UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07288

Franklin Strategic Mortgage Portfolio

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 9/30

Date of reporting period: 9/30/14

Item 1. Reports to Stockholders.

| Contents | |

| Shareholder Letter | 1 |

| Annual Report | |

| Franklin Strategic Mortgage | |

| Portfolio | 3 |

| Performance Summary | 6 |

| Your Fund’s Expenses | 11 |

| Financial Highlights and | |

| Statement of Investments | 13 |

| Financial Statements | 24 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered | |

| Public Accounting Firm | 39 |

| Tax Information | 40 |

| Board Members and Officers | 41 |

| Shareholder Information | 46 |

| 1

Annual Report

Franklin Strategic Mortgage Portfolio

We are pleased to bring you Franklin Strategic Mortgage Portfolio’s annual report for the fiscal year ended September 30, 2014.

Your Fund’s Goal and Main Investments

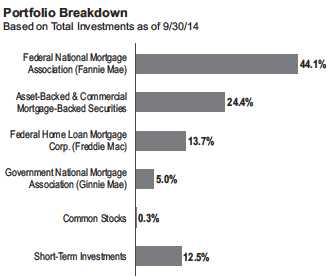

The Fund seeks high total return (a combination of high current income and capital appreciation) relative to the performance of the general mortgage securities market by investing at least 80% of its net assets in a portfolio of mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by the Government National Mortgage Association (Ginnie Mae), Fannie Mae and Freddie Mac.1

Performance Overview

For the year under review, the Fund’s Class A shares delivered a +5.09% cumulative total return. In comparison, the Fund’s new primary benchmark, the Barclays U.S. Mortgage-Backed Securities (MBS) Fixed Rate Index, which measures the performance of investment grade fixed-rate mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac, posted a +3.81% total return.2 We replaced the previous benchmark, the Citigroup U.S. Broad Investment Grade (USBIG) Mortgage Index, because the new benchmark is more widely used in the industry. For the 12-month period, the Citigroup USBIG Mortgage Index posted a +3.68% total return.2 The Lipper U.S. Mortgage Funds Classification Average, which consists of funds chosen by Lipper that invest primarily in mortgages and securities issued or guaranteed by the U.S. government and certain federal agencies, returned +3.67%.3 The Barclays U.S. Treasury Index, the U.S. Treasury component of the Barclays U.S. Government Index, produced a +2.28% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Economic and Market Overview

The U.S. economy continued to show signs of recovery during the 12-month period ended September 30, 2014, underpinned by manufacturing activity, consumer and business spending, and rising inventories. Economic activity rebounded strongly

1. Securities owned by the Fund but not shares of the Fund are guaranteed by the U.S. government, its agencies or instrumentalities as to the timely payment of principal

and interest. Although U.S. government-sponsored entities may be chartered or sponsored by acts of Congress, their securities are neither insured nor guaranteed by the

U.S. Treasury. Please refer to the Fund’s prospectus for a detailed discussion regarding various levels of credit support for government agency or instrumentality securities.

The Fund’s yield and share price are not guaranteed and will fluctuate with market conditions.

2. Source: Morningstar.

3. Source: Lipper, a Thomson Reuters Company. For the 12-month period ended 9/30/14, this category consisted of 128 funds. Lipper calculations do not include sales

charges or subsidization by a fund’s manager. The Fund’s performance relative to the average might have differed if these or other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 17.

franklintempleton.com Annual Report | 3

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

in the second quarter of 2014 after severe weather conditions and a slowdown in health care spending led to a contraction in the first quarter. Except for a sharp rebound in March, retail sales rose at a modest pace that missed consensus expectations for most of the period. In the housing market, home sales experienced some weather-related weakness early in 2014 but ticked up in May, and home prices remained higher than a year earlier. The unemployment rate declined to 5.9% in September 2014 from 7.2% in September 2013.4 Inflation, as measured by the Consumer Price Index, was subdued for the period.

U.S. economic growth trends were generally encouraging during the period. In January 2014, the U.S. Federal Reserve Board (Fed) began reducing its bond purchases $10 billion a month, based on largely positive economic and employment data in late 2013. The Fed continued to taper its asset purchases during the year. In September 2014, the Fed indicated it planned to maintain its near-zero interest-rate policy for “a considerable time” after its bond-buying program likely ends in October. The Fed also noted that inflation remained below its unofficial 2.0% target. Fed actions to normalize monetary policy remained dependent on economic performance, and the Fed lowered its U.S. economic growth projections in September.

The 10-year Treasury yield rose from 2.64% at the beginning of the period to a high of 3.04% on December 31, 2013, mainly because of an improved economic environment and market uncertainty about the Fed’s plans. However, the yield declined to 2.52% at period-end, as investors shifted to less risky assets following the crises in Ukraine and the Middle East, growth concerns about emerging markets, record low bond yields and weak economic data in Europe, and lower Treasury issuance.

Investment Strategy

We invest at least 80% of the Fund’s net assets in mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac.1 We may also invest in other types of mortgage securities that may be issued by private issuers, in U.S. Treasuries and in mortgage loans. At least 80% of total assets are invested in securities rated BBB or higher by Standard & Poor’s (S&P), or Baa by Moody’s Investors Service (Moody’s), independent credit rating agencies. Within these parameters, we rely on our research to help us identify attractive investment opportunities.

| Dividend Distributions* | ||||

| 10/1/13–9/30/14 | ||||

| Dividend per Share (cents) | ||||

| Advisor | ||||

| Month | Class A | Class A1 | Class C | Class |

| October | 3.4787 | 3.6810 | 3.1614 | 3.6788 |

| November | 4.2028 | 4.3924 | 3.9062 | 4.3897 |

| December** | 5.5047 | 5.7107 | 5.1784 | 5.7085 |

| January | 3.5549 | 3.7597 | 3.3255 | 3.7590 |

| February | 3.4932 | 3.6724 | 3.2018 | 3.6688 |

| March | 3.3360 | 3.5373 | 2.9654 | 3.5363 |

| April | 3.3195 | 3.5165 | 3.0144 | 3.5035 |

| May | 3.2477 | 3.4441 | 2.9381 | 3.4412 |

| June | 3.5069 | 3.7077 | 3.3880 | 3.7049 |

| July | 3.3283 | 3.5313 | 3.0087 | 3.5285 |

| August*** | 1.7112 | 1.9005 | 1.4082 | 1.8987 |

| September | 2.0129 | 2.2220 | 1.4919 | 2.2185 |

| Total | 40.6968 | 43.0756 | 36.9880 | 43.0364 |

*Assumes shares were purchased and held for the entire accrual period. Since

dividends accrue daily, your actual distributions will vary depending on the date

you purchased your shares and any account activity. All Fund distributions will vary

depending upon current market conditions, and past distributions are not indicative

of future trends.

**Includes an additional 1.61 cent per share distribution to meet excise tax

requirements.

***The decline in the distribution reflects a change in the tax treatment of certain

security transactions.

Manager’s Discussion

Mortgages outpaced Treasuries during the period as the agency mortgage market has benefited from continued, low interest rates. We feel that if the U.S. economy continues to strengthen in line with the Fed’s expectations, the Fed could terminate its purchases of MBS later in the year. In our view, agency mortgages were fully valued. Questions still remained, however, about the demand source for agency MBS after the Fed ends its buying program. We felt demand from banks, mortgage real estate investment trusts, overseas investors and domestic money managers would need to rise to compensate for the Fed’s reduced presence in the MBS sector once the central bank ends its stimulus measures. Despite the low interest rate and mortgage rate environment over the period, mortgage credit issuance continued to be constrained and actual prepayment levels remained relatively low.

The Fund’s allocations to non-agency residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS) were significant contributors to performance.

4. Source: Bureau of Labor Statistics.

4 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Our adjustable-rate MBS (ARMS) positions also benefited returns. Although the Fund’s conventional fixed-rate MBS sector allocation detracted from performance, our security selection within the sector was positive. The Fund’s shorter duration positioning detracted from performance over the period as interest rate movements had a negative impact.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest rate changes than a portfolio with a higher duration.

Our broad mortgage strategy looks across all mortgage opportunities to find relative value. The investment team continued to look for strong cash flow fundamentals and valuations seeking to uncover attractive valuations across the mortgage investment universe. We reduced our exposure to RMBS and ARMS. At period-end, the portfolio’s heaviest mortgage allocations were in fixed rate MBS and ARMS. Although we selectively reduced holdings, the Fund remained allocated to CMBS, as we believe commercial real estate fundamentals could slowly and steadily improve over the intermediate term.

We continued to employ a flexible investment approach seeking to take advantage of what we felt were additional investment opportunities in non-agency mortgage securities, non-investment grade mortgage securities and non-U.S. dollar-denominated mortgage securities while maintaining core holdings in agency MBS.

The Fund transacts in mortgage dollar rolls, which require future mortgage settlements. To meet forward liabilities, the Fund holds cash or invests in high-quality, liquid assets. The Fund’s allocation to cash and cash equivalents did not materially impact performance during the period.

Thank you for your continued participation in Franklin Strategic Mortgage Portfolio. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com Annual Report | 5

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Performance Summary as of September 30, 2014

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||

| Share Class (Symbol) | 9/30/14 | 9/30/13 | Change | |||

| A (N/A) | $ | 9.43 | $ | 9.37 | +$ | 0.06 |

| A1 (FSMIX) | $ | 9.44 | $ | 9.38 | +$ | 0.06 |

| C (N/A) | $ | 9.43 | $ | 9.37 | +$ | 0.06 |

| Advisor (N/A) | $ | 9.43 | $ | 9.37 | +$ | 0.06 |

| Distributions (10/1/13–9/30/14) | ||||||

| Dividend | ||||||

| Share Class | Income | |||||

| A | $ | 0.406968 | ||||

| A1 | $ | 0.430756 | ||||

| C | $ | 0.369880 | ||||

| Advisor | $ | 0.430364 | ||||

6 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

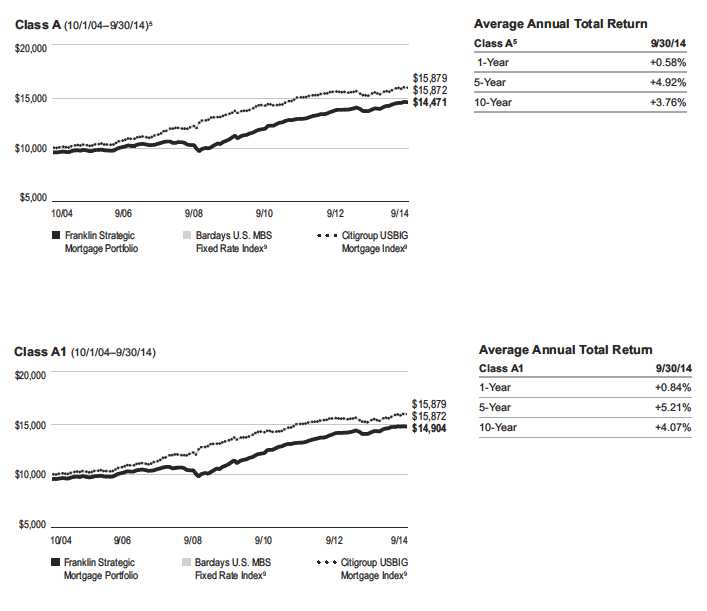

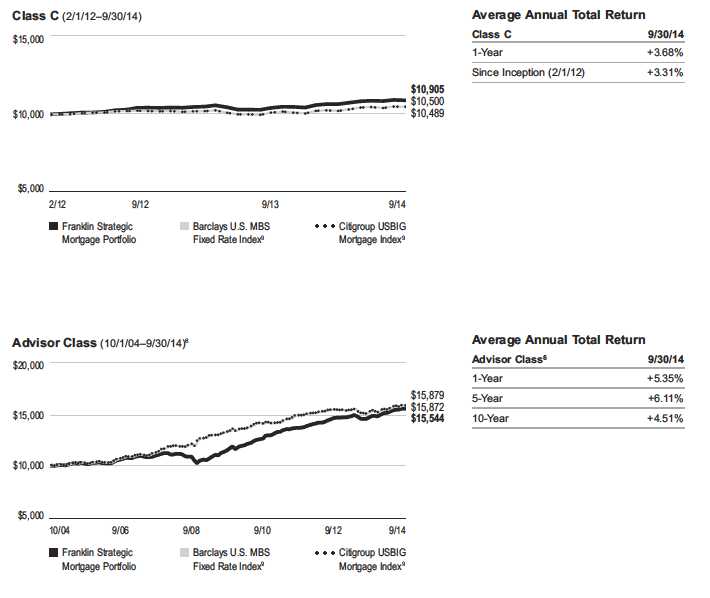

Performance as of 9/30/141

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Class A/A1: 4.25% maximum initial sales charge. Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| Cumulative | Average Annual | Total Annual Operating Expenses4 | ||||||||

| Share Class | Total Return2 | Total Return3 | (with waiver) | (without waiver) | ||||||

| A5 | 0.97 | % | 0.98 | % | ||||||

| 1-Year | + | 5.09 | % | + | 0.58 | % | ||||

| 5-Year | + | 32.79 | % | + | 4.92 | % | ||||

| 10-Year | + | 51.13 | % | + | 3.76 | % | ||||

| A1 | 0.72 | % | 0.73 | % | ||||||

| 1-Year | + | 5.35 | % | + | 0.84 | % | ||||

| 5-Year | + | 34.64 | % | + | 5.21 | % | ||||

| 10-Year | + | 55.62 | % | + | 4.07 | % | ||||

| C | 1.37 | % | 1.38 | % | ||||||

| 1-Year | + | 4.68 | % | + | 3.68 | % | ||||

| Since Inception (2/1/12) | + | 9.05 | % | + | 3.31 | % | ||||

| Advisor6 | 0.72 | % | 0.73 | % | ||||||

| 1-Year | + | 5.35 | % | + | 5.35 | % | ||||

| 5-Year | + | 34.49 | % | + | 6.11 | % | ||||

| 10-Year | + | 55.44 | % | + | 4.51 | % | ||||

| Distribution | 30-Day Standardized Yield8 | ||||||

| Share Class | Rate7 | (with waiver) | (without waiver) | ||||

| A | + | 2.36 | % | 1.85 | % | 1.85 | % |

| A1 | + | 2.60 | % | 2.09 | % | 2.09 | % |

| C | + | 1.82 | % | 1.54 | % | 1.54 | % |

| Advisor | + | 2.71 | % | 2.19 | % | 2.18 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com Annual Report | 7

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

8 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1 (continued)

franklintempleton.com Annual Report | 9

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements and mortgage

prepayments. During periods of declining interest rates, principal prepayments tend to increase as borrowers refinance their mortgages at lower rates; there-

fore the Fund may be forced to reinvest returned principal at lower interest rates, reducing income. Bond prices generally move in the opposite direction of

interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a

bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions

will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| Class A: | The Fund began offering a new Class A share on 2/1/12 with a 25 basis point (0.25%) Rule 12b-1 fee. Prior to that date, the Fund offered a Class A share |

| (renamed Class A1). | |

| Class A1 | |

| (formerly Class A): | Effective 2/1/12, Class A shares closed to new investors and were renamed Class A1. |

| Class C: | These shares have higher fees and expenses than Class A shares. |

| Advisor Class: | These shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

5. Performance quotations for Class A shares reflect the following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on Class A1

performance and including the Class A Rule 12b-1 fee, and (b) for periods after 2/1/12, actual Class A performance is used, reflecting all charges and fees applicable to

that class. Since 2/1/12 (commencement of sales), the cumulative and average annual total returns of Class A shares were +10.20% and +2.04%.

6. Effective 2/1/12, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 fee. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on the Fund’s oldest share class, Class A1, excluding the effect of its

maximum initial sales charge; and (b) for periods after 2/1/12, actual Advisor Class performance is used, reflecting all charges and fees applicable to that class. Since

2/1/12 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +10.93% and +3.97%.

7. Distribution rate is based on an annualization of the sum of distributions per share for the 30 days of September and the maximum offering price (NAV for classes C and

Advisor) on 9/30/14.

8. The 30-day standardized yield for the 30 days ended 9/30/14 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

9. Source: Morningstar. The Barclays Fixed Rate MBS Index is the FNMA component of the Barclays Fixed Rate Mortgage Backed Securities (MBS) Index and includes the

mortgage-backed pass-through securities of the Federal National Mortgage Association (FNMA). The Citigroup USBIG Mortgage Index is the mortgage component of the

Citigroup USBIG Bond Index and comprises 30- and 15-year GNMA, FNMA and FHLMC securities and FNMA and FHLMC balloon mortgages.

See www.franklintempletondatasources.com for additional data provider information.

10 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com Annual Report | 11

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||

| YOUR FUND’S EXPENSES | ||||||

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 4/1/14 | Value 9/30/14 | Period* 4/1/14–9/30/14 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 1,024.80 | $ | 5.43 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.70 | $ | 5.42 |

| A1 | ||||||

| Actual | $ | 1,000 | $ | 1,027.20 | $ | 4.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.96 | $ | 4.15 |

| C | ||||||

| Actual | $ | 1,000 | $ | 1,022.80 | $ | 7.45 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.70 | $ | 7.44 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 1,026.10 | $ | 4.16 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.96 | $ | 4.15 |

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, annualized for each class

(A: 1.07%; A1: 0.82%; C: 1.47%; and Advisor: 0.82%), multiplied by the average account value over the period, multiplied by 183/365 to

reflect the one-half year period.

12 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Financial Highlights | |||||||||

| Year Ended September 30, | |||||||||

| 2014 | 2013 | 2012 | a | ||||||

| Class A | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the year) | |||||||||

| Net asset value, beginning of year | $ | 9.37 | $ | 9.69 | $ | 9.47 | |||

| Income from investment operationsb: | |||||||||

| Net investment income | 0.249 | 0.229 | 0.172 | ||||||

| Net realized and unrealized gains (losses) | 0.218 | (0.202 | ) | 0.255 | |||||

| Total from investment operations | 0.467 | 0.027 | 0.427 | ||||||

| Less distributions from net investment income | (0.407 | ) | (0.347 | ) | (0.207 | ) | |||

| Net asset value, end of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | |||

| Total returnc | 5.09 | % | 0.28 | % | 4.57 | % | |||

| Ratios to average net assetsd | |||||||||

| Expenses | 1.06 | %e | 0.96 | % | 1.01 | % | |||

| Net investment income | 2.37 | % | 2.04 | % | 2.07 | % | |||

| Supplemental data | |||||||||

| Net assets, end of year (000’s) | $ | 9,920 | $ | 8,627 | $ | 4,856 | |||

| Portfolio turnover rate | 514.95 | % | 674.91 | % | 594.80 | % | |||

| Portfolio turnover rate excluding mortgage dollar rollsf | 133.55 | % | 252.41 | % | 167.39 | % | |||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 13

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||

| Class A1 | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 9.38 | $ | 9.69 | $ | 9.39 | $ | 9.09 | $ | 8.75 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment income | 0.232 | 0.190 | 0.212 | 0.269 | 0.333 | ||||||||||

| Net realized and unrealized gains (losses) | 0.259 | (0.129 | ) | 0.436 | 0.469 | 0.487 | |||||||||

| Total from investment operations | 0.491 | 0.061 | 0.648 | 0.738 | 0.820 | ||||||||||

| Less distributions from net investment income | (0.431 | ) | (0.371 | ) | (0.348 | ) | (0.438 | ) | (0.480 | ) | |||||

| Net asset value, end of year | $ | 9.44 | $ | 9.38 | $ | 9.69 | $ | 9.39 | $ | 9.09 | |||||

| Total returnb | 5.35 | % | 0.64 | % | 7.04 | % | 8.24 | % | 9.61 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expenses | 0.81 | %c | 0.71 | % | 0.76 | % | 0.65 | % | 0.70 | % | |||||

| Net investment income | 2.62 | % | 2.29 | % | 2.32 | % | 2.85 | % | 3.76 | % | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 64,325 | $ | 75,609 | $ | 109,162 | $ | 102,529 | $ | 100,549 | |||||

| Portfolio turnover rate | 514.95 | % | 674.91 | % | 594.80 | % | 539.76 | % | 341.45 | % | |||||

| Portfolio turnover rate excluding mortgage dollar rollsd | 133.55 | % | 252.41 | % | 167.39 | % | 126.63 | % | 20.82 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

cBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

dSee Note 1(f) regarding mortgage dollar rolls.

14 | Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | |||||||||

| 2014 | 2013 | 2012 | a | ||||||

| Class C | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the year) | |||||||||

| Net asset value, beginning of year | $ | 9.37 | $ | 9.69 | $ | 9.47 | |||

| Income from investment operationsb: | |||||||||

| Net investment income | 0.207 | 0.167 | 0.155 | ||||||

| Net realized and unrealized gains (losses) | 0.223 | (0.178 | ) | 0.247 | |||||

| Total from investment operations | 0.430 | (0.011 | ) | 0.402 | |||||

| Less distributions from net investment income | (0.370 | ) | (0.309 | ) | (0.182 | ) | |||

| Net asset value, end of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | |||

| Total returnc | 4.68 | % | (0.11 | )% | 4.29 | % | |||

| Ratios to average net assetsd | |||||||||

| Expenses | 1.46 | %e | 1.36 | % | 1.41 | % | |||

| Net investment income | 1.97 | % | 1.64 | % | 1.67 | % | |||

| Supplemental data | |||||||||

| Net assets, end of year (000’s) | $ | 2,409 | $ | 2,137 | $ | 1,540 | |||

| Portfolio turnover rate | 514.95 | % | 674.91 | % | 594.80 | % | |||

| Portfolio turnover rate excluding mortgage dollar rollsf | 133.55 | % | 252.41 | % | 167.39 | % | |||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 15

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | |||||||||

| 2014 | 2013 | 2012 | a | ||||||

| Advisor Class | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the year) | |||||||||

| Net asset value, beginning of year | $ | 9.37 | $ | 9.69 | $ | 9.47 | |||

| Income from investment operationsb: | |||||||||

| Net investment income | 0.371 | 0.252 | 0.149 | ||||||

| Net realized and unrealized gains (losses) | 0.119 | (0.201 | ) | 0.294 | |||||

| Total from investment operations | 0.490 | 0.051 | 0.443 | ||||||

| Less distributions from net investment income | (0.430 | ) | (0.371 | ) | (0.223 | ) | |||

| Net asset value, end of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | |||

| Total returnc | 5.35 | % | 0.54 | % | 4.74 | % | |||

| Ratios to average net assetsd | |||||||||

| Expenses | 0.81 | %e | 0.71 | % | 0.76 | % | |||

| Net investment income | 2.62 | % | 2.29 | % | 2.32 | % | |||

| Supplemental data | |||||||||

| Net assets, end of year (000’s) | $ | 9,049 | $ | 3,007 | $ | 1,281 | |||

| Portfolio turnover rate | 514.95 | % | 674.91 | % | 594.80 | % | |||

| Portfolio turnover rate excluding mortgage dollar rollsf | 133.55 | % | 252.41 | % | 167.39 | % | |||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

16 | Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Statement of Investments, September 30, 2014 | |||

| Shares | Value | ||

| Common Stocks 0.4% | |||

| Mortgage REITs 0.4% | |||

| American Capital Agency Corp. | 10,000 | $ | 212,500 |

| Annaly Capital Management Inc. | 15,300 | 163,404 | |

| Total Common Stocks (Cost $409,719) | 375,904 | ||

| Principal | |||

| Amount* | |||

| Asset-Backed Securities and Commercial Mortgage-Backed | |||

| Securities 35.7% | |||

| Finance 35.7% | |||

| a,bAmerican Homes 4 Rent, 2014-SFR1, A, 144A, 1.25%, 6/17/31 | 199,107 | 198,372 | |

| a,bAmerican Residential Properties Trust, 2014-SFR1, B, 144A, 1.904%, 9/17/31 | 430,000 | 424,584 | |

| aAnthracite CDO II Ltd., 2002-2A, D, 144A, 6.97%, 12/24/37 | 13,544 | 13,597 | |

| aAnthracite Ltd., | |||

| b2004-1A, BFL, 144A, 0.704%, 3/23/39 (Cayman Islands) | 85,883 | 85,721 | |

| c2004-HY1A, E, 144A, 7.147%, 6/20/41 | 1,598,000 | 86,212 | |

| b2005-HY2A, A, 144A, 0.524%, 7/26/45 (Cayman Islands) | 174,527 | 172,673 | |

| a,bArbor Realty Mortgage Securities, 2004-1A, A, 144A, 0.684%, 2/21/40 (Cayman Islands) | 166,965 | 164,148 | |

| aARCap Resecuritization Trust, 2004-A1, A, 144A, 4.73%, 4/21/24 | 188,911 | 191,799 | |

| Banc of America Commercial Mortgage Trust, | |||

| 2006-1, AJ, 5.46%, 9/10/45 | 1,000,000 | 1,044,175 | |

| 2006-4, AJ, 5.695%, 7/10/46 | 450,000 | 467,591 | |

| 2006-4, AM, 5.675%, 7/10/46 | 300,000 | 323,339 | |

| bBear Stearns Alt-A Trust, 2004-13, A2, 1.035%, 11/25/34 | 242,254 | 232,190 | |

| Bear Stearns Commercial Mortgage Securities Inc., | |||

| b2006-PW11, AJ, 5.605%, 3/11/39 | 750,000 | 780,390 | |

| b2006-PW12, AJ, 5.751%, 9/11/38 | 300,000 | 311,623 | |

| 2006-PW13, AJ, 5.611%, 9/11/41 | 750,000 | 778,377 | |

| b2007-PW16, AM, 5.706%, 6/11/40 | 750,000 | 823,138 | |

| bBear Stearns Commercial Mortgage Securities Trust, | |||

| 2004-PWR3, E, 4.998%, 2/11/41 | 425,000 | 425,430 | |

| 2005-T20, E, 5.288%, 10/12/42 | 215,000 | 215,799 | |

| Citigroup Commercial Mortgage Trust, | |||

| 2006-C5, AJ, 5.482%, 10/15/49 | 440,000 | 438,739 | |

| b2007-C6, AM, 5.706%, 6/10/17 | 500,000 | 543,364 | |

| bCitigroup Mortgage Loan Trust Inc., | |||

| 2006-WFH3, A3, 0.305%, 10/25/36 | 97,920 | 97,828 | |

| a2013-A, A, 144A, 3.00%, 5/25/42 | 172,336 | 175,011 | |

| bCitigroup/Deutsche Bank Commercial Mortgage Trust, | |||

| 2005-CD1, E, 5.219%, 7/15/44 | 215,000 | 216,264 | |

| 2006-CD3, AJ, 5.688%, 10/15/48 | 450,000 | 433,642 | |

| a,bColony American Homes, 2014-1A, A, 144A, 1.40%, 5/17/31 | 104,151 | 104,531 | |

| aCountryplace Manufactured Housing Contract Trust, 2007-1, A3, 144A, 5.593%, 7/15/37 | 360,266 | 370,656 | |

| bCountrywide Asset-Backed Certificates, | |||

| 2004-1, M1, 0.905%, 3/25/34 | 221,503 | 213,115 | |

| 2004-7, MV3, 1.205%, 12/25/34 | 120,878 | 120,484 | |

| 2004-14, M1, 0.665%, 6/25/35 | 173,601 | 173,312 | |

| Countrywide Home Loans, 2003-14, A3, 5.50%, 6/25/33 | 3,781 | 3,784 | |

| a,bCredit Suisse Mortgage Capital Certificates, 2009-15R, 3A1, 144A, 5.371%, 3/26/36 | 178,279 | 183,926 | |

| aCrest Ltd., | |||

| 2003-2A, C2, 144A, 5.709%, 12/28/38 | 28,896 | 29,109 | |

| b2004-1A, B1, 144A, 0.725%, 1/28/40 | 698,889 | 683,964 | |

| aCT CDO III Ltd., 2005-3A, C, 144A, 5.471%, 6/25/35 | 280,000 | 279,007 | |

franklintempleton.com Annual Report | 17

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Asset-Backed Securities and Commercial Mortgage-Backed | |||

| Securities (continued) | |||

| Finance (continued) | |||

| a,bCT CDO IV Ltd., 2006-4A, A1, 144A, 0.464%, 10/20/43 | 364,930 | $ | 359,933 |

| bFirst Franklin Mortgage Loan Asset-Backed Certificates, 2005-FF6, M1, 0.575%, 5/25/36 | 242,105 | 239,147 | |

| bFNMA, 2007-1, NF, 0.405%, 2/25/37 | 268,013 | 268,668 | |

| aG-Force LLC, | |||

| b2005-RR2, A3FL, 144A, 0.455%, 12/25/39 | 245,801 | 238,678 | |

| 2005-RRA, B, 144A, 5.09%, 8/22/36 | 281,768 | 284,687 | |

| 2005-RRA, C, 144A, 5.20%, 8/22/36 | 300,000 | 288,831 | |

| dGMAC Commercial Mortgage Securities Inc., 2005-C1, B, 4.936%, 5/10/43 | 800,000 | 196,669 | |

| Green Tree Financial Corp., | |||

| 1996-9, M1, 7.63%, 8/15/27 | 356,607 | 392,866 | |

| 1997-3, A6, 7.32%, 3/15/28 | 32,601 | 34,869 | |

| 1997-6, A7, 7.14%, 1/15/29 | 20,210 | 21,236 | |

| 1998-4, A7, 6.87%, 4/01/30 | 145,418 | 154,825 | |

| 1999-3, A7, 6.74%, 2/01/31 | 53,924 | 54,158 | |

| Greenpoint Manufactured Housing, 1999-3, 1A7, 7.27%, 6/15/29 | 497,974 | 502,726 | |

| bGreenpoint Mortgage Funding Trust, 2005-HE4, 2A4C, 0.875%, 7/25/30 | 3,660 | 3,654 | |

| bGreenwich Capital Commercial Funding Corp., 2006-GG7, | |||

| AJ, 5.82%, 7/10/38 | 400,000 | 416,380 | |

| AM, 6.014%, 7/10/38 | 200,000 | 213,795 | |

| bGSAA Home Equity Trust, 0.525%, 6/25/35 | 215,820 | 207,156 | |

| bGSAMP Trust, 2005-HE3, M2, 1.16%, 6/25/35 | 310,383 | 300,744 | |

| bHome Equity Mortgage Trust, 2004-4, M3, 1.13%, 12/25/34 | 623,352 | 567,688 | |

| a,bInvitation Homes Trust, 2014-SFR2, B, 144A, 1.754%, 9/17/31 | 200,000 | 197,672 | |

| JP Morgan Chase Commercial Mortgage Securities Trust, | |||

| b2005-LDP5, A, 5.393%, 12/15/44 | 300,000 | 302,616 | |

| b,d2006-CB14, B, 5.537%, 12/12/44 | 1,000,000 | 427,250 | |

| b,d2006-CB16, B, 5.672%, 5/12/45 | 240,000 | 191,653 | |

| 2006-CB17, AM, 5.464%, 12/12/43 | 490,000 | 513,286 | |

| b2006-LDP7, AJ, 5.873%, 4/15/45 | 385,000 | 393,822 | |

| bJP Morgan Mortgage Acquisition Corp., 2006-ACC1, A4, 0.305%, 5/25/36 | 285,054 | 281,363 | |

| a,bJPMorgan Chase Commercial Mortgage Securities Trust, 2003-LN1, H, 144A, 5.462%, 10/15/37 | 260,000 | 259,150 | |

| a,bKildare Securities Ltd., 2007-1A, A2, 144A, 0.354%, 12/10/43 (Ireland) | 157,611 | 157,203 | |

| a,bLake Country Mortgage Loan Trust, 2005-HE1, M1, 144A, 0.935%, 12/25/32 | 51,656 | 51,657 | |

| bLB-UBS Commercial Mortgage Trust, | |||

| a2001-C3, E, 144A, 6.95%, 6/15/36 | 300,000 | 304,753 | |

| a2004-C7, H, 144A, 5.239%, 10/15/36 | 274,000 | 283,386 | |

| 2006-C1, AJ, 5.276%, 2/15/41 | 350,000 | 361,014 | |

| 2006-C4, AJ, 5.857%, 6/15/38 | 500,000 | 527,598 | |

| Lehman ABS Corp., 2003-1, A1, 5.50%, 12/25/33 | 555,430 | 569,049 | |

| bLehman XS Trust, 2005-1, 2A2, 1.655%, 7/25/35 | 136,937 | 133,321 | |

| a,bLNR CDO Ltd., 2003-1A, DFL, 144A, 2.254%, 7/23/36 (Cayman Islands) | 316,290 | 313,393 | |

| a,bMach One 2004-1A ULC, G, 144A, 6.82%, 5/28/40 | 300,000 | 299,081 | |

| bMaster Asset-Backed Securities Trust, 2004-HE1, M2, 1.25%, 9/25/34 | 250,000 | 247,965 | |

| bMerrill Lynch Mortgage Investors Inc., 2003-A, 1A, 0.895%, 3/25/28 | 366,630 | 362,847 | |

| bMerrill Lynch Mortgage Trust, 2005-CKI1, AJ, 5.282%, 11/12/37 | 322,000 | 333,295 | |

| bML-CFC Commercial Mortgage Trust, 2006-3, A1A, 5.409%, 7/12/46 | 162,364 | 173,850 | |

| bMorgan Stanley ABS Capital I Inc. Trust, | |||

| 2003-HE1, M1, 1.355%, 5/25/33 | 412,056 | 389,432 | |

| 2005-WMC, M2, 0.89%, 1/25/35 | 314,977 | 304,978 |

18 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | ||||

| Amount* | Value | |||

| Asset-Backed Securities and Commercial Mortgage-Backed | ||||

| Securities (continued) | ||||

| Finance (continued) | ||||

| Morgan Stanley Capital I Trust, | ||||

| a2005-RR6, AJ, 144A, 5.233%, 5/24/43 | 300,000 | $ | 297,054 | |

| b2006-HQ8, AJ, 5.497%, 3/12/44 | 399,000 | 413,796 | ||

| a,bN-Star Real Estate CDO Ltd., 2006-6A, A1, 144A, 0.565%, 6/16/41 (Cayman Islands) | 329,983 | 318,513 | ||

| a,bNewcastle CDO Ltd., 2004-5A, 1, 144A, 0.576%, 12/24/39 | 81,612 | 81,009 | ||

| bNovastar Home Equity Loan, 2004-4, M4, 1.805%, 3/25/35 | 500,000 | 492,390 | ||

| Oakwood Mortgage Investors Inc., 1999-A, A3, 6.09%, 4/15/29 | 526,935 | 533,449 | ||

| Residential Asset Securities Corp., | ||||

| 2004-KS1, AI4, 4.213%, 4/25/32 | 217,370 | 217,284 | ||

| 2004-KS8, AI6, 4.79%, 9/25/34 | 239,836 | 242,305 | ||

| b2005-AHL2, A2, 0.415%, 10/25/35 | 6,932 | 6,939 | ||

| bResidential Funding Mortgage Securities II, | ||||

| 2002-HI5, M1, 6.14%, 1/25/28 | 111,027 | 112,958 | ||

| 2003-HI2, M2, 5.58%, 7/25/28 | 228,202 | 230,872 | ||

| 2004-HI3, A5, 5.48%, 6/25/34 | 174,312 | 181,241 | ||

| a,bSilver Bay Realty Trust, 2014-1, A, 144A, 1.154%, 9/17/31 | 199,167 | 198,247 | ||

| bSoundview Home Equity Loan Trust, 2005-D01, M2, 0.605%, 5/25/35 | 81,455 | 81,569 | ||

| a,bSpringleaf Mortgage Loan Trust, 2013-1A, M4, 144A, 4.44%, 6/25/58 | 400,000 | 405,321 | ||

| b,eTalisman 6 Finance, Reg S, 0.382%, 10/22/16 (Germany) | 264,521 | EUR | 327,800 | |

| Vanderbilt Mortgage Finance, | ||||

| 2002-A, M1, 7.12%, 4/07/32 | 125,050 | 132,102 | ||

| 2002-C, M1, 7.82%, 12/07/32 | 314,531 | 334,655 | ||

| bWachovia Bank Commercial Mortgage Trust, | ||||

| 5.727%, 5/15/16 | 400,000 | 403,012 | ||

| a2003-C7, F, 144A, 5.004%, 10/15/35 | 200,000 | 201,666 | ||

| 2006-C23, AJ, 5.515%, 1/18/45 | 400,000 | 417,827 | ||

| 2006-C25, AJ, 5.86%, 5/15/43 | 300,000 | 315,402 | ||

| a2007-WHL8, A2, 144A, 0.294%, 6/15/20 | 300,000 | 294,987 | ||

| bWaMu Mortgage Pass-Through Certificates, | ||||

| 2005-AR8, 2A1A, 0.445%, 7/25/45 | 208,519 | 200,329 | ||

| 2005-AR19, A1A1, 0.425%, 12/25/45 | 406,138 | 391,559 | ||

| Wells Fargo Mortgage Backed Securities Trust, | ||||

| b2004-W, A9, 2.762%, 11/25/34 | 229,143 | 237,155 | ||

| b2005-AR9, 2A2, 2.641%, 10/25/33 | 335,241 | 334,098 | ||

| b2005-AR10, 2A3, 2.616%, 6/25/35 | 215,080 | 215,156 | ||

| 2007-3, 3A1, 5.50%, 4/25/37 | 65,600 | 68,047 | ||

| Total Asset-Backed Securities and Commercial Mortgage-Backed | ||||

| Securities (Cost $29,551,606) | 30,618,980 | |||

| Mortgage-Backed Securities 91.8% | ||||

| bFederal Home Loan Mortgage Corp. (FHLMC) Adjustable Rate 10.3% | ||||

| FHLMC, 1.875% - 2.298%, 11/01/16 - 11/01/25 | 602,050 | 614,574 | ||

| FHLMC, 2.302%, 11/01/37 | 1,846,167 | 1,973,157 | ||

| FHLMC, 2.313% - 2.32%, 3/01/19 - 6/01/23 | 69,802 | 70,465 | ||

| FHLMC, 2.338%, 5/01/37 | 934,602 | 1,007,183 | ||

| FHLMC, 2.355% - 2.50%, 4/01/18 - 10/01/36 | 758,450 | 794,666 | ||

| FHLMC, 2.52%, 6/01/37 | 2,929,258 | 3,147,203 | ||

| FHLMC, 2.566% - 2.932%, 1/01/18 - 4/01/31 | 356,619 | 366,967 | ||

| FHLMC, 3.104% - 6.876%, 11/01/19 - 7/01/30 | 783,651 | 821,301 | ||

| 8,795,516 | ||||

franklintempleton.com Annual Report | 19

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Mortgage-Backed Securities (continued) | |||

| Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate 9.7% | |||

| fFHLMC Gold 30 Year, 3.50%, 8/01/42 | 750,000 | $ | 765,557 |

| fFHLMC Gold 30 Year, 4.00%, 10/01/41 | 2,000,000 | 2,105,780 | |

| fFHLMC Gold 30 Year, 4.50%, 10/01/39 | 1,150,000 | 1,240,383 | |

| FHLMC Gold 30 Year, 4.50%, 4/01/40 | 1,299,101 | 1,403,128 | |

| FHLMC Gold 30 Year, 5.00%, 10/01/33 - 7/01/35 | 184,834 | 204,282 | |

| FHLMC Gold 30 Year, 5.00%, 2/01/39 | 819,446 | 901,903 | |

| FHLMC Gold 30 Year, 5.50%, 9/01/33 | 80,359 | 90,019 | |

| FHLMC Gold 30 Year, 6.00%, 7/01/28 - 11/01/36 | 325,073 | 366,540 | |

| FHLMC Gold 30 Year, 6.50%, 2/01/19 - 7/01/32 | 246,016 | 278,568 | |

| FHLMC Gold 30 Year, 7.50%, 10/01/25 - 8/01/32 | 353,133 | 400,514 | |

| FHLMC Gold 30 Year, 8.00%, 7/01/24 - 5/01/30 | 119,702 | 131,478 | |

| FHLMC Gold 30 Year, 8.50%, 10/01/17 - 6/01/21 | 51,308 | 54,776 | |

| FHLMC Gold 30 Year, 9.00%, 9/01/30 | 82,403 | 94,563 | |

| FHLMC Gold 30 Year, 9.50%, 12/01/16 - 4/01/25 | 132,772 | 141,565 | |

| FHLMC PC 30 Year, 8.50%, 5/01/17 | 147,946 | 156,706 | |

| FHLMC PC 30 Year, 9.00%, 6/01/16 | 159 | 166 | |

| FHLMC PC 30 Year, 9.50%, 8/01/19 | 5,630 | 5,697 | |

| 8,341,625 | |||

| bFederal National Mortgage Association (FNMA) Adjustable Rate 15.4% | |||

| FNMA, 1.645% - 2.202%, 1/01/18 - 4/01/33 | 804,610 | 829,663 | |

| FNMA, 2.205% - 2.28%, 9/01/18 - 2/01/32 | 627,540 | 642,153 | |

| FNMA, 2.284%, 9/01/39 | 1,926,287 | 2,055,159 | |

| FNMA, 2.29% - 2.33%, 12/01/22 - 8/01/27 | 355,562 | 362,408 | |

| FNMA, 2.332%, 10/01/36 | 896,189 | 957,963 | |

| FNMA, 2.345% - 2.433%, 9/01/24 - 7/01/38 | 535,959 | 544,796 | |

| FNMA, 2.436%, 6/01/35 | 3,114,145 | 3,362,589 | |

| FNMA, 2.437%, 9/01/37 | 2,311,587 | 2,489,501 | |

| FNMA, 2.451% - 2.50%, 2/01/21 - 10/01/32 | 776,067 | 783,831 | |

| FNMA, 2.504% - 2.825%, 4/01/18 - 6/01/28 | 682,847 | 699,821 | |

| FNMA, 2.942% - 5.00%, 6/01/17 - 7/01/31 | 451,303 | 454,195 | |

| 13,182,079 | |||

| Federal National Mortgage Association (FNMA) Fixed Rate 49.1% | |||

| FNMA 15 Year, 5.00%, 6/01/18 - 7/01/18 | 538,099 | 568,190 | |

| FNMA 15 Year, 5.50%, 3/01/16 - 2/01/18 | 344,682 | 364,883 | |

| FNMA 15 Year, 6.50%, 5/01/16 - 10/01/16 | 13,587 | 13,985 | |

| fFNMA 30 Year, 3.00%, 8/01/42 | 12,500,000 | 12,875,977 | |

| fFNMA 30 Year, 3.50%, 8/01/42 | 1,650,000 | 1,686,609 | |

| fFNMA 30 Year, 4.00%, 10/01/40 | 14,200,000 | 14,965,247 | |

| fFNMA 30 Year, 4.50%, 10/01/39 | 3,710,000 | 4,003,322 | |

| FNMA 30 Year, 5.00%, 4/01/34 | 213,790 | 236,670 | |

| FNMA 30 Year, 5.50%, 9/01/33 - 10/01/33 | 688,836 | 771,444 | |

| FNMA 30 Year, 5.50%, 10/01/33 - 11/01/33 | 615,125 | 688,491 | |

| FNMA 30 Year, 5.50%, 11/01/33 - 11/01/34 | 344,513 | 386,470 | |

| FNMA 30 Year, 5.50%, 11/01/34 - 11/01/35 | 759,054 | 848,452 | |

| FNMA 30 Year, 6.00%, 10/01/34 | 1,146,732 | 1,311,974 | |

| FNMA 30 Year, 6.00%, 10/01/34 | 406,714 | 462,390 | |

| FNMA 30 Year, 6.00%, 12/01/23 - 8/01/35 | 695,881 | 793,089 | |

| FNMA 30 Year, 6.50%, 12/01/27 - 7/01/32 | 724,734 | 824,770 | |

| FNMA 30 Year, 6.50%, 7/01/32 - 8/01/32 | 697,538 | 793,606 | |

| FNMA 30 Year, 7.50%, 8/01/25 - 5/01/32 | 41,462 | 48,938 | |

| FNMA 30 Year, 8.00%, 1/01/25 - 7/01/31 | 43,763 | 50,969 | |

| 20 | Annual Report | franklintempleton.com | ||

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | ||||

| Amount* | Value | |||

| Mortgage-Backed Securities (continued) | ||||

| Federal National Mortgage Association (FNMA) Fixed Rate (continued) | ||||

| FNMA 30 Year, 8.50%, 11/01/26 - 11/01/28 | 227,222 | $ | 254,777 | |

| FNMA 30 Year, 9.00%, 12/01/16 - 4/01/25 | 13,959 | 14,559 | ||

| FNMA 30 Year, 9.50%, 11/01/21 - 4/01/30 | 65,455 | 72,163 | ||

| FNMA 30 Year, 10.00%, 7/01/16 - 4/01/21 | 37,903 | 41,733 | ||

| FNMA 30 Year, 10.50%, 4/01/22 - 5/01/30 | 6,658 | 6,697 | ||

| FNMA 30 Year, 12.00%, 5/01/16 | 15 | 15 | ||

| FNMA PL 30 Year, 10.00%, 9/01/20 | 14,390 | 14,968 | ||

| 42,100,388 | ||||

| bGovernment National Mortgage Association (GNMA) Adjustable Rate 0.2% | ||||

| GNMA, 1.625%, 11/20/25 - 7/20/27 | 114,028 | 117,909 | ||

| Government National Mortgage Association (GNMA) Fixed Rate 7.1% | ||||

| GNMA I SF 15 Year, 8.00%, 9/15/15 | 4,320 | 4,336 | ||

| GNMA I SF 30 Year, 6.50%, 1/15/24 - 9/15/32 | 191,581 | 218,292 | ||

| GNMA I SF 30 Year, 7.00%, 5/15/17 - 2/15/32 | 145,621 | 156,364 | ||

| GNMA I SF 30 Year, 7.50%, 10/15/23 - 10/15/29 | 48,541 | 52,955 | ||

| GNMA I SF 30 Year, 8.00%, 1/15/17 - 9/15/27 | 93,183 | 104,168 | ||

| GNMA I SF 30 Year, 8.25%, 1/15/21 - 5/15/21 | 53,958 | 54,210 | ||

| GNMA I SF 30 Year, 8.50%, 3/15/17 - 7/15/24 | 83,749 | 86,131 | ||

| GNMA I SF 30 Year, 9.00%, 9/15/16 - 8/15/28 | 13,694 | 13,823 | ||

| GNMA I SF 30 Year, 10.00%, 12/15/18 | 3,974 | 3,998 | ||

| GNMA I SF 30 Year, 10.50%, 1/15/16 | 232 | 233 | ||

| fGNMA II SF 30 Year, 3.50%, 10/01/42 | 2,000,000 | 2,066,719 | ||

| GNMA II SF 30 Year, 3.50%, 5/20/44 | 2,709,802 | 2,806,614 | ||

| GNMA II SF 30 Year, 6.50%, 1/20/26 - 1/20/33 | 280,924 | 326,398 | ||

| GNMA II SF 30 Year, 7.50%, 11/20/22 - 7/20/32 | 185,322 | 215,580 | ||

| GNMA II SF 30 Year, 8.00%, 1/20/17 - 8/20/26 | 25,976 | 26,116 | ||

| GNMA II SF 30 Year, 8.50%, 7/20/16 | 6,032 | 6,056 | ||

| GNMA II SF 30 Year, 9.00%, 11/20/19 - 3/20/25 | 2,142 | 2,363 | ||

| GNMA II SF 30 Year, 10.50%, 6/20/20 | 17 | 17 | ||

| 6,144,373 | ||||

| Total Mortgage-Backed Securities (Cost $77,461,666) | 78,681,890 | |||

| Total Investments before Short Term Investments (Cost $107,422,991) | 109,676,774 | |||

| Shares | ||||

| Short Term Investments 18.3% | ||||

| Money Market Funds (Cost $4,274,614) 5.0% | ||||

| g,hInstitutional Fiduciary Trust Money Market Portfolio | 4,274,614 | 4,274,614 | ||

| Principal | ||||

| Amount* | ||||

| Repurchase Agreements (Cost $11,365,779) 13.3% | ||||

| i Joint Repurchase Agreement, 0.006%, 10/01/14 (Maturity Value $11,365,781) | 11,365,779 | 11,365,779 | ||

| BNP Paribas Securities Corp. (Maturity Value $1,589,619) | ||||

| HSBC Securities (USA) Inc. (Maturity Value $6,676,373) | ||||

| Merrill Lynch, Pierce, Fenner & Smith Inc. (Maturity Value $3,099,789) | ||||

| Collateralized by U.S. Government Agency Securities, 0.125% - 5.50%, 12/29/14 - 12/17/29; | ||||

| jU.S. Government Agency Discount Notes, 11/17/14 - 3/19/15; U.S. Government Agency | ||||

| Securities, zero cpn., 12/11/25 - 12/17/29; and U.S. Government Agency Securities, Strips, | ||||

| 6/01/17 (valued at $11,596,011) | ||||

| Total Investments (Cost $123,063,384) 146.2% | 125,317,167 | |||

| TBA Sale Commitments (2.0)% | (1,750,140 | ) | ||

| Other Assets, less Liabilities (44.2)% | (37,865,513 | ) | ||

| Net Assets 100.0% | $ | 85,701,514 | ||

franklintempleton.com Annual Report | 21

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | ||||||

| Amount* | Value | |||||

| TBA Sale Commitments (Proceeds $1,743,619) | ||||||

| Government National Mortgage Association (GNMA) Fixed Rate (2.0)% | ||||||

| kGNMA II SF 30 Year, 3.00%, 10/01/42 | $ | (1,739,000 | ) | $ | (1,750,140 | ) |

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional

buyers or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of

Trustees. At September 30, 2014, the aggregate value of these securities was $7,998,531, representing 9.33% of net assets.

bThe coupon rate shown represents the rate at period end.

cSee Note 7 regarding defaulted securities.

dThe bond pays interest and/or principal based upon the issuer’s ability to pay, which may be less than the stated interest rate or principal paydown.

eSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States.

Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption

from registration. This security has been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At September 30, 2014, the value of this security was

$327,800, representing 0.38% of net assets.

fSecurity purchased on a to-be-announced (TBA) basis. See Note 1(d).

gNon-income producing.

hSee Note 3(f) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

iSee Note 1(c) regarding joint repurchase agreement.

jThe security is traded on a discount basis with no stated coupon rate.

kSecurity sold on a to-be-announced basis in a short position. As such, the Fund is not subject to the deposit requirement or fees and expenses with short sale transactions.

At September 30, 2014, the Fund had the following financial futures contracts outstanding. See Note 1(e).

| Financial Futures Contracts | |||||||||||

| Number of | Notional | Expiration | Unrealized | Unrealized | |||||||

| Description | Type | Contracts | Value | Date | Appreciation | Depreciation | |||||

| Interest Rate Contracts | |||||||||||

| U.S. Treasury 5 Year Note | Short | 15 | $ | 1,773,867 | 12/31/14 | $ | 7,465 | $ | — | ||

| U.S. Treasury 30 Year Bond | Long | 26 | 3,585,563 | 12/19/14 | 372 | — | |||||

| Net unrealized appreciation (depreciation) | $ | 7,837 | |||||||||

| At September 30, 2014, the Fund had the following forward exchange contracts outstanding. See Note 1(e). | |||||||||||

| Forward Exchange Contracts | |||||||||||

| Contract | Settlement | Unrealized | Unrealized | ||||||||

| Currency | Counterpartya | Type | Quantity | Amount | Date | Appreciation | Depreciation | ||||

| Euro | DBAB | Buy | 30,000 | $ | 40,259 | 2/06/15 | $ | — | $ | (2,334 | ) |

| Euro | DBAB | Sell | 150,000 | 195,799 | 2/06/15 | 6,177 | — | ||||

| Euro | DBAB | Sell | 150,000 | 196,493 | 2/05/16 | 5,722 | — | ||||

| Unrealized appreciation (depreciation) | 11,899 | (2,334 | ) | ||||||||

| Net unrealized appreciation (depreciation) | $ | 9,565 | |||||||||

| aMay be comprised of multiple contracts with the same counterparty, currency and settlement date. | |||||||||||

22 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| At September 30, 2014, the Fund had the following credit default swap contracts outstanding. See Note 1(e). | ||||||||||||||||||

| Credit Default Swap Contracts | ||||||||||||||||||

| Upfront | ||||||||||||||||||

| Periodic | Premiums | |||||||||||||||||

| Counterparty/ | Notional | Payment | Expiration | Paid | Unrealized | Unrealized | Market | |||||||||||

| Description | Exchange | Amounta | Rate | Date | (Received) | Appreciation | Depreciation | Value | Ratingb | |||||||||

| OTC Swaps | ||||||||||||||||||

| Contracts to Sell Protectionc | ||||||||||||||||||

| Traded Index | ||||||||||||||||||

| CMBX.NA.AJ.2 | FBCO | $ | 74,459 | 1.09 | % | 3/15/49 | $ | (10,797 | ) | $ | 4,513 | $ | — | $ | (6,284 | ) | Non | |

| Investment | ||||||||||||||||||

| Grade | ||||||||||||||||||

| CMBX.NA.AM.2 | FBCO | 290,000 | 0.50 | % | 3/15/49 | (4,082 | ) | — | (550 | ) | (4,632 | ) | Investment | |||||

| Grade | ||||||||||||||||||

| OTC Swaps unrealized appreciation (depreciation) | 4,513 | (550 | ) | |||||||||||||||

| Net unrealized appreciation (depreciation) | $ | 3,963 | ||||||||||||||||

aIn U.S. dollars unless otherwise indicated. For contracts to sell protection, the notional amount is equal to the maximum potential amount of the future payments and no

recourse provisions have been entered into in association with the contracts.

bBased on Standard and Poor's (S&P) Rating for single name swaps and internal ratings for index swaps. Internal ratings based on mapping into equivalent ratings from

external vendors.

cThe fund enters contracts to sell protection to create a long credit position. Performance triggers include failure to pay or bankruptcy of the underlying securities for traded

index swaps.

See Note 9 regarding other derivative information.

See Abbreviations on page 38.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 23

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Financial Statements | |||

| Statement of Assets and Liabilities | |||

| September 30, 2014 | |||

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 107,422,991 | |

| Cost - Sweep Money Fund (Note 3f) | 4,274,614 | ||

| Cost - Repurchase agreements | 11,365,779 | ||

| Total cost of investments | $ | 123,063,384 | |

| Value - Unaffiliated issuers | $ | 109,676,774 | |

| Value - Sweep Money Fund (Note 3f) | 4,274,614 | ||

| Value - Repurchase agreements | 11,365,779 | ||

| Total value of investments | 125,317,167 | ||

| Cash | 17,329 | ||

| Receivables: | |||

| Investment securities sold | 1,863,331 | ||

| Capital shares sold | 200,217 | ||

| Dividends and interest | 292,871 | ||

| Due from brokers | 46,560 | ||

| Unrealized appreciation on forward exchange contracts | 11,899 | ||

| Unrealized appreciation on OTC swap contracts | 4,513 | ||

| Other assets | 22 | ||

| Total assets | 127,753,909 | ||

| Liabilities: | |||

| Payables: | |||

| Investment securities purchased | 39,983,344 | ||

| Capital shares redeemed | 154,881 | ||

| Management fees | 27,843 | ||

| Distribution fees | 7,082 | ||

| Transfer agent fees | 19,053 | ||

| Distributions to shareholders | 24,381 | ||

| Variation margin | 9,859 | ||

| OTC Swaps (premiums received $15,356) | 14,879 | ||

| TBA Sale Commitments, at value (proceeds $1,743,619) | 1,750,140 | ||

| Unrealized depreciation on forward exchange contracts | 2,334 | ||

| Unrealized depreciation on OTC swap contracts | 550 | ||

| Accrued expenses and other liabilities | 58,049 | ||

| Total liabilities | 42,052,395 | ||

| Net assets, at value | $ | 85,701,514 | |

| Net assets consist of: | |||

| Paid-in capital | $ | 108,881,352 | |

| Distributions in excess of net investment income | (18,218 | ) | |

| Net unrealized appreciation (depreciation) | 2,268,682 | ||

| Accumulated net realized gain (loss) | (25,430,302 | ) | |

| Net assets, at value | $ | 85,701,514 | |

24 | Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL STATEMENTS

| Statement of Assets and Liabilities (continued) | ||

| September 30, 2014 | ||

| Class A: | ||

| Net assets, at value | $ | 9,919,527 |

| Shares outstanding | 1,051,795 | |

| Net asset value per sharea | $ | 9.43 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.85 |

| Class A1: | ||

| Net assets, at value | $ | 64,324,610 |

| Shares outstanding | 6,815,100 | |

| Net asset value per sharea | $ | 9.44 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.86 |

| Class C: | ||

| Net assets, at value | $ | 2,408,538 |

| Shares outstanding | 255,287 | |

| Net asset value and maximum offering price per sharea | $ | 9.43 |

| Advisor Class: | ||

| Net assets, at value | $ | 9,048,839 |

| Shares outstanding | 959,771 | |

| Net asset value and maximum offering price per share | $ | 9.43 |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 25

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | |||

| FINANCIAL STATEMENTS | |||

| Statement of Operations | |||

| for the year ended September 30, 2014 | |||

| Investment income: | |||

| Dividends | $ | 30,590 | |

| Interest | 2,954,100 | ||

| Paydown gain (loss) | (173,681 | ) | |

| Total investment income | 2,811,009 | ||

| Expenses: | |||

| Management fees (Note 3a) | 328,237 | ||

| Distribution fees: (Note 3c) | |||

| Class A | 21,435 | ||

| Class C | 13,893 | ||

| Transfer agent fees: (Note 3e) | |||

| Class A | 12,302 | ||

| Class A1 | 98,230 | ||

| Class C | 3,084 | ||

| Advisor Class | 4,318 | ||

| Custodian fees (Note 4) | 1,109 | ||

| Reports to shareholders | 31,644 | ||

| Registration and filing fees | 69,948 | ||

| Professional fees | 57,249 | ||

| Trustees’ fees and expenses | 2,232 | ||

| Other | 61,725 | ||

| Total expenses | 705,406 | ||

| Expense reductions (Note 4) | (21 | ) | |

| Expenses waived/paid by affiliates (Note 3f) | (2,708 | ) | |

| Net expenses | 702,677 | ||

| Net investment income | 2,108,332 | ||

| Realized and unrealized gains (losses): | |||

| Net realized gain (loss) from: | |||

| Investments | 3,217,355 | ||

| Foreign currency transactions | (13,393 | ) | |

| Futures contracts | 301,084 | ||

| Swap contracts | 8,459 | ||

| Net realized gain (loss) | 3,513,505 | ||

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (1,436,863 | ) | |

| Translation of other assets and liabilities denominated in foreign currencies | 37,470 | ||

| Net change in unrealized appreciation (depreciation) | (1,399,393 | ) | |

| Net realized and unrealized gain (loss) | 2,114,112 | ||

| Net increase (decrease) in net assets resulting from operations | $ | 4,222,444 | |

26 | Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL STATEMENTS

| Statements of Changes in Net Assets | ||||||

| Year Ended | ||||||

| September 30, | ||||||

| 2014 | 2013 | |||||

| Increase (decrease) in net assets: | ||||||

| Operations: | ||||||

| Net investment income | $ | 2,108,332 | $ | 2,334,844 | ||

| Net realized gain (loss) from investments, foreign currency transactions, futures contracts and swap | ||||||

| contracts | 3,513,505 | (1,811,322 | ) | |||

| Net change in unrealized appreciation (depreciation) on investments and translation of other assets | ||||||

| and liabilities denominated in foreign currencies | (1,399,393 | ) | 29,071 | |||

| Net increase (decrease) in net assets resulting from operations | 4,222,444 | 552,593 | ||||

| Distributions to shareholders from: | ||||||

| Net investment income: | ||||||

| Class A | (365,627 | ) | (230,712 | ) | ||

| Class A1 | (3,152,499 | ) | (3,584,375 | ) | ||

| Class C | (83,256 | ) | (64,353 | ) | ||

| Advisor Class | (122,273 | ) | (73,980 | ) | ||

| Total distributions to shareholders | (3,723,655 | ) | (3,953,420 | ) | ||

| Capital share transactions: (Note 2) | ||||||

| Class A | 1,244,640 | 3,973,626 | ||||

| Class A1 | (11,725,704 | ) | (30,500,722 | ) | ||

| Class C | 258,547 | 666,801 | ||||

| Advisor Class | 6,044,410 | 1,802,603 | ||||

| Total capital share transactions | (4,178,107 | ) | (24,057,692 | ) | ||

| Net increase (decrease) in net assets | (3,679,318 | ) | (27,458,519 | ) | ||

| Net assets: | ||||||

| Beginning of year | 89,380,832 | 116,839,351 | ||||

| End of year | $ | 85,701,514 | $ | 89,380,832 | ||

| Undistributed net investment income (distributions in excess of net investment income) included in net | ||||||

| assets: | ||||||

| End of year | $ | (18,218 | ) | $ | 53,285 | |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 27

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Franklin Strategic Mortgage Portfolio (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end management investment company, consisting of one fund, Franklin Strategic Mortgage Portfolio (Fund). The Fund offers four classes of shares: Class A, Class A1, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and derivative financial instruments (derivatives) listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

Debt securities generally trade in the OTC market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the date that the values of the foreign debt securities are determined. Repurchase agreements are valued at cost, which approximates fair value.

Certain derivatives trade in the OTC market. The Fund’s pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund’s net benefit or obligation under the derivative contract, as measured by the fair value of the contract, is included in net assets.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

28 | Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Joint Repurchase Agreement

The Fund enters into a joint repurchase agreement whereby its uninvested cash balance is deposited into a joint cash account with other funds managed by the investment manager or an affiliate of the investment manager and is used to invest in one or more repurchase agreements. The value and face amount of the joint repurchase agreement are allocated to the funds based on their pro-rata interest. A repurchase agreement is accounted for as a loan by the Fund to the seller, collateralized by securities which are delivered to the Fund’s custodian. The fair value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the funds, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. Repurchase

agreements are subject to the terms of Master Repurchase Agreements (MRAs) with approved counterparties (sellers). The MRAs contain various provisions, including but not limited to events of default and maintenance of collateral for repurchase agreements. In the event of default by either the seller or the fund, certain MRAs may permit the non-defaulting party to net and close-out all transactions, if any, traded under such agreements. The Fund may sell securities it holds as collateral and apply the proceeds towards the repurchase price and any other amounts owed by the seller to the Fund in the event of default by the seller. This could involve costs or delays in addition to a loss on the securities if their value falls below the repurchase price owed by the seller. The joint repurchase agreement held by the Fund at year end, as indicated in the Statement of Investments, had been entered into on September 30, 2014.

d. Securities Purchased on a TBA Basis

The Fund purchases securities on a to-be-announced (TBA) basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Sufficient assets have been segregated for these securities.

e. Derivative Financial Instruments

The Fund invested in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

Derivative counterparty credit risk is managed through a formal evaluation of the creditworthiness of all potential counterparties. The Fund attempts to reduce its exposure to counterparty credit risk on OTC derivatives, whenever possible, by entering into International Swaps and Derivatives Association (ISDA) master agreements with certain coun-terparties. These agreements contain various provisions,

franklintempleton.com Annual Report | 29

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

1. Organization and Significant Accounting

Policies (continued)

e. Derivative Financial Instruments (continued)