UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2009

Date of reporting period: October 31, 2009

Item 1. Reports to Stockholders.

HENNESSY FUNDS

ANNUAL REPORT

OCTOBER 31, 2009

Hennessy Cornerstone Growth Fund

Hennessy Cornerstone Growth Fund, Series II

Hennessy Focus 30 Fund

Hennessy Cornerstone Large Growth Fund

Hennessy Cornerstone Value Fund

Hennessy Total Return Fund

Hennessy Balanced Fund

| Letter to shareholders | 1 |

| Performance overview | |

| Hennessy Cornerstone Growth Fund | 4 |

| Hennessy Cornerstone Growth Fund, Series II | 6 |

| Hennessy Focus 30 Fund | 8 |

| Hennessy Cornerstone Large Growth Fund | 10 |

| Hennessy Cornerstone Value Fund | 12 |

| Hennessy Total Return Fund | 14 |

| Hennessy Balanced Fund | 15 |

| Summaries of investments | |

| Hennessy Cornerstone Growth Fund | 17 |

| Hennessy Cornerstone Growth Fund, Series II | 22 |

| Hennessy Focus 30 Fund | 27 |

| Hennessy Cornerstone Large Growth Fund | 31 |

| Hennessy Cornerstone Value Fund | 36 |

| Hennessy Total Return Fund | 41 |

| Hennessy Balanced Fund | 45 |

| Financial statements | |

| Statements of assets and liabilities | 50 |

| Statements of operations | 52 |

| Statements of changes in net assets | 54 |

| Financial highlights | |

| Hennessy Cornerstone Growth Fund | 64 |

| Hennessy Cornerstone Growth Fund, Series II | 66 |

| Hennessy Focus 30 Fund | 68 |

| Hennessy Cornerstone Large Growth Fund | 70 |

| Hennessy Cornerstone Value Fund | 72 |

| Hennessy Total Return Fund | 74 |

| Hennessy Balanced Fund | 76 |

| Statement of cash flows – Hennessy Total Return Fund | 78 |

| Notes to the financial statements | 79 |

| Report of Independent Registered Public Accounting Firm | 90 |

| Directors and Officers of the Funds | 92 |

| Expense example | 98 |

| Proxy voting policy | 100 |

December, 2009

Dear Hennessy Funds Shareholder:

The past year is one that I believe many investors will be glad to have behind them. At the beginning of the Fund’s fiscal year (November, 2008) the economy and financial markets were in chaos, and it felt as though they were on the brink of collapse following the AIG bailout, Lehman Brothers failure and the mega mergers between some of the country’s largest banks and investment houses. Many investors saw their portfolios and 401K’s cut nearly in half, while at the same time watched the values of their homes tumble; there was truly nowhere for investors to hide from the financial fallout. In my 30 years in the business, I have never witnessed the crisis of confidence we experienced in late February/March of this year. Even the most seasoned, disciplined and long-term investors I know simply had had enough and were pulling money out of the stock market.

Since their lows in March, the major indices have rallied back roughly 50-60%. There is certainly some ground to make up for the markets to return to their pre-recession levels, but I believe we are now in the midst of a recovery and that we should see steady, sustainable growth in the coming years. I actually believe the recovery began in November of 2008, with the first injection of government TARP (Trouble Asset Relief Program) spending. Like anything that is broken, a fix takes time to work, however, I believe that investors had seen such staggering losses that they were not willing to take a wait and see approach with this government stimulus. While the markets will no doubt have their ups and downs, I am confident that the lows of March should be behind us.

While the markets are in recovery, in my opinion, investor confidence is not. The magnitude of the most recent downturn has left investors feeling overwhelmed and distraught, and fear has kept many people on the sidelines, causing them to miss the recent rally. I believe there are several key factors that could push the stock market higher:

| • | During the past year companies have seen their stock prices crushed, and many have taken this as an opportunity to cut costs and position their balance sheets for the future. Companies have de-leveraged themselves, laid off employees, closed unprofitable business lines and taken any available write-offs. As these companies emerge leaner, we expect to see their quarterly |

HENNESSY FUNDS 1-800-966-4354

| | earnings steadily improving, as any additional revenue falls to their bottom lines. |

| • | The Federal Reserve appears to remain committed to very low interest rates. With 30-year U.S. Treasury yields hovering in the 4% range, investors may need to look to the market for more aggressive returns to try to stay ahead of inflation, and I believe this should drive increased investment in high-quality equities. |

| • | The price to sales ratio, one of the tools we use to determine a stock’s value, has returned to normalized historical levels. Over the past ten years the price to sales ratio of the Dow Jones Industrial Average has averaged $1.23. At the market low on March 9th the price to sales ratio of the Dow had dropped to just $0.60, meaning that investors were able to buy a dollar of revenue for just sixty cents. As of the end of September, 2009, this ratio had rebounded to $1.21 and is again within its historical norm. I believe this ratio will hold steady and that stock prices should rise proportionally with any increase in sales. |

| • | U.S. investors are holding an estimated $9 trillion on the sidelines. Once investor confidence starts to build, I believe this will encourage equity investing. Confidence should beget more widespread confidence and investing may beget further investing. |

| • | Banks are steadily regaining strength, with many already paying back their TARP loans. They have begun to lend again to credit-worthy consumers, who in turn have been able to purchase homes and other big ticket items. |

| • | I believe that companies with strong balance sheets will consider increasing or beginning to pay dividends as a way to increase the attractiveness of their stocks. Should shareholders receive dividend payments and see their investments rise in value, I believe that may spur confidence and increased consumer spending and investing. |

During the past decade, the tech bubble and the housing bubble created large financial gains. Many consumers were allowed, maybe even encouraged, to borrow more heavily than they should have and live beyond their means. In the past year, investors across the globe have learned a lesson about leverage and its downside, and I believe the markets have now made a move back to “normal”, where growth is based on fundamentals, and will be driven by increases in personal income and consumer spending, which should result in increases in

LETTER TO SHAREHOLDERS

corporate earnings. Using history as my guide, I believe the markets should return to a more normalized annual return. Since 1980, even with several major corrections along the way and including the most recent downturn, the Dow Jones Industrial Average has produced a 12% average annual return. While this may not be the 35% return investors were getting in the late 1990’s, I do believe a more normalized growth rate is sustainable for the foreseeable future.

I continue to believe that historical performance data has shown how patience, discipline and a long-term investing view can be rewarded. Many of the savviest investors, who realize that sometimes the best time to invest is when things look the worst, have already benefitted from the recent rally since the market lows in March.

We maintain our focus on long-term investing and on building value for all of our shareholders. At Hennessy Funds, we serve our shareholders directly, so that we can provide answers to shareholder questions and concerns. Please don’t hesitate to contact us at 800-966-4354 if we can answer any questions or can be of service.

Best regards,

Neil J. Hennessy

Portfolio Manager & Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Price-to-sales ratio is a tool for calculating a stock’s valuation relative to other companies. It is calculated by dividing a stock’s current price by its revenue per share.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. You cannot invest directly in an index.

HENNESSY FUNDS 1-800-966-4354

Hennessy Cornerstone Growth Fund

Original Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | | | Since Inception |

| | | One Year | Five Years | Ten Years | (11/1/96) |

| | Hennessy Cornerstone | | | | |

| | Growth Fund – Original Class | 0.11% | -4.40% | 4.97% | 7.23% |

| | Russell 2000 Index | 6.46% | 0.59% | 4.11% | 5.32% |

| | S&P 500 Index | 9.80% | 0.33% | -0.95% | 4.82% |

Gross expense ratio: 1.25%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

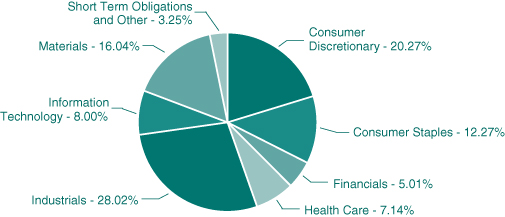

The Hennessy Cornerstone Growth Fund returned 0.11% for the twelve-month period ending October 31, 2009, underperforming its benchmark, the Russell 2000, which returned 6.46%, and the S&P 500, which returned 9.80%. The underperformance is primarily due to individual security selection after the rebalance (which occurred in the winter), which offset the positive overall sector allocation in the Fund. Post rebalance, the portfolio maintained an overweight position in Consumer Discretionary stocks which outperformed as the economy rebounded, but also held an underweight position in Financials, which underperformed despite the sharp rally in Financials within the broader market off the March lows. Post rebalance, performance of the portfolio was hampered by Consumer Discretionary stock Hot Topic, which was down over 10%, Industrial stock Aceto Corp., which was down over 30%, and Information Technology stock Mantech International Corp., which was down over 15%.

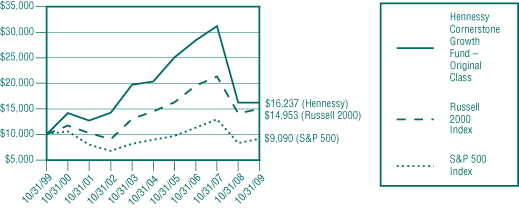

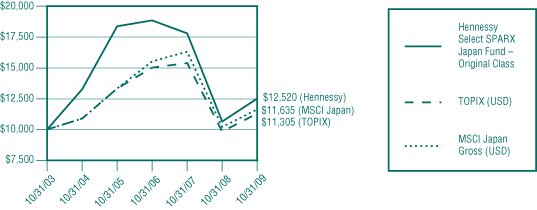

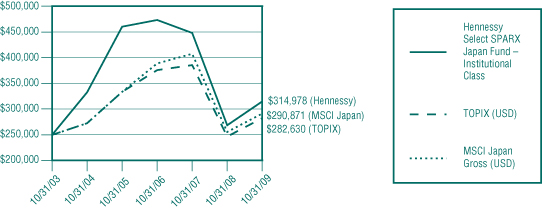

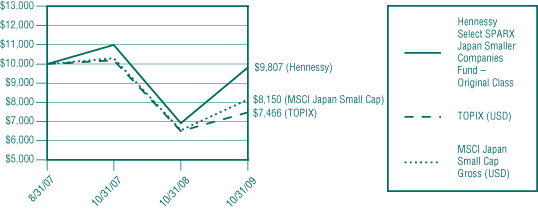

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 1999. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE GROWTH FUND

Hennessy Cornerstone Growth Fund

Institutional Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Year | 3/3/08 |

| | Hennessy Cornerstone | | |

| | Growth Fund – Institutional Class | 0.45% | -21.99% |

| | Russell 2000 Index | 6.46% | -9.66% |

| | S&P 500 Index | 9.80% | -11.88% |

Gross expense ratio: 1.12%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

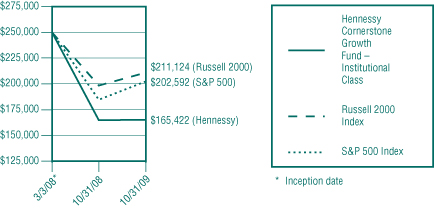

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The S&P 500 Index and Russell 2000 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

Hennessy Cornerstone Growth Fund, Series II

Original Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Year | 7/1/05 |

| | Hennessy Cornerstone Growth | | |

| | Fund, Series II – Original Class | 7.15% | -13.22% |

| | Russell 2000 Growth Index | 11.34% | -0.85% |

| | S&P 500 Index | 9.80% | -1.17% |

Gross expense ratio: 1.37%.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

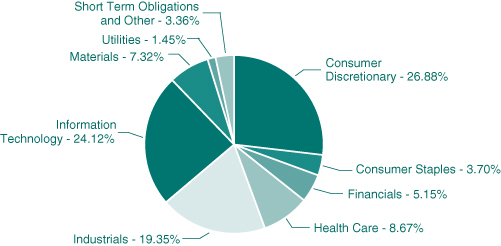

The Hennessy Cornerstone Growth Fund, Series II returned 7.15% for the twelve-month period ending October 31, 2009, trailing its benchmark, the Russell 2000 Growth Index, which returned 11.34%, and the S&P 500, which returned 9.80%. The underperformance of the Fund versus its benchmark was primarily the result of individual security selection after the rebalance (which occurred in the summer), particularly in the Consumer Discretionary Sector. Within that sector, Spartan Motors was a particularly poor performer, down over 50% after the rebalance, as was Isle of Capri, which was down over 40%. The poor overall security selection in the Fund post rebalance offset positive sector allocation during that same period, particularly an overweight position in the Consumer Discretionary sector, which outperformed over the period. Prior to the rebalance, an underweight position in Health Care stocks (which underperformed) positively impacted the Fund’s performance, while overweight positions in Materials and Energy (which both underperformed) negatively impacted performance. Prior to the rebalance Energy stock Interoil Corp., was up over 70%, Materials stock Schnitzer Steel was up over 100% and Industrials stock Aecom Technology Corp. was up over 60%.

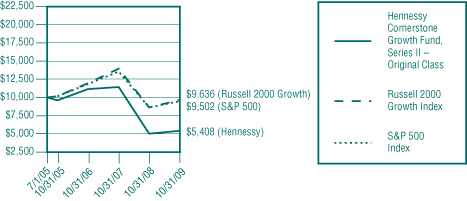

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on July 1, 2005 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

Hennessy Cornerstone Growth Fund, Series II

Institutional Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Year | 3/3/08 |

| | Hennessy Cornerstone Growth | | |

| | Fund, Series II – Institutional Class | 7.89% | -27.58% |

| | Russell 2000 Growth Index | 11.34% | -9.67% |

| | S&P 500 Index | 9.80% | -11.88% |

Gross expense ratio: 1.22%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

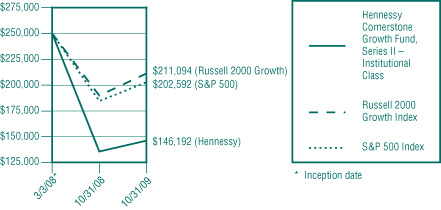

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (date of share class inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000 Growth Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

Hennessy Focus 30 Fund

Original Class Shares

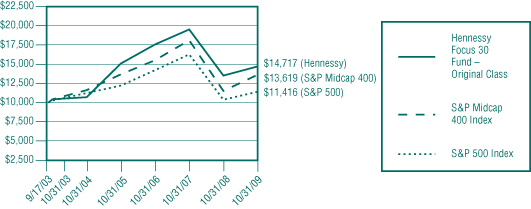

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | | Since Inception |

| | | One Year | Five Years | (9/17/03) |

| | Hennessy Focus 30 Fund – Original Class | 8.85% | 6.52% | 6.52% |

| | S&P Midcap 400 Index | 18.18% | 3.24% | 5.18% |

| | S&P 500 Index | 9.80% | 0.33% | 2.19% |

Gross expense ratio: 1.27%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Focus 30 Fund returned 8.85% for the twelve-month period ending October 31, 2009, underperforming both its benchmark, the S&P Midcap 400, which returned 18.18%, and the S&P 500, which returned 9.80%. The Fund’s underperformance relative to its benchmark was primarily attributable to individual stock selection prior to the rebalance, which occurred in the fall of 2009. The contribution to the portfolio’s performance from strong security selection in the Financials sector as well as the positive overall sector allocation prior to the rebalance (specifically an overweight position in the Consumer Discretionary sector) was overshadowed by weak security selection, chiefly in the Industrial and Utilities sectors. In the Industrial sector, Teledyne Technologies Inc. (down over 20% prior to the rebalance) and Hub Group Inc. (down over 25%) both suffered. Within the Utilities sector, Piedmont Natural Gas (down over 20%) and Hawaiian Electric Industries, Inc. (down over 30%) both negatively impacted the performance of the Fund. These weak performers offset some strong holdings prior to the rebalance, specifically in Financials, such as Odyssey Re Holdings (up over 50%), which benefitted from strong operating results and an acquisition bid announced prior to the rebalance. Following the rebalance, the Fund has outperformed its benchmark, with the outperformance resulting from strong security selection, specifically in the Materials, Energy, Health Care, and Financial sectors. Materials stock Newmarket Corp. is up over 5% since the rebalance, as is Energy stock Linn Energy and generic pharmaceutical maker, Mylan Inc. Americredit, the sole Financial stock in the Fund, has performed well, up over 10% since the rebalance.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on September 17, 2003 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

PERFORMANCE OVERVIEW — HENNESSY FOCUS 30 FUND

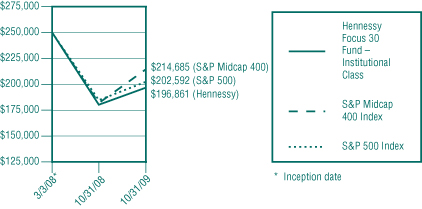

Hennessy Focus 30 Fund

Institutional Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Year | 3/3/08 |

| | Hennessy Focus 30 Fund – Institutional Class | 9.20% | -13.38% |

| | S&P Midcap 400 Index | 18.18% | -8.75% |

| | S&P 500 Index | 9.80% | -11.88% |

Gross expense ratio: 1.13%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The S&P 500 Index and S&P Midcap 400 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

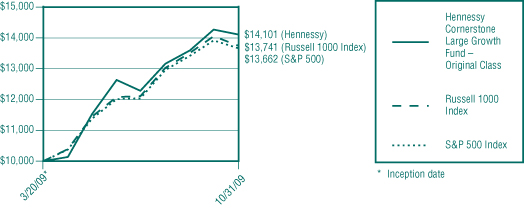

Hennessy Cornerstone Large Growth Fund

Original Class Shares

CUMULATIVE TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Month | (3/20/09) |

| | Hennessy Cornerstone Large | | |

| | Growth Fund – Original Class* | -1.15% | 41.01% |

| | Russell 1000 Index | -2.21% | 37.41% |

| | S&P 500 Index | -1.86% | 36.62% |

Gross expense ratio: 1.33%. Net expense ratio: 1.30%. The expense ratio is contractually capped at 1.30% through March, 2010.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

| * | On March 20, 2009, the Tamarack Large Cap Growth Fund was reorganized into the Hennessy Cornerstone Large Growth Fund. At that time, the Fund began utilizing a purely quantitative formula to choose stocks for the portfolio, which differs from the investment strategy employed by the previous investment manager. Accordingly, performance is being reported for the period after the reorganization. |

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Large Growth Fund has changed its fiscal year end from September 30th to October 31st, effective with this report for the period ending October 31, 2009. Therefore, the following narrative describes performance for the one-month period since the Fund’s last published annual report (for the twelve-month period ending September 30, 2009). The Hennessy Cornerstone Large Growth Fund returned -1.15% for the one-month period ending October 31, 2009, outperforming both its benchmark, the Russell 1000 Index, which returned -2.21%, and the S&P 500, which returned -1.86% . The Fund’s outperformance for the period was primarily the result of positive sector allocation, particularly an overweight position in the Energy sector. McGraw-Hill Companies was the strongest performing stock in the portfolio for the period, gaining 14%.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 20, 2009 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

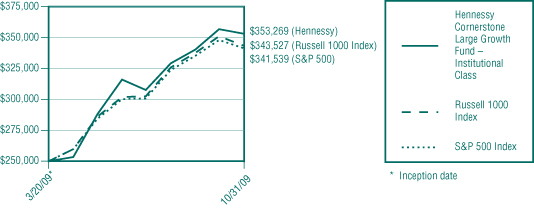

Hennessy Cornerstone Large Growth Fund

Institutional Class Shares

CUMULATIVE TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Month | (3/20/09) |

| | Hennessy Cornerstone Large | | |

| | Growth Fund – Institutional Class | -1.04% | 41.31% |

| | Russell 1000 Index | -2.21% | 37.41% |

| | S&P 500 Index | -1.86% | 36.62% |

Gross expense ratio: 1.15%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 20, 2009 (inception date). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The S&P 500 and Russell 1000 are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index. Medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Growth stocks typically are more volatile than value stocks; however value stocks have a lower expected growth rate in earnings and sales. The Fund’s composition and sector weightings are shown as a percentage of the Fund’s total net assets. Portfolio composition and sector weightings are subject to change at any time and should not be considered a recommendation to buy or sell a particular security. Please refer to the Summary of Investments within this Annual Report for additional portfolio information, including percentages of holdings.

HENNESSY FUNDS 1-800-966-4354

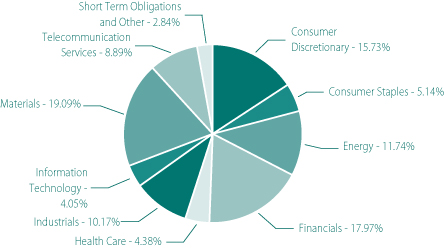

Hennessy Cornerstone Value Fund

Original Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | | | Since Inception |

| | | One Year | Five Years | Ten Years | (11/1/96) |

| | Hennessy Cornerstone | | | | |

| | Value Fund – Original Class | 25.51% | -0.01% | 2.66% | 4.20% |

| | Russell 1000 Value Index | 4.78% | -0.05% | 1.70% | 5.92% |

| | S&P 500 Index | 9.80% | 0.33% | -0.95% | 4.82% |

Gross expense ratio: 1.20%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Value Fund returned 25.51% for the twelve-month period ending October 31, 2009, outperforming its benchmark, the Russell 1000 Value, which returned 4.78%, and the S&P 500, which returned 9.80%. The Fund’s strong outperformance of its benchmark is primarily attributable to strong security selection across a number of sectors, namely Materials, Consumer Discretionary, Telecom, Industrials, Financials and Energy. The positive effects of security selection were augmented by positive overall sector allocation, specifically in Materials, where an overweight position benefited from the sector’s outperformance in 2009. After the rebalance (which occurred in the winter), the best performing stocks within the Materials sector were Rio Tinto, which gained over 140%, and Southern Copper Corp., which gained over 110%. Within the Consumer Discretionary sector, Macy’s Inc. (up over 90%) and Limited Brands Inc. (up over 80%) both contributed to the portfolio’s performance. Telecom stock Vimpelcom gained over 90% after the rebalance, Industrial stock RR Donnelly & Sons gained over 50% and Energy stock CNOOC Ltd. gained over 70%. Financial stocks led the rally of 2009 as credit losses slowed, credit markets improved substantially and unprecedented liquidity was injected by the Fed. Morgan Stanley was one beneficiary of this, which gained over 90% after the rebalance. The effects of strong security selection were augmented by positive overall sector allocation, specifically in Materials, where an overweight position benefited from the sector’s outperformance in 2009.

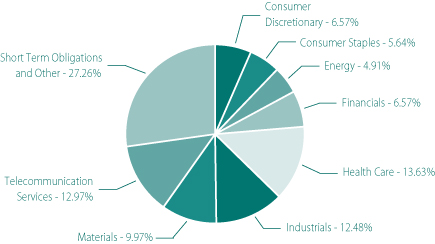

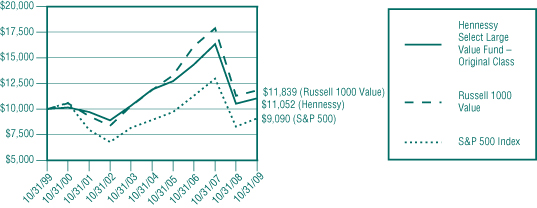

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 1999. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE VALUE FUND

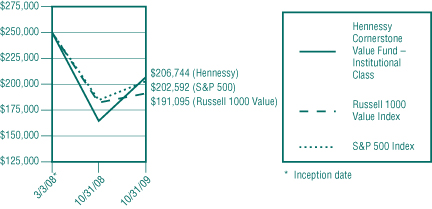

Hennessy Cornerstone Value Fund

Institutional Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | Since Inception |

| | | One Year | 3/3/08 |

| | Hennessy Cornerstone Value Fund – Institutional Class | 25.87% | -10.80% |

| | Russell 1000 Value Index | 4.78% | -14.92% |

| | S&P 500 Index | 9.80% | -11.88% |

Gross expense ratio: 1.14%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The gross expense ratio presented is that from the most recent prospectus.

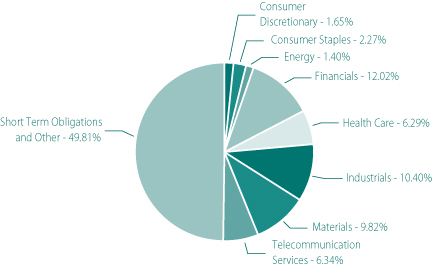

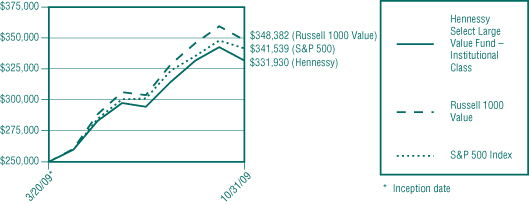

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000 Value Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Fund may invest in medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

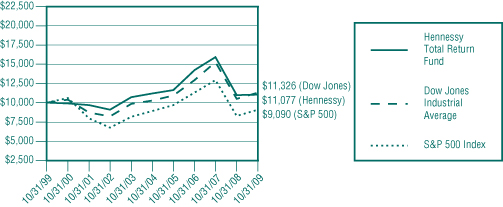

Original Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | | | Since Inception |

| | | One Year | Five Years | Ten Years | (7/29/98) |

| | Hennessy Total Return Fund | 0.69% | -0.26% | 1.03% | 1.30% |

| | Dow Jones Industrial Average | 7.71% | 1.95% | 1.25% | 2.99% |

| | S&P 500 Index | 9.80% | 0.33% | -0.95% | 1.01% |

Gross expense ratio: 2.36%

Expenses net of interest expense: 1.20%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Total Return Fund returned 0.69% for the twelve-month period ending October 31, 2009, lagging both the Dow Jones Industrial Average, which returned 7.71%, and the S&P 500 Index, which returned 9.80%. Citigroup, AIG, and General Motors significantly contributed to the Fund’s underperformance, as each saw severe stock price declines over the course of the twelve-month period and were eventually removed from the Dow Jones index. The Fund’s 25% position in short-term Treasury Bills hampered overall performance as Treasury yields remained relatively low throughout the twelve-month period, lagging performance of the stock market.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 1999. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Hennessy Total Return Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the included Schedule of Investments. Current or future portfolio holdings are subject to risk.

PERFORMANCE OVERVIEW — HENNESSY TOTAL RETURN FUND AND HENNESSY BALANCED FUND

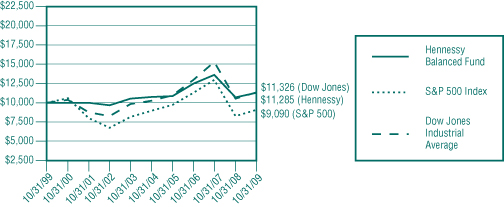

Hennessy Balanced Fund

Original Class Shares

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2009

| | | | | | Since Inception |

| | | One Year | Five Years | Ten Years | (3/8/96) |

| | Hennessy Balanced Fund | 5.46% | 0.97% | 1.22% | 3.29% |

| | Dow Jones Industrial Average | 7.71% | 1.95% | 1.25% | 6.53% |

| | S&P 500 Index | 9.80% | 0.33% | -0.95% | 5.51% |

Gross expense ratio: 1.56%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Balanced Fund returned 5.46% for the twelve-month period ending October 31, 2009, lagging both the Dow Jones Industrial Average, which returned 7.71%, and the S&P 500 Index, which returned 9.80%. Citigroup, AIG, and General Motors significantly contributed to the Fund’s underperformance, as each saw severe stock price declines over the course of the twelve-month period and were eventually removed from the Dow Jones index. The Fund’s 50% position in short-term Treasury Bills hampered overall performance as Treasury yields remained relatively low throughout the twelve-month period, lagging performance of the stock market.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000, made on October 31, 1999. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Hennessy Balanced Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the included Schedule of Investments. Current or future portfolio holdings are subject to risk.

HENNESSY FUNDS 1-800-966-4354

(This Page Intentionally Left Blank.)

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

Summaries of Investments

The following summaries of investment portfolios are designed to help investors better understand each fund’s principal holdings. Each summary is as of October 31, 2009.

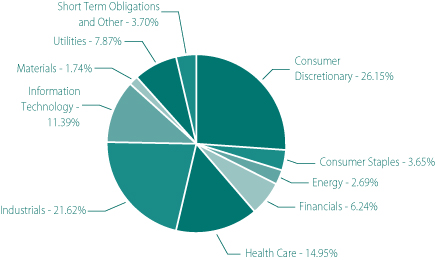

HENNESSY CORNERSTONE GROWTH FUND

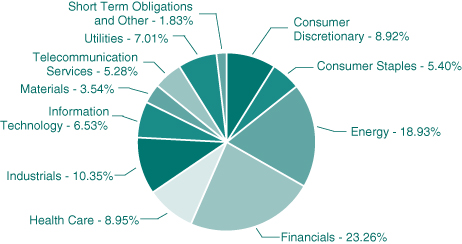

(% of Net Assets)

| | TOP TEN EQUITY HOLDINGS | % of net assets |

| | SXC Health Solutions Corp. | 4.79% |

| | NetFlix, Inc. | 3.51% |

| | World Fuel Services Corp. | 2.69% |

| | Emergency Medical Services Corp. | 2.57% |

| | Carter’s, Inc. | 2.40% |

| | American Italian Pasta Co. | 2.38% |

| | Monro Muffler, Inc. | 2.38% |

| | Viasat, Inc. | 2.37% |

| | Panera Bread Co. | 2.25% |

| | Applied Signal Technology Inc. | 2.24% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 96.30% | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Consumer Discretionary – 26.15% | | | | | | | | | | |

| | Aaron’s, Inc. | | | 172,000 | | | $ | 4,308,600 | | | | 1.84 | % | |

| | Autozone, Inc. (a) | | | 32,800 | | | | 4,438,168 | | | | 1.90 | % | |

| | Carter’s, Inc. (a) | | | 237,700 | | | | 5,609,720 | | | | 2.40 | % | |

| | Corinthian Colleges, Inc. (a) | | | 279,600 | | | | 4,434,456 | | | | 1.90 | % | |

| | Dollar Tree, Inc. (a) | | | 109,800 | | | | 4,955,274 | | | | 2.12 | % | |

| | Family Dollar Stores, Inc. | | | 175,600 | | | | 4,969,480 | | | | 2.13 | % | |

| | FGX International Holdings, Ltd. (a)(b) | | | 333,200 | | | | 4,394,908 | | | | 1.88 | % | |

| | HOT Topic, Inc. (a) | | | 493,800 | | | | 3,802,260 | | | | 1.63 | % | |

| | Monro Muffler, Inc. | | | 179,500 | | | | 5,562,705 | | | | 2.38 | % | |

| | National Presto Inds, Inc. | | | 59,500 | | | | 5,172,335 | | | | 2.21 | % | |

| | NetFlix, Inc. (a) | | | 153,200 | | | | 8,188,540 | | | | 3.51 | % | |

| | Panera Bread Co. (a) | | | 87,600 | | | | 5,254,248 | | | | 2.25 | % | |

| | | | | | | | | 61,090,694 | | | | 26.15 | % | |

| | Consumer Staples – 3.65% | | | | | | | | | | | | | |

| | American Italian Pasta Co. (a) | | | 204,900 | | | | 5,567,133 | | | | 2.38 | % | |

| | Nash Finch Co. | | | 102,000 | | | | 2,955,960 | | | | 1.27 | % | |

| | | | | | | | | 8,523,093 | | | | 3.65 | % | |

| | Energy – 2.69% | | | | | | | | | | | | | |

| | World Fuel Services Corp. | | | 123,700 | | | | 6,290,145 | | | | 2.69 | % | |

| | | | | | | | | | | | | | | |

| | Financials – 6.24% | | | | | | | | | | | | | |

| | Amerisafe, Inc. (a) | | | 223,000 | | | | 4,134,420 | | | | 1.77 | % | |

| | First Bancorp PR (b) | | | 410,900 | | | | 776,601 | | | | 0.33 | % | |

| | Nelnet, Inc. (a) | | | 319,500 | | | | 4,482,585 | | | | 1.92 | % | |

| | Stifel Financial Corp. (a) | | | 99,800 | | | | 5,185,608 | | | | 2.22 | % | |

| | | | | | | | | 14,579,214 | | | | 6.24 | % | |

| | Health Care – 14.95% | | | | | | | | | | | | | |

| | Cantel Medical Corp. (a) | | | 312,000 | | | | 5,010,720 | | | | 2.15 | % | |

| | Emergency Medical Services Corp. (a) | | | 125,000 | | | | 6,002,500 | | | | 2.57 | % | |

| | Ensign Group, Inc. | | | 273,500 | | | | 4,042,330 | | | | 1.73 | % | |

| | Gentiva Health Services, Inc. (a) | | | 156,500 | | | | 3,756,000 | | | | 1.61 | % | |

| | PSS World Med, Inc. (a) | | | 243,200 | | | | 4,917,504 | | | | 2.10 | % | |

| | SXC Health Solutions Corp. (a)(b) | | | 245,200 | | | | 11,200,736 | | | | 4.79 | % | |

| | | | | | | | | 34,929,790 | | | | 14.95 | % | |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

| | COMMON STOCKS | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Industrials – 21.62% | | | | | | | | | | |

| | Aaon, Inc. | | | 219,200 | | | $ | 3,947,792 | | | | 1.69 | % | |

| | Aceto Corp. | | | 457,300 | | | | 2,533,442 | | | | 1.08 | % | |

| | Aecom Technology Corp Delaware Co. (a) | | | 149,000 | | | | 3,760,760 | | | | 1.61 | % | |

| | Applied Signal Technology, Inc. | | | 255,200 | | | | 5,229,048 | | | | 2.24 | % | |

| | Baker Michael Corp. (a) | | | 124,000 | | | | 4,426,800 | | | | 1.89 | % | |

| | Beacon Roofing Supply, Inc. (a) | | | 329,800 | | | | 4,735,928 | | | | 2.03 | % | |

| | Granite Construction, Inc. | | | 104,200 | | | | 2,975,952 | | | | 1.27 | % | |

| | Insituform Technologies, Inc. (a) | | | 232,500 | | | | 4,929,000 | | | | 2.11 | % | |

| | Stanley, Inc. (a) | | | 126,400 | | | | 3,570,800 | | | | 1.53 | % | |

| | Tetra Tech, Inc. (a) | | | 189,600 | | | | 4,878,408 | | | | 2.09 | % | |

| | Trex, Inc. (a) | | | 278,100 | | | | 4,424,571 | | | | 1.89 | % | |

| | VSE Corp. | | | 116,700 | | | | 5,110,293 | | | | 2.19 | % | |

| | | | | | | | | 50,522,794 | | | | 21.62 | % | |

| | Information Technology – 11.39% | | | | | | | | | | | | | |

| | CACI International, Inc. (a) | | | 101,500 | | | | 4,833,430 | | | | 2.07 | % | |

| | CSG Systems International, Inc. (a) | | | 262,000 | | | | 4,281,080 | | | | 1.83 | % | |

| | Mantech International Corp. – Class A (a) | | | 84,500 | | | | 3,706,170 | | | | 1.59 | % | |

| | NCI, Inc. (a) | | | 151,900 | | | | 4,087,629 | | | | 1.75 | % | |

| | SAIC, Inc. (a) | | | 235,000 | | | | 4,161,850 | | | | 1.78 | % | |

| | Viasat, Inc. (a) | | | 190,100 | | | | 5,541,415 | | | | 2.37 | % | |

| | | | | | | | | 26,611,574 | | | | 11.39 | % | |

| | Materials – 1.74% | | | | | | | | | | | | | |

| | Zep, Inc. | | | 237,100 | | | | 4,054,410 | | | | 1.74 | % | |

| | | | | | | | | | | | | | | |

| | Utilities – 7.87% | | | | | | | | | | | | | |

| | Laclede Group, Inc. | | | 97,700 | | | | 3,000,367 | | | | 1.28 | % | |

| | New Jersey Resource Corp. | | | 116,300 | | | | 4,093,760 | | | | 1.75 | % | |

| | NSTAR | | | 125,500 | | | | 3,884,225 | | | | 1.66 | % | |

| | Piedmont Natural Gas Co. | | | 144,500 | | | | 3,363,960 | | | | 1.44 | % | |

| | South Jersey Industries, Inc. | | | 114,900 | | | | 4,054,821 | | | | 1.74 | % | |

| | | | | | | | | 18,397,133 | | | | 7.87 | % | |

| | | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $220,732,744) | | | | | | | 224,998,847 | | | | 96.30 | % | |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | SHORT-TERM INVESTMENTS – 1.42% | | Number | | | | | | % of | | |

| | | | of Shares | | | Value | | | Net Assets | | |

| | Money Market Funds – 1.42% | | | | | | | | | | |

| | Fidelity Government Portfolio, 0.0623% (c) | | $ | 3,310,638 | | | $ | 3,310,638 | | | | 1.42 | % | |

| | | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | | |

| | (Cost $3,310,638) | | | | | | | 3,310,638 | | | | 1.42 | % | |

| | | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | | |

| | (Cost $3,310,638) | | | | | | | 3,310,638 | | | | 1.42 | % | |

| | | | | | | | | | | | | | | |

| | Total Investments – 97.72% | | | | | | | | | | | | | |

| | (Cost $224,043,382) | | | | | | | 228,309,485 | | | | 97.72 | % | |

| | | | | | | | | | | | | | | |

| | Other Assets in Excess of Liabilities – 2.28% | | | | | | | 5,328,868 | | | | 2.28 | % | |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 233,638,353 | | | | 100.00 | % | |

Percentages are stated as a percent of net assets.

(a)Non Income Producing

(b)Foreign Issued Security

(c)The rate listed is the Fund’s 7-day yield as of October 31, 2009.

Summary of Fair Value Exposure at October 31, 2009

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| | Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the fund has access at the date of measurement |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2009:

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Equity | | | | | | | | | | | | |

| | Consumer Discretionary | | $ | 61,090,694 | | | $ | — | | | $ | — | | | $ | 61,090,694 | |

| | Consumer Staples | | | 8,523,093 | | | | — | | | | — | | | | 8,523,093 | |

| | Energy | | | 6,290,145 | | | | — | | | | — | | | | 6,290,145 | |

| | Financials | | | 14,579,214 | | | | — | | | | — | | | | 14,579,214 | |

| | Health Care | | | 34,929,790 | | | | — | | | | — | | | | 34,929,790 | |

| | Industrials | | | 50,522,794 | | | | — | | | | — | | | | 50,522,794 | |

| | Information Technology | | | 26,611,574 | | | | — | | | | — | | | | 26,611,574 | |

| | Materials | | | 4,054,410 | | | | — | | | | — | | | | 4,054,410 | |

| | Utilities | | | 18,397,133 | | | | — | | | | — | | | | 18,397,133 | |

| | Total Equity | | $ | 224,998,847 | | | $ | — | | | $ | — | | | | 224,998,847 | |

| | Short-Term Investments | | $ | 3,310,638 | | | $ | — | | | $ | — | | | | 3,310,638 | |

| | Total Investments in Securities | | $ | 228,309,485 | | | $ | — | | | $ | — | | | $ | 228,309,485 | |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

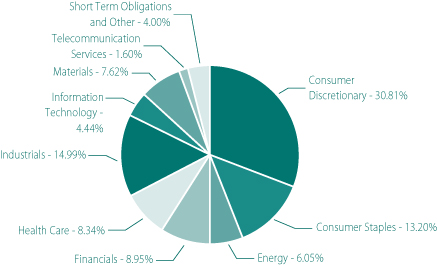

HENNESSY CORNERSTONE

GROWTH FUND, SERIES II

(% of Net Assets)

| | TOP TEN EQUITY HOLDINGS | % of net assets |

| | Schweitzer-Mauduit International, Inc. | 3.53% |

| | Dollar Thrifty Automotive Group Co. | 3.42% |

| | SXC Health Solutions Corp. | 3.22% |

| | Evercore Partners, Inc. | 3.01% |

| | Cott Corp. | 2.79% |

| | Madden Steven Ltd. | 2.73% |

| | Kirklands, Inc. | 2.44% |

| | Jos. A Bank Clothiers, Inc. | 2.38% |

| | Peet’s Coffee & Tea, Inc. | 2.34% |

| | APAC Customer Services, Inc. | 2.27% |

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| | COMMON STOCKS – 96.00% | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Consumer Discretionary – 30.81% | | | | | | | | | | |

| | 99 Cents Only Stores (a) | | | 39,900 | | | $ | 453,663 | | | | 1.51 | % | |

| | Aaron’s, Inc. | | | 17,600 | | | | 440,880 | | | | 1.46 | % | |

| | Carter’s, Inc. (a) | | | 22,800 | | | | 538,080 | | | | 1.79 | % | |

| | Fuqi International, Inc. (a) | | | 30,900 | | | | 633,141 | | | | 2.10 | % | |

| | H H Gregg, Inc. (a) | | | 33,800 | | | | 557,362 | | | | 1.85 | % | |

| | Isle Of Capri Casinos, Inc. (a) | | | 43,700 | | | | 338,675 | | | | 1.13 | % | |

| | Jos A Bank Clothiers, Inc. (a) | | | 17,500 | | | | 717,150 | | | | 2.38 | % | |

| | Kirklands, Inc. (a) | | | 58,300 | | | | 733,414 | | | | 2.44 | % | |

| | Lincoln Educational Services Corp. (a) | | | 28,800 | | | | 570,816 | | | | 1.90 | % | |

| | Madden Steven Ltd. (a) | | | 20,300 | | | | 822,150 | | | | 2.73 | % | |

| | National Presto Industries, Inc. | | | 6,900 | | | | 599,817 | | | | 1.99 | % | |

| | P F Changs China Bistro, Inc. (a) | | | 17,100 | | | | 499,149 | | | | 1.66 | % | |

| | Peet’s Coffee & Tea, Inc. (a) | | | 20,700 | | | | 703,800 | | | | 2.34 | % | |

| | Pep Boys Manny Moe & Jack | | | 56,600 | | | | 496,382 | | | | 1.65 | % | |

| | Spartan Motors, Inc. | | | 50,000 | | | | 249,500 | | | | 0.83 | % | |

| | Sturm Ruger & Co., Inc. | | | 42,800 | | | | 454,536 | | | | 1.51 | % | |

| | Texas Roadhouse, Inc. (a) | | | 48,900 | | | | 463,083 | | | | 1.54 | % | |

| | | | | | | | | 9,271,598 | | | | 30.81 | % | |

| | Consumer Staples – 13.20% | | | | | | | | | | | | | |

| | Calavo Growers, Inc. | | | 26,900 | | | | 480,165 | | | | 1.60 | % | |

| | Central Garden & Pet Co. (a) | | | 56,200 | | | | 531,652 | | | | 1.77 | % | |

| | Coca Cola Bottling Co. Consolidated | | | 9,600 | | | | 431,136 | | | | 1.43 | % | |

| | Cott Corp. (a)(b) | | | 106,100 | | | | 838,190 | | | | 2.79 | % | |

| | J & J Snack Foods Corp. | | | 15,000 | | | | 587,550 | | | | 1.95 | % | |

| | Lancaster Colony Corp. | | | 12,100 | | | | 587,818 | | | | 1.95 | % | |

| | United Natural Foods, Inc. (a) | | | 21,400 | | | | 515,954 | | | | 1.71 | % | |

| | | | | | | | | 3,972,465 | | | | 13.20 | % | |

| | Energy – 6.05% | | | | | | | | | | | | | |

| | Nustar Energy LP | | | 10,500 | | | | 563,430 | | | | 1.87 | % | |

| | Sunoco Logistics Partners LP | | | 10,100 | | | | 590,345 | | | | 1.96 | % | |

| | World Fuel Services Corp. | | | 13,100 | | | | 666,135 | | | | 2.22 | % | |

| | | | | | | | | 1,819,910 | | | | 6.05 | % | |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Financials – 8.95% | | | | | | | | | | |

| | Encore Cap Group, Inc. (a) | | | 44,300 | | | $ | 663,171 | | | | 2.20 | % | |

| | Evercore Partners, Inc. | | | 27,700 | | | | 904,128 | | | | 3.01 | % | |

| | First Horizon National Corp. (a) | | | 43,300 | | | | 512,239 | | | | 1.70 | % | |

| | Stifel Financial Corp. (a) | | | 11,800 | | | | 613,128 | | | | 2.04 | % | |

| | | | | | | | | 2,692,666 | | | | 8.95 | % | |

| | Health Care – 8.34% | | | | | | | | | | | | | |

| | Bio-reference Labs, Inc. (a) | | | 17,200 | | | | 556,076 | | | | 1.85 | % | |

| | Cantel Medical Corp. (a) | | | 33,600 | | | | 539,616 | | | | 1.79 | % | |

| | Rehabcare Group, Inc. (a) | | | 23,800 | | | | 446,250 | | | | 1.48 | % | |

| | SXC Health Solutions Corp. (a)(b) | | | 21,200 | | | | 968,416 | | | | 3.22 | % | |

| | | | | | | | | 2,510,358 | | | | 8.34 | % | |

| | Industrials – 14.99% | | | | | | | | | | | | | |

| | APAC Customer Services, Inc. (a) | | | 105,900 | | | | 683,055 | | | | 2.27 | % | |

| | Baker Michael Corp. (a) | | | 13,300 | | | | 474,810 | | | | 1.58 | % | |

| | Cubic Corp. | | | 15,300 | | | | 531,063 | | | | 1.76 | % | |

| | Dollar Thrifty Automotive Group Co. (a) | | | 55,600 | | | | 1,029,156 | | | | 3.42 | % | |

| | Force Protection, Inc. (a) | | | 69,100 | | | | 304,040 | | | | 1.01 | % | |

| | Goodrich Corp. | | | 10,600 | | | | 576,110 | | | | 1.91 | % | |

| | Marten Transport Ltd. (a) | | | 25,300 | | | | 443,762 | | | | 1.48 | % | |

| | Tetra Tech, Inc. (a) | | | 18,300 | | | | 470,859 | | | | 1.56 | % | |

| | | | | | | | | 4,512,855 | | | | 14.99 | % | |

| | Information Technology – 4.44% | | | | | | | | | | | | | |

| | Black Box Corp. | | | 14,900 | | | | 394,999 | | | | 1.31 | % | |

| | Global Cash Access Holdings Inc (a) | | | 75,600 | | | | 478,548 | | | | 1.59 | % | |

| | NCI, Inc. (a) | | | 17,200 | | | | 462,852 | | | | 1.54 | % | |

| | | | | | | | | 1,336,399 | | | | 4.44 | % | |

| | Materials – 7.62% | | | | | | | | | | | | | |

| | Bway Holding Co. (a) | | | 33,500 | | | | 595,295 | | | | 1.98 | % | |

| | Rock-Tenn Co. | | | 14,500 | | | | 635,100 | | | | 2.11 | % | |

| | Schweitzer-Mauduit International, Inc. | | | 20,600 | | | | 1,063,990 | | | | 3.53 | % | |

| | | | | | | | | 2,294,385 | | | | 7.62 | % | |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| | COMMON STOCKS | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Telecommunication Services – 1.60% | | | | | | | | | | |

| | USA Mobility, Inc. | | | 44,100 | | | $ | 480,690 | | | | 1.60 | % | |

| | | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $26,393,200) | | | | | | | 28,891,326 | | | | 96.00 | % | |

| | | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 4.25% | | | | | | | | | | | | | |

| | Money Market Funds – 4.25% | | | | | | | | | | | | | |

| | Fidelity Government Portfolio, 0.0623% (c) | | $ | 1,280,481 | | | $ | 1,280,481 | | | | 4.25 | % | |

| | | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | | |

| | (Cost $1,280,481) | | | | | | | 1,280,481 | | | | 4.25 | % | |

| | | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | | |

| | (Cost $1,280,481) | | | | | | | 1,280,481 | | | | 4.25 | % | |

| | | | | | | | | | | | | | | |

| | Total Investments – 100.25% | | | | | | | | | | | | | |

| | (Cost $27,673,681) | | | | | | | 30,171,807 | | | | 100.25 | % | |

| | | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.25)% | | | | | | | (74,144 | ) | | | -0.25 | % | |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 30,097,663 | | | | 100.00 | % | |

Percentages are stated as a percent of net assets.

(a)Non Income Producing

(b)Foreign Issued Security

(c)The rate listed is the Fund’s 7-day yield as of October 31, 2009.

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Summary of Fair Value Exposure at October 31, 2009

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| | Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the fund has access at the date of measurement |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2009:

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Equity | | | | | | | | | | | | |

| | Consumer Discretionary | | $ | 9,271,598 | | | $ | — | | | $ | — | | | $ | 9,271,598 | |

| | Consumer Staples | | | 3,972,465 | | | | — | | | | — | | | | 3,972,465 | |

| | Energy | | | 1,819,910 | | | | — | | | | — | | | | 1,819,910 | |

| | Financials | | | 2,692,666 | | | | — | | | | — | | | | 2,692,666 | |

| | Health Care | | | 2,510,358 | | | | — | | | | — | | | | 2,510,358 | |

| | Industrials | | | 4,512,855 | | | | — | | | | — | | | | 4,512,855 | |

| | Information Technology | | | 1,336,399 | | | | — | | | | — | | | | 1,336,399 | |

| | Materials | | | 2,294,385 | | | | — | | | | — | | | | 2,294,385 | |

| | Telecommunication Services | | | 480,690 | | | | — | | | | — | | | | 480,690 | |

| | Total Equity | | $ | 28,891,326 | | | $ | — | | | $ | — | | | | 28,891,326 | |

| | Short-Term Investments | | $ | 1,280,481 | | | $ | — | | | $ | — | | | | 1,280,481 | |

| | Total Investments in Securities | | $ | 30,171,807 | | | $ | — | | | $ | — | | | $ | 30,171,807 | |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY FOCUS 30 FUND

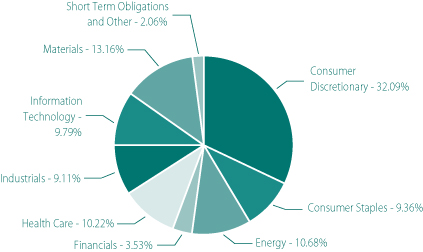

HENNESSY FOCUS 30 FUND

(% of Net Assets)

| | TOP TEN EQUITY HOLDINGS | % of net assets |

| | Tupperware Brands Corp. | 3.89% |

| | Virgin Media, Inc. | 3.86% |

| | Linn Energy LLC | 3.77% |

| | World Fuel Services Corp. | 3.66% |

| | Mylan, Inc. | 3.65% |

| | Newmarket Corp. | 3.64% |

| | Americredit Corp. | 3.53% |

| | Computer Sciences Corp. | 3.41% |

| | Emergency Medical Services Corp. | 3.35% |

| | Ball Corp. | 3.32% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 97.94% | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Consumer Discretionary – 32.09% | | | | | | | | | | |

| | Aeropostale, Inc. (a) | | | 122,000 | | | $ | 4,578,660 | | | | 2.94 | % | |

| | Carter’s, Inc. (a) | | | 202,200 | | | | 4,771,920 | | | | 3.06 | % | |

| | Darden Restaurants, Inc. | | | 147,700 | | | | 4,476,787 | | | | 2.87 | % | |

| | Dollar Tree, Inc. (a) | | | 103,400 | | | | 4,666,442 | | | | 3.00 | % | |

| | Gymboree Corp. (a) | | | 112,500 | | | | 4,789,125 | | | | 3.07 | % | |

| | O Reilly Automotive, Inc. (a) | | | 135,400 | | | | 5,047,712 | | | | 3.24 | % | |

| | Ross Stores, Inc. | | | 108,200 | | | | 4,761,882 | | | | 3.06 | % | |

| | Tractor Supply Co. (a) | | | 107,900 | | | | 4,823,130 | | | | 3.10 | % | |

| | Tupperware Brands Corp. | | | 134,600 | | | | 6,059,692 | | | | 3.89 | % | |

| | Virgin Media, Inc. | | | 430,800 | | | | 6,018,276 | | | | 3.86 | % | |

| | | | | | | | | 49,993,626 | | | | 32.09 | % | |

| | Consumer Staples – 9.36% | | | | | | | | | | | | | |

| | Coca Cola Enterprises, Inc. | | | 250,200 | | | | 4,771,314 | | | | 3.06 | % | |

| | Del Monte Foods Co. | | | 452,300 | | | | 4,884,840 | | | | 3.14 | % | |

| | Lancaster Colony Corp. | | | 101,300 | | | | 4,921,154 | | | | 3.16 | % | |

| | | | | | | | | 14,577,308 | | | | 9.36 | % | |

| | Energy – 10.68% | | | | | | | | | | | | | |

| | Linn Energy LLC | | | 239,700 | | | | 5,872,650 | | | | 3.77 | % | |

| | Plains All American Pipeline LP | | | 106,000 | | | | 5,069,980 | | | | 3.25 | % | |

| | World Fuel Services Corp. | | | 112,200 | | | | 5,705,370 | | | | 3.66 | % | |

| | | | | | | | | 16,648,000 | | | | 10.68 | % | |

| | Financials – 3.53% | | | | | | | | | | | | | |

| | Americredit Corp. (a) | | | 311,300 | | | | 5,494,445 | | | | 3.53 | % | |

| | | | | | | | | | | | | | | |

| | Health Care – 10.22% | | | | | | | | | | | | | |

| | Emergency Medical Services Corp. (a) | | | 108,600 | | | | 5,214,972 | | | | 3.35 | % | |

| | Mylan, Inc. (a) | | | 349,900 | | | | 5,682,376 | | | | 3.65 | % | |

| | Watson Pharmaceuticals, Inc. (a) | | | 146,000 | | | | 5,025,320 | | | | 3.22 | % | |

| | | | | | | | | 15,922,668 | | | | 10.22 | % | |

| | Industrials – 9.11% | | | | | | | | | | | | | |

| | Goodrich Corp. | | | 90,800 | | | | 4,934,980 | | | | 3.17 | % | |

| | KBR, Inc. | | | 233,100 | | | | 4,771,557 | | | | 3.06 | % | |

| | Tetra Tech, Inc. (a) | | | 174,300 | | | | 4,484,739 | | | | 2.88 | % | |

| | | | | | | | | 14,191,276 | | | | 9.11 | % | |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY FOCUS 30 FUND

| | COMMON STOCKS | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Information Technology – 9.79% | | | | | | | | | | |

| | Broadridge Financial Solutions Inc. | | | 236,800 | | | $ | 4,927,808 | | | | 3.16 | % | |

| | Computer Sciences Corp. (a) | | | 104,700 | | | | 5,309,337 | | | | 3.41 | % | |

| | Tech Data Corp. (a) | | | 130,400 | | | | 5,011,272 | | | | 3.22 | % | |

| | | | | | | | | 15,248,417 | | | | 9.79 | % | |

| | Materials – 13.16% | | | | | | | | | | | | | |

| | Ball Corp. | | | 105,000 | | | | 5,179,650 | | | | 3.32 | % | |

| | Newmarket Corp. | | | 60,700 | | | | 5,675,450 | | | | 3.64 | % | |

| | Rock-Tenn Co. | | | 103,100 | | | | 4,515,780 | | | | 2.90 | % | |

| | Scotts Miracle Gro Co. | | | 126,600 | | | | 5,142,492 | | | | 3.30 | % | |

| | | | | | | | | 20,513,372 | | | | 13.16 | % | |

| | | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $152,647,649) | | | | | | | 152,589,112 | | | | 97.94 | % | |

| | | | | | | | | | | | | | | |

| | WARRANTS – 0.00% | | | | | | | | | | | | | |

| | Lantronix Inc., Warrant ^ | | | | | | | | | | | | | |

| | Expiration: February, 2011, | | | | | | | | | | | | | |

| | Exercise Price: $0.850 | | | 158 | | | | 0 | | | | 0.00 | % | |

| | | | | | | | | | | | | | | |

| | Total Warrants (Cost $0) | | | | | | | 0 | | | | 0.00 | % | |

| | | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 2.28% | | | | | | | | | | | | | |

| | Money Market Funds – 2.28% | | | | | | | | | | | | | |

| | Fidelity Government Portfolio, 0.0623% (b) | | $ | 3,549,694 | | | | 3,549,694 | | | | 2.28 | % | |

| | | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | | |

| | (Cost $3,549,694) | | | | | | | 3,549,694 | | | | 2.28 | % | |

| | | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | | |

| | (Cost $3,549,694) | | | | | | | 3,549,694 | | | | 2.28 | % | |

| | | | | | | | | | | | | | | |

| | Total Investments – 100.22% | | | | | | | | | | | | | |

| | (Cost $156,197,343) | | | | | | | 156,138,806 | | | | 100.22 | % | |

| | | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.22)% | | | | | | | (341,332 | ) | | | -0.22 | % | |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 155,797,474 | | | | 100.00 | % | |

Percentages are stated as a percent of net assets.

| (b) | The rate listed is the Fund’s 7-day yield as of October 31, 2009. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Summary of Fair Value Exposure at October 31, 2009

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| | Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the fund has access at the date of measurement |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2009:

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Equity | | | | | | | | | | | | |

| | Consumer Discretionary | | $ | 49,993,626 | | | $ | — | | | $ | — | | | $ | 49,993,626 | |

| | Consumer Staples | | | 14,577,308 | | | | — | | | | — | | | | 14,577,308 | |

| | Energy | | | 16,648,000 | | | | — | | | | — | | | | 16,648,000 | |

| | Financials | | | 5,494,445 | | | | — | | | | — | | | | 5,494,445 | |

| | Health Care | | | 15,922,668 | | | | — | | | | — | | | | 15,922,668 | |

| | Industrials | | | 14,191,276 | | | | — | | | | — | | | | 14,191,276 | |

| | Information Technology | | | 15,248,417 | | | | — | | | | — | | | | 15,248,417 | |

| | Materials | | | 20,513,372 | | | | — | | | | — | | | | 20,513,372 | |

| | Total Equity | | $ | 152,589,112 | | | $ | — | | | $ | — | | | $ | 152,589,112 | |

| | Warrants | | $ | — | | | $ | — | | | $ | — | (1) | | $ | — | |

| | Short-Term Investments | | $ | 3,549,694 | | | $ | — | | | $ | — | | | $ | 3,549,694 | |

| | Total Investments in Securities | | $ | 156,138,806 | | | $ | — | | | $ | — | | | $ | 156,138,806 | |

| (1) | If the Lantronix, Inc. warrant would have had a value, it would have been a Level 3 fair value. The warrant has been fair valued at $0 during the entire reporting period. |

The accompanying notes are an integral part of these financial statements.

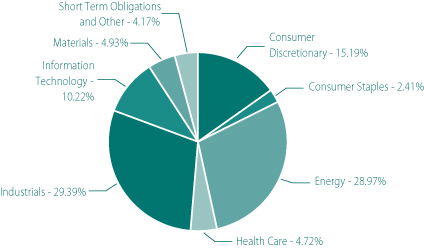

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE LARGE GROWTH FUND

HENNESSY CORNERSTONE

LARGE GROWTH FUND

(% of Net Assets)

| | TOP TEN EQUITY HOLDINGS | % of net assets |

| | Coach, Inc. | 2.95% |

| | Western Digital Corp. | 2.61% |

| | Cummins, Inc. | 2.46% |

| | Avon Products, Inc. | 2.41% |

| | The Gap, Inc. | 2.39% |

| | Halliburton Co. | 2.33% |

| | Dish Network Corp. | 2.26% |

| | General Dynamics Corp. | 2.24% |

| | Precision Castparts Corp. | 2.23% |

| | Cameron International Corp. | 2.20% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 95.83% | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Consumer Discretionary – 15.19% | | | | | | | | | | |

| | Best Buy Co, Inc. | | | 28,900 | | | $ | 1,103,402 | | | | 1.59 | % | |

| | Coach, Inc. | | | 62,100 | | | | 2,047,437 | | | | 2.95 | % | |

| | Dish Network Corp. (a) | | | 90,100 | | | | 1,567,740 | | | | 2.26 | % | |

| | The Gap, Inc. | | | 77,800 | | | | 1,660,252 | | | | 2.39 | % | |

| | The McGraw-Hill Companies, Inc. | | | 49,300 | | | | 1,418,854 | | | | 2.04 | % | |

| | Omnicom Group | | | 39,200 | | | | 1,343,776 | | | | 1.93 | % | |

| | TJX Cos., Inc. | | | 37,800 | | | | 1,411,830 | | | | 2.03 | % | |

| | | | | | | | | 10,553,291 | | | | 15.19 | % | |

| | Consumer Staples – 2.41% | | | | | | | | | | | | | |

| | Avon Products, Inc. | | | 52,200 | | | | 1,673,010 | | | | 2.41 | % | |

| | | | | | | | | | | | | | | |

| | Energy – 28.97% | | | | | | | | | | | | | |

| | Baker Hughes, Inc. | | | 30,100 | | | | 1,266,307 | | | | 1.82 | % | |

| | Cameron International Corp. (a) | | | 41,300 | | | | 1,526,861 | | | | 2.20 | % | |

| | ChevronTexaco Corp. | | | 14,400 | | | | 1,102,176 | | | | 1.59 | % | |

| | ConocoPhillips | | | 24,700 | | | | 1,239,446 | | | | 1.78 | % | |

| | Denbury Resources, Inc. (a) | | | 59,400 | | | | 867,240 | | | | 1.25 | % | |

| | Diamond Offshore Drilling | | | 14,100 | | | | 1,343,025 | | | | 1.93 | % | |

| | ENSCO International, Inc. | | | 33,200 | | | | 1,520,228 | | | | 2.19 | % | |

| | EOG Resources, Inc. | | | 15,100 | | | | 1,233,066 | | | | 1.78 | % | |

| | Exxon Mobil Corp. | | | 14,100 | | | | 1,010,547 | | | | 1.45 | % | |

| | Halliburton Co. | | | 55,400 | | | | 1,618,234 | | | | 2.33 | % | |

| | Hess Corp. | | | 15,100 | | | | 826,574 | | | | 1.19 | % | |

| | Marathon Oil Corp. | | | 38,400 | | | | 1,227,648 | | | | 1.77 | % | |

| | Murphy Oil Corp. | | | 19,500 | | | | 1,192,230 | | | | 1.72 | % | |

| | Noble Corporation Baar (b) | | | 37,000 | | | | 1,507,380 | | | | 2.17 | % | |

| | Occidental Petroleum Corp. | | | 16,400 | | | | 1,244,432 | | | | 1.79 | % | |

| | Schlumberger Ltd. (b) | | | 22,500 | | | | 1,399,500 | | | | 2.01 | % | |

| | | | | | | | | 20,124,894 | | | | 28.97 | % | |

| | Health Care – 4.72% | | | | | | | | | | | | | |

| | Eli Lilly & Co. | | | 28,700 | | | | 976,087 | | | | 1.41 | % | |

| | Forest Laboratories, Inc. (a) | | | 44,100 | | | | 1,220,247 | | | | 1.76 | % | |

| | Merck & Co., Inc. | | | 34,900 | | | | 1,079,457 | | | | 1.55 | % | |

| | | | | | | | | 3,275,791 | | | | 4.72 | % | |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE LARGE GROWTH FUND

| | COMMON STOCKS | | Number | | | | | | % of Net | | |

| | | | of Shares | | | Value | | | Assets | | |

| | Industrials – 29.39% | | | | | | | | | | |

| | 3M Co. | | | 20,300 | | | $ | 1,493,471 | | | | 2.15 | % | |

| | Boeing Co. | | | 28,700 | | | | 1,371,860 | | | | 1.98 | % | |

| | Cooper Industries Ltd. (b) | | | 39,300 | | | | 1,520,517 | | | | 2.19 | % | |

| | Cummins, Inc. | | | 39,700 | | | | 1,709,482 | | | | 2.46 | % | |

| | Emerson Electric Co. | | | 34,800 | | | | 1,313,700 | | | | 1.89 | % | |

| | Fluor Corp. | | | 25,500 | | | | 1,132,710 | | | | 1.63 | % | |

| | General Dynamics Corp. | | | 24,800 | | | | 1,554,960 | | | | 2.24 | % | |

| | Goodrich Corp. | | | 25,000 | | | | 1,358,750 | | | | 1.96 | % | |

| | Honeywell International, Inc. | | | 34,600 | | | | 1,241,794 | | | | 1.79 | % | |

| | ITT Industries, Inc. | | | 24,700 | | | | 1,252,290 | | | | 1.80 | % | |

| | Lockheed Martin Corp. | | | 13,800 | | | | 949,302 | | | | 1.37 | % | |

| | Pitney Bowes, Inc. | | | 42,700 | | | | 1,046,150 | | | | 1.51 | % | |

| | Precision Castparts Corp. | | | 16,200 | | | | 1,547,586 | | | | 2.23 | % | |

| | Rockwell Collins, Inc. | | | 29,700 | | | | 1,496,286 | | | | 2.15 | % | |

| | United Technologies Corp. | | | 23,000 | | | | 1,413,350 | | | | 2.04 | % | |

| | | | | | | | | 20,402,208 | | | | 29.39 | % | |

| | Information Technology – 10.22% | | | | | | | | | | | | | |

| | Dell, Inc. (a) | | | 94,400 | | | | 1,367,856 | | | | 1.97 | % | |

| | International Business Machines Corp. | | | 10,100 | | | | 1,218,161 | | | | 1.75 | % | |

| | Mastercard, Inc. | | | 6,000 | | | | 1,314,120 | | | | 1.89 | % | |

| | Texas Instruments, Inc. | | | 59,100 | | | | 1,385,895 | | | | 2.00 | % | |

| | Western Digital Corp. (a) | | | 53,900 | | | | 1,815,352 | | | | 2.61 | % | |

| | | | | | | | | 7,101,384 | | | | 10.22 | % | |

| | Materials – 4.93% | | | | | | | | | | | | | |

| | Consol Energy, Inc. | | | 32,400 | | | | 1,387,044 | | | | 1.99 | % | |

| | Mosaic Co. | | | 22,400 | | | | 1,046,752 | | | | 1.51 | % | |

| | Nucor Corp. | | | 24,900 | | | | 992,265 | | | | 1.43 | % | |

| | | | | | | | | 3,426,061 | | | | 4.93 | % | |

| | | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $51,037,781) | | | | | | | 66,556,639 | | | | 95.83 | % | |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | SHORT-TERM INVESTMENTS – 4.21% | | Shares/Principal | | | | | | % of Net | | |

| | | | Amount | | | Value | | | Assets | | |

| | Money Market Funds – 4.18% | | | | | | | | | | |

| | Fidelity Government Portfolio, 0.080% (c) | | $ | 2,898,149 | | | $ | 2,898,149 | | | | 4.18 | % | |

| | | | | | | | | | | | | | | |

| | Total Investment Company | | | | | | | | | | | | | |

| | (Cost $2,898,149) | | | | | | | 2,898,149 | | | | 4.18 | % | |

| | | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 0.03% | | | | | | | | | | | | | |

| | American Family Financial Services, 0.100% | | | 21,078 | | | | 21,078 | | | | 0.03 | % | |

| | | | | | | | | | | | | | | |

| | Total Variable Demand Notes | | | | | | | | | | | | | |