Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 28 Feb 23, 6:24am

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2023

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

Banco Santander, S.A.

TABLE OF CONTENTS

Item | |

| 1 | Investor Day Presentation – José García Cantera, Group CFO |

Item 1

1 José García Cantera Group CFO

Important information Forward - looking statements Santander hereby warns that this document contains “forward - looking statements” as per the meaning of the U . S . Private Securities Litigation Reform Act of 1995 . Such statements can be understood through words and expressions like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “CoE”, “RoTE”, “TNAV”, “efficiency ratio”, “target”, “goal”, “objective”, “estimate”, “future”, “commitment”, “commit”, “focus”, “pledge” and similar expressions . They include (but are not limited to) statements on future business development, shareholder remuneration policy and NFI . However, risks, uncertainties and other important factors may lead to developments and results to differ materially from those anticipated, expected, projected or assumed in forward - looking statements . In particular, references in this document to any metric, data or plan relating to the periods 2023 to 2025 are stated as forward - looking statements and should be understood as targets or goals . The following important factors (and others described elsewhere in this document and other risk factors, uncertainties or contingencies detailed in our most recent Form 20 - F and subsequent 6 - Ks filed with, or furnished to, the SEC), as well as other unknown or unpredictable factors, could affect our future development and results and could lead to outcomes materially different from what our forward - looking statements anticipate, expect, project or assume : ( 1 ) general economic or industry conditions (e . g . , an economic downturn ; higher volatility in the capital markets ; inflation ; deflation ; changes in demographics, consumer spending, investment or saving habits ; and the effects of the war in Ukraine or the COVID - 19 pandemic in the global economy) in areas where we have significant operations or investments ; ( 2 ) climate - related conditions, regulations, targets and weather events ; ( 3 ) exposure to various market risks (e . g . , risks from interest rates, foreign exchange rates, equity prices and new benchmark indices) ; ( 4 ) potential losses from early loan repayment, collateral depreciation or counterparty risk ; ( 5 ) political instability in Spain, the UK, other European countries, Latin America and the US ; ( 6 ) legislative, regulatory or tax changes (including regulatory capital and liquidity requirements), especially in view of the UK s exit from the European Union and increased regulation prompted by financial crises ; ( 7 ) acquisition integration challenges arising from deviating management’s resources and attention from other strategic opportunities and operational matters ; and ( 8 ) uncertainty over the scope of actions that may be required by us, governments and others to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and industry and governmental standards and regulations ; and ( 9 ) changes affecting our access to liquidity and funding on acceptable terms, especially due to credit spread shifts or credit rating downgrades for the entire group or core subsidiaries . Forward looking statements are based on current expectations and future estimates about Santander’s and third - parties’ operations and businesses and address matters that are uncertain to varying degrees, including, but not limited to developing standards that may change in the future ; plans, projections, expectations, targets, objectives, strategies and goals relating to environmental, social, safety and governance performance, including expectations regarding future execution of Santander’s and third - parties’ energy and climate strategies, and the underlying assumptions and estimated impacts on Santander’s and third - parties’ businesses related thereto ; Santander’s and third - parties’ approach, plans and expectations in relation to carbon use and targeted reductions of emissions ; changes in operations or investments under existing or future environmental laws and regulations ; and changes in government regulations and regulatory requirements, including those related to climate - related initiatives . Forward - looking statements are aspirational, should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this document, are informed by the knowledge, information and views available on such date and are subject to change without notice . Santander is not required to update or revise any forward - looking statements, regardless of new information, future events or otherwise, except as required by applicable law . Non - IFRS and alternative performance measures This document contains financial information prepared according to International Financial Reporting Standards (IFRS) and taken from our consolidated financial statements, as well as alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 , and other non - IFRS measures . The APMs and non - IFRS measures were calculated with information from Grupo Santander ; however, they are neither defined or detailed in the applicable financial reporting framework nor audited or reviewed by our auditors . We use these APMs and non - IFRS measures when planning, monitoring and evaluating our performance . We consider them to be useful metrics for our management and investors to compare operating performance between periods . 2

Nonetheless, the APMs and non - IFRS measures are supplemental information ; their purpose is not to substitute IFRS measures . Furthermore, companies in our industry and others may calculate or use APMs and non - IFRS measures differently, thus making them less useful for comparison purposes . For further details on APMs and Non - IFRS Measures, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2021 Annual Report on Form 20 - F filed with the U . S . Securities and Exchange Commission (the SEC) on 1 March 2022 , as updated by the Form 6 - K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the section “Alternative performance measures” of the annex to the Banco Santander, S . A . (Santander) 2022 Annual Report, published as Inside Information on 28 February 2023 . These documents are available on Santander’s website (www . santander . com) . Underlying measures, which are included in this document, are non - IFRS measures . The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the businesses included and local applicable accounting principles of our public subsidiaries in such geographies . Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries . Non - financial information This document contains, in addition to financial information, non - financial information (NFI), including environmental, social and governance - related metrics, statements, goals, commitments and opinions . NFI is included to comply with Spanish Act 11 / 2018 on non - financial information and diversity and to provide a broader view of our impact . NFI is not audited nor, save as expressly indicated under ‘Auditors’ review’ of the 2022 Annual Report, reviewed by an external auditor . NFI is prepared following various external and internal frameworks, reporting guidelines and measurement, collection and verification methods and practices, which are materially different from those applicable to financial information and are in many cases emerging and evolving . NFI is based on various materiality thresholds, estimates, assumptions, judgments and underlying data derived internally and from third parties . NFI is thus subject to significant measurement uncertainties, may not be comparable to NFI of other companies or over time or across periods and its inclusion is not meant to imply that the information is fit for any particular purpose or that it is material to us under mandatory reporting standards . NFI is for informational purposes only and without any liability being accepted in connection with it except where such liability cannot be limited under overriding provisions of applicable law . Not a securities offer This document and the information it contains does not constitute an offer to sell nor the solicitation of an offer to buy any securities . Past performance does not indicate future outcomes Statements about historical performance or growth rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will necessarily be the same or higher than in a previous period . Nothing in this document should be taken as a profit and loss forecast . Third party information In this document, Santander relies on and refers to certain information and statistics obtained from publicly - available information and third - party sources, which it believes to be reliable . Neither Santander nor its directors, officers and employees have independently verified the accuracy or completeness of any such publicly - available and third - party information, make any representation or warranty as to the quality, fitness for a particular purpose, non - infringement, accuracy or completeness of such information or undertake any obligation to update such information after the date of this report . In no event shall Santander be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for inaccuracies or errors in, or omission from, such publicly - available and third - party information contained herein . Any sources of publicly - available information and third - party information referred or contained herein retain all rights with respect to such information and use of such information herein shall not be deemed to grant a license to any third party . 3 Important information

4 Entering a new phase of shareholder value creation 2023 - 2025 targets Profitability RoTE 15 - 17 % >12% Strength CET1 FL c.85% Disciplined capital allocation RWA with RoRWA > CoE Pa y out Cash dividend + SBB 50% Shareholder remuneration Note: Target payout will be c.50% of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. TNAVps+DPS Doub l e - di g it growth Average through - the - cycle

5 Macro framework of our guidance | Market consensus, IMF & forward curves Source: IMF World Economic Outlook, latest estimates available; Bloomberg Forward curve OIS as at 31 - Dec - 22. EUR and USD OIS fwd. curve 1 (%) 5 4 3 2 1Y 2Y USD OIS CURVE 3Y 4Y 5Y EUR OIS ESTR 6M 2023e (Δ22) GDP 1.1% ( - 4.1pp) - 0.6% 1.4% 1.7% 1.2% ( - 4.7pp) ( - 0.6pp) ( - 1.4pp) ( - 1.9pp) CPI 4.9% ( - 3.9pp) 9.0% 3.5% 6.3% 4.7% ( - 0.1pp) ( - 4.6pp) ( - 1.7pp) ( - 4.7pp) 2024e (Δ23e) GDP 2.4% (+1.3pp) 0.9% 1.0% 1.6% 1.5% (+1.5pp) ( - 0.4pp) ( - 0.1pp) (+0.3pp) CPI 3.5% ( - 1.4pp) 3.7% 2.2% 3.9% 3.9% ( - 5.3pp) ( - 1.3pp) ( - 2.4pp) ( - 0.8pp) 2025e (Δ24e) GDP 2.7% (+0.3pp) 2.3% 1.8% 2.1% 2.0% (+1.4pp) (+0.8pp) (+0.5pp) (+0.5pp) CPI 2.3% ( - 1.2pp) 1.8% 2.0% 3.3% 3.0% ( - 1.9pp) ( - 0.2pp) ( - 0.6pp) ( - 0.9pp)

6 Against this backdrop, we are aiming to: Expand customer margins Ensure proper pricing of new deposits Capitalize from higher rates Positive sensitivity to increasing rates in most countries Ensure a strong capital ratio Focusing on capital efficiency and asset rotation Focus on cost efficiency Fostering ONE transformation (process automation & simplification) Optimize risk - reward in higher risk businesses Maintaining a low business risk profile

7 Low business risk profile Conservative financial management Improving p r ofi t ability Capi t al allocation st r a t egy Shareholder value creation

8 L o w

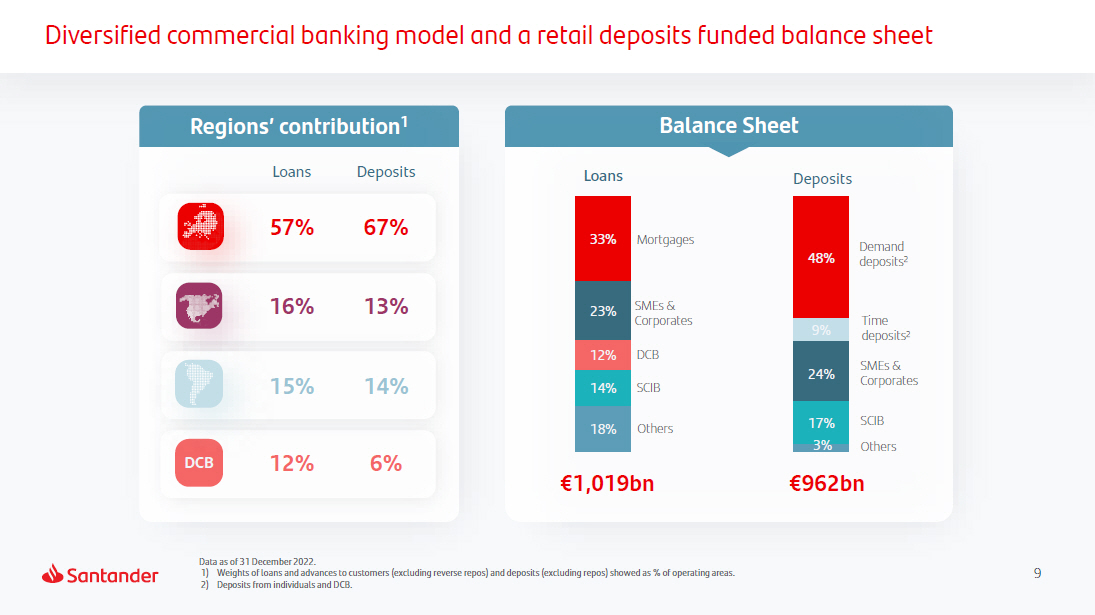

9 33% 23% 12% 14% 18% 48% 9% 24% 17% 3% Diversified commercial banking model and a retail deposits funded balance sheet 16% 13% 12% 6 % 15% 14% DCB Balance Sheet D e posits Demand d epo s it s 2 L o a ns Mort g ag es SMEs & C orpora t es Oth e rs DCB S C IB €1,019bn €962bn SMEs & C orpora t es SCIB Oth e rs Time d epo s it s 2 Regions’ contribution 1 Loans Deposits 57% 67% Data as of 31 December 2022. 1) Weights of loans and advances to customers (excluding reverse repos) and deposits (excluding repos) showed as % of operating areas. 2) Deposits from individuals and DCB.

10 Balance sheet: 1/3 mortgages primarily in Europe. Very low risk profile Main sensitivity in Spain and UK is to unemployment 33% Mortgages out of total portfolio 79% 7% c.90% Loan - to - values <80% 12 % 2% New business with strong affordability metrics Improved overall risk profile in recent years LTV >80% exposure reducing down c.50% since 2019 12% of portfolio at variable rate Unemployment rate at low levels Average affordability rate 27% Better LTV mix from 2019 to 2022 From 66% average LTV to 62% Reduction of €6bn in LTV >80% (to 16% from 25%) Below historical average unemployment rate O t her s Data as of 31 December 2022.

11 Balance sheet: 23% SMEs & Corporates, mainly in Europe 23% SMEs & Corporates out of total portfolio SMEs 81% 3% 16% Corporates 51% 28% 21% Corporates CRE Average LTV < c.50% in 2022 CRE new business with <1% of new business written above 60% LTV; no new loans for developers Stage 3 : 0.5% of CCB portfolio SMEs c.75% are secured loans Of which, 44% are ICO loans guaranteed at 78% Corporates c.75% of secured loans €12bn with public entities SMEs Coverage 96% Loss absorption 2.4x Corporates Low concentration Corporates Avg. Rating 1 : 5.6 vs 4.7 2018 (out of 9) Corporates NPL coverage of total portfolio > 100% Main credit indicators remain stable: - CoR 23bps - NCOs 22bps Data as of 31 December 2022. 1) Internal rating.

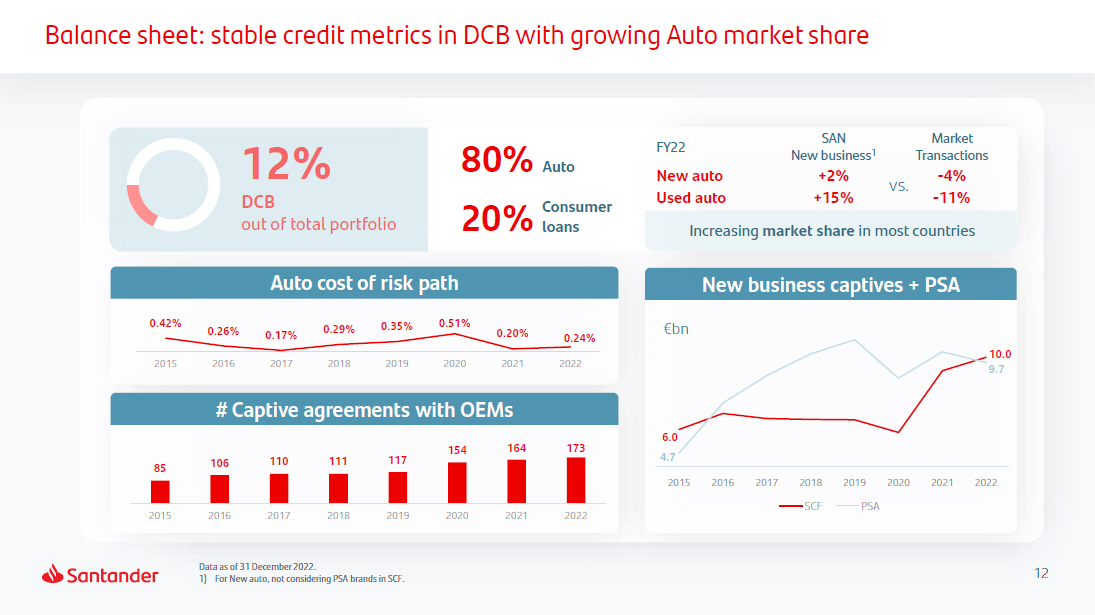

12 10 . 0 9.7 6000 6.0 5000 4.7 4000 70 0 0 80 0 0 90 0 0 10 0 0 0 11 0 0 0 12 0 0 0 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 SCF PSA Balance sheet: stable credit metrics in DCB with growing Auto market share 80% Auto C ons u m er loans New business captives + PSA €bn 12% DCB ou t o f t o t a l por t f ol i o 20% Auto cost of risk path # Captive agreements with OEMs 0 . 42 % 0 . 26 % 0 . 17 % 0 . 29 % 0 . 35 % 0 . 51 % 0 . 20 % 0 . 24 % 0 .2 5 % 0 .2 0 % 0 .1 5 % 0 .3 0 % 0 .3 5 % 0 .5 5 % 0 .5 0 % 0 .4 5 % 0 .4 0 % 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 106 110 111 117 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 85 154 164 173 2 0 1 5 FY22 SAN New business 1 Market T r an s actions New auto +2 % v s. - 4% Used auto +15% - 11% Increasing market share in most countries Data as of 31 December 2022. 1) For New auto, not considering PSA brands in SCF.

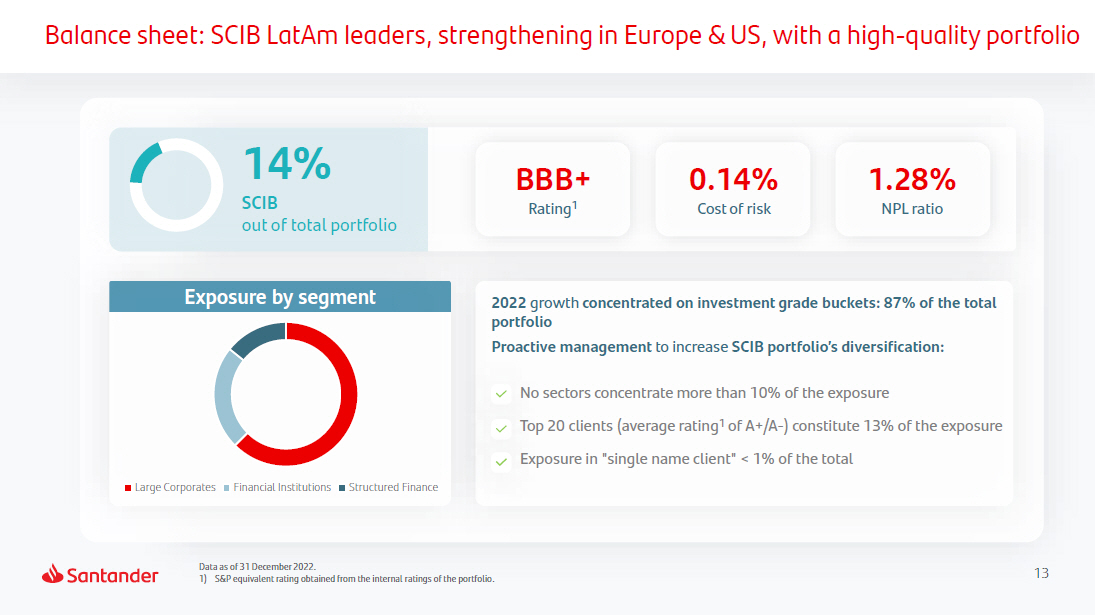

13 Balance sheet: SCIB LatAm leaders, strengthening in Europe & US, with a high - quality portfolio 14% SCIB out of total portfolio BBB+ Rating 1 0.14% Cost of risk 1.28% NPL ratio No sectors concentrate more than 10% of the exposure Top 20 clients (average rating 1 of A+/A - ) constitute 13% of the exposure Exposure in "single name client" < 1% of the total 2022 growth concentrated on investment grade buckets: 87% of the total portfolio Proactive management to increase SCIB portfolio’s diversification: Exposure by segment Large Corporates Financial Institutions Structured Finance Data as of 31 December 2022. 1) S&P equivalent rating obtained from the internal ratings of the portfolio.

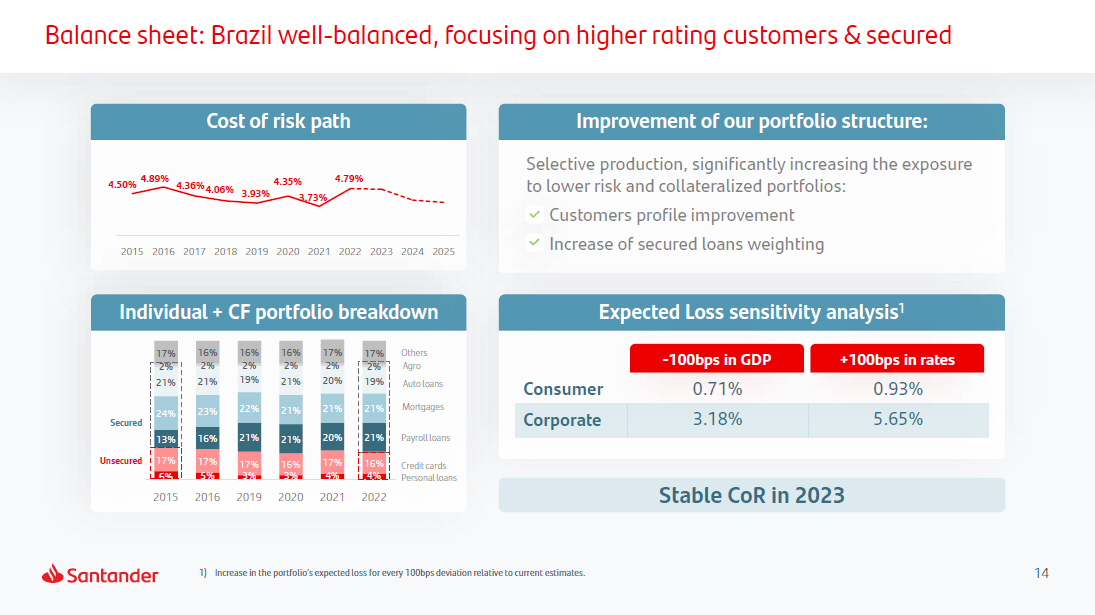

14 Balance sheet: Brazil well - balanced, focusing on higher rating customers & secured Cost of risk path Individual + CF portfolio breakdown Stable CoR in 2023 Improvement of our portfolio structure: Selective production, significantly increasing the exposure to lower risk and collateralized portfolios: Customers profile improvement Increase of secured loans weighting 4.50 % 4.89% 4.36% 4.06% 3.93% 4.35% 3.73% 4.79% 2 .5 0 % 3 .0 0 % 3 .5 0 % 4 .0 0 % 4 .5 0 % 5 .0 0 % 5 .5 0 % 2.0 0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 16% 2% 21% 23% 16% 17% 5% 16% 2% 19% 22% 21% 17% 3% 16% 2% 21% 21% 21% 16% 3% 17% 17% 2% 20% 21% 20% 17% 4% 17% 2% 2% 21% 19 % 24% 21% 21% 13% 17% 16% 6% 4% 2015 2016 2019 2020 2021 2022 Unsecured Secured Payroll loans Credit cards Personal loans O t h e r s Agro Auto loans Mortgages Consumer 0.71% 0.93% Corporate 3.18% 5.65% Expected Loss sensitivity analysis 1 - 100bps in GDP +100bps in rates 1) Increase in the portfolio’s expected loss for every 100bps deviation relative to current estimates.

15 Balance sheet: US Auto Finance, shifting to Prime and more deposit funding Manheim index 2 124 133 138 142 159 177 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 238 198 185 182 Auto loan portfolio mix shift Deposit funding allows us to consistently compete across credit spectrum Illustrative US auto loan contribution margin (CM) 1 % Portfolio credit performance and profitability will benefit from credit mix shift and increased customer deposits, lowering funding costs 2.9 % 2 .9 % 3 .4 % Prior Mix of Credit and Funding Current Mix of Credit and Funding Target Mix of Credit and Funding Y ie l d NCO CM 16% 6.6% 15% 5.8% 15% 5.8% Non - Prime 50% 42% 40% 2019 2022 2025 20 % 34 % 16 % 41 % 17 % 40 % t a r get P ri me Near - P ri me % auto balance funded with dep o si t s 17% 30% 45 - 50 % Recovery sensitivity 1% decrease in used car prices represents a 1% to 2% increase in Net Charge Offs ($) 1) Using constant rates as of 31/01/2023. Illustrative Pre - Tax through - the - cycle contribution of Auto lending (excluding lease), applying wholesale or deposit funding as appropriate given credit mix shift and booking entity. “NCO” represents normal net charge off rate levels through – the - cycle. Not reflective of segment reporting. 2) Data labels represent year - end Manheim index values. Actual and forecasted values based on the 1995 Manheim based index. Projections based on Moody’s Baseline scenario.

16 Balance sheet Balance sheet: just 4% medium - high risk, with adequate risk - reward L o a n s Low risk profile Me d i u m - high risk profile Consumer 4% 96% Mort g ag es SMEs & C orpora t es DCB Oth e rs S C IB 33% 23% 12% 14% 18% € 1,019bn 23% of the total Group provisions 1 Our 4% higher risk portfolio has delivered superior profitability in the last years %LLPs o/Group Ro R W A Consumer 2019 - 2022 1 2019 - 2022 1 5% 2.7% 18% 3.9% Data as of 31 December 2022. 1) Calculated as simple average of the period.

17 We expect CoR to remain at c.1% through - the - cycle and below 1.2% in 2023 10 .1 9 .5 9 .1 8 .9 9 .3 12 .2 7 .4 10 .5 1 . 2 5 1 .18 1 .07 1 .00 1 .00 1 .28 0 .77 0 .99 0 0. 2 0. 4 0. 6 0. 8 1 1. 2 1. 4 0 2 4 6 8 10 12 Credit provisions (€bn) CoR (%) 73 74 65 67 68 76 71 68 4 .4 3 .9 4 .1 3 .7 3 .3 3 .2 3 .2 3 .1 58 60 62 64 66 68 70 72 74 76 78 0 0. 5 1 1. 5 2 2. 5 3 3. 5 4 4. 5 5 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 Coverage (%) NPL (%) 2025 targets Cost of risk c. 0. 3 - 0.4% c.2. 0 - 2.2% Better starting point than previous crisis Downward trend in CoR in Spain Gradual normalization in the UK Very sound asset quality in Mexico Cost of risk in the US will normalize below pre - pandemic levels c. 3. 2 - 3.4% Brazil cost of risk is expected to improve despite one - offs Rest of SA good asset quality levels Stable and predictable DCB c.0. 6 - 0.7% c . 1.0 - 1.1%

18 Conservative

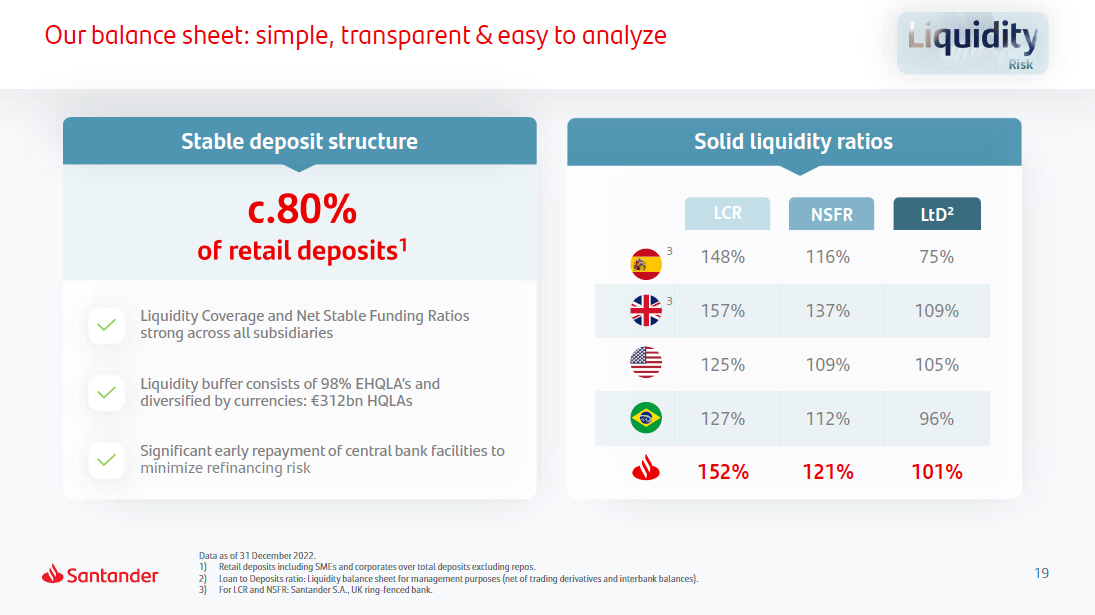

19 Our balance sheet: simple, transparent & easy to analyze Stable deposit structure Solid liquidity ratios R i sk Liquidity Coverage and Net Stable Funding Ratios strong across all subsidiaries Liquidity buffer consists of 98% EHQLA’s and diversified by currencies: €312bn HQLAs Significant early repayment of central bank facilities to minimize refinancing risk L CR NSFR 3 148% 116% 75% 3 157% 137% 109% 125% 109% 105% 127% 112% 96% 152% 121% 101% LtD 2 Data as of 31 December 2022. 1) Retail deposits including SMEs and corporates over total deposits excluding repos. 2) Loan to Deposits ratio: Liquidity balance sheet for management purposes (net of trading derivatives and interbank balances). 3) For LCR and NSFR: Santander S.A., UK ring - fenced bank.

20 13% 3% 5% 13% 19% 16% 18% 10% 2% We will continue rebuilding our EUR ALCO portfolio Bond portfolio 1 €107bn R i sk Rate risk ALCO IRR BB €82bn Li qui d ity port f olio €25bn ALCO IRRBB portfolio €82bn o/w HTC €35bn ALCO portfolio in Spain Continue rebuilding ALCO portfolio: ALCO in Spain would have to increase c.3x to reach neutral rate position €16bn Avg. 2023 target €2bn Avg. 2022 Data as of 31 December 2022. 1) ALCO portfolio: Interest rate risk in the banking book (IRRBB) €82bn; other government bond holdings: €25bn.

21 % RWAs T L A C M R EL Comfortable financial plan that complies with TLAC & MREL requirements 26% 36% 24% 37% 33.8% 23 % 37% Surplus Total ratio Requirement 36.1% 36.1% 21 .9 % 21 .9 % 21 .9 % Banco Santander S.A. funding plan R i sk Rate risk Liquidity position remains solid, with LCR and NFSR above minimum requirements and ample liquidity buffers For 2023, continue fulfilling the 1.5% AT1 and 2% T2 buffers subject to RWA growth MREL & TLAC ratios above regulatory requirements €bn 2023 2024 2025 Hybrids 0.5 - 1.5 2 - 3 2 - 3 SNP+Senior 9 - 10 12 - 13 8 - 9 Covered Bonds 6 - 7 1 - 2 1 - 2 Total issuance 15.5 - 18.5 15 - 18 11 - 14 c.60% of 2023 already executed Focused on optimizing liquidity and refinancing maturities:

22 Conservative approach to FX risk in P&L and capital ratio Financial results Tactically: hedge to protect the Group P&L generated in non - Euro currencies Decisions based on current estimates €1.2bn CET1 ratio: 100% excess 1 hedged 2022 2025 target €23bn c.€20bn €0.6 - 1.0bn FX Exposure Cost of hedge 2 Ri sk 2023 P&L hedge Fully covered Partially covered 1) Excess: We hedge excess capital using European capital requirements regulation (CRR) on all the Group's RWAs, above the capital level of the Group. 2) Cost of hedge is calculated considering the incurred cost due to the realized hedges. Figures updated with the latest information available.

23 Improving

2 4 24 We have ambitious profitability targets in all our businesses Payout 50% Cash + SBB TNAVps +DPS Double - digit growth Average through - the - cycle Aiming to be the most profitable bank where we operate RoTE targets 13.4% 15 - 17 % 2022 9.3% 2025 c.15% 11.1% c.15% 1 18.8% c.19% DCB 13.7% c.15% Note : Target payout will be c . 50 % of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50 % in cash dividend and 50 % in share buybacks . Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals . 1) North America RoTE: calculated using US RoTE adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%.

25 Strong revenue growth ahead… Other r e v en u e 1 R e v en u e 2022 R e v en u e 2025 c.7 - 8% Fee i n c ome c. 8 - 9 % NII c.6 - 7% 22 - 25 Group revenue % CAGR 22 - 25 target (Constant €) 1) Other revenue includes gains (losses) on financial transactions and other operating income.

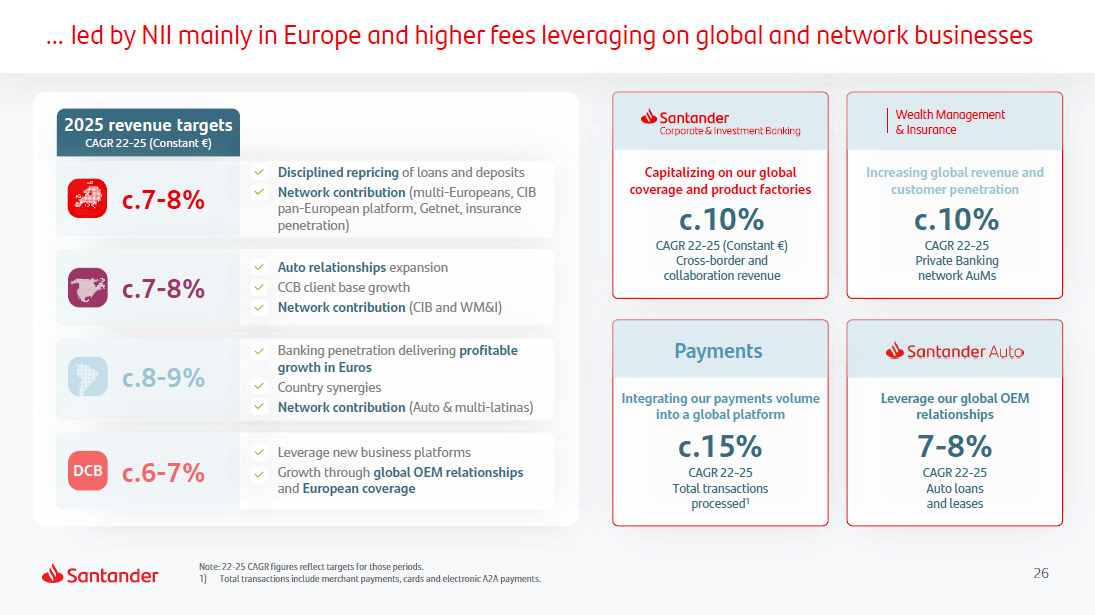

26 … led by NII mainly in Europe and higher fees leveraging on global and network businesses Capitalizing on our global coverage and product factories c.10% CAGR 22 - 25 (Constant €) Cross - border and collaboration revenue Increasing global revenue and customer penetration c.10% CAGR 22 - 25 Private Banking network AuMs Wealth Management & Insurance Leverage our global OEM relationships 7 - 8% CAGR 22 - 25 Auto loans and leases Payments Integrating our payments volume into a global platform c.15% CAGR 22 - 25 Total transactions processed 1 Note: 22 - 25 CAGR figures reflect targets for those periods. 1) Total transactions include merchant payments, cards and electronic A2A payments. 2025 revenue targets CAGR 22 - 25 (Constant €) c. 7 - 8% Disciplined repricing of loans and deposits Network contribution (multi - Europeans, CIB pan - European platform, Getnet, insurance penetration) c. 7 - 8% Auto relationships expansion CCB client base growth Network contribution (CIB and WM&I) c. 8 - 9% c. 6 - 7% D CB Banking penetration delivering profitable growth in Euros Country synergies Network contribution (Auto & multi - latinas) Leverage new business platforms Growth through global OEM relationships and European coverage

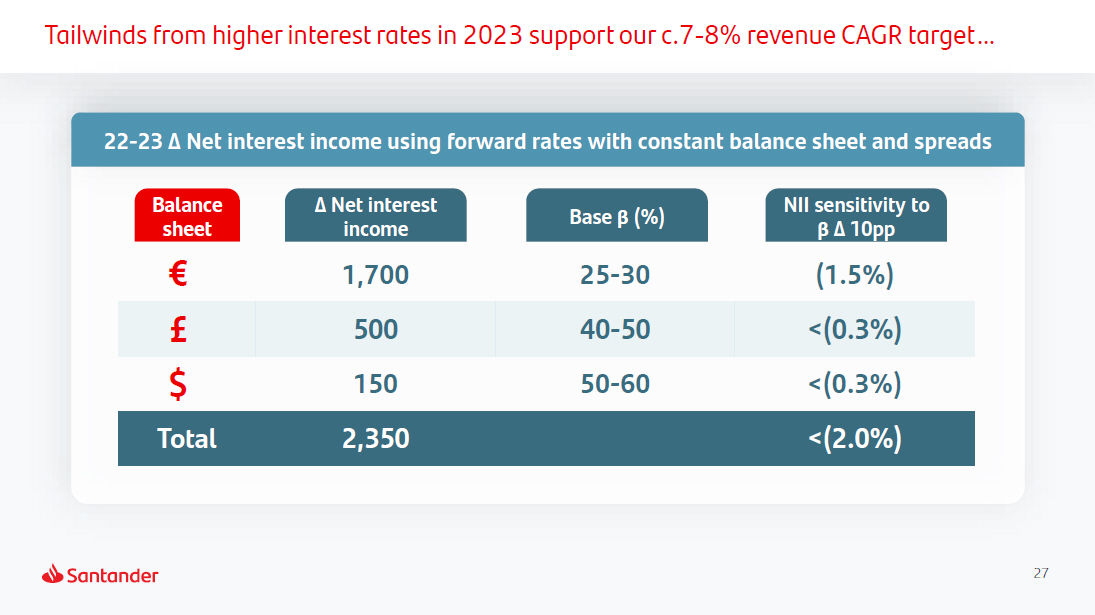

27 Tailwinds from higher interest rates in 2023 support our c.7 - 8% revenue CAGR target… 22 - 23 Δ Net interest income using forward rates with constant balance sheet and spreads € 1,700 25 - 30 (1.5%) £ 500 40 - 5 0 <(0.3%) $ 150 50 - 60 <(0.3%) Total 2,350 <(2.0%) Bala nce sheet Δ Net interest income Base β (%) NII sensitivity to β Δ 10pp

28 … & strong volumes and double - digit growth in fee income in 2023 Net interest income Double - digit growth Base interest rates c.+8pp Volumes c.+2% YoY Spread expansion NIM 1 c.+8bps Fee income Double - digit growth Active customers 2 c.+6% YoY Global and network businesses +3pp increase in contribution 2023 Revenue Dou b l e - d i g i t growth 1) NIM target as Net interest income / Average Earning Assets. 2) Those customers who meet the transactionality threshold in the past 90 days.

29 High - single digit growth in fee income supported by our global and network businesses Active customers 1 increase, +8% CAGR 22 - 25 Main countries reaching c.40% in transactional fees on average Re t ail >40% activity related to global OEM relationships in Europe Strengthening value - added services (e.g. ESG and digital solution) One Trade and Payment Hub serving our Group payments needs Open - market development: business maturity By launching new products and expanding collaboration with SCIB Wealth Management & Insurance 59% 41% Retail c.48% W M &I c.52% SCIB A u t o 2022 2025 Global and network businesses target to reach >50% of total fee income by 2025 c.8 - 9% % CAGR 22 - 25 target (Constant €) 1) Those customers who meet the transactionality threshold in the past 90 days.

30 1) YoY costs growth in real terms, excluding inflation impact. We will maintain our relentless drive to expand operating jaws 2025 target One Transformation Efficiencies , processes simplification and automation , the use of common platforms and synergies across the board (7. 5 %) c. 4 2% Costs containment paired with income growth will lead to positive jaws in most of our geographies 2022 (5%) Cost growth below inflation 1 Imp r ov e efficiency ratio 45.8%

31 Our aim is to remain best - in - class in operating leverage c. 4 2% Simplification and automation Shared tech platforms and services Accumulated inflation will pressure personnel costs c.42% Consolidating contact centers and selected operations into Mexico In US, transformation and efficiency in CCB c. 3 6% Continue being best - in - class in efficiency in inflationary period Synergies in multi - latinas, Getnet, Cards and WM&I c. 4 2% Simplification and automation Evolve to common platforms delivering lower unitary cost DCB 22 - 25 Group efficiency ratio target Efficiency ratio 2025 c . 42 % C o s ts c.4 - 5% % CAGR 22 - 25 Efficiency ratio 2022 4 5 .8 % R e v en u e c.7 - 8% % CAGR 22 - 25 Positive jaws for the Group and all the regions throughout the period Note: Efficiency ratio in current €. 22 - 25 CAGR figures reflect targets for those periods in constant €. 2025 targets Efficiency ratio

32 Corporate Centre weight trending downwards Corporate Centre weight out of Group underlying profit 1 2019 2022 2025 target 18% 13% 7% 1 Reporting changes introduced in 2022 improving allocation criteria and ensuring all costs are considered by business units : MREL/TLAC costs of eligible debt issuances 2 allocated to the business units Cost of funding excess capital (above Group's ratio) charged to operating units FX lower impact from P&L FX hedges 1 2 Our highly liquid balance sheet will now benefit from a normalized interest rate environment 1) % weight over operating areas. Corporate Centre weight for 2019 and 2022 is excluding the negative impact of FX Hedge.

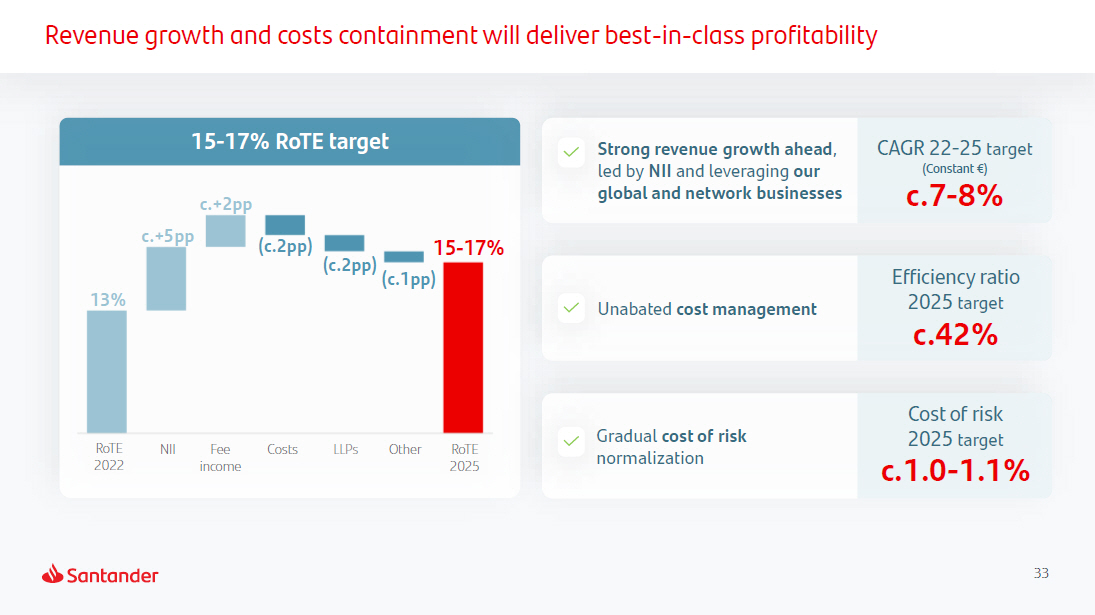

33 Revenue growth and costs containment will deliver best - in - class profitability 15 - 17% RoTE target 15 - 17 % c. + 5 p p c. + 2 p p (c. 2 p p ) 13% (c.2pp) (c.1pp) Fee income LLPs NII C o s ts Other RoTE 2025 RoTE 2022 Strong revenue growth ahead , led by NII and leveraging our global and network businesses CAGR 22 - 25 target (Constant €) c. 7 - 8% Unabated cost management Efficiency ratio 2025 target c.42% Gradual cost of risk normalization Cost of risk 2025 target c.1.0 - 1.1%

34 st r a t egy

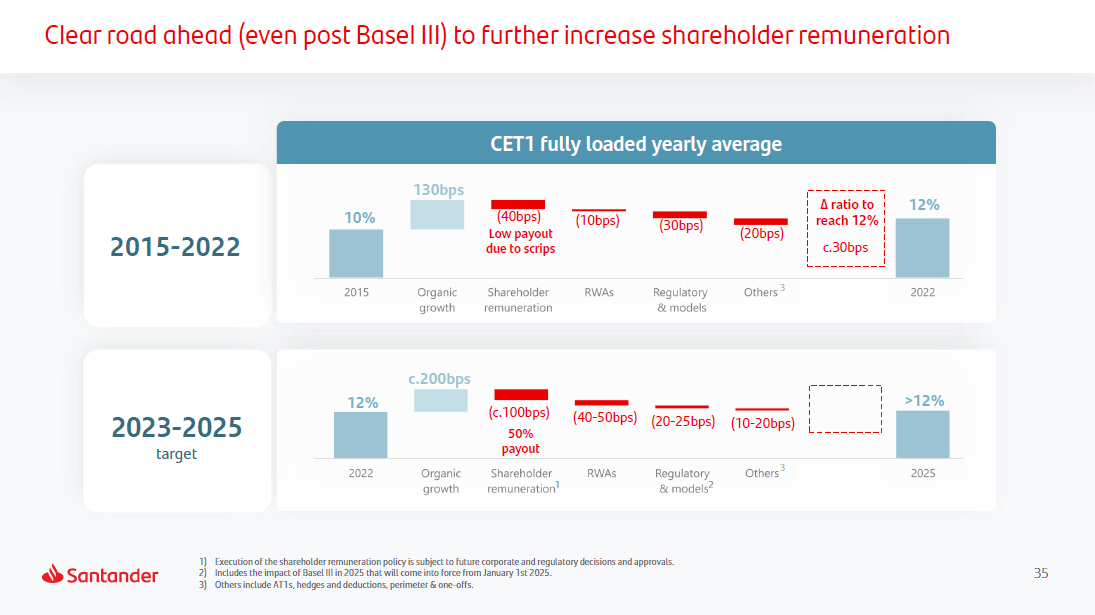

35 Clear road ahead (even post Basel III) to further increase shareholder remuneration c .2 0 0 b p s (c.100bps) (40 - 50bps) (20 - 25bps) >12% 2 3 12% 201 5 - 2022 1 3 0 b p s 3 (10bp s) ( 30b p s) ( 20b p s) (40bps) Low payout due to scrips Δ ratio to reach 12% c.30bps 10% 12% 50 % payout (10 - 20bps) 1 CET1 fully loaded yearly average 2023 - 2025 target 1) Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. 2) Includes the impact of Basel III in 2025 that will come into force from January 1st 2025. 3) Others include AT1s, hedges and deductions, perimeter & one - offs.

36 40% 70% 80% 85% 60% 30% 20% 15% Capital allocation discipline is a key element to improve profitability and create value Maximize capital productivity by: Front book pricing Asset rotation and risk transfer activities RoRWA of New Book 2021 2022 2025 2.1% 2.6% 2.6% 1% 1% 1% 2% 2% 2% 2% 2% 3% 3% 2021 2022 7% 10% 12% 0% 2% 4% 6% 8% 10% 12% 2025 RWAs mobilized vs. total RWAs Value generation and profitability Increase RWAs with EVA>0 2015 2021 2022 EVA <0 portfolios EVA >0 portfolios Base 100 2025 Note: 2025 figures reflect targets for that period.

37 value creation

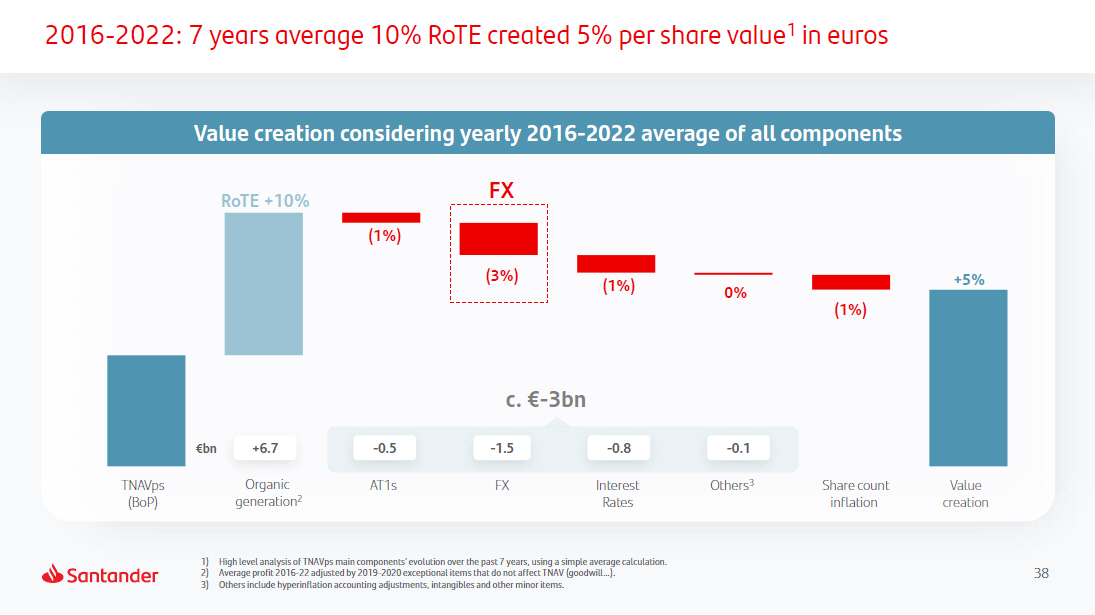

38 2016 - 2022: 7 years average 10% RoTE created 5% per share value 1 in euros € b n - 0.5 - 0.8 - 0.1 c. € - 3bn - 1.5 RoTE +10% ( 1% ) (3%) ( 1% ) 0% ( 1% ) +5% FX Share count inflation Value c r eation Others 3 I n t e r e st Rates FX A T1s +6.7 Organic gen e r ation 2 TN A V ps (BoP) Value creation considering yearly 2016 - 2022 average of all components 1) High level analysis of TNAVps main components’ evolution over the past 7 years, using a simple average calculation. 2) Average profit 2016 - 22 adjusted by 2019 - 2020 exceptional items that do not affect TNAV (goodwill…). 3) Others include hyperinflation accounting adjustments, intangibles and other minor items.

39 2022: value creation offset by interest rates, which will reverse over time 10% ( 1 %) +1% +6% +3% + 6 .3 - 0 .5 + 0 .4 - 4 .0 - 5 .4 4.12 4.37 Will reverse +2% +0.04 +0.11 € b n Buyback Cash DPS 3 Shareholder remuneration Value c r ea tion Others 2 I n t e r e st Rates FX A T1s Organic gen e r ation 1 TN A V ps (BoP) TNAVps bu i l d - up 1) Organic generation net of SBB effect ( - €1.5bn) and Cash DPS ( - €1.8bn). 2) Others include intangibles and other items. 3) 2022 final cash dividend subject to shareholder approval. 0.41 - 0.03 0.03 - 0.24 (6%) - 0.08 ( 2 %)

40 2023 - 2025: TNAVps growth to benefit from higher profitability & share count accretion (SBB) ( 5 %) ( 1 %) 15 - 17% ( 5 %) c . + 2 % Double - digit 1 Looking at specific measures to reduce TNAV impacts Note: 2023 - 2025 TNAV build - up assuming value accretion generated by SBBs on future periods. 1) Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. 2016 - 2022 2023 - 2025 target

41 Entering a new phase of shareholder value creation 2023 - 2025 targets Profitability RoTE 15 - 17 % >12% Strength CET1 FL c.85% Disciplined capital allocation RWA with RoRWA > CoE Pa y out Cash dividend + SBB 50% Shareholder remuneration Note: Target payout will be c.50% of group reported profit (excluding non - cash, non - capital ratios impact items), distributed in approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. TNAVps+DPS Doub l e - di g it growth Average through - the - cycle

4 2 Our purpose is to help people and business prosper. Our culture is based on believing that everything we do should be: Thank You.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Santander, S.A. | |||||

| Date: | February 28, 2023 | By: | /s/ Pedro de Mingo Kaminouchi | ||

| Name: | Pedro de Mingo Kaminouchi | ||||

| Title: | Head of Regulatory Compliance | ||||