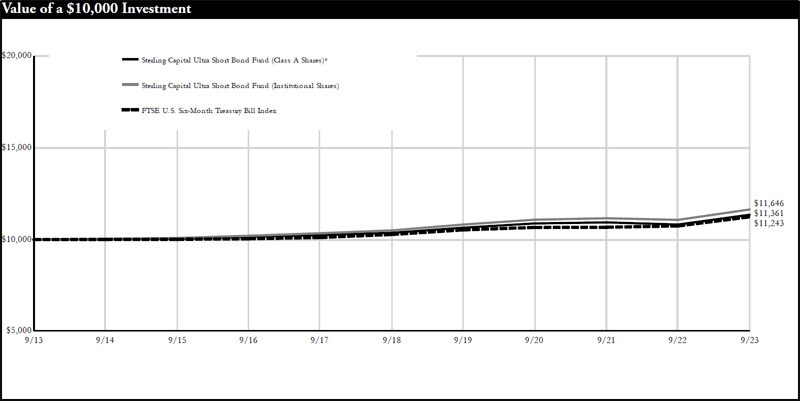

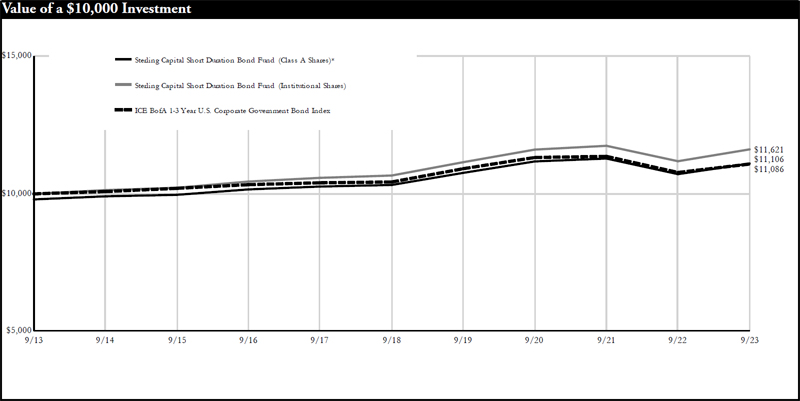

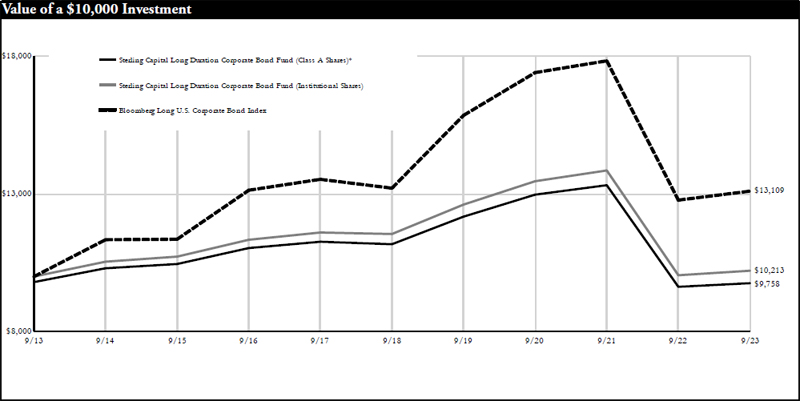

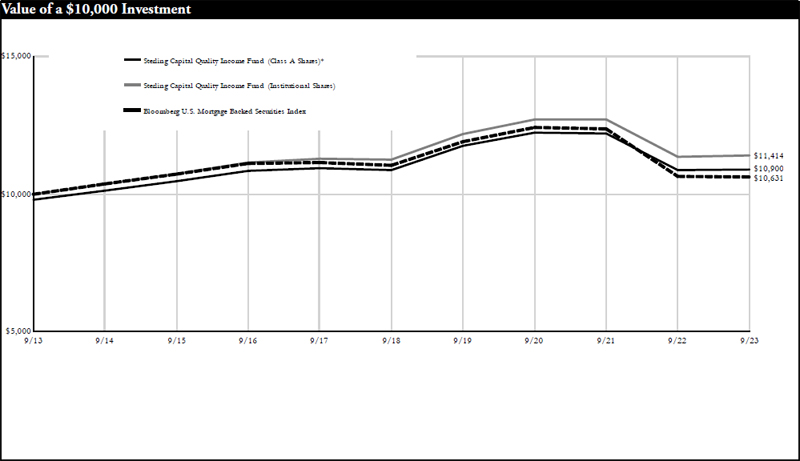

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06719

Sterling Capital Funds

(Exact name of registrant as specified in charter)

434 Fayetteville St., Suite 500

Raleigh, NC 27601

(Address of principal executive offices) (Zip code)

James T. Gillespie, President

Sterling Capital Funds

434 Fayetteville St., Suite 500

Raleigh, NC 27601

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

(This page is intentionally left blank.)

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this Sterling Capital Funds Annual Report covering the 12 months from October 1, 2022, to September 30, 2023.

Equity markets posted double-digit returns over the 12-month period under review. Share prices rebounded strongly in October 2022 after relatively weak performance for much of the calendar year. Stock prices peaked early in the third quarter of 2023 before declining modestly through the end of the period.

Inflation and the Federal Reserve’s (Fed’s) monetary policy decisions were major themes influencing domestic equity performance during the 12-month period under review. Investors began the period concerned that the Fed’s rate hikes would drive the U.S. economy into a recession. Those fears faded with the New Year as inflation showed signs of cooling and economic fundamentals remained strong, but they were renewed after the Fed raised interest rates in July and again in September after Fed Chair Jerome Powell adopted a more hawkish tone about potential interest rate moves in 2024.

Although U.S. and developed international equities ended the 12-month period largely in line with one another, the pace of those gains and the nature of the trends differed. For instance, domestic equities underperformed international equities for the fourth quarter of 2022, while that pattern reversed across the latter half of the period. In fact, most of the gains for international stocks took place during the fourth quarter of 2022, when large-cap international stocks, as measured by the MSCI1 EAFE Large Cap (LC) Index, gained 17.3% and the S&P 500®2 Index, a measure of large-cap U.S. stocks, posted a 7.5% gain. Value stocks also generally outperformed growth names during this final quarter of 2022, as they did for most of 2022.

In early 2023, U.S. Investors appeared to regain some of their appetite for risk. Fears of a financial crisis, triggered by the well-publicized failure of a few regional banks in March, kept share prices mostly in check across the first quarter of 2023. However, U.S. equities rebounded strongly through the second quarter of 2023. Despite mixed economic data, investors’ appetite for risk increased, leading to a shift toward growth stocks and away from value names. In fact, across the first three quarters of 2023, U.S. large-cap growth stocks, as measured by the Russell3 1000® Growth Index, returned 25.0%, outperforming the 1.8% return by U.S. large-cap value stocks, as measured by the Russell 1000® Value Index. By comparison, value stocks continued to outperform growth names in international markets across the same final three quarters of the period, even as the difference was more muted. The MSCI ACWI ex USA Value Index, a measure of large- and mid-cap international value stocks, returned 8.8% during the first nine months of 2023. That compared to a 2.9% gain for the MSCI ACWI ex USA Growth Index. It was only in the final quarter of the period that investor enthusiasm for growth stocks waned. During that period, investors worried about the potential for additional interest rate hikes, a more hawkish stance by the Fed, the risk of a government shutdown, and the economic impact of a prolonged autoworkers strike. U.S. large-cap growth and value stocks both declined equally across the final quarter of the period.

Domestic investors’ pivot to growth during the period was visible in the performance of individual sectors of the S&P 500. In the fourth quarter of 2022, the energy, industrials, and materials sectors posted the strongest gains, while consumer discretionary and communication services were the only sectors of the index to post a loss for the quarter. When considering the first three quarters of 2023, however, the three top-performing sectors were communications services, information technology, and consumer discretionary. Meanwhile, more-defensive areas such as health care, consumer staples, real estate, and utilities all lagged their peers.

Over the course of the 12-month period, the Fed raised the fed funds rate4 – a key short-term interest rate – six times for a total increase of 225 basis points5 (bps), or 2.25%. The two rate hikes in the fourth quarter of 2022 accounted for 125bps, while the four rate hikes in February, March, May, and July were each 25bp increases. The rapid rise in interest rates had the expected effect on bonds of pushing down prices. However, those effects were mixed along the length of the yield curve6 as investors worked to process the monthly changes in inflation data and the shifting tone of the Fed.

In the fourth quarter of 2022, short-term yields skyrocketed, with the yield on 6-month Treasuries up 100bps for the quarter. Meanwhile, the yield on 10-year Treasuries remained relatively flat. In the first quarter of 2023, a banking crisis among regional banks in March 2023 led to a flight to safety which saw Treasury yields decline despite the single Fed interest rate increase that took place in February. The inversion between two- and 10-year Treasuries declined to -56bps by the end of the quarter. Meanwhile, the spread on corporate yields narrowed as the Fed and FDIC aggressively intervened in the regional banking crisis, and confidence in the resilience of the banking system returned.

In the second quarter, yields rose once again as investors regained confidence in the economy, but the increases were uneven across the length of the yield curve. The inversion between 2- and 10-year Treasuries grew -106bps by the end of the quarter. The spread on corporate yields tightened even further. In the third quarter, yields increased sharply across the curve as the economy demonstrated its resilience to the aggressive Fed rate hikes as it added more jobs than expected, and markets began to weigh future rate increases. The yield curve began to normalize near the end of the period, and the inversion between two- and 10-year Treasuries was reduced to just -50bps by the end of the quarter. Yields on 2-year Treasuries ended the period at 5.0% (up from 4.2% at the start of the period) and yields on 10-year Treasuries ended the period at 4.6% (up from 3.8% at the start of the period) – levels not seen since before the 2008 Financial Crisis. The rise in interest rates across the period negatively affected bond returns, and the Bloomberg7 U.S. Aggregate Bond Index was down 1.21% YTD through September 30.

The Fed’s aggressive rate hikes proved effective in cooling inflation over the 12-month period, although not quite down to the Fed’s target of 2.0%. The Consumer Price Index8 (CPI) began the period at 7.7% and finished the period at 3.7%, with its lowest point at 3.0% in June. Despite the aggressive rate hikes, the economy remained resilient, with gross domestic product9 (GDP) increasing at an annualized rate of 2.6% in the fourth quarter of 2022 and increases of 2.2% and 2.1% across the first and second quarters of 2023, respectively. The advance estimate for GDP growth in the third quarter of 2023 is a robust 4.9%. Employment data was one of the key metrics investors turned to for confirmation of the U.S. economy’s strength in the face of rising interest rates. The monthly unemployment rate started the 12-month period at 3.7% and ended the period at 3.8%.

The S&P 500 gained 21.6% (total return) during the 12 months under review. Small-cap stocks underperformed their large-cap counterparts over the same period, with the Russell 2000® Index gaining 8.9% (total return). International markets also posted strong returns, with the MSCI EAFE Index up 22.3% (price return), while the MSCI Emerging Markets Index posted a more modest gain of 11.7% (net return) for the period.

We will continue to monitor the evolving economic and market climate and will manage the Sterling Capital Funds accordingly. Thank you for your confidence in Sterling Capital Management. We look forward to serving your investment needs during the months and years ahead.

Past performance is not indicative of future results. Any type of investing involves risk and there are no guarantees that these methods will be successful.

Specific securities identified and described do not represent all of the securities purchased, sold or recommended to clients. There are no assurances that securities identified will be profitable investments. The securities described are neither a recommendation nor a solicitation. Security information is being obtained from resources the firm believes to be accurate, but no warrant is made as to the accuracy or completeness of the information.

The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

Sincerely,

James T. Gillespie

President

Sterling Capital Funds

Jeffrey J. Schappe, CFA®

Managing Director

Sterling Capital Management LLC

| 1 | “MSCI Inc. is an American finance company headquartered in New York, NY. MSCI is a global provider of equity, fixed income, real estate indexes, multi-asset portfolio analysis tools, ESG and climate products. It operates the MSCI Europe/Australasia/Far East (EAFE) Indices (EAFE), the MSCI All Country World Indices (ACWI), and the MSCI Emerging Markets Indices referenced herein, among others. |

| 2 | “S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Sterling Capital Funds. The S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. |

| 3 | LSEG Group, the parent company of FTSE Russell, is a global finance company headquartered in London, UK and is a provider of investment data, indices, and analytics across multiple asset classes. FTSE Russell operates the Russell 1000® and Russell 2000® U.S. equity indices referenced herein, among others. |

Letter from the President and the Investment Advisor

| 4 | The Fed Funds Rate refers to the interest rate that depository institutions (such as banks and credit unions) charge other depository institutions for overnight lending of capital from their reserve balances on an uncollateralized basis. |

| 5 | Basis points (bps) are a measure equal to 1/100 of one percent, typically used to express differences in interest rates. |

| 6 | A yield curve is a line that plots the yields of bonds of similar credit quality but different maturity dates. |

| 7 | “Bloomberg®” and the Bloomberg indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Sterling Capital Management LLC and its affiliates. Bloomberg is not affiliated with Sterling Capital Management LLC or its affiliates, and Bloomberg does not approve, endorse, review, or recommend the product(s) presented herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the product(s) presented herein. It operates the Bloomberg U.S. Aggregate Bond Index referenced herein, among others. |

| 8 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available. |

| 9 | Real gross domestic product (GDP) is an inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given year, expressed in base-year prices. |

Past performance does not guarantee future results. Mutual fund investing involves risk including the possible loss of principal.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) and is paid a fee for its services. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, Truist Financial Corporation (“Truist”) or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, LLC. The distributor is not affiliated with Truist Financial Corporation or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice.

Sterling Capital Behavioral Large Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Large Cap Value Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA®, Senior Managing Director, and Robert O. Weller, CFA®, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA®

Robert W. Bridges, CFA, Senior Managing Director, CIO and Head of Equity, joined Sterling Capital in 1996 and has investment experience since 1991. He has been co-portfolio manager of the Behavioral Large Cap Value Equity Fund since August 2013. Bob is a graduate of Wake Forest University, where he received a B.S. in Business. He holds the Chartered Financial Analyst designation.

Robert O. Weller, CFA®

Robert O. Weller, CFA, Executive Director, joined Sterling Capital in 2012 and has investment experience since 1996. He has been co-portfolio manager of the Behavioral Large Cap Value Equity Fund since August 2013. Rob is a graduate of Loyola University Maryland, where he received a B.B.A. in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and price momentum. The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. The overall results of the Fund will be dependent on the process and ability of the Adviser to recognize a company’s value. The Fund may invest in REITs (Real Estate Investment Trusts), the value of which will be affected by conditions of the real estate industry. The Fund may also invest in exchange-traded funds (ETFs); thus shareholders may bear additional costs and the ETF may not exactly replicate the performance it seeks to track.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its current benchmark, the Russell 1000® Value Index.

Q. What factors affected the Fund’s performance?

A. The Russell 1000® Index as a whole posted double-digit gains during the 12-month period amid strong domestic equity returns. A large portion of those gains were driven by large-cap, high-growth technology companies that make up a large portion of the Index. These companies benefited from investor enthusiasm about artificial intelligence (AI) and a general increase in investor optimism in the resilience of the economy despite the rapid rise in interest rates. This shift in attitude helped drive investors to pivot in early 2023 toward growth-oriented names and away from value-oriented stocks. This trend negatively affected the absolute performance of both the Fund and its value-oriented benchmark as it drove value to underperform growth for the period under review. Investor enthusiasm waned briefly in March after the well-publicized failures of a few regional financial institutions fanned fears about liquidity and potential bank runs. However, markets quickly rebounded in the second quarter of 2023 and continued to post steady gains throughout most of the rest of the period.

The Fund applies principles of behavioral finance to its investment strategy. This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear, and ego. One element of the Fund’s strategy is a focus on how investor fears result in cheaper stocks. Shares held at discounts provided most of the relative outperformance over the year as such holdings posted positive returns, while expensive stocks underperformed.

The Fund’s relative performance suffered from investors’ pivot toward riskier investments in January. This shift led momentum stocks to underperform, and targeting momentum is one of the Fund’s priorities. The shift caused the Fund to underperform significantly in January, but some of those losses were recouped later in the quarter when the regional bank failures triggered investor concerns around liquidity and caused the markets to pull back.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe.

The Russell 1000® Value Index measures the performance of value-style investing in large-cap U.S. stocks.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

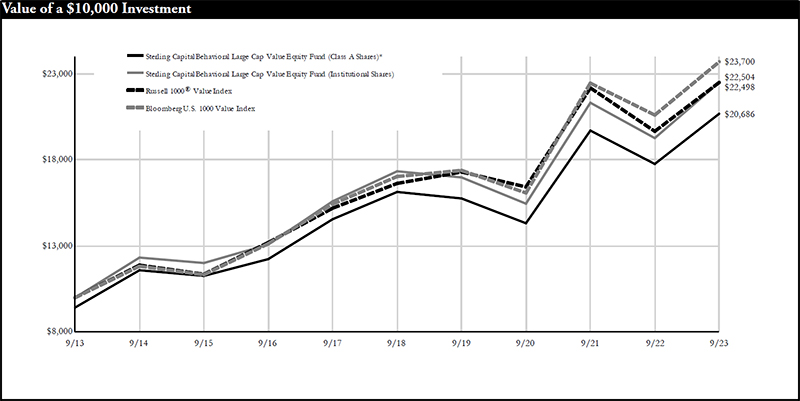

| Average Annual Total Returns |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 10/9/92 | 9.74% | 3.85% | 7.54% |

| Class C Shares** | 2/1/01 | 15.57% | 4.31% | 7.38% |

| Institutional Shares | 10/9/92 | 16.74% | 5.34% | 8.45% |

| Class R6 Shares | 2/1/181 | 16.84% | 5.43% | 8.49% |

| Russell 1000® Value Index | N/A | 14.44% | 6.23% | 8.45% |

| Bloomberg U.S. 1000 Value Index | N/A | 14.99% | 6.81% | 9.01% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

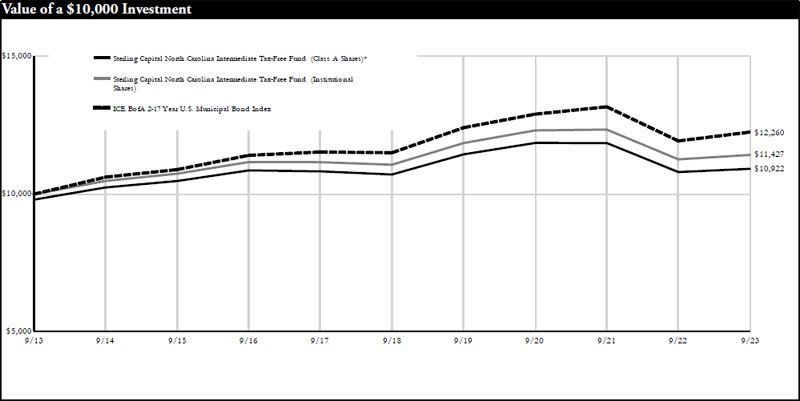

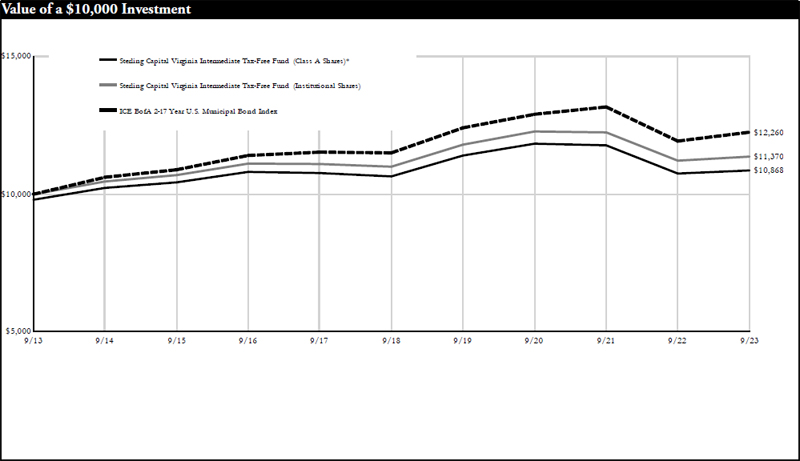

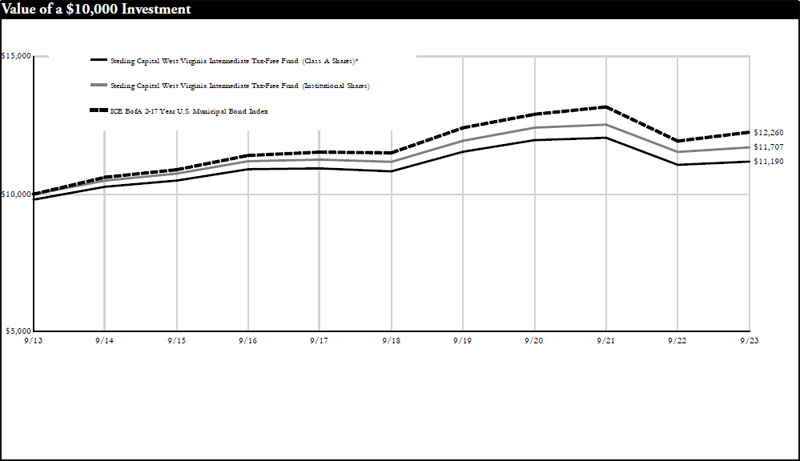

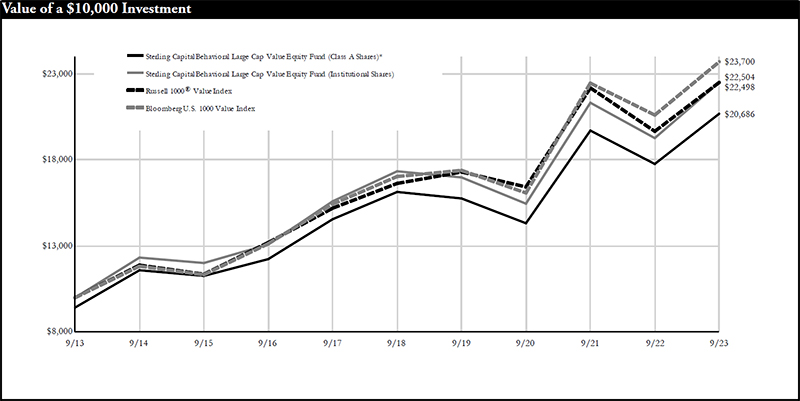

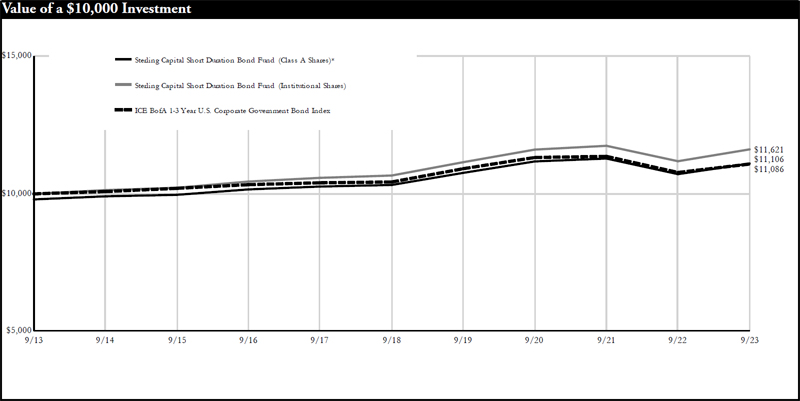

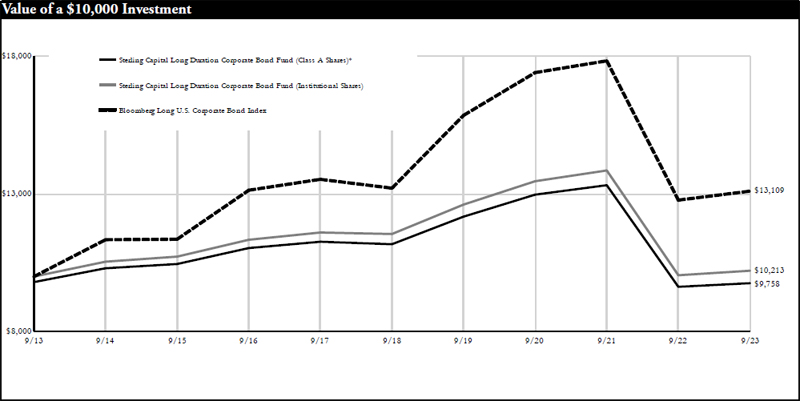

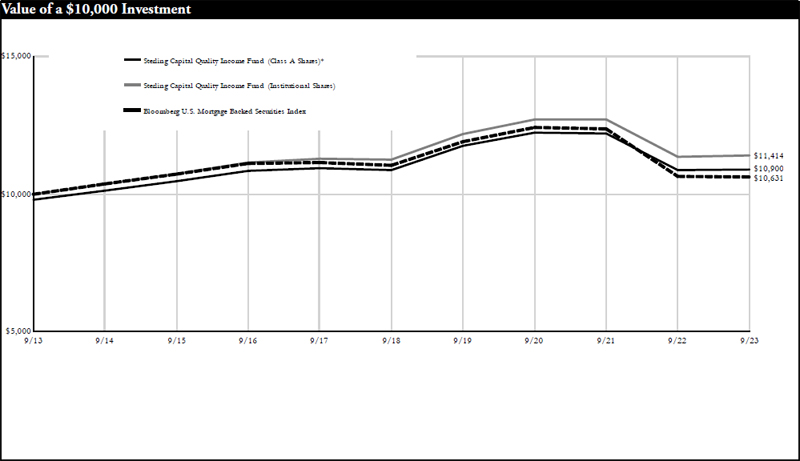

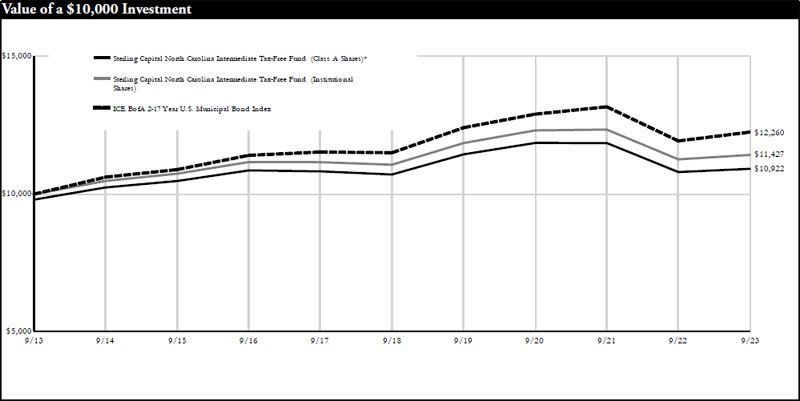

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Russell 1000® Value Index is a widely recognized index of common stocks that measures the performance of the large-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. 1000 Value Index provides exposure to companies with superior value factor scores based on their earnings yield, valuation, dividend yield, and growth.

Sterling Capital Mid Value Fund

Portfolio Managers

Sterling Capital Mid Value Fund (the “Fund”) is managed by Portfolio Managers Patrick W. Rau, CFA®, Managing Director, William C. Smith, CFA®, Executive Director and Lee D. Houser, CFA®, Executive Director for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Patrick W. Rau, CFA®

Patrick W. Rau, CFA®, Managing Director, joined Sterling Capital Management in 2001 and has investment experience since 1993. Patrick has been co-portfolio manager of Mid Value Fund since August 2021. Patrick received his A.B. in Political Science from Duke University and his MBA from Vanderbilt University. He holds the Chartered Financial Analyst designation.

William C. Smith, CFA®

William C. Smith, CFA®, Executive Director, joined Sterling Capital Management in 2015 and has investment experience since 2002. Will has been co-portfolio manager of the Mid Value Fund since August 2021 and served as associate portfolio manager of the Fund from February 2021 to August 2021. Will received his B.E. in Structural Engineering from Vanderbilt University and his MBA from the London Business School. He holds the Chartered Financial Analyst® designation.

Lee D. Houser, CFA®

Lee D. Houser, CFA®, Executive Director, joined Sterling Capital Management in 2006 and has investment experience since 1999. Lee has been associate portfolio manager of the Mid Value Fund since February 2021. Lee received his B.S. in Mathematics and Economics from James Madison University, where he was a summa cum laude graduate, and his MBA from Duke University. He holds the Chartered Financial Analyst® designation.

Investment Considerations

The Fund may invest in undervalued securities that may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities, which may be more volatile and less liquid due to currency fluctuation, political instability, and social and economic risks.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. Despite an aggressive series of interest rate hikes by the Federal Reserve (the Fed) throughout the period under review, the economy remained resilient. As the period progressed, investors grew increasingly optimistic about the Fed’s ability to rein in inflation without triggering a recession. The stubbornly high inflation rate eased throughout the 12-month period, even as the unemployment rate remained near historic lows. In this environment, domestic equities generally performed well as investors, encouraged by healthy corporate profits, shifted significant assets into equities, which helped boost the Fund’s absolute returns. Amid this shift to a more risk-on attitude, the Fund’s holdings within the consumer discretionary, real estate, and utilities sectors added to absolute

performance, while investments in industrials, materials, and consumer staples generally lagged on an absolute basis.

The Fund’s relative performance benefited from stock selection in the consumer discretionary, health care, and communications services sectors. Leading contributors included a video game company that announced a major product upgrade and an outpatient services company that benefitted from lower labor costs.

Stock selection within industrials and materials dragged on the Fund’s performance relative to its benchmark. Detractors included a staffing company experiencing a slowdown in demand and an agricultural products company facing a destocking cycle.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell Midcap® Value Index measures the performance of value-style investing in mid-cap U.S. stocks.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 8/1/96 | 6.92% | 2.99% | 5.80% |

| Class C Shares** | 7/25/01 | 12.57% | 3.44% | 5.64% |

| Institutional Shares | 8/1/96 | 13.77% | 4.49% | 6.70% |

| Class R6 Shares | 2/1/181 | 13.86% | 4.56% | 6.75% |

| Russell Midcap® Value Index | N/A | 11.05% | 5.18% | 7.92% |

| Bloomberg U.S. Mid Cap Value Index | N/A | 11.50% | 6.24% | 8.84% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. Mid Cap Value Index is a float market-cap-weighted index based on an equal-weighted combination of four factors:

earnings yield, valuation, dividend yield, and growth.

Sterling Capital Behavioral Small Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Small Cap Value Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA®, Senior Managing Director, and Robert O. Weller, CFA®, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA®

Robert W. Bridges, CFA®, Senior Managing Director, CIO and Head of Equity, joined Sterling Capital in 1996 and has investment experience since 1991. He has been co-portfolio manager of the Behavioral Small Cap Value Equity Fund since June 2013. Bob is a graduate of Wake Forest University, where he received a B.S. in Business. He holds the Chartered Financial Analyst® designation.

Robert O. Weller, CFA®

Robert O. Weller, CFA®, Executive Director, joined Sterling Capital in 2012 and has investment experience since 1996. He has been co-portfolio manager of the Behavioral Small Cap Value Equity Fund since June 2013. Rob is a graduate of Loyola University Maryland, where he received a B.B.A. in Finance. He holds the Chartered Financial Analyst® designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and price momentum. The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory as well as more sensitive to adverse conditions.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its current benchmark, the Russell 2000® Value Index.

Q. What factors affected the Fund’s performance?

A. The Russell 2000 posted single-digit gains during the 12-month period amid strong domestic equity returns. Small-cap stocks generally underperformed their large-cap counterparts in large part due to robust gains by the equity market’s biggest, highest-growth technology companies who benefited from investor enthusiasm about artificial intelligence (AI). Investors regained their appetite for risk in early 2023 as inflation showed signs of easing without slowing the economy enough to tip it into a recession. However, rates continued to increase throughout most of the period, causing markets to rise and fall as investors attempted to predict the Federal Reserve’s strategy and to interpret the future effects of higher rates on the economy.

The Fund applies principles of behavioral finance to its investment strategy. This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear, and ego. One

element of the Fund’s strategy is a focus on how investor fears result in cheaper stocks. Shares held at discounts provided most of the relative outperformance over the year as such holdings posted positive returns, while expensive stocks underperformed.

The shift by investors toward a risk on attitude in January detracted from the Fund’s performance relative to its benchmark due to the Fund’s strategy of targeting momentum stocks. The shift led investors to pivot to growth-oriented stocks and away from value-oriented stocks that had previously experienced increased momentum, which caused the momentum strategy to significantly detract from relative returns early in the period. The Fund was able to recapture some of those lost returns after the well-publicized failures of a few regional banks caused markets to pull back in March. However, the strategy remained largely neutral to relative results throughout the rest of the period.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

The Russell 2000® Value Index measures the performance of value-style investing in small cap U.S. stocks.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

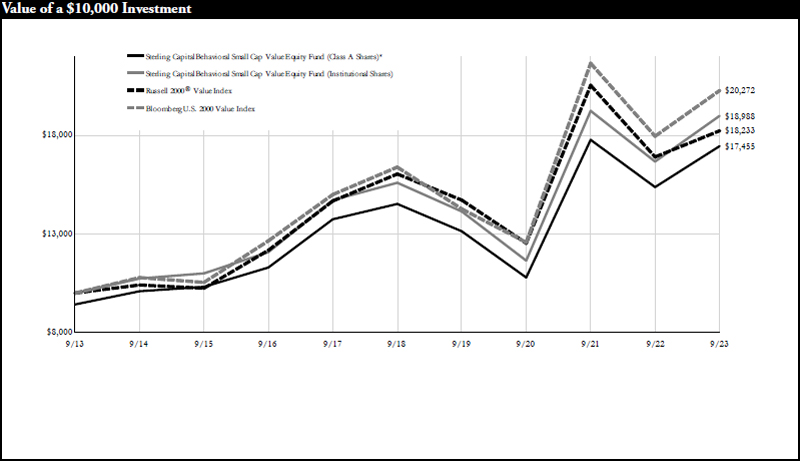

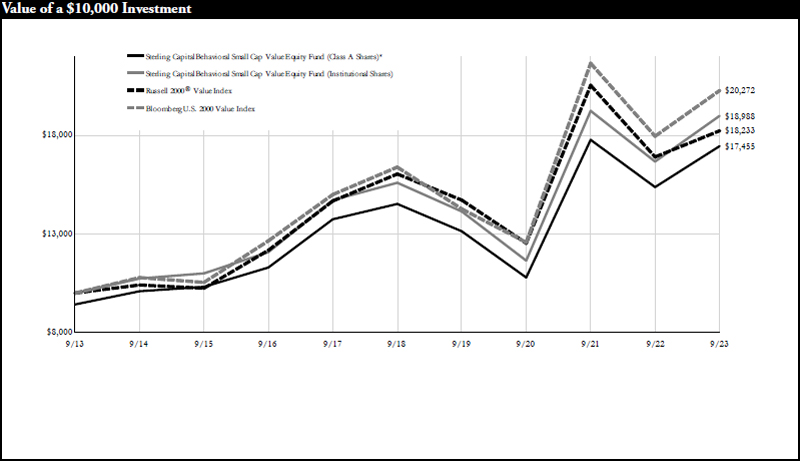

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 1/29/10 | 6.99% | 2.52% | 5.73% |

| Class C Shares** | 1/29/10 | 12.70% | 2.97% | 5.56% |

| Institutional Shares | 1/2/97 | 13.86% | 4.01% | 6.62% |

| Class R6 Shares | 2/1/181 | 13.94% | 4.07% | 6.66% |

| Russell 2000® Value Index | N/A | 7.84% | 2.59% | 6.19% |

| Bloomberg U.S. 2000 Value Index | N/A | 12.88% | 4.34% | 7.32% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of the small-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. 2000 Value Index is a float market-cap-weighted benchmark of the lower 2000 in capitalization of the Bloomberg U.S. 3000 Index that provides exposure to companies with superior value factor scores based on their earnings yield, valuation, dividend yield, and growth.

Sterling Capital Special Opportunities Fund

Portfolio Managers

Sterling Capital Special Opportunities Fund (the “Fund”) is managed by Portfolio Managers James L. Curtis, CFA®, Executive Director and Daniel A. Morrall, Executive Director for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

James L. Curtis, CFA®

James L. Curtis, CFA®, Executive Director, first worked at Sterling Capital Management from 1999 to 2001 and rejoined the firm in 2020. He has investment experience since 1996 and has served as Co-Portfolio Manager of the Special Opportunities Fund since April 2023. Jim received his B.S.B.A. in Finance from the University of North Carolina at Chapel Hill’s Kenan-Flagler Business School and his M.B.A. in Finance from Emory University’s Goizueta Business School. He holds the Chartered Financial Analyst® designation.

Daniel A. Morrall

Daniel A. Morrall, Executive Director, joined Sterling Capital Management in 2014 and has investment experience since 2001. Dan has been co-portfolio manager of the Special Opportunities Fund since December 2021 and was associate portfolio manager of the Fund from July 2021 to December 2021. Dan received his B.S. in Business and Economics from Washington and Lee University, his MBA from Columbia Business School, and his M.S.I.T. from Capella University.

Investment Considerations

The Fund is subject to investment style risk, which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares underperformed its current benchmark, the Russell 3000® Index.

Q. What factors affected the Fund’s performance?

A. The Russell 3000® posted double-digit gains during the 12-month period despite continued hikes in the federal funds interest rate by the Federal Reserve. Rising corporate earnings helped boost investor optimism about growth prospects in 2023 and dampen any concerns about the potential for a recession. As a result, counter-cyclical sectors such as utilities, consumer staples, real estate, and health care did poorly, while investor appetite for high-growth technology areas such as artificial intelligence (AI), cloud-based services, video streaming, and electric vehicles all increased. These economic conditions similarly drove the Fund to post double-digit returns for the period, although those gains mostly came across the first three quarters of the period. The Fund declined on an absolute basis in the third quarter 2023 due to concerns about the effects of higher costs of capital.

The Fund’s performance relative to its benchmark suffered mostly from allocation decisions. For example, an above-benchmark exposure to the health care sector lagged as investors sought growth opportunities elsewhere. Similarly, the Fund’s overweight exposure to the financials sector detracted due to investor concerns

about liquidity and potential bank runs after the well-publicized failures of a few regional banks in March. Meanwhile, the Fund’s below-benchmark exposure to the energy sector (a result of its strategy of focusing on enterprises with strong secular growth and balance sheets) also weighed on relative results as oil prices rose during the period, boosting share prices in that sector. Lastly, the Fund’s lack of ownership of four large technology companies, which comprise 12% of the benchmark, was a detractor from relative performance as those companies outperformed during the period. The Fund management team regarded those names as either too pricey or had issues with their underlying fundamentals.

The Fund’s relative returns benefitted from an above-benchmark exposure to the technology and communications services sectors as well as stock selection within the sectors that benefited from developments in generative AI and other digital transformations. Those investments included holdings of a leading Internet company, as well as two semiconductor providers and a major software business. The Fund’s below-benchmark exposure to the struggling sectors of utilities, real estate, and consumer staples also added on a relative basis.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

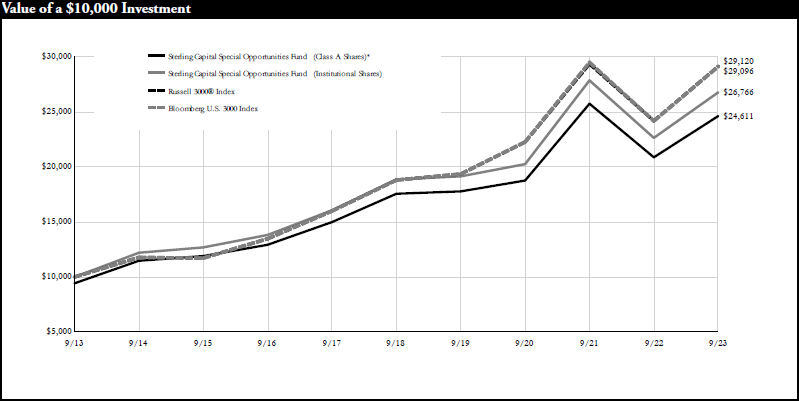

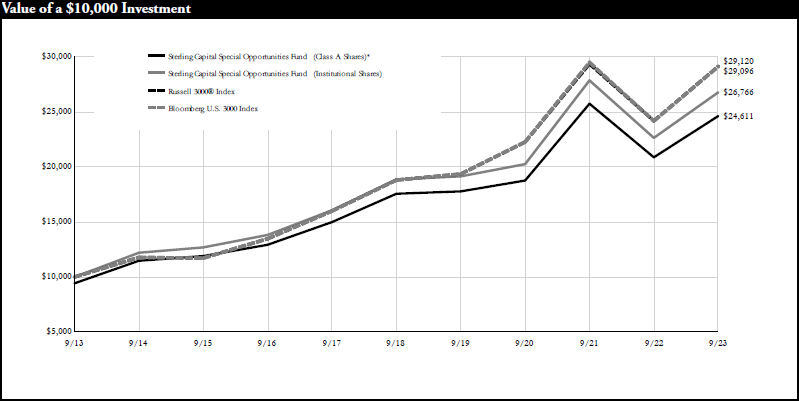

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 6/2/03 | 11.18% | 5.73% | 9.42% |

| Class C Shares** | 6/2/03 | 17.07% | 6.19% | 9.25% |

| Institutional Shares | 6/2/03 | 18.28% | 7.25% | 10.35% |

| Class R6 Shares | 2/1/181 | 18.39% | 7.34% | 10.40% |

| Russell 3000® Index | N/A | 20.46% | 9.14% | 11.28% |

| Bloomberg U.S. 3000 Index | N/A | 20.41% | 9.12% | 11.27% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the Russell 3000® Index, an unmanaged index that is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. 3000 Index is a float market-cap-weighted benchmark of the 3000 most highly capitalized U.S. companies.

Sterling Capital Equity Income Fund

Portfolio Managers

Sterling Capital Equity Income Fund (the “Fund”) is managed by Portfolio Managers Jeremy M. Lopez, CFA®, Executive Director and Charles J. Wittmann, CFA®, Executive Director for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Jeremy M. Lopez, CFA®

Jeremy M. Lopez, CFA®, Executive Director, joined Sterling Capital Management in 2016 and has investment experience since 1997. Jeremy has been co-manager of the Equity Income Fund since November 2022. Jeremy received his B.A. in Economics from Wheaton College and his M.B.A. from the University of Chicago's Booth School of Business. He holds the Chartered Financial Analyst® designation.

Charles J. Wittmann, CFA®

Charles J. Wittmann, CFA®, Executive Director, joined Sterling Capital Management in 2014 and has investment experience since 1995. He has been co-portfolio manager of the Equity Income Fund since December 2021 and was associate portfolio manager of the Fund from July 2021 to December 2021. Chip received his B.A. in Economics from Davidson College and his MBA from Duke University's Fuqua School of Business. He earned the Certificate in ESG Investing, which is developed, administered and awarded by the CFA® Society of the United Kingdom. He holds the Chartered Financial Analyst® designation.

Investment Considerations

The Fund invests primarily in dividend-paying securities. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares underperformed its benchmark, the Russell 1000 Value® Index.

Q. What factors affected the Fund’s performance?

A. Equity markets experienced strong gains for the 12-month period under review, including the Fund’s benchmark, which posted double-digit gains. Share prices rose as investors grew less concerned that the economy was headed for a recession and more optimistic about corporate earnings estimates for 2024. The optimism persisted, despite continued interest rate hikes by the Federal Reserve (the Fed). In total, the Fed raised interest rates six times throughout the period, bringing the federal funds rate from 3.25% at the start of the period up to 5.50% by the end. In this environment, the investment pillars that underlie the Fund’s strategy had mixed performance for the period under review, with dividend growth and yield falling out of favor. From a sector perspective, consumer discretionary, energy, industrials, information technology, and materials all posted gains of more than 20% on an absolute basis.

The Fund’s lack of exposure to a major social media platform company was the largest single detractor from relative performance for the period. That company, which does not pay a dividend, made up a large portion of the Russell 1000

Value Index for the first three quarters of the period, posting strong gains over that timeframe. The Fund’s exposure to the underperforming health care sector also weighed on relative results, along with a below-benchmark exposure to the outperforming energy sector. The latter sector did well, as oil prices rose during the final quarter of the period under review.

The Fund’s relative results benefited from its investments within the information technology sector. In particular, the Fund benefited from stock selection related to generative artificial intelligence (AI) and semiconductor companies (as well as its above-benchmark exposure to the sector in general) which outperformed. The Fund’s investments in a variety of insurance companies within the financials sector also added to relative results, as did stock selection within industrials. The Fund’s new investments in a plumbing and HVAC company as well as a human resources management provider both added to relative results as those companies outperformed. The Fund’s lack of exposure to the struggling utilities sector also added to performance on a relative basis.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 6/30/04 | 6.08% | 7.74% | 8.88% |

| Class C Shares** | 6/30/04 | 11.71% | 8.21% | 8.71% |

| Institutional Shares | 6/30/04 | 12.83% | 9.29% | 9.80% |

| Class R6 Shares | 2/1/181 | 12.94% | 9.40% | 9.86% |

| Russell 1000® Value Index | N/A | 14.44% | 6.23% | 8.45% |

| Bloomberg U.S. 1000 Value Index | N/A | 14.99% | 6.81% | 9.01% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the Russell 1000® Value Index, an unmanaged index that is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. 1000 Value Index provides exposure to companies with superior value factor scores based on their earnings yield, valuation, dividend yield, and growth.

Sterling Capital Behavioral International Equity Fund

Portfolio Managers

Sterling Capital Behavioral International Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA®, Senior Managing Director, and Robert O. Weller, CFA®, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA®

Robert W. Bridges, CFA®, Senior Managing Director, CIO and Head of Equity, joined Sterling Capital in 1996 and has investment experience since 1991. He has been co-portfolio manager of the Behavioral International Equity Fund since inception. Bob is a graduate of Wake Forest University, where he received a B.S. in Business. He holds the Chartered Financial Analyst® designation.

Robert O. Weller, CFA®

Robert O. Weller, CFA®, Executive Director, joined Sterling Capital in 2012 and has investment experience since 1996. He has been co-portfolio manager of the Behavioral International Equity Fund since inception. Rob is a graduate of Loyola University Maryland, where he received a B.B.A. in Finance. He holds the Chartered Financial Analyst® designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and market momentum. The Fund will invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, and social and economic risks. The Fund may invest in REITs (Real Estate Investment Trusts), the value of which will be affected by conditions of the real estate industry, and exchange-traded funds (ETFs). Investing in ETFs may cause shareholders to bear additional costs, and an ETF may not exactly replicate the performance it seeks to track.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its current benchmark, the Bloomberg Developed Markets ex.-North America Large and Mid-Cap Index.

Q. What factors affected the Fund’s performance?

A. International large- and mid-cap stocks posted double-digit returns during the 12-month period under review. Most of these gains occurred in late 2022 and January 2023 as investors saw that Europe would avoid a worst-case scenario energy shortage caused by the war in Ukraine. The international financials sector also benefitted from the relative strength of European Union banks compared to their American counterparts, where mid-cap financial institutions have suffered from higher costs and the fallout from the failure of a few regional banks in March 2023.

The Fund applies principles of behavioral finance to its investment strategy. This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear, and ego.

The Fund’s relative performance benefited from its strategy by targeting momentum stocks. Unlike the shift toward high-growth technology names that occurred in domestic markets as investors adopted a risk-on attitude in January 2023, international investors remained more cautious and continued with their strategies from 2022, which allowed momentum stocks and the Fund’s momentum strategy to outperform. Value-oriented stocks remained more in favor in international markets

than they did domestically, which also added to the Fund’s relative results through its behavioral strategy, as stocks held at discounts generally outperformed.

The two biggest detractors from the Fund’s performance relative to its benchmark were sector allocations that resulted from its strategies targeting favorable valuations, momentum, and earnings revisions. An above-benchmark exposure to the industrials sector and an underweight position in information technology both weighed on relative results as the former underperformed and the latter outperformed.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Bloomberg Developed Markets ex.-North America Large & Mid Cap Index is a float market-cap-weighted equity benchmark that covers 85% market cap of the measured market.

“Bloomberg®” and the Bloomberg indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Sterling Capital Management LLC and its affiliates. Bloomberg is not affiliated with Sterling Capital Management LLC or its affiliates, and Bloomberg does not approve, endorse, review, or recommend the product(s) presented herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the product(s) presented herein.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | Since Inception |

| Class A Shares* | 11/28/14 | 24.95% | -1.25% | 1.39% |

| Class C Shares** | 11/28/14 | 31.56% | -0.83% | 1.31% |

| Institutional Shares | 11/28/14 | 33.01% | 0.19% | 2.31% |

| Class R6 Shares | 2/1/181 | 32.87% | 0.20% | 2.33% |

| Bloomberg Developed Markets ex North America Large and Mid Cap Index (Net) | N/A | 25.72% | 3.32% | 3.82% |

| MSCI EAFE® Net Index | 11/30/14 | 25.65% | 3.24% | 3.86% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit ww.sterlingcapitalfunds.com. Performance would have been lower without limitations and/or waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the MSCI EAFE® Net Index, an unmanaged index which is generally representative of large- and mid-cap equity across developed markets countries around the world, excluding the U.S. and Canada. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities. Effective February 1, 2023, the primary benchmark for the Fund changed from the MSCI EAFE Net Index to the Bloomberg Developed Markets ex North America Large and Mid Cap Index (Net).

Sterling Capital SMID Opportunities Fund

Portfolio Manager

Sterling Capital SMID Opportunities Fund (the “Fund”) is managed by Portfolio Manager Lee D. Houser, CFA®, Executive Director.

Lee D. Houser, CFA®

Lee D. Houser, CFA®, Executive Director, joined Sterling Capital Management in 2006 and has investment experience since 1999. Lee has been portfolio manager of the SMID Opportunities Fund since August 2021. Lee received his B.S. in Mathematics and Economics from James Madison University, where he was a summa cum laude graduate, and his MBA from Duke University. He holds the Chartered Financial Analyst® designation.

Investment Considerations

The Fund uses a multi-style approach and invests in both growth and value-oriented companies. A growth investment style may be particularly sensitive to market conditions. Value investing involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time. The Fund invests in small and middle capitalization companies which may be riskier, more volatile and vulnerable to economic, market and industry changes than investments in larger more established companies. As a result, share price changes may be more erratic or trade less frequently in lesser quantities.

Q. How did the Fund perform during the period from its inception on October 1, 2022 to September 30, 2023?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell 2500® Index.

Q. What factors affected the Fund’s performance?

A. Despite an aggressive series of interest rate hikes by the Federal Reserve (the Fed) throughout the period under review, the economy remained resilient. As the period progressed, investors grew increasingly optimistic about the Fed’s ability to rein in inflation without triggering a recession. The stubbornly high inflation rate eased throughout the 12-month period, even as the unemployment rate remained near historic lows. In this environment, domestic equities generally performed well as investors, encouraged by healthy corporate profits, shifted significant assets into equities, which helped boost the Fund’s absolute returns. Amid this shift to a more risk-on attitude, the Fund’s holdings within the healthcare, consumer discretionary, and materials sectors added to absolute performance, while investments in industrials, information technology, and financials lagged on an absolute basis.

The Fund held an above-benchmark exposure to mid-cap firms during the period. This relative positioning contributed to the Fund’s outperformance relative to its benchmark as stocks of medium-sized companies generally outperformed those of smaller companies.

Stock selection in the industrials sector weighed most heavily on the Fund’s relative performance during the period. A manufacturer of sensors used in automobiles performed poorly as supply chain disruptions negatively impacted global automobile production, thus generating a headwind that negatively affected the company’s profit margin. A below-benchmark exposure to the information technology sector also dragged on relative results, as the sector outperformed partly due to the excitement surrounding advancements in artificial intelligence.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell 2500® Index is a market cap-weighted index that includes the smallest 2,500 companies covered in the Russell 3000 universe of U.S.-based listed equities.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | Since Inception |

| Class A Shares* | 9/30/16 | 5.05% | 3.08% | 5.75% |

| Class C Shares** | 9/30/16 | 10.74% | 3.54% | 5.86% |

| Institutional Shares | 9/30/16 | 11.84% | 4.58% | 6.92% |

| Russell 2500® Index | 9/30/16 | 11.28% | 4.55% | 7.96% |

| Bloomberg U.S. 2500 Index | N/A | 11.61% | 4.28% | 7.79% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without limitations and/ or waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

The Russell 2500® Index is a widely recognized index of common stocks that measures the performance of the small and mid cap sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. 2500 Index is a float market-cap-weighted benchmark of the lower 2500 in capitalization of the Bloomberg U.S. 3000 Index.

Sterling Capital Mid Cap Relative Value Fund

Portfolio Managers

Sterling Capital Mid Cap Relative Value Fund (the “Fund”) is managed by Portfolio Managers Shawn M. Gallagher, CFA®, Executive Director and Andrew T. DiZio, CFA, Executive Director for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Shawn M. Gallagher, CFA®

Shawn M. Gallagher, CFA®, Executive Director, joined Stratton Management Company in 2005 and Sterling Capital Management as part of a business acquisition in 2015. He has investment experience since 2003 and has been co-portfolio manager of the Stratton Mid Cap Value Fund since November 2015. Shawn received his B.S. in Finance from Pennsylvania State University. He holds the Chartered Financial Analyst designation and is a member of the CFA Society of Philadelphia and the CFA Institute.

Andrew T. DiZio, CFA®

Andrew T. DiZio, CFA®, Executive Director, joined Stratton Management Company in 2012 and Sterling Capital Management as part of a business acquisition in 2015. He has investment experience since 2003. Andy has been co-portfolio manager of the Mid Cap Value Fund since August 2021 and was associate portfolio manager of the Fund from November 2015 to August 2021. Andy received his B.S. in Finance with a minor in Economics from Pennsylvania State University. He holds the Chartered Financial Analyst® designation and is a member of the CFA Society of Philadelphia and the CFA Institute.

Investment Considerations

Mid-capitalization companies are generally riskier than large company stocks due to greater volatility and less liquidity. Value stocks can perform differently than other types of stocks and can continue to be undervalued by the market for long periods of time.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell Midcap® Value Index.

| Q. | What factors affected the Fund’s performance? |

A. Equity markets posted strong returns for the 12-month period under review, due in part to a resilient domestic economy. Share prices rose as investors maintained their risk-on attitude in the face of a historically aggressive tightening campaign by the Federal Reserve (the Fed) and fading pandemic-era stimuli. Low unemployment and easing inflation helped drive increased investor optimism that the Fed would manage a soft landing for the economy and avoid a recession. The Fund’s holdings within the consumer discretionary, energy, and consumer staples sectors added to absolute performance, while investments in utilities, financials, and real estate weighed on the Fund’s overall return on an absolute basis.

Stock selection within the consumer staples sector added the most to the Fund’s relative returns. The Fund’s three investments in that sector (a convenience store operator, a restaurant supply distributor, and a producer of frozen potato products) all outperformed based on strong earnings and resilient fundamentals. The Fund also benefited from stock selection within the technology and communications services sectors, which added to relative performance.

Stock selection within the financials sector was the largest drag on relative results for the period under review. The Fund’s investments in several banks underperformed as they were caught in the broader sell-off triggered by a few notable regional banks in the middle of March. Stock selection within the utilities sector also weighed on relative results, as did the Fund’s below-benchmark exposure to the outperforming consumer discretionary sector.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

The Russell Midcap® Value Index measures the performance of value-style investing in mid-cap U.S. stocks.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

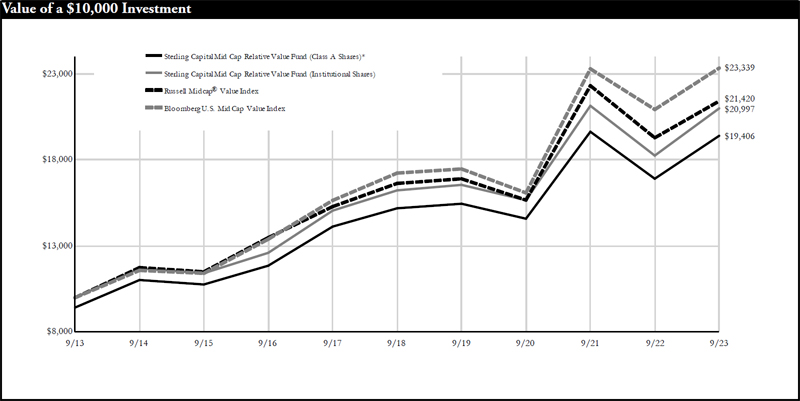

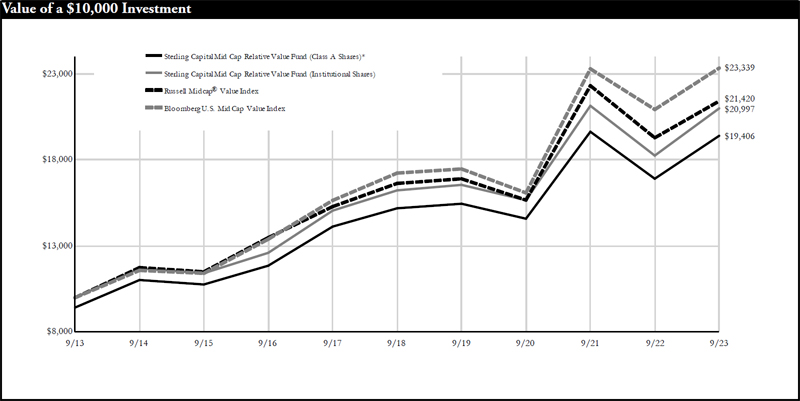

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 11/13/15 | 8.15% | 3.78% | 6.85% |

| Class C Shares** | 11/13/15 | 14.00% | 4.34% | 6.91% |

| Institutional Shares | 9/30/72 | 15.03% | 5.28% | 7.70% |

| Russell Midcap® | | | | |

| Value Index | N/A | 11.05% | 5.18% | 7.92% |

| Bloomberg U.S. Mid | | | | |

| Cap Value Index | N/A | 11.50% | 6.24% | 8.84% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The performance shown here (for periods prior to the date of commencement of operations on November 16, 2015) is that of Mid Cap Value Fund (the “Predecessor Fund”), whose shares were reorganized into Institutional Shares of the Fund at the close of business on November 13, 2015. Because the Fund had no investment operations prior to the closing of the reorganization, and based on the similarity of the Fund to the Predecessor Fund, the Predecessor Fund is treated as the survivor of the reorganization for accounting and performance reporting purposes. Accordingly, all performance and other information shown for the Fund for periods prior to November 16, 2015 is that of the Predecessor Fund. Performance for Class A Shares and Class C Shares, prior to the date of commencement of operations on November 16, 2015, is based on the performance of the shares of the Predecessor Fund. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Bloomberg U.S. Mid Cap Value Index is a float market-cap-weighted index based on an equal-weighted combination of four factors: earnings yield, valuation, dividend yield, and growth.

Sterling Capital Real Estate Fund

Portfolio Managers

Sterling Capital Real Estate Fund (the “Fund”) is managed by Portfolio Managers Andrew T. DiZio, CFA®, Executive Director and Shawn M. Gallagher, CFA®, Executive Director for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Andrew T. DiZio, CFA®

Andrew T. DiZio, CFA®, Executive Director, joined Stratton Management Company in 2012 and Sterling Capital Management as part of a business acquisition in 2015. He has investment experience since 2003. Andy is co-portfolio manager of the Real Estate Fund and has managed the Fund since November 2015. Andy received his B.S. in Finance with a minor in Economics from Pennsylvania State University. He holds the Chartered Financial Analyst® designation and is a member of the CFA Society of Philadelphia and the CFA Institute.

Shawn M. Gallagher, CFA®

Shawn M. Gallagher, CFA®, Executive Director, joined Stratton Management Company in 2005 and Sterling Capital Management as part of a business acquisition in 2015. He has investment experience since 2003. Shawn has been co-portfolio manager of the Real Estate Fund since August 2021 and was associate portfolio manager of the Fund from November 2015 to August 2021. Shawn received his B.S. in Finance from Pennsylvania State University. He holds the Chartered Financial Analyst® designation and is a member of the CFA Society of Philadelphia and the CFA Institute.

Investment Considerations

Real Estate Funds may be subject to a higher degree of market risk because of concentration in a specific industry or geographic sector. Risks include declines in value of real estate, general and economic conditions, changes in the value of the underlying property and defaults by borrowers.

Q. How did the Fund perform during the 12-month period between October 1, 2022 and September 30, 2023?

A. The Fund’s Institutional Shares outperformed its benchmark, the Bloomberg U.S. 3000 REIT Index.

| Q. | What factors affected the Fund’s performance? |

A.The rise in interest rates was the largest single factor influencing REIT share prices throughout the 12-month period under review. Higher interest rates typically have a negative effect on real estate values as financing becomes more expensive, and that relationship held true over the past 12 months. The Federal Reserve (the Fed) chose to hike interest rates six times during the period, leading to a total increase of 2.25 percentage points, or 225 basis points. The successive rate hikes dragged on share prices of REITs as the values of the underlying property declined. In this challenging environment, leasing demand for several property types remained strong, including data centers, shopping centers, hotels, warehouses, and senior living. REITs with exposure to those sectors generally increased their cash flows and experienced gains in their share price despite the higher interest rates.

The Fund’s stock selection within the retail and self-storage subsectors were the largest positive contributors to relative performance. Within the retail space, the Fund benefited from an above-benchmark exposure to an outlet-based REIT that outperformed as the company’s new management team did a better-than-expected job of growing leasing and accelerating its cash flow. Within the self-storage subsector, the Fund benefited from an above-benchmark investment in a smaller operator whose share price gained strongly when it was acquired by a larger public competitor.

Stock selection within the residential subsector dragged on the Fund’s relative results, as did an above-benchmark exposure to the infrastructure subsector. Together, these two factors were the largest negative contributors to relative performance. Within the residential space, the Fund’s above-benchmark exposure to landlords with concentrated assets

across the southeastern United States weighed on results, as the leasing fundamentals in that region weakened as new supply became available. The Fund’s investments in the infrastructure subsector dragged on results as rising interest rates, along with slower leasing as deployment of 5G decelerated, combined to generate headwinds for REITs with cell tower exposure.

A Note on Indices: The volatility of an index varies greatly. All indices are unmanaged and investments cannot be made directly in an index.

FTSE NAREIT All Equity REITs Index contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real properly that also meet minimum size and liquidity criteria. The FTSE NAREIT All Equity REITs Index is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the U.S. economy. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes provide the facility to concentrate commercial real estate exposure in more selected markets.

The Bloomberg U.S. 3000 REIT Index is a float market-capitalization-weighted index that provides exposure to companies classified as per the Bloomberg Industry Classification System (BICS) with a level 3 sub-industry of REIT.

“Bloomberg®” and the Bloomberg indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Sterling Capital Management LLC and its affiliates. Bloomberg is not affiliated with Sterling Capital Management LLC or its affiliates, and Bloomberg does not approve, endorse, review, or recommend the product(s) presented herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the product(s) presented herein.

Portfolio composition is as of September 30, 2023 and is subject to change and risk.

| Average Annual Total Returns | | | | |

| As of September 30, 2023 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 11/13/15 | -5.10% | 1.82% | 5.65% |

| Class C Shares** | 11/13/15 | -0.06% | 2.27% | 5.66% |

| Institutional Shares | 5/31/08 | 0.95% | 3.29% | 6.49% |

| Class R6 Shares | 1/31/201 | 1.01% | 3.38% | 6.53% |

| S&P 500® Index | N/A | 21.62% | 9.92% | 11.91% |

| Bloomberg U.S. 3000 REIT Index | N/A | -1.68% | 2.83% | 6.22% |

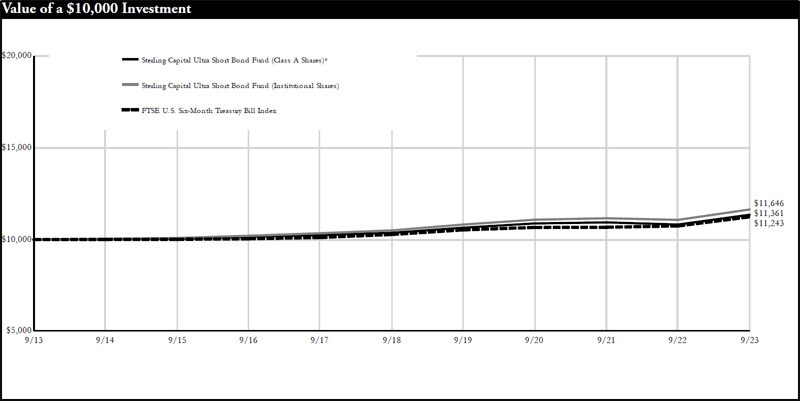

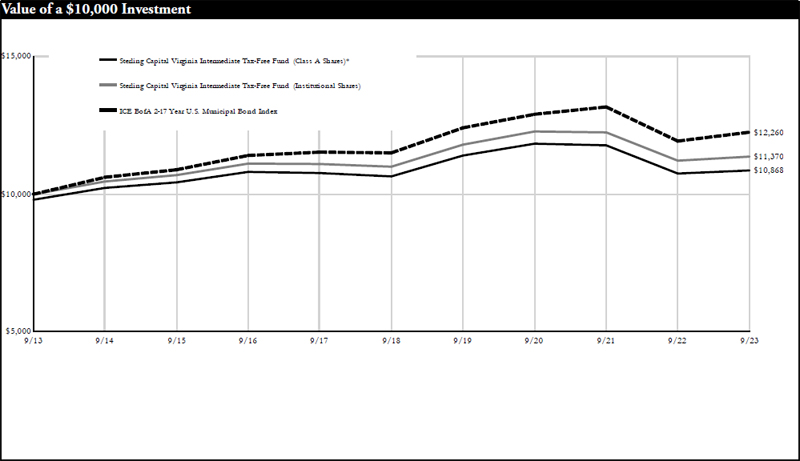

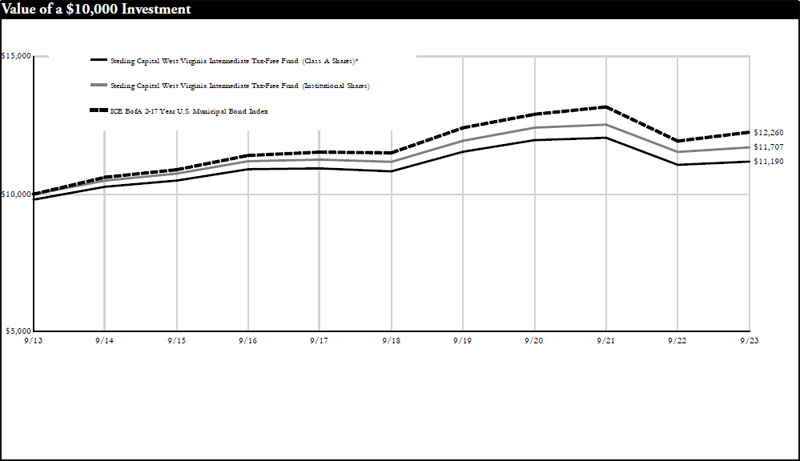

| FTSE NAREIT All Equity REITs Index | N/A | -1.71% | 2.80% | 6.17% |