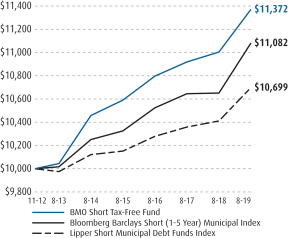

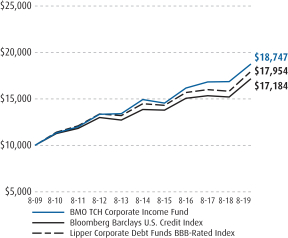

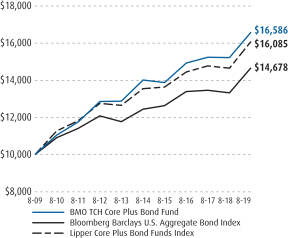

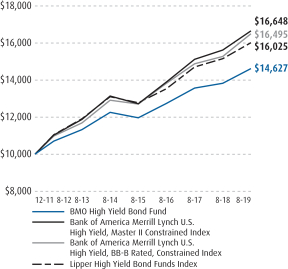

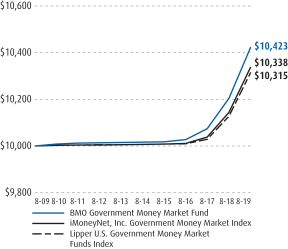

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number811-58433

BMO Funds, Inc.

(Exact name of registrant as specified in charter)

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

John M. Blaser

BMO Asset Management Corp.

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Name and address of agent for service)

Copies to:

Michael P. O’Hare, Esq.

Stradley, Ronon, Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

Registrant’s telephone number, including area code:(800)236-3863

Date of fiscal year end:August 31

Date of reporting period:August 31, 2019

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940, as amended (the “Act”).

Annualreport

Equity Funds

International & Global Funds

Alternative Funds

Fixed Income Funds

Money Market Funds

Notification of electronic delivery of shareholder materials

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your broker/dealer, investment professional, or financial institution. Instead, the reports will be made available online at bmofunds.com/documents, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by calling 1-800-236-FUND (3863), by sending an email request to bmofundsus.services@bmo.com, or by asking your broker/dealer, investment professional, or financial institution.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call the Funds toll-free at1-800-236-FUND (3863) or send an email request to bmofundsus.services@bmo.com. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Funds.

Table of Contents

| | | | |

Not FDIC Insured | | No Bank Guarantee | | May Lose Value |

| | |

| | |

| Annual Report | | BMO Low Volatility Equity Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | Since

Inception | |

| Advisor Class (A)NAV | | | 11.80 | | | | 9.96 | | | | 10.26 | |

| Advisor Class (A)OFFER | | | 6.20 | | | | 8.84 | | | | 9.20 | |

| Institutional Class (I) | | | 12.18 | | | | 10.26 | | | | 12.20 | |

| Russell 1000® Index | | | 2.49 | | | | 9.85 | | | | 13.08 | |

| Lipper Multi-Cap Core Funds Index | | | (0.85 | ) | | | 7.89 | | | | 11.53 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMO Low Volatility Equity Fund (the Fund) returned 12.18% for the fiscal year ended August 31, 2019 versus the Russell 1000® Index and the LipperMulti-Cap Core Funds Index, which returned 2.49% and -0.85%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund outperformed the Russell 1000® Index in the fiscal year. Both sector allocation and stock selection were positive for the period. The Fund’s overweight positions in Utilities and Consumer Staples added to performance, while underweight positions in Information Technology and Communication Services detracted from performance. Stock selection was strongest in Consumer Discretionary and Financials. Consumer Staples was the only sector in which stock selection contributed negatively for the period. Autozone Inc. (AZO) (2.3% of the Fund, 43.7% return) and Motorola Solutions Inc. (MSI) (2.6% of the Fund, 43.2% return) added to the Fund’s performance, while Occidental Petroleum Corp. (OXY) (0.5% of the Fund, -42.8% return) and Kroger Co. (KR) (1.4% of the Fund, -23.1% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Jay Kaufman, CFA; since 2006

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception

date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BAEGX | | | | 09658W105 | | | | 5/27/2014 | | | | 1.03 | | | | 0.90 | |

| Institutional (I) | | | MLVEX | | | | 09658L208 | | | | 9/28/2012 | | | | 0.78 | | | | 0.65 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 5.1 | |

| Consumer Discretionary | | | 10.9 | |

| Consumer Staples | | | 16.5 | |

| Energy | | | 3.0 | |

| Financials | | | 13.9 | |

| Healthcare | | | 10.0 | |

| Industrials | | | 6.7 | |

| Information Technology | | | 4.6 | |

| Materials | | | 2.1 | |

| Real Estate | | | 10.2 | |

| Utilities | | | 12.8 | |

| Other Assets & Liabilities, Net | | | 4.2 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

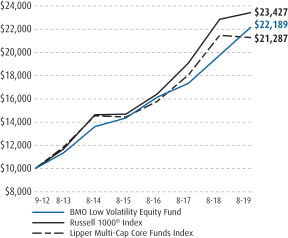

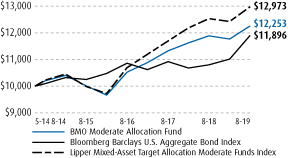

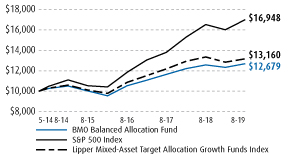

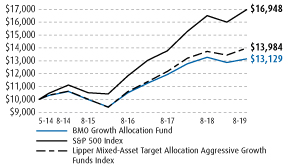

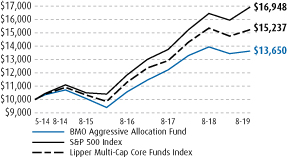

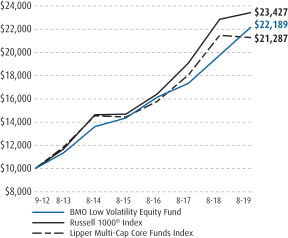

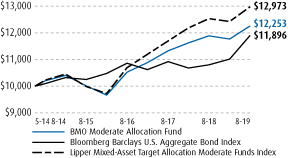

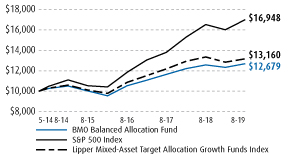

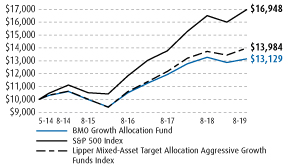

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

2

| | |

| | |

| Annual Report | | BMO Dividend Income Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (3.51 | ) | | | 7.80 | | | | 8.56 | |

| Advisor Class (A)OFFER | | | (8.31 | ) | | | 6.71 | | | | 7.52 | |

| Institutional Class (I) | | | (3.24 | ) | | | 8.07 | | | | 11.68 | |

| Russell 1000® Value Index | | | 0.62 | | | | 6.59 | | | | 11.80 | |

| Standard & Poor’s 500® Index | | | 2.92 | | | | 10.11 | | | | 13.92 | |

| Lipper Equity Income Funds Index | | | 2.95 | | | | 7.26 | | | | 11.11 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMO Dividend Income Fund (the Fund) returned-3.24% for the fiscal year ended August 31, 2019 versus the Russell 1000® Value Index, the Standard & Poor’s 500® Index and the Lipper Equity Income Funds Index, which returned 0.62%, 2.92% and 2.95%, respectively.

Trade war escalation and volatile interest rate outlooks continued to influence the market environment during the 2019 fiscal year. Despite early optimism on a finalized trade deal with Canada and Mexico, and progress towards an agreement with China, the narrative has been negative as tariffs have increased and caused investors additional concerns. The U.S. Federal Reserve did an about face on raising interest rates early in 2019 and have now begun a rate cutting cycle. This shift has led to investors flocking to stocks with higher growth and/or lower volatility characteristics. Conversely, they have shunned cheap economically cyclical stocks.

The Fund’s performance was hampered by our active decision to rotate out of stocks that have seen their valuations become historically stretched. Our research shows that the spread between expensive and cheap stocks has now become statistically significant such that the expected future return of cheaper stocks is attractive. Unfortunately, this worked against the Fund as the global economic and trade related uncertainty led investors to continue to shun cheap value stocks with higher dividend yields. Our exposure to higher yielding, cyclical stocks in the Financials, Materials, and Energy sectors detracted from performance.

The Fund benefited from strong stock selection within the new Communication Services sector. Comcast (3.0% of the Fund, +22.2% return) benefited from healthy demand for its broadband services. Investors were attracted to telecom giants Verizon (3.0% of the Fund, +11.6% return) and AT&T (2.0% of the Fund, +17.5 return) due to their domestic focus, high dividend yields, and low risk profiles. Stock selection in the Consumer Discretionary sector detracted from Fund performance. Retailer Kohl’s (1.2% of the Fund,-37.8% return) was hurt by a combination of bad weather, poor business execution, and online competitive threats.

As we look toward fiscal year 2020, we believe several themes exist that will influence equity markets. From a policy standpoint, we believe investor sentiment will be influenced by any improvement in the trade wars and an improvement in the global economy. Investors also will assess potential outcomes of the next presidential election and their impact on financial markets. Finally, the actions of the Federal Reserve likely will play an important role in the markets over the coming year. Accordingly, we have positioned the Fund to participate in appreciating markets while managing downside risks.

Fund Managers; Investment Experience

Kenneth M. Conrad, Ph.D., CFA; since 2000

Casey J. Sambs, CFA; since 2004

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BADIX | | | | 09658W204 | | | | 5/27/2014 | | | | 1.04 | | | | 0.90 | |

| Institutional (I) | | | MDIVX | | | | 09658L604 | | | | 12/29/2011 | | | | 0.79 | | | | 0.65 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 8.0 | |

| Consumer Discretionary | | | 6.0 | |

| Consumer Staples | | | 5.7 | |

| Energy | | | 7.6 | |

| Financials | | | 15.9 | |

| Healthcare | | | 11.4 | |

| Industrials | | | 7.7 | |

| Information Technology | | | 16.4 | |

| Materials | | | 2.6 | |

| Real Estate | | | 6.5 | |

| Utilities | | | 6.7 | |

| Other Assets & Liabilities, Net | | | 5.5 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

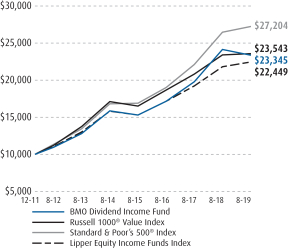

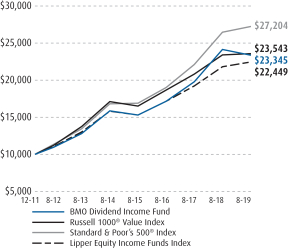

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

3

| | |

| | |

| Annual Report | | BMOLarge-Cap Value Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | 10-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (7.15 | ) | | | 5.11 | | | | — | | | | 5.89 | |

| Advisor Class (A)OFFER | | | (11.78 | ) | | | 4.03 | | | | — | | | | 4.86 | |

| Institutional Class (I) | | | (6.97 | ) | | | 5.37 | | | | 10.32 | | | | 6.12 | |

| Retirement Class (R-6) | | | (6.80 | ) | | | — | | | | — | | | | 7.13 | |

| Russell 1000® Value Index | | | 0.62 | | | | 6.59 | | | | 11.49 | | | | 11.49 | |

| Lipper Multi-Cap Value Funds Index | | | (4.31 | ) | | | 4.63 | | | | 9.90 | | | | 9.90 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOLarge-Cap Value Fund (the Fund) returned-6.97% for the fiscal year ended August 31, 2019 versus the Russell 1000® Value Index and the LipperMulti-Cap Value Funds Index, which returned 0.62% and-4.31%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell 1000® Value Index in the fiscal year. Sector allocation was positive for the period, while stock selection was negative. The Fund’s overweight position in Utilities and underweight position in Energy added to performance, while underweight positions in Communication Services and Consumer Staples detracted from performance. Stock selection was strongest in Utilities and Communication Services and weakest in Information Technology and Health Care. Essex Property Trust, Inc. (ESS) (2.8% of the Fund, 34.2% return) and Entergy Corporation (ETR) (3.0% of the Fund, 40.4% return) added to the portfolio’s performance, while DXC Technology, Co. (DXC) (0.2% of the Fund, -63.1% return) and Procter & Gamble Company (PG) (0.4% of the Fund, -43.2% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BALVX | | | | 09658W303 | | | | 5/27/2014 | | | | 0.85 | | | | 0.79 | |

| Institutional (I) | | | MLVIX | | | | 09658L844 | | | | 1/31/2008 | | | | 0.61 | | | | 0.54 | |

| Retirement(R-6) | | | BLCRX | | | | 09658W568 | | | | 12/28/2015 | | | | 0.42 | | | | 0.39 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 5.3 | |

| Consumer Discretionary | | | 8.1 | |

| Consumer Staples | | | 10.2 | |

| Energy | | | 6.6 | |

| Financials | | | 21.4 | |

| Healthcare | | | 12.5 | |

| Industrials | | | 8.9 | |

| Information Technology | | | 9.6 | |

| Materials | | | 1.1 | |

| Real Estate | | | 7.5 | |

| Utilities | | | 6.8 | |

| Other Assets & Liabilities, Net | | | 2.0 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

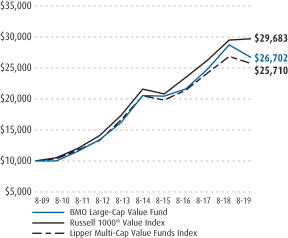

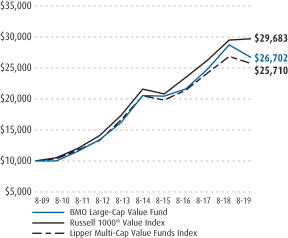

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class and RetirementR-6 shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

4

| | |

| | |

| Annual Report | | BMOLarge-Cap Growth Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | 10-Years | | | Since Inception | |

| Investor Class (Y) | | | (0.62 | ) | | | 12.09 | | | | 14.61 | | | | 8.12 | |

| Advisor Class (A)NAV | | | (0.63 | ) | | | 12.10 | | | | — | | | | 12.83 | |

| Advisor Class (A)OFFER | | | (5.59 | ) | | | 10.96 | | | | — | | | | 11.76 | |

| Institutional Class (I) | | | (0.40 | ) | | | 12.38 | | | | 14.89 | | | | 10.70 | |

| Retirement Class (R-6) | | | (0.22 | ) | | | — | | | | — | | | | 14.14 | |

| Russell 1000® Growth Index | | | 4.27 | | | | 13.06 | | | | 15.42 | | | | 15.42 | |

| Lipper Multi-Cap Growth Funds Index | | | 2.52 | | | | 10.76 | | | | 13.89 | | | | 13.89 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOLarge-Cap Growth Fund (the Fund) returned -0.40% for the fiscal year ended August 31, 2019 versus the Russell 1000® Growth Index and the LipperMulti-Cap Growth Funds Index, which returned 4.27% and 2.52%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell 1000® Growth Index in the fiscal year. Both sector allocation and stock selection were negative for the period. The Fund’s overweight positions in Real Estate and Financials added to performance, while an overweight position in Energy and an underweight position in Consumer Staples detracted from performance. Stock selection was strongest in Health Care and Consumer Staples and weakest in Information Technology and Consumer Discretionary. Hershey Company (HSY) (1.8% of the Fund, 61.4% return) and Essex Property Trust, Inc. (ESS) (1.0% of the Fund, 34.2% return) (1.8% of the Fund, 61.4% return) added to the portfolio’s performance, while TripAdvisor, Inc. (TRIP) (0.7% of the Fund, -30.1% return) and ConocoPhillips, Co. (COP) (1.4% of the Fund, -27.6% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Jason C. Hans, CFA; since 1999

Ernesto Ramos, Ph.D.; since 1988

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Investor (Y) | | | MASTX | | | | 09658L745 | | | | 11/20/1992 | | | | 0.85 | | | | 0.79 | |

| Advisor (A) | | | BALGX | | | | 09658W402 | | | | 5/27/2014 | | | | 0.85 | | | | 0.79 | |

| Institutional (I) | | | MLCIX | | | | 09658L752 | | | | 1/31/2008 | | | | 0.60 | | | | 0.54 | |

| Retirement(R-6) | | | BLGRX | | | | 09658W576 | | | | 12/28/2015 | | | | 0.42 | | | | 0.39 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 11.2 | |

| Consumer Discretionary | | | 12.5 | |

| Consumer Staples | | | 6.7 | |

| Energy | | | 1.4 | |

| Financials | | | 6.3 | |

| Healthcare | | | 13.1 | |

| Industrials | | | 9.7 | |

| Information Technology | | | 34.7 | |

| Materials | | | 1.2 | |

| Real Estate | | | 1.5 | |

| Other Assets & Liabilities, Net | | | 1.7 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

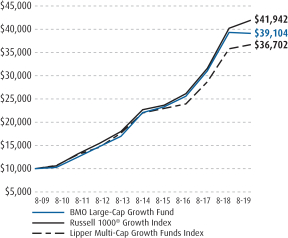

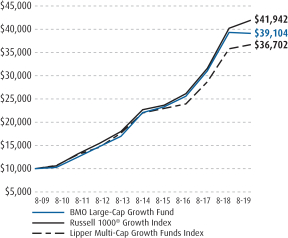

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Investor Class shares of the Fund. Performance for the Institutional Class, Advisor Class and RetirementR-6 shares will vary from the performance of the Investor Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Investor Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

5

| | |

| | |

| Annual Report | | BMOMid-Cap Value Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | 10-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (9.63 | ) | | | 3.20 | | | | — | | | | 4.24 | |

| Advisor Class (A)OFFER | | | (14.18 | ) | | | 2.14 | | | | — | | | | 3.24 | |

| Institutional Class (I) | | | (9.47 | ) | | | 3.44 | | | | 10.43 | | | | 7.18 | |

| Retirement Class (R-6) | | | (9.37 | ) | | | 3.58 | | | | — | | | | 4.64 | |

| Russell Midcap® Value Index | | | (3.13 | ) | | | 5.88 | | | | 12.46 | | | | 12.46 | |

| Lipper Mid-Cap Value Funds Index | | | (8.57 | ) | | | 3.63 | | | | 10.47 | | | | 10.47 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOMid-Cap Value Fund (the Fund) returned-9.47% for the fiscal year ended August 31, 2019 versus the Russell Midcap® Value Index and the LipperMid-Cap Value Funds Index, which returned-3.13% and -8.57%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell Midcap® Value Index in the fiscal year. Both sector allocation and stock selection were negative for the period. The Fund’s overweight position in Information Technology and underweight position in Energy added to performance, while an overweight position in Health Care and an underweight position in Utilities detracted from performance. Stock selection was strongest in Health Care and Energy and weakest in Information Technology and Consumer Discretionary. Hershey Company (HSY) (1.9% of the Fund, 61.4% return) and AutoZone, Inc (AZO) (1.7% of the Fund; 43.7% return) added to the portfolio’s performance, while PBF Energy, Inc. (PBF) (0.8% of the Fund, -52.4% return) and Cimarex Energy, Co. (XEC) (0.7% of the Fund, -48.7% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; Since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BAMCX | | | | 09658W501 | | | | 5/27/2014 | | | | 1.25 | | | | 1.24 | |

| Institutional (I) | | | MRVIX | | | | 09658L711 | | | | 1/31/2008 | | | | 1.00 | | | | 0.99 | |

| Retirement(R-6) | | | BMVGX | | | | 09658V438 | | | | 5/27/2014 | | | | 0.83 | | | | 0.83 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 1.1 | |

| Consumer Discretionary | | | 6.9 | |

| Consumer Staples | | | 7.1 | |

| Energy | | | 3.8 | |

| Financials | | | 19.3 | |

| Healthcare | | | 10.2 | |

| Industrials | | | 10.5 | |

| Information Technology | | | 10.0 | |

| Materials | | | 3.7 | |

| Real Estate | | | 14.8 | |

| Utilities | | | 10.3 | |

| Other Assets & Liabilities, Net | | | 2.3 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

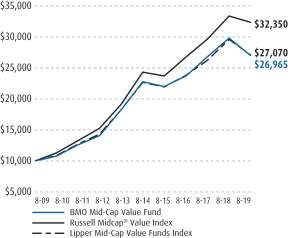

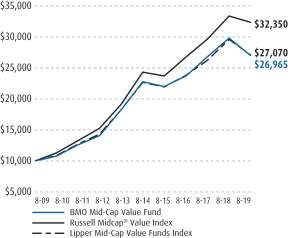

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class and RetirementR-6 shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

6

| | |

| | |

| Annual Report | | BMOMid-Cap Growth Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | 10-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (2.95 | ) | | | 6.40 | | | | — | | | | 6.97 | |

| Advisor Class (A)OFFER | | | (7.83 | ) | | | 5.31 | | | | — | | | | 5.93 | |

| Institutional Class (I) | | | (2.75 | ) | | | 6.66 | | | | 12.41 | | | | 8.33 | |

| Retirement Class (R-6) | | | (2.54 | ) | | | 6.84 | | | | — | | | | 7.40 | |

| Russell Midcap® Growth Index | | | 5.96 | | | | 10.72 | | | | 14.85 | | | | 14.85 | |

| Lipper Mid-Cap Growth Funds Index | | | 5.03 | | | | 10.53 | | | | 13.68 | | | | 13.68 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOMid-Cap Value Fund (the Fund) returned-2.75% for the fiscal year ended August 31, 2019 versus the Russell Midcap® Growth Index and the LipperMid-Cap Growth Funds Index, which returned 5.96% and 5.03%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell Midcap® Growth Index in the fiscal year. Both sector allocation and stock selection were negative for the period. The Fund’s underweight position in Consumer Discretionary and overweight position in Information Technology added to performance, while an overweight position in Energy and an underweight position in Industrials detracted from performance. Health Care was the only sector in which stock selection contributed positively for the period. Stock selection was weakest in Industrials and Materials. Euronet Worldwide, Inc. (EEFT) (1.7% of the Fund, 56.6% return) and Keysight Technologies, Inc (KEYS) (2.0% of the Fund, 49.3% return) added to the portfolio’s performance, while Schneider National, Inc. (SNDR) (0.0% of the Fund; -27.3% return) and Brunswick Corporation (BC) (0.0% of the Fund; -28.6% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BGMAX | | | | 09658W600 | | | | 5/27/2014 | | | | 1.31 | | | | 1.24 | |

| Institutional (I) | | | MRMIX | | | | 09658L737 | | | | 1/31/2008 | | | | 1.06 | | | | 0.99 | |

| Retirement(R-6) | | | BMGGX | | | | 09658V412 | | | | 5/27/2014 | | | | 0.88 | | | | 0.84 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 2.6 | |

| Consumer Discretionary | | | 16.0 | |

| Consumer Staples | | | 4.0 | |

| Energy | | | 1.8 | |

| Financials | | | 4.3 | |

| Healthcare | | | 14.5 | |

| Industrials | | | 12.8 | |

| Information Technology | | | 34.6 | |

| Materials | | | 2.2 | |

| Real Estate | | | 5.5 | |

| Other Assets & Liabilities, Net | | | 1.7 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

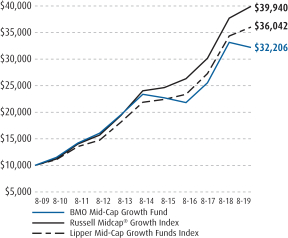

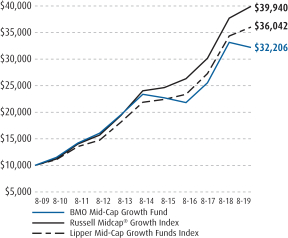

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class and RetirementR-6 shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

7

| | |

| | |

| Annual Report | | BMOSmall-Cap Value Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (16.19 | ) | | | 2.70 | | | | 3.13 | |

| Advisor Class (A)OFFER | | | (20.39 | ) | | | 1.65 | | | | 2.12 | |

| Institutional Class (I) | | | (15.93 | ) | | | 2.96 | | | | 7.91 | |

| Retirement Class (R-6) | | | (15.81 | ) | | | 3.14 | | | | 3.57 | |

| Russell 2000® Value Index | | | (14.89 | ) | | | 4.63 | | | | 7.35 | |

| Lipper Small-Cap Core Funds Index | | | (10.51 | ) | | | 6.34 | | | | 8.56 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOSmall-Cap Value Fund (the Fund) returned-15.93% for the fiscal year ended August 31, 2019 versus the Russell 2000® Value Index and the LipperSmall-Cap Core Funds Index, which returned-14.89% and -10.51%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell 2000® Value Index in the fiscal year. Sector allocation was negative for the period, while stock selection was positive. The Fund’s underweight positions in Energy and Consumer Staples added to performance, while an overweight position in Health Care and an underweight position in Utilities detracted from performance. Stock selection was strongest in Health Care and Communication Services and weakest in Consumer Discretionary and Real Estate. Sinclair Broadcast Group, Inc. (SBGI) (0.0% of the Fund, 57.1% return) and Ciena Corporation (CIEN) (0.6% of the Fund, 29.6% return) added to the portfolio’s performance, while Cooper-Standard Holdings, Inc. (CPS) (0.2% of the Fund, -73.0% return) and Realogy Holdings Corp. (RLGY) (0.2% of the Fund, -76.8% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; Since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BACVX | | | | 09658W709 | | | | 5/27/2014 | | | | 1.41 | | | | 1.24 | |

| Institutional (I) | | | MRSNX | | | | 09658L596 | | | | 2/28/2011 | | | | 1.16 | | | | 0.99 | |

| Retirement(R-6) | | | BSVGX | | | | 09658V388 | | | | 5/27/2014 | | | | 0.97 | | | | 0.84 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 0.6 | |

| Consumer Discretionary | | | 6.8 | |

| Consumer Staples | | | 0.9 | |

| Energy | | | 5.4 | |

| Financials | | | 27.1 | |

| Healthcare | | | 7.4 | |

| Industrials | | | 15.6 | |

| Information Technology | | | 10.8 | |

| Materials | | | 5.0 | |

| Real Estate | | | 13.5 | |

| Utilities | | | 5.6 | |

| Other Assets & Liabilities, Net | | | 1.3 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

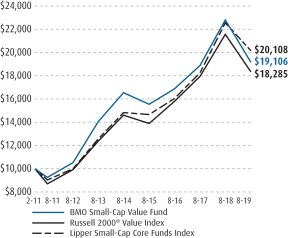

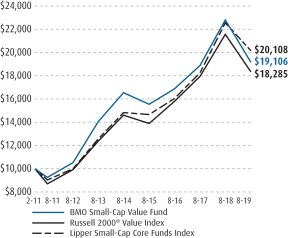

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class and RetirementR-6 shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

8

| | |

| | |

| Annual Report | | BMOSmall-Cap Core Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | Since Inception | |

| Advisor Class (A)NAV | | | (17.39 | ) | | | 5.47 | | | | 5.78 | |

| Advisor Class (A)OFFER | | | (21.55 | ) | | | 4.39 | | | | 4.75 | |

| Institutional Class (I) | | | (17.18 | ) | | | 5.73 | | | | 5.76 | |

| Russell 2000® Index | | | (12.89 | ) | | | 6.41 | | | | 5.98 | |

| Lipper Small-Cap Core Funds Index | | | (10.51 | ) | | | 6.34 | | | | 6.04 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOSmall-Cap Core Fund (the Fund) returned-17.18% for the fiscal year ended August 31, 2019 versus the Russell 2000® Index and the LipperSmall-Cap Core Funds Index, which returned-12.89% and-10.51%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell 2000® Index in the fiscal year. Both sector allocation and stock selection were negative for the period. The Fund’s overweight position in Information Technology and underweight position in Energy added to performance, while an overweight position in Health Care and an underweight position in Utilities detracted from performance. Stock selection was strongest in Health Care and Energy and weakest in Information Technology and Consumer Discretionary. Novocure, Ltd. (NVCRE) (1.0% of the Fund, 101.7% return) and Performance Food Group Company (PFGC) (1.3% of the Fund, 41.4% return) added to the portfolio’s performance, while Evolent Health, Inc. (EVH) (0.4% of the Fund,-73.1% return) and Realogy Holdings Corp. (RLGY) (0.2% of the Fund; -76.8% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; Since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BCCAX | | | | 09658W808 | | | | 5/27/2014 | | | | 1.62 | | | | 1.15 | |

Institutional

(I) | | | BSCNX | | | | 09658V537 | | | | 12/27/2013 | | | | 1.37 | | | | 0.90 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 2.8 | |

| Consumer Discretionary | | | 7.6 | |

| Consumer Staples | | | 3.7 | |

| Energy | | | 2.0 | |

| Financials | | | 15.8 | |

| Healthcare | | | 19.3 | |

| Industrials | | | 18.0 | |

| Information Technology | | | 16.2 | |

| Materials | | | 3.0 | |

| Real Estate | | | 6.6 | |

| Utilities | | | 2.9 | |

| Other Assets & Liabilities, Net | | | 2.1 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

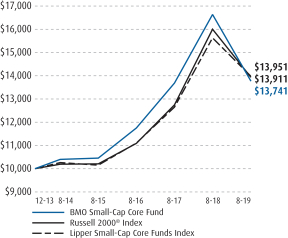

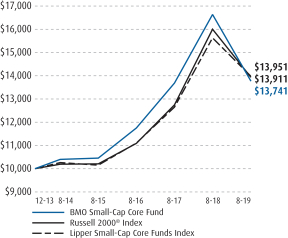

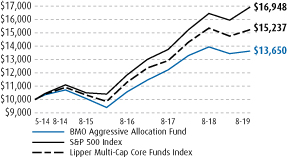

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

9

| | |

| | |

| Annual Report | | BMOSmall-Cap Growth Fund |

| | | | | | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | 10-Years | | | Since

Inception | |

| Advisor Class (A)NAV | | | (16.12 | ) | | | — | | | | — | | | | 5.96 | |

| Advisor Class (A)OFFER | | | (20.33 | ) | | | — | | | | — | | | | 3.57 | |

| Institutional Class (I) | | | (15.92 | ) | | | 3.79 | | | | 11.52 | | | | 7.92 | |

| Russell 2000® Growth Index | | | (11.02 | ) | | | 8.06 | | | | 13.06 | | | | 13.06 | |

| Lipper Small-Cap Growth Funds Index | | | (4.41 | ) | | | 10.09 | | | | 13.50 | | | | 13.50 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMOSmall-Cap Growth Fund (the Fund) returned-15.92% for the fiscal year ended August 31, 2019 versus the Russell 2000® Growth Index and the LipperSmall-Cap Growth Funds Index, which returned-11.02% and-4.41%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund underperformed the Russell 2000® Growth Index in the fiscal year. Both sector allocation and stock selection were negative for the period. The Fund’s overweight positions in Information Technology and Real Estate added to performance, while an overweight position in Energy and an underweight position in Utilities detracted from performance. Stock selection was strongest in Health Care and Consumer Staples and weakest in Information Technology andConsumer Discretionary. Ciena Corporation (CIEN) (0.9% of the Fund, 29.6% return) and Genomic Health Inc. (GHDX) (1.2% of the Fund, 25.3% return) added to the portfolio’s performance, while Evolent Health, Inc. (EVH) (0.5% of the Fund; -73.1% return) and TrueCar, Inc. (TRUE) (0.4% of the Fund, -69.2% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

David A. Corris, CFA; since 1999

Thomas Lettenberger, CFA; Since 1994

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BSLAX | | | | 09658V339 | | | | 5/31/2017 | | | | 1.28 | | | | 1.24 | |

Institutional

(I) | | | MSGIX | | | | 09658L620 | | | | 1/31/2008 | | | | 1.02 | | | | 0.99 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 3.2 | |

| Consumer Discretionary | | | 10.2 | |

| Consumer Staples | | | 5.1 | |

| Energy | | | 1.0 | |

| Financials | | | 5.3 | |

| Healthcare | | | 28.3 | |

| Industrials | | | 19.7 | |

| Information Technology | | | 18.9 | |

| Materials | | | 2.6 | |

| Real Estate | | | 4.4 | |

| Other Assets & Liabilities, Net | | | 1.3 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

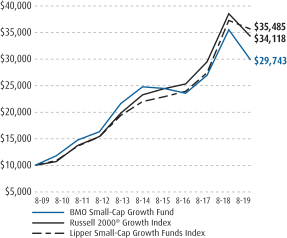

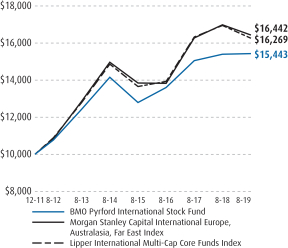

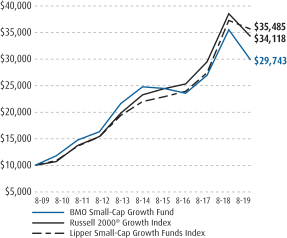

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

10

| | |

| | |

| Annual Report | | BMO Global Low Volatility Equity Fund |

| | | | | | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | 5-Years | | | Since

Inception | |

| Advisor Class (A)NAV | | | 2.21 | | | | 6.06 | | | | 6.38 | |

| Advisor Class (A)OFFER | | | (2.92 | ) | | | 4.99 | | | | 5.34 | |

| Institutional Class (I) | | | 2.48 | | | | 6.31 | | | | 7.82 | |

| Morgan Stanley Capital International All Country World Index | | | (0.28 | ) | | | 5.51 | | | | 7.14 | |

| Lipper Global Multi-Cap Value Funds Index | | | (6.16 | ) | | | 2.47 | | | | 4.27 | |

| * | Cumulative for periods less than one year. Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

Commentary

The BMO Global Low Volatility Equity Fund (the Fund) returned 2.48% for the fiscal year ended August 31, 2019 versus the Morgan Stanley Capital International All Country World Index (MSCI ACW) Net and the Lipper GlobalMulti-Cap Value Funds Index, which returned -0.28% and -6.16%, respectively.

Despite multiple pullbacks and periods of elevated market volatility, global equity markets finished the trailing fiscal year in positive territory. Equities finished calendar year 2018 in negative territory, with the fourth quarter marking the single worst quarter of performance since the financial crisis, ending a nine consecutive calendar year stretch of positive returns. The fourth quarter’ssell-off was greatly influenced by instability at the macro-level, which included continued trade tensions between the U.S. and China, concerns over tightening by the U.S. Federal Reserve, Brexit, and the U.S. Government shutdown.

U.S. equities quickly recovered from 2018’s losses, despite negative returns in May and August, as concerns continued to mount over tariffs, yield curve inversion, and slowing global economic growth. Drivers of gains included the continuation of accommodative policy by central bankers and a resilient consumer. The most dominant theme during the year was the continued underperformance of more attractively valued securities in the market. While equities finished the period in positive territory, increasing market volatility, a sharp decrease in interest rates, and the influence of macroeconomic risks continued to drive the outperformance of lower risk stocks. Similarly, larger companies outperformed smaller ones, while investors continued to favor stocks with higher sales and earnings growth, with no regard to valuations.

The Fund outperformed the MSCI ACWI Index Net in the fiscal year. Sector allocation was positive while stock selection was negative for the period. The Fund’s overweight position in Utilities and underweight position in Energy added to performance, while an underweight position in Information Technology and overweight position in Financials detracted from performance. Stock selection was strongest in Materials and Real Estate and weakest in Utilities and Consumer Discretionary. Merck & Co. Inc. (2.3% of the Fund, 29.6% return) and IRB Brasil Resseguros SA (1.1% of the Fund, 88.4% return) added to the Fund’s performance, while Public Bank Bhd. (1.7% of the Fund, -17.4% return) and Hang Seng Bank Ltd. (1.2% of the Fund, -19.8% return) detracted from returns.

As we look ahead, the potential for increased market volatility remains. Elevated volatility presents opportunities to add value through active stock selection and risk management. While equities continue to post record gains, markets may react negatively to a number of risks, including the threat of ongoing trade tensions between the U.S. and China, a slowdown in global economic growth, and uncertainty surrounding the expectations of accommodative policy. We focus on stock selection while using a variety of portfolio construction tools to manage these risks. In addition, valuation spreads remain historically wide, suggesting a potentially favorable environment for more attractively valued securities in the market. Similarly, mispricings in the U.S. equity market are more extreme in defensive sectors, such as Utilities, as investors position against increased volatility. The portfolio continues to trade at a discount relative to the benchmark, while owning what we believe are fundamentally strong companies with positive or improving investor sentiment.

Fund Managers; Investment Experience

Jay Kaufman, CFA; since 2006

Ernesto Ramos, Ph.D.; since 1988

David Rosenblatt, CFA; since 2007

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | Gross | | | Net | |

| Advisor (A) | | | BAEGX | | | | 09658W873 | | | | 5/27/2014 | | | | 1.46 | | | | 1.10 | |

Institutional

(I) | | | BGLBX | | | | 09658V768 | | | | 9/30/2013 | | | | 1.19 | | | | 0.85 | |

The above expense ratios are from the Funds’ Prospectus dated April 1, 2019, and are inclusive of Acquired Fund Fees and Expenses. See Note 6 in the Notes to Financial Statements for additional information. Net expense ratios reflect contractual fee waivers and/or expense reimbursements if applicable, made by BMO Asset Management Corp., the investment adviser (Adviser). The Adviser may not terminate these fee waivers and/or expense reimbursements prior to December 31, 2020 without the consent of the Board of Directors, unless the investment advisory agreement is terminated. Without these contractual waivers, the Fund’s returns would have been lower.

| | | | |

Portfolio sector allocation | |

| Sector | | Fund (%) | |

| Communication Services | | | 11.0 | |

| Consumer Discretionary | | | 4.5 | |

| Consumer Staples | | | 12.7 | |

| Energy | | | 1.8 | |

| Financials | | | 17.7 | |

| Healthcare | | | 10.7 | |

| Industrials | | | 3.5 | |

| Information Technology | | | 0.3 | |

| Materials | | | 2.7 | |

| Real Estate | | | 12.3 | |

| Utilities | | | 20.4 | |

| Other Assets & Liabilities, Net | | | 2.4 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2019 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

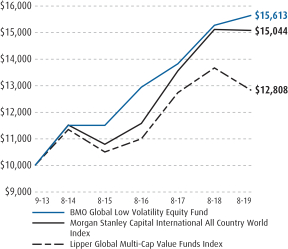

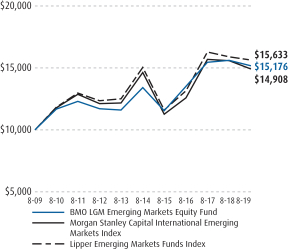

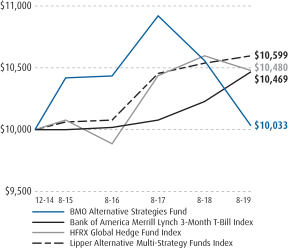

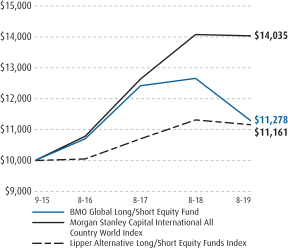

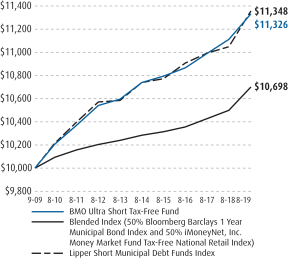

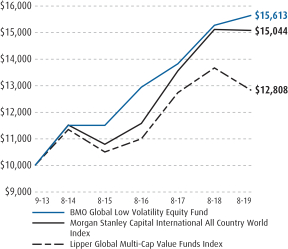

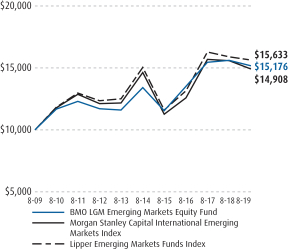

Growth of an assumed $10,000 investment

See Explanation of the Indices and Notes in the Commentary for additional information.The above graph relates to the Institutional Class shares of the Fund. Performance for the Advisor Class shares will vary from the performance of the Institutional Class shares shown above due to differences in charges and expenses. This graph illustrates the hypothetical investment of $10,000 in the Institutional Class shares of the Fund from the lesser of the Fund’s inception date or August 31, 2009 to August 31, 2019.

11

| | |

| | |

| Annual Report | | BMO Disciplined International Equity Fund |

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-Year | | | Since

Inception | |

| Advisor Class (A)NAV | | | (6.91 | ) | | | 1.63 | |

| Advisor Class (A)OFFER | | | (11.60 | ) | | | 0.31 | |

| Institutional Class (I) | | | (6.64 | ) | | | 1.88 | |

| Morgan Stanley Capital International Europe, Australasia, Far East Index | | | (3.26 | ) | | | 4.74 | |

| Lipper International Multi-Cap Core Funds Index | | | (4.01 | ) | | | 9.16 | |

| * | Benchmarks since inception reflect the inception date of the Institutional Class. |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recentmonth-end, please call1-800-236-3863 or visit www.bmofunds.com.

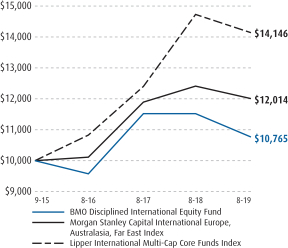

Commentary

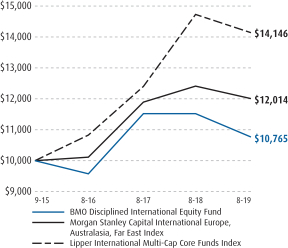

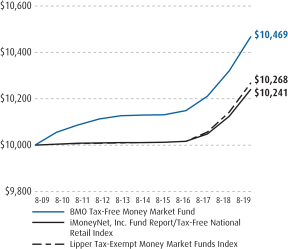

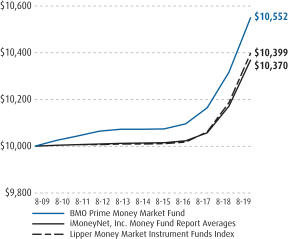

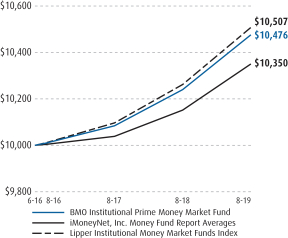

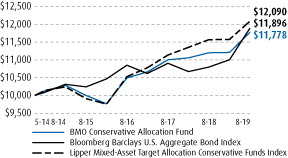

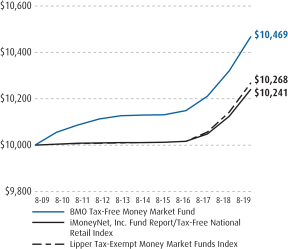

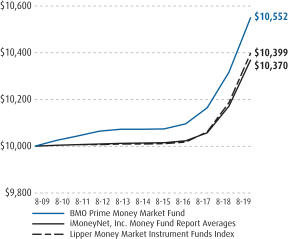

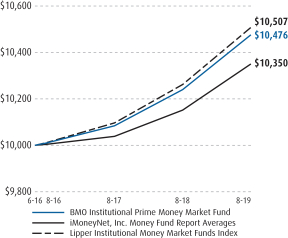

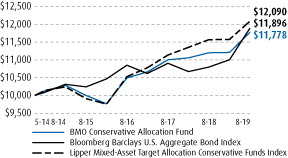

The BMO Disciplined International Equity Fund (the Fund) returned-6.64% for the fiscal year ended August 31, 2019 versus the Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE) and the Lipper InternationalMulti-Cap Core Funds Index, which returned-3.26% and-4.01%, respectively.