UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | Investment Company Act file number | 811-06719 | |

Sterling Capital Funds

(Exact name of registrant as specified in charter)

3605 Glenwood Ave., Suite 100

Raleigh, NC 27612

(Address of principal executive offices) (Zip code)

James T. Gillespie, President

Sterling Capital Funds

3605 Glenwood Ave., Suite 100

Raleigh, NC 27612

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the shareholder reports of the Sterling Capital Funds (each, a “Fund” and, collectively, the “Funds”) like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.sterlingcapitalfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary or, if you are a direct investor, by calling 1-800-228-1872 or by sending an e-mail request to fundinfo@sterlingcapital.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-800-228-1872 or send an email request to fundinfo@sterlingcapital.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

Table of Contents

(This page has been left blank intentionally.)

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this Sterling Capital Funds annual report covering the 12 months between October 1, 2019 and September 30, 2020.

Equity markets posted uneven results during a remarkable 12-month period that included a global pandemic, mixed economic reports, heightened social unrest, and considerable political uncertainty. Stocks largely weathered a sharp downturn in February and March to finish the 12-month period in positive territory, although performance was very uneven across sectors and asset classes.

Stocks began the period on a positive note. Following several months of falling interest rates and concerns about slowing economic growth, investor sentiment rose in late 2019 on improving economic data. That data eased fears of an economic recession and helped push both small-and large-cap equities higher. However, the rapid spread of the novel coronavirus in February and March sent investors on a sudden and dramatic retreat. After closing at a record-high on February 19, the S&P 500® Index1 declined more than 35% through the end of March, resulting the worst first-quarter equity decline since 1987.

The virus put a halt to consumption and capital investment, and essentially shut down global markets. Multiple trading days were volatile enough to trigger market “circuit breakers” that temporarily halted trading.The declines hit domestic and international markets alike, and no economic sector was immune from the selloff. Rate-sensitive sectors such as Energy, Financials and Materials fared the worst during the downturn. But even the better-performing sectors of Technology, Health Care, and Consumer Staples declined by double digits over just a handful of weeks.

After bottoming in late March, stocks rebounded during the three months through June, posting their best quarterly performance since 1987. The surge in stock prices was felt broadly across U.S. markets as all major equity indices jumped more than 20%. The second-quarter bounce was not enough to erase the declines from earlier in the year, but it breathed life into investors’ optimism about the ability of businesses to weather the pandemic. Growth-oriented stocks led the rebound, particularly Technology, Communication Services, and Consumer Discretionary stocks.

The rebound carried over into the third quarter of 2020 despite a weak September. The momentum helped stocks post their best back-to-back quarterly gains since 2009. Growth-oriented sectors such as Technology and Consumer Discretionary continued to lead the way during the third quarter amid signs that the U.S. economy was reopening and recovering. The Federal Reserve’s comments in early September that interest rates would remain low for the foreseeable future also helped improve investor sentiment. Meanwhile, the Energy and Financials sectors continued to lag.

Fixed income markets largely mirrored the tumultuous equity story for the period. Tighter credit spreads during the final months of 2019 helped drive positive returns for fixed income investors. But interest rates were extremely volatile in early 2020 amid liquidity concerns and market disruptions. Yields on taxable and municipal bonds fluctuated violently. And with equity markets in a freefall, investors flocked to the perceived safety ofTreasuries, which helped drive prices up and pushed the yield on 10-year Treasuries down to all-time lows in early March.

As stocks rebounded in the second and third quarters, fixed income markets responded accordingly. Investor confidence in an economic recovery grew slowly, which translated into tightening yield spreads.The spread between the 10-year Treasury and investment grade “BBB” bonds contracted from 354 basis point in early April to 193 basis points at the end of June, and again to 170 basis point by the end of the third quarter. The Bloomberg Barclay’s U.S. Aggregate Bond Index2 returned 6.98% for the period, while the Bloomberg Barclay’s U.S. High Yield Corporate Bond Index3 returned 3.25%.

Domestic macro-economic data reflected the story told by equity markets during the period. U.S. GDP increased at an annualized rate of 2.1% in the final quarter of 2019, but decreased at an annual rate of -5% in the first quarter of 2020 and an estimated decline of -31.4% in the second quarter. In similar fashion, the monthly unemployment rate ranged between 3.5% and 3.6% through the first five months of the 12-month period, only to jump to 4.4% in March. As layoffs rose sharply due to the economic fallout from COVID-19, that rate leapt up to 14.7% in April, before slowing ticking downward over the rest of the period. By September, the unemployment rate was down to 7.9%.

The S&P 500® Index returned 15.15% during the 12 months under review. However, small-cap stocks generally fared worse than large-caps during the downturn, with the Russell 2000® Index4 of small-cap stocks returning just 0.39%. Growth outperformed value for the period, with the Russell 1000® Growth Index5 returning 37.53% while the Russell 1000Value declined -5.03%. International markets underperformed the U.S. markets, with the MSCI EAFE Index6 gaining just 0.49%, although emerging markets fared better on strength in China and India, with the MSCI Emerging Markets Index7 returning 10.54% (net return).

During the 12 months under review, Information Technology, Consumer Discretionary and Communication Services generally outperformed the broader markets as growth-oriented stocks benefited from the robust market rebound over the second and third quarters of 2020. Financials and Energy stocks lagged their peers, with Energy underperforming by a significant margin on soft prices due to concerns over slowed global growth.

We will continue to monitor the evolving economic and market climate and will manage the Sterling Capital Funds accordingly. Thank you for your confidence in Sterling Capital Management. We look forward to serving your investment needs during the months and years ahead.

Sincerely,

James T. Gillespie

President

Sterling Capital Funds

Jeffrey J. Schappe, CFA

Managing Director

Sterling Capital Management LLC

| 1 | “S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Sterling Capital Funds. The S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. A Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| 2 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index composed of securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. It is not possible to invest in the Bloomberg Barclays U.S. Aggregate Bond Index, which is unmanaged and does not incur fees and charges. |

| 3 | The Bloomberg Barclays U.S. High Yield Corporate Index measures performance of the US corporate market of non-investment grade, fixed-rate corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. |

| 4 | “Russell 2000®” Index is a registered service mark of FTSE Russell, which does not sponsor and is in no way affiliated with the Sterling Capital Funds. The Russell 2000® Index is a small-cap market index of the bottom 2,000 stocks in the Russell 3000® Index. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. A Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| 5 | “Russell 1000®” Index is a registered service mark of FTSE Russell, which does not sponsor and is in no way affiliated with the Sterling Capital Funds. The Russell 1000® Index is a large-cap market index of the largest stocks in the U.S. equity markets. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. A Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| 6 | The MSCI EAFE® Index measures the performance of the developed stock markets of Europe, Australia, and the Far East. |

| 7 | The MSCI Emerging Markets Index captures large and mid cap equity representation across 26 developing market countries. The Index covers approximately 85% of the free float-adjusted market capitalization in each country. |

Past performance does not guarantee future results. Mutual fund investing involves risk including the possible loss of principal.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) and is paid a fee for its services. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, LLC. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice. The credit rating source referenced in the fund commentaries, if applicable, was the S&P 500.

Sterling Capital Behavioral Large Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Large Cap Value Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA, Senior Managing Director, and Robert O. Weller, CFA, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA

Robert W. Bridges, CFA, Senior Managing Director, joined Sterling Capital in 1996 and is head of equity. He also leads Sterling Capital’s fundamental equity team and serves as co-head of the factor investing/behavioral finance portfolios. He has investment experience since 1991 and has co-managed the Fund since 2013. Bob is a graduate of Wake Forest University where he received a BS in Business. He holds the Chartered Financial Analyst designation.

Robert O. Weller, CFA

Robert O. Weller, CFA, Executive Director, joined Sterling Capital in 2012 and is co-head of the factor investing/behavioral finance. He has investment experience since 1996 and has co-managed the Fund since 2013. Rob is a graduate of Loyola University Maryland where he received a BBA in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and price momentum. The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. The overall results of the Fund will be dependent on the process and ability of the Adviser to recognize a company’s value. The Fund may invest in REITs (Real Estate Investment Trusts), the value of which will be affected by conditions of the real estate industry. The Fund may also invest in exchange-traded funds (ETFs); thus shareholders may bear additional costs and the ETF may not exactly replicate the performance it seeks to track.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares underperformed its current benchmark, the Russell 1000® Value Index.

Q. What factors affected the Fund’s performance?

U.S. large-cap stocks weathered severe volatility to post modest gains during the period. Stocks performed well in the final months of 2019 and the first month and a half of 2020, but the negative economic impact of the COVID-19 pandemic sent global stocks into a freefall at the end of February. Stock markets bottomed in late March in response to economic stimulus efforts and the rebound gained momentum with the easing of some restrictions throughout the early summer. By mid summer, large-cap stocks in general had fully recovered their losses. But value-oriented companies continued to lag their growth-oriented counterparts.

The Fund applies principles of behavioral finance to its investment strategy. This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear and ego.

The Fund’s behavioral-driven factors had an overall negative effect on the portfolio’s performance relative to its benchmark. The Fund’s momentum strategy contributed marginally to relative returns, but those gains were more than offset by the Fund’s exposure to value stocks, which underperformed during the period.

Stock selection in REITs was a major detractor on the Fund’s relative performance. In particular, the Fund’s lack of exposure to more defensive healthcare REITs weighed on relative results, as those performed well during the period. The Fund’s strategy of maintaining a smaller-than-benchmark average market capitalization profile also detracted from returns, as larger stocks generally outperformed smaller ones during the period.

Although the Fund underperformed the benchmark during the year, its stock selection in industrials contributed to relative returns, particularly within the capital goods subsector. The Fund’s lack of exposure to two underperforming aerospace and defense companies also added to relative returns.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

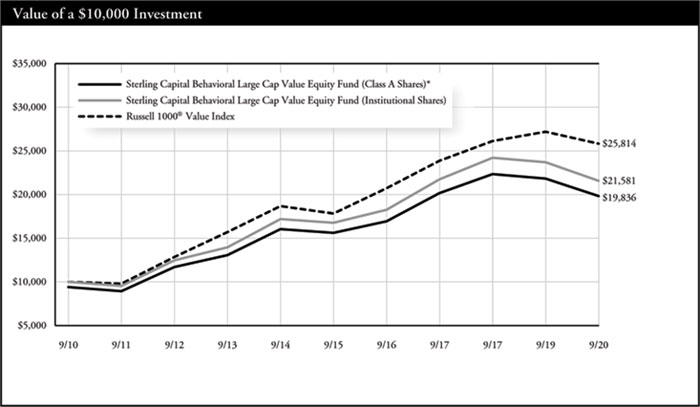

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| Average Annual Total Returns |

| As of September 30, 2020 | Inception

Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 10/9/92 | -14.38% | 3.68% | 7.09% |

| Class C Shares** | 2/1/01 | -9.81% | 4.15% | 6.93% |

| Institutional Shares | 10/9/92 | -8.96% | 5.18% | 8.00% |

| Class R6 Shares | 2/1/181 | -8.88% | 5.21% | 8.01% |

| Russell 1000® Value Index | N/A | -5.03% | 7.66% | 9.95% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

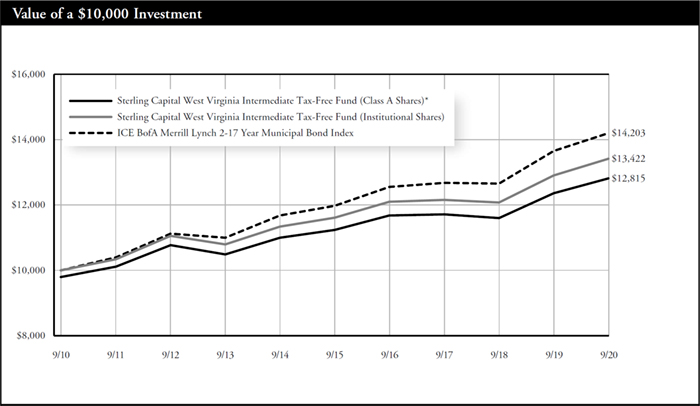

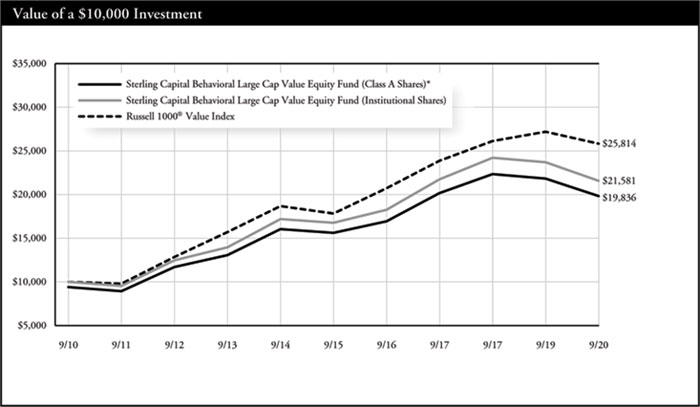

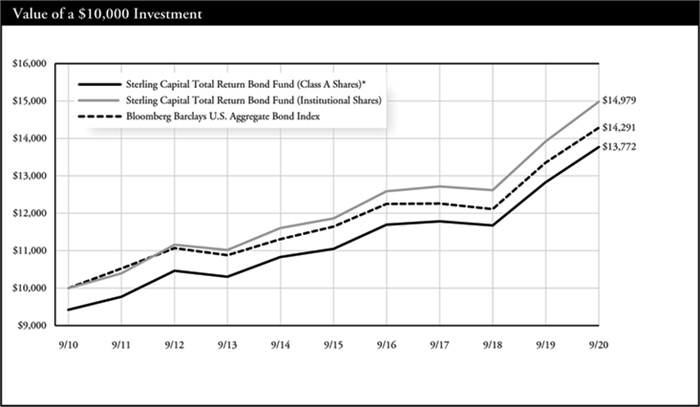

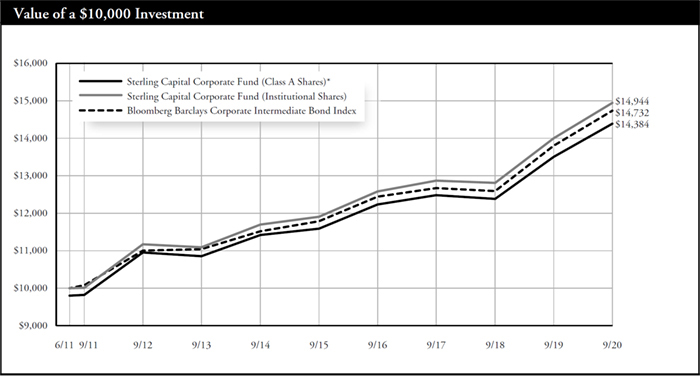

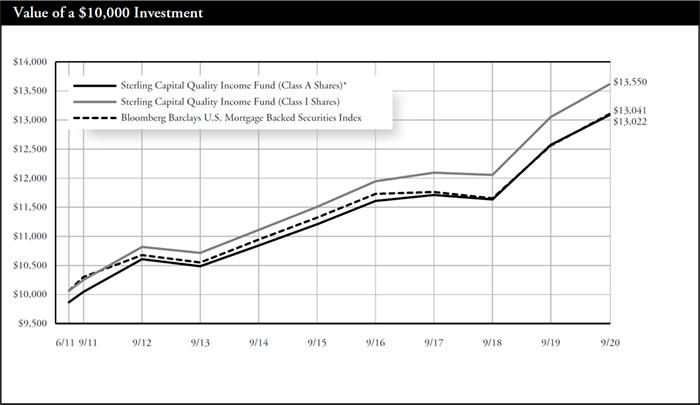

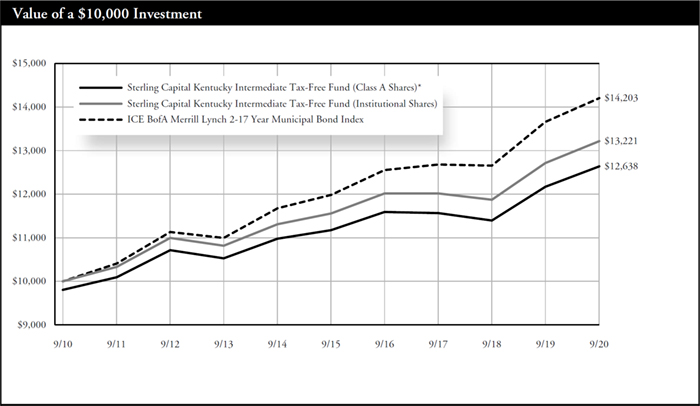

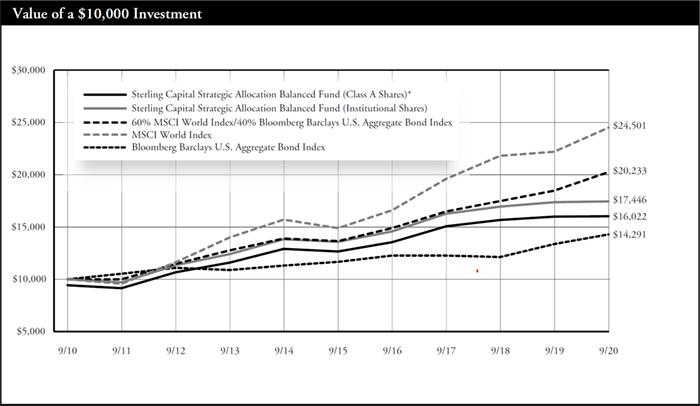

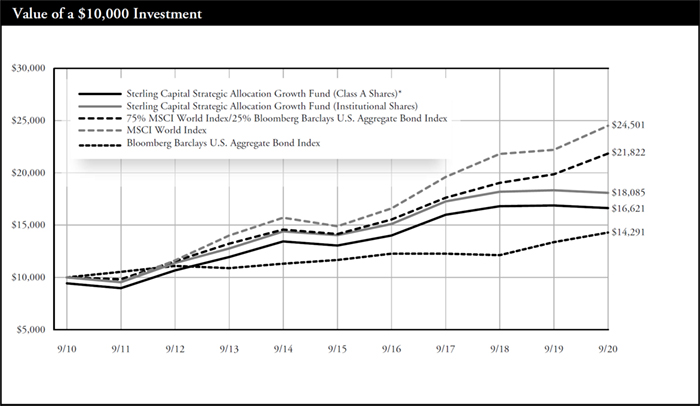

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Russell 1000® Value Index is a widely recognized index of common stocks that measures the performance of the large-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Mid Value Fund

Portfolio Manager

Sterling Capital Mid Value Fund (the “Fund”) is managed by Patrick W. Rau, CFA, Managing Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Patrick W. Rau, CFA

Patrick W. Rau, CFA, Managing Director, joined Sterling Capital in 2001 and has investment experience since 1991. He has been an associate portfolio manager of the Fund since 2016 and became lead portfolio manager of the Fund in 2020. He received his AB in Political Science from Duke University and his MBA from Vanderbilt University. He holds the Chartered Financial Analyst designation.

Investment Considerations

The Fund may invest in undervalued securities that may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities, which may be more volatile and less liquid due to currency fluctuation, political instability, social and economic risks.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares outperformed its current benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. U.S. mid-cap value stocks posted single-digit percentage losses for the period. The negative economic impacts stemming from actions taken to mitigate the COVID-19 pandemic weighed on economically sensitive stocks, particularly those associated with travel. Despite a nascent recovery, this economic damage from the pandemic negatively impacted the Fund’s absolute performance.

Favorable stock selection in consumer discretionary as well as the Fund’s

significant underweighting of poor-performing real estate and utilities stocks contributed to the Fund’s relative performance. Adverse stock selection among technology, materials and communications services stocks hindered relative performance.

An overweight allocation to financials, which underperformed meaningfully during the period, was more than overcome by strong stock selection among these stocks. Three buyout offers among our portfolio holdings also aided the Fund’s relative performance.

Actions taken by OPEC+ near the onset of the pandemic had a material negative impact on oil prices and led to the severe underperformance of energy stocks during the period. An underweighting to energy stocks during the period benefited the Fund’s relative performance.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

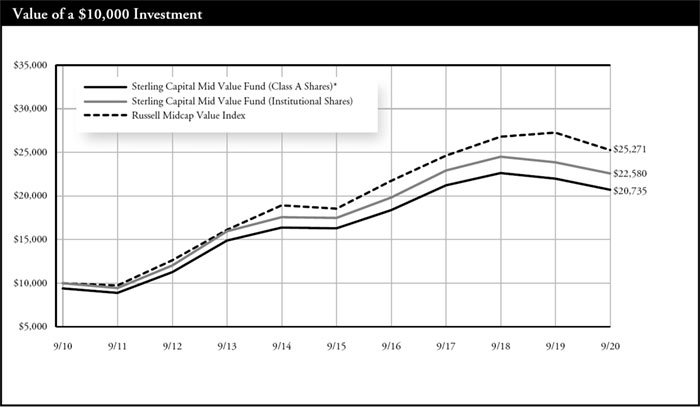

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

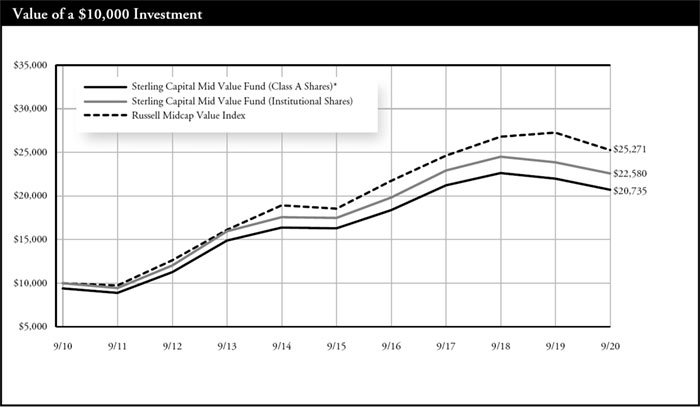

| Average Annual Total Returns |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 8/1/96 | -11.17% | 3.72% | 7.56% |

| Class C Shares** | 7/25/01 | -6.46% | 4.17% | 7.40% |

| Institutional Shares | 8/1/96 | -5.50% | 5.23% | 8.49% |

| Class R Shares | 2/1/101 | -5.97% | 4.72% | 7.84% |

| Class R6 Shares | 2/1/182 | -5.56% | 5.26% | 8.50% |

| Russell Midcap® Value Index | N/A | -7.30% | 6.38% | 9.71% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of the Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

| 2 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of the Institutional Shares. |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Behavioral Small Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Small Cap Value Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA, Senior Managing Director, and Robert O. Weller, CFA, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA

Robert W. Bridges, CFA, Senior Managing Director, joined Sterling Capital in 1996 and is head of equity. He also leads Sterling Capital’s fundamental equity team and serves as co-head of the factor investing/behavioral finance portfolios. He has investment experience since 1991 and has co-managed the Fund since 2013. Bob is a graduate of Wake Forest University where he received a BS in Business. He holds the Chartered Financial Analyst designation.

Robert O. Weller, CFA

Robert O. Weller, CFA, Executive Director, joined Sterling Capital in 2012 and is co-head of the factor investing/behavioral finance. He has investment experience since 1991 and has co-managed the Fund since 2013. Rob is a graduate of Loyola University Maryland where he received a BBA in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and price momentum. The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory as well as more sensitive to adverse conditions.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares underperformed its benchmark, the Russell 2000® Value Index.

Q. What factors affected the Fund’s performance?

A. Small-cap equities experienced a significant decline early in 2020 due to the economic fallout of the COVID-19 pandemic. Corporate earnings and stock prices suffered from late February to mid-March, as governments around the world implemented strict economic and social restrictions. Stocks rebounded later in the spring in response to economic stimulus efforts and the easing of some restrictions, but this partial recovery failed to boost prices to their pre-pandemic highs. Small-cap value equities ended the period at a loss, underperforming both small-cap growth stocks as well as large-cap equities in general, as the economic re-start benefited growth-oriented stocks and larger companies more than small-value names.

The Fund applies principles of behavioral finance to its investment strategy. This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear and ego.

The Fund’s behavioral-driven factors had an overall negative effect on the portfolio’s performance relative to its benchmark. The Fund’s momentum strategy contributed marginally to relative returns, but those gains were more than offset by the Fund’s value exposure, as value stocks underperformed their core counterparts during the period.

An overweight position and stock selection in the financials sector were the largest detractors to the Fund’s relative returns. This sector was among the hardest hit by the economic impact of the pandemic, and the Fund’s investments in banks, diversified financials and mortgage real estate investment trusts also weighed as those holdings underperformed.

Stock selection in health care equipment and services added to the Fund’s relative performance during the period. The Fund’s strategy of maintaining a larger-than-benchmark average market capitalization also benefited on a relative basis, as larger companies generally outperformed smaller companies for the period.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

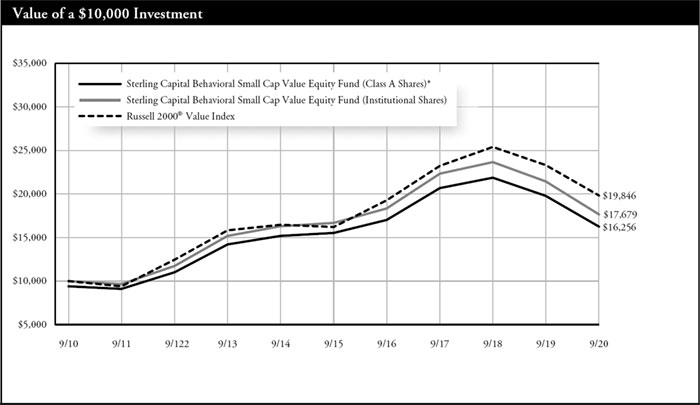

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

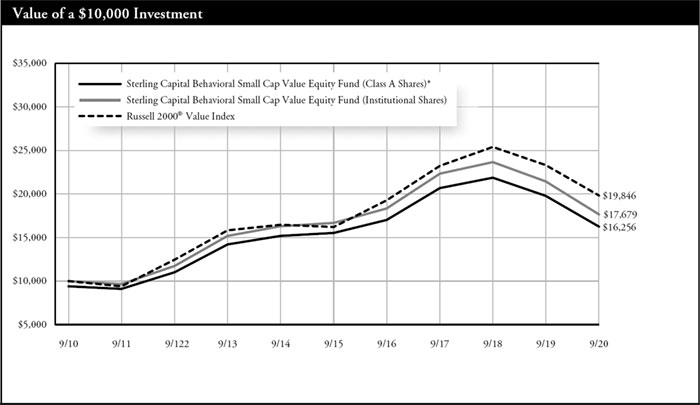

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 1/29/10 | -22.58% | -0.29% | 4.98% |

| Class C Shares** | 1/29/10 | -18.47% | 0.13% | 4.79% |

| Institutional Shares | 1/2/97 | -17.64% | 1.16% | 5.86% |

| Class R Shares | 2/1/10 | -18.04% | 0.67% | 5.44% |

| Class R6 Shares | 2/1/181 | -17.63% | 1.19% | 5.88% |

| Russell 2000® Value Index | N/A | -14.88% | 4.11% | 7.09% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without waivers in effect.

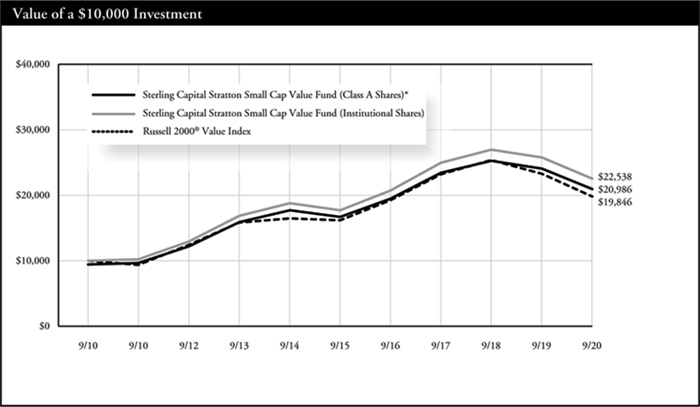

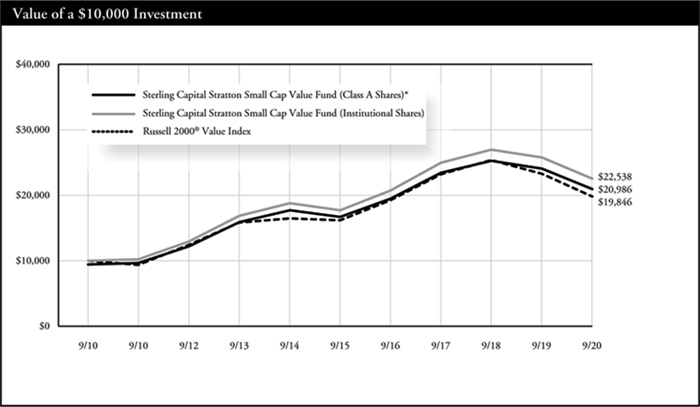

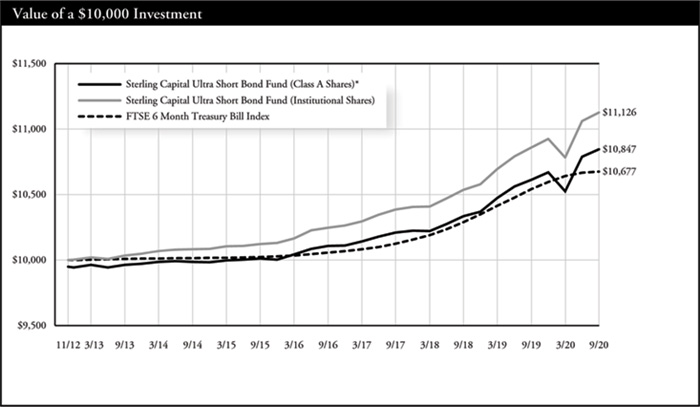

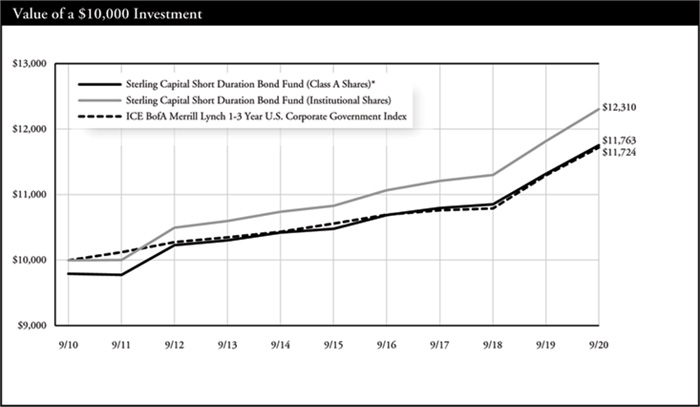

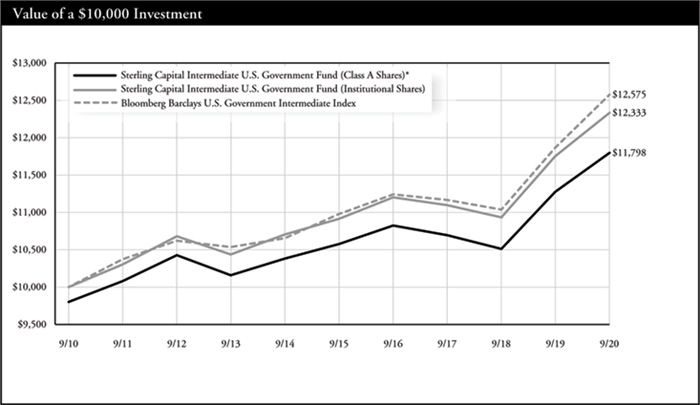

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of the small-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Special Opportunities Fund

Portfolio Manager

Sterling Capital Special Opportunities Fund (the “Fund”) is managed by George F. Shipp, CFA, Managing Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

George F. Shipp, CFA

George F. Shipp, CFA, Managing Director, founded what is now the Sterling Capital Equity Opportunities group in December 2000, after serving for 18 years as a sell-side equity analyst with the broker-dealer BB&T Scott & Stringfellow. George has served as the lead portfolio manager for the Special Opportunities Fund since its inception. George is a graduate of the University of Virginia where he received a B.A. in Biology, and an MBA from its Darden Graduate School of Business in 1982. He holds the Chartered Financial Analyst designation.

Investment Considerations

The Fund is subject to investment style risk, which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Sterling Capital Special Opportunities Fund provided a +5.79% total return (Institutional Class) during its September 30, 2020 fiscal year. If we had known in advance that the year would be dominated by the COVID-19 pandemic causing the worst global economic downturn since the 1930s, not to mention social upheaval and the most acrimonious U.S. political climate in memory, we would have gladly accepted that result. The Fund nevertheless trailed the Russell 3000® Index by a disappointing 9.21%, the largest underperformance in its 17-year history.

Q. What factors affected the Fund’s performance?

A. As readers are well aware, in response to the pandemic, governments worldwide compelled many businesses not to conduct business, and workers not to work. Service sector industries such as travel and restaurants were crippled, even as established trends favoring technology spending enabling work, shop, and play from home accelerated. The equity markets reflected this world of “haves and have nots,” as “Growth” stocks beat those characterized as “Values” by an unprecedented 42 percentage points (+36% in 12 months versus -6%). Our “biggest mistake” was not owning Apple, Amazon and Microsoft; those three tech platforms alone contributed 8.18% to the Russell 3000® Index, but zero to the Fund.

Norwegian Cruise Lines, Alaska Airlines and destination hotelier Ryman Properties took a direct hit from COVID-19, transitioning from record earnings in 2019 almost overnight to docked, parked and closed. Sharp declines in those three stocks contributed a 7.95% combined loss to the Fund before we sold them.

Even with those errors of omission and commission, the Fund more than doubled the return of the equally-weighted equity market (effectively, the median stock). Ironically a “value” holding was our top contributor. Federal Express provided a +76% total return (portfolio contribution +2.3%, reflecting its 3% average weight), as initial evidence of a global freight collapse quickly blossomed to a tight market, confirming our thesis that the company’s services benefit from e-commerce and logistics scale.

Healthcare holdings Danaher (+50%; contribution +2.25%) and Hologic (+32%; +1.6%) were uniquely positioned to help solve the COVID-19 crisis. Danaher’s Cepheid diagnostics unit provides point-of-care tests, while its Cytiva instruments and bioprocessing subsidiary is a primary beneficiary of vaccine research and scale-up. Hologic’s “Panther” high-throughput testing equipment has become the gold standard for reference labs, accounting for approximately one-third of molecular tests. Insurance leader United Health Group is increasingly appreciated for its data analytics, supporting its 46% return (1.5% contribution).

Engagement in Activision Blizzard’s games surged, fueling its shares’ 54% gain (1.7% contribution). Alphabet, also known as Google (+21%; +1.7%), continues to benefit from more searches, more YouTube views, and its Android software’s 74% world share of mobile devices, while its datacenter infrastructure platform has witnessed high growth as more businesses move to the “Cloud.” Akamai (+21%, +1.4%) likewise benefits from exponential growth in data and the corresponding need to keep it secure; almost one third of internet traffic worldwide moves through its 250,000 “edge” servers.

We believe our portfolio is well positioned to benefit from a broadening of the emerging economic recovery. Improvement in the housing (Lennar) and auto industries (Aptiv, CDK Global, NXP Semiconductor) already is evident. Recoveries in consumer spending (Capital One), investor activity (Charles Schwab, Broadridge), and industrial investment (PTC, Flir Systems) should follow, and combine with ongoing technological deepening of everyday processes (Fiserv, F5, Verisk).

We greatly appreciate your continued confidence in our strategies, and in these high quality enterprises.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

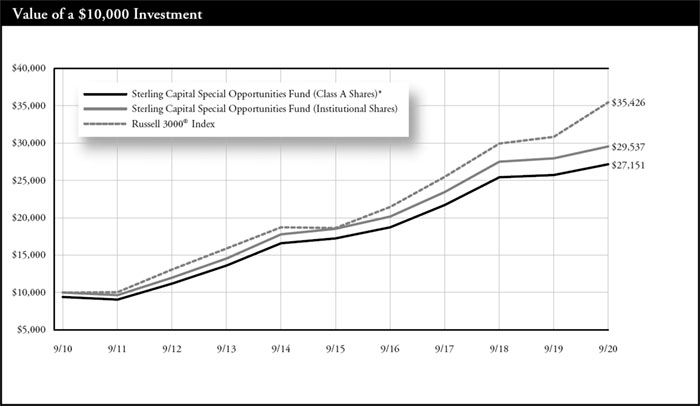

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

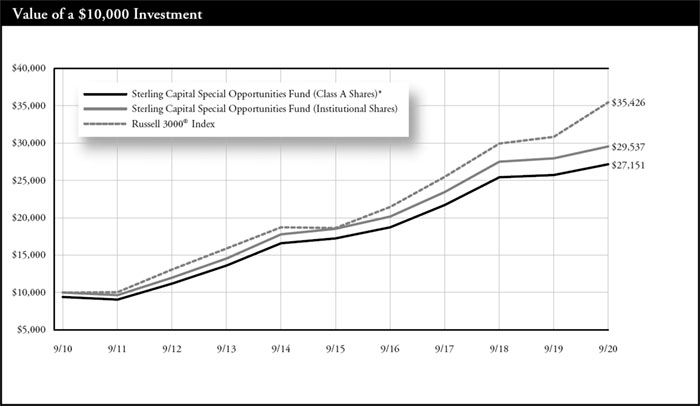

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 6/2/03 | -0.52% | 8.23% | 10.50% |

| Class C Shares** | 6/2/03 | 4.73% | 8.70% | 10.33% |

| Institutional Shares | 6/2/03 | 5.79% | 9.79% | 11.44% |

| Class R Shares | 2/1/10 | 5.29% | 9.24% | 10.88% |

| Class R6 Shares | 2/1/181 | 5.87% | 9.84% | 11.46% |

| Russell 3000® Index | N/A | 15.00% | 13.69% | 13.48% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the Russell 3000® Index, an unmanaged index that is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Equity Income Fund

Portfolio Manager

Sterling Capital Equity Income Fund (the “Fund”) is managed by George F. Shipp, CFA, Managing Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

George F. Shipp, CFA

George F. Shipp, CFA, Managing Director, founded what is now the Sterling Capital Equity Opportunities group in December 2000, after serving for 18 years as a sell-side equity analyst with the broker-dealer BB&T Scott & Stringfellow. George has served as the lead portfolio manager for the Equity Income Fund since its inception. George is a graduate of the University of Virginia where he received a B.A. in Biology, and an MBA from its Darden Graduate School of Business in 1982. He holds the Chartered Financial Analyst designation.

Investment Considerations

The Fund invests primarily in dividend-paying securities. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Sterling Capital Equity Income Fund (Institutional shares) provided a +0.15% total return for the fiscal year ended September 30, 2020, a solid result considering the COVID-19 pandemic triggered the worst global economic downturn since the 1930s. The Fund comfortably beat the Russell 1000® Value Index by 5.18%, continuing a four-year streak of outperformance.

Q. What factors affected the Fund’s performance?

A. The virtually-unchanged result for 12 months belies volatility, which witnessed the Index’s 38% four-week plunge from all-time highs to the March 23 lows. Historically, the high quality orientation of the Fund’s holdings has allowed it to play “good defense” during market downturns, but the unique nature of this recession proved more difficult to navigate than usual. Delta Airlines and Royal Caribbean Cruise, for example, had just announced record 2019 earnings and upbeat outlooks, when suddenly they were forced to ground planes and dock fleets. The combined impact of our travel holdings hurt our return by 4.60% (annual effect) until sold.

General Motors shuttered all 84 production facilities and proactively eliminated its dividend, impacting the Fund by another -1.4%. Occidental Petroleum’s (-1.5% contribution) ill-fated buyout of Anadarko Petroleum just months earlier caused an unbearable debt burden as oil briefly plunged below $0/barrel in commodity markets. Despite the unanticipated events, the Fund managed to slightly beat the market drawdown from the beginning of the year to March lows by 0.98%.

One potential advantage active portfolio managers have is that we can at times monetize losses for tax benefit when circumstances change, pivoting to stronger companies positioned to thrive in a new reality. We don’t “passively” sit idle with impaired securities. While not claiming perfect execution, the Fund fully participated in the stock market’s recovery, gaining 46.8% from March 23 through September 30, compared to the 41.2% gain of the benchmark.

We “took advantage” of perceived bargains. The Fund upped its exposure to Financials as share prices for global leaders like Goldman Sachs (investment banking), Citigroup (treasury and card services), and Northern Trust (securities processing) became more attractive. We added communications software provider Amdocs and public safety software leader Motorola Solutions, believing in their relatively resilient cash flows. We became attracted to Coca Cola following its “30% off sale,” due to its competitive yield and 58-year history of dividend increases.

Our technology overweight proved favorable. Microsoft enables working, networking (LinkedIn) and playing (X-Box) from home, and its Azure Cloud infrastructure helps businesses of all sizes become more efficient. Its 53% total return for the year contributed 2.65% to the portfolio overall. Accenture (+19%; 1.0% contribution) is another net debt free global juggernaut helping clients securely move operations to the Cloud. Semiconductor maker Analog Devices agreed to buy fellow portfolio holding Maxim Integrated (+20%), building an even stronger platform to gain content in 5G networks, autos, factories, and datacenters.

Long standing e-commerce tailwinds helped UPS’ pricing as the trend accelerated; its 44% total return translated to a 1.9% contribution. Home Depot capitalized on booming “order online pick up at store” capabilities to capture out-sized share of home improvements (+23%, +1.2%). Abbott Labs’ (+30%, +1.5%) diagnostic platforms were perfectly positioned to benefit from COVID-19 testing, while its Libre diabetes monitor grew rapidly despite difficulties accessing healthcare providers.

With interest rates effectively pegged at zero “for as long as it takes” in Fed Chairman Powell’s words, we believe our income-producing holdings could prove attractive in a yield-starved world. We thank our clients for ongoing confidence in our strategies.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

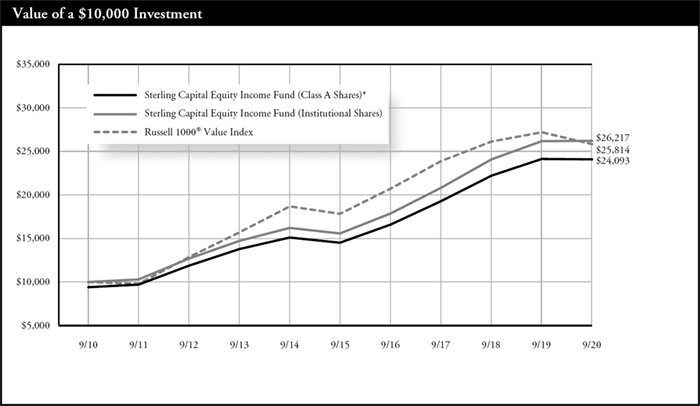

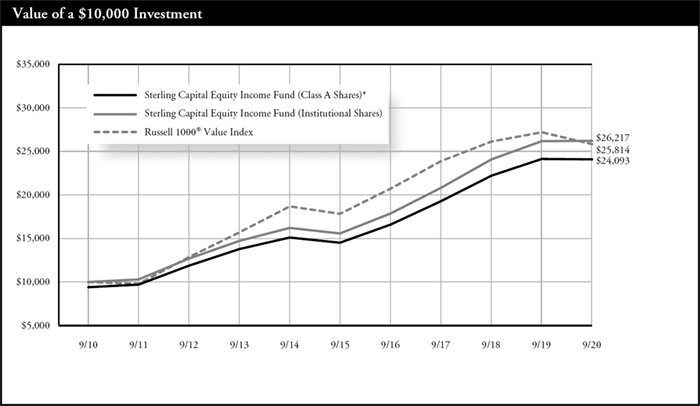

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 6/30/04 | -5.85% | 9.39% | 9.19% |

| Class C Shares** | 6/30/04 | -0.85% | 9.87% | 9.02% |

| Institutional Shares | 6/30/04 | 0.15% | 10.97% | 10.12% |

| Class R Shares | 2/1/10 | -0.40% | 10.41% | 9.58% |

| Class R6 Shares | 2/1/181 | 0.21% | 11.03% | 10.15% |

| Russell 1000® Value Index | N/A | -5.03% | 7.66% | 9.95% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

The Fund is measured against the Russell 1000® Value Index, an unmanaged index that is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Behavioral International Equity Fund

Portfolio Managers

Sterling Capital Behavioral International Equity Fund (the “Fund”) is managed by Portfolio Managers Robert W. Bridges, CFA, Senior Managing Director, and Robert O. Weller, CFA, Executive Director, for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Robert W. Bridges, CFA

Robert W. Bridges, CFA, Senior Managing Director, joined Sterling Capital in 1996 and is head of equity. He also leads Sterling Capital’s fundamental equity team and serves as co-head of the factor investing/behavioral finance portfolios. He has investment experience since 1991 and has co-managed the Fund since its inception. Bob is a graduate of Wake Forest University where he received a BS in Business. He holds the Chartered Financial Analyst designation.

Robert O. Weller, CFA

Robert O. Weller, CFA, Executive Director, joined Sterling Capital in 2012 and is co-head of the factor investing/behavioral finance. He has investment experience since 1996 and has co-managed the Fund since its inception. Rob is a graduate of Loyola University Maryland where he received a BBA in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and market momentum. The Fund will invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, and social and economic risks. The Fund may invest in REITs (Real Estate Investment Trusts), the value of which will be affected by conditions of the real estate industry, and exchange-traded funds (ETFs). Investing in ETFs may cause shareholders to bear additional costs, and an ETF may not exactly replicate the performance it seeks to track.

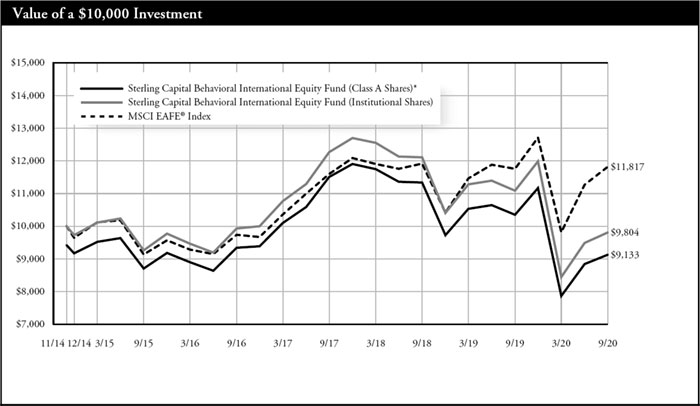

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares underperformed its current benchmark, the MSCI EAFE Index.

Q. What factors affected the Fund’s performance?

A. International equities survived a turbulent period following the onset of the COVID-19 pandemic, and managed to post modest gains during the period. Global markets continued a long-term upward trend in the final months of 2019 and the first month and a half of 2020, but the negative economic impact of the pandemic sent stocks plunging in late February. Many international stocks hit a low point in late March in response to government-initiated shutdowns, but as economies around the world began to cautiously reopen, equity markets began to rebound. By midsummer, international large-cap stocks had largely recovered their losses, although value-oriented companies continued to lag their growth-oriented counterparts.

The Fund applies principles of behavioral finance to its investment strategy.

This process is designed to capitalize on known investor biases and heuristics (mental shortcuts) by accounting for the impact on markets of behavioral factors such as greed, fear and ego.

The Fund’s behavioral-driven factors had a net negative effect on the portfolio’s performance relative to its benchmark. Modest gains from the Fund’s momentum strategy were offset by the Fund’s exposure to stocks with value characteristics, resulting in a drag on relative returns.

Stock selection in the financials sector detracted the most from the Fund’s relative performance. The Fund’s holdings in global banks proved especially detrimental to returns, most notably a French multinational investment bank and an Australian bank that do business in Asia, the U.K. and the U.S.

Stock selection in the materials sector provided the largest boost to relative performance. The metals and mining subsector stood out as a leading contributor, with holdings in an Australian iron ore company and a British international mining company performing especially well.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

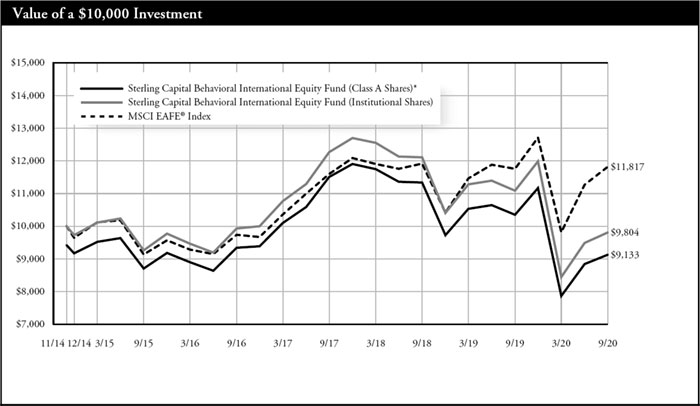

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | Since Inception |

| Class A Shares* | 11/28/14 | -16.84% | -0.23% | -1.54% |

| Class C Shares** | 11/28/14 | -12.41% | 0.17% | -1.28% |

| Institutional Shares | 11/28/14 | -11.65% | 1.14% | -0.34% |

| Class R6 Shares | 2/1/181 | -11.49% | 1.18% | -0.30% |

| MSCI EAFE® Index | 11/30/14 | 0.49% | 5.26% | 2.90% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without limitations and/or waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

| 1 | Class R6 Shares were not in existence prior to 2/1/18. Performance for periods prior to 2/1/18 is based on the performance of Institutional Shares. |

Fund is measured against the MSCI EAFE® Index, an unmanaged Index which is generally representative of large- and mid-cap equity across developed markets countries around the world, excluding the U.S. and Canada. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital SMID Opportunities Fund

Portfolio Manager

Sterling Capital SMID Opportunities Fund (the “Fund”) is managed by Joshua L. Haggerty, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Joshua L. Haggerty, CFA

Joshua L. Haggerty, CFA, Executive Director, joined the CHOICE Asset Management team of BB&T Scott & Stringfellow in 2005, which integrated with Sterling Capital Management in January 2013. He has investment experience since 1998 and has managed the Fund since its inception. Josh is a graduate of James Madison University where he received his BBA in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

The Fund uses a multi-style approach and invests in both growth and value-oriented companies. A growth investment style may be particularly sensitive to market conditions. Value investing involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time. The Fund invests in small and middle capitalization companies which may be riskier, more volatile and vulnerable to economic, market and industry changes than investments in larger more established companies. As a result, share price changes may be more erratic or trade less frequently in lesser quantities.

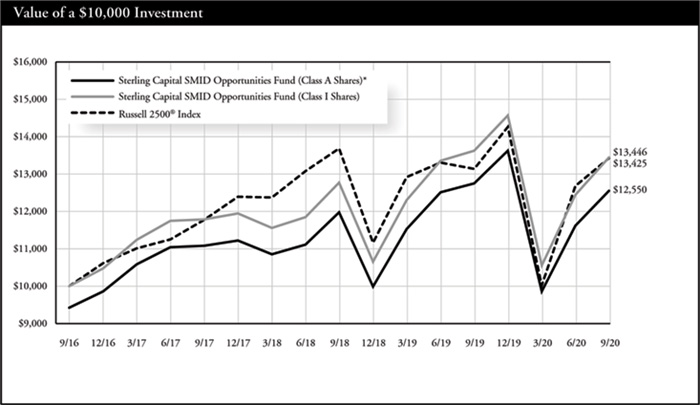

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares fell 1.3% during the fiscal year ending September 30, 2020, trailing the Russell 2500® Index’s 2.2% gain. The Fund’s three year and since inception annualized returns of 4.49% and 7.7%, respectively, were both slightly ahead of the Russell 2500® Index’s 4.45% and 7.6% returns over the same periods.

Q. What factors affected the Fund’s performance?

A. During the fiscal year, larger companies outperformed, led by a narrow group of mega cap stocks. Apple crossed the $2 trillion market cap threshold and became more valuable than the entire small cap asset class, as measured by the Russell 2000. The dichotomy in returns between growth and value was similar, with growth outperforming by 30% over the past year, the largest spread since March 2000.

As a reminder, we strive to only invest in profitable companies. Coming into the fiscal year, every prior 15% pullback in the Russell 2500® Index has coincided with significant underperformance of unprofitable companies. During the pandemic-led decline in early 2020, the opposite occurred. The 645 profitless companies in the Russell 2500® Index gained 40.7% over the past year while profitable companies in the index fell 6.5%. Similarly at odds with historical data, the most expensive Russell 2500® Index constituents rose 17.4%, while the cheapest declined 28.8% and the highest ROE companies lost 1.1%, the second highest quintile slumped 20.6%, while the lowest return on equity cohort gained 12.9%. This year was an enigma.

The biggest contributors to the Fund’s performance were: (1) women’s health and diagnostics provider, Hologic (+43%, contribution 2.13%), which is expected to grow revenues nearly 60% in fiscal 2020 driven by COVID-19 diagnostic testing equipment and assays (the company is providing nearly 2 million tests per week, or around 40% of all tests in the U.S.); (2) health insurance provider Centene (+35%, 1.89%), which was the Fund’s largest detractor in the prior year, rebounding as Medicare-for-All concerns faded (we see more upside if/as Medicaid is expanded in new geographies); (3) railroad Kansas City Southern (43%, 1.76%), which reported significant productivity gains as precision scheduled railroading was implemented (we departed on news of a takeout offer that was subsequently rebuffed); and (4) Arthur Gallagher (+35%, 1.38%), an insurance broker benefiting from strong pricing supplemented by tuck-in acquisitions.

The biggest detractors were all directly impacted by COVID-19, including: (1) Norwegian Cruise Line (-84%, contribution -3.64%), which reported record earnings in late February only to halt all cruises a month later; (2) food service provider Aramark (-47%, -3.27%), which experienced shutdowns to many of its end markets, such as concerts and sporting events, as well as heretofore resilient verticals such as K-12 schools and universities; (3) Alaska Air (-43%, -2.08%), which is grappling with load factors down by more than half and is focused on reducing its cash burn, yet amazingly its leverage ended the fiscal year the same as it was entering the year; and (4) aerospace supplier Hexcel (-65%, -1.82%), which not only saw an eight-year backlog at Boeing and Airbus disappear into thin air, but called off its merger with Woodward as well.

We redeployed capital from three of the four detractors into businesses offering more reliable income streams, supported by secular growth in applications transitioning to the cloud, cybersecurity, industrial automation, and increased healthcare use due to an aging demographic.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

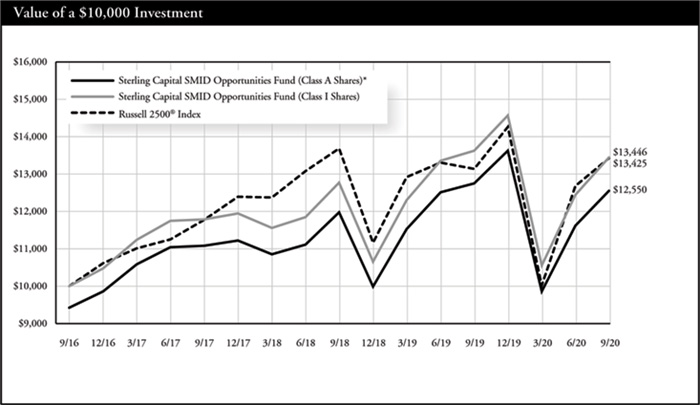

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | Since Inception |

| Class A Shares* | 09/30/16 | -7.22% | 5.84% |

| Class C Shares** | 09/30/16 | -2.22% | 6.63% |

| Institutional Shares | 09/30/16 | -1.30% | 7.68% |

| Russell 2500® Index | N/A | 2.22% | 7.64% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without limitations and/or waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

The Russell 2500® Index is a widely recognized index of common stocks that measures the performance of the small and mid cap sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Stratton Mid Cap Value Fund

Portfolio Manager

Sterling Capital Stratton Mid Cap Value Fund (the “Fund”) is managed by Shawn M. Gallagher, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Shawn M. Gallagher, CFA

Shawn M. Gallagher, CFA, Executive Director, joined the Stratton Funds team of Stratton Management Company in 2005 and Sterling Capital Management as part of a business acquisition in August 2015. He has managed the Fund since 2015 and the predecessor fund since 2012, when it was repositioned as a Mid Cap Value strategy. He has investment experience since 2003 and is a graduate of Pennsylvania State University where he received his BS in Finance. He holds the Chartered Financial Analyst designation.

Investment Considerations

Mid-capitalization companies are generally riskier than large company stocks due to greater volatility and less liquidity. Value stocks can perform differently than other types of stocks and can continue to be undervalued by the market for long periods of time.

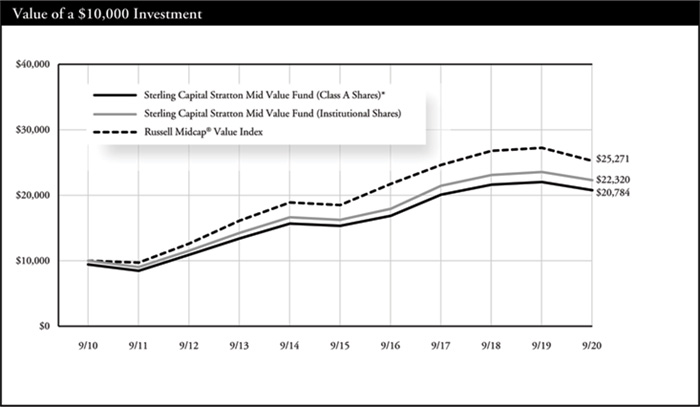

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

U.S. mid-cap stocks posted modest losses for the period despite opening with strong gains during the final months of 2019 and opening months of 2020. This positive initial trend gave way to steep declines in late February and early March as markets responded to the negative economic impacts of the global pandemic. U.S. mid-cap stocks declined more than 40% from their February peak through the market’s bottom in late March. A subsequent rebound through the end of the period was not enough to erase the impact of the earlier decline, however. The various government-led shutdown orders had an uneven impact on the economy, benefiting some sectors of the economy while hurting others. The energy sector was the largest drag on the Fund’s absolute returns, as the contraction in the global economy led to a decline in energy prices. Meanwhile, certain communication services holdings added the most to the Fund’s absolute returns as this sector benefited from the “stay-at-home” environment. The health care sector also added to absolute returns.

Stock selection within the health care sector was the biggest contributor to relative performance. Specific holdings benefited from strong demand for medical diagnostics, supplies, and outsourced drug research and development. Selection within the real estate sector also added to relative results, particularly investments in an industrial real estate investment trust (REIT) that benefited from increased demand for warehouse space due to a rise in e-commerce activity. Holdings of two data-center REITs also added to results as cloud migration and bandwidth demand accelerated during the pandemic.

Stock selection within the industrial and consumer staples sectors weighed the most on relative results. In particular, the Fund’s investment in an energy and communications infrastructure provider detracted amid a decline in energy pipeline construction. Meanwhile, two major domestic food distributors lagged the overall consumer staples sector as the economic lockdowns dealt a major blow to the restaurant industry. The Fund’s underweight position to the consumer discretionary sector also weighed on relative results, as that sector outperformed during the market rebound in the second half of the period.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

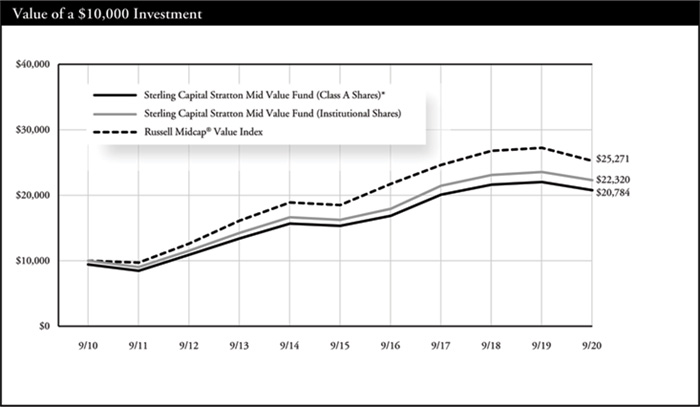

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 11/13/15 | -11.06% | 5.01% | 7.59% |

| Class C Shares** | 11/13/15 | -6.21% | 5.53% | 7.85% |

| Institutional Shares | 09/30/72 | -5.39% | 6.52% | 8.36% |

| Russell Midcap® Value Index | N/A | -7.30% | 6.38% | 9.71% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The performance shown here (for periods prior to the date of commencement of operations on November 16, 2015) is that of Stratton Mid Cap Value Fund (the “Predecessor Fund”), whose shares were reorganized into Institutional Shares of the Fund at the close of business on November 13, 2015. Because the Fund had no investment operations prior to the closing of the reorganization, and based on the similarity of the Fund to the Predecessor Fund, the Predecessor Fund is treated as the survivor of the reorganization for accounting and performance reporting purposes. Accordingly, all performance and other information shown for the Fund for periods prior to November 16, 2015 is that of the Predecessor Fund. Performance for Class A Shares and Class C Shares, prior to the date of commencement of operations on November 16, 2015, is based on the performance of the shares of the Predecessor Fund. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without waivers in effect.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark.

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Sterling Capital Stratton Real Estate Fund

Portfolio Manager

Sterling Capital Stratton Real Estate Fund (the “Fund”) is managed by Andrew T. DiZio, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Andrew T. DiZio, CFA

Andrew T. DiZio, CFA, Executive Director, joined the Stratton Funds team of Stratton Management Company in 2012 and Sterling Capital Management as part of a business acquisition in August 2015. He has investment experience since 2003. He has managed the Fund since 2015 and the predecessor fund since 2012. Andy received his BS in Finance with a minor in Economics from Pennsylvania State University. He holds the Chartered Financial Analyst designation.

Investment Considerations

Real Estate Funds may be subject to a higher degree of market risk because of concentration in a specific industry or geographic sector. Risks include declines in value of real estate, general and economic conditions, changes in the value of the underlying property and defaults by borrowers.

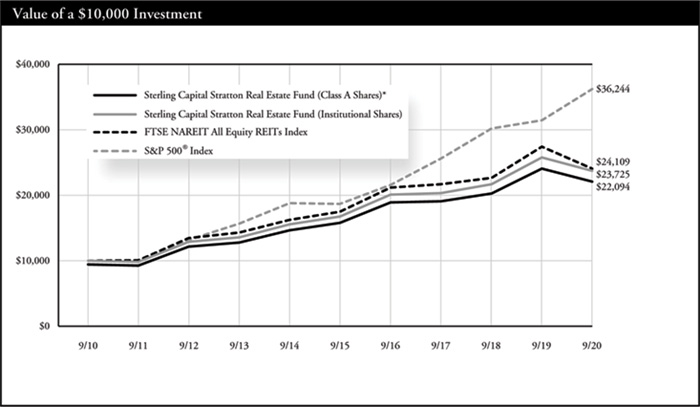

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares outperformed its benchmark, the FTSE NAREIT All Equity REITs Index.

Q. What factors affected the Fund’s performance?

The global pandemic negatively impacted real estate investment trust (REIT) share prices during the 12-month period under review. The broader markets experienced a sharp downturn in late February that extended through the middle of March, driving significant losses across multiple sectors of the economy. Markets rebounded throughout the rest of the period, but not enough to offset the losses during the market freefall. The economic contraction resulting from government-led efforts to limit the spread of COVID-19 did not impact all REIT subsectors equally, however. Data center, infrastructure and industrial REITs outperformed their peers and added the most to the Fund’s absolute returns. The “stay-at-home” environment increased demand for computing power, which boosted data centers, while online shopping drove strong performance among warehouses in the industrial REIT space. Lodging and retail REITs weighed the most on the Fund’s absolute returns due to the negative impacts of social distancing and shutdown orders.

The Fund’s overweight position to data centers added the most to relative results. Stock selection within office and residential REITs also benefited, particularly a REIT that primarily leases lab space which has experienced steady demand amid the pandemic. Among the Fund’s residential REITs, exposure to the southeast U.S. benefited as that region maintained strong demand during the period. The Fund’s general tilt away from exposure to downtown apartments in major coastal cities also added to relative results, as demand in this space dropped meaningfully during the pandemic.

Stock selection in the retail subsector weighed the most on relative performance. The Fund’s investment in a REIT with more exposure to restaurants and fitness tenants than the average of its peers weighed on results given the concern that those businesses would not be able to meet their rent obligations during the shutdown. Stock selection in the diversified REIT subsector also detracted, driven by the Fund’s investment in a Hawaii-focused REIT. That state’s economy struggled as the pandemic triggered significant travel restrictions, and tourism represents a significant portion of its GDP.

Portfolio composition is as of September 30, 2020 and is subject to change and risk.

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| Average Annual Total Returns | |

| As of September 30, 2020 | Inception Date | 1 Year | 5 Years | 10 Years |

| Class A Shares* | 11/13/15 | -13.60% | 5.67% | 8.25% |

| Class C Shares** | 11/13/15 | -9.02% | 6.16% | 8.50% |

| Institutional Shares | 05/31/80 | -8.09% | 7.19% | 9.02% |

| Class R6 Shares | 01/31/201 | -8.01% | 7.21% | 9.03% |

| FTSE NAREIT All Equity REITs Index | N/A | -12.15% | 6.61% | 9.20% |

| S&P 500® Index | N/A | 15.15% | 14.15% | 13.74% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The performance shown here (for periods prior to the date of commencement of operations on November 16, 2015) is that of Stratton Real Estate Fund (the “Predecessor Fund”), whose shares were reorganized into Institutional Shares of the Fund at the close of business on November 13, 2015. Because the Fund had no investment operations prior to the closing of the reorganization, and based on the similarity of the Fund to the Predecessor Fund, the Predecessor Fund is treated as the survivor of the reorganization for accounting and performance reporting purposes. Accordingly, all performance and other information shown for the Fund for periods prior to November 16, 2015 is that of the Predecessor Fund. Performance for Class A Shares and Class C Shares, prior to the date of commencement of operations on November 16, 2015, is based on the performance of the shares of the Predecessor Fund. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com. Performance would have been lower without waivers in effect.

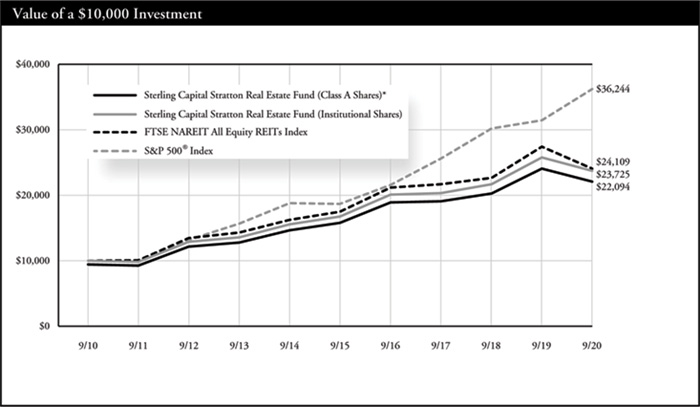

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks.

The Fund is measured against the FTSE NAREIT All Equity REIT Index, an unmanaged index, which contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. The Fund is also measured against the S&P 500® Index, an unmanaged index, which is generally considered to be representative of the performance of the stock market as a whole. The indices do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 1 | Class R6 Shares were not in existence prior to 01/31/20. Performance for periods prior to 01/31/20 is based on the performance of Institutional Shares. |

Sterling Capital Stratton Small Cap Value Fund

Portfolio Manager

Sterling Capital Stratton Small Cap Value Fund (the “Fund”) is managed by Gerald M. Van Horn, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Gerald M. Van Horn, CFA

Gerald M. Van Horn, CFA, Executive Director, joined the Stratton Funds team of Stratton Management Company in 1998 and Sterling Capital Management as part of a business acquisition in August 2015. He has investment experience since 1996. He has managed the Fund since 2015 and the predecessor fund since 2000. Jerry received his BA in Economics from The College of New Jersey. He holds the Chartered Financial Analyst designation.

Investment Considerations

Small cap company stocks are generally riskier than large company stocks due to greater volatility and less liquidity. Value stocks can perform differently than other types of stocks and can continue to be undervalued by the market for long periods of time.

Q. How did the Fund perform during the 12-month period between October 1, 2019 and September 30, 2020?

A. The Fund’s Institutional Shares outperformed its current benchmark, the Russell 2000® Value Index.

Q. What factors affected the Fund’s performance?

Small-cap equities experienced a sharp drawdown from late February to mid-March due to the negative economic impacts of the global pandemic. The economic and social restrictions put in place by various governments seeking to control the spread of COVID-19 severely impacted corporate earnings and equity prices during the period. Economic stimulus efforts and the easing of some restrictions helped stocks rebound from their late-March lows, but not enough to erase the earlier losses. U.S. small cap stocks ended the period with substantial losses. The Fund’s holdings in the energy, utilities and financials sectors weighed the most on absolute returns as these sectors suffered most from the contracting economic environment. The Fund’s health care and communication services sectors contributed the most to absolute returns, as these sectors were better insulated from the negative impacts of the economic and social restrictions.

Stock selection in the health care sector added to the Fund’s relative performance during the period. Investments in a manufacturer of injectable drug delivery systems outperformed amid the broader push for vaccine and therapeutic treatments for COVID-19. An underweight position in the energy sector also added to results on a relative basis, as did stock selection in the information technology sector as two holdings within the semiconductor industry outperformed.

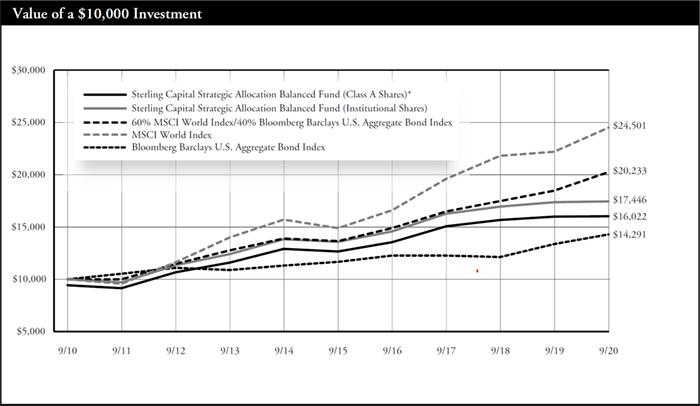

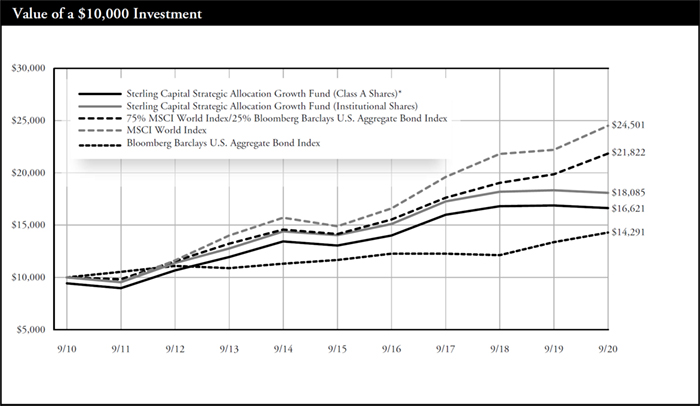

An underweight position to consumer discretionary sector dragged the most on relative results, as those stocks rebounded strongly off the market low in March. Stock selection in the industrials sector also weighed on results, particularly holdings of a manufacturer of engineered industrial products and an infrastructure construction company, which both underperformed their peers for the period. Stock selection in the utilities sector also detracted on a relative basis as an investment in an electric utility company underperformed.