| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

NOTE 1 – ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

A. Organization

Total Return US Treasury Fund, Inc. (“Total Return”), Managed Municipal Fund, Inc. (“Managed Municipal”), North American Government Bond Fund, Inc. (“North American”) and ISI Strategy Fund, Inc. (“Strategy”) (each a “Fund” and collectively, the “Funds”) are registered under the Investment Company Act of 1940, as amended, as open-end management investment companies. The Funds are organized as corporations under the laws of the State of Maryland.

Total Return’s investment objectives are to provide a high level of total return with relative stability of principal and, secondarily, high current income. Managed Municipal’s investment objectives are to provide a high level of total return with relative stability of principal and, secondarily, high current income exempt from Federal income tax. North American’s investment objective is to provide a high level of current income, consistent with prudent investment risk. Strategy’s investment objective is to maximize total return through a combination of long-term growth of capital and current income.

Total Return and Strategy each currently offer a single class of shares (ISI Shares) to investors. Managed Municipal offers two classes of shares – ISI Class A Shares and ISI Class I Shares. North American offers three classes of shares – ISI Class A Shares, ISI Class C Shares and ISI Class I Shares. ISI Shares and ISI Class A Shares are subject to a maximum front-end sales charge equal to 3.00%. A contingent deferred sales charge of 1.00% is imposed on the sale of ISI Class C Shares if redeemed within the first year of purchase.

Total Return and Strategy are authorized to issue 115,000,000 and 25,000,000 shares, respectively, of ISI Shares at $0.001 par value. Managed Municipal is authorized to issue 50,000,000 ISI Class A Shares and 5,000,000 ISI Class I Shares at $0.001 par value. North American is authorized to issue 50,000,000 ISI Class A Shares, 5,000,000 ISI Class C Shares and 5,000,000 ISI Class I Shares at $0.001 par value.

B. Valuation of Securities

Exchange traded securities and over-the-counter securities listed on the NASDAQ National Market System for which market quotations are readily available are valued each Fund business day using the last reported sales price or the NASDAQ Official Closing Price (“NOCP”) provided by independent pricing services as of the close of trading on the New York Stock Exchange (normally 4:00 p.m. Eastern Time). In the absence of a sale price or NOCP, such securities are valued at the mean of the last bid and the last asked prices. Non-exchange traded securities for which quotations are readily available are generally valued at the mean between the last bid and the last asked prices. Debt securities may be valued at prices supplied by a Fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate, and maturity. Short term instruments that mature in 60 days or less may be valued at amortized cost unless the Fund’s investment advisor believes another valuation is more appropriate.

When valuing securities for which market quotations are not readily available or for which the market quotations that are readily available are considered unreliable, the Funds determine a fair value in good faith under procedures established by and under the general supervision of the

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

Funds’ Boards of Directors (the “Board”). The Funds may use these procedures to establish the fair value of securities when, for example, a significant event occurs between the time the market closes and the calculation of the net asset value per share, and the event is likely to affect the Fund’s net asset value per share. Fair valuation may also be used for securities that are subject to legal or contractual restrictions on resale, securities for which no or limited trading activity has occurred for a period of time, or securities that are otherwise deemed to be illiquid (i.e., securities that cannot be disposed of within seven days at approximately the price at which the security is currently priced by the Funds).

If a fair value is required, the investment advisor, or the sub-advisor in the case of Strategy, determines the value of the security until the Board meets to establish the fair value of the security.

As of October 31, 2014, there were no fair valued securities.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a frame work for measuring fair value and require additional disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs

Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The following is a summary of the inputs used to value each Fund’s investments as of October 31, 2014:

| Total Return | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Treasury Obligations | | $ | – | | | $ | 45,804,693 | | | $ | – | | | $ | 45,804,693 | |

| U.S. Treasury Bills | | | – | | | | 7,374,981 | | | | – | | | | 7,374,981 | |

| Total | | $ | – | | | $ | 53,179,674 | | | $ | – | | | $ | 53,179,674 | |

| Managed Municipal | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Municipal Bonds | | $ | – | | | $ | 58,782,543 | | | $ | – | | | $ | 58,782,543 | |

| U.S. Treasury Bills | | | – | | | | 3,449,279 | | | | – | | | | 3,449,279 | |

| Total | | $ | – | | | $ | 62,231,822 | | | $ | – | | | $ | 62,231,822 | |

| | |

Annual Report | October 31, 2014 | 59 |

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

| North American | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Canadian Securities | | $ | – | | | $ | 13,271,081 | | | $ | – | | | $ | 13,271,081 | |

| Mexican Securities | | | – | | | | 12,977,473 | | | | – | | | | 12,977,473 | |

| U.S. Treasury Obligations | | | – | | | | 43,531,795 | | | | – | | | | 43,531,795 | |

| U.S. Treasury Bills | | | – | | | | 614,922 | | | | – | | | | 614,922 | |

| Total | | $ | – | | | $ | 70,395,271 | | | $ | – | | | $ | 70,395,271 | |

| Strategy | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 84,575,820 | | | $ | – | | | $ | – | | | $ | 84,575,820 | |

| U.S. Treasury Obligations | | | – | | | | 7,904,029 | | | | – | | | | 7,904,029 | |

| U.S. Treasury Bills | | | – | | | | 1,794,860 | | | | – | | | | 1,794,860 | |

| Total | | $ | 84,575,820 | | | $ | 9,698,889 | | | $ | – | | | $ | 94,274,709 | |

See Strategy’s Schedule of Investments for a listing of the common stocks valued using Level 1 inputs by industry type.

The Funds’ policy is to disclose significant transfers between Levels based on valuations at the end of the reporting period. The Funds may hold securities which are periodically fair valued in accordance with the Funds’ Fair Value Procedures. This may result in movements between Level 1 and Level 2 throughout the period. There were no transfers between Level 1, 2, or 3 as of October 31, 2014, based on the valuation input Levels on October 31, 2013 for the Funds.

C. Securities Transactions and Investment Income

Securities transactions are recorded on trade date. Realized gains and losses are determined by comparing the proceeds of a sale or the cost of a purchase with a specific offsetting transaction. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premiums and accretion of discounts, is accrued daily. Estimated expenses are also accrued daily. With respect to North American and Managed Municipal, income, gains (losses) and common expenses are allocated to each class based on its respective net assets. Class specific expenses are charged directly to each class.

D. Distributions

Total Return declares distributions daily, and North American declares monthly distributions at fixed rates approved by the Board. These distributions are paid monthly. To the extent that a Fund’s net investment income is less than an approved fixed rate, some of its distributions may be designated as a return of capital. Managed Municipal declares and pays dividends monthly from its net investment income. Strategy declares and pays dividends quarterly from its net investment income. Net realized capital gains, if any, are distributed at least annually. The Funds record dividends and distributions on the ex-dividend date.

E. Federal Income Taxes

Each Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and distribute substantially all of its taxable income to shareholders. Therefore, no provision for Federal Income tax or excise tax is required.

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

F. Foreign Currency Translation

The Funds maintain their accounting records in U.S. dollars. North American determines the U.S. dollar value of foreign currency-denominated assets, liabilities and transactions by using prevailing exchange rates. In valuing security transactions, the receipt of income and the payment of expenses, North American uses the prevailing exchange rate on the transaction date.

Net realized gains and losses on foreign currency transactions shown on North American’s financial statements result from the sale of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and from the difference between the amounts of interest recorded on North American’s books and the U.S. dollar equivalent of the amounts actually received or paid. That portion of realized gains (losses) from security transactions that results from fluctuation in foreign currency exchange rates relating to the sale of foreign securities is not separately disclosed but is included in net realized gains (losses) from security transactions. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included in the net change in unrealized appreciation/depreciation on investments.

G. Forward Foreign Currency Contracts

North American may use forward foreign currency contracts to manage foreign exchange rate risk. The Fund may use these contracts to fix the U.S. dollar value of securities transactions for the period between the date of the transaction and the date the security is received or delivered or to hedge the U.S. dollar value of securities that it already owns. The use of forward foreign currency contracts does not eliminate fluctuations in the prices of the underlying securities, but does establish a rate of exchange that can be achieved in the future. North American determines the net U.S. dollar value of the forward foreign currency contracts using prevailing exchange rates. The Fund did not hold any forward foreign currency contracts at year end October 31, 2014.

H. Estimates

In preparing the Funds’ financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the year. Actual results may be different.

NOTE 2 – FEES AND TRANSACTIONS WITH AFFILIATES

International Strategy & Investment, Inc. (“ISI”) is the Funds’ investment advisor. As compensation for ISI’s advisory services, Total Return pays ISI an annual fee based on the Fund’s average daily net assets, which is calculated daily and paid monthly at the following annual rates: 0.20% of the first $100 million, 0.18% of the next $100 million, 0.16% of the next $100 million, 0.14% of the next $200 million and 0.12% of the amount over $500 million. In addition, Total Return pays ISI 1.50% of the Fund’s gross interest income. As compensation for ISI’s advisory services, Managed Municipal, North American and Strategy each pay ISI a fee, which is calculated daily and paid monthly, at the annual rate of 0.40% of such Fund’s average daily net assets.

ISI has contractually agreed to reimburse expenses with respect to Class C Shares of North American through March 1, 2015 to the extent necessary to limit the annual ordinary operating expenses of ISI Class C Shares to 1.85% of the average daily net assets attributable to such shares.

| | |

Annual Report | October 31, 2014 | 61 |

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

During the year ended October 31, 2014, $14,340 of expenses were waived by ISI under the expense limitation agreement.

Los Angeles Capital Management and Equity Research, Inc. is Strategy’s Sub-Advisor and is responsible for managing the common stocks in Strategy’s portfolio. The Sub-Advisor is paid by ISI, not the Strategy Fund.

International Strategy & Investment Group LLC (“ISI Group”), an affiliate of ISI, is the distributor for the Funds. Total Return, Managed Municipal (ISI Class A Shares, only) and Strategy each pay ISI Group a distribution/shareholder service fee, pursuant to Rule 12b-1, that is calculated daily and paid monthly at the annual rate of 0.25% of average daily net assets. North American’s ISI Class A Shares and ISI Class C Shares pay ISI Group a distribution/shareholder service fee, pursuant to Rule 12b-1, that is calculated daily and paid monthly at the annual rates of 0.40% and 1.00% (which may include up to 0.25% for shareholder servicing fees for each class) of their average daily net assets, respectively.

During the year ended October 31, 2014, ISI Group earned commissions on sales of ISI Shares of Total Return, Managed Municipal and Strategy of $656, $738 and $5,110, respectively, and earned commissions of $1,082 on sales of ISI Class A Shares of North American. ISI Group retained $781 of contingent deferred sales charges on redemptions of ISI Class C Shares of North American during the year ended October 31, 2014.

ISI (“ISI” or the “Administrator”) serves as the Funds’ administrator pursuant to an Administration Agreement (“Administration Agreement”). As compensation for ISI’s administration services the Funds shall pay an annual fee of 0.02% of each Fund’s average daily net assets.

ALPS Fund Services, Inc. (“ALPS” or the “Sub-Administrator”) serves as the Funds’ sub-administrator pursuant to an Administration, Bookkeeping and Pricing Services Agreement (“Sub-Administration Agreement”) with the Funds which became effective September 8, 2014. As compensation for its sub-administration and fund accounting services to the Funds, ALPS receives an annual sub-administration fee from the Administrator, subject to an annual minimum, based on the annual net assets of the Funds. The Sub-Administrator is also reimbursed by the Funds for certain out-of-pocket expenses. For the period September 8, 2014 through October 31, 2014 Sub-Administrator earned sub-administration fees if $50,272.

The Administrator also pays the Sub-Administrator an annual fee for certain compliance support services. For the period September 8, 2014 through October 31, 2014, the Sub-Administrator earned compliance support services fees of $1,723.

ALPS serves as transfer, dividend paying, and shareholder servicing agent for the Funds. For its services, ALPS receives an annual minimum fee from each ISI Fund, a fee based upon each shareholder account and is reimbursed for out-of-pocket expenses. The Transfer Agent is also reimbursed by the Fund for certain out-of-pocket expenses.

Prior to September 8, 2014 State Street Bank and Trust Company (“State Street”) was the administrator of the Funds. State Street was responsible for providing certain administrative services to the Funds, and assisted in managing and supervising all aspects of the general day-to-day business activities and operations of the Funds other than investment advisory activities, including maintaining the books and records of the Funds, and preparing certain reports and other

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

documents required by federal and/or state laws and regulations. For the performance of these services, the Funds paid State Street an annual fee of $300,000. This fee was allocated among the Funds based on the relative net assets of each Fund. State Street was the fund accountant and fund custodian, and State Street was responsible for safeguarding and controlling the Funds’ cash and securities, handling the delivery of securities and collecting interest and dividends on the Funds’ investments.

Prior to September 8, 2014 State Street served as the fund accounting agent and was responsible for maintaining the books and records and calculating the daily net asset value of each Fund. For fund accounting services, the Funds paid State Street an annual base fee of $180,000. This fee was allocated among the Funds based on the relative net assets for each Fund. For fund custodian services, the Funds paid State Street an annual base fee of 1 (one) basis point on net assets, plus other asset-based fees that vary according to the number of positions and transactions, plus out-of-pocket fees.

Prior to September 8, 2014 State Street also served as transfer agent for the Funds and was responsible for the issuance, transfer and redemption of shares and the opening, maintenance and servicing of shareholder accounts. For these services State Street received an annual amount of $130,000, allocated among the Funds based on the relative net assets of each Fund and a monthly fee from each Fund at an annual rate of $20 for each direct account and $15 for certain accounts established through financial intermediaries. In addition, the Funds reimbursed State Street for its out-of-pocket expenses including, but not limited to, postage and supplies.

EJV Financial Services, LLC (“EJV”) provides certain compliance services to the Funds. Edward J. Veilleux, Vice President and Chief Compliance Officer (“CCO”) of the Funds, is also a principal of EJV. The Funds pay EJV $20,000 quarterly for providing CCO services. This fee is allocated among the Funds based on the relative net assets of each Fund. In addition, the Funds reimburse EJV for any reasonable out-of-pocket expenses relating to these compliance services.

Effective January 1, 2014, the Funds pay each independent Director an annual fee of $23,000. The Audit Committee Chairman and Chairman of the Board receive an additional annual fee of $4,000 and $5,000, respectively. The Funds also reimburse each of the Directors for out-of-pocket expenses incurred in connection with attending the Board of Directors’ meetings. Certain officers of the Funds are also officers or employees of the above named service providers, and during their terms of office, receive no compensation from the Funds.

NOTE 3 – FEDERAL INCOME TAX

The Funds may periodically make reclassifications among certain capital accounts as a result of differences in the characterization and allocation of certain income and capital gain distributions determined annually in accordance with Federal tax regulations, which may differ from GAAP. These book/tax differences may be either temporary or permanent in nature. To the extent they are permanent, they are charged or credited to paid-in-capital, undistributed net investment income or accumulated net realized gains, as appropriate, in the period that the differences arose. The reclassifications have no impact on the net assets or net asset value per share of the Funds.

The Funds determine their net investment income and capital gain distributions in accordance with income tax regulations, which may differ from GAAP.

| | |

Annual Report | October 31, 2014 | 63 |

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

During the years ended October 31, 2014 and October 31, 2013, the tax character of distributions paid by each of the Funds was as follows:

| | | Ordinary Income | | | Tax-Exempt Income | | | Long-Term Capital Gains | | | Return of Capital | |

| Total Return | | $ | 551,713 | | | $ | – | | | $ | 40,188 | | | $ | 476,450 | |

| Managed Municipal | | | 42,867 | | | | 1,539,918 | | | | 490,843 | | | | – | |

| North American | | | 50,338 | | | | – | | | | 133,998 | | | | 1,998,282 | |

| Strategy | | | 1,420,075 | | | | – | | | | 4,709,107 | | | | – | |

| | | Ordinary Income | | | Tax-Exempt Income | | | Long-Term Capital Gains | | | Return of Capital | |

| Total Return | | $ | 1,000,452 | | | $ | – | | | $ | 1,407,934 | | | $ | 246,880 | |

| Managed Municipal | | | 20,586 | | | | 2,341,706 | | | | 492,954 | | | | – | |

| North American | | | 1,766,138 | | | | – | | | | 1,468,203 | | | | 38,354 | |

| Strategy | | | 703,061 | | | | – | | | | 2,703,899 | | | | – | |

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions taken on Federal and state income tax returns for all open tax years (tax years ended October 31, 2011 through October 31, 2014) and concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

As of October 31, 2014, the components of distributable earnings (accumulated deficit) on a tax basis were as follows:

| | | Total Return | | | Managed Municipal | | | North American | | | Strategy | |

| Undistributed ordinary income | | $ | – | | | $ | 43,476 | | | $ | – | | | $ | 626,404 | |

| Accumulated undistributed long-term capital gains/(losses) | | | – | | | | (163,802 | ) | | | – | | | | 4,983,353 | |

| Net unrealized appreciation | | | 2,017,671 | | | | 3,174,147 | | | | 311,423 | | | | 21,973,888 | |

| Other temporary differences | | | (23,842 | ) | | | (45,165 | ) | | | (50,338 | ) | | | – | |

| Total | | $ | 1,993,829 | | | $ | 3,008,656 | | | $ | 261,085 | | | $ | 27,583,645 | |

As of October 31, 2014, the Funds recorded the following reclassifications primarily due to foreign exchange gains/losses, REIT adjustments to increase (decrease) the accounts listed below:

| Fund | | Undistributed Net Investment Income/(Loss) | | | Accumulated Net Realized Gain/(Loss) on Investments | | | Paid-in Capital | |

| Total Return | | $ | – | | | $ | 1 | | | $ | (1 | ) |

| Managed Municipal | | | (1,789 | ) | | | 1,789 | | | | – | |

| North American | | | (1,214,797 | ) | | | 1,441,763 | | | | (226,966 | ) |

| Strategy | | | 57,124 | | | | (57,905 | ) | | | 781 | |

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

Included in the amounts reclassified was a net operating loss of $226,966 for ISI North American Government Bond Fund.

The difference between the federal income tax cost of portfolio investments and the financial statement cost for Strategy is due to certain timing differences in the recognition of capital gains or losses under income tax reporting regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales and passive foreign investment company (PFIC) mark to market.

Post‐Enactment Capital Losses*:

Capital losses deferred to next tax year were as follows:

| | | Short Term | | | Long Term | |

| Total Return | | $ | – | | | $ | – | |

| Managed Municipal | | | 163,802 | | | | – | |

| North American | | | – | | | | – | |

| Strategy | | | – | | | | – | |

| * | Post-Enactment Capital Losses arise in fiscal years beginning after December 22, 2010, and exclude any election for late year capital loss (during the period November 1st to December 31st) deferred for the current fiscal year. As a result of the enactment of the Regulated Investment Company Act of 2010, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term losses rather than being considered all short-term as under previous law. |

NOTE 4 – INVESTMENT TRANSACTIONS

The aggregate cost of purchases and proceeds from sales of investments, other than short-term obligations, for the fiscal year ended October 31, 2014 were as follows:

| | | U.S Government Obligations | |

| Fund | | Purchases | | | Sales | | | Purchases | | | Sales | |

| Total Return | | $ | – | | | $ | – | | | $ | 1,552,680 | | | $ | 2,387,233 | |

| Managed Municipal | | | 3,934,325 | | | | 26,771,829 | | | | – | | | | – | |

| North American | | | 12,193,728 | | | | 17,765,042 | | | | 10,843,984 | | | | 17,487,438 | |

| Strategy | | | 36,481,598 | | | | 32,720,889 | | | | – | | | | 1,703,286 | |

NOTE 5 – MARKET AND CREDIT RISK

North American invests in Canadian and Mexican government securities. Investing in Canadian and Mexican government securities may have different risks than investing in U.S. government securities. An investment in Canada or Mexico may be affected by developments unique to those countries. These developments may not affect the U.S. economy or the prices of U.S. government securities in the same manner. In addition, the value of bonds issued by non-U.S. governments may be affected by adverse international political and economic developments that may not impact the value of U.S. government securities.

| | |

Annual Report | October 31, 2014 | 65 |

| ISI Funds | Notes to Financial Statements |

| | October 31, 2014 |

NOTE 6 – CONTRACTUAL OBLIGATIONS

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds. The Trust expects the risk of loss to be remote.

NOTE 7 – SUBSEQUENT EVENTS

On December 10, 2014, the Board of Directors (the “Board”) of each of the Funds approved, subject to certain conditions and shareholder approval, a proposed reorganization (the “Reorganization”) of the Funds into series of Centre Funds. International Strategy & Investment Inc., the investment adviser to the Funds, recommended the Reorganization to the Board. In order to accomplish the Reorganization, the Board approved the submission of the Agreement and Plan of Reorganization (the “Plan”) to shareholders of each Fund at a Special Joint Meeting of Shareholders to be held on or about March 16, 2015.

Under the Plan, Total Return and North American would be reorganized into the existing Centre Active U.S. Treasury Fund (“Centre Treasury”). Centre Asset Management, LLC (“Centre”) manages Centre Treasury’s portfolio using a similar investment objective and strategies as Total Return and North American. Strategy would be reorganized into the Centre American Select Equity Fund (“Centre Select Equity”). Centre manages Centre Select Equity’s portfolio using a similar investment objective and strategies as Strategy. Managed Municipal would be reorganized into a newly created series of Centre Funds called the Centre Active U.S. Tax-Exempt Fund (“Centre Tax-Exempt”). After the Reorganization, Centre will manage the Centre Tax-Exempt’s portfolio using a similar investment objective and strategies as Managed Municipal.

| ISI Funds | Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of Total Return U.S. Treasury Fund, Inc.,

Managed Municipal Fund, Inc., North American Government Bond Fund, Inc., and ISI Strategy Fund, Inc.

We have audited the accompanying statements of assets and liabilities of Total Return U.S. Treasury Fund, Inc., Managed Municipal Fund, Inc., North American Government Bond Fund, Inc., and ISI Strategy Fund, Inc., (the “Funds”) including the schedules of investments, as of October 31, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years and periods in the five year period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2014, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Total Return U.S. Treasury Fund, Inc., Managed Municipal Fund, Inc., North American Government Bond Fund, Inc., and ISI Strategy Fund, Inc., as of October 31, 2014, the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years and periods in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

December 30, 2014

| | |

Annual Report | October 31, 2014 | 67 |

| ISI Funds | Fund Directors and Officers |

| | October 31, 2014 (Unaudited) |

| INDEPENDENT DIRECTORS |

| Name and Age | Length of Time Served | Business Experience During the Past Five Years | Other Directorship Held by Director |

W. Murray Jacques (age 78) | Since 2002 | President, WMJ Consulting, LLC (real estate investment management company) (1999 to present); formerly, principal of CM Coastal Development, LLC (real estate development) (2002 to 2006); Member of FLJ Design, LLC (jewelry design) (2005 to present). | None |

Louis E. Levy (age 82) | Since 1994 | Retired Partner, KPMG Peat Marwick (retired 1990); Scudder Group of Mutual Funds (retired 2005). | None |

Edward A. Kuczmarski (age 65) | Since 2007 | Certified Public Accountant and retired Partner of Crowe Horwath LLP (accounting firm) (1980 to 2013). | Board Member of Reich & Tang Funds; Board Member of Brookfield Investment Management Funds. Trustee of Stralem Funds. |

| INTERESTED DIRECTOR |

R. Alan Medaugh* (age 71) President and Director | President since 1991; Director since 2007 | President, International Strategy & Investment Inc. (registered investment advisor) (1991 to present) Director, International Strategy & Investment Group LLC (registered broker-dealer) (1991 to 2014). | None |

| * | Mr. Medaugh is deemed to be an Interested Director, as defined in the Investment Company Act of 1940, as amended because he serves as the President of ISI Inc. and served as a Director of ISI Group LLC. |

| ISI Funds | Fund Directors and Officers |

| | October 31, 2014 (Unaudited) |

| EXECUTIVE OFFICERS |

| Name and Age | Length of Time Served | Business Experience During the Past Five Years |

Thomas D. Stevens* (age 65) Vice President | Since 1997 | Chairman and President, Los Angeles Capital Management and Equity Research, Inc. (registered investment advisor) (March 2002 to present). |

Carrie L. Butler (age 47) Vice President and Secretary | Vice President since 1991; Secretary since 2013 | Senior Managing Director, International Strategy Investments (registered investment advisor) (2014-present); Managing Director, International Strategy & Investment Inc. (registered investment advisor) (2000 to 2014). |

Edward J. Veilleux (age 71) Vice President and Chief Compliance Officer | Vice President since 1992; Chief Compliance Officer since 2008 | President, EJV Financial Services, LLC (mutual fund consulting company) (2002 to present); Officer of various investment companies for which EJV Financial Services provides consulting and compliance services. |

Anthony Rose (age 44) Treasurer and Vice President | Vice President, Chief Financial Officer, and Treasurer since 2013 | CFO, International Strategy & Investment Group, LLC (June 2013 to present); CFO – Equities, Credit Suisse (2008 – 2013). |

Heena Dhruv (age 38) Vice President | Assistant Vice President from 2005-2013; Vice President since 2013 | Managing Director, International Strategy & Investment Inc. (registered investment advisor) (2005 to present); formerly, Associate Managing Director, International Strategy & Investment Inc. (January 2003 to July 2005). |

Erich A. Rettinger (age 29) Assistant Treasurer ALPS Fund Services, Inc. 1290 Broadway Denver, CO 80203 | Since 2014 | Fund Controller, ALPS Fund Services, Inc. (2013 to present); formerly, Assistant Fund Controller, ALPS Fund Services, Inc. (2011 – 2013); Fund Accounting, ALPS Fund Services, Inc. (2007 – 2011). |

Megan Hadley Koehler (age 36) Assistant Secretary ALPS Fund Services, Inc. 1290 Broadway Denver, CO 80203 | Since 2014 | Senior Counsel, ALPS Fund Services, Inc. (2014 to present); Associate Counsel, Atlantic Fund Services, 2008 – 2014; Assistant Vice President, Citigroup Fund Services, LLC (2007 – 2008). |

| * | Thomas D. Stevens is an officer of the ISI Strategy Fund, Inc. only. |

| | |

Annual Report | October 31, 2014 | 69 |

| ISI Funds | |

| | October 31, 2014 |

TAX INFORMATION (UNAUDITED)

The ISI Managed Municipal Fund designates the following for federal income tax purposes for the year ended October 31, 2014:

| | Tax-Exempt Percentage |

| ISI Managed Municipal Fund | 99.36% |

The Funds designate the following for federal income tax purposes for distributions made during the calendar year ended December 31, 2013 qualified dividend income (“QDI”) and as qualifying for the corporate dividends received deduction (“DRD”).

| | QDI | DRD |

| ISI Strategy Fund | 75.55% | 76.71% |

Pursuant to Section 852(b)(3) the ISI Total Return U.S. Treasury, ISI Managed Municipal, ISI North America Government Bond, and ISI Strategy Funds designated $40,188, $490,843, $133,998, and $4,709,107 as long‐term capital gain for the year ended October 31, 2014.

In early 2014, if applicable, shareholders of record received this information for the distribution paid to them by the Funds during the calendar year 2013 via Form 1099. The Funds will notify shareholders in early 2015 of amounts paid to them by the Funds, if any, during the calendar

year 2014.

PROXY VOTING POLICIES AND PROCEDURES

A description of the policies and procedures that Strategy uses to determine how to vote proxies relating to securities held in Strategy’s portfolio is available, without charge and upon request, by calling (800) 955-7175.Information regarding how Strategy voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available, without charge, upon request, by calling (800) 955-7175 or on the SEC’s website at http://www.sec.gov.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Each Fund’s Form N-Q is available on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

| ISI Funds | Investment Advisory Agreements and Investment Sub-Advisory Agreement Approvals |

| | October 31, 2014 (Unaudited) |

NATURE, EXTENT AND QUALITY OF SERVICES

In considering the nature, extent and quality of the services provided by the Advisor, the Directors relied on their prior experience as Directors of the ISI Funds as well as on the Meeting materials. The Directors noted that under the Investment Advisory Agreements the Advisor is responsible for, among other things, with respect to each of the ISI Funds: (i) managing the investment operations of the ISI Funds in accordance with their respective investment objectives and policies, applicable legal and regulatory requirements, and the instructions of the Directors, (ii) providing necessary and appropriate reports and information to the Directors, (iii) maintaining all necessary books and records pertaining to the ISI Funds’ securities transactions, and (iv) furnishing the ISI Funds with the assistance, cooperation, and information necessary for the ISI Funds to meet various legal requirements regarding registration and reporting. The Board discussed the distinctive nature of the services provided by the Advisor in offering specialized fixed income management for bond portfolios and the experience and expertise appropriate for an investment adviser to such funds. The Board noted that the Advisor has demonstrated consistency in its investment approach and provides an extensive array of services to the ISI Funds in the areas of oversight and administration. The Directors reviewed the background and experience of the Advisor’s key investment professionals, including those individuals responsible for the investment and compliance operations of the ISI Funds. They also considered the resources, operational

| | |

Annual Report | October 31, 2014 | 71 |

| ISI Funds | Investment Advisory Agreements and Investment Sub-Advisory Agreement Approvals |

| | October 31, 2014 (Unaudited) |

structures and practices of the Advisor in managing the ISI Funds, in monitoring and securing each Fund’s compliance with its investment objectives and policies and with applicable laws and regulations. The Directors also considered information about the Advisor’s overall investment management business, noting that the Advisor serves as the investment advisor for two primary lines of business. The Directors also considered the potential effect that the transaction between Evercore Partners Inc. (“Evercore”) and the Distributor (the “Evercore Transaction”) discussed at Executive Session would have on all of the above factors. Drawing upon the materials provided and their general knowledge of the business of the Advisor and the information provided at the Meeting with respect to the Evercore Transaction, the Directors determined that the Advisor has the experience and resources necessary to manage the ISI Funds and concluded that the nature and extent of the services provided by the Advisor to the ISI Funds were appropriate and that it was in the best interest of each of the Fund’s shareholders that the Advisor continue to provide services to the Funds.

INVESTMENT PERFORMANCE OF THE FUND AND THE ADVISOR

The Directors reviewed information provided by ISI which included information on each Fund’s performance and that of its peer group for various time periods ended July 31, 2014, each Fund’s total assets under management, each Fund’s portfolio structure, and a summary of purchase and sales activity for each Fund for the period April 30, 2014 through July 31, 2014. The Boards noted that on a quarterly basis ISI senior management provides each Board with detailed information regarding its investment approach for each Fund, recent economic information and reports, market updates, performance and expenses, and the Advisor’s general economic outlook.

Each Board then considered the short-term and long-term performance information for its respective Fund as compared to each Fund’s benchmark index and peer group.

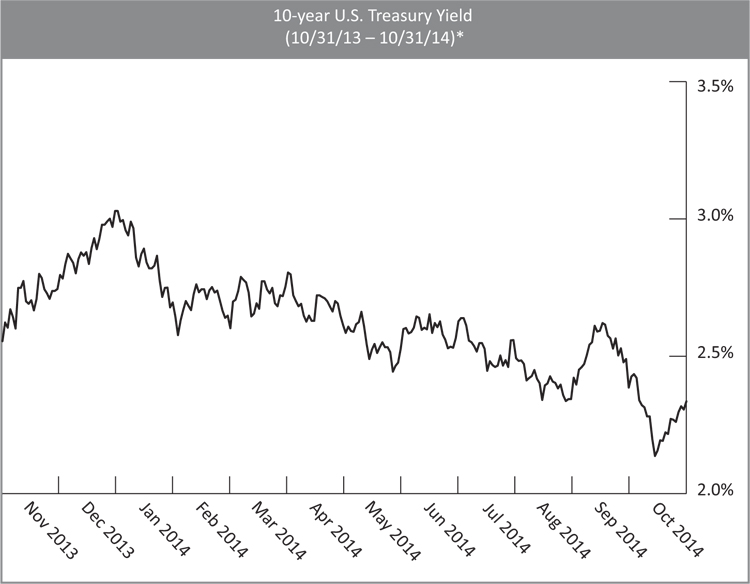

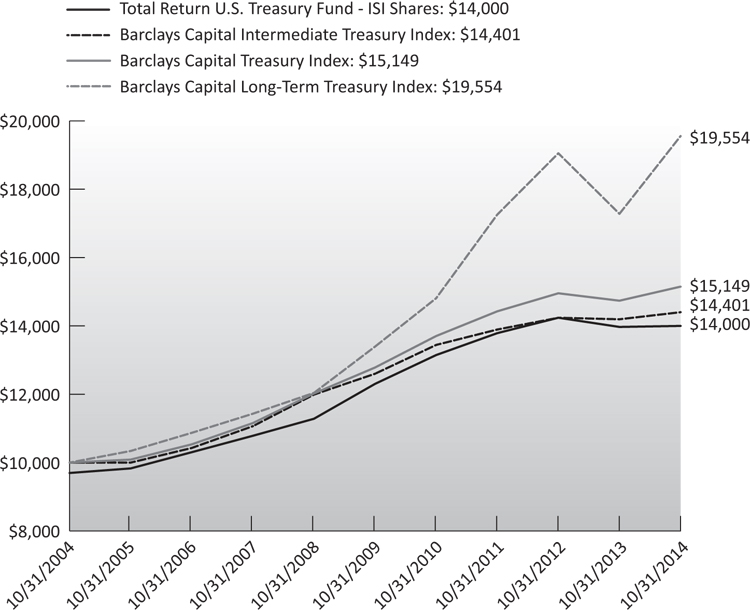

| · | Total Return. The Board reviewed the investment objective of the Fund and the information comparing the Fund’s performance to the returns of relevant indices for selected periods ended July 31, 2014. The Board noted Total Return’s performance results during the year ending July 31, 2014, wherein the Fund returned 0.10%, as compared to the Barclays U.S. Treasury Total Return Index, which returned 1.99%. The Board noted that although Total Return had lower returns than the average in the Lipper category for the 1-, 3-, and 5-years periods and below the average for 1-, 3-, and 5-years periods in the Morningstar category, Total Return’s performance was above average for the Lipper and Morningstar categories for the 10-years period, and Total Return’s performance is in line with management’s expectations, given the challenges of the current interest rate environment. |

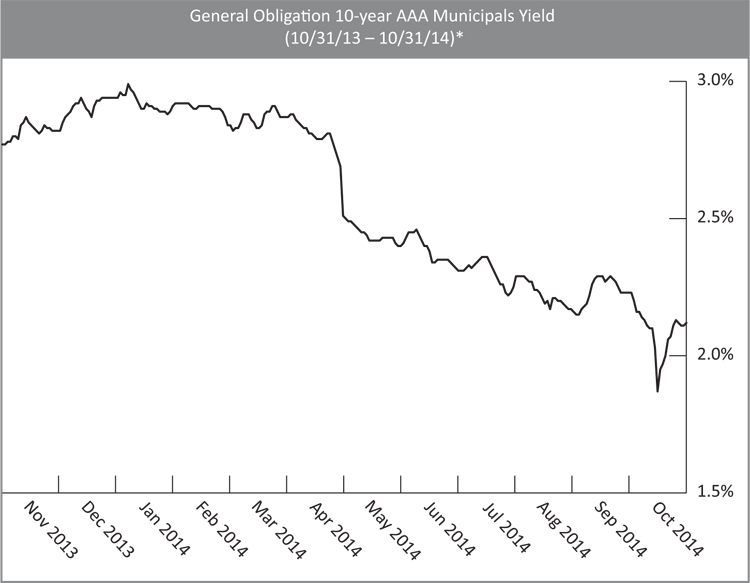

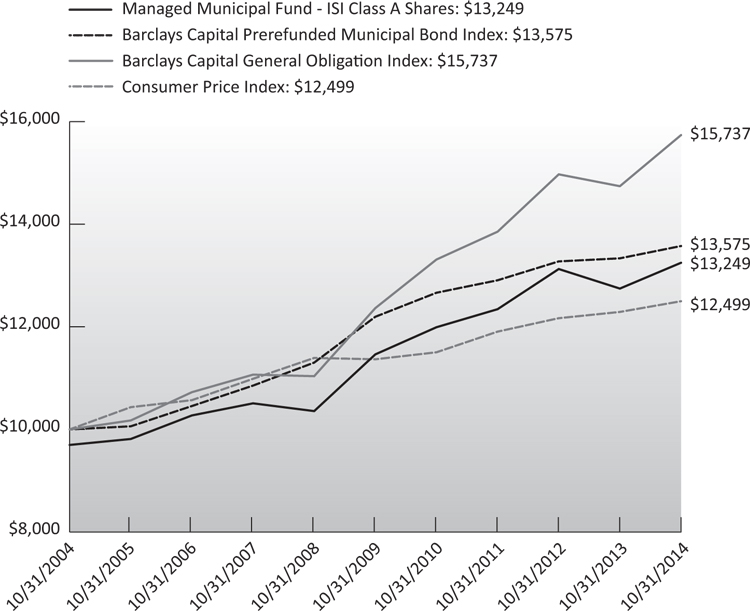

| · | Managed Municipal. The Board reviewed the investment objective of the Fund and the Fund’s performance for selected periods ended July 31, 2014. The Board noted that the Fund returned 5.09% during the one year period ended July 31, 2014, as compared to the Barclay’s AAA High Quality Index, which returned 4.19% for one year. The Board also noted that while the Fund’s performance was helped more recently by the widening of the spread between high quality and medium quality municipals, the rally in the long sector of the municipal market held back the Fund’s performance against its peers within the Morningstar and Lipper categories. The Board further noted that the returns were in line with management’s expectations when taking into consideration the challenges of the current interest rate environment and the near record rate of redemptions in the municipal funds sector which have elevated the performance of lower quality bonds. |

| ISI Funds | Investment Advisory Agreements and Investment Sub-Advisory Agreement Approvals |

| | October 31, 2014 (Unaudited) |

| · | North American. The Board reviewed the investment objective of the Fund and the Fund’s performance for selected periods ended July 31, 2014. The Board noted that the returns for North American were slightly behind the CDA/Lipper average for the quarter ended July 31, 2014 and the year-ended July 31, 2014, given the adverse impact of currency movements on the Fund’s Canadian investment and challenges of the current interest rate environment. The Board further noted that in light of these challenges, the Fund's returns were in line with management's expectations. |

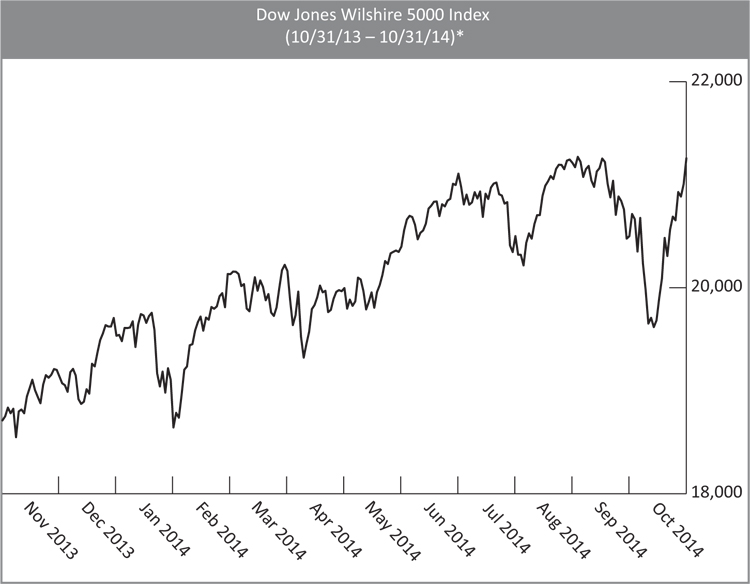

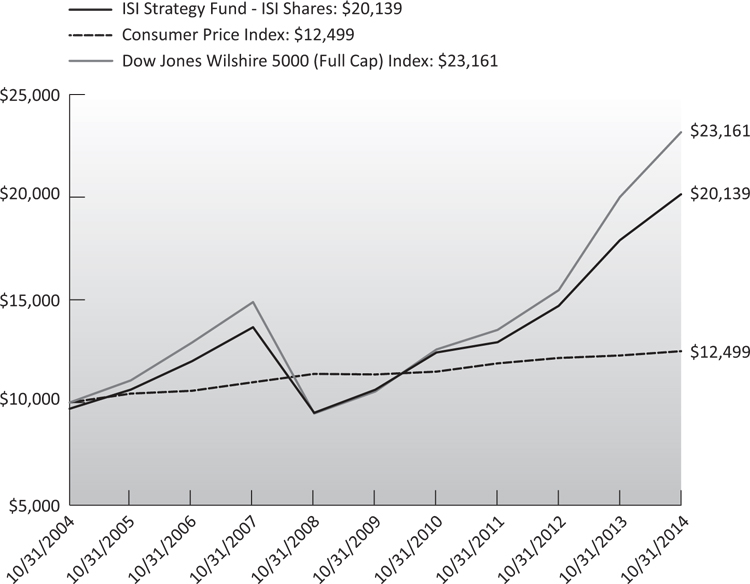

| · | Strategy. The Board reviewed the investment objective of the Fund and the Fund’s performance for selected periods ended July 31, 2014. The Board noted that the returns for Strategy demonstrated a consistent pattern of favorable performance and that given the current popularity of equity-oriented funds, the Fund had met expectations. In reviewing the Investment Advisory Agreements, the Board took into consideration the high credit qualities of the portfolio securities held by Managed Municipal, North American and Strategy, noting that Managed Municipal and North American invest in high quality bonds, while the bond section of Strategy is invested in U.S. Treasury securities. |

COSTS OF SERVICES PROVIDED, FEES AND EXPENSES PAID AND PROFIT MARGIN OF THE ADVISOR AND ITS AFFILIATES

Each Board considered the investment advisory fees paid by each Fund to ISI. The Board of Directors of Strategy noted that the sub-advisory fee for Strategy is paid by ISI and not the Fund. Each Board concluded that the Advisor’s fees are fair and reasonable in light of those services provided to the Funds.

Each Board reviewed the costs associated with ISI’s portfolio management, research and corporate governance and considered the profitability of ISI from the advisory and ancillary services provided to each of the Funds. Each Board was advised by ISI of the methodology it used to assign its costs associated with the portfolio management, research and corporate governance services provided to each of the Funds. The Board of Directors of Strategy was also provided with a report from the Sub-Advisor showing its profitability with respect to its management of Strategy and the methodology used by the Sub-Advisor to prepare its profitability analysis.

Each Board reviewed an expense ratio comparison report for each of the Funds sourced from CDA/Lipper. The report compared the actual expense ratio of each Fund as a percentage of net assets for each Fund versus the peer group of funds selected by CDA/Lipper. The Boards noted that the total expense ratio of each Fund was at or near the average of its respective peer group, with the exception of North American. North American’s expenses were relatively higher than the

| | |

Annual Report | October 31, 2014 | 73 |

| ISI Funds | Investment Advisory Agreements and Investment Sub-Advisory Agreement Approvals |

| | October 31, 2014 (Unaudited) |

average of its respective peer group as the cost of custody services for Canadian and Mexican securities is higher than U.S. securities. The Boards also reviewed the allocation of shared costs and expenses with respect to the Advisor’s Institutional Business, UIT Business and the Funds. The Board noted the reduction in the Fund’s overall expenses for the year ended June 30, 2014 versus the year ended June 30, 2013, based on both the Adviser’s revenue increase in the Institutional and UIT Businesses, and the Funds’ lower revenues, which resulted in the Funds bearing a lower proportion in overall costs for the year ended June 30, 2014. The Board concluded that the services provided by the Advisor under the terms of the Investment Advisory Agreements are fair and reasonable; and that the Advisor’s fees and total expenses of the Funds are reasonable in light of those services provided to the Funds.

The Boards considered whether the ISI Funds would benefit from any economies of scale and concluded that the asset levels of the Funds were not at a point that would make economy of scale considerations relevant at this time.

Each Board considered other benefits received by the Advisor from its relationship with the Funds. The Board noted that the Advisor benefits from the shared costs of its three primary lines of business and that the Advisor’s profit from its management of the ISI Funds had exceeded the profit margin for both its Institutional Business line for the fiscal years ended June 30, 2013 and June 30, 2014, and for its UIT Business line for the fiscal year ended June 30, 2014. Each Board considered the fact that International Strategy & Investment Group LLC (the “Distributor”), an affiliate of ISI, serves as the distributor of each of the Funds. Each Board reviewed the costs and profitability of ISI Group in rendering distribution services to each of the Funds for the year ended June 30, 2014. Each Board also noted that the Distributor had operated at a loss during the past year; however, each Board further noted that the Distributor had reduced both its total expenses and its operating loss year over year, becoming closer to profitability. The Board also noted that the Advisor is responsible for providing certain administrative services to the Funds and assists in managing and supervising all aspects of the general day-to-day business activities and operations of the Fund, including preparing certain reports and other documents required by federal and/or state laws and regulations. The Board further noted that under the Administration Agreement with the Fund, the Advisor, oversees the activities of the sub-administrator, and, after paying the sub-administrator for its services, the Advisor is entitled to an annual fee of 0.02% based on the average daily net assets of each Fund for services it provides to the Funds. Based on the foregoing, the Board concluded that other benefits received by the Adviser from its relationship with the Funds were not a material factor to consider in approving the Advisory Agreements.

| BOARD OF DIRECTORS | |

Louis E. Levy Chairman | Edward J. Veilleux Vice President Chief Compliance Officer |

W. Murray Jacques Director | Thomas D. Stevens * Vice President |

Edward A. Kuczmarski Director | Anthony Rose Vice President Treasurer |

R. Alan Medaugh President Director | Heena Dhruv Vice President |

Carrie L. Butler Vice President Secretary | Edward S. Hyman Senior Economic Advisor *Thomas D. Stevens is an officer for only the ISI Strategy Fund, Inc. |

| INVESTMENT ADVISOR | |

ISI Inc. 666 Fifth Avenue New York, NY 10103 (800) 955-7175 | |

| SHAREHOLDER SERVICING AGENT | |

ALPS Fund Services, Inc. P.O. Box 1920 Denver, CO 80201 (800) 882-8585 | |

| DISTRIBUTOR | |

ISI Group LLC 666 Fifth Avenue New York, NY 10103 (800) 955-7175 | |