UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2010

Date of reporting period: October 31, 2010

Item 1. Reports to Stockholders.

HENNESSY FUNDS

ANNUAL REPORT

OCTOBER 31, 2010

Hennessy Cornerstone Growth Fund

Hennessy Cornerstone Growth Fund, Series II

Hennessy Focus 30 Fund

Hennessy Cornerstone Large Growth Fund

Hennessy Cornerstone Value Fund

Hennessy Total Return Fund

Hennessy Balanced Fund

Contents

| Letter to shareholders | 1 |

| Performance overview | |

| Hennessy Cornerstone Growth Fund | 4 |

| Hennessy Cornerstone Growth Fund, Series II | 6 |

| Hennessy Focus 30 Fund | 8 |

| Hennessy Cornerstone Large Growth Fund | 10 |

| Hennessy Cornerstone Value Fund | 12 |

| Hennessy Total Return Fund | 14 |

| Hennessy Balanced Fund | 15 |

| Financial statements | |

| Schedules of investments | |

| Hennessy Cornerstone Growth Fund | 17 |

| Hennessy Cornerstone Growth Fund, Series II | 22 |

| Hennessy Focus 30 Fund | 27 |

| Hennessy Cornerstone Large Growth Fund | 31 |

| Hennessy Cornerstone Value Fund | 36 |

| Hennessy Total Return Fund | 41 |

| Hennessy Balanced Fund | 45 |

| Statements of assets and liabilities | 50 |

| Statements of operations | 52 |

| Statements of changes in net assets | 54 |

| Statement of cash flows – Hennessy Total Return Fund | 65 |

| Financial highlights | |

| Hennessy Cornerstone Growth Fund | 66 |

| Hennessy Cornerstone Growth Fund, Series II | 70 |

| Hennessy Focus 30 Fund | 74 |

| Hennessy Cornerstone Large Growth Fund | 78 |

| Hennessy Cornerstone Value Fund | 82 |

| Hennessy Total Return Fund | 86 |

| Hennessy Balanced Fund | 88 |

| Notes to the financial statements | 91 |

| Report of Independent Registered Public Accounting Firm | 102 |

| Directors and Officers of the Funds | 104 |

| Expense example | 110 |

| Proxy voting policy | 112 |

| Quarterly Filings on Form N-Q | 112 |

| Federal Tax Distribution Information | 112 |

| Privacy Policy | 113 |

Dear Hennessy Funds Shareholder:

As I look back over the twelve-month period ended October 31, 2010, two themes emerge. First, the majority of individual investors have exhibited extremely low confidence in the financial markets. Throughout the year I talk to many of our clients, and some truly believe the markets are still in a free fall. What I hear that really troubles me are the following misconceptions about our economy:

• Despite the fact that the Dow Jones Industrial Average and S&P 500 Index each gained well over 20% in 2009 and are up approximately 8% year-to-date in 2010 (through 11/30/10), many people believe that the stock market has been down the past two years.

• American corporations are profitable, yet investors believe they are losing money.

• While 90% of Americans remain employed, people sense that everyone is losing their job.

Second, the crisis of confidence we experienced following the lows in 2009 and throughout this past year has now become a crisis of clarity. I believe we are in dire need of clarity on healthcare, taxes and regulation from our leaders in Washington for this recovery to gain momentum.

Right now, we are experiencing slow economic growth, home values continue to be unstable and unemployment is approaching multi-decade highs of 10% or more. Companies are continuing to slash costs, close unprofitable business lines, eliminate employees and hoard cash at record levels – there is $3.2 trillion in cash, in fact, among the S&P 500 companies alone. Why? I believe that the ambiguity coming from our government leaders has paralyzed American businesses, both large and small, leaving them few attractive options for deploying cash reserves.

As a business person, it feels as though every proposal coming out of Washington is focused on short-term political gain rather than on the long-term strength of our country and the economy. The rhetoric and lack of actionable direction out of Congress and the White House is having a devastating effect on our economy. The current environment has crippled businesses that need to feel confident that government is on their side.

For the twelve-month period ending October 31, 2010, the major U.S. indices returned approximately 17-18%. Small and mid-cap stocks

HENNESSY FUNDS 1-800-966-4354

significantly outperformed their large-cap brethren during the period. For the relatively small number of investors who did return to the equity market, I believe that there was a return to quality stocks, those that exhibit strong value and long term growth potential. While the markets have remained extremely volatile, I believe that the recession is firmly behind us and that the underlying economy is fundamentally sound.

What can we look forward to in the year ahead? Well, I know that for business to lead the U.S. to economic stability, we will need to have strong leadership from Washington. The Fed has shown its commitment and consistent policy to keep rates low. I am convinced that, with clarity from our government, companies will begin to gain confidence, begin to reinvest in their business models, begin to hire, and all of that will lead to an expanded economic recovery for the foreseeable future. If you look at the third calendar year of all the Presidential terms since 1950, the Dow Jones Industrial Average has returned on average 18% during those periods. While I am not sure we will hit that level in 2011, the third year of the Obama presidency, I do believe we may se e moderate growth in the range of 8-12%. If there are any major surprises, I think they may well be to the upside.

We maintain our focus on long-term investing and on building value for each of our shareholders. At Hennessy Funds, we serve our shareholders directly, so that we can provide answers to shareholder questions and concerns. Please don’t hesitate to contact us at 800-966-4354 if we can answer any questions or can be of service.

Best regards,

Neil J. Hennessy

Portfolio Manager & Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and current risk and differences in accounting methods.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average and the S&P 500 are an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. The Tokyo Stock Price Index (TOPIX) is a market capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange (TSE). You cannot invest directly in an index.

(This Page Intentionally Left Blank.)

HENNESSY FUNDS 1-800-966-4354

Hennessy Cornerstone Growth Fund

Original Class Shares (HFCGX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | | Since Inception |

| | One Year | Five Years | Ten Years | (11/1/96) |

| Hennessy Cornerstone | | | | |

| Growth Fund – Original Class | 16.69% | -5.43% | 2.94% | 7.88% |

| Russell 2000 Index | 26.58% | 3.07% | 4.89% | 6.72% |

| S&P 500 Index | 16.52% | 1.73% | -0.02% | 5.62% |

Gross expense ratio: 1.36%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

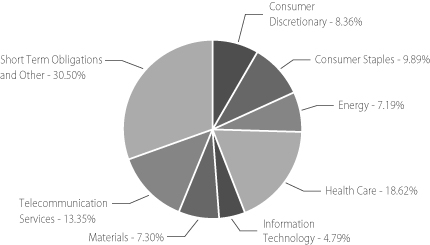

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Growth Fund returned 16.69% for the twelve-month period ended October 31, 2010, underperforming the Russell 2000 benchmark, which returned 26.58%, while slightly outperforming the S&P 500 benchmark, which returned 16.52% for the same period. The Fund’s underperformance to the Russell 2000 Index is primarily due to an underweight sector allocation in Information Technology and Industrials and an overweight sector allocation in Consumer Staples. This offset a positive sector allocation in Consumer Discretionary stocks, which outperformed as the economy rebounded, and an underweight position in Financials stocks, which underperformed for the past twelve months, despite rallying significantly off their lows of March 6, 2009. Within the Information Technology sector, both Glob al Cash Access Holdings (down over 50%) and Unisys Corp. (down over 20%) hindered the performance of the portfolio. Global Cash Access Holdings announced the loss of their largest customer in July of 2010, which pressured the stock severely, while Unisys Corp. produced lower than expected first quarter earnings due to currency related losses. In the Industrials sector, Gencorp, Inc. (down over 30%) suffered after they announced plans to refinance existing debt.

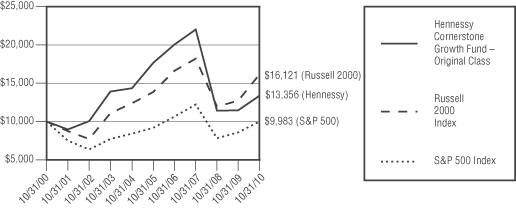

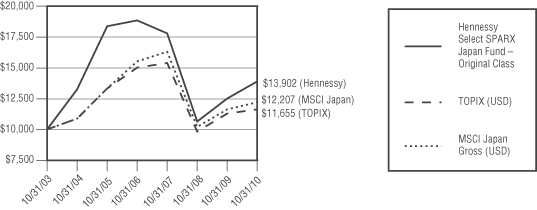

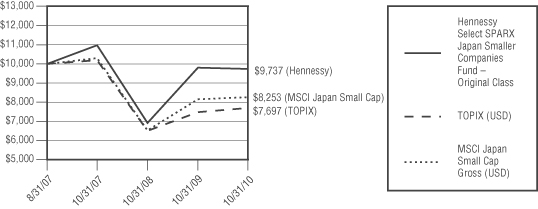

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 2000. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE GROWTH FUND

Hennessy Cornerstone Growth Fund

Institutional Class Shares (HICGX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | 3/3/08 |

| Hennessy Cornerstone | | |

| Growth Fund – Institutional Class | 17.04% | -9.15% |

| Russell 2000 Index | 26.58% | 2.54% |

| S&P 500 Index | 16.52% | -2.13% |

Gross expense ratio: 1.11%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The expense ratios presented are that from the most recent prospectus.

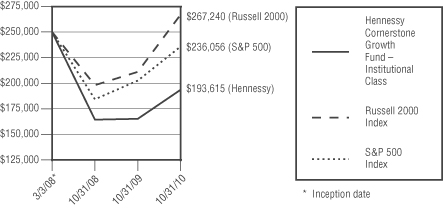

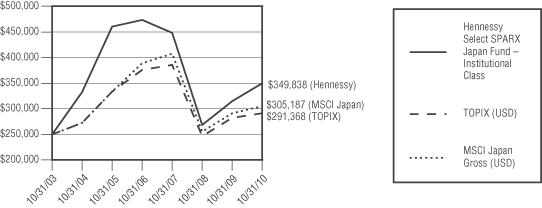

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index and Russell 2000 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

Original Class Shares (HENLX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | Since Inception |

| | One Year | Five Years | 7/1/05 |

| Hennessy Cornerstone Growth | | | |

| Fund, Series II – Original Class | 26.15% | -6.59% | -6.92% |

| Russell 2000 Growth Index | 28.67% | 3.99% | 4.11% |

| S&P 500 Index | 16.52% | 1.73% | 1.93% |

Gross expense ratio: 1.70%.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

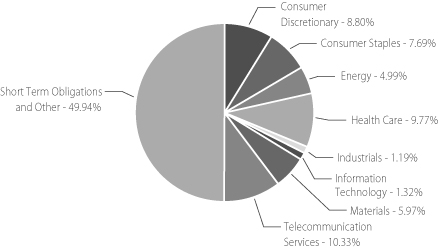

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Growth Fund, Series II, returned 26.15% for the twelve-month period ended October 31, 2010, slightly underperforming the Russell 2000 Growth benchmark, which returned 28.67%, but significantly outperforming the S&P 500, which returned 16.52% for the same period. The Fund’s underperformance of the Russell 2000 Growth Index was primarily the result of security selection after the rebalance (which occurred in the summer), specifically in the Information Technology and Consumer Discretionary sectors. Information Technology stock Ultra Clean Holdings, Inc. was down over 30% on worse than expected third quarter earnings and lower guidance for the fourth quarter. Consumer Discretionary stocks Skechers USA, Inc. and Media General (both down over 45%) also hampered the performance of the por tfolio. Skechers USA, Inc. fell on a downgrade due to sluggish demand for their Shape-ups toning sneakers, while Media General announced worse than expected third quarter earnings due to higher interest expense related to the company’s new financing structure and a non-cash tax expense. After the rebalance, the weak overall security selection in the Fund more than offset positive overweight sector allocations in Industrials and Financials. Prior to the rebalance, an underweight position in Health Care stocks (which underperformed) and an overweight position in Consumer Dictionary stocks positively impacted the Fund. Pep Boys-Manny Moe & Jack reported strong third and fourth quarter results, achieving their commitment to return to profitability in 2009.

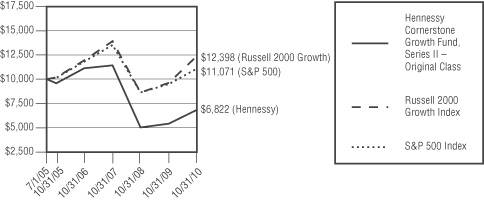

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on July 1, 2005 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

Hennessy Cornerstone Growth Fund, Series II

Institutional Class Shares (HINLX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | 3/3/08 |

| Hennessy Cornerstone Growth | | |

| Fund, Series II – Institutional Class | 26.94% | -10.59% |

| Russell 2000 Growth Index | 26.58% | 2.54% |

| S&P 500 Index | 16.52% | -2.13% |

Gross expense ratio: 1.46%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The expense ratios presented are that from the most recent prospectus.

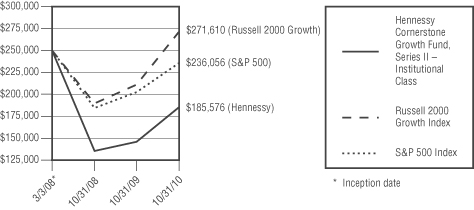

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (date of share class inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Russell 2000 Growth Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

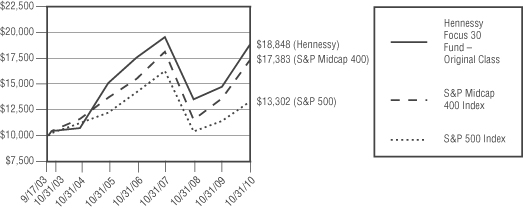

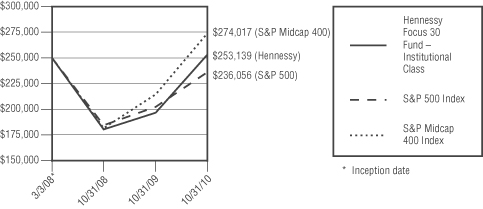

Original Class Shares (HFTFX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | Since Inception |

| | One Year | Five Years | (9/17/03) |

| Hennessy Focus 30 Fund – | | | |

| Original Class | 28.06% | 4.52% | 9.31% |

| S&P Midcap 400 Index | 27.64% | 4.93% | 8.07% |

| S&P 500 Index | 16.52% | 1.73% | 4.09% |

Gross expense ratio: 1.39%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Focus 30 Fund returned 28.06% for the twelve-month period ended October 31, 2010, outperforming both the S&P Midcap 400 and the S&P 500, which returned 27.64% and 16.52% respectively for the same period. The overweight Consumer Discretionary sector allocation was a primary reason for the portfolio’s outperformance over the past year. This allocation helped to overcome the underweight Information Technology sector allocation. This was the case for the periods both pre and post rebalance of the portfolio, which occurred in the fall of 2010. In addition, an increase in Industrial sector stocks, which was made after the rebalance, drove the more recent performance of the Fund higher. The strongest performing stock in the portfolio prior to rebalance was Virgin Media, Inc. This equity gained over 55% on news of a stock buyback program and strong second quarter results, which were both released in July of 2010. The worst performing stock before the rebalance was Tetra Tech, Inc., falling -21% on lower than expected first quarter earnings and cuts to their 2010 outlook. Solid performance for both Dollar Tree, Inc. (a keeper from the current rebalance) and Darden Restaurants, Inc., which returned over 70% and over 45% respectively, confirmed that consumer spending was not dead and that lower-end retailers were able to grow during the recovery as consumers looked to get more value for their dollar.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on September 17, 2003 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PERFORMANCE OVERVIEW — HENNESSY FOCUS 30 FUND

Hennessy Focus 30 Fund

Institutional Class Shares (HIFTX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | 3/3/08 |

| Hennessy Focus 30 Fund – Institutional Class | 28.59% | 0.47% |

| S&P Midcap 400 Index | 27.64% | 3.50% |

| S&P 500 Index | 16.52% | -2.13% |

Gross expense ratio: 1.15%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The expense ratios presented are that from the most recent prospectus.

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index and S&P Midcap 400 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS �� 1-800-966-4354

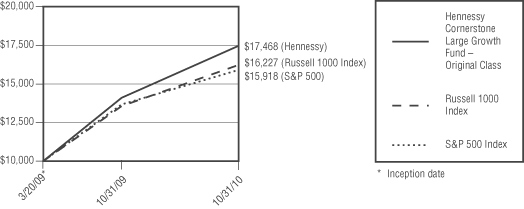

Original Class Shares (HFLGX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | (3/20/09) |

| Hennessy Cornerstone Large | | |

| Growth Fund – Original Class* | 23.88% | 41.21% |

| Russell 1000 Index | 17.67% | 34.61% |

| S&P 500 Index | 16.52% | 33.32% |

Gross expense ratio: 1.30%. The expense ratio was capped at 1.30% through March, 2010.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

| * | On March 20, 2009, the Tamarack Large Cap Growth Fund was reorganized into the Hennessy Cornerstone Large Growth Fund. At that time, the Fund began utilizing a purely quantitative formula to choose stocks for the portfolio, which differs from the investment strategy employed by the previous investment manager. Accordingly, performance is being reported for the period after the reorganization. |

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Large Growth Fund returned 23.88% for the twelve-month period ended October 31, 2010, outperforming both the Russell 1000 and the S&P 500, which returned 17.67% and 16.52% respectively for the same period. Prior to the rebalance in the winter, an underweight allocation in the Financial sector and an overweight allocation in the Consumer Dictionary sector were significant reasons for the portfolio’s outperformance and helped to overcome an underweight sector allocation in the Telecomm and Information Technology. AutoZone, Inc. was one of the strongest performers post rebalance, due to strong Q3, 2010 earnings and strong same store sales. Apollo Group, Inc. had weak performance due to decreases on their enrollment forecast as well as issues on financial aid reform for the f or-profit education industry. Prior to the rebalance, an overweight sector allocation in Industrials drove performance. Cummins, Inc., which reported strong Q4, 2009 earnings, was a strong performing stock in the portfolio.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 20, 2009 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE LARGE GROWTH FUND

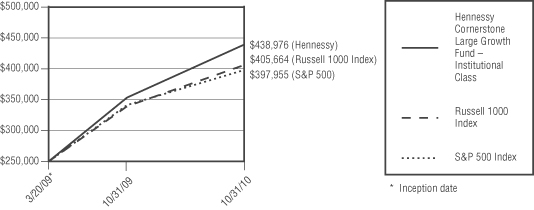

Hennessy Cornerstone Large Growth Fund

Institutional Class Shares (HILGX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | (3/20/09) |

| Hennessy Cornerstone Large | | |

| Growth Fund – Institutional Class | 24.26% | 41.66% |

| Russell 1000 Index | 17.67% | 34.61% |

| S&P 500 Index | 16.52% | 33.32% |

Gross expense ratio: 1.14%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The expense ratios presented are that from the most recent prospectus.

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 20, 2009 (inception date). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 and Russell 1000 are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index. Medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Growth stocks typically are more volatile than value stocks; however value stocks have a lower expected growth rate in earnings and sales. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

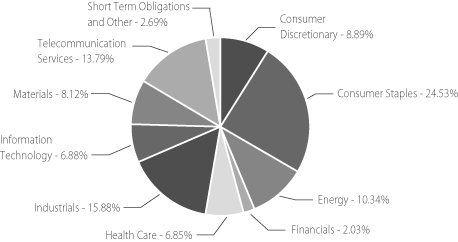

Original Class Shares (HFCVX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | | Since Inception |

| | One Year | Five Years | Ten Years | (11/1/96) |

| Hennessy Cornerstone | | | | |

| Value Fund – Original Class | 19.98% | 2.56% | 4.31% | 5.26% |

| Russell 1000 Value Index | 15.71% | 0.62% | 2.64% | 6.59% |

| S&P 500 Index | 16.52% | 1.73% | -0.02% | 5.62% |

Gross expense ratio: 1.27%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

The Hennessy Cornerstone Value Fund returned 19.98% for the twelve-month period ended October 31, 2010, outperforming its benchmark, the Russell 1000 Value, which returned 15.71%, and the S&P 500, which returned 16.52% for the same period. The Fund’s outperformance was the result of strong security selection across a number of sectors, specifically Consumer Staples, Consumer Discretionary, Telecom, Health Care and Materials. The positive effects of security selection were augmented by an underweight sector allocation in Financials and Health Care and an overweight sector allocation in Industrials and Telecom. The top performing stock in the portfolio during the period was Limited Brands, Inc. (+66%), which reported strong sales in the summer and raised their second quarter earnings guidance. Both Du Pont and Boeing also had strong performance while in the portfolio.

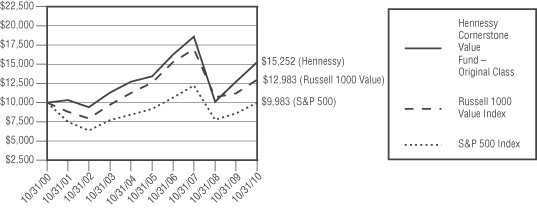

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PERFORMANCE OVERVIEW — HENNESSY CORNERSTONE VALUE FUND

Hennessy Cornerstone Value Fund

Institutional Class Shares (HICVX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | Since Inception |

| | One Year | 3/3/08 |

| Hennessy Cornerstone Value Fund – Institutional Class | 20.31% | -0.19% |

| Russell 1000 Value Index | 15.71% | -4.51% |

| S&P 500 Index | 16.52% | -2.13% |

Gross expense ratio: 1.13%. Net expense ratio: 0.98%. The expense ratio is contractually capped at 0.98% indefinitely.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The expense ratios presented are that from the most recent prospectus.

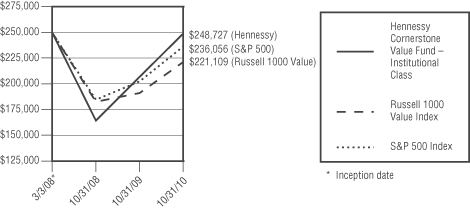

CHANGE IN VALUE OF $250,000 INVESTMENT

This chart assumes an initial gross investment of $250,000 (minimum investment) made on March 3, 2008 (inception date of share class). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Russell 1000 Value Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Fund may invest in medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the included Schedule of Investments.

HENNESSY FUNDS 1-800-966-4354

Original Class Shares (HDOGX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | | Since Inception |

| | One Year | Five Years | Ten Years | (7/29/98) |

| Hennessy Total Return Fund | 18.09% | 2.35% | 2.81% | 2.57% |

| Dow Jones Industrial Average | 17.62% | 4.01% | 2.53% | 4.11% |

| S&P 500 Index | 16.52% | 1.73% | -0.02% | 2.20% |

Gross expense ratio: 1.56%

Expenses net of interest expense: 1.27%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

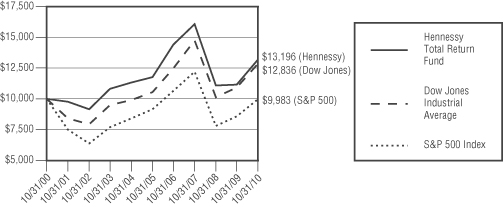

The Hennessy Total Return Fund returned 18.09% for the twelve-month period ended October 31, 2010, outperforming both the Dow Jones Industrial Average, which returned 17.62%, and the S&P 500 Index, which returned 16.52% for the same period. While there were continued low yields on Treasury Bills, which make up approximately 25% of the Fund’s assets, the Fund’s 75% equity weighting was able to capture the full move of the equity markets over the year. The Fund’s largest holdings (Du Pont, McDonald’s and Home Depot) were positive contributors to the Fund’s outperformance.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 2000. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Hennessy Total Return Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the included Schedule of Investments.

PERFORMANCE OVERVIEW — HENNESSY TOTAL RETURN FUND AND HENNESSY BALANCED FUND

Hennessy Balanced Fund

Original Class Shares (HBFBX)

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2010

| | | | | Since Inception |

| | One Year | Five Years | Ten Years | (3/8/96) |

| Hennessy Balanced Fund | 10.53% | 2.79% | 2.23% | 3.77% |

| Dow Jones Industrial Average | 17.62% | 4.01% | 2.53% | 7.25% |

| S&P 500 Index | 16.52% | 1.73% | -0.02% | 6.22% |

Gross expense ratio: 1.73%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The gross expense ratio presented is that from the most recent prospectus.

PERFORMANCE NARRATIVE

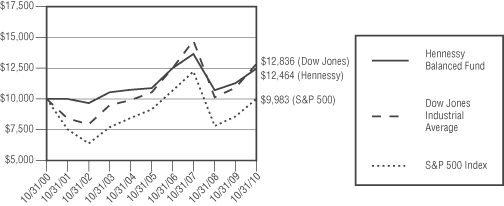

The Hennessy Balanced Fund returned 10.53% for the twelve-month period ended October 31, 2010, lagging both the Dow Jones Industrial Average, which returned 17.62%, and the S&P 500 Index, which returned 16.52% for the same period. The Fund’s relative underperformance to its benchmarks is due primarily to the continued low yields on Treasury Bills. The Fund’s position of approximately 50% in Treasuries did not allow it to capture the strong performance of the equity markets over the year. In addition, compared to the benchmark indices, the Fund’s largest underperforming holdings (Pfizer and Chevron) were concentrated more heavily within the Fund and were also a drag on relative performance. While the portfolio may underperform the indices in periods where equities rise sharply, the str ategy is geared to capture near market returns with a lower risk profile, since only half of the assets are invested in equities. Conversely, if equity markets were to fall sharply, we would expect the Fund to perform better than the indices. Ultimately, the overall goal of this portfolio is to capture upside performance while mitigating downside risk.

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000, made on October 31, 2000. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

HENNESSY FUNDS 1-800-966-4354

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. The Hennessy Balanced Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the included Schedule of Investments.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

Schedules of Investments

HENNESSY CORNERSTONE GROWTH FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Ulta Salon Cosmetics & Fragrance, Inc. | 2.95% |

| KapStone Paper & Packaging Corp. | 2.84% |

| Sanmina-SCI Corp. | 2.74% |

| Ford Motor Co. | 2.74% |

| Virgin Media, Inc. | 2.70% |

| CarMax, Inc. | 2.69% |

| Brunswick Corp. | 2.58% |

| SXC Health Solutions Corp. | 2.51% |

| Cardtronics, Inc. | 2.50% |

| Cooper Companies, Inc. | 2.50% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 98.26% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 28.62% | | | | | | | | | |

| | American Axle & Manufacturing | | | | | | | | | |

| | Holdings, Inc. (a) | | | 529,300 | | | $ | 4,880,146 | | | | 2.32 | % |

| | Big 5 Sporting Goods Corp. | | | 219,700 | | | | 2,970,344 | | | | 1.41 | % |

| | Brunswick Corp. | | | 342,400 | | | | 5,416,768 | | | | 2.58 | % |

| | CarMax, Inc. (a) | | | 182,100 | | | | 5,643,279 | | | | 2.69 | % |

| | Ford Motor Co. (a) | | | 407,700 | | | | 5,760,801 | | | | 2.74 | % |

| | H.H. Gregg, Inc. (a) | | | 175,100 | | | | 4,034,304 | | | | 1.92 | % |

| | Jo-Ann Stores, Inc. (a) | | | 111,700 | | | | 4,831,025 | | | | 2.30 | % |

| | Kirkland’s, Inc. (a) | | | 233,100 | | | | 3,135,195 | | | | 1.49 | % |

| | Knology, Inc. (a) | | | 357,000 | | | | 5,194,350 | | | | 2.47 | % |

| | La-Z-Boy, Inc. (a) | | | 384,300 | | | | 2,986,011 | | | | 1.42 | % |

| | Lumber Liquidators Holdings, Inc. (a) | | | 142,600 | | | | 3,433,808 | | | | 1.63 | % |

| | Ulta Salon Cosmetics & Fragrance, Inc. (a) | | | 201,800 | | | | 6,193,242 | | | | 2.95 | % |

| | Virgin Media, Inc. | | | 223,500 | | | | 5,683,605 | | | | 2.70 | % |

| | | | | | | | | 60,162,878 | | | | 28.62 | % |

| | Consumer Staples – 6.79% | | | | | | | | | | | | |

| | Cia Brasileira de Distribuicao | | | | | | | | | | | | |

| | Grupo Pao de Acucar – ADR (b) | | | 108,400 | | | | 4,293,724 | | | | 2.04 | % |

| | Cott Corp. (a)(b) | | | 443,700 | | | | 3,638,340 | | | | 1.73 | % |

| | Nu Skin Enterprises, Inc. | | | 132,600 | | | | 4,057,560 | | | | 1.93 | % |

| | Revlon, Inc. (a) | | | 199,500 | | | | 2,278,290 | | | | 1.09 | % |

| | | | | | | | | 14,267,914 | | | | 6.79 | % |

| | Energy – 12.84% | | | | | | | | | | | | |

| | Acergy SA – ADR (b) | | | 239,600 | | | | 4,832,732 | | | | 2.30 | % |

| | Calumet Specialty Products | | | 193,300 | | | | 4,212,007 | | | | 2.00 | % |

| | DCP Midstream Partners LP | | | 146,400 | | | | 5,223,552 | | | | 2.49 | % |

| | Massey Energy Corp. | | | 96,000 | | | | 4,038,720 | | | | 1.92 | % |

| | Patriot Coal Corp. (a) | | | 286,500 | | | | 3,864,885 | | | | 1.84 | % |

| | Regency Energy Partners LP | | | 190,100 | | | | 4,817,134 | | | | 2.29 | % |

| | | | | | | | | 26,989,030 | | | | 12.84 | % |

| | Financials – 7.93% | | | | | | | | | | | | |

| | Advance America Cash Advance Centers, Inc. | | | 610,200 | | | | 3,044,898 | | | | 1.45 | % |

| | Cardtronics, Inc. (a) | | | 310,000 | | | | 5,254,500 | | | | 2.50 | % |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Financials (Continued) | | | | | | | | | |

| | Encore Capital Group, Inc. (a) | | | 204,800 | | | $ | 4,161,536 | | | | 1.98 | % |

| | XL Capital Ltd. (b) | | | 199,500 | | | | 4,219,425 | | | | 2.00 | % |

| | | | | | | | | 16,680,359 | | | | 7.93 | % |

| | Health Care – 8.81% | | | | | | | | | | | | |

| | CIGNA Corp. | | | 110,100 | | | | 3,874,419 | | | | 1.84 | % |

| | Cooper Companies, Inc. | | | 106,300 | | | | 5,244,842 | | | | 2.50 | % |

| | Providence Service Corp. (a) | | | 250,800 | | | | 4,120,644 | | | | 1.96 | % |

| | SXC Health Solutions Corp. (a)(b) | | | 135,600 | | | | 5,282,976 | | | | 2.51 | % |

| | | | | | | | | 18,522,881 | | | | 8.81 | % |

| | Industrials – 4.69% | | | | | | | | | | | | |

| | Bucyrus International, Inc. | | | 69,800 | | | | 4,757,568 | | | | 2.26 | % |

| | GenCorp, Inc. (a) | | | 437,300 | | | | 2,129,651 | | | | 1.02 | % |

| | M&F Worldwide Corp. (a) | | | 110,300 | | | | 2,964,864 | | | | 1.41 | % |

| | | | | | | | | 9,852,083 | | | | 4.69 | % |

| | Information Technology – 11.48% | | | | | | | | | | | | |

| | Advanced Micro Devices, Inc. (a) | | | 503,200 | | | | 3,688,456 | | | | 1.76 | % |

| | Global Cash Access Holdings, Inc. (a) | | | 489,200 | | | | 1,780,688 | | | | 0.85 | % |

| | GSI Commerce, Inc. (a) | | | 156,900 | | | | 3,831,498 | | | | 1.82 | % |

| | Sanmina-SCI Corp. (a) | | | 437,300 | | | | 5,763,614 | | | | 2.74 | % |

| | Tech Data Corp. (a) | | | 86,700 | | | | 3,727,233 | | | | 1.77 | % |

| | Telvent GIT SA (a)(b) | | | 109,000 | | | | 2,765,330 | | | | 1.31 | % |

| | Unisys Corp. (a) | | | 112,400 | | | | 2,590,820 | | | | 1.23 | % |

| | | | | | | | | 24,147,639 | | | | 11.48 | % |

| | Materials – 13.54% | | | | | | | | | | | | |

| | Braskem SA – ADR (b) | | | 249,200 | | | | 5,195,820 | | | | 2.47 | % |

| | Huntsman Corp. | | | 370,300 | | | | 5,128,655 | | | | 2.44 | % |

| | KapStone Paper & Packaging Corp. (a) | | | 465,600 | | | | 5,959,680 | | | | 2.84 | % |

| | NewMarket Corp. | | | 33,700 | | | | 3,994,124 | | | | 1.90 | % |

| | Omnova Solutions, Inc. (a) | | | 545,800 | | | | 4,355,484 | | | | 2.07 | % |

| | Schweitzer-Mauduit International, Inc. | | | 59,700 | | | | 3,831,546 | | | | 1.82 | % |

| | | | | | | | | 28,465,309 | | | | 13.54 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Telecommunication Services – 3.56% | | | | | | | | | |

| | Tim Participacoes SA – ADR (b) | | | 130,300 | | | $ | 4,203,478 | | | | 2.00 | % |

| | Vivo Participacoes SA – ADR (b) | | | 114,600 | | | | 3,282,144 | | | | 1.56 | % |

| | | | | | | | | 7,485,622 | | | | 3.56 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $179,762,975) | | | | | | | 206,573,715 | | | | 98.26 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENT – 1.87% | | | | | | | | | | | | |

| | Money Market Funds – 1.87% | | | | | | | | | | | | |

| | Fidelity Government Portfolio – | | | | | | | | | | | | |

| | Institutional Class, 0.06% (c) | | | 3,933,218 | | | | 3,933,218 | | | | 1.87 | % |

| | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | |

| | (Cost $3,933,218) | | | | | | | 3,933,218 | | | | 1.87 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $3,933,218) | | | | | | | 3,933,218 | | | | 1.87 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 100.13% | | | | | | | | | | | | |

| | (Cost 183,696,193) | | | | | | | 210,506,933 | | | | 100.13 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.13)% | | | | | | | (273,500 | ) | | | (0.13 | )% |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 210,233,433 | | | | 100.00 | % |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | The rate listed is the Fund’s 7-day yield as of October 31, 2010. |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

Summary of Fair Value Exposure at October 31, 2010

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2010:

| Common Stock | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 60,162,878 | | | $ | — | | | $ | — | | | $ | 60,162,878 | |

| Consumer Staples | | | 14,267,914 | | | | — | | | | — | | | | 14,267,914 | |

| Energy | | | 26,989,030 | | | | — | | | | — | | | | 26,989,030 | |

| Financials | | | 16,680,359 | | | | — | | | | — | | | | 16,680,359 | |

| Health Care | | | 18,522,881 | | | | — | | | | — | | | | 18,522,881 | |

| Industrials | | | 9,852,083 | | | | — | | | | — | | | | 9,852,083 | |

| Information Technology | | | 24,147,639 | | | | — | | | | — | | | | 24,147,639 | |

| Materials | | | 28,465,309 | | | | — | | | | — | | | | 28,465,309 | |

| Telecommunication Services | | | 7,485,622 | | | | — | | | | — | | | | 7,485,622 | |

| Total Common Stock | | $ | 206,573,715 | | | $ | — | | | $ | — | | | $ | 206,573,715 | |

| Short-Term Investments | | $ | 3,933,218 | | | $ | — | | | $ | — | | | $ | 3,933,218 | |

| Total Investments in Securities | | $ | 210,506,933 | | | $ | — | | | $ | — | | | $ | 210,506,933 | |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

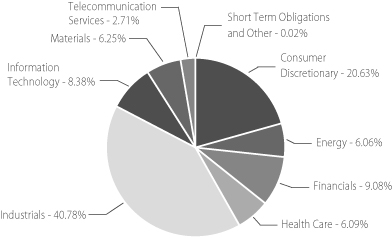

HENNESSY CORNERSTONE

GROWTH FUND, SERIES II

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Banco Macro SA – ADR | 2.95% |

| TRW Automotive Holdings Corp. | 2.75% |

| IDT Corp. | 2.71% |

| Power One, Inc. | 2.56% |

| United Continental Holdings, Inc. | 2.55% |

| Clearwater Paper Corp. | 2.51% |

| Trimas Corp. | 2.48% |

| Enterprise Group Holdings LP | 2.47% |

| Cardtronics, Inc. | 2.45% |

| Loral Space & Communications, Inc. | 2.44% |

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| | COMMON STOCKS – 99.98% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 20.63% | | | | | | | | | |

| | Brown Shoe, Inc. | | | 33,500 | | | $ | 393,625 | | | | 1.29 | % |

| | Crocs, Inc. (a) | | | 49,100 | | | | 683,963 | | | | 2.24 | % |

| | Libbey, Inc. (a) | | | 41,500 | | | | 551,535 | | | | 1.80 | % |

| | Lifetime Brands, Inc. (a) | | | 35,300 | | | | 453,252 | | | | 1.48 | % |

| | Media General, Inc. (a) | | | 51,900 | | | | 285,969 | | | | 0.93 | % |

| | Select Comfort Corp. (a) | | | 59,100 | | | | 491,121 | | | | 1.60 | % |

| | Sinclair Broadcast Group, Inc. – Class A (a) | | | 84,300 | | | | 673,557 | | | | 2.20 | % |

| | Skechers USA, Inc. (a) | | | 14,000 | | | | 272,160 | | | | 0.89 | % |

| | TRW Automotive Holdings Corp. (a) | | | 18,400 | | | | 840,696 | | | | 2.75 | % |

| | Ulta Salon Cosmetics & Fragrance, Inc. (a) | | | 22,500 | | | | 690,525 | | | | 2.26 | % |

| | Valassis Communications, Inc. (a) | | | 16,200 | | | | 534,600 | | | | 1.75 | % |

| | Whirlpool Corp. | | | 5,800 | | | | 439,814 | | | | 1.44 | % |

| | | | | | | | | 6,310,817 | | | | 20.63 | % |

| | Energy – 6.06% | | | | | | | | | | | | |

| | Callon Petroleum Co. (a) | | | 91,300 | | | | 450,109 | | | | 1.47 | % |

| | Enterprise Group Holdings LP | | | 11,800 | | | | 755,200 | | | | 2.47 | % |

| | Inergy Holdings LP | | | 21,500 | | | | 649,300 | | | | 2.12 | % |

| | | | | | | | | 1,854,609 | | | | 6.06 | % |

| | Financials – 9.08% | | | | | | | | | | | | |

| | American International Group, Inc. (a) | | | 15,200 | | | | 638,552 | | | | 2.09 | % |

| | Banco Macro SA – ADR (b) | | | 18,100 | | | | 902,285 | | | | 2.95 | % |

| | Cardtronics, Inc. (a) | | | 44,300 | | | | 750,885 | | | | 2.45 | % |

| | Zions Bancorporation | | | 23,500 | | | | 485,510 | | | | 1.59 | % |

| | | | | | | | | 2,777,232 | | | | 9.08 | % |

| | Health Care – 6.09% | | | | | | | | | | | | |

| | Hill Rom Holdings, Inc. | | | 18,000 | | | | 697,500 | | | | 2.28 | % |

| | SXC Health Solutions Corp. (a)(b) | | | 15,206 | | | | 592,426 | | | | 1.94 | % |

| | Universal American Corp. | | | 35,700 | | | | 574,056 | | | | 1.87 | % |

| | | | | | | | | 1,863,982 | | | | 6.09 | % |

| | Industrials – 40.78% | | | | | | | | | | | | |

| | Air Transport Services Group Inc. (a) | | | 107,000 | | | | 719,040 | | | | 2.35 | % |

| | Alamo Group, Inc. | | | 24,900 | | | | 597,600 | | | | 1.95 | % |

| | Alaska Air Group, Inc. (a) | | | 11,800 | | | | 623,040 | | | | 2.04 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Industrials (Continued) | | | | | | | | | |

| | ArvinMeritor, Inc. (a) | | | 37,400 | | | $ | 620,092 | | | | 2.03 | % |

| | Cascade Corp. | | | 14,300 | | | | 506,077 | | | | 1.65 | % |

| | Commercial Vehicle Group, Inc. (a) | | | 47,800 | | | | 641,954 | | | | 2.10 | % |

| | Consolidated Graphics, Inc. (a) | | | 12,100 | | | | 563,255 | | | | 1.84 | % |

| | Diamond Management & | | | | | | | | | | | | |

| | Technology Consultants, Inc. | | | 51,100 | | | | 637,217 | | | | 2.08 | % |

| | Esterline Technologies Corp. (a) | | | 11,000 | | | | 664,840 | | | | 2.17 | % |

| | Gardner Denver, Inc. | | | 11,500 | | | | 664,930 | | | | 2.17 | % |

| | Interface, Inc. | | | 46,200 | | | | 664,818 | | | | 2.17 | % |

| | Macquarie Infrastructure Company, Inc. (a) | | | 40,100 | | | | 725,008 | | | | 2.37 | % |

| | NACCO Industries, Inc. | | | 5,800 | | | | 575,708 | | | | 1.88 | % |

| | Owens Corning (a) | | | 17,400 | | | | 470,496 | | | | 1.54 | % |

| | Pacer International, Inc. (a) | | | 77,900 | | | | 433,903 | | | | 1.42 | % |

| | Standex International Corp. | | | 21,000 | | | | 565,530 | | | | 1.85 | % |

| | Tennant Co. | | | 16,200 | | | | 543,510 | | | | 1.78 | % |

| | Trimas Corp. (a) | | | 47,900 | | | | 758,257 | | | | 2.48 | % |

| | US Airways Group, Inc. (a) | | | 61,200 | | | | 721,548 | | | | 2.36 | % |

| | United Continental Holdings, Inc. (a) | | | 26,800 | | | | 778,272 | | | | 2.55 | % |

| | | | | | | | | 12,475,095 | | | | 40.78 | % |

| | Information Technology – 8.38% | | | | | | | | | | | | |

| | Lionbridge Technologies, Inc. (a) | | | 111,400 | | | | 557,000 | | | | 1.82 | % |

| | Loral Space & Communications, Inc. (a) | | | 13,400 | | | | 745,442 | | | | 2.44 | % |

| | Power One, Inc. (a) | | | 75,300 | | | | 783,873 | | | | 2.56 | % |

| | Ultra Clean Holdings, Inc. (a) | | | 63,300 | | | | 476,649 | | | | 1.56 | % |

| | | | | | | | | 2,562,964 | | | | 8.38 | % |

| | Materials – 6.25% | | | | | | | | | | | | |

| | Clearwater Paper Corp. (a) | | | 9,500 | | | | 767,125 | | | | 2.51 | % |

| | Neenah Paper, Inc. | | | 28,700 | | | | 440,545 | | | | 1.44 | % |

| | Quaker Chemical Corp. | | | 19,300 | | | | 702,906 | | | | 2.30 | % |

| | | | | | | | | 1,910,576 | | | | 6.25 | % |

| | Telecommunication Services – 2.71% | | | | | | | | | | | | |

| | IDT Corp. (a) | | | 56,500 | | | | 829,420 | | | | 2.71 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $27,709,116) | | | | | | | 30,584,695 | | | | 99.98 | % |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| | SHORT-TERM INVESTMENTS – 0.37% | | Principal | | | | | | % of Net | |

| | | | Amount | | | Value | | | Assets | |

| | Demand Notes# – 0.37% | | | | | | | | | |

| | American Family Financial Services, 0.10% | | $ | 114,233 | | | $ | 114,233 | | | | 0.37 | % |

| | | | | | | | | | | | | | |

| | Total Demand Notes | | | | | | | | | | | | |

| | (Cost $114,233) | | | | | | | 114,233 | | | | 0.37 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $114,233) | | | | | | | 114,233 | | | | 0.37 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 100.35% | | | | | | | | | | | | |

| | (Cost 27,823,349) | | | | | | | 30,698,928 | | | | 100.35 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.35)% | | | | | | | (105,634 | ) | | | (0.35 | )% |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 30,593,294 | | | | 100.00 | % |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. Interest rates listed are as of October 31, 2010. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2010:

| Common Stock | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 6,310,817 | | | $ | — | | | $ | — | | | $ | 6,310,817 | |

| Energy | | | 1,854,609 | | | | — | | | | — | | | | 1,854,609 | |

| Financials | | | 2,777,232 | | | | — | | | | — | | | | 2,777,232 | |

| Health Care | | | 1,863,982 | | | | — | | | | — | | | | 1,863,982 | |

| Industrials | | | 12,475,095 | | | | — | | | | — | | | | 12,475,095 | |

| Information Technology | | | 2,562,964 | | | | — | | | | — | | | | 2,562,964 | |

| Materials | | | 1,910,576 | | | | — | | | | — | | | | 1,910,576 | |

| Telecommunication Services | | | 829,420 | | | | — | | | | — | | | | 829,420 | |

| Total Common Stock | | $ | 30,584,695 | | | $ | — | | | $ | — | | | $ | 30,584,695 | |

| Short-Term Investments | | $ | — | | | $ | 114,233 | | | $ | — | | | $ | 114,233 | |

| Total Investments in Securities | | $ | 30,584,695 | | | $ | 114,233 | | | $ | — | | | $ | 30,698,928 | |

The accompanying notes are an integral part of these financial statements.

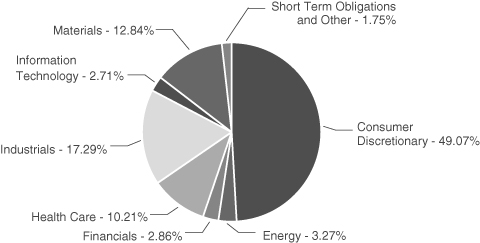

SCHEDULE OF INVESTMENTS — HENNESSY FOCUS 30 FUND

HENNESSY FOCUS 30 FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| United Continental Holdings, Inc. | 3.92% |

| U.S. Airways Group, Inc. | 3.87% |

| Healthspring, Inc. | 3.78% |

| TRW Automotive Holdings Corp. | 3.77% |

| Crocs, Inc. | 3.59% |

| Tenneco, Inc. | 3.52% |

| Borgwarner, Inc. | 3.51% |

| Autoliv, Inc. | 3.49% |

| ArvinMeritor, Inc. | 3.43% |

| Polyone Corp. | 3.41% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 98.25% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 49.07% | | | | | | | | | |

| | Advance Auto Parts, Inc. | | | 73,900 | | | $ | 4,802,022 | | | | 3.32 | % |

| | Autoliv, Inc. | | | 70,800 | | | | 5,048,040 | | | | 3.49 | % |

| | Borgwarner, Inc. (a) | | | 90,400 | | | | 5,072,344 | | | | 3.51 | % |

| | Crocs, Inc. (a) | | | 372,500 | | | | 5,188,925 | | | | 3.59 | % |

| | Dollar Tree, Inc. (a) | | | 90,300 | | | | 4,633,293 | | | | 3.21 | % |

| | Family Dollar Stores, Inc. | | | 99,500 | | | | 4,593,915 | | | | 3.18 | % |

| | HSN, Inc. (a) | | | 142,900 | | | | 4,278,426 | | | | 2.96 | % |

| | Jo-Ann Stores, Inc. (a) | | | 97,400 | | | | 4,212,550 | | | | 2.91 | % |

| | Tenneco, Inc. (a) | | | 156,000 | | | | 5,088,720 | | | | 3.52 | % |

| | Tractor Supply Co. | | | 113,936 | | | | 4,511,866 | | | | 3.12 | % |

| | TRW Automotive Holdings Corp. (a) | | | 119,300 | | | | 5,450,817 | | | | 3.77 | % |

| | Ulta Salon Cosmetics & Fragrance, Inc. (a) | | | 154,900 | | | | 4,753,881 | | | | 3.29 | % |

| | Valassis Communications, Inc. (a) | | | 129,200 | | | | 4,263,600 | | | | 2.95 | % |

| | Williams Sonoma, Inc. | | | 140,000 | | | | 4,531,800 | | | | 3.13 | % |

| | Wyndham Worldwide Corp. | | | 157,000 | | | | 4,513,750 | | | | 3.12 | % |

| | | | | | | | | 70,943,949 | | | | 49.07 | % |

| | Energy – 3.27% | | | | | | | | | | | | |

| | Complete Production Services, Inc. (a) | | | 202,000 | | | | 4,732,860 | | | | 3.27 | % |

| | | | | | | | | | | | | | |

| | Financials – 2.86% | | | | | | | | | | | | |

| | Jones Lang Lasalle, Inc. | | | 53,000 | | | | 4,137,180 | | | | 2.86 | % |

| | | | | | | | | | | | | | |

| | Health Care – 10.21% | | | | | | | | | | | | |

| | Amerigroup Corp. (a) | | | 112,000 | | | | 4,673,760 | | | | 3.23 | % |

| | Healthspring, Inc. (a) | | | 187,300 | | | | 5,467,287 | | | | 3.78 | % |

| | Magellan Health Services, Inc. (a) | | | 96,300 | | | | 4,622,400 | | | | 3.20 | % |

| | | | | | | | | 14,763,447 | | | | 10.21 | % |

| | Industrials – 17.29% | | | | | | | | | | | | |

| | Applied Industrial Technologies, Inc. | | | 145,200 | | | | 4,415,532 | | | | 3.05 | % |

| | ArvinMeritor, Inc. (a) | | | 298,700 | | | | 4,952,446 | | | | 3.43 | % |

| | Toro Co. | | | 77,000 | | | | 4,370,520 | | | | 3.02 | % |

| | U.S. Airways Group, Inc. (a) | | | 474,800 | | | | 5,597,892 | | | | 3.87 | % |

| | United Continental Holdings, Inc. (a) | | | 195,000 | | | | 5,662,800 | | | | 3.92 | % |

| | | | | | | | | 24,999,190 | | | | 17.29 | % |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY FOCUS 30 FUND

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Information Technology – 2.71% | | | | | | | | | |

| | Lexmark International (a) | | | 102,900 | | | $ | 3,913,287 | | | | 2.71 | % |

| | | | | | | | | | | | | | |

| | Materials – 12.84% | | | | | | | | | | | | |

| | Ferro Corp. (a) | | | 347,900 | | | | 4,773,188 | | | | 3.30 | % |

| | Lubrizol Corp. | | | 40,800 | | | | 4,181,592 | | | | 2.89 | % |

| | Polyone Corp. (a) | | | 381,200 | | | | 4,925,104 | | | | 3.41 | % |

| | Rockwood Holdings, Inc. (a) | | | 138,200 | | | | 4,687,744 | | | | 3.24 | % |

| | | | | | | | | 18,567,628 | | | | 12.84 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $128,675,287) | | | | | | | 142,057,541 | | | | 98.25 | % |

| | | | | | | | | | | | | | |

| | WARRANTS – 0.00% | | | | | | | | | | | | |

| | Lantronix, Inc., Warrant Ω | | | | | | | | | | | | |

| | Expiration: February, 2011, Exercise Price: $0.85 | | | 158 | | | | 0 | | | | 0.00 | % |

| | | | | | | | | | | | | | |

| | Total Warrants (Cost $0) | | | | | | | 0 | | | | 0.00 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENT – 1.48% | | | | | | | | | | | | |

| | Money Market Funds – 1.48% | | | | | | | | | | | | |

| | Fidelity Government Portfolio – | | | | | | | | | | | | |

| | Institutional Class, 0.06% (b) | | | 2,133,285 | | | | 2,133,285 | | | | 1.48 | % |

| | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | |

| | (Cost $2,133,285) | | | | | | | 2,133,285 | | | | 1.48 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $2,133,285) | | | | | | | 2,133,285 | | | | 1.48 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 99.73% | | | | | | | | | | | | |

| | (Cost 130,808,572) | | | | | | | 144,190,826 | | | | 99.73 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – 0.27% | | | | | | | 386,102 | | | | 0.27 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 144,576,928 | | | | 100.00 | % |

| (a) | Non-income producing security. |

| (b) | The rate listed is the Fund’s 7-day yield as of October 31, 2010. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2010:

| Common Stock | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 70,943,949 | | | $ | — | | | $ | — | | | $ | 70,943,949 | |

| Energy | | | 4,732,860 | | | | — | | | | — | | | | 4,732,860 | |

| Financials | | | 4,137,180 | | | | — | | | | — | | | | 4,137,180 | |

| Health Care | | | 14,763,447 | | | | — | | | | — | | | | 14,763,447 | |

| Industrials | | | 24,999,190 | | | | — | | | | — | | | | 24,999,190 | |

| Information Technology | | | 3,913,287 | | | | — | | | | — | | | | 3,913,287 | |

| Materials | | | 18,567,628 | | | | — | | | | — | | | | 18,567,628 | |

| Total Common Stock | | $ | 142,057,541 | | | $ | — | | | $ | — | | | $ | 142,057,541 | |

| Warrants | | $ | — | | | $ | — | | | $ | — | (1) | | $ | — | |

| Short-Term Investments | | $ | 2,133,285 | | | $ | — | | | $ | — | | | $ | 2,133,285 | |

| Total Investments in Securities | | $ | 144,190,826 | | | $ | — | | | $ | — | | | $ | 144,190,826 | |

| (1) | If the Lantronix, Inc. warrant would have had a value, it would have been a Level 3 fair value. The warrant has been fair valued at $0 during the entire reporting period. |

The accompanying notes are an integral part of these financial statements.

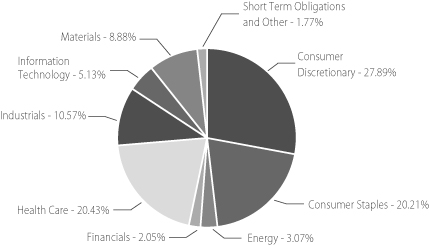

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE LARGE GROWTH FUND

HENNESSY CORNERSTONE

LARGE GROWTH FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Liberty Global, Inc. | 2.60% |

| Humana, Inc. | 2.52% |

| AutoZone, Inc. | 2.47% |

| Dollar Tree, Inc. | 2.37% |

| Freeport-McMoRan Copper & Gold, Inc. | 2.34% |

| Forest Laboratories, Inc. | 2.30% |

| Altria Group, Inc. | 2.29% |

| Philip Morris International, Inc. | 2.28% |

| DIRECTV | 2.27% |

| Crown Holdings, Inc. | 2.25% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 98.23% | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Consumer Discretionary – 27.89% | | | | | | | | | |

| | Apollo Group, Inc. (a) | | | 24,000 | | | $ | 899,520 | | | | 1.14 | % |

| | AutoZone, Inc. (a) | | | 8,200 | | | | 1,948,566 | | | | 2.47 | % |

| | Best Buy Co., Inc. | | | 32,000 | | | | 1,375,360 | | | | 1.74 | % |

| | DIRECTV (a) | | | 41,200 | | | | 1,790,552 | | | | 2.27 | % |

| | Dish Network Corp. | | | 67,500 | | | | 1,340,550 | | | | 1.70 | % |

| | Dollar Tree, Inc. (a) | | | 36,400 | | | | 1,867,684 | | | | 2.37 | % |

| | Family Dollar Stores, Inc. | | | 37,900 | | | | 1,749,843 | | | | 2.22 | % |

| | The Gap, Inc. | | | 59,100 | | | | 1,123,491 | | | | 1.42 | % |

| | Liberty Global, Inc. (a) | | | 54,200 | | | | 2,048,218 | | | | 2.60 | % |

| | Mattel, Inc. | | | 63,900 | | | | 1,490,787 | | | | 1.89 | % |

| | Ross Stores, Inc. | | | 26,000 | | | | 1,533,740 | | | | 1.94 | % |

| | The McGraw-Hill Companies, Inc. | | | 44,200 | | | | 1,664,130 | | | | 2.11 | % |

| | TJX Companies, Inc. | | | 31,600 | | | | 1,450,124 | | | | 1.84 | % |

| | Yum Brands, Inc. | | | 34,700 | | | | 1,719,732 | | | | 2.18 | % |

| | | | | | | | | 22,002,297 | | | | 27.89 | % |

| | Consumer Staples – 20.21% | | | | | | | | | | | | |

| | Altria Group, Inc. | | | 71,100 | | | | 1,807,362 | | | | 2.29 | % |

| | Campbell Soup Co. | | | 42,300 | | | | 1,533,375 | | | | 1.94 | % |

| | Clorox Co. | | | 23,300 | | | | 1,550,615 | | | | 1.96 | % |

| | General Mills, Inc. | | | 42,800 | | | | 1,606,712 | | | | 2.04 | % |

| | H.J. Heinz Co. | | | 32,700 | | | | 1,605,897 | | | | 2.03 | % |

| | Kellogg Co. | | | 28,400 | | | | 1,427,384 | | | | 1.81 | % |

| | Kimberly – Clark Corp. | | | 24,500 | | | | 1,551,830 | | | | 1.97 | % |

| | Lorillard, Inc. | | | 19,200 | | | | 1,638,528 | | | | 2.08 | % |

| | Philip Morris International, Inc. | | | 30,700 | | | | 1,795,950 | | | | 2.28 | % |

| | Sysco Corp. | | | 48,500 | | | | 1,428,810 | | | | 1.81 | % |

| | | | | | | | | 15,946,463 | | | | 20.21 | % |

| | Energy – 3.07% | | | | | | | | | | | | |

| | Consol Energy, Inc. | | | 34,300 | | | | 1,260,868 | | | | 1.60 | % |

| | Diamond Offshore Drilling | | | 17,600 | | | | 1,164,416 | | | | 1.47 | % |

| | | | | | | | | 2,425,284 | | | | 3.07 | % |

| | Financials – 2.05% | | | | | | | | | | | | |

| | Moody’s Corp. | | | 59,800 | | | | 1,618,188 | | | | 2.05 | % |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE LARGE GROWTH FUND

| | COMMON STOCKS | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Health Care – 20.43% | | | | | | | | | |

| | Baxter International, Inc. | | | 31,300 | | | $ | 1,593,170 | | | | 2.02 | % |

| | Becton, Dickinson & Co. | | | 19,600 | | | | 1,480,192 | | | | 1.88 | % |

| | Bristol-Myers Squibb Co. | | | 61,400 | | | | 1,651,660 | | | | 2.09 | % |

| | Cardinal Health, Inc. | | | 41,600 | | | | 1,443,104 | | | | 1.83 | % |

| | CIGNA Corp. | | | 45,900 | | | | 1,615,221 | | | | 2.05 | % |

| | Eli Lilly & Co. | | | 42,600 | | | | 1,499,520 | | | | 1.90 | % |

| | Forest Laboratories, Inc. (a) | | | 55,000 | | | | 1,817,750 | | | | 2.30 | % |

| | Humana, Inc. (a) | | | 34,100 | | | | 1,987,689 | | | | 2.52 | % |

| | Johnson & Johnson | | | 23,100 | | | | 1,470,777 | | | | 1.86 | % |

| | Laboratory Corp. of America Holdings (a) | | | 19,200 | | | | 1,561,344 | | | | 1.98 | % |

| | | | | | | | | 16,120,427 | | | | 20.43 | % |

| | Industrials – 10.57% | | | | | | | | | | | | |

| | Flowserve Corp. | | | 12,800 | | | | 1,280,000 | | | | 1.62 | % |

| | Fluor Corp. | | | 28,500 | | | | 1,373,415 | | | | 1.74 | % |

| | Honeywell International, Inc. | | | 31,700 | | | | 1,493,387 | | | | 1.90 | % |

| | Joy Global, Inc. | | | 24,600 | | | | 1,745,370 | | | | 2.21 | % |

| | Lockheed Martin Corp. | | | 17,600 | | | | 1,254,704 | | | | 1.59 | % |

| | Raytheon Co. | | | 25,800 | | | | 1,188,864 | | | | 1.51 | % |

| | | | | | | | | 8,335,740 | | | | 10.57 | % |

| | Information Technology – 5.13% | | | | | | | | | | | | |

| | International Business Machines Corp. | | | 11,500 | | | | 1,651,400 | | | | 2.09 | % |

| | SAIC, Inc. (a) | | | 82,500 | | | | 1,282,050 | | | | 1.63 | % |

| | Western Digital Corp. (a) | | | 34,700 | | | | 1,111,094 | | | | 1.41 | % |

| | | | | | | | | 4,044,544 | | | | 5.13 | % |

| | Materials – 8.88% | | | | | | | | | | | | |

| | Crown Holdings, Inc. (a) | | | 55,200 | | | | 1,776,888 | | | | 2.25 | % |

| | FMC Corp. | | | 23,300 | | | | 1,703,230 | | | | 2.16 | % |

| | Freeport-McMoRan Copper & Gold, Inc. | | | 19,500 | | | | 1,846,260 | | | | 2.34 | % |

| | Lubrizol Corp. | | | 16,400 | | | | 1,680,836 | | | | 2.13 | % |

| | | | | | | | | 7,007,214 | | | | 8.88 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $68,227,078) | | | | | | | 77,500,157 | | | | 98.23 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | SHORT-TERM INVESTMENTS – 1.85% | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Money Market Funds – 1.85% | | | | | | | | | |

| | Fidelity Government Portfolio – | | | | | | | | | |

| | Institutional Class, 0.06% (b) | | | 1,458,228 | | | $ | 1,458,228 | | | | 1.85 | % |

| | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | |

| | (Cost $1,458,228) | | | | | | | 1,458,228 | | | | 1.85 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $1,458,228) | | | | | | | 1,458,228 | | | | 1.85 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 100.08% | | | | | | | | | | | | |

| | (Cost 69,685,306) | | | | | | | 78,958,385 | | | | 100.08 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.08)% | | | | | | | (60,139 | ) | | | (0.08 | )% |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 78,898,246 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate listed is the Fund’s 7-day yield as of October 31, 2010. |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS — HENNESSY CORNERSTONE LARGE GROWTH FUND

Summary of Fair Value Exposure at October 31, 2010

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination.

| Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| Level 3 – | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2010:

| Common Stock | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 22,002,297 | | | $ | — | | | $ | — | | | $ | 22,002,297 | |

| Consumer Staples | | | 15,946,463 | | | | — | | | | — | | | | 15,946,463 | |

| Energy | | | 2,425,284 | | | | — | | | | — | | | | 2,425,284 | |

| Financials | | | 1,618,188 | | | | — | | | | — | | | | 1,618,188 | |