- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 29 Jul 16, 12:00am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2016

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

KT Gwanghwamun Building East

33, Jongno 3-gil, Jongno-gu

03155 Seoul, Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: | July 29, 2016 | |

| KT Corporation | ||

| By: | /s/ Youngwoo Kim | |

| Name: | Youngwoo Kim | |

| Title: | Vice President | |

| By: | /s/ Jungsup Jung | |

| Name: | Jungsup Jung | |

| Title: | Director | |

KT 2Q16 Earnings Release Investor Relations| 2016. 7. 29

Disclaimer This presentation has been prepared by KT Corp.(the Company”). This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to change without notice. No presentation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented. Please be informed that items included in our operating income have been prepared in accordance with K-IFRS 1001 released on October 17, 2012, which was revised to coincide with the Korean Accounting Standards for Non-Public Entities (“KAS-NPEs”). As such, our disposal gains from real estate and others have been excluded from our operating income. The Company, its affiliates or representatives accept no liability whatsoever for any losses arising from any information contained in the presentation. This presentation does not constitute an offer or invitation to purchase or subscribe for any shares of the Company, and no part of this presentation shall form the Basis of or be relied upon in connection with any contract or commitment. Any decision to purchase shares o the Company could be made solely on the Basis of information, which has been publicly filed with the Securities and Exchange Commission or the Korea Stock Exchange and distributed to all investors. The contents of this presentation may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose. If you have any related questions to this material, please contact IR department. Tel : 82-2-3495-3557, 3558, 3564, 5529, 5343, 5344 Fax : 82-2-3495-5917

Contents 1 Financial Highlights 2 Business Overview 3 Q&A 4 Appendix

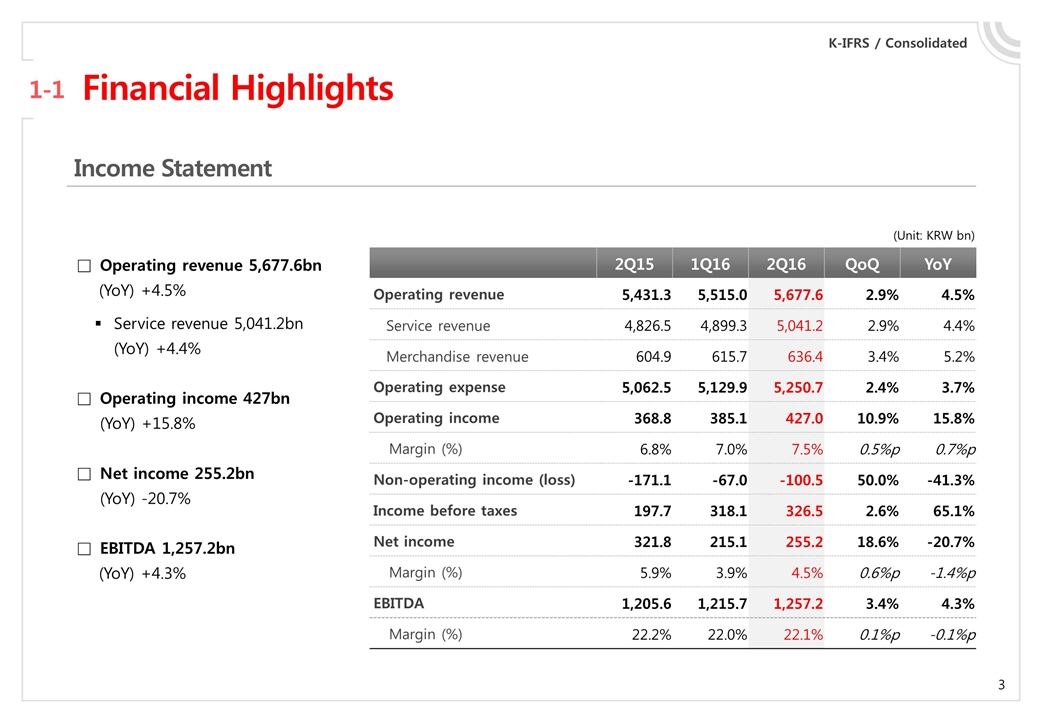

Financial Highlights 1-1 (Unit: KRW bn) K-IFRS / Consolidated Operating revenue 5,677.6bn (YoY) +4.5% Service revenue 5,041.2bn (YoY) +4.4% Operating income 427bn (YoY) +15.8% Net income 255.2bn (YoY) -20.7% EBITDA 1,257.2bn (YoY) +4.3% 2Q15 1Q16 2Q16 QoQ YoY Operating revenue 5,431.3 5,515.0 5,677.6 2.9% 4.5% Service revenue 4,826.5 4,899.3 5,041.2 2.9% 4.4% Merchandise revenue 604.9 615.7 636.4 3.4% 5.2% Operating expense 5,062.5 5,129.9 5,250.7 2.4% 3.7% Operating income 368.8 385.1 427.0 10.9% 15.8% Margin (%) 6.8% 7.0% 7.5% 0.5%p 0.7%p Non-operating income (loss) -171.1 -67.0 -100.5 50.0% -41.3% Income before taxes 197.7 318.1 326.5 2.6% 65.1% Net income 321.8 215.1 255.2 18.6% -20.7% Margin (%) 5.9% 3.9% 4.5% 0.6%p -1.4%p EBITDA 1,205.6 1,215.7 1,257.2 3.4% 4.3% Margin (%) 22.2% 22.0% 22.1% 0.1%p -0.1%p Income Statement

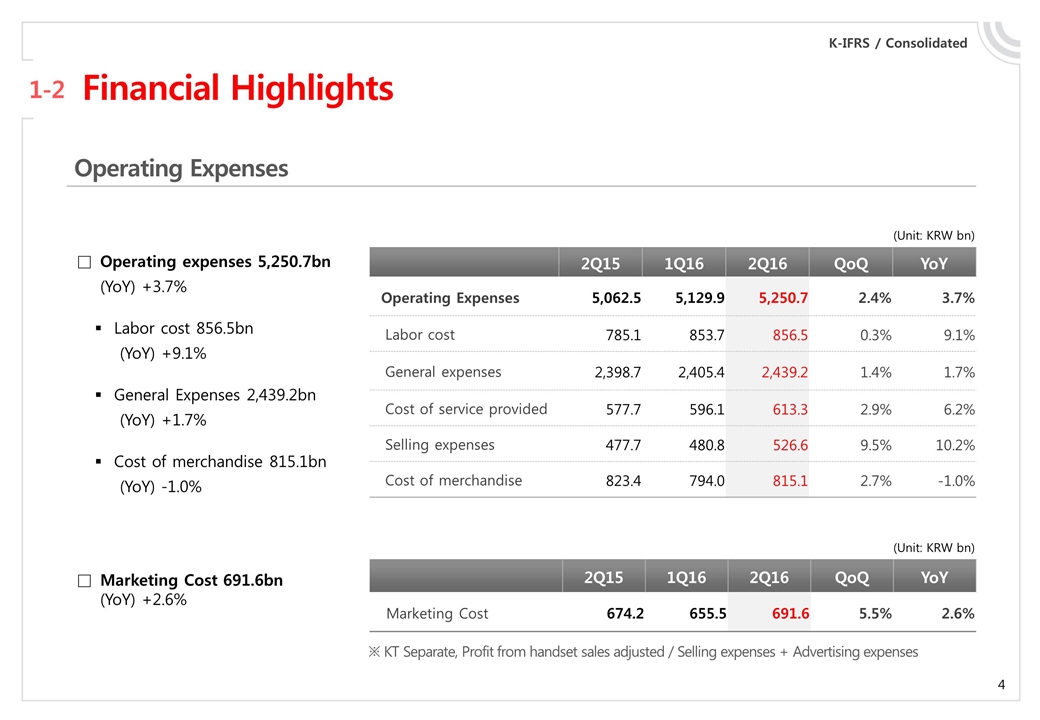

1-2 K-IFRS / Consolidated Financial Highlights Operating expenses 5,250.7bn (YoY) +3.7% Labor cost 856.5bn (YoY) +9.1% General Expenses 2,439.2bn (YoY) +1.7% Cost of merchandise 815.1bn (YoY) -1.0% 2Q15 1Q16 2Q16 QoQ YoY Operating Expenses 5,062.5 5,129.9 5,250.7 2.4% 3.7% Labor cost 785.1 853.7 856.5 0.3% 9.1% General expenses 2,398.7 2,405.4 2,439.2 1.4% 1.7% Cost of service provided 577.7 596.1 613.3 2.9% 6.2% Selling expenses 477.7 480.8 526.6 9.5% 10.2% Cost of merchandise 823.4 794.0 815.1 2.7% -1.0% 2Q15 1Q16 2Q16 QoQ YoY Marketing Cost 674.2 655.5 691.6 5.5% 2.6% Operating Expenses Marketing Cost 691.6bn (YoY) +2.6% (Unit: KRW bn) (Unit: KRW bn) ※ KT Separate, Profit from handset sales adjusted / Selling expenses + Advertising expenses

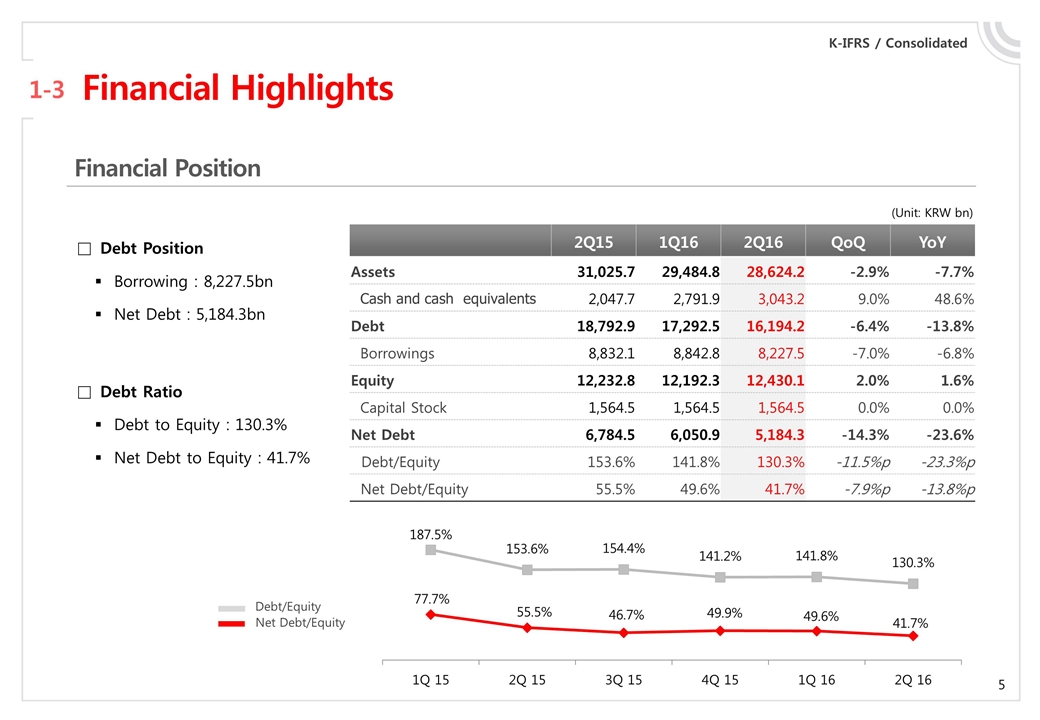

Financial Highlights 1-3 K-IFRS / Consolidated (Unit: KRW bn) Debt Position Borrowing : 8,227.5bn Net Debt : 5,184.3bn Debt Ratio Debt to Equity : 130.3% Net Debt to Equity : 41.7% 2Q15 1Q16 2Q16 QoQ YoY Assets 31,025.7 29,484.8 28,624.2 -2.9% -7.7% Cash and cash equivalents 2,047.7 2,791.9 3,043.2 9.0% 48.6% Debt 18,792.9 17,292.5 16,194.2 -6.4% -13.8% Borrowings 8,832.1 8,842.8 8,227.5 -7.0% -6.8% Equity 12,232.8 12,192.3 12,430.1 2.0% 1.6% Capital Stock 1,564.5 1,564.5 1,564.5 0.0% 0.0% Net Debt 6,784.5 6,050.9 5,184.3 -14.3% -23.6% Debt/Equity 153.6% 141.8% 130.3% -11.5%p -23.3%p Net Debt/Equity 55.5% 49.6% 41.7% -7.9%p -13.8%p Debt/Equity Net Debt/Equity Financial Position

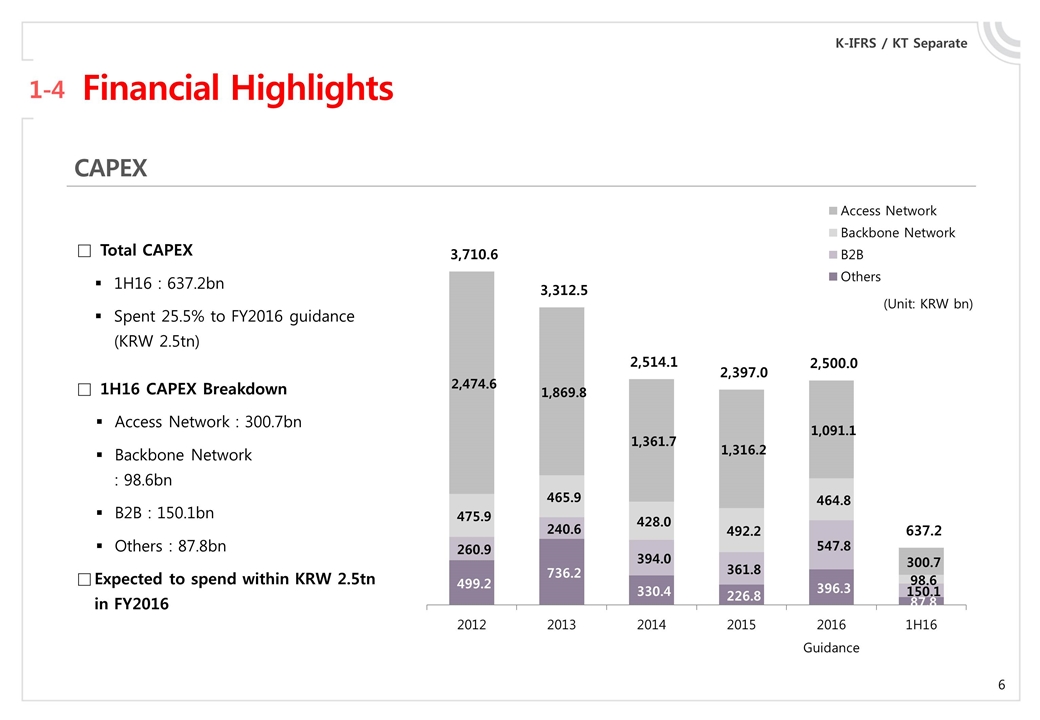

Financial Highlights 1-4 K-IFRS / KT Separate Total CAPEX 1H16 : 637.2bn Spent 25.5% to FY2016 guidance (KRW 2.5tn) 1H16 CAPEX Breakdown Access Network : 300.7bn Backbone Network : 98.6bn B2B : 150.1bn Others : 87.8bn Expected to spend within KRW 2.5tn in FY2016 CAPEX (Unit: KRW bn)

1 Financial Highlights 2 Business Overview 3 Q&A 4 Appendix

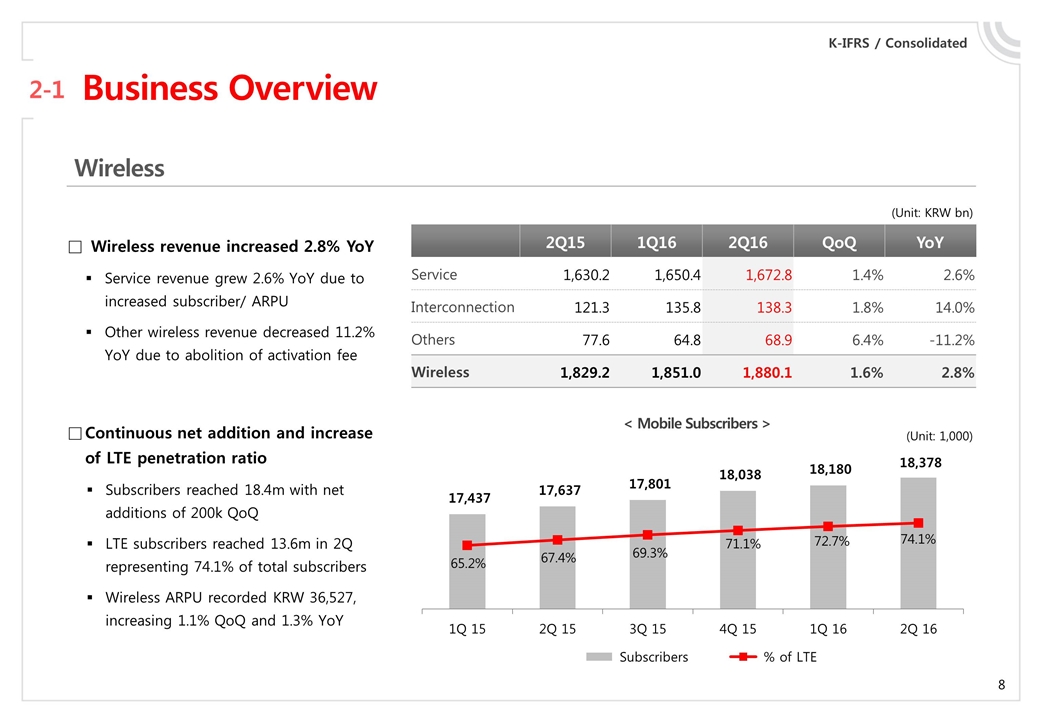

Business Overview 2-1 (Unit: KRW bn) Wireless revenue increased 2.8% YoY Service revenue grew 2.6% YoY due to increased subscriber/ ARPU Other wireless revenue decreased 11.2% YoY due to abolition of activation fee Continuous net addition and increase of LTE penetration ratio Subscribers reached 18.4m with net additions of 200k QoQ LTE subscribers reached 13.6m in 2Q representing 74.1% of total subscribers Wireless ARPU recorded KRW 36,527, increasing 1.1% QoQ and 1.3% YoY (Unit: 1,000) < Mobile Subscribers > 2Q15 1Q16 2Q16 QoQ YoY Service 1,630.2 1,650.4 1,672.8 1.4% 2.6% Interconnection 121.3 135.8 138.3 1.8% 14.0% Others 77.6 64.8 68.9 6.4% -11.2% Wireless 1,829.2 1,851.0 1,880.1 1.6% 2.8% Wireless K-IFRS / Consolidated

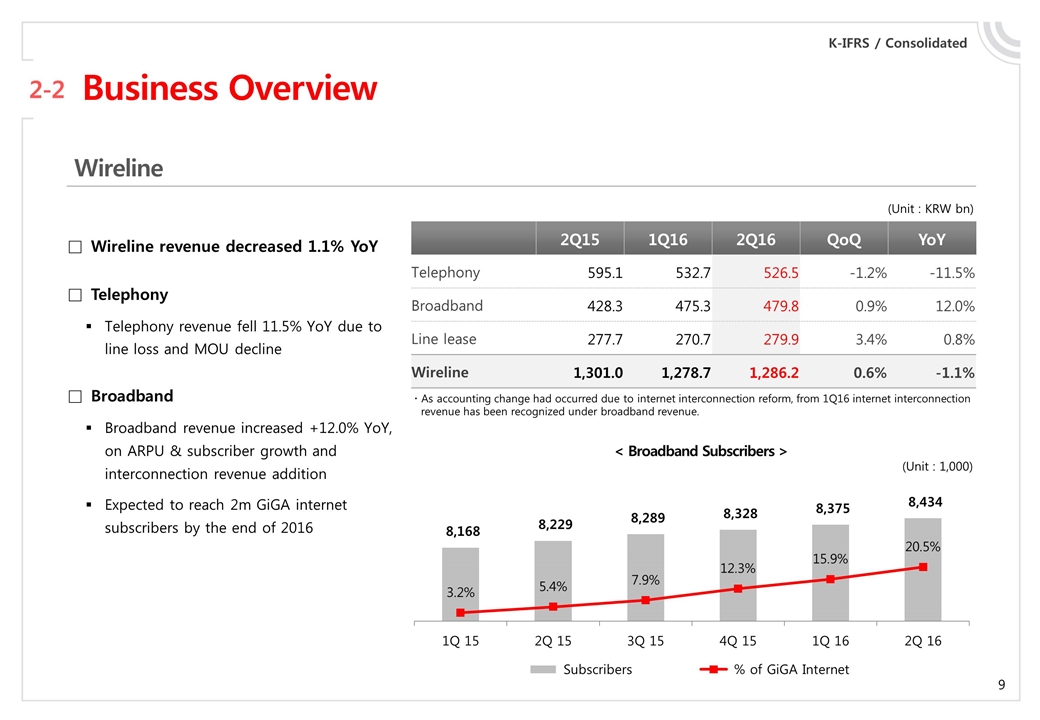

Business Overview 2-2 K-IFRS / Consolidated (Unit : KRW bn) (Unit : 1,000) Wireline revenue decreased 1.1% YoY Telephony Telephony revenue fell 11.5% YoY due to line loss and MOU decline Broadband Broadband revenue increased +12.0% YoY, on ARPU & subscriber growth and interconnection revenue addition Expected to reach 2m GiGA internet subscribers by the end of 2016 < Broadband Subscribers > 2Q15 1Q16 2Q16 QoQ YoY Telephony 595.1 532.7 526.5 -1.2% -11.5% Broadband 428.3 475.3 479.8 0.9% 12.0% Line lease 277.7 270.7 279.9 3.4% 0.8% Wireline 1,301.0 1,278.7 1,286.2 0.6% -1.1% ž As accounting change had occurred due to internet interconnection reform, from 1Q16 internet interconnection revenue has been recognized under broadband revenue. Wireline

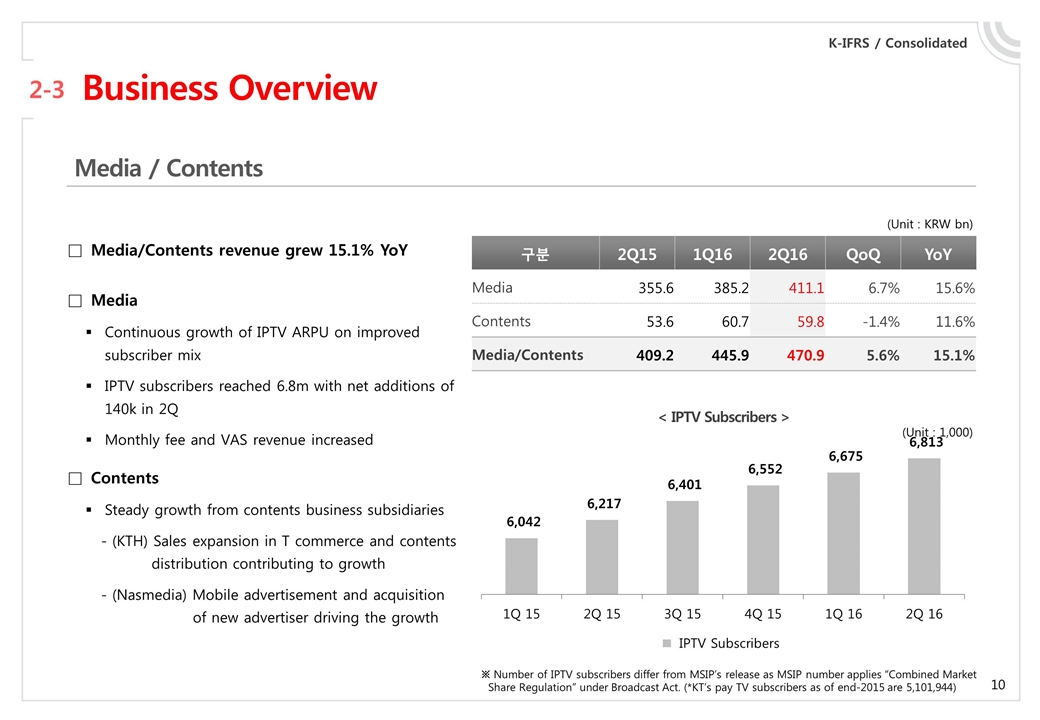

Business Overview 2-3 (Unit : 1,000) (Unit : KRW bn) < IPTV Subscribers > Media/Contents revenue grew 15.1% YoY Media Continuous growth of IPTV ARPU on improved subscriber mix IPTV subscribers reached 6.8m with net additions of 140k in 2Q Monthly fee and VAS revenue increased Contents Steady growth from contents business subsidiaries - (KTH) Sales expansion in T commerce and contents distribution contributing to growth - (Nasmedia) Mobile advertisement and acquisition of new advertiser driving the growth 구분 2Q15 1Q16 2Q16 QoQ YoY Media 355.6 385.2 411.1 6.7% 15.6% Contents 53.6 60.7 59.8 -1.4% 11.6% Media/Contents 409.2 445.9 470.9 5.6% 15.1% Media / Contents K-IFRS / Consolidated ※ Number of IPTV subscribers differ from MSIP’s release as MSIP number applies “Combined Market Share Regulation” under Broadcast Act. (*KT’s pay TV subscribers as of end-2015 are 5,101,944)

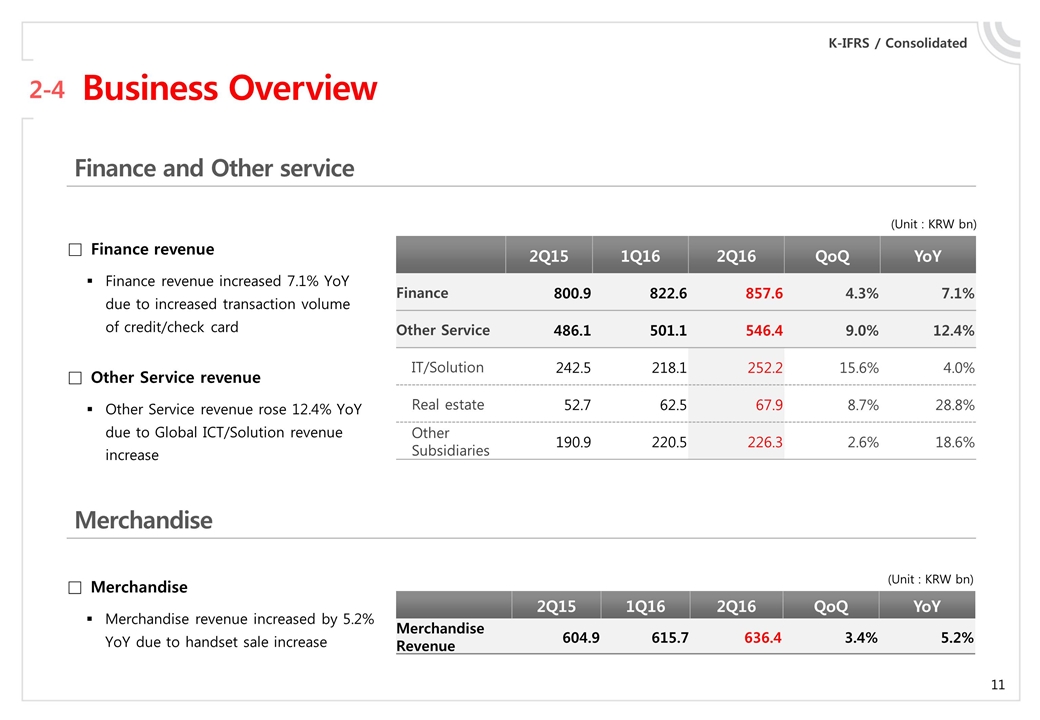

Business Overview 2-4 Merchandise Merchandise revenue increased by 5.2% YoY due to handset sale increase Finance revenue Finance revenue increased 7.1% YoY due to increased transaction volume of credit/check card Other Service revenue Other Service revenue rose 12.4% YoY due to Global ICT/Solution revenue increase (Unit : KRW bn) (Unit : KRW bn) 2Q15 1Q16 2Q16 QoQ YoY Finance 800.9 822.6 857.6 4.3% 7.1% Other Service 486.1 501.1 546.4 9.0% 12.4% IT/Solution 242.5 218.1 252.2 15.6% 4.0% Real estate 52.7 62.5 67.9 8.7% 28.8% Other Subsidiaries 190.9 220.5 226.3 2.6% 18.6% 2Q15 1Q16 2Q16 QoQ YoY Merchandise Revenue 604.9 615.7 636.4 3.4% 5.2% Finance and Other service Merchandise K-IFRS / Consolidated

1 Financial Highlights 2 Business Overview 3 Q&A 4 Appendix

1 Financial Highlights 2 Business Overview 3 Q&A 4 Appendix

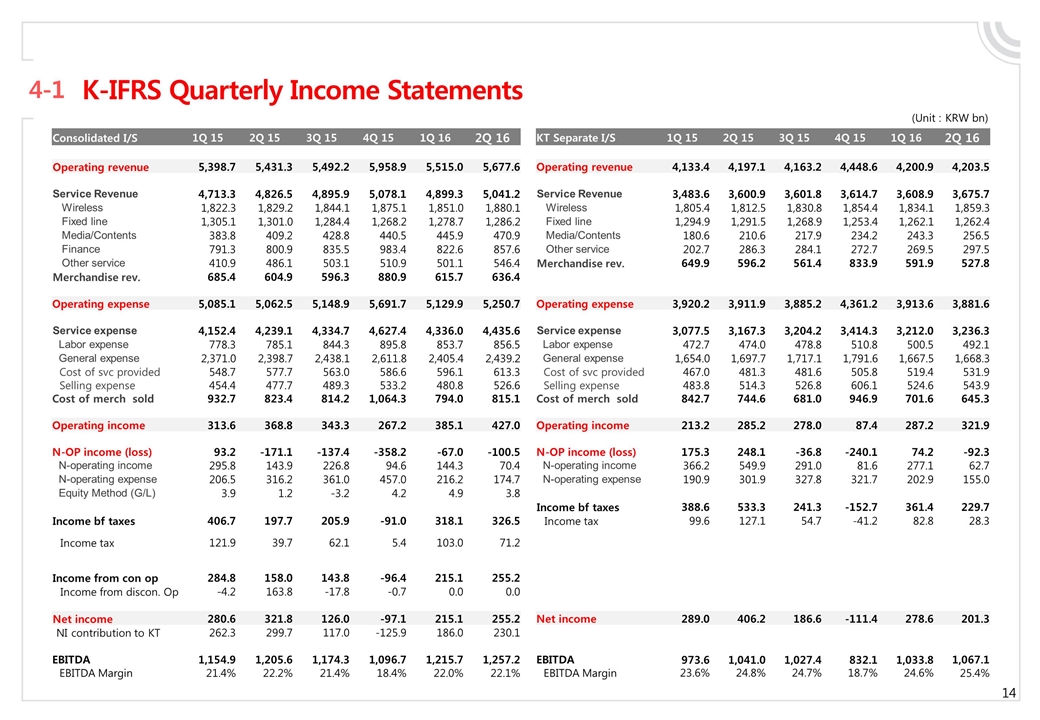

K-IFRS Quarterly Income Statements 4-1 (Unit : KRW bn) Consolidated I/S 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 KT Separate I/S 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Operating revenue 5,398.7 5,431.3 5,492.2 5,958.9 5,515.0 5,677.6 Operating revenue 4,133.4 4,197.1 4,163.2 4,448.6 4,200.9 4,203.5 Service Revenue 4,713.3 4,826.5 4,895.9 5,078.1 4,899.3 5,041.2 Service Revenue 3,483.6 3,600.9 3,601.8 3,614.7 3,608.9 3,675.7 Wireless 1,822.3 1,829.2 1,844.1 1,875.1 1,851.0 1,880.1 Wireless 1,805.4 1,812.5 1,830.8 1,854.4 1,834.1 1,859.3 Fixed line 1,305.1 1,301.0 1,284.4 1,268.2 1,278.7 1,286.2 Fixed line 1,294.9 1,291.5 1,268.9 1,253.4 1,262.1 1,262.4 Media/Contents 383.8 409.2 428.8 440.5 445.9 470.9 Media/Contents 180.6 210.6 217.9 234.2 243.3 256.5 Finance 791.3 800.9 835.5 983.4 822.6 857.6 Other service 202.7 286.3 284.1 272.7 269.5 297.5 Other service 410.9 486.1 503.1 510.9 501.1 546.4 Merchandise rev. 649.9 596.2 561.4 833.9 591.9 527.8 Merchandise rev. 685.4 604.9 596.3 880.9 615.7 636.4 Operating expense 5,085.1 5,062.5 5,148.9 5,691.7 5,129.9 5,250.7 Operating expense 3,920.2 3,911.9 3,885.2 4,361.2 3,913.6 3,881.6 Service expense 4,152.4 4,239.1 4,334.7 4,627.4 4,336.0 4,435.6 Service expense 3,077.5 3,167.3 3,204.2 3,414.3 3,212.0 3,236.3 Labor expense 778.3 785.1 844.3 895.8 853.7 856.5 Labor expense 472.7 474.0 478.8 510.8 500.5 492.1 General expense 2,371.0 2,398.7 2,438.1 2,611.8 2,405.4 2,439.2 General expense 1,654.0 1,697.7 1,717.1 1,791.6 1,667.5 1,668.3 Cost of svc provided 548.7 577.7 563.0 586.6 596.1 613.3 Cost of svc provided 467.0 481.3 481.6 505.8 519.4 531.9 Selling expense 454.4 477.7 489.3 533.2 480.8 526.6 Selling expense 483.8 514.3 526.8 606.1 524.6 543.9 Cost of merch sold 932.7 823.4 814.2 1,064.3 794.0 815.1 Cost of merch sold 842.7 744.6 681.0 946.9 701.6 645.3 Operating income 313.6 368.8 343.3 267.2 385.1 427.0 Operating income 213.2 285.2 278.0 87.4 287.2 321.9 N-OP income (loss) 93.2 -171.1 -137.4 -358.2 -67.0 -100.5 N-OP income (loss) 175.3 248.1 -36.8 -240.1 74.2 -92.3 N-operating income 295.8 143.9 226.8 94.6 144.3 70.4 N-operating income 366.2 549.9 291.0 81.6 277.1 62.7 N-operating expense 206.5 316.2 361.0 457.0 216.2 174.7 N-operating expense 190.9 301.9 327.8 321.7 202.9 155.0 Equity Method (G/L) 3.9 1.2 -3.2 4.2 4.9 3.8 Income bf taxes 388.6 533.3 241.3 -152.7 361.4 229.7 Income bf taxes 406.7 197.7 205.9 -91.0 318.1 326.5 Income tax 99.6 127.1 54.7 -41.2 82.8 28.3 Income tax 121.9 39.7 62.1 5.4 103.0 71.2 Income from con op 284.8 158.0 143.8 -96.4 215.1 255.2 Income from discon. Op -4.2 163.8 -17.8 -0.7 0.0 0.0 Net income 280.6 321.8 126.0 -97.1 215.1 255.2 Net income 289.0 406.2 186.6 -111.4 278.6 201.3 NI contribution to KT 262.3 299.7 117.0 -125.9 186.0 230.1 EBITDA 1,154.9 1,205.6 1,174.3 1,096.7 1,215.7 1,257.2 EBITDA 973.6 23.6% 1,041.0 24.8% 1,027.4 24.7% 832.1 18.7% 1,033.8 24.6% 1,067.1 EBITDA Margin 21.4% 22.2% 21.4% 18.4% 22.0% 22.1% EBITDA Margin 25.4%

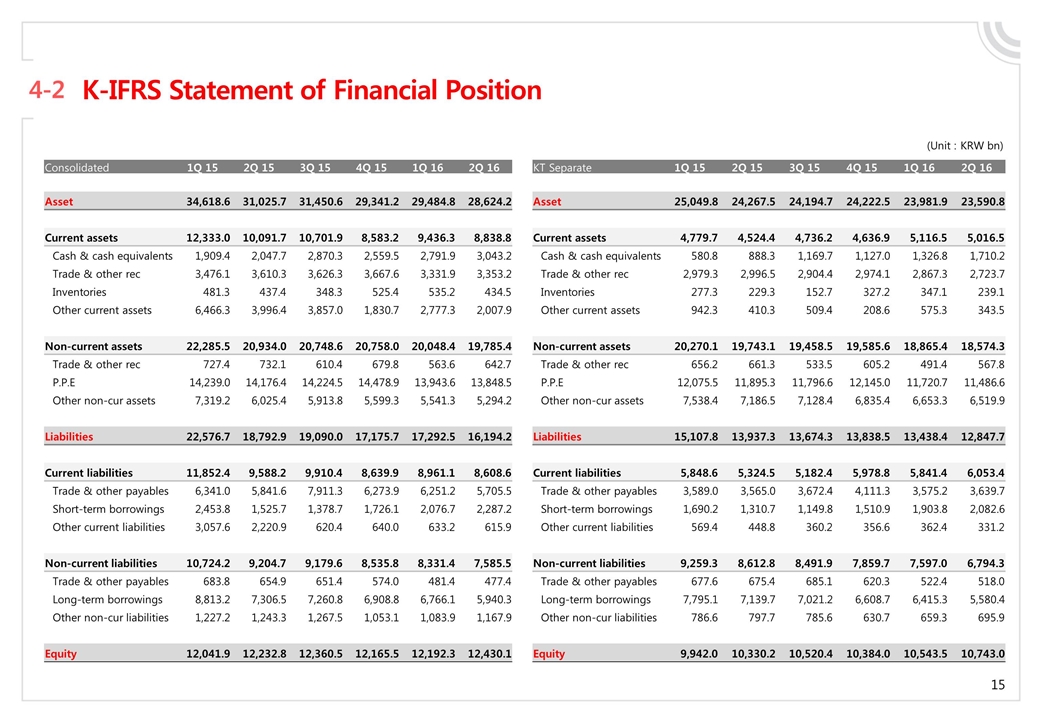

K-IFRS Statement of Financial Position 4-2 (Unit : KRW bn) Consolidated 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 KT Separate 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 Asset 34,618.6 31,025.7 31,450.6 29,341.2 29,484.8 28,624.2 Asset 25,049.8 24,267.5 24,194.7 24,222.5 23,981.9 23,590.8 Current assets 12,333.0 10,091.7 10,701.9 8,583.2 9,436.3 8,838.8 Current assets 4,779.7 4,524.4 4,736.2 4,636.9 5,116.5 5,016.5 Cash & cash equivalents 1,909.4 2,047.7 2,870.3 2,559.5 2,791.9 3,043.2 Cash & cash equivalents 580.8 888.3 1,169.7 1,127.0 1,326.8 1,710.2 Trade & other rec 3,476.1 3,610.3 3,626.3 3,667.6 3,331.9 3,353.2 Trade & other rec 2,979.3 2,996.5 2,904.4 2,974.1 2,867.3 2,723.7 Inventories 481.3 437.4 348.3 525.4 535.2 434.5 Inventories 277.3 229.3 152.7 327.2 347.1 239.1 Other current assets 6,466.3 3,996.4 3,857.0 1,830.7 2,777.3 2,007.9 Other current assets 942.3 410.3 509.4 208.6 575.3 343.5 Non-current assets 22,285.5 20,934.0 20,748.6 20,758.0 20,048.4 19,785.4 Non-current assets 20,270.1 19,743.1 19,458.5 19,585.6 18,865.4 18,574.3 Trade & other rec 727.4 732.1 610.4 679.8 563.6 642.7 Trade & other rec 656.2 661.3 533.5 605.2 491.4 567.8 P.P.E 14,239.0 14,176.4 14,224.5 14,478.9 13,943.6 13,848.5 P.P.E 12,075.5 11,895.3 11,796.6 12,145.0 11,720.7 11,486.6 Other non-cur assets 7,319.2 6,025.4 5,913.8 5,599.3 5,541.3 5,294.2 Other non-cur assets 7,538.4 7,186.5 7,128.4 6,835.4 6,653.3 6,519.9 Liabilities 22,576.7 18,792.9 19,090.0 17,175.7 17,292.5 16,194.2 Liabilities 15,107.8 13,937.3 13,674.3 13,838.5 13,438.4 12,847.7 Current liabilities 11,852.4 9,588.2 9,910.4 8,639.9 8,961.1 8,608.6 Current liabilities 5,848.6 5,324.5 5,182.4 5,978.8 5,841.4 6,053.4 Trade & other payables 6,341.0 5,841.6 7,911.3 6,273.9 6,251.2 5,705.5 Trade & other payables 3,589.0 3,565.0 3,672.4 4,111.3 3,575.2 3,639.7 Short-term borrowings 2,453.8 1,525.7 1,378.7 1,726.1 2,076.7 2,287.2 Short-term borrowings 1,690.2 1,310.7 1,149.8 1,510.9 1,903.8 2,082.6 Other current liabilities 3,057.6 2,220.9 620.4 640.0 633.2 615.9 Other current liabilities 569.4 448.8 360.2 356.6 362.4 331.2 Non-current liabilities 10,724.2 9,204.7 9,179.6 8,535.8 8,331.4 7,585.5 Non-current liabilities 9,259.3 8,612.8 8,491.9 7,859.7 7,597.0 6,794.3 Trade & other payables 683.8 654.9 651.4 574.0 481.4 477.4 Trade & other payables 677.6 675.4 685.1 620.3 522.4 518.0 Long-term borrowings 8,813.2 7,306.5 7,260.8 6,908.8 6,766.1 5,940.3 Long-term borrowings 7,795.1 7,139.7 7,021.2 6,608.7 6,415.3 5,580.4 Other non-cur liabilities 1,227.2 1,243.3 1,267.5 1,053.1 1,083.9 1,167.9 Other non-cur liabilities 786.6 797.7 785.6 630.7 659.3 695.9 Equity 12,041.9 12,232.8 12,360.5 12,165.5 12,192.3 12,430.1 Equity 9,942.0 10,330.2 10,520.4 10,384.0 10,543.5 10,743.0

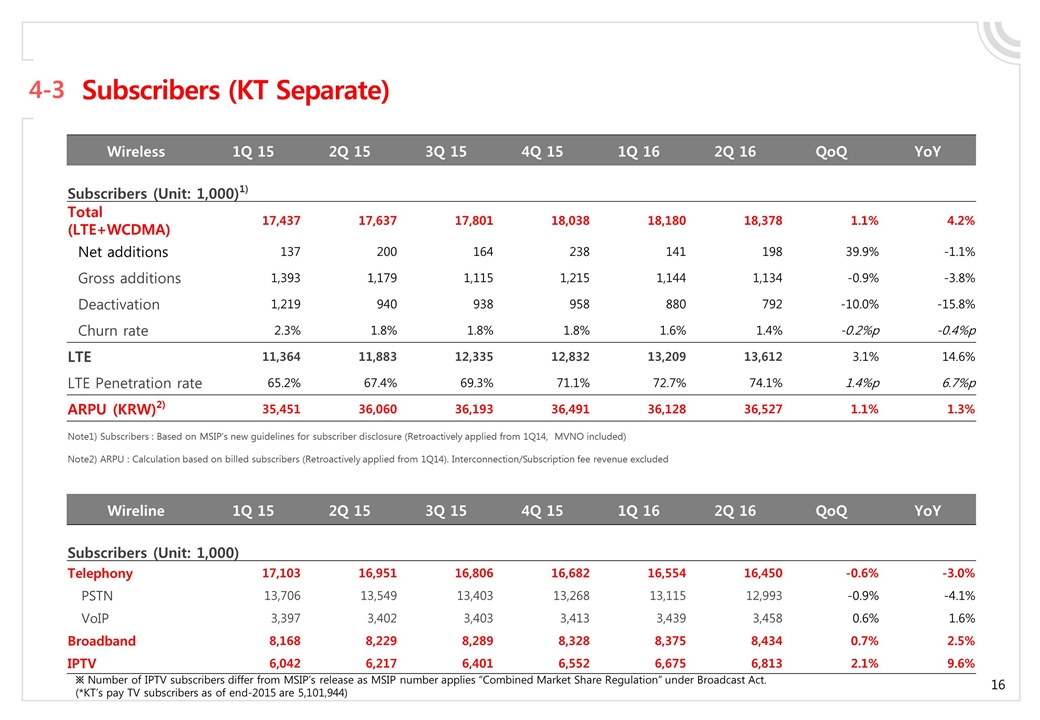

Subscribers (KT Separate) 4-3 Wireless 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 QoQ YoY Subscribers (Unit: 1,000)1) Total (LTE+WCDMA) 17,437 17,637 17,801 18,038 18,180 18,378 1.1% 4.2% Net additions 137 200 164 238 141 198 39.9% -1.1% Gross additions 1,393 1,179 1,115 1,215 1,144 1,134 -0.9% -3.8% Deactivation 1,219 940 938 958 880 792 -10.0% -15.8% Churn rate 2.3% 1.8% 1.8% 1.8% 1.6% 1.4% -0.2%p -0.4%p LTE 11,364 11,883 12,335 12,832 13,209 13,612 3.1% 14.6% LTE Penetration rate 65.2% 67.4% 69.3% 71.1% 72.7% 74.1% 1.4%p 6.7%p ARPU (KRW)2) 35,451 36,060 36,193 36,491 36,128 36,527 1.1% 1.3% Note1) Subscribers : Based on MSIP’s new guidelines for subscriber disclosure (Retroactively applied from 1Q14, MVNO included) Note2) ARPU : Calculation based on billed subscribers (Retroactively applied from 1Q14). Interconnection/Subscription fee revenue excluded Wireline 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 QoQ YoY Subscribers (Unit: 1,000) Telephony 17,103 16,951 16,806 16,682 16,554 16,450 -0.6% -3.0% PSTN 13,706 13,549 13,403 13,268 13,115 12,993 -0.9% -4.1% VoIP 3,397 3,402 3,403 3,413 3,439 3,458 0.6% 1.6% Broadband 8,168 8,229 8,289 8,328 8,375 8,434 0.7% 2.5% IPTV 6,042 6,217 6,401 6,552 6,675 6,813 2.1% 9.6% ※ Number of IPTV subscribers differ from MSIP’s release as MSIP number applies “Combined Market Share Regulation” under Broadcast Act. (*KT’s pay TV subscribers as of end-2015 are 5,101,944)