UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7064

The Target Portfolio Trust

(Exact name of registrant as specified in charter)

| | |

Gateway Center 3 100 Mulberry Street Newark, New Jersey 07102 |

| (Address of principal executive offices) |

Lori E. Bostrom

Gateway Center 3

100 Mulberry Street

Newark, New Jersey 07102

(Name and address of agent for service)

Registrant’s telephone number, including area code: 973-367-1495

Date of fiscal year end: 12/31/03

Date of reporting period: 12/31/03

Item 1 – Reports to Stockholders – [INSERT REPORT]

The TARGETPortfolio Trust®

Annual Report

December 31, 2003

TARGET

A STRUCTURED AND PERSONALIZED INVESTMENT PROGRAM

Dear TARGET Shareholder:

February 23, 2004

As you may know, the mutual fund industry recently has been the subject of much media attention. As president of The TARGET Portfolio Trust, I’d like to provide you with an update on the issues as they pertain to your Portfolio.

Regulators and government authorities have requested information regarding trading practices from many mutual fund companies across the nation. Our fund family has been cooperating with inquiries it has received, and at the same time, Prudential Financial, Inc. has been conducting its own internal review. This review encompasses the policies, systems, and procedures of our fund family, Prudential Financial’s investment units and its proprietary distribution channels. The review also includes mutual fund trading activity by investment professionals who manage our funds.

Market timing

The frequent trading of shares in response to short-term fluctuations in the market is known as “market timing”. When market timing occurs in violation of a fund’s prospectus, in certain circumstances, a fund may have to sell portfolio securities to have the cash necessary to redeem the market timer’s shares. The redemption may happen when it is not advantageous to sell securities and result in harming the fund’s performance and/or subject the fund to additional transaction costs.

Prudential Investments LLC, the Fund’s investment manager, has actively discouraged market timing and for years our mutual fund prospectuses have identified and addressed this issue. Prudential Investments has established operating policies and procedures that are designed to detect and deter frequent trading activities that would be disruptive to the management of our mutual fund portfolios, and has rejected numerous orders placed by market timers in the past.

Late trading

The Securities and Exchange Commission requires that orders to purchase or redeem mutual fund shares be received either by the fund or by an intermediary (such as a broker, financial adviser, or 401(k) record keeper) before the time at which the fund calculates its net asset value (normally 4:00 p.m., Eastern time) if they are to receive that day’s price. The policies of our mutual funds do not make and have not made allowances for the practice known as “late trading”.

For more than 40 years we have offered investors quality investment products, financial guidance, and responsive customer service. Today we remain committed to this heritage and to the highest ethical principles in our investment practices.

Sincerely,

Judy A. Rice, President

The TARGET Portfolio Trust

| | |

| THE TARGET PORTFOLIO TRUST | | 1 |

| | | | | | | | | | | |

| Equity Portfolios as of 12/31/03 | | | | | | | | | | | |

| | | Total Returns1

(Without

TARGET

Program Fee)

One Year | | | Average Annual Total Returns1

(With TARGET Program Fee) |

| | | | One Year | | | Five Years | | | Ten Years2 |

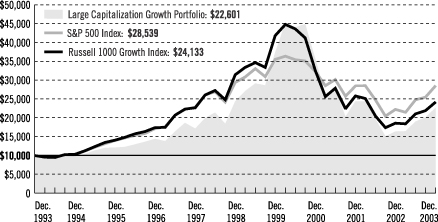

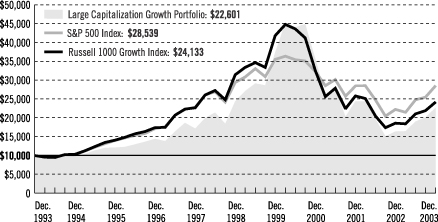

Large Capitalization Growth Portfolio | | 39.53 | % | | 37.45 | % | | –1.55 | % | | 8.50% |

|

S&P 500 Index4 | | 28.67 | | | 28.67 | | | –0.57 | | | 11.06 |

|

Russell 1000 Growth Index4 | | 29.75 | | | 29.75 | | | –5.11 | | | 9.21 |

|

Lipper Large-Cap Core Funds Avg.5 | | 25.59 | | | 25.59 | | | –1.75 | | | 8.78 |

|

| | | | | | | | | | | | |

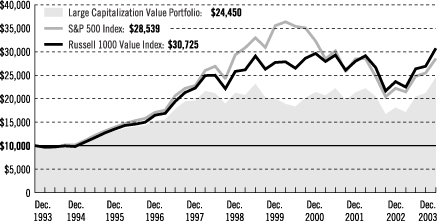

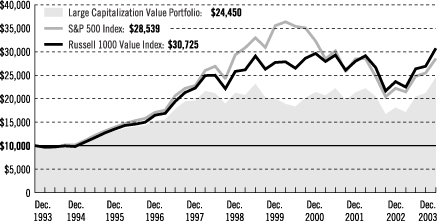

Large Capitalization Value Portfolio | | 36.38 | % | | 34.35 | % | | 2.75 | % | | 9.35% |

|

S&P 500 Index4 | | 28.67 | | | 28.67 | | | –0.57 | | | 11.06 |

|

Russell 1000 Value Index4 | | 30.03 | | | 30.03 | | | 3.56 | | | 11.88 |

|

Lipper Multi-Cap Value Funds Avg.5 | | 30.80 | | | 30.80 | | | 4.95 | | | 11.00 |

|

| | | | | | | | | | | | |

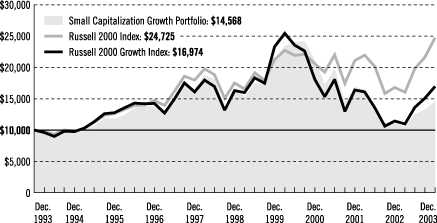

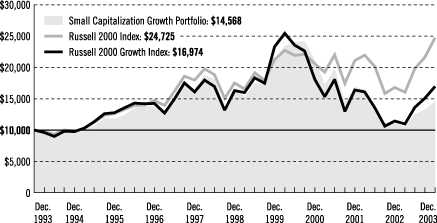

Small Capitalization Growth Portfolio | | 33.05 | % | | 31.07 | % | | –2.65 | % | | 3.83% |

|

Russell 2000 Index4 | | 47.25 | | | 47.25 | | | 7.13 | | | 9.47 |

|

Russell 2000 Growth Index4 | | 48.54 | | | 48.54 | | | 0.86 | | | 5.43 |

|

Lipper Small-Cap Growth Funds Avg.5 | | 44.36 | | | 44.36 | | | 4.88 | | | 8.53 |

|

| | | | | | | | | | | | |

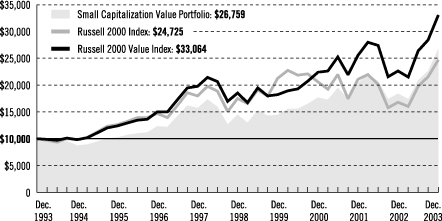

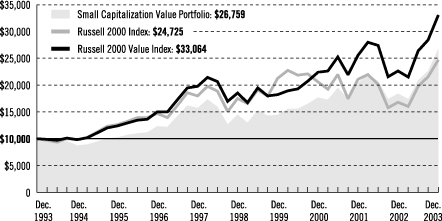

Small Capitalization Value Portfolio | | 47.10 | % | | 44.91 | % | | 12.96 | % | | 10.34% |

|

Russell 2000 Index4 | | 47.25 | | | 47.25 | | | 7.13 | | | 9.47 |

|

Russell 2000 Value Index4 | | 46.03 | | | 46.03 | | | 12.28 | | | 12.70 |

|

Lipper Small-Cap Core Funds Avg.5 | | 44.24 | | | 44.24 | | | 10.07 | | | 10.04 |

|

| | | | | | | | | | | | |

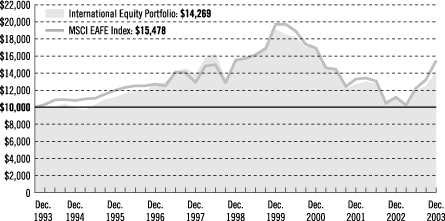

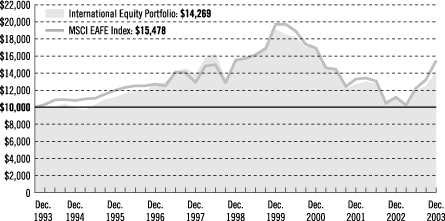

International Equity Portfolio | | 28.76 | % | | 26.84 | % | | –2.00 | % | | 3.62% |

|

MSCI EAFE Index4 | | 38.59 | | | 38.59 | | | –0.05 | | | 4.47 |

|

Lipper International Funds Avg.5 | | 34.74 | | | 34.74 | | | 1.28 | | | 4.65 |

|

| | | | | | | | | | | | |

| | | | |

| Fixed Income Portfolios as of 12/31/03 | | | | | | | | | | | |

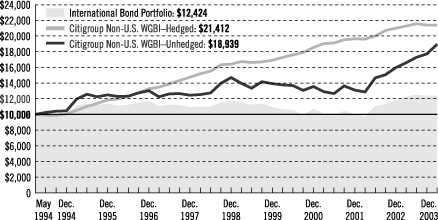

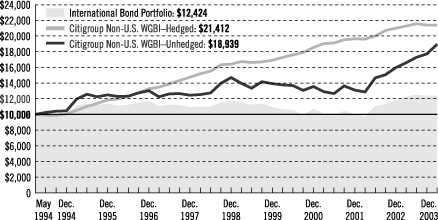

International Bond Portfolio | | 5.31 | % | | 4.26 | % | | 1.05 | % | | 2.28% (2.24)2,3 |

|

Citigroup Non-U.S. WGBI–Hedged4 | | 1.88 | | | 1.88 | | | 5.44 | | | 8.272 |

|

Citigroup Non-U.S. WGBI–Unhedged4 | | 18.52 | | | 18.52 | | | 5.21 | | | 6.892 |

|

Lipper International Income Funds Avg.5 | | 15.75 | | | 15.75 | | | 5.89 | | | 7.202 |

|

| | | | | | | | | | | | |

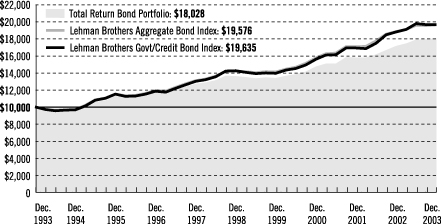

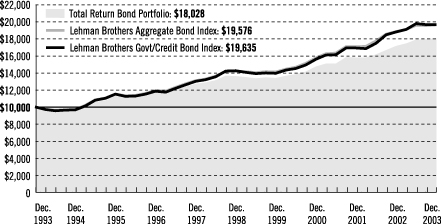

Total Return Bond Portfolio | | 6.22 | % | | 5.17 | % | | 5.75 | % | | 6.07% |

|

Lehman Brothers Aggregate Bond Index4 | | 4.10 | | | 4.10 | | | 6.62 | | | 6.95 |

|

Lehman Brothers Govt/Credit Bond Index4 | | 4.67 | | | 4.67 | | | 6.66 | | | 6.98 |

|

Lipper Corporate Debt BBB-Rated Funds Avg.5 | | 8.23 | | | 8.23 | | | 6.11 | | | 6.49 |

|

| | | | | | | | | | | | |

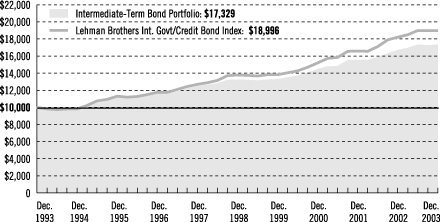

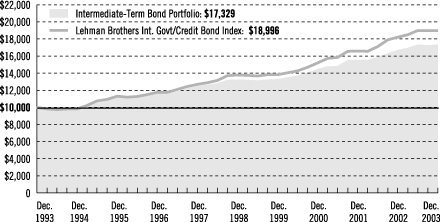

Intermediate-Term Bond Portfolio | | 4.58 | % | | 3.54 | % | | 5.44 | % | | 5.65% |

|

Lehman Brothers Int. Govt/Credit Bond Index4 | | 4.31 | | | 4.31 | | | 6.65 | | | 6.63 |

|

Lipper Int. Inv.-Grade Debt Funds Avg.5 | | 4.55 | | | 4.55 | | | 5.82 | | | 6.17 |

|

| | | | | | | | | | | | |

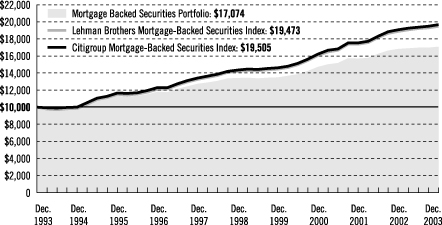

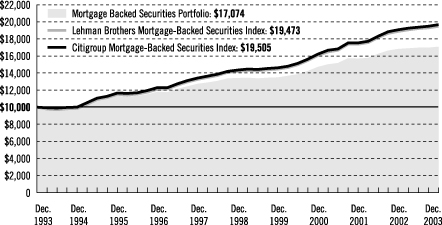

Mortgage Backed Securities Portfolio | | 2.20 | % | | 1.18 | % | | 4.89 | % | | 5.48% (5.47)3 |

|

Lehman Brothers Mortgage-Backed Securities Index4 | | 3.07 | | | 3.07 | | | 6.55 | | | 6.89 |

|

Citigroup Mortgage-Backed Securities Index4 | | 3.07 | | | 3.07 | | | 6.59 | | | 6.91 |

|

Lipper U.S. Mortgage Funds Avg.5 | | 2.48 | | | 2.48 | | | 5.68 | | | 5.88 |

|

| | |

| 2 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | |

| Money Market Portfolio as of 12/31/03 | | | | | | | | |

| | | Total Returns1

(Without

TARGET Program

Fee) One Year | | | Net Asset Value

(NAV) | | 7-Day Current

Yield | |

U.S. Government Money Market Portfolio7 | | 0.70 | % | | $ | 1.00 | | 0.55 | % |

| |

Lipper U.S. Government Money Market Funds Avg.5 | | 0.46 | | | | N/A | | N/A | |

| |

iMoneyNet, Inc. All Taxable Money Market Fund Avg.6 | | N/A | | | | N/A | | 0.53 | |

| |

Past performance is not indicative of future results. Principal value and investment return will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. 1Source: Prudential Investments LLC, Lipper Inc., and iMoneyNet, Inc. Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. The one-year total returns (without advisory fee) do not reflect a deduction for the annual TARGET program fee. Returns would be lower if the fee were deducted. The average annual total returns for the TARGET portfolios assume the imposition of the maximum TARGET annual advisory fee of 1.50% for stock portfolios and 1% for bond portfolios for retail investors. Returns for retirement accounts will differ. The maximum advisory fees for these accounts are 1.25% and 1.35% of equity portfolio and bond portfolio assets respectively. The returns in the table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or following the redemption of fund shares. 2The inception date for the International Bond Portfolio is 5/17/94, and therefore the performance is for the since-inception period. 3Without waiver of fees and/or expense subsidization, the portfolios’ returns would have been lower, as indicated in parentheses. 4Investors cannot invest directly in an index. The returns for the benchmark indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. The Standard & Poor’s Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how stock prices have performed. The Russell 1000 Growth Index contains those securities in the Russell 1000 Index with an above-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings ratios, lower dividend yields, and higher forecasted growth rates. The Russell 1000 Value Index contains those securities in the Russell 1000 Index with a below-average growth orientation. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. The Russell 2000 Index is an unmanaged index of the stocks of the 2,000 smallest U.S. companies included in the Russell 3000 Index. It gives a broad look at how the stock prices of smaller companies have performed. The Russell 2000 Growth Index contains those securities in the Russell 2000 Index with an above-average growth orientation. Companies in this index generally have higher price-to-book and price-to-earnings ratios. The Russell 2000 Value Index contains those securities in the Russell 2000 Index with a below-average growth orientation. Companies in this index generally have low price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. The Morgan Stanley Capital International Europe, Australasia, and Far East Index (MSCI EAFE Index) is an unmanaged, weighted index that reflects stock price movements in Europe, Australasia, and the Far East. It gives a broad look at how foreign stocks have performed. The Citigroup Non-U.S. World Government Bond Index (WGBI)–Hedged is an unmanaged index of approximately 600 high-quality bonds with foreign currency exposure hedged to the U.S. dollar. The Citigroup Non-U.S. World Government Bond Index (WGBI)–Unhedged is an unmanaged index of approximately 600 high-quality bonds issued in several different currencies. It gives a broad look at how foreign bonds have performed. The Lehman Brothers Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies and by corporations with between 1 and 10 years remaining to maturity. It gives a broad look at how bond prices of short- and intermediate-term bonds have performed. The Lehman Brothers Government/Credit Bond Index (formerly Lehman Brothers Government/Corporate Bond Index) is an unmanaged index of publicly traded intermediate- and long-term government and corporate debt with an average maturity of 10 years. It gives a broad look at how bonds have performed. The Lehman Brothers Intermediate Government/Credit Bond Index (formerly Lehman Brothers Intermediate Government/Corporate Bond Index) is an unmanaged index of publicly traded U.S. government bonds and investment-grade corporate bonds with maturities of up to 10 years. It gives a broad look at how intermediate-term bonds have performed. The Lehman Brothers Mortgage-Backed Securities Index is a market capitalization-weighted index of 15- and

| | |

| THE TARGET PORTFOLIO TRUST | | 3 |

30-year fixed-rate securities backed by GNMA, FNMA, and FHLMC mortgage pools, and balloon mortgages with fixed-rate coupons. The Citigroup Mortgage-Backed Securities Index is an unmanaged index of 15- and 30-year mortgage-related securities issued by U.S. government agencies. Each of them gives a broad look at how mortgage-backed securities have performed. 5The Lipper averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages would be lower if they included the effects of sales charges or taxes. Large-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap core funds have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P 500 Index. Multi-Cap Value funds invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Multi-cap value funds typically have a below-average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P 500 Index. Small-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P SmallCap 600 Index. Small-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P SmallCap 600 Index. International funds invest their assets in securities with primary trading markets outside of the United States. International Income funds invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least three countries, excluding the United States, except in periods of market weakness. Corporate Debt BBB-Rated funds invest primarily in corporate and government debt issues rated in the top four grades. Intermediate Investment-Grade Debt funds invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of 5 to 10 years. U.S. Mortgage funds invest primarily in mortgages/securities issued or guaranteed as to principal and interest by the U.S. government and certain federal agencies. U.S. Government Money Market funds invest principally in financial instruments issued or guaranteed by the U.S. government, its agencies or instrumentalities with dollar-weighted average maturities of less than 90 days. These funds intend to keep a constant net asset value. 6The iMoneyNet, Inc. Average is based upon the average yield of all mutual funds in the iMoneyNet, Inc. All Taxable Money Market Fund category. 7An investment in the U.S. Government Money Market Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although this Portfolio seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in this Portfolio.

| | |

| 4 | | THE TARGET PORTFOLIO TRUST |

Investment Advisers’ Report

| | |

|

| DECEMBER 31, 2003 | | ANNUAL REPORT |

The TARGET Portfolio Trust

Investment Advisers’ Report

Large Capitalization Growth Portfolio

The total return of the Large Capitalization Growth Portfolio, subadvised by Oak Associates, Ltd. and Columbus Circle Investors LLC, was 39.53% during the one-year period ended December 31, 2003. During the same period, the S&P 500 Index returned 28.67%, the Russell 1000 Growth Index returned 29.75%, and the Lipper Large-Cap Core Funds Average returned 25.59%.

Oak Associates, Ltd.

The year 2003 was a good one for the equity markets in general, and Oak Associates’ portion of the Portfolio significantly outperformed the S&P 500 Index. This was due to a variety of factors, including strong top-down economic analysis, a concentration in the stocks in which Oak had the highest confidence, low turnover, and Oak’s maintaining the Portfolio’s top performers as they continued to appreciate during the year.

Oak Associates takes a top-down approach to determine the sectors that it believes will provide the Portfolio with optimal long-term growth. It then concentrates the number of sectors in which to invest, as well as the number of securities to hold. During the year, Oak felt that technology, healthcare, and financial services would be the driving forces of productivity and economic growth. These sectors have also tended to outperform on a longer-term basis following an economic recovery.

This stance proved beneficial as all three sectors positively impacted the Portfolio during the year. Oak’s technology holdings generated the greatest relative results, highlighted by its semiconductors and networking stocks, many of which more than doubled in price. These securities performed well as investors anticipated an increase in demand due to stronger business spending. Examples of technology holdings that generated strong results were Veritas Software, Juniper Networks, EMC Corp., Cisco Systems, and Xilinx Inc. The Portfolio’s financial stocks also did well after starting the year slowly. Examples of winning holdings in this area were Morgan Stanley and Citigroup. Oak’s healthcare positions tended to lag the overall market until the fourth quarter, consistent with what one would expect in the earlier stages of an economic recovery. As the economic recovery evolved, healthcare began to reverse its underperformance. The sector has also experienced a relief rally after passage of the Medicare reform bill. An example of a healthcare stock that performed well toward the end of the year was Pfizer, Inc.

| | |

| 6 | | THE TARGET PORTFOLIO TRUST |

Columbus Circle Investors LLC

Columbus Circle Investors’ (CCI) portion of the Portfolio outperformed the S&P 500 Index during 2003. For the most part, smaller and less established growth stocks generated the best results during the year. The factors that hindered stock performance in 2002 reversed course in 2003 as investors became less risk averse and increasingly more willing to pay higher multiples for future results, especially in the technology and cyclical sectors. The market’s rally gained momentum during the year as corporate earnings continued to show positive signs, inflation and interest rates remained stable, and the employment picture began to improve.

The greatest lift to CCI’s portion of the portfolio during the reporting period came from its exposure to technology, financials, and consumer discretionary stocks. These sectors benefited as consumers continued to show the strong spending patterns they had shown through most of the previous decade. Although CCI’s portion of the Portfolio was underweight in healthcare, the stocks selected in this area outperformed the healthcare component of the Index. For example, CCI identified opportunities in medical technology (Boston Scientific), biotechnology (Amgen), and healthcare services (Aetna). In the technology sector, portfolio holdings Cisco Systems, Veritas Software, and Intel Corp. benefited from signs of increased capital spending and effective cost-cutting measures that were implemented in 2002. A favorable interest-rate environment and a stronger economy enabled CCI’s financial stocks, such as Capital One Financial, to make meaningful contributions to the Portfolio as well. The Portfolio was negatively affected by the poor performance of holdings Lockheed Martin and AT&T Corp. and by its underweight in the industrial sector.

| | |

| THE TARGET PORTFOLIO TRUST | | 7 |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

Large Capitalization Value Portfolio

The total return of the Large Capitalization Value Portfolio, subadvised by Hotchkis and Wiley Capital Management, LLC and J.P. Morgan Investment Management Inc., was 36.38% during the one-year period ended December 31, 2003. During the same period, the S&P 500 Index returned 28.67%, the Russell 1000 Value Index returned 30.03%, and the Lipper Multi-Cap Value Funds Average returned 30.80%.

Hotchkis and Wiley Capital Management, LLC

Hotchkis and Wiley’s portion of the Portfolio strongly outperformed the S&P 500 Index in 2003, driven largely by strong security selection. Positive contributions to returns in the Portfolio were broad-based, with positive returns recorded in 9 of the 10 economic sectors.

Hotchkis and Wiley follows a bottom-up approach to stock selection based on a highly disciplined investment process that emphasizes rigorous, internally generated research in order to identify out-of-favor stocks that represent solid fundamental value. The largest contributor to absolute performance was the Portfolio’s overweight in the consumer discretionary sector. Within this sector, retail stocks did particularly well, with Sears Roebuck and J.C. Penney leading the way. Sears Roebuck & Co. gained as the sale of its credit card business was finalized in November and as news of management’s plans to repurchase nearly one-third of its outstanding shares was announced. J.C. Penney benefited as the sale of its troubled Eckerd drugstore division appeared imminent. Strong results were also generated by financial stocks as insurance industry holdings Metlife, Allmerica Financial, St. Paul, and Allstate all posted double-digit gains during the year. Also making a significant contribution was the Portfolio’s exposure to Computer Associates as the stock made considerable gains along with the rest of the technology sector.

Conversely, a larger technology weighting would have boosted the Portfolio’s performance, as relatively expensive industries such as semiconductors, which were not held in the Portfolio, performed very well. The Portfolio’s holding in Eastman Kodak also detracted from results. The company’s share price fell due to investor skepticism regarding its restructuring efforts. In addition, shares of DTE Energy declined on news that its third-quarter profits fell.

| | |

| 8 | | THE TARGET PORTFOLIO TRUST |

J.P. Morgan Investment Management Inc.

J.P. Morgan’s portion of the Portfolio outperformed the S&P 500 Index during the one-year period ended December 31, 2003. Throughout much of the year, investors were drawn to lower-quality, higher-risk investments, driving up price/earnings multiples for the stocks that had underperformed in recent years. In particular, stocks in the technology, financial, and industrial sectors generated superior results, while dividend-paying stocks and high-quality stable growers did not perform as well. During the year, J.P. Morgan carefully analyzed whether corporate capital spending would accelerate to help reduce the economy’s dependence on consumer spending. Toward the end of the reporting period, this appeared to be the case.

Looking at the Portfolio’s performance, it generated exceptional results from its stocks in the finance and capital markets sectors. Examples of winning holdings in these areas included Countrywide Financial, which returned 97%; FleetBoston Financial, which returned 88%; and E-Trade Financial Corp., which soared 160%. The Portfolio’s performance was also enhanced by the success of holding United States Steel Corp., as its stock returned 170% in 2003. Conversely, the poor performance of the Portfolio’s energy stocks, in particular Anadarko Petroleum Corp. (which returned only 8%) and the defense manufacturer Raytheon Co. (whose total return was close to zero), detracted from relative results.

| | |

| THE TARGET PORTFOLIO TRUST | | 9 |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

Small Capitalization Growth Portfolio

The total return of the Small Capitalization Growth Portfolio was 33.05% during the one-year period ended December 31, 2003. During the same period, the Russell 2000 Index returned 47.25%, the Russell 2000 Growth Index returned 48.54%, and the Lipper Small-Cap Growth Funds Average returned 44.36%.

The Portfolio is subadvised by Westcap Investors, LLC (which replaced Sawgrass Asset Management L.L.C. as a subadvisor during the third quarter of 2003) and RS Investment Management, L.P. (which replaced J.P. Morgan Fleming Asset Management (USA) Inc. during the fourth quarter of 2003).

Sawgrass Asset Management, L.L.C.

While Sawgrass Asset Management produced positive results during the period it served as a Portfolio subadvisor, it underperformed its indexes. This was largely the result of stock selection. In particular, Sawgrass’s performance was adversely affected due to its bias toward higher-quality stocks. During the reporting period, more speculative stocks generated the best investment results.

Westcap Investors, LLC

From its inception as a Portfolio subadvisor through the end of 2003, Westcap generated solid absolute results, but lagged the return of the Russell 2000 Growth Index over the same period. Because of its expectations for the aftermath of the war in Iraq, Westcap maintained a more conservative posture for the Portfolio than it normally would have, considering the signs of impending economic expansion. However, for much of the year, investors embraced lower-quality stocks, leaving managers of higher-quality portfolios disadvantaged from a relative performance standpoint. Many of these lower-quality companies quickly became very expensive. Given their valuations, many of these firms will have to execute their business plans to perfection in order to produce the revenue and earnings expected. Westcap believes the market has started to refocus on higher-quality companies that exhibit less risk and are selling at more reasonable price multiples. As such, it feels that, going forward, this investor focus will benefit shares of higher-quality, earnings- and cash-flow-driven companies.

| | |

| 10 | | THE TARGET PORTFOLIO TRUST |

From a stock selection standpoint, Westcap’s top performing sector versus the benchmark was financials. Portfolio returns were also enhanced by an overweight in information technology. Conversely, its worst performing sector allocations were an underweight in healthcare and an overweight in energy. Westcap’s stock selection was the poorest in the industrials sector.

In the information technology sector, Avocent Corporation, Semtech Corporation, Benchmark Electronics, and Rogers Corporation were examples of companies that contributed to overall performance. In the financial sector, Investors Financial Services and Jeffries Group boosted performance. On the other hand, in the healthcare sector, ICU Medical, Zoll Medical, and Charles River Laboratories detracted from results. In the industrials sector, slowing growth rates at Coinstar and RMH Teleservices caused their stock prices to decline. Given their lower growth prospects, both of these positions have been eliminated so that Westcap can invest in companies with stronger prospects for growth over a full market cycle.

J.P. Morgan Fleming Asset Management (USA) Inc.

Although J.P. Morgan generated positive investment results during its tenure as a Portfolio subadvisor this period, it underperformed its indexes. During 2003, higher-risk, more speculative stocks generated the best results. However, J.P. Morgan generally held less risky stocks, which did not perform as well during the reporting period. J.P. Morgan’s portion of the Portfolio was also hurt due to the performance of its holding in Medcath, an owner and operator of cardiac hospitals. Medcath’s stock price fell due to disappointing earnings results.

RS Investment Management, L.P.

During the short period since its inception as a subadvisor for the Portfolio, RS Investments (RS) produced positive absolute results but underperformed its benchmark. Throughout this period, RS continued to harvest gains from many of its technology positions. While it redeployed some of the gains into other technology-related companies, RS remained valuation sensitive, and stuck to its discipline of purchasing companies selling at a discount to their growth rate. While the firm’s overall technology exposure was underweight compared with that of the benchmark, stock selection in this sector continued to be very strong and contributed the largest source of returns during the reporting period. Holdings such as Lionbridge Technologies Inc., Tumbleweed Communications Corporation, and Opnet Technologies, Inc. all enhanced results.

| | |

| THE TARGET PORTFOLIO TRUST | | 11 |

The Portfolio held an overweight exposure to the consumer sector during the period. Throughout most of 2003, specialty retailers and numerous Internet-related companies generated significant gains. However, investors somewhat retreated from both of these groups late in the year, and several Portfolio positions underperformed. We view stock price weakness in certain Internet-related companies as an opportunity to expand our positions with the purchase of additional shares in companies that we believe have the best fundamentals.

Healthcare, at approximately 21% of the Portfolio, proved to be one of the weakest sectors relative to the benchmark over the period. Examples of stocks that detracted from results included a number of pharmaceutical-related stocks, including Pozen, Inc. and AtheroGenics, Inc. RS was also hurt by price weakness in several medical device and biotech positions. However, RS continues to have conviction in its research premise, and has added to these positions on price weakness.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 12 | | THE TARGET PORTFOLIO TRUST |

Small Capitalization Value Portfolio

The total return of the Small Capitalization Value Portfolio was 47.10% during the one-year period ended December 31, 2003. During the same period, the Russell 2000 Index returned 47.25%, the Russell 2000 Value Index returned 46.03%, and the Lipper Small-Cap Core Funds Average returned 44.24%.

The Portfolio is subadvised by EARNEST Partners, LLC and NFJ Investment Group L. P. (which replaced National City Investment Management Company as a subadvisor to the Portfolio in October 2003).

National City Investment Management Company

While National City Investment Management produced positive results during the period it served as a Portfolio subadvisor, it underperformed the Portfolio’s indexes. Two factors detracted from performance. National City’s portion of the Portfolio included fewer speculative stocks than the overall indexes, which detracted from results as more speculative stocks led the market. In addition, the Portfolio’s market capitalization was somewhat larger than the indexes, which hurt relative results as the smallest-cap stocks generally outperformed stocks of firms at the larger end of the small-cap range. Aside from these considerations, National City benefited from favorable stock selection during the period when it served as a subadvisor for the Portfolio.

EARNEST Partners, LLC

Equity investors were rewarded with strong results in 2003. A resilient consumer, increasing productivity, and improving corporate profitability all resulted in a solid year for equities. The year proved to be especially good for small-cap stocks, with small-cap growth stocks outperforming their value stock counterparts.

During the year, EARNEST Partners significantly outperformed its indexes. As a bottom-up manager, EARNEST focuses on identifying and investing in high-quality, attractively valued securities. The lion’s share of performance was created by individual stock selection across a variety of industries. The Portfolio’s consumer discretionary stocks enhanced results as home builders like Hovnanian (+174%) and D.R. Horton (+150%) rose sharply due to historically low mortgage rates and record home purchases. Consumer electronics manufacturer Harman International appreciated by over 148% as the company experienced strong sales of its automotive entertainment and information systems. Financial holdings, such as Americredit (+105%) and Jefferies (+58%), also boosted returns as both companies benefited from

| | |

| THE TARGET PORTFOLIO TRUST | | 13 |

improvements in the overall credit and brokerage markets. EARNEST believes that equity markets will continue to benefit from low inflation coupled with a favorable fiscal and monetary policy. This combination should continue to drive consumer spending and improve corporate profitability over the long term. EARNEST also feels that the equity markets may remain volatile and that stock selection will remain the primary driver for Portfolio performance.

NFJ Investment Group L.P.

During the short period since its inception as a Portfolio subadvisor, NFJ Investment Group (NFJ) generated strong absolute results but underperformed the Russell 2000 Value Index. NFJ employs a conservative investment discipline that calls for the purchase of higher-quality companies that pay dividends. As such, NFJ typically holds lower risk stocks than those in the benchmark indexes. However, during the reporting period, riskier, more speculative stocks generated better results than their less risky counterparts.

While NFJ’s investment decisions are based on bottom-up fundamental analysis, and it looks to remain diversified across industries, its Portfolio sector exposures aided performance for the period. In particular, slight overweight positions in basic materials and energy, and an underweight position in technology boosted relative returns. During the period, NFJ’s stock selection was neutral, neither aiding nor hurting relative performance.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 14 | | THE TARGET PORTFOLIO TRUST |

International Equity Portfolio

Lazard Asset Management LLC

The total return of the International Equity Portfolio, subadvised by Lazard Asset Management LLC, was 28.76% during the one-year period ended December 31, 2003. During the same period, the MSCI EAFE Index rose 38.59% and the Lipper International Funds Average returned 34.74%.

The early part of 2003, which saw a continuation of the previous year’s bear market, proved an anomaly in an otherwise bull market year. In mid-March, just before the start of the war in Iraq, sentiment swung abruptly from very negative to very positive. Investors rotated into stocks that stood to gain from an improving economy. The stocks that benefited most from this change in sentiment included highly leveraged and economically sensitive companies. In fact, many of the greatest beneficiaries were those same lower-quality companies whose business models had been most questioned during the bear market. The technology sector, which led 2002’s decline, proved to be 2003’s strongest performer. However, late in the year, there were signs that the rebound in lower-quality stocks had begun to fade as investors started focusing once again on individual company fundamentals.

For the one-year period ended December 31, 2003, the Portfolio generated strong absolute results but lagged its benchmark indexes. During the year, the Portfolio’s performance was helped by stock selection in the consumer discretionary sector. An example of a strong performing stock was Nissan Motor Co., which benefited from new model introductions and strong U.S. demand. With the leadership of CEO Carlos Ghosn, Nissan has steadily gained market share, improved its marketing efforts, rolled out new models, and implemented good capital discipline. Luxury goods manufacturer Richemont also performed well as the improving economy led to a rebound in demand for luxury items. Conversely, the Portfolio was hurt by stock selection in the financial sector. Lazard avoided unprofitable Japanese financial stocks such as Sumitomo Mitsui, Mizuho, UFJ Holdings, and Resona. However, these stocks significantly outperformed the sector and the market. Stock selection in the technology sector posed a similar problem, with unprofitable companies such as Ericsson and Alcatel significantly outperforming their peers and the overall market, while Portfolio holdings in companies with consistently high return on capital, such as Nokia, failed to fully participate in the rally.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 15 |

International Bond Portfolio

Fischer Francis Trees & Watts, Inc.

The total return of the International Bond Portfolio, subadvised by Fischer Francis Trees & Watts, Inc. (FFTW), was 5.31% during the one-year period ended December 31, 2003. During the same period, the Citigroup Non-U.S. World Government Bond Index–Hedged Index returned 1.88%, the Citigroup Non-U.S. World Government Bond Index–Unhedged Index returned 18.52%, and the Lipper International Income Funds Average returned 15.75%.

In May 2003, the Portfolio adopted a U.S. dollar hedged mandate instead of an unhedged mandate. This means that the Portfolio now includes contracts intended to buffer the impact of currency changes on the value of its holdings. However, bond portfolios that were hedged underperformed their unhedged counterparts in 2003 due to the sharp decline in the U.S. dollar. As a result, the Portfolio outperformed the Hedged Index and underperformed the Unhedged Index.

During the year, FFTW enhanced results through its exposure to corporate bonds. FFTW increased the Portfolio’s exposure to these securities on price weakness in 2002. This proved beneficial as corporate bonds performed well throughout much of 2003. From a country standpoint, the Portfolio’s European government bonds added to returns over the year. However, poor performance in the first and third quarters, combined with fourth-quarter Japanese government bond losses, countered these gains.

Despite strong positioning in the second and fourth quarters, FFTW’s interest-rate stance was fairly neutral for the year. This was largely due to increased interest-rate volatility in the first and third quarters. In terms of currency positioning, during the first half of 2003, currency exposures were primarily focused on a euro overweight versus the yen. For the second half of the year, the Portfolio’s positions focused more on the U.S. dollar’s weakness versus other major currencies.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 16 | | THE TARGET PORTFOLIO TRUST |

Total Return Bond Portfolio

Pacific Investment Management Company LLC

The total return of the Total Return Bond Portfolio, subadvised by Pacific Investment Management Company LLC (PIMCO), was 6.22% in 2003 versus 4.10% for the Lehman Brothers Aggregate Bond Index, 4.67% for the Lehman Brothers Government/Credit Bond Index, and 8.23% for the Lipper Corporate Debt BBB-Rated Funds Average.

Bonds gained ground in 2003, despite volatile interest rates, led by higher-yielding corporate bonds and emerging market securities. Interest rates fell in the first half of the year as the markets were anxious about deflation, but then reversed course as the mood swung toward optimism about faster economic growth. Inflation was not a factor even in the face of surging commodity prices and a falling U.S. dollar. As such, it helped to mitigate the rise in interest rates.

For the year, the Portfolio outperformed its benchmark index, driven by favorable security selection. An allocation to Treasury inflation-protected securities (TIPS) helped returns as less volatile assets outperformed amid rising rates. Emerging market bonds strongly boosted returns as credit fundamentals within the asset class continued to improve. Asset-backed bonds added to returns due to their relatively high yields. The Portfolio’s select mortgages added value as well. Modest currency exposure to the euro and yen helped returns as the U.S. dollar fell amid concern about the U.S. trade deficit. Interest-rate strategies were neutral to slightly positive as a near index duration and curve position had little impact on returns. Non-U.S. exposure, mainly to Eurozone issues, had minimal impact as rates rose in major developed markets.

Conversely, an underweight in corporate bonds had a negative impact as profits and margins improved. However, positive security selection helped to mitigate this impact. A mortgage underweight in the fourth quarter detracted from returns as lower volatility caused this area of the market to perform well.

| | |

| THE TARGET PORTFOLIO TRUST | | 17 |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

Intermediate-Term Bond Portfolio

Pacific Investment Management Company LLC

The total return of the Intermediate-Term Bond Portfolio, subadvised by Pacific Investment Management Company LLC (PIMCO), was 4.58% in 2003 versus 4.31% for the Lehman Brothers Intermediate Government/Credit Bond Index (formerly the Lehman Brothers Intermediate Government/Corporate Bond Index) and 4.55% for the Lipper Intermediate Investment-Grade Debt Funds Average.

Bonds gained ground in 2003, despite volatile interest rates, led by higher-yielding corporate bonds and emerging market securities. Interest rates fell in the first half of the year as the markets were anxious about deflation, but then reversed course as the mood swung toward optimism about faster economic growth. Inflation was not a factor even in the face of surging commodity prices and a falling U.S. dollar. As such, it helped to mitigate the rise in interest rates.

For the year, the Portfolio outperformed its index, driven largely by active security selection. Our exposure to select mortgages was positive as attractive yields provided adequate compensation for the assumption of prepayment risk. A small allocation to Treasury inflation-protected securities (TIPS) helped returns as TIPS were less volatile amid rising rates. Emerging market bonds strongly boosted returns as credit fundamentals within the asset class continued to improve. A modest currency exposure to the euro and yen helped returns as the dollar fell amid concern about the U.S. trade deficit. Non-U.S. exposure, mainly to Eurozone issues, had minimal impact as rates rose in major developed markets. Interest-rate strategies were neutral to slightly positive. A strategy that kept the Portfolio’s duration profile near that of the Index had little impact on returns.

Conversely, an underweight in corporate securities had a strong negative impact as profits and margins improved. However, positive security selection helped mitigate some of this.

During the year, the Portfolio experienced significant portfolio turnover, which was attributable mainly to the use of certain types of mortgage securities and derivatives. We do not frequently trade holdings that generate significant transaction costs to the Portfolio, such as less liquid corporate bonds and emerging market securities. However, we often purchase mortgage pass-through securities on a to-be-announced (TBA) basis. Provided that pricing is to our advantage, we may sell a mortgage TBA

| | |

| 18 | | THE TARGET PORTFOLIO TRUST |

prior to settlement date and buy or “roll” the same position forward, moving the settlement date to the next month. Although frequently rolling mortgage TBAs generates a large number of transactions, we believe that this technique can contribute to the Portfolio’s investment returns without contributing additional risk.

In the U.S. Treasury market, we frequently use futures contracts and options as substitutes for physical Treasury securities. Derivative contracts with short maturities need to be rolled forward frequently, which typically results in more trades. The cash-equivalent securities that back the mortgage and derivatives contracts also generate additional trades, but can also earn attractive returns. We believe that the benefits of these trading strategies outweigh the costs associated with them.

| | |

| THE TARGET PORTFOLIO TRUST | | 19 |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

Mortgage Backed Securities Portfolio

Wellington Management Company, LLP

The total return of the Mortgage Backed Securities Portfolio, subadvised by Wellington Management Company, LLP, was 2.20% in 2003 versus 3.07% for both the Lehman Brothers Mortgage-Backed Securities Index and the Citigroup Mortgage-Backed Securities Index, and 2.48% for the Lipper U.S. Mortgage Funds Average.

In 2003, the mortgage-backed securities market rose modestly, with the asset class experiencing significant volatility during the course of the year. During the first half of 2003, Treasury yields fell to their lowest rates in decades. The market rally (bond yields and prices move in the opposite direction) was precipitated by a weak economy and the possibility that the Federal Reserve Board (the Fed) may use “unconventional policy,” such as targeting interest rates through outright Treasury bond purchases. These low rates triggered the largest refinancing wave the mortgage-backed securities market has ever experienced. As the market became more confident in an economic recovery and the Fed removed the prospect of “unconventional policy,” yields rose sharply. Although the Fed did not raise interest rates in 2003, the reaction in the bond market resembled the last Fed tightening cycle back in 1994.

For the first half of the year, the Portfolio outperformed its Indexes due to its superior prepayment protection and security selection. In particular, the Portfolio was aided by its exposure to commercial mortgage-backed securities and Federal National Mortgage Association (FNMA) Delegated Underwriting and Servicing issues. An overweight in seasoned Government National Mortgage Association (GNMA) securities also boosted results.

In the second half of the year, the Portfolio’s longer-than-benchmark duration stance was the major detractor from performance. Interest rates rose significantly on the belief that the Fed would not use unconventional policy, such as purchasing longer Treasurys or targeting interest rates, to stimulate an economic recovery and ward off deflation.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 20 | | THE TARGET PORTFOLIO TRUST |

U.S. Government Money Market Portfolio

Wellington Management Company, LLP

The total return of the U.S. Government Money Market Portfolio, subadvised by Wellington Management Company, LLP, was 0.70% in 2003 versus 0.46% for the Lipper U.S. Government Money Market Funds Average.

During 2003, money market securities produced fairly minimal returns. To further stimulate the economy, in June 2003, the Federal Reserve Board (the Fed) cut interest rates 0.25% to a 45-year low of 1%. This created an atmosphere that favored riskier assets, such as equities.

The primary driver of performance for the Portfolio was Wellington’s duration posture during the year compared to the 90-day Treasury Bill. When interest rates are flat or declining, portfolios with longer maturities fare comparatively better. The Portfolio’s performance was aided as its average maturity was lengthened gradually over the first half of the year in anticipation of the Fed easing.

Also enhancing results was the Portfolio’s exposure to securities issued by government-sponsored agencies. Wellington’s agency exposure remained fairly constant through the first half of 2003. However, it began to increase the Portfolio’s exposure to agencies as they became more attractive relative to repurchase agreements later in the year.

| | |

| THE TARGET PORTFOLIO TRUST | | 21 |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

Large Capitalization Growth Portfolio | | Portfolio of Investments

December 31, 2003 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | LONG-TERM INVESTMENTS—96.6% | | | |

| | |

| | | Common Stocks | | | |

| | |

| | | Aluminum—1.2% | | | |

| 114,000 | | Alcoa, Inc. | | $ | 4,332,000 |

| | | | |

|

|

| | |

| | | Apparel—1.0% | | | |

| 52,500 | | Nike, Inc. (Class B shares) | | | 3,594,150 |

| | | | |

|

|

| | |

| | | Computer Software & Services—13.7% | | | |

| 180,000 | | Advent Software, Inc.(a) | | | 3,137,400 |

| 300,000 | | Brocade Communications Systems, Inc.(a) | | | 1,734,000 |

| 701,500 | | EMC Corp.(a) | | | 9,063,380 |

| 454,500 | | Microsoft Corp. | | | 12,516,930 |

| 277,000 | | Oracle Corp.(a) | | | 3,656,400 |

| 130,500 | | PeopleSoft, Inc.(a) | | | 2,975,400 |

| 393,000 | | VERITAS Software Corp.(a) | | | 14,603,880 |

| | | | |

|

|

| | | | | | 47,687,390 |

| | | | |

|

|

| | |

| | | Computers & Business Equipment—10.6% | | | |

| 1,320,900 | | Cisco Systems, Inc.(a) | | | 32,084,661 |

| 139,000 | | Dell, Inc.(a) | | | 4,720,440 |

| | | | |

|

|

| | | | | | 36,805,101 |

| | | | |

|

|

| | |

| | | Cosmetics & Toiletries—1.4% | | | |

| 36,500 | | Avon Products, Inc. | | | 2,463,385 |

| 66,500 | | Estee Lauder Cos., Inc. (Class A shares) | | | 2,610,790 |

| | | | |

|

|

| | | | | | 5,074,175 |

| | | | |

|

|

| | |

| | | Drugs & Healthcare—12.9% | | | |

| 59,000 | | Amgen, Inc.(a) | | | 3,646,200 |

| 71,000 | | Boston Scientific Corp.(a) | | | 2,609,960 |

| 81,000 | | Bristol-Myers Squibb Co. | | | 2,316,600 |

| 106,000 | | Cardinal Health, Inc. | | | 6,482,960 |

| 117,000 | | Caremark Rx, Inc.(a) | | | 2,963,610 |

| 38,000 | | Gilead Sciences, Inc.(a) | | | 2,209,320 |

| 32,500 | | Invitrogen Corp.(a) | | | 2,275,000 |

| 162,700 | | Medtronic, Inc. | | | 7,908,847 |

| 348,500 | | Pfizer, Inc. | | | 12,312,505 |

| 45,000 | | Watson Pharmaceuticals, Inc.(a) | | | 2,070,000 |

| | | | |

|

|

| | | | | | 44,795,002 |

| | | | |

|

|

| | |

| | | Education—0.8% | | | |

| 39,000 | | Apollo Group, Inc. (Class A shares)(a) | | | 2,652,000 |

| | | | |

|

|

See Notes to Financial Statements

| | |

| 22 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | Electronic Components—9.7% | | | |

| 729,000 | | Applied Materials, Inc.(a) | | $ | 16,366,050 |

| 453,000 | | Xilinx, Inc.(a) | | | 17,549,220 |

| | | | |

|

|

| | | | | | 33,915,270 |

| | | | |

|

|

| | | Financial Services—15.1% | | | |

| 83,000 | | Capital One Financial Corp. | | | 5,087,070 |

| 72,500 | | CIT Group, Inc. | | | 2,606,375 |

| 304,000 | | Citigroup, Inc. | | | 14,756,160 |

| 97,000 | | J.P. Morgan Chase & Co. | | | 3,562,810 |

| 468,150 | | MBNA Corp. | | | 11,633,528 |

| 154,400 | | Morgan Stanley | | | 8,935,128 |

| 53,000 | | Radian Group, Inc. | | | 2,583,750 |

| 90,000 | | SLM Corp. | | | 3,391,200 |

| | | | |

|

|

| | | | | | 52,556,021 |

| | | | |

|

|

| | |

| | | Hotels & Restaurants—1.6% | | | |

| 227,000 | | McDonald’s Corp. | | | 5,636,410 |

| | | | |

|

|

| | |

| | | Household Products—0.6% | | | |

| 53,000 | | Energizer Holdings, Inc.(a) | | | 1,990,680 |

| | | | |

|

|

| | |

| | | Insurance—2.4% | | | |

| 126,000 | | American International Group, Inc. | | | 8,351,280 |

| | | | |

|

|

| | |

| | | Internet—2.1% | | | |

| 79,500 | | Amazon.com, Inc.(a) | | | 4,184,880 |

| 163,300 | | Juniper Networks, Inc.(a) | | | 3,050,444 |

| | | | |

|

|

| | | | | | 7,235,324 |

| | | | |

|

|

| | |

| | | Machinery—1.1% | | | |

| 61,000 | | Deere & Co. | | | 3,968,050 |

| | | | |

|

|

| | |

| | | Media—2.5% | | | |

| 36,000 | | Clear Channel Communications, Inc. | | | 1,685,880 |

| 99,999 | | Comcast Corp. (Class A shares)(a) | | | 3,286,967 |

| 209,500 | | Time Warner Cos., Inc.(a) | | | 3,768,905 |

| | | | |

|

|

| | | | | | 8,741,752 |

| | | | |

|

|

| | |

| | | Oil Field/Equipment & Services—1.9% | | | |

| 48,500 | | Apache Corp. | | | 3,933,350 |

| 77,000 | | BJ Services Co.(a) | | | 2,764,300 |

| | | | |

|

|

| | | | | | 6,697,650 |

| | | | |

|

|

| | |

| | | Retail Trade—6.1% | | | |

| 211,000 | | GAP, Inc. (The) | | | 4,897,310 |

| 137,000 | | Home Depot, Inc. (The) | | | 4,862,130 |

| 94,500 | | Nordstrom, Inc. | | | 3,241,350 |

| 190,500 | | Staples, Inc.(a) | | | 5,200,650 |

| 55,000 | | Wal-Mart Stores, Inc. | | | 2,917,750 |

| | | | |

|

|

| | | | | | 21,119,190 |

| | | | |

|

|

See Notes to Financial Statements

| | |

| THE TARGET PORTFOLIO TRUST | | 23 |

| | |

Large Capitalization Growth Portfolio (cont’d) | | Portfolio of Investments

December 31, 2003 |

| | | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) | |

| |

| | | | | | | |

| | |

| | | Semiconductor & Semiconductor Equipment—10.5% | | | | |

| 54,500 | | Analog Devices, Inc. | | $ | 2,487,925 | |

| 166,000 | | Intel Corp. | | | 5,345,200 | |

| 325,000 | | Linear Technology Corp. | | | 13,672,750 | |

| 300,000 | | Maxim Integrated Products, Inc. | | | 14,940,000 | |

| | | | |

|

|

|

| | | | | | 36,445,875 | |

| | | | |

|

|

|

| | |

| | | Telecommunications—1.4% | | | | |

| 250,000 | | Corning, Inc.(a) | | | 2,607,500 | |

| 167,000 | | Motorola, Inc. | | | 2,349,690 | |

| | | | |

|

|

|

| | | | | | 4,957,190 | |

| | | | |

|

|

|

| | | Total long-term investments

(cost $226,774,040) | | | 336,554,510 | |

| | | | |

|

|

|

| | |

| | | SHORT-TERM INVESTMENT—3.6% | | | | |

| | |

| | | Mutual Fund | | | | |

| 12,375,527 | | Dryden Core Investment Fund—Taxable Money Market Series

(cost $12,375,527; Note 3) | | | 12,375,527 | |

| | | | |

|

|

|

| | | Total Investments—100.2%

(cost $239,149,567; Note 5) | | | 348,930,037 | |

| | | Liabilities in excess of other assets—(0.2%) | | | (544,987 | ) |

| | | | |

|

|

|

| | | Net Assets—100% | | $ | 348,385,050 | |

| | | | |

|

|

|

| (a) | Non-income producing security. |

See Notes to Financial Statements

| | |

| 24 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | LONG-TERM INVESTMENTS—98.0% | | | |

| | |

| | | Common Stocks | | | |

| | |

| | | Aerospace/Defense—2.3% | | | |

| 19,400 | | Honeywell International, Inc. | | $ | 648,542 |

| 23,500 | | Lockheed Martin Corp. | | | 1,207,900 |

| 11,300 | | Northrop Grumman Corp. | | | 1,080,280 |

| 102,700 | | Raytheon Co. | | | 3,085,108 |

| 12,500 | | United Technologies Corp. | | | 1,184,625 |

| | | | |

|

|

| | | | | | 7,206,455 |

| | | | |

|

|

| | |

| | | Automobiles—0.7% | | | |

| 49,700 | | Ford Motor Co. | | | 795,200 |

| 16,200 | | General Motors Corp. | | | 865,080 |

| 13,400 | | Harley-Davidson, Inc. | | | 636,902 |

| | | | |

|

|

| | | | | | 2,297,182 |

| | | | |

|

|

| | |

| | | Automotive Components—0.9% | | | |

| 2,900 | | Dana Corp. | | | 53,215 |

| 141,862 | | Delphi Corp. | | | 1,448,411 |

| 7,800 | | Johnson Controls, Inc. | | | 905,736 |

| 6,900 | | Lear Corp. | | | 423,177 |

| | | | |

|

|

| | | | | | 2,830,539 |

| | | | |

|

|

| | |

| | | Chemicals—1.5% | | | |

| 10,400 | | Air Products & Chemicals, Inc. | | | 549,432 |

| 3,000 | | Dow Chemical Co. | | | 124,710 |

| 31,700 | | Eastman Chemical Co. | | | 1,253,101 |

| 7,500 | | EI du Pont de Nemours & Co. | | | 344,175 |

| 8,500 | | Monsanto Co. | | | 244,630 |

| 7,600 | | PPG Industries, Inc. | | | 486,552 |

| 33,800 | | Praxair, Inc. | | | 1,291,160 |

| 13,100 | | Rohm & Haas Co. | | | 559,501 |

| | | | |

|

|

| | | | | | 4,853,261 |

| | | | |

|

|

| | |

| | | Commercial Banks—7.5% | | | |

| 35,300 | | Bank of America Corp. | | | 2,839,179 |

| 20,400 | | Bank One Corp. | | | 930,036 |

| 5,100 | | City National Corp. | | | 316,812 |

| 5,000 | | Compass Bancshares, Inc. | | | 196,550 |

| 14,300 | | First Tennessee National Corp. | | | 630,630 |

| 41,100 | | FleetBoston Financial Corp. | | | 1,794,015 |

| 21,800 | | GreenPoint Financial Corp. | | | 769,976 |

| 13,800 | | Hibernia Corp. (Class A shares) | | | 324,438 |

| 108,100 | | KeyCorp | | | 3,169,492 |

| 9,100 | | Marshall & Ilsley Corp. | | | 348,075 |

| 20,400 | | Mellon Financial Corp. | | | 655,044 |

See Notes to Financial Statements

| | |

| THE TARGET PORTFOLIO TRUST | | 25 |

| | |

Large Capitalization Value Portfolio (cont’d) | | Portfolio of Investments

December 31, 2003 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | |

| | | Commercial Banks (cont’d) | | | |

| 16,300 | | North Fork Bancorporation, Inc. | | $ | 659,661 |

| 22,700 | | SouthTrust Corp. | | | 742,971 |

| 20,800 | | SunTrust Banks, Inc. | | | 1,487,200 |

| 96,700 | | U.S. Bancorp | | | 2,879,726 |

| 38,200 | | UnionBanCal Corp. | | | 2,198,028 |

| 53,500 | | Wachovia Corp. | | | 2,492,565 |

| 23,800 | | Wells Fargo & Co. | | | 1,401,582 |

| | | | |

|

|

| | | | | | 23,835,980 |

| | | | |

|

|

| | | Commercial Services & Supplies—3.0% | | | |

| 1,700 | | BearingPoint, Inc.(a) | | | 17,153 |

| 162,500 | | Cendant Corp.(a) | | | 3,618,875 |

| 194,600 | | Waste Management, Inc. | | | 5,760,160 |

| | | | |

|

|

| | | | | | 9,396,188 |

| | | | |

|

|

| | |

| | | Computers & Peripherals—1.7% | | | |

| 49,100 | | Cisco Systems, Inc.(a) | | | 1,192,639 |

| 85,100 | | Gateway, Inc.(a) | | | 391,460 |

| 93,200 | | Hewlett-Packard Co. | | | 2,140,804 |

| 10,500 | | International Business Machines Corp. | | | 973,140 |

| 1,900 | | Lexmark International, Inc.(a) | | | 149,416 |

| 12,500 | | NCR Corp.(a) | | | 485,000 |

| 7,400 | | Oracle Corp. | | | 93,610 |

| | | | |

|

|

| | | | | | 5,426,069 |

| | | | |

|

|

| | |

| | | Consumer Products—0.7% | | | |

| 3,600 | | Fortune Brands, Inc. | | | 257,364 |

| 18,500 | | Procter & Gamble Co. | | | 1,847,780 |

| | | | |

|

|

| | | | | | 2,105,144 |

| | | | |

|

|

| | |

| | | Cosmetics & Toiletries—0.3% | | | |

| 24,400 | | Gillette Co. | | | 896,212 |

| | | | |

|

|

| | |

| | | Data Processing Systems—0.1% | | | |

| 6,100 | | First Data Corp. | | | 250,649 |

| | | | |

|

|

| | |

| | | Diversified Manufacturing—0.1% | | | |

| 4,300 | | SPX Corp.(a) | | | 252,883 |

| | | | |

|

|

| | |

| | | Electric Utilities—7.3% | | | |

| 76,700 | | Alliant Energy Corp. | | | 1,909,830 |

| 4,600 | | Ameren Corp. | | | 211,600 |

| 157,920 | | American Electric Power Co., Inc. | | | 4,818,139 |

| 23,700 | | Consolidated Edison, Inc. | | | 1,019,337 |

| 7,900 | | Constellation Energy Group, Inc. | | | 309,364 |

| 22,000 | | DTE Energy Co. | | | 866,800 |

| 30,300 | | Edison International | | | 664,479 |

See Notes to Financial Statements

| | |

| 26 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | Electric Utilities (cont’d) | | | |

| 75,900 | | Entergy Corp. | | $ | 4,336,167 |

| 149,996 | | FirstEnergy Corp. | | | 5,279,860 |

| 8,700 | | General Electric Co. | | | 269,526 |

| 9,000 | | NiSource, Inc. | | | 197,460 |

| 22,300 | | PG&E Corp.(a) | | | 619,271 |

| 16,900 | | Pinnacle West Capital Corp. | | | 676,338 |

| 19,600 | | PPL Corp. | | | 857,500 |

| 14,000 | | TXU Corp. | | | 332,080 |

| 6,200 | | Wisconsin Energy Corp. | | | 207,390 |

| 38,300 | | Xcel Energy, Inc. | | | 650,334 |

| | | | |

|

|

| | | | | | 23,225,475 |

| | | | |

|

|

| | |

| | | Electrical Equipment—0.1% | | | |

| 1,100 | | Agilent Technologies, Inc.(a) | | | 32,164 |

| 7,000 | | Cooper Industries, Ltd. (Class A shares) | | | 405,510 |

| | | | |

|

|

| | | | | | 437,674 |

| | | | |

|

|

| | |

| | | Electronics—0.2% | | | |

| 22,500 | | Altera Corp.(a) | | | 510,750 |

| 2,600 | | QLogic Corp.(a) | | | 134,160 |

| 1,300 | | Xilinx, Inc.(a) | | | 50,362 |

| | | | |

|

|

| | | | | | 695,272 |

| | | | |

|

|

| | |

| | | Energy Equipment & Services—0.1% | | | |

| 14,800 | | Pride International, Inc.(a) | | | 275,872 |

| | | | |

|

|

| | |

| | | Exchange Traded Funds—0.1% | | | |

| 6,280 | | Ishares Russell 1000 Value Index Fund | | | 366,564 |

| | | | |

|

|

| | |

| | | Financial Services—9.2% | | | |

| 1,700 | | Bear Stearns Cos., Inc. (The) | | | 135,915 |

| 10,600 | | Capital One Financial Corp. | | | 649,674 |

| 7,300 | | Charles Schwab Corp. (The) | | | 86,432 |

| 165,600 | | CIT Group, Inc. | | | 5,953,320 |

| 142,300 | | Citigroup, Inc. | | | 6,907,242 |

| 18,900 | | Countrywide Credit Industries, Inc. | | | 1,433,590 |

| 25,300 | | Freddie Mac | | | 1,475,496 |

| 19,600 | | Goldman Sachs Group, Inc. | | | 1,935,108 |

| 20,700 | | Janus Capital Group, Inc. | | | 339,687 |

| 2,400 | | Legg Mason, Inc. | | | 185,232 |

| 10,100 | | MBIA, Inc. | | | 598,223 |

| 16,700 | | MBNA Corp. | | | 414,995 |

| 17,700 | | Merrill Lynch & Co., Inc. | | | 1,038,105 |

| 42,600 | | Morgan Stanley | | | 2,465,262 |

| 161,700 | | Principal Financial Group, Inc. (The) | | | 5,347,419 |

| | | | |

|

|

| | | | | | 28,965,700 |

| | | | |

|

|

| | |

| | | Food Products—1.8% | | | |

| 13,600 | | Archer-Daniels-Midland Co. | | | 206,992 |

| 33,800 | | Coca-Cola Co. | | | 1,715,350 |

See Notes to Financial Statements

| | |

| THE TARGET PORTFOLIO TRUST | | 27 |

| | |

Large Capitalization Value Portfolio (cont’d) | | Portfolio of Investments

December 31, 2003 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | Food Products (cont’d) | | | |

| 1,100 | | General Mills, Inc. | | $ | 49,830 |

| 800 | | H.J. Heinz Co. | | | 29,144 |

| 200 | | Hershey Foods Corp. | | | 15,398 |

| 9,300 | | Kellogg Co. | | | 354,144 |

| 54,700 | | Kraft Foods, Inc. (Class A shares) | | | 1,762,434 |

| 69,300 | | Sara Lee Corp. | | | 1,504,503 |

| | | | |

|

|

| | | | | | 5,637,795 |

| | | | |

|

|

| | |

| | | Gas & Pipeline Utilities—0.2% | | | |

| 19,300 | | El Paso Corp. | | | 158,067 |

| 7,100 | | Valero Energy Corp. | | | 329,014 |

| | | | |

|

|

| | | | | | 487,081 |

| | | | |

|

|

| | |

| | | Healthcare Equipment & Supplies—1.5% | | | |

| 6,600 | | Amgen, Inc.(a) | | | 407,880 |

| 16,300 | | Bausch & Lomb, Inc. | | | 845,970 |

| 400 | | Baxter International, Inc. | | | 12,208 |

| 4,200 | | Bristol-Myers Squibb Co. | | | 120,120 |

| 2,300 | | Eli Lilly & Co. | | | 161,759 |

| 5,100 | | Gilead Sciences, Inc.(a) | | | 296,514 |

| 11,500 | | Guidant Corp. | | | 692,300 |

| 6,300 | | Human Genome Sciences, Inc.(a) | | | 83,475 |

| 4,900 | | MedImmune, Inc.(a) | | | 124,460 |

| 13,800 | | Merck & Co., Inc. | | | 637,560 |

| 5,800 | | Pfizer, Inc. | | | 204,914 |

| 8,700 | | Sepracor, Inc. | | | 208,191 |

| 3,300 | | Watson Pharmaceuticals, Inc.(a) | | | 151,800 |

| 16,800 | | Wyeth | | | 713,160 |

| | | | |

|

|

| | | | | | 4,660,311 |

| | | | |

|

|

| | |

| | | Healthcare Providers & Services—4.1% | | | |

| 97,700 | | Aetna, Inc. | | | 6,602,566 |

| 4,300 | | Anthem, Inc.(a) | | | 322,500 |

| 366,600 | | Tenet Healthcare Corp.(a) | | | 5,883,930 |

| | | | |

|

|

| | | | | | 12,808,996 |

| | | | |

|

|

| | |

| | | Homebuilding—0.1% | | | |

| 1,200 | | D.R. Horton, Inc. | | | 51,912 |

| 3,600 | | KB Home | | | 261,072 |

| 700 | | Pulte Homes, Inc. | | | 65,534 |

| | | | |

|

|

| | | | | | 378,518 |

| | | | |

|

|

| | |

| | | Hotels, Restaurants & Leisure—3.9% | | | |

| 1,800 | | Carnival Corp. | | | 71,514 |

| 80,400 | | Mandalay Resort Group(a) | | | 3,595,488 |

| 300 | | Marriott International, Inc. | | | 13,860 |

See Notes to Financial Statements

| | |

| 28 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | |

| | | Hotels, Restaurants & Leisure (cont’d) | | | |

| 38,300 | | McDonald’s Corp. | | $ | 950,989 |

| 156,900 | | Park Place Entertainment Corp. | | | 1,699,227 |

| 171,800 | | Yum! Brands, Inc.(a) | | | 5,909,920 |

| | | | |

|

|

| | | | | | 12,240,998 |

| | | | |

|

|

| | | Household Durables—1.8% | | | |

| 1,600 | | Black & Decker Corp. | | | 78,912 |

| 3,900 | | Centex Corp. | | | 419,835 |

| 46,600 | | Lennar Corp. (Class A Shares) | | | 4,473,600 |

| 4,590 | | Lennar Corp. (Class B shares) | | | 419,526 |

| 15,600 | | Masco Corp. | | | 427,596 |

| | | | |

|

|

| | | | | | 5,819,469 |

| | | | |

|

|

| | |

| | | Industrial Conglomerates—1.8% | | | |

| 1,800 | | 3M Co. | | | 153,054 |

| 3,900 | | ITT Industries, Inc. | | | 289,419 |

| 200,300 | | Tyco International Ltd. (Bermuda) | | | 5,307,950 |

| | | | |

|

|

| | | | | | 5,750,423 |

| | | | |

|

|

| | |

| | | Industrial Machinery—0.4% | | | |

| 5,500 | | Deere & Co. | | | 357,775 |

| 4,500 | | Eaton Corp. | | | 485,910 |

| 5,300 | | Ingersoll-Rand Co. (Class A shares) | | | 359,764 |

| | | | |

|

|

| | | | | | 1,203,449 |

| | | | |

|

|

| | |

| | | Insurance—10.6% | | | |

| 89,800 | | Allmerica Financial Corp.(a) | | | 2,763,146 |

| 191,100 | | Allstate Corp. (The) | | | 8,221,122 |

| 15,300 | | Ambac Financial Group, Inc. | | | 1,061,667 |

| 7,300 | | American International Group, Inc. | | | 483,844 |

| 600 | | Chubb Corp. (The) | | | 40,860 |

| 15,400 | | CIGNA Corp. | | | 885,500 |

| 26,900 | | Hartford Financial Services Group, Inc. (The) | | | 1,587,907 |

| 4,100 | | John Hancock Financial Services, Inc. | | | 153,750 |

| 19,300 | | Lincoln National Corp. | | | 779,141 |

| 260,770 | | MetLife, Inc. | | | 8,780,126 |

| 7,400 | | Protective Life Corp. | | | 250,416 |

| 1,000 | | SAFECO Corp. | | | 38,930 |

| 173,100 | | St. Paul Cos., Inc. | | | 6,863,415 |

| 7,300 | | Torchmark Corp. | | | 332,442 |

| 44,000 | | Travelers Property Casualty Corp., (Class A shares) | | | 738,320 |

| 7,900 | | Travelers Property Casualty Corp., (Class B shares) | | | 134,063 |

| 29,300 | | UnumProvident Corp. | | | 462,061 |

| | | | |

|

|

| | | | | | 33,576,710 |

| | | | |

|

|

| | | IT Services—3.0% | | | |

| 14,800 | | Computer Sciences Corp.(a) | | | 654,604 |

| 334,600 | | Electronic Data Systems Corp. | | | 8,211,084 |

| 6,100 | | EMC Corp.(a) | | | 78,812 |

See Notes to Financial Statements

| | |

| THE TARGET PORTFOLIO TRUST | | 29 |

| | |

Large Capitalization Value Portfolio (cont’d) | | Portfolio of Investments

December 31, 2003 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | IT Services (cont’d) | | | |

| | | | | | |

| 18,500 | | SunGard Data Systems, Inc.(a) | | $ | 512,635 |

| 39,400 | | Sun Microsystems, Inc.(a) | | | 176,906 |

| | | | |

|

|

| | | | | | 9,634,041 |

| | | | |

|

|

| | |

| | | Leisure Equipment & Products—0.9% | | | |

| 113,800 | | Eastman Kodak Co. | | | 2,921,246 |

| | | | |

|

|

| | |

| | | Manufacturing | | | |

| 900 | | Illinois Tool Works, Inc. | | | 75,519 |

| | | | |

|

|

| | |

| | | Media—2.7% | | | |

| 4,400 | | E.W. Scripps Co. (Class A shares) | | | 414,216 |

| 30,400 | | Fox Entertainment Group, Inc. (Class A shares)(a) | | | 886,160 |

| 16,300 | | Gannett Co., Inc. | | | 1,453,308 |

| 1,300 | | Knight-Ridder, Inc. | | | 100,581 |

| 49,800 | | Liberty Media Corp. (Class A shares)(a) | | | 592,122 |

| 400 | | McGraw-Hill Companies, Inc. (The) | | | 27,968 |

| 63,400 | | Time Warner Cos., Inc. | | | 1,140,566 |

| 11,500 | | Tribune Co. | | | 593,400 |

| 41,000 | | Viacom, Inc. (Class B shares) | | | 1,819,580 |

| 61,700 | | Walt Disney Co. | | | 1,439,461 |

| | | | |

|

|

| | | | | | 8,467,362 |

| | | | |

|

|

| | |

| | | Metals & Mining—1.8% | | | |

| 129,976 | | Alcoa, Inc. | | | 4,939,088 |

| 24,100 | | United States Steel Corp. | | | 843,982 |

| | | | |

|

|

| | | | | | 5,783,070 |

| | | | |

|

|

| | |

| | | Multi-Utilities—0.1% | | | |

| 12,001 | | SCANA Corp. | | | 411,034 |

| | | | |

|

|

| | |

| | | Networking Equipment—0.1% | | | |

| 16,500 | | Juniper Networks, Inc.(a) | | | 308,220 |

| | | | |

|

|

| | |

| | | Oil & Gas—4.9% | | | |

| 16,200 | | Anadarko Petroleum Corp. | | | 826,362 |

| 1,300 | | Baker Hughes, Inc. | | | 41,808 |

| 29,400 | | ChevronTexaco Corp. | | | 2,539,866 |

| 139,200 | | Exxon Mobil Corp. | | | 5,707,200 |

| 78,128 | | Sunoco, Inc. | | | 3,996,247 |

| 37,100 | | Teekay Shipping Corp. | | | 2,115,813 |

| 9,700 | | Unocal Corp. | | | 357,251 |

| | | | |

|

|

| | | | | | 15,584,547 |

| | | | |

|

|

| | |

| | | Oil Field/Equipment & Services—1.4% | | | |

| 34,800 | | ConocoPhillips | | | 2,281,836 |

| 4,800 | | Cooper Cameron Corp.(a) | | | 223,680 |

See Notes to Financial Statements

| | |

| 30 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | | Oil Field/Equipment & Services (cont’d) | | | |

| 30,700 | | Devon Energy Corp. | | $ | 1,757,882 |

| 15,600 | | Dynegy, Inc. | | | 66,768 |

| 1,300 | | ENSCO International, Inc. | | | 35,321 |

| 8,800 | | Rowan Cos., Inc.(a) | | | 203,896 |

| | | | |

|

|

| | | | | | 4,569,383 |

| | | | |

|

|

| | |

| | | Paper & Forest Products—1.1% | | | |

| 9,500 | | Bowater, Inc. | | | 439,945 |

| 15,100 | | Georgia-Pacific Group | | | 463,117 |

| 3,200 | | Smurfit-Stone Container Corp.(a) | | | 59,424 |

| 3,100 | | Temple-Inland, Inc. | | | 194,277 |

| 35,720 | | Weyerhaeuser Co. | | | 2,286,080 |

| | | | |

|

|

| | | | | | 3,442,843 |

| | | | |

|

|

| | |

| | | Railroads & Equipment—0.2% | | | |

| 1,800 | | CSX Corp. | | | 64,692 |

| 400 | | FedEx Corp. | | | 27,000 |

| 10,800 | | Norfolk Southern Corp. | | | 255,420 |

| 1,700 | | Union Pacific Corp. | | | 118,116 |

| | | | |

|

|

| | | | | | 465,228 |

| | | | |

|

|

| | |

| | | Real Estate Investment Trust—1.4% | | | |

| 1,700 | | Apartment Investment & Management Co. | | | 58,650 |

| 4,300 | | Archstone-Smith Trust | | | 120,314 |

| 2,100 | | Camden Property Trust | | | 93,030 |

| 5,000 | | CarrAmerica Realty Corp. | | | 148,900 |

| 9,100 | | Duke Realty Corp. | | | 282,100 |

| 31,800 | | Equity Office Properties Trust | | | 911,070 |

| 12,000 | | Equity Residential | | | 354,120 |

| 11,700 | | General Growth Properties, Inc. | | | 324,675 |

| 2,500 | | Highwoods Properties, Inc. | | | 63,500 |

| 5,700 | | Hospitality Properties Trust | | | 235,296 |

| 2,900 | | Mack-Cali Realty Corp. | | | 120,698 |

| 25,585 | | Plum Creek Timber Co., Inc. | | | 779,063 |

| 12,700 | | ProLogis Trust | | | 407,543 |

| 6,500 | | Rouse Co. (The) | | | 305,500 |

| 6,500 | | United Dominion Realty Trust, Inc. | | | 124,800 |

| | | | |

|

|

| | | | | | 4,329,259 |

| | | | |

|

|

| | |

| | | Retailing—6.9% | | | |

| 8,900 | | Abercrombie & Fitch Co. (Class A shares)(a) | | | 219,919 |

| 107,400 | | Albertson’s, Inc. | | | 2,432,610 |

| 31,100 | | CVS Corp. | | | 1,123,332 |

| 16,300 | | Federated Department Stores, Inc.(a) | | | 768,219 |

| 19,900 | | Home Depot, Inc. (The) | | | 706,251 |

| 274,700 | | J. C. Penney Co., Inc. | | | 7,219,116 |

| 10,200 | | Kohl’s Corp.(a) | | | 458,388 |

See Notes to Financial Statements

| | |

| THE TARGET PORTFOLIO TRUST | | 31 |

| | |

Large Capitalization Value Portfolio (cont’d) | | Portfolio of Investments

December 31, 2003 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

|

| | | | | | |

| | |

| | | Retailing (cont’d) | | | |

| 6,600 | | May Department Stores Co. (The) | | $ | 191,862 |

| 192,000 | | Sears, Roebuck & Co. | | | 8,734,080 |

| | | | |

|

|

| | | | | | 21,853,777 |

| | | | |

|

|

| | |

| | | Semiconductors & Semiconductor Equipment—0.1% | | | |

| 800 | | Intersil Corp. (Class A shares)(a) | | | 19,880 |

| 5,800 | | Micron Technology, Inc.(a) | | | 78,126 |

| 1,400 | | Novellus Systems, Inc.(a) | | | 58,870 |

| | | | |

|

|

| | | | | | 156,876 |

| | | | |

|

|

| | |

| | | Software—2.2% | | | |

| 9,600 | | BMC Software, Inc.(a) | | | 179,040 |

| 229,200 | | Computer Associates International, Inc. | | | 6,266,328 |

| 8,500 | | Mercury Interactive Corp.(a) | | | 413,440 |

| 2,700 | | Take-Two Interactive Software, Inc. | | | 77,787 |

| | | | |

|

|

| | | | | | 6,936,595 |

| | | | |

|

|

| | |

| | | Supplier & Networking Equipment—0.1% | | | |

| 21,100 | | Lucent Technologies, Inc.(a) | | | 59,924 |

| 43,000 | | Tellabs, Inc.(a) | | | 362,490 |

| | | | |

|

|

| | | | | | 422,414 |

| | | | |

|

|

| | |

| | | Telecommunications Services—2.8% | | | |