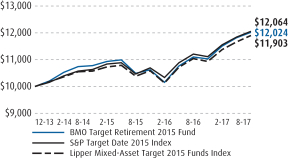

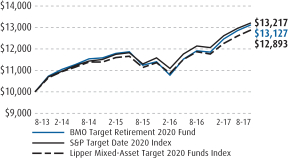

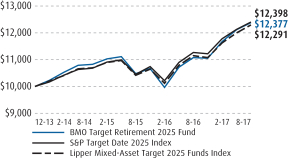

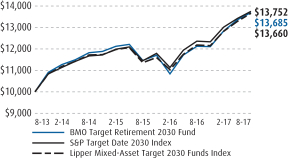

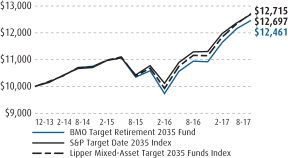

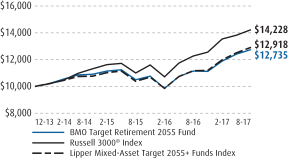

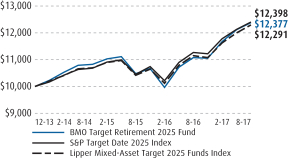

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-58433

BMO Funds, Inc.

(Exact name of registrant as specified in charter)

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

John M. Blaser

BMO Asset Management Corp.

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Name and address of agent for service)

Copies to:

Michael P. O’Hare, Esq.

Stradley, Ronon, Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 236-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2017

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

Annual report

Equity Funds

International & Global Funds

Alternative Funds

Fixed Income Funds

Money Market Funds

Table of Contents

| | | | |

Not FDIC Insured | | No Bank Guarantee | | May Lose Value |

| | |

| Annual Report | | BMO Low Volatility Equity Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | 6.94 | | | | 8.69 | |

| Advisor Class (A) OFFER | | | 1.57 | | | | 7.00 | |

| Institutional Class (I) | | | 7.24 | | | | 11.82 | |

| Russell 1000® Index | | | 16.16 | | | | 14.01 | |

| Lipper Multi-Cap Core Funds Index | | | 14.49 | | | | 12.76 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

Consistent with our long term objective, the Fund provided upside participation during another positive year for equities. Our emphasis on stocks with attractive valuations was a detractor from performance, as investors favored more expensive growth companies. Sector positioning largely reflected our emphasis on risk reduction with significant weight in sectors like Consumer Staples and Utilities. An overweight to Consumer Staples and underweight to Information Technology were significant detractors from returns. An underweight position in Energy, however, was a positive contributor as a sudden pull back in oil prices caused the sector to trade lower.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Jay Kaufman, CFA; since 2006

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BLVAX | | | | 09658W105 | | | | 5/27/2014 | | | | 1.06 | | | | 0.91 | |

| Institutional (I) | | | MLVEX | | | | 09658L208 | | | | 9/28/2012 | | | | 0.81 | | | | 0.66 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 8.4 | |

| Consumer Staples | | | 17.9 | |

| Energy | | | 2.3 | |

| Financials | | | 18.1 | |

| Healthcare | | | 18.7 | |

| Industrials | | | 7.1 | |

| Information Technology | | | 7.8 | |

| Real Estate | | | 3.2 | |

| Telecommunication Services | | | 1.7 | |

| Utilities | | | 12.8 | |

| Other Assets & Liabilities, Net | | | 2.0 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

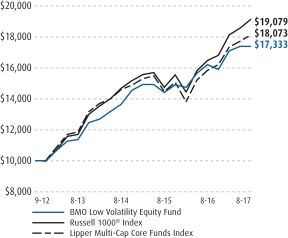

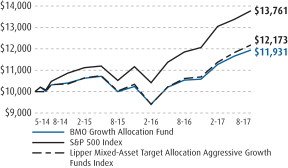

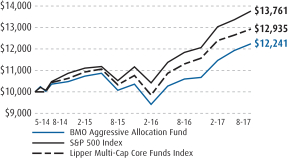

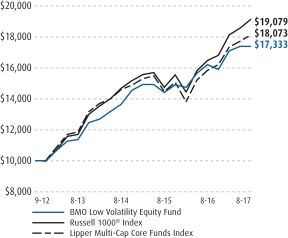

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

2

| | |

| Annual Report | | BMO Dividend Income Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | 14.80 | | | | — | | | | 8.63 | |

| Advisor Class (A) OFFER | | | 9.07 | | | | — | | | | 6.95 | |

| Institutional Class (I) | | | 15.15 | | | | 12.52 | | | | 12.74 | |

| Russell 1000® Value Index | | | 11.58 | | | | 13.25 | | | | 14.02 | |

| Standard & Poor’s 500® Index | | | 16.23 | | | | 14.34 | | | | 15.00 | |

| Lipper Equity Income Funds Index | | | 12.26 | | | | 11.77 | | | | 12.20 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund benefited from strong stock selection within the Industrials sector. After the U.S. presidential election, industrial stocks performed well on the expectation of increased federal infrastructure spending. Boeing Co. (2.7% of the Fund, 90.8%) benefited from global growth and has thus seen demand for its airplanes grow. Investors have been attracted to the company’s cash flow generation and healthy capital return growth.

The Fund’s performance was hampered by weak stock selection and an underweight position within the Information Technology sector. The Fund’s Information Technology holdings are typically mature companies that offer less growth, yet higher capital returns via dividends. During the fiscal year, investors preferred Information Technology companies that offered above average growth and little or no dividend. Investors rewarded Apple, Inc. (1.1% of the Fund, 57.3%) ahead of its newest iPhone launch. Unfortunately, the company is held at a relative underweight due to its below market average dividend yield and was the Fund’s largest detractor from performance.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

Kenneth M. Conrad, Ph.D., CFA; since 2000

Casey J. Sambs, CFA; since 2004

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BADIX | | | | 09658W204 | | | | 5/27/2014 | | | | 1.08 | | | | 0.90 | |

| Institutional (I) | | | MDIVX | | | | 09658L604 | | | | 12/29/2011 | | | | 0.83 | | | | 0.65 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 8.3 | |

| Consumer Staples | | | 7.7 | |

| Energy | | | 6.6 | |

| Financials | | | 14.3 | |

| Healthcare | | | 11.1 | |

| Industrials | | | 9.1 | |

| Information Technology | | | 18.2 | |

| Materials | | | 4.7 | |

| Real Estate | | | 5.4 | |

| Telecommunication Services | | | 4.8 | |

| Utilities | | | 8.0 | |

| Other Assets & Liabilities, Net | | | 1.8 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

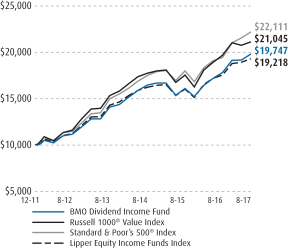

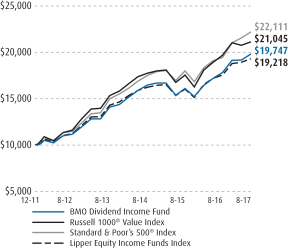

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

3

| | |

| Annual Report | | BMO Large-Cap Value Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | 14.33 | | | | — | | | | 7.32 | |

| Advisor Class (A) OFFER | | | 8.64 | | | | — | | | | 5.65 | |

| Institutional Class (I) | | | 14.66 | | | | 13.06 | | | | 6.60 | |

| Retirement Class (R-6) | | | 14.75 | | | | — | | | | 10.97 | |

| Russell 1000® Value Index | | | 11.58 | | | | 13.25 | | | | 6.97 | |

| Lipper Multi-Cap Value Funds Index | | | 12.58 | | | | 12.63 | | | | 6.58 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund outperformed its benchmark due to our preference for companies with positive or improving investor interest. Additionally, our focus on fundamentals was rewarded as high-quality companies outperformed lower quality counterparts. The Fund’s performance also was enhanced by strong stock selection, as sector allocation was a modest contributor to returns. The Fund’s underweight position in Telecommunication Services added to performance, while an underweight position in Financials detracted. Stock selection was particularly strong in Industrials while selection in Consumer Staples detracted from performance. Within Industrials, Boeing Co. (1.9% of the Fund, 90.8%) was the top contributor to returns. Top detractors included Tyson Foods, Inc., Class A (0.0% of the Fund, -22.4%) and CVS Health Corp. (2.3% of the Fund, -15.2%) in Consumer Staples.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BALVX | | | | 09658W303 | | | | 5/27/2014 | | | | 1.03 | | | | 1.00 | |

| Institutional (I) | | | MLVIX | | | | 09658L844 | | | | 1/31/2008 | | | | 0.78 | | | | 0.75 | |

| Retirement (R-6) | | | BLCRX | | | | 09658W568 | | | | 12/28/2015 | | | | 0.63 | | | | 0.60 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 6.4 | |

| Consumer Staples | | | 9.5 | |

| Energy | | | 9.3 | |

| Financials | | | 22.5 | |

| Healthcare | | | 11.8 | |

| Industrials | | | 11.4 | |

| Information Technology | | | 9.3 | |

| Materials | | | 4.0 | |

| Real Estate | | | 7.7 | |

| Telecommunication Services | | | 0.2 | |

| Utilities | | | 6.3 | |

| Other Assets & Liabilities, Net | | | 1.6 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

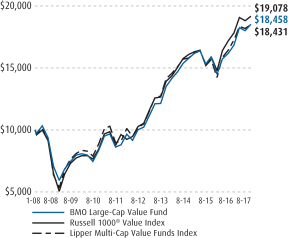

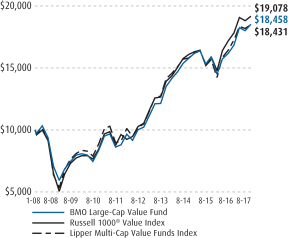

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class and Retirement R-6 shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

| | |

| Annual Report | | BMO Large-Cap Growth Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | 10-year | | | Since

inception | |

| Investor Class (Y) | | | 21.30 | | | | 16.07 | | | | 9.00 | | | | — | |

| Advisor Class (A) NAV | | | 21.30 | | | | — | | | | — | | | | 13.21 | |

| Advisor Class (A) OFFER | | | 15.21 | | | | — | | | | — | | | | 11.45 | |

| Institutional Class (I) | | | 21.63 | | | | 16.37 | | | | — | | | | 10.31 | |

| Retirement Class (R-6) | | | 21.83 | | | | — | | | | — | | | | 15.83 | |

| Russell 1000® Growth Index | | | 20.82 | | | | 15.41 | | | | 9.39 | | | | — | |

| Lipper Multi-Cap Growth Funds Index | | | 20.14 | | | | 14.45 | | | | 7.96 | | | | — | |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund outperformed its benchmark due to our preference for companies with positive or improving investor interest. Additionally, our focus on fundamentals was rewarded as high-quality companies outperformed lower quality counterparts. The Fund’s performance also was enhanced by strong stock selection, as sector allocation was a modest detractor to returns. The Fund’s underweight position in Consumer Staples added to performance, while an overweight position in Telecommunication Services detracted. Stock selection was particularly strong in Consumer Discretionary while selection in Real Estate detracted from performance. Within Consumer Discretionary, Wyndham Worldwide Corp. (1.8% of the Fund, 44.5%) and Sirius XM Holdings, Inc. (2.0% of the Fund, 40.1%) were top contributors to returns. Top detractors included EPR Properties (0.6% of the Fund, -6.0%) in Real Estate.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Investor (Y) | | | MASTX | | | | 09658L745 | | | | 11/20/1992 | | | | 1.06 | | | | 1.00 | |

| Advisor (A) | | | BALGX | | | | 09658W402 | | | | 5/27/2014 | | | | 1.06 | | | | 1.00 | |

| Institutional (I) | | | MLCIX | | | | 09658L752 | | | | 1/31/2008 | | | | 0.81 | | | | 0.75 | |

| Retirement (R-6) | | | BLGRX | | | | 09658W576 | | | | 12/28/2015 | | | | 0.66 | | | | 0.60 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 16.2 | |

| Consumer Staples | | | 4.3 | |

| Financials | | | 6.3 | |

| Healthcare | | | 16.2 | |

| Industrials | | | 11.5 | |

| Information Technology | | | 35.4 | |

| Materials | | | 2.4 | |

| Real Estate | | | 5.0 | |

| Telecommunication Services | | | 1.3 | |

| Other Assets & Liabilities, Net | | | 1.4 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

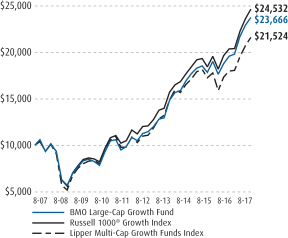

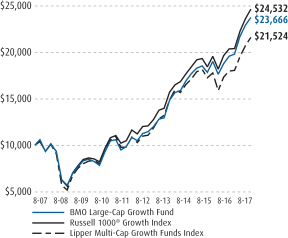

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Investor Class shares of the Fund. Performance for the Institutional Class, Advisor Class and Retirement R-6 shares will vary from the performance of the Investor Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Investor Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

5

| | |

| Annual Report | | BMO Mid-Cap Value Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception | |

| Advisor Class (A)NAV | | | 12.88 | | | | — | | | | 6.86 | |

| Advisor Class (A)OFFER | | | 7.22 | | | | — | | | | 5.20 | |

| Institutional Class (I) | | | 13.10 | | | | 13.76 | | | | 8.67 | |

| Retirement Class (R-3) | | | 12.60 | | | | — | | | | 6.58 | |

| Retirement Class (R-6) | | | 13.31 | | | | — | | | | 7.26 | |

| Russell Midcap® Value Index | | | 10.82 | | | | 14.22 | | | | 9.35 | |

| Lipper Mid-Cap Value Funds Index | | | 10.18 | | | | 12.84 | | | | 8.05 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund outperformed its benchmark due to our preference for companies with positive or improving investor interest. Additionally, our focus on fundamentals was rewarded as high-quality companies outperformed lower quality counterparts. The Fund’s performance also was enhanced via strong stock selection, as sector allocation was a modest contributor to returns. The Fund’s overweight position in Information Technology added to performance, while an overweight position in Consumer Staples detracted. Stock selection was particularly strong in Information Technology while selection in Consumer Discretionary slightly detracted from performance. Within Information Technology, Western Digital Corp. (1.2% of the Fund, 94.4%) and Lam Research Corp. (1.5% of the Fund, 80.4%) were top contributors to returns. Top detractors included Brinker International, Inc. (0.0% of the Fund, -17.6%) and American Eagle Outfitters, Inc. (0.0% of the Fund, -21.8%) in Consumer Discretionary.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BAMCX | | | | 09658W501 | | | | 5/27/2014 | | | | 1.23 | | | | 1.23 | |

| Institutional (I) | | | MRVIX | | | | 09658L711 | | | | 1/31/2008 | | | | 0.98 | | | | 0.98 | |

| Retirement (R-3) | | | BMVDX | | | | 09658V446 | | | | 5/27/2014 | | | | 1.48 | | | | 1.48 | |

| Retirement (R-6) | | | BMVGX | | | | 09658V438 | | | | 5/27/2014 | | | | 0.83 | | | | 0.83 | |

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 9.5 | |

| Consumer Staples | | | 4.6 | |

| Energy | | | 7.3 | |

| Financials | | | 17.5 | |

| Healthcare | | | 6.2 | |

| Industrials | | | 14.5 | |

| Information Technology | | | 9.2 | |

| Materials | | | 5.9 | |

| Real Estate | | | 13.1 | |

| Utilities | | | 11.2 | |

| Other Assets & Liabilities, Net | | | 1.0 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

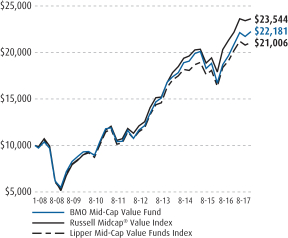

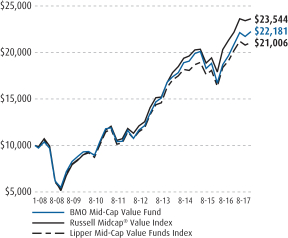

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class, Retirement R-3 and Retirement R-6 Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

6

| | |

| Annual Report | | BMO Mid-Cap Growth Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception | |

| Advisor Class (A)NAV | | | 16.73 | | | | — | | | | 3.96 | |

| Advisor Class (A)OFFER | | | 10.87 | | | | — | | | | 2.34 | |

| Institutional Class (I) | | | 17.07 | | | | 9.73 | | | | 7.51 | |

| Retirement Class (R-3) | | | 16.47 | | | | — | | | | 3.71 | |

| Retirement Class (R-6) | | | 17.22 | | | | — | | | | 4.37 | |

| Russell Midcap® Growth Index | | | 14.52 | | | | 13.99 | | | | 9.57 | |

| Lipper Mid-Cap Growth Funds Index | | | 16.89 | | | | 13.12 | | | | 8.25 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund outperformed its benchmark due to our preference for companies with positive or improving investor interest. Additionally, our focus on fundamentals was rewarded as high-quality companies outperformed lower quality counterparts. The Fund’s performance also was enhanced by strong stock selection, as sector allocation was a modest contributor to returns. The Fund’s overweight position in Information Technology added to performance, while an overweight position in Energy detracted. Stock selection was particularly strong in Healthcare while selection in Real Estate slightly detracted from performance. Within Healthcare, Align Technology, Inc. (1.7% of the Fund, 90.3%) and WellCare Health Plans, Inc. (1.8% of the Fund, 55.0%) were top contributors to returns. Top detractors included Boston Properties, Inc. (1.5% of the Fund, -12.0%) and EPR Properties (0.0% of the Fund, -1.8%) in Real Estate.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | Net | |

| Advisor (A) | | | BGMAX | | | | 09658W600 | | | 5/27/2014 | | 1.30 | | | 1.25 | |

| Institutional (I) | | | MRMIX | | | | 09658L737 | | | 1/31/2008 | | 1.05 | | | 1.00 | |

| Retirement (R-3) | | | BMGDX | | | | 09658V420 | | | 5/27/2014 | | 1.55 | | | 1.50 | |

| Retirement (R-6) | | | BMGGX | | | | 09658V412 | | | 5/27/2014 | | 0.90 | | | 0.85 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 15.6 | |

| Consumer Staples | | | 2.8 | |

| Energy | | | 1.7 | |

| Financials | | | 6.0 | |

| Healthcare | | | 15.2 | |

| Industrials | | | 16.2 | |

| Information Technology | | | 28.9 | |

| Materials | | | 5.4 | |

| Real Estate | | | 5.2 | |

| Telecommunication Services | | | 1.3 | |

| Other Assets & Liabilities, Net | | | 1.7 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

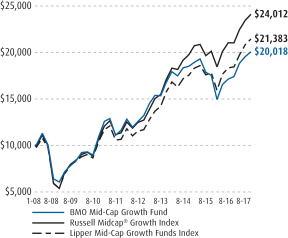

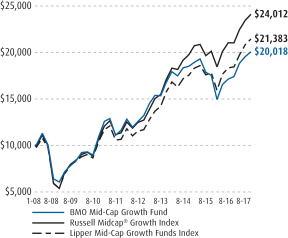

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class, Retirement R-3 and Retirement R-6 Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

7

| | |

| Annual Report | | BMO Small-Cap Value Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

| Advisor Class (A)NAV | | | 11.58 | | | | — | | | | 4.83 | |

| Advisor Class (A)OFFER | | | 5.96 | | | | — | | | | 3.18 | |

| Institutional Class (I) | | | 11.87 | | | | 12.38 | | | | 10.22 | |

| Retirement Class (R-3) | | | 11.32 | | | | — | | | | 4.56 | |

| Retirement Class (R-6) | | | 12.05 | | | | — | | | | 5.25 | |

| Russell 2000® Value Index | | | 13.47 | | | | 12.51 | | | | 9.36 | |

| Lipper Small-Cap Core Funds Index | | | 13.79 | | | | 12.71 | | | | 9.64 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund underperformed its benchmark due to stock selection, as sector allocation was a modest contributor to returns. The Fund’s underweight position in Energy added to performance, while an underweight position in Real Estate detracted. Stock selection was particularly strong in Industrials while selection in Health Care detracted from performance. Within Industrials, Brink’s Company (0.9% of the Fund, 116.9%) and ArcBest Corp. (0.9% of the fund, 64.3%) were top contributors to returns. Top detractors included Lannett Company, Inc. (0.2% of the Fund, -42.1%) and Acorda Therapeutics, Inc. (0.3% of the Fund, -33.1%) in Health Care.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BACVX | | | | 09658W709 | | | | 5/27/2014 | | | | 1.40 | | | | 1.25 | |

| Institutional (I) | | | MRSNX | | | | 09658L596 | | | | 2/28/2011 | | | | 1.15 | | | | 1.00 | |

| Retirement (R-3) | | | BSVDX | | | | 09658V396 | | | | 5/27/2014 | | | | 1.65 | | | | 1.50 | |

| Retirement (R-6) | | | BSVGX | | | | 09658V388 | | | | 5/27/2014 | | | | 1.00 | | | | 0.85 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 7.4 | |

| Consumer Staples | | | 1.8 | |

| Energy | | | 4.9 | |

| Financials | | | 27.0 | |

| Healthcare | | | 9.1 | |

| Industrials | | | 14.6 | |

| Information Technology | | | 10.8 | |

| Materials | | | 7.1 | |

| Real Estate | | | 10.2 | |

| Utilities | | | 6.3 | |

| Other Assets & Liabilities, Net | | | 0.8 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

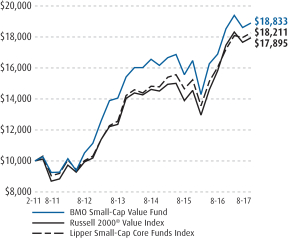

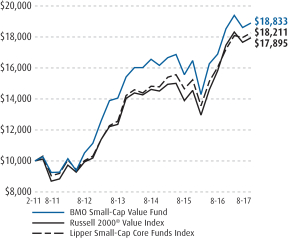

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class, Retirement R-3 and Retirement R-6 Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

8

| | |

| Annual Report | | BMO Small-Cap Core Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception* | |

| Advisor Class (A)NAV | | | 16.09 | | | | 9.44 | |

| Advisor Class (A)OFFER | | | 10.28 | | | | 7.74 | |

| Institutional Class (I) | | | 16.33 | | | | 8.85 | |

| Russell 2000® Index | | | 14.92 | | | | 6.75 | |

| Lipper Small-Cap Core Funds Index | | | 13.79 | | | | 6.56 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund outperformed its benchmark due to strong stock selection, as sector allocation was a modest contributor to returns. The Fund’s overweight position in Health Care added to performance, with no significant detractors in terms of sector allocation. Stock selection was particularly strong in Industrials while selection in Consumer Discretionary detracted from performance. Within Industrials, Brink’s Company (0.9% of the Fund, 116.9%) and ArcBest Corp. (0.9% of the Fund, 64.3%) were top contributors to returns. Top detractors included Francesca’s Holding Corporation (0.4% of the Fund, -54.6%) and Express, Inc. (0.5% of the Fund, -46.2%) in Consumer Discretionary.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | |

| | | | | | | | Inception date | | Expenses (%) | |

| Share class | | Ticker | | Cusip | | | | Gross | | Net | |

| Advisor (A) | | BCCAX | | | 09658W808 | | | 5/27/2014 | | 2.54 | | | 1.15 | |

| Institutional (I) | | BSCNX | | | 09658V537 | | | 12/27/2013 | | 2.29 | | | 0.90 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 9.3 | |

| Consumer Staples | | | 2.2 | |

| Energy | | | 2.0 | |

| Financials | | | 15.6 | |

| Healthcare | | | 18.6 | |

| Industrials | | | 14.8 | |

| Information Technology | | | 20.3 | |

| Materials | | | 6.0 | |

| Real Estate | | | 5.9 | |

| Telecommunication Services | | | 0.8 | |

| Utilities | | | 2.6 | |

| Other Assets & Liabilities, Net | | | 1.9 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

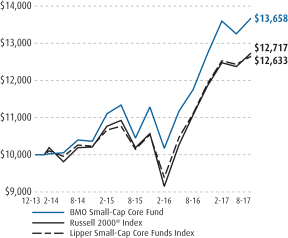

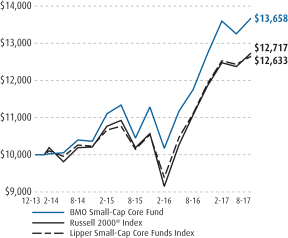

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

9

| | |

| Annual Report | | BMO Small-Cap Growth Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | — | | | | — | | | | 3.26 | |

| Advisor Class (A) OFFER | | | — | | | | — | | | | (1.92 | ) |

| Institutional Class (I) | | | 14.32 | | | | 10.51 | | | | 8.47 | |

| Russell 2000® Growth Index | | | 16.39 | | | | 13.75 | | | | 9.82 | |

| Lipper Small-Cap Growth Funds Index | | | 14.49 | | | | 12.26 | | | | 8.19 | |

| * | Cumulative for periods less than one year. Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

The Fund underperformed its benchmark due to stock selection, as sector allocation was a positive contributor to returns. The Fund’s overweight position in Healthcare added to performance, with no significant detractors in terms of sector allocation. Stock selection was particularly strong in Energy while selection in Consumer Discretionary detracted from performance. Within Energy, Sanchez Energy Corp. (0.0% of the Fund, 52.1%) was the top contributor to returns. Top detractors included Francesca’s Holding Corp. (0.4% of the Fund, -56.3%) and MarineMax, Inc. (0.8% of the Fund, -23.8%) in Consumer Discretionary.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BSLAX | | | | 09658V339 | | | | 5/31/2017 | | | | 1.17 | | | | 1.17 | |

| Institutional (I) | | | MSGIX | | | | 09658L620 | | | | 1/31/2008 | | | | 0.92 | | | | 0.92 | |

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 10.8 | |

| Consumer Staples | | | 2.8 | |

| Energy | | | 1.1 | |

| Financials | | | 4.5 | |

| Healthcare | | | 24.6 | |

| Industrials | | | 17.3 | |

| Information Technology | | | 27.0 | |

| Materials | | | 6.2 | |

| Real Estate | | | 2.5 | |

| Telecommunication Services | | | 1.0 | |

| Utilities | | | 1.0 | |

| Other Assets & Liabilities, Net | | | 1.2 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

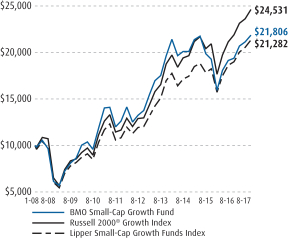

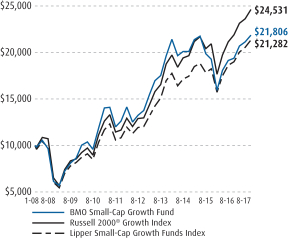

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

10

| | |

| Annual Report | | BMO Global Low Volatility Equity Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | 6.59 | | | | 6.52 | |

| Advisor Class (A) OFFER | | | 1.29 | | | | 4.85 | |

| Institutional Class (I) | | | 6.76 | | | | 8.56 | |

| Morgan Stanley Capital International All Country World Index | | | 17.75 | | | | 8.05 | |

| Lipper Global Multi-Cap Value Funds Index | | | 15.70 | | | | 6.32 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, the market experienced a partial reversal of post-election themes; with growth becoming scarce in the market, investors preferred stocks with higher growth rates over company valuations.

Consistent with our long term objective, the Fund provided upside participation during another positive year for equities. Our emphasis on stocks with attractive valuations was a detractor from performance, as investors favored more expensive growth companies. Sector positioning largely reflects our emphasis on risk reduction with significant weight in sectors like Consumer Staples and Utilities. An overweight to Consumer Staples and underweight to Information Technology were significant detractors from returns. An underweight position in Energy, however, was a positive contributor as a sudden pull back in oil prices caused the sector to trade lower.

Heading into the next fiscal year, we believe several themes will influence equity markets. From a policy standpoint, tax reform and infrastructure spending could support economic growth. These factors, combined with continued corporate earnings growth, could lead to positive stock market returns. However, markets could react negatively if fiscal or monetary policy falls short of expectations, including a more aggressive Federal Reserve. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

Jay Kaufman, CFA; since 2006

Ernesto Ramos, Ph.D.; since 1988

David Rosenblatt, CFA; since 2007

| | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) |

| Share class | | Ticker | | | Cusip | | | | Gross | | Net |

| Advisor (A) | | | BAEGX | | | | 09658W873 | | | | 5/27/2014 | | | 1.64 | | 1.11 |

| Institutional (I) | | | BGLBX | | | | 09658V768 | | | | 9/30/2013 | | | 1.39 | | 0.86 |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 4.7 | |

| Consumer Staples | | | 16.2 | |

| Financials | | | 20.0 | |

| Healthcare | | | 21.4 | |

| Industrials | | | 4.2 | |

| Information Technology | | | 7.3 | |

| Real Estate | | | 6.2 | |

| Telecommunication Services | | | 6.3 | |

| Utilities | | | 11.8 | |

| Other Assets & Liabilities, Net | | | 1.9 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

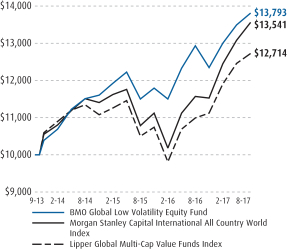

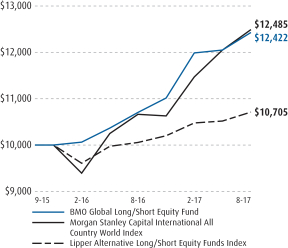

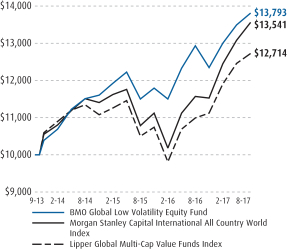

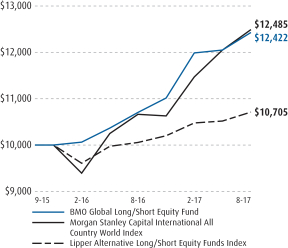

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

11

| | |

| Annual Report | | BMO Disciplined International Equity Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception* | |

| Advisor Class (A)NAV | | | 19.97 | | | | 7.26 | |

| Advisor Class (A)OFFER | | | 14.01 | | | | 4.47 | |

| Institutional Class (I) | | | 20.30 | | | | 7.52 | |

| Morgan Stanley Capital International Europe, Australasia, Far East Index | | | 17.64 | | | | 8.69 | |

| Lipper International Multi-Cap Core Funds Index | | | 17.28 | | | | 9.36 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

The fiscal year featured two distinct market environments. Immediately following the unanticipated outcome of the U.S. election, expectations of fiscal spending, deregulation, and tax cuts for individuals and corporations inspired a new sense of optimism among investors. That renewed outlook for future economic growth and inflation led to an increase in U.S. 10 year treasury yields, the repricing of expensive “bond proxy” stocks, and outperformance of more attractively valued pro-cyclical stocks. Since the end of 2016, however, international stocks in both developed and emerging markets outpaced U.S. stocks as corporate earnings and economic growth stabilized in international markets.

The Fund outperformed its benchmark due to our preference for fundamentally strong companies with reasonable valuations. The Fund’s relative performance was mostly driven by stock selection. An overweight position in Healthcare detracted from performance, while an underweight position in Real Estate contributed positively. In terms of country weights, an overweight position in France added to performance while an underweight position in Spain detracted. Stock selection was particularly strong in Financials, where Societe Generale SA (1.6% of the Fund, 61.0%) was a top contributor. Within Industrials, Royal Mail PLC (0.6% of the Fund, -20.5%) was the biggest detractor from returns.

As we look ahead, continued corporate earnings growth should lead to positive stock market returns. Any tax reform and infrastructure spending could further support economic growth, although with more uncertainty around these drivers. However, markets could react negatively with a slowdown in corporate earnings, or fiscal or monetary policy falls short of expectations. We also recognize a seeming disconnect between the equity and bond market that we continue to monitor. Accordingly, we have positioned your portfolio to participate in up markets while managing downside risks.

Fund Managers; Investment Experience

Jay Kaufman, CFA; since 2006

Ernesto Ramos, Ph.D.; since 1988

David Rosenblatt, CFA; since 2007

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Advisor (A) | | | BDAQX | | | | 09658W667 | | | | 9/17/2015 | | | | 1.45 | | | | 1.15 | |

| Institutional (I) | | | BDIQX | | | | 09658W659 | | | | 9/17/2015 | | | | 1.20 | | | | 0.90 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 10.2 | |

| Consumer Staples | | | 11.0 | |

| Energy | | | 2.6 | |

| Financials | | | 19.4 | |

| Healthcare | | | 14.7 | |

| Industrials | | | 15.4 | |

| Information Technology | | | 7.9 | |

| Materials | | | 9.4 | |

| Telecommunication Services | | | 3.7 | |

| Utilities | | | 2.8 | |

| Real Estate | | | 1.6 | |

| Other Assets & Liabilities, Net | | | 1.3 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

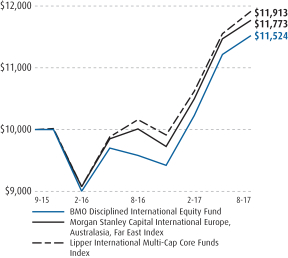

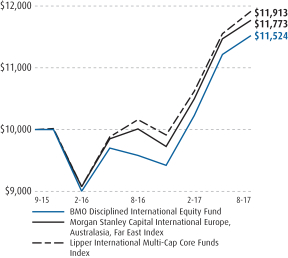

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

12

| | |

| Annual Report | | BMO Pyrford International Stock Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

| Investor Class (Y) | | | 10.38 | | | | 6.63 | | | | 7.19 | |

| Advisor Class (A)NAV | | | 10.38 | | | | — | | | | 1.59 | |

| Advisor Class (A)OFFER | | | 4.87 | | | | — | | | | 0.00 | |

| Institutional Class (I) | | | 10.68 | | | | 6.90 | | | | 7.47 | |

| Retirement Class (R-3) | | | 10.17 | | | | — | | | | 1.34 | |

| Retirement Class (R-6) | | | 10.85 | | | | — | | | | 1.98 | |

| Class F-3 | | | — | | | | — | | | | 0.08 | |

| Morgan Stanley Capital International Europe, Australasia, Far East Index | | | 17.64 | | | | 8.48 | | | | 8.96 | |

| Lipper International Multi-Cap Core Funds Index | | | 17.28 | | | | 8.44 | | | | 9.03 | |

| * | Cumulative for periods less than one year. Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

International equity markets were marked by a reflation trade over the second half of 2016 as investors looked to rotate out of defensive sectors into more cyclical areas of the market. Since the turn of the year, European equities have performed strongly though a strengthening Euro has the potential to tighten conditions. Concerns on economic growth remain with forecasts steadily being revised downward, though market sentiment has been helped by supportive central bank policy from Japan, Europe, and the U.S. Ordinarily, this liquidity would have translated into robust credit growth in the real economy, but in a world where banks are reluctant to lend because of capital constraints and asset quality concerns and the private sector is unwilling to borrow because of already high existing levels of debt, this traditional transmission mechanism is broken.

We maintained a very defensive stance during the year, concentrating on characteristics of value and quality—high dividend yield, low financial leverage, and high return on equity. The Fund underperformed during the period under review. Underperformance was predominantly driven by underweight financials and stock selection within Europe. Low quality cyclical stocks in peripheral Europe were buoyed by the potential for reflation and a steeper yield curve over the second half of 2016, an area we are underweight. We continue to be underweight as we remain concerned with asset quality. We strongly believe that the European debt crisis has not gone away and banks remain the most exposed when the structural problems of peripheral southern Europe resurface. Indeed, Italian banks have been the focus of the market given high levels of bad debts.

In Asia, Hong Kong stock selection was positive led by Information Technology names. The Hong Kong market has performed strongly year-to-date, leading us to reduce our country allocation on valuation concerns. Currency contribution was positive by being underweight the Japanese Yen, despite the best efforts of the Bank of Japan, the currency depreciated by more than 6% over the period.

Investment Adviser:

BMO Asset Management Corp.

Sub-adviser:

Pyrford International Ltd.

Fund Managers; Investment Experience

Tony Cousins, CFA; since 1985

Daniel McDonagh, CFA; since 1997

Paul Simons, CFA; since 1996

| | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) |

| Share class | | Ticker | | | Cusip | | | | Gross | | Net |

| Investor (Y) | | | MISYX | | | | 09658L497 | | | | 12/29/2011 | | | 1.31 | | 1.19 |

| Advisor (A) | | | BPIAX | | | | 09658W840 | | | | 5/27/2014 | | | 1.31 | | 1.19 |

| Institutional (I) | | | MISNX | | | | 09658L513 | | | | 12/29/2011 | | | 1.06 | | 0.94 |

| Retirement (R-3) | | | BISDX | | | | 09658V370 | | | | 5/27/2014 | | | 1.56 | | 1.44 |

| Retirement (R-6) | | | BISGX | | | | 09658V362 | | | | 5/27/2014 | | | 0.91 | | 0.79 |

| Class F-3 | | | BISBX | | | | 09658V321 | | | | 5/31/2017 | | | 0.91 | | 0.79 |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 3.0 | |

| Consumer Staples | | | 13.0 | |

| Energy | | | 9.9 | |

| Financials | | | 8.8 | |

| Healthcare | | | 9.9 | |

| Industrials | | | 18.5 | |

| Information Technology | | | 6.2 | |

| Materials | | | 4.1 | |

| Telecommunication Services | | | 11.9 | |

| Utilities | | | 6.5 | |

| Other Assets & Liabilities, Net | | | 8.2 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

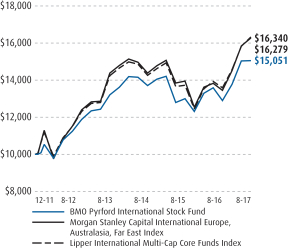

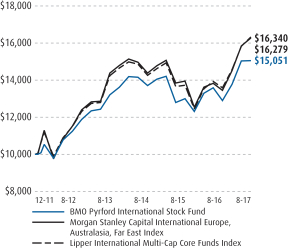

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Investor Class, Advisor Class, Retirement R-3, Retirement R-6 and F-3 Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

| | |

| Annual Report | | BMO LGM Emerging Markets Equity Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | 5-year | | | Since

inception* | |

Advisor Class (A) NAV | | | 14.03 | | | | — | | | | 5.60 | |

Advisor Class (A) OFFER | | | 8.32 | | | | — | | | | 3.96 | |

Institutional Class (I) | | | 14.36 | | | | 5.70 | | | | 9.72 | |

Morgan Stanley Capital International Emerging Markets Index | | | 24.53 | | | | 5.30 | | | | 10.69 | |

Lipper Emerging Markets Funds Index | | | 23.67 | | | | 5.65 | | | | 10.88 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

Two major events occurred in the fourth quarter of 2016, demonetization in India and the impact of Trump’s election on certain emerging market countries, in particular Mexico. The Fund has several investments in both markets. While both caused a significant spike in volatility, we believed they did not diminish the investment case for the Fund’s holdings and, as such, we added to conviction positions. This action materially benefited the Fund’s return in 2017.

The Fund’s relative underperformance was primarily due to negative allocation effects from underweighting China and security selection in Indonesia, Vietnam, and the Philippines. In the Philippines, Universal Robina Corp. (URC) (3.6% of the Fund, -37.7%) was the largest detractor to the Fund’s performance. We raised our concerns with the stock in conversations with company management while in Manila in 2017. Our concerns included the high cost of recent acquisitions, the overall competitive environment, and lingering problems caused by product recalls in Vietnam. We came away greatly reassured, even though the competitive environment is likely to remain tough over the medium term. With URC’s market-leading brands in underpenetrated categories, superior distribution, robust balance sheet, and great management team, we remain confident in the long-term outlook for this business.

Adding to performance included security selection in India, South Africa, and Turkey. BIM Birlesik Magazalar AS (BIM), a Turkish discount retailer, (3.5% of the Fund, 31.7%) has a focus on the long-term and a ruthless attention to cost efficiency. BIM only operates in non-prime locations, has a narrow product offering (roughly 600 products of which about 70% are private label), and has a first-mover advantage, allowing them to build scale. This scale gives BIM bargaining power with suppliers and, combined with lower real estate costs and fewer product offerings, provides BIM with a much lower cost base than competitors.

Investment Adviser:

BMO Asset Management Corp.

Sub-adviser:

LGM Investments Limited

Fund Managers; Investment Experience

Damian Bird, CFA; since 2008

Irina Hunter; since 1994

Rishikesh Patel; since 2003

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

Advisor (A) | | | BAEMX | | | | 09658W824 | | | | 5/27/2014 | | | | 1.64 | | | | 1.40 | |

Institutional (I) | | | MIEMX | | | | 09658L489 | | | | 12/22/2008 | | | | 1.39 | | | | 1.15 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

Consumer Discretionary | | | 11.7 | |

Consumer Staples | | | 39.0 | |

Financials | | | 32.7 | |

Healthcare | | | 1.5 | |

Industrials | | | 1.6 | |

Information Technology | | | 1.9 | |

Materials | | | 1.0 | |

Utilities | | | 1.7 | |

Common Stock Units | | | 2.4 | |

Participation Notes | | | 2.6 | |

| Other Assets & Liabilities, Net | | | 3.9 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

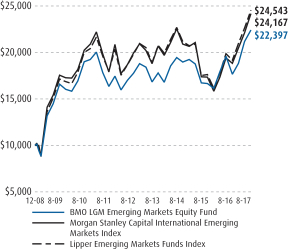

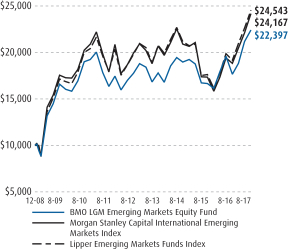

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information. The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2007 to August 31, 2017.

14

| | |

| Annual Report | | BMO TCH Emerging Markets Bond Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception* | |

| Advisor Class (A) NAV | | | 4.92 | | | | 3.91 | |

| Advisor Class (A) OFFER | | | 1.23 | | | | 2.78 | |

| Institutional Class (I) | | | 5.07 | | | | 5.75 | |

| JP Morgan Emerging Markets Bond Global Diversified Index | | | 5.02 | | | | 7.44 | |

| Lipper Emerging Markets Hard Currency Debt Funds Index | | | 7.67 | | | | 5.40 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

Commentary

In our view, the moderate approach the Federal Reserve (the Fed) appears to be taking with regard to their balance sheet is positive for the emerging market debt sector. Many investors had feared that eventual policy normalization would withdraw liquidity and hurt the sector, but the slow, deliberate course the Fed is charting projects more stability for the sector. Emerging market debt performance has been more positive than many expected and with spread tightening in other sectors even more in the second quarter, emerging market debt continues to appear attractive on a relative basis. The dollar continued to weaken in the second quarter, erasing almost all of the rise post-election in 2016, despite the second rate hike of 2017. This weakening should benefit hard currency emerging market debt.

The Fund delivered strong absolute returns for the fiscal year, outperforming the benchmark, but lagged the peer group. The period was characterized by meaningful rate increases and spread compression that left overall yields in a similar position after a strong year of performance for the sector.

The Fund is diversified to various sectors relative to its benchmark, which is comprised primarily of sovereign and fully owned quasi-sovereign issuers. Corporate and quasi-sovereign sectors outperformed the sovereign benchmark, adding to the Fund’s relative returns. The Fund maintains a higher quality bias versus the benchmark. For the trailing period, non-investment grade outperformed investment grade emerging market debt by nearly 600 basis points, detracting from relative performance.

Regional allocations contributed to Fund performance. Below benchmark allocations to Asia benefited performance for the trailing twelve months, and increasing allocations to the Middle East and North Africa from approximately benchmark weight to overweight benefited the Fund as that was the top performing region for the Fund’s fiscal year. By country, the Fund was overweight Mexico which underperformed, but underweight Philippines, which underperformed.

While U.S. policy priorities appear less focused on trade than several months ago, potential further volatility around U.S. political rhetoric could continue to create opportunities. As a whole, current emerging market yields remain attractive and we expect sub-sector and security selection opportunities to be important drivers of returns in the coming quarters.

Investment Adviser:

BMO Asset Management Corp.

Sub-adviser:

Taplin, Canida & Habacht, LLC

Fund Managers; Investment Experience

Scott M. Kimball, CFA; since 2004

Daniela Mardarovici, CFA; since 2000

Frank J. Reda, CMT; since 2001

Janelle Woodward, CFA; since 2003

| | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) |

| Share class | | Ticker | | | Cusip | | | | Gross | | Net |

| Advisor (A) | | | BAMEX | | | | 09658W816 | | | | 5/27/2014 | | | 2.84 | | 1.00 |

| Institutional (I) | | | MEBIX | | | | 09658L448 | | | | 9/30/2013 | | | 2.59 | | 0.85 |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2017. The Adviser has committed to continue this arrangement through December 31, 2018. The Fund’s return would have been lower without these contractual expense limitations.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Corporate Bonds & Notes | | | 55.0 | |

| International Bonds | | | 41.5 | |

| Other Assets & Liabilities, Net | | | 3.5 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2017 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

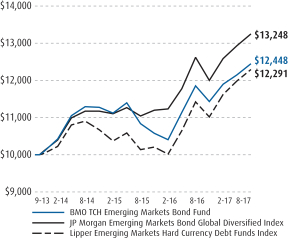

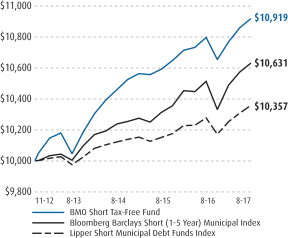

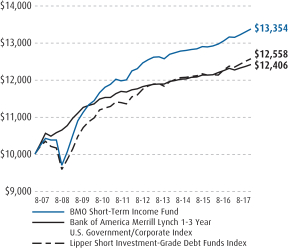

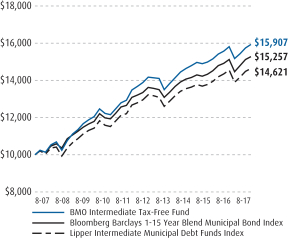

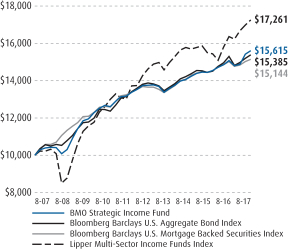

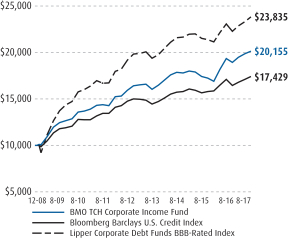

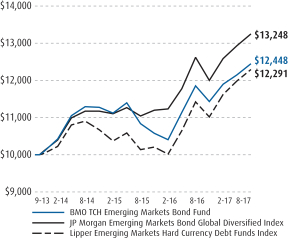

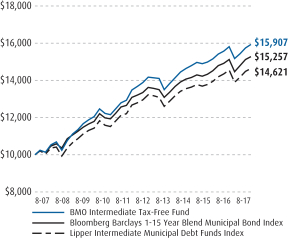

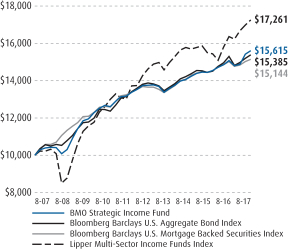

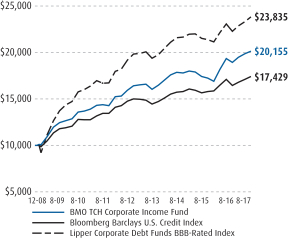

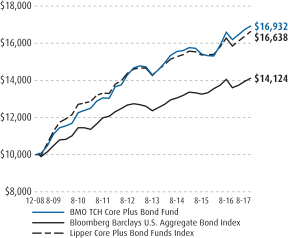

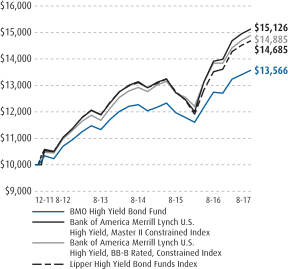

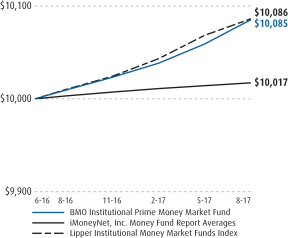

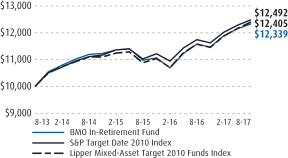

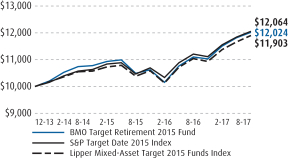

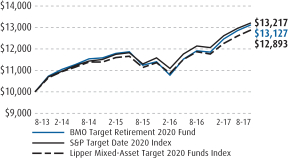

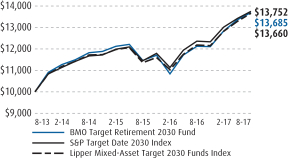

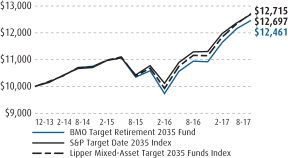

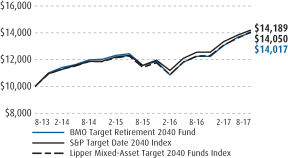

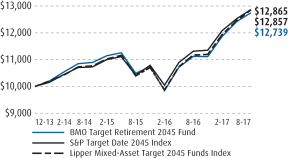

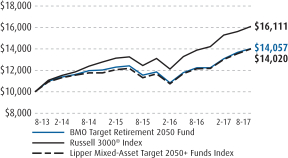

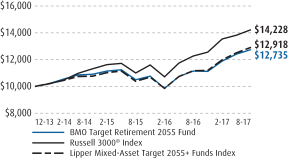

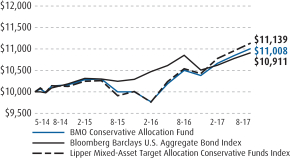

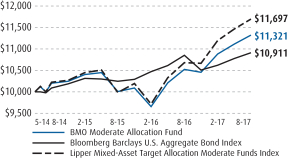

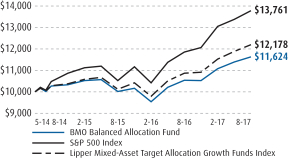

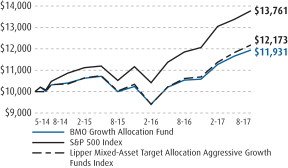

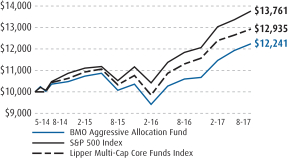

Growth of an assumed $10,000 investment