Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 28 Feb 23, 6:21am

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2023

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

Banco Santander, S.A.

TABLE OF CONTENTS

Item | ||

| 1 | Investor Day Presentation – Ana Botín, Executive Chair |

Item 1

1 Ana Botín Executive Chair

Important information Forward - looking statements Santander hereby warns that this document contains “forward - looking statements” as per the meaning of the U . S . Private Securities Litigation Reform Act of 1995 . Such statements can be understood through words and expressions like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “CoE”, “RoTE”, “TNAV”, “efficiency ratio”, “target”, “goal”, “objective”, “estimate”, “future”, “commitment”, “commit”, “focus”, “pledge” and similar expressions . They include (but are not limited to) statements on future business development, shareholder remuneration policy and NFI . However, risks, uncertainties and other important factors may lead to developments and results to differ materially from those anticipated, expected, projected or assumed in forward - looking statements . In particular, references in this document to any metric, data or plan relating to the periods 2023 to 2025 are stated as forward - looking statements and should be understood as targets or goals . The following important factors (and others described elsewhere in this document and other risk factors, uncertainties or contingencies detailed in our most recent Form 20 - F and subsequent 6 - Ks filed with, or furnished to, the SEC), as well as other unknown or unpredictable factors, could affect our future development and results and could lead to outcomes materially different from what our forward - looking statements anticipate, expect, project or assume : ( 1 ) general economic or industry conditions (e . g . , an economic downturn ; higher volatility in the capital markets ; inflation ; deflation ; changes in demographics, consumer spending, investment or saving habits ; and the effects of the war in Ukraine or the COVID - 19 pandemic in the global economy) in areas where we have significant operations or investments ; ( 2 ) climate - related conditions, regulations, targets and weather events ; ( 3 ) exposure to various market risks (e . g . , risks from interest rates, foreign exchange rates, equity prices and new benchmark indices) ; ( 4 ) potential losses from early loan repayment, collateral depreciation or counterparty risk ; ( 5 ) political instability in Spain, the UK, other European countries, Latin America and the US ; ( 6 ) legislative, regulatory or tax changes (including regulatory capital and liquidity requirements), especially in view of the UK s exit from the European Union and increased regulation prompted by financial crises ; ( 7 ) acquisition integration challenges arising from deviating management’s resources and attention from other strategic opportunities and operational matters ; and ( 8 ) uncertainty over the scope of actions that may be required by us, governments and others to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and industry and governmental standards and regulations ; and ( 9 ) changes affecting our access to liquidity and funding on acceptable terms, especially due to credit spread shifts or credit rating downgrades for the entire group or core subsidiaries . Forward looking statements are based on current expectations and future estimates about Santander’s and third - parties’ operations and businesses and address matters that are uncertain to varying degrees, including, but not limited to developing standards that may change in the future ; plans, projections, expectations, targets, objectives, strategies and goals relating to environmental, social, safety and governance performance, including expectations regarding future execution of Santander’s and third - parties’ energy and climate strategies, and the underlying assumptions and estimated impacts on Santander’s and third - parties’ businesses related thereto ; Santander’s and third - parties’ approach, plans and expectations in relation to carbon use and targeted reductions of emissions ; changes in operations or investments under existing or future environmental laws and regulations ; and changes in government regulations and regulatory requirements, including those related to climate - related initiatives . Forward - looking statements are aspirational, should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this document, are informed by the knowledge, information and views available on such date and are subject to change without notice . Santander is not required to update or revise any forward - looking statements, regardless of new information, future events or otherwise, except as required by applicable law . Non - IFRS and alternative performance measures This document contains financial information prepared according to International Financial Reporting Standards (IFRS) and taken from our consolidated financial statements, as well as alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 , and other non - IFRS measures . The APMs and non - IFRS measures were calculated with information from Grupo Santander ; however, they are neither defined or detailed in the applicable financial reporting framework nor audited or reviewed by our auditors . We use these APMs and non - IFRS measures when planning, monitoring and evaluating our performance . We consider them to be useful metrics for our management and investors to compare operating performance between periods . 2

Nonetheless, the APMs and non - IFRS measures are supplemental information ; their purpose is not to substitute IFRS measures . Furthermore, companies in our industry and others may calculate or use APMs and non - IFRS measures differently, thus making them less useful for comparison purposes . For further details on APMs and Non - IFRS Measures, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2021 Annual Report on Form 20 - F filed with the U . S . Securities and Exchange Commission (the SEC) on 1 March 2022 , as updated by the Form 6 - K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the section “Alternative performance measures” of the annex to the Banco Santander, S . A . (Santander) 2022 Annual Report, published as Inside Information on 28 February 2023 . These documents are available on Santander’s website (www . santander . com) . Underlying measures, which are included in this document, are non - IFRS measures . The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the businesses included and local applicable accounting principles of our public subsidiaries in such geographies . Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries . Non - financial information This document contains, in addition to financial information, non - financial information (NFI), including environmental, social and governance - related metrics, statements, goals, commitments and opinions . NFI is included to comply with Spanish Act 11 / 2018 on non - financial information and diversity and to provide a broader view of our impact . NFI is not audited nor, save as expressly indicated under ‘Auditors’ review’ of the 2022 Annual Report, reviewed by an external auditor . NFI is prepared following various external and internal frameworks, reporting guidelines and measurement, collection and verification methods and practices, which are materially different from those applicable to financial information and are in many cases emerging and evolving . NFI is based on various materiality thresholds, estimates, assumptions, judgments and underlying data derived internally and from third parties . NFI is thus subject to significant measurement uncertainties, may not be comparable to NFI of other companies or over time or across periods and its inclusion is not meant to imply that the information is fit for any particular purpose or that it is material to us under mandatory reporting standards . NFI is for informational purposes only and without any liability being accepted in connection with it except where such liability cannot be limited under overriding provisions of applicable law . Not a securities offer This document and the information it contains does not constitute an offer to sell nor the solicitation of an offer to buy any securities . Past performance does not indicate future outcomes Statements about historical performance or growth rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will necessarily be the same or higher than in a previous period . Nothing in this document should be taken as a profit and loss forecast . Third party information In this document, Santander relies on and refers to certain information and statistics obtained from publicly - available information and third - party sources, which it believes to be reliable . Neither Santander nor its directors, officers and employees have independently verified the accuracy or completeness of any such publicly - available and third - party information, make any representation or warranty as to the quality, fitness for a particular purpose, non - infringement, accuracy or completeness of such information or undertake any obligation to update such information after the date of this report . In no event shall Santander be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for inaccuracies or errors in, or omission from, such publicly - available and third - party information contained herein . Any sources of publicly - available information and third - party information referred or contained herein retain all rights with respect to such information and use of such information herein shall not be deemed to grant a license to any third party . 3 Important information

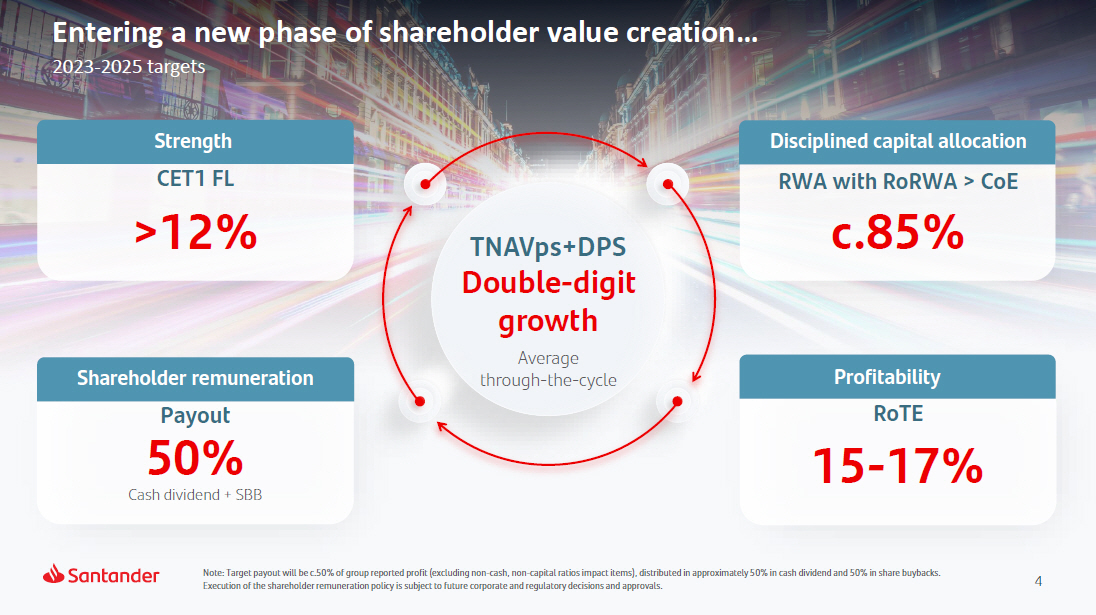

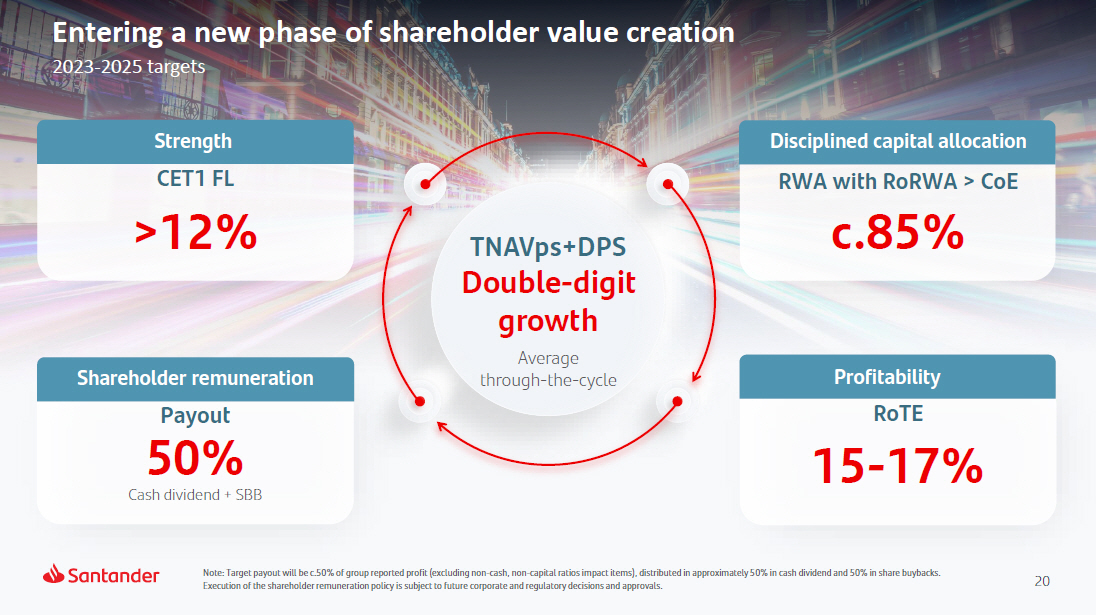

4 Entering a new phase of shareholder value creation… 2023 - 2025 targets TNAVps+DPS Doub l e - di g it growth Average through - the - cycle Profitability RoTE 15 - 17 % >12% Strength CET1 FL c.85% Disciplined capital allocation RWA with RoRWA > CoE Pa y out Cash dividend + SBB 50% Shareholder remuneration Note: Target payout will be c.50% of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

5 Global and network businesses to increase local banks’ profitability >30% of revenue currently from global and network businesses SCIB, WM&I, PagoNxt, Auto business As a result, we aim to be the most profitable bank in every market We are Top 3 in profitability in 9 out of our 10 markets Retail & Commercial Banks … given our unique combination: local leadership with global scale & network

6 1) Underlying. 2) Including acquisition of SCUSA minority interest which closed on 31 January 2022 and the acquisition of Amherst Pierpont. 3) Fiscal year total shareholder remuneration: cash dividend + share buybacks, not including scrip dividends. 2022 final cash dividend subject to shareholder approval. Our business model brings profitable growth, capital strength and shareholder remuneration… 8 . 3 10 . 1 10 . 6 10 . 8 11 . 3 11 . 4 11 . 9 12 . 0 11 . 0 11 . 0 11.1 11.8 12 . 1 11 . 8 4 . 2 5 . 8 6 . 6 6 . 6 7 . 5 8 . 1 8 . 3 8 . 7 Growth and profitability Capital strength and shareholder remuneration Attributable profit evolution 1 (€bn) CET1 evolution (%) RoTE evolution 1 (%) 2017 2014 2015 2016 2022 2018 2019 2020 2021 2 9.6 1 3 .4 12.7 1 2 .0 2020 2021 2022 2013 2014 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2020 2021 2022 2013 2014 9 . 6 1 . 1 2 . 3 2 . 5 3 . 0 3 . 3 1 . 7 0 . 5 3 . 5 2 0 14 2 0 15 2 0 16 2 0 17 2 0 18 2 0 19 2 0 20 2 0 21 2 0 22 Shareholder remuneration 3 (€bn) Cash SBB 3.8 COVID crisis C O V ID crisis 7.4 C O V ID crisis 5.1

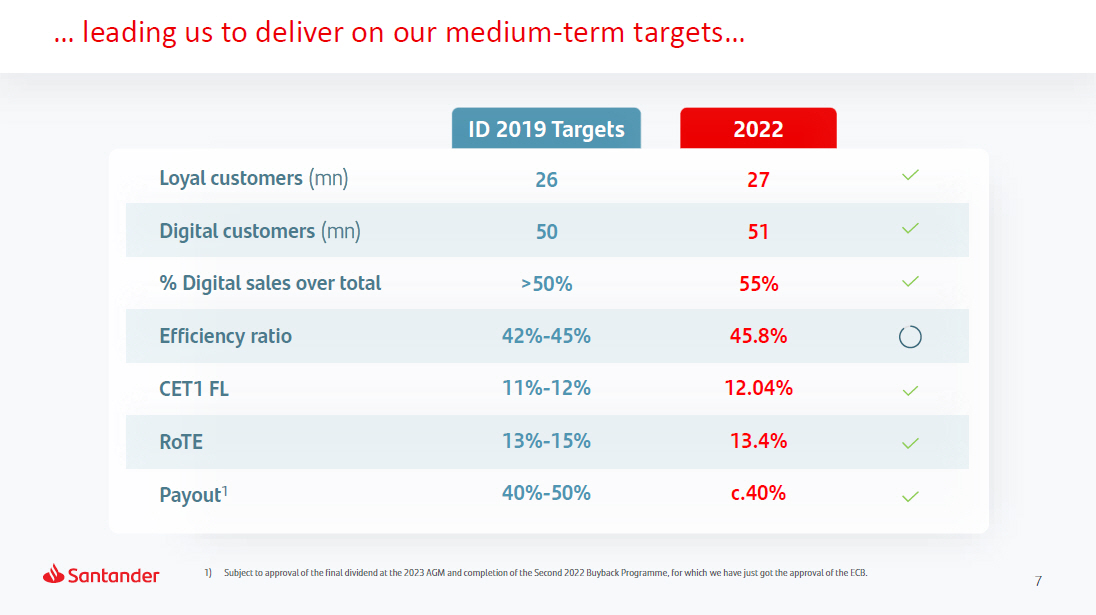

7 … leading us to deliver on our medium - term targets… 1) Subject to approval of the final dividend at the 2023 AGM and completion of the Second 2022 Buyback Programme, for which we have just got the approval of the ECB. ID 2019 Targets 2022 Loyal customers (mn) 26 27 Digital customers (mn) 50 51 % Digital sales over total >50% 55% Efficiency ratio 42% - 45% 45.8% CET1 FL 11% - 12% 12.04% RoTE 13% - 15% 13.4% Payout 1 40% - 50% c.40%

8 1) Constant €. 2) 2022 vs. 2021 in € +12%. … and meeting our 2022 targets Our 2022 ac hi ev ement Our 2022 t a r ge t s +6% 2 Growth Revenue 1 Mid - single digit growth c . 4 5 % Profitability C /I R o TE 45.8 % 13.4% >13% c . 1 2 % Strength C ET1 FL C oR 12.04 % 99bps < 100 b p s TN A V ps + Cash DPS +6% EPS growth +23%

9 Our Aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities Our how Everything we do should be Simple, Personal and Fair Our Purpose To help people and businesses prosper Looking ahead: who we are and what guides us remains

10 Our business model is based on unique competitive advantages In - market and Global Geography Business Balance sheet Digital bank with branches

11 CUSTOMER FOCUS and SCALE powered by higher network contribution will drive value creation focus Capi t al RWA with RoRWA > CoE Digital Bank with Branches 2 3 5 4 Customer activity Transactions volume growth 1) Those customers who meet transactionality threshold in the past 90 days. Customer centric Net new customers (total, active 1 ) 1 Network contribution Higher revenue and lower costs Network revenue Simplification & automation Cost per customer and efficiency ratio Value creation RoTE, TNAVps + DPS

12 Our customers value our ESG focus – a growth opportunity 1) Since 2019. Additional 5mn people by 2025 with access and finance initiatives. Does not include financial education. Green Finance raised and facilitated €120 b n €94. 5 bn Socially responsible Investments (AuM) €100 b n €53 b n People financially emp o w e r ed 1 15mn >10mn 2019 – 2022 delivery 2025 targets focus

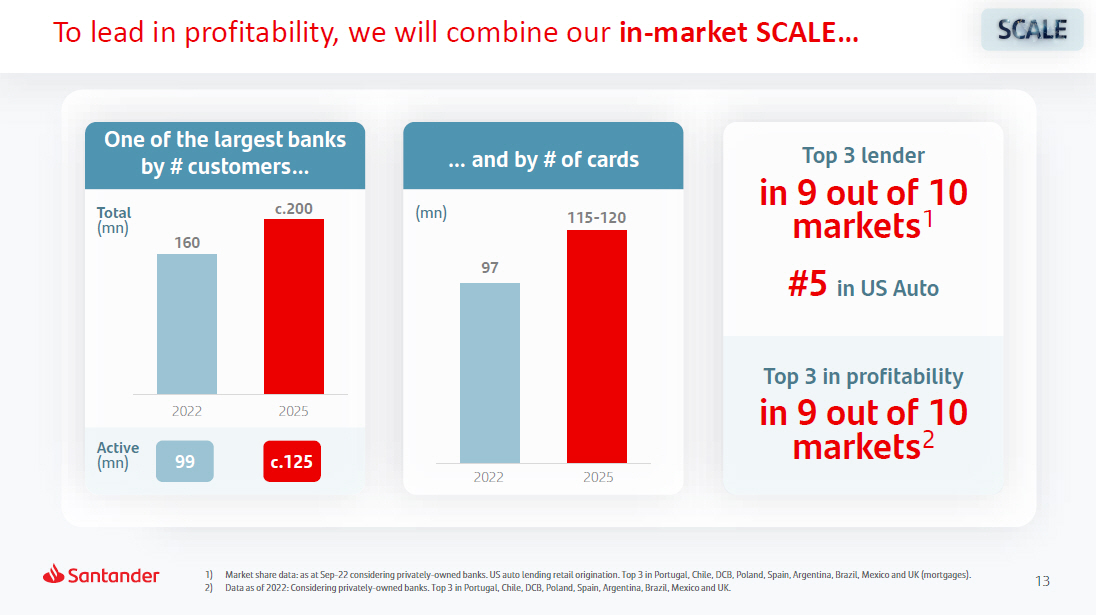

13 1) Market share data: as at Sep - 22 considering privately - owned banks. US auto lending retail origination. Top 3 in Portugal, Chile, DCB, Poland, Spain, Argentina, Brazil, Mexico and UK (mortgages). 2) Data as of 2022: Considering privately - owned banks. Top 3 in Portugal, Chile, DCB, Poland, Spain, Argentina, Brazil, Mexico and UK. To lead in profitability, we will combine our in - market SCALE… One of the largest banks by # customers… A c t i v e ( mn ) 160 2025 2022 c . 200 99 c. 1 25 T ot al ( mn ) … and by # of cards ( mn ) 97 2025 2022 115 - 120 Top 3 in profitability in 9 out of 10 markets 2 Top 3 lender in 9 out of 10 m a r k ets 1 #5 in US Auto

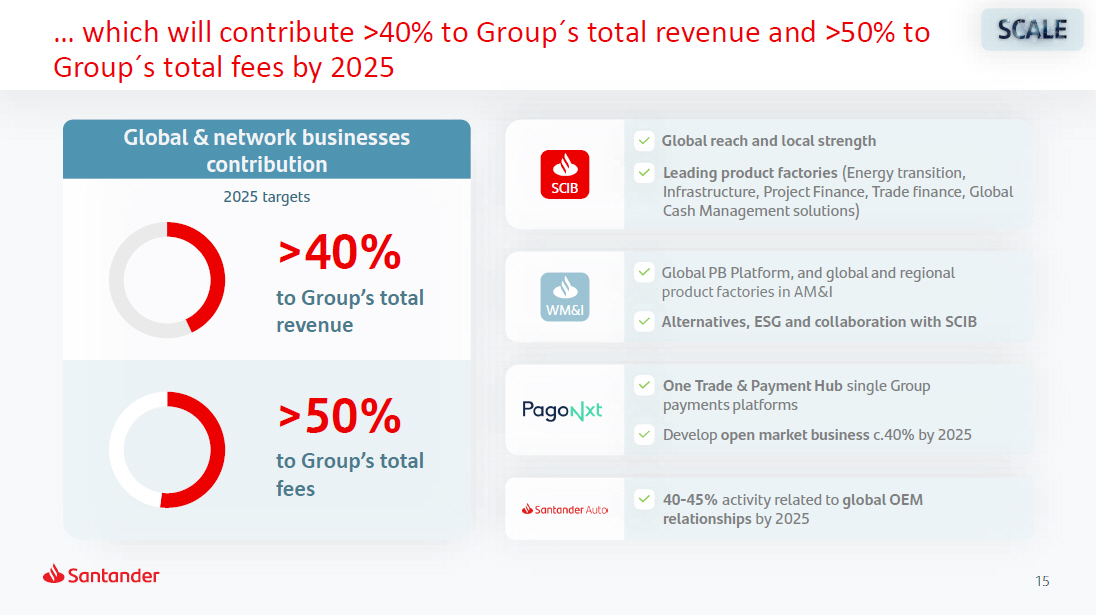

14 c.15% CAGR 22 - 25 Total t r an sactions processed 2 c.10% CAGR 22 - 25 Private Banking network AuMs … with our Global & Network SCALE… Network contribution to our banks 2025 t a r g ets 2022 €51bn Private Banking network AuMs 21% % of total Private Banking AuMs WM&I Leader in the corridors Latam - NA – EU in Private Banking 97mm Cards managed globally c.31bn Total transactions processed 2 Payments #3 Latam Getnet Merchant Acquiring Business 7 - 8 % CAGR 22 - 25 Auto loans and leases c.€160bn Auto loans and leases c.40% Activity from global OEMs relationships Auto #1 Europe and Latam c.10% CAGR 22 - 25 Cross - border and collaboration revenue 1 47% % of total CIB revenue €3.4bn Cross - border and collaboration revenue SCIB Leader in Latam and Iberia >30 % by 2025 P ag oNx t ’ s EBITDA margin 1) In constant €. 2) Total transactions include merchant payments, cards and electronic A2A payments.

15 … which will contribute >40% to Group Dz s total revenue and >50% to Group Dz s total fees by 2025 Global & network businesses contribution 2025 targets >40% to Group’s total revenue >50% to Group’s total fees Global reach and local strength Leading product factories (Energy transition, Infrastructure, Project Finance, Trade finance, Global Cash Management solutions) S C I B W M & I Global PB Platform, and global and regional product factories in AM&I Alternatives, ESG and collaboration with SCIB One Trade & Payment Hub single Group payments platforms Develop open market business c.40% by 2025 40 - 45% activity related to global OEM relationships by 2025

16 We will converge our Consumer & Commercial customers to a common operating and business model – One Transformation… Santander b a n k s Less time spent on operations in branches… % Operational Activity in Branches Santander P ortu g a l S a n t a nd er b a n k s … with a high level of automation # Operational FTEs per mn Customers Customer value - added branch network Lean processes Better customer experience Digital platform P r opri e t a ry t e c h n o l ogy 3 - 5 x We are executing One Transformation based on proven operating model and technology 20 - 50 c.10 c.50 Data as of 31 December 2022.

17 … which will drive the Group’s journey to a digital bank with branches powered by Santander network 4 5 .8 % Operating performance improvement - Cost to income (%) 200 – 250 bps 100 – 150 bps 2022 c .4 2 % One Transformation Global Tech capabilities & others 2025 target Consumer and commercial customers b u s i ne s s Global & network businesses SCIB, WM&I, Auto, PagoNxt, Cards 50 - 75bps • Strengthening of SCIB and WM&I product factories; tapping on Green Finance opportunity • Deploying common platform in auto loans, leasing, subscription, BaaS for partners in Auto • Synergies from Global cards, Getnet & payments hub • Full cloud migration • Consolidation of Operations & Tech in Europe • Global cyber, software re - usability and data capabilities • Simplification & automation • In US, efficiencies in Consumer and Commercial of c.$400mn in inflationary period • Positive sensitivity to increasing rates

18 1) Pre - provision profit. Our DIVERSIFICATION provides us with a better risk - return profile than our peers 1 Simple, transparent and easy to analyze balance sheet 2 Stable deposit structure , c.80% of high - quality retail customer deposits 3 Low - risk business profile , 96% low - risk loans 4 Positive sensitivity to increasing rates in most countries 5 Strong capital ratio , focused on efficiency and asset rotation PPP 1 2.2x uncovered NPLs NPL and coverage 65% 67% 73% 74% 65% 67% 68% 76% 5.2% 4.4% 3.9% 4.1% 3.7% 3.3% 3.2% 0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 5.6% 180% 160% 140% 3.2% 120% 3.1% 100% 71% 68% 80% 60% 40% 20% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 NPL Coverage NPL

19 Our KPIs by 2025 1) Target payout will be c.50% of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. 2) Those customers who meet transactionality threshold in the past 90 days. 3) Total transactions include merchant payments, cards and electronic A2A payments. Target c.+8% CAGR 2022 - 25. 4) Since 2019. 5) Since 2019. Additional 5mn people by 2025 with access and finance initiatives. Does not include financial education. TNAVps + DPS growth 2023 - 2025 RoTE (%) 13.4 15 - 17 Payout (Cash + SBB) 1 (%) 40 50 EPS Growth (%) 23 Double - digit Customer centric Total customers (mn) 160 c.200 Active customers (mn) 2 99 c.125 Simplification & automation Network contribution Efficiency ratio (%) 45.8 c.42 Global & network businesses contribution to total revenue (%) >30 >40 Global & network businesses contribution to total fees (%) c.40 >50 Customer activity Transactions volume per active customer (#/month) 3 27 c.+8% Capital CET1 FL (%) 12.04 >12 RWA with RoRWA>CoE (%) 80 c.85 Green financed raised & facilitated (€bn) 4 94.5 120 Socially responsible Investments (AuM) (€bn) 53 100 ESG People financially empowered (mn) 5 >10 15 Women in leadership positions (%) c.29 35 Equal pay gap (%) c.1 c.0 2022 2025 targets 1 2 3 4 5

20 Entering a new phase of shareholder value creation 2023 - 2025 targets Profitability RoTE 15 - 17 % >12% Strength CET1 FL c.85% Disciplined capital allocation RWA with RoRWA > CoE Pa y out Cash dividend + SBB 50% Shareholder remuneration Note: Target payout will be c.50% of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. TNAVps+DPS Doub l e - di g it growth Average through - the - cycle

2 1 Our purpose is to help people and business prosper. Our culture is based on believing that everything we do should be: Thank You.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Santander, S.A. | ||||

| Date: | February 28, 2023 | By: | /s/ Pedro de Mingo Kaminouchi | |

| Name: | Pedro de Mingo Kaminouchi | |||

| Title: | Head of Regulatory Compliance | |||