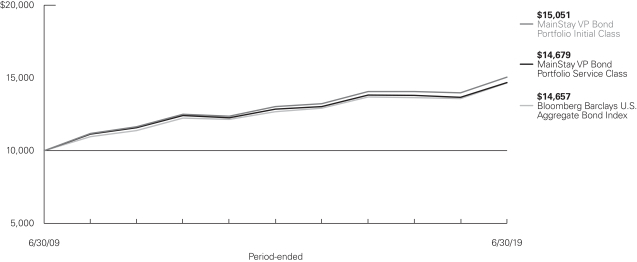

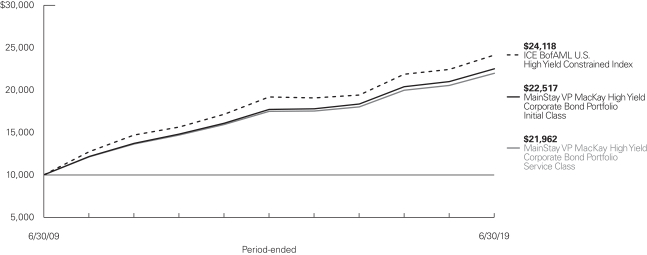

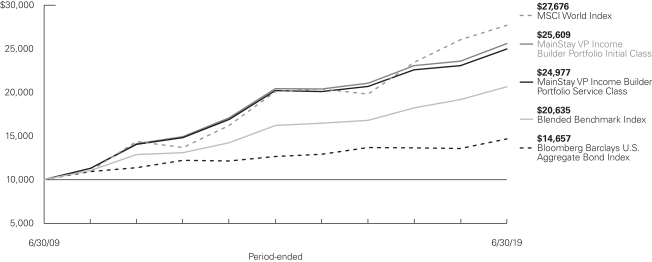

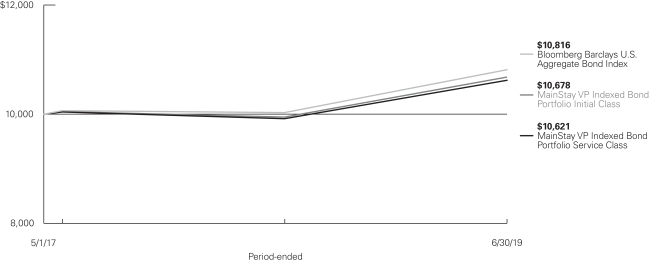

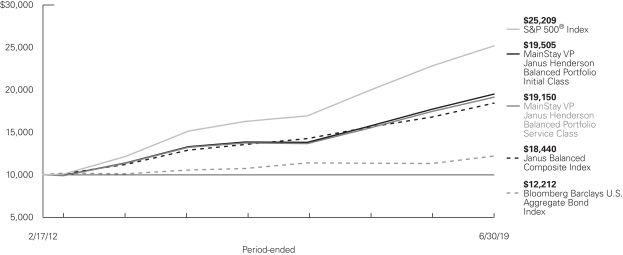

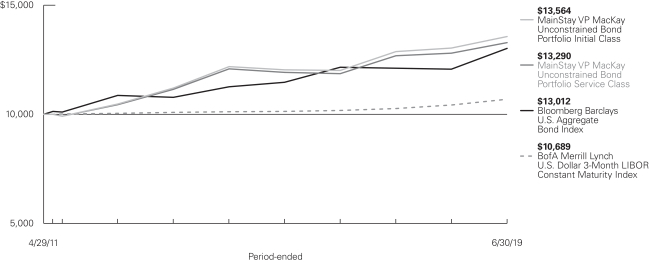

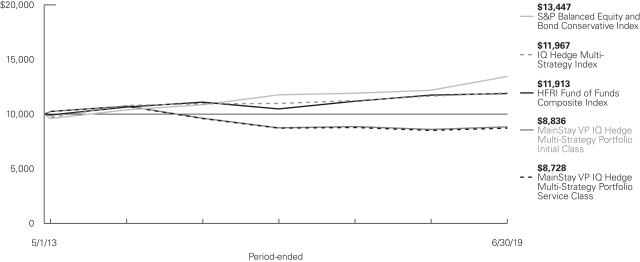

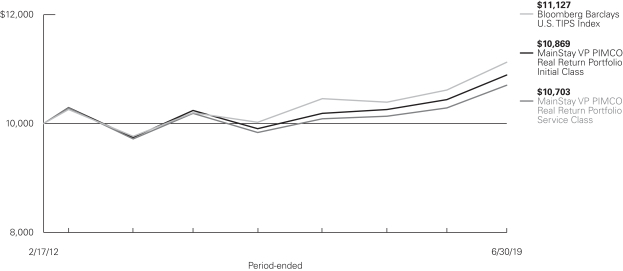

Investment and Performance Comparison1(Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The performance table and graph do not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. Please refer to the Performance Summary appropriate for your policy. For performance information current to the most recent month-end, please call800-598-2019 or visit www.newyorklife.com.

Average Annual Total Returns for the Period-Ended June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | |

| Class | | Inception

Date | | Six Months | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio2 | |

| | | | | | |

Initial Class Shares | | 5/2/2005 | | | 11.81 | % | | | 4.07 | % | | | 4.82 | % | | | 9.60 | % | | | 0.75 | % |

Service Class Shares | | 5/2/2005 | | | 11.67 | | | | 3.81 | | | | 4.56 | | | | 9.33 | | | | 1.00 | |

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

| | | | |

Russell Midcap® Value Index3 | | | 18.02 | % | | | 3.68 | % | | | 6.72 | % | | | 14.56 | % |

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index4 | | | 4.97 | | | | 6.93 | | | | 2.39 | | | | 3.24 | |

Balanced Composite Index5 | | | 12.88 | | | | 5.49 | | | | 5.18 | | | | 10.18 | |

Morningstar Allocation—50% to 70% Equity Category Average6 | | | 12.21 | | | | 5.73 | | | | 5.04 | | | | 8.93 | |

| 1. | Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been different. For information on current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements. |

| 2. | The gross expense ratios presented reflect the Portfolio’s “Total Annual Portfolio Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| 3. | The Russell Midcap® Value Index is the Portfolio’s primary broad-based securities market index for comparison purposes. The Russell Midcap® Value Index measures the performance of themid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lowerprice-to-book ratios and lower forecasted growth values. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 4. | The Portfolio has selected the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index as a secondary benchmark. The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index measures the |

| | performance of U.S. dollar-denominated U.S. Treasurys, government-related and investment-grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 5. | The Portfolio has selected the Balanced Composite Index as an additional benchmark. The Balanced Composite Index consists of the Russell Midcap® Value Index (60% weighted) and the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index (40% weighted). Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 6. | The Morningstar Allocation—50% to 70% Equity Category Average is representative of funds that seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These funds are dominated by domestic holdings and have equity exposures between 50% and 70%. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

Cost in Dollars of a $1,000 Investment in MainStay VP Balanced Portfolio (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from January 1, 2019, to June 30, 2019, and the impact of those costs on your investment.

Example

As a shareholder of the Portfolio you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2019, to June 30, 2019. Shares are only sold in connection with variable life and annuity contracts and the example does not reflect any contract level or transactional fees or expenses. If these costs had been included, your costs would have been higher.

This example illustrates your Portfolio’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June 30, 2019. Simply divide your account value by $1,000

(for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for thesix-month period shown. You may use this information to compare the ongoing costs of investing in the Portfolio with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

1/1/19 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/19 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/19 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2 |

| | | | | | |

| Initial Class Shares | | $ | 1,000.00 | | | $ | 1,118.10 | | | $ | 3.99 | | | $ | 1,021.03 | | | $ | 3.81 | | | 0.76% |

| | | | | | |

| Service Class Shares | | $ | 1,000.00 | | | $ | 1,116.70 | | | $ | 5.30 | | | $ | 1,019.79 | | | $ | 5.06 | | | 1.01% |

| 1. | Expenses are equal to the Portfolio’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 181 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Portfolio’s annualized expense ratio to reflect the six-month period. |

| | |

| 6 | | MainStay VP Balanced Portfolio |

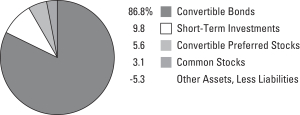

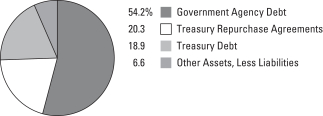

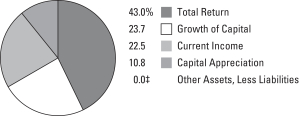

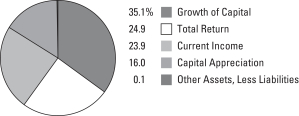

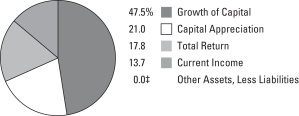

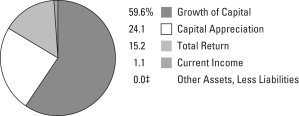

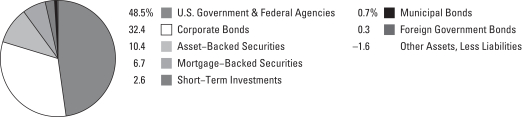

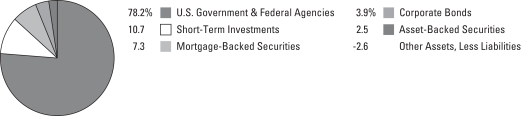

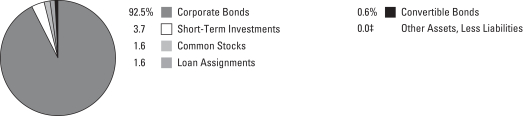

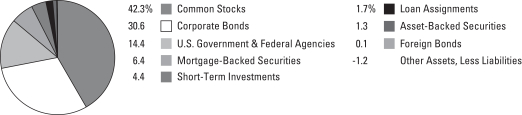

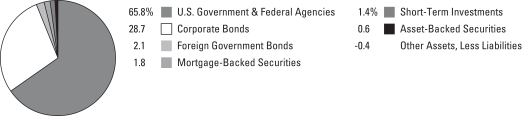

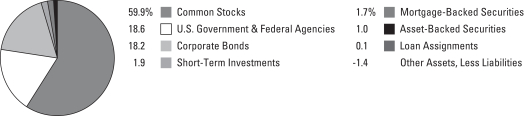

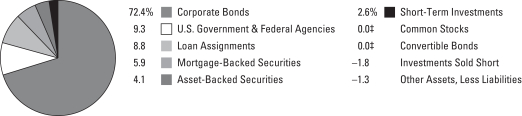

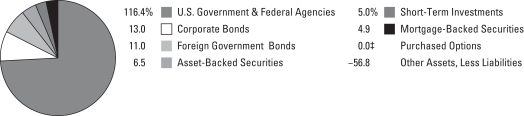

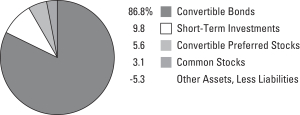

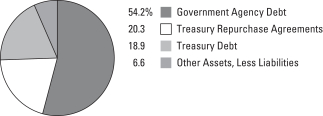

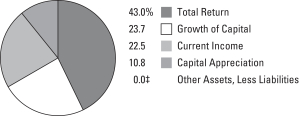

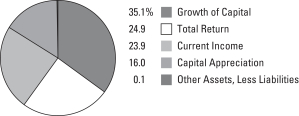

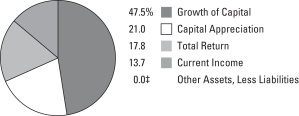

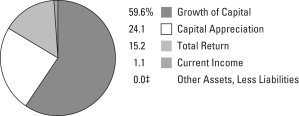

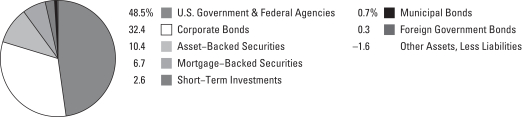

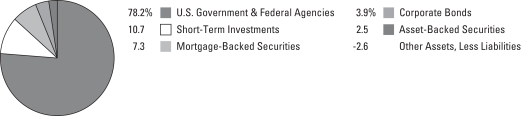

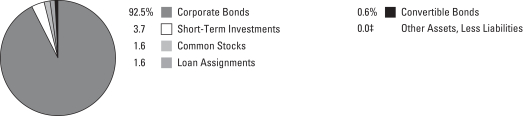

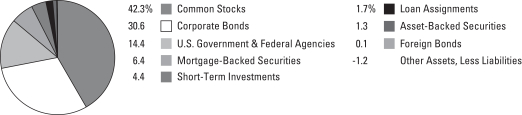

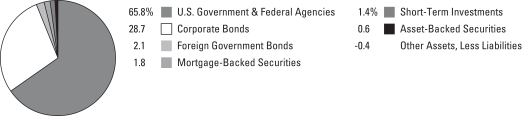

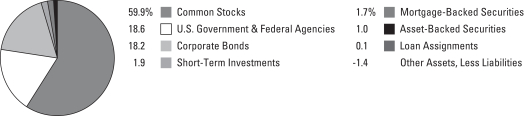

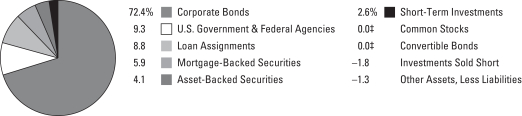

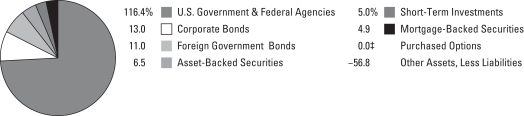

Portfolio Composition as of June 30, 2019(Unaudited)

See Portfolio of Investments beginning on page 11 for specific holdings within these categories. The Portfolio’s holdings are subject to change.

Top Ten Holdings or Issuers Held as of June 30, 2019(excludingshort-term investments) (Unaudited)

| 1. | United States Treasury Notes, 1.75%–3.00%, due 4/30/20–5/15/29 |

| 2. | iShares Intermediate Government / Credit Bond ETF |

| 3. | Federal Home Loan Bank, 1.70%–3.25%, due 5/15/20–11/16/28 |

| 4. | Federal Home Loan Mortgage Corporation, 1.25%–2.90%, due 8/15/19–6/17/24 |

| 8. | iShares Russell 1000 Value ETF |

| 10. | Anadarko Petroleum Corp. |

Portfolio Management Discussion and Analysis(Unaudited)

Answers to the questions reflect the views of portfolio managers Jae S. Yoon, CFA, and Jonathan Swaney of New York Life Investment Management LLC, the Portfolio’s Manager; Kenneth Sommer and AJ Rzad, CFA, of NYL Investors LLC, the Portfolio’s fixed-income Subadvisor; and Migene Kim, CFA, and Mona Patni of MacKay Shields LLC, the Portfolio’s equity Subadvisor.

How did MainStay VP Balanced Portfolio perform relative to its benchmarks and peers during the six months ended June 30, 2019?

For the six months ended June 30, 2019, MainStay VP Balanced Portfolio returned 11.81% for Initial Class shares and 11.67% for Service Class shares. Over the same period, both share classes underperformed the 18.02% return of the Russell Midcap® Value Index, which is the Portfolio’s primary benchmark, and outperformed the 4.97% return of the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index, which is a secondary benchmark of the Portfolio. For the six months ended June 30, 2019, both share classes underperformed the 12.88% return of the Balanced Composite Index, which is an additional benchmark of the Portfolio, and the 12.21% return of the Morningstar Allocation—50% to 70% Equity Category Average.1

What factors affected the Portfolio’s performance relative to its benchmarks and peers during the reporting period?

In the equity portion of the Portfolio, stock selection was primarily responsible for the Portfolio’s underperformance relative to the Russell Midcap® Value Index during the reporting period, whereas sector allocation effect was neutral. The Portfolio’s performance directly reflected the performance of our stock selection model, particularly the weak effectiveness of the model’s valuation signals, which seek to evaluate companies across sales- and cash-based measures on a peer-relative basis. Valuation ranges across markets were compressed and value signals, which tend to prove most effective in an environment in which profits are accelerating, struggled amid a decelerating global growth outlook. Valuation signals proved more effective in June 2019 when value performance rebounded. Positive contributions from the stock selection model’s other factors provided only partial mitigation. (Contributions take weightings and total returns into account.) Momentum signals, which evaluate historical price trends, generated positive performance for the Portfolio during the reporting period, but proved volatile and inconsistent, hence difficult to capture. Sentiment signals, a gauge of institutional investor sentiment, were not effective during the first half of the reporting period but rebounded in the second half of the same period thanks to the Portfolio’s underweight positions.

The fixed-income portion of the Portfolio held overweight exposure relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index in the corporate, asset-backed and commercial mortgage-backed sectors throughout the

reporting period. Of these, corporate sector holdings generated the strongest performance. Within the corporate sector, the Portfolio’s allocations to financials and industrials were most accretive to returns. Within the asset-backed sector, the Portfolio’s allocation to collateralized loan obligations bolstered performance. During the first half of the reporting period, the Portfolio’s overweight exposure to U.S. government agencies was accretive to performance. During the second half of the same period, the Portfolio’s overweight allocation to fixed-rate asset-backed securities detracted from performance. Throughout the reporting period, the Portfolio’s underweight position in thenon-corporate sector detracted from performance as well.

During the reporting period, how was the Portfolio’s performance materially affected by investments in derivatives?

During the reporting period, the equity portion of the Portfolio did not use derivatives. Over the same period, the use of derivatives by the fixed-income portion of Portfolio was limited to interest-rate derivatives used to keep the duration2 of the Portfolio in line with the Subadvisor’s target. These interest-rate derivatives had a slightly positive impact on the performance of the fixed-income portion of the Portfolio during the reporting period.

During the reporting period, which sectors were the strongest positive contributors to relative performance in the equity portion of Portfolio and which sectors were particularly weak?

During the reporting period, the sectors that made the greatest positive contributions to the performance of the equity portion of the Portfolio relative to the Russell Midcap® Value Index included consumer staples, consumer discretionary and materials. Over the same period, the sectors that detracted the most from the relative performance of the equity portion of the Portfolio included health care, information technology and industrials.

During the reporting period, which individual stocks made the strongest positive contributions to the absolute performance of the equity portion of the Portfolio and which individual stocks detracted the most?

The stocks that made the most substantial positive contributions to the absolute performance of the equity portion of the Portfolio during the reporting period included packing & containers

| 1. | See page 5 for more information on benchmark and peer group returns. |

| 2. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| | |

| 8 | | MainStay VP Balanced Portfolio |

manufacturer Ball, consumer finance company Synchrony Financial, and food manufacturer Tyson Foods. The stocks that detracted the most from the absolute performance of the equity portion of the Portfolio during the reporting period included communications equipment company CommScope, generic drug maker Mylan and department store chain Kohl’s.

Did the equity portion of the Portfolio make any significant purchases or sales during the reporting period?

During the reporting period, the equity portion of the Portfolio made its largest initial purchase in insurance company Arch Capital, and its largest increase in position size in payment processing firm Worldpay. Over the same period, the equity portion of the Portfolio made its largest complete sale of a position in reinsurance group Everest Re Group, and its most substantial decrease in position size in life sciences tools & services company Agilent Technologies.

How did sector weightings change in the equity portion of the Portfolio during the reporting period?

Relative to the Russell Midcap® Value Index, the equity portion of the Portfolio saw its most substantial weighting increases of the reporting period in the industrials and consumer staples sectors. Over the same period, the equity portion of the Portfolio saw its most significant decreases in sector exposures relative to the benchmark in utilities and energy.

How was the equity portion of the Portfolio positioned at the end of the reporting period?

As of June 30, 2019, the equity portion of the Portfolio held its most substantially overweight sector positions relative to the Russell Midcap® Value Index in communication services and consumer staples. As of the same date, the equity portion of the Portfolio held its most substantially underweight sector positions relative to the Index in real estate and utilities.

What was the duration strategy of the fixed-income portion of the Portfolio during the reporting period?

During the reporting period, the fixed-income portion of the Portfolio generally maintained a duration that was relatively close to that of the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. However, on several occasions we shortened the duration of the Portfolio relative to the benchmark, a strategy that had a slightly positive impact on the Portfolio’s performance. As of June 30, 2019, the effective duration of the fixed-income portion of the Portfolio was 3.94 years, compared to a duration of

3.92 years for the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index.

What specific factors, risks or market forces prompted significant decisions for the fixed-income portion of the Portfolio during the reporting period?

The fixed-income portion of the Portfolio maintained overweight positions relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index in corporate bonds, commercial mortgage-backed securities and asset-backed securities throughout the reporting period. During the reporting period, we reduced the Portfolio’s exposure to the corporate sector as yields declined and valuations became less attractive, despite lingering concerns about global growth and unresolved trade-related tensions with China. Specifically, we reduced the Portfolio’s exposure to financials, health care and wirelines as these sectors constituted the largest risk positions in the Portfolio. During the first half of the reporting period, we increased the Portfolio’s allocation to U.S. government agencies. Spreads3 on longer-duration U.S. government agency securities moved wider as market volatility picked up towards the end of 2018. This created an attractive opportunity to add to the Portfolio’s overweight exposure to the sector. Throughout the reporting period we maintained the Portfolio’s overweight allocation to asset-backed securities and commercial mortgage-backed securities, sectors that, in our opinion, offered favorable yield dynamics and superior credit quality.

During the reporting period, which market segments made the strongest positive contributions to the performance of the fixed-income portion of the Portfolio and which market segments were particularly weak?

During the reporting period, the fixed-income portion of the Portfolio maintained overweight exposure relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index in the financial, industrial and utilities sectors. This positioning contributed positively to the Portfolio’s performance relative to the Index. Among financials, the banking subsector had the most positive impact on the Portfolio’s relative performance, with overweight positions in securities issued by Bank of America, Morgan Stanley and Citigroup all adding to relative performance. Leading holdings among industrial bonds included securities issued by Anheuser-Busch, InBev Worldwide and Verizon Communications. Among utilities, the Portfolio’s overweight exposure to the electric subsector enhanced relative performance. In thenon-corporate sector, the Portfolio’s underweight position versus the benchmark in the sovereign subsector detracted from relative performance.

| 3. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. |

Did the fixed-income portion of the Portfolio make any significant purchases or sales during the reporting period?

During the reporting period, the fixed-income portion of the Portfolio generally sought to purchase corporate bonds during periods of market weakness. As the market stabilized, the fixed-income portion of the Portfolio sold corporate bonds to reduce the degree to which it was overweight relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index.

During the reporting period, how did sector (or industry) weightings change in the fixed-income portion of the Portfolio?

The fixed-income portion of the Portfolio held overweight exposures to commercial mortgage-backed securities and asset-backed securities throughout the reporting period. In the second half of the reporting period, we moderately reduced the Portfolio’s allocation to commercial mortgage-backed securities and remained focused on asset-backed securities due to compelling relative value opportunities in collateralized loan obligations and student loans. As we trimmed the Portfolio’s corporate sector holdings, we increased the Portfolio’s exposure to the Treasury sector.

How was the fixed-income portion of the Portfolio positioned at the end of the reporting period?

As of June 30, 2019, the fixed-income portion of the Portfolio held an overweight position relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index in corporate bonds. Within the corporate sector, the fixed-income portion of the Portfolio held overweight positions in financials and utilities. As of the same date, the fixed-income portion of the Portfolio also held overweight positions in asset-backed securities, commercial mortgage-backed securities and U.S. government agencies. The largest overweight allocation in spread assets at the end of the reporting period was in the asset-backed securities sector.

As of June 30, 2019, the fixed-income portion of the Portfolio held underweight positions relative to the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index in the sovereign, supranational, foreign agency and foreign local government sectors.

As of June 30, 2019, the fixed-income portion of the Portfolio maintained a duration that was slightly longer than the duration of the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

| | |

| 10 | | MainStay VP Balanced Portfolio |

Portfolio of InvestmentsJune 30, 2019 (Unaudited)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 37.6%† Asset-Backed Securities 3.3% | | | | | | | | |

Automobile 0.2% | |

Avis Budget Rental Car Funding AESOP LLC

Series 2019-1A, Class A

3.45%, due 3/20/23 (a) | | $ | 100,000 | | | $ | 102,418 | |

Mercedes Benz Auto Lease Trust

Series 2019-A, Class A3

3.10%, due 11/15/21 | | | 150,000 | | | | 151,609 | |

Toyota Auto Loan Extended Note Trust

Series 2019-1A, Class A

2.56%, due 11/25/31 (a) | | | 750,000 | | | | 758,789 | |

| | | | | | | | |

| | | | | | | 1,012,816 | |

| | | | | | | | |

Other Asset-Backed Securities 3.1% | |

AIMCO CLO

Series 2017-AA, Class A

3.852% (3 Month LIBOR + 1.26%),

due 7/20/29 (a)(b) | | | 250,000 | | | | 250,098 | |

Apidos CLO

Series 2015-21A, Class A1R

3.531% (3 Month LIBOR + 0.93%),

due 7/18/27 (a)(b) | | | 400,000 | | | | 400,026 | |

Apidos CLO XXV

Series 2016-25A, Class A1R

3.762% (3 Month LIBOR + 1.17%),

due 10/20/31 (a)(b) | | | 400,000 | | | | 399,359 | |

Ares XXIX CLO, Ltd.

Series 2014-1A, Class A1R

3.778% (3 Month LIBOR + 1.19%),

due 4/17/26 (a)(b) | | | 113,759 | | | | 113,789 | |

Benefit Street Partners CLO, Ltd.

Series 2015-VIIA, Class A1AR

3.381% (3 Month LIBOR + 0.78%),

due 7/18/27 (a)(b) | | | 250,000 | | | | 249,264 | |

Benefit Street Partners CLO IV, Ltd.

Series 2014-IVA, Class A1

3.842% (3 Month LIBOR + 1.25%),

due 1/20/29 (a)(b) | | | 300,000 | | | | 300,067 | |

Cedar Funding IV CLO, Ltd.

Series 2014-4A, Class AR

3.822% (3 Month LIBOR + 1.23%),

due 7/23/30 (a)(b) | | | 750,000 | | | | 749,464 | |

DB Master Finance LLC

Series 2019-1A, Class A2I

3.787%, due 5/20/49 (a) | | | 550,000 | | | | 561,726 | |

Domino’s Pizza Master Issuer LLC

Series 2017-1A, Class A2II

3.082%, due 7/25/47 (a) | | | 1,277,250 | | | | 1,279,179 | |

Dryden Senior Loan Fund

Series 2018-71A, Class A

3.843% (3 Month LIBOR + 1.15%),

due 1/15/29 (a)(b) | | | 300,000 | | | | 300,003 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Other Asset-Backed Securities (continued) | |

Elara HGV Timeshare Issuer LLC

Series 2017-A, Class A

2.69%, due 3/25/30 (a) | | $ | 119,810 | | | $ | 120,034 | |

FOCUS Brands Funding LLC

Series 2017-1A, Class A2I

3.857%, due 4/30/47 (a) | | | 98,000 | | | | 100,731 | |

Galaxy XXII CLO, Ltd.

Series 2016-22A, Class A1R

3.779% (3 Month LIBOR + 1.00%),

due 7/16/28 (a)(b) | | | 250,000 | | | | 249,997 | |

Highbridge Loan Management, Ltd.

Series 2011-A17, Class A

3.825%, due 5/6/30 (a) | | | 850,000 | | | | 850,026 | |

Hilton Grand Vacations Trust

Series 2018-AA, Class A

3.54%, due 2/25/32 (a) | | | 350,260 | | | | 360,782 | |

Magnetite XVIII, Ltd.

Series 2016-18A, Class AR

3.598% (3 Month LIBOR + 1.08%),

due 11/15/28 (a)(b) | | | 400,000 | | | | 399,417 | |

MVW Owner Trust

Series 2019-1A, Class A

2.89%, due 11/20/36 (a) | | | 250,000 | | | | 253,294 | |

Navient Private Education Refi Loan Trust

Series 2019-CA, Class A2

3.13%, due 2/15/68 (a) | | | 300,000 | | | | 306,386 | |

Octagon Investment Partners 30, Ltd.

Series 2017-1A, Class A1

3.912% (3 Month LIBOR + 1.32%),

due 3/17/30 (a)(b) | | | 350,000 | | | | 350,907 | |

Palmer Square CLO, Ltd.

Series 2015-1A, Class A1R2

3.742% (3 Month LIBOR + 1.22%),

due 5/21/29 (a)(b) | | | 500,000 | | | | 499,997 | |

Regatta VI Funding, Ltd.

Series 2016-1A, Class AR

3.672% (3 Month LIBOR + 1.08%),

due 7/20/28 (a)(b) | | | 400,000 | | | | 399,741 | |

Sierra Receivables Funding Co. LLC

Series 2019-1A, Class A

3.20%, due 1/20/36 (a) | | | 173,829 | | | | 178,100 | |

SMB Private Education Loan Trust

Series 2019-B, Class A2A

2.84%, due 6/15/37 (a) | | | 500,000 | | | | 503,895 | |

SoFi Professional Loan Program LLC

Series 2019-A, Class A1FX

3.18%, due 6/15/48 (a) | | | 263,115 | | | | 265,610 | |

Sound Point CLO XVI, Ltd.

Series 2017-2A, Class A

3.86% (3 Month LIBOR + 1.28%),

due 7/25/30 (a)(b) | | | 450,000 | | | | 449,554 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of InvestmentsJune 30, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Asset-Backed Securities (continued) | |

Other Asset-Backed Securities (continued) | |

Taco Bell Funding, LLC

Series 2018-1A, Class A2I

4.318%, due 11/25/48 (a) | | $ | 398,000 | | | $ | 412,841 | |

THL Credit Wind River CLO, Ltd.

Series 2017-4A, Class A

3.67% (3 Month LIBOR + 1.15%),

due 11/20/30 (a)(b) | | | 250,000 | | | | 249,201 | |

TIAA CLO III, Ltd.

Series 2017-2A, Class A

3.751% (3 Month LIBOR + 1.15%),

due 1/16/31 (a)(b) | | | 350,000 | | | | 347,696 | |

TICP CLO XIII, Ltd.

Series 2019 13A, Class A

3.665% (3 Month LIBOR + 1.3%),

due 7/15/32 (a)(b) | | | 350,000 | | | | 349,992 | |

Treman Park CLO, Ltd.

Series 2015-1A, Class ARR

3.662% (3 Month LIBOR + 1.07%),

due 10/20/28 (a)(b) | | | 260,000 | | | | 260,001 | |

Voya CLO, Ltd.

Series 2019-1A, Class A

3.813% (3 Month LIBOR + 1.17%),

due 4/15/29 (a)(b) | | | 250,000 | | | | 250,007 | |

Westcott Park CLO, Ltd.

Series 2016 1A, Class AR

3.684% (3 Month LIBOR + 1.21%),

due 7/20/28 (a)(b) | | | 400,000 | | | | 400,021 | |

| | | | | | | | |

| | | | | | | 12,161,205 | |

| | | | | | | | |

Total Asset-Backed Securities

(Cost $13,103,736) | | | | | | | 13,174,021 | |

| | | | | | | | |

| | |

| Corporate Bonds 14.5% | | | | | | | | |

Aerospace & Defense 0.4% | |

BAE Systems PLC

4.75%, due 10/11/21 (a) | | | 1,050,000 | | | | 1,099,528 | |

Boeing Co.

3.10%, due 5/1/26 | | | 425,000 | | | | 437,379 | |

| | | | | | | | |

| | | | | | | 1,536,907 | |

| | | | | | | | |

Auto Manufacturers 0.6% | |

Ford Motor Credit Co. LLC | | | | | | | | |

4.25%, due 9/20/22 | | | 620,000 | | | | 635,888 | |

5.875%, due 8/2/21 | | | 365,000 | | | | 384,878 | |

General Motors Financial Co., Inc.

4.35%, due 4/9/25 | | | 500,000 | | | | 515,792 | |

Volkswagen Group of America Finance LLC

4.00%, due 11/12/21 (a) | | | 725,000 | | | | 748,298 | |

| | | | | | | | |

| | | | | | | 2,284,856 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Banks 4.2% | |

Bank of America Corp.

4.45%, due 3/3/26 | | $ | 1,920,000 | | | $ | 2,070,995 | |

Bank of Montreal

3.081% (3 Month LIBOR + 0.63%),

due 9/11/22 (b) | | | 600,000 | | | | 602,521 | |

Citigroup, Inc.

4.60%, due 3/9/26 | | | 1,600,000 | | | | 1,731,136 | |

Credit Agricole S.A.

3.375%, due 1/10/22 (a) | | | 250,000 | | | | 254,965 | |

Credit Suisse Group Funding Guernsey, Ltd.

3.80%, due 9/15/22 | | | 865,000 | | | | 896,747 | |

Discover Bank

3.20%, due 8/9/21 | | | 850,000 | | | | 862,583 | |

Fifth Third Bancorp

4.30%, due 1/16/24 | | | 750,000 | | | | 800,930 | |

Goldman Sachs Group, Inc. | | | | | | | | |

2.905%, due 7/24/23 (c) | | | 870,000 | | | | 878,414 | |

3.85%, due 1/26/27 | | | 475,000 | | | | 496,468 | |

HSBC Holdings PLC | | | | | | | | |

3.086% (3 Month LIBOR + 0.65%),

due 9/11/21 (b) | | | 900,000 | | | | 900,832 | |

3.973%, due 5/22/30 (c) | | | 250,000 | | | | 261,139 | |

JPMorgan Chase & Co. | | | | | | | | |

3.702%, due 5/6/30 (c) | | | 175,000 | | | | 184,515 | |

3.875%, due 9/10/24 | | | 2,275,000 | | | | 2,391,784 | |

Lloyds Banking Group PLC

2.907%, due 11/7/23 (c) | | | 1,000,000 | | | | 1,001,661 | |

Morgan Stanley | | | | | | | | |

3.625%, due 1/20/27 | | | 250,000 | | | | 262,384 | |

4.10%, due 5/22/23 | | | 1,000,000 | | | | 1,052,664 | |

4.35%, due 9/8/26 | | | 595,000 | | | | 638,034 | |

Santander UK PLC

3.40%, due 6/1/21 | | | 200,000 | | | | 203,321 | |

SunTrust Bank

3.115% (3 Month LIBOR + 0.59%),

due 5/17/22 (b) | | | 800,000 | | | | 801,245 | |

UBS Group Funding Switzerland A.G.

4.125%, due 4/15/26 (a) | | | 500,000 | | | | 534,157 | |

| | | | | | | | |

| | | | | | | 16,826,495 | |

| | | | | | | | |

Beverages 0.3% | |

Anheuser-Busch InBev Worldwide, Inc. | | | | | | | | |

4.00%, due 4/13/28 | | | 350,000 | | | | 378,018 | |

4.75%, due 1/23/29 | | | 770,000 | | | | 874,109 | |

| | | | | | | | |

| | | | | | | 1,252,127 | |

| | | | | | | | |

Building Materials 0.4% | |

Fortune Brands Home & Security, Inc.

4.00%, due 6/15/25 | | | 850,000 | | | | 894,360 | |

Masco Corp.

4.45%, due 4/1/25 | | | 850,000 | | | | 905,265 | |

| | | | | | | | |

| | | | | | | 1,799,625 | |

| | | | | | | | |

| | | | |

| 12 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Chemicals 0.2% | |

Dow Chemical Co. (a) | | | | | | | | |

3.15%, due 5/15/24 | | $ | 175,000 | | | $ | 178,481 | |

4.80%, due 11/30/28 | | | 250,000 | | | | 281,171 | |

NewMarket Corp.

4.10%, due 12/15/22 | | | 400,000 | | | | 414,793 | |

| | | | | | | | |

| | | | | | | 874,445 | |

| | | | | | | | |

Diversified Financial Services 0.5% | |

American Express Co.

3.70%, due 11/5/21 | | | 500,000 | | | | 515,435 | |

Discover Financial Services

5.20%, due 4/27/22 | | | 25,000 | | | | 26,768 | |

GE Capital International Funding Co.

3.373%, due 11/15/25 | | | 1,015,000 | | | | 1,027,487 | |

TD Ameritrade Holding Corp.

2.95%, due 4/1/22 | | | 300,000 | | | | 305,425 | |

| | | | | | | | |

| | | | | | | 1,875,115 | |

| | | | | | | | |

Electric 1.6% | |

Arizona Public Service Co.

2.20%, due 1/15/20 | | | 250,000 | | | | 249,674 | |

Commonwealth Edison Co.

3.10%, due 11/1/24 | | | 400,000 | | | | 412,807 | |

DTE Electric Co.

2.65%, due 6/15/22 | | | 375,000 | | | | 379,516 | |

Electricite de France S.A.

2.35%, due 10/13/20 (a) | | | 1,500,000 | | | | 1,500,827 | |

Emera U.S. Finance, L.P.

2.70%, due 6/15/21 | | | 750,000 | | | | 752,564 | |

Entergy Arkansas LLC

3.70%, due 6/1/24 | | | 375,000 | | | | 397,028 | |

Entergy Corp.

4.00%, due 7/15/22 | | | 750,000 | | | | 780,244 | |

Evergy, Inc.

4.85%, due 6/1/21 | | | 280,000 | | | | 290,003 | |

Exelon Corp.

2.85%, due 6/15/20 | | | 425,000 | | | | 426,346 | |

FirstEnergy Transmission LLC

4.35%, due 1/15/25 (a) | | | 500,000 | | | | 536,641 | |

NextEra Energy Capital Holdings, Inc.

3.25%, due 4/1/26 (d) | | | 375,000 | | | | 385,495 | |

WEC Energy Group, Inc.

3.375%, due 6/15/21 | | | 350,000 | | | | 356,869 | |

| | | | | | | | |

| | | | | | | 6,468,014 | |

| | | | | | | | |

Food 0.3% | |

Conagra Brands, Inc.

4.85%, due 11/1/28 | | | 350,000 | | | | 388,194 | |

Ingredion, Inc.

4.625%, due 11/1/20 | | | 175,000 | | | | 179,757 | |

Kraft Heinz Foods Co.

3.00%, due 6/1/26 | | | 140,000 | | | | 136,232 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Food (continued) | | | | | | | | |

Tyson Foods, Inc.

4.00%, due 3/1/26 | | $ | 325,000 | | | $ | 345,666 | |

| | | | | | | | |

| | | | | | | 1,049,849 | |

| | | | | | | | |

Forest Products & Paper 0.1% | |

Fibria Overseas Finance, Ltd.

4.00%, due 1/14/25 | | | 375,000 | | | | 377,812 | |

| | | | | | | | |

|

Health Care—Products 0.3% | |

Becton Dickinson & Co.

2.894%, due 6/6/22 | | | 1,213,000 | | | | 1,229,479 | |

| | | | | | | | |

|

Health Care—Services 0.3% | |

Cigna Corp.

4.125%, due 11/15/25 (a) | | | 965,000 | | | | 1,027,668 | |

| | | | | | | | |

|

Iron & Steel 0.2% | |

Carpenter Technology Corp.

4.45%, due 3/1/23 | | | 125,000 | | | | 126,869 | |

Reliance Steel & Aluminum Co.

4.50%, due 4/15/23 | | | 700,000 | | | | 734,977 | |

| | | | | | | | |

| | | | | | | 861,846 | |

| | | | | | | | |

Media 0.1% | |

Fox Corp.

4.709%, due 1/25/29 (a) | | | 265,000 | | | | 296,468 | |

| | | | | | | | |

|

Miscellaneous—Manufacturing 0.1% | |

Parker-Hannifin Corp.

3.25%, due 6/14/29 | | | 250,000 | | | | 259,298 | |

| | | | | | | | |

|

Multi-National 0.6% | |

International Bank for Reconstruction & Development | | | | | | | | |

2.00%, due 10/30/20 | | | 600,000 | | | | 600,001 | |

2.60%, due 6/28/24 | | | 350,000 | | | | 349,560 | |

2.70%, due 5/16/22 | | | 575,000 | | | | 582,880 | |

2.88%, due 5/15/24 | | | 650,000 | | | | 665,377 | |

| | | | | | | | |

| | | | | | | 2,197,818 | |

| | | | | | | | |

Oil & Gas 0.6% | |

Anadarko Petroleum Corp. | | | | | | | | |

4.85%, due 3/15/21 | | | 797,000 | | | | 825,035 | |

5.55%, due 3/15/26 | | | 675,000 | | | | 758,619 | |

Cenovus Energy, Inc.

4.25%, due 4/15/27 (d) | | | 200,000 | | | | 207,175 | |

Helmerich & Payne, Inc.

4.65%, due 3/15/25 | | | 400,000 | | | | 423,469 | |

Nabors Industries, Inc.

5.00%, due 9/15/20 (d) | | | 126,000 | | | | 126,315 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of InvestmentsJune 30, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Oil & Gas (continued) | |

Petroleos Mexicanos | | | | | | | | |

3.50%, due 1/30/23 | | $ | 100,000 | | | $ | 94,890 | |

4.875%, due 1/24/22 | | | 75,000 | | | | 74,812 | |

5.35%, due 2/12/28 | | | 50,000 | | | | 45,505 | |

| | | | | | | | |

| | | | | | | 2,555,820 | |

| | | | | | | | |

Oil & Gas Services 0.2% | |

Schlumberger Holdings Corp.

3.75%, due 5/1/24 (a) | | | 925,000 | | | | 963,831 | |

| | | | | | | | |

|

Packaging & Containers 0.2% | |

WRKCo., Inc.

3.75%, due 3/15/25 | | | 675,000 | | | | 700,312 | |

| | | | | | | | |

|

Pharmaceuticals 0.3% | |

Bayer U.S. Finance II LLC

3.875%, due 12/15/23 (a) | | | 425,000 | | | | 441,321 | |

Bristol-Myers Squibb Co.

3.20%, due 6/15/26 (a) | | | 625,000 | | | | 649,382 | |

| | | | | | | | |

| | | | | | | 1,090,703 | |

| | | | | | | | |

Pipelines 0.6% | |

Energy Transfer Partners, L.P. / Regency Energy Finance Corp.

5.875%, due 3/1/22 | | | 850,000 | | | | 911,800 | |

Kinder Morgan, Inc.

5.00%, due 2/15/21 (a) | | | 1,264,000 | | | | 1,310,971 | |

Texas Eastern Transmission, L.P.

2.80%, due 10/15/22 (a) | | | 175,000 | | | | 174,770 | |

| | | | | | | | |

| | | | | | | 2,397,541 | |

| | | | | | | | |

Real Estate Investment Trusts 1.0% | |

American Campus Communities Operating Partnership, L.P.

3.30%, due 7/15/26 | | | 650,000 | | | | 656,569 | |

HCP, Inc.

3.25%, due 7/15/26 | | | 450,000 | | | | 453,518 | |

Highwoods Realty, L.P.

3.625%, due 1/15/23 | | | 1,000,000 | | | | 1,021,670 | |

Realty Income Corp.

3.25%, due 10/15/22 | | | 475,000 | | | | 487,337 | |

VEREIT Operating Partnership, L.P.

4.875%, due 6/1/26 | | | 1,230,000 | | | | 1,330,101 | |

| | | | | | | | |

| | | | | | | 3,949,195 | |

| | | | | | | | |

Retail 0.3% | |

CVS Health Corp.

4.30%, due 3/25/28 | | | 975,000 | | | | 1,028,116 | |

Home Depot, Inc.

2.95%, due 6/15/29 | | | 300,000 | | | | 307,746 | |

| | | | | | | | |

| | | | | | | 1,335,862 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Software 0.5% | |

Fidelity National Information Services, Inc.

2.25%, due 8/15/21 | | $ | 1,075,000 | | | $ | 1,072,797 | |

Fiserv, Inc. | | | | | | | | |

3.20%, due 7/1/26 | | | 300,000 | | | | 306,204 | |

4.20%, due 10/1/28 | | | 475,000 | | | | 514,225 | |

4.75%, due 6/15/21 | | | 200,000 | | | | 208,868 | |

| | | | | | | | |

| | | | | | | 2,102,094 | |

| | | | | | | | |

Telecommunications 0.4% | |

AT&T, Inc.

4.35%, due 3/1/29 | | | 575,000 | | | | 619,321 | |

Verizon Communications, Inc. | | | | | | | | |

3.376%, due 2/15/25 | | | 131,000 | | | | 136,736 | |

4.016%, due 12/3/29 (a) | | | 862,000 | | | | 933,323 | |

| | | | | | | | |

| | | | | | | 1,689,380 | |

| | | | | | | | |

Transportation 0.2% | |

Union Pacific Corp.

3.70%, due 3/1/29 | | | 600,000 | | | | 645,556 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $55,717,443) | | | | | | | 57,648,116 | |

| | | | | | | | |

|

| Foreign Government Bonds 0.2% | |

Colombia 0.1% | |

Colombia Government International Bond

3.875%, due 4/25/27 | | | 220,000 | | | | 229,460 | |

| | | | | | | | |

|

Mexico 0.1% | |

Mexico Government International Bond

3.75%, due 1/11/28 | | | 300,000 | | | | 305,625 | |

| | | | | | | | |

|

Philippines 0.0%‡ | |

Philippine Government International Bond

3.00%, due 2/1/28 | | | 200,000 | | | | 205,370 | |

| | | | | | | | |

|

Poland 0.0%‡ | |

Republic of Poland Government International Bond

5.00%, due 3/23/22 | | | 50,000 | | | | 53,688 | |

| | | | | | | | |

Total Foreign Government Bonds

(Cost $746,488) | | | | | | | 794,143 | |

| | | | | | | | |

|

| Mortgage-Backed Securities 1.7% | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) 1.7% | |

Bank | | | | | | | | |

Series 2017-BNK5, Class A2

2.987%, due 6/15/60 | | | 300,000 | | | | 305,636 | |

Series 2018-BN14, Class A2

4.128%, due 9/15/60 | | | 400,000 | | | | 428,052 | |

| | | | |

| 14 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Mortgage-Backed Securities (continued) | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) (continued) | |

Benchmark Mortgage Trust | | | | | | | | |

Series 2018-B1, Class A2

3.571%, due 1/15/51 | | $ | 200,000 | | | $ | 208,222 | |

Series 2018-B2, Class A2

3.662%, due 2/15/51 | | | 150,000 | | | | 156,754 | |

CD Mortgage Trust

Series 2017-CD4, Class A2

3.03%, due 5/10/50 | | | 600,000 | | | | 610,796 | |

CFCRE Commercial Mortgage Trust

Series 2017-C8, Class A2

2.982%, due 6/15/50 | | | 900,000 | | | | 912,150 | |

DBJPM Mortgage Trust

Series 2017-C6, Class A2

2.917%, due 6/10/50 | | | 800,000 | | | | 813,345 | |

Federal Home Loan Mortgage Corporation Multifamily Structured Pass Through Certificates | | | | | | | | |

Series K090, Class A2

3.422%, due 2/25/29 | | | 300,000 | | | | 322,797 | |

Series K091, Class A2

3.505%, due 3/25/29 | | | 195,000 | | | | 211,386 | |

GRACE Mortgage Trust

Series 2014-GRCE, Class A

3.369%, due 6/10/28 (a) | | | 200,000 | | | | 203,777 | |

Morgan Stanley Bank of America Merrill Lynch Trust | | | | | | | | |

Series 2013-C13, Class A2

2.936%, due 11/15/46 | | | 5,323 | | | | 5,417 | |

Series 2017-C33, Class A2

3.14%, due 5/15/50 | | | 1,000,000 | | | | 1,021,497 | |

Morgan Stanley Capital I Trust

Series 2017-H1, Class A2

3.089%, due 6/15/50 | | | 900,000 | | | | 923,217 | |

UBS Commercial Mortgage Trust

Series 2018-C8, Class A2

3.713%, due 2/15/51 | | | 500,000 | | | | 521,353 | |

| | | | | | | | |

Total Mortgage-Backed Securities

(Cost $6,634,602) | | | | | | | 6,644,399 | |

| | | | | | | | |

|

| U.S. Government & Federal Agencies 17.9% | |

Federal Home Loan Bank 1.6% | | | | | | | | |

1.70%, due 5/15/20 | | | 500,000 | | | | 498,545 | |

2.30%, due 1/26/21 | | | 475,000 | | | | 475,107 | |

2.50%, due 12/10/27 | | | 1,050,000 | | | | 1,070,672 | |

2.51%, due 12/29/22 | | | 400,000 | | | | 400,447 | |

2.65%, due 5/23/22 | | | 275,000 | | | | 275,079 | |

3.00%, due 3/10/28 | | | 300,000 | | | | 316,958 | |

3.125%, due 9/12/25 | | | 800,000 | | | | 850,968 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Federal Home Loan Bank (continued) | | | | | | | | |

3.25%, due 6/9/28 | | $ | 800,000 | | | $ | 864,211 | |

3.25%, due 11/16/28 | | | 1,375,000 | | | | 1,494,223 | |

| | | | | | | | |

| | | | | | | 6,246,210 | |

| | | | | | | | |

Federal Home Loan Mortgage Corporation 1.0% | |

1.25%, due 8/15/19 | | | 350,000 | | | | 349,580 | |

2.55%, due 6/6/22 | | | 400,000 | | | | 400,149 | |

2.55%, due 6/20/22 | | | 325,000 | | | | 325,058 | |

2.70%, due 9/27/21 | | | 400,000 | | | | 400,489 | |

2.70%, due 4/5/22 | | | 400,000 | | | | 400,024 | |

2.70%, due 4/8/22 | | | 400,000 | | | | 400,629 | |

2.75%, due 6/17/24 | | | 400,000 | | | | 400,076 | |

2.753%, due 1/30/23 | | | 400,000 | | | | 400,215 | |

2.89%, due 4/16/24 | | | 400,000 | | | | 400,667 | |

2.90%, due 5/9/24 | | | 500,000 | | | | 500,318 | |

| | | | | | | | |

| | | | | | | 3,977,205 | |

| | | | | | | | |

Federal National Mortgage Association 0.4% | |

1.25%, due 7/26/19 | | | 450,000 | | | | 449,698 | |

1.875%, due 9/24/26 (d) | | | 1,125,000 | | | | 1,113,534 | |

| | | | | | | | |

| | | | | | | 1,563,232 | |

| | | | | | | | |

United States Treasury Notes 14.9% | | | | | | | | |

1.75%, due 6/15/22 | | | 8,000,000 | | | | 8,011,250 | |

1.875%, due 9/30/22 | | | 300,000 | | | | 301,477 | |

2.00%, due 5/31/24 | | | 9,900,000 | | | | 10,016,402 | |

2.125%, due 5/31/21 | | | 7,700,000 | | | | 7,752,336 | |

2.125%, due 5/31/26 | | | 900,000 | | | | 915,047 | |

2.25%, due 11/15/25 | | | 1,075,000 | | | | 1,100,909 | |

2.375%, due 4/30/20 | | | 425,000 | | | | 426,245 | |

2.375%, due 5/15/29 (d) | | | 1,825,000 | | | | 1,885,952 | |

2.50%, due 2/15/22 | | | 7,375,000 | | | | 7,519,907 | |

2.75%, due 4/30/23 | | | 3,825,000 | | | | 3,968,438 | |

2.875%, due 10/31/20 | | | 15,925,000 | | | | 16,132,149 | |

3.00%, due 9/30/25 | | | 1,200,000 | | | | 1,282,031 | |

| | | | | | | | |

| | | | | | | 59,312,143 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $70,094,347) | | | | | | | 71,098,790 | |

| | | | | | | | |

TotalLong-Term Bonds

(Cost $146,296,616) | | | | | | | 149,359,469 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | Shares | | | | |

| Common Stocks 56.5% | |

Aerospace & Defense 0.8% | |

Arconic, Inc. | | | 6,422 | | | | 165,816 | |

Curtiss-Wright Corp. | | | 1,459 | | | | 185,483 | |

General Dynamics Corp. | | | 3,368 | | | | 612,370 | |

Hexcel Corp. | | | 2,161 | | | | 174,782 | |

Huntington Ingalls Industries, Inc. | | | 439 | | | | 98,661 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of InvestmentsJune 30, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Aerospace & Defense (continued) | |

Raytheon Co. | | | 3,371 | | | $ | 586,149 | |

Spirit AeroSystems Holdings, Inc., Class A | | | 3,068 | | | | 249,643 | |

Textron, Inc. | | | 5,251 | | | | 278,513 | |

United Technologies Corp. | | | 5,452 | | | | 709,850 | |

| | | | | | | | |

| | | | | | | 3,061,267 | |

| | | | | | | | |

Air Freight & Logistics 0.2% | |

FedEx Corp. | | | 3,767 | | | | 618,504 | |

XPO Logistics, Inc. (e) | | | 1,040 | | | | 60,122 | |

| | | | | | | | |

| | | | | | | 678,626 | |

| | | | | | | | |

Airlines 1.0% | |

Alaska Air Group, Inc. | | | 10,895 | | | | 696,300 | |

Copa Holdings S.A., Class A | | | 2,942 | | | | 287,051 | |

Delta Air Lines, Inc. | | | 14,023 | | | | 795,805 | |

JetBlue Airways Corp. (e) | | | 16,752 | | | | 309,745 | |

Southwest Airlines Co. | | | 15,594 | | | | 791,863 | |

United Continental Holdings, Inc. (e) | | | 12,366 | | | | 1,082,643 | |

| | | | | | | | |

| | | | | | | 3,963,407 | |

| | | | | | | | |

Auto Components 0.2% | |

Aptiv PLC | | | 165 | | | | 13,337 | |

Lear Corp. | | | 4,726 | | | | 658,190 | |

| | | | | | | | |

| | | | | | | 671,527 | |

| | | | | | | | |

Automobiles 0.4% | |

Ford Motor Co. | | | 79,787 | | | | 816,221 | |

General Motors Co. | | | 15,803 | | | | 608,890 | |

| | | | | | | | |

| | | | | | | 1,425,111 | |

| | | | | | | | |

Banks 2.5% | |

Bank of America Corp. | | | 28,329 | | | | 821,541 | |

Bank OZK | | | 19,986 | | | | 601,379 | |

BB&T Corp. | | | 12,533 | | | | 615,746 | |

CIT Group, Inc. | | | 12,706 | | | | 667,573 | |

Citigroup, Inc. | | | 11,762 | | | | 823,693 | |

Citizens Financial Group, Inc. | | | 16,547 | | | | 585,102 | |

Comerica, Inc. | | | 6,618 | | | | 480,732 | |

Fifth Third Bancorp | | | 12,436 | | | | 346,964 | |

First Citizens BancShares, Inc., Class A | | | 722 | | | | 325,095 | |

First Hawaiian, Inc. | | | 20,661 | | | | 534,500 | |

JPMorgan Chase & Co. | | | 6,421 | | | | 717,868 | |

KeyCorp | | | 158 | | | | 2,804 | |

M&T Bank Corp. | | | 938 | | | | 159,526 | |

PNC Financial Services Group, Inc. | | | 4,509 | | | | 618,995 | |

Signature Bank | | | 2,782 | | | | 336,177 | |

SunTrust Banks, Inc. | | | 12,946 | | | | 813,656 | |

Synovus Financial Corp. | | | 7,553 | | | | 264,355 | |

U.S. Bancorp | | | 11,592 | | | | 607,421 | |

Wells Fargo & Co. | | | 15,210 | | | | 719,737 | |

| | | | | | | | |

| | | | | | | 10,042,864 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Beverages 0.8% | |

Coca-Cola Co. | | | 11,787 | | | $ | 600,194 | |

Constellation Brands, Inc., Class A | | | 3,256 | | | | 641,237 | |

Keurig Dr. Pepper, Inc. | | | 24,222 | | | | 700,016 | |

Molson Coors Brewing Co., Class B | | | 6,631 | | | | 371,336 | |

PepsiCo., Inc. | | | 5,264 | | | | 690,268 | |

| | | | | | | | |

| | | | | | | 3,003,051 | |

| | | | | | | | |

Biotechnology 1.0% | |

Alexion Pharmaceuticals, Inc. (e) | | | 4,807 | | | | 629,621 | |

Alkermes PLC (e) | | | 4,832 | | | | 108,913 | |

Amgen, Inc. | | | 3,803 | | | | 700,817 | |

Biogen, Inc. (e) | | | 3,320 | | | | 776,448 | |

Bluebird Bio, Inc. (e) | | | 231 | | | | 29,383 | |

Gilead Sciences, Inc. | | | 11,857 | | | | 801,059 | |

Regeneron Pharmaceuticals, Inc. (e) | | | 1,974 | | | | 617,862 | |

United Therapeutics Corp. (e) | | | 2,782 | | | | 217,163 | |

| | | | | | | | |

| | | | | | | 3,881,266 | |

| | | | | | | | |

Building Products 0.5% | |

Johnson Controls International PLC | | | 19,465 | | | | 804,099 | |

Masco Corp. | | | 18,505 | | | | 726,136 | |

Owens Corning | | | 7,384 | | | | 429,749 | |

| | | | | | | | |

| | | | | | | 1,959,984 | |

| | | | | | | | |

Capital Markets 1.8% | |

Ameriprise Financial, Inc. | | | 3,525 | | | | 511,689 | |

Bank of New York Mellon Corp. | | | 18,336 | | | | 809,534 | |

BlackRock, Inc. | | | 1,510 | | | | 708,643 | |

Charles Schwab Corp. | | | 17,560 | | | | 705,736 | |

CME Group, Inc. | | | 3,137 | | | | 608,923 | |

E*TRADE Financial Corp. | | | 8,557 | | | | 381,642 | |

Goldman Sachs Group, Inc. | | | 3,058 | | | | 625,667 | |

Intercontinental Exchange, Inc. | | | 8,241 | | | | 708,232 | |

Janus Henderson Group PLC | | | 13,894 | | | | 297,332 | |

Lazard, Ltd., Class A | | | 5,674 | | | | 195,129 | |

Morgan Stanley | | | 16,204 | | | | 709,897 | |

Northern Trust Corp. | | | 155 | | | | 13,950 | |

Raymond James Financial, Inc. | | | 2,575 | | | | 217,716 | |

State Street Corp. | | | 623 | | | | 34,925 | |

TD Ameritrade Holding Corp. | | | 14,318 | | | | 714,755 | |

| | | | | | | | |

| | | | | | | 7,243,770 | |

| | | | | | | | |

Chemicals 1.8% | |

Air Products & Chemicals, Inc. | | | 3,530 | | | | 799,086 | |

Celanese Corp. | | | 3,921 | | | | 422,684 | |

CF Industries Holdings, Inc. | | | 17,384 | | | | 812,007 | |

Corteva, Inc. (e) | | | 9,936 | | | | 293,808 | |

Dow, Inc. (e) | | | 15,672 | | | | 772,786 | |

DuPont de Nemours, Inc. | | | 8,160 | | | | 612,571 | |

FMC Corp. | | | 2,998 | | | | 248,684 | |

Huntsman Corp. | | | 21,811 | | | | 445,817 | |

Linde PLC | | | 3,003 | | | | 603,002 | |

LyondellBasell Industries N.V., Class A | | | 9,164 | | | | 789,295 | |

| | | | |

| 16 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Chemicals (continued) | |

Mosaic Co. | | | 6,976 | | | $ | 174,609 | |

PPG Industries, Inc. | | | 6,843 | | | | 798,647 | |

Valvoline, Inc. | | | 13,682 | | | | 267,210 | |

| | | | | | | | |

| | | | | | | 7,040,206 | |

| | | | | | | | |

Commercial Services & Supplies 0.4% | |

ADT, Inc. (d) | | | 32,695 | | | | 200,093 | |

Clean Harbors, Inc. (e) | | | 8,829 | | | | 627,742 | |

IAA, Inc. (e) | | | 578 | | | | 22,415 | |

KAR Auction Services, Inc. | | | 578 | | | | 14,450 | |

Republic Services, Inc. | | | 818 | | | | 70,871 | |

Waste Management, Inc. | | | 6,899 | | | | 795,938 | |

| | | | | | | | |

| | | | | | | 1,731,509 | |

| | | | | | | | |

Communications Equipment 0.2% | |

CommScope Holding Co., Inc. (e) | | | 13,606 | | | | 214,022 | |

EchoStar Corp., Class A (e) | | | 9,336 | | | | 413,771 | |

Motorola Solutions, Inc. | | | 461 | | | | 76,863 | |

| | | | | | | | |

| | | | | | | 704,656 | |

| | | | | | | | |

Construction & Engineering 0.2% | |

AECOM (e) | | | 19,101 | | | | 722,973 | |

| | | | | | | | |

|

Construction Materials 0.3% | |

Eagle Materials, Inc. | | | 5,813 | | | | 538,865 | |

Martin Marietta Materials, Inc. | | | 1,862 | | | | 428,465 | |

Vulcan Materials Co. | | | 504 | | | | 69,204 | |

| | | | | | | | |

| | | | | | | 1,036,534 | |

| | | | | | | | |

Consumer Finance 1.0% | |

American Express Co. | | | 5,636 | | | | 695,708 | |

Capital One Financial Corp. | | | 8,846 | | | | 802,686 | |

Discover Financial Services | | | 12,088 | | | | 937,908 | |

OneMain Holdings, Inc. | | | 1,810 | | | | 61,196 | |

SLM Corp. | | | 65,430 | | | | 635,980 | |

Synchrony Financial | | | 28,639 | | | | 992,914 | |

| | | | | | | | |

| | | | | | | 4,126,392 | |

| | | | | | | | |

Containers & Packaging 0.5% | |

Ardagh Group S.A. | | | 9,164 | | | | 160,370 | |

Ball Corp. | | | 9,458 | | | | 661,965 | |

Berry Global Group, Inc. (e) | | | 12,347 | | | | 649,329 | |

International Paper Co. | | | 720 | | | | 31,190 | |

Silgan Holdings, Inc. | | | 18,018 | | | | 551,351 | |

WestRock Co. | | | 2,899 | | | | 105,727 | |

| | | | | | | | |

| | | | | | | 2,159,932 | |

| | | | | | | | |

Diversified Consumer Services 0.3% | |

Graham Holdings Co., Class B | | | 714 | | | | 492,682 | |

H&R Block, Inc. | | | 23,193 | | | | 679,555 | |

ServiceMaster Global Holdings, Inc. (e) | | | 1,515 | | | | 78,916 | |

| | | | | | | | |

| | | | | | | 1,251,153 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Diversified Financial Services 0.5% | |

AXA Equitable Holdings, Inc. | | | 31,542 | | | $ | 659,228 | |

Berkshire Hathaway, Inc., Class B (e) | | | 3,341 | | | | 712,201 | |

Voya Financial, Inc. | | | 13,392 | | | | 740,577 | |

| | | | | | | | |

| | | | | | | 2,112,006 | |

| | | | | | | | |

Diversified Telecommunication Services 0.4% | |

AT&T, Inc. | | | 21,414 | | | | 717,583 | |

CenturyLink, Inc. | | | 14,422 | | | | 169,603 | |

Verizon Communications, Inc. | | | 12,223 | | | | 698,300 | |

| | | | | | | | |

| | | | | | | 1,585,486 | |

| | | | | | | | |

Electric Utilities 2.0% | |

American Electric Power Co., Inc. | | | 7,871 | | | | 692,727 | |

Avangrid, Inc. | | | 2,915 | | | | 147,208 | |

Duke Energy Corp. | | | 6,849 | | | | 604,356 | |

Edison International | | | 1,974 | | | | 133,067 | |

Entergy Corp. | | | 7,843 | | | | 807,280 | |

Evergy, Inc. | | | 1,520 | | | | 91,428 | |

Eversource Energy | | | 3,290 | | | | 249,250 | |

Exelon Corp. | | | 14,576 | | | | 698,773 | |

FirstEnergy Corp. | | | 4,473 | | | | 191,489 | |

Hawaiian Electric Industries, Inc. | | | 15,049 | | | | 655,384 | |

NextEra Energy, Inc. | | | 2,967 | | | | 607,820 | |

OGE Energy Corp. | | | 6,214 | | | | 264,468 | |

PG&E Corp. (e) | | | 12,791 | | | | 293,170 | |

Pinnacle West Capital Corp. | | | 4,791 | | | | 450,785 | |

PPL Corp. | | | 17,011 | | | | 527,511 | |

Southern Co. | | | 12,670 | | | | 700,398 | |

Xcel Energy, Inc. | | | 16,029 | | | | 953,565 | |

| | | | | | | | |

| | | | | | | 8,068,679 | |

| | | | | | | | |

Electrical Equipment 0.7% | |

Acuity Brands, Inc. | | | 4,576 | | | | 631,076 | |

Eaton Corp. PLC | | | 8,430 | | | | 702,050 | |

Emerson Electric Co. | | | 10,577 | | | | 705,697 | |

GrafTech International, Ltd. | | | 10,735 | | | | 123,453 | |

Regal Beloit Corp. | | | 6,756 | | | | 552,033 | |

| | | | | | | | |

| | | | | | | 2,714,309 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components 0.4% | |

Avnet, Inc. | | | 14,645 | | | | 662,979 | |

Corning, Inc. | | | 3,566 | | | | 118,498 | |

Jabil, Inc. | | | 21,342 | | | | 674,408 | |

| | | | | | | | |

| | | | | | | 1,455,885 | |

| | | | | | | | |

Energy Equipment & Services 0.5% | |

Halliburton Co. | | | 1,281 | | | | 29,130 | |

Helmerich & Payne, Inc. | | | 6,194 | | | | 313,540 | |

Nabors Industries, Ltd. | | | 87,444 | | | | 253,588 | |

Patterson-UTI Energy, Inc. | | | 47,249 | | | | 543,836 | |

RPC, Inc. (d) | | | 30,349 | | | | 218,816 | |

Schlumberger, Ltd. | | | 17,852 | | | | 709,439 | |

| | | | | | | | |

| | | | | | | 2,068,349 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of InvestmentsJune 30, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Entertainment 0.9% | |

Activision Blizzard, Inc. | | | 12,895 | | | $ | 608,644 | |

Cinemark Holdings, Inc. | | | 13,795 | | | | 497,999 | |

Electronic Arts, Inc. (e) | | | 6,191 | | | | 626,901 | |

Take-Two Interactive Software, Inc. (e) | | | 5,395 | | | | 612,494 | |

Viacom, Inc. | | | | | | | | |

Class A (d) | | | 3,735 | | | | 127,364 | |

Class B | | | 21,159 | | | | 632,019 | |

Walt Disney Co. | | | 4,292 | | | | 599,335 | |

| | | | | | | | |

| | | | | | | 3,704,756 | |

| | | | | | | | |

Equity Real Estate Investment Trusts 4.7% | |

American Campus Communities, Inc. | | | 13,909 | | | | 642,039 | |

American Homes 4 Rent, Class A | | | 13,767 | | | | 334,676 | |

Apartment Investment & Management Co., Class A | | | 10,015 | | | | 501,952 | |

Apple Hospitality REIT, Inc. | | | 38,064 | | | | 603,695 | |

AvalonBay Communities, Inc. | | | 3,633 | | | | 738,153 | |

Boston Properties, Inc. | | | 608 | | | | 78,432 | |

Brandywine Realty Trust | | | 15,197 | | | | 217,621 | |

Brixmor Property Group, Inc. | | | 19,470 | | | | 348,124 | |

Brookfield Property REIT, Inc., Class A | | | 15,462 | | | | 292,077 | |

Camden Property Trust | | | 4,514 | | | | 471,216 | |

Colony Capital, Inc. | | | 113,615 | | | | 568,075 | |

Corporate Office Properties Trust | | | 7,046 | | | | 185,803 | |

Digital Realty Trust, Inc. | | | 2,485 | | | | 292,708 | |

Douglas Emmett, Inc. | | | 4,334 | | | | 172,667 | |

Empire State Realty Trust, Inc., Class A | | | 37,705 | | | | 558,411 | |

EPR Properties | | | 8,826 | | | | 658,331 | |

Equity Residential | | | 9,811 | | | | 744,851 | |

Essex Property Trust, Inc. | | | 2,062 | | | | 601,960 | |

Gaming and Leisure Properties, Inc. | | | 17,739 | | | | 691,466 | |

Hospitality Properties Trust | | | 23,015 | | | | 575,375 | |

Host Hotels & Resorts, Inc. | | | 48,619 | | | | 885,838 | |

Iron Mountain, Inc. | | | 10,035 | | | | 314,095 | |

Kimco Realty Corp. | | | 2,426 | | | | 44,832 | |

Lamar Advertising Co., Class A | | | 516 | | | | 41,646 | |

Medical Properties Trust, Inc. | | | 4,124 | | | | 71,923 | |

Mid-America Apartment Communities, Inc. | | | 6,866 | | | | 808,540 | |

National Retail Properties, Inc. | | | 2,558 | | | | 135,600 | |

Omega Healthcare Investors, Inc. | | | 19,664 | | | | 722,652 | |

Outfront Media, Inc. | | | 4,116 | | | | 106,152 | |

Park Hotels & Resorts, Inc. | | | 17,703 | | | | 487,895 | |

Prologis, Inc. | | | 7,711 | | | | 617,651 | |

Public Storage | | | 3,377 | | | | 804,300 | |

Rayonier, Inc. | | | 7,487 | | | | 226,856 | |

Realty Income Corp. | | | 7,216 | | | | 497,688 | |

Retail Properties of America, Inc., Class A | | | 379 | | | | 4,457 | |

Simon Property Group, Inc. | | | 4,964 | | | | 793,049 | |

Sun Communities, Inc. | | | 804 | | | | 103,065 | |

Taubman Centers, Inc. | | | 270 | | | | 11,024 | |

| | | | | | | | |

| | | Shares | | | Value | |

Equity Real Estate Investment Trusts (continued) | |

UDR, Inc. | | | 2,544 | | | $ | 114,200 | |

Ventas, Inc. | | | 14,021 | | | | 958,335 | |

VEREIT, Inc. | | | 67,660 | | | | 609,617 | |

Weingarten Realty Investors | | | 5,766 | | | | 158,104 | |

Welltower, Inc. | | | 12,000 | | | | 978,360 | |

Weyerhaeuser Co. | | | 913 | | | | 24,048 | |

| | | | | | | | |

| | | | | | | 18,797,559 | |

| | | | | | | | |

Food & Staples Retailing 0.4% | |

Casey’s General Stores, Inc. | | | 60 | | | | 9,359 | |

Kroger Co. | | | 2,632 | | | | 57,141 | |

Walgreens Boots Alliance, Inc. | | | 13,299 | | | | 727,056 | |

Walmart, Inc. | | | 7,177 | | | | 792,987 | |

| | | | | | | | |

| | | | | | | 1,586,543 | |

| | | | | | | | |

Food Products 1.9% | |

Archer-Daniels-Midland Co. | | | 3,635 | | | | 148,308 | |

Campbell Soup Co. | | | 14,700 | | | | 589,029 | |

Flowers Foods, Inc. | | | 27,516 | | | | 640,297 | |

General Mills, Inc. | | | 13,576 | | | | 713,011 | |

Ingredion, Inc. | | | 3,835 | | | | 316,349 | |

J.M. Smucker Co. | | | 7,360 | | | | 847,798 | |

Kellogg Co. | | | 3,633 | | | | 194,620 | |

Kraft Heinz Co. | | | 22,588 | | | | 701,132 | |

McCormick & Co., Inc. | | | 78 | | | | 12,091 | |

Mondelez International, Inc., Class A | | | 11,064 | | | | 596,350 | |

Pilgrim’s Pride Corp. (e) | | | 20,848 | | | | 529,331 | |

Post Holdings, Inc. (e) | | | 5,267 | | | | 547,610 | |

TreeHouse Foods, Inc. (e) | | | 10,712 | | | | 579,519 | |

Tyson Foods, Inc., Class A | | | 14,719 | | | | 1,188,412 | |

| | | | | | | | |

| | | | | | | 7,603,857 | |

| | | | | | | | |

Gas Utilities 0.2% | |

National Fuel Gas Co. | | | 5,531 | | | | 291,760 | |

UGI Corp. | | | 6,994 | | | | 373,550 | |

| | | | | | | | |

| | | | | | | 665,310 | |

| | | | | | | | |

Health Care Equipment & Supplies 1.5% | |

Abbott Laboratories | | | 8,397 | | | | 706,188 | |

Baxter International, Inc. | | | 8,640 | | | | 707,616 | |

Becton, Dickinson and Co. | | | 2,428 | | | | 611,880 | |

Cooper Cos., Inc. | | | 2,500 | | | | 842,225 | |

Danaher Corp. | | | 4,276 | | | | 611,126 | |

DENTSPLY SIRONA, Inc. | | | 11,157 | | | | 651,122 | |

Hill-Rom Holdings, Inc. | | | 4,899 | | | | 512,533 | |

Hologic, Inc. (e) | | | 482 | | | | 23,146 | |

Medtronic PLC | | | 7,165 | | | | 697,799 | |

STERIS PLC (e) | | | 2,528 | | | | 376,369 | |

Zimmer Biomet Holdings, Inc. | | | 1,539 | | | | 181,202 | |

| | | | | | | | |

| | | | | | | 5,921,206 | |

| | | | | | | | |

| | | | |

| 18 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Shares | | | Value | |

| Common Stocks (continued) | |

Health Care Providers & Services 1.2% | |

Anthem, Inc. | | | 2,159 | | | $ | 609,291 | |

Cardinal Health, Inc. | | | 8,977 | | | | 422,817 | |

Cigna Corp. (e) | | | 3,840 | | | | 604,992 | |

CVS Health Corp. | | | 11,221 | | | | 611,432 | |

Encompass Health Corp. | | | 193 | | | | 12,228 | |

HCA Healthcare, Inc. | | | 5,915 | | | | 799,531 | |

Henry Schein, Inc. (e) | | | 3,755 | | | | 262,474 | |

Humana, Inc. | | | 2,299 | | | | 609,925 | |

McKesson Corp. | | | 4,087 | | | | 549,252 | |

Universal Health Services, Inc., Class B | | | 2,645 | | | | 344,882 | |

| | | | | | | | |

| | | | | | | 4,826,824 | |

| | | | | | | | |

Hotels, Restaurants & Leisure 1.6% | |

Aramark | | | 20,145 | | | | 726,429 | |

Caesars Entertainment Corp. (e) | | | 16,787 | | | | 198,422 | |

Carnival Corp. | | | 17,423 | | | | 811,041 | |

Darden Restaurants, Inc. | | | 2,032 | | | | 247,355 | |

Las Vegas Sands Corp. | | | 11,871 | | | | 701,457 | |

McDonald’s Corp. | | | 2,945 | | | | 611,559 | |

MGM Resorts International | | | 14,897 | | | | 425,607 | |

Norwegian Cruise Line Holdings, Ltd. (e) | | | 9,927 | | | | 532,385 | |

Royal Caribbean Cruises, Ltd. | | | 4,955 | | | | 600,596 | |

Yum China Holdings, Inc. | | | 17,821 | | | | 823,330 | |

Yum! Brands, Inc. | | | 5,472 | | | | 605,586 | |

| | | | | | | | |

| | | | | | | 6,283,767 | |

| | | | | | | | |

Household Durables 0.6% | |

Garmin, Ltd. | | | 2,490 | | | | 198,702 | |

Lennar Corp., Class A | | | 150 | | | | 7,269 | |

Newell Brands, Inc. | | | 2,392 | | | | 36,885 | |

PulteGroup, Inc. | | | 22,098 | | | | 698,739 | |

Toll Brothers, Inc. | | | 16,486 | | | | 603,717 | |

Whirlpool Corp. | | | 5,428 | | | | 772,730 | |

| | | | | | | | |

| | | | | | | 2,318,042 | |

| | | | | | | | |

Household Products 0.5% | |

Colgate-Palmolive Co. | | | 8,328 | | | | 596,868 | |

Kimberly-Clark Corp. | | | 5,926 | | | | 789,817 | |

Procter & Gamble Co. | | | 6,348 | | | | 696,058 | |

| | | | | | | | |

| | | | | | | 2,082,743 | |

| | | | | | | | |

Independent Power & Renewable Electricity Producers 0.5% | |

AES Corp. | | | 26,835 | | | | 449,754 | |

NRG Energy, Inc. | | | 20,707 | | | | 727,230 | |

Vistra Energy Corp. | | | 32,853 | | | | 743,792 | |

| | | | | | | | |

| | | | | | | 1,920,776 | |

| | | | | | | | |

Industrial Conglomerates 0.9% | |

3M Co. | | | 4,052 | | | | 702,374 | |

Carlisle Cos., Inc. | | | 4,707 | | | | 660,910 | |

General Electric Co. | | | 58,675 | | | | 616,088 | |

Honeywell International, Inc. | | | 4,012 | | | | 700,455 | |

| | | | | | | | |

| | | Shares | | | Value | |

Industrial Conglomerates (continued) | |

Roper Technologies, Inc. | | | 2,245 | | | $ | 822,253 | |

| | | | | | | | |

| | | | | | | 3,502,080 | |

| | | | | | | | |

Insurance 4.6% | |

Aflac, Inc. | | | 12,843 | | | | 703,925 | |

Allstate Corp. | | | 7,947 | | | | 808,130 | |

American International Group, Inc. | | | 15,129 | | | | 806,073 | |

American National Insurance Co. | | | 2,209 | | | | 257,282 | |

Arch Capital Group, Ltd. (e) | | | 24,071 | | | | 892,553 | |

Arthur J. Gallagher & Co. | | | 2,583 | | | | 226,245 | |

Assured Guaranty, Ltd. | | | 14,528 | | | | 611,338 | |

Athene Holding, Ltd., Class A (e) | | | 7,601 | | | | 327,299 | |

AXIS Capital Holdings, Ltd. | | | 6,187 | | | | 369,055 | |

Brighthouse Financial, Inc. (e) | | | 13,983 | | | | 513,036 | |

Chubb, Ltd. | | | 4,738 | | | | 697,860 | |

Cincinnati Financial Corp. | | | 323 | | | | 33,485 | |

CNA Financial Corp. | | | 5,837 | | | | 274,748 | |

Fidelity National Financial, Inc. | | | 20,591 | | | | 829,817 | |

First American Financial Corp. | | | 12,486 | | | | 670,498 | |

Hanover Insurance Group, Inc. | | | 4,098 | | | | 525,773 | |

Hartford Financial Services Group, Inc. | | | 13,320 | | | | 742,190 | |

Kemper Corp. | | | 3,461 | | | | 298,650 | |

Lincoln National Corp. | | | 13,466 | | | | 867,884 | |

Marsh & McLennan Cos., Inc. | | | 6,175 | | | | 615,956 | |

Mercury General Corp. | | | 9,432 | | | | 589,500 | |

MetLife, Inc. | | | 16,178 | | | | 803,561 | |

Old Republic International Corp. | | | 30,861 | | | | 690,669 | |

Principal Financial Group, Inc. | | | 9,264 | | | | 536,571 | |

Progressive Corp. | | | 10,060 | | | | 804,096 | |

Prudential Financial, Inc. | | | 8,025 | | | | 810,525 | |