UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07062 |

|

PACIFIC GLOBAL FUND INC. D/B/A PACIFIC ADVISORS FUND INC. |

(Exact name of registrant as specified in charter) |

|

101 NORTH BRAND BLVD., SUITE 1950 GLENDALE, CALIFORNIA | | 91203 |

(Address of principal executive offices) | | (Zip code) |

|

GEORGE A. HENNING 101 NORTH BRAND BLVD., SUITE 1950 GLENDALE, CA 91203 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 818-242-6693 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2019 | |

| | | | | | | | |

Item 1. Report to Shareholders

Filed herewith.

annual report

december 31, 2019

income and equity fund

balanced fund

large cap value fund

mid cap value fund

small cap value fund

Pacific Advisors

table of contents

Message from the Chairman (unaudited) | | | 1 | | |

Income and Equity Fund (unaudited) | | | 4 | | |

Balanced Fund (unaudited) | | | 8 | | |

Large Cap Value Fund (unaudited) | | | 11 | | |

Mid Cap Value Fund (unaudited) | | | 14 | | |

Small Cap Value Fund (unaudited) | | | 17 | | |

Schedule of Investments | | | 22 | | |

Statements of Assets and Liabilities | | | 40 | | |

Statements of Operations | | | 42 | | |

Statements of Changes in Net Assets | | | 44 | | |

Financial Highlights | | | 46 | | |

Notes to Financial Statements | | | 52 | | |

Report of Independent Registered

Public Accounting Firm | | | 61 | | |

Disclosure Regarding the Board's

Approval of the Funds' Advisory

Contracts (unaudited) | | | 62 | | |

Directors and Officers (unaudited) | | | 66 | | |

Additional Tax Information (unaudited) | | | 68 | | |

This Report is submitted for the general information of the shareholders of Pacific Advisors Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by the Funds' current prospectus, which contains information concerning the investment policies of the Funds as well as other pertinent information.

This Report is for informational purposes only and is not a solicitation or recommendation that any particular investor should purchase or sell any particular security. The statements in the Chairman's Letter and the discussions of the Funds' performance are the opinions and beliefs expressed at the time of this commentary and are not intended to represent opinions and beliefs at any other time. These opinions are subject to change at any time based on market or other conditions and are not meant as a market forecast. All economic and performance information referenced is historical. Past performance does not guarantee future results.

For more information on the Pacific Advisors Funds, including information on charges, expenses and other classes offered, please obtain a copy of the prospectus by calling (800) 989-6693. Please read the prospectus and consider carefully the investment risks, objectives, charges and expenses before you invest or send money. Shares of the Pacific Advisors Funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost.

Dear Shareholders,

Throughout the year, the ebb and flow in both the equity and bond markets reflected underlying optimism or angst amidst on again, off again updates on U.S./China trade negotiations. In mid-December, the White House and China announced a 'phase one' trade agreement; the deal, then light on the details, nevertheless de-escalated trade tensions. The deal canceled the 25% tariff on $160 billion of Chinese goods scheduled for mid-December yet retained tariffs on $370 billion of imports ($250 billion at 25%, and $120 billion at a reduced 7.5% rate). China agreed to purchase an extra $200 billion in U.S. agricultural, energy and manufactured products over the next two years, and develop a plan to implement practices regarding intellectual property rights. The agreement, while arguably achieving little regarding Chinese business practices, nevertheless delivered the sought after 'cease fire' in the trade war. Investors remained confident throughout the slow progress towards resolution that an agreement would alleviate some of the economic pressure for both economies. This optimism supported the markets' price gains during the quarter.

The U.S. economy remains resilient; fourth quarter GDP growth estimates anticipate a repeat of the third quarter's 2.1% GDP growth rate. The recent employment reports, with gains of over 400,000 jobs in November and December, an unemployment rate at 3.5%, a 50-year low, and, modest wage growth continue to support the economic growth forecast. That is, job growth helps support consumer spending which accounts for approximately 66% of the U.S. economy; the consumer portion of the domestic economy has offset the reduction in business spending related to trade uncertainties.

Across the globe, economies have managed modest growth despite the trade wars. The European Central Bank (ECB) continues to utilize negative interest rates to stimulate growth even though the long-term effectiveness of this strategy is increasingly problematic. Sweden, which introduced negative interest rates in 2015, one year after the ECB, discontinued the practice in December; the Riksbank determined that lending did not grow as expected because consumers instead hoarded cash. The policy continues in Japan, Switzerland and Denmark.

December elections in the United Kingdom provided the means for Prime Minister Boris Johnson to "get Brexit done," thereby removing the dark cloud over the UK and the European Union since 2016. The outright majority for the Conservative Party, the largest margin of victory since 1987, handed the Labour Party its largest loss since 1935. The unassailable victory for the Conservative Party, and Parliament's subsequent vote in favor of the Withdrawal Agreement, paved the way for the UK's departure from the EU on January 31st of this year and the beginning of an 11-month transition period.

Oil prices have ranged between the low $50s to low $60s per barrel. OPEC+ (including Russia) continue to reduce production in order to maintain a supply and demand equilibrium; meanwhile, geopolitical events in the Middle East remain a source of on-going concerns to oil supplies and prices. In the U.S., shale drilling has leveled off following multi-year growth. The recent emergence of energy as a significant component of the U.S. economy has helped to keep inflation rates low while supporting consumer and industrial products and services across the domestic economy.

The Federal Reserve, following its interest rate cut in mid-September and as widely expected, announced a further 25 basis point cut in late October. At that time, Chairman Powell stated, "The current ... [interest-rate] policy is likely to remain appropriate" as long as the economy expands moderately and the labor market stays strong. At the final, mid-December meeting of the year, the Fed confirmed that a 'no-interest rate change' policy would likely continue through 2020. The rate of inflation, which has long remained below the Fed's 2% target, continues to provide flexibility in monetary policy decision making.

Equity Investment Review

All of the major markets posted impressive results in 2019. For the third consecutive year, the technology-heavy Nasdaq (35.23%) maintained its leadership position, followed by the almost-identical results for the S&P 500® Index (28.88%) and the Russell Midcap® Index (28.25%), followed by the Russell 2000® Index (23.72%), and the Dow Jones Industrial Average (22.34%).

Market Review • December 31, 2019

Index1 | | Close | | YTD Price Return | |

Dow Jones Industrial Average | | | 28,538.44 | | | | 22.34 | % | |

S&P 500® Index | | | 3,230.78 | | | | 28.88 | % | |

Nasdaq | | | 8,972.61 | | | | 35.23 | % | |

Russell Midcap® Index | | | 2,381.91 | | | | 28.25 | % | |

Russell 2000® Index (small cap) | | | 1,668.47 | | | | 23.72 | % | |

| | 12/31/19 | | 12/31/18 | |

| 10-Year T-Note Yield | | | 1.92 | % | | | 2.69 | % | |

Data: Bloomberg; Federal Reserve

1

Message

from the chairman continued

All of the eleven market sectors in the S&P 500® Index rose by double digits during the year; three of the four largest sectors by market weight, Information Technology (50.32%), Financials (32.13%), and Communication Services (32.69%), were also the top performers. Other sectors with impressive gains included Industrials (29.38%), Consumer Discretionary (27.94%), Consumer Staples (27.61%) and Health Care (20.82%).

Information Technology, the largest sector by market weight, contributed 32% of the Index's annual performance. Two companies, Apple, and Microsoft, which alone represented 7.8% of the Index by market weight, contributed 16% of the Index's results.

The yields on U.S. Treasuries declined during the year in reflecting both market demand and the Fed's actions to reduce the Fed Funds rate. The yield on the 3-month U.S. Treasury Bill fell from 2.45% to 1.55%; similarly, the yield on the 2-year U.S. Treasury Note fell 90 basis points to 1.58%. The yields on longer-term Treasuries also declined; the yield on the 10-year fell by 77 basis points, to 1.92%, while the yield on the 30-year declined by 63 basis points to 2.39%. Starting in May, and continuing into early October, the yield on the 10-year U.S. Treasury Note remained below the 3-month T-bill; and, the yield on the 2-year Treasury Note remained below the 3-month T-bill from March through late October. Normally, an "inverted yield curve" condition, which occurred in 2019 for the first time in twelve years, might indicate an upcoming recession. However, most economists consider this to be an anomaly related to the trade disputes. Interest rates began to stabilize in the fourth quarter following the Fed's interest rate cut and the trade agreement.

Looking Ahead

The global outlook is decidedly more positive than expectations one year ago when trade disputes generated fears of a potential recession. The U.S. and China have signed a phase one trade deal; the USMCA agreement to replace NAFTA, recently approved by the U.S., awaits Parliamentary approval in Canada; and the United Kingdom's exit from the EU has advanced to the challenges of implementation Brexit's 11-month transition period. Even so, trade-related constraints on business spending may continue as many tariffs remain in effect.

The outlook for interest rates and inflation remains stable. Chairman Powell, in meetings with both Houses of Congress, reiterated that the economy continues to expand; and that the Fed, which otherwise plans no interest rate changes, would be prepared to further reduce rates, if necessary, should the economy stumble. The Federal Reserve historically tries to maintain a neutral monetary policy during an election year.

Historically, election years tend to reward investors as incumbents seek to provide a positive economic backdrop for their re-election campaigns. And, inflationary concerns and the risk of a recession remains low as the Fed seeks to maintain a neutral approach to the economy. Overall market volatility may remain low; still, certain sectors may experience turbulence in response to specific market events.

Many analysts expect a recovery in global economic growth following the near-recessionary slide in 2019. Currently, the Organisation for Economic Cooperation and Development forecasts 2020 global growth at 3% and U.S. growth at 2%. The U.S. GDP forecast anticipates a somewhat more modest 1.5% expansion in 2020. Any additional improvement in trade relations with China and elsewhere would benefit these forecasts. A cautionary note emerged early in 2020 with the emergence in China of the deadly coronavirus. Investors remain vigilant to assess the potential global impact as the virus has spread to multiple countries and challenged

2

Message

from the chairman continued

health officials to contain the virus's spread. We anticipate that, as the health threat subsides, the modest economic expansion will continue as interest and inflation rates remain low and business managers remain cautious.

Sincerely,

George A. Henning

1 The Dow Jones Industrial Average is an unmanaged, price weighted measure of 30 U.S. stocks selected by the Averages Committee to represent the performance of all U.S. stocks outside the Transportation and Utilities sectors. The S&P 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is an unmanaged, market capitalization weighted measure of all domestic and international common stocks (currently over 3,000 stocks) listed on The Nasdaq Stock Market. The Russell Indices are unmanaged, market-weighted indices. The Russell Midcap® Index measures the 800 smallest companies within the Russell 1000® Index based on a combination of their market cap and current index membership. The Russell 2000® Index measures the stocks of the 2,000 smallest publicly traded companies of the Russell 3000® Index. These indices are not available for direct investment.

Economic and performance information referenced is historical and past performance does not guarantee future results. The principal value and return of an investment will fluctuate so that an investor's shares may be worth less than the original cost when redeemed. For more information on the Pacific Advisors Funds, including information on charges, expenses and other classes offered, please obtain a copy of the prospectus by calling (800) 989-6693. Please read the prospectus and consider carefully the investment risks, objectives, charges and expenses before you invest or send money.

Shares of the Funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested. The views expressed represent the opinions and beliefs at the time of this commentary and are not meant as a market forecast. These views are subject to change at any time based on market or other conditions. This information may not be relied on as investment advice or as an indication of trading.

3

Pacific Advisors

Income and Equity Fund (unaudited)

Fund Objective: Current income and, secondarily, long-term capital appreciation.

Investment Invests primarily in investment grade U.S. corporate bonds and in dividend-paying

Strategy: stocks.

Investor Profile: Conservative. Some current income required; capital preservation aim.

Please see the Chairman's Letter for a detailed market and economic review

as well as the Manager's general market outlook.

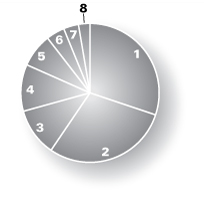

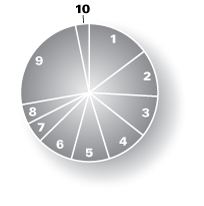

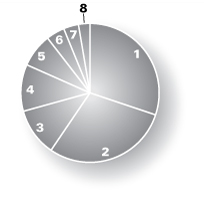

Portfolio Holdings (As of 12/31/19 based on total investments)

| 1. | | Corporate Bonds | | | 32.25 | % | |

| | Equities | | | 58.90 | % | |

| 2. | | Industrials | | | 7.81 | % | |

| 3. | | Consumer Discretionary | | | 7.68 | % | |

| 4. | | Information Technology | | | 7.64 | % | |

| 5. | | Health Care | | | 7.63 | % | |

| 6. | | Financials | | | 7.39 | % | |

| 7. | | Consumer Staples | | | 6.14 | % | |

| 8. | | Energy | | | 5.42 | % | |

| 9. | | Communication Services | | | 3.93 | % | |

| 10. | | Utilities | | | 3.86 | % | |

| 11. | | Materials | | | 1.40 | % | |

| 12. | | Preferred Stock | | | 8.85 | % | |

| Total Returns (For the year ended 12/31/19) | |

Class A | | | 11.26 | % | |

Class C | | | 10.35 | % | |

| |

Barclays Capital U.S. Intermediate

Corporate Bond Index1 | | | 10.14 | % | |

S&P 500® Index1 | | | 31.49 | % | |

Current expense ratio: net 4.19% (A), 4.96% (C); gross 4.94% (A), 5.71% (C). Prospectus expense ratio: net 3.25% (A), 4.00% (C); gross 4.00% (A); 4.75% (C).2

Performance quoted is past performance which does not guarantee future results. Current performance may be higher or lower than the performance quoted. Call (800) 989-6693 for performance current to the most recent month-end. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Returns represent the change in value over the stated period assuming reinvestment of dividends and capital gains at net asset value. Returns do not take into account the maximum 4.75% sales charge on Class A shares or the 1% Contingent Deferred Sales Charge (CDSC) for Class C shares sold within one year of purchase. Returns would be lower if the applicable sales charge and CDSC were included. Returns do not take into account individual taxes which may reduce actual returns when shares are sold.

The Fund's investment adviser is waiving a portion of its management fees pursuant to an Expense Limitation Agreement. The waiver may be discontinued at any time with ninety days written notice in consultation with the Fund's board, but is expected to continue at current levels. Please see the Notes to Financial Statements in this report for details. Performance shown reflects the waiver, without which the results would have been lower.

1 The S&P 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy. Index returns assume the reinvestment of dividends, but, unlike the Fund's returns, do not reflect the effects of management fees or expenses. The Barclays Capital U.S. Intermediate Corporate Bond Index is an unmanaged index of publicly issued investment grade U.S. corporate bonds with one to ten years to maturity. It is not possible to invest directly in either Index.

2 "Current" expense ratio is as of 12/31/19. "Prospectus" expense ratio is for the fiscal year ended 12/31/18.

4

Discussion with Portfolio Managers February 26, 2020

Jingjing Yan, CFA

Fund Strategy

The Fund employs a conservative strategy that seeks to achieve total return through current income and capital appreciation. The Fund's fixed income holdings, typically investment-grade bonds and preferred stocks, are actively managed to seek the greatest income and return potential while minimizing risk. The Fund's equity holdings are a focused selection of 30-40 dividend-paying, blue chip stocks; the equity allocation depends upon economic and market conditions. When interest rates are low and the economic outlook is optimistic, the Fund's equity allocation, which typically ranges between 20% and 40%, often increases above 40% to capture dividend income as well as opportunities for price appreciation. During the period, the allocation to common stocks remained between 45% and 50%. Equity investments are selected based upon a history of price stability, long-term growth potential, and attractive dividend income.

Fund Performance1

During 2019, Class A shares rose 11.26% to underperform the Fund's the equity benchmark, the S&P 500® Index (31.49%), and outperform the fixed income benchmark, the Barclays Capital U.S. Intermediate Corporate Bond Index (10.14%).

Overall Fund performance is best compared to a blended return2 based on the benchmarks (22.74% for the 1-year period) even though the composition of the Fund's fixed income and equity holdings differ from their respective benchmarks. Importantly, the Fund maintained substantially lower volatility than the benchmark as demonstrated by the Fund's one-year beta3 of 0.50 vs. the S&P 500® Index as of December 31st.

The Fund's combination of stock selection and sector allocation in Health Care, Industrials, and Consumer Staples outperformed the Index's results in each of these sectors. In particular, the Fund's overweighting in Health Care companies Abbvie and CVS, Industrials holdings Fastenal and Lockheed Martin, and Consumer company Proctor & Gamble, benefitted the Fund. The most significant contributors to performance during the year were global pharmaceutical giant Abbvie, Target, and Microsoft. Target (+94.0%) increased its earnings outlook and reported impressive multi-year growth in same store sales and digital sales with same-day fulfillment. Microsoft (+55.3%), now the second largest provider of cloud-based services, reported a 39% year-over-year increase in cloud services revenue, and a 38% increase in quarterly net income.

The Fund's most significant detractors from returns were Kohl's (-23.2%); Tapestry (-20.1%), and Pfizer (-10.2%). Retailer Kohl's lowered guidance and reported a decline in revenues, income and earnings per share. Tapestry, the corporate entity which includes the Coach, Kate Spade and Stuart Weitzman lines, continues to suffer from integration challenges, a decline in same store sales for Kate Spade, and delays in developing and delivering product for the Stuart Weitzman line. Pfizer reported a decline in revenues and earnings per share as the company is in the midst of a consumer healthcare joint venture with GlaxoSmithKline and a restructuring of the company's biopharma business into a new Upjohn division to include Mylan-Japan.

Fixed income holdings were primarily short-to-intermediate-term bonds (typically maturing in five years or less). During the period, several of the Fund's corporate bonds matured or were called in as issuers retired debt. The Fund holds corporate bonds and preferred stock of companies in the Financials sector;

1 For detailed information on Fund holdings, please see the Fund's Schedule of Investments in this Report.

2 Blended return calculated from the benchmark index returns based on ratio of stocks to fixed-income securities in the Fund's portfolio as of the end of the period.

3 "Beta" measures volatility relative to the stock market or an alternative benchmark. A beta less than 1.0 indicates lower risk than the market or the benchmark; a beta greater than 1.0 indicates higher risk than the market or the benchmark.

5

Pacific Advisors

Income and Equity Fund (unaudited) continued

most of these are variable rate securities with interest rates that adjust based on the 3-month LIBOR rate or the year-over-year change in the consumer price index ("CPI"); these investments provide both principal protection and attractive yields.

The Fund's fixed income allocation also reduces price volatility. The Fund's 3.56% dividend yield is significantly higher than the Barclays Capital benchmark's 2.42% yield while the Fund's fixed income holdings provided a 3.35% yield to maturity (or call) with a weighted average duration (1.50 years as of December 31st) substantially shorter than the 4.28 year weighted average duration of the benchmark, an unmanaged bond portfolio. Duration measures a portfolio's sensitivity to interest rate movements; when rates increase by 1%, the value of a portfolio with a 4-year duration would decrease by approximately 4%.

6

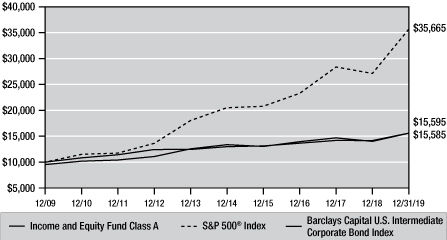

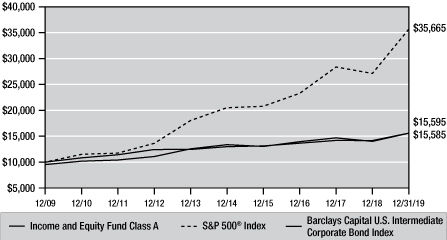

Change in Value of $10,000 Investment1

This chart compares the growth of a $10,000 investment in Class A shares of the Income and Equity Fund for the period January 1, 2010 through December 31, 2019 with the same investment in the S&P 500® Index2 and the Barclays Capital U.S. Intermediate Corporate Bond Index3.

Average Annual Compounded Returns as of December 31, 2019

| | | Class A | | Class C | | Barclays Capital U.S.

Intermediate

Corporate Bond Index | | S&P 500®

Index | |

One Year | | | 5.99 | % | | | 9.35 | % | | | 10.14 | % | | | 31.49 | % | |

Five Year | | | 2.11 | % | | | 2.34 | % | | | 3.73 | % | | | 11.70 | % | |

Ten Year | | | 4.54 | % | | | 4.25 | % | | | 4.54 | % | | | 13.56 | % | |

Past performance does not guarantee future results. Performance quoted represents past performance. Current performance may be higher or lower than the performance data quoted. Returns include reinvested dividends and capital gains. Returns for Class A shares reflect a maximum front-end sales charge of 4.75%; and returns for Class C shares reflect the deduction of a contingent deferred sales charge of 1% on shares sold within the first year of purchase. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Call (800) 989-6693 for the most recent month-end performance.

1 Fund results are shown for Class A shares and reflect deduction of the maximum front-end sales charge of 4.75% on the $10,000 investment for a net amount invested of $9,525. At the end of the same period, a $10,000 investment in Class C shares would have been valued at $15,163, and no contingent deferred sales charges would apply. Performance of the share classes will vary based on the difference in charges and expenses. The inception date is 02/08/93 for Class A shares and 04/01/98 for Class C shares. It is not possible to invest directly in either Index. Index results assume reinvestment of dividends, but, unlike the Fund's results, do not reflect sales charges, fees or expenses.

2 The Standard & Poor's 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy.

3 The Barclays Capital U.S. Intermediate Corporate Bond Index is an unmanaged index of publicly issued investment grade U.S. corporate bonds with one to ten years to maturity.

7

Pacific Advisors

Balanced Fund (unaudited)

Fund Objective: Long-term capital appreciation and income consistent with reduced risk.

Investment Invests primarily in large cap common stocks and investment grade U.S. corporate

Strategy: bonds. Invests at least 25% of its assets in fixed income securities and preferred stocks and at least 25% in equities.

Investor Profile: Moderately conservative. Seeks combination of long-term growth, income, liquidity and reduced risk of price fluctuations.

Please see the Chairman's Letter for a detailed market and economic review

as well as the Manager's general market outlook.

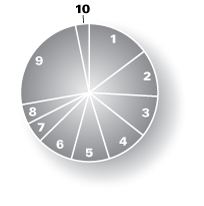

Portfolio Holdings (As of 12/31/19 based on total investments)

| | Equities | | | 72.21 | % | |

| 1. | | Industrials | | | 14.77 | % | |

| 2. | | Communication Services | | | 11.09 | % | |

| 3. | | Financials | | | 9.75 | % | |

| 4. | | Health Care | | | 9.64 | % | |

| 5. | | Consumer Discretionary | | | 8.96 | % | |

| 6. | | Information Technology | | | 8.46 | % | |

| 7. | | Consumer Staples | | | 4.86 | % | |

| 8. | | Energy | | | 4.68 | % | |

| 9. | | Corporate Bonds | | | 24.56 | % | |

| 10. | | Preferred Stock | | | 3.23 | % | |

| Total Returns (For the year ended 12/31/19) | |

Class A | | | 12.28 | % | |

Class C | | | 11.40 | %

| |

| |

S&P 500® Index1 | | | 31.49 | % | |

Barclays Capital U.S. Intermediate

Corporate Bond Index1 | | | 10.14

| % | |

Current expense ratio: 6.54% (A); 7.27% (C). Prospectus expense ratio: 5.16% (A); 5.91% (C).2

Performance quoted is past performance which does not guarantee future results. Current performance may be higher or lower than the performance quoted. Call (800) 989-6693 for performance current to the most recent month-end. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Returns represent the change in value over the stated period assuming reinvestment of dividends and capital gains at net asset value. Returns do not take into account the maximum 5.75% sales charge on Class A shares or the 1% Contingent Deferred Sales Charge (CDSC) for Class C shares sold within one year of purchase. Returns would be lower if the applicable sales charge and CDSC were included. Returns do not take into account individual taxes which may reduce actual returns when shares are sold.

1 The S&P 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy. Index returns assume the reinvestment of dividends, but, unlike the Fund's returns, do not reflect the effects of management fees or expenses. The Barclays Capital U.S. Intermediate Corporate Bond Index is an unmanaged index of publicly issued investment grade U.S. corporate bonds with one to ten years to maturity. It is not possible to invest directly in either Index.

2 "Current" expense ratio is as of 12/31/19. "Prospectus" expense ratio is for the fiscal year ended 12/31/18.

8

Discussion with Portfolio Managers February 26, 2020

George A. Henning and Jingjing Yan, CFA

Fund Strategy

The Fund is designed for investors seeking to participate in the equity markets with reduced volatility. The Fund's strategy combines high-quality stocks across all market capitalizations with investment-grade corporate bonds. We identify leading, well-managed companies that generate high returns on capital and consistent earnings over a full economic cycle. We look to purchase stocks at a discount to our internal price targets with the expectation that, as the companies' growth strategies unfold, the stocks will appreciate over the medium-to-long-term. The Fund may experience periods of underperformance when short-term market trends overshadow long-term outlooks; yet, over time, performance should reflect the strength of these companies as they demonstrate the ability to grow through various economic and business cycles.

We manage the Fund's asset allocation based on our assessment of risk-appropriate investments in the context of the overall economic, market, and interest rate outlook. This balanced approach enables the Fund to take advantage of specific growth opportunities while reducing overall risk.

Fund Performance1

Class A shares of the Fund rose 12.28% in 2019 to underperform the Fund's equity benchmark, the S&P 500® Index (31.49%), and outperform the fixed income benchmark, the Barclays Capital U.S. Intermediate Corporate Bond Index (10.14%).

The equity portion of the Fund includes a 54% allocation to large cap stocks; mid-cap stocks and small cap stocks represent 19% and 27%, respectively. Despite the mid-cap and small cap stock allocations, the Fund's one-year beta2, as compared against the S&P 500® Index, was 0.79. The results are in-line with the Fund's investment objective of participating in the equity markets with reduced volatility. The Fund's fixed income holdings remained concentrated in investment-grade issuers and shorter-term maturities (less than five years); the Fund's average duration (2.28 years) is significantly less than the Barclays Capital benchmark's 4.28 years.

The Fund's combination of stock selection and sector allocation in Communication Services, Health Care and Industrials outperformed the Index's results in each of these sectors. In particular, the Fund's overweighting in Alphabet Class A (+28.2%), CVS (+13.4%), AbbVie and container leasing company, Triton International, (+29.4%) benefitted performance. CVS reported a 32% growth in revenues for the year with the successful integration of its November 2018 acquisition of Aetna Inc. while Triton gained due to a combination of high utilization rates, cost savings and a 6.83% dividend yield (as of year-end). The Fund's top performer during the year was Apple (+86.2%) which soared on record quarterly revenues (earnings per share rose 19%) driven by strong demand for iPhone 11 and Wearables.

Underperformance, and relative over- or under-weightings compared to the benchmark in Consumer Discretionary, Information Technology and Energy stocks hurt the Fund. The Fund's most significant detractors during the year were Ulta Beauty (+3.4%); Conn's (-34.3%), and Navistar (+11.5%). Ulta Beauty, the largest U.S. beauty retailer, disappointed with lower sales growth due to delays in new product introductions. Conn's, a specialty retailer which offers in-house credit, reported an 8.4% decline in same store sales due to increased competition and price deflation in large screen televisions; still, the company continues to open new stores, including its initial entry into the Florida market in 2020. Truck manufacturer and distributor, Navistar suffered due to analyst expectations for lower sales in commercial Class 8 trucks. In late January 2020, the much anticipated buyout announcement from Traton (formerly Volkswagen Truck and Bus) was priced at a 21% premium over the year-end valuation.

1 For detailed information on Fund holdings, please see the Fund's Schedule of Investments in this Report.

2 "Beta" measures volatility relative to the stock market or an alternative benchmark. A beta less than 1.0 indicates lower risk than the market or the benchmark; a beta greater than 1.0 indicates higher risk than the market or the benchmark.

9

Pacific Advisors

Balanced Fund (unaudited) continued

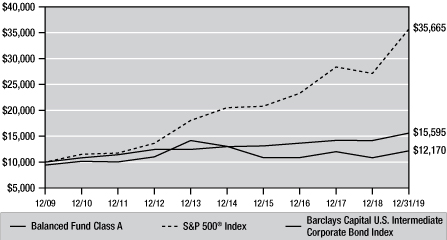

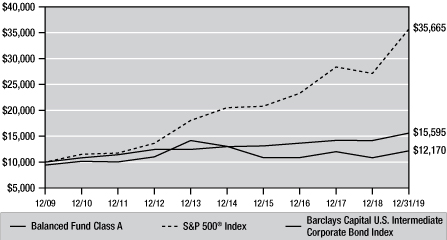

Change in Value of $10,000 Investment1

This chart compares the growth of a $10,000 investment in Class A shares of the Balanced Fund for the period January 1, 2010 through December 31, 2019 with the same investment in the S&P 500® Index2 and the Barclays Capital U.S. Intermediate Corporate Bond Index3.

Average Annual Compounded Returns as of December 31, 2019

| | | Class A | | Class C | | S&P 500®

Index | | Barclays Capital U.S.

Intermediate

Corporate Bond Index | |

One Year | | | 5.84 | % | | | 10.40 | % | | | 31.49 | % | | | 10.14 | % | |

Five Year | | | –2.54 | % | | | –2.12 | % | | | 11.70 | % | | | 3.73 | % | |

Ten Year | | | 1.98 | % | | | 1.81 | % | | | 13.56 | % | | | 4.54 | % | |

Past performance does not guarantee future results. Performance quoted represents past performance. Current performance may be higher or lower than the performance data quoted. Returns include reinvested dividends and capital gains. Returns for Class A shares reflect a maximum front-end sales charge of 5.75%; and returns for Class C shares reflect the deduction of a contingent deferred sales charge of 1% on shares sold within the first year of purchase. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Call (800) 989-6693 for the most recent month-end performance.

1 Fund results are shown for Class A shares and reflect deduction of the maximum front-end sales charge of 5.75% on the $10,000 investment for a net amount invested of $9,425. At the end of the same period, a $10,000 investment in Class C shares would have been valued at $11,963, and no contingent deferred sales charges would apply. Performance of the share classes will vary based on the difference in charges and expenses. The inception date is 02/08/93 for Class A shares and 04/01/98 for Class C shares. It is not possible to invest directly in either Index. Index results assume reinvestment of dividends, but, unlike the Fund's results, do not reflect sales charges, fees or expenses.

2 The Standard & Poor's 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy.

3 The Barclays Capital U.S. Intermediate Corporate Bond Index is an unmanaged index of publicly issued investment grade U.S. corporate bonds with one to ten years to maturity.

10

Pacific Advisors

Large Cap Value Fund (unaudited)

Fund Objective: Long-term capital appreciation.

Investment Invests at least 80% of its assets in large cap companies that are, at the time of

Strategy: purchase, within the market cap range of companies in the S&P 500® Index1.

Investor Profile: Conservative equity. Growth-oriented with a long-term investment horizon.

Please see the Chairman's Letter for a detailed market and economic review

as well as the Manager's general market outlook.

Portfolio Holdings (As of 12/31/19 based on total investments)

| | Equities | | | 100.00 | % | |

| 1. | | Information Technology | | | 18.47 | % | |

| 2. | | Consumer Staples | | | 18.19 | % | |

| 3. | | Industrials | | | 17.49 | % | |

| 4. | | Financials | | | 16.21 | % | |

| 5. | | Consumer Discretionary | | | 12.68 | % | |

| 6. | | Communication Services | | | 12.13 | % | |

| 7. | | Health Care | | | 4.83 | % | |

| Total Returns (For the year ended 12/31/19) | |

Class A | | | 27.87 | % | |

Class C | | | 26.97 | % | |

Current expense ratio: net 5.26% (A), 6.02% (C); gross 6.01% (A), 6.78% (C). Prospectus expense ratio: net 4.12% (A), 4.87% (C); gross 4.87% (A); 5.62% (C).2

Performance quoted is past performance which does not guarantee future results. Current performance may be higher or lower than the performance quoted. Call (800) 989-6693 for performance current to the most recent month-end. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Returns represent the change in value over the stated period assuming reinvestment of dividends and capital gains at net asset value. Returns do not take into account the maximum 5.75% sales charge on Class A shares or the 1% Contingent Deferred Sales Charge (CDSC) for Class C shares sold within one year of purchase. Returns would be lower if the applicable sales charge and CDSC were included. Returns do not take into account individual taxes which may reduce actual returns when shares are sold.

The Fund's investment adviser is waiving a portion of its management fees pursuant to an Expense Limitation Agreement. The waiver may be discontinued at any time with ninety days written notice in consultation with the Fund's board, but is expected to continue at current levels. Please see the Notes to Financial Statements in this report for details. Performance shown reflects the waiver, without which the results would have been lower.

1 The Standard & Poor's 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy. Index returns assume the reinvestment of dividends, but, unlike the Fund's returns, do not reflect the effects of management fees or expenses. It is not possible to invest directly in the Index.

2 "Current" expense ratio is as of 12/31/19. "Prospectus" expense ratio is for the fiscal year ended 12/31/18.

11

Pacific Advisors

Large Cap Value Fund (unaudited) continued

Discussion with Portfolio Manager February 26, 2020

Samuel C. Coquillard

Fund Strategy

The Fund uses a value-oriented, focused portfolio strategy (25 holdings as of 12/31/19) to invest in more conservative, less volatile U.S. stocks that pay attractive dividends. The Fund seeks to achieve long-term capital appreciation with reduced volatility. Holdings concentrate on mega-cap stocks of well-managed companies with dominant market positions, strong financials, and track records of steady growth. The weighted average market capitalization of Fund holdings ($304 billion as of 12/31/19) is over five times larger than the average of the benchmark S&P 500® Index. The mega-cap emphasis helps achieve stable total returns with moderate volatility relative to the broader market; as of December 31st, the Fund's one- and five-year betas1 were 1.00. The weighted average dividend yield was 2.05%; several holdings, including AT&T, MetLife, Coca-Cola, Wells Fargo, and United Parcel Service, paid dividends in excess of 3.00%.

Fund Performance2

During 2019, Class A shares rose 27.87% to underperform the benchmark S&P 500® Index's 31.49% gain. The Fund's combination of stock selection and sector allocation in Information Technology, Industrials, Consumer Staples, Financials, Consumer Discretionary, and Communication Services outperformed the Index's results in each of these sectors. In particular, the Fund's overweighting in Industrials holding Illinois Tool Works, Information Technology companies MasterCard and Apple, and Consumer Staples company Sysco, benefitted the Fund. The Fund's top contributors to returns during the year were Apple, Mastercard and Microsoft. Apple (+86.2%) soared on record quarterly revenues (earnings per share rose 19%) driven by strong demand for iPhone 11 and Wearables. Mastercard (+58.3%) reported a 13% increase in dollar volume and a 6% decrease in operating expenses. Microsoft (+55.3%), now the second largest provider of cloud-based services, reported a 39% year-over-year increase in cloud services revenue, and a 38% increase in quarterly net income.

Underperformance, and relative over- or under-weightings compared to the benchmark in Financials, Industrials and Consumer Discretionary stocks hurt the Fund. The Fund's most significant detractors during the period were FedEx (-6.3%), ExxonMobil (2.3%), and Wells Fargo (16.8%). FedEx reported lower operating results, higher ground delivery costs and the loss of business with Amazon (the one-month ban was lifted in January) as the company reworks its operations to better compete in the e-commerce arena. ExxonMobil reported lower earnings due to depressed oil prices and higher expenses. Wells Fargo's earnings losses reflect the bank's litigation accruals related to its retail sales practices; in February, the bank's new leadership agreed to a $3 billion settlement with the Department of Justice and the Securities and Exchange Commission.

The Fund's positioning in mega-cap holdings is suitable for investors who want to participate in the equity markets while incurring lower volatility. The Fund typically outperforms its benchmark during a correction or bear market and trails during a strong bull market.

1 "Beta" measures volatility relative to the stock market or an alternative benchmark. A beta less than 1.0 indicates lower risk than the market or the benchmark; a beta greater than 1.0 indicates higher risk than the market or the benchmark.

2 For detailed information on Fund holdings, please see the Fund's Schedule of Investments in this Report.

12

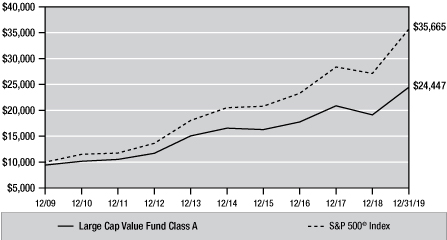

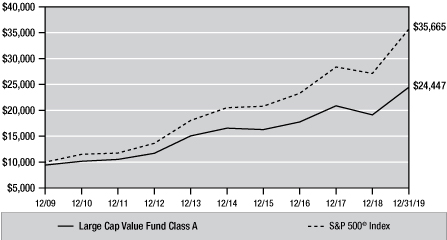

Change in Value of $10,000 Investment1

This chart compares the growth of a $10,000 investment in Class A shares of the Large Cap Value Fund for the period January 1, 2010 through December 31, 2019 with the same investment in the S&P 500® Index2.

Average Annual Compounded Returns as of December 31, 2019

| | | Class A | | Class C | | S&P 500®

Index | |

One Year | | | 20.55 | % | | | 25.70 | % | | | 31.49 | % | |

Five Year | | | 6.83 | % | | | 7.29 | % | | | 11.70 | % | |

Ten Year | | | 9.35 | % | | | 9.19 | % | | | 13.56 | % | |

Past performance does not guarantee future results. Performance quoted represents past performance. Current performance may be higher or lower than the performance data quoted. Returns include reinvested dividends and capital gains. Returns for Class A shares reflect a maximum front-end sales charge of 5.75%; and returns for Class C shares reflect the deduction of a contingent deferred sales charge of 1% on shares sold within the first year of purchase. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Call (800) 989-6693 for the most recent month-end performance.

1 Fund results are shown for Class A shares and reflect deduction of the maximum front-end sales charge of 5.75% on the $10,000 investment for a net amount invested of $9,425. At the end of the same period, a $10,000 investment in Class C shares would have been valued at $24,081, and no contingent deferred sales charges would apply. Performance of the share classes will vary based on the difference in charges and expenses. The inception date for Class A shares and Class C shares is 05/01/99. It is not possible to invest directly in either Index. Index results assume reinvestment of dividends, but, unlike the Fund's results, do not reflect sales charges, fees or expenses.

2 The Standard & Poor's 500® Index is an unmanaged, market capitalization weighted index which measures the performance of the large cap segment of the U.S. equities market, covering approximately 75% of the U.S. equities market. The Index includes 500 leading companies in leading industries of the U.S. economy.

13

Pacific Advisors

Mid Cap Value Fund (unaudited)

Fund Objective: Long-term capital appreciation.

Investment Invests at least 80% of its assets in mid-cap companies that are, at the time of

Strategy: purchase, within the market cap range of companies in the Russell Midcap® Index.1

Investor Profile: Moderately aggressive. Growth-oriented with a long-term investment horizon.

Please see the Chairman's Letter for a detailed market and economic review

as well as the Manager's general market outlook.

Portfolio Holdings (As of 12/31/19 based on total investments)

| | Equities | | | 100.00 | % | |

| 1. | | Consumer Discretionary | | | 30.14 | % | |

| 2. | | Industrials | | | 29.38 | % | |

| 3. | | Energy | | | 11.20 | % | |

| 4. | | Financials | | | 10.90 | % | |

| 5. | | Communication Services | | | 7.85 | % | |

| 6. | | Health Care | | | 4.33 | % | |

| 7. | | Information Technology | | | 3.52 | % | |

| 8. | | Materials | | | 2.68 | % | |

| Total Returns (For the year ended 12/31/19) | |

Class A | | | 9.59 | % | |

Class C | | | 8.87 | % | |

| |

Russell Midcap® Index1 | | | 30.54 | % | |

Current expense ratio: 6.86% (A); 7.45% (C). Prospectus expense ratio: 5.33% (A); 6.08% (C).2

Performance quoted is past performance which does not guarantee future results. Current performance may be higher or lower than the performance quoted. Call (800) 989-6693 for performance current to the most recent month-end. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Returns represent the change in value over the stated period assuming reinvestment of dividends and capital gains at net asset value. Returns do not take into account the maximum 5.75% sales charge on Class A shares or the 1% Contingent Deferred Sales Charge (CDSC) for Class C shares sold within one year of purchase. Returns would be lower if the applicable sales charge and CDSC were included. Returns do not take into account individual taxes which may reduce actual returns when shares are sold.

1 The Russell Midcap® Index is an unmanaged, weighted measure of the 800 smallest companies within the Russell 1000® Index based on a combination of their market cap and current index membership. Index returns assume the reinvestment of dividends, but, unlike the Fund's returns, do not reflect management fees or expenses. It is not possible to invest directly in the Index.

2 "Current" expense ratio is as of 12/31/19. "Prospectus" expense ratio is for the fiscal year ended 12/31/18.

14

Discussion with Portfolio Manager February 26, 2020

George A. Henning

Fund Strategy

Mid-cap companies provide distinctive advantages for long-term investors by combining the strategic flexibility of smaller businesses with the economies of scale typically enjoyed by large corporations. The Fund uses a fundamental, bottom-up strategy to identify leading mid-cap companies with attractive opportunities for long-term appreciation. Our focused, value-oriented approach selects approximately 30 to 40 stocks; we expect to hold each investment for 3 to 5 years, or longer. Our long-term investment horizon typically reduces turnover and contributes to tax efficiency by minimizing the realization of short-term gains. For the year, the Fund's annualized turnover rate of 12% was consistent with its five-year average annual turnover rate of 12.2%1. The Fund invests in companies that are within the market cap range of the Russell Midcap® Index (between $2.4 and $35.5 billion as of the Index's latest reconstitution in May 2019). The Fund's average (mean) market cap of $7.8 billion (as of 12/31/19) underscores the Fund's focus on smaller mid-cap holdings.

Fund Performance2

During 2019, Class A shares rose 9.59% to underperform the benchmark Russell Midcap® Index's 30.54% gain. The Fund's larger weighting in market sectors that typically respond well during periods of economic growth, such as Industrials, and Consumer Discretionary, outperformed the Index's results in these sectors. In particular, the Fund's overweight positions in Helix Energy Solutions, and transportation holdings, including railroad companies Genesee & Wyoming and Kansas City Southern, and trucking company Knight-Swift Transportation, benefitted the Fund. Helix Energy Solutions (+78.0%), a provider of subsea construction, maintenance and salvage services for the offshore natural gas and oil industry, reported strong equipment utilization and projected a debt-free balance sheet in 2020. Kansas City Southern (60.5%), which operates rail lines throughout the north-south corridor into Mexico, rose due to the anticipated signing of the USMCA replacement for NAFTA. Railway company Genesee & Wyoming (51.2%) rose in response to acquisition-related speculation in March; a deal was announced in July at a 39.5% premium early-March prices. The acquisition closed in late December.

The Fund was underweighted in the Information Technology, Financials, Health Care, Utilities and Real Estate sectors; the Fund's lack of representation in these areas (16.5% weighting compared to 57.6% for the benchmark) hurt the Fund. The Fund's most significant detractors to returns were McDermott International, Spirit Airlines and Noble Corporation. Oil & gas engineering company, McDermott International (-75.1%), struggled to manage the debt incurred with the 2018 purchase of Chicago Bridge & Iron construction company. Spirit Airlines (-30.4%) underperformed due to increased price competition from the major airlines. Offshore drilling contractor Noble Corporation (-53.4%) continues to suffer from the protracted recovery in offshore drilling projects; the company, though, reported higher rates of operating activity. The Fund may continue to hold positions in companies with depressed valuations yet favorable fundamental outlooks for appreciation potential.

1 Annual turnover: 2% (2018); 9% (2017); 13% (2016); and 25% (2015).

2 For detailed information on Fund holdings, please see the Fund's Schedule of Investments in this Report.

15

Pacific Advisors

Mid Cap Value Fund (unaudited) continued

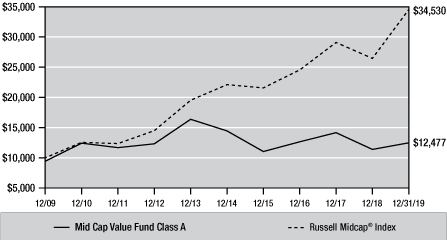

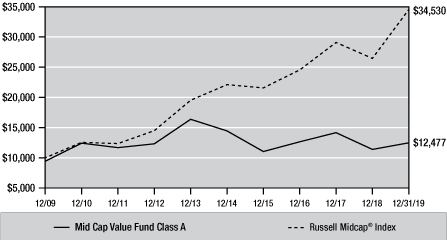

Change in Value of $10,000 Investment1

This chart compares the growth of a $10,000 investment in Class A shares of the Mid Cap Value Fund for the period January 1, 2010 through December 31, 2019 with the same investment in the Russell Midcap® Index2.

Average Annual Compounded Returns as of December 31, 2019

| | | Class A | | Class C | | Russell Midcap®

Index | |

One Year | | | 3.30 | % | | | 7.78 | % | | | 30.54 | % | |

Five Year | | | –4.03 | % | | | –3.60 | % | | | 9.33 | % | |

Ten Year | | | 2.23 | % | | | 2.06 | % | | | 13.19 | % | |

Past performance does not guarantee future results. Performance quoted represents past performance. Current performance may be higher or lower than the performance data quoted. Returns include reinvested dividends and capital gains. Returns for Class A shares reflect a maximum front-end sales charge of 5.75%; and returns for Class C shares reflect the deduction of a contingent deferred sales charge of 1% on shares sold within the first year of purchase. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Call (800) 989-6693 for the most recent month-end performance.

1 Fund results are shown for Class A shares and reflect deduction of the maximum front-end sales charge of 5.75% on the $10,000 investment for a net amount invested of $9,425. At the end of the same period, a $10,000 investment in Class C shares would have been valued at $12,260, and no contingent deferred sales charges would apply. Performance of the share classes will vary based on the difference in charges and expenses. The inception date for Class A shares and Class C shares is 04/01/02. It is not possible to invest directly in either Index. Index results assume reinvestment of dividends, but, unlike the Fund's results, do not reflect sales charges, fees or expenses.

2 The Russell Midcap® Index is an unmanaged, weighted measure of the 800 smallest companies within the Russell 1000® Index based on a combination of their market cap and current index membership.

16

Pacific Advisors

Small Cap Value Fund (unaudited)

Fund Objective: Capital appreciation through investment in small cap companies.

Investment Invests at least 80% of its assets in small cap companies which are, at the time of

Strategy: purchase, not greater than the highest market capitalization of companies within the Russell 2000® Index1. Generally invests a significant proportion of its assets in companies with market capitalizations that are, at the time of purchase, not greater than the highest market capitalization of companies in the Russell Microcap® Index1 (which are often referred to as "micro-cap" stocks).

Investor Profile: Aggressive. Opportunity-oriented with a long-term investment horizon.

Please see the Chairman's Letter for a detailed market and economic review

as well as the Manager's general market outlook.

Portfolio Holdings (As of 12/31/19 based on total investments)

| | Equities | | | 100.00 | % | |

| 1. | | Industrials | | | 34.60 | % | |

| 2. | | Energy | | | 26.16 | % | |

| 3. | | Consumer Discretionary | | | 15.54 | % | |

| 4. | | Financials | | | 11.17 | % | |

| 5. | | Consumer Staples | | | 6.14 | % | |

| 6. | | Communication Services | | | 3.79 | % | |

| 7. | | Health Care | | | 2.60 | % | |

| Total Returns (For the year ended 12/31/19) | |

Class A | | | 15.59 | % | |

Class C | | | 14.68 | % | |

Class I | | | 15.91 | % | |

| |

Russell 2000® Index1 | | | 25.53 | % | |

Current expense ratio: 5.39% (A); 6.12% (C); 5.13% (I). Prospectus expense ratio: 4.40% (A); 5.15% (C); 4.41% (I).2

Performance quoted is past performance which does not guarantee future results. Current performance may be higher or lower than the performance quoted. Call (800) 989-6693 for performance current to the most recent month-end. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Returns represent the change in value over the stated period assuming reinvestment of dividends and capital gains at net asset value. Rankings shown are for Class A shares; rankings for other share classes may be different. Returns and rankings do not take into account the maximum 5.75% sales charge on Class A shares or the 1% Contingent Deferred Sales Charge (CDSC) for Class C shares sold within one year of purchase. Returns would be lower if the applicable sales charge and CDSC were included. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. Small cap companies typically have fewer financial resources and may carry higher investment risks and experience greater stock price volatility than larger stocks.

1 The Russell 2000® Index is an unmanaged, market-weighted measure of the 2,000 smallest companies of the Russell 3000® Index which represents approximately 98% of the investable U.S. equity market. Index returns assume the reinvestment of dividends, but, unlike the Fund's returns, do not reflect management fees or expenses. The Russell Microcap® Index is an unmanaged, market capitalization weighted measure of the 1,000 smallest publicly traded companies within the Russell 2000® Index, plus the next smallest 1,000 U.S. based listed stocksIt is not possible to invest directly in either Index.

2 "Current" expense ratio is as of 12/31/19. "Prospectus" expense ratio is for the fiscal year ended 12/31/18.

17

Pacific Advisors

Small Cap Value Fund (unaudited) continued

Discussion with Portfolio Manager February 26, 2020

George A. Henning

Fund Strategy

The Fund employs a value-oriented approach to identify when high-quality, well-managed companies with attractive growth outlooks become undervalued. Periods of heightened market volatility often create opportunities to strategically invest in these companies for long-term appreciation. The Fund takes a business ownership view in seeking to identify stocks that are undervalued or temporarily out-of-favor and have a catalyst for multi-year growth. The Fund focuses on a limited number of small cap stocks (typically 25 to 50 holdings), including a significant number of micro-cap stocks which tend to attract limited analyst attention. Investing in small and micro-cap stocks may contribute to above-average volatility; yet, smaller, well-positioned companies can provide superior long-term results. Partly due to the strategic allocation to undervalued micro-cap stocks, the Fund's one-year beta1 was 1.17, as of December 31st, in comparison to the Russell 2000® Index.

Fund Performance2

During 2019, Class A shares rose 15.59% to underperform the benchmark Russell 2000® Index's 25.53% gain. The Fund's larger weighting in market sectors that typically respond well during periods of economic growth, such as Industrials, Energy, and Consumer Discretionary, weighed on performance; these sectors accounted for more than 83% of Fund assets compared to a weighting of 30% for the benchmark. Fund holdings in Industrials, including trucking company SAIA, services company DXP Enterprises, truck manufacturer and retailer Rush Enterprises, container leasing company Triton International and Energy company Helix Energy Solutions outperformed. The Fund's top contributors to returns during the year were Helix Energy Solutions (+78.0%), SAIA (+66.8%), and DXP Enterprises (+43.0%). Helix Energy, a provider of subsea construction, maintenance and salvage services for the offshore natural gas and oil industry, reported strong equipment utilization and projected a debt-free balance sheet in 2020. SAIA's geographic expansion into the Northeast is ahead of schedule in generating better-than-expected revenues and earnings. Industrial products and service distributor and manufacturer, DXP Enterprises, continued to increase the company's market share; the Pumping Solutions division benefits from advantages in cost, quality and delivery times; also, the company's efforts to expand into industrial applications diminishes its previous reliance on the energy sector.

The Fund's most significant detractors to returns were Conn's (-34.3%), Independence Drilling Contractors (-68.0%) and home décor superstore At Home Group (-70.5%). Conn's, a specialty retailer which offers in-house credit, reported an 8.4% decline in same store sales due to increased competition and price deflation in large screen televisions; still, the company continues to open new stores, including its initial entry into the Florida market in 2020. Independence Drilling Contractors declined sharply on diminished drilling activity and the idling of four drilling rigs pending upgrades and improved market conditions. At Home Group declined on lower same store sales, decreased margins; even so, the company opened nine new stores in the most recent quarter and reported higher net sales. Several Consumer stocks and Energy holdings weighed on performance. Also, the Fund was underweighted in the Information Technology, Financials, Health Care, Utilities and Real Estate sectors; the Fund's lack of representation in these areas (10.1% weighting compared to 60.1% for the benchmark) hurt the Fund.

1 "Beta" measures volatility relative to the stock market or an alternative benchmark. A beta less than 1.0 indicates lower risk than the market or the benchmark and a beta greater than 1.0 indicates higher risk than the market or the benchmark.

2 For detailed information on Fund holdings, please see the Fund's Schedule of Investments in this Report.

18

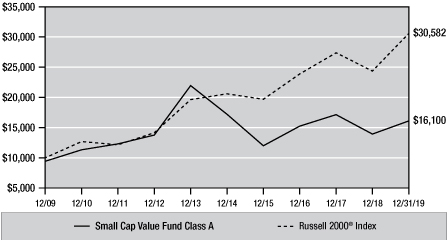

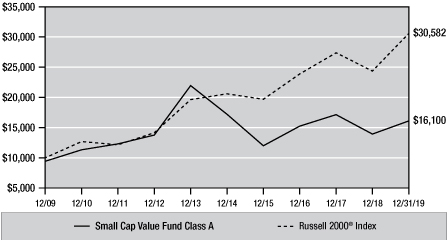

Change in Value of $10,000 Investment1

This chart compares the growth of a $10,000 investment in Class A shares of the Small Cap Value Fund for the period January 1, 2010 through December 31, 2019 with the same investment in the Russell 2000® Index2.

Average Annual Compounded Returns as of December 31, 2019

| | | Class A | | Class C | | Class I | | Russell 2000®

Index | |

One Year | | | 8.96 | % | | | 13.54 | % | | | 15.91 | % | | | 25.53 | % | |

Five Year | | | –2.49 | % | | | –2.07 | % | | | –1.07 | % | | | 8.23 | % | |

Ten Year | | | 4.88 | % | | | 4.71 | % | | | 6.05 | % | | | 11.83 | % | |

Past performance does not guarantee future results. Performance quoted represents past performance. Current performance may be higher or lower than the performance data quoted. Returns include reinvested dividends and capital gains. Returns for Class A shares reflect a maximum front-end sales charge of 5.75%; and returns for Class C shares reflect the deduction of a contingent deferred sales charge of 1% on shares sold within the first year of purchase. Returns do not take into account individual taxes which may reduce actual returns when shares are sold. Small cap stocks typically have fewer financial resources and may carry higher risks and experience greater volatility than large cap stocks. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Call (800) 989-6693 for the most recent month-end performance.

1 Fund results are shown for Class A shares and reflect deduction of the maximum front-end sales charge of 5.75% on the $10,000 investment for a net amount invested of $9,425. At the end of the same period, a $10,000 investment in Class C shares and Class I shares would have been valued at $15,846, and $17,998, respectively, and no contingent deferred sales charges would apply. The inception date is 02/08/93 for Class A shares; 04/01/98 for Class C shares; and 10/09/06 for Class I shares. Performance of the share classes will vary based on the difference in charges and expenses. It is not possible to invest directly in the Index. Index results assume reinvestment of dividends, but, unlike the Fund's results, do not reflect sales charges, commissions or expenses.

2 The Russell 2000® Index is an unmanaged, weighted measure of the 2,000 smallest companies within the Russell 3000® Index.

19

Expense Examples

(unaudited)

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2019 through December 31, 2019.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period.

The following transaction costs are not included in the expenses shown in the table and, if applicable, would increase the expenses that you paid over the period: (1) a front-end sales charge (load) of 4.75% on Class A shares of the Income and Equity Fund and 5.75% on Class A shares of all other funds; (2) a 2% redemption fee if you sell or exchange shares within 30 days of purchase, with certain exceptions. The redemption fee does not apply to: (a) redemptions under an automatic withdrawal program or periodic asset reallocation plan, required minimum distributions (RMD), employer mandated distributions from a qualified plan, or redemptions under a qualified domestic relations order (QDRO); (b) redemptions to pay for expenses related to terminal illness, extended hospital or nursing home care, or other serious medical conditions, including death; (c) redemptions of shares acquired through dividend or capital gains reinvestments; (d) loans from a qualified plan account; and (e) redemptions initiated by the Fund; and (3) a $10 service fee on each exchange after the first five exchanges in each calendar year.

The following ongoing costs are not included in the expenses shown in the table and, if applicable, would increase the expenses that you paid over the period: (1) a $12 low balance fee on accounts with balances of less than $250 as of September 30th of each calendar year and no investment activity (excluding reinvestment of dividends and/or capital gains) during the prior calendar year or the first nine months of the current calendar year. This fee does not apply to IRAs, qualified plan accounts, or Coverdell Education Savings Accounts; (2) a $15 annual custodial fee on IRAs, SEPs, SIMPLE IRAs, and Coverdell Education Savings Accounts; and (3) a $20 annual custodial fee on 403(b) accounts.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which in not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The following transaction costs are not included in the expenses shown in the table and, if applicable, would increase the expenses that you paid over the period: (1) a front-end sales charge (load) of 4.75% on Class A shares of the Income and Equity Fund and 5.75% on Class A shares of all other funds; (2) a 2% redemption fee if you sell or exchange shares within 30 days of purchase, with certain exceptions. The redemption fee does not apply to: (a) redemptions under an automatic withdrawal program or periodic asset reallocation plan, required minimum distributions (RMD), employer mandated distributions from a qualified plan, or redemptions under a qualified domestic relations order (QDRO); (b) redemptions to pay for expenses related to terminal illness, extended hospital or nursing home care, or other serious medical conditions, including death; (c) redemptions of shares acquired through dividend or capital gains reinvestments; (d) loans from a qualified plan account; and (e) redemptions initiated by the Fund; and (3) a $10 service fee on each exchange after the first five exchanges in each calendar year.

The following ongoing costs are not included in the expenses shown in the table and, if applicable, would increase the expenses that you paid over the period: (1) a $12 low balance fee on accounts with balances of less than $250 as of September 30th of each calendar year and no investment activity (excluding reinvestment of dividends and/or capital gains) during the prior calendar year or the first nine months of the current calendar year. This fee does not apply to IRAs, qualified plan accounts, or Coverdell Education Savings Accounts; (2) a $15 annual custodial fee on IRAs, SEPs, SIMPLE IRAs, and Coverdell Education Savings Accounts; and (3) a $20 annual custodial fee on 403(b) accounts.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

07/01/19 | | Ending

Account Value

12/31/19 | | Expense Paid

During Period

07/01/19 – 12/31/19 | |

Income and Equity Fund Class A | |

Actual | | $ | 1,000.00 | | | $ | 1,045.90 | | | $ | 25.47 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,000.30 | | | $ | 24.91 | | |

Income and Equity Fund Class C | |

Actual | | $ | 1,000.00 | | | $ | 1,041.00 | | | $ | 29.37 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 996.42 | | | $ | 28.73 | | |

20

| | Beginning

Account Value

07/01/19 | | Ending

Account Value

12/31/19 | | Expense Paid

During Period

07/01/19 – 12/31/19 | |

Balanced Fund Class A | |

Actual | | $ | 1,000.00 | | | $ | 1,025.70 | | | $ | 33.39 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 992.24 | | | $ | 32.84 | | |

Balanced Fund Class C | |

Actual | | $ | 1,000.00 | | | $ | 1,021.90 | | | $ | 37.05 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 988.56 | | | $ | 36.44 | | |

Large Cap Value Fund Class A | |

Actual | | $ | 1,000.00 | | | $ | 1,107.90 | | | $ | 31.93 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 994.91 | | | $ | 30.22 | | |

Large Cap Value Fund Class C | |

Actual | | $ | 1,000.00 | | | $ | 1,103.80 | | | $ | 35.95 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 991.03 | | | $ | 34.03 | | |

Mid Cap Value Fund Class A | |

Actual | | $ | 1,000.00 | | | $ | 950.30 | | | $ | 33.72 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 990.62 | | | $ | 34.42 | | |

Mid Cap Value Fund Class C | |

Actual | | $ | 1,000.00 | | | $ | 948.40 | | | $ | 36.59 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 987.65 | | | $ | 37.32 | | |

Small Cap Value Class A | |

Actual | | $ | 1,000.00 | | | $ | 1,073.10 | | | $ | 28.16 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 998.03 | | | $ | 27.14 | | |

Small Cap Value Class C | |

Actual | | $ | 1,000.00 | | | $ | 1,068.70 | | | $ | 31.91 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 994.35 | | | $ | 30.76 | | |

Small Cap Value Class I | |

Actual | | $ | 1,000.00 | | | $ | 1,074.80 | | | $ | 26.83 | | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 999.34 | | | $ | 25.85 | | |

Expenses are equal to each Fund's annualized expense ratio (net of expense waivers), as follows, multiplied by the average account value over the period, multiplied by 184/365 days to reflect the one-half year period:

• Income and Equity Fund: 4.94% (A); 5.71% (C)

• Balanced Fund: 6.54% (A); 7.27% (C)

• Large Cap Value Fund: 6.01% (A); 6.78% (C)

• Mid Cap Value Fund: 6.86% (A); 7.45% (C)

• Small Cap Value Fund: 5.39% (A); 6.12% (C); 5.13% (I)

21

Pacific Advisors Income and Equity Fund

Schedule of Investments

as of December 31, 2019

Quantity or

Principal* | | Description | | Current

$ Value* | | % of Total

Net Assets | |

COMMON STOCK | | | |

COMMUNICATION SERVICES | | | 3.94 | | |

DIVERSIFIED TELECOM. SERVICES | | | |

| | 3,900 | | | AT&T INC. | | | 152,412 | | | | | | |

| | 2,525 | | | VERIZON COMMUNICATIONS INC. | | | 155,035 | | | | | | |

| | | | | | | | 307,447 | | | | 3.94 | | |

CONSUMER DISCRETIONARY | | | 7.70 | | |

DISTRIBUTORS | | | |

| | 1,500 | | | GENUINE PARTS CO. | | | 159,345 | | | | | | |

| | | | | | | | 159,345 | | | | 2.04 | | |

MULTILINE RETAIL | | | |

| | 3,000 | | | KOHLS CORP. | | | 152,850 | | | | | | |

| | 1,200 | | | TARGET CORP. | | | 153,852 | | | | | | |

| | | | | | | | 306,702 | | | | 3.93 | | |

TEXTILES, APPAREL & LUXURY GOODS | | | |

| | 5,000 | | | TAPESTRY INC. | | | 134,850 | | | | | | |

| | | | | | | | 134,850 | | | | 1.73 | | |

CONSUMER STAPLES | | | 6.15 | | |

BEVERAGES | | | |

| | 2,800 | | | COCA-COLA CO. | | | 154,980 | | | | | | |

| | | | | | | | 154,980 | | | | 1.99 | | |

FOOD & STAPLES RETAILING | | | |

| | 1,900 | | | SYSCO CORP. | | | 162,526 | | | | | | |

| | | | | | | | 162,526 | | | | 2.08 | | |

HOUSEHOLD PRODUCTS | | | |

| | 1,300 | | | PROCTER & GAMBLE CO. | | | 162,370 | | | | | | |

| | | | | | | | 162,370 | | | | 2.08 | | |

ENERGY | | | 5.43 | | |

ENERGY EQUIPMENT & SERVICES | | | |

| | 3,000 | | | SCHLUMBERGER LTD | | | 120,600 | | | | | | |

| | | | | | | | 120,600 | | | | 1.54 | | |

OIL, GAS & CONSUMABLE FUELS | | | |

| | 1,300 | | | CHEVRON CORP. | | | 156,663 | | | | | | |

| | 2,100 | | | EXXON MOBIL CORP. | | | 146,538 | | | | | | |

| | | | | | | | 303,201 | | | | 3.89 | | |

See Accompanying Notes to Financial Statements which are an integral part of these financial statements.

22

Pacific Advisors Income and Equity Fund

Schedule of Investments

as of December 31, 2019

Quantity or

Principal* | | Description | | Current

$ Value* | | % of Total

Net Assets | |

COMMON STOCK continued | | | |

FINANCIALS | | | 7.40 | | |

BANKS | | | |

| | 2,600 | | | U.S. BANCORP | | | 154,154 | | | | | | |

| | | | | | | | 154,154 | | | | 1.98 | | |

CAPITAL MARKETS | | | |

| | 1,200 | | | T. ROWE PRICE GROUP INC. | | | 146,208 | | | | | | |

| | | | | | | | 146,208 | | | | 1.87 | | |

INSURANCE | | | |

| | 2,500 | | | METLIFE INC. | | | 127,425 | | | | | | |

| | 1,600 | | | PRUDENTIAL FINANCIAL | | | 149,984 | | | | | | |

| | | | | | | | 277,409 | | | | 3.55 | | |

HEALTH CARE | | | 7.65 | | |

BIOTECHNOLOGY | | | |

| | 1,700 | | | ABBVIE INC. | | | 150,518 | | | | | | |

| | | | | | | | 150,518 | | | | 1.93 | | |

HEALTH CARE PROVIDERS & SERVICES | | | |

| | 2,000 | | | CVS HEALTH CORP. | | | 148,580 | | | | | | |

| | | | | | | | 148,580 | | | | 1.90 | | |

PHARMACEUTICALS | | | |

| | 1,050 | | | JOHNSON & JOHNSON | | | 153,163 | | | | | | |

| | 3,700 | | | PFIZER INC. | | | 144,966 | | | | | | |

| | | | | | | | 298,129 | | | | 3.82 | | |

INDUSTRIALS | | | 7.83 | | |

AEROSPACE & DEFENSE | | | |

| | 400 | | | LOCKHEED MARTIN CORP. | | | 155,752 | | | | | | |

| | | | | | | | 155,752 | | | | 2.00 | | |

AIR FREIGHT & LOGISTICS | | | |

| | 1,300 | | | UNITED PARCEL SERVICE, INC. B | | | 152,178 | | | | | | |

| | | | | | | | 152,178 | | | | 1.95 | | |

INDUSTRIAL CONGLOMERATES | | | |

| | 875 | | | HONEYWELL INTERNATIONAL INC. | | | 154,875 | | | | | | |

| | | | | | | | 154,875 | | | | 1.99 | | |

TRADING COMPANIES & DISTRIBUTORS | | | |

| | 4,000 | | | FASTENAL COMPANY | | | 147,800 | | | | | | |

| | | | | | | | 147,800 | | | | 1.89 | | |

See Accompanying Notes to Financial Statements which are an integral part of these financial statements.

23

Pacific Advisors Income and Equity Fund

Schedule of Investments

as of December 31, 2019

Quantity or

Principal* | | Description | | Current

$ Value* | | % of Total

Net Assets | |

COMMON STOCK continued | | | |

INFORMATION TECHNOLOGY | | | 7.66 | | |

COMMUNICATIONS EQUIPMENT | | | |

| | 2,800 | | | CISCO SYSTEMS INC. | | | 134,288 | | | | | | |

| | | | | | | | 134,288 | | | | 1.72 | | |

IT SERVICES | | | |

| | 1,075 | | | INT'L BUSINESS MACHINES CORP. | | | 144,093 | | | | | | |

| | | | | | | | 144,093 | | | | 1.85 | | |

SEMICONDUCTORS & EQUIPMENT | | | |