| Item 1. | Reports to Stockholders. |

| |  | |

| | | | ANNUAL REPORT October 31, 2011 | | | |

| | | | TOTAL RETURN U.S. TREASURY FUND, INC.

MANAGED MUNICIPAL FUND, INC.

NORTH AMERICAN GOVERNMENT BOND FUND, INC.

ISI STRATEGY FUND, INC. | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| ISI Funds Annual Report – Table of Contents |

Investment Advisor’s Message | 1 |

Management Discussion & Analysis | 3 |

Performance Comparisons | 11 |

Shareholder Expense Examples | 19 |

Portfolio Profiles | 22 |

Schedule of Investments | 23 |

Statements of Assets and Liabilities | 36 |

Statements of Operations | 40 |

Statements of Changes in Net Assets | 42 |

Financial Highlights | 48 |

Notes to Financial Statements | 55 |

Report of Independent Registered Public Accounting Firm | 65 |

Fund Directors and Officers | 66 |

Notice to Shareholders | 69 |

Investment Advisory Agreement Approval | 71 |

| Investment Advisor’s Message | 10/31/2011 |

Dear Shareholder:

I am pleased to present the Annual Report to Shareholders for the ISI Funds. This report covers the 12-month reporting period through October 31, 2011 and includes commentary from the Funds’ portfolio managers at International Strategy & Investment, Inc. (“ISI”) (see Management Discussion and Analysis that follows this letter for more details), a complete list of holdings and the financial statements.

Stocks recorded a positive return for the last year and a small positive return for the last five years. For example, the Wilshire 5000 Index was +7.58% for the last year and averaged +0.94% for the past five years. U.S. Treasuries increased over the last year and the last 5 years. The Barclays Capital Treasury Index was +5.27% for the past year and averaged +6.49% for the past five years. Top quality municipal indices were also up for the last year and for the last five years. For example, the Barclays Capital Municipal GO Index was +4.08% for the past year and averaged +5.26% for the past five years. The following is a summary of fund performance during the reporting period. These performance figures assume the reinvestment of dividend and capital gain distributions, and exclude the impact of any sales charges.

During the year ended October 31, 2011, Total Return U.S. Treasury Fund and North American Government Bond Fund continued their policy of paying dividends at a fixed rate, which resulted in dividends consisting of net investment income, short-term capital gains, and long-term capital gains.

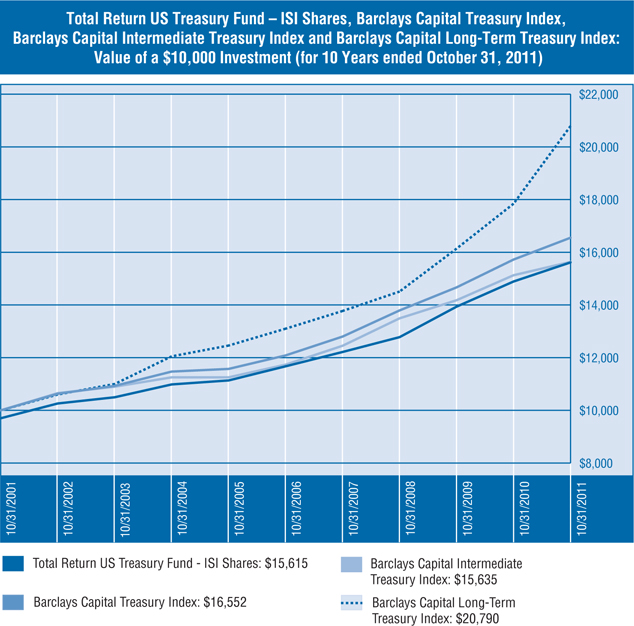

Total Return U.S. Treasury Fund’s investment objective is to achieve a high level of total return with relative stability of principal, and secondarily, high current income consistent with an investment in securities issued by the United States Treasury. For the reporting period, the Fund produced a one-year total return of +4.87% and a five-year average annual total return of +6.00%. From its inception on August 10, 1988 through October 31, 2011, the Fund has posted a cumulative total return of +368.87%, which translates into an average annual total return of +6.88%. The Fund’s net assets totaled $85.49 million at the end of the reporting period.

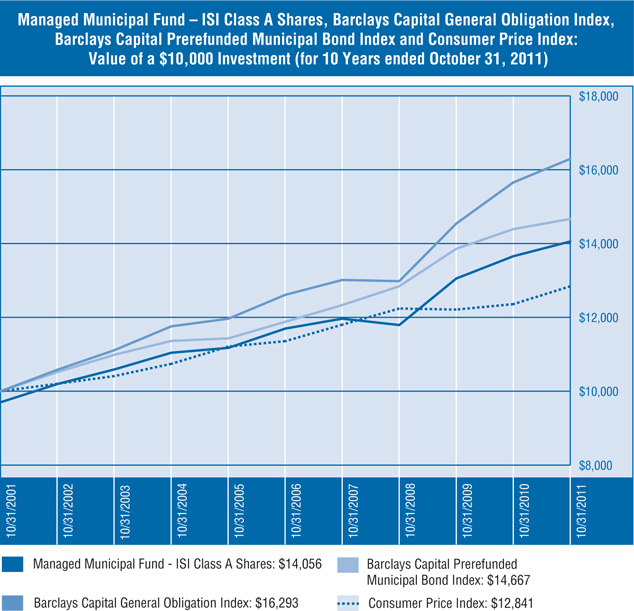

ISI Managed Municipal Fund’s investment objective is to provide a high level of total return with relative stability of principal and, secondarily, high current income exempt from federal income tax through investment in a portfolio consisting primarily of tax-free municipal obligations. For the reporting period, the ISI Class A Shares produced a one-year total return of +2.93% and a five-year average annual total return of +3.74%. From its inception on February 26, 1990 through October 31, 2011, the ISI Class A Shares has posted a cumulative total return of +202.74%, which translates into an average annual total return of +5.24%. From its inception on October 7, 2010 through October 31, 2011, the ISI Class I Shares have posted a cumulative total return of +2.40%, which translates to an average annual total return of +2.24%. The Fund’s net assets totaled $107.95 million at the end of the reporting period.

| Investment Advisor’s Message (continued) |

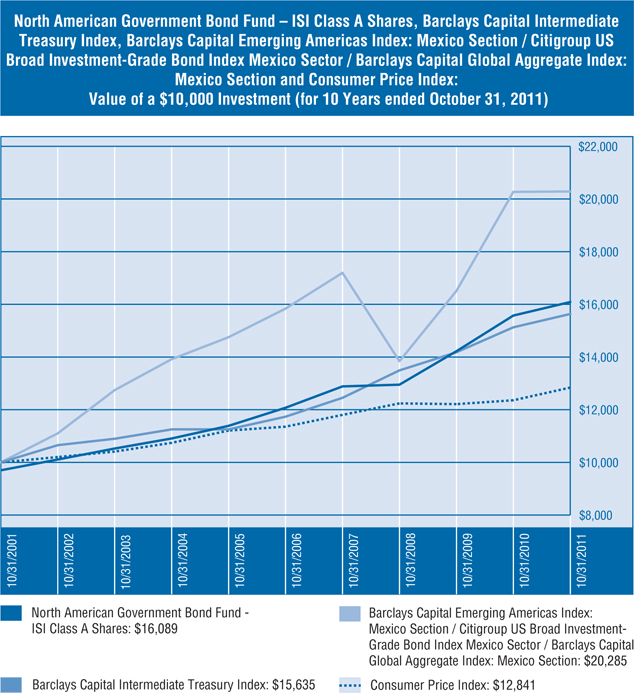

ISI North American Government Bond Fund’s investment objective is to provide a high level of current income, consistent with prudent investment risk, by investing primarily in a portfolio consisting of fixed income securities issued or guaranteed by the governments of the United States, Canada and Mexico. For the reporting period, the ISI Class A Shares produced a one-year total return of +3.30% and a five year average annual total return of +5.91%. From its inception on January 15, 1993 through October 31, 2011, the ISI Class A Shares have posted a cumulative total return of +196.26%, which translates into an average annual total return of +5.95%. For the reporting period, the ISI Class C Shares produced a one-year total return of +2.84% and a five year average annual total return of +5.26%. From its inception on May 16, 2003 through October 31, 2011, the ISI Class C Shares have posted a cumulative total return of +41.48%, which translates into an average annual total return of +4.18%. From its inception on September 16, 2010 through October 31, 2011, the ISI Class I Shares have posted a cumulative total return of +5.69%, which translates to an average annual total return of +5.04%. The Fund’s net assets totaled $147.71 million at the end of the reporting period.

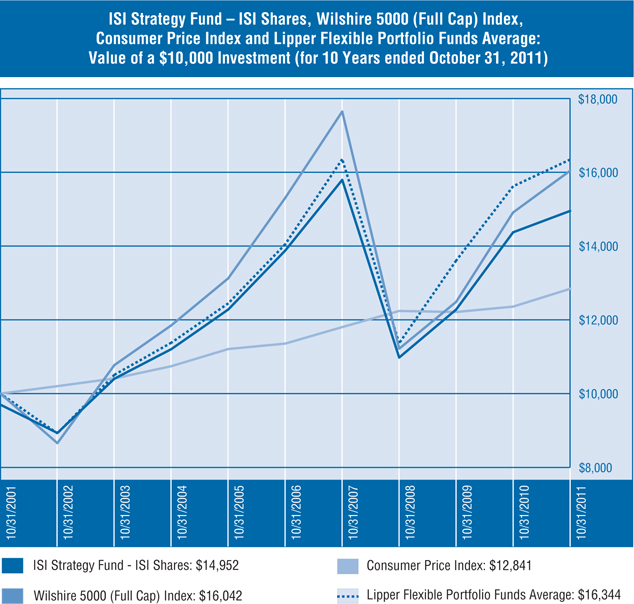

ISI Strategy Fund has an investment objective of maximizing total return through a combination of long-term growth of capital and current income by actively allocating the Fund’s assets between common stocks of U.S. issuers and U.S. Treasury securities. For the reporting period, the Fund produced a one-year total return of +4.03% and a five-year average annual total return of +1.50%. From its inception on September 16, 1997 through October 31, 2011, the Fund has posted a cumulative total return of +81.43%, which translates into an average annual total return of +4.31%. The Fund’s net assets totaled $57.26 million at the end of the reporting period.

We would like to welcome new investors to the ISI Funds and thank those who have been with us for some time. We appreciate your confidence.

Sincerely,

R. Alan Medaugh

President

November 14, 2011

The performance numbers stated above do not include a deduction for the maximum sales charge (3.00%) or maximum deferred sales charge, as applicable to each Fund. If the maximum sales charge or maximum deferred sales charge (as applicable) was deducted for each Fund the stated performance numbers would be lower. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance of a Fund, please call (800) 882-8585. The total annualized operating expense ratios of the Funds as of October 31, 2011 were as follows: Total Return US Treasury Fund, Inc. – 0.84%; Managed Municipal Fund, Inc.-Class A – 1.01%; Managed Municipal Fund, Inc.-Class I – 0.76%; North American Government Bond Fund, Inc.-Class A – 1.18%; North American Government Bond Fund, Inc.-Class C – 1.78% ; North American Government Bond Fund, Inc.-Class I – 0.78% and ISI Strategy Fund, Inc. – 1.04%. The operating expense ratios may vary over time.

| Management Discussion & Analysis (Unaudited) |

The Total Return U.S. Treasury Fund

This fiscal year, the Treasury market rallied from February through the end of the year. The drop in yield was caused by (1) The stalling of the U.S. economic recovery; (2) The building financial crisis in Europe; and (3) The move by the Federal Reserve to do “Operation Twist”, i.e. selling some of their short maturity (1 – 5 year) issues, replacing them with longer issues, predominantly in the 5 – 10 year maturity range. The Fund’s active maturity management anticipated the Federal Reserve’s move by increasing the Fund’s holdings of 5 – 10 year issues. At the end of the fiscal year, the Fund had 70.4% of its maturities in the 5 – 10 year range. By comparison, the Treasury market as a whole, according to Barclays Capital Treasury Index, the 5 – 10 year maturity range represented only 25.8% of the Treasury market.

Management Discussion & Analysis (Unaudited) (continued) |

The Managed Municipal Fund

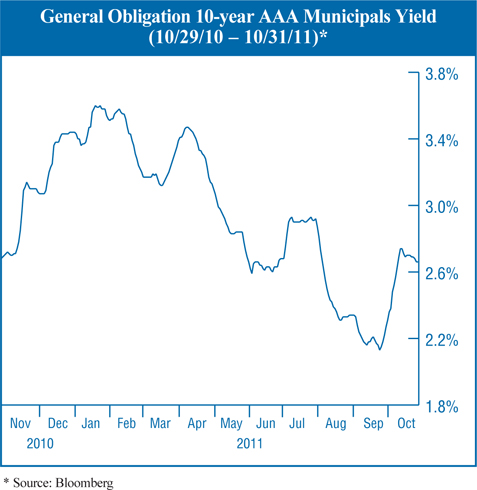

Municipal yields, although volatile during the year, were basically unchanged from the beginning of the fiscal year to the end of the fiscal year. Please see 10-year AAA yield chart for fiscal year 2011 below.

Management Discussion & Analysis (Unaudited) (continued) |

The Fund purchased issues primarily in the 10+ year range during the fiscal year. The reason was the attractive yield on tax free, high quality municipals when compared to U.S. Treasuries. Treasury yields moved down significantly because of the European financial crisis and Federal Reserve action. The result is that municipal yields as a percentage of Treasury yields moved up from generally attractive levels to very attractive levels during the Fiscal year. Please see table below.

Comparison of AAA Municipal Yields

as a Percentage of U.S. Treasury Yields

(10/29/10 and 10/31/11)

|

| | | | | | |

| 5 Year | | 111.24 | | 136.86 | | +25.62 |

| 10 year | | 101.15 | | 121.86 | | +20.71 |

| 15 year | | 109.14 | | 130.41 | | +21.27 |

| 20 year | | 107.58 | | 133.77 | | +26.19 |

Management Discussion & Analysis (Unaudited) (continued) |

The North American Government Bond Fund

The Fund’s positive performance in the fiscal year was due to it’s roughly 70% investment in U.S. Treasuries, which rallied strongly. Please see the U.S. Treasury Fund write-up for details.

The 30% in Canada and Mexico remained steady during the year (30.1% at the beginning of the fiscal year and 30.1% at fiscal year end). The mix between Canada and Mexico shifted during the year. Canada began the fiscal year representing 21.7% of the Fund and was reduced to 18.4% by the end of the fiscal year. Mexico moved up a bit during the fiscal year from 8.4% to 11.7% at fiscal year end. Mexico’s currency was under more pressure than Canada during the year due to the higher reliance by Mexico on goods production than products from natural resources which are the hallmark of Canadian exports. As a result, the Canadian dollar outperformed the Mexico peso during the fiscal year. Please see relative strength of the Canadian dollar in the chart below.

Management Discussion & Analysis (Unaudited) (continued) |

ISI believes that the U.S. reliance on Mexico’s manufacturing products will continue and represents a solid base for Mexico in 2012. The yields in Mexico are significantly higher than those in Canada, adding another aspect to their investment attraction. Please see table below showing the Mexican versus Canadian yield advantage for various maturities.

Mexican Government Bond Yield Advantage over Canadian Government Bonds

for various short maturities as of Fiscal Year End 10/31/11

| | | | | | |

| 2 Year | | 4.51 | | 0.99 | | +352 bps |

| 3 Year | | 4.63 | | 1.14 | | +349 bps |

| 5 Year | | 5.01 | | 1.50 | | +351 bps |

| 7 Year | | 5.62 | | 1.79 | | +383 bps |

| 10 Year | | 6.18 | | 2.28 | | +390 bps |

Management Discussion & Analysis (Unaudited) (continued) |

The Strategy Fund

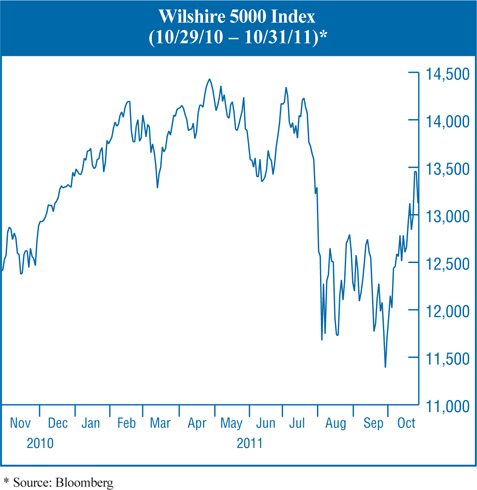

Both stocks and bonds rallied this fiscal year, with the result the Fund was positive for the Fiscal year. Stocks somewhat outpaced bonds (Wilshire 5000 +7.58% while the Barclays Treasury Index +5.27%). The stock market was principally driven by rising corporate earnings reports. Treasury bonds were helped by a slowing recovery, a financial crisis in Europe, and prospects for Federal Reserve’s next steps in quantitative easing. The charts on the Treasury 10-year bond yield and the stock market are below.

Management Discussion & Analysis (Unaudited) (continued) |

The Fund’s performance was helped by having a majority weighting in stocks this fiscal year. At the beginning of the year the mix favored stocks 81% to 19%. Stocks remained in the majority over the fiscal year ending at 94% to 6%.

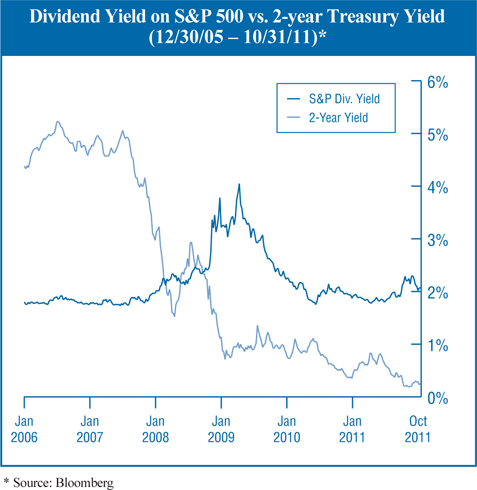

A more recent help for stocks is their dividend yield versus short maturity Treasuries. Please see chart below as reference. With corporate earnings rising, the dividend payout rate could rise further adding to the yield support for equities.

Management Discussion & Analysis (Unaudited) (continued) |

Total Return US Treasury Fund – Performance Comparison1 (Unaudited) |

Total Return US Treasury Fund – Performance Comparison1 (Unaudited) (continued) |

| | Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended October 31, 2011 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 |

Total Return US

Treasury Fund | | | | | | | | | | |

Barclays Capital

Treasury Index3 | | | | | | | | | | |

Barclays Capital Intermediate

Treasury Index3 | | | | | | | | | | |

Barclays Capital

Long-Term

Treasury Index3 | | | | | | | | | | |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the Fund’s maximum 3.00% sales charge. Distributions of the Fund’s capital gains and non-US Treasury income may be subject to state and local taxes. Management is not aware of any single index that is truly representative of the Fund since its active maturity management policy allows the manager to adjust the weighted average maturity throughout each US Treasury sector. Currently, the Fund’s weighted average maturity is approximately 5.95 years. |

| | |

| 2 | The Fund’s inception date is August 10, 1988. Benchmark returns are for the periods beginning August 31, 1988. |

| | |

| 3 | The Barclays Capital Treasury Index is an unmanaged index reflecting the performance of all public Treasury obligations and does not focus on one particular segment of the Treasury market. The Barclays Capital Intermediate Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the intermediate-term Treasury sector. The Barclays Capital Long-Term Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the long-term Treasury sector. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| Expense Ratio Information as of: | October 31, 2011 |

| Gross Expense Ratio | 0.84% |

Managed Municipal Fund – Performance Comparison1 (Unaudited) |

Managed Municipal Fund – Performance Comparison1 (Unaudited) (continued) |

| | Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended October 31, 2011 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception |

Managed Municipal

Fund - ISI Class A Shares2 | | | | | | | | | | |

Managed Municipal

Fund - ISI Class I Shares3 | | | | | | | | | | |

Barclays Capital General Obligation Index4 | | | | | | | | | | |

Barclays Capital

Prerefunded Municipal

Bond Index4 | | | | | | | | | | |

| | | | | | | | | | |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the sales charge, if applicable. ISI Class A Shares have a maximum 3.00% sales charges. Distributions of the Fund’s income and capital gains may be subject to state and local taxes. |

| | |

| 2 | The ISI Class A Shares inception date is February 26, 1990. Benchmark returns are for the periods beginning February 28, 1990. |

| | |

| 3 | The ISI Class I Shares inception date is October 7, 2010. Benchmark returns are for the period beginning October 31, 2010. |

| | |

| 4 | The Barclays Capital General Obligation Index is an unmanaged index reflecting general municipal bond market performance. The Barclays Capital Prerefunded Municipal Bond Index, an unmanaged index, is a subcomponent of the general Barclays Capital Municipal Bond Index, and contains only bonds from that index that have been prerefunded or escrowed to maturity. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| | |

| 5 | The Consumer Price Index is a widely used measure of inflation. |

| Expense Ratio Information as of: | October 31, 2011 |

| Gross Expense Ratio – Class A | 1.01% |

| Gross Expense Ratio – Class I | 0.76% |

North American Government Bond Fund – Performance Comparison1 (Unaudited) |

North American Government Bond Fund – Performance Comparison1 (Unaudited) (continued) |

| | Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended October 31, 2011 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception |

North American Government Bond Fund - ISI Class A Shares2 | | | | | | | | | | |

North American Government Bond Fund - ISI Class C Shares3 | | | | | | | | | | |

North American Government Bond Fund - ISI Class I Shares4 | | | | | | | | | | |

Barclays Capital Intermediate Treasury Index5 | | | | | | | | | | |

Barclays Capital Emerging Americas Index: Mexico Section / Citigroup US

Broad Investment-Grade

Bond Index Mexico

Sector / Barclays Capital

Global Aggregate Index:

Mexico Section6 | | | | | | | | | | |

| | | | | | | | | | |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes sales charges, if applicable. ISI Class A shares have a maximum 3.00% sales charge. ISI Class C Shares have a maximum 1.00% contingent deferred sales charge in the first year, which is eliminated thereafter. |

| | |

| 2 | ISI Class A Shares inception date is January 15, 1993. Benchmark returns are for the periods beginning January 31, 1993. |

| | |

| 3 | ISI Class C Shares inception date is May 16, 2003. Cumulative and annualized returns for the Barclays Capital Intermediate Treasury Index from May 31, 2003 through October 31, 2011 were 41.81% and 4.24%, respectively. |

| | |

| 4 | ISI Class I Shares inception date is September 16, 2010. Benchmark returns are for the periods beginning September 30, 2010. |

| | |

| 5 | The Barclays Capital Intermediate Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the intermediate-term Treasury sector. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| | |

| 6 | Reflects the performance of the Barclays Capital Emerging Americas Index: Mexico Section through October 31, 2004 and the Citigroup US Broad Investment-Grade Bond Index Mexico Sector from that date through October 31, 2006 and the Barclays Capital Global Aggregate Index: Mexico from October 31, 2006 through October 31, 2011. The Barclays Capital Emerging Americas Index: Mexico Section has been discontinued. Barclays Capital Emerging Americas Index: Mexico Section was an unmanaged sub-index of the Barclays Capital Emerging Americas Index reflecting the performance of selected Mexican debt instruments with maturities of one year or more. The Citigroup US Broad Investment-Grade Bond Index Mexico Sector is an unmanaged sub-index of the Citigroup US Broad Investment-Grade Bond Index reflecting the performance of selected Mexican debt instruments with maturities of one year or more. The Barclays Capital Global Aggregate Index: Mexico Section is an unmanaged sub-index of Barclays Capital Global Aggregate Index which provides broad-based measure of global investment-grade fixed income markets. The Mexico Section reflects the US dollar performance of selected Mexican government peso-denominated debt instruments with maturities of one year or more. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| | |

| 7 | The Consumer Price Index is a widely used measure of inflation. |

| Expense Ratio Information as of: | October 31, 2011 |

| Gross Expense Ratio – Class A | 1.18% |

| Gross Expense Ratio – Class C | 1.78% |

| Gross Expense Ratio – Class I | 0.78% |

ISI Strategy Fund – Performance Comparison1 (Unaudited) |

ISI Strategy Fund – Performance Comparison1 (Unaudited) (continued) |

| | Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended October 31, 2011 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 |

| | | | | | | | | | |

Wilshire 5000

(Full Cap) Index3 | | | | | | | | | | |

| | | | | | | | | | |

Lipper Flexible Portfolio Funds Average5 | | | | | | | | | | |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the Fund’s maximum 3.00% sales charge. |

| | |

| 2 | The Fund’s inception date is September 16, 1997. Benchmark returns are for the periods beginning September 30, 1997. |

| | |

| 3 | The Wilshire 5000 (Full Cap) Index is an unmanaged index that represents the broadest measure of the US equity market. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| | |

| 4 | The Consumer Price Index is a widely used measure of inflation. |

| | |

| 5 | Lipper figures represent the average total returns by all mutual funds designated by Lipper as falling into the category indicated. The Lipper Flexible Portfolio Funds Average category includes funds that allocate their investments across various asset classes, including domestic common stocks, bonds and money market instruments with a focus on total return. |

| Expense Ratio Information as of: | October 31, 2011 |

| Gross Expense Ratio | 1.04% |

| Shareholder Expense Examples (Unaudited) |

As a shareholder of the Funds, you may incur two types of cost; (1) transaction costs, including sales charges (loads); and (2) ongoing costs, including management fees, Rule 12b-1 distribution/shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the tables below are based on an investment of $1,000 made at the beginning of the period shown (May 1, 2011) and held for the entire period (October 31, 2011).

Actual Expenses – “Actual Return” in the following table provides information about actual account values and actual expenses. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Expenses Paid During Period” column to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – “Hypothetical Returns” in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return of each Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, “Hypothetical Returns” in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

Shareholder Expense Examples (Unaudited) (continued) |

| Total Return US Treasury Fund |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,075.20 | $4.08 | 0.78% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,021.27 | $3.97 | 0.78% |

| | | | | |

| Managed Municipal Fund – Class A |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,040.20 | $5.25 | 1.02% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,020.06 | $5.19 | 1.02% |

| | | | | |

| Managed Municipal Fund – Class I |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,041.50 | $3.96 | 0.77% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,021.32 | $3.92 | 0.77% |

| | | | | |

| North American Government Bond Fund – Class A |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,034.40 | $6.00 | 1.17% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.31 | $5.96 | 1.17% |

| | | | | |

| North American Government Bond Fund – Class C |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,032.20 | $9.07 | 1.77% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,016.28 | $9.00 | 1.77% |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| Shareholder Expense Examples (Unaudited) (continued) |

| North American Government Bond Fund – Class I |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $1,037.20 | $3.95 | 0.77% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,021.32 | $3.92 | 0.77% |

| | | | | |

| ISI Strategy Fund |

| Beginning Account Value May 1, 2011 | Ending Account Value October 31, 2011 | Expenses Paid During Period(1) | |

| Based on Actual Fund Return | $1,000.00 | $ 914.80 | $5.07 | 1.05% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.91 | $5.35 | 1.05% |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| Portfolio Profiles (Unaudited) |

| Portfolio Profiles (as a % of Net Assets) | October 31, 2011 |

| Total Return US Treasury Fund |

| US Treasury Obligations | 88.96% |

| Repurchase Agreements | 9.53% |

| Other Assets and Liabilities | |

| | 100.00% |

| | |

| Managed Municipal Fund |

| Aaa Municipal Obligations* | 80.81% |

| Aa Municipal Obligations* | 12.30% |

| US Treasury Obligations | 4.64% |

| Repurchase Agreements | 1.36% |

| Other Assets and Liabilities | |

| | 100.00% |

| | |

| * Ratings are based on Moody’s Investors Service, Inc. |

| | |

| North American Government Bond Fund |

| Canadian Securities | 18.38% |

| Mexican Securities | 11.69% |

| US Treasury Obligations | 65.57% |

| Repurchase Agreements | 3.26% |

| Other Assets and Liabilities | |

| | 100.00% |

| | |

| ISI Strategy Fund | |

| Consumer Discretionary | 13.09% |

| Consumer Staples | 11.47% |

| Energy | 10.23% |

| Financials | 13.19% |

| Health Care | 11.92% |

| Industrials | 9.91% |

| Information Technology | 16.45% |

| Materials | 3.68% |

| Telecommunication Services | 1.60% |

| Utilities | 2.89% |

| US Treasury Obligations | 5.15% |

| Repurchase Agreements | 0.50% |

| Other Assets and Liabilities | |

| | 100.00% |

| Total Return US Treasury Fund |

| Schedule of Investments | October 31, 2011 |

| | | | | | | | | |

| US TREASURY OBLIGATIONS - 88.96% | | | | | | | |

| US Treasury Notes | | | 0.625% | 07/31/12 | | $ | 1,500,000 | | | $ | 1,505,799 | |

| US Treasury Notes | | | 0.375% | 08/31/12 | | | 10,000,000 | | | | 10,020,710 | |

| US Treasury Notes | | | 2.250% | 11/30/17 | | | 16,600,000 | | | | 17,474,089 | |

| US Treasury Notes | | | 3.750% | 11/15/18 | | | 1,370,000 | | | | 1,567,580 | |

| US Treasury Notes | | | 2.625% | 08/15/20 | | | 7,000,000 | | | | 7,365,862 | |

| US Treasury Bonds | | | 8.125% | 08/15/19 | | | 10,000,000 | | | | 14,692,190 | |

| US Treasury Bonds | | | 8.750% | 08/15/20 | | | 11,300,000 | | | | 17,545,013 | |

| US Treasury Bonds | | | 7.875% | 02/15/21 | | | 1,000,000 | | | | 1,496,719 | |

| US Treasury Bonds | | | 6.375% | 08/15/27 | | | 3,000,000 | | | | 4,384,218 | |

| | | | | | | | | | | | | |

| Total US Treasury Obligations (Cost $70,993,001) | | | $ | 76,052,180 | |

| | | | | | |

| REPURCHASE AGREEMENTS - 9.53% | | | | | | |

| JPMorgan Chase, N.A. | | | | | | |

Dated 10/31/11, 0.03%, principal and interest in the amount of $8,152,007 to be repurchased 11/01/11, collateralized by US Treasury Inflation-Protected Note, par value of $6,355,000 due 07/15/16 with a value of $8,320,530 (Cost $8,152,000) | | $ | 8,152,000 | | | $ | 8,152,000 | |

| | | | | | | | | |

| Total Investments - 98.49% (Cost $79,145,001)* | | | $ | 84,204,180 | |

| Other Assets in Excess of Liabilities - 1.51% | | | | 1,289,598 | |

| Net Assets - 100.00% | | | $ | 85,493,778 | |

| * | Cost for Federal income tax purposes is $79,145,001 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 5,060,807 | |

| Gross Unrealized Depreciation | | | (1,628 | ) |

| Net Unrealized Appreciation | | $ | 5,059,179 | |

See Notes to Financial Statements.

| Schedule of Investments | October 31, 2011 |

| | | | | | | | | | | |

| MUNICIPAL BONDS - 93.11% | | | | | | | | | | | |

| General Obligation - 57.27% | | | | | | | | | | | |

| Alexandria, VA, Capital Improvements | | | 4.250% | | 06/15/21 | Aaa/AAA | | $ | 3,300,000 | | | $ | 3,542,517 | |

| Arlington County, VA, Public Improvements | | | 4.500% | | 01/15/28 | Aaa/AAA | | | 1,600,000 | | | | 1,620,640 | |

| Austin, TX, Public Improvements, Series A | | | 3.500% | | 09/01/30 | Aaa/AAA | | | 2,500,000 | | | | 2,319,625 | |

| Baltimore County, MD | | | 4.000% | | 08/01/22 | Aaa/AAA | | | 1,665,000 | | | | 1,862,636 | |

| Delaware State, Series B | | | 3.000% | | 07/01/19 | Aaa/AAA | | | 1,400,000 | | | | 1,507,814 | |

| Delaware State, Series B | | | 3.250% | | 01/01/21 | Aaa/AAA | | | 2,000,000 | | | | 2,096,500 | |

| Du Page County, IL, Jail Project | | | 5.600% | | 01/01/21 | Aaa/AAA | | | 1,600,000 | | | | 1,862,816 | |

| Florida State, Board of Education, Public Education, Series I | | | 4.125% | | 06/01/21 | Aa1/AAA | | | 3,000,000 | | | | 3,098,220 | |

| Georgia State, Series B | | | 4.250% | | 04/01/25 | Aaa/AAA | | | 1,120,000 | | | | 1,183,750 | |

| Georgia State, Series G | | | 4.125% | | 10/01/23 | Aaa/AAA | | | 2,000,000 | | | | 2,128,740 | |

| Henrico County, VA, Public Improvements | | | 4.250% | | 07/15/24 | Aaa/AAA | | | 2,830,000 | | | | 2,963,519 | |

| Mecklenburg County, NC | | | 3.500% | | 02/01/26 | Aaa/AAA | | | 2,000,000 | | | | 2,018,980 | |

| Mecklenburg County, NC, Public Improvements, Series B | | | 4.000% | | 03/01/27 | Aaa/AAA | | | 1,000,000 | | | | 1,036,970 | |

Minnesota State, State Trunk Highway,

Series B | | | 4.000% | | 08/01/30 | Aa1/AA+ | | | 2,830,000 | | | | 2,943,313 | |

| Missouri State, Fourth State Building, Series A | | | 4.125% | | 10/01/19 | Aaa/AAA | | | 2,000,000 | | | | 2,039,300 | |

| Oregon State, State Property, ODOT Building, Public Improvements, Series K | | | 5.000% | | 05/01/30 | Aa1/AA+ | | | 1,915,000 | | | | 2,145,796 | |

| Prince Georges County, MD, Public Improvements | | | 4.125% | | 07/15/26 | Aaa/AAA | | | 2,000,000 | | | | 2,094,160 | |

| South Carolina State, Coastal Carolina University, Series A | | | 4.000% | | 04/01/28 | Aaa/AA+ | | | 1,000,000 | | | | 1,034,310 | |

| South Carolina State, Highway, Series A | | | 3.000% | | 08/01/22 | Aaa/AA+ | | | 1,475,000 | | | | 1,485,812 | |

| Tennessee State, Series A | | | 5.000% | | 05/01/26 | Aaa/AA+ | | | 500,000 | | | | 552,355 | |

| Tennessee State, Series A | | | 5.000% | | 05/01/27 | Aaa/AA+ | | | 2,075,000 | | | | 2,292,958 | |

| Tennessee State, Series A | | | 4.000% | | 05/01/28 | Aaa/AA+ | | | 2,000,000 | | | | 2,047,740 | |

| Tennessee State, Series A | | | 3.625% | | 05/01/31 | Aaa/AA+ | | | 2,000,000 | | | | 1,928,820 | |

| Texas, Water Financial Assistance, Series C-1 | | | 5.000% | | 08/01/39 | Aaa/AA+ | | | 3,515,000 | | | | 3,755,496 | |

| Utah State, Series A | | | 3.000% | | 07/01/18 | Aaa/AAA | | | 1,000,000 | | | | 1,073,100 | |

| Utah State, Series A | | | 5.000% | | 07/01/23 | Aaa/AAA | | | 2,785,000 | | | | 3,358,264 | |

| Virginia State, Series B | | | 4.250% | | 06/01/26 | Aaa/AAA | | | 2,500,000 | | | | 2,606,150 | |

| Washington State, Series F | | | 4.500% | | 07/01/27 | Aa1/AA+ | | | 2,500,000 | | | | 2,616,250 | |

| Washington, Suburban Sanitation District, Water Supply | | | 4.250% | | 06/01/26 | Aaa/AAA | | | 2,500,000 | | | | 2,603,975 | |

| | | | | | | | | | | | | $ | 61,820,526 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | October 31, 2011 |

| | | | | | | | | | | |

| MUNICIPAL BONDS - 93.11% (continued) | | | | | | | | | |

Prerefunded2 Issues - 17.25% | | | | | | | | | | | |

| Arlington County, VA, Public Improvements, 01/15/13 @ 100 | | | 4.500% | | 01/15/28 | Aaa/AA+ | | $ | 400,000 | | | $ | 420,012 | |

| Dallas, TX, 02/15/12 @ 100 | | | 4.000% | | 02/15/16 | Aa1/AA+ | | | 2,450,000 | | | | 2,476,828 | |

| Delaware State, Series A, 01/01/12 @ 100 | | | 4.200% | | 01/01/20 | Aaa/AAA | | | 1,675,000 | | | | 1,686,223 | |

| Gwinnett County, GA, Water & Sewer Authority, 08/01/12 @ 100 | | | 5.250% | | 08/01/24 | Aaa/AAA | | | 1,500,000 | | | | 1,556,295 | |

| Maryland State, Capital Improvements, Series A, 02/15/12 @ 100 | | | 4.000% | | 02/15/20 | Aaa/AAA | | | 4,000,000 | | | | 4,411,600 | |

Mecklenburg County, NC, Public Improvements, Series A,

02/01/14 @ 100 | | | 4.000% | | 02/01/20 | Aaa/AAA | | | 3,000,000 | | | | 3,123,540 | |

Montgomery County, MD, Public Improvements, Series A,

05/01/13 @ 100 | | | 4.000% | | 05/01/21 | Aaa/AAA | | | 2,450,000 | | | | 2,583,745 | |

| Salt Lake City, UT, School District, School Board Guaranty, Series A, 03/01/13 @ 100 | | | 4.500% | | 03/01/20 | Aaa/NR | | | 2,240,000 | | | | 2,363,290 | |

| | | | | | | | | | | | | $ | 18,621,533 | |

| Revenue Bonds - 18.59% | | | | | | | | | | | | | | |

| Colorado, Water Resources & Power Development Authority, Series A | | | 4.000% | | 09/01/29 | Aaa/AAA | | $ | 2,000,000 | | | $ | 2,012,500 | |

| Fairfax County, VA, Water Authority Water Revenue | | | 4.500% | | 04/01/27 | Aaa/AAA | | | 2,500,000 | | | | 2,636,850 | |

| Florida, Water Pollution Control Financing, Series A | | | 5.000% | | 01/15/29 | Aaa/AAA | | | 500,000 | | | | 548,210 | |

| Florida, Water Pollution Control Financing, Series A | | | 5.100% | | 01/15/29 | Aaa/AAA | | | 550,000 | | | | 606,507 | |

| Gwinnett County, GA, Water & Sewer Authority, Series A | | | 4.000% | | 08/01/28 | Aaa/AAA | | | 2,000,000 | | | | 2,061,100 | |

| Kansas State, Development Finance Authority, Series DW-1 | | | 3.000% | | 04/01/20 | Aaa/AAA | | | 2,865,000 | | | | 2,956,938 | |

| Kansas State, Development Finance Authority, Series DW-1 | | | 3.125% | | 04/01/22 | Aaa/AAA | | | 2,975,000 | | | | 3,022,481 | |

| Texas, Water Development Board Revenue, State Revolving Fund-Senior Lien, Series A | | | 4.750% | | 07/15/20 | Aaa/AAA | | | 3,000,000 | | | | 3,005,760 | |

| Virginia State Resources Authority Clean Water Revenue | | | 4.500% | | 10/01/28 | Aaa/AAA | | | 3,000,000 | | | | 3,211,140 | |

| | | | | | | | | | | | | $ | 20,061,486 | |

| | | | | | | | | | | | | | | |

| Total Municipal Bonds (Cost $95,892,628) | | | $ | 100,503,545 | |

| | | | | | | | | | | | | | | |

| US TREASURY OBLIGATIONS - 4.64% | | | | | | | | | | | |

US Treasury Notes (Cost $5,011,169) | | | 0.375% | | 08/31/12 | — | | $ | 5,000,000 | | | $ | 5,010,355 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | October 31, 2011 |

| | | | | | |

| REPURCHASE AGREEMENTS - 1.36% | | | | | | |

| JPMorgan Chase, N.A. | | | | | | |

Dated 10/31/11, 0.03%, principal and interest in the amount of $1,467,001 to be repurchased 11/01/11, collateralized by US Treasury Inflation-Protected Note, par value of $1,145,000 due 07/15/16 with a value of $1,499,136 (Cost $1,467,000) | | $ | 1,467,000 | | | $ | 1,467,000 | |

| | | | | | | | | |

| Total Investments - 99.11% (Cost $102,370,797)* | | | $ | 106,980,900 | |

| Other Assets in Excess of Liabilities - 0.89% | | | | 965,447 | |

| Net Assets - 100.00% | | | $ | 107,946,347 | |

| 1 | Moody’s Municipal Bond Ratings: |

| | | | |

| | | Aaa | Judged to be of the best quality. |

| | | | |

| | | Aa | Judged to be of high quality by all standards. Issues are sometimes denoted with a 1, 2 or 3, which denote a high, medium or low ranking within the rating. |

| | | | |

| | S&P Municipal Bond Ratings: |

| | | | |

| | | AAA | Of the highest quality. |

| | | | |

| | | AA | The second strongest capacity of payment of debt services. Those issues determined to possess very strong safety characteristics are denoted with a plus (+) sign. |

| | | | |

| | | NR | Bond is not rated by this rating organization. |

| | | | |

| 2 | Prerefunded: Bonds which are prerefunded are collateralized by US Treasury securities which are held in escrow and are used to pay principal and interest on tax-exempt issues and to retire the bonds in full at the earliest refunding date. |

| | |

| * | Cost for Federal income tax purposes is $102,370,797 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 4,754,026 | |

| Gross Unrealized Depreciation | | | (143,923 | ) |

| Net Unrealized Appreciation | | $ | 4,610,103 | |

See Notes to Financial Statements.

| North American Government Bond Fund |

| Schedule of Investments | October 31, 2011 |

| | | | | | | | | |

| CANADIAN SECURITIES - 18.38% | | | | | | | | | |

| Canadian Government Bonds | | | 1.500% | 03/01/12 | | CAD | 2,000,000 | | | $ | 2,010,414 | |

| Canadian Government Bonds | | | 1.500% | 06/01/12 | | | 2,000,000 | | | | 2,013,082 | |

| Canadian Government Bonds | | | 3.750% | 06/01/12 | | | 7,500,000 | | | | 7,646,802 | |

| Canadian Government Bonds | | | 3.500% | 06/01/13 | | | 3,100,000 | | | | 3,232,304 | |

| Canadian Government Bonds | | | 4.000% | 06/01/17 | | | 9,000,000 | | | | 10,140,045 | |

| Canadian Government Bonds | | | 3.250% | 06/01/21 | | | 1,950,000 | | | | 2,111,400 | |

| | | | | | | | | | | | | |

| Total Canadian Securities (Cost $25,402,646) | | | $ | 27,154,047 | |

| | | | | | | | | | | | | |

| MEXICAN SECURITIES - 11.69% | | | | | | | | | | | | |

Mexican Bono2 | | | 9.000% | 12/20/12 | | MXN | 31,782,400 | | | $ | 2,504,370 | |

Mexican Bono2 | | | 8.000% | 12/19/13 | | | 17,850,000 | | | | 1,433,651 | |

Mexican Bono2 | | | 6.000% | 06/18/15 | | | 23,850,000 | | | | 1,863,285 | |

Mexican Bono2 | | | 8.000% | 12/17/15 | | | 93,907,000 | | | | 7,833,128 | |

Mexican Bono2 | | | 7.250% | 12/15/16 | | | 44,050,000 | | | | 3,630,854 | |

| | | | | | | | | | | | | |

| Total Mexican Securities (Cost $18,509,286) | | | $ | 17,265,288 | |

| | | | | | | | | | | | | |

| US TREASURY OBLIGATIONS - 65.57% | | | | | | | | | |

| US Treasury Notes | | | 0.375% | 08/31/12 | | $ | 4,000,000 | | | $ | 4,008,284 | |

| US Treasury Notes | | | 2.250% | 11/30/17 | | | 24,200,000 | | | | 25,474,275 | |

| US Treasury Notes | | | 2.625% | 08/15/20 | | | 10,850,000 | | | | 11,417,086 | |

| US Treasury Bonds | | | 8.750% | 05/15/17 | | | 12,800,000 | | | | 18,033,997 | |

| US Treasury Bonds | | | 8.875% | 08/15/17 | | | 10,300,000 | | | | 14,723,366 | |

| US Treasury Bonds | | | 8.125% | 08/15/19 | | | 6,500,000 | | | | 9,549,924 | |

| US Treasury Bonds | | | 8.500% | 02/15/20 | | | 6,000,000 | | | | 9,102,186 | |

| US Treasury Bonds | | | 8.750% | 08/15/20 | | | 2,300,000 | | | | 3,571,109 | |

| US Treasury Bonds | | | 7.875% | 02/15/21 | | | 650,000 | | | | 972,867 | |

| | | | | | | | | | | | | |

| Total US Treasury Obligations (Cost $90,946,799) | | | $ | 96,853,094 | |

See Notes to Financial Statements.

| North American Government Bond Fund |

| Schedule of Investments (continued) | October 31, 2011 |

| | | | | | |

| REPURCHASE AGREEMENTS - 3.26% | | | | | | |

| JPMorgan Chase, N.A. | | | | | | |

Dated 10/31/11, 0.03%, principal and interest in the amount of $4,817,004 to be repurchased 11/01/11, collateralized by US Treasury Inflation-Protected Note, par value of $3,755,000 due 07/15/16 with a value of $4,916,379 (Cost $4,817,000) | | $ | 4,817,000 | | | $ | 4,817,000 | |

| | | | | | | | | |

| Total Investments - 98.90% (Cost $139,675,731)* | | | $ | 146,089,429 | |

| Other Assets in Excess of Liabilities - 1.10% | | | | 1,621,791 | |

| Net Assets - 100.00% | | | $ | 147,711,220 | |

| CAD | Canadian dollar |

| | |

| MXN | Mexican peso |

| 1 | Principal Amount is shown in US dollars unless otherwise noted. |

| | |

| 2 | Bonos are fixed rate, local currency-denominated coupon bonds issued by the Mexican government. |

| | |

| * | Cost for Federal income tax purposes is $139,675,731 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 7,658,347 | |

| Gross Unrealized Depreciation | | | (1,244,649 | ) |

| Net Unrealized Appreciation | | $ | 6,413,698 | |

See Notes to Financial Statements.

| Schedule of Investments | October 31, 2011 |

| | | | | | |

| COMMON STOCKS - 94.43% | | | | |

| Consumer Discretionary - 13.09% | | | | |

| Automobiles - 0.09% | | | | | | |

| Ford Motor Co.* | | | 4,400 | | | $ | 51,392 | |

| | | | | | | | | |

| Distributors - 0.22% | | | | | | | | |

| LKQ Corp.* | | | 4,400 | | | | 128,392 | |

| | |

| Diversified Consumer Services - 0.31% | |

| ITT Educational Services, Inc.* | | | 1,700 | | | | 105,332 | |

| Weight Watchers International, Inc. | | | 1,000 | | | | 74,620 | |

| | | | | | | | 179,952 | |

| Hotels, Restaurants & Leisure - 4.50% | |

| Ameristar Casinos, Inc. | | | 10,780 | | | | 199,430 | |

| Brinker International, Inc. | | | 1,170 | | | | 26,793 | |

| Chipotle Mexican Grill, Inc.* | | | 1,000 | | | | 336,120 | |

| Choice Hotels International, Inc. | | | 1,970 | | | | 70,506 | |

| International Game Technology | | | 11,650 | | | | 204,924 | |

| Las Vegas Sands Corp.* | | | 6,880 | | | | 323,016 | |

| Marriott International, Inc. - Class A | | | 4,806 | | | | 151,389 | |

| McDonald's Corp. | | | 12,176 | | | | 1,130,542 | |

| Wynn Resorts Ltd. | | | 1,000 | | | | 132,800 | |

| | | | | | | | 2,575,520 | |

| Internet & Catalog Retail - 0.42% | |

| Blue Nile, Inc.* | | | 1,500 | | | | 67,695 | |

| Expedia, Inc. | | | 3,195 | | | | 83,901 | |

| HSN, Inc.* | | | 1,600 | | | | 57,072 | |

| Overstock.com, Inc.* | | | 4,057 | | | | 33,673 | |

| | | | | | | | 242,341 | |

| Media - 3.06% | |

| AMC Networks, Inc. - Class A* | | | 2,264 | | | | 73,852 | |

| Cablevision Systems Corp. - New York Group - Class A | | | 9,058 | | | | 131,069 | |

| CBS Corp. - Class B - Non-Voting Shares | | | 5,413 | | | | 139,709 | |

| Comcast Corp. - Class A | | | 11,050 | | | | 259,122 | |

| DIRECTV - Class A* | | | 11,760 | | | | 534,610 | |

| Interpublic Group of Cos., Inc. (The) | | | 95 | | | | 901 | |

| | |

| Media - 3.06%(continued) | |

| Liberty Global, Inc. - Class A* | | | 4,066 | | | $ | 163,372 | |

| Liberty Media Corp. - Liberty Starz - Series A* | | | 846 | | | | 57,782 | |

| News Corp. - Class A | | | 605 | | | | 10,600 | |

| Scholastic Corp. | | | 1,100 | | | | 29,535 | |

| Sirius XM Radio, Inc.* | | | 41,300 | | | | 73,927 | |

| Time Warner Cable, Inc. | | | 883 | | | | 56,238 | |

| Virgin Media, Inc. | | | 650 | | | | 15,847 | |

| Walt Disney Co. (The) | | | 5,113 | | | | 178,341 | |

| World Wrestling Entertainment, Inc. | | | 2,510 | | | | 26,380 | |

| | | | | | | | 1,751,285 | |

| Multi-Line Retail - 0.88% | |

| Dollar General Corp.* | | | 2,595 | | | | 102,918 | |

| Dollar Tree, Inc.* | | | 1,240 | | | | 99,150 | |

| Macy's, Inc. | | | 3,000 | | | | 91,590 | |

| Nordstrom, Inc. | | | 2,800 | | | | 141,932 | |

| Target Corp. | | | 1,251 | | | | 68,492 | |

| | | | | | | | 504,082 | |

| Specialty Retail - 3.04% | |

| Abercrombie & Fitch Co. - Class A | | | 100 | | | | 7,440 | |

| AutoZone, Inc.* | | | 1,000 | | | | 323,590 | |

| Bed Bath & Beyond, Inc.* | | | 1,800 | | | | 111,312 | |

| Buckle, Inc. (The) | | | 1,000 | | | | 44,560 | |

| Chico's FAS, Inc. | | | 3,000 | | | | 37,080 | |

| Express, Inc. | | | 2,800 | | | | 63,252 | |

| Finish Line, Inc. (The) - Class A | | | 1,100 | | | | 22,110 | |

| Foot Locker, Inc. | | | 3,232 | | | | 70,652 | |

| Gap, Inc. (The) | | | 7,669 | | | | 144,944 | |

| Hibbett Sports, Inc.* | | | 1,500 | | | | 61,785 | |

| Home Depot, Inc. (The) | | | 5,113 | | | | 183,045 | |

| Limited Brands, Inc. | | | 2,500 | | | | 106,775 | |

| Lowe's Cos., Inc. | | | 4,110 | | | | 86,392 | |

| PetSmart, Inc. | | | 2,500 | | | | 117,375 | |

| Systemax, Inc.* | | | 4,121 | | | | 62,351 | |

| Tiffany & Co. | | | 1,100 | | | | 87,703 | |

| Ulta Salon, Cosmetics & Fragrance, Inc.* | | | 1,000 | | | | 67,290 | |

| Williams-Sonoma, Inc. | | | 2,700 | | | | 101,358 | |

| Zumiez, Inc.* | | | 1,800 | | | | 40,950 | |

| | | | | | | | 1,739,964 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| COMMON STOCKS - 94.43% (continued) | |

| Consumer Discretionary - 13.09% (continued) | |

| Textiles, Apparel & Luxury Goods - 0.57% | |

| NIKE, Inc. - Class B | | | 2,500 | | | $ | 240,875 | |

| Under Armour, Inc. - Class A* | | | 1,000 | | | | 84,410 | |

| | | | | | | | 325,285 | |

| Consumer Staples - 11.47% | | | | | | | | |

| Beverages - 2.07% | | | | | | | | |

| Beam, Inc. | | | 5,113 | | | | 252,736 | |

| Coca-Cola Co. (The) | | | 2,500 | | | | 170,800 | |

| Coca-Cola Enterprises, Inc. | | | 10,720 | | | | 287,510 | |

| Constellation Brands, Inc.* | | | 12,250 | | | | 247,695 | |

| Hansen Natural Corp.* | | | 1,600 | | | | 142,544 | |

| PepsiCo, Inc. | | | 1,328 | | | | 83,598 | |

| | | | | | | | 1,184,883 | |

| Food & Staples Retailing - 2.69% | |

| CVS Caremark Corp. | | | 200 | | | | 7,260 | |

| Kroger Co. (The) | | | 2,600 | | | | 60,268 | |

| Sysco Corp. | | | 2,100 | | | | 58,212 | |

| Wal-Mart Stores, Inc. | | | 18,606 | | | | 1,055,332 | |

| Walgreen Co. | | | 3,700 | | | | 122,840 | |

| Whole Foods Market, Inc. | | | 3,300 | | | | 237,996 | |

| | | | | | | | 1,541,908 | |

| Food Products - 1.72% | | | | | | | | |

| General Mills, Inc. | | | 4,926 | | | | 189,799 | |

| Hershey Co. (The) | | | 5,113 | | | | 292,617 | |

| Hormel Foods Corp. | | | 10,226 | | | | 301,360 | |

| McCormick & Co., Inc. - Non-Voting Shares | | | 1,598 | | | | 77,599 | |

| Smart Balance, Inc.* | | | 2,090 | | | | 13,689 | |

| Tyson Foods, Inc. - Class A | | | 5,500 | | | | 106,150 | |

| | | | | | | | 981,214 | |

| Household Products - 1.23% | | | | | | | | |

| Procter & Gamble Co. (The) | | | 11,021 | | | | 705,234 | |

| | | | | | | | | |

| Personal Products - 0.69% | | | | | | | | |

| Herbalife Ltd. | | | 6,032 | | | | 376,156 | |

| Revlon, Inc. - Class A* | | | 1,200 | | | | 17,676 | |

| | | | | | | | 393,832 | |

| Tobacco - 3.07% | | | | | | | | |

| Altria Group, Inc. | | | 5,252 | | | | 144,693 | |

| Philip Morris International, Inc. | | | 16,689 | | | | 1,166,060 | |

| Reynolds American, Inc. | | | 10,326 | | | | 399,410 | |

| Vector Group Ltd. | | | 2,790 | | | | 49,020 | |

| | | | | | | | 1,759,183 | |

| Energy - 10.23% | | | | | | | | |

| Energy Equipment & Services - 1.35% | |

| Bristow Group, Inc. | | | 1,120 | | | $ | 55,754 | |

| Complete Production Services, Inc.* | | | 1,695 | | | | 55,596 | |

| Diamond Offshore Drilling, Inc. | | | 1,000 | | | | 65,540 | |

| Halliburton Co. | | | 4,200 | | | | 156,912 | |

| McDermott International, Inc.* | | | 4,600 | | | | 50,508 | |

| Newpark Resources, Inc.* | | | 1,000 | | | | 8,930 | |

| Patterson-UTI Energy, Inc. | | | 1,270 | | | | 25,806 | |

| RPC, Inc. | | | 11,620 | | | | 215,783 | |

| SEACOR Holdings, Inc. | | | 1,000 | | | | 85,150 | |

| Unit Corp.* | | | 1,100 | | | | 53,966 | |

| | | | | | | | 773,945 | |

| Oil, Gas & Consumable Fuels - 8.88% | |

| Berry Petroleum Co. - Class A | | | 3,060 | | | | 105,723 | |

| Chesapeake Energy Corp. | | | 6,600 | | | | 185,592 | |

| Chevron Corp. | | | 8,502 | | | | 893,135 | |

| ConocoPhillips | | | 8,950 | | | | 623,367 | |

| Continental Resources, Inc.* | | | 4,110 | | | | 249,271 | |

| Crosstex Energy, Inc. | | | 6,500 | | | | 84,695 | |

| Enbridge Energy Management LLC* | | | 1,290 | | | | 39,758 | |

| Energy XXI (Bermuda) Ltd.* | | | 1,900 | | | | 55,803 | |

| Exxon Mobil Corp. | | | 19,841 | | | | 1,549,384 | |

| Kinder Morgan, Inc. | | | 1,310 | | | | 37,466 | |

| Marathon Oil Corp. | | | 8,223 | | | | 214,045 | |

| Marathon Petroleum Corp. | | | 4,111 | | | | 147,585 | |

| McMoRan Exploration Co.* | | | 5,000 | | | | 60,900 | |

| Murphy Oil Corp. | | | 2,400 | | | | 132,888 | |

| Quicksilver Resources, Inc.* | | | 10,000 | | | | 77,000 | |

| Rex Energy Corp.* | | | 1,570 | | | | 24,304 | |

| Ship Finance International Ltd. | | | 5,112 | | | | 73,153 | |

| Southern Union Co. | | | 2,100 | | | | 88,263 | |

| Southwestern Energy Co.* | | | 500 | | | | 21,020 | |

| Spectra Energy Corp. | | | 1,860 | | | | 53,252 | |

| Tesoro Corp.* | | | 3,390 | | | | 87,936 | |

| W&T Offshore, Inc. | | | 2,500 | | | | 49,225 | |

| Whiting Petroleum Corp.* | | | 2,000 | | | | 93,100 | |

| World Fuel Services Corp. | | | 3,500 | | | | 139,475 | |

| | | | | | | | 5,086,340 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| COMMON STOCKS - 94.43% (continued) | |

| Financials - 13.19% | | | | | | | | |

| Capital Markets - 2.33% | | | | | | | | |

| American Capital Ltd.* | | | 12,300 | | | $ | 95,571 | |

| Artio Global Investors, Inc. | | | 6,600 | | | | 48,312 | |

| BlackRock, Inc. - Class A | | | 2,346 | | | | 370,175 | |

| Charles Schwab Corp. (The) | | | 14,435 | | | | 177,262 | |

| Invesco Ltd. | | | 4,511 | | | | 90,536 | |

| Morgan Stanley | | | 4,612 | | | | 81,356 | |

| SEI Investments Co. | | | 6,566 | | | | 106,303 | |

| TD AMERITRADE Holding Corp. | | | 21,690 | | | | 363,958 | |

| | | | | | | | 1,333,473 | |

| Commercial Banks - 2.08% | | | | | | | | |

| Centerstate Banks, Inc. | | | 496 | | | | 2,817 | |

| Cullen/Frost Bankers, Inc. | | | 5,263 | | | | 258,098 | |

| First Horizon National Corp. | | | 11,600 | | | | 81,084 | |

| FirstMerit Corp. | | | 3,500 | | | | 49,035 | |

| MB Financial, Inc. | | | 4,900 | | | | 81,193 | |

| Susquehanna Bancshares, Inc. | | | 6,112 | | | | 44,373 | |

| SVB Financial Group* | | | 4,700 | | | | 215,918 | |

| Webster Financial Corp. | | | 3,000 | | | | 58,920 | |

| Wells Fargo & Co. | | | 15,363 | | | | 398,055 | |

| | | | | | | | 1,189,493 | |

| Consumer Finance - 0.48% | | | | | | | | |

| Advance America Cash Advance Centers, Inc. | | | 3,360 | | | | 28,325 | |

| DFC Global Corp.* | | | 2,400 | | | | 52,608 | |

| Discover Financial Services | | | 8,240 | | | | 194,134 | |

| | | | | | | | 275,067 | |

| Diversified Financial Services - 2.36% | |

| Bank of America Corp. | | | 35,721 | | | | 243,974 | |

| CBOE Holdings, Inc. | | | 3,400 | | | | 88,842 | |

| Citigroup, Inc. | | | 1,470 | | | | 46,437 | |

| CME Group, Inc. | | | 852 | | | | 234,777 | |

| JPMorgan Chase & Co. | | | 20,881 | | | | 725,824 | |

| Leucadia National Corp. | | | 500 | | | | 13,415 | |

| | | | | | | | 1,353,269 | |

| Insurance - 3.36% | | | | | | | | |

| Allstate Corp. (The) | | | 2,400 | | | | 63,216 | |

| American Equity Investment Life Holding Co. | | | 10,400 | | | | 112,736 | |

| Brown & Brown, Inc. | | | 14,000 | | | | 309,120 | |

| Cincinnati Financial Corp. | | | 4,712 | | | | 136,365 | |

| Insurance - 3.36% (continued) | |

| CNA Financial Corp. | | | 4,100 | | | $ | 109,060 | |

| CNO Financial Group, Inc.* | | | 15,600 | | | | 97,500 | |

| Loews Corp. | | | 7,920 | | | | 314,424 | |

| MetLife, Inc. | | | 75 | | | | 2,637 | |

| ProAssurance Corp. | | | 5,648 | | | | 432,354 | |

| Protective Life Corp. | | | 6,280 | | | | 116,808 | |

| Prudential Financial, Inc. | | | 4,163 | | | | 225,635 | |

| StanCorp Financial Group, Inc. | | | 101 | | | | 3,428 | |

| | | | | | | | 1,923,283 | |

| Real Estate Investment Trusts - 1.85% | |

| American Capital Agency Corp. | | | 14,250 | | | | 392,017 | |

| Hatteras Financial Corp. | | | 9,368 | | | | 240,758 | |

| National Retail Properties, Inc. | | | 2,550 | | | | 69,488 | |

| Public Storage | | | 2,760 | | | | 356,178 | |

| | | | | | | | 1,058,441 | |

| Thrifts & Mortgage Finance - 0.73% | |

| First Niagara Financial Group, Inc. | | | 4,113 | | | | 37,799 | |

| New York Community Bancorp, Inc. | | | 21,800 | | | | 290,158 | |

| TFS Financial Corp.* | | | 10,000 | | | | 92,100 | |

| | | | | | | | 420,057 | |

| Health Care - 11.92% | | | | | | | | |

| Biotechnology - 1.63% | | | | | | | | |

| Acorda Therapeutics, Inc.* | | | 3,000 | | | | 65,520 | |

| Amylin Pharmaceuticals, Inc.* | | | 7,300 | | | | 84,096 | |

| Biogen Idec, Inc.* | | | 1,910 | | | | 222,248 | |

| Cepheid, Inc.* | | | 5,080 | | | | 182,270 | |

| Cubist Pharmaceuticals, Inc.* | | | 2,160 | | | | 81,670 | |

| Emergent Biosolutions, Inc.* | | | 1,000 | | | | 18,860 | |

| Incyte Corp.* | | | 4,100 | | | | 56,457 | |

| Maxygen, Inc. | | | 10,230 | | | | 60,357 | |

| Momenta Pharmaceuticals, Inc.* | | | 5,410 | | | | 80,068 | |

| Myriad Genetics, Inc.* | | | 3,000 | | | | 63,840 | |

| Neurocrine Biosciences, Inc.* | | | 2,900 | | | | 18,154 | |

| | | | | | | | 933,540 | |

| Health Care Equipment & Supplies - 1.29% | |

| Baxter International, Inc. | | | 502 | | | | 27,600 | |

| IDEXX Laboratories, Inc.* | | | 5,163 | | | | 371,684 | |

| Meridian Bioscience, Inc. | | | 3,105 | | | | 56,573 | |

| Sirona Dental Systems, Inc.* | | | 4,800 | | | | 229,920 | |

| STERIS Corp. | | | 1,748 | | | | 54,153 | |

| | | | | | | | 739,930 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| COMMON STOCKS - 94.43% (continued) | |

| Health Care - 11.92% (continued) | |

| Health Care Providers & Services - 3.11% | |

| AmerisourceBergen Corp. | | | 10,700 | | | $ | 436,560 | |

| Catalyst Health Solutions, Inc.* | | | 2,500 | | | | 137,425 | |

| Community Health Systems, Inc.* | | | 4,900 | | | | 85,652 | |

| Express Scripts, Inc.* | | | 1,500 | | | | 68,595 | |

| Health Management Associates, Inc. - Class A* | | | 12,000 | | | | 105,120 | |

| Health Net, Inc.* | | | 1,800 | | | | 50,022 | |

| LifePoint Hospitals, Inc.* | | | 2,000 | | | | 77,320 | |

| Magellan Health Services, Inc.* | | | 3,100 | | | | 159,557 | |

| McKesson Corp. | | | 1,200 | | | | 97,860 | |

| Medco Health Solutions, Inc.* | | | 1,230 | | | | 67,478 | |

| MEDNAX, Inc.* | | | 2,900 | | | | 190,820 | |

| Omnicare, Inc. | | | 100 | | | | 2,982 | |

| Owens & Minor, Inc. | | | 1,100 | | | | 32,912 | |

| Select Medical Holdings Corp.* | | | 7,900 | | | | 68,730 | |

| Team Health Holdings, Inc.* | | | 6,600 | | | | 134,112 | |

| Tenet Healthcare Corp.* | | | 13,990 | | | | 66,172 | |

| | | | | | | | 1,781,317 | |

| Health Care Technology - 0.46% | |

| Allscripts Healthcare Solutions, Inc.* | | | 12,450 | | | | 238,418 | |

| Omnicell, Inc.* | | | 1,600 | | | | 23,920 | |

| | | | | | | | 262,338 | |

| Life Sciences Tools & Services - 0.47% | |

| Bruker Corp.* | | | 9,470 | | | | 136,652 | |

| Pharmaceutical Product Development, Inc. | | | 4,000 | | | | 131,960 | |

| | | | | | | | 268,612 | |

| Pharmaceuticals - 4.96% | | | | | | | | |

| Abbott Laboratories | | | 4,546 | | | | 244,893 | |

| Allergan, Inc. | | | 921 | | | | 77,475 | |

| Bristol-Myers Squibb Co. | | | 2,803 | | | | 88,547 | |

| Forest Laboratories, Inc.* | | | 7,200 | | | | 225,360 | |

| Johnson & Johnson | | | 13,038 | | | | 839,517 | |

| Medicis Pharmaceutical Corp. - Class A | | | 2,500 | | | | 95,725 | |

| Merck & Co., Inc. | | | 13,102 | | | | 452,019 | |

| Pfizer, Inc. | | | 36,340 | | | | 699,908 | |

| Pharmaceuticals - 4.96% (continued) | |

| Salix Pharmaceuticals Ltd.* | | | 1,400 | | | $ | 47,957 | |

| ViroPharma, Inc.* | | | 3,400 | | | | 68,816 | |

| | | | | | | | 2,840,217 | |

| Industrials - 9.91% | | | | | | | | |

| Aerospace & Defense - 2.15% | |

| AAR Corp. | | | 2,052 | | | | 40,896 | |

| Alliant Techsystems, Inc. | | | 4,300 | | | | 249,744 | |

| Boeing Co. (The) | | | 1,300 | | | | 85,527 | |

| Goodrich Corp. | | | 1,153 | | | | 141,392 | |

| Honeywell International, Inc. | | | 3,609 | | | | 189,112 | |

| Huntington Ingalls Industries, Inc.* | | | 718 | | | | 21,181 | |

| Northrop Grumman Corp. | | | 4,311 | | | | 248,960 | |

| Taser International, Inc.* | | | 2,110 | | | | 10,487 | |

| United Technologies Corp. | | | 3,108 | | | | 242,362 | |

| | | | | | | | 1,229,661 | |

| Air Freight & Logistics - 0.43% | |

| FedEx Corp. | | | 856 | | | | 70,046 | |

| United Parcel Service, Inc. - Class B | | | 2,500 | | | | 175,600 | |

| | | | | | | | 245,646 | |

| Airlines - 0.15% | | | | | | | | |

| United Continental Holdings, Inc.* | | | 4,502 | | | | 86,979 | |

| | | | | | | | | |

| Building Products - 0.30% | | | | | | | | |

| Fortune Brands Home & Security, Inc.* | | | 5,113 | | | | 74,292 | |

| Griffon Corp.* | | | 4,700 | | | | 44,509 | |

| Simpson Manufacturing Co., Inc. | | | 1,710 | | | | 52,428 | |

| | | | | | | | 171,229 | |

| Commercial Services & Supplies - 0.38% | |

| ABM Industries, Inc. | | | 500 | | | | 10,110 | |

| Geo Group, Inc. (The)* | | | 2,900 | | | | 52,867 | |

| United Stationers, Inc. | | | 2,400 | | | | 76,344 | |

| US Ecology, Inc. | | | 540 | | | | 9,752 | |

| Viad Corp. | | | 3,300 | | | | 69,069 | |

| | | | | | | | 218,142 | |

| Construction & Engineering - 0.22% | |

| Aecom Technology Corp.* | | | 2,000 | | | | 41,840 | |

| Tutor Perini Corp. | | | 5,800 | | | | 84,274 | |

| | | | | | | | 126,114 | |

| Industrial Conglomerates - 1.03% | |

| 3M Co. | | | 2,456 | | | | 194,073 | |

| General Electric Co. | | | 23,560 | | | | 393,688 | |

| | | | | | | | 587,761 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| COMMON STOCKS - 94.43% (continued) | |

| Industrials - 9.91% (continued) | |

| Machinery - 2.38% | | | | | | | | |

| Actuant Corp. - Class A | | | 2,000 | | | $ | 45,000 | |

| Blount International, Inc.* | | | 3,800 | | | | 59,014 | |

| Briggs & Stratton Corp. | | | 2,900 | | | | 42,340 | |

| Caterpillar, Inc. | | | 3,567 | | | | 336,939 | |

| CLARCOR, Inc. | | | 1,790 | | | | 86,779 | |

| Graco, Inc. | | | 3,490 | | | | 149,861 | |

| Illinois Tool Works, Inc. | | | 1,191 | | | | 57,918 | |

| Joy Global, Inc. | | | 5,163 | | | | 450,213 | |

| Mueller Industries, Inc. | | | 3,300 | | | | 133,485 | |

| | | | | | | | 1,361,549 | |

| Professional Services - 0.99% | |

| Acacia Research - Acacia Technologies* | | | 2,800 | | | | 111,552 | |

| FTI Consulting, Inc.* | | | 1,470 | | | | 57,933 | |

| Mistras Group, Inc.* | | | 1,200 | | | | 26,160 | |

| Verisk Analytics, Inc. - Class A* | | | 10,600 | | | | 372,590 | |

| | | | | | | | 568,235 | |

| Road & Rail - 0.80% | | | | | | | | |

| Knight Transportation, Inc. | | | 2,850 | | | | 43,320 | |

| Landstar System, Inc. | | | 1,690 | | | | 75,425 | |

| Union Pacific Corp. | | | 3,400 | | | | 338,538 | |

| | | | | | | | 457,283 | |

| Trading Companies & Distributors - 1.08% | |

| Aircastle Ltd. | | | 597 | | | | 7,242 | |

| Fastenal Co. | | | 10,726 | | | | 408,553 | |

| Titan Machinery, Inc.* | | | 500 | | | | 11,665 | |

| Watsco, Inc. | | | 1,330 | | | | 82,008 | |

| WESCO International, Inc.* | | | 2,300 | | | | 111,458 | |

| | | | | | | | 620,926 | |

| Information Technology - 16.45% | |

| Communications Equipment - 0.21% | |

| Brocade Communications Systems, Inc.* | | | 6,230 | | | | 27,287 | |

| Motorola Solutions, Inc. | | | 2,000 | | | | 93,820 | |

| | | | | | | | 121,107 | |

| Computers & Peripherals - 4.14% | |

| Apple, Inc.* | | | 5,113 | | | | 2,069,640 | |

| Cray, Inc.* | | | 1,280 | | | | 8,102 | |

| Hewlett-Packard Co. | | | 1,700 | | | | 45,237 | |

| Lexmark International, Inc.* | | | 1,700 | | | | 53,890 | |

| NCR Corp.* | | | 3,100 | | | | 59,024 | |

| Computers & Peripherals - 4.14% (continued) | |

| QLogic Corp.* | | | 3,700 | | | $ | 51,689 | |

| STEC, Inc.* | | | 4,120 | | | | 46,639 | |

| Synaptics, Inc.* | | | 1,170 | | | | 39,534 | |

| | | | | | | | 2,373,755 | |

| Electronic Equipment, Instruments & Components - 1.36% | |

| Agilent Technologies, Inc.* | | | 1,768 | | | | 65,540 | |

| Anixter International, Inc.* | | | 200 | | | | 11,738 | |

| AVX Corp. | | | 7,480 | | | | 100,307 | |

| Brightpoint, Inc.* | | | 7,250 | | | | 73,588 | |

| Insight Enterprises, Inc.* | | | 4,800 | | | | 81,120 | |

| Itron, Inc.* | | | 3,130 | | | | 115,153 | |

| Power-One, Inc.* | | | 1,000 | | | | 4,950 | |

| ScanSource, Inc.* | | | 1,674 | | | | 58,188 | |

| Tech Data Corp.* | | | 4,669 | | | | 229,621 | |

| Vishay Intertechnology, Inc.* | | | 3,400 | | | | 36,550 | |

| | | | | | | | 776,755 | |

| Internet Software & Services - 1.92% | |

| Earthlink, Inc. | | | 13,300 | | | | 93,233 | |

| Google, Inc. - Class A* | | | 1,166 | | | | 691,018 | |

| j2 Global Communications, Inc. | | | 1,640 | | | | 50,479 | |

| NIC, Inc. | | | 2,270 | | | | 31,349 | |

| ValueClick, Inc.* | | | 1,000 | | | | 17,600 | |

| WebMD Health Corp.* | | | 1,200 | | | | 43,140 | |

| XO Group, Inc.* | | | 11,050 | | | | 101,992 | |

| Yahoo!, Inc.* | | | 4,400 | | | | 68,816 | |

| | | | | | | | 1,097,627 | |

| IT Services - 3.68% | |

| CACI International, Inc. - Class A* | | | 990 | | | | 54,341 | |

| Cardtronics, Inc.* | | | 2,033 | | | | 50,683 | |

| DST Systems, Inc. | | | 2,500 | | | | 125,475 | |

| Fidelity National Information Services, Inc. | | | 280 | | | | 7,330 | |

| Heartland Payment Systems, Inc. | | | 4,062 | | | | 88,389 | |

| International Business Machines Corp. | | | 8,744 | | | | 1,614,405 | |

| ManTech International Corp. - Class A | | | 1,400 | | | | 49,182 | |

| Teradata Corp.* | | | 1,933 | | | | 115,323 | |

| | | | | | | | 2,105,128 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| COMMON STOCKS - 94.43% (continued) | |

| Information Technology - 16.45% (continued) | |

| Semiconductors & Semiconductor Equipment - 1.93% | |

| Cirrus Logic, Inc.* | | | 976 | | | $ | 16,241 | |

| Intel Corp. | | | 22,959 | | | | 563,414 | |

| Novellus Systems, Inc.* | | | 2,200 | | | | 76,010 | |

| OmniVision Technologies, Inc.* | | | 2,600 | | | | 42,406 | |

| Texas Instruments, Inc. | | | 10,275 | | | | 315,751 | |

| Veeco Instruments, Inc.* | | | 3,540 | | | | 94,482 | |

| | | | | | | | 1,108,304 | |

| Software - 3.21% | |

| ANSYS, Inc.* | | | 5,113 | | | | 277,943 | |

| Blackbaud, Inc. | | | 2,910 | | | | 81,567 | |

| Microsoft Corp. | | | 31,122 | | | | 828,779 | |

| Oracle Corp. | | | 7,169 | | | | 234,928 | |

| Pegasystems, Inc. | | | 1,050 | | | | 39,679 | |

| Quest Software, Inc.* | | | 7,000 | | | | 123,130 | |

| SolarWinds, Inc.* | | | 1,060 | | | | 30,592 | |

| Taleo Corp. - Class A* | | | 900 | | | | 29,160 | |

| Tyler Technologies, Inc.* | | | 6,090 | | | | 192,261 | |

| | | | | | | | 1,838,039 | |

| Materials - 3.68% | | | | | | | | |

| Chemicals - 2.61% | |

| A. Schulman, Inc. | | | 1,958 | | | | 41,333 | |

| CF Industries Holdings, Inc. | | | 1,900 | | | | 308,313 | |

| Cytec Industries, Inc. | | | 5,113 | | | | 228,398 | |

| Dow Chemical Co. (The) | | | 4,169 | | | | 116,232 | |

| Olin Corp. | | | 4,388 | | | | 82,758 | |

| PolyOne Corp. | | | 4,377 | | | | 48,979 | |

| Rockwood Holdings, Inc.* | | | 3,058 | | | | 140,790 | |

| RPM International, Inc. | | | 12,608 | | | | 283,302 | |

| W.R. Grace & Co.* | | | 5,841 | | | | 244,095 | |

| | | | | | | | 1,494,200 | |

| Containers & Packaging - 0.16% | |

| Graphic Packaging Holding Co.* | | | 335 | | | | 1,481 | |

| Silgan Holdings, Inc. | | | 2,490 | | | | 93,474 | |

| | | | | | | | 94,955 | |

| Metals & Mining - 0.91% | | | | | | | | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 2,000 | | | | 80,520 | |

| Hecla Mining Co.* | | | 1,000 | | | | 6,270 | |

| Metals USA Holdings Corp.* | | | 2,600 | | | | 28,314 | |

| Metals & Mining - 0.91% (continued) | |

| Newmont Mining Corp. | | | 1,300 | | | $ | 86,879 | |

| Royal Gold, Inc. | | | 1,595 | | | | 114,170 | |

| Southern Copper Corp. | | | 2,145 | | | | 65,809 | |

| Titanium Metals Corp. | | | 4,512 | | | | 75,576 | |

| Worthington Industries, Inc. | | | 3,559 | | | | 61,499 | |

| | | | | | | | 519,037 | |

| Telecommunication Services - 1.60% | |

| Diversified Telecommunication Services - 1.20% | |

| AT&T, Inc. | | | 1,000 | | | | 29,310 | |

| CenturyLink, Inc. | | | 11,449 | | | | 403,692 | |

| Cogent Communications Group, Inc.* | | | 4,100 | | | | 65,805 | |

| Premiere Global Services, Inc.* | | | 1,010 | | | | 9,150 | |

| Verizon Communications, Inc. | | | 4,800 | | | | 177,504 | |

| | | | | | | | 685,461 | |

| Wireless Telecommunication Services - 0.40% | |

| American Tower Corp. - Class A* | | | 1,900 | | | | 104,690 | |

| MetroPCS Communications, Inc.* | | | 700 | | | | 5,950 | |

| USA Mobility, Inc. | | | 8,970 | | | | 117,238 | |

| | | | | | | | 227,878 | |

| Utilities - 2.89% | | | | | | | | |

| Electric Utilities - 1.28% | |

| Exelon Corp. | | | 7,819 | | | | 347,085 | |

| Northeast Utilities | | | 3,270 | | | | 113,044 | |

| NV Energy, Inc. | | | 7,700 | | | | 123,508 | |

| PPL Corp. | | | 5,113 | | | | 150,169 | |

| | | | | | | | 733,806 | |

| Gas Utilities - 0.32% | | | | | | | | |

| National Fuel Gas Co. | | | 3,010 | | | | 184,483 | |

| | | | | | | | | |

| Multi-Utilities - 0.73% | | | | | | | | |

| Alliant Energy Corp. | | | 2,300 | | | | 93,794 | |

| Ameren Corp. | | | 10,200 | | | | 325,176 | |

| | | | | | | | 418,970 | |

| Water Utilities - 0.56% | | | | | | | | |

| American Water Works Co., Inc. | | | 10,400 | | | | 317,512 | |

| | | | | | | | | |

Total Common Stocks

(Cost $45,331,803) | | | $ | 54,074,331 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | |

| | | | | | | | | |

| US TREASURY OBLIGATIONS - 5.15% | | | | | | | |

| US Treasury Notes | | | 2.000% | 01/31/16 | | $ | 550,000 | | | $ | 578,273 | |

| US Treasury Notes | | | 2.625% | 08/15/20 | | | 300,000 | | | | 315,680 | |

| US Treasury Bonds | | | 8.125% | 08/15/19 | | | 1,400,000 | | | | 2,056,907 | |

| | | | | | |

| Total US Treasury Obligations (Cost $2,739,381) | | | $ | 2,950,860 | |

| | | | | | |

| REPURCHASE AGREEMENTS - 0.50% | | | | | | |

| JPMorgan Chase, N.A. | | | | | | |

Dated 10/31/11, 0.03%, principal and interest in the amount of $284,000 to be repurchased 11/01/11, collateralized by US Treasury Inflation-Protected Note, par value of $225,000 due to 07/15/16 with a value of $294,590 (Cost $284,000) | | $ | 284,000 | | | $ | 284,000 | |

| | | | | | | | | |

| Total Investments - 100.08% (Cost $48,355,184)** | | | $ | 57,309,191 | |

| Liabilities in Excess of Other Assets - (0.08)% | | | | (48,068 | ) |

| Net Assets - 100.00% | | | $ | 57,261,123 | |

| * | Non-income producing security. |

| | |

| ** | Cost for Federal income tax purposes is $48,417,226 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 12,508,142 | |

| Gross Unrealized Depreciation | | | (3,616,177 | ) |

| Net Unrealized Appreciation | | $ | 8,891,965 | |

| | The difference between the federal income tax cost of portfolio investments and the Schedule of Investments cost is due to certain timing differences in the recognition of capital gains and losses under income tax regulations and accounting principles generally accepted in the United States. These timing differences are temporary in nature and are due to the tax deferral of losses on wash sales. |

See Notes to Financial Statements.

| Statements of Assets and Liabilities | October 31, 2011 |

| | | Total Return US Treasury Fund | | | | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At cost | | $ | 79,145,001 | | | $ | 102,370,797 | |

| At value (Note 1) | | $ | 84,204,180 | | | $ | 106,980,900 | |

| Cash | | | 877 | | | | 606 | |

| Interest receivable | | | 667,614 | | | | 1,101,456 | |

| Receivable for capital shares sold | | | 786,772 | | | | 52,957 | |

| Other assets | | | 26,847 | | | | 43,149 | |

| TOTAL ASSETS | | | 85,686,290 | | | | 108,179,068 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Distributions payable | | | 39,557 | | | | 112,216 | |

| Payable for capital shares redeemed | | | 76,880 | | | | 24,999 | |

| Accrued investment advisory fees (Note 2) | | | 19,291 | | | | 36,723 | |

| Accrued distribution fees (Note 2) | | | 18,006 | | | | 22,207 | |

| Accrued administration fees (Note 2) | | | 6,387 | | | | 5,818 | |

| Accrued transfer agent fees (Note 2) | | | 3,564 | | | | 2,459 | |

| Accrued directors' fees (Note 2) | | | 4,541 | | | | 4,834 | |

| Other accrued expenses and liabilities | | | 24,286 | | | | 23,465 | |

| TOTAL LIABILITIES | | | 192,512 | | | | 232,721 | |

| | | | | | | | | |

| NET ASSETS | | $ | 85,493,778 | | | $ | 107,946,347 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 79,167,956 | | | $ | 103,376,811 | |

| Undistributed (distributions in excess of) net investment income | | | — | | | | 690 | |

| Accumulated net realized gains (losses) from security transactions | | | 1,266,643 | | | | (41,257 | ) |

| Net unrealized appreciation on investments | | | 5,059,179 | | | | 4,610,103 | |

| Net assets | | $ | 85,493,778 | | | $ | 107,946,347 | |

See Notes to Financial Statements.

| Statements of Assets and Liabilities (continued) | October 31, 2011 |

| | | Total Return US Treasury Fund | | | | |

| SHARES OF CAPITAL STOCK OUTSTANDING OF $0.001 PAR VALUE | | | | | | |

| ISI Class A Shares (50,000,000 shares authorized) | | | — | | | | 9,685,478 | |

| ISI Class I Shares (5,000,000 shares authorized) | | | — | | | | 334,404 | |

| ISI Shares (115,000,000 shares authorized) | | | 8,239,136 | | | | — | |

| | | | | | | | | |

| NET ASSET VALUE AND REDEMPTION PRICE PER SHARE | | | | | | | | |

| ISI Class A Shares (based on net assets of $104,341,764) | | $ | — | | | $ | 10.77 | |

| ISI Class I Shares (based on net assets of $3,604,583) | | $ | — | | | $ | 10.78 | |

| ISI Shares (based on net assets of $85,493,778) | | $ | 10.38 | | | $ | — | |

| | | | | | | | | |

| MAXIMUM OFFERING PRICE VALUE PER SHARE (100/97) X NET ASSET VALUE PER SHARE | | | | | | | | |

| ISI Class A Shares | | $ | — | | | $ | 11.10 | |

| ISI Shares | | $ | 10.70 | | | $ | — | |

See Notes to Financial Statements.

| Statements of Assets and Liabilities | October 31, 2011 |

| | | North American Government

Bond Fund | | | | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At cost | | $ | 139,675,731 | | | $ | 48,355,184 | |

| At value (Note 1) | | $ | 146,089,429 | | | $ | 57,309,191 | |

| Cash | | | 181 | | | | 319 | |

| Dividends and interest receivable, at value | | | 2,084,820 | | | | 65,982 | |

| Receivable for capital shares sold | | | 26,044 | | | | 128 | |

| Other assets | | | 70,461 | | | | 26,876 | |

| TOTAL ASSETS | | | 148,270,935 | | | | 57,402,496 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Distributions payable | | | 124,437 | | | | — | |

| Payable for capital shares redeemed | | | 267,883 | | | | 82,535 | |

| Accrued investment advisory fees (Note 2) | | | 49,476 | | | | 18,764 | |

| Accrued distribution fees (Note 2) | | | 48,604 | | | | 11,727 | |

| Accrued shareholder servicing fees (Note 2) | | | 3,644 | | | | — | |

| Accrued transfer agent fees (Note 2) | | | 10,269 | | | | 1,291 | |

| Accrued administration fees (Note 2) | | | 9,146 | | | | 3,804 | |