| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07076 | |

| Wilshire Mutual Funds, Inc. |

| (Exact name of registrant as specified in charter) |

| 1299 Ocean Avenue, Suite 700 Santa Monica, CA | 90401-1085 |

| (Address of principal executive offices) | (Zip code) |

Jason A. Schwarz

| Wilshire Associates Incorporated, 1299 Ocean Avenue, Suite 700, Santa Monica, CA 90401-1085 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (866) 591-1568 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | June 30, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Wilshire Mutual Funds, Inc. |

SEMI-ANNUAL REPORT (Unaudited) Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire International Equity Fund Wilshire Income Opportunities Fund |

June 30, 2018 http://advisor.wilshire.com |

Wilshire Mutual Funds, Inc. Table of Contents |

|

Letter to Shareholders | 1 |

Commentary: | |

Large Company Growth Portfolio | 4 |

Large Company Value Portfolio | 7 |

Small Company Growth Portfolio | 10 |

Small Company Value Portfolio | 13 |

Wilshire 5000 IndexSM Fund | 16 |

Wilshire International Equity Fund | 19 |

Wilshire Income Opportunities Fund | 22 |

Disclosure of Fund Expenses | 25 |

Schedule of Investments/Condensed Schedules of Investments: | |

Large Company Growth Portfolio | 28 |

Large Company Value Portfolio | 30 |

Small Company Growth Portfolio | 32 |

Small Company Value Portfolio | 34 |

Wilshire 5000 IndexSM Fund | 36 |

Wilshire International Equity Fund | 38 |

Wilshire Income Opportunities Fund | 42 |

Statements of Assets and Liabilities | 67 |

Statements of Operations | 70 |

Statements of Changes in Net Assets | 72 |

Financial Highlights: | |

Large Company Growth Portfolio | 77 |

Large Company Value Portfolio | 79 |

Small Company Growth Portfolio | 81 |

Small Company Value Portfolio | 83 |

Wilshire 5000 IndexSM Fund | 85 |

Wilshire International Equity Fund | 87 |

Wilshire Income Opportunities Fund | 91 |

Notes to Financial Statements | 93 |

Additional Fund Information | 118 |

Board Approval of Subadvisory Agreements | 119 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund and Wilshire Income Opportunities Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by Ultimus Fund Distributors, LLC.

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) |

|

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this semi-annual report to all shareholders of the Wilshire Mutual Funds. This report covers the period from January 1, 2018 to June 30, 2018, for all share classes of the Large Company Growth Fund, Large Company Value Fund, Small Company Growth Fund, Small Company Value Fund, Wilshire 5000 Index Fund, Wilshire International Equity Fund, and Wilshire Income Opportunities Fund.

MARKET ENVIRONMENT

U.S. Equity Market

The U.S. stock market, represented by the Wilshire 5000 Total Market IndexSM, was up 3.04% for the first half of the year. During the first six months of the year, growth-oriented stocks outpaced value securities across all market capitalizations. Within the small cap space, growth stocks have generally outpaced value stocks except for the most recent quarter where value led growth. Sector performance was mixed with six of the eleven major sectors producing gains. Information Technology and Consumer Discretionary were the top performers, returning, +11.34% and +10.22%, respectively. Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the largest laggards. Concerns over trade and tariffs continued to drive markets this spring, as did increased anti-euro sentiment in Italy.

International Equity Market

Equity markets outside of the U.S. produced mixed results, with the MSCI All Country World ex USA Index down -3.77% for the year-to-date period ended June 30. As global growth slowed and the Federal Reserve adopted a more aggressive stance on interest rates, the U.S. dollar was up approximately 5% versus a basket of international currencies. Equity price volatility affected global markets, as tensions seemed to escalate between the U.S. and its major trading partners. The broad developed markets index represented by the MSCI EAFE Index, however, returned 3.47% in local currency. Additionally, the MSCI Japan Index returned -3.66% through June 30. Emerging markets struggled during the second quarter as U.S. trade war fears weighed on export-driven economies, erasing all of the earlier gains from the first quarter. The MSCI Emerging Markets Index produced -6.66% over the same time period.

Bond Market

Bonds overall did not fare well during the first six months of 2018 as concerns around inflation, a global trade war, continued geopolitical risk, and slower than expected economic growth weighed on sentiment. The Bloomberg Barclays US Aggregate Bond Index returned -1.62% for the period. While the Federal Reserve raised the federal funds rate in both March and June meetings, rates on longer-term bonds remain low, and the U.S. Treasury yield curve flattened in the second quarter. U.S. Treasuries hit a peak of 3.11% in mid-May but fell to 2.85% by the end of the second quarter. Credit spreads for investment grade bonds widened to 116 bps over U.S. Treasuries at the end of the period. The Bloomberg Barclays U.S. High Yield Index returned 0.16% for the first half of the year as credit spreads remained within a tight range.

1

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

Fund Performance Review

The Large Company Growth Portfolio Institutional Class returned 7.83%, outperforming the Russell 1000 Growth Index by 58 bps. The Large Company Value Portfolio Institutional Class returned -1.91%, underperforming the Russell 1000 Value Index by 0.22%. The Small Company Growth Portfolio Institutional Class returned 8.88%, underperforming the Russell 2000 Growth Index by 0.82%. The Small Company Value Portfolio Institutional Class returned 5.02%, underperforming the Russell 2000 Value Index by 0.42%. The Wilshire 5000 Index Fund Institutional Class returned 2.78%, underperforming the Wilshire 5000 Total Market Index by 0.26%. The Wilshire International Equity Fund Institutional Class returned -2.17%, outperforming the MSCI All Country World ex USA Index by 1.60%. The Wilshire Income Opportunities Fund Institutional Share Class returned 0.00% outperforming the Bloomberg Barclays US Universal Index by 1.67%. While some of the Funds struggled during this period, we are confident that each Fund is well positioned for future growth.

As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President, Wilshire Mutual Funds

2

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Returns assume reinvestment of all distributions.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transactions costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Investments in smaller companies typically exhibit higher volatility.

Investing involves risk including loss of principal. This report identifies each Portfolio’s investments on June 30, 2018. These holdings are subject to change. Not all investments in each Portfolio performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across developed markets countries around the world, excluding the U.S. and Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The Wilshire 5000 Total Market IndexSM is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

3

Large Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | 7.64% |

One Year Ended 6/30/18 | 19.30% |

Five Years Ended 6/30/18 | 14.13% |

Ten Years Ended 6/30/18 | 9.45% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | 7.83% |

One Year Ended 6/30/18 | 19.70% |

Five Years Ended 6/30/18 | 14.49% |

Ten Years Ended 6/30/18 | 9.80% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/18* | 7.25% |

One Year Ended 6/30/18 | 22.51% |

Five Years Ended 6/30/18 | 16.36% |

Ten Years Ended 6/30/18 | 11.83% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Not annualized. |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

4

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 3.04% for the first half of the year as concerns around inflation, global trade war, continued geopolitical risk, and slower than expected economic growth weighed on investors’ minds. Inflation fears and valuation concerns caused the CBOE Volatility Index to spike to 37.32 in February before falling to 16.09 at the end of June. Ironically, it was mostly good news on the economic front that caused much of the volatility. Strong jobs reports and wage growth during the first quarter prompted concerns that higher inflation might spur the Federal Reserve to accelerate increases in its short-term rate. Following a global sell-off during early February, the U.S. equity market recovered in the second quarter of 2018. This marks the second longest U.S. bull market since World War II. Volatility continued to be a theme during the second quarter, as U.S. tariffs on Chinese goods and Beijing’s intent to respond “in kind” have increased fears of a trade war; however, these levels are in line with long term historical figures.

Personal income, consumer spending, and the consumer price index have all increased over the year through June 2018, albeit at a slower pace compared to the previous year. Together, with a slight decrease in trade deficits, strong consumer and business spending contributed to growth.

Domestically, job growth has been solid in 2018, with unemployment decreasing to 4.0% in June. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the federal funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. On the equity front, year to date, growth-oriented securities have outperformed value-oriented stocks, and small capitalization stocks outperformed their large capitalization counterparts.

Sector performance for the Wilshire 5000 Total Market Index was mostly positive with six of the eleven major sectors producing gains. Increased consumer spending and tax cut benefits propelled performance of the Consumer Discretionary and Information Technology sectors, which returned 11.34% and 10.22%, respectively. The Energy sector was up 7.49% as Brent crude prices increased 4.4% in the first quarter and another 17.2% in the second quarter. Conversely, Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the worst performing sectors as interest rate sensitivity remained a concern. Going forward, continued threats of a trade war could prove to be a headwind to equities overall.

The Wilshire Large Company Growth Portfolio Institutional Class returned 7.83% for the first six months of 2018, outperforming the Russell 1000 Growth Index return of 7.25%. Weak stock selection in both Financials and Consumer Discretionary, as well as overweight allocation to the Financials sector was detractive from performance. Strong selection in Health Care and Industrials, as well as an overweight to the Information Technology sector contributed to performance.

We are pleased with the Fund’s performance for the year-to-date period and believe that the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

5

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

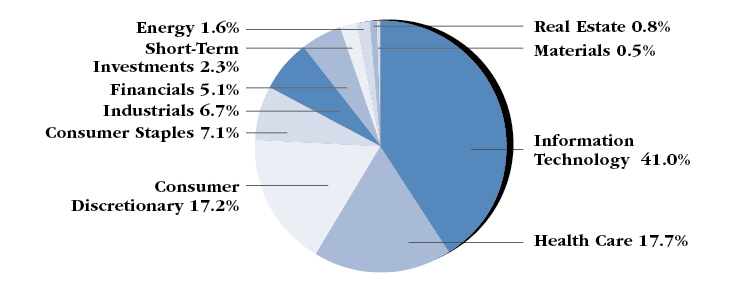

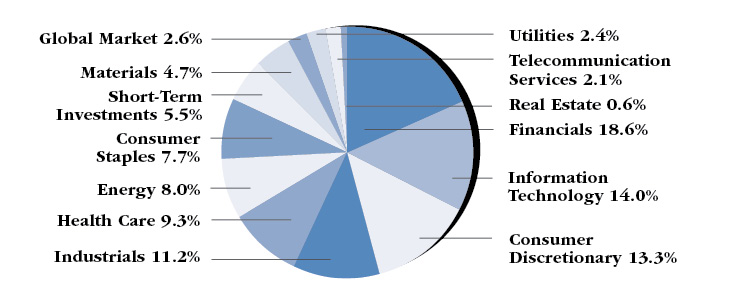

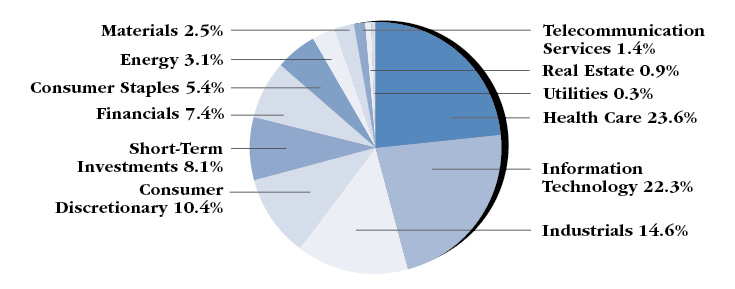

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

6

Large Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | (2.03%) |

One Year Ended 6/30/18 | 7.32% |

Five Years Ended 6/30/18 | 9.45% |

Ten Years Ended 6/30/18 | 7.56% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | (1.91%) |

One Year Ended 6/30/18 | 7.57% |

Five Years Ended 6/30/18 | 9.70% |

Ten Years Ended 6/30/18 | 7.80% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/18* | (1.69%) |

One Year Ended 6/30/18 | 6.77% |

Five Years Ended 6/30/18 | 10.34% |

Ten Years Ended 6/30/18 | 8.49% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Not annualized. |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

7

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 3.04% for the first half of the year as concerns around inflation, global trade war, continued geopolitical risk, and slower than expected economic growth weighed on investors’ minds. Inflation fears and valuation concerns caused the CBOE Volatility Index to spike to 37.32 in February before falling to 16.09 at the end of June. Ironically, it was mostly good news on the economic front that caused much of the volatility. Strong jobs reports and wage growth during the first quarter prompted concerns that higher inflation might spur the Federal Reserve to accelerate increases in its short-term rate. Following a global sell-off during early February, the U.S. equity market recovered in the second quarter of 2018. This marks the second longest U.S. bull market since World War II. Volatility continued to be a theme during the second quarter, as U.S. tariffs on Chinese goods and Beijing’s intent to respond “in kind” have increased fears of a trade war; however, these levels are in line with long term historical figures.

Personal income, consumer spending, and the consumer price index have all increased over the year through June 2018, albeit at a slower pace compared to the previous year. Together, with a slight decrease in trade deficits, strong consumer and business spending contributed to growth.

Domestically, job growth has been solid in 2018, with unemployment decreasing to 4.0% in June. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the federal funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. On the equity front, year to date, growth-oriented securities have outperformed value-oriented stocks, and small capitalization stocks outperformed their large capitalization counterparts.

Sector performance for the Wilshire 5000 Total Market Index was mostly positive with six of the eleven major sectors producing gains. Increased consumer spending and tax cut benefits propelled performance of the Consumer Discretionary and Information Technology sectors, which returned 11.34% and 10.22%, respectively. The Energy sector was up 7.49% as Brent crude prices increased 4.4% in first quarter and another 17.2% in the second quarter. Conversely, Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the worst performing sectors as interest rate sensitivity remained a concern. Going forward, continued threats of a trade war could prove to be a headwind to equities overall.

The Wilshire Large Company Value Portfolio Institutional Class returned -1.91% for the first six months of 2018, underperforming the Russell 1000 Value Index return of -1.69%. Fund performance benefited modestly from stock selection in Financials and from an overweight to Energy, but was weighed down by weak stock selection in Consumer Discretionary and Health Care, as well as an underweight allocation to Real Estate.

Despite the Fund’s underperformance for the year-to-date period, we believe that the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

8

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

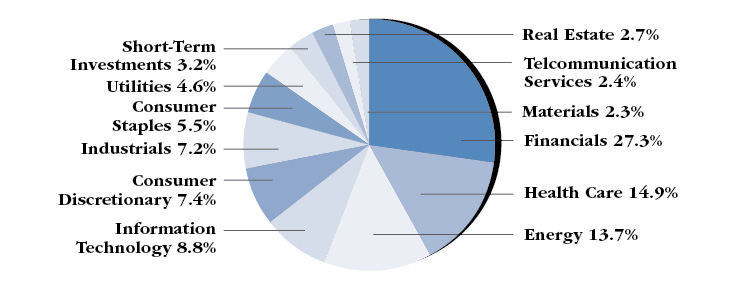

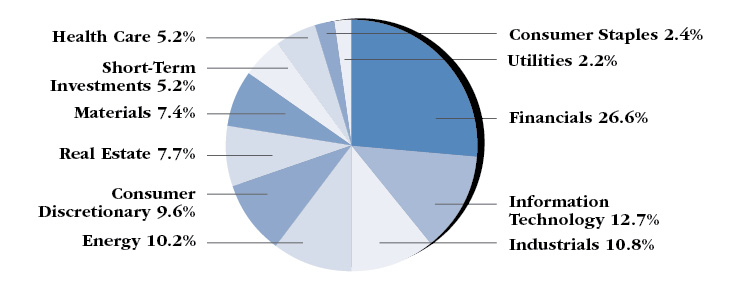

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

9

Small Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | 8.74% |

One Year Ended 6/30/18 | 17.35% |

Five Years Ended 6/30/18 | 13.55% |

Ten Years Ended 6/30/18 | 10.60% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | 8.88% |

One Year Ended 6/30/18 | 17.65% |

Five Years Ended 6/30/18 | 13.87% |

Ten Years Ended 6/30/18 | 10.89% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/18** | 9.70% |

One Year Ended 6/30/18 | 21.86% |

Five Years Ended 6/30/18 | 13.65% |

Ten Years Ended 6/30/18 | 11.24% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | During the ten years ended June 30, 2018, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2018, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.24% and 0.19% of average net assets for Investment Class Shares and Institutional Class Shares, respectively. |

** | Not annualized. |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

10

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 3.04% for the first half of the year as concerns around inflation, global trade war, continued geopolitical risk, and slower than expected economic growth weighed on investors’ minds. Inflation fears and valuation concerns caused the CBOE Volatility Index to spike to 37.32 in February before falling to 16.09 at the end of June. Ironically, it was mostly good news on the economic front that caused much of the volatility. Strong jobs reports and wage growth during the first quarter prompted concerns that higher inflation might spur the Federal Reserve to accelerate increases in its short-term rate. Following a global sell-off during early February, the U.S. equity market recovered in the second quarter of 2018. This marks the second longest U.S. bull market since World War II. Volatility increased and continued to be a theme during the second quarter, as U.S. tariffs on Chinese goods and Beijing’s intent to respond “in kind” have increased fears of a trade war; however, these levels are in line with long term historical figures.

Personal income, consumer spending, and the consumer price index have all increased over the year through June 2018, albeit at a slower pace compared to the previous year. Together, with a slight decrease in trade deficits, strong consumer and business spending contributed to growth.

Domestically, job growth has been solid in 2018, with unemployment decreasing to 4.0% in June. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the federal funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. On the equity front, year to date, growth-oriented securities have outperformed value-oriented stocks, and small capitalization stocks outperformed their large capitalization counterparts.

Sector performance for the Wilshire 5000 Total Market Index was mostly positive with eight of the eleven major sectors producing gains. Increased consumer spending and tax cut benefits propelled performance of the Consumer Discretionary and Information Technology sectors, which returned 11.34% and 10.22%, respectively. The Energy sector was up 7.49% as Brent crude prices increased 4.4% in first quarter and another 17.2% in the second quarter. Conversely, Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the worst performing sectors as interest rate sensitivity remained a concern. Going forward, continued threats of a trade war could prove to be a headwind to equities overall.

The Wilshire Small Company Growth Portfolio Institutional Class returned 8.88% for the first six months of 2018, underperforming the Russell 2000 Growth Index return of 9.70%. Fund performance benefited from strong stock selection in Health Care and Financials, as well as an underweight to the Consumer Staples sector, but was weighed down by weak stock selection in Consumer Staples, Information Technology and Health Care, as well as an underweight allocation to the Consumer Discretionary sector.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

11

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

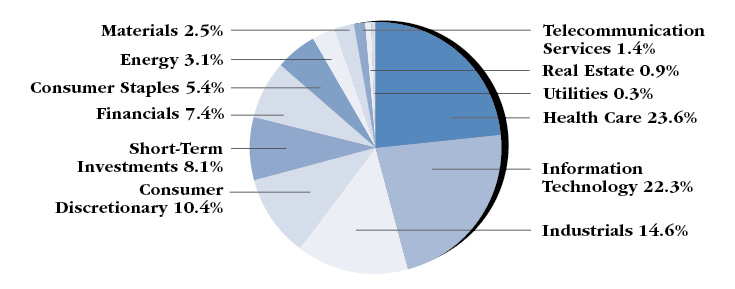

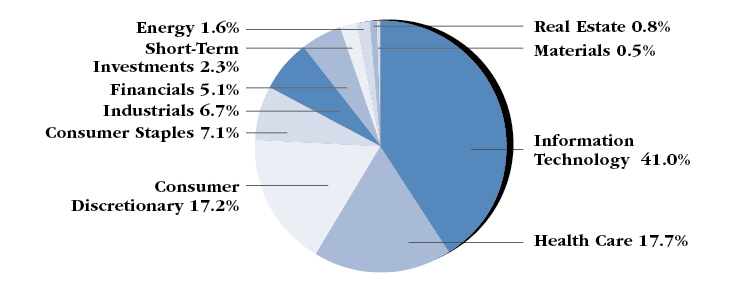

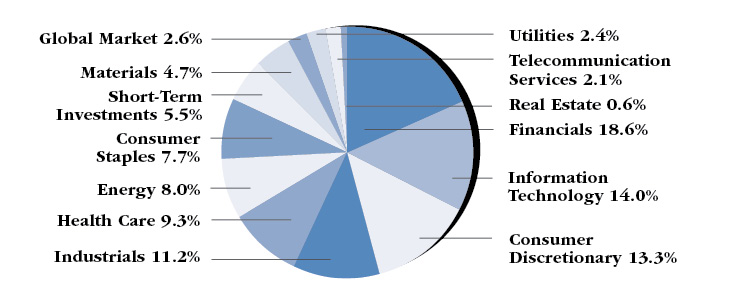

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

12

Small Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | 4.92% |

One Year Ended 6/30/18 | 14.91% |

Five Years Ended 6/30/18 | 12.05% |

Ten Years Ended 6/30/18 | 9.92% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | 5.02% |

One Year Ended 6/30/18 | 15.21% |

Five Years Ended 6/30/18 | 12.36% |

Ten Years Ended 6/30/18 | 10.25% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/18** | 5.44% |

One Year Ended 6/30/18 | 13.10% |

Five Years Ended 6/30/18 | 11.18% |

Ten Years Ended 6/30/18 | 9.88% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | During the ten years ended June 30, 2018, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2018, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.26% and 0.20% of average net assets for Investment Class Shares and Institutional Class Shares, respectively. |

** | Not annualized. |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

13

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 3.04% for the first half of the year as concerns around inflation, global trade war, continued geopolitical risk, and slower than expected economic growth weighed on investors’ minds. Inflation fears and valuation concerns caused the CBOE Volatility Index to spike to 37.32 in February before falling to 16.09 at the end of June. Ironically, it was mostly good news on the economic front that caused much of the volatility. Strong jobs reports and wage growth during the first quarter prompted concerns that higher inflation might spur the Federal Reserve to accelerate increases in its short-term rate. Following a global sell-off during early February, the U.S. equity market recovered in the second quarter of 2018. This marks the second longest U.S. bull market since World War II. Volatility continued to be a theme during the second quarter, as U.S. tariffs on Chinese goods and Beijing’s intent to respond “in kind” have increased fears of a trade war; however, these levels are in line with long term historical figures.

Personal income, consumer spending, and the consumer price index have all increased over the year through June 2018, albeit at a slower pace compared to the previous year. Together, with a slight decrease in trade deficits, strong consumer and business spending contributed to growth.

Domestically, job growth has been solid in 2018, with unemployment decreasing to 4.0% in June. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the federal funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. On the equity front, year to date, growth-oriented securities have outperformed value-oriented stocks, and small capitalization stocks outperformed their large capitalization counterparts.

Sector performance for the Wilshire 5000 Total Market Index was mostly positive with six of the eleven major sectors producing gains. Increased consumer spending and tax cut benefits propelled performance of the Consumer Discretionary and Information Technology sectors, which returned 11.34% and 10.22%, respectively. The Energy sector was up 7.49% as Brent crude prices increased 4.4% in first quarter and another 17.2% in the second quarter. Conversely, Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the worst performing sectors as interest rate sensitivity remained a concern. Going forward, continued threats of a trade war could prove to be a headwind to equities overall.

The Wilshire Small Company Value Portfolio Institutional Class returned 5.02% for the first six months of 2018, underperforming the Russell 2000 Value Index return of 5.44%. The Fund benefited from strong stock selection in Energy and Information Technology as well as overweight in Energy. Performance was impacted by weak stock selection in Financials, Information Technology and Health Care as well as an underweight allocation to Real Estate.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

14

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

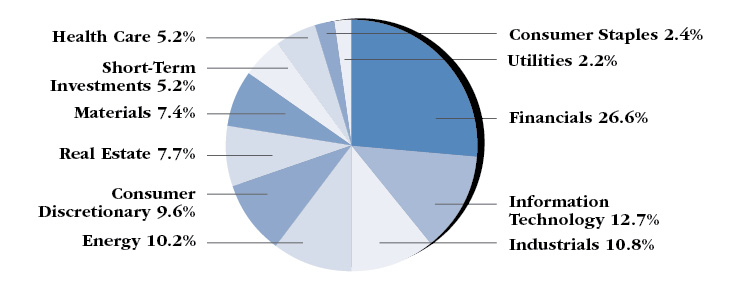

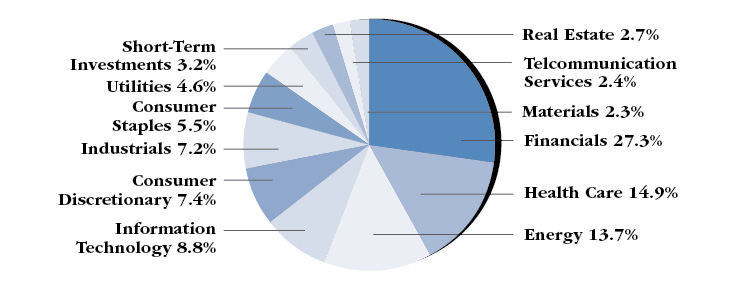

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

15

Wilshire 5000 Indexsm Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | 2.69% |

One Year Ended 6/30/18 | 13.95% |

Five Years Ended 6/30/18 | 12.68% |

Ten Years Ended 6/30/18 | 9.60% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18* | 2.78% |

One Year Ended 6/30/18 | 14.18% |

Five Years Ended 6/30/18 | 12.95% |

Ten Years Ended 6/30/18 | 9.84% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Returns

Six Months Ended 6/30/18* | 3.04% |

One Year Ended 6/30/18 | 14.66% |

Five Years Ended 6/30/18 | 13.36% |

Ten Years Ended 6/30/18 | 10.23% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Not annualized. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

16

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 3.04% for the first half of the year as concerns around inflation, global trade war, continued geopolitical risk, and slower than expected economic growth weighed on investors’ minds. Inflation fears and valuation concerns caused the CBOE Volatility Index to spike to 37.32 in February before falling to 16.09 at the end of June. Ironically, it was mostly good news on the economic front that caused much of the volatility. Strong jobs reports and wage growth during the first quarter prompted concerns that higher inflation might spur the Federal Reserve to accelerate increases in its short-term rate. Following a global sell-off during early February, the U.S. equity market recovered in the second quarter of 2018. This marks the second longest U.S. bull market since World War II. Volatility continued to be a theme during the second quarter, as U.S. tariffs on Chinese goods and Beijing’s intent to respond “in kind” have increased fears of a trade war; however, these levels are in line with long term historical figures.

Personal income, consumer spending, and the consumer price index have all increased over the year through June 2018, albeit at a slower pace compared to the previous year. Together, with a slight decrease in trade deficits, strong consumer and business spending contributed to growth.

Domestically, job growth has been solid in 2018, with unemployment decreasing to 4.0% in June. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the federal funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. On the equity front, year to date, growth-oriented securities have outperformed value-oriented stocks, and small capitalization stocks outperformed their large capitalization counterparts.

Sector performance for the Wilshire 5000 Total Market Index was mostly positive with six of the eleven major sectors producing gains. Increased consumer spending and tax cut benefits propelled performance of the Consumer Discretionary and Information Technology sectors, which returned 11.34% and 10.22%, respectively. The Energy sector was up 7.49% as Brent crude prices increased 4.4% in first quarter and another 17.2% in the second quarter. Conversely, Consumer Staples (-7.72%) and Telecommunication Services (-7.78%) were the worst performing sectors as interest rate sensitivity remained a concern. Going forward, continued threats of a trade war could prove to be a headwind to equities overall.

The Wilshire 5000 Index Fund Institutional Class returned 2.78% for the first six months of 2018, underperforming the Wilshire 5000 Total Market Index return of 3.04%. Underperformance is attributable to both Fund expenses and the optimization approach utilized by Los Angeles Capital, the Fund’s sub-advisor, and is well within its historical range.

Despite the Fund’s performance for the year-to-date period, we believe the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

17

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Fund’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

18

Wilshire International Equity Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | (2.23%) |

One Year Ended 6/30/18 | 7.75% |

Five Years Ended 6/30/18 | 5.62% |

Ten Years Ended 6/30/18 | 3.40% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | (2.17%) |

One Year Ended 6/30/18 | 7.98% |

Five Years Ended 6/30/18 | 5.85% |

Ten Years Ended 6/30/18 | 3.66% |

MSCI ALL COUNTRY WORLD INDEX EX USA(1)

Average Annual Total Returns

Six Months Ended 6/30/18** | (3.77%) |

One Year Ended 6/30/18 | 7.28% |

Five Years Ended 6/30/18 | 5.99% |

Ten Years Ended 6/30/18 | 2.54% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | During the ten years ended June 30, 2018, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, historical total returns would have been lower. For the six months ended June 30, 2018, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.09% of average net assets for Investment Class Shares. |

** | Not annualized. |

(1) | The MSCI All Country World ex USA Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

19

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

Outside of the United States, equities have not fared well, with the MSCI All Country World ex USA Index returning -3.77% for the year-to-date period through June 30. As global growth slowed and the Federal Reserve adopted a more aggressive stance on interest rates, the U.S. dollar reversed its previous trend and ended the period up approximately 5% versus a basket of international currencies, which heavily impacted U.S.-based investors.

Eurozone economic data was mixed during the second quarter as the unemployment rate fell to 8.4%. Equity price volatility affected global markets as tensions seemed to escalate between the U.S. and its major trading partners. It has yet to be seen, however, how much of the threatened tariffs and retaliation will actually be implemented. Already having been rattled by the Greek financial crisis and Brexit in recent years, the European Union faces a fresh challenge with political developments in Italy. The broad developed markets index, however, was in positive territory for the second quarter in local currency terms. Emerging markets struggled during the second quarter as trade war concerns weighed on export-driven economies, erasing all of the earlier gain in the first quarter. Latin America was hit especially hard, with the MSCI EM Latin America Index declining -17.75% for the quarter. The broader MSCI Emerging Markets Index has returned -6.66% for the year-to-date period through June 30.

Growth outperformed Value overseas as well, with the MSCI EAFE Growth Index returning 0.11% versus -2.64% for the MSCI EAFE Value Index. The MSCI Pacific ex Japan Index (+1.77%) outperformed the MSCI Europe Index (-1.27%). After a strong first quarter, Japan faltered during the second quarter as Japanese manufacturers’ confidence fell and a weakening yen contributed to a decrease of -2.84% for the MSCI Japan Index.

Sector performance for the MSCI All Country World ex USA Index was mostly negative for the quarter. Energy (+5.70%) was the top performing sector, boosted by a rebound in the price of Brent crude from 2017 lows. Conversely, Telecommunication Services (-9.59%) was the worst performing sector as interest rate sensitivity remained a concern.

The Wilshire International Equity Fund Institutional Class returned -2.17% for the first six months of 2018, outperforming the MSCI All Country World ex USA Index return of -3.77%. Fund performance benefited from strong stock selection in Financials and an underweight to the Telecommunication Services sector. Weak stock selection in Consumer Staples and an overweight allocation to the Information Technology sector detracted from returns. Regionally, the Fund benefited from strong stock selection in Australia and Japan and an overweight allocation to France overall. Weak stock selection in Brazil weighed on relative performance.

We are pleased with the Fund’s performance for the year-to-date period through June 30 and believe the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

20

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Fund’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

21

Wilshire Income Opportunities Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/18** | (0.10%) |

One Year Ended 6/30/18 | 1.88% |

Inception (03/30/16) through 6/30/18 | 4.17% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/18** | 0.00% |

One Year Ended 6/30/18 | 2.01% |

Inception (03/30/16) through 6/30/18 | 4.28% |

Bloomberg Barclays US Universal Index(1)

Average Annual Total Returns

Six Months Ended 6/30/18** | (1.67%) |

One Year Ended 6/30/18 | (0.27%) |

Inception (03/30/16) through 6/30/18 | 1.51% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The tables above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | During certain periods since inception, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, historical returns would have been lower. For the six months ended June 30, 2018, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.02% of average net assets for Investment Class Shares. |

** | Not annualized. |

(1) | The Bloomberg Barclays US Universal Index represents the union of the US Aggregate Index, US Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, US Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some US Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Bloomberg Barclays US Universal Index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. |

22

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The Bloomberg Barclays US Aggregate Bond Index returned -1.62% for the first six months of the year, as credit spread continue to widen. The ICE Bank of America/Merrill Lynch US High Yield Index gained 1.00% as spreads remained within a tight range. Reflecting an improved outlook for growth, the Federal Open Market Committee raised the fed funds rate again in June to between 1.75% and 2.00% and signaled plans to raise rates two more times this year. This was the seventh rate hike since late 2015. The yield curve flattened during the period as the long end of the curve did not keep pace with the rising yields on the short end of the curve. While the short end of the curve is directly influenced by the federal funds rate, the long end is driven by market outlook. Continued economic growth without upward movement in long rates could be an indication that market participants are expecting an economic slowdown.

Globally, continued rhetoric around a trade war, as well as fresh challenges with political developments in Italy, weighed on performance. Demand for risk assets has decreased as central banks roll back stimulus. The Citi World Government Bond Index ended the first six months of the year down -0.94%. Emerging market bonds were heavily impacted by the geopolitical uncertainty.

The Wilshire Income Opportunities Fund Institutional Class returned flat at 0.00% for the period, outperforming the Bloomberg Barclays US Universal Index return of -1.67%. MBS, U.S. Treasuries, high yield, bank loans, CMBS and CLO boosted performance while investment grade and emerging market debt detracted from performance.

We are pleased with the Fund’s outperformance for the year-to-date period through June 30 and believe the Fund is well positioned going into the second half of 2018 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

23

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

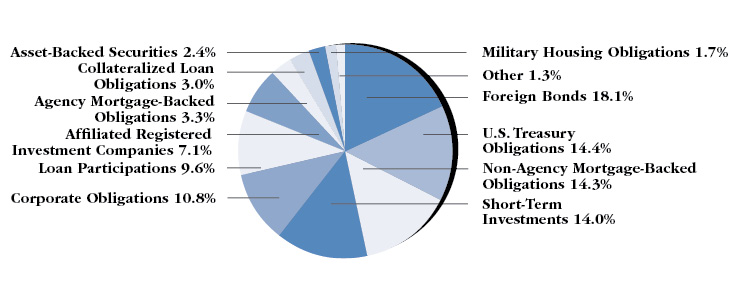

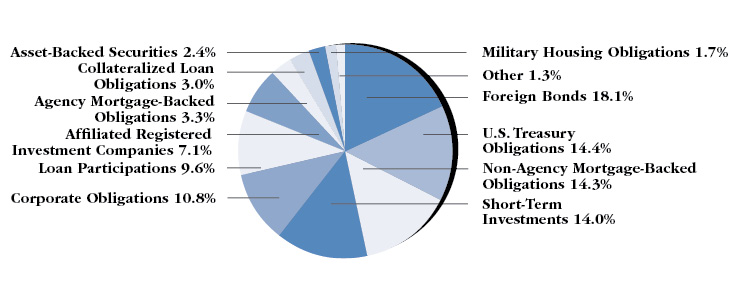

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2018)

† | Based on percent of the Fund’s total investments in securities at value. |

24

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the Portfolio. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in the Portfolios and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2018 to June 30, 2018.

The table on the next page illustrates the Portfolios’ costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee reductions, that you paid over the period. The “Ending Account Value” shown is derived from each Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolios at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare the Portfolios’ costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that each Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not each Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess the Portfolios’ ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

25

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) - (Continued) |

|

| | Beginning

Account

Value

01/01/2018 | Ending

Account

Value

06/30/2018 | Net

Expense

Ratio(1) | Expenses Paid

During Period

01/01/18-06/30/18(2) |

Large Company Growth Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,076.40 | 1.31% | $ 6.74 |

Institutional Class | $ 1,000.00 | $ 1,078.30 | 0.97% | $ 5.00 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.30 | 1.31% | $ 6.56 |

Institutional Class | $ 1,000.00 | $ 1,019.98 | 0.97% | $ 4.86 |

Large Company Value Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 979.70 | 1.22% | $ 5.99 |

Institutional Class | $ 1,000.00 | $ 980.90 | 0.95% | $ 4.67 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.74 | 1.22% | $ 6.11 |

Institutional Class | $ 1,000.00 | $ 1,020.08 | 0.95% | $ 4.76 |

Small Company Growth Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,087.40 | 1.33% | $ 6.88 |

Institutional Class | $ 1,000.00 | $ 1,088.80 | 1.08% | $ 5.59 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.20 | 1.33% | $ 6.66 |

Institutional Class | $ 1,000.00 | $ 1,019.44 | 1.08% | $ 5.41 |

Small Company Value Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,049.20 | 1.32% | $ 6.71 |

Institutional Class | $ 1,000.00 | $ 1,050.20 | 1.07% | $ 5.44 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.25 | 1.32% | $ 6.61 |

Institutional Class | $ 1,000.00 | $ 1,019.49 | 1.07% | $ 5.36 |

26

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) - (Continued) |

|

| | Beginning

Account

Value

01/01/2018 | Ending

Account

Value

06/30/2018 | Net

Expense

Ratio(1) | Expenses Paid

During Period

01/01/18-06/30/18(2) |

Wilshire 5000 IndexSM Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,026.90 | 0.57% | $ 2.86 |

Institutional Class | $ 1,000.00 | $ 1,027.80 | 0.33% | $ 1.66 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,021.97 | 0.57% | $ 2.86 |

Institutional Class | $ 1,000.00 | $ 1,023.16 | 0.33% | $ 1.66 |

Wilshire International Equity Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 977.70 | 1.51% | $ 7.40 |

Institutional Class | $ 1,000.00 | $ 978.30 | 1.26% | $ 6.18 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,017.31 | 1.51% | $ 7.55 |

Institutional Class | $ 1,000.00 | $ 1,018.55 | 1.26% | $ 6.31 |

Wilshire Income Opportunities Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 999.00 | 1.15% | $ 5.70 |

Institutional Class | $ 1,000.00 | $ 1,000.00 | 0.88% | $ 4.36 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,019.09 | 1.15% | $ 5.76 |

Institutional Class | $ 1,000.00 | $ 1,020.43 | 0.88% | $ 4.41 |

(1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

(2) | Expenses are equal to the Portfolio’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

27

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 93.8% (a) |

Consumer Discretionary — 16.5% |

Amazon.com, Inc. (b) | | | 10,295 | | | $ | 17,499,440 | |

Booking Holdings, Inc. (b) | | | 1,895 | | | | 3,841,336 | |

Burlington Stores, Inc. (b) | | | 18,897 | | | | 2,844,565 | |

Floor & Decor Holdings, Inc. - Class A (b) (c) | | | 47,675 | | | | 2,351,808 | |

Starbucks Corp. | | | 48,188 | | | | 2,353,984 | |

Ulta Beauty, Inc. (b) | | | 10,870 | | | | 2,537,710 | |

Yum! Brands, Inc. | | | 20,620 | | | | 1,612,896 | |

Other Securities (c) (d) | | | | | | | 10,843,357 | |

| | | | | | | | 43,885,096 | |

Consumer Staples — 6.8% | | | | | | | | |

Coca-Cola Co. (The) | | | 53,845 | | | | 2,361,642 | |

Colgate-Palmolive Co. | | | 28,328 | | | | 1,835,938 | |

Danone S.A. - ADR (c) | | | 175,459 | | | | 2,558,192 | |

Monster Beverage Corp. (b) | | | 123,624 | | | | 7,083,654 | |

Procter & Gamble Co. (The) | | | 29,313 | | | | 2,288,173 | |

Other Securities (c) (d) | | | | | | | 2,143,278 | |

| | | | | | | | 18,270,877 | |

Energy — 1.5% | | | | | | | | |

Schlumberger Ltd. | | | 39,521 | | | | 2,649,093 | |

Other Securities (c) (d) | | | | | | | 1,349,265 | |

| | | | | | | | 3,998,358 | |

Financials — 4.9% | | | | | | | | |

Charles Schwab Corp. (The) | | | 36,300 | | | | 1,854,930 | |

First Republic Bank | | | 18,325 | | | | 1,773,677 | |

MarketAxess Holdings, Inc. | | | 10,550 | | | | 2,087,423 | |

SEI Investments Co. | | | 40,303 | | | | 2,519,743 | |

Other Securities (c) (d) | | | | | | | 4,728,589 | |

| | | | | | | | 12,964,362 | |

Health Care — 17.0% | | | | | | | | |

ABIOMED, Inc. (b) | | | 5,784 | | | | 2,365,945 | |

Alexion Pharmaceuticals, Inc. (b) | | | 23,967 | | | | 2,975,503 | |

Align Technology, Inc. (b) | | | 8,401 | | | | 2,874,318 | |

Amgen, Inc. | | | 8,932 | | | | 1,648,758 | |

Cerner Corp. (b) | | | 36,883 | | | | 2,205,235 | |

Edwards Lifesciences Corp. (b) | | | 18,935 | | | | 2,756,368 | |

Illumina, Inc. (b) | | | 7,654 | | | | 2,137,686 | |

Novo Nordisk A/S - ADR | | | 55,339 | | | | 2,552,235 | |

Regeneron Pharmaceuticals, Inc. (b) | | | 8,521 | | | | 2,939,660 | |

UnitedHealth Group, Inc. | | | 24,043 | | | | 5,898,709 | |

Zoetis, Inc. | | | 42,663 | | | | 3,634,461 | |

Other Securities (c) (d) | | | | | | | 13,301,254 | |

| | | | | | | | 45,290,132 | |

Industrials — 6.4% | | | | | | | | |

CSX Corp. | | | 42,800 | | | | 2,729,784 | |

Deere & Co. | | | 16,732 | | | | 2,339,133 | |

Expeditors International of Washington, Inc. | | | 44,612 | | | | 3,261,137 | |

XPO Logistics, Inc. (b) | | | 21,256 | | | | 2,129,426 | |

Other Securities (c) (d) | | | | | | | 6,644,920 | |

| | | | | | | | 17,104,400 | |

Information Technology — 39.4% | | | | | | | | |

Activision Blizzard, Inc. | | | 39,670 | | | | 3,027,614 | |

Adobe Systems, Inc. (b) | | | 14,035 | | | | 3,421,873 | |

Alibaba Group Holding Ltd. - ADR (b) (c) | | | 42,250 | | | | 7,838,643 | |

Alphabet, Inc. - Class A (b) | | | 3,846 | | | | 4,342,865 | |

Alphabet, Inc. - Class C (b) | | | 7,953 | | | | 8,872,764 | |

Apple, Inc. | | | 23,522 | | | | 4,354,158 | |

Arista Networks, Inc. (b) | | | 8,523 | | | | 2,194,587 | |

Autodesk, Inc. (b) | | | 28,511 | | | | 3,737,507 | |

Cisco Systems, Inc. | | | 53,548 | | | | 2,304,170 | |

Facebook, Inc. - Class A (b) | | | 66,681 | | | | 12,957,451 | |

Microsoft Corp. | | | 71,451 | | | | 7,045,783 | |

NVIDIA Corp. | | | 14,321 | | | | 3,392,646 | |

Oracle Corp. | | | 92,522 | | | | 4,076,519 | |

PayPal Holdings, Inc. (b) | | | 40,115 | | | | 3,340,376 | |

QUALCOMM, Inc. | | | 43,879 | | | | 2,462,489 | |

Red Hat, Inc. (b) | | | 17,870 | | | | 2,401,192 | |

salesforce.com, Inc. (b) | | | 25,715 | | | | 3,507,526 | |

ServiceNow, Inc. (b) | | | 15,636 | | | | 2,696,741 | |

Visa, Inc. - Class A (c) | | | 80,742 | | | | 10,694,278 | |

Other Securities (c) (d) | | | | | | | 12,246,514 | |

| | | | | | | | 104,915,696 | |

Materials — 0.5% | | | | | | | | |

Other Securities (c) (d) | | | | | | | 1,336,680 | |

| | | | | | | | | |

Real Estate — 0.8% | | | | | | | | |

Other Securities (c) (d) | | | | | | | 2,159,026 | |

| | | | | | | | | |

Total Common Stocks (Cost $168,097,077) | | | | | | $ | 249,924,627 | |

See Notes to Financial Statements.

28

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

MONEY MARKET FUNDS — 2.2% |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 1.73% (e) | | | 5,818,517 | | | $ | 5,818,517 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 1.98% (e) (f) | | | 147,988 | | | | 147,988 | |

Total Money Market Funds (Cost $5,966,505) | | | | | | $ | 5,966,505 | |

| | | | | | | | | |

Total Investments at Value — 96.0% (Cost $174,063,582) | | $ | 255,891,132 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 4.0% | | | 10,594,214 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 266,485,346 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issue that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800)607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | Non-income producing security. |

(c) | This security or a partial position of this security is on loan at June 30, 2018. The total market value of securities on loan at June 30, 2018 was $24,520,199 (Note 7). |

(d) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of June 30, 2018. |

(e) | The rate shown is the 7-day effective yield as of June 30, 2018. |

(f) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2018 was $147,988. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $25,044,009 (Note 7). |

See Notes to Financial Statements.

29

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 91.8% (a) |

Consumer Discretionary — 7.0% |

Ford Motor Co. | | | 278,077 | | | $ | 3,078,312 | |

Interpublic Group of Cos., Inc. (The) (b) | | | 78,158 | | | | 1,832,023 | |

Newell Brands, Inc. | | | 67,418 | | | | 1,738,710 | |

Omnicom Group, Inc. | | | 24,236 | | | | 1,848,479 | |

Other Securities (b) (c) | | | | | | | 9,197,233 | |

| | | | | | | | 17,694,757 | |

Consumer Staples — 5.3% | | | | | | | | |

Altria Group, Inc. | | | 37,183 | | | | 2,111,623 | |

Philip Morris International, Inc. | | | 29,622 | | | | 2,391,679 | |

Walmart, Inc. | | | 56,980 | | | | 4,880,336 | |

Other Securities (b) (c) | | | | | | | 3,835,767 | |

| | | | | | | | 13,219,405 | |

Energy — 13.0% | | | | | | | | |

BP plc - ADR | | | 82,248 | | | | 3,755,444 | |

Chevron Corp. | | | 29,294 | | | | 3,703,640 | |

ConocoPhillips | | | 28,730 | | | | 2,000,183 | |

Exxon Mobil Corp. | | | 42,536 | | | | 3,519,003 | |

Occidental Petroleum Corp. | | | 32,540 | | | | 2,722,947 | |

Phillips 66 | | | 20,077 | | | | 2,254,848 | |

Royal Dutch Shell plc - Class A - ADR | | | 53,532 | | | | 3,706,020 | |

Other Securities (b) (c) | | | | | | | 10,951,446 | |

| | | | | | | | 32,613,531 | |

Financials — 25.9% | | | | | | | | |

American Express Co. | | | 28,507 | | | | 2,793,686 | |

American International Group, Inc. | | | 48,752 | | | | 2,584,832 | |

Bank of America Corp. | | | 199,954 | | | | 5,636,703 | |

Capital One Financial Corp. | | | 30,536 | | | | 2,806,258 | |

Citigroup, Inc. | | | 46,063 | | | | 3,082,536 | |

Goldman Sachs Group, Inc. (The) | | | 8,807 | | | | 1,942,560 | |

JPMorgan Chase & Co. | | | 60,991 | | | | 6,355,262 | |

MetLife, Inc. | | | 48,233 | | | | 2,102,959 | |

Morgan Stanley | | | 39,076 | | | | 1,852,202 | |

State Street Corp. | | | 33,029 | | | | 3,074,670 | |

U.S. Bancorp | | | 53,348 | | | | 2,668,467 | |

Wells Fargo & Co. | | | 119,932 | | | | 6,649,031 | |

XL Group Ltd. | | | 32,616 | | | | 1,824,865 | |

Other Securities (b) (c) | | | | | | | 21,942,911 | |

| | | | | | | | 65,316,942 | |

Health Care — 14.1% | | | | | | | | |

Amgen, Inc. | | | 13,625 | | | | 2,515,039 | |

Cardinal Health, Inc. | | | 35,797 | | | | 1,747,968 | |

CVS Health Corp. | | | 54,228 | | | | 3,489,573 | |

Express Scripts Holding Co. (d) | | | 26,554 | | | | 2,050,234 | |

Johnson & Johnson | | | 30,645 | | | | 3,718,464 | |

Merck & Co., Inc. | | | 77,080 | | | | 4,678,755 | |

Mylan N.V. (d) | | | 71,704 | | | | 2,591,383 | |

Pfizer, Inc. | | | 158,552 | | | | 5,752,266 | |

Other Securities (b) (c) | | | | | | | 9,039,107 | |

| | | | | | | | 35,582,789 | |

Industrials — 6.8% | | | | | | | | |

Dover Corp. (b) | | | 23,971 | | | | 1,754,677 | |

General Electric Co. | | | 227,860 | | | | 3,101,175 | |

Johnson Controls International plc | | | 52,771 | | | | 1,765,190 | |

Stanley Black & Decker, Inc. | | | 13,996 | | | | 1,858,809 | |

United Technologies Corp. | | | 15,935 | | | | 1,992,353 | |

Other Securities (b) (c) | | | | | | | 6,647,747 | |

| | | | | | | | 17,119,951 | |

Information Technology — 8.3% | | | | | | | | |

Cisco Systems, Inc. | | | 47,526 | | | | 2,045,044 | |

Cognizant Technology Solutions Corp. - Class A | | | 21,733 | | | | 1,716,691 | |

Hewlett Packard Enterprise Co. | | | 129,143 | | | | 1,886,779 | |

Oracle Corp. | | | 116,667 | | | | 5,140,347 | |

Other Securities (b) (c) | | | | | | | 10,202,336 | |

| | | | | | | | 20,991,197 | |

Materials — 2.2% | | | | | | | | |

DowDuPont, Inc. | | | 40,338 | | | | 2,659,081 | |

Other Securities (b) (c) | | | | | | | 2,913,206 | |

| | | | | | | | 5,572,287 | |

Real Estate — 2.6% | | | | | | | | |

Other Securities (b) (c) | | | | | | | 6,445,276 | |

| | | | | | | | | |

Telecommunication Services — 2.3% |

AT&T, Inc. | | | 89,643 | | | | 2,878,437 | |

Verizon Communications, Inc. | | | 47,845 | | | | 2,407,082 | |

Other Securities (c) | | | | | | | 485,053 | |

| | | | | | | | 5,770,572 | |

Utilities — 4.3% | | | | | | | | |

Edison International | | | 36,629 | | | | 2,317,517 | |

Entergy Corp. | | | 36,444 | | | | 2,944,310 | |

Exelon Corp. | | | 41,529 | | | | 1,769,135 | |

Other Securities (b) (c) | | | | | | | 3,883,082 | |

| | | | | | | | 10,914,044 | |

Total Common Stocks (Cost $205,425,923) | | | | | | $ | 231,240,751 | |

See Notes to Financial Statements.

30

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

MONEY MARKET FUNDS — 3.0% |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 1.73% (e) | | | 5,068,858 | | | $ | 5,068,858 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 1.98% (e) (f) | | | 2,552,002 | | | | 2,552,002 | |

Total Money Market Funds (Cost $7,620,860) | | | | | | $ | 7,620,860 | |

| | | | | | | | | |

Total Investments at Value — 94.8% (Cost $213,046,783) | | $ | 238,861,611 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 5.2% | | | 12,963,751 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 251,825,362 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issue that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800)607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | This security or a partial position of this security is on loan at June 30, 2018. The total market value of securities on loan at June 30, 2018 was $11,631,429 (Note 7). |

(c) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of June 30, 2018. |

(d) | Non-income producing security. |

(e) | The rate shown is the 7-day effective yield as of June 30, 2018. |

(f) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2018 was $2,552,002. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $9,301,730 (Note 7). |

See Notes to Financial Statements.

31

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 90.2% (a) |

Consumer Discretionary — 10.3% |

Malibu Boats, Inc. - Class A (b) | | | 16,113 | | | $ | 675,779 | |

Sonic Corp. (c) | | | 17,127 | | | | 589,510 | |

Steven Madden Ltd. | | | 26,063 | | | | 1,383,945 | |

TopBuild Corp. (b) | | | 7,250 | | | | 567,965 | |

Other Securities (c) (d) | | | | | | | 2,810,834 | |

| | | | | | | | 6,028,033 | |

Consumer Staples — 5.3% | | | | | | | | |

Calavo Growers, Inc. (c) | | | 9,556 | | | | 918,810 | |

e.l.f. Beauty, Inc. (b) (c) | | | 25,713 | | | | 391,866 | |

Inter Parfums, Inc. | | | 16,965 | | | | 907,627 | |

J & J Snack Foods Corp. (c) | | | 3,607 | | | | 549,959 | |

Other Securities (c) (d) | | | | | | | 355,453 | |

| | | | | | | | 3,123,715 | |

Energy — 3.0% | | | | | | | | |

Callon Petroleum Co. (b) (c) | | | 23,337 | | | | 250,639 | |

Extraction Oil & Gas, Inc. (b) (c) | | | 33,625 | | | | 493,951 | |

WildHorse Resource Development Corp. (b) (c) | | | 23,916 | | | | 606,509 | |

Other Securities (c) (d) | | | | | | | 421,112 | |

| | | | | | | | 1,772,211 | |

Financials — 7.2% | | | | | | | | |

Banc of California, Inc. (c) | | | 53,812 | | | | 1,052,024 | |

CenterState Bank Corp. | | | 20,099 | | | | 599,352 | |

Green Dot Corp. - Class A (b) | | | 3,185 | | | | 233,747 | |

LegacyTexas Financial Group, Inc. | | | 16,623 | | | | 648,629 | |

South State Corp. | | | 2,889 | | | | 249,176 | |

Veritex Holdings, Inc. (b) | | | 15,718 | | | | 488,358 | |

Other Securities (c) (d) | | | | | | | 973,930 | |

| | | | | | | | 4,245,216 | |

Health Care — 23.2% | | | | | | | | |

BioTelemetry, Inc. (b) (c) | | | 9,657 | | | | 434,565 | |

Cambrex Corp. (b) (c) | | | 17,951 | | | | 938,837 | |

Cantel Medical Corp. | | | 7,695 | | | | 756,879 | |

Cotiviti Holdings, Inc. (b) | | | 12,888 | | | | 568,747 | |

Inogen, Inc. (b) | | | 1,355 | | | | 252,477 | |

LeMaitre Vascular, Inc. (c) | | | 14,041 | | | | 470,093 | |

Medidata Solutions, Inc. (b) (c) | | | 8,905 | | | | 717,388 | |

Neogen Corp. (b) | | | 6,043 | | | | 484,588 | |

PRA Health Sciences, Inc. (b) | | | 10,944 | | | | 1,021,732 | |

Repligen Corp. (b) (c) | | | 20,456 | | | | 962,249 | |

Supernus Pharmaceuticals, Inc. (b) (c) | | | 12,367 | | | | 740,164 | |

Tabula Rasa HealthCare, Inc. (b) (c) | | | 10,325 | | | | 659,045 | |

Other Securities (c) (d) | | | | | | | 5,583,136 | |

| | | | | | | | 13,589,900 | |

Industrials — 14.3% | | | | | | | | |

Insteel Industries, Inc. | | | 19,196 | | | | 641,145 | |

Knoll, Inc. | | | 38,211 | | | | 795,170 | |

Marten Transport Ltd. | | | 23,134 | | | | 542,492 | |

Mercury Systems, Inc. (b) (c) | | | 13,673 | | | | 520,394 | |

Saia, Inc. (b) | | | 13,449 | | | | 1,087,351 | |

SiteOne Landscape Supply, Inc. (b) (c) | | | 12,927 | | | | 1,085,480 | |

WageWorks, Inc. (b) | | | 10,959 | | | | 547,950 | |

Other Securities (c) (d) | | | | | | | 3,191,770 | |

| | | | | | | | 8,411,752 | |

Information Technology — 21.9% | | | | | | | | |

Box, Inc. - Class A (b) (c) | | | 28,843 | | | | 720,786 | |

Cabot Microelectronics Corp. | | | 5,797 | | | | 623,524 | |

CEVA, Inc. (b) | | | 9,391 | | | | 283,608 | |

Ellie Mae, Inc. (b) | | | 3,205 | | | | 332,807 | |

Integrated Device Technology, Inc. (b) | | | 14,376 | | | | 458,307 | |

MAXIMUS, Inc. | | | 10,037 | | | | 623,398 | |

MaxLinear, Inc. (b) | | | 16,914 | | | | 263,689 | |

MINDBODY, Inc. - Class A (b) (c) | | | 26,103 | | | | 1,007,575 | |

Pegasystems, Inc. (c) | | | 25,461 | | | | 1,395,263 | |

Qualys, Inc. (b) | | | 12,255 | | | | 1,033,097 | |

Silicon Laboratories, Inc. (b) | | | 4,362 | | | | 434,455 | |

WNS Holdings Ltd. - ADR (b) | | | 18,244 | | | | 951,971 | |

Other Securities (c) (d) | | | | | | | 4,730,316 | |

| | | | | | | | 12,858,796 | |

Materials — 2.5% | | | | | | | | |

Quaker Chemical Corp. | | | 4,014 | | | | 621,647 | |

Other Securities (d) | | | | | | | 849,489 | |

| | | | | | | | 1,471,136 | |

Real Estate — 0.9% | | | | | | | | |

Other Securities (c) (d) | | | | | | | 528,386 | |

| | | | | | | | | |

Telecommunication Services — 1.3% |

Cogent Communications Holdings, Inc. (c) | | | 13,428 | | | | 717,055 | |

Other Securities (d) | | | | | | | 69,076 | |

| | | | | | | | 786,131 | |

See Notes to Financial Statements.

32

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2018

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 90.2% (a) (Continued) |

Utilities — 0.3% | | | | | | | | |

Other Securities (d) | | | | | | $ | 177,886 | |

| | | | | | | | | |

Total Common Stocks (Cost $40,533,857) | | | | | | $ | 52,993,162 | |

| | | | | | | | | |

RIGHTS — 0.0% | | | | | | | | |

Dyax Corp. (b) (c) (e) (Cost $0) | | | 860 | | | $ | 0 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 8.0% |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 1.73% (f) | | | 2,090,903 | | | $ | 2,090,903 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 1.98% (f) (g) | | | 2,584,771 | | | | 2,584,771 | |

Total Money Market Funds (Cost $4,675,674) | | | | | | $ | 4,675,674 | |

| | | | | | | | | |

Total Investments at Value — 98.2% (Cost $45,209,531) | | $ | 57,668,836 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.8% | | | 1,056,394 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 58,725,230 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issue that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800)607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | Non-income producing security. |

(c) | This security or a partial position of this security is on loan at June 30, 2018. The total market value of securities on loan at June 30, 2018 was $17,043,667 (Note 7). |

(d) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of June 30, 2018. |

(e) | Level 3 security. Security has been valued at fair value in accordance with procedures adopted by and under the general supervision of the Board of Directors. The total value of such securities is $0 as of June 30, 2018, representing 0.0% of net assets (Note 2). |

(f) | The rate shown is the 7-day effective yield as of June 30, 2018. |