UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07288

Franklin Strategic Mortgage Portfolio

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_650 312-2000

Date of fiscal year end: 9/30

Date of reporting period: 9/30/15

Item 1. Reports to Stockholders.

| Contents | |

| Annual Report | |

| Franklin Strategic Mortgage Portfolio | 3 |

| Performance Summary | 6 |

| Your Fund’s Expenses | 11 |

| Financial Highlights and Statement of Investments | 13 |

| Financial Statements | 24 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered | |

| Public Accounting Firm | 38 |

| Tax Information | 39 |

| Board Members and Officers | 40 |

| Shareholder Information | 45 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

2 Annual Report

franklintempleton.com

Annual Report

Franklin Strategic Mortgage Portfolio

This annual report for Franklin Strategic Mortgage Portfolio covers the period ended September 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks high total return (a combination of high current income and capital appreciation) relative to the performance of the general mortgage securities market by investing at least 80% of its net assets in a portfolio of mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by the Government National Mortgage Association (Ginnie Mae), Fannie Mae and Freddie Mac.1

Performance Overview

For the year under review, the Fund’s Class A shares delivered a +2.91% cumulative total return. In comparison, the Fund’s primary benchmark, the Barclays U.S. Mortgage-Backed Securities (MBS) Fixed Rate Index, which measures the performance of investment-grade fixed-rate mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac, produced a +3.45% total return.2 The Lipper U.S. Mortgage Funds Classification Average, which consists of funds chosen by Lipper that invest primarily in mortgages and securities issued or guaranteed by the U.S. government and certain federal agencies, returned +3.15%.3 The Barclays U.S. Treasury Index, the U.S. Treasury component of the Barclays U.S. Government Index, generated a +3.76% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Economic and Market Overview

U.S. economic growth was mixed during the 12 months under review. Growth expanded in 2014’s fourth quarter, slowed in 2015’s first quarter and rebounded in 2015’s second quarter. Additionally, estimates indicated tepid third-quarter growth despite healthy consumer spending as businesses cut back on inventories, exports declined and governments reduced their spending. Manufacturing and service activities expanded

1. Securities owned by the Fund but not shares of the Fund are guaranteed by the U.S. government, its agencies or instrumentalities as to the timely payment of principal

and interest. Although U.S. government-sponsored entities may be chartered or sponsored by acts of Congress, their securities are neither insured nor guaranteed by the

U.S. Treasury. Please refer to the Fund’s prospectus for a detailed discussion regarding various levels of credit support for government agency or instrumentality securities.

2. Source: Morningstar.

3. Source: Lipper, a Thomson Reuters Company. For the 12-month period ended 9/30/15, this category consisted of 115 funds. Lipper calculations do not include sales

charges or subsidization by a fund’s manager. The Fund’s performance relative to the average might have differed if these or other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 17.

franklintempleton.com Annual Report 3

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

during the 12-month period, contributing to new jobs, and the unemployment rate declined from 5.9% in September 2014 to 5.1% at period-end.4 Housing market data were generally encouraging as home sales and prices rose amid declining mortgage rates. Retail sales generally climbed for the 12-month period as strong employment gains led to broad-based improvement, especially for auto and auto components sales. Inflation, as measured by the Consumer Price Index, remained subdued for the period and declined toward period-end mainly due to a sharp drop in energy prices.

The Federal Reserve (Fed) ended its bond buying program in October 2014 and kept its target interest rate at 0%–0.25% while considering when an increase might be appropriate. Although global financial markets anticipated an increase, in September the Fed kept interest rates unchanged and said it would continue to monitor developments domestically and abroad. The Fed also raised its forecast for 2015 U.S. economic growth and lowered its unemployment projections.

The 10-year Treasury yield, which moves inversely to price, shifted throughout the period. It began at 2.52% in September 2014, declined to a period low of 1.68% in late January 2015 and ended the period at 2.06%. The moves seemed to reflect investor uncertainty given concerns about soft domestic data, Greece’s debt issues and the Fed’s cautious tone on raising interest rates. China’s moderating growth and its currency devaluation toward period-end also affected Treasury prices.

Investment Strategy

We invest at least 80% of the Fund’s net assets in mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac.1 We may also invest in other types of mortgage securities that may be issued by private issuers, in U.S. Treasuries and in mortgage loans. At least 80% of total assets are invested in securities rated BBB or higher by Standard & Poor’s (S&P), or Baa by Moody’s Investors Service (Moody’s), independent credit rating agencies. Within these parameters, we rely on our research to help us identify attractive investment opportunities.

| Dividend Distributions* | ||||

| 10/1/14–9/30/15 | ||||

| Dividend per Share (cents) | ||||

| Advisor | ||||

| Month | Class A | Class A1 | Class C | Class |

| October | 1.6747 | 1.8832 | 1.3539 | 1.8594 |

| November | 1.6353 | 1.8191 | 1.3449 | 1.8165 |

| December | 1.9886 | 2.2058 | 1.6483 | 2.2033 |

| January | 1.4663 | 1.6635 | 1.1522 | 1.6616 |

| February | 1.7610 | 1.9457 | 1.4695 | 1.9435 |

| March | 1.9657 | 2.1675 | 1.6407 | 2.1651 |

| April | 1.6147 | 1.8189 | 1.2940 | 1.8179 |

| May | 1.6989 | 1.8891 | 1.3963 | 1.8876 |

| June | 2.2084 | 2.4160 | 1.8740 | 2.4126 |

| July | 1.7147 | 1.9172 | 1.4049 | 1.9143 |

| August | 1.6222 | 1.8245 | 1.3005 | 1.8221 |

| September | 1.9443 | 2.1334 | 1.6517 | 2.1324 |

| Total | 21.2948 | 23.6839 | 17.5309 | 23.6363 |

*The distribution amount is the sum of the dividend payments to shareholders for

the period shown and includes only estimated tax-basis net investment income.

Assumes shares were purchased and held for the entire accrual period. Since

dividends accrue daily, your actual distributions will vary depending on the date

you purchased your shares and any account activity. All Fund distributions will vary

depending upon current market conditions, and past distributions are not indicative

of future trends.

Manager’s Discussion

U.S. economic indicators were generally encouraging during the Fund’s fiscal year, with increases in consumer and investment spending and a declining unemployment rate. Ongoing domestic growth contrasted with a decline in the rate of foreign growth, and the U.S. dollar strengthened against other major currencies, creating a headwind for U.S. exports. We felt the domestic expansionary environment led to an increase in home sales and a rise in property values, while supply in that sector continued to shrink. Consumer credit remained tight even as mortgage interest rates continued to decline. The Federal Reserve (Fed) decided against raising the federal funds rate in September 2015, leaving the target rate at historically low levels, in part due to a decline in foreign growth prospects throughout the period.

4. Source: Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

4 Annual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

High-quality securitized sectors performed well during the period. All sectors produced positive total returns but were outpaced by strong performance from Treasuries. Fannie Mae led results, followed by commercial mortgage-backed securities (CMBS) and Freddie Mac mortgage-backed securities (MBS).

In our view, agency MBS remained fully valued. The Fed’s participation in agency MBS has, in our view, kept mortgage valuations high. Questions persist about the demand source for agency MBS once the Fed moves closer to ceasing reinvestment in MBS. We felt demand from banks, mortgage real estate investment trusts, overseas investors and domestic money managers would need to rise to compensate for the Fed’s reduced presence in the MBS sector. We believe prepayment levels could moderate with mortgage rates staying in the same range and underwriting standards remaining tight.

The Fund’s allocations to conventional fixed-rate MBS and CMBS were significant contributors to performance. The Fund’s shorter duration positioning detracted from performance over the period as interest rate movements had a negative impact.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest rate changes than a portfolio with a higher duration.

Franklin Strategic Mortgage Portfolio’s broad mortgage strategy looks across all mortgage opportunities to find relative value. The investment team continued to look for strong cash flow fundamentals and valuations seeking to uncover attractive valuations across the mortgage investment universe. Within the agency MBS sector, we increased our allocation to 3.5% coupon securities and reduced our exposure to 3.0%, 4.0% and 4.5% MBS. The portfolio’s heaviest mortgage allocations were in 3.0%, 3.5% and 4.0% coupon securities. We increased our exposure to residential MBS and adjustable-rate MBS (ARMS) and reduced our exposure to fixed-rate MBS and CMBS. At period-end, the portfolio’s heaviest mortgage allocations were in fixed-rate MBS, followed by ARMS and CMBS. Although we selectively reduced holdings, the Fund remained allocated to CMBS, as we believe commercial real estate fundamentals could slowly and steadily improve over the intermediate term.

We continued to employ a flexible investment approach seeking to take advantage of what we felt were additional investment opportunities in non-agency mortgage securities and non-investment grade mortgage securities while maintaining core holdings in agency MBS.

Thank you for your continued participation in Franklin Strategic Mortgage Portfolio. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Annual Report

5

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Performance Summary as of September 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | |||||

| Share Class (Symbol) | 9/30/15 | 9/30/14 | Change | ||

| A (N/A) | $ | 9.49 | $ | 9.43 | +$0.06 |

| A1 (FSMIX) | $ | 9.49 | $ | 9.44 | +$0.05 |

| C (N/A) | $ | 9.49 | $ | 9.43 | +$0.06 |

| Advisor (N/A) | $ | 9.48 | $ | 9.43 | +$0.05 |

| Distributions1 (10/1/14–9/30/15) | ||

| Dividend | ||

| Share Class | Income | |

| A | $ | 0.212948 |

| A1 | $ | 0.236839 |

| C | $ | 0.175309 |

| Advisor | $ | 0.236363 |

6 Annual Report franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

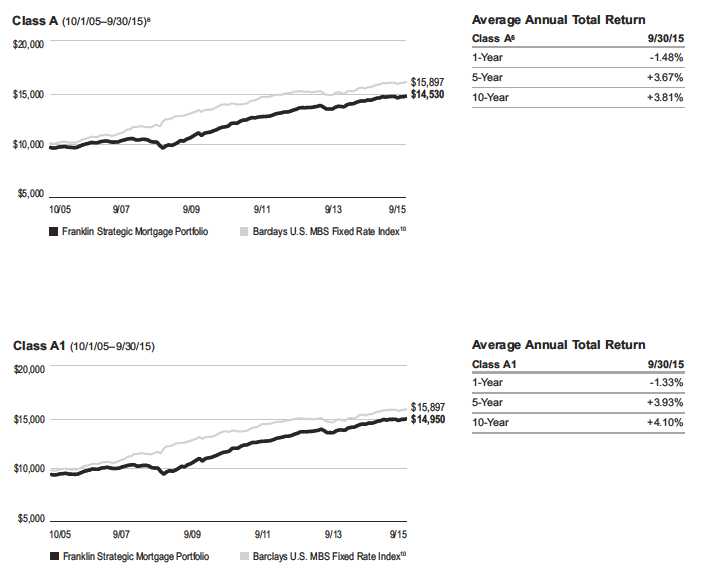

Performance as of 9/30/152

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Class A/A1: 4.25% maximum initial sales charge. Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| Cumulative | Average Annual | Total Annual | ||||

| Share Class | Total Return3 | Total Return4 | Operating Expenses5 | |||

| A6 | 1.06 | % | ||||

| 1-Year | +2.91 | % | -1.48 | % | ||

| 5-Year | +25.01 | % | +3.67 | % | ||

| 10-Year | +51.76 | % | +3.81 | % | ||

| A1 | 0.81 | % | ||||

| 1-Year | +3.06 | % | -1.33 | % | ||

| 5-Year | +26.60 | % | +3.93 | % | ||

| 10-Year | +56.11 | % | +4.10 | % | ||

| C | 1.46 | % | ||||

| 1-Year | +2.51 | % | +1.51 | % | ||

| Since Inception (2/1/12) | +11.78 | % | +3.09 | % | ||

| Advisor7 | 0.81 | % | ||||

| 1-Year | +3.06 | % | +3.06 | % | ||

| 5-Year | +26.45 | % | +4.81 | % | ||

| 10-Year | +55.92 | % | +4.54 | % |

| Distribution | 30-Day Standardized Yield9 | |||||

| Share Class | Rate8 | (with waiver) | (without waiver) | |||

| A | +2.39 | % | 1.52 | % | 1.52 | % |

| A1 | +2.62 | % | 1.78 | % | 1.78 | % |

| C | +2.12 | % | 1.20 | % | 1.20 | % |

| Advisor | +2.74 | % | 1.85 | % | 1.85 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com

Annual Report

|

7

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

8 Annual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1 (continued)

franklintempleton.com Annual Report 9

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements and mortgage prepayments. During periods of declining interest rates, principal prepayments tend to increase as borrowers refinance their mortgages at lower rates; therefore the Fund may be forced to reinvest returned principal at lower interest rates, reducing income. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| Class A: | The Fund began offering a new Class A share on 2/1/12 with a 25 basis point (0.25%) Rule 12b-1 fee. Prior to that date, the Fund offered a Class A share |

| (renamed Class A1). | |

| Class A1 | |

| (formerly Class A): | Effective 2/1/12, Class A shares closed to new investors and were renamed Class A1. |

| Class C: | These shares have higher fees and expenses than Class A shares. |

| Advisor Class: | These shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses

to become higher than the figures shown.

6. Performance quotations for Class A shares reflect the following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on Class A1

performance and including the Class A Rule 12b-1 fee, and (b) for periods after 2/1/12, actual Class A performance is used, reflecting all charges and fees applicable to

that class. Since 2/1/12 (commencement of sales), the cumulative and average annual total returns of Class A shares were +13.41% and +2.28%.

7. Effective 2/1/12, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 fee. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on the Fund’s oldest share class, Class A1, excluding the effect of its

maximum initial sales charge; and (b) for periods after 2/1/12, actual Advisor Class performance is used, reflecting all charges and fees applicable to that class. Since

2/1/12 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +14.32% and +3.72%.

8. Distribution rate is based on an annualization of the sum of distributions per share for the 30 days of September and the maximum offering price (NAV for Classes C

and Advisor) on 9/30/15.

9. The 30-day standardized yield for the 30 days ended 9/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends

paid to shareholders) or the income reported in the Fund’s financial statements.

10. Source: Morningstar. The Barclays MBS Fixed Rate Index is the FNMA component of the Barclays Fixed Rate MBS Index and includes the mortgage-backed

pass-through securities of the Federal National Mortgage Association.

See www.franklintempletondatasources.com for additional data provider information.

10 Annual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com

Annual Report

11

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||

| YOUR FUND’S EXPENSES | ||||||

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 4/1/15 | Value 9/30/15 | Period* 4/1/15–9/30/15 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 1,004.00 | $ | 5.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.90 | $ | 5.22 |

| A1 | ||||||

| Actual | $ | 1,000 | $ | 1,004.20 | $ | 3.92 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.16 | $ | 3.95 |

| C | ||||||

| Actual | $ | 1,000 | $ | 1,002.00 | $ | 7.18 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.90 | $ | 7.23 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 1,004.20 | $ | 3.92 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.16 | $ | 3.95 |

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, annualized for each class

(A: 1.03%; A1: 0.78%; C: 1.43%; and Advisor: 0.78%), multiplied by the average account value over the period, multiplied by 183/365 to

reflect the one-half year period.

|

12 Annual Report

franklintempleton.com

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||||||||

| Financial Highlights | ||||||||||||

| Year Ended September 30, | ||||||||||||

| 2015 | 2014 | 2013 | 2012 | a | ||||||||

| Class A | ||||||||||||

| Per share operating performance | ||||||||||||

| (for a share outstanding throughout the year) | ||||||||||||

| Net asset value, beginning of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | ||||

| Income from investment operationsb: | ||||||||||||

| Net investment income | 0.185 | 0.249 | 0.229 | 0.172 | ||||||||

| Net realized and unrealized gains (losses) | 0.088 | 0.218 | (0.202 | ) | 0.255 | |||||||

| Total from investment operations | 0.273 | 0.467 | 0.027 | 0.427 | ||||||||

| Less distributions from net investment income | (0.213 | ) | (0.407 | ) | (0.347 | ) | (0.207 | ) | ||||

| Net asset value, end of year | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | ||||

| Total returnc | 2.91 | % | 5.09 | % | 0.28 | % | 4.57 | % | ||||

| Ratios to average net assetsd | ||||||||||||

| Expenses | 1.01 | %e | 1.06 | %e | 0.96 | % | 1.01 | % | ||||

| Net investment income | 1.84 | % | 2.37 | % | 2.04 | % | 2.07 | % | ||||

| Supplemental data | ||||||||||||

| Net assets, end of year (000’s) | $ | 26,328 | $ | 9,920 | $ | 8,627 | $ | 4,856 | ||||

| Portfolio turnover rate | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | ||||

| Portfolio turnover rate excluding mortgage dollar rollsf | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | ||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report 13

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

| Class A1 | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 9.44 | $ | 9.38 | $ | 9.69 | $ | 9.39 | $ | 9.09 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment income | 0.197 | 0.232 | 0.190 | 0.212 | 0.269 | ||||||||||

| Net realized and unrealized gains (losses) | 0.090 | 0.259 | (0.129 | ) | 0.436 | 0.469 | |||||||||

| Total from investment operations | 0.287 | 0.491 | 0.061 | 0.648 | 0.738 | ||||||||||

| Less distributions from net investment income | (0.237 | ) | (0.431 | ) | (0.371 | ) | (0.348 | ) | (0.438 | ) | |||||

| Net asset value, end of year | $ | 9.49 | $ | 9.44 | $ | 9.38 | $ | 9.69 | $ | 9.39 | |||||

| Total returnb | 3.06 | % | 5.35 | % | 0.64 | % | 7.04 | % | 8.24 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expenses | 0.76 | %c | 0.81 | %c | 0.71 | % | 0.76 | % | 0.65 | % | |||||

| Net investment income | 2.09 | % | 2.62 | % | 2.29 | % | 2.32 | % | 2.85 | % | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 59,352 | $ | 64,325 | $ | 75,609 | $ | 109,162 | $ | 102,529 | |||||

| Portfolio turnover rate | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | 539.76 | % | |||||

| Portfolio turnover rate excluding mortgage dollar rollsd | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | 126.63 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

cBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

dSee Note 1(f) regarding mortgage dollar rolls.

14 Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||

| Year Ended September 30, | ||||||||||||

| 2015 | 2014 | 2013 | 2012 | a | ||||||||

| Class C | ||||||||||||

| Per share operating performance | ||||||||||||

| (for a share outstanding throughout the year) | ||||||||||||

| Net asset value, beginning of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | ||||

| Income from investment operationsb: | ||||||||||||

| Net investment income | 0.142 | 0.207 | 0.167 | 0.155 | ||||||||

| Net realized and unrealized gains (losses) | 0.093 | 0.223 | (0.178 | ) | 0.247 | |||||||

| Total from investment operations | 0.235 | 0.430 | (0.011 | ) | 0.402 | |||||||

| Less distributions from net investment income | (0.175 | ) | (0.370 | ) | (0.309 | ) | (0.182 | ) | ||||

| Net asset value, end of year | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | ||||

| Total returnc | 2.51 | % | 4.68 | % | (0.11 | )% | 4.29 | % | ||||

| Ratios to average net assetsd | ||||||||||||

| Expenses | 1.41 | %e | 1.46 | %e | 1.36 | % | 1.41 | % | ||||

| Net investment income | 1.44 | % | 1.97 | % | 1.64 | % | 1.67 | % | ||||

| Supplemental data | ||||||||||||

| Net assets, end of year (000’s) | $ | 4,067 | $ | 2,409 | $ | 2,137 | $ | 1,540 | ||||

| Portfolio turnover rate | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | ||||

| Portfolio turnover rate excluding mortgage dollar rollsf | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | ||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report 15

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | ||||||||||||

| 2015 | 2014 | 2013 | 2012 | a | ||||||||

| Advisor Class | ||||||||||||

| Per share operating performance | ||||||||||||

| (for a share outstanding throughout the year) | ||||||||||||

| Net asset value, beginning of year | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | ||||

| Income from investment operationsb: | ||||||||||||

| Net investment income | 0.199 | 0.371 | 0.252 | 0.149 | ||||||||

| Net realized and unrealized gains (losses) | 0.087 | 0.119 | (0.201 | ) | 0.294 | |||||||

| Total from investment operations | 0.286 | 0.490 | 0.051 | 0.443 | ||||||||

| Less distributions from net investment income | (0.236 | ) | (0.430 | ) | (0.371 | ) | (0.223 | ) | ||||

| Net asset value, end of year | $ | 9.48 | $ | 9.43 | $ | 9.37 | $ | 9.69 | ||||

| Total returnc | 3.06 | % | 5.35 | % | 0.54 | % | 4.74 | % | ||||

| Ratios to average net assetsd | ||||||||||||

| Expenses | 0.76 | %e | 0.81 | %e | 0.71 | % | 0.76 | % | ||||

| Net investment income | 2.09 | % | 2.62 | % | 2.29 | % | 2.32 | % | ||||

| Supplemental data | ||||||||||||

| Net assets, end of year (000’s) | $ | 12,651 | $ | 9,049 | $ | 3,007 | $ | 1,281 | ||||

| Portfolio turnover rate | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | ||||

| Portfolio turnover rate excluding mortgage dollar rollsf | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | ||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(f) regarding mortgage dollar rolls.

16 Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Statement of Investments, September 30, 2015 | ||||

| Shares | Value | |||

| Common Stocks 0.8% | ||||

| Mortgage REITs 0.8% | ||||

| American Capital Agency Corp. | 22,000 | $ | 411,400 | |

| Annaly Capital Management Inc. | 26,700 | 263,529 | ||

| Hatteras Financial Corp. | 10,000 | 151,500 | ||

| Total Common Stocks (Cost $970,671) | 826,429 | |||

| Principal | ||||

| Amount* | ||||

| Asset-Backed Securities and Commercial Mortgage-Backed | ||||

| Securities 34.7% | ||||

| Finance 34.7% | ||||

| aAmerican Home Mortgage Investment Trust, 2005-1, 6A, 2.535%, 6/25/45 | 230,045 | 226,325 | ||

| a,bAmerican Homes 4 Rent, 2014-SFR1, | ||||

| A, 144A, 1.25%, 6/17/31 | 195,537 | 192,222 | ||

| C, 144A, 2.00%, 6/17/31 | 250,000 | 246,704 | ||

| b,cAnthracite Ltd., 2004-HY1A, E, 144A, 7.147%, 6/20/41 | 1,598,000 | 20,638 | ||

| a,bARCap REIT Inc., 2004-RR3, A2, 144A, 4.76%, 9/21/45 | 218,369 | 221,523 | ||

| bARCap Resecuritization Trust, 2004-A1, A, 144A, 4.73%, 4/21/24 | 26,883 | 27,067 | ||

| Banc of America Commercial Mortgage Trust, | ||||

| 2006-1, AJ, 5.46%, 9/10/45 | 1,000,000 | 1,010,520 | ||

| 2006-4, AJ, 5.695%, 7/10/46 | 450,000 | 458,433 | ||

| 2006-4, AM, 5.675%, 7/10/46 | 300,000 | 309,738 | ||

| aBear Stearns Alt-A Trust, 2004-13, A2, 1.074%, 11/25/34 | 199,644 | 192,318 | ||

| Bear Stearns Commercial Mortgage Securities Inc., | ||||

| a2006-PW11, AJ, 5.522%, 3/11/39 | 750,000 | 758,310 | ||

| a2006-PW12, AJ, 5.753%, 9/11/38 | 300,000 | 303,726 | ||

| 2006-PW13, AJ, 5.611%, 9/11/41 | 750,000 | 757,513 | ||

| a2007-PW16, AM, 5.895%, 6/11/40 | 750,000 | 794,828 | ||

| aBear Stearns Commercial Mortgage Securities Trust, | ||||

| 2004-PWR3, E, 4.998%, 2/11/41 | 123,285 | 123,506 | ||

| 2005-T20, E, 5.173%, 10/12/42 | 215,000 | 214,713 | ||

| b2006-PW12, B, 144A, 5.753%, 9/11/38 | 250,000 | 246,403 | ||

| bCenterline REIT Inc., 2004-RR3, B, 144A, 5.04%, 9/21/45 | 200,000 | 193,484 | ||

| Citigroup Commercial Mortgage Trust, | ||||

| 2006-C5, AJ, 5.482%, 10/15/49 | 328,000 | 323,254 | ||

| a2007-C6, AM, 5.711%, 6/10/17 | 500,000 | 524,858 | ||

| 2015-GC27, A5, 3.137%, 2/10/48 | 225,000 | 225,200 | ||

| a,bCitigroup Mortgage Loan Trust Inc., 2013-A, A, 144A, 3.00%, 5/25/42 | 117,691 | 117,836 | ||

| aCitigroup/Deutsche Bank Commercial Mortgage Trust, | ||||

| 2005-CD1, E, 5.289%, 7/15/44 | 215,000 | 214,592 | ||

| 2006-CD3, AJ, 5.688%, 10/15/48 | 450,000 | 365,976 | ||

| bColony American Homes, | ||||

| a2014-1A, A, 144A, 1.40%, 5/17/31 | 101,981 | 100,808 | ||

| a2014-1A, C, 144A, 2.10%, 5/17/31 | 250,000 | 246,224 | ||

| 2014-2A, C, 144A, 2.107%, 7/17/31 | 200,000 | 196,255 | ||

| bColony MFM Trust, 2014-1, A, 144A, 2.543%, 4/20/50 | 319,234 | 319,641 | ||

| bCOMM Mortgage Trust, 2012-9W57, A, 144A, 2.365%, 2/10/29 | 220,000 | 223,134 | ||

| a,dCommercial Mortgage Trust, 2005-GG5, AJ, 5.486%, 4/10/37 | 315,000 | 314,803 | ||

| aConseco Finance Securitizations Corp., 2002-2, M1, 7.424%, 3/01/33 | 450,000 | 494,753 | ||

| bCountryplace Manufactured Housing Contract Trust, 2007-1, A3, 144A, 5.593%, 7/15/37 | 249,631 | 253,674 | ||

| aCountrywide Asset-Backed Certificates, | ||||

| 2004-1, M1, 0.944%, 3/25/34 | 165,332 | 158,952 | ||

| 2004-7, MV3, 1.244%, 12/25/34 | 74,908 | 74,696 | ||

| 2004-14, M1, 0.959%, 6/25/35 | 3,089 | 3,095 | ||

| franklintempleton.com | Annual Report | | | 17 | |

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Asset-Backed Securities and Commercial Mortgage-Backed | |||

| Securities (continued) | |||

| Finance (continued) | |||

| a,bCredit Suisse Mortgage Capital Certificates, 2009-15R, 3A1, 144A, 5.466%, 3/26/36 | 112,014 | $ | 112,556 |

| bCT CDO III Ltd., 2005-3A, C, 144A, 5.471%, 6/25/35 | 54,111 | 54,303 | |

| a,bCT CDO IV Ltd., 2006-4A, A1, 144A, 0.526%, 10/20/43 | 166,722 | 166,399 | |

| bEleven Madison Trust Mortgage Trust, 2015-11MD, A, 144A, 3.555%, 9/10/35 | 400,000 | 411,024 | |

| a,bFairfield Street Solar, 2004-1A, A1, 144A, 0.675%, 11/28/39 (Cayman Islands) | 340,908 | 330,971 | |

| aFHLMC Structured Agency Credit Risk Debt Notes, | |||

| 2014-DN1, M2, 2.394%, 2/25/24 | 250,000 | 251,997 | |

| 2014-DN1, M3, 4.694%, 2/25/24 | 250,000 | 250,036 | |

| 2014-DN3, M2, 2.594%, 8/25/24 | 250,000 | 253,005 | |

| 2014-DN4, M2, 2.594%, 10/25/24 | 370,000 | 372,975 | |

| 2014-DNA, M3, 4.744%, 10/25/24 | 250,000 | 248,914 | |

| 2014-HQ1, M2, 2.694%, 8/25/24 | 250,000 | 253,609 | |

| 2014-HQ2, M2, 2.394%, 9/25/24 | 250,000 | 248,551 | |

| 2014-HQ3, M3, 2.844%, 10/25/24 | 250,000 | 255,108 | |

| 2015-DN1, M2, 2.594%, 1/25/25 | 250,000 | 253,177 | |

| 2015-DN1, M3, 4.344%, 1/25/25 | 250,000 | 250,364 | |

| 2015-DNA1, M2, 2.044%, 10/25/27 | 250,000 | 248,993 | |

| 2015-DNA1, M3, 3.494%, 10/25/27 | 250,000 | 238,454 | |

| 2015-HQ1, M1, 1.244%, 3/25/25 | 232,888 | 232,655 | |

| 2015-HQ1, M2, 2.394%, 3/25/25 | 250,000 | 250,220 | |

| 2015-HQ1, M3, 3.994%, 3/25/25 | 250,000 | 243,159 | |

| 2015-HQA1, M2, 2.844%, 3/25/28 | 250,000 | 250,000 | |

| aFNMA, 2007-1, NF, 0.444%, 2/25/37 | 203,519 | 203,293 | |

| aFNMA Connecticut Avenue Securities, 1.144%, 5/25/24 | 167,435 | 166,493 | |

| bG-Force LLC, | |||

| a2005-RR2, A3FL, 144A, 0.494%, 12/25/39 | 63,241 | 62,307 | |

| 2005-RRA, B, 144A, 5.09%, 8/22/36 | 260,299 | 263,526 | |

| 2005-RRA, C, 144A, 5.20%, 8/22/36 | 300,000 | 294,972 | |

| dGMAC Commercial Mortgage Securities Inc., 2005-C1, B, 4.936%, 5/10/43 | 800,000 | 200,180 | |

| Green Tree Financial Corp., | |||

| 1996-9, M1, 7.63%, 8/15/27 | 299,868 | 328,555 | |

| 1997-3, A6, 7.32%, 3/15/28 | 22,803 | 23,968 | |

| 1997-6, A7, 7.14%, 1/15/29 | 10,722 | 11,093 | |

| 1998-4, A7, 6.87%, 4/01/30 | 121,302 | 132,706 | |

| Greenpoint Manufactured Housing, 1999-3, 1A7, 7.27%, 6/15/29 | 447,205 | 448,563 | |

| aGreenwich Capital Commercial Funding Corp., 2006-GG7, | |||

| AJ, 5.819%, 7/10/38 | 400,000 | 397,011 | |

| AM, 5.819%, 7/10/38 | 200,000 | 204,892 | |

| aGSAA Home Equity Trust, 0.564%, 6/25/35 | 164,478 | 158,672 | |

| aGSAMP Trust, 2005-HE3, M2, 1.199%, 6/25/35 | 247,584 | 242,941 | |

| a,bHilton USA Trust, 2013-HLF, BFL, 144A, 1.704%, 11/05/30 | 246,366 | 246,004 | |

| aHome Equity Mortgage Trust, 2004-4, M3, 1.169%, 12/25/34 | 623,352 | 580,933 | |

| a,bInvitation Homes Trust, | |||

| 2014-SFR1, B, 144A, 1.707%, 6/17/31 | 250,000 | 244,887 | |

| 2014-SFR2, B, 144A, 1.807%, 9/17/31 | 200,000 | 196,410 | |

| 2014-SFR3, C, 144A, 2.713%, 12/17/31 | 250,000 | 248,865 | |

| 2015-SFR2, A, 144A, 1.557%, 6/17/32 | 245,050 | 243,001 | |

| 2015-SFR2, C, 144A, 2.207%, 6/17/32 | 200,000 | 198,757 | |

| 2015-SFR3, C, 144A, 2.207%, 8/17/32 | 225,000 | 220,236 | |

| 18 | Annual Report | franklintempleton.com | ||

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Asset-Backed Securities and Commercial Mortgage-Backed | |||

| Securities (continued) | |||

| Finance (continued) | |||

| JP Morgan Chase Commercial Mortgage Securities Trust, | |||

| a,b2003-LN1, H, 144A, 5.639%, 10/15/37 | 190,810 | $ | 191,743 |

| a2005-LDP5, A, 5.563%, 12/15/44 | 300,000 | 301,701 | |

| a2005-LPD5, F, 5.563%, 12/15/44 | 250,000 | 251,015 | |

| a,d2006-CB16, B, 5.672%, 5/12/45 | 240,000 | 162,801 | |

| 2006-CB17, AM, 5.464%, 12/12/43 | 490,000 | 497,458 | |

| a,d2006-LDP7, AJ, 6.10%, 4/15/45 | 350,000 | 339,966 | |

| JPMBB Commercial Mortgage Securities Trust, 2015 C-28, A4, 3.227%, 10/15/48 | 225,000 | 227,462 | |

| a,bLake Country Mortgage Loan Trust, 2005-HE1, M1, 144A, 0.974%, 12/25/32 | 7,605 | 7,611 | |

| aLB-UBS Commercial Mortgage Trust, | |||

| b2001-C3, E, 144A, 6.95%, 6/15/36 | 300,000 | 300,717 | |

| b2004-C7, H, 144A, 4.944%, 10/15/36 | 252,170 | 254,311 | |

| 2006-C1, AJ, 5.276%, 2/15/41 | 350,000 | 352,716 | |

| 2006-C3, AJ, 5.72%, 3/15/39 | 250,000 | 253,122 | |

| 2006-C4, AJ, 6.05%, 6/15/38 | 500,000 | 507,480 | |

| aLehman XS Trust, 2005-1, 2A2, 1.697%, 7/25/35 | 117,781 | 113,647 | |

| bLNR CDO Ltd., | |||

| a2002-1A, DFL, 144A, 1.596%, 7/24/37 (Cayman Islands) | 178,352 | 177,507 | |

| 2002-1A, DFX, 144A, 6.727%, 7/24/37 | 98,563 | 98,908 | |

| a2003-1A, EFL, 144A, 3.195%, 7/23/36 (Cayman Islands) | 430,830 | 430,985 | |

| a,bMach One 2004-1A ULC, H, 144A, 6.074%, 5/28/40 | 111,039 | 111,004 | |

| aMadison Avenue Manufactured Housing Contract Trust, 2002-A, B1, 3.444%, 3/25/32 | 250,000 | 254,769 | |

| aMaster Asset-Backed Securities Trust, 2004-HE1, M2, 1.289%, 9/25/34 | 147,193 | 146,537 | |

| aMerrill Lynch Mortgage Investors Trust, | |||

| 2003-A, 1A, 0.934%, 3/25/28 | 284,239 | 271,582 | |

| 2004-A1, M1, 2.49%, 2/25/34 | 242,754 | 207,008 | |

| aMerrill Lynch Mortgage Trust, 2005-CKI1, | |||

| AJ, 5.46%, 11/12/37 | 176,488 | 176,419 | |

| C, 5.46%, 11/12/37 | 225,000 | 224,993 | |

| D, 5.46%, 11/12/37 | 230,000 | 230,047 | |

| aML-CFC Commercial Mortgage Trust, 2006-3, A1A, 5.409%, 7/12/46 | 158,049 | 162,811 | |

| aMorgan Stanley ABS Capital I Inc. Trust, | |||

| 2003-HE1, M1, 1.394%, 5/25/33 | 363,485 | 343,787 | |

| 2005-WMC, M2, 0.929%, 1/25/35 | 269,654 | 262,325 | |

| Morgan Stanley Capital I Trust, | |||

| b2005-RR6, AJ, 144A, 5.233%, 5/24/43 | 434,619 | 435,028 | |

| b,d2005-RR6, B, 144A, 5.306%, 5/24/43 | 310,000 | 311,207 | |

| a2006-HQ8, AJ, 5.495%, 3/12/44 | 399,000 | 400,921 | |

| a,bN-Star Real Estate CDO Ltd., 2006-6A, A1, 144A, 0.666%, 6/16/41 (Cayman Islands) | 312,092 | 306,403 | |

| a,bNewcastle CDO Ltd., 2004-5A, 1, 144A, 0.667%, 12/24/39 | 21,980 | 21,810 | |

| aNovastar Home Equity Loan, 2004-4, M4, 1.844%, 3/25/35 | 500,000 | 493,896 | |

| Oakwood Mortgage Investors Inc., 1999-A, A3, 6.09%, 4/15/29 | 376,883 | 380,436 | |

| a,bProgress Residential Trust, | |||

| 2014-SFR, B, 144A, 2.107%, 10/17/31 | 250,000 | 248,094 | |

| 2014-SFR1, A, 144A, 1.307%, 10/17/31 | 250,000 | 246,028 | |

| 2015-SFR1, A, 144A, 1.607%, 2/17/32 | 390,000 | 387,683 | |

| Residential Asset Securities Corp., | |||

| 2004-KS1, AI4, 4.213%, 4/25/32 | 55,468 | 55,449 | |

| 2004-KS8, AI6, 4.79%, 9/25/34 | 125,367 | 126,893 |

franklintempleton.com

Annual Report

19

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Mortgage-Backed Securities (continued) | |||

| Finance (continued) | |||

| aResidential Funding Mortgage Securities II, | |||

| 2002-HI5, M1, 6.14%, 1/25/28 | 80,767 | $ | 81,578 |

| 2003-HI2, M2, 5.58%, 7/25/28 | 159,564 | 160,681 | |

| 2004-HI3, A5, 5.48%, 6/25/34 | 119,365 | 123,537 | |

| a,bSilver Bay Realty Trust, 2014-1, A, 144A, 1.207%, 9/17/31 | 189,873 | 186,397 | |

| a,bSpringleaf Mortgage Loan Trust, 2013-1A, M4, 144A, 4.44%, 6/25/58 | 400,000 | 404,053 | |

| a,bSWAY Residential 2014-1 Trust, 2014-1, A, 144A, 1.507%, 1/17/32 | 247,825 | 247,233 | |

| a,eTalisman 6 Finance, Reg S, 0.161%, 10/22/16 (Germany) | 8,352 | EUR | 9,230 |

| bTricon American Homes Trust, 2015-SFR1, | |||

| A, 144A, 1.457%, 5/17/32 | 250,000 | 247,052 | |

| C, 144A, 2.107%, 5/17/32 | 200,000 | 194,672 | |

| Vanderbilt Mortgage Finance, 2002-C, M1, 7.82%, 12/07/32 | 231,885 | 244,053 | |

| aWachovia Bank Commercial Mortgage Trust, | |||

| 5.90%, 5/15/16 | 400,000 | 404,678 | |

| b2003-C7, F, 144A, 6.091%, 10/15/35 | 100,751 | 101,755 | |

| 2006-C23, AJ, 5.515%, 1/18/45 | 400,000 | 403,116 | |

| 2006-C25, AJ, 5.90%, 5/15/43 | 300,000 | 304,043 | |

| aWaMu Mortgage Pass-Through Certificates, | |||

| 2005-AR8, 1A1A, 0.484%, 7/25/45 | 184,305 | 173,832 | |

| 2005-AR19, A1A1, 0.464%, 12/25/45 | 361,769 | 337,339 | |

| Wells Fargo Mortgage Backed Securities Trust, | |||

| a2004-W, A9, 2.641%, 11/25/34 | 183,929 | 187,702 | |

| a2005-AR9, 2A2, 2.725%, 10/25/33 | 261,306 | 259,217 | |

| a2005-AR10, 2A3, 2.685%, 6/25/35 | 169,473 | 168,193 | |

| 2007-3, 3A1, 5.50%, 4/25/37 | 42,806 | 43,663 | |

| Total Asset-Backed Securities and Commercial Mortgage-Backed | |||

| Securities (Cost $35,204,586) | 35,506,761 | ||

| Mortgage-Backed Securities 85.6% | |||

| aFederal Home Loan Mortgage Corp. (FHLMC) Adjustable Rate 7.3% | |||

| FHLMC, 2.00% - 2.319%, 4/01/17 - 11/01/25 | 393,236 | 403,619 | |

| FHLMC, 2.351%, 11/01/37 | 1,563,195 | 1,657,640 | |

| FHLMC, 2.355% - 2.375%, 5/01/22 - 5/01/37 | 956,380 | 1,016,635 | |

| FHLMC, 2.434% - 2.595%, 1/01/18 - 10/01/36 | 599,285 | 629,328 | |

| FHLMC, 2.60%, 6/01/37 | 2,505,973 | 2,682,534 | |

| FHLMC, 2.625% - 3.587%, 10/01/28 – 8/01/31 | 787,474 | 818,366 | |

| FHLMC, 3.878% - 6.877%, 11/01/19 - 7/01/30 | 229,605 | 237,240 | |

| 7,445,362 | |||

| Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate 8.4% | |||

| fFHLMC Gold 30 Year, 3.50%, 10/01/45 | 3,150,000 | 3,279,199 | |

| fFHLMC Gold 30 Year, 4.00%, 10/01/45 | 2,000,000 | 2,129,531 | |

| FHLMC Gold 30 Year, 4.50%, 4/01/40 | 948,170 | 1,029,532 | |

| FHLMC Gold 30 Year, 5.00%, 10/01/33 - 2/01/39 | 739,752 | 811,529 | |

| FHLMC Gold 30 Year, 5.50%, 9/01/33 | 68,310 | 76,187 | |

| FHLMC Gold 30 Year, 6.00%, 7/01/28 - 11/01/36 | 228,884 | 258,624 | |

| FHLMC Gold 30 Year, 6.50%, 2/01/19 - 7/01/32 | 171,500 | 196,294 | |

| FHLMC Gold 30 Year, 7.50%, 10/01/25 - 8/01/32 | 337,839 | 385,448 | |

| FHLMC Gold 30 Year, 8.00%, 7/01/24 - 5/01/30 | 113,058 | 123,023 | |

| FHLMC Gold 30 Year, 8.50%, 10/01/17 - 6/01/21 | 31,928 | 32,435 | |

| FHLMC Gold 30 Year, 9.00%, 9/01/30 | 75,574 | 85,582 | |

| FHLMC Gold 30 Year, 9.50%, 12/01/16 - 4/01/25 | 89,480 | 93,055 | |

| FHLMC PC 30 Year, 8.50%, 5/01/17 | 80,274 | 83,395 | |

| 20 | Annual Report | franklintempleton.com | ||

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | |||

| Amount* | Value | ||

| Mortgage-Backed Securities (continued) | |||

| Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate (continued) | |||

| FHLMC PC 30 Year, 9.00%, 6/01/16 | 47 | $ | 48 |

| FHLMC PC 30 Year, 9.50%, 8/01/19 | 1,910 | 1,926 | |

| 8,585,808 | |||

| aFederal National Mortgage Association (FNMA) Adjustable Rate 19.3% | |||

| FNMA, 1.379% - 1.727%, 1/01/34 - 4/01/37 | 976,880 | 1,022,455 | |

| FNMA, 1.784%, 7/01/34 | 820,240 | 855,907 | |

| FNMA, 1.909% - 1.996%, 1/01/18 - 11/01/34 | 660,726 | 676,124 | |

| FNMA, 2.169%, 10/01/33 | 1,115,210 | 1,177,802 | |

| FNMA, 2.198% - 2.206%, 4/01/18 - 4/01/33 | 76,246 | 77,970 | |

| FNMA, 2.216, 4/01/41 | 2,691,322 | 2,830,181 | |

| FNMA, 2.233% - 2.27%, 9/01/18 - 4/01/37 | 139,159 | 146,635 | |

| FNMA, 2.272%, 9/01/34 | 1,696,861 | 1,796,816 | |

| FNMA, 2.273% - 2.36%, 7/01/19 - 4/01/37 | 853,189 | 882,668 | |

| FNMA, 2.364% - 2.375%, 5/01/25 - 2/01/37 | 434,530 | 450,788 | |

| FNMA, 2.378%, 9/01/39 | 1,597,590 | 1,698,561 | |

| FNMA, 2.379% - 2.401%, 6/01/24 - 10/01/36 | 919,674 | 974,439 | |

| FNMA, 2.406% - 2.455%, 9/01/26 - 401/37 | 112,849 | 117,837 | |

| FNMA, 2.456%, 9/01/37 | 2,010,312 | 2,147,553 | |

| FNMA, 2.46% - 2.525%, 1/01/22 - 6/01/34 | 511,817 | 532,864 | |

| FNMA, 2.532%, 6/01/35 | 2,709,732 | 2,897,440 | |

| FNMA, 2.538% - 2.723%, 2/01/20 - 7/01/38 | 986,861 | 1,009,652 | |

| FNMA, 2.77% - 5.00%, 6/01/17 - 7/01/31 | 461,072 | 470,589 | |

| 19,766,281 | |||

| Federal National Mortgage Association (FNMA) Fixed Rate 41.4% | |||

| FNMA 15 Year, 5.00%, 6/01/18 - 7/01/18 | 348,357 | 362,221 | |

| FNMA 15 Year, 5.50%, 3/01/16 - 2/01/18 | 172,891 | 177,650 | |

| FNMA 15 Year, 6.50%, 8/01/16 - 10/01/16 | 4,881 | 4,928 | |

| fFNMA 30 Year, 3.00%, 10/01/45 | 8,260,000 | 8,376,027 | |

| fFNMA 30 Year, 3.50%, 10/01/45 | 16,650,000 | 17,375,842 | |

| fFNMA 30 Year, 4.00%, 10/01/45 | 9,400,000 | 10,029,359 | |

| FNMA 30 Year, 5.00%, 4/01/34 | 170,311 | 188,096 | |

| FNMA 30 Year, 5.50%, 9/01/33 - 10/01/33 | 887,288 | 994,326 | |

| FNMA 30 Year, 5.50%, 10/01/33 - 11/01/35 | 833,899 | 938,896 | |

| FNMA 30 Year, 5.50%, 11/01/35 | 90,785 | 103,395 | |

| FNMA 30 Year, 6.00%, 12/01/23 - 10/01/34 | 523,584 | 599,354 | |

| FNMA 30 Year, 6.00%, 10/01/34 | 892,729 | 1,019,631 | |

| FNMA 30 Year, 6.00%, 5/01/35 - 8/01/35 | 415,052 | 471,197 | |

| FNMA 30 Year, 6.50%, 12/01/27 - 8/01/32 | 888,655 | 1,018,341 | |

| FNMA 30 Year, 6.50%, 8/01/32 | 321,873 | 368,011 | |

| FNMA 30 Year, 7.50%, 8/01/25 - 5/01/32 | 38,623 | 46,372 | |

| FNMA 30 Year, 8.00%, 1/01/25 - 7/01/31 | 30,163 | 33,136 | |

| FNMA 30 Year, 8.50%, 11/01/26 - 11/01/28 | 205,663 | 229,164 | |

| FNMA 30 Year, 9.00%, 12/01/16 - 4/01/25 | 7,610 | 8,005 | |

| FNMA 30 Year, 9.50%, 11/01/21 - 4/01/30 | 55,363 | 59,894 | |

| FNMA 30 Year, 10.00%, 7/01/16 - 4/01/21 | 21,522 | 23,633 | |

| FNMA 30 Year, 10.50%, 4/01/22 - 5/01/30 | 5,273 | 5,302 | |

| FNMA PL 30 Year, 10.00%, 9/01/20 | 12,412 | 12,916 | |

| 42,445,696 |

franklintempleton.com

Annual Report

21

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

| Principal | ||||

| Amount* | Value | |||

| Mortgage-Backed Securities (continued) | ||||

| aGovernment National Mortgage Association (GNMA) Adjustable Rate 0.1% | ||||

| GNMA, 1.625%, 11/20/25 - 7/20/27 | 100,235 | $ | 104,485 | |

| Government National Mortgage Association (GNMA) Fixed Rate 9.1% | ||||

| GNMA I SF 30 Year, 6.50%, 1/15/24 - 9/15/32 | 172,164 | 197,574 | ||

| GNMA I SF 30 Year, 7.00%, 5/15/17 - 2/15/32 | 110,995 | 119,920 | ||

| GNMA I SF 30 Year, 7.50%, 10/15/23 - 10/15/29 | 44,729 | 48,687 | ||

| GNMA I SF 30 Year, 8.00%, 1/15/17 - 9/15/27 | 74,013 | 82,922 | ||

| GNMA I SF 30 Year, 8.25%, 2/15/21 - 5/15/21 | 37,601 | 37,769 | ||

| GNMA I SF 30 Year, 8.50%, 3/15/17 - 7/15/24 | 63,211 | 64,666 | ||

| GNMA I SF 30 Year, 9.00%, 9/15/16 - 8/15/28 | 7,458 | 7,511 | ||

| GNMA I SF 30 Year, 10.00%, 12/15/18 | 3,170 | 3,188 | ||

| GNMA I SF 30 Year, 10.50%, 1/15/16 | 48 | 48 | ||

| fGNMA II SF 30 Year, 3.00%, 10/01/45 | 1,500,000 | 1,531,582 | ||

| GNMA II SF 30 Year, 3.50%, 6/20/45 | 2,355,636 | 2,473,528 | ||

| fGNMA II SF 30 Year, 3.50%, 10/01/45 | 4,060,000 | 4,255,229 | ||

| GNMA II SF 30 Year, 6.50%, 1/20/26 - 1/20/33 | 243,278 | 290,024 | ||

| GNMA II SF 30 Year, 7.50%, 11/20/22 - 7/20/32 | 152,686 | 178,284 | ||

| GNMA II SF 30 Year, 8.00%, 1/20/17 - 8/20/26 | 12,053 | 12,130 | ||

| GNMA II SF 30 Year, 9.00%, 11/20/19 - 3/20/25 | 1,626 | 1,748 | ||

| GNMA II SF 30 Year, 10.50%, 6/20/20 | 14 | 14 | ||

| 9,304,824 | ||||

| Total Mortgage-Backed Securities (Cost $86,300,634) | 87,652,456 | |||

| Total Investments before Short Term Investments (Cost $122,475,891) | 123,985,646 | |||

| Shares | ||||

| Short Term Investments 23.8% | ||||

| Money Market Funds (Cost $5,085,478) 5.0% | ||||

| g,hInstitutional Fiduciary Trust Money Market Portfolio | 5,085,478 | 5,085,478 | ||

| Principal | ||||

| Amount* | ||||

| Repurchase Agreements (Cost $19,262,236) 18.8% | ||||

| i Joint Repurchase Agreement, 0.071%, 10/01/15 (Maturity Value $19,262,274) | ||||

| BNP Paribas Securities Corp. (Maturity Value $5,543,105) | ||||

| HSBC Securities (USA) Inc. (Maturity Value $11,086,209) | ||||

| Merrill Lynch, Pierce, Fenner & Smith Inc. (Maturity Value $2,632,960) | ||||

| Collateralized by U.S. Government Agency Securities, 0.00% - 5.125%, 12/01/15 - 2/01/20; | ||||

| U.S. Government Agency Securities, Strips, 6/01/17; and U.S. Treasury Notes, 2.125% - 3.125%, | ||||

| 5/15/19 - 8/31/20 (valued at $19,657,215) | 19,262,236 | 19,262,236 | ||

| Total Investments (Cost $146,823,605) 144.9% | 148,333,360 | |||

| Other Assets, less Liabilities (44.9)% | (45,936,301 | ) | ||

| Net Assets 100.0% | $ | 102,397,059 | ||

22 Annual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aThe coupon rate shown represents the rate at period end.

bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional

buyers or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of

Trustees. At September 30, 2015, the aggregate value of these securities was $10,810,032, representing 10.56% of net assets.

cSee Note 7 regarding defaulted securities.

dThe bond pays interest and/or principal based upon the issuer’s ability to pay, which may be less than the stated interest rate or principal paydown.

eSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United

States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an

exemption from registration. This security has been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At September 30, 2015, the value of this

security was $9,230, representing 0.01% of net assets.

fSecurity purchased on a to-be-announced (TBA) basis. See Note 1(d).

gNon-income producing.

hSee Note 3(f) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

iSee Note 1(c) regarding joint repurchase agreement.

At September 30, 2015, the Fund had the following financial futures contracts outstanding. See Note 1(e).

| Financial Futures Contracts | ||||||||||||

| Number of | Notional | Expiration | Unrealized | Unrealized | ||||||||

| Description | Type | Contracts | Value | Date | Appreciation | Depreciation | ||||||

| Interest Rate Contracts | ||||||||||||

| CME Ultra Long Term U.S. Treasury Bond | Long | 1 | $ | 160,406 | 12/21/15 | $ | 2,005 | $ | — | |||

| U.S. Treasury 5 Year Note | Short | 8 | 964,125 | 12/31/15 | — | (6,162 | ) | |||||

| U.S. Treasury 10 Year Note | Long | 25 | 3,218,359 | 12/21/15 | 39,389 | — | ||||||

| U.S. Treasury 30 Year Bond | Long | 18 | 2,832,188 | 12/21/15 | 48,892 | — | ||||||

| Totals | $ | 90,286 | $ | (6,162 | ) | |||||||

| Net unrealized appreciation (depreciation) | $ | 84,124 | ||||||||||

| At September 30, 2015, the Fund had the following forward exchange contracts outstanding. See Note 1(e). | ||||||||||||

| Forward Exchange Contracts | ||||||||||||

| Contract | Settlement | Unrealized | Unrealized | |||||||||

| Currency | Counterpartya | Type | Quantity | Amount | Date | Appreciation | Depreciation | |||||

| OTC Forward Exchange Contracts | ||||||||||||

| Euro | DBAB | Buy | 150,000 | $ | 167,025 | 2/05/16 | $ | 1,052 | $ | — | ||

| Euro | DBAB | Sell | 150,000 | 196,493 | 2/05/16 | 28,416 | — | |||||

| Net unrealized appreciation (depreciation) | $ | 29,468 | ||||||||||

| aMay be comprised of multiple contracts with the same counterparty, currency and settlement date. | ||||||||||||

See Abbreviations on page 37.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report 23

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Financial Statements | |||

| Statement of Assets and Liabilities | |||

| September 30, 2015 | |||

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 122,475,891 | |

| Cost - Sweep Money Fund (Note 3f) | 5,085,478 | ||

| Cost - Repurchase agreements | 19,262,236 | ||

| Total cost of investments | $ | 146,823,605 | |

| Value - Unaffiliated issuers | $ | 123,985,646 | |

| Value - Sweep Money Fund (Note 3f) | 5,085,478 | ||

| Value - Repurchase agreements | 19,262,236 | ||

| Total value of investments | 148,333,360 | ||

| Cash | 30,047 | ||

| Receivables: | |||

| Investment securities sold | 96,540 | ||

| Capital shares sold | 377,567 | ||

| Dividends and interest | 297,422 | ||

| Due from brokers | 95,306 | ||

| Unrealized appreciation on OTC forward exchange contracts | 29,468 | ||

| Other assets | 23 | ||

| Total assets | 149,259,733 | ||

| Liabilities: | |||

| Payables: | |||

| Investment securities purchased | 46,643,795 | ||

| Capital shares redeemed | 83,851 | ||

| Management fees | 32,636 | ||

| Distribution fees | 12,884 | ||

| Transfer agent fees | 18,469 | ||

| Distributions to shareholders | 26,621 | ||

| Variation margin | 12,516 | ||

| Accrued expenses and other liabilities | 31,902 | ||

| Total liabilities | 46,862,674 | ||

| Net assets, at value | $ | 102,397,059 | |

| Net assets consist of: | |||

| Paid-in capital | $ | 121,037,210 | |

| Net investment income | 12,660 | ||

| Net unrealized appreciation (depreciation) | 1,623,378 | ||

| Accumulated net realized gain (loss) | (20,276,189 | ) | |

| Net assets, at value | $ | 102,397,059 | |

24 Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL STATEMENTS

| Statement of Assets and Liabilities (continued) | ||

| September 30, 2015 | ||

| Class A: | ||

| Net assets, at value | $ | 26,327,574 |

| Shares outstanding | 2,775,601 | |

| Net asset value per sharea | $ | 9.49 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.91 |

| Class A1: | ||

| Net assets, at value | $ | 59,351,617 |

| Shares outstanding | 6,253,906 | |

| Net asset value per sharea | $ | 9.49 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.91 |

| Class C: | ||

| Net assets, at value | $ | 4,066,669 |

| Shares outstanding | 428,639 | |

| Net asset value and maximum offering price per sharea | $ | 9.49 |

| Advisor Class: | ||

| Net assets, at value | $ | 12,651,199 |

| Shares outstanding | 1,334,837 | |

| Net asset value and maximum offering price per share | $ | 9.48 |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report 25

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

FINANCIAL STATEMENTS

Statement of Operations

for the year ended September 30, 2015

| Investment income: | |||

| Dividends | $ | 83,014 | |

| Interest | 2,785,512 | ||

| Paydown gain (loss) | (242,739 | ) | |

| Total investment income | 2,625,787 | ||

| Expenses: | |||

| Management fees (Note 3a) | 368,467 | ||

| Distribution fees: (Note 3c) | |||

| Class A | 39,970 | ||

| Class C | 20,083 | ||

| Transfer agent fees: (Note 3e) | |||

| Class A | 21,402 | ||

| Class A1 | 83,361 | ||

| Class C | 4,158 | ||

| Advisor Class | 14,490 | ||

| Custodian fees (Note 4) | 1,236 | ||

| Reports to shareholders | 29,062 | ||

| Registration and filing fees | 73,044 | ||

| Professional fees | 59,164 | ||

| Trustees’ fees and expenses | 2,789 | ||

| Other | 46,785 | ||

| Total expenses | 764,011 | ||

| Expense reductions (Note 4) | (8 | ) | |

| Expenses waived/paid by affiliates (Note 3f) | (4,607 | ) | |

| Net expenses | 759,396 | ||

| Net investment income | 1,866,391 | ||

| Realized and unrealized gains (losses): | |||

| Net realized gain (loss) from: | |||

| Investments | 1,137,017 | ||

| Foreign currency transactions | 22,482 | ||

| Futures contracts | 290,771 | ||

| Swap contracts | 7,296 | ||

| Net realized gain (loss) | 1,457,566 | ||

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (737,539 | ) | |

| Translation of other assets and liabilities denominated in foreign currencies | 19,911 | ||

| Futures contracts | 76,287 | ||

| Swap contracts | (3,963 | ) | |

| Net change in unrealized appreciation (depreciation) | (645,304 | ) | |

| Net realized and unrealized gain (loss) | 812,262 | ||

| Net increase (decrease) in net assets resulting from operations | $ | 2,678,653 |

26 Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||

| FINANCIAL STATEMENTS | ||||||

| Statements of Changes in Net Assets | ||||||

| Year Ended | ||||||

| September 30, | ||||||

| 2015 | 2014 | |||||

| Increase (decrease) in net assets: | ||||||

| Operations: | ||||||

| Net investment income | $ | 1,866,391 | $ | 2,108,332 | ||

| Net realized gain (loss) | 1,457,566 | 3,513,505 | ||||

| Net change in unrealized appreciation (depreciation) | (645,304 | ) | (1,399,393 | ) | ||

| Net increase (decrease) in net assets resulting from operations | 2,678,653 | 4,222,444 | ||||

| Distributions to shareholders from: | ||||||

| Net investment income: | ||||||

| Class A | (361,427 | ) | (365,627 | ) | ||

| Class A1 | (1,550,020 | ) | (3,152,499 | ) | ||

| Class C | (57,702 | ) | (83,256 | ) | ||

| Advisor Class | (269,405 | ) | (122,273 | ) | ||

| Total distributions to shareholders | (2,238,554 | ) | (3,723,655 | ) | ||

| Capital share transactions: (Note 2) | ||||||

| Class A | 16,373,968 | 1,244,640 | ||||

| Class A1 | (5,324,027 | ) | (11,725,704 | ) | ||

| Class C | 1,650,264 | 258,547 | ||||

| Advisor Class | 3,555,241 | 6,044,410 | ||||

| Total capital share transactions | 16,255,446 | (4,178,107 | ) | |||

| Net increase (decrease) in net assets | 16,695,545 | (3,679,318 | ) | |||

| Net assets: | ||||||

| Beginning of year | 85,701,514 | 89,380,832 | ||||

| End of year | $ | 102,397,059 | $ | 85,701,514 | ||

| Net investment income included in net assets: | ||||||

| End of year | $ | 12,660 | $ | (18,218 | ) | |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report 27

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Franklin Strategic Mortgage Portfolio (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as an open-end management investment company, consisting of one fund, Franklin Strategic Mortgage Portfolio (Fund) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The Fund offers four classes of shares: Class A, Class A1, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share as of 4 p.m. Eastern time each day the New York Stock Exchange (NYSE) is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and derivative financial instruments (derivatives) listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Debt securities generally trade in the OTC market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the date that the values of the foreign debt securities are determined.

Investments in open-end mutual funds are valued at the closing NAV. Repurchase agreements are valued at cost, which approximates fair value.

Certain derivatives trade in the OTC market. The Fund’s pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund’s net benefit or obligation under the derivative contract, as measured by the fair value of the contract, is included in net assets.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for

28 Annual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Joint Repurchase Agreement

The Fund enters into a joint repurchase agreement whereby its uninvested cash balance is deposited into a joint cash account with other funds managed by the investment manager or an affiliate of the investment manager and is used to invest in one or more repurchase agreements. The value and face amount of the joint repurchase agreement are allocated to the funds based on their pro-rata interest. A repurchase agreement is accounted for as a loan by the Fund to the seller, collateralized by securities which are delivered to the Fund’s custodian. The fair value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the funds, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. Repurchase agreements are subject to the terms of Master Repurchase Agreements (MRAs) with approved counterparties (sellers). The MRAs contain various provisions, including but not limited to events of default and maintenance of collateral for repurchase agreements. In the event of default by either the seller or the Fund, certain MRAs may permit the non-defaulting party to net and close-out all transactions, if any, traded under such agreements. The Fund may sell securities it holds as collateral and apply the proceeds towards the repurchase price and any other amounts owed by the seller to the Fund in the event of default by the seller. This could involve costs or delays in addition to a loss on the securities if their value falls below the repurchase price owed by the seller. The joint repurchase agreement held by the Fund at year end, as indicated in the Statement of Investments, had been entered into on September 30, 2015.

d. Securities Purchased on a TBA Basis

The Fund purchases securities on a to-be-announced (TBA) basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of holding the securities, it may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

e. Derivative Financial Instruments

The Fund invested in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown in the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

franklintempleton.com

Annual Report

29

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

1. Organization and Significant Accounting

Policies (continued)

e. Derivative Financial Instruments (continued)