Shareholder Accounts c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-9331 |  | Corporate Offices 3707 W. Maple Road Suite 100 Bloomfield Hills, MI 48301 (248) 644-8500 Fax (248) 644-4250 |

Dear Shareowner of the Ave Maria Mutual Funds:

Catholic Advisory Board member Larry Kudlow, says, “Corporate profits are the mother’s milk of economic prosperity.” Well, corporate profits expanded nicely in 2010, up 40%+ by most measures. Investor sentiment also improved. In my mid-2010 report, I wrote:

“What could trigger a positive change in sentiment? One possibility – an election in November, 2010 which sends more representatives to Washington who are freedom-loving, pro-growth, pro-business, low tax-rate oriented, and anti-big-government-spending.”

Fortunately that materialized. Indeed, the American electorate may have reached a breaking point on government spending. It’s encouraging to see Americans demonstrating at tea parties and other gatherings demanding smaller government. The rallying cry seems to be “Give us less!” At the same time, socialized Europeans have marched and burned, demanding more handouts, while their governments teeter on the brink of financial collapse, thanks to unsustainable social benefits previously promised.

There are good reasons for optimism regarding the U.S. capital markets, despite many obvious problems. Between the massive healthcare regulation and the Dodd-Frank financial reform law, the last Congress vastly expanded the government’s intrusion into the private economy. In the next few years, we are hopeful that many of these growth and prosperity-stifling policies will be reversed.

The portfolio managers of the Ave Maria Mutual Funds screen out companies based on the guidelines established by our Catholic Advisory Board. This eliminates from consideration, companies that support abortion, pornography and those that engage in embryonic stem cell research.

I’m happy to report that for the Overall Periods ended December 31, 2010, Morningstar* has rated the Ave Maria Growth Fund (AVEGX out of 677 Mid-Cap Growth Funds) and the Ave Maria Rising Dividend Fund (AVEDX out of 373 Mid-Cap Blend Funds) 5 stars, and rated the Ave Maria Opportunity Fund (AVESX out of 373 Mid-Cap Blend Funds) 4-stars based on each Fund’s risk-adjusted performance. Our investment

research emphasis on fundamentals with a long-term focus seems to be working.

Thanks for being a shareholder.

Sincerely,

George P. Schwartz, CFA

Chairman & President

January 31, 2011

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

The Letter to Shareholders and the Portfolio Manager Commentaries that follow seek to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. Keep in mind that the information and opinions cover the period through the date of this report.

* Source: Morningstar 12/31/2010. For each fund with at least a 3-year history, Morningstar calculates a risk-adjusted measure that accounts for variation in a fund’s monthly performance (including the effects of all sales charges), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive a Morningstar Rating™ of 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Ave Maria Rising Dividend Fund was rated against 373 and 304 Mid-Cap Blend Funds, and received Morningstar Ratings of 5 stars for the 3 and 5 year periods, respectively. The Ave Maria Growth Fund was rated against 677 and 594 Mid-Cap Growth Funds, and received Morningstar Ratings of 4 stars and 5 stars fo r the 3 and 5 year periods, respectively. The Ave Maria Opportunity Fund was rated against 373 and 304 Mid-Cap Blend Funds, and received a Morningstar Rating of 4 stars for the 3 year period. © 2006. Morningstar, Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers, may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

AVE MARIA MUTUAL FUNDS TABLE OF CONTENTS |

| Ave Maria Catholic Values Fund: | |

Portfolio Manager Commentary | 2 |

Performance | 4 |

| Annual Total Rates of Return Comparison with Major Indices | 5 |

Ten Largest Equity Holdings | 6 |

Asset Allocation | 6 |

Schedule of Investments | 7 |

| | |

| Ave Maria Growth Fund: | |

Portfolio Manager Commentary | 10 |

Performance | 12 |

| Annual Total Rates of Return Comparison with Major Indices | 13 |

Ten Largest Equity Holdings | 14 |

Asset Allocation | 14 |

Schedule of Investments | 15 |

| | |

| Ave Maria Rising Dividend Fund: | |

Portfolio Manager Commentary | 18 |

Performance | 20 |

| Annual Total Rates of Return Comparison with Major Indices | 21 |

Ten Largest Equity Holdings | 22 |

Asset Allocation | 22 |

Schedule of Investments | 23 |

| | |

| Ave Maria Opportunity Fund: | |

Portfolio Manager Commentary | 26 |

Performance | 28 |

| Annual Total Rates of Return Comparison with Major Indices | 29 |

Ten Largest Equity Holdings | 30 |

Asset Allocation | 30 |

Schedule of Investments | 31 |

| | |

| Ave Maria World Equity Fund: | |

Portfolio Manager Commentary | 34 |

Performance | 36 |

Ten Largest Equity Holdings | 37 |

Asset Allocation | 37 |

Schedule of Investments | 38 |

| | |

| Ave Maria Bond Fund: | |

Portfolio Manager Commentary | 42 |

Performance | 43 |

| Annual Total Rates of Return Comparison with Major Indices | 44 |

Ten Largest Holdings | 45 |

Asset Allocation | 45 |

Schedule of Investments | 46 |

AVE MARIA MUTUAL FUNDS TABLE OF CONTENTS (Continued) |

Statements of Assets and Liabilities | 51 |

| | |

Statements of Operations | 53 |

| | |

| Statements of Changes in Net Assets: | |

Ave Maria Catholic Values Fund | 55 |

Ave Maria Growth Fund | 56 |

Ave Maria Rising Dividend Fund | 57 |

Ave Maria Opportunity Fund | 58 |

Ave Maria World Equity Fund | 59 |

Ave Maria Bond Fund | 60 |

| | |

| Financial Highlights: | |

Ave Maria Catholic Values Fund | 61 |

Ave Maria Growth Fund | 62 |

Ave Maria Rising Dividend Fund | 63 |

Ave Maria Opportunity Fund | 64 |

Ave Maria World Equity Fund | 65 |

Ave Maria Bond Fund | 66 |

| | |

Notes to Financial Statements | 67 |

| | |

Report of Independent Registered Public Accounting Firm | 78 |

| | |

Board of Trustees and Executive Officers | 79 |

| | |

Catholic Advisory Board | 81 |

| | |

About Your Funds’ Expenses | 82 |

| | |

Federal Tax Information | 85 |

| | |

Other Information | 85 |

This report is for the information of the shareholders of the Ave Maria Mutual Funds, but it may also be used as sales literature when preceded or accompanied by a current prospectus, which gives details about charges, expenses, investment objectives and operating policies of the Funds. To obtain a copy of the prospectus, please visit our website at www.avemariafunds.com or call 1-888-726-9331 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Ave Maria Mutual Funds are distributed by Ultimus Fund Distributors, LLC.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA CATHOLIC VALUES FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareowner:

The Ave Maria Catholic Values Fund’s (AVEMX) return for 2010 was 20.5% compared to 15.1% for the S&P 500 Index and 26.7% for the S&P 400 MidCap Index. Since its inception on May 1, 2001, the Fund’s performance versus its benchmarks is:

| | Since 5-01-01 Inception through 12-31-10 |

| | |

| | | |

| Ave Maria Catholic Values Fund (AVEMX) | 87.8% | 6.7% |

| S&P 500 Index | 19.5% | 1.9% |

| S&P 400 MidCap Index | 99.9% | 7.4% |

Six months ago, many market participants were mired in fear of an economic “double dip,” out-of-control Federal spending, Washington’s increasingly anti-business rhetoric, and the prospect of higher taxes. In our semi-annual report, we expressed confidence that mid-term elections would bring change for the better and the economic recovery would not falter.

The market soon thereafter began to recover in anticipation of the Republican victories that put them in control of the House and reduced the Democratic majority in the Senate. The Federal Reserve also announced its second quantitative easing program. From their July lows, most market indices appreciated more than 20% by year-end. Time will tell whether Washington will bring sanity to fiscal policy and roll back regulatory excesses, however things are looking up. Tax increases have been forestalled at least two years. Economic activity is accelerating, and double-digit corporate profit growth is likely for 2011. Unemployment may have finally peaked and should gradually decline. Housing seems to be bottoming, and consumer balance sheets are improving. Meanwhile, Federal Reserve monetary policy remains extremely accommodative. We believe that overall, 2011 will be another good year for stocks. Selectivity, as always, will be important.

Stocks making significant contributions to the Fund’s performance in 2010 were Caterpillar, Inc. (Construction Machinery), FMC Corporation (Specialty Chemicals), BE Aerospace, Inc. (Aircraft Parts), Halliburton Company (Oil Service), The Sherwin Williams Company (Paints), Meadowbrook Insurance Group, Inc., Varian Medical Systems, Inc. (Medical Devices), Genuine Parts Company (Automotive Parts Distribution) and Coach, Inc. (Retail). Negative contributors were ION Geophysical Corporation (Oil Service), Southwestern Energy Company (Natural Gas Exploration), Hewlett-Packard Company (Technology), Abbott Laboratories (Medical Products), and Avon Products, Inc. (Cosmetics).

AVE MARIA CATHOLIC VALUES FUND PORTFOLIO MANAGER COMMENTARY (Continued) |

Over the last six months, the Fund eliminated several stocks from the portfolio. Cisco Systems, Inc. violated the Fund’s moral screens by contributing corporate funds to Planned Parenthood. Other liquidations were: Forest Oil Corporation, Evolution Petroleum Corporation, ION Geophysical Corporation, and Suncor Energy, Inc. CenturyLink, Inc, (Telecommunications), Advance Auto Parts, Inc. (Auto Parts Retail), Balchem Corporation (Specialty Chemicals), and Adtran, Inc. (Telecom Equipment) were selling at our estimate of intrinsic value, after significant price appreciation.

Proceeds from these sales were used to purchase shares in Devon Energy Corporation, Chico’s FAS, Inc., U.S. Bancorp, Hewlett-Packard Company and MasterCard, Inc. Each of these stocks meet our criteria as very high quality companies with strong balance sheets and attractive long-term growth prospects. Importantly, none of these companies violate the Fund’s moral screens.

Thank you for being a shareowner.

Sincerely,

|  |

| George P. Schwartz, CFA | Gregory R. Heilman, CFA |

| Co-Portfolio Manager | Co-Portfolio Manager |

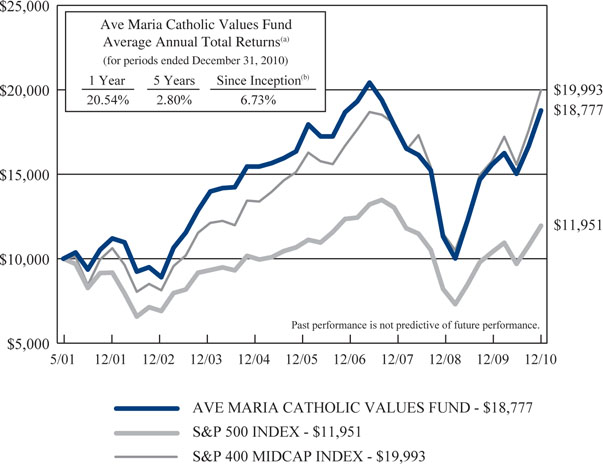

AVE MARIA CATHOLIC VALUES FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Catholic Values Fund, the S&P 500 Index,

and the S&P 400 MidCap Index

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2010. |

Expense Ratio information as of: | Year Ended 12-31-09 (as disclosed in April 30, 2010 prospectus) | |

| Gross | 1.52% | 1.51% |

| Net | 1.51% | 1.50% |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA CATHOLIC VALUES FUND ANNUAL TOTAL RATES OF RETURN COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA CATHOLIC VALUES FUND | | | | | |

2001 (a) | 5.3% | -8.5% | -0.5% | 5.0% | -10.1% | -7.3% |

| 2002 | -9.8% | -22.1% | -14.5% | -14.6% | -31.5% | -28.6% |

| 2003 | 35.6% | 28.7% | 35.6% | 38.8% | 50.0% | 37.4% |

| 2004 | 20.1% | 10.9% | 16.5% | 22.7% | 8.6% | 11.5% |

| 2005 | 5.8% | 4.9% | 12.6% | 7.7% | 1.4% | 2.0% |

| 2006 | 14.2% | 15.8% | 10.3% | 15.1% | 9.5% | 11.0% |

| 2007 | -4.0% | 5.5% | 8.0% | -0.3% | 9.8% | -3.8% |

| 2008 | -36.8% | -37.0% | -36.2% | -31.1% | -40.5% | -48.7% |

| 2009 | 37.6% | 26.5% | 37.4% | 25.6% | 43.9% | 36.8% |

| 2010 | 20.5% | 15.1% | 26.7% | 26.3% | 16.9% | 20.5% |

AVERAGE ANNUAL TOTAL RETURNS As of December 31, 2010 (Unaudited) |

| AVE MARIA CATHOLIC VALUES FUND | | | | | |

| 3 Years | 1.6% | -2.9% | 3.5% | 3.0% | 0.0% | -5.4% |

| 5 Years | 2.8% | 2.3% | 5.7% | 4.6% | 3.8% | -2.0% |

Since Inception (c) | 6.7% | 1.9% | 7.4% | 7.8% | 2.1% | -0.7% |

| (a) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2001. |

| | |

| (b) | Excluding dividends. |

| | |

| (c) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2010. |

AVE MARIA CATHOLIC VALUES FUND TEN LARGEST EQUITY HOLDINGS December 31, 2010 (Unaudited) |

| | | | | | | | |

| | 120,000 | | Stryker Corporation | | $ | 6,444,000 | | | | 3.4 | % |

| | 300,000 | | Western Union Company (The) | | | 5,571,000 | | | | 3.0 | % |

| | 40,000 | | SPDR Gold Trust | | | 5,548,800 | | | | 2.9 | % |

| | 135,000 | | Halliburton Company | | | 5,512,050 | | | | 2.9 | % |

| | 70,000 | | United Technologies Corporation | | | 5,510,400 | | | | 2.9 | % |

| | 75,000 | | Exxon Mobil Corporation | | | 5,484,000 | | | | 2.9 | % |

| | 110,000 | | Accenture PLC - Class A | | | 5,333,900 | | | | 2.8 | % |

| | 150,000 | | General Cable Corporation | | | 5,263,500 | | | | 2.8 | % |

| | 200,000 | | Federated Investors, Inc. - Class B | | | 5,234,000 | | | | 2.8 | % |

| | 120,000 | | Comerica, Inc. | | | 5,068,800 | | | | 2.7 | % |

ASSET ALLOCATION (Unaudited) |

| |

Consumer Discretionary | 10.6% | |

Consumer Staples | 2.1% | |

Energy | 19.0% | |

Financials | 18.9% | |

Health Care | 13.1% | |

Industrials | 14.9% | |

Information Technology | 10.3% | |

Materials | 6.0% | |

Exchange-Traded Funds | 2.9% | |

Cash Equivalents, Other Assets and Liabilities | | |

| | | |

AVE MARIA CATHOLIC VALUES FUND SCHEDULE OF INVESTMENTS December 31, 2010 |

| | | | | | |

| Consumer Discretionary — 10.6% | | | | | | |

| Diversified Consumer Services — 1.9% | | | | | | |

Education Management Corporation * | | | 200,000 | | | $ | 3,620,000 | |

| | | | | | | | | |

| Household Durables — 0.2% | | | | | | | | |

Craftmade International, Inc. * | | | 75,000 | | | | 371,250 | |

| | | | | | | | | |

| Specialty Retail — 5.7% | | | | | | | | |

American Eagle Outfitters, Inc. | | | 100,000 | | | | 1,463,000 | |

Chico's FAS, Inc. | | | 400,000 | | | | 4,812,000 | |

Lowe's Companies, Inc. | | | 175,000 | | | | 4,389,000 | |

| | | | | | | | 10,664,000 | |

| Textiles, Apparel & Luxury Goods — 2.8% | | | | | | | | |

Coach, Inc. | | | 55,000 | | | | 3,042,050 | |

VF Corporation | | | 25,000 | | | | 2,154,500 | |

| | | | | | | | 5,196,550 | |

| Consumer Staples — 2.1% | | | | | | | | |

| Food & Staples Retailing — 0.9% | | | | | | | | |

Sysco Corporation | | | 60,000 | | | | 1,764,000 | |

| | | | | | | | | |

| Personal Products — 1.2% | | | | | | | | |

Avon Products, Inc. | | | 75,000 | | | | 2,179,500 | |

| | | | | | | | | |

| Energy — 19.0% | | | | | | | | |

| Energy Equipment & Services — 7.8% | | | | | | | | |

Halliburton Company | | | 135,000 | | | | 5,512,050 | |

Schlumberger Limited | | | 45,000 | | | | 3,757,500 | |

Tidewater, Inc. | | | 50,000 | | | | 2,692,000 | |

Transocean Ltd. * | | | 40,000 | | | | 2,780,400 | |

| | | | | | | | 14,741,950 | |

| Oil, Gas & Consumable Fuels — 11.2% | | | | | | | | |

ConocoPhillips | | | 35,000 | | | | 2,383,500 | |

Devon Energy Corporation | | | 30,000 | | | | 2,355,300 | |

Exxon Mobil Corporation | | | 75,000 | | | | 5,484,000 | |

Peabody Energy Corporation | | | 50,000 | | | | 3,199,000 | |

Range Resources Corporation | | | 95,000 | | | | 4,273,100 | |

Southwestern Energy Company * | | | 90,000 | | | | 3,368,700 | |

| | | | | | | | 21,063,600 | |

| Financials — 18.9% | | | | | | | | |

| Capital Markets — 2.8% | | | | | | | | |

Federated Investors, Inc. - Class B | | | 200,000 | | | | 5,234,000 | |

| | | | | | | | | |

| Commercial Banks — 4.3% | | | | | | | | |

Comerica, Inc. | | | 120,000 | | | | 5,068,800 | |

U.S. Bancorp | | | 110,000 | | | | 2,966,700 | |

| | | | | | | | 8,035,500 | |

AVE MARIA CATHOLIC VALUES FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 94.9% (Continued) | | | | | | |

| Financials — 18.9% (Continued) | | | | | | |

| Diversified Financial Services — 3.8% | | | | | | |

MasterCard, Inc. - Class A | | | 7,500 | | | $ | 1,680,825 | |

Western Union Company (The) | | | 300,000 | | | | 5,571,000 | |

| | | | | | | | 7,251,825 | |

| Insurance — 5.9% | | | | | | | | |

Alleghany Corporation * | | | 12,253 | | | | 3,753,952 | |

Hanover Insurance Group, Inc. (The) | | | 70,000 | | | | 3,270,400 | |

Meadowbrook Insurance Group, Inc. | | | 150,000 | | | | 1,537,500 | |

Unico American Corporation | | | 282,945 | | | | 2,586,117 | |

| | | | | | | | 11,147,969 | |

| Real Estate Investment Trusts — 1.0% | | | | | | | | |

HCP, Inc. | | | 50,000 | | | | 1,839,500 | |

| | | | | | | | | |

| Real Estate Management & Development — 1.1% | | | | | | | | |

Kennedy-Wilson Holdings, Inc. * | | | 200,000 | | | | 1,998,000 | |

| | | | | | | | | |

| Health Care — 13.1% | | | | | | | | |

| Health Care Equipment & Supplies — 5.6% | | | | | | | | |

Stryker Corporation | | | 120,000 | | | | 6,444,000 | |

Varian Medical Systems, Inc. * | | | 60,000 | | | | 4,156,800 | |

| | | | | | | | 10,600,800 | |

| Health Care Providers & Services — 2.2% | | | | | | | | |

Patterson Companies, Inc. | | | 135,000 | | | | 4,135,050 | |

| | | | | | | | | |

| Life Sciences Tools & Services — 3.3% | | | | | | | | |

Mettler-Toledo International, Inc. * | | | 20,000 | | | | 3,024,200 | |

Waters Corporation * | | | 40,000 | | | | 3,108,400 | |

| | | | | | | | 6,132,600 | |

| Pharmaceuticals — 2.0% | | | | | | | | |

Abbott Laboratories | | | 80,000 | | | | 3,832,800 | |

| | | | | | | | | |

| Industrials — 14.9% | | | | | | | | |

| Aerospace & Defense — 4.7% | | | | | | | | |

BE Aerospace, Inc. * | | | 25,000 | | | | 925,750 | |

General Dynamics Corporation | | | 35,000 | | | | 2,483,600 | |

United Technologies Corporation | | | 70,000 | | | | 5,510,400 | |

| | | | | | | | 8,919,750 | |

| Commercial Services & Supplies — 2.2% | | | | | | | | |

Genuine Parts Company | | | 80,000 | | | | 4,107,200 | |

| | | | | | | | | |

| Construction & Engineering — 1.3% | | | | | | | | |

Foster Wheeler AG * | | | 70,000 | | | | 2,416,400 | |

| | | | | | | | | |

| Electrical Equipment — 2.8% | | | | | | | | |

General Cable Corporation * | | | 150,000 | | | | 5,263,500 | |

AVE MARIA CATHOLIC VALUES FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 94.9% (Continued) | | | | | | |

| Industrials — 14.9% (Continued) | | | | | | |

| Machinery — 3.9% | | | | | | |

Caterpillar, Inc. | | | 40,000 | | | $ | 3,746,400 | |

Graco, Inc. | | | 90,000 | | | | 3,550,500 | |

| | | | | | | | 7,296,900 | |

| Information Technology — 10.3% | | | | | | | | |

| Computers & Peripherals — 2.6% | | | | | | | | |

Hewlett-Packard Company | | | 115,000 | | | | 4,841,500 | |

| | | | | | | | | |

| IT Services — 6.6% | | | | | | | | |

Accenture PLC - Class A | | | 110,000 | | | | 5,333,900 | |

International Business Machines Corporation | | | 22,500 | | | | 3,302,100 | |

Teradata Corporation * | | | 90,000 | | | | 3,704,400 | |

| | | | | | | | 12,340,400 | |

| Office Electronics — 1.1% | | | | | | | | |

Zebra Technologies Corporation - Class A * | | | 55,000 | | | | 2,089,450 | |

| | | | | | | | | |

| Materials — 6.0% | | | | | | | | |

| Chemicals — 6.0% | | | | | | | | |

FMC Corporation | | | 50,000 | | | | 3,994,500 | |

Lubrizol Corporation (The) | | | 40,000 | | | | 4,275,200 | |

Sherwin-Williams Company (The) | | | 35,000 | | | | 2,931,250 | |

| | | | | | | | 11,200,950 | |

| | | | | | | | | |

Total Common Stocks (Cost $137,589,570) | | | | | | $ | 178,284,944 | |

EXCHANGE-TRADED FUNDS — 2.9% | | | | | | |

SPDR Gold Trust * (Cost $4,115,521) | | | 40,000 | | | $ | 5,548,800 | |

MONEY MARKET FUNDS — 2.4% | | | | | | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.01% (a) (Cost $4,466,753) | | | 4,466,753 | | | $ | 4,466,753 | |

| | | | | | | | | |

Total Investments at Market Value — 100.2% (Cost $146,171,844) | | | | | | $ | 188,300,497 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.2%) | | | | | | | (387,665 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 187,912,832 | |

| * | Non-income producing security. |

| | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See notes to financial statements. |

AVE MARIA GROWTH FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareholders:

For the year ended December 31, 2010, the Ave Maria Growth Fund had a total return of 26.5% compared with 15.1% for the S&P 500 Index. For the three years ended December 31, 2010, the Fund’s total return was 2.8% annualized compared with -2.9% annualized for the S&P 500 Index. Since inception (May 1, 2003), the Fund’s total return was 10.2%, annualized compared with 6.3% annualized for the S&P 500 Index.

The top five performing issues in the Ave Maria Growth Fund for 2010 were:

| Polaris Industries, Inc. - (all-terrain vehicles, snowmobiles, motorcycles) | +85.8% |

| Expeditors International of Washington, Inc. - (global air & ocean freight forwarder) | +58.4% |

| Dionex Corporation - (analytical instrumentation & related accessories) | +58.1% |

| Cognizant Technologies Solutions Corporation - (software consulting & maintenance) | +57.4% |

| Rollins, Inc. - (pest & termite control services) | +53.5% |

The bottom five performing issues were:

| Gilead Sciences, Inc. - (antiviral, antibacterial & antifungal biopharmaceuticals) | –19.3% |

| Hewlett-Packard Company - (computer products including printers, servers & PCs) | –16.6% |

| VCA Antech, Inc. - (animal healthcare products) | –16.4% |

| Cisco Systems, Inc. - (routers & switching products) | –15.8% |

| Beckman-Coulter, Inc. - (systems & supplies used for biological analysis) | –8.4% |

AVE MARIA GROWTH FUND PORTFOLIO MANAGER COMMENTARY (Continued) |

The Fund is diversified among seven economic sectors:

| Consumer Discretionary | 13.3% |

| Consumer Staples | 8.7% |

| Energy | 5.4% |

| Financials | 7.9% |

| Health Care | 17.8% |

| Industrials | 28.1% |

| Information Technology | 17.7% |

As of December 31, 2010, the Ave Maria Growth Fund’s Overall Morningstar Rating* was 5-stars, placing it in the top ten percent of Mid-Cap Growth Funds. The Fund was rated against 677 Mid-Cap Growth Funds for the overall rating.

Respectfully,

James L. Bashaw, CFA

Portfolio Manager

| * | Past performance is no guarantee of future returns. Morningstar Ratings™ are based on risk-adjusted returns. The Overall Morningstar Rating™ is derived from a weighted average of the performance figures associated with a fund’s 3, 5, and 10-year (if applicable) Morningstar Rating™ metrics. For funds with at least a 3-year history, a Morningstar Rating™ is based on a risk-adjusted return measure (including the effects of sales charges, loads, and redemption fees) with emphasis on downward variations and consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% 4 stars, the next 35% 3 stars, the next 22.5% 2 stars, and the bottom 10% one star. For the 3-year and 5-year periods ended December 31, 2010, the Fund was rated 4 stars (out of 677 Mid-Cap Growth Funds) and 5 stars (out of 594 Mid-Cap Growth Funds), respectively. |

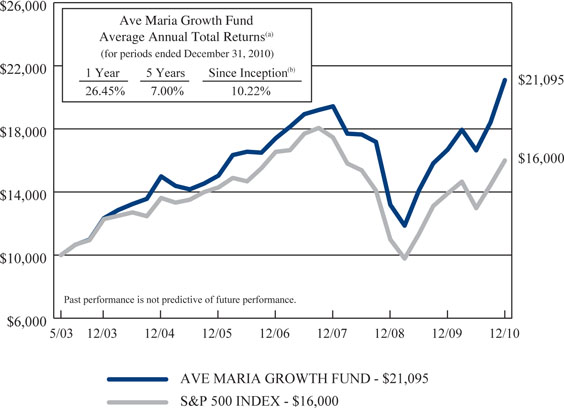

AVE MARIA GROWTH FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Growth Fund and the S&P 500 Index

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2003) through December 31, 2010. |

Expense Ratio information as of: | Year Ended 12-31-09 (as disclosed in April 30, 2010 prospectus) | |

| Gross | 1.56% | 1.52% |

| Net | 1.50% | 1.50% |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA GROWTH FUND ANNUAL TOTAL RATES OF RETURN COMPARISON WITH MAJOR INDICES (Unaudited) |

| | |

2003 (a) | 23.4% | 22.8% |

| 2004 | 21.5% | 10.9% |

| 2005 | 0.3% | 4.9% |

| 2006 | 15.8% | 15.8% |

| 2007 | 11.6% | 5.5% |

| 2008 | -32.1% | -37.0% |

| 2009 | 26.4% | 26.5% |

| 2010 | 26.5% | 15.1% |

AVERAGE ANNUAL TOTAL RETURNS As of December 31, 2010 (Unaudited) |

| | |

| 3 Years | 2.8% | -2.9% |

| 5 Years | 7.0% | 2.3% |

Since Inception (b) | 10.2% | 6.3% |

| (a) | Represents the period from the commencement of operations (May 1, 2003) through December 31, 2003. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2003) through December 31, 2010. |

AVE MARIA GROWTH FUND TEN LARGEST EQUITY HOLDINGS December 31, 2010 (Unaudited) | |

| | | | | | | | |

| | 51,900 | | Dionex Corporation | | $ | 6,124,719 | | | | 4.2 | % |

| | 170,900 | | Altera Corporation | | | 6,080,622 | | | | 4.1 | % |

| | 69,500 | | Polaris Industries, Inc. | | | 5,422,390 | | | | 3.7 | % |

| | 274,350 | | Rollins, Inc. | | | 5,418,413 | | | | 3.7 | % |

| | 95,800 | | Coach, Inc. | | | 5,298,698 | | | | 3.6 | % |

| | 71,200 | | Cognizant Technology Solutions Corporation - Class A | | | 5,218,248 | | | | 3.5 | % |

| | 128,400 | | AMETEK, Inc. | | | 5,039,700 | | | | 3.4 | % |

| | 54,300 | | C.R. Bard, Inc. | | | 4,983,111 | | | | 3.4 | % |

| | 94,200 | | Amphenol Corporation - Class A | | | 4,971,876 | | | | 3.4 | % |

| | 117,300 | | Hewlett-Packard Company | | | 4,938,330 | | | | 3.3 | % |

ASSET ALLOCATION (Unaudited) |

| |

Consumer Discretionary | 13.3% | |

Consumer Staples | 8.7% | |

Energy | 5.4% | |

Financials | 7.9% | |

Health Care | 17.8% | |

Industrials | 28.1% | |

Information Technology | 17.7% | |

Cash Equivalents, Other Assets and Liabilities | | |

| | | |

AVE MARIA GROWTH FUND SCHEDULE OF INVESTMENTS December 31, 2010 |

| | | | | | |

| Consumer Discretionary — 13.3% | | | | | | |

| Leisure Equipment & Products — 3.7% | | | | | | |

Polaris Industries, Inc. | | | 69,500 | | | $ | 5,422,390 | |

| | | | | | | | | |

| Specialty Retail — 6.0% | | | | | | | | |

AutoZone, Inc. * | | | 15,000 | | | | 4,088,850 | |

Ross Stores, Inc. | | | 76,600 | | | | 4,844,950 | |

| | | | | | | | 8,933,800 | |

| Textiles, Apparel & Luxury Goods — 3.6% | | | | | | | | |

Coach, Inc. | | | 95,800 | | | | 5,298,698 | |

| | | | | | | | | |

| Consumer Staples — 8.7% | | | | | | | | |

| Food Products — 6.0% | | | | | | | | |

Kellogg Company | | | 81,600 | | | | 4,168,128 | |

McCormick & Company, Inc. | | | 101,300 | | | | 4,713,489 | |

| | | | | | | | 8,881,617 | |

| Household Products — 2.7% | | | | | | | | |

Clorox Company (The) | | | 63,600 | | | | 4,024,608 | |

| | | | | | | | | |

| Energy — 5.4% | | | | | | | | |

| Oil, Gas & Consumable Fuels — 5.4% | | | | | | | | |

Exxon Mobil Corporation | | | 41,400 | | | | 3,027,168 | |

Occidental Petroleum Corporation | | | 50,300 | | | | 4,934,430 | |

| | | | | | | | 7,961,598 | |

| Financials — 7.9% | | | | | | | | |

| Capital Markets — 5.3% | | | | | | | | |

Eaton Vance Corporation | | | 120,000 | | | | 3,627,600 | |

SEI Investments Company | | | 175,900 | | | | 4,184,661 | |

| | | | | | | | 7,812,261 | |

| Insurance — 2.6% | | | | | | | | |

Brown & Brown, Inc. | | | 160,200 | | | | 3,835,188 | |

| | | | | | | | | |

| Health Care — 17.8% | | | | | | | | |

| Biotechnology — 2.9% | | | | | | | | |

Gilead Sciences, Inc. * | | | 118,000 | | | | 4,276,320 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 9.1% | | | | | | | | |

C.R. Bard, Inc. | | | 54,300 | | | | 4,983,111 | |

Stryker Corporation | | | 65,800 | | | | 3,533,460 | |

Varian Medical Systems, Inc. * | | | 70,700 | | | | 4,898,096 | |

| | | | | | | | 13,414,667 | |

| Life Sciences Tools & Services — 5.8% | | | | | | | | |

Dionex Corporation * | | | 51,900 | | | | 6,124,719 | |

Mettler-Toledo International, Inc. * | | | 16,000 | | | | 2,419,360 | |

| | | | | | | | 8,544,079 | |

AVE MARIA GROWTH FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.9% (Continued) | | | | | | |

| Industrials — 28.1% | | | | | | |

| Aerospace & Defense — 4.3% | | | | | | |

General Dynamics Corporation | | | 57,700 | | | $ | 4,094,392 | |

Precision Castparts Corporation | | | 15,500 | | | | 2,157,755 | |

| | | | | | | | 6,252,147 | |

| Air Freight & Logistics — 1.8% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 49,100 | | | | 2,680,860 | |

| | | | | | | | | |

| Commercial Services & Supplies — 3.7% | | | | | | | | |

Rollins, Inc. | | | 274,350 | | | | 5,418,413 | |

| | | | | | | | | |

| Electrical Equipment — 3.4% | | | | | | | | |

AMETEK, Inc. | | | 128,400 | | | | 5,039,700 | |

| | | | | | | | | |

| Machinery — 14.9% | | | | | | | | |

Danaher Corporation | | | 101,500 | | | | 4,787,755 | |

Donaldson Company, Inc. | | | 61,400 | | | | 3,578,392 | |

Flowserve Corporation | | | 37,000 | | | | 4,411,140 | |

Graco, Inc. | | | 119,200 | | | | 4,702,440 | |

Toro Company (The) | | | 72,900 | | | | 4,493,556 | |

| | | | | | | | 21,973,283 | |

| Information Technology — 17.7% | | | | | | | | |

| Computers & Peripherals — 3.3% | | | | | | | | |

Hewlett-Packard Company | | | 117,300 | | | | 4,938,330 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 3.4% | | | | | | | | |

Amphenol Corporation - Class A | | | 94,200 | | | | 4,971,876 | |

| | | | | | | | | |

| IT Services — 6.9% | | | | | | | | |

Accenture PLC - Class A | | | 100,900 | | | | 4,892,641 | |

Cognizant Technology Solutions Corporation - Class A * | | | 71,200 | | | | 5,218,248 | |

| | | | | | | | 10,110,889 | |

| Semiconductors & Semiconductor Equipment — 4.1% | | | | | | | | |

Altera Corporation | | | 170,900 | | | | 6,080,622 | |

| | | | | | | | | |

Total Common Stocks (Cost $108,055,626) | | | | | | $ | 145,871,346 | |

AVE MARIA GROWTH FUND SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 1.8% | | | | | | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.01% (a) (Cost $2,673,175) | | | 2,673,175 | | | $ | 2,673,175 | |

| | | | | | | | | |

Total Investments at Market Value — 100.7% (Cost $110,728,801) | | | | | | $ | 148,544,521 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.7%) | | | | | | | (1,101,027 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 147,443,494 | |

| * | Non-income producing security. |

| | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See notes to financial statements. |

AVE MARIA RISING DIVIDEND FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareholders:

2010 was a good year for the Ave Maria Rising Dividend Fund. The total return for the Fund for the year was 17.9% (compared to 15.1% for the S&P 500 Index.). When we reported to you at June 30, 2010, it didn’t look as though it would be a very good year with the Fund down 2.0%. At that point fears of a “double dip” recession were playing on investors’ emotions. But as the year progressed it became increasingly apparent the economy was growing, and corporate profits were recovering fast.

Positive contributions to performance in the portfolio came from Family Dollar Stores, Inc., Ross Stores, Inc., Halliburton Company and Emerson Electric Company. Conversely, Medtronic, Inc., Abbott Laboratories, FPL Group, Inc., and DENTSPLY International, Inc., were a drag on portfolio returns. Health care stocks as a group hurt our performance in 2010. The controversy surrounding passage of the healthcare bill no doubt contributed to this disappointing showing. Notwithstanding, we continue to believe that carefully selected stocks in the industry offer the opportunity for outstanding long-term performance and we have selectively added to positions in recent months.

A year ago, we made mention in our letter that Standard & Poors had described 2009 as the worst year for dividends since they had started keeping records. Against that dismal backdrop we also reported that of the companies in the portfolio at year end, only five had reduced their dividends during the year, while 28 had increased theirs. This year has been considerably better. Of the 41 companies in the Rising Dividend Fund at year end, none reduced their dividend during the year and 33 raised theirs.

Dividends are getting a lot more attention among investors – and rightly so, in our view. For quite a while now, several decades actually, dividends were seen as “your father’s Oldsmobile” – something for old people content to hold high-dividend stocks for the income and willing to accept little growth in exchange. That seems to be changing. Now that the baby boomers are sweeping towards retirement, they can identify with that need for income, and especially if it is a rising stream of income. In addition, after all of the financial deceit of the last ten years, dividends have come to be seen as “quality assurance” in terms of accounting creditability. You can fake earnings, but you can’t fake a dividend. We consider this increased emphasis on dividends as a trend with staying power.

We are optimistic in our outlook for the economy and solidly confident in the long-term outlook for companies held in the Fund. We select companies that have a record of compounding their earnings and dividends at above-average rates on a sustained basis. And through the last few years, as other companies faltered, these great companies haven’t let us down.

AVE MARIA RISING DIVIDEND FUND PORTFOLIO MANAGER COMMENTARY (Continued) |

Thank you for your participation in the Fund. We appreciate the confidence you have placed in us and work hard to be worthy of it.

With best regards,

|  |

| George P. Schwartz, CFA | Richard L. Platte, Jr., CFA |

| Co-portfolio Manager | Co-portfolio Manager |

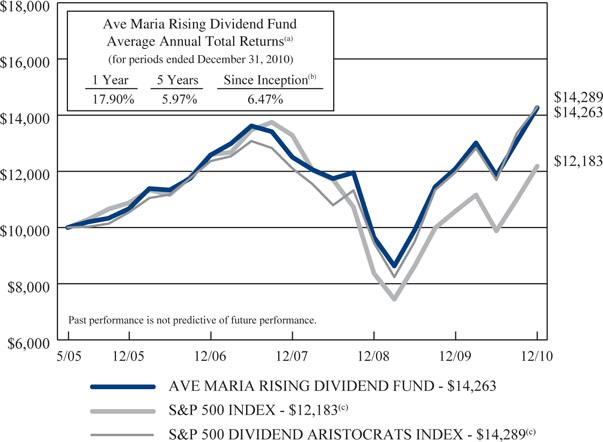

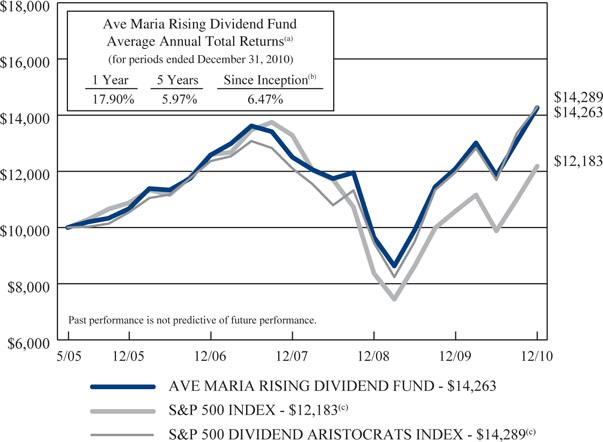

AVE MARIA RISING DIVIDEND FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Rising Dividend Fund, the S&P 500 Index,

and the S&P 500 Dividend Aristocrats Index

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (May 2, 2005) through December 31, 2010. |

| | |

| (c) | Prior to December 31, 2010, the S&P 500 Dividend Aristocrats Index was used as the Fund’s primary benchmark. The S&P 500 Dividend Aristocrats Index measures the performance of large cap, blue chip companies within the S&P 500 that have followed a policy of increasing dividends every year for at least 25 consecutive years. The Fund’s managers believe the S&P 500 Dividend Aristocrats Index is becoming less relevant for comparison purposes because, among other things, S&P has changed the criteria for companies inclusion in the index. The Fund’s managers believe S&P has lowered the standard for a company to qualify for inclusion in the S&P 500 Dividend Aristocrats Index. Therefore, the Fund’s managers believe the S&P 500 Index is the most appropriate index for comparison purposes. |

Expense Ratio information as of: | Year Ended 12-31-09 (as disclosed in April 30, 2010 prospectus) | |

| | 1.13% | 1.06% |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA RISING DIVIDEND FUND ANNUAL TOTAL RATES OF RETURN COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA RISING DIVIDEND FUND | | S&P 500 DIVIDEND ARISTOCRATS INDEX |

2005 (a) | 6.7% | 8.8% | 1.3% |

| 2006 | 17.9% | 15.8% | 17.3% |

| 2007 | -0.6% | 5.5% | -2.1% |

| 2008 | -22.8% | -37.0% | -21.9% |

| 2009 | 25.3% | 26.5% | 26.6% |

| 2010 | 17.9% | 15.1% | 19.4% |

AVERAGE ANNUAL TOTAL RETURNS As of December 31, 2010 (Unaudited) |

| AVE MARIA RISING DIVIDEND FUND | | S&P 500 DIVIDEND ARISTOCRATS INDEX |

| 3 Years | 4.5% | -2.9% | 5.7% |

| 5 Years | 6.0% | 2.3% | 6.3% |

Since Inception (b) | 6.5% | 3.6% | 6.5% |

| (a) | Represents the period from the commencement of operations (May 2, 2005) through December 31, 2005. |

| | |

| (b) | Represents the period from the commencement of operations (May 2, 2005) through December 31, 2010. |

AVE MARIA RISING DIVIDEND FUND TEN LARGEST EQUITY HOLDINGS December 31, 2010 (Unaudited) |

| | | | | | | | |

| | 70,000 | | Exxon Mobil Corporation | | $ | 5,118,400 | | | | 4.0 | % |

| | 65,000 | | ConocoPhillips | | | 4,426,500 | | | | 3.5 | % |

| | 50,000 | | 3M Company | | | 4,315,000 | | | | 3.4 | % |

| | 100,000 | | Halliburton Company | | | 4,083,000 | | | | 3.2 | % |

| | 180,000 | | RPM International, Inc. | | | 3,978,000 | | | | 3.1 | % |

| | 55,000 | | General Dynamics Corporation | | | 3,902,800 | | | | 3.1 | % |

| | 125,000 | | Paychex, Inc. | | | 3,863,750 | | | | 3.0 | % |

| | 60,000 | | Procter & Gamble Company (The) | | | 3,859,800 | | | | 3.0 | % |

| | 108,000 | | Home Depot, Inc. (The) | | | 3,786,480 | | | | 3.0 | % |

| | 42,500 | | VF Corporation | | | 3,662,650 | | | | 2.9 | % |

ASSET ALLOCATION (Unaudited) |

| |

Consumer Discretionary | 17.3% | |

Consumer Staples | 17.9% | |

Energy | 13.0% | |

Financials | 11.8% | |

Health Care | 9.0% | |

Industrials | 13.6% | |

Information Technology | 7.1% | |

Materials | 5.7% | |

Cash Equivalents, Other Assets and Liabilities | | |

| | | |

AVE MARIA RISING DIVIDEND FUND SCHEDULE OF INVESTMENTS December 31, 2010 |

| | | | | | |

| Consumer Discretionary — 17.3% | | | | | | |

| Diversified Consumer Services — 2.0% | | | | | | |

Weight Watchers International, Inc. | | | 70,000 | | | $ | 2,624,300 | |

| | | | | | | | | |

| Media — 1.1% | | | | | | | | |

John Wiley & Sons, Inc. - Class A | | | 30,000 | | | | 1,357,200 | |

| | | | | | | | | |

| Multiline Retail — 0.8% | | | | | | | | |

Family Dollar Stores, Inc. | | | 20,000 | | | | 994,200 | |

| | | | | | | | | |

| Specialty Retail — 8.4% | | | | | | | | |

Cato Corporation (The) - Class A | | | 75,000 | | | | 2,055,750 | |

Home Depot, Inc. (The) | | | 108,000 | | | | 3,786,480 | |

Ross Stores, Inc. | | | 45,000 | | | | 2,846,250 | |

Tractor Supply Company | | | 40,000 | | | | 1,939,600 | |

| | | | | | | | 10,628,080 | |

| Textiles, Apparel & Luxury Goods — 5.0% | | | | | | | | |

VF Corporation | | | 42,500 | | | | 3,662,650 | |

Wolverine World Wide, Inc. | | | 85,000 | | | | 2,709,800 | |

| | | | | | | | 6,372,450 | |

| Consumer Staples — 17.9% | | | | | | | | |

| Food & Staples Retailing — 2.8% | | | | | | | | |

Sysco Corporation | | | 120,000 | | | | 3,528,000 | |

| | | | | | | | | |

| Food Products — 6.6% | | | | | | | | |

Hormel Foods Corporation | | | 50,000 | | | | 2,563,000 | |

Kellogg Company | | | 70,000 | | | | 3,575,600 | |

Lancaster Colony Corporation | | | 40,000 | | | | 2,288,000 | |

| | | | | | | | 8,426,600 | |

| Household Products — 5.6% | | | | | | | | |

Clorox Company (The) | | | 52,500 | | | | 3,322,200 | |

Procter & Gamble Company (The) | | | 60,000 | | | | 3,859,800 | |

| | | | | | | | 7,182,000 | |

| Personal Products — 2.9% | | | | | | | | |

Avon Products, Inc. | | | 125,000 | | | | 3,632,500 | |

| | | | | | | | | |

| Energy — 13.0% | | | | | | | | |

| Energy Equipment & Services — 5.5% | | | | | | | | |

Halliburton Company | | | 100,000 | | | | 4,083,000 | |

Schlumberger Limited | | | 35,000 | | | | 2,922,500 | |

| | | | | | | | 7,005,500 | |

| Oil, Gas & Consumable Fuels — 7.5% | | | | | | | | |

ConocoPhillips | | | 65,000 | | | | 4,426,500 | |

Exxon Mobil Corporation | | | 70,000 | | | | 5,118,400 | |

| | | | | | | | 9,544,900 | |

AVE MARIA RISING DIVIDEND FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | | | | | |

| Financials — 11.8% | | | | | | |

| Capital Markets — 2.7% | | | | | | |

Federated Investors, Inc. - Class B | | | 130,000 | | | $ | 3,402,100 | |

| | | | | | | | | |

| Commercial Banks — 6.1% | | | | | | | | |

BB&T Corporation | | | 100,000 | | | | 2,629,000 | |

Comerica, Inc. | | | 60,000 | | | | 2,534,400 | |

United Bankshares, Inc. | | | 90,000 | | | | 2,628,000 | |

| | | | | | | | 7,791,400 | |

| Insurance — 3.0% | | | | | | | | |

Chubb Corporation (The) | | | 15,000 | | | | 894,600 | |

HCC Insurance Holdings, Inc. | | | 100,000 | | | | 2,894,000 | |

| | | | | | | | 3,788,600 | |

| Health Care — 9.0% | | | | | | | | |

| Health Care Equipment & Supplies — 6.4% | | | | | | | | |

DENTSPLY International, Inc. | | | 20,000 | | | | 683,400 | |

Medtronic, Inc. | | | 55,000 | | | | 2,039,950 | |

Meridian Bioscience, Inc. | | | 80,000 | | | | 1,852,800 | |

Stryker Corporation | | | 66,000 | | | | 3,544,200 | |

| | | | | | | | 8,120,350 | |

| Pharmaceuticals — 2.6% | | | | | | | | |

Abbott Laboratories | | | 70,000 | | | | 3,353,700 | |

| | | | | | | | | |

| Industrials — 13.6% | | | | | | | | |

| Aerospace & Defense — 5.6% | | | | | | | | |

General Dynamics Corporation | | | 55,000 | | | | 3,902,800 | |

United Technologies Corporation | | | 40,000 | | | | 3,148,800 | |

| | | | | | | | 7,051,600 | |

| Commercial Services & Supplies — 2.4% | | | | | | | | |

Republic Services, Inc. | | | 100,000 | | | | 2,986,000 | |

| | | | | | | | | |

| Electrical Equipment — 2.2% | | | | | | | | |

Emerson Electric Company | | | 50,000 | | | | 2,858,500 | |

| | | | | | | | | |

| Industrial Conglomerates — 3.4% | | | | | | | | |

3M Company | | | 50,000 | | | | 4,315,000 | |

| | | | | | | | | |

| Information Technology — 7.1% | | | | | | | | |

| IT Services — 4.5% | | | | | | | | |

Jack Henry & Associates, Inc. | | | 65,000 | | | | 1,894,750 | |

Paychex, Inc. | | | 125,000 | | | | 3,863,750 | |

| | | | | | | | 5,758,500 | |

| Semiconductors & Semiconductor Equipment — 2.6% | | | | | | | | |

Microchip Technology, Inc. | | | 95,000 | | | | 3,249,950 | |

AVE MARIA RISING DIVIDEND FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | | | | | |

| Materials — 5.7% | | | | | | |

| Chemicals — 5.7% | | | | | | |

Lubrizol Corporation (The) | | | 30,000 | | | $ | 3,206,400 | |

RPM International, Inc. | | | 180,000 | | | | 3,978,000 | |

| | | | | | | | 7,184,400 | |

| | | | | | | | | |

Total Common Stocks (Cost $98,194,771) | | | | | | $ | 121,155,830 | |

MONEY MARKET FUNDS — 4.3% | | | | | | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.01% (a) (Cost $5,488,017) | | | 5,488,017 | | | $ | 5,488,017 | |

| | | | | | | | | |

Total Investments at Market Value — 99.7% (Cost $103,682,788) | | | | | | $ | 126,643,847 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.3% | | | | | | | 378,037 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 127,021,884 | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See notes to financial statements. |

AVE MARIA OPPORTUNITY FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareowner:

For 2010 the Ave Maria Opportunity Fund had a total return of 19.2%. It was another good year for the Fund, on top of the 40.8% gain achieved in 2009. For the second year in a row, the smallest, most leveraged companies outperformed larger, less leveraged companies. In that environment, our low-risk, value-oriented investment style resulted in the Fund underperforming its two primary benchmarks during 2010. The Fund has outperformed both benchmarks over longer time periods, as outlined in the table below.

| | Average Annual Total Return |

| | For periods ended 12/31/10 |

| | | | | |

| Ave Maria Opportunity Fund | 19.2% | 29.5% | 4.4% | 2.6% |

| S&P 600 Smallcap Index | 26.3% | 25.9% | 3.0% | 2.3% |

| Russell 2000 Index | 26.9% | 27.0% | 2.2% | 2.0% |

* 5/1/06

Several energy related holdings were among the Fund’s best performers in 2010, as oil prices (and many other commodities) rose sharply, based on inflationary fears and the rebounding global economy. Also posting a large gain for the year was Endo Pharmaceuticals Holdings, Inc. Endo, a specialty drug company, made a series of strategic acquisitions in 2010 that should boost long-term growth. Another big winner was Signet Jewelers Ltd., the world’s largest specialty jewelry retailer, with brands such as Kay Jewelers and Jared. The five stocks that performed best for the Fund during 2010 were:

| Cimarex Energy Company | Oil, Gas & Consumable Fuels | +84.6% |

| Rosetta Resources, Inc. | Oil, Gas & Consumable Fuels | +80.8% |

| Endo Pharmaceuticals Holdings, Inc. | Pharmaceuticals | +74.0% |

| Rowan Companies, Inc. | Energy Equipment & Services | +72.8% |

| Signet Jewelers Ltd. | Specialty Retail | +62.5% |

The five stocks that performed worst for the Fund during 2010 were:

| H&R Block, Inc. | Diversified Financial Services | -23.7% |

| Investment Technology Group, Inc. | Financials – Capital Markets | -10.3% |

| Lexmark International, Inc. | Technology Printing & Supplies | -5.9% |

| Federated Investors, Inc. | Financials – Capital Markets | -2.0% |

| Forest Laboratories, Inc. | Pharmaceuticals | -0.4% |

AVE MARIA OPPORTUNITY FUND PORTFOLIO MANAGER COMMENTARY (Continued) |

H&R Block’s stock price suffered as the company reported declining revenue due to the high unemployment rate and fewer customer tax returns filed. Investment Technology Group, Inc. is a service provider to the brokerage and investment community whose revenue and profits were hurt by lackluster institutional equity trading volume last year. Federated Investors, Inc., one of the country’s largest managers of money market funds, was forced to waive a portion of their management fees due to short-term interest rates near 0% for much of the year. We believe each of the companies’ share prices have significant recovery potential from currently depressed levels.

Small and micro-cap stocks have been the biggest winners since the March 2009 low, and the Fund has benefitted a good deal from our small-cap holdings, as reflected above. But as the new decade begins, there appears to be a good bit of speculative froth in many small and micro-cap issues. We of course want to own only high quality, non-speculative shares in our portfolios. And we try to avoid the mistake many investors make during bulls markets – to become unduly focused on return and forget about risk. Managing risk is an essential part of our investment process. As the legendary value investor Seth Klarman says, “the best investors do not target return – they focus first on risk, and only then decide whether the projected return justifies taking each particular risk.”

A fundamental tenet of our investment philosophy is that shares of a well-managed business, purchased at a compelling valuation and held for many years to allow the power of compounding to work, will generate a superior investment result over the long-term. True to this contrarian, value-orientation, the portfolio at year end was heavily represented by what we believe are high quality, low-risk, reasonably priced securities. The average PE ratio for the Fund was 12x. We believe the risk in the portfolio is low and the upside potential is significant.

Thanks for being a shareholder of the Ave Maria Opportunity Fund.

With best regards,

Timothy S. Schwartz, CFA

Portfolio Manager

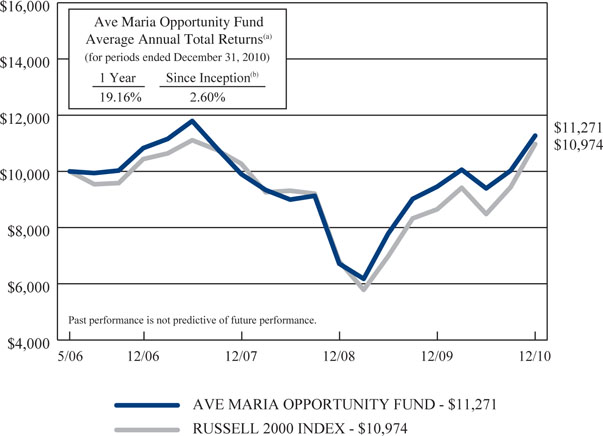

AVE MARIA OPPORTUNITY FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Opportunity Fund and the Russell 2000 Index

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2006) through December 31, 2010. |

Expense Ratio information as of: | Year Ended 12-31-09 (as disclosed in April 30, 2010 prospectus) | |

| Gross | 2.29% | 1.79% |

| Net | 1.28% | 1.25% |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA OPPORTUNITY FUND ANNUAL TOTAL RATES OF RETURN COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA OPPORTUNITY FUND | | |

2006 (a) | 8.3% | 4.4% | 2.2% |

| 2007 | -8.5% | -1.6% | -0.3% |

| 2008 | -32.2% | -33.8% | -31.1% |

| 2009 | 40.8% | 27.2% | 25.6% |

| 2010 | 19.2% | 26.9% | 26.3% |

AVERAGE ANNUAL TOTAL RETURNS As of December 31, 2010 (Unaudited) |

| AVE MARIA OPPORTUNITY FUND | | |

| 3 Years | 4.4% | 2.2% | 3.0% |

Since Inception (b) | 2.6% | 2.0% | 2.3% |

| (a) | Represents the period from the commencement of operations (May 1, 2006) through December 31, 2006. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2006) through December 31, 2010. |

AVE MARIA OPPORTUNITY FUND TEN LARGEST EQUITY HOLDINGS December 31, 2010 (Unaudited) |

| | | | | | | | |

| | 40,000 | | Avnet, Inc. | | $ | 1,321,200 | | | | 5.3 | % |

| | 16,000 | | Exxon Mobil Corporation | | | 1,169,920 | | | | 4.7 | % |

| | 20,000 | | Ensco PLC - ADR | | | 1,067,600 | | | | 4.3 | % |

| | 30,000 | | Arrow Electronics, Inc. | | | 1,027,500 | | | | 4.1 | % |

| | 25,000 | | Nintendo Company Ltd. - ADR | | | 908,250 | | | | 3.7 | % |

| | 6,000 | | SPDR Gold Trust | | | 832,320 | | | | 3.4 | % |

| | 20,000 | | Weight Watchers International, Inc. | | | 749,800 | | | | 3.0 | % |

| | 25,000 | | Federated Investors, Inc. - Class B | | | 654,250 | | | | 2.6 | % |

| | 1,997 | | Alleghany Corporation | | | 611,821 | | | | 2.5 | % |

| | 12,500 | | Accenture PLC - Class A | | | 606,125 | | | | 2.4 | % |

ASSET ALLOCATION (Unaudited) |

| |

Consumer Discretionary | 12.4% | |

Consumer Staples | 1.7% | |

Energy | 17.6% | |

Financials | 22.3% | |

Health Care | 3.7% | |

Industrials | 1.1% | |

Information Technology | 18.9% | |

Exchange-Traded Funds | 4.0% | |

Cash Equivalents, Other Assets and Liabilities | | |

| | | |

AVE MARIA OPPORTUNITY FUND SCHEDULE OF INVESTMENTS December 31, 2010 |

| | | | | | |

| Consumer Discretionary — 12.4% | | | | | | |

| Diversified Consumer Services — 3.0% | | | | | | |

Weight Watchers International, Inc. | | | 20,000 | | | $ | 749,800 | |

| | | | | | | | | |

| Leisure Equipment & Products — 3.7% | | | | | | | | |

Nintendo Company Ltd. - ADR | | | 25,000 | | | | 908,250 | |

| | | | | | | | | |

| Media — 1.5% | | | | | | | | |

John Wiley & Sons, Inc. - Class A | | | 7,934 | | | | 358,934 | |

| | | | | | | | | |

| Specialty Retail — 2.3% | | | | | | | | |

Ross Stores, Inc. | | | 4,000 | | | | 253,000 | |

Signet Jewelers Ltd. * | | | 7,500 | | | | 325,500 | |

| | | | | | | | 578,500 | |

| Textiles, Apparel & Luxury Goods — 1.9% | | | | | | | | |

Wolverine World Wide, Inc. | | | 15,000 | | | | 478,200 | |

| | | | | | | | | |

| Consumer Staples — 1.7% | | | | | | | | |

| Food Products — 1.7% | | | | | | | | |

Lancaster Colony Corporation | | | 7,400 | | | | 423,280 | |

| | | | | | | | | |

| Energy — 17.6% | | | | | | | | |

| Energy Equipment & Services — 9.9% | | | | | | | | |

Atwood Oceanics, Inc. * | | | 8,000 | | | | 298,960 | |

Ensco PLC - ADR | | | 20,000 | | | | 1,067,600 | |

Nabors Industries Ltd. * | | | 12,500 | | | | 293,250 | |

Patterson-UTI Energy, Inc. | | | 25,000 | | | | 538,750 | |

Rowan Companies, Inc. * | | | 7,500 | | | | 261,825 | |

| | | | | | | | 2,460,385 | |

| Oil, Gas & Consumable Fuels — 7.7% | | | | | | | | |

Cimarex Energy Company | | | 2,000 | | | | 177,060 | |

Exxon Mobil Corporation | | | 16,000 | | | | 1,169,920 | |

Rosetta Resources, Inc. * | | | 5,000 | | | | 188,200 | |

Southwestern Energy Company * | | | 10,000 | | | | 374,300 | |

| | | | | | | | 1,909,480 | |

| Financials — 22.3% | | | | | | | | |

| Capital Markets — 4.3% | | | | | | | | |

Federated Investors, Inc. - Class B | | | 25,000 | | | | 654,250 | |

Investment Technology Group, Inc. * | | | 25,000 | | | | 409,250 | |

| | | | | | | | 1,063,500 | |

| Commercial Banks — 1.4% | | | | | | | | |

United Bancorp Inc. * | | | 100,000 | | | | 335,000 | |

| | | | | | | | | |

| Diversified Financial Services — 8.4% | | | | | | | | |

Dun & Bradstreet Corporation (The) | | | 5,000 | | | | 410,450 | |

H&R Block, Inc. | | | 30,000 | | | | 357,300 | |

Leucadia National Corporation | | | 10,000 | | | | 291,800 | |

AVE MARIA OPPORTUNITY FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 77.7% (Continued) | | | | | | |

| Financials — 22.3% (Continued) | | | | | | |

| Diversified Financial Services — 8.4% (Continued) | | | | | | |

PICO Holdings, Inc. * | | | 15,000 | | | $ | 477,000 | |

Western Union Company (The) | | | 30,000 | | | | 557,100 | |

| | | | | | | | 2,093,650 | |

| Insurance — 5.8% | | | | | | | | |

Alleghany Corporation * | | | 1,997 | | | | 611,821 | |

Markel Corporation * | | | 500 | | | | 189,065 | |

Meadowbrook Insurance Group, Inc. | | | 30,000 | | | | 307,500 | |

White Mountains Insurance Group Ltd. | | | 1,000 | | | | 335,600 | |

| | | | | | | | 1,443,986 | |

| Real Estate Management & Development — 1.8% | | | | | | | | |

St. Joe Company (The) * | | | 20,000 | | | | 437,000 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance — 0.6% | | | | | | | | |

Oritani Financial Corporation | | | 10,000 | | | | 122,400 | |

ViewPoint Financial Group | | | 2,981 | | | | 34,848 | |

| | | | | | | | 157,248 | |

| Health Care — 3.7% | | | | | | | | |

| Pharmaceuticals — 3.7% | | | | | | | | |

Endo Pharmaceuticals Holdings, Inc. * | | | 12,000 | | | | 428,520 | |

Forest Laboratories, Inc. * | | | 15,000 | | | | 479,700 | |

| | | | | | | | 908,220 | |

| Industrials — 1.1% | | | | | | | | |

| Aerospace & Defense — 1.1% | | | | | | | | |

Sparton Corporation * | | | 33,715 | | | | 277,812 | |

| | | | | | | | | |

| Information Technology — 18.9% | | | | | | | | |

| Computers & Peripherals — 2.3% | | | | | | | | |

Dell, Inc. * | | | 25,000 | | | | 338,750 | |

Lexmark International, Inc. - Class A * | | | 6,800 | | | | 236,776 | |

| | | | | | | | 575,526 | |

| Electronic Equipment, Instruments & Components — 11.0% | | | | | | | | |

Arrow Electronics, Inc. * | | | 30,000 | | | | 1,027,500 | |

Avnet, Inc. * | | | 40,000 | | | | 1,321,200 | |

Ingram Micro, Inc. - Class A * | | | 20,000 | | | | 381,800 | |

| | | | | | | | 2,730,500 | |

| IT Services — 4.2% | | | | | | | | |

Accenture PLC - Class A | | | 12,500 | | | | 606,125 | |

Broadridge Financial Solutions, Inc. | | | 19,800 | | | | 434,214 | |

| | | | | | | | 1,040,339 | |

| Semiconductors & Semiconductor Equipment — 1.4% | | | | | | | | |

Microchip Technology, Inc. | | | 10,000 | | | | 342,100 | |

| | | | | | | | | |

Total Common Stocks (Cost $14,502,173) | | | | | | $ | 19,271,710 | |

AVE MARIA OPPORTUNITY FUND SCHEDULE OF INVESTMENTS (Continued) |

EXCHANGE-TRADED FUNDS — 4.0% | | | | | | |

iShares Barclays TIPS Bond Fund | | | 1,500 | | | $ | 161,280 | |

SPDR Gold Trust * | | | 6,000 | | | | 832,320 | |

Total Exchange-Traded Funds (Cost $759,934) | | | | | | $ | 993,600 | |

REPURCHASE AGREEMENTS (a) — 4.9% | | | | | | |

| U.S. Bank N.A., 0.01%, dated 12/31/10, due 01/03/11, repurchase proceeds: $1,219,290 (Cost $1,219,289) | | $ | 1,219,289 | | | $ | 1,219,289 | |

MONEY MARKET FUNDS — 13.3% | | | | | | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.01% (b) | | | 1,099,284 | | | $ | 1,099,284 | |

Federated Treasury Obligations Fund - Institutional Shares, 0.01% (b) | | | 1,099,284 | | | | 1,099,284 | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.01% (b) | | | 1,099,284 | | | | 1,099,284 | |

Total Money Market Funds (Cost $3,297,852) | | | | | | $ | 3,297,852 | |

| | | | | | | | | |

Total Investments at Market Value — 99.9% (Cost $19,779,248) | | | | | | $ | 24,782,451 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 11,428 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 24,793,879 | |

| ADR - American Depositary Receipt. |

| |

| * | Non-income producing security. |

| | |

| (a) | Repurchase agreement is fully collateralized by $1,178,366 FGCI Pool #G11649, 4.50%, due 02/01/20. The aggregate market value of the collateral at December 31, 2010 was $1,244,010. |

| | |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See notes to financial statements. |

AVE MARIA WORLD EQUITY FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareowners:

The Ave Maria World Equity Fund (AVEWX) was launched on May 1, 2010. For the period April 30, 2010 (initial public offering) through December 31, 2010 the Fund was up 12.4%, while the S&P 1200 Global Index return was up 8.5% for the same period. Returns from the world’s stock markets varied widely last year especially in Europe due to the ongoing sovereign debt crisis. Markets in weaker countries such as Greece, Portugal and Ireland declined, while Germany, Sweden, Denmark and others experienced double-digit advances. Markets in many developing economies were up 20% or more. Accelerating inflation and rising interest rates held China and Brazil to single-digit gains.

The investment strategy of the Ave Maria World Equity Fund is to invest for long-term capital appreciation, primarily in non-U.S. companies that operate globally. We want companies that generate above-average returns on invested capital by virtue of superior products, good management and efficient utilization of assets. The Fund focuses on non-U.S. companies and U.S. companies with at least 50% of their revenues derived from outside of the U.S. All of the stocks owned by the Fund trade in the United States and are denominated in U.S. dollars with shares of foreign domiciled companies represented by American Depositary Receipts (ADRs).

Stocks with the largest positive impact on Fund performance in 2010 were energy and capital infrastructure related, particularly companies with substantial participation in the developing economies of Asia, the Middle East, Africa and South America. These stocks included Foster Wheeler AG (Engineering and Construction), General Cable Corporation (Electrical Wire & Cable), Siemens AG (Capital Equipment), Schlumberger Limited (Oil Service), and BHP Billiton Ltd. (Mining & Energy). Negative contributors included Banco Santander S.A. (Banking), Mindray Medical International Ltd. (Medical Equipment), Hewlett-Packard Company (Technology), and Delhaize Group (Food Retail).

As of December 31st, the Fund’s geographic weightings versus the S&P Global 1200 Index were approximately:

| | Ave Maria World Equity Fund | |

| United States | 39% | 48% |

| Europe | 21% | 18% |

| United Kingdom | 2% | 10% |

| Japan | 4% | 8% |

| Canada | 9% | 5% |

| Asia ex Japan | 5% | 5% |

| Australia | 2% | 4% |

| Latin America | 3% | 2% |

| Other | 1% | — |

| Cash | 14% | — |

AVE MARIA WORLD EQUITY FUND PORTFOLIO MANAGER COMMENTARY (Continued) |

The Fund’s cash position was elevated by significant new inflows near year end.

All investments comply with the Ave Maria Mutual Fund moral screens established by our Catholic Advisory Board.

Thank you for your interest in the Fund.

Gregory R. Heilman, CFA

Portfolio Manager

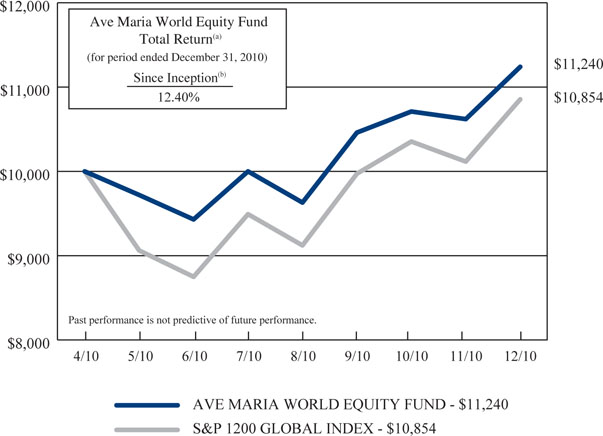

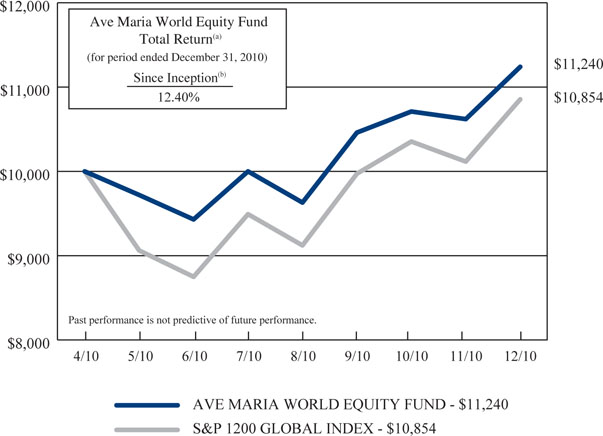

AVE MARIA WORLD EQUITY FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria World Equity Fund and the S&P 1200 Global Index

| (a) | The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (April 30, 2010) through December 31, 2010. |

| | |

| (c) | Annualized. |

Expense Ratio information as of: | Projected (as disclosed in April 30, 2010 prospectus) | Period Ended 12-31-10 (b) (c) |

| Gross | 3.62% | 2.45% |

| Net | 1.52% | 1.50% |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA WORLD EQUITY FUND TEN LARGEST EQUITY HOLDINGS December 31, 2010 (Unaudited) |

| | | | | | | | |

| | 3,500 | | Toyota Motor Corporation - ADR | | $ | 275,205 | | | | 2.3 | % |

| | 6,500 | | Hewlett-Packard Company | | | 273,650 | | | | 2.3 | % |

| | 11,000 | | Heineken NV - Unsponsored ADR | | | 270,380 | | | | 2.3 | % |

| | 5,000 | | Tidewater, Inc. | | | 269,200 | | | | 2.2 | % |

| | 5,500 | | Accenture PLC - Class A | | | 266,695 | | | | 2.2 | % |

| | 5,500 | | Abbott Laboratories | | | 263,505 | | | | 2.2 | % |

| | 7,500 | | Foster Wheeler AG | | | 258,900 | | | | 2.1 | % |

| | 3,000 | | 3M Company | | | 258,900 | | | | 2.1 | % |

| | 3,200 | | Colgate-Palmolive Company | | | 257,184 | | | | 2.1 | % |

| | 13,500 | | Western Union Company (The) | | | 250,695 | | | | 2.1 | % |

ASSET ALLOCATION (Unaudited) |

| |

Consumer Discretionary | 5.4% | |

Consumer Staples | 12.1% | |

Energy | 14.2% | |

Financials | 10.5% | |

Health Care | 3.7% | |

Industrials | 15.2% | |

Information Technology | 11.4% | |

Materials | 5.6% | |

Telecommunication Services | 6.2% | |

Exchange-Traded Funds | 1.4% | |

Cash Equivalents, Other Assets and Liabilities | | |

| | | |

AVE MARIA WORLD EQUITY FUND SCHEDULE OF INVESTMENTS December 31, 2010 |

| | | | | | |

| Consumer Discretionary — 5.4% | | | | | | |

| Automobiles — 2.3% | | | | | | |

Toyota Motor Corporation - ADR | | | 3,500 | | | $ | 275,205 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 1.9% | | | | | | | | |

McDonald's Corporation | | | 3,000 | | | | 230,280 | |

| | | | | | | | | |

| Leisure Equipment & Products — 1.2% | | | | | | | | |

Nintendo Company Ltd. - ADR | | | 4,000 | | | | 145,320 | |

| | | | | | | | | |

| Consumer Staples — 12.1% | | | | | | | | |

| Beverages — 4.1% | | | | | | | | |

Diageo PLC - ADR | | | 3,000 | | | | 222,990 | |

Heineken NV - Unsponsored ADR | | | 11,000 | | | | 270,380 | |

| | | | | | | | 493,370 | |

| Food & Staples Retailing — 1.8% | | | | | | | | |

Delhaize Group - ADR | | | 3,000 | | | | 221,130 | |

| | | | | | | | | |

| Food Products — 2.0% | | | | | | | | |

Nestlé S.A. - ADR | | | 4,000 | | | | 235,280 | |

| | | | | | | | | |

| Household Products — 2.1% | | | | | | | | |

Colgate-Palmolive Company | | | 3,200 | | | | 257,184 | |

| | | | | | | | | |

| Personal Products — 2.1% | | | | | | | | |

Avon Products, Inc. | | | 8,500 | | | | 247,010 | |

| | | | | | | | | |

| Energy — 14.2% | | | | | | | | |

| Energy Equipment & Services — 6.1% | | | | | | | | |

Schlumberger Limited | | | 3,000 | | | | 250,500 | |

Tidewater, Inc. | | | 5,000 | | | | 269,200 | |

Transocean Ltd. * | | | 3,000 | | | | 208,530 | |

| | | | | | | | 728,230 | |

| Oil, Gas & Consumable Fuels — 8.1% | | | | | | | | |

Advantage Oil & Gas Ltd. * | | | 25,000 | | | | 170,000 | |

Canadian Natural Resources Ltd. | | | 4,500 | | | | 199,890 | |

Exxon Mobil Corporation | | | 3,000 | | | | 219,360 | |

Petróleo Brasileiro S.A. - ADR | | | 5,000 | | | | 189,200 | |

Suncor Energy, Inc. | | | 5,000 | | | | 191,450 | |

| | | | | | | | 969,900 | |

| Financials — 10.5% | | | | | | | | |

| Commercial Banks — 3.3% | | | | | | | | |

Banco Santander S.A. - ADR | | | 16,000 | | | | 170,400 | |

Toronto-Dominion Bank (The) | | | 3,000 | | | | 222,930 | |

| | | | | | | | 393,330 | |

AVE MARIA WORLD EQUITY FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 84.3% (Continued) | | | | | | |

| Financials — 10.5% (Continued) | | | | | | |

| Diversified Financial Services — 3.9% | | | | | | |

MasterCard, Inc. - Class A | | | 1,000 | | | $ | 224,110 | |

Western Union Company (The) | | | 13,500 | | | | 250,695 | |

| | | | | | | | 474,805 | |

| Insurance — 3.3% | | | | | | | | |

Allianze SE - ADR | | | 11,000 | | | | 130,570 | |

AXA S.A. - ADR | | | 8,000 | | | | 133,200 | |

Zurich Financial Services AG - ADR | | | 5,000 | | | | 129,450 | |

| | | | | | | | 393,220 | |

| Health Care — 3.7% | | | | | | | | |

| Health Care Equipment & Supplies — 1.5% | | | | | | | | |

Mindray Medical International Ltd. - ADR | | | 7,000 | | | | 184,800 | |

| | | | | | | | | |

| Pharmaceuticals — 2.2% | | | | | | | | |

Abbott Laboratories | | | 5,500 | | | | 263,505 | |

| | | | | | | | | |

| Industrials — 15.2% | | | | | | | | |

| Aerospace & Defense — 2.0% | | | | | | | | |

United Technologies Corporation | | | 3,000 | | | | 236,160 | |

| | | | | | | | | |

| Construction & Engineering — 2.1% | | | | | | | | |

Foster Wheeler AG * | | | 7,500 | | | | 258,900 | |

| | | | | | | | | |

| Electrical Equipment — 2.0% | | | | | | | | |

General Cable Corporation * | | | 7,000 | | | | 245,630 | |

| | | | | | | | | |

| Industrial Conglomerates — 5.8% | | | | | | | | |

3M Company | | | 3,000 | | | | 258,900 | |

Koninklijke Philips Electronics NV - ADR | | | 6,000 | | | | 184,200 | |

Siemens AG - ADR | | | 2,000 | | | | 248,500 | |

| | | | | | | | 691,600 | |

| Machinery — 1.4% | | | | | | | | |

Lincoln Electric Holdings, Inc. | | | 2,500 | | | | 163,175 | |

| | | | | | | | | |

| Road & Rail — 1.9% | | | | | | | | |

Canadian National Railway Company | | | 3,500 | | | | 232,645 | |

| | | | | | | | | |

| Information Technology — 11.4% | | | | | | | | |

| Computers & Peripherals — 2.3% | | | | | | | | |

Hewlett-Packard Company | | | 6,500 | | | | 273,650 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 1.6% | | | | | | | | |

LG Display Company Ltd. - ADR | | | 11,000 | | | | 195,250 | |

AVE MARIA WORLD EQUITY FUND SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 84.3% (Continued) | | | | | | |

| Information Technology — 11.4% (Continued) | | | | | | |

| IT Services — 4.1% | | | | | | |

Accenture PLC - Class A | | | 5,500 | | | $ | 266,695 | |

International Business Machines Corporation | | | 1,500 | | | | 220,140 | |

| | | | | | | | 486,835 | |

| Office Electronics — 1.6% | | | | | | | | |

Zebra Technologies Corporation - Class A * | | | 5,000 | | | | 189,950 | |

| | | | | | | | | |

| Software — 1.8% | | | | | | | | |

Longtop Financial Technologies Limited - ADR * | | | 6,000 | | | | 217,080 | |

| | | | | | | | | |

| Materials — 5.6% | | | | | | | | |

| Chemicals — 3.7% | | | | | | | | |

Lubrizol Corporation (The) | | | 1,900 | | | | 203,072 | |

Syngenta AG - ADR | | | 4,000 | | | | 235,120 | |

| | | | | | | | 438,192 | |

| Metals & Mining — 1.9% | | | | | | | | |

BHP Billiton Ltd. - ADR | | | 2,500 | | | | 232,300 | |

| | | | | | | | | |

| Telecommunication Services — 6.2% | | | | | | | | |

| Diversified Telecommunication Services — 2.9% | | | | | | | | |

CenturyLink, Inc. | | | 4,000 | | | | 184,680 | |

Telefónica S.A. - ADR | | | 2,500 | | | | 171,050 | |

| | | | | | | | 355,730 | |

| Wireless Telecommunication Services — 3.3% | | | | | | | | |

América Móvil S.A.B. de C.V. - Series L - ADR | | | 3,500 | | | | 200,690 | |

Millicom International Cellular S.A. | | | 2,000 | | | | 191,200 | |

| | | | | | | | 391,890 | |

| | | | | | | | | |

Total Common Stocks (Cost $9,108,729) | | | | | | $ | 10,121,556 | |

EXCHANGE-TRADED FUNDS — 1.4% | | | | | | |

SPDR Gold Trust * (Cost $143,155) | | | 1,200 | | | $ | 166,464 | |

AVE MARIA WORLD EQUITY FUND SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 14.3% | | | | | | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.01% (a) | | | 571,640 | | | $ | 571,640 | |

Federated Treasury Obligations Fund - Institutional Shares, 0.01% (a) | | | 566,692 | | | | 566,692 | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.01% (a) | | | 571,641 | | | | 571,641 | |

Total Money Market Funds (Cost $1,709,973) | | | | | | $ | 1,709,973 | |

| | | | | | | | | |

Total Investments at Market Value — 100.0% (Cost $10,961,857) | | | | | | $ | 11,997,993 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.0% | | | | | | | 1,615 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 11,999,608 | |

| ADR - American Depositary Receipt. |

| |

| * | Non-income producing security. |

| | |

| (a) | The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See notes to financial statements. |

AVE MARIA BOND FUND PORTFOLIO MANAGER COMMENTARY |

Dear Fellow Shareholders,

2010 was another good year for the Ave Maria Bond Fund. The Fund had a total return of 6.7% for the year while the Barclays Capital Intermediate Government/Credit Index had a total return of 5.9%.

Portfolio returns for the year were aided by the overweighting of investment grade corporate bonds while the relatively short average maturity of the portfolio acted as a moderate drag on performance. Positions in dividend paying common stocks also added to performance. At year end, the dividend yield on the common stock position was an attractive 3.4%. Of the 22 common stocks held in the portfolio at year end, 19, or 86%, raised their dividend during 2010.

Factors seen as impacting the fixed-income markets in 2011 include an improving economy and continued stimulative monetary policy. There is also reason to hope that with the new Congress there will be a more focused effort to address the runaway budgetary deficits that have mushroomed in recent years. (In our view that would be a distinct positive for the fixed-income markets.) There remains the risk that the Fed will be slow in withdrawing the highly stimulative monetary policy it has applied for so long, the unintended consequences of which could be an increase in the rate of inflation. A recovering economy and increase in the rate of inflation would likely mean higher interest rates. Accordingly, we have structured the bond portion of the portfolio in a defensive manner with a short average maturity. A stronger economy also increase s the likelihood that corporate bonds and dividend-paying stocks will do well. The portfolio currently has an overweight position in investment grade corporate bonds and maximum 20% position in common stocks. We are constructive in our outlook for the capital markets and expect the Ave Maria Bond Fund to have another good year in 2011.

Thank you for your participation in the Fund. We appreciate the confidence you have placed in us and work hard to be worthy of it.

With best regards,

Richard L. Platte, Jr., CFA

Portfolio Manager

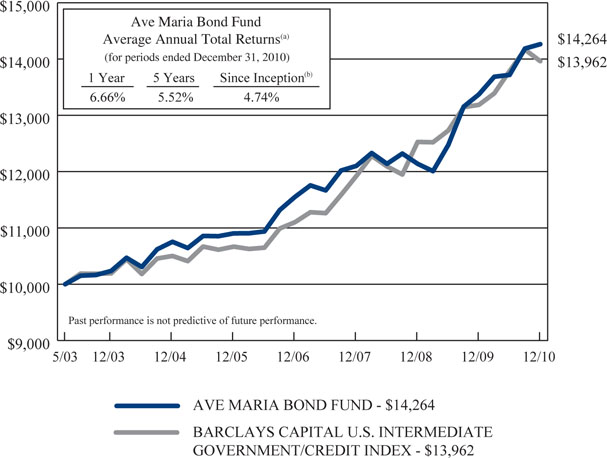

AVE MARIA BOND FUND PERFORMANCE (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Bond Fund and the Barclays Capital U.S.

Intermediate Government/Credit Index

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Represents the period from the commencement of operations (May 1, 2003) through December 31, 2010. |

Expense Ratio information as of: | Year Ended 12-31-09 (as disclosed in April 30, 2010 prospectus) | |

| Gross | 0.95% | 0.85% |

| Net | 0.72% | 0.70% |