UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-03833

MAINSTAY VP FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

| Item 1. | Reports to Stockholders. |

MainStay VP Wellington U.S. Equity Portfolio

(formerly known as MainStay VP MacKay Common Stock Portfolio)

Message from the President and Semiannual Report

Unaudited | June 30, 2021

Sign up for e-delivery of your shareholder reports. For full details on e-delivery, including who can participate and what you can receive via e-delivery,

please log in to newyorklifeinvestments.com/accounts.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

The COVID-19 pandemic continued to afflict our personal lives and broad segments of the U.S. and global economy throughout the six-month reporting period ended June 30, 2021. However, with the deployment of multiple vaccines around the world, including three highly effective versions approved for emergency use in the United States, investors began to turn their attention toward the gradual reopening of the economy and the shape the “new normal” would take.

The first half of the reporting period saw increasing inflationary concerns as fiscal stimulus business reopenings drove accelerating economic growth, rising commodity prices and increased consumer spending. However, the U.S. Federal Reserve noted that price increases were likely to prove temporary and made clear their intention to remain accommodative for the foreseeable future. Accordingly, after moving higher in the first quarter of 2021, interest rates declined in the second quarter.

In response to the uncertain inflation outlook, equity market leadership shifted from value in the first quarter of the year to growth in the second quarter. Nevertheless, investor sentiment remained buoyant throughout the reporting period, with all eleven sectors in the S&P 500® Index, a widely regarded benchmark of market performance, producing positive returns. Energy led the market’s rise fueled by rapidly increasing oil and gas prices, followed by financials and real estate, which benefited from rising interest rates and the economic reopening, respectively. Communication services produced the slowest growth, followed by the traditionally defensive utilities and consumer staples

sectors. In the fixed income market, lower-credit-quality issues tended to outperform their higher-grade counterparts, with high-yield corporate bonds generating the strongest performance. Among securitized products, commercial mortgage-backed securities generally produced the strongest returns, followed by mortgage-backed securities and asset-backed securities, while Treasury securities lagged.

Despite the tremendous progress we’ve seen so far this year, the United States and the world continue to face significant pandemic-related challenges. Newer, more contagious variants of COVID-19 threaten the return of restrictions and lockdowns that could stall the economic recovery. At the same time, supply chain shortages have led to rising prices on everything from laptops to autos, stoking fears of uncontrolled inflation despite reassurance from the U.S. Federal Reserve. At New York Life Investments, we recognize that the shape that the “new normal” eventually takes may differ from our expectations. You can depend on us to keep a sharp watch for the unexpected, and to continue to help you find your way through this rapidly evolving investment landscape.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Investors should refer to the Portfolio’s Summary Prospectus and/or Prospectus and consider the Portfolio’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Portfolio. You may obtain copies of the Portfolio’s Summary Prospectus and/or the Prospectus and the Statement of Additional Information free of charge, upon request, by calling toll-free 800-598-2019, by writing to New York Life Insurance and Annuity Corporation, 51 Madison Avenue, Room 251, New York, New York 10010 or by sending an email to MainStayShareholdersServices@nylim.com. These documents are also available at nylinvestments.com/vpdocuments. Please read the Portfolio's Summary Prospectus and/or Prospectus carefully before investing. MainStay VP Funds Trust portfolios are separate account options which are purchased through a variable insurance or variable annuity contract.

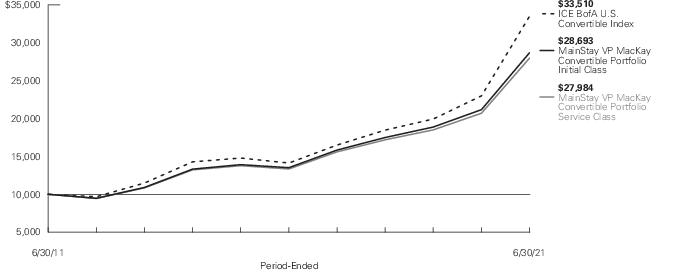

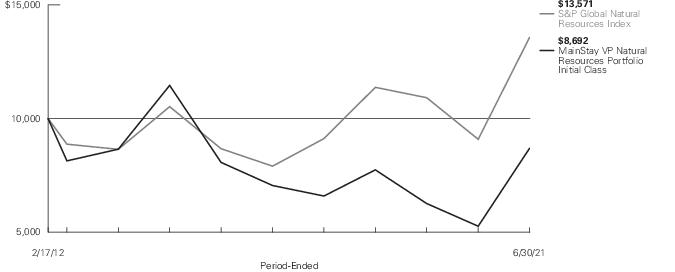

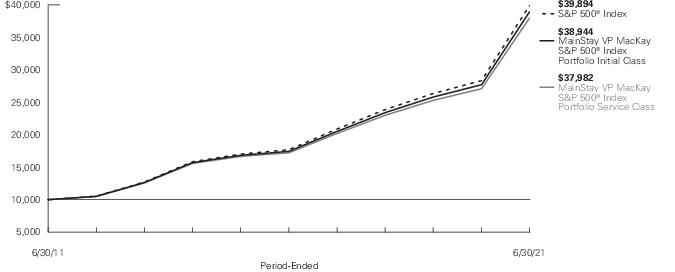

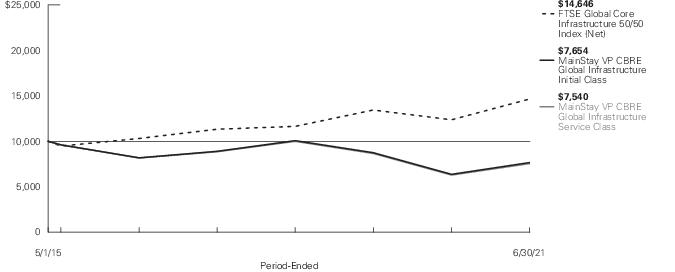

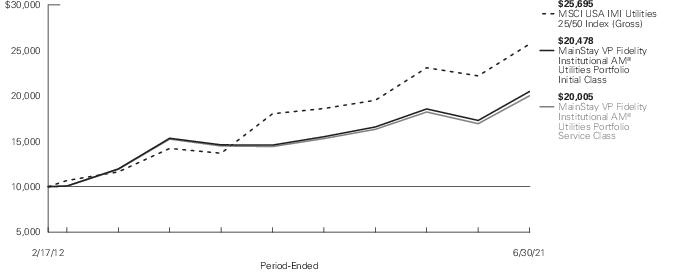

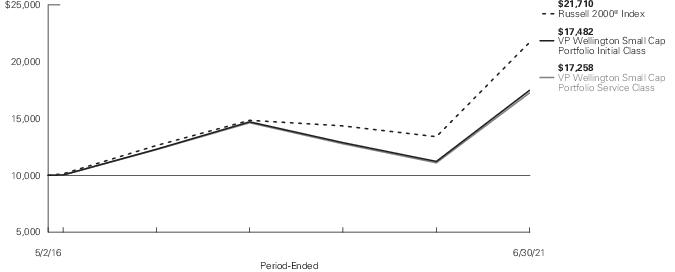

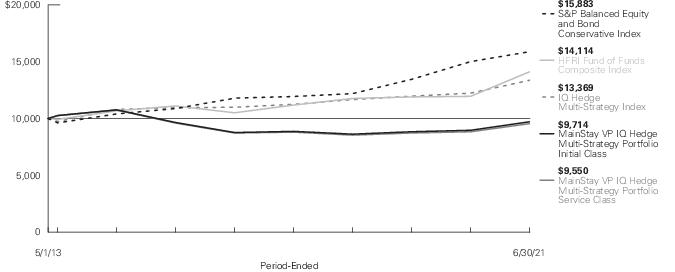

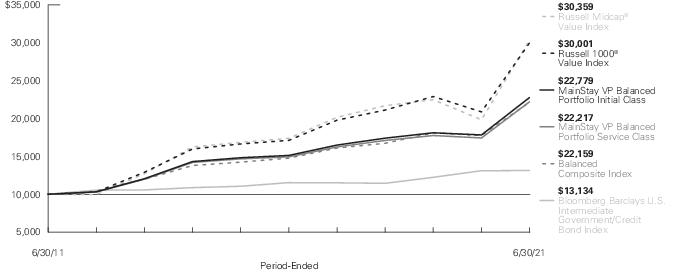

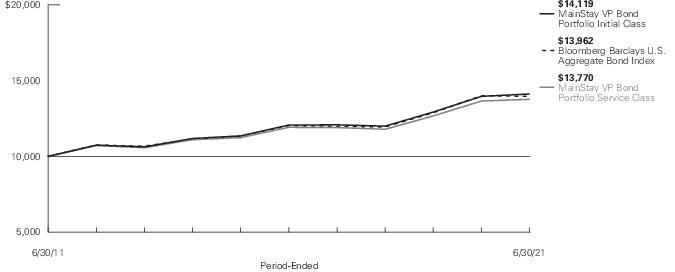

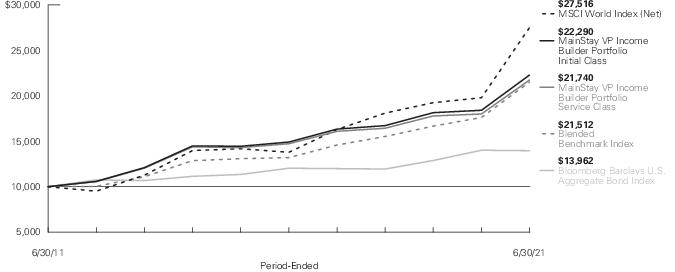

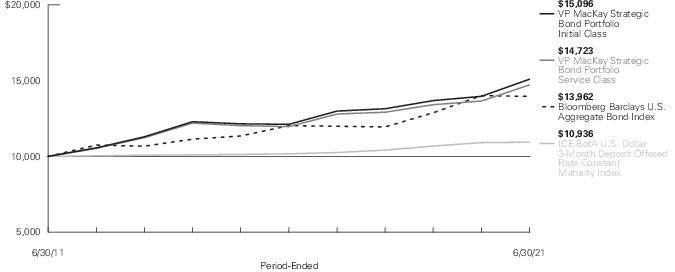

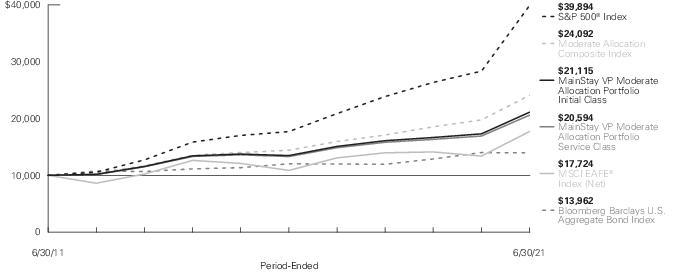

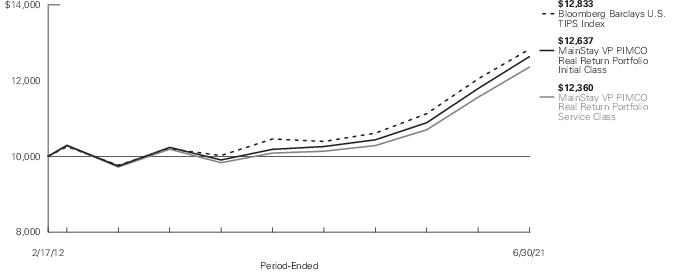

Investment and Performance Comparison (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The performance table and graph do not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. Please refer to the Performance Summary appropriate for your policy. For performance information current to the most recent month-end, please call 800-598-2019 or visit www.newyorklife.com.

Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been different. For information on current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

| Average Annual Total Returns for the Period-Ended June 30, 2021 |

| Class | Inception

Date1, 2 | Six

Months | One

Year | Five

Years | Ten

Years | Gross

Expense

Ratio3 |

| Initial Class Shares | 1/23/1984 | 16.26% | 40.15% | 15.94% | 14.13% | 0.58% |

| Service Class Shares | 6/5/2003 | 16.11 | 39.80 | 15.65 | 13.84 | 0.83 |

| 1. | Effective January 1, 2018, due to an organizational restructuring whereby all investment personnel of Cornerstone Capital Management Holdings LLC, a former subadvisor, transitioned to MacKay Shields LLC, a former subadvisor. The past performance in the chart and table prior to that date reflects the Portfolio’s prior subadvisor and principal investment strategies. |

| 2. | Effective May 1, 2021, the Portfolio replaced its subadvisor and modified its principal investment strategies. The past performance in the graph and table prior to that date reflects the Portfolio's prior subadvisor and principal investment strategies. |

| 3. | The gross expense ratios presented reflect the Portfolio’s “Total Annual Portfolio Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| Benchmark Performance | Six

Months | One

Year | Five

Years | Ten

Years |

| S&P 500® Index1 | 15.25% | 40.79% | 17.65% | 14.84% |

| Morningstar Large Blend Category Average2 | 14.78 | 39.87 | 15.65 | 12.51 |

| 1. | The S&P 500® Index is the Portfolio’s primary benchmark. "S&P 500®" is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 2. | The Morningstar Large Blend Category Average is representative of funds that represent the overall U.S. stock market in size, growth rates and price. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. The blend style is assigned to funds' where neither growth nor value characteristics predominate. These funds tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, the funds' returns are often similar to those of the S&P 500® Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

Cost in Dollars of a $1,000 Investment in MainStay VP Wellington U.S. Equity Portfolio (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from January 1, 2021 to June 30, 2021, and the impact of those costs on your investment.

Example

As a shareholder of the Portfolio you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2021 to June 30, 2021. Shares are only sold in connection with variable life and annuity contracts and the example does not reflect any contract level or transactional fees or expenses. If these costs had been included, your costs would have been higher.

This example illustrates your Portfolio’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended June

30, 2021. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Portfolio with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning

Account

Value

1/1/21 | Ending Account

Value (Based

on Actual

Returns and

Expenses)

6/30/21 | Expenses

Paid

During

Period1 | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

6/30/21 | Expenses

Paid

During

Period1 | Net Expense

Ratio

During

Period2 |

| Initial Class Shares | $1,000.00 | $1,162.60 | $3.06 | $1,021.97 | $2.86 | 0.57% |

| Service Class Shares | $1,000.00 | $1,161.10 | $4.39 | $1,020.73 | $4.11 | 0.82% |

| 1. | Expenses are equal to the Portfolio’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 181 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Portfolio's annualized expense ratio to reflect the six-month period. |

| 6 | MainStay VP Wellington U.S. Equity Portfolio |

Industry Composition as of June 30, 2021 (Unaudited)

| Software | 9.0% |

| Interactive Media & Services | 8.4 |

| Semiconductors & Semiconductor Equipment | 5.8 |

| Technology Hardware, Storage & Peripherals | 5.5 |

| Banks | 5.4 |

| Internet & Direct Marketing Retail | 4.6 |

| Health Care Equipment & Supplies | 4.5 |

| IT Services | 4.2 |

| Capital Markets | 3.8 |

| Textiles, Apparel & Luxury Goods | 3.4 |

| Entertainment | 3.4 |

| Pharmaceuticals | 3.3 |

| Household Products | 2.9 |

| Hotels, Restaurants & Leisure | 2.7 |

| Machinery | 2.6 |

| Beverages | 2.4 |

| Electric Utilities | 2.2 |

| Health Care Providers & Services | 2.1 |

| Chemicals | 2.1 |

| Biotechnology | 2.0 |

| Professional Services | 1.7% |

| Equity Real Estate Investment Trusts | 1.7 |

| Electronic Equipment, Instruments & Components | 1.7 |

| Consumer Finance | 1.6 |

| Specialty Retail | 1.6 |

| Oil, Gas & Consumable Fuels | 1.5 |

| Air Freight & Logistics | 1.3 |

| Life Sciences Tools & Services | 1.3 |

| Diversified Telecommunication Services | 1.2 |

| Aerospace & Defense | 1.2 |

| Building Products | 1.0 |

| Electrical Equipment | 0.9 |

| Insurance | 0.8 |

| Commercial Services & Supplies | 0.6 |

| Automobiles | 0.4 |

| Short–Term Investment | 1.1 |

| Other Assets, Less Liabilities | 0.1 |

| | 100.0% |

See Portfolio of Investments beginning on page 10 for specific holdings within these categories. The Portfolio's holdings are subject to change.

Top Ten Holdings as of June 30, 2021 (excluding short-term investments) (Unaudited)

| 1. | Microsoft Corp. |

| 2. | Alphabet, Inc. |

| 3. | Amazon.com, Inc. |

| 4. | Apple, Inc. |

| 5. | Facebook, Inc., Class A |

| 6. | JPMorgan Chase & Co. |

| 7. | Bank of America Corp. |

| 8. | UnitedHealth Group, Inc. |

| 9. | Walt Disney Co. (The) |

| 10. | Procter & Gamble Co. (The) |

Portfolio Management Discussion and Analysis (Unaudited)

Answers to the questions reflect the views of portfolio managers Migene Kim, CFA, and Mona Patni of MacKay Shields LLC (“MacKay Shields”), the Portfolio’s former Subadvisor, and Mammen Chally, CFA, Douglas W. McLane, CFA, and David A. Siegle, CFA, of Wellington Management Company LLP (“Wellington”), the Portfolio's current Subadvisor.

How did MainStay VP Wellington U.S. Equity Portfolio perform relative to its benchmark and peers during the six months ended June 30, 2021?

For the six months ended June 30, 2021, MainStay VP Wellington U.S. Equity Portfolio returned 16.26% for Initial Class shares and 16.11% for Service Class shares. Over the same period, both share classes outperformed the 15.25% return of the S&P 500® Index (“the Index”), which is the Portfolio’s primary benchmark. For the six months ended June 30, 2021, both share classes also outperformed the 14.78% return of the Morningstar Large Blend Category Average.1

Were there any changes to the Portfolio during the reporting period?

At meetings held on January 21, January 25 and February 3, 2021, the Board of Trustees of MainStay VP Funds Trust considered and approved, among other related proposals: (i) appointing Wellington Management Company LLP as the Portfolio’s subadvisor, and the related subadvisory agreement; (ii) changing the Portfolio’s name and modifying its non-fundamental “names rule” investment policy; and (iii) modifying the Portfolio’s principal investment strategies and investment process. For more information on these and other changes refer to the supplement dated February 5, 2021.

In the process of implementing the new principal investment strategies and investment process, the Portfolio may have experienced a high level of portfolio turnover. Also, during this transition period, the Portfolio may not have been pursuing its investment objective or may not have been managed consistent with its investment strategies as stated in the Prospectus. This may have impacted the Portfolio’s performance.

What factors affected the Portfolio’s relative performance during the reporting period?

MacKay Shields

During the time MacKay Shields managed the Portfolio, the Portfolio outperformed the Index, helped by strong stock selection, most notably among financials, industrials and information technology stocks. Sector allocation effect mildly detracted from relative returns due to underweight exposure to the strong-performing energy and financials sectors. In terms of stock-selection model efficacy, the combination of signals used by the Portfolio’s quantitative stock selection model was rewarded primarily by valuation measures.

Wellington

During the time Wellington managed the Portfolio, the Portfolio underperformed the Index, primarily due to security selection. Sector attribution, a result of Wellington's bottom-up stock

selection process, also weighed on results.

Which sectors were the strongest positive contributors to the Portfolio’s relative performance, and which sectors were particularly weak?

MacKay Shields

During the time MacKay Shields managed the Portfolio, the strongest positive contributors to the Portfolio’s performance relative to the Index were the industrials, financials and information technology sectors. (Contributions take weightings and total returns into account.) During the same period, the most significant detractors from benchmark-relative performance were the real estate, energy and materials sectors.

Wellington

During the time Wellington managed the Portfolio, security selection in the financials and health care sectors contributed positively to performance relative to the Index, while security selection in the information technology, consumer discretionary and consumer staples sectors detracted. From an allocation perspective, the Portfolio’s underweight exposure to utilities enhanced relative returns, while underweight exposure to the energy sector weighed on relative performance.

During the reporting period, which individual stocks made the strongest positive contributions to the Portfolio’s absolute performance and which stocks detracted the most?

MacKay Shields

The stocks providing the strongest positive contributions to the Portfolio’s absolute performance during the time MacKay Shields managed the portfolio included systems software developer Microsoft and Internet content and information services provider Alphabet, the parent company of Google. During the same period, the most significant detractors from absolute performance were consumer technology company Apple, wireless communications technology firm Qualcomm and interactive home entertainment developer Take-Two Interactive Software.

Wellington

The strongest contributors to absolute performance during the time Wellington managed the Portfolio were holdings in Microsoft, pharmaceutical company Eli Lilly and semiconductor developer Marvell Technology. Microsoft shares rebounded with the broader technology sector in May 2021, as hawkish rhetoric from the U.S. Federal Reserve prompted a market rotation away from cyclically sensitive value stocks into growth stocks. Eli Lilly shares rose after the U.S. Food and Drug Administration granted Breakthrough Therapy designation for donanemab, an Alzheimer’s Disease treatment. Donanemab targets N3pG, a form of beta amyloid, and has exhibited positive safety and efficacy results. The

| 1. | See page 5 for more information on benchmark and peer group returns. |

| 8 | MainStay VP Wellington U.S. Equity Portfolio |

company announced plans to submit a Biologics License Application in 2021. Eli Lilly also gained emergency use authorization in India for the use of baricitinib to treat severely ill COVID-19 patients. Shares of Marvell Technology rose after the company reported fiscal first-quarter results that exceeded consensus estimates, while also forecasting record revenue for the second quarter bolstered by its April 2021 acquisition of Inphi, a leading producer of high-speed networking semiconductors.

The most significant detractors from the Portfolio’s absolute performance were holdings in financial technology company Global Payments, entertainment provider The Walt Disney Company and travel technology company Booking Holdings. Shares of Global Payments lost ground despite posting first-quarter 2021 earnings that exceeded consensus estimates. Rather than reward this positive news, market participants appeared more focused on increasing competition in the electronic payments space, while also reacting skeptically to the company’s two announced acquisitions. Shares of Disney fell after reporting second-quarter revenue below expectations, with fewer Disney+ subscribers than expected. Management noted that the average monthly revenue per Disney+ subscriber decreased significantly from $5.63 to $3.99 due to the launch of Hotstar, the company’s Indian streaming service, which had grown to make up approximately a third of the total Disney+ subscriber base. Shares of Booking Holdings suffered along with other travel-related stocks amid a global rise in COVID-19 cases and increased travel restrictions.

Did the Portfolio make any significant purchases or sales during the reporting period?

MacKay Shields

The Portfolio’s largest initial purchase during the time MacKay Shields managed the Portfolio was in diversified banking firm Citigroup, while the largest increase in position size was in conglomerate Berkshire Hathaway. The Portfolio's largest full sale was its position in freight and logistics company FedEx Corporation, while its most significantly decreased position size was in Apple.

Wellington

There were no notable purchases or sales during the time Wellington managed the Portfolio.

How did the Portfolio’s sector weightings change during the reporting period?

MacKay Shields

During the time MacKay Shields managed the portfolio, the largest increases in benchmark-relative sector exposures were in the

financials and communication services sectors. Conversely, the Portfolio's largest decreases in benchmark-relative sector exposures were in the industrials and information technology sectors.

Wellington

During the time Wellington managed the Portfolio, there were no significant changes to sector weights.

How was the Portfolio positioned at the end of the reporting period?

MacKay Shields

At the end of the period when MacKay Shields managed the Portfolio, the Portfolio held its most overweight exposures relative to the Index in the health care and consumer discretionary sectors. As of the same date, the Portfolio held its most relatively underweight exposures in the industrials and materials sectors.

Wellington

As of June 30, 2021, the Portfolio’s largest overweight positions relative to the Index were in communication services and industrials, while its most significantly underweight positions were in real estate and consumer staples.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

Portfolio of Investments June 30, 2021† (Unaudited)

| | Shares | Value |

| Common Stocks 98.8% |

| Aerospace & Defense 1.2% |

| Raytheon Technologies Corp. | 124,620 | $ 10,631,332 |

| Air Freight & Logistics 1.3% |

| FedEx Corp. | 38,982 | 11,629,500 |

| Automobiles 0.4% |

| Tesla, Inc. (a) | 5,500 | 3,738,350 |

| Banks 5.4% |

| Bank of America Corp. | 467,775 | 19,286,363 |

| JPMorgan Chase & Co. | 140,717 | 21,887,122 |

| PNC Financial Services Group, Inc. (The) | 38,046 | 7,257,655 |

| | | 48,431,140 |

| Beverages 2.4% |

| Constellation Brands, Inc., Class A | 49,989 | 11,691,927 |

| Monster Beverage Corp. (a) | 106,336 | 9,713,794 |

| | | 21,405,721 |

| Biotechnology 2.0% |

| Regeneron Pharmaceuticals, Inc. (a) | 12,880 | 7,193,995 |

| Seagen, Inc. (a) | 27,300 | 4,310,124 |

| Vertex Pharmaceuticals, Inc. (a) | 31,147 | 6,280,170 |

| | | 17,784,289 |

| Building Products 1.0% |

| Fortune Brands Home & Security, Inc. | 93,081 | 9,271,798 |

| Capital Markets 3.8% |

| BlackRock, Inc. | 12,604 | 11,028,122 |

| Charles Schwab Corp. (The) | 118,059 | 8,595,876 |

| Morgan Stanley | 159,105 | 14,588,337 |

| | | 34,212,335 |

| Chemicals 2.1% |

| PPG Industries, Inc. | 57,221 | 9,714,409 |

| Sherwin-Williams Co. (The) | 33,635 | 9,163,856 |

| | | 18,878,265 |

| Commercial Services & Supplies 0.6% |

| Copart, Inc. (a) | 40,861 | 5,386,706 |

| Consumer Finance 1.6% |

| American Express Co. | 88,744 | 14,663,171 |

| | Shares | Value |

| |

| Diversified Telecommunication Services 1.2% |

| Verizon Communications, Inc. | 197,025 | $ 11,039,311 |

| Electric Utilities 2.2% |

| American Electric Power Co., Inc. | 56,502 | 4,779,504 |

| Duke Energy Corp. | 86,038 | 8,493,672 |

| Pinnacle West Capital Corp. | 79,964 | 6,554,649 |

| | | 19,827,825 |

| Electrical Equipment 0.9% |

| AMETEK, Inc. | 62,696 | 8,369,916 |

| Electronic Equipment, Instruments & Components 1.7% |

| CDW Corp. | 43,626 | 7,619,281 |

| Corning, Inc. | 176,309 | 7,211,038 |

| | | 14,830,319 |

| Entertainment 3.4% |

| Netflix, Inc. (a) | 24,581 | 12,983,930 |

| Walt Disney Co. (The) (a) | 97,240 | 17,091,875 |

| | | 30,075,805 |

| Equity Real Estate Investment Trusts 1.7% |

| American Tower Corp. | 33,018 | 8,919,483 |

| Gaming and Leisure Properties, Inc. | 128,337 | 5,945,853 |

| | | 14,865,336 |

| Health Care Equipment & Supplies 4.5% |

| Abbott Laboratories | 63,742 | 7,389,610 |

| Baxter International, Inc. | 108,991 | 8,773,775 |

| Becton Dickinson and Co. | 30,308 | 7,370,603 |

| Danaher Corp. | 38,012 | 10,200,900 |

| Hologic, Inc. (a) | 91,651 | 6,114,955 |

| | | 39,849,843 |

| Health Care Providers & Services 2.1% |

| UnitedHealth Group, Inc. | 47,705 | 19,102,990 |

| Hotels, Restaurants & Leisure 2.7% |

| Airbnb, Inc., Class A (a) | 40,795 | 6,247,346 |

| Booking Holdings, Inc. (a) | 3,819 | 8,356,316 |

| McDonald's Corp. | 40,004 | 9,240,524 |

| | | 23,844,186 |

| Household Products 2.9% |

| Colgate-Palmolive Co. | 115,525 | 9,397,959 |

| Procter & Gamble Co. (The) | 123,869 | 16,713,644 |

| | | 26,111,603 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 10 | MainStay VP Wellington U.S. Equity Portfolio |

| | Shares | Value |

| Common Stocks (continued) |

| Insurance 0.8% |

| Chubb Ltd. | 46,655 | $ 7,415,346 |

| Interactive Media & Services 8.4% |

| Alphabet, Inc. (a) | | |

| Class A | 15,577 | 38,035,763 |

| Class C | 4,862 | 12,185,728 |

| |

| Facebook, Inc., Class A (a) | 71,476 | 24,852,920 |

| | | 75,074,411 |

| Internet & Direct Marketing Retail 4.6% |

| Amazon.com, Inc. (a) | 11,963 | 41,154,634 |

| IT Services 4.2% |

| Fidelity National Information Services, Inc. | 58,370 | 8,269,278 |

| Global Payments, Inc. | 42,892 | 8,043,966 |

| GoDaddy, Inc., Class A (a) | 79,437 | 6,907,841 |

| Mastercard, Inc., Class A | 39,745 | 14,510,502 |

| | | 37,731,587 |

| Life Sciences Tools & Services 1.3% |

| Thermo Fisher Scientific, Inc. | 22,286 | 11,242,619 |

| Machinery 2.6% |

| Deere & Co. | 21,284 | 7,507,079 |

| Illinois Tool Works, Inc. | 32,071 | 7,169,793 |

| Nordson Corp. | 36,749 | 8,066,773 |

| | | 22,743,645 |

| Oil, Gas & Consumable Fuels 1.5% |

| EOG Resources, Inc. | 82,993 | 6,924,936 |

| Pioneer Natural Resources Co. | 38,029 | 6,180,473 |

| | | 13,105,409 |

| Pharmaceuticals 3.3% |

| Eli Lilly and Co. | 68,028 | 15,613,786 |

| Merck & Co., Inc. | 182,214 | 14,170,783 |

| | | 29,784,569 |

| Professional Services 1.7% |

| Equifax, Inc. | 31,477 | 7,539,056 |

| Leidos Holdings, Inc. | 76,706 | 7,754,977 |

| | | 15,294,033 |

| Semiconductors & Semiconductor Equipment 5.8% |

| Advanced Micro Devices, Inc. (a) | 99,149 | 9,313,066 |

| KLA Corp. | 28,594 | 9,270,461 |

| | Shares | | Value |

| |

| Semiconductors & Semiconductor Equipment (continued) |

| Marvell Technology, Inc. | 143,004 | | $ 8,341,423 |

| QUALCOMM, Inc. | 71,836 | | 10,267,519 |

| Texas Instruments, Inc. | 73,861 | | 14,203,470 |

| | | | 51,395,939 |

| Software 9.0% |

| Microsoft Corp. | 199,013 | | 53,912,621 |

| salesforce.com, Inc. (a) | 56,900 | | 13,898,963 |

| SS&C Technologies Holdings, Inc. | 65,472 | | 4,717,912 |

| Workday, Inc., Class A (a) | 32,326 | | 7,717,509 |

| | | | 80,247,005 |

| Specialty Retail 1.6% |

| TJX Cos., Inc. (The) | 216,454 | | 14,593,329 |

| Technology Hardware, Storage & Peripherals 5.5% |

| Apple, Inc. | 299,363 | | 41,000,757 |

| NetApp, Inc. | 103,142 | | 8,439,078 |

| | | | 49,439,835 |

| Textiles, Apparel & Luxury Goods 3.4% |

| NIKE, Inc., Class B | 73,979 | | 11,429,016 |

| PVH Corp. (a) | 58,747 | | 6,320,590 |

| Under Armour, Inc., Class C (a) | 252,492 | | 4,688,776 |

| VF Corp. | 97,235 | | 7,977,159 |

| | | | 30,415,541 |

Total Common Stocks

(Cost $750,392,539) | | | 883,587,643 |

| Short-Term Investment 1.1% |

| Affiliated Investment Company 1.1% |

| MainStay U.S. Government Liquidity Fund, 0.01% (b) | 9,906,952 | | 9,906,952 |

Total Short-Term Investment

(Cost $9,906,952) | | | 9,906,952 |

Total Investments

(Cost $760,299,491) | 99.9% | | 893,494,595 |

| Other Assets, Less Liabilities | 0.1 | | 493,777 |

| Net Assets | 100.0% | | $ 893,988,372 |

| † | Percentages indicated are based on Portfolio net assets. |

| (a) | Non-income producing security. |

| (b) | Current yield as of June 30, 2021. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

11

Portfolio of Investments June 30, 2021† (Unaudited) (continued)

The following is a summary of the fair valuations according to the inputs used as of June 30, 2021, for valuing the Portfolio’s assets:

| Description | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Asset Valuation Inputs | | | | | | | |

| Investments in Securities (a) | | | | | | | |

| Common Stocks | $ 883,587,643 | | $ — | | $ — | | $ 883,587,643 |

| Short-Term Investment | | | | | | | |

| Affiliated Investment Company | 9,906,952 | | — | | — | | 9,906,952 |

| Total Investments in Securities | $ 893,494,595 | | $ — | | $ — | | $ 893,494,595 |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 12 | MainStay VP Wellington U.S. Equity Portfolio |

Statement of Assets and Liabilities as of June 30, 2021 (Unaudited)

| Assets |

Investment in unaffiliated securities, at value

(identified cost $750,392,539) | $883,587,643 |

Investment in affiliated investment companies, at value

(identified cost $9,906,952) | 9,906,952 |

| Cash | 1,549 |

| Receivables: | |

| Portfolio shares sold | 638,157 |

| Dividends | 369,158 |

| Other assets | 52,351 |

| Total assets | 894,555,810 |

| Liabilities |

| Payables: | |

| Manager (See Note 3) | 386,650 |

| Portfolio shares redeemed | 77,870 |

| NYLIFE Distributors (See Note 3) | 59,119 |

| Professional fees | 27,357 |

| Custodian | 16,442 |

| Total liabilities | 567,438 |

| Net assets | $893,988,372 |

| Composition of Net Assets |

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | $ 27,335 |

| Additional paid-in-capital | 543,509,191 |

| | 543,536,526 |

| Total distributable earnings (loss) | 350,451,846 |

| Net assets | $893,988,372 |

| Initial Class | |

| Net assets applicable to outstanding shares | $602,746,265 |

| Shares of beneficial interest outstanding | 18,333,437 |

| Net asset value per share outstanding | $ 32.88 |

| Service Class | |

| Net assets applicable to outstanding shares | $291,242,107 |

| Shares of beneficial interest outstanding | 9,001,563 |

| Net asset value per share outstanding | $ 32.35 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

13

Statement of Operations for the six months ended June 30, 2021 (Unaudited)

| Investment Income (Loss) |

| Income | |

| Dividends-unaffiliated | $ 5,070,969 |

| Securities lending | 3,617 |

| Dividends-affiliated | 202 |

| Total income | 5,074,788 |

| Expenses | |

| Manager (See Note 3) | 2,227,357 |

| Distribution/Service—Service Class (See Note 3) | 348,997 |

| Professional fees | 50,041 |

| Shareholder communication | 36,225 |

| Custodian | 13,970 |

| Trustees | 7,788 |

| Miscellaneous | 10,674 |

| Total expenses | 2,695,052 |

| Net investment income (loss) | 2,379,736 |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on unaffiliated investments | 165,789,628 |

| Net change in unrealized appreciation (depreciation) on unaffiliated investments | (42,893,265) |

| Net realized and unrealized gain (loss) | 122,896,363 |

| Net increase (decrease) in net assets resulting from operations | $125,276,099 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 14 | MainStay VP Wellington U.S. Equity Portfolio |

Statements of Changes in Net Assets

for the six months ended June 30, 2021 (Unaudited) and the year ended December 31, 2020

| | 2021 | 2020 |

| Increase (Decrease) in Net Assets |

| Operations: | | |

| Net investment income (loss) | $ 2,379,736 | $ 7,124,852 |

| Net realized gain (loss) | 165,789,628 | 44,306,392 |

| Net change in unrealized appreciation (depreciation) | (42,893,265) | 43,345,069 |

| Net increase (decrease) in net assets resulting from operations | 125,276,099 | 94,776,313 |

| Distributions to shareholders: | | |

| Initial Class | — | (40,145,517) |

| Service Class | — | (22,213,114) |

| Total distributions to shareholders | — | (62,358,631) |

| Capital share transactions: | | |

| Net proceeds from sales of shares | 94,819,838 | 95,611,235 |

| Net asset value of shares issued to shareholder in reinvestment of distributions | — | 62,358,631 |

| Cost of shares redeemed | (93,921,544) | (234,921,020) |

| Increase (decrease) in net assets derived from capital share transactions | 898,294 | (76,951,154) |

| Net increase (decrease) in net assets | 126,174,393 | (44,533,472) |

| Net Assets |

| Beginning of period | 767,813,979 | 812,347,451 |

| End of period | $893,988,372 | $ 767,813,979 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

15

Financial Highlights selected per share data and ratios

| | Six months ended

June 30,

2021* | | Year Ended December 31, |

| Initial Class | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value at beginning of period | $ 28.28 | | $ 26.83 | | $ 25.23 | | $ 29.75 | | $ 25.60 | | $ 25.43 |

| Net investment income (loss) (a) | 0.10 | | 0.28 | | 0.38 | | 0.42 | | 0.43 | | 0.40 |

| Net realized and unrealized gain (loss) on investments | 4.50 | | 3.68 | | 5.74 | | (1.69) | | 5.30 | | 1.82 |

| Total from investment operations | 4.60 | | 3.96 | | 6.12 | | (1.27) | | 5.73 | | 2.22 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | — | | (0.43) | | (0.43) | | (0.49) | | (0.39) | | (0.40) |

| From net realized gain on investments | — | | (2.08) | | (4.09) | | (2.76) | | (1.19) | | (1.65) |

| Total distributions | — | | (2.51) | | (4.52) | | (3.25) | | (1.58) | | (2.05) |

| Net asset value at end of period | $ 32.88 | | $ 28.28 | | $ 26.83 | | $ 25.23 | | $ 29.75 | | $ 25.60 |

| Total investment return (b) | 16.27%(c) | | 15.55% | | 26.21% | | (5.84)% | | 22.83% | | 9.12% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 0.66%†† | | 1.09% | | 1.37% | | 1.40% | | 1.53% | | 1.57% |

| Net expenses (d) | 0.57%†† | | 0.58% | | 0.58% | | 0.57% | | 0.57% | | 0.58% |

| Portfolio turnover rate | 22% | | 143% | | 119% | | 125% | | 98% | | 125% |

| Net assets at end of period (in 000’s) | $ 602,746 | | $ 497,644 | | $ 543,355 | | $ 454,804 | | $ 639,120 | | $ 577,310 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Six months ended

June 30,

2021* | | Year Ended December 31, |

| Service Class | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value at beginning of period | $ 27.87 | | $ 26.47 | | $ 24.94 | | $ 29.45 | | $ 25.37 | | $ 25.23 |

| Net investment income (loss) (a) | 0.06 | | 0.21 | | 0.31 | | 0.35 | | 0.35 | | 0.33 |

| Net realized and unrealized gain (loss) on investments | 4.42 | | 3.62 | | 5.67 | | (1.68) | | 5.26 | | 1.81 |

| Total from investment operations | 4.48 | | 3.83 | | 5.98 | | (1.33) | | 5.61 | | 2.14 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | — | | (0.35) | | (0.36) | | (0.42) | | (0.34) | | (0.35) |

| From net realized gain on investments | — | | (2.08) | | (4.09) | | (2.76) | | (1.19) | | (1.65) |

| Total distributions | — | | (2.43) | | (4.45) | | (3.18) | | (1.53) | | (2.00) |

| Net asset value at end of period | $ 32.35 | | $ 27.87 | | $ 26.47 | | $ 24.94 | | $ 29.45 | | $ 25.37 |

| Total investment return (b) | 16.07%(c) | | 15.26% | | 25.89% | | (6.08)% | | 22.52% | | 8.85% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 0.41%†† | | 0.83% | | 1.12% | | 1.17% | | 1.28% | | 1.32% |

| Net expenses (d) | 0.82%†† | | 0.83% | | 0.83% | | 0.82% | | 0.82% | | 0.83% |

| Portfolio turnover rate | 22% | | 143% | | 119% | | 125% | | 98% | | 125% |

| Net assets at end of period (in 000’s) | $ 291,242 | | $ 270,170 | | $ 268,992 | | $ 237,094 | | $ 268,526 | | $ 194,992 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 16 | MainStay VP Wellington U.S. Equity Portfolio |

Notes to Financial Statements (Unaudited)

Note 1–Organization and Business

MainStay VP Funds Trust (the “Fund”) was organized as a Delaware statutory trust on February 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is comprised of thirty-one separate series (collectively referred to as the “Portfolios”). These financial statements and notes relate to the MainStay VP Wellington U.S. Equity Portfolio (formerly known as MainStay VP MacKay Common Stock Portfolio) (the "Portfolio"), a "diversified” portfolio, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

Shares of the Portfolio are currently offered to certain separate accounts to fund variable annuity policies and variable universal life insurance policies issued by New York Life Insurance and Annuity Corporation (“NYLIAC”), a wholly-owned subsidiary of New York Life Insurance Company (“New York Life”) and may also be offered to fund variable annuity policies and variable universal life insurance policies issued by other insurance companies. NYLIAC allocates shares of the Portfolios to, among others, certain NYLIAC separate accounts. Shares of the Portfolio are also offered to the MainStay VP Conservative Allocation Portfolio, MainStay VP Moderate Allocation Portfolio, MainStay VP Growth Allocation Portfolio (formerly known as MainStay VP Moderate Growth Allocation Portfolio) and MainStay VP Equity Allocation Portfolio (formerly known as MainStay VP Growth Allocation Portfolio), which operate as “funds-of-funds," and other variable insurance funds.

The following table lists the Portfolio's share classes that have been registered and commenced operations:

| Class | Commenced Operations |

| Initial Class | January 23, 1984 |

| Service Class | June 5, 2003 |

Shares of the Portfolio are offered and are redeemed at a price equal to their respective net asset value (“NAV”) per share. No sales or redemption charge is applicable to the purchase or redemption of the Portfolio's shares. Under the terms of the Fund’s multiple class plan, adopted pursuant to Rule 18f-3 under the 1940 Act, the classes differ in that, among other things, Service Class shares of the Portfolio pay a combined distribution and service fee of 0.25% of average daily net assets attributable to Service Class shares of the Portfolio to the Distributor (as defined in Note 3(B)) pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act. Contract owners of variable annuity contracts purchased after June 2, 2003, are permitted to invest only in the Service Class shares.

The Portfolio's investment objective is to seek long-term growth of capital.

Note 2–Significant Accounting Policies

The Portfolio is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The Portfolio prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the "Exchange") (usually 4:00 p.m. Eastern time) on each day the Portfolio is open for business ("valuation date").

The Board of Trustees of the Fund (the "Board") adopted procedures establishing methodologies for the valuation of the Portfolio's securities and other assets and delegated the responsibility for valuation determinations under those procedures to the Valuation Committee of the Fund (the “Valuation Committee”). The procedures state that, subject to the oversight of the Board and unless otherwise noted, the responsibility for the day-to-day valuation of portfolio assets (including fair value measurements for the Portfolio's assets and liabilities) rests with New York Life Investment Management LLC (“New York Life Investments” or the "Manager"), aided to whatever extent necessary by the Subadvisor (as defined in Note 3(A)). To assess the appropriateness of security valuations, the Manager, the Subadvisor or the Portfolio's third-party service provider, who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities and the sale prices to the prior and current day prices and challenges prices with changes exceeding certain tolerance levels with third-party pricing services or broker sources.

The Board authorized the Valuation Committee to appoint a Valuation Subcommittee (the “Subcommittee”) to establish the prices of securities for which market quotations are not readily available or the prices of which are not otherwise readily determinable under the procedures. The Subcommittee meets (in person, via electronic mail or via teleconference) on an as-needed basis. The Valuation Committee meets to ensure that actions taken by the Subcommittee were appropriate.

For those securities valued through either a standardized fair valuation methodology or a fair valuation measurement, the Subcommittee deals with such valuation and the Valuation Committee reviews and affirms, if appropriate, the reasonableness of the valuation based on such methodologies and measurements on a regular basis after considering information that is reasonably available and deemed relevant by the Valuation Committee. Any action taken by the Subcommittee with respect to the valuation of a portfolio security or other asset is submitted for review and ratification (if appropriate) to the Valuation Committee and the Board at the next regularly scheduled meeting.

"Fair value" is defined as the price the Portfolio would reasonably expect to receive upon selling an asset or liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the

Notes to Financial Statements (Unaudited) (continued)

asset or liability. Fair value measurements are determined within a framework that establishes a three-tier hierarchy that maximizes the use of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. "Inputs" refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Portfolio. Unobservable inputs reflect the Portfolio’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing assets or liabilities may not be an indication of the risks associated with investing in those assets or liabilities. The three-tier hierarchy of inputs is summarized below.

| • | Level 1—quoted prices in active markets for an identical asset or liability |

| • | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Portfolio's own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The level of an asset or liability within the fair value hierarchy is based on the lowest level of an input, both individually and in the aggregate, that is significant to the fair value measurement. The aggregate value by input level of the Portfolio’s assets and liabilities as of June 30, 2021, is included at the end of the Portfolio of Investments.

The Portfolio may use third-party vendor evaluations, whose prices may be derived from one or more of the following standard inputs, among others:

| • Broker/dealer quotes | • Benchmark securities |

| • Two-sided markets | • Reference data (corporate actions or material event notices) |

| • Bids/offers | • Monthly payment information |

| • Industry and economic events | • Reported trades |

An asset or liability for which market values cannot be measured using the methodologies described above is valued by methods deemed reasonable in good faith by the Valuation Committee, following the procedures established by the Board, to represent fair value. Under these procedures, the Portfolio generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information. The Portfolio may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to

calculate fair value. Discounts may also be applied due to the nature and/or duration of any restrictions on the disposition of the asset or liability. Fair value represents a good faith approximation of the value of a security. Fair value determinations involve the consideration of a number of subjective factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Portfolio's valuation procedures may differ from valuations for the same security determined by other funds using their own valuation procedures. Although the Portfolio's valuation procedures are designed to value a security at the price the Portfolio may reasonably expect to receive upon the security's sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Portfolio would actually realize upon the sale of the security or the price at which the security would trade if a reliable market price were readily available. During the six-month period ended June 30, 2021, there were no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been delisted from a national exchange; (v) a security for which the market price is not readily available from a third-party pricing source or, if so provided, does not, in the opinion of the Manager or the Subadvisor, reflect the security's market value; (vi) a security subject to trading collars for which no or limited trading takes place; and (vii) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities valued in this manner are generally categorized as Level 3 in the hierarchy. No securities held by the Portfolio as of June 30, 2021 were fair valued in such a manner.

Equity securities are valued at the last quoted sales prices as of the close of regular trading on the relevant exchange on each valuation date. Securities that are not traded on the valuation date are valued at the mean of the last quoted bid and ask prices. Prices are normally taken from the principal market in which each security trades. These securities are generally categorized as Level 1 in the hierarchy.

Investments in mutual funds, including money market funds, are valued at their respective NAVs at the close of business each day on the valuation date. These securities are generally categorized as Level 1 in the hierarchy.

Temporary cash investments acquired in excess of 60 days to maturity at the time of purchase are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities and ratings), both as furnished by independent pricing services. Temporary cash investments that mature in 60 days or less at the time of purchase ("Short-Term Investments") are valued using the amortized cost method of valuation, unless the use of such method would be inappropriate. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter

| 18 | MainStay VP Wellington U.S. Equity Portfolio |

assuming a constant amortization to maturity of the difference between such cost and the value on maturity date. Amortized cost approximates the current fair value of a security. Securities valued using the amortized cost method are not valued using quoted prices in an active market and are generally categorized as Level 2 in the hierarchy.

The information above is not intended to reflect an exhaustive list of the methodologies that may be used to value portfolio investments. The valuation procedures permit the use of a variety of valuation methodologies in connection with valuing portfolio investments. The methodology used for a specific type of investment may vary based on the market data available or other considerations. The methodologies summarized above may not represent the specific means by which portfolio investments are valued on any particular business day.

(B) Income Taxes. The Portfolio's policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute all of its taxable income to the shareholders of the Portfolio within the allowable time limits.

The Manager evaluates the Portfolio’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is permitted only to the extent the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Manager analyzed the Portfolio's tax positions taken on federal, state and local income tax returns for all open tax years (for up to three tax years) and has concluded that no provisions for federal, state and local income tax are required in the Portfolio's financial statements. The Portfolio's federal, state and local income tax and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

(C) Dividends and Distributions to Shareholders. Dividends and distributions are recorded on the ex-dividend date. The Portfolio intends to declare and pay dividends from net investment income and distributions from net realized capital and currency gains, if any, at least annually. Unless a shareholder elects otherwise, all dividends and distributions are reinvested at NAV in the same class of shares of the Portfolio. Dividends and distributions to shareholders are determined in accordance with federal income tax regulations and may differ from determinations using GAAP.

(D) Security Transactions and Investment Income. The Portfolio records security transactions on the trade date. Realized gains and losses on security transactions are determined using the identified cost method. Dividend income is recognized on the ex-dividend date, net of any foreign tax withheld at the source, and interest income is accrued as earned using the effective interest rate method. Distributions received from real

estate investment trusts may be classified as dividends, capital gains and/or return of capital.

Investment income and realized and unrealized gains and losses on investments of the Portfolio are allocated pro rata to the separate classes of shares based upon their relative net assets on the date the income is earned or realized and unrealized gains and losses are incurred.

(E) Expenses. Expenses of the Fund are allocated to the individual Portfolios in proportion to the net assets of the respective Portfolios when the expenses are incurred, except where direct allocations of expenses can be made. Expenses (other than fees incurred under the distribution and service plans, further discussed in Note 3(B), which are charged directly to the Service Class shares) are allocated to separate classes of shares pro rata based upon their relative net assets on the date the expenses are incurred. The expenses borne by the Portfolio, including those of related parties to the Portfolio, are shown in the Statement of Operations.

Additionally, the Portfolio may invest in exchange-traded funds ("ETFs") and mutual funds, which are subject to management fees and other fees that may cause the costs of investing in ETFs and mutual funds to be greater than the costs of owning the underlying securities directly. These indirect expenses of ETFs and mutual funds are not included in the amounts shown as expenses in the Statement of Operations or in the expense ratios included in the Financial Highlights.

(F) Use of Estimates. In preparing financial statements in conformity with GAAP, the Manager makes estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and assumptions.

(G) Securities Lending. In order to realize additional income, the Portfolio may engage in securities lending, subject to the limitations set forth in the 1940 Act and relevant guidance by the staff of the Securities and Exchange Commission (“SEC”). If the Portfolio engages in securities lending, the Portfolio will lend through its custodian, JPMorgan Chase Bank, N.A., ("JPMorgan"), acting as securities lending agent on behalf of the Portfolio. Under the current arrangement, JPMorgan will manage the Portfolio's collateral in accordance with the securities lending agency agreement between the Portfolio and JPMorgan, and indemnify the Portfolio against counterparty risk. The loans will be collateralized by cash (which may be invested in a money market fund) and/or non-cash collateral (which may include U.S. Treasury securities and/or U.S. government agency securities issued or guaranteed by the United States government or its agencies or instrumentalities) at least equal at all times to the market value of the securities loaned. The Portfolio bears the risk of delay in recovery of, or loss of rights in, the securities loaned. The Portfolio may also record a realized gain or loss on securities deemed sold due to a borrower’s inability to return securities on loan. The Portfolio bears the risk of any loss on investment of cash collateral. The Portfolio will receive compensation for lending its securities in the form of fees or it will retain a portion of interest earned on the investment of any cash collateral. The Portfolio will also continue to receive interest and dividends

Notes to Financial Statements (Unaudited) (continued)

on the securities loaned and any gain or loss in the market price of the securities loaned that may occur during the term of the loan will be for the account of the Portfolio. Income earned from securities lending activities, if any, is reflected in the Statement of Operations. As of June 30, 2021, the Portfolio did not have any portfolio securities on loan.

Prior to February 22, 2021, these services were provided by State Street Bank and Trust Company (“State Street”).

(H) Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Portfolio enters into contracts with third-party service providers that contain a variety of representations and warranties and that may provide general indemnifications. The Portfolio's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet occurred. The Manager believes that the risk of loss in connection with these potential indemnification obligations is remote. However, there can be no assurance that material liabilities related to such obligations will not arise in the future, which could adversely impact the Portfolio.

Note 3–Fees and Related Party Transactions

(A) Manager and Subadvisor. New York Life Investments, a registered investment adviser and an indirect, wholly-owned subsidiary of New York Life, serves as the Portfolio's Manager, pursuant to an Amended and Restated Management Agreement ("Management Agreement"). The Manager provides offices, conducts clerical, recordkeeping and bookkeeping services and keeps most of the financial and accounting records required to be maintained by the Portfolio. Except for the portion of salaries and expenses that are the responsibility of the Portfolio, the Manager pays the salaries and expenses of all personnel affiliated with the Portfolio and certain operational expenses of the Portfolio. The Portfolio reimburses New York Life Investments in an amount equal to the portion of the compensation of the Chief Compliance Officer attributable to the Portfolio. The Portfolio’s subadvisor changed effective May 1, 2021, due to the replacement of MacKay Shields LLC ("MacKay Shields") as the Portfolio’s subadvisor and the appointment of Wellington Management Company LLP (“Wellington” or the “Subadvisor”) as the Portfolio’s subadvisor. Wellington, a registered investment adviser, is responsible for the day-to-day portfolio management of the Portfolio. Pursuant to the terms of a Subadvisory Agreement ("Subadvisory Agreement") between New York Life Investments and Wellington, New York Life Investments pays for the services of the Subadvisor.

Pursuant to the Management Agreement, the Fund pays the Manager, on behalf of the Portfolio, a monthly fee for the services performed and the facilities furnished at an annual rate of the Portfolio's average daily net assets as follows: 0.55% up to $500 million; 0.525% from $500 million to $1 billion; and 0.50% in excess of $1 billion. During the six-month period ended June 30, 2021, the effective management fee rate was 0.54%

During the six-month period ended June 30, 2021, New York Life Investments earned fees from the Portfolio in the amount of $2,227,357 and paid MacKay Shields and Wellington $726,612 and $337,696, respectively.

JPMorgan provides sub-administration and sub-accounting services to the Portfolio pursuant to an agreement with New York Life Investments. These services include calculating the daily NAVs of the Portfolio, maintaining the general ledger and sub-ledger accounts for the calculation of the Portfolio's NAVs, and assisting New York Life Investments in conducting various aspects of the Portfolio's administrative operations. For providing these services to the Portfolio, JPMorgan is compensated by New York Life Investments.

Prior to February 22, 2021, these services were provided by State Street.

Pursuant to an agreement between the Fund and New York Life Investments, New York Life Investments is responsible for providing or procuring certain regulatory reporting services for the Portfolio. The Portfolio will reimburse New York Life Investments for the actual costs incurred by New York Life Investments in connection with providing or procuring these services for the Portfolio.

(B) Distribution and Service Fees. The Fund, on behalf of the Portfolio, has entered into a distribution agreement with NYLIFE Distributors LLC (the “Distributor”), an affiliate of New York Life Investments. The Portfolio has adopted a distribution plan (the “Plan”) in accordance with the provisions of Rule 12b-1 under the 1940 Act. Under the Plan, the Distributor has agreed to provide, through its affiliates or independent third parties, various distribution-related, shareholder and administrative support services to the Service Class shareholders. For its services, the Distributor is entitled to a combined distribution and service fee accrued daily and paid monthly at an annual rate of 0.25% of the average daily net assets attributable to the Service Class shares of the Portfolio.

| 20 | MainStay VP Wellington U.S. Equity Portfolio |

(C) Investments in Affiliates (in 000’s). During the six-month period ended June 30, 2021, purchases and sales transactions, income earned from investments and shares held of investment companies managed by New York Life Investments or its affiliates were as follows:

| Affiliated Investment Companies | Value,

Beginning

of Period | Purchases

at Cost | Proceeds

from

Sales | Net

Realized

Gain/(Loss)

on Sales | Change in

Unrealized

Appreciation/

(Depreciation) | Value,

End of

Period | Dividend

Income | Other

Distributions | Shares

End of

Period |

| MainStay U.S. Government Liquidity Fund | $ 2,314 | $ 85,626 | $ (78,033) | $ — | $ — | $ 9,907 | $ —(a) | $ — | 9,907 |

Note 4-Federal Income Tax

As of June 30, 2021, the cost and unrealized appreciation (depreciation) of the Portfolio’s investment portfolio, including applicable derivative contracts and other financial instruments, as determined on a federal income tax basis, were as follows:

| | Federal Tax

Cost | Gross

Unrealized

Appreciation | Gross

Unrealized

(Depreciation) | Net

Unrealized

Appreciation/

(Depreciation) |

| Investments in Securities | $762,718,292 | $141,348,864 | $(10,572,561) | $130,776,303 |

During the year ended December 31, 2020, the tax character of distributions paid as reflected in the Statements of Changes in Net Assets was as follows:

| | 2020 |

| Distributions paid from: | |

| Ordinary Income | $19,229,381 |

| Long-Term Capital Gains | 43,129,250 |

| Total | $62,358,631 |

Note 5–Custodian

JPMorgan is the custodian of cash and securities held by the Portfolio. Custodial fees are charged to the Portfolio based on the Portfolio's net assets and/or the market value of securities held by the Portfolio and the number of certain transactions incurred by the Portfolio.

Prior to February 22, 2021, these services were provided by State Street. The services provided by State Street were a direct expense of the Portfolio and are included in the Statement of Operations as Custodian fees which totaled $3,859 for the period January 1, 2021 through February 21, 2021.

Note 6–Line of Credit

The Portfolio and certain other funds managed by New York Life Investments maintain a line of credit with a syndicate of banks in order to secure a source of funds for temporary purposes to meet unanticipated or excessive redemption requests.

Effective July 27, 2021, under the credit agreement (the “Credit Agreement”), the aggregate commitment amount is $600,000,000 with

an additional uncommitted amount of $100,000,000. The commitment fee is an annual rate of 0.15% of the average commitment amount payable quarterly, regardless of usage, to JPMorgan, who serves as the agent to the syndicate. The commitment fee is allocated among the Portfolio and certain other funds managed by New York Life Investments based upon their respective net assets and other factors. Interest on any revolving credit loan is charged based upon the Federal Funds Rate or the one-month London Interbank Offered Rate ("LIBOR"), whichever is higher. The Credit Agreement expires on July 26, 2022, although the Portfolio, certain other funds managed by New York Life Investments and the syndicate of banks may renew the Credit Agreement for an additional year on the same or different terms or enter into a credit agreement with a different syndicate of banks. Prior to July 27, 2021, the aggregate commitment amount and the commitment fee were the same as those under the current Credit Agreement. During the six-month period ended June 30, 2021, there were no borrowings made or outstanding with respect to the Portfolio under the Credit Agreement.

Note 7–Interfund Lending Program

Pursuant to an exemptive order issued by the SEC, the Portfolio, along with certain other funds managed by New York Life Investments, may participate in an interfund lending program. The interfund lending program provides an alternative credit facility that permits the Portfolio and certain other funds managed by New York Life Investments to lend or borrow money for temporary purposes directly to or from one another, subject to the conditions of the exemptive order. During the six-month period ended June 30, 2021, there were no interfund loans made or outstanding with respect to the Portfolio.

Note 8–Purchases and Sales of Securities (in 000’s)

During the six-month period ended June 30, 2021, purchases and sales of securities, other than short-term securities, were $189,308 and $179,712, respectively.

Note 9–Capital Share Transactions

Transactions in capital shares for the six-month period ended June 30, 2021 and the year ended December 31, 2020, were as follows:

Notes to Financial Statements (Unaudited) (continued)

| Initial Class | Shares | Amount |

| Period ended June 30, 2021: | | |

| Shares sold | 2,921,509 | $ 90,733,745 |

| Shares redeemed | (2,185,238) | (68,849,134) |

| Net increase (decrease) | 736,271 | $ 21,884,611 |

| Year ended December 31, 2020: | | |

| Shares sold | 2,990,187 | $ 77,797,974 |

| Shares issued to shareholders in reinvestment of distributions | 1,546,962 | 40,145,517 |

| Shares redeemed | (7,190,684) | (182,095,530) |

| Net increase (decrease) | (2,653,535) | $ (64,152,039) |

| |

| Service Class | Shares | Amount |

| Period ended June 30, 2021: | | |

| Shares sold | 138,469 | $ 4,086,093 |

| Shares redeemed | (832,555) | (25,072,410) |

| Net increase (decrease) | (694,086) | $ (20,986,317) |

| Year ended December 31, 2020: | | |

| Shares sold | 742,721 | $ 17,813,261 |

| Shares issued to shareholders in reinvestment of distributions | 868,198 | 22,213,114 |

| Shares redeemed | (2,077,311) | (52,825,490) |

| Net increase (decrease) | (466,392) | $ (12,799,115) |

Note 10-Litigation

The Portfolio has been named as a defendant in the case entitled Kirschner v. FitzSimons, No. 12-2652 (S.D.N.Y.) (the “FitzSimons action”) as a result of its ownership of shares in the Tribune Company (“Tribune”) in 2007 when Tribune effected a leveraged buyout transaction (“LBO”) by which Tribune converted to a privately-held company. In its complaint, the plaintiff asserts claims against certain insiders, shareholders, professional advisers, and others involved in the LBO.

Separately, the complaint also seeks to obtain from former Tribune shareholders, including the Portfolio, any proceeds they received in connection with the LBO. The sole claim and cause of action brought against the Portfolio is for fraudulent conveyance pursuant to United States Bankruptcy Code Section 548(a)(1)(A).

In June 2011, certain Tribune creditors filed numerous additional actions asserting state law constructive fraudulent conveyance claims (the “SLCFC actions”) against specifically-named former Tribune shareholders and, in some cases, putative defendant classes comprised of former Tribune shareholders. One of the SLCFC actions, entitled Deutsche Bank Trust Co. Americas v. Blackrock Institutional Trust Co., No. 11-9319 (S.D.N.Y.) (the “Deutsche Bank action”), named the Portfolio as a defendant.

The FitzSimons action and Deutsche Bank action have been consolidated with the majority of the other Tribune LBO-related lawsuits in a multidistrict litigation proceeding entitled In re Tribune Co. Fraudulent Conveyance Litig., No. 11-md-2296 (S.D.N.Y.) (the “MDL Proceeding”).