UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07148 | |

| Schwartz Investment Trust |

| (Exact name of registrant as specified in charter) |

| 801 W. Ann Arbor Trail, Suite 244 Plymouth, Michigan | 48170 |

| (Address of principal executive offices) | (Zip code) |

George P. Schwartz

| Schwartz Investment Counsel, Inc. 801 W. Ann Arbor Trail, Plymouth, MI 48170 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (734) 455-7777 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Schwartz Value Focused Fund

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-0753 | | Investment Adviser Schwartz Investment Counsel, Inc.

801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 |

Dear Fellow Shareholders:

2022 was a good year for the Schwartz Value Focused Fund (“the Fund”) with a total return of 21.15%, compared to -17.77% for the benchmark S&P 1500 Index, and -14.02% for the Morningstar Mid-Cap Blend category average. For the year, the Fund ranked #1 out of 370 equity mutual funds in the Morningstar Mid-Cap Blend category. This performance has been recognized by the investment community, as the Fund was highlighted in The Wall Street Journal’s January 9, 2023 edition, in the article titled “The Best Stock-Fund Managers of 2022.” As stated in the article, the Fund’s 2022 performance ranked #3 out of 1,410 U.S. equity funds, as tracked by Morningstar, an independent rating service.

The Fund’s outperformance in 2022 was driven primarily by the Fund’s energy sector investments. In particular, the share prices of Chevron Corporation (oil & natural gas integrated), Devon Energy (oil & natural gas exploration and production), Pioneer Natural Resources Company (oil & natural gas exploration and production), Schlumberger Limited (oil & natural gas equipment and services), and Texas Pacific Land Corporation (real estate and royalties) all rose substantially in 2022. We believe the worldwide demand for energy, including oil and natural gas, will continue to grow for many years. With rising demand, coupled with constrained supply (due to a myriad of factors), we believe energy prices may escalate in 2023 and beyond. As such, we remain optimistic that the Fund’s energy sector companies will continue to grow revenues, earnings, cash flows, and dividends.

The Fund’s five best performing securities in 2022 were:

Company | Industry | 2022 Return |

Schlumberger Limited | Oil/Gas Equipment & Services | 91.98% |

Texas Pacific Land Corporation | Real Estate/Royalties | 91.28% |

Devon Energy Corporation | Oil/Gas Exploration & Production | 67.21% |

Chevron Corporation | Integrated Oil/Gas | 56.94% |

Pioneer Natural Resources Co. | Oil/Gas Exploration & Production | 44.11% |

The Fund’s five worst performing securities in 2022 were:

Company | Industry | 2022 Return |

Purple Innovation, Inc. | Consumer Products | -44.22% |

Garmin Ltd. | Technology Products | -30.38% |

Moody’s Corporation | Debt Rating Services | -28.04% |

Vontier Corporation | Technology Mobility | -27.49% |

CME Group Inc. | Financial Exchanges | -20.48% |

1

Due to its strong performance in 2021 and 2022, the Fund’s longer-term performance measures have markedly improved. For the 3-year and 5-year periods ending December 31, 2022, the Fund placed in the 1st percentile in Morningstar’s Mid-Cap Blend category. The Fund’s 1, 3, 5, and 10-year performance figures for periods ending December 31, 2022 are as follows:

| | Average Annual Total Return

For the Periods Ending 12/31/22 |

| | 1 year | 3 years | 5 years | 10 years |

Schwartz Value Focused Fund | 21.15% | 21.04% | 14.09% | 10.06% |

S&P 1500 Index | -17.77% | 7.59% | 9.15% | 12.40% |

Value-oriented investment managers were vindicated in 2022. It was a year in which many investors got sucked into the vortex of a speculative stock market mania driven by tech stocks that got ridiculously overpriced, even though many were unprofitable enterprises. These “story stocks” were hailed as industry disruptors, and no share price was too high. The carnage here was brutal.

Recent performance of 10 former high-flying technology stocks:

Company | Performance

Since 2021 Peak

through

2022 Year End |

Carvana Co. | -99% |

Peloton Interactive, Inc. | -95% |

Coinbase Global, Inc. | -92% |

Teladoc Health, Inc. | -92% |

Leamonade, Inc. | -91% |

Robinhood Markets, Inc. | -91% |

Snap Inc. | -90% |

Zoom Video Communications, Inc. | -88% |

Docusign, Inc. | -83% |

Spotify Technology S.A. | -80% |

Individual and institutional investors alike in these issues probably learned again the truism that real investing is not a game, and success is not assured. One cannot ignore valuations and expect to achieve successful results. Fundamentals matter.

In managing the Schwartz Value Focused Fund, we will continue to pursue a risk-averse, value-focused investment approach that utilizes fundamental security analysis to identify securities available at a discount to intrinsic value. We believe this approach provides the best opportunities to achieve above-average investment results.

2

The year-end distribution of $0.394 per share consisted solely of investment income, as there were no realized short or long-term capital gains. The net asset value of the Fund ended the year at $45.06 per share.

Thank you for being a shareholder in the Schwartz Value Focused Fund.

|

|

Timothy S. Schwartz, CFA | George P. Schwartz, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

Past performance is no guarantee of future results. Rank in Category is the fund’s total return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1.

3

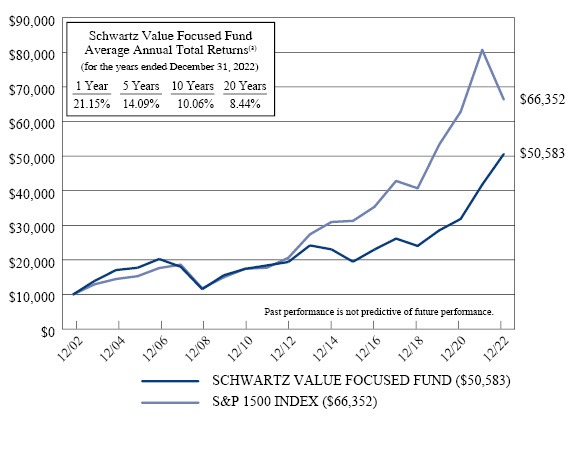

SCHWARTZ VALUE FOCUSED FUND

PERFORMANCE

(Unaudited)

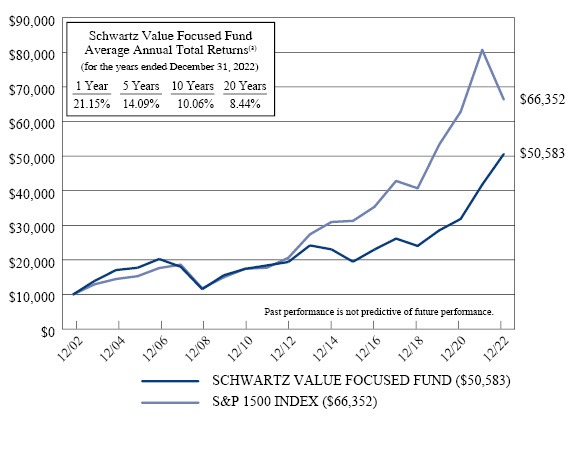

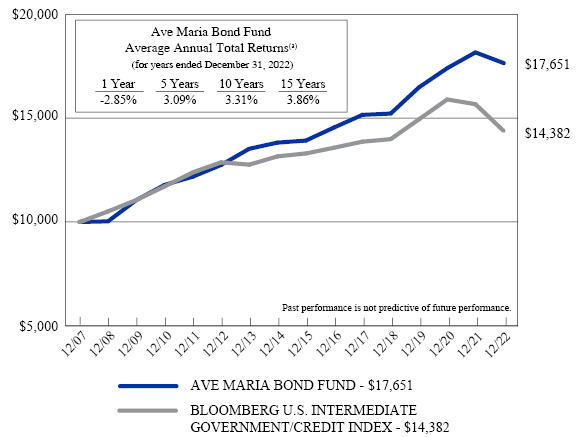

Comparison of the Change in Value of a $10,000 Investment

in Schwartz Value Focused Fund and the S&P 1500 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense Ratio

information as of: | Year Ended 12-31-21

(as disclosed in May 1, 2022

prospectus) | Year Ended 12-31-22 |

Gross | 1.32%* | 1.28% |

Net | 1.26%* | 1.25% |

* | Includes Acquired Fund Fees and Expenses and had been adjusted to reflect a reduction in the annual management fees of 0.20% effective May 1, 2022 (Note 2). |

4

SCHWARTZ VALUE FOCUSED FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

1984 | 11.1% | N/A | -8.4% |

1985 | 21.7% | N/A | 20.7% |

1986 | 16.4% | N/A | 5.0% |

1987 | -0.6% | N/A | -10.6% |

1988 | 23.1% | N/A | 15.4% |

1989 | 8.3% | N/A | 11.2% |

1990 | -5.3% | N/A | -24.3% |

1991 | 32.0% | N/A | 27.2% |

1992 | 22.7% | N/A | 7.0% |

1993 | 20.5% | N/A | 10.7% |

1994 | -6.8% | N/A | -6.0% |

1995 | 16.9% | 36.5% | 19.3% |

1996 | 18.3% | 22.4% | 13.4% |

1997 | 28.0% | 32.9% | 21.1% |

1998 | -10.4% | 26.4% | -3.8% |

1999 | -2.5% | 20.3% | -1.4% |

2000 | 9.3% | -7.0% | -8.7% |

2001 | 28.1% | -10.6% | -6.1% |

2002 | -14.9% | -21.3% | -28.6% |

2003 | 39.3% | 29.6% | 37.4% |

2004 | 22.6% | 11.8% | 11.5% |

2005 | 3.8% | 5.7% | 2.0% |

2006 | 14.3% | 15.3% | 11.0% |

2007 | -11.1% | 5.5% | -3.8% |

2008 | -35.9% | -36.7% | -48.7% |

2009 | 34.8% | 27.2% | 36.8% |

2010 | 12.0% | 16.4% | 20.5% |

2011 | 5.6% | 1.7% | -11.4% |

2012 | 5.4% | 16.2% | 9.5% |

2013 | 24.7% | 32.8% | 35.5% |

2014 | -4.7% | 13.1% | 2.7% |

2015 | -15.5% | 1.0% | -11.2% |

2016 | 18.1% | 13.0% | 13.5% |

2017 | 13.7% | 21.1% | 11.1% |

2018 | -8.1% | -5.0% | -16.0% |

2019 | 18.7% | 30.9% | 16.9% |

2020 | 11.6% | 17.9% | 1.2% |

2021 | 31.1% | 28.5% | 18.1% |

2022 | 21.2% | -17.8% | -20.2% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

5

SCHWARTZ VALUE FOCUSED FUND

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2022 (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

3 Years | 21.0% | 7.6% | -1.0% |

5 Years | 14.1% | 9.2% | -0.9% |

10 Years | 10.1% | 12.4% | 3.8% |

20 Years | 8.4% | 9.9% | 3.6% |

39 Years | 9.4% | N/A | 2.6% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

6

SCHWARTZ VALUE FOCUSED FUND

TEN LARGEST HOLDINGS

December 31, 2022 (Unaudited)

| | Shares | | | Security Description | | Fair

Value | | | % of

Net Assets | |

| | | 5,500 | | | Texas Pacific Land Corporation | | $ | 12,893,265 | | | | 24.9% | |

| | | 24,400 | | | Intercontinental Exchange, Inc. | | | 2,503,196 | | | | 4.8% | |

| | | 9,000 | | | RH | | | 2,404,710 | | | | 4.7% | |

| | | 17,390 | | | Franco-Nevada Corporation | | | 2,373,387 | | | | 4.6% | |

| | | 12,169 | | | Chevron Corporation | | | 2,184,214 | | | | 4.2% | |

| | | 12,400 | | | CME Group, Inc. | | | 2,085,184 | | | | 4.0% | |

| | | 47,600 | | | St. Joe Company (The) | | | 1,839,740 | | | | 3.6% | |

| | | 84,900 | | | Vontier Corporation | | | 1,641,117 | | | | 3.2% | |

| | | 29,800 | | | Schlumberger Ltd. | | | 1,593,108 | | | | 3.1% | |

| | | 6,000 | | | Pioneer Natural Resources Company | | | 1,370,340 | | | | 2.6% | |

ASSET ALLOCATION (Unaudited)

| % of

Net Assets |

COMMON STOCKS | |

Sector | |

Consumer Discretionary | 14.2% |

Energy | 12.3% |

Financials | 11.9% |

Health Care | 0.1% |

Industrials | 5.4% |

Materials | 9.2% |

Real Estate | 28.5% |

Technology | 2.3% |

Money Market Funds, Other Assets in Excess of Liabilities | 16.1% |

| | 100.0% |

7

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

December 31, 2022

COMMON STOCKS — 83.9% | | Shares | | | Fair Value | |

Consumer Discretionary — 14.2% | | | | | | | | |

Automotive — 1.5% | | | | | | | | |

Gentex Corporation | | | 28,800 | | | $ | 785,376 | |

| | | | | | | | | |

Home & Office Products — 1.6% | | | | | | | | |

Purple Innovation, Inc. * | | | 175,000 | | | | 838,250 | |

| | | | | | | | | |

Home Construction — 2.5% | | | | | | | | |

Masco Corporation | | | 27,900 | | | | 1,302,093 | |

| | | | | | | | | |

Leisure Facilities & Services — 2.3% | | | | | | | | |

Madison Square Garden Sports Corporation | | | 6,400 | | | | 1,173,312 | |

| | | | | | | | | |

Leisure Products — 1.6% | | | | | | | | |

YETI Holdings, Inc. * | | | 20,000 | | | | 826,200 | |

| | | | | | | | | |

Retail - Discretionary — 4.7% | | | | | | | | |

RH * | | | 9,000 | | | | 2,404,710 | |

| | | | | | | | | |

Energy — 12.3% | | | | | | | | |

Oil & Gas Producers — 9.2% | | | | | | | | |

Chevron Corporation | | | 12,169 | | | | 2,184,214 | |

Devon Energy Corporation | | | 20,000 | | | | 1,230,200 | |

Pioneer Natural Resources Company | | | 6,000 | | | | 1,370,340 | |

| | | | | | | | 4,784,754 | |

Oil & Gas Services & Equipment — 3.1% | | | | | | | | |

Schlumberger Ltd. | | | 29,800 | | | | 1,593,108 | |

| | | | | | | | | |

Financials — 11.9% | | | | | | | | |

Institutional Financial Services — 8.8% | | | | | | | | |

CME Group, Inc. | | | 12,400 | | | | 2,085,184 | |

Intercontinental Exchange, Inc. | | | 24,400 | | | | 2,503,196 | |

| | | | | | | | 4,588,380 | |

Insurance — 3.1% | | | | | | | | |

Berkshire Hathaway, Inc. - Class A * | | | 2 | | | | 937,422 | |

Markel Corporation * | | | 500 | | | | 658,745 | |

| | | | | | | | 1,596,167 | |

Health Care — 0.1% | | | | | | | | |

Biotech & Pharma — 0.1% | | | | | | | | |

Avid Bioservices, Inc. * | | | 5,000 | | | | 68,850 | |

8

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

COMMON STOCKS — 83.9% (Continued) | | Shares | | | Fair Value | |

Industrials — 5.4% | | | | | | | | |

Electrical Equipment — 4.3% | | | | | | | | |

A.O. Smith Corporation | | | 10,600 | | | $ | 606,744 | |

Vontier Corporation | | | 84,900 | | | | 1,641,117 | |

| | | | | | | | 2,247,861 | |

Industrial Support Services — 1.1% | | | | | | | | |

U-Haul Holding Company | | | 1,000 | | | | 60,190 | |

U-Haul Holding Company - Series N | | | 9,000 | | | | 494,820 | |

| | | | | | | | 555,010 | |

Materials — 9.2% | | | | | | | | |

Chemicals — 1.6% | | | | | | | | |

Valvoline, Inc. | | | 25,000 | | | | 816,250 | |

| | | | | | | | | |

Containers & Packaging — 0.4% | | | | | | | | |

Ardagh Metal Packaging S.A. | | | 50,000 | | | | 240,500 | |

| | | | | | | | | |

Metals & Mining — 7.2% | | | | | | | | |

Barrick Gold Corporation | | | 35,300 | | | | 606,454 | |

Franco-Nevada Corporation | | | 17,390 | | | | 2,373,387 | |

Pan American Silver Corporation | | | 45,500 | | | | 743,470 | |

| | | | | | | | 3,723,311 | |

Real Estate — 28.5% | | | | | | | | |

Real Estate Owners & Developers — 28.5% | | | | | | | | |

St. Joe Company (The) | | | 47,600 | | | | 1,839,740 | |

Texas Pacific Land Corporation | | | 5,500 | | | | 12,893,265 | |

| | | | | | | | 14,733,005 | |

Technology — 2.3% | | | | | | | | |

Technology Hardware — 0.5% | | | | | | | | |

Garmin Ltd. | | | 2,500 | | | | 230,725 | |

| | | | | | | | | |

Technology Services — 1.8% | | | | | | | | |

Mastercard, Inc. - Class A | | | 1,500 | | | | 521,595 | |

Moody’s Corporation | | | 1,500 | | | | 417,930 | |

| | | | | | | | 939,525 | |

| | | | | | | | | |

Total Common Stocks (Cost $25,935,722) | | | | | | $ | 43,447,387 | |

9

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

MONEY MARKET FUNDS — 16.0% | | Shares | | | Fair Value | |

Federated Hermes Government Obligations Tax-Managed Fund - Institutional Shares, 3.97% (a) | | | 2,480,746 | | | $ | 2,480,746 | |

Federated Hermes Treasury Obligations Fund - Institutional Shares, 4.15% (a) | | | 2,480,746 | | | | 2,480,746 | |

Federated Hermes U.S. Treasury Cash Reserves Fund - Institutional Shares, 3.85% (a) | | | 2,442,705 | | | | 2,442,705 | |

Invesco Short-Term Investments Trust (The) - Treasury Portfolio - Institutional Class, 4.19% (a) | | | 899,682 | | | | 899,682 | |

Total Money Market Funds (Cost $8,303,879) | | | | | | $ | 8,303,879 | |

| | | | | | | | | |

Total Investments at Fair Value — 99.9% (Cost $34,239,601) | | | | | | $ | 51,751,266 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 21,308 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 51,772,574 | |

* | Non-income producing security. |

(a) | The rate shown is the 7-day effective yield as of December 31, 2022. |

See notes to financial statements. |

10

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2022

ASSETS | | | | |

Investments, at fair value (cost of $34,239,601) (Note 1) | | $ | 51,751,266 | |

Cash | | | 1,825 | |

Receivable for capital shares sold | | | 46,677 | |

Dividends receivable | | | 89,689 | |

Other assets | | | 14,317 | |

TOTAL ASSETS | | | 51,903,774 | |

| | | | | |

LIABILITIES | | | | |

Payable for capital shares redeemed | | | 10,672 | |

Payable to Adviser (Note 2) | | | 102,568 | |

Payable to administrator (Note 2) | | | 4,386 | |

Other accrued expenses | | | 13,574 | |

TOTAL LIABILITIES | | | 131,200 | |

| | | | | |

NET ASSETS | | $ | 51,772,574 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 34,481,786 | |

Distributable earnings | | | 17,290,788 | |

NET ASSETS | | $ | 51,772,574 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 1,149,070 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 1) | | $ | 45.06 | |

See notes to financial statements. |

11

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2022

INVESTMENT INCOME | | | | |

Dividends | | $ | 856,873 | |

Foreign withholding taxes on dividends | | | (7,117 | ) |

TOTAL INVESTMENT INCOME | | | 849,756 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 256,610 | |

Administration, accounting and transfer agent fees (Note 2) | | | 38,565 | |

Legal fees | | | 29,174 | |

Registration and filing fees | | | 27,299 | |

Audit and tax services fees | | | 16,047 | |

Shareholder reporting expenses | | | 8,667 | |

Custodian and bank service fees | | | 7,760 | |

Trustees’ fees and expenses (Note 2) | | | 5,134 | |

Postage and supplies | | | 3,909 | |

Insurance expense | | | 3,665 | |

Compliance service fees and expenses (Note 2) | | | 1,726 | |

Other expenses | | | 13,549 | |

TOTAL EXPENSES | | | 412,105 | |

Less fee reductions by the Adviser (Note 2) | | | (36,210 | ) |

Previous investment advisory fee reductions recouped by the Adviser (Note 2) | | | 25,276 | |

NET EXPENSES | | | 401,171 | |

| | | | | |

NET INVESTMENT INCOME | | | 448,585 | |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized losses from investment transactions | | | (221,016 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 6,358,455 | |

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 6,137,439 | |

| | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,586,024 | |

See notes to financial statements. |

12

SCHWARTZ VALUE FOCUSED FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | Year Ended

December 31,

2022 | | | Year Ended

December 31,

2021 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 448,585 | | | $ | 68,100 | |

Net realized gains (losses) from investment transactions | | | (221,016 | ) | | | 1,420,261 | |

Net change in unrealized appreciation (depreciation) on investments | | | 6,358,455 | | | | 3,917,570 | |

Net increase in net assets resulting from operations | | | 6,586,024 | | | | 5,405,931 | |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 1) | | | (448,446 | ) | | | (1,488,406 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 26,360,198 | | | | 6,691,800 | |

Reinvestment of distributions to shareholders | | | 401,888 | | | | 1,430,459 | |

Payments for shares redeemed | | | (4,688,357 | ) | | | (6,575,752 | ) |

Net increase in net assets from capital share transactions | | | 22,073,729 | | | | 1,546,507 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 28,211,307 | | | | 5,464,032 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 23,561,267 | | | | 18,097,235 | |

End of year | | $ | 51,772,574 | | | $ | 23,561,267 | |

| | | | | | | | | |

SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 621,397 | | | | 161,720 | |

Shares issued in reinvestment of distributions to shareholders | | | 8,925 | | | | 38,257 | |

Shares redeemed | | | (109,141 | ) | | | (164,577 | ) |

Net increase in shares outstanding | | | 521,181 | | | | 35,400 | |

Shares outstanding, beginning of year | | | 627,889 | | | | 592,489 | |

Shares outstanding, end of year | | | 1,149,070 | | | | 627,889 | |

See notes to financial statements. |

13

SCHWARTZ VALUE FOCUSED FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | Year

Ended

Dec. 31,

2022 | | | Year

Ended

Dec. 31,

2021 | | | Year

Ended

Dec. 31,

2020 | | | Year

Ended

Dec. 31,

2019 | | | Year

Ended

Dec. 31,

2018 | |

Net asset value at beginning of year | | $ | 37.52 | | | $ | 30.54 | | | $ | 28.03 | | | $ | 23.62 | | | $ | 26.44 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.39 | | | | 0.12 | | | | 0.15 | | | | (0.03 | ) | | | (0.08 | ) |

Net realized and unrealized gains (losses) on investments | | | 7.54 | | | | 9.39 | | | | 3.11 | | | | 4.44 | | | | (2.08 | ) |

Total from investment operations | | | 7.93 | | | | 9.51 | | | | 3.26 | | | | 4.41 | | | | (2.16 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.39 | ) | | | (0.12 | ) | | | (0.15 | ) | | | — | | | | — | |

Net realized gains on investments | | | — | | | | (2.41 | ) | | | (0.60 | ) | | | — | | | | (0.66 | ) |

Total distributions | | | (0.39 | ) | | | (2.53 | ) | | | (0.75 | ) | | | — | | | | (0.66 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 45.06 | | | $ | 37.52 | | | $ | 30.54 | | | $ | 28.03 | | | $ | 23.62 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 21.15 | % | | | 31.14 | % | | | 11.62 | % | | | 18.67 | % | | | (8.14 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 51,773 | | | $ | 23,561 | | | $ | 18,097 | | | $ | 22,461 | | | $ | 19,428 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.28 | % | | | 1.51 | % | | | 1.71 | % | | | 1.61 | % | | | 1.67 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets (b) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (b) | | | 1.39 | % | | | 0.28 | % | | | 0.49 | % | | | (0.13 | %) | | | (0.31 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 14 | % | | | 18 | % | | | 45 | % | | | 28 | % | | | 34 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Ratio was determined after advisory fee reductions and/or recoupments (Note 2). |

See notes to financial statements. |

14

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2022

1. Organization and Significant Accounting Policies

Schwartz Value Focused Fund (the “Fund”) is a non-diversified series of Schwartz Investment Trust (the “Trust”), an open-end management investment company established as an Ohio business trust under a Declaration of Trust dated August 31, 1992. Other series of the Trust are not incorporated in this report. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The investment objective of the Fund is to seek long-term capital appreciation. See the Prospectus for information regarding the principal investment strategies of the Fund.

Shares of the Fund are sold at net asset value (“NAV”). To calculate the NAV, the Fund’s assets are valued and totaled, liabilities are subtracted, and the balance is divided by the number of shares outstanding. The offering price and redemption price per share are equal to the NAV per share.

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

(a) Valuation of investments — Securities which are traded on stock exchanges, other than NASDAQ, are valued at the closing sales price as of the close of the regular session of trading on the New York Stock Exchange on the day the securities are being valued, or, if not traded on a particular day, at the closing bid price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price or, if an Official Closing Price is not available, at the most recently quoted bid price. Securities traded in the over-the-counter market are valued at the last reported sales price or, if there is no reported sale on the valuation date, at the most recently quoted bid price. Securities which are traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. Fixed income securities, if any, are generally valued using prices provided by an independent pricing service. The independent pricing service uses information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining these prices. Investments representing shares of other open-end investment companies are valued at their NAV as reported by such companies. When using quoted prices and when the market for the securities are considered active, the securities will be classified as Level 1 within the fair value hierarchy (see below). Securities (and other assets) for which market quotations are not readily available are valued at their fair value as determined in good faith in accordance with consistently applied procedures established by and under the general supervision of the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that stock over an extended period of time; (ii) the exchange on which the portfolio security

15

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

● Level 1 – quoted prices in active markets for identical securities

● Level 2 – other significant observable inputs

● Level 3 – significant unobservable inputs

U.S. Government & Agencies securities held by the Fund, if any, are classified as Level 2 since the values for such securities are based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments and the levels assigned to the investments, by security type, as of December 31, 2022:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 43,447,387 | | | $ | — | | | $ | — | | | $ | 43,447,387 | |

Money Market Funds | | | 8,303,879 | | | | — | | | | — | | | | 8,303,879 | |

Total | | $ | 51,751,266 | | | $ | — | | | $ | — | | | $ | 51,751,266 | |

Refer to the Fund’s Schedule of Investments for a listing of the securities by security type, sector and industry type. There were no Level 3 securities or derivative instruments held by or transferred in/out of the Fund as of or during the year ended December 31, 2022.

(b) Income taxes — The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

16

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income and 98.2% of its net realized capital gains plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of December 31, 2022:

Federal income tax cost | | $ | 34,239,601 | |

Gross unrealized appreciation | | $ | 18,274,240 | |

Gross unrealized depreciation | | | (762,575 | ) |

Net unrealized appreciation | | | 17,511,665 | |

Undistributed ordinary income | | | 139 | |

Accumulated capital and other losses | | | (221,016 | ) |

Distributable earnings | | $ | 17,290,788 | |

As of December 31, 2022, the Fund had a short-term capital loss carryforward of $221,016 for federal income tax purposes, which may be carried forward indefinitely. This capital loss carryforward is available to offset net realized gains in future years, thereby reducing future taxable gain distributions.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

(c) Investment transactions and investment income — Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Interest income is recognized on the accrual basis. Realized capital gains and losses on investment transactions are determined on the identified cost basis. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

(d) Dividends and distributions — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid annually in December. Dividends and distributions to shareholders are recorded on the ex-

17

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

dividend date. The tax character of distributions paid to shareholders during the years ended December 31, 2022 and 2021 was as follows:

Year Ended | | Ordinary Income | | | Long-Term

Capital Gains | | | Total

Distributions* | |

December 31, 2022 | | $ | 448,446 | | | $ | — | | | $ | 448,446 | |

December 31, 2021 | | $ | 68,386 | | | $ | 1,419,975 | | | $ | 1,488,361 | |

| | * | Total Distributions may not tie to the amounts listed on the Statements of Changes in Net Assets due to reclassifications of the character of the distributions as a result of permanent differences between the financial statements and income tax reporting. |

(e) Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(f) Common expenses — Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on relative net assets of each series or the nature of the services performed and the relative applicability to each series.

2. Investment Advisory Agreement and Transactions with Related Parties

The Chairman and President of the Trust is also the Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. (the “Adviser”). Certain other officers of the Trust are officers of the Adviser, or of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative, accounting and transfer agent for the Fund, or of Ultimus Fund Distributors, LLC (the “Distributor”), the Fund’s principal underwriter.

Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is responsible for the management of the Fund and provides investment advice along with the necessary personnel, facilities, equipment and certain other services necessary to the operations of the Fund. Effective May 1, 2022, the Adviser receives from the Fund a quarterly fee at the annual rate of 0.75% per annum of the Fund’s average daily net assets. Prior to May 1, 2022, the Adviser received from the Fund a quarterly fee at the annual rate of 0.95% per annum of the Fund’s average daily net assets.

The Adviser has contractually agreed to reduce its advisory fees or reimburse a portion of the Fund’s expenses until at least May 1, 2023, so that the ordinary operating expenses of the Fund do not exceed 1.25% per annum of average daily net assets. Accordingly, during the year ended December 31, 2022, the Adviser reduced its investment advisory fees by $36,210.

Any fee reductions or expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided repayment to the Adviser does not cause the ordinary operating expenses of the Fund to exceed 1.25% per annum of average daily net assets. During the year ended December 31, 2022, the Fund recouped $25,276 of prior years’ investment advisory fee

18

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

reductions. As of December 31, 2022, the Adviser may seek recoupment of investment advisory fee reductions totaling $180,194 no later than the dates stated below:

December 31, 2023 | | $ | 79,720 | |

December 31, 2024 | | | 64,264 | |

December 31, 2025 | | | 36,210 | |

Total | | $ | 180,194 | |

The Chief Compliance Officer of the Trust (the “CCO”) is an employee of the Adviser. The Trust pays the Adviser a fee for providing CCO services, of which the Fund pays its proportionate share along with the other series of the Trust. In addition, the Trust reimburses the Adviser for out-of-pocket expenses incurred, if any, for providing these services.

Pursuant to a Mutual Fund Services Agreement between the Trust and Ultimus, Ultimus supplies regulatory and compliance services, calculates the daily NAV per share, maintains the financial books and records of the Fund, maintains the records of each shareholder’s account, and processes purchases and redemptions of the Fund’s shares. For these services Ultimus receives fees computed as a percentage of the average daily net assets of the Fund, subject to a minimum monthly fee.

Pursuant to a Distribution Agreement between the Trust and the Distributor, the Distributor serves as the Fund’s exclusive agent for the distribution of its shares. The Distributor is an affiliate of Ultimus.

Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Adviser or Ultimus (“Independent Trustee”) receives from the Trust an annual retainer of $63,000 (except that such fee is $76,500 for the Lead Independent Trustee/Chairman of the Governance Committee and $71,500 for the Chairman of the Audit Committee), payable quarterly; a fee of $6,000 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings. Trustee Emeritus, if any, receives one-half of both the annual retainer and fee for attendance at each meeting; plus reimbursement of travel and other expenses incurred in attending meetings. The Fund paid its proportionate share of the Independent Trustees’ fees and expenses along with the other series of the Trust.

3. Investment Transactions

During the year ended December 31, 2022, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments and U.S. government securities, amounted to $17,977,693 and $4,052,957, respectively.

4. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum

19

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

5. Sector Risk

If the Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments may negatively impact all companies in a particular sector and therefore the value of the Fund’s portfolio will be adversely affected. As of December 31, 2022, the Fund had 28.5% of the value of its net assets invested in common stocks within the real estate sector. The Fund had 24.9% of the value of its net assets invested in Texas Pacific Land Corporation (“TPL”) within the real estate sector. The financial statements for TPL can be found at www.sec.gov.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

20

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of Schwartz Investment Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Schwartz Value Focused Fund, one of the series constituting the Schwartz Investment Trust (the “Fund”), as of December 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2022, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed

21

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM (Continued)

other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Chicago, Illinois

February 22, 2023

We have served as the auditor of one or more Schwartz Investment Trust investment companies since 1993.

22

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

Overall responsibility for management of the Trust rests with the Board of Trustees. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement or removal. The Trustees, in turn, elect the officers of the Trust to actively supervise its day-to-day operations. The officers have been elected for an annual term. The following are the Trustees and executive officers of the Trust:

Trustee/Officer | Address | Year of

Birth | Position Held

with the Trust | Length of

Time Served |

Interested Trustee: |

* | George P. Schwartz, CFA | 801 W. Ann Arbor Trail,

Plymouth, MI | 1944 | Chairman of the Board/President/Trustee | Since 1992 |

Independent Trustees: |

| | Donald J. Dawson, Jr. | 801 W. Ann Arbor Trail,

Plymouth, MI | 1947 | Trustee | Since 1993 |

| | John J. McHale, Jr. | 801 W. Ann Arbor Trail,

Plymouth, MI | 1949 | Trustee | Since 2014 |

| | Edward J. Miller | 801 W. Ann Arbor Trail,

Plymouth, MI | 1946 | Trustee | Since 2017 |

| | William A. Morrow | 801 W. Ann Arbor Trail,

Plymouth, MI | 1947 | Trustee | Since 2018 |

Executive Officers: |

* | Robert C. Schwartz | 801 W. Ann Arbor Trail,

Plymouth, MI | 1976 | Vice President and Secretary | Since 2013 |

* | Timothy S. Schwartz, CFA | 5060 Annunciation Circle,

Ave Maria, FL | 1971 | Treasurer | Since 2000 |

* | Cathy M. Stoner, CPA, IACCP | 801 W. Ann Arbor Trail,

Plymouth, MI | 1970 | Chief Compliance Officer | Since 2010 |

* | George P. Schwartz, Robert C. Schwartz, Timothy S. Schwartz and Cathy M. Stoner, as affiliated persons of Schwartz Investment Counsel, Inc., the Funds’ investment adviser, are “interested persons” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. George P. Schwartz is the father of Robert C. Schwartz and Timothy S. Schwartz. |

23

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Each Trustee oversees seven series of the Trust: the Ave Maria Value Fund, the Ave Maria Growth Fund, the Ave Maria Rising Dividend Fund, the Ave Maria World Equity Fund, the Ave Maria Focused Fund, the Ave Maria Bond Fund and the Fund. The principal occupations of the Trustees and executive officers of the Trust during the past five years and public directorships held by the Trustees are set forth below:

George P. Schwartz, CFA is Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. and the co-portfolio manager of the Fund.

Donald J. Dawson, Jr. retired in March 2015. Prior to retirement, he was Chairman of Payroll 1, Inc. (a payroll processing company).

John J. McHale, Jr. is a consultant to the Commissioner of Major League Baseball. From 2015 until 2020, he was the Special Assistant to Commissioner of Major League Baseball.

Edward J. Miller retired in 2019. Prior to his retirement, he was Vice Chairman and Director of Detroit Investment Fund from 2001 until 2019 and Invest Detroit Foundation (financiers for redevelopment of Detroit, Michigan) from 2010 until 2019.

William A. Morrow retired in 2017. Prior to his retirement, he was Senior Executive Vice President of Crain Communications, Inc. (business media) from 1985 until 2017.

Robert C. Schwartz is Executive Vice President and Secretary of Schwartz Investment Counsel, Inc.

Timothy S. Schwartz, CFA is President of Schwartz Investment Counsel, Inc. and the lead portfolio manager of the Fund.

Cathy M. Stoner, CPA, IACCP is Vice President, Chief Financial Officer, Chief Compliance Officer, and Treasurer of Schwartz Investment Counsel, Inc.

Additional information regarding the Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call (888) 726-0753.

24

SCHWARTZ VALUE FOCUSED FUND

ABOUT YOUR FUND’S EXPENSES

(Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The ongoing costs reflected in the table below are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (July 1, 2022) and held until the end of the period (December 31, 2022).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the result does not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

25

SCHWARTZ VALUE FOCUSED FUND

ABOUT YOUR FUND’S EXPENSES

(Unaudited) (Continued)

More information about the Fund’s expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s Prospectus.

| Beginning

Account Value

July 1, 2022 | Ending

Account Value

December 31, 2022 | Expenses Paid

During Period* |

Based on Actual Fund Return | $1,000.00 | $1,207.60 | $6.96 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,018.90 | $6.36 |

* | Expenses are equal to the Fund’s annualized net expense ratio of 1.25% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

26

SCHWARTZ VALUE FOCUSED FUND

OTHER INFORMATION

(Unaudited)

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit on Form N-PORT. The filings are available free of charge, upon request, by calling (888) 726-0753. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

FEDERAL TAX INFORMATION (Unaudited)

Qualified Dividend Income – The Fund designates 100% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distributions that qualifies under tax law. For the fiscal year ended December 31, 2022, 100% of ordinary income dividends qualified for the corporate dividends received deduction.

27

SCHWARTZ VALUE FOCUSED FUND

LIQUIDITY RISK

(Unaudited)

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act of 1940. The program is reasonably designed to assess, manage, and periodically review the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board of Trustees approved the appointment of a Liquidity Risk Management Program Administrator (the “Liquidity Administrator”), which includes representatives from Schwartz Investment Counsel, Inc., the Fund’s investment adviser. The Liquidity Administrator is responsible for the administration of the program and its policies and procedures and for reporting to the Board on an annual basis regarding the program’s operation, adequacy and effectiveness, as well as any material changes to the program. The Liquidity Administrator assessed the Fund’s liquidity risk profile and the adequacy and effectiveness of the liquidity risk management program’s operations during the period from June 1, 2021 through June 30, 2022 (the “Review Period”) in order to prepare a written report for the Board of Trustees (the “Report”) for consideration at its meeting held on August 5, 2022. During the Review Period, the Fund did not experience unusual stress or disruption to its operations from any purchase and redemption activity. Also, during the Review Period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that (i) the Fund’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program has been effectively implemented during the Review Period.

28

Shareholder Accounts c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-9331 |

| Corporate Offices 801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 (734) 455-7777 Fax (734) 455-7720 |

To the owners of:

Ave Maria Value Fund (AVEMX)

Ave Maria Growth Fund (AVEGX)

Ave Maria Rising Dividend Fund (AVEDX)

Ave Maria World Equity Fund (AVEWX)

Ave Maria Focused Fund (AVEAX)

Ave Maria Bond Fund (AVEFX)

Ave Maria Money Market Account

2022 was a year that scared many investors. It was the first year in several decades that both stocks and bonds declined as measured by popular indices. One anxiety producer among many was the fear of recession. The jury is still out as to whether the current economic slowdown will be officially called a recession or not. In this environment, retail and institutional investors alike seem paralyzed, holding on to their cash reserves “until things are clearer”. I wonder where they think stock prices will be when things are clearer.

Successful investors have learned not to try outguessing the market. They don’t overanalyze and burden themselves by fretting over the unknowable and instead stay long-term oriented. That’s the only thing that matters for serious investors. Indeed, long-term is the essence of investing – deferral of gratification or consumption now with the hope of gaining greater purchasing power later. Currently, it’s possible that the stock market is pricing in the widespread negative sentiments.

Also, it’s worth noting that there has been a significant shift in investor thinking to a healthy focus on fundamentals. This, as opposed to mania for meme stocks, overhyped information technology companies, and the infatuation with quarterly results. The crash of inflated stock prices has shocked the get-rich-quick artists, as well as investors with unrealistic expectations for infinite growth. Value is back after a long period of investor infatuation with hypergrowth stocks selling at unrealistic prices. It’s a new world. Actually, it’s a return to the old world of disciplined balance sheet and cash flow analysis used to calculate intrinsic value.

While short-term thinkers, traders, and speculators were weeping and gnashing their teeth in 2022, as the enclosed pages show, three of the Ave Maria Mutual Funds beat their benchmarks for performance, in one case quite handily.

Sincerely,

George P. Schwartz, CFA

Chairman & CEO

December 31, 2022

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

| | |

Ave Maria Value Fund | |

Portfolio Manager Commentary | 1 |

Performance | 4 |

Annual Total Rates of Return Comparison with Major Indices | 5 |

Ten Largest Equity Holdings | 6 |

Asset Allocation | 6 |

Schedule of Investments | 7 |

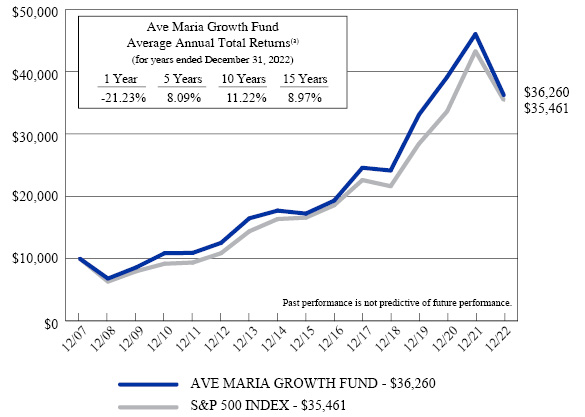

Ave Maria Growth Fund | |

Portfolio Manager Commentary | 10 |

Performance | 12 |

Annual Total Rates of Return Comparison with Major Indices | 13 |

Ten Largest Equity Holdings | 14 |

Asset Allocation | 14 |

Schedule of Investments | 15 |

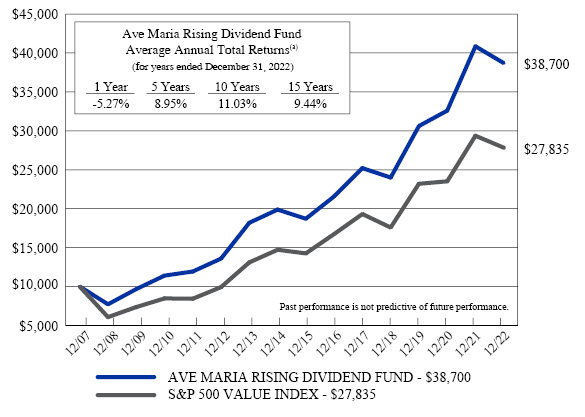

Ave Maria Rising Dividend Fund | |

Portfolio Manager Commentary | 18 |

Performance | 19 |

Annual Total Rates of Return Comparison with Major Indices | 20 |

Ten Largest Equity Holdings | 21 |

Asset Allocation | 21 |

Schedule of Investments | 22 |

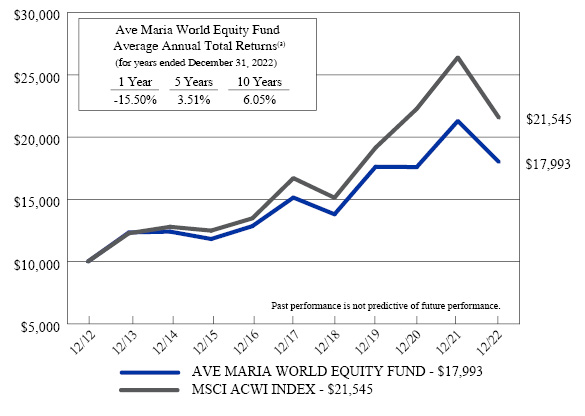

Ave Maria World Equity Fund | |

Portfolio Manager Commentary | 25 |

Performance | 28 |

Annual Total Rates of Return Comparison with Major Indices | 29 |

Ten Largest Equity Holdings | 30 |

Asset Allocation | 30 |

Schedule of Investments | 31 |

Summary of Common Stocks by Country | 35 |

Ave Maria Focused Fund | |

Portfolio Manager Commentary | 36 |

Performance | 39 |

Annual Total Rates of Return Comparison with Major Indices | 40 |

Ten Largest Equity Holdings | 41 |

Asset Allocation | 41 |

Schedule of Investments | 42 |

Ave Maria Bond Fund | |

Portfolio Manager Commentary | 44 |

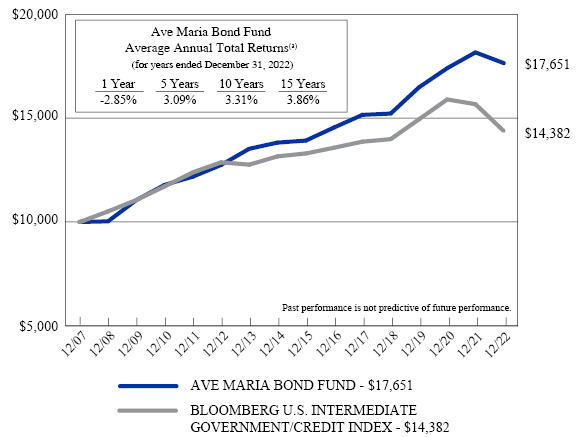

Performance | 45 |

Annual Total Rates of Return Comparison with Major Indices | 46 |

Ten Largest Holdings | 47 |

Asset Allocation | 47 |

Schedule of Investments | 48 |

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

(Continued)

Statements of Assets and Liabilities | 54 |

Statements of Operations | 56 |

Statements of Changes in Net Assets | |

Ave Maria Value Fund | 58 |

Ave Maria Growth Fund | 59 |

Ave Maria Rising Dividend Fund | 60 |

Ave Maria World Equity Fund | 61 |

Ave Maria Focused Fund | 62 |

Ave Maria Bond Fund | 63 |

Financial Highlights | |

Ave Maria Value Fund | 64 |

Ave Maria Growth Fund | 65 |

Ave Maria Rising Dividend Fund | 66 |

Ave Maria World Equity Fund | 67 |

Ave Maria Focused Fund | 68 |

Ave Maria Bond Fund | 69 |

Notes to Financial Statements | 70 |

Report of Independent Registered Public Accounting Firm | 82 |

Board of Trustees and Executive Officers | 84 |

Catholic Advisory Board | 86 |

About Your Funds’ Expenses | 88 |

Federal Tax Information | 90 |

Other Information | 91 |

Liquidity Risk | 92 |

This report is for the information of the shareholders of the Ave Maria Mutual Funds. To obtain a copy of the prospectus, please visit our website at www.avemariafunds.com or call 1-888-726-9331 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Ave Maria Mutual Funds are distributed by Ultimus Fund Distributors, LLC.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

This page intentionally left blank.

Ave Maria Value Fund

Portfolio Manager Commentary

(Unaudited)

Dear Fellow Shareholders:

2022 was a relatively good year for the Ave Maria Value Fund (the “Fund”) with a total return of 4.18%, compared to -13.06% for the benchmark S&P MidCap 400 Index, and -14.02% for the Morningstar Mid-Cap Blend category average. For the year, the Fund ranked in the 1st percentile out of 370 equity mutual funds in the Morningstar Mid-Cap Blend category. This performance has been recognized by the investment community, as the Fund was mentioned in The Wall Street Journal’s January 9, 2023 edition, in the article titled “The Best Stock-Fund Managers of 2022.” As stated in the article, the Fund’s 2022 performance ranked #11 out of 1,410 U.S. stocks funds, as tracked by Morningstar, an independent rating service. Likewise, in the same edition of The Wall Street Journal, in the “Category Kings in 9 realms” section, the Fund was ranked #1 out of 390 Midcap Growth equity mutual funds for 2022 performance, as tracked by Lipper, an independent rating service.

The Fund’s outperformance in 2022 was driven primarily by the Fund’s energy sector investments. In particular, the share prices of Chevron Corporation (oil & natural gas integrated), Pioneer Natural Resources Company (oil & natural gas exploration and production), Schlumberger Limited (oil & natural gas equipment and services), and Texas Pacific Land Corporation (real estate and royalties) all rose substantially in 2022. We believe the worldwide demand for energy, including oil and natural gas, will continue to grow for many years. With rising demand, coupled with constrained supply (due to a myriad of factors), we believe energy prices may escalate in 2023 and beyond. As such, we remain optimistic that the Fund’s energy sector companies will continue to grow revenues, earnings, cash flows, and dividends.

The Fund’s five best performing securities in 2022 were:

Company | Industry | 2022 Return |

Texas Pacific Land Corporation | Real Estate/Royalties | 91.28% |

Schlumberger Limited | Oil/Gas Equipment & Services | 83.51% |

Chevron Corporation | Integrated Oil/Gas | 56.94% |

Bowlero Corporation | Bowling Centers | 53.97% |

Haemonetics Corporation | Medical Instruments & Supplies | 49.92% |

1

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

The Fund’s five worst performing securities in 2022 were:

Company | Industry | 2022 Return |

Purple Innovation, Inc. | Consumer Products | -41.43% |

Vontier Corporation | Technology Mobility | -32.85% |

Intercontinental Exchange, Inc. | Financial Exchanges | -32.25% |

YETI Holdings, Inc. | Consumer Products | -32.15% |

A.O. Smith Corporation | Specialty Machinery | -27.05% |

Due to the recent, strong relative outperformance, the Fund’s longer-term performance measures have markedly improved. For the 3-year and 5-year periods ending December 31, 2022, the Fund placed in the top 3rd percentile and top 9th percentile, respectively, in Morningstar’s Mid-Cap Blend category. The Fund’s 1, 3, 5, and 10-year performance figures for periods ending December 31, 2022 are as follows:

| | Average Annual Total Return

For the Periods Ending 12/31/22 |

| | 1 year | 3 years | 5 years | 10 years |

Ave Maria Value Fund | 4.18% | 11.44% | 8.77% | 8.35% |

S&P MidCap 400 Index | -13.06% | 7.23% | 6.71% | 10.78% |

Value-oriented investment managers were vindicated in 2022. It was a year in which many investors got sucked into the vortex of a speculative stock market mania driven by tech stocks that got ridiculously overpriced, even though many were unprofitable enterprises. These “story stocks” were hailed as industry disruptors, and no share price was too high. The carnage here was brutal.

Recent performance of 10 former high-flying technology stocks:

Company | Performance Since 2021

Peak through 2022 Year End |

Carvana Co. | -99% |

Peloton Interactive, Inc. | -95% |

Coinbase Global, Inc. | -92% |

Teladoc Health, Inc. | -92% |

Leamonade, Inc. | -91% |

Robinhood Markets, Inc. | -91% |

Snap Inc. | -90% |

Zoom Video Communications, Inc. | -88% |

Docusign, Inc. | -83% |

Spotify Technology S.A. | -80% |

2

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

Individual and institutional investors alike in these issues probably learned again the truism that real investing is not a game, and success is not assured. One cannot ignore valuations and expect to achieve successful results. Fundamentals matter.

In managing the Ave Maria Value Fund, we will continue to pursue a risk-averse, value-focused investment approach that utilizes fundamental security analysis to identify securities available at a discount to intrinsic value. We believe this approach provides the best opportunities to achieve above-average investment results.

The year-end distribution of $0.2764 per share consisted solely of investment income, as there were no realized short or long-term capital gains. The net asset value of the Fund ended the year at $24.05 per share.

Thank you for being a shareholder in the Ave Maria Value Fund.

|

|

Timothy S. Schwartz, CFA | Ryan M. Kuyawa, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

Past performance is no guarantee of future results. Rank in Category is the fund’s total return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1.

3

AVE MARIA VALUE FUND Performance (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Value Fund and the S&P MidCap 400 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense ratio as of 12-31-21 (as disclosed in May 1, 2022 prospectus) | 0.97%* |

Expense ratio for the year ended 12-31-22 | 0.93% |

* | Includes Acquired Fund Fees and Expenses. |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

4

AVE MARIA VALUE FUND Annual Total Rates of Return

Comparison with Major Indices (Unaudited) |

| AVE MARIA

VALUE FUND | S&P MidCap 400

INDEX | S&P 500

INDEX |

2001(a) | 5.3% | -0.5% | -8.5% |

2002 | -9.8% | -14.5% | -22.1% |

2003 | 35.6% | 35.6% | 28.7% |

2004 | 20.1% | 16.5% | 10.9% |

2005 | 5.8% | 12.6% | 4.9% |

2006 | 14.2% | 10.3% | 15.8% |

2007 | -4.0% | 8.0% | 5.5% |

2008 | -36.8% | -36.2% | -37.0% |

2009 | 37.6% | 37.4% | 26.5% |

2010 | 20.5% | 26.7% | 15.1% |

2011 | -1.3% | -1.7% | 2.1% |

2012 | 13.3% | 17.9% | 16.0% |

2013 | 26.2% | 33.5% | 32.4% |

2014 | 2.9% | 9.8% | 13.7% |

2015 | -17.7% | -2.2% | 1.4% |

2016 | 16.4% | 20.7% | 12.0% |

2017 | 17.7% | 16.2% | 21.8% |

2018 | -8.8% | -11.1% | -4.4% |

2019 | 20.5% | 26.2% | 31.5% |

2020 | 6.2% | 13.7% | 18.4% |

2021 | 25.2% | 24.8% | 28.7% |

2022 | 4.2% | -13.1% | -18.1% |

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2022 (Unaudited)

| AVE MARIA

VALUE FUND | S&P MidCap

400

INDEX | S&P 500

INDEX |

3 Years | 11.4% | 7.2% | 7.7% |

5 Years | 8.8% | 6.7% | 9.4% |

10 Years | 8.4% | 10.8% | 12.6% |

20 Years | 8.3% | 10.7% | 9.8% |

Since Inception (b) | 7.4% | 9.0% | 7.3% |

(a) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2001. |

(b) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2022. |

5

AVE MARIA VALUE FUND

Ten Largest Equity Holdings

December 31, 2022 (Unaudited)

| | Shares | | | Company | | Fair Value | | | % of Net Assets | |

| | | 25,500 | | | Texas Pacific Land Corporation | | $ | 59,777,865 | | | | 16.1 | % |

| | | 90,000 | | | Pioneer Natural Resources Company | | | 20,555,100 | | | | 5.5 | % |

| | | 100,180 | | | Chevron Corporation | | | 17,981,308 | | | | 4.9 | % |

| | | 323,900 | | | Schlumberger Ltd. | | | 17,315,694 | | | | 4.7 | % |

| | | 184,000 | | | Haemonetics Corporation | | | 14,471,600 | | | | 3.9 | % |

| | | 104,000 | | | Franco-Nevada Corporation | | | 14,193,920 | | | | 3.8 | % |

| | | 150,000 | | | Chesapeake Energy Corporation | | | 14,155,500 | | | | 3.8 | % |

| | | 330,000 | | | Valvoline, Inc. | | | 10,774,500 | | | | 2.9 | % |

| | | 100,000 | | | Intercontinental Exchange, Inc. | | | 10,259,000 | | | | 2.8 | % |

| | | 506,402 | | | Vontier Corporation | | | 9,788,751 | | | | 2.6 | % |

Asset Allocation (Unaudited)

| | % of Net Assets | |

COMMON STOCKS | | | | |

Sector | | | | |

Communications | | | 1.3 | % |

Consumer Discretionary | | | 9.6 | % |

Consumer Staples | | | 0.8 | % |

Energy | | | 20.6 | % |

Financials | | | 10.6 | % |

Health Care | | | 10.9 | % |

Industrials | | | 10.2 | % |

Materials | | | 7.9 | % |

Real Estate | | | 17.2 | % |

Technology | | | 3.8 | % |

| | | | | |

MONEY MARKET FUNDS, OTHER ASSETS IN EXCESS OF LIABILITIES | | | 7.1 | % |

| | | | 100.0 | % |

6

AVE MARIA VALUE FUND

Schedule of Investments

December 31, 2022

COMMON STOCKS — 92.9% | | Shares | | | Fair Value | |

Communications — 1.3% | | | | | | | | |

Publishing & Broadcasting — 1.3% | | | | | | | | |

Liberty Media Corporation - Liberty Formula One - Series C * | | | 80,000 | | | $ | 4,782,400 | |

| | | | | | | | | |

Consumer Discretionary — 9.6% | | | | | | | | |

Automotive — 1.3% | | | | | | | | |

Gentex Corporation | | | 170,000 | | | | 4,635,900 | |

| | | | | | | | | |

Home & Office Products — 1.8% | | | | | | | | |

Purple Innovation, Inc. * | | | 1,409,490 | | | | 6,751,457 | |

| | | | | | | | | |

Leisure Facilities & Services — 2.5% | | | | | | | | |

Bowlero Corporation * | | | 489,574 | | | | 6,599,457 | |

Madison Square Garden Sports Corporation | | | 15,000 | | | | 2,749,950 | |

| | | | | | | | 9,349,407 | |

Leisure Products — 1.5% | | | | | | | | |

YETI Holdings, Inc. * | | | 132,500 | | | | 5,473,575 | |

| | | | | | | | | |

Retail - Discretionary — 2.5% | | | | | | | | |

RH * | | | 14,000 | | | | 3,740,660 | |

Winmark Corporation | | | 23,700 | | | | 5,589,171 | |

| | | | | | | | 9,329,831 | |

Consumer Staples — 0.8% | | | | | | | | |

Beverages — 0.8% | | | | | | | | |

Remy Cointreau S.A. - ADR | | | 175,550 | | | | 2,946,835 | |

| | | | | | | | | |

Energy — 20.6% | | | | | | | | |

Oil & Gas Producers — 14.2% | | | | | | | | |

Chesapeake Energy Corporation | | | 150,000 | | | | 14,155,500 | |

Chevron Corporation | | | 100,180 | | | | 17,981,308 | |

Pioneer Natural Resources Company | | | 90,000 | | | | 20,555,100 | |

| | | | | | | | 52,691,908 | |

Oil & Gas Services & Equipment — 6.4% | | | | | | | | |

Core Laboratories N.V. | | | 318,000 | | | | 6,445,860 | |

Schlumberger Ltd. | | | 323,900 | | | | 17,315,694 | |

| | | | | | | | 23,761,554 | |

Financials — 10.6% | | | | | | | | |

Banking — 2.5% | | | | | | | | |

Hingham Institution for Savings (The) | | | 34,000 | | | | 9,382,640 | |

| | | | | | | | | |

Institutional Financial Services — 4.6% | | | | | | | | |

CME Group, Inc. | | | 40,000 | | | | 6,726,400 | |

Intercontinental Exchange, Inc. | | | 100,000 | | | | 10,259,000 | |

| | | | | | | | 16,985,400 | |

7

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

COMMON STOCKS — 92.9% (Continued) | | Shares | | | Fair Value | |

Financials — 10.6% (Continued) | | | | | | | | |

Insurance — 3.5% | | | | | | | | |

Brown & Brown, Inc. | | | 117,450 | | | $ | 6,691,126 | |

Markel Corporation * | | | 4,850 | | | | 6,389,827 | |

| | | | | | | | 13,080,953 | |

Health Care — 10.9% | | | | | | | | |

Biotech & Pharma — 2.5% | | | | | | | | |

Mirion Technologies, Inc. * | | | 1,390,000 | | | | 9,187,900 | |

| | | | | | | | | |

Health Care Facilities & Services — 2.5% | | | | | | | | |

Chemed Corporation | | | 18,300 | | | | 9,340,869 | |

| | | | | | | | | |

Medical Equipment & Devices — 5.9% | | | | | | | | |

Alcon, Inc. | | | 110,000 | | | | 7,540,500 | |

Haemonetics Corporation * | | | 184,000 | | | | 14,471,600 | |

| | | | | | | | 22,012,100 | |

Industrials — 10.2% | | | | | | | | |

Aerospace & Defense — 1.3% | | | | | | | | |

HEICO Corporation - Class A | | | 40,000 | | | | 4,794,000 | |

| | | | | | | | | |

Electrical Equipment — 7.3% | | | | | | | | |

A.O. Smith Corporation | | | 113,000 | | | | 6,468,120 | |

Allegion plc | | | 37,500 | | | | 3,947,250 | |

Otis Worldwide Corporation | | | 85,000 | | | | 6,656,350 | |

Vontier Corporation | | | 506,402 | | | | 9,788,751 | |

| | | | | | | | 26,860,471 | |

Industrial Support Services — 1.6% | | | | | | | | |

U-Haul Holding Company | | | 10,800 | | | | 650,052 | |

U-Haul Holding Company - Series N | | | 97,200 | | | | 5,344,056 | |

| | | | | | | | 5,994,108 | |

Materials — 7.9% | | | | | | | | |

Chemicals — 2.9% | | | | | | | | |

Valvoline, Inc. | | | 330,000 | | | | 10,774,500 | |

| | | | | | | | | |

Metals & Mining — 5.0% | | | | | | | | |

Barrick Gold Corporation | | | 175,000 | | | | 3,006,500 | |

Franco-Nevada Corporation | | | 104,000 | | | | 14,193,920 | |

Newmont Corporation | | | 30,000 | | | | 1,416,000 | |

| | | | | | | | 18,616,420 | |

Real Estate — 17.2% | | | | | | | | |

Real Estate Owners & Developers — 17.2% | | | | | | | | |

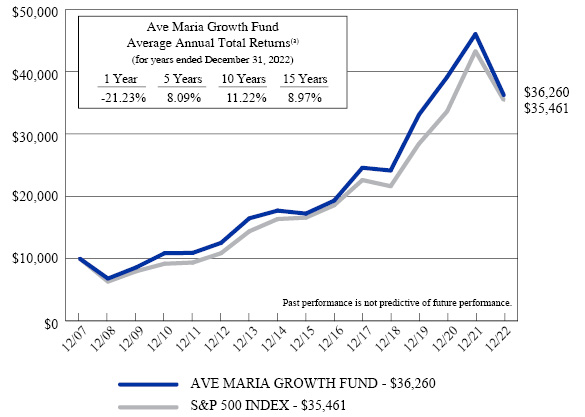

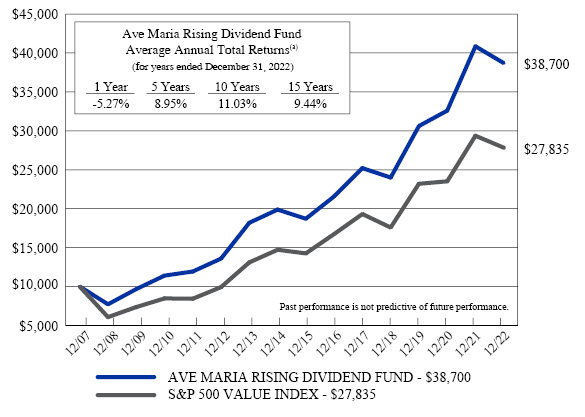

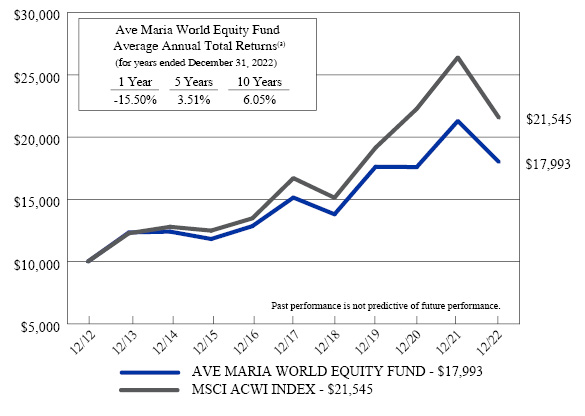

St. Joe Company (The) | | | 103,000 | | | | 3,980,950 | |