| OMB APPROVAL |

OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07076 | |

| Wilshire Mutual Funds, Inc. |

| (Exact name of registrant as specified in charter) |

| 1299 Ocean Avenue, Suite 700 Santa Monica, CA | 90401-1085 |

| (Address of principal executive offices) | (Zip code) |

Jason A. Schwarz

| Wilshire Associates Incorporated, 1299 Ocean Avenue, Suite 700, Santa Monica, CA 90401-1085 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (310) 451-3051 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | June 30, 2019 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Wilshire Mutual Funds, Inc. |

SEMI-ANNUAL REPORT (Unaudited) Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire International Equity Fund Wilshire Income Opportunities Fund |

June 30, 2019 http://advisor.wilshire.com |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Portfolios’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Portfolios or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Portfolios electronically by contacting the Portfolios at (866) 591-1568 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Portfolios that you wish to continue receiving paper copies of your shareholder reports by contacting the Portfolios at (866) 591-1568. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Wilshire Mutual Funds, Inc. Table of Contents |

|

| | |

Letter to Shareholders | 1 |

Commentary: | |

Large Company Growth Portfolio | 3 |

Large Company Value Portfolio | 6 |

Small Company Growth Portfolio | 9 |

Small Company Value Portfolio | 12 |

Wilshire 5000 IndexSM Fund | 15 |

Wilshire International Equity Fund | 18 |

Wilshire Income Opportunities Fund | 22 |

Disclosure of Fund Expenses | 25 |

Schedule of Investments/Condensed Schedules of Investments: | |

Large Company Growth Portfolio | 28 |

Large Company Value Portfolio | 30 |

Small Company Growth Portfolio | 32 |

Small Company Value Portfolio | 34 |

Wilshire 5000 IndexSM Fund | 36 |

Wilshire International Equity Fund | 38 |

Wilshire Income Opportunities Fund | 42 |

Statements of Assets and Liabilities | 55 |

Statements of Operations | 57 |

Statements of Changes in Net Assets | 59 |

Financial Highlights: | |

Large Company Growth Portfolio | 63 |

Large Company Value Portfolio | 65 |

Small Company Growth Portfolio | 67 |

Small Company Value Portfolio | 69 |

Wilshire 5000 IndexSM Fund | 71 |

Wilshire International Equity Fund | 73 |

Wilshire Income Opportunities Fund | 77 |

Notes to Financial Statements | 79 |

Additional Fund Information | 106 |

Board Approval of Subadvisory Agreement | 107 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund and Wilshire Income Opportunities Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by Ultimus Fund Distributors, LLC.

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) |

|

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this semi-annual report to all shareholders of the Wilshire Mutual Funds. This report covers the period from January 1, 2019 to June 30, 2019, for all share classes of the Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 Index Fund, Wilshire International Equity Fund, and Wilshire Income Opportunities Fund.

Market Environment

U.S. Equity

The U.S. stock market, represented by the Wilshire 5000 Total Market IndexSM, was up 18.66% for the first half of the year. This marks the strongest first half-year for U.S. equities in 24 years. Markets have been volatile this year as trade concerns and a possible global economic slowdown continue to sway investor sentiment, while the Q4 2018 selloff created attractive valuations and buying opportunities that propelled markets early in the year. Equity prices are also responding to the actions and statements of the Federal Reserve, which has softened its monetary policy stance over the past few months. Investors are expecting one or more Federal Funds rate cuts and the markets have begun to react strongly to perceived changes in the likelihood and magnitude of future rate cuts.

Non-U.S. Equity

Equity markets outside of the U.S. continue to enjoy a strong 2019, although they are generally underperforming the U.S. equity market. The MSCI All Country World ex-U.S. Index and MSCI Emerging Markets Index returned 13.60% and 10.58%, respectively. Indicators out of Europe are still gloomy as recent data show that the manufacturing sector in Germany has weakened, which could also mean problems for countries with close industrial ties. Manufacturing in Britain has worsened as well, as businesses continue to struggle with the effects of Brexit. These negative headlines were offset by continued corporate earnings growth and expectations that European corporate earnings growth will outpace U.S. corporate earnings growth over the coming twelve months. News out of Japan is also troubling as consumption and capital spending shows little or no growth. Trade negotiations between the U.S. and China, the world’s two largest economies, continue with both countries maintaining firm stances going into the G20. There was some good news following the conference as the two countries agreed to not impose new trade sanctions and, rather, continue negotiations.

Fixed Income

The U.S. Treasury yield curve fell across all maturities during the quarter ended June 30, 2019, with the biggest decreases occurring in the 1- to 10-year portion of the yield curve. The bellwether 10-year Treasury yield ended the quarter at 2.00%, down 41 basis points from March. The Federal Open Market Committee left its overnight rate unchanged during the quarter, at a range of 2.25% to 2.50%. The committee softened some of its messaging to indicate that it is willing to ease should conditions deteriorate. The commitee current forecast, however, is for no rate changes this year and a minor downward adjustment in 2020. Credit spreads tightened modestly within both the investment grade and high yield markets, and the Bloomberg Barclays Long Government/Credit Index and the Bloomberg Barclays US Corporate High Yield Index returned 13.46% and 9.94%, respectively. Emerging market debt benefited from dovish central bank announcements (both in the U.S. and from the ECB), and in the case of local currency issues, currency tailwinds.

Fund Performance Review

The Large Company Growth Portfolio Institutional Class returned 20.71%, underperforming the Russell 1000 Growth Index by 0.78 %. The Large Company Value Portfolio Institutional Class returned 14.29%, underperforming the Russell 1000 Value Index by 1.95%. The Small Company Growth Portfolio Institutional Class returned 20.72%, outperforming the Russell 2000 Growth Index by 0.36%. The Small Company Value Portfolio Institutional Class returned 14.41%,

1

Wilshire Mutual Funds, Inc. Letter to Shareholders (Unaudited) - (Continued) |

|

outperforming the Russell 2000 Value Index by 0.94%. The Wilshire 5000 Index Fund Institutional Class returned 18.03%, underperforming the Wilshire 5000 Total Market Index by 0.63%. The Wilshire International Equity Fund Institutional Class returned 14.15%, outperforming the MSCI All Country World ex-USA Investable Market Index by 0.82%. The Wilshire Income Opportunities Fund Institutional Share Class returned 7.60%, outperforming the Bloomberg Barclays U.S. Universal Index by 1.06%. While some of the Funds underperformed during the six month period, we are confident that each fund is well positioned for future growth.

As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President, Wilshire Mutual Funds

2

Large Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 20.52% |

One Year Ended 6/30/19 | 9.84% |

Five Years Ended 6/30/19 | 11.63% |

Ten Years Ended 6/30/19 | 14.14% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19** | 20.71% |

One Year Ended 6/30/19 | 10.18% |

Five Years Ended 6/30/19 | 11.99% |

Ten Years Ended 6/30/19 | 14.51% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 21.49% |

One Year Ended 6/30/19 | 11.56% |

Five Years Ended 6/30/19 | 13.39% |

Ten Years Ended 6/30/19 | 16.28% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | During the ten years ended June 30, 2019, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2019, the investment adviser reimbursed expenses in the annualized amount of 0.03% for Investment Class Shares. |

** | Not annualized. |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

3

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 18.66% for the first half of the year. Global equities reached new highs, albeit with a heightened degree of market volatility. The dovish tone of global central banks has boosted the rally in equities, resulting in a significant decline in global government bond yields. U.S. growth continues to outpace major foreign developed economies, as Gross Domestic Product (“GDP”) in the first half of the year outperformed expectations due to strength in Personal Consumption Expenditures. However, the recent decline in Gross Private Domestic Investment has weighed on GDP growth, which may be an indicator of declining businesses sentiment and lack of willingness to spend due to uncertainty regarding the business cycle and trade.

Sector returns for the Wilshire 5000 Total Market Index were all positive for the first half of 2019. Information Technology (+27.55%), Industrials (+21.92%) and Consumer Discretionary (+19.90%) were the best performing sectors while Health Care (9.99%) and Energy (+11.94%) were the laggards. Large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 18.74% versus 17.85% for the Wilshire U.S. Small-Cap IndexSM. Year to date, Growth has outperformed Value.

Although U.S. real estate securities underperformed broader equities during the quarter ended June 30, 2019, they are still experiencing a surge for the year. Global real estate securities are up double-digits for the year as well. Commodity results were negative for the quarter as crude oil fell -2.8% to $58.47 per barrel. Natural gas prices were down -13.3%, ending the quarter at $2.31 per million BTUs. MLPs were modestly positive for the quarter (+0.12%) but are up significantly for the year. Gold prices finished at approximately $1,414 per troy ounce, up +9.3% from last quarter.

The Wilshire Large Company Growth Portfolio - Institutional Class returned 20.71% in the first six months of 2019, underperforming the Russell 1000 Growth Index return of 21.49% by 0.78%. Sector allocations to Health Care and Information Technology as well as stock selection within Industrials were detractive to performance. Stock selection within Health Care was the primary driver to relative performance.

Despite the Portfolio’s underperformance, we believe the Portfolio is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

4

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

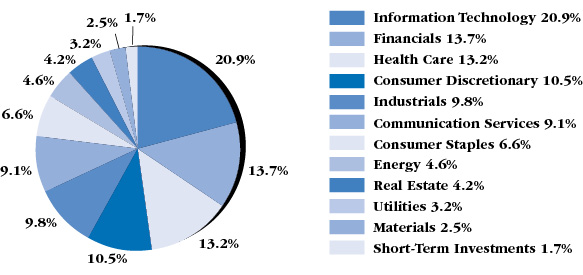

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

5

Large Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19* | 14.11% |

One Year Ended 6/30/19 | 2.84% |

Five Years Ended 6/30/19 | 5.51% |

Ten Years Ended 6/30/19 | 11.77% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19* | 14.29% |

One Year Ended 6/30/19 | 3.15% |

Five Years Ended 6/30/19 | 5.76% |

Ten Years Ended 6/30/19 | 12.03% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19* | 16.24% |

One Year Ended 6/30/19 | 8.46% |

Five Years Ended 6/30/19 | 7.46% |

Ten Years Ended 6/30/19 | 13.19% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Not annualized. |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

6

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 18.66% for the first half of the year global equities reached new highs, albeit with a heightened degree of market volatility. The dovish tone of global central banks has boosted the rally in equities, resulting in a significant decline in global government bond yields. U.S. growth continues to outpace major foreign developed economies, as Gross Domestic Product (“GDP”) in the first half of the year outperformed expectations due to strength in Personal Consumption Expenditures. However, the recent decline in Gross Private Domestic Investment has weighed on GDP growth, which may be an indicator of declining businesses sentiment and lack of willingness to spend due to uncertainty regarding the business cycle and trade.

Sector returns for the Wilshire 5000 Total Market Index were all positive for the first half of 2019. Information Technology (+27.55%), Industrials (+21.92%) and Consumer Discretionary (+19.90%) were the best performing sectors while Health Care (9.99%) and Energy (+11.94%) were the laggards. Large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 18.74% versus 17.85% for the Wilshire U.S. Small-Cap IndexSM. Year to date, Growth has outperformed Value.

Although U.S. real estate securities underperformed broader equities during the quarter ended June 30, 2019, they are still experiencing a surge for the year. Global real estate securities are up double-digits for the year as well. Commodity results were negative for the quarter as crude oil fell -2.8% to $58.47 per barrel. Natural gas prices were down -13.3%, ending the quarter at $2.31 per million BTUs. MLPs were modestly positive for the quarter (+0.12%) but are up significantly for the year. Gold prices finished at approximately $1,414 per troy ounce, up +9.3% from last quarter.

The Wilshire Large Company Value Portfolio - Institutional Class returned 14.29% in 2019, underperforming the Russell 1000 Value Index return of 16.24% by 1.95%. Weak stock selection within Health Care and Energy weighted on performance. Conversely, the Portfolio benefited from strong stock selection within Industrials and sector allocation to Industrials.

Despite the Portfolio’s underperformance versus its benchmark, we believe the Portfolio is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

7

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

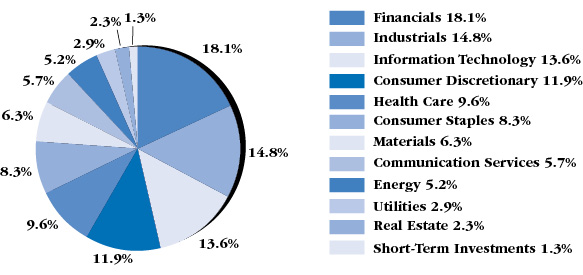

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

8

Small Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 20.54% |

One Year Ended 6/30/19 | 2.13% |

Five Years Ended 6/30/19 | 9.77% |

Ten Years Ended 6/30/19 | 14.99% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 20.72% |

One Year Ended 6/30/19 | 2.41% |

Five Years Ended 6/30/19 | 10.07% |

Ten Years Ended 6/30/19 | 15.29% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 20.36% |

One Year Ended 6/30/19 | (0.49%) |

Five Years Ended 6/30/19 | 8.63% |

Ten Years Ended 6/30/19 | 14.41% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | During the ten years ended June 30, 2019, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2019, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.21% and 0.19% of average net assets for Investment Class Shares and Institutional Class Shares, respectively. |

** | Not annualized. |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

9

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 18.66% for the first half of the year. Global equities reached new highs, albeit with a heightened degree of market volatility. The dovish tone of global central banks has boosted the rally in equities, resulting in a significant decline in global government bond yields. U.S. growth continues to outpace major foreign developed economies, as Gross Domestic Product (“GDP”) in the first half of the year outperformed expectations due to strength in Personal Consumption Expenditures. However, the recent decline in Gross Private Domestic Investment has weighed on GDP growth, which may be an indicator of declining businesses sentiment and lack of willingness to spend due to uncertainty regarding the business cycle and trade.

Sector returns for the Wilshire 5000 Total Market Index were all positive for the first half of 2019. Information Technology (+27.55%), Industrials (+21.92%) and Consumer Discretionary (+19.90%) were the best performing sectors while Health Care (9.99%) and Energy (+11.94%) were the laggards. Large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 18.74% versus 17.85% for the Wilshire U.S. Small-Cap IndexSM. Year to date, Growth has outperformed Value.

Although U.S. real estate securities underperformed broader equities during the quarter ended June 30, 2019, they are still experiencing a surge for the year. Global real estate securities are up double-digits for the year as well. Commodity results were negative for the quarter as crude oil fell -2.8% to $58.47 per barrel. Natural gas prices were down -13.3%, ending the quarter at $2.31 per million BTUs. MLPs were modestly positive for the quarter (+0.12%) but are up significantly for the year. Gold prices finished at approximately $1,414 per troy ounce, up +9.3% from last quarter.

The Wilshire Small Company Growth Portfolio - Institutional Class returned 20.72% in 2019, outperforming the Russell 2000 Growth Index return of 20.36% by 0.36%. Stock selection within Health Care and Information Technology, and sector allocation to Consumer Staples were detractive. Conversely, the Portfolio benefited from sector allocation in Information Technology, as well as from strong stock selection within Financials and Consumer Discretionary.

We are pleased with the Portfolio’s outperformance for the first half of 2019 and believe that the Portfolio is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

10

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

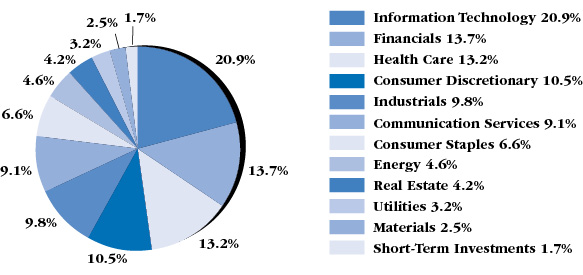

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

11

Small Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 14.29% |

One Year Ended 6/30/19 | (8.88%) |

Five Years Ended 6/30/19 | 5.00% |

Ten Years Ended 6/30/19 | 12.71% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 14.41% |

One Year Ended 6/30/19 | (8.68%) |

Five Years Ended 6/30/19 | 5.28% |

Ten Years Ended 6/30/19 | 13.02% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 13.47% |

One Year Ended 6/30/19 | (6.24%) |

Five Years Ended 6/30/19 | 5.39% |

Ten Years Ended 6/30/19 | 12.40% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | During the ten years ended June 30, 2019, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2019, the investment adviser reduced its fees or reimbursed expenses in the annualized amount of 0.25% and 0.21% of average net assets for Investment Class Shares and Institutional Class Shares, respectively. |

** | Not annualized. |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

12

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 18.66% for the first half of the year. Global equities reached new highs, albeit with a heightened degree of market volatility. The dovish tone of global central banks has boosted the rally in equities, resulting in a significant decline in global government bond yields. U.S. growth continues to outpace major foreign developed economies, as Gross Domestic Product (“GDP”) in the first half of the year outperformed expectations due to strength in Personal Consumption Expenditures. However, the recent decline in Gross Private Domestic Investment has weighed on GDP growth, which may be an indicator of declining businesses sentiment and lack of willingness to spend due to uncertainty regarding the business cycle and trade.

Sector returns for the Wilshire 5000 Total Market Index were all positive for the first half of 2019. Information Technology (+27.55%), Industrials (+21.92%) and Consumer Discretionary (+19.90%) were the best performing sectors while Health Care (9.99%) and Energy (+11.94%) were the laggards. Large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 18.74% versus 17.85% for the Wilshire U.S. Small-Cap IndexSM. Year to date, Growth has outperformed Value.

Although U.S. real estate securities underperformed broader equities during the quarter ended June 30, 2019, they are still experiencing a surge for the year. Global real estate securities are up double-digits for the year as well. Commodity results were negative for the quarter as crude oil fell -2.8% to $58.47 per barrel. Natural gas prices were down -13.3%, ending the quarter at $2.31 per million BTUs. MLPs were modestly positive for the quarter (+0.12%) but are up significantly for the year. Gold prices finished at approximately $1,414 per troy ounce, up +9.3% from last quarter.

The Wilshire Small Company Value Portfolio - Institutional Class returned 14.41% in 2019, outperforming the Russell 2000 Value Index return of 13.47% by 0.94%. The Fund benefited from stock selection within Industrials and Financials as well as overweight to Industrials. However, performance was weighed down by weak stock selection within Energy and Health Care.

We are pleased with the Portfolio’s outperformance for the first half of 2019 and believe that the Portfolio is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

13

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

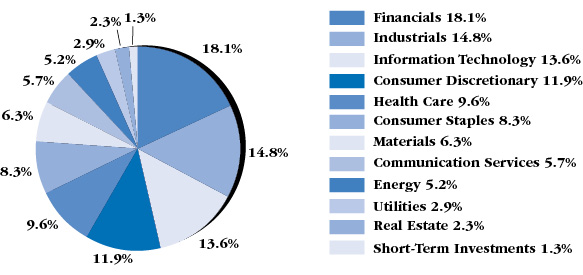

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

14

Wilshire 5000 Indexsm Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19* | 17.87% |

One Year Ended 6/30/19 | 8.35% |

Five Years Ended 6/30/19 | 9.60% |

Ten Years Ended 6/30/19 | 13.97% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19* | 18.03% |

One Year Ended 6/30/19 | 8.72% |

Five Years Ended 6/30/19 | 9.90% |

Ten Years Ended 6/30/19 | 14.25% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Returns

Six Months Ended 6/30/19* | 18.66% |

One Year Ended 6/30/19 | 9.09% |

Five Years Ended 6/30/19 | 10.33% |

Ten Years Ended 6/30/19 | 14.66% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Not annualized. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

15

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

The Wilshire 5000 Total Market IndexSM returned 18.66% for the first half of the year. Global equities reached new highs, albeit with a heightened degree of market volatility. The dovish tone of global central banks has boosted the rally in equities, resulting in a significant decline in global government bond yields. U.S. growth continues to outpace major foreign developed economies, as Gross Domestic Product (“GDP”) in the first half of the year outperformed expectations due to strength in Personal Consumption Expenditures. However, the recent decline in Gross Private Domestic Investment has weighed on GDP growth, which may be an indicator of declining businesses sentiment and lack of willingness to spend due to uncertainty regarding the business cycle and trade.

Outside of the United States, equities also performed well. The MSCI All Country World ex-U.S. Index returned 13.60% for the year-to-date period through June 30. Despite signs of stability, the U.K. and Europe both face cyclical and structural risks to economic growth, due to geopolitical uncertainty and the challenges associated with implementing a unified monetary policy across misaligned economies, respectively. In particular, the European Central Bank has acknowledged this issue and has communicated the willingness to be very supportive of growth through monetary stimulus. The MSCI Emerging Markets Index returned 10.59% during the period as trade war and lower earnings expectations weighed on export-driven economies.

Sector returns for the Wilshire 5000 Total Market Index were all positive for the first half of 2019. Information Technology (+27.55%), Industrials (+21.92%) and Consumer Discretionary (+19.90%) were the best performing sectors while Health Care (9.99%) and Energy (+11.94%) were the laggards. Large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 18.74% versus 17.85% for the Wilshire U.S. Small-Cap IndexSM. Year to date, Growth has outperformed Value.

Although U.S. real estate securities underperformed broader equities during the quarter ended June 30, 2019, they are still experiencing a surge for the year. Global real estate securities are up double-digits for the year as well. Commodity results were negative for the quarter as crude oil fell -2.8% to $58.47 per barrel. Natural gas prices were down -13.3%, ending the quarter at $2.31 per million BTUs. MLPs were modestly positive for the quarter (+0.12%) but are up significantly for the year. Gold prices finished at approximately $1,414 per troy ounce, up +9.3% from last quarter.

The Wilshire 5000 Index Fund - Institutional Class returned 18.03% in 2019, underperforming the Wilshire 5000 Index return of 18.66% by 0.63%. Relative underperformance is attributable to Fund expenses and is well within the historical range.

16

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

17

Wilshire International Equity Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 14.06% |

One Year Ended 6/30/19 | 1.90% |

Five Years Ended 6/30/19 | 2.72% |

Ten Years Ended 6/30/19 | 7.62% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 14.15% |

One Year Ended 6/30/19 | 2.23% |

Five Years Ended 6/30/19 | 2.98% |

Ten Years Ended 6/30/19 | 7.87% |

MSCI ALL COUNTRY WORLD EX-USA INVESTABLE MARKET INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 13.33% |

One Year Ended 6/30/19 | 0.26% |

Five Years Ended 6/30/19 | 2.25% |

Ten Years Ended 6/30/19 | 6.78% |

MSCI ALL COUNTRY WORLD EX-U.S. INDEX(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 13.60% |

One Year Ended 6/30/19 | 1.29% |

Five Years Ended 6/30/19 | 2.16% |

Ten Years Ended 6/30/19 | 6.54% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods.

18

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

* | During the ten years ended June 30, 2019, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, historical total returns would have been lower. For the six months ended June 30, 2019, the investment adviser reimbursed expenses in the annualized amount of 0.10% for Investment Class Shares. |

** | Not annualized. |

(1) | Effective June 28, 2019, the Wilshire International Equity Fund’s (the “Fund”) primary benchmark index was changed from MSCI All Country World Ex-U.S. Index (“MSCI ACWI ex-US”) to the MSCI All Country World Ex-USA Investable Market Index (the “MSCI ACWI ex-US IMI”) because the investment adviser has determined that the MSCI ACWI ex-US IMI more closely aligns with the investment strategies of the Fund. The MSCI ACWI ex-US IMI captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the United States) and 26 Emerging Markets countries, covering approximately 99% of the global equity investment opportunity set outside the United States. The MSCI ACWI ex-US is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

19

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

Outside of the United States, equities performed well. The MSCI All Country World ex-U.S. Index returned 13.60% for the year-to-date period through June 30. Despite signs of stability, the U.K. and Europe both face cyclical and structural risks to economic growth, due to geopolitical uncertainty and the challenges associated with implementing a unified monetary policy across misaligned economies, respectively. In particular, the European Central Bank has acknowledged this issue and has communicated the willingness to be very supportive of growth through monetary stimulus. The MSCI Emerging Markets Index returned 10.59% during the period as trade war and lower earnings expectations weighed on export-driven economies.

The Wilshire International Equity Fund - Institutional Class returned 14.15% in 2019, outperforming the MSCI All Country World ex-USA Investable Market Index return of 13.33% by 0.82%. Performance was weighed down by weak stock selection in Energy and Utilities as well as sector allocation regional selection in Canada. Conversely, strong stock selection within Consumer Discretionary, Industrials and Information Technology were contributive to returns. Additionally, an overweight to Information Technology aided relative performance.

We are pleased with the Fund’s relative outperformance for 2019 and believe that the Fund is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

20

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Portfolio’s total investments in securities at value. Includes investments held as collateral for securities on loan (see Note 7 in Notes to Financial Statements). |

21

Wilshire Income Opportunities Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Returns*

Six Months Ended 6/30/19** | 7.42% |

One Year Ended 6/30/19 | 6.83% |

Inception (03/30/16) through 6/30/19 | 4.98% |

INSTITUTIONAL CLASS SHARES

Average Annual Total Returns

Six Months Ended 6/30/19** | 7.60% |

One Year Ended 6/30/19 | 7.14% |

Inception (03/30/16) through 6/30/19 | 5.15% |

Bloomberg Barclays U.S. Universal Index(1)

Average Annual Total Returns

Six Months Ended 6/30/19** | 6.54% |

One Year Ended 6/30/19 | 8.07% |

Inception (03/30/16) through 6/30/19 | 3.48% |

* | During certain periods since inception, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, historical returns would have been lower. For the six months ended June 30, 2019, the investment adviser reimbursed expenses in the annualized amount of 0.08% for Investment Class Shares. |

** | Not annualized. |

(1) | The Bloomberg Barclays U.S. Universal Index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some U.S. Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Bloomberg Barclays U.S. Universal Index includes Treasury securities, Government agency bonds, mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. |

22

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The Bloomberg Barclays US Aggregate Bond Index returned 6.11% for the first six months of the year as the U.S. Treasury yield curve fell across all maturities, particularly at the front-end of the curve. Credit spread tightened modestly in both investment grade and high yield markets with the Bloomberg Barclays Long Government/Credit Index and the Bloomberg Barclays US Corporate High Yield Index returned 13.46% and 9.94%, respectively. Globally, the trend of declining inflation across developed markets since mid-2018 has persisted into 2019. At the same time, inflation in emerging markets is well below historic levels, albeit higher than developed markets. This trend has fueled a dovish change in sentiment and central bank rhetoric on a global basis, including but not limited to the European Central Bank, Bank of Korea, Bank of Japan, and the U.S. Federal Reserve, all of which are communicating plans for monetary stimulus.

The Wilshire Income Opportunities Fund - Institutional Class returned 7.60% for the first six months of the year, outperforming the Bloomberg Barclays U.S. Universal Index return of 6.54% by 1.06%. Exposures to emerging market debt, investment grade and high yield issues were positive contributors to performance. Allocations to bank loans weighed on relative performance.

We are pleased with the Fund’s relative outperformance for 2019 and believe that the Fund is well-positioned going into the second half of 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

23

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2019)

† | Based on percent of the Fund’s total investments in securities at value. |

24

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the Portfolio. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in the Portfolios and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2019 to June 30, 2019.

The table on the next page illustrates the Portfolios’ costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee reductions, that you paid over the period. The “Ending Account Value” shown is derived from each Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolios at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare the Portfolios’ costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that each Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not each Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the U.S. Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess the Portfolios’ ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

25

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) - (Continued) |

|

| | Beginning

Account

Value

01/01/2019 | Ending

Account

Value

06/30/2019 | Net

Expense

Ratio(1) | Expenses

Paid During Period

01/01/19-06/30/19(2) |

Large Company Growth Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,205.20 | 1.30% | $ 7.11 |

Institutional Class | $ 1,000.00 | $ 1,207.10 | 1.00% | $ 5.47 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.35 | 1.30% | $ 6.51 |

Institutional Class | $ 1,000.00 | $ 1,019.84 | 1.00% | $ 5.01 |

Large Company Value Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,141.10 | 1.26% | $ 6.69 |

Institutional Class | $ 1,000.00 | $ 1,142.90 | 0.99% | $ 5.26 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.55 | 1.26% | $ 6.31 |

Institutional Class | $ 1,000.00 | $ 1,019.89 | 0.99% | $ 4.96 |

Small Company Growth Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,205.40 | 1.33% | $ 7.27 |

Institutional Class | $ 1,000.00 | $ 1,207.20 | 1.08% | $ 5.91 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.20 | 1.33% | $ 6.66 |

Institutional Class | $ 1,000.00 | $ 1,019.44 | 1.08% | $ 5.41 |

Small Company Value Portfolio |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,142.90 | 1.34% | $ 7.12 |

Institutional Class | $ 1,000.00 | $ 1,144.10 | 1.09% | $ 5.79 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.15 | 1.34% | $ 6.71 |

Institutional Class | $ 1,000.00 | $ 1,019.39 | 1.09% | $ 5.46 |

26

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses (Unaudited) - (Continued) |

|

| | Beginning

Account

Value

01/01/2019 | Ending

Account

Value

06/30/2019 | Net

Expense

Ratio(1) | Expenses

Paid During Period

01/01/19-06/30/19(2) |

Wilshire 5000 IndexSM Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,178.70 | 0.61% | $ 3.30 |

Institutional Class | $ 1,000.00 | $ 1,180.30 | 0.33% | $ 1.78 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,021.77 | 0.61% | $ 3.06 |

Institutional Class | $ 1,000.00 | $ 1,023.16 | 0.33% | $ 1.66 |

Wilshire International Equity Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,140.60 | 1.52% | $ 8.07 |

Institutional Class | $ 1,000.00 | $ 1,141.50 | 1.27% | $ 6.74 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,017.26 | 1.52% | $ 7.60 |

Institutional Class | $ 1,000.00 | $ 1,018.50 | 1.27% | $ 6.36 |

Wilshire Income Opportunities Fund |

Based on Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,074.20 | 1.19% | $ 6.12 |

Institutional Class | $ 1,000.00 | $ 1,076.00 | 0.92% | $ 4.74 |

Based on Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,018.89 | 1.19% | $ 5.96 |

Institutional Class | $ 1,000.00 | $ 1,020.23 | 0.92% | $ 4.61 |

(1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

(2) | Expenses are equal to the Portfolio’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period. |

27

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 99.3%(a) |

Communication Services — 11.4% |

Alphabet, Inc. - Class A(b) | | | 3,119 | | | $ | 3,377,253 | |

Alphabet, Inc. - Class C(b) | | | 6,204 | | | | 6,705,966 | |

Facebook, Inc. - Class A(b) | | | 56,594 | | | | 10,922,642 | |

Netflix, Inc.(b) | | | 8,004 | | | | 2,940,029 | |

Other Securities(c) (d) | | | | | | | 441,686 | |

| | | | | | | | 24,387,576 | |

Consumer Discretionary — 18.6% | | | | | | | | |

Alibaba Group Holding Ltd. - ADR(b) | | | 40,153 | | | | 6,803,926 | |

Amazon.com, Inc.(b) | | | 7,217 | | | | 13,666,327 | |

Burlington Stores, Inc.(b) | | | 11,636 | | | | 1,979,865 | |

lululemon athletica, inc.(b) | | | 13,908 | | | | 2,506,361 | |

Starbucks Corp. | | | 37,062 | | | | 3,106,908 | |

Ulta Beauty, Inc.(b) | | | 7,752 | | | | 2,689,091 | |

Yum China Holdings, Inc. | | | 33,685 | | | | 1,556,247 | |

Yum! Brands, Inc. | | | 16,002 | | | | 1,770,941 | |

Other Securities(c) (d) | | | | | | | 5,563,600 | |

| | | | | | | | 39,643,266 | |

Consumer Staples — 6.4% | | | | | | | | |

Coca-Cola Co. (The) | | | 50,007 | | | | 2,546,356 | |

Colgate-Palmolive Co. | | | 22,495 | | | | 1,612,217 | |

Danone S.A. - ADR(d) | | | 127,086 | | | | 2,151,566 | |

Monster Beverage Corp.(b) | | | 53,528 | | | | 3,416,693 | |

Procter & Gamble Co. (The) | | | 20,660 | | | | 2,265,368 | |

Other Securities(c) | | | | | | | 1,671,394 | |

| | | | | | | | 13,663,594 | |

Energy — 0.5% | | | | | | | | |

Other Securities(c) | | | | | | | 1,136,723 | |

| | | | | | | | | |

Financials — 4.6% | | | | | | | | |

CME Group, Inc. | | | 8,590 | | | | 1,667,406 | |

FactSet Research Systems, Inc. | | | 5,202 | | | | 1,490,686 | |

SEI Investments Co. | | | 29,124 | | | | 1,633,857 | |

Other Securities(c) | | | | | | | 5,058,975 | |

| | | | | | | | 9,850,924 | |

Health Care — 17.1% | | | | | | | | |

ABIOMED, Inc.(b) | | | 7,002 | | | | 1,823,951 | |

Alexion Pharmaceuticals, Inc.(b) | | | 21,260 | | | | 2,784,634 | |

Align Technology, Inc.(b) | | | 8,373 | | | | 2,291,689 | |

Cerner Corp. | | | 27,854 | | | | 2,041,698 | |

Edwards Lifesciences Corp.(b) | | | 9,800 | | | | 1,810,452 | |

Illumina, Inc.(b) | | | 6,818 | | | | 2,510,047 | |

Novo Nordisk A/S - ADR | | | 40,082 | | | | 2,045,785 | |

Regeneron Pharmaceuticals, Inc.(b) | | | 6,104 | | | | 1,910,552 | |

UnitedHealth Group, Inc. | | | 13,397 | | | | 3,269,002 | |

Varian Medical Systems, Inc.(b) | | | 10,822 | | | | 1,473,199 | |

Veeva Systems, Inc. - Class A(b) | | | 13,955 | | | | 2,262,245 | |

Zoetis, Inc. | | | 27,920 | | | | 3,168,642 | |

Other Securities(c) (d) | | | | | | | 9,016,746 | |

| | | | | | | | 36,408,642 | |

Industrials — 6.9% | | | | | | | | |

CoStar Group, Inc.(b) | | | 2,968 | | | | 1,644,450 | |

Deere & Co. | | | 12,065 | | | | 1,999,292 | |

Expeditors International of Washington, Inc. | | | 28,081 | | | | 2,130,225 | |

Union Pacific Corp. | | | 12,994 | | | | 2,197,415 | |

Other Securities(c) (d) | | | | | | | 6,702,745 | |

| | | | | | | | 14,674,127 | |

Information Technology — 33.0% | | | | | | | | |

Apple, Inc. | | | 22,292 | | | | 4,412,033 | |

Autodesk, Inc.(b) | | | 21,093 | | | | 3,436,050 | |

Cisco Systems, Inc. | | | 49,417 | | | | 2,704,593 | |

EPAM Systems, Inc.(b) | | | 10,380 | | | | 1,796,777 | |

Keysight Technologies, Inc.(b) | | | 17,355 | | | | 1,558,652 | |

Microsoft Corp. | | | 54,643 | | | | 7,319,976 | |

NVIDIA Corp. | | | 26,166 | | | | 4,297,243 | |

Oracle Corp. | | | 80,359 | | | | 4,578,052 | |

PayPal Holdings, Inc.(b) | | | 32,147 | | | | 3,679,545 | |

PTC, Inc.(b) | | | 18,119 | | | | 1,626,361 | |

QUALCOMM, Inc. | | | 33,300 | | | | 2,533,131 | |

salesforce.com, inc.(b) | | | 20,640 | | | | 3,131,707 | |

ServiceNow, Inc.(b) | | | 12,760 | | | | 3,503,513 | |

Visa, Inc. - Class A(d) | | | 66,713 | | | | 11,578,040 | |

Workday, Inc. - Class A(b) | | | 10,655 | | | | 2,190,455 | |

Other Securities(c) (d) | | | | | | | 12,091,511 | |

| | | | | | | | 70,437,639 | |

Materials — 0.1% | | | | | | | | |

Other Securities(c) (d) | | | | | | | 214,005 | |

| | | | | | | | | |

Real Estate — 0.7% | | | | | | | | |

Other Securities(c) (d) | | | | | | | 1,510,699 | |

| | | | | | | | | |

Total Common Stocks(Cost $126,444,241) | | | | | | $ | 211,927,195 | |

See Notes to Financial Statements.

28

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

MONEY MARKET FUNDS — 1.1% |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 2.24%(e) | | | 1,758,447 | | | $ | 1,758,447 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 2.36%(e) (f) | | | 565,233 | | | | 565,233 | |

Total Money Market Funds(Cost $2,323,680) | | | | | | $ | 2,323,680 | |

| | | | | | | | | |

Total Investments at Value — 100.4%(Cost $128,767,921) | | $ | 214,250,875 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.4%) | | | (775,680 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 213,475,195 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issue that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (866) 591-1568; (ii) on the SEC’s website at www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | Non-income producing security. |

(c) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of June 30, 2019. |

(d) | This security or a partial position of this security is on loan at June 30, 2019. The total market value of securities on loan at June 30, 2019 was $14,049,802 (Note 7). |

(e) | The rate shown is the 7-day effective yield as of June 30, 2019. |

(f) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2019 was $565,233. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $13,619,670 (Note 7). |

See Notes to Financial Statements.

29

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 98.5%(a) |

Communication Services — 5.5% |

AT&T, Inc. | | | 103,172 | | | $ | 3,457,293 | |

Comcast Corp. - Class A | | | 53,924 | | | | 2,279,907 | |

Verizon Communications, Inc. | | | 32,974 | | | | 1,883,805 | |

Other Securities(b) | | | | | | | 2,969,278 | |

| | | | | | | | 10,590,283 | |

Consumer Discretionary — 9.5% | | | | | | | | |

Ford Motor Co. | | | 229,062 | | | | 2,343,304 | |

Lear Corp. | | | 15,454 | | | | 2,152,278 | |

Lowe’s Cos., Inc. | | | 15,119 | | | | 1,525,658 | |

Mohawk Industries, Inc.(c) | | | 10,078 | | | | 1,486,203 | |

Target Corp. | | | 27,573 | | | | 2,388,098 | |

Other Securities(b) (d) | | | | | | | 8,262,580 | |

| | | | | | | | 18,158,121 | |

Consumer Staples — 4.0% | | | | | | | | |

Philip Morris International, Inc. | | | 22,963 | | | | 1,803,284 | |

Walmart, Inc. | | | 17,751 | | | | 1,961,308 | |

Other Securities(b) | | | | | | | 3,862,285 | |

| | | | | | | | 7,626,877 | |

Energy — 10.1% | | | | | | | | |

BP plc - ADR | | | 45,459 | | | | 1,895,640 | |

EOG Resources, Inc. | | | 19,852 | | | | 1,849,412 | |

Exxon Mobil Corp. | | | 33,157 | | | | 2,540,821 | |

Halliburton Co. | | | 76,373 | | | | 1,736,722 | |

National Oilwell Varco, Inc. | | | 81,943 | | | | 1,821,594 | |

Phillips 66 | | | 20,692 | | | | 1,935,530 | |

Royal Dutch Shell plc - Class A - ADR | | | 22,295 | | | | 1,450,736 | |

Schlumberger Ltd. | | | 42,142 | | | | 1,674,723 | |

Other Securities(b) (d) | | | | | | | 4,308,277 | |

| | | | | | | | 19,213,455 | |

Financials — 27.0% | | | | | | | | |

American International Group, Inc. | | | 46,735 | | | | 2,490,040 | |

AXA Equitable Holdings, Inc. | | | 78,734 | | | | 1,645,540 | |

Bank of America Corp. | | | 173,460 | | | | 5,030,339 | |

Capital One Financial Corp. | | | 26,591 | | | | 2,412,867 | |

Chubb Ltd. | | | 13,668 | | | | 2,013,159 | |

Citigroup, Inc. | | | 41,006 | | | | 2,871,650 | |

JPMorgan Chase & Co. | | | 39,010 | | | | 4,361,318 | |

MetLife, Inc. | | | 40,355 | | | | 2,004,433 | |

Morgan Stanley | | | 43,345 | | | | 1,898,944 | |

Northern Trust Corp. | | | 17,291 | | | | 1,556,190 | |

U.S. Bancorp | | | 39,411 | | | | 2,065,136 | |

Wells Fargo & Co. | | | 98,337 | | | | 4,653,306 | |

Other Securities(b) (d) | | | | | | | 18,493,943 | |

| | | | | | | | 51,496,865 | |

Health Care — 11.4% | | | | | | | | |

CVS Health Corp. | | | 37,221 | | | | 2,028,173 | |

Johnson & Johnson | | | 19,141 | | | | 2,665,958 | |

McKesson Corp. | | | 11,395 | | | | 1,531,374 | |

Medtronic plc | | | 19,461 | | | | 1,895,306 | |

Merck & Co., Inc. | | | 23,959 | | | | 2,008,962 | |

Pfizer, Inc. | | | 45,640 | | | | 1,977,125 | |

Other Securities(b) | | | | | | | 9,602,155 | |

| | | | | | | | 21,709,053 | |

Industrials — 10.7% | | | | | | | | |

General Electric Co. | | | 463,629 | | | | 4,868,105 | |

Stanley Black & Decker, Inc. | | | 18,689 | | | | 2,702,617 | |

United Technologies Corp. | | | 12,301 | | | | 1,601,590 | |

Westinghouse Air Brake Technologies Corp.(d) | | | 23,227 | | | | 1,666,771 | |

Other Securities(b) | | | | | | | 9,539,085 | |

| | | | | | | | 20,378,168 | |

Information Technology — 8.4% | | | | | | | | |

Cognizant Technology Solutions Corp. - Class A | | | 25,602 | | | | 1,622,910 | |

Hewlett Packard Enterprise Co. | | | 114,735 | | | | 1,715,288 | |

International Business Machines Corp. | | | 10,964 | | | | 1,511,936 | |

Oracle Corp. | | | 71,045 | | | | 4,047,434 | |

QUALCOMM, Inc. | | | 21,671 | | | | 1,648,512 | |

Other Securities(b) (d) | | | | | | | 5,507,012 | |

| | | | | | | | 16,053,092 | |

Materials — 2.7% | | | | | | | | |

Linde plc | | | 11,926 | | | | 2,394,740 | |

Other Securities(b) (d) | | | | | | | 2,792,622 | |

| | | | | | | | 5,187,362 | |

Real Estate — 2.8% | | | | | | | | |

HCP, Inc.(d) | | | 61,673 | | | | 1,972,302 | |

Other Securities(b) (d) | | | | | | | 3,443,151 | |

| | | | | | | | 5,415,453 | |

Utilities — 6.4% | | | | | | | | |

Dominion Energy, Inc. | | | 32,772 | | | | 2,533,931 | |

Edison International | | | 23,541 | | | | 1,586,899 | |

Entergy Corp. | | | 28,448 | | | | 2,928,152 | |

Exelon Corp. | | | 45,735 | | | | 2,192,536 | |

See Notes to Financial Statements.

30

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 98.5%(a) (Continued) |

Utilities — 6.4% (Continued) | | | | | | | | |

Other Securities(b) | | | | | | $ | 2,882,304 | |

| | | | | | | | 12,123,822 | |

Total Common Stocks(Cost $167,855,211) | | | | | | $ | 187,952,551 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 1.4% | | | | |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 2.24%(e) | | | 2,508,295 | | | $ | 2,508,295 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 2.36%(e) (f) | | | 117,111 | | | | 117,111 | |

Total Money Market Funds(Cost $2,625,406) | | | | | | $ | 2,625,406 | |

| | | | | | | | | |

Total Investments at Value — 99.9%(Cost $170,480,617) | | $ | 190,577,957 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | 207,900 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 190,785,857 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issue that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (866) 591-1568; (ii) on the SEC’s website at www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of June 30, 2019. |

(c) | Non-income producing security. |

(d) | This security or a partial position of this security is on loan at June 30, 2019. The total market value of securities on loan at June 30, 2019 was $5,634,669 (Note 7). |

(e) | The rate shown is the 7-day effective yield as of June 30, 2019. |

(f) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2019 was $117,111. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $5,567,232 (Note 7). |

See Notes to Financial Statements.

31

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 97.1%(a) |

Communication Services — 1.5% |

Cogent Communications Holdings, Inc. | | | 7,680 | | | $ | 455,884 | |

Other Securities(b) | | | | | | | 490,727 | |

| | | | | | | | 946,611 | |

Consumer Discretionary — 10.0% | | | | | | | | |

Chegg, Inc.(c) | | | 13,931 | | | | 537,598 | |

Oxford Industries, Inc.(d) | | | 6,514 | | | | 493,761 | |

Skyline Champion Corp.(c) | | | 37,410 | | | | 1,024,285 | |

Steven Madden Ltd. | | | 20,632 | | | | 700,456 | |

TopBuild Corp.(c) | | | 10,114 | | | | 837,035 | |

Other Securities(b) (d) | | | | | | | 2,709,915 | |

| | | | | | | | 6,303,050 | |

Consumer Staples — 5.7% | | | | | | | | |

Calavo Growers, Inc.(d) | | | 7,690 | | | | 743,931 | |

Inter Parfums, Inc. | | | 18,650 | | | | 1,240,039 | |

J & J Snack Foods Corp. | | | 7,433 | | | | 1,196,340 | |

Other Securities(b) (d) | | | | | | | 408,279 | |

| | | | | | | | 3,588,589 | |

Energy — 1.3% | | | | | | | | |

Select Energy Services, Inc. - Class A(c) | | | 64,480 | | | | 748,613 | |

Other Securities(b) | | | | | | | 80,548 | |

| | | | | | | | 829,161 | |

Financials — 7.4% | | | | | | | | |

Banc of California, Inc. | | | 25,385 | | | | 354,628 | |

CenterState Bank Corp. | | | 29,165 | | | | 671,670 | |

Goosehead Insurance, Inc. - Class A(d) | | | 17,647 | | | | 843,526 | |

LegacyTexas Financial Group, Inc. | | | 7,104 | | | | 289,204 | |

LendingTree, Inc.(c) (d) | | | 1,610 | | | | 676,249 | |

Other Securities(b) (d) | | | | | | | 1,793,046 | |

| | | | | | | | 4,628,323 | |

Health Care — 26.7% | | | | | | | | |

BioTelemetry, Inc.(c) (d) | | | 11,373 | | | | 547,609 | |

Cambrex Corp.(c) | | | 12,785 | | | | 598,466 | |

Enanta Pharmaceuticals, Inc.(c) | | | 3,240 | | | | 273,391 | |

Heska Corp.(c) | | | 4,815 | | | | 410,094 | |

HMS Holdings Corp.(c) | | | 9,674 | | | | 313,341 | |

Integer Holdings Corp.(c) | | | 9,200 | | | | 772,065 | |

LeMaitre Vascular, Inc. | | | 13,735 | | | | 384,305 | |

Medidata Solutions, Inc.(c) | | | 6,385 | | | | 577,906 | |

Medpace Holdings, Inc.(c) | | | 12,626 | | | | 825,993 | |

Mesa Laboratories, Inc. | | | 4,260 | | | | 1,040,889 | |

Neogen Corp.(c) | | | 12,256 | | | | 761,220 | |

NeoGenomics, Inc.(c) | | | 35,010 | | | | 768,119 | |

PRA Health Sciences, Inc.(c) | | | 15,750 | | | | 1,561,613 | |

Repligen Corp.(c) (d) | | | 15,840 | | | | 1,361,448 | |

Supernus Pharmaceuticals, Inc.(c) | | | 14,433 | | | | 477,587 | |

Tabula Rasa HealthCare, Inc. (c) (d) | | | 16,430 | | | | 820,349 | |

Tactile Systems Technology, Inc. (c)(d) | | | 11,832 | | | | 673,477 | |

Other Securities(b) (d) | | | | | | | 4,612,850 | |

| | | | | | | | 16,780,722 | |

Industrials — 15.1% | | | | | | | | |

Axon Enterprise, Inc.(c) (d) | | | 16,290 | | | | 1,045,980 | |

Kratos Defense & Security Solutions, Inc.(c) | | | 24,390 | | | | 558,287 | |

Marten Transport Ltd.(d) | | | 20,700 | | | | 375,705 | |

Mercury Systems, Inc.(c) | | | 9,040 | | | | 635,963 | |

Saia, Inc.(c) | | | 10,091 | | | | 652,585 | |

SiteOne Landscape Supply, Inc. (c)(d) | | | 14,074 | | | | 975,329 | |

Other Securities(b) (d) | | | | | | | 5,240,807 | |

| | | | | | | | 9,484,656 | |

Information Technology — 25.8% | | | | | | | | |

AppFolio, Inc. - Class A(c) (d) | | | 4,537 | | | | 463,999 | |

Box, Inc. - Class A(c) | | | 47,949 | | | | 844,382 | |

Cabot Microelectronics Corp. | | | 5,465 | | | | 601,587 | |

EVO Payments, Inc. - Class A(c) | | | 36,937 | | | | 1,164,624 | |

MAXIMUS, Inc. | | | 17,138 | | | | 1,243,190 | |

Mimecast Ltd.(c) | | | 24,475 | | | | 1,143,227 | |

Pegasystems, Inc. | | | 24,635 | | | | 1,754,258 | |

Qualys, Inc.(c) (d) | | | 14,000 | | | | 1,219,120 | |

Silicon Laboratories, Inc.(c) | | | 7,090 | | | | 733,105 | |

WNS Holdings Ltd. - ADR(c) | | | 29,119 | | | | 1,723,844 | |

Workiva, Inc.(c) | | | 14,234 | | | | 826,853 | |

Other Securities(b) (d) | | | | | | | 4,509,543 | |

| | | | | | | | 16,227,732 | |

Materials — 2.0% | | | | | | | | |

Ferroglobe Representation & Warranty Insurance Trust(c) (e) (f) | | | 840 | | | | 0 | |

Quaker Chemical Corp.(d) | | | 3,675 | | | | 745,584 | |

Other Securities(b) | | | | | | | 493,393 | |

| | | | | | | | 1,238,977 | |

See Notes to Financial Statements.

32

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 97.1%(a) (Continued) |

Real Estate — 1.2% | | | | | | | | |

Other Securities(b) (d) | | | | | | $ | 767,903 | |

| | | | | | | | | |

Utilities — 0.4% | | | | | | | | |

Other Securities(b) (d) | | | | | | | 258,046 | |

| | | | | | | | | |

Total Common Stocks(Cost $47,346,515) | | | | | | $ | 61,053,770 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 4.7% | | | | |

Northern Trust Institutional Government Select Portfolio - Institutional Class, 2.24%(g) | | | 1,822,932 | | | $ | 1,822,932 | |

Northern Trust Institutional Liquid Asset Portfolio - Institutional Class, 2.36%(g) (h) | | | 1,119,629 | | | | 1,119,629 | |

Total Money Market Funds(Cost $2,942,561) | | | | | | $ | 2,942,561 | |

| | | | | | | | | |

Total Investments at Value — 101.8%(Cost $50,289,076) | | $ | 63,996,331 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (1.8%) | | | (1,142,713 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 62,853,618 | |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings, each investment of any issue that exceeds 1% of the Portfolio’s net assets, and any illiquid investments or investments classified as Level 3. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (866) 591-1568; (ii) on the SEC’s website at www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

ADR — American Depositary Receipt.

(a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

(b) | Represents issuers not identified as a top 50 holding in terms of market value, issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, or any issuers not classified as illiquid or Level 3 investments, as of June 30, 2019. |

(c) | Non-income producing security. |

(d) | This security or a partial position of this security is on loan at June 30, 2019. The total market value of securities on loan at June 30, 2019 was $12,008,905 (Note 7). |

(e) | Level 3 security. Security has been valued at fair value in accordance with procedures adopted by and under the general supervision of the Board of Directors. The total value of such securities is $0 as of June 30, 2019, representing 0.0% of net assets (Note 2). |

(f) | Illiquid security. The total value of such securities is $0 as of June 30, 2019, representing 0.0% of net assets. |

(g) | The rate shown is the 7-day effective yield as of June 30, 2019. |

(h) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2019 was $1,119,629. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $11,090,664 (Note 7). |

See Notes to Financial Statements.

33

Wilshire Mutual Funds, Inc. Small Company Value Portfolio Condensed Schedule of Investments | June 30, 2019

(Unaudited) |

|

| | | Shares | | | Value | |

COMMON STOCKS — 96.5%(a) |

Communication Services — 1.1% |

Other Securities(b) (d) | | | | | | $ | 662,500 | |

| | | | | | | | | |

Consumer Discretionary — 7.2% | | | | | | | | |

Hooker Furniture Corp. | | | 28,777 | | | | 593,381 | |

Stoneridge, Inc.(c) | | | 14,113 | | | | 445,265 | |

Taylor Morrison Home Corp. - Class A(c) | | | 38,015 | | | | 796,793 | |

Other Securities(b) (d) | | | | | | | 2,391,327 | |

| | | | | | | | 4,226,766 | |

Consumer Staples — 1.8% | | | | | | | | |

Landec Corp.(c) | | | 65,795 | | | | 616,499 | |

Other Securities(b) (d) | | | | | | | 405,080 | |

| | | | | | | | 1,021,579 | |

Energy — 7.0% | | | | | | | | |

Centennial Resource Development, Inc. - Class A (c) (d) | | | 82,405 | | | | 625,454 | |

Equitrans Midstream Corp.(d) | | | 41,440 | | | | 816,782 | |

PDC Energy, Inc.(c) | | | 13,520 | | | | 487,531 | |

WPX Energy, Inc.(c) | | | 43,725 | | | | 503,275 | |

Other Securities(b) (d) | | | | | | | 1,650,089 | |

| | | | | | | | 4,083,131 | |

Financials — 28.0% | | | | | | | | |

Ameris Bancorp(d) | | | 32,096 | | | | 1,257,841 | |

Bank of N.T. Butterfield & Son Ltd. (The) | | | 25,076 | | | | 851,580 | |

Cadence Bancorp. | | | 15,230 | | | | 316,784 | |

CVB Financial Corp. | | | 14,860 | | | | 312,506 | |

Essent Group Ltd.(c) | | | 8,120 | | | | 381,559 | |

First Horizon National Corp.(d) | | | 45,337 | | | | 676,881 | |

HomeStreet, Inc.(c) | | | 20,655 | | | | 612,213 | |

PacWest Bancorp(d) | | | 15,065 | | | | 584,974 | |

Radian Group, Inc. | | | 12,746 | | | | 291,246 | |

RenaissanceRe Holdings Ltd. | | | 6,255 | | | | 1,113,452 | |

Texas Capital Bancshares, Inc.(c) | | | 9,275 | | | | 569,207 | |

Western Alliance Bancorp.(c) | | | 25,592 | | | | 1,144,473 | |

Other Securities(b) (d) | | | | | | | 8,317,131 | |

| | | | | | | | 16,429,847 | |

Health Care — 2.3% | | | | | | | | |

LivaNova plc(c) | | | 6,925 | | | | 498,322 | |

Other Securities(b) (d) | | | | | | | 865,531 | |

| | | | | | | | 1,363,853 | |

Industrials — 19.3% | | | | | | | | |

Alamo Group, Inc. | | | 6,055 | | | | 605,075 | |

Albany International Corp. - Class A | | | 4,035 | | | | 334,542 | |

Apogee Enterprises, Inc. | | | 11,410 | | | | 495,650 | |

Astronics Corp.(c) | | | 11,480 | | | | 461,726 | |

Barnes Group, Inc. | | | 7,515 | | | | 423,395 | |

BMC Stock Holdings, Inc.(c) | | | 33,180 | | | | 703,416 | |

EnerSys | | | 10,177 | | | | 697,124 | |

Federal Signal Corp. | | | 16,803 | | | | 449,480 | |

GP Strategies Corp.(c) | | | 20,375 | | | | 307,256 | |

HNI Corp. | | | 12,265 | | | | 433,935 | |

Knight-Swift Transportation Holdings, Inc.(d) | | | 22,679 | | | | 744,778 | |

Quanta Services, Inc. | | | 24,160 | | | | 922,671 | |

Other Securities(b) (d) | | | | | | | 4,723,591 | |

| | | | | | | | 11,302,639 | |

Information Technology — 12.2% | | | | | | | | |

Coherent, Inc.(c) | | | 4,389 | | | | 598,528 | |

Entegris, Inc.(d) | | | 14,814 | | | | 552,858 | |

Mellanox Technologies Ltd.(c) | | | 9,000 | | | | 996,030 | |

Methode Electronics, Inc. | | | 18,550 | | | | 529,974 | |

Rambus, Inc.(c) | | | 43,820 | | | | 527,593 | |

Verint Systems, Inc.(c) | | | 4,925 | | | | 264,866 | |

Other Securities(b) (d) | | | | | | | 3,713,517 | |

| | | | | | | | 7,183,366 | |

Materials — 5.5% | | | | | | | | |

Boise Cascade Co. | | | 9,945 | | | | 279,554 | |

Kaiser Aluminum Corp. | | | 5,932 | | | | 579,023 | |

Materion Corp. | | | 5,853 | | | | 396,892 | |

Neenah, Inc. | | | 7,525 | | | | 508,314 | |

P.H. Glatfelter Co.(d) | | | 46,525 | | | | 785,342 | |

Other Securities(b) (d) | | | | | | | 661,969 | |

| | | | | | | | 3,211,094 | |

Real Estate — 9.4% | | | | | | | | |

Brandywine Realty Trust | | | 49,329 | | | | 706,391 | |

First Industrial Realty Trust, Inc. | | | 7,080 | | | | 260,119 | |

PotlatchDeltic Corp. | | | 9,534 | | | | 371,635 | |

RLJ Lodging Trust(d) | | | 16,590 | | | | 294,307 | |