UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07076

| |

| Wilshire Mutual Funds, Inc. |

| (Exact name of Registrant as specified in charter) |

| |

Wilshire Associates Incorporated 1299 Ocean Avenue, Suite 700 Santa Monica, CA 90401-1085 |

| (Address of principal executive offices) (Zip code) |

| |

Jason A. Schwarz, President 1299 Ocean Avenue, Suite 700 Santa Monica, CA 90401-1085 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 310-451-3051

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Wilshire Mutual Funds |

SEMI-ANNUAL REPORT (Unaudited) Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire International Equity Fund Wilshire Income Opportunities Fund |

June 30, 2016

http://advisor.wilshire.com |

Wilshire Mutual Funds Table of Contents |

|

Letter to Shareholders | 1 |

Commentary: | |

Large Company Growth Portfolio | 3 |

Large Company Value Portfolio | 7 |

Small Company Growth Portfolio | 11 |

Small Company Value Portfolio | 15 |

Wilshire 5000 IndexSM Fund | 19 |

Wilshire International Equity Fund | 25 |

Wilshire Income Opportunities Fund | 29 |

Disclosure of Fund Expenses | 33 |

Schedule of Investments/Condensed Schedules of Investments: | |

Large Company Growth Portfolio | 36 |

Large Company Value Portfolio | 38 |

Small Company Growth Portfolio | 40 |

Small Company Value Portfolio | 42 |

Wilshire 5000 IndexSM Fund | 44 |

Wilshire International Equity Fund | 46 |

Wilshire Income Opportunities Fund | 50 |

Statements of Assets and Liabilities | 67 |

Statements of Operations | 70 |

Statements of Changes in Net Assets | 72 |

Financial Highlights: | |

Large Company Growth Portfolio | 79 |

Large Company Value Portfolio | 81 |

Small Company Growth Portfolio | 83 |

Small Company Value Portfolio | 85 |

Wilshire 5000 IndexSM Fund | 87 |

Wilshire International Equity Fund | 91 |

Wilshire Income Opportunities Fund | 93 |

Notes to Financial Statements | 95 |

Additional Fund Information | 113 |

Board Approval of Advisory and Subadvisory Agreements | 114 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund and Wilshire Income Opportunities Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by SEI Investments Distribution Co.

Wilshire Mutual Funds Letter to Shareholders (Unaudited) |

|

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this semiannual report to all shareholders of the Wilshire Mutual Funds. This report covers the period from January 1, 2016 to June 30, 2016, for all share classes of the Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund, Wilshire International Equity Fund and Wilshire Income Opportunities Fund.

Market Environment

U.S. Equity Market

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 3.98% during the first half of the year. During the first six months of the year, value oriented stocks outpaced growth securities across capitalizations. While large-cap stocks outpaced small-cap stocks in the first quarter, small-cap stocks lead during the second quarter. Sector performance varied during the period, with defensive and cyclically oriented sectors being the top performers. Utilities, Telecom Services, Energy, and Materials returned 23.8%, 23.4%, 15.5%, and 11.0%, respectively. Conversely, Financials were weighed down by decreasing interest yields and Health Care struggled as biotechnology holdings sold off over fears about potential health care reform. The sectors returned -1.0% and -0.7%, respectively.

International Equity Market

International equities trailed domestic equity market during the first half of the year as the MSCI EAFE Index returned -4.4%. Emerging markets surged during the period benefitting from rising energy and commodity prices as well as expectations for continued accommodative policies from central banks around the world. The MSCI Emerging Markets index rose 6.4% through June 30. The period ended with increased volatility as uncertainty regarding the potential political contagion emanating from the “Brexit” vote weighed on markets. Equity markets fell sharply immediately following the referendum, and the British pound slumped to its lowest level in 30 years. As in the U.S., foreign markets bounced back over the last few days of the period erasing some of the earlier losses. Japan was among the worst performing developed international markets for the first six months of the year as a strengthening yen and a sluggish economy weighed on investor sentiment. The MSCI Japan Index retuned -5.6% in U.S. dollar terms and -19.5% in local currency terms for the period.

Bond Market

U.S. Treasury yields plunged during the first six months of 2016 as stock market volatility fed safe-haven trades into longer-term Treasuries. The 10-year U.S. Treasury started the year yielding 2.27%, then steadily fell during the first quarter market decline to 1.64% on February 11 before rising to 1.78% by the end of the first quarter as equities stabilized. Treasury securities extended their rally in the second quarter due to broad investor uncertainty, initially over the outcome of the Brexit vote, then over the details and timetable of the withdrawal of the United Kingdom from the European Union. The 10-year U.S. Treasury ended June yielding 1.49%. Credit spreads tightened somewhat over second half of the period, as investors continued to seek incremental yield wherever they could find it. Globally, sovereigns benefited from overall market uneasiness.

Fund Performance Review

The Large Company Growth Portfolio Institutional Class returned 1.38%, performing in-line with the Russell 1000 Growth Index. The Large Company Value Portfolio Institutional Class returned 1.55%, underperforming the Russell 1000 Value Index by 4.75%. The Small Company Growth Portfolio Institutional Class returned 4.53%, outperforming the Russell 2000 Growth Index by 6.12%. The Small Company Value Portfolio Institutional Class returned 3.46%, underperforming the Russell 2000 Value Index by 2.62%. The Wilshire 5000 IndexSM Fund Institutional Class returned 3.77%, underperforming the Wilshire 5000 Total Market IndexSM by 0.21%. The Wilshire International Equity Fund Institutional Class returned

1

Wilshire Mutual Funds Letter to Shareholders (Unaudited) - (Continued) |

|

0.46%, outperforming the MSCI All Country World ex-U.S. Index by 1.48%. The Wilshire Income Opportunities Fund Institutional Share Class returned 3.10% outperforming the Barclays U.S. Universal Index by 0.32% (for the since inception period). We are pleased with the Funds’ performance for the first half of 2016. While some of the Funds struggled during this period, we are confident that each Fund is well positioned for future growth

As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President, Wilshire Mutual Funds

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Returns assume reinvestment of all distributions.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transactions costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise.

In addition to the normal risks associated with investing, international investments may involves risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Investments in smaller companies typically exhibit higher volatility.

Investing involves risk including loss of principal. This report identifies the Portfolio’s investments on June 30, 2016. These holdings are subject to change. Not all investments in each Portfolio performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The MSCI Japan Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

The Wilshire 5000 Total Market IndexSM is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

2

Large Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 1.22% |

One Year Ended 06/30/16 | 3.05% |

Five Years Ended 06/30/16 | 9.94% |

Ten Years Ended 06/30/16 | 6.84% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 1.36% |

One Year Ended 06/30/16 | 3.02% |

Five Years Ended 06/30/16 | 12.35% |

Ten Years Ended 06/30/16 | 8.78% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

3

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 1.38% |

One Year Ended 06/30/16 | 3.39% |

Five Years Ended 06/30/16 | 10.29% |

Ten Years Ended 06/30/16 | 7.20% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 1.36% |

One Year Ended 06/30/16 | 3.02% |

Five Years Ended 06/30/16 | 12.35% |

Ten Years Ended 06/30/16 | 8.78% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

4

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

Markets tumbled globally to start the year as worries over a slowing Chinese economy, falling oil prices, and weakness in U.S. earnings growth rattled investors. The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, fell 9% during the first dozen trading days. The U.S. market eventually rallied from its trough as investor concerns were met with sound economic data and aggressive action by some of the world’s major central banks. In January, the Bank of Japan joined the European Central Bank (ECB) in adopting a negative interest rate policy. In April, markets posted modest returns supported by rising oil prices and increased monetary stimulus measures from the ECB. Equity returns were mixed in May as improving global growth was overshadowed by concerns over a potential increase in U.S. interest rates. The first half of the year closed out with a sharp increase in volatility as the UK referendum to exit the European Union rattled global markets during the last week of trading in June. The U.S. stock market experienced its worst two-day decline since August 2015 before rallying back as investor panic eased. Year to date, value securities have outperformed growth while trends shifted between the first and second quarters in terms of capitalization with large capitalization stock outperforming their smaller capitalization counterparts in the first quarter and smaller capitalization stocks outperforming in the second quarter. Within large capitalization securities, lower beta stocks significantly outperformed their higher beta counterparts, and within small capitalization stocks, low beta and dividend yield were strong performing characteristics over the first six months of the year.

Sector performance for the Wilshire 5000 IndexSM was mixed through June 30. Defensive sectors led with Utilities and Telecom Services returning over 23%. Energy (+15.2%) and Materials (+10.7%) also had strong performance as oil prices rebounded beginning late January. Financials (-1.1%) and Health Care (-0.3%) were the worst performing sectors as banks were weighed down by decreasing interest yields and biotechnology holdings sold off over fears about potential health care reform. Information Technology (-0.3%) also experience negative returns.

The Wilshire Large Company Growth Portfolio Institutional Class returned 1.38% for the first six months of 2016, performing in-line with the Russell 1000 Growth Index return of 1.36%. The Fund benefited from strong stock selection in the Health Care, Industrials, and Information Technology. Weak stock selection in the Consumer Staples sector and an underweight allocation the Telecom Services sector weighed on relative performance.

We are pleased with the Fund’s performance for the year-to-date period and believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

5

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

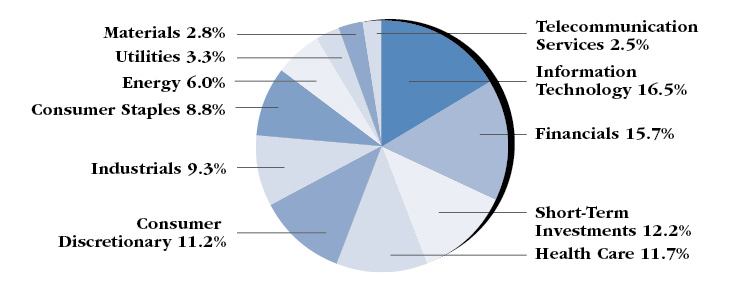

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

6

Large Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 1.40% |

One Year Ended 06/30/16 | -3.78% |

Five Years Ended 06/30/16 | 8.81% |

Ten Years Ended 06/30/16 | 4.39% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 6.30% |

One Year Ended 06/30/16 | 2.86% |

Five Years Ended 06/30/16 | 11.35% |

Ten Years Ended 06/30/16 | 6.13% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

7

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 1.55% |

One Year Ended 06/30/16 | -3.50% |

Five Years Ended 06/30/16 | 9.10% |

Ten Years Ended 06/30/16 | 4.64% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 6.30% |

One Year Ended 06/30/16 | 2.86% |

Five Years Ended 06/30/16 | 11.35% |

Ten Years Ended 06/30/16 | 6.13% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

8

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

Markets tumbled globally to start the year as worries over a slowing Chinese economy, falling oil prices, and weakness in U.S. earnings growth rattled investors. The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, fell 9% during the first dozen trading days. The U.S. market eventually rallied from its trough as investor concerns were met with sound economic data and aggressive action by some of the world’s major central banks. In January, the Bank of Japan joined the European Central Bank (ECB) in adopting a negative interest rate policy. In April, markets posted modest returns supported by rising oil prices and increased monetary stimulus measures from the ECB. Equity returns were mixed in May as improving global growth was overshadowed by concerns over a potential increase in U.S. interest rates. The first half of the year closed out with a sharp increase in volatility as the UK referendum to exit the European Union rattled global markets during the last week of trading in June. The U.S. stock market experienced its worst two-day decline since August 2015 before rallying back as investor panic eased. Year to date, value securities have outperformed growth while trends shifted between the first and second quarters in terms of capitalization with large capitalization stock outperforming their smaller capitalization counterparts in the first quarter and smaller capitalization stocks outperforming in the second quarter. Within large capitalization securities, lower beta stocks significantly outperformed their higher beta counterparts, and within small capitalization stocks, low beta and dividend yield were strong performing characteristics over the first six months of the year.

Sector performance for the Wilshire 5000 IndexSM was mixed through June 30. Defensive sectors led with Utilities and Telecom Services returning over 23%. Energy (+15.2%) and Materials (+10.7%) also had strong performance as oil prices rebounded beginning late January. Financials (-1.1%) and Health Care (-0.3%) were the worst performing sectors as banks were weighed down by decreasing interest yields and biotechnology holdings sold off over fears about potential health care reform. Information Technology (-0.3%) also experience negative returns.

The Wilshire Large Company Value Portfolio Institutional Class returned 1.55% for the first six months of 2016, underperforming the Russell 1000 Value Index return of 6.30% by 4.75%. The Fund was hurt by poor stock selection in the Financials, Industrials, and Energy sectors as well as an overweight allocation to the Financials sector. Strong stock selection in the Consumer Discretionary sector helped mitigate some relative losses.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

9

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

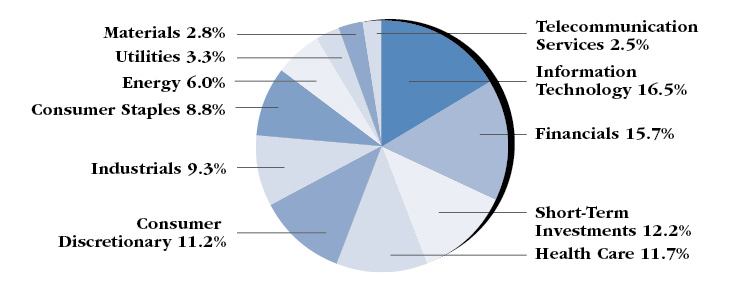

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Portfolio’s total investments in securities, at value. |

10

Small Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 4.33% |

One Year Ended 06/30/16 | -1.83% |

Five Years Ended 06/30/16 | 9.76% |

Ten Years Ended 06/30/16 | 7.40% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | -1.59% |

One Year Ended 06/30/16 | -10.75% |

Five Years Ended 06/30/16 | 8.51% |

Ten Years Ended 06/30/16 | 7.14% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended June 30, 2016, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2016, 0.08% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

11

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 4.53% |

One Year Ended 06/30/16 | -1.54% |

Five Years Ended 06/30/16 | 10.04% |

Ten Years Ended 06/30/16 | 7.67% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | -1.59% |

One Year Ended 06/30/16 | -10.75% |

Five Years Ended 06/30/16 | 8.51% |

Ten Years Ended 06/30/16 | 7.14% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended June 30, 2016, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2016, 0.08% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

12

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

Markets tumbled globally to start the year as worries over a slowing Chinese economy, falling oil prices, and weakness in U.S. earnings growth rattled investors. The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, fell 9% during the first dozen trading days. The U.S. market eventually rallied from its trough as investor concerns were met with sound economic data and aggressive action by some of the world’s major central banks. In January, the Bank of Japan joined the European Central Bank (ECB) in adopting a negative interest rate policy. In April, markets posted modest returns supported by rising oil prices and increased monetary stimulus measures from the ECB. Equity returns were mixed in May as improving global growth was overshadowed by concerns over a potential increase in U.S. interest rates. The first half of the year closed out with a sharp increase in volatility as the UK referendum to exit the European Union rattled global markets during the last week of trading in June. The U.S. stock market experienced its worst two-day decline since August 2015 before rallying back as investor panic eased. Year to date, value securities have outperformed growth while trends shifted between the first and second quarters in terms of capitalization with large capitalization stock outperforming their smaller capitalization counterparts in the first quarter and smaller capitalization stocks outperforming in the second quarter. Within large capitalization securities, lower beta stocks significantly outperformed their higher beta counterparts, and within small capitalization stocks, low beta and dividend yield were strong performing characteristics over the first six months of the year.

Sector performance for the Wilshire 5000 IndexSM was mixed through June 30. Defensive sectors led with Utilities and Telecom Services returning over 23%. Energy (+15.2%) and Materials (+10.7%) also had strong performance as oil prices rebounded beginning late January. Financials (-1.1%) and Health Care (-0.3%) were the worst performing sectors as banks were weighed down by decreasing interest yields and biotechnology holdings sold off over fears about potential health care reform. Information Technology (-0.3%) also experience negative returns.

The Wilshire Small Company Growth Portfolio Institutional Class returned 4.53% for the first six months of 2016, outperforming the Russell 2000 Growth Index return of -1.59% by 6.12%. The Fund benefited from strong stock selection in the Health Care, Industrials, and Information Technology sectors as well as an overweight allocation to the Consumer Staples sector. Weak stock selection in the Consumer Discretionary sector weighed on relative performance.

We are pleased with the Fund’s outperformance for the year-to-date period and believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

13

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

14

Small Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.28% |

One Year Ended 06/30/16 | -2.34% |

Five Years Ended 06/30/16 | 9.73% |

Ten Years Ended 06/30/16 | 5.73% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 6.08% |

One Year Ended 06/30/16 | -2.58% |

Five Years Ended 06/30/16 | 8.15% |

Ten Years Ended 06/30/16 | 5.15% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended June 30, 2016, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2016, 0.08% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

15

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.46% |

One Year Ended 06/30/16 | -2.03% |

Five Years Ended 06/30/16 | 10.10% |

Ten Years Ended 06/30/16 | 6.08% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 6.08% |

One Year Ended 06/30/16 | -2.58% |

Five Years Ended 06/30/16 | 8.15% |

Ten Years Ended 06/30/16 | 5.15% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended June 30, 2016, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the six months ended June 30, 2016, 0.07% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

16

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

Markets tumbled globally to start the year as worries over a slowing Chinese economy, falling oil prices, and weakness in U.S. earnings growth rattled investors. The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, fell 9% during the first dozen trading days. The U.S. market eventually rallied from its trough as investor concerns were met with sound economic data and aggressive action by some of the world’s major central banks. In January, the Bank of Japan joined the European Central Bank (ECB) in adopting a negative interest rate policy. In April, markets posted modest returns supported by rising oil prices and increased monetary stimulus measures from the ECB. Equity returns were mixed in May as improving global growth was overshadowed by concerns over a potential increase in U.S. interest rates. The first half of the year closed out with a sharp increase in volatility as the UK referendum to exit the European Union rattled global markets during the last week of trading in June. The U.S. stock market experienced its worst two-day decline since August 2015 before rallying back as investor panic eased. Year to date, value securities have outperformed growth while trends shifted between the first and second quarters in terms of capitalization with large capitalization stock outperforming their smaller capitalization counterparts in the first quarter and smaller capitalization stocks outperforming in the second quarter. Within large capitalization securities, lower beta stocks significantly outperformed their higher beta counterparts, and within small capitalization stocks, low beta and dividend yield were strong performing characteristics over the first six months of the year.

Sector performance for the Wilshire 5000 IndexSM was mixed through June 30. Defensive sectors led with Utilities and Telecom Services returning over 23%. Energy (+15.2%) and Materials (+10.7%) also had strong performance as oil prices rebounded beginning late January. Financials (-1.1%) and Health Care (-0.3%) were the worst performing sectors as banks were weighed down by decreasing interest yields and biotechnology holdings sold off over fears about potential health care reform. Information Technology (-0.3%) also experience negative returns.

The Wilshire Small Company Value Portfolio Institutional Class returned 3.46% for the first six months of 2016, underperforming the Russell 2000 Value Index return of 6.08% by 2.62%. The Fund was hurt by weak stock selection in the Materials and Consumer Staples sectors. An overweight allocation to the Consumer Staples sector helped mitigate some relative underperformance.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

17

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

18

Wilshire 5000 Indexsm Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.66% |

One Year Ended 06/30/16 | 2.54% |

Five Years Ended 06/30/16 | 10.99% |

Ten Years Ended 06/30/16 | 6.81% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 3.98% |

One Year Ended 06/30/16 | 2.97% |

Five Years Ended 06/30/16 | 11.66% |

Ten Years Ended 06/30/16 | 7.47% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

19

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.77% |

One Year Ended 06/30/16 | 2.77% |

Five Years Ended 06/30/16 | 11.25% |

Ten Years Ended 06/30/16 | 7.02% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 3.98% |

One Year Ended 06/30/16 | 2.97% |

Five Years Ended 06/30/16 | 11.66% |

Ten Years Ended 06/30/16 | 7.47% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

20

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

QUALIFIED CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.71% |

One Year Ended 06/30/16 | 1.62% |

Five Years Ended 06/30/16 | 11.31% |

Ten Years Ended 06/30/16 | 6.93% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 3.98% |

One Year Ended 06/30/16 | 2.97% |

Five Years Ended 06/30/16 | 11.66% |

Ten Years Ended 06/30/16 | 7.47% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

21

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

HORACE MANN CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 3.61% |

One Year Ended 06/30/16 | 2.49% |

Five Years Ended 06/30/16 | 10.97% |

Ten Years Ended 06/30/16 | 6.76% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

Six Months Ended 06/30/16** | 3.98% |

One Year Ended 06/30/16 | 2.97% |

Five Years Ended 06/30/16 | 11.66% |

Ten Years Ended 06/30/16 | 7.47% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

22

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

Markets tumbled globally to start the year as worries over a slowing Chinese economy, tumbling oil prices, and weakness in U.S. earnings growth rattled investors. The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, fell 9% during the first dozen trading days. The U.S. market eventually rallied from its trough as investor concerns were met with sound economic data and aggressive action by some of the world’s major central banks. In January, the Bank of Japan joined the European Central Bank (ECB) in adopting a negative interest rate policy. In April, markets posted modest returns supported by rising oil prices and increased monetary stimulus measures from the ECB. Equity returns were mixed in May as improving global growth was overshadowed by concerns over a potential increase in U.S. interest rates. The first half of the year closed out with a sharp increase in volatility as the UK referendum to exit the European Union rattled global markets during the last week of trading in June. The U.S. stock market experienced its worst two-day decline since August 2015, before rallying back as investor panic eased. Year to date, value securities have outperformed growth while trends shifted between the first and second quarters in terms of capitalization with large capitalization stock outperforming their smaller capitalization counterparts in the first quarter and smaller capitalization stocks outperforming in the second quarter. Within large capitalization securities, lower beta stocks significantly outperformed their higher beta counterparts, and within small capitalization stocks, low beta and dividend yield were strong performing characteristics over the six months of the year.

Sector performance for the Wilshire 5000 IndexSM was mixed through June 30. Defensive sectors led with Utilities and Telecom Services returning over 23%. Energy (+15.2%) and Materials (+10.7%) also had strong performance as oil prices rebounded beginning late January. Financials (-1.1%) and Health Care (-0.3%) were the worst performing sectors as banks were weighed down by decreasing interest rates and biotechnology holdings sold off over fears about potential health care reform. Information Technology (-0.3%) also experience negative returns.

The Wilshire 5000 IndexSM Fund Institutional Class returned 3.77% for the first six months of 2016, underperforming the Fund’s benchmark (the Wilshire 5000 IndexSM) return of 3.98% by 0.21%. Underperformance is attributable to both Fund expenses as well as the optimization approach utilized by Los Angeles Capital, the Fund’s sub-advisor, and is well within the range of historical experiences.

23

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Fund’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

24

Wilshire International Equity Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 0.22% |

One Year Ended 06/30/16 | -5.50% |

Five Years Ended 06/30/16 | 2.99% |

Inception (11/16/07) through 06/30/16 | 0.07% |

MSCI ALL COUNTRY WORLD INDEX EX-U.S.(1)

Average Annual Total Return

Six Months Ended 06/30/16** | -1.02% |

One Year Ended 06/30/16 | -10.24% |

Five Years Ended 06/30/16 | 0.10% |

Inception (11/16/07) through 06/30/16 | -1.26% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods. Effective May 28, 2014, the MSCI All Country World Index Ex-U.S. replaced the MSCI EAFE Index as the Wilshire International Equity Fund’s primary benchmark index. The adviser believes the MSCI All Country World Index Ex-U.S. is a more appropriate index given the Wilshire International Equity Fund’s investment strategy.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the six months ended June 30, 2016, 0.0% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The MSCI All Country World Ex-U.S. Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

25

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Six Months Ended 06/30/16** | 0.46% |

One Year Ended 06/30/16 | -5.24% |

Five Years Ended 06/30/16 | 3.24% |

Inception (11/16/07) through 06/30/16 | 0.33% |

MSCI ALL COUNTRY WORLD INDEX EX-U.S.(1)

Average Annual Total Return

Six Months Ended 06/30/16** | -1.02% |

One Year Ended 06/30/16 | -10.24% |

Five Years Ended 06/30/16 | -0.10% |

Inception (11/16/07) through 06/30/16 | -1.26% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods. Effective May 28, 2014, the MSCI All Country World Index Ex-U.S. replaced the MSCI EAFE Index as the Wilshire International Equity Fund’s primary benchmark index. The adviser believes the MSCI All Country World Index Ex-U.S. is a more appropriate index given the Wilshire International Equity Fund’s investment strategy.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the six months ended June 30, 2016, 0.0% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

| | |

** | Not annualized. |

| | |

(1) | The MSCI All Country World Ex-U.S. Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

26

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

International stock markets underperformed the U.S. as the MSCI All Country World ex-U.S. Index returned -1.02% in the first half of the year. More evidence of a Chinese economic slowdown, continued slack in the European economy and an anemic pulse related to Japan’s financial markets reforms all weighed on returns for most of the period. During the first quarter, some of this weakness was offset by stronger language on behalf of the European Central Bank (ECB) as it embarked on a more aggressive quantitative easing campaign to stimulate the regional economy. Currency effects were fairly pronounced as the U.S. dollar weakened against some of the world’s major currencies and contributed to enhancing returns for U.S. dollar-denominated investors. The second quarter started off by recording gains on behalf of European equities, only to retrench later in the period in the wake of the UK’s decision to exit the European Union. In the Pacific region, the Japanese economy’s slack, amid an aggressively monetary policy campaign, was a drag on returns. Japan’s currency appreciated significantly offsetting some of the weakness in this market. Emerging markets outperformed developed international markets by 10.83% for the year to date period. Emerging markets stocks benefitted from rising energy and commodity prices as well as expectations for continued accommodative policies from central banks around the world.

Sector performance for the MSCI All Country World ex-U.S. Index was mixed through June 30. Energy (+18.4%) and Materials (+11.0%) were the leading sectors supported by the rebound in oil prices beginning in late January. Consumer Discretionary (-9.1%), Financials (-8.6%) and Health Care (-3.0%) were the worst performing sectors consumer spending was dampened by global growth fears, banks were weighed down by decreasing interest rates and biotechnology holdings sold off over concerns about potential health care reform.

The Wilshire International Equity Fund Institutional Class returned 0.46% for the first six months of 2016, outperforming the MSCI All Country World ex U.S. Index return of -1.02% by 1.48%. The Fund benefited from strong stock selection in the Consumer Discretionary and Information Technology sectors. Weak stock selection in the Industrials and Materials sectors weighed on relative performance. Regionally, the Fund benefited from strong stock selection in Japan, Switzerland and Germany. Weak stock selection in Canada and an underweight allocation to the country weighed on relative performance.

We are pleased with the Fund’s outperformance for the year-to-date period and believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

27

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Fund’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

28

Wilshire Income Opportunities Fund(1) Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

Inception (03/30/16) through 06/30/16** | 3.30% |

Barclays U.S. Universal Index(2)

Average Annual Total Return

Inception (03/30/16) through 06/30/16** | 2.78% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Fund commenced operations on March 30, 2016. |

| | |

(2) | The Barclays U.S. Universal Index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some U.S. Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Barclays U.S. Universal Index includes Treasury securities, Government agency bonds, Mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. |

29

Wilshire Income Opportunities Fund(1) Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

Inception (03/30/16) through 06/30/16** | 3.10% |

Barclays U.S. Universal Index(2)

Average Annual Total Return

Inception (03/30/16) through 06/30/16** | 2.78% |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

| | |

** | Not annualized. |

| | |

(1) | The Fund commenced operations on March 30, 2016. |

| | |

(2) | The Barclays U.S. Universal Index represents the union of the U.S. Aggregate Index, U.S. Corporate High Yield Index, Investment Grade 144A Index, Eurodollar Index, U.S. Emerging Markets Index, and the non-ERISA eligible portion of the CMBS Index. The index covers USD-denominated, taxable bonds that are rated either investment grade or high-yield. Some U.S. Universal Index constituents may be eligible for one or more of its contributing subcomponents that are not mutually exclusive. The Barclays U.S. Universal Index includes Treasury securities, Government agency bonds, Mortgage-backed bonds, corporate bonds, and a small amount of foreign bonds traded in U.S. |

30

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

The U.S. fixed income market got off to strong start as the Barclays U.S. Aggregate Bond Index retuned 5.31% for the first six months of the year. Volatility spiked at the start of the year as going concerns heightened for commodity-related companies. Fears of escalating corporate defaults from both investment grade and high yield energy companies caused the market to reprice these securities at distressed levels. Investors pushed US rates lower on the backs of reduced global growth expectations. U.S. Treasury securities extended their rally in the second quarter due to broad investor uncertainty over the United Kingdom’s decision to leave the European Union. Most of the rally occurred after the referendum results as investors sought out safe haven assets in the two trading days after the vote. The bellwether 10-year U.S. Treasury yield fell from 2.27% as of December 31 to 1.49% as of June 30. Credit spreads tightened over the second quarter as well, as investors continued to seek incremental yield wherever they could find it. Globally, sovereigns benefited from overall market uneasiness. Year to date, the Barclays U.S. Aggregate Bond Index returned 5.31%. The best performing sector was Corporate, up 3.57% followed by U.S. Treasury, up 2.10%. Securitized products posted a positive performance as well, up 1.17%. As for non-investment grade, the Barclays High Yield Master II Index returned 9.32% for the period. After retrenching to start the year, high yield rallied in March as oil prices appeared to have bottomed and central banks maintained supportive policy measures. Spreads compressed during the second quarter as demand for risk assets remained strong.

The Wilshire Income Opportunities Fund Institutional Class returned 3.10% for the period since inception, outperforming the Barclays U.S. Universal Index return of 2.78% by 0.32% during that time. A long U.S. Treasury position and positive yield carry boosted overall performance. The Fund also benefited from strong performance from its emerging market debt and collateralized loan obligation holdings. Conversely, Agency mortgage backed securities weighed on returns as the sector lagged others during the since inception period.

We are pleased with the Fund’s outperformance for the since inception period and believe the Fund is well positioned going into the second half of 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

31

Wilshire Income Opportunities Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of June 30, 2016)

† | Based on percent of the Fund’s total investments in securities, at value. |

32

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses For the Six Months Ended June 30, 2016 (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a portfolio (or a “fund”), you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2016 to June 30, 2016.

The table on the next page illustrates your Portfolio’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee waivers, that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that the Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess your Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

33

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended June 30, 2016 (Unaudited) |

|

| | Beginning

Account

Value

01/01/2016 | Ending

Account

Value

06/30/2016 | Expense

Ratio(1) | Expenses Paid

During Period

01/01/16-06/30/2016 |

Large Company Growth Portfolio |

Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $1,012.20 | 1.30% | $6.53(2) |

Institutional Class | $1,000.00 | $1,013.80 | 0.99% | $4.94(2) |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,018.38 | 1.30% | $6.55(2) |

Institutional Class | $1,000.00 | $1,019.96 | 0.99% | $4.96(2) |

Large Company Value Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $1,014.00 | 1.23% | $6.16(2) |

Institutional Class | $1,000.00 | $1,015.50 | 0.96% | $4.79(2) |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,018.75 | 1.23% | $6.17(2) |

Institutional Class | $1,000.00 | $1,020.11 | 0.96% | $4.80(2) |

Small Company Growth Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $1,043.30 | 1.50% | $7.61(2) |

Institutional Class | $1,000.00 | $1,045.30 | 1.16% | $5.92(2) |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,017.42 | 1.50% | $7.51(2) |

Institutional Class | $1,000.00 | $1,019.08 | 1.16% | $5.84(2) |

Small Company Value Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $1,032.80 | 1.48% | $7.49(2) |

Institutional Class | $1,000.00 | $1,034.60 | 1.16% | $5.85(2) |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,017.49 | 1.48% | $7.44(2) |

Institutional Class | $1,000.00 | $1,019.11 | 1.16% | $5.81(2) |

34

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended June 30, 2016 (Unaudited) |

|

| | Beginning

Account

Value

01/01/2016 | Ending

Account

Value

06/30/2016 | Expense

Ratio(1) | Expenses Paid

During Period

01/01/16-06/30/2016 |

Wilshire 5000 IndexSM Fund |

Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,036.60 | 0.66% | $ 3.36(2) |

Institutional Class | $ 1,000.00 | $ 1,037.70 | 0.36% | $ 1.82(2) |

Qualified Class | $ 1,000.00 | $ 1,037.10 | 0.31% | $ 1.57(2) |

Horace Mann Class | $ 1,000.00 | $ 1,036.10 | 0.71% | $ 3.57(2) |

Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,021.57 | 0.66% | $ 3.33(2) |

Institutional Class | $ 1,000.00 | $ 1,023.08 | 0.36% | $ 1.81(2) |

Qualified Class | $ 1,000.00 | $ 1,023.32 | 0.31% | $ 1.56(2) |

Horace Mann Class | $ 1,000.00 | $ 1,021.36 | 0.71% | $ 3.55(2) |

Wilshire International Equity Fund |

Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,002.20 | 1.50% | $ 7.49(2) |

Institutional Class | $ 1,000.00 | $ 1,004.60 | 1.25% | $ 6.25(2) |

Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,017.38 | 1.50% | $ 7.54(2) |

Institutional Class | $ 1,000.00 | $ 1,018.63 | 1.25% | $ 6.29(2) |

Wilshire Income Opportunity Fund |

Actual Fund Return | | | | |

Investment Class | $ 1,000.00 | $ 1,033.00 | 1.10% | $ 2.80(3) |

Institutional Class | $ 1,000.00 | $ 1,031.00 | 0.85% | $ 2.18(3) |

Hypothetical 5% Return | | | | |

Investment Class | $ 1,000.00 | $ 1,019.41 | 1.10% | $ 5.51(2) |

Institutional Class | $ 1,000.00 | $ 1,020.61 | 0.85% | $ 4.29(2) |

(1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

| | |

(2) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/366 (to reflect one-half year period). |

| | |

(3) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 92/366 (to reflect March 30, 2016 inception). |

35

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | June 30, 2016 (Unaudited) |

|

Shares | | Percentage of

Net Assets (%) | | | Value | |

COMMON STOCK — 98.5%†† | |

Consumer Discretionary — 17.0% | | | | | | |

| | 17,539 | | Amazon.com, Inc.† | | | 4.5 | | | $ | 12,551,259 | |

| | 45,350 | | NIKE, Inc., Class B | | | 0.9 | | | | 2,503,320 | |

| | 11,475 | | O'Reilly Automotive, Inc.† (a) | | | 1.1 | | | | 3,110,873 | |

| | 53,515 | | Starbucks Corp. | | | 1.1 | | | | 3,056,777 | |

| | 31,875 | | Tractor Supply Co. | | | 1.1 | | | | 2,906,362 | |

| | 17,200 | | Ulta Salon Cosmetics & Fragrance, Inc.† (a) | | | 1.5 | | | | 4,190,608 | |

| | 36,717 | | Yum! Brands, Inc. | | | 1.1 | | | | 3,044,574 | |

| | 204,804 | | Other Securities | | | 5.7 | | | | 15,647,351 | |

| | | | | | | | | | | 47,011,124 | |

Consumer Staples — 13.9% | | | | | | | | |

| | 130,031 | | Coca-Cola Co. (The) | | | 2.1 | | | | 5,894,305 | |

| | 18,600 | | Constellation Brands, Inc., Class A | | | 1.1 | | | | 3,076,440 | |

| | 15,355 | | Costco Wholesale Corp.(a) | | | 0.9 | | | | 2,411,349 | |

| | 254,834 | | Danone SA ADR(a) | | | 1.3 | | | | 3,610,998 | |

| | 50,132 | | Monster Beverage Corp.† (a) | | | 2.9 | | | | 8,056,714 | |

| | 42,432 | | Procter & Gamble Co. (The) | | | 1.3 | | | | 3,592,718 | |

| | 39,941 | | SABMiller PLC ADR(a) | | | 0.9 | | | | 2,338,146 | |

| | 138,761 | | Other Securities | | | 3.4 | | | | 9,568,184 | |

| | | | | | | | | | | 38,548,854 | |

Energy — 1.3% | | | | | | | | |

| | 34,613 | | Schlumberger, Ltd. | | | 1.0 | | | | 2,737,196 | |

| | 26,608 | | Other Securities | | | 0.3 | | | | 898,183 | |

| | | | | | | | | | | 3,635,379 | |

Financials — 4.4% | | | | | | | | |

| | 206,216 | | Other Securities | | | 4.4 | | | | 12,162,527 | |

| | | | | | | | | | | | |

Health Care — 16.0% | | | | | | | | |

| | 21,075 | | Alexion Pharmaceuticals, Inc.† | | | 0.9 | | | | 2,460,717 | |

| | 20,707 | | Amgen, Inc. | | | 1.1 | | | | 3,150,570 | |

| | 53,049 | | Bristol-Myers Squibb Co. | | | 1.4 | | | | 3,901,754 | |

| | 35,158 | | Celgene Corp.† (a) | | | 1.3 | | | | 3,467,633 | |

| | 46,875 | | Centene Corp.† | | | 1.2 | | | | 3,345,469 | |

| | 56,602 | | Cerner Corp.† | | | 1.2 | | | | 3,316,877 | |

| | 26,525 | | Edwards Lifesciences Corp.† | | | 0.9 | | | | 2,645,338 | |

| | 40,999 | | Merck & Co., Inc. | | | 0.9 | | | | 2,361,952 | |

| | 27,884 | | Novartis AG ADR(a) | | | 0.8 | | | | 2,300,709 | |

| | 58,363 | | Novo Nordisk ADR(a) | | | 1.1 | | | | 3,138,762 | |

| | 29,439 | | Varian Medical Systems, Inc.† (a) | | | 0.9 | | | | 2,420,769 | |

| | 165,102 | | Other Securities | | | 4.3 | | | | 11,616,136 | |

| | | | | | | | | | | 44,126,686 | |

Industrials — 6.9% | | | | | | | | |

| | 10,350 | | Acuity Brands, Inc.(a) | | | 0.9 | | | | 2,566,386 | |

| | 21,025 | | Canadian Pacific Railway, Ltd. | | | 1.0 | | | | 2,707,810 | |

| | 63,101 | | Expeditors International of Washington, Inc. | | | 1.1 | | | | 3,094,473 | |

| | 38,165 | | United Parcel Service, Inc., Class B | | | 1.5 | | | | 4,111,134 | |

| | 85,649 | | Other Securities | | | 2.4 | | | | 6,523,361 | |

| | | | | | | | | | | 19,003,164 | |

Information Technology — 35.3% | | | | | | | | |

| | 29,325 | | Adobe Systems, Inc.† | | | 1.0 | | | | 2,809,042 | |

| | 54,586 | | Alibaba Group Holding, Ltd. ADR† (a) | | | 1.6 | | | | 4,341,224 | |

| | 5,562 | | Alphabet, Inc., Class A† | | | 1.4 | | | | 3,913,034 | |

| | 11,099 | | Alphabet, Inc., Class C† | | | 2.8 | | | | 7,681,618 | |

| | 57,032 | | Apple, Inc. | | | 2.0 | | | | 5,452,259 | |

| | 55,973 | | ARM Holdings PLC ADR | | | 0.9 | | | | 2,547,331 | |

| | 53,275 | | Autodesk, Inc.† (a) | | | 1.1 | | | | 2,884,309 | |

| | 173,171 | | Cisco Systems, Inc. | | | 1.8 | | | | 4,968,276 | |

| | 47,250 | | Cognizant Technology Solutions Corp., Class A† | | | 1.0 | | | | 2,704,590 | |

| | 106,838 | | Facebook, Inc., Class A† | | | 4.4 | | | | 12,209,447 | |

| | 77,923 | | Microsoft Corp. | | | 1.4 | | | | 3,987,320 | |

| | 28,600 | | NXP Semiconductors NV† | | | 0.8 | | | | 2,240,524 | |

| | 126,975 | | Oracle Corp. | | | 1.9 | | | | 5,197,087 | |

| | 89,388 | | QUALCOMM, Inc. | | | 1.7 | | | | 4,788,515 | |

| | 96,785 | | Sabre Corp. | | | 0.9 | | | | 2,592,870 | |

| | 37,725 | | salesforce.com, Inc.† | | | 1.1 | | | | 2,995,742 | |

| | 113,321 | | Visa, Inc., Class A(a) | | | 3.1 | | | | 8,405,019 | |

| | 415,444 | | Other Securities | | | 6.4 | | | | 17,792,515 | |

| | | | | | | | | | | 97,510,722 | |

Materials — 3.2% | | | | | | | | |

| | 13,556 | | Sherwin-Williams Co. (The) | | | 1.4 | | | | 3,980,991 | |

| | 65,829 | | Other Securities | | | 1.8 | | | | 4,737,937 | |

| | | | | | | | | | | 8,718,928 | |

Telecommunication Services — 0.5% | | | | | | | | |

| | 24,941 | | Other Securities | | | 0.5 | | | | 1,329,126 | |

| | | | | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $212,026,765) | | | | | | | 272,046,510 | |

See Notes to Financial Statements.

36

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | June 30, 2016 (Unaudited) |

|

Shares | | Percentage of

Net Assets (%) | | | Value | |

SHORT-TERM INVESTMENTS (b) — 22.5% | |

| | 4,012,423 | | Northern Trust Institutional Government Select Portfolio, Institutional Class, 0.240% | | | 1.4 | | | $ | 4,012,423 | |

| | 58,285,375 | | Northern Trust Institutional Liquid Asset Portfolio, Institutional Class,

0.520% (c) | | | 21.1 | | | | 58,285,375 | |

| | | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | |

(Cost $62,297,798) | | | | | | | 62,297,798 | |

| | | | | | | | | | | | |

Total Investments ��� 121.0% | | | | | | | | |

(Cost $274,324,563) | | | | | | | 334,344,308 | |

Other Assets & Liabilities, Net — (21.0)% | | | | | | | (58,079,584 | ) |

| | | | | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 276,264,724 | |

†† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

† | Non-income producing security. |

(a) | This security or a partial position of this security is on loan at June 30, 2016. The total market value of securities on loan at June 30, 2016 was $59,217,936 (Note 6). |

(b) | Rate shown in the 7-day effective yield as of June 30, 2016. |

(c) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of June 30, 2016 was $58,285,375. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $1,960,847 (Note 6). |

ADR — American Depositary Receipt

Ltd. — Limited

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

As of June 30, 2016, all of the Portfolio’s investments were considered Level 1. For the six months ended June 30, 2016, there have been no transfers between Level 1 and Level 2 assets and liabilities. For the six months ended June 30, 2016, there have been no transfers between Level 2 and Level 3 assets and liabilities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

37

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments | June 30, 2016 (Unaudited) |

|

Shares | | Percentage of

Net Assets (%) | | | Value | |

COMMON STOCK — 98.9%†† | |

Consumer Discretionary — 6.5% | | | | | | |

| | 112,525 | | Ford Motor Co. | | | 0.7 | | | $ | 1,414,439 | |

| | 30,300 | | Lennar Corp., Class A | | | 0.7 | | | | 1,396,830 | |

| | 17,600 | | Omnicom Group, Inc. | | | 0.7 | | | | 1,434,224 | |

| | 24,274 | | Target Corp. | | | 0.8 | | | | 1,694,811 | |

| | 369,287 | | Other Securities | | | 3.6 | | | | 7,450,177 | |

| | | | | | | | | | | 13,390,481 | |

Consumer Staples — 6.9% | | | | | | | | |

| | 32,300 | | Altria Group, Inc. | | | 1.1 | | | | 2,227,408 | |

| | 26,096 | | Philip Morris International, Inc. | | | 1.3 | | | | 2,654,485 | |

| | 20,327 | | Procter & Gamble Co. (The) | | | 0.8 | | | | 1,721,087 | |

| | 57,275 | | Wal-Mart Stores, Inc. | | | 2.1 | | | | 4,182,221 | |

| | 47,794 | | Other Securities | | | 1.6 | | | | 3,368,967 | |

| | | | | | | | | | | 14,154,168 | |

Energy — 13.3% | | | | | | | | |