Item 1: Report to Shareholders| Dividend Growth Fund | December 31, 2007 |

The views and opinions in this report were current as of December 31, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

Large-cap stocks generally rose in 2007 despite suffering second-half weakness following the collapse of the subprime lending business and a subsequent flight to quality by investors. Financial stocks were particularly hard hit, as were consumer discretionary companies, which felt the brunt of concerns that a weaker economy would hurt consumer spending. Market volatility was extremely high in the final six months of the year, and in October and November, the broad S&P 500 Index suffered its first correction—a drop of 10% or more—in about five years. For the year, energy, materials, utilities, and information technology were the best performing sectors. Overall, investors favored growth stocks in 2007 rather than value.

Companies are continuing to initiate and add to their dividends, although the trend—which began following the May 2003 tax cuts on dividends and capital gains—slowed somewhat in 2007. Some analysts believe that companies are instead buying back more of their own shares, which allows them greater flexibility than increasing dividends. While we think that share repurchases can be a good use of a company’s free cash flow, we favor dividends—cash in investors’ pockets is a clear demonstration of a company’s commitment to creating value for its shareholders. The number of S&P 500 companies paying a dividend rose to 390 from 383 at the end of 2006, with 287 firms increasing their dividends in 2007. Dividends accounted for nearly two percentage points of the S&P 500 total return during the year.

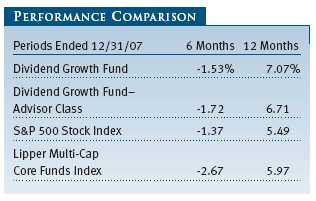

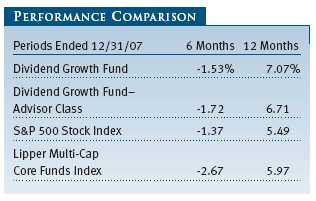

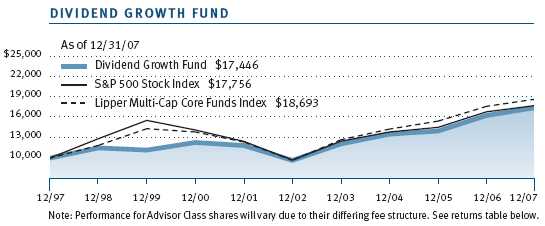

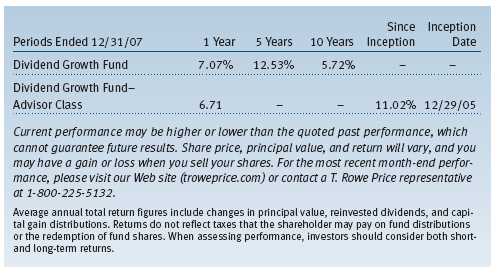

Despite struggling along with the market over the second half of the year, your fund posted a solid gain for the 12 months ended December 31, 2007, outpacing both the S&P 500 Stock Index and its Lipper peer group. (Performance for the Advisor Class was slightly lower due to its differing fee structure.) Stock selection in financials was the primary reason the fund outperformed the S&P 500 for the year, while our heavier allocation versus the broad market benchmark to consumer discretionary stocks hampered relative results. Both our underweight to information technology and stock selection in the sector hurt results relative to the S&P 500 in the most recent six months, while stock selection in financials continued to benefit performance.

HIGHLIGHTS

• U.S. large-cap stocks ended the year with modest gains, despite weakness in the second half due to fears of a slowing economy and the collapse of the subprime lending market.

• The Dividend Growth Fund outpaced the broad market as measured by the S&P 500 Stock Index during 2007, aided by stock selection in the weak financials sector.

• The fund’s top absolute contributors came from the energy and information technology sectors while financials and consumer discretionary stocks stumbled due to the slowing economy.

• The extreme market sell-off early in 2008 is creating opportunities in certain market sectors for the kind of high-quality, consistent growth companies we favor.

ENVIRONMENT

Equities were hobbled throughout 2007 by the implosion of the subprime mortgage market. At the beginning of the year, many companies that loaned to homebuyers with poor credit histories or challenging financial situations acknowledged an increase in defaults and delinquencies. By the summer, major Wall Street firms and commercial banks with exposure to subprime mortgages were reporting substantial losses. In August, liquidity in the asset-backed commercial paper market evaporated. In response, the Federal Reserve reduced short-term interest rates and took other measures to boost liquidity and keep credit market distress from weakening the economy. Concerns about generally slower corporate profit growth and rising oil prices also weighed on the stock market. The boom in leveraged buyouts, which was very supportive for equities in the first half of the year, evaporated due to tighter lending conditions.

In the large-cap universe, energy and materials stocks generated excellent returns, helped by global demand for commodities and rising commodity prices. Technology shares rose strongly, and utilities, which often act like bonds because of their relatively high dividend payouts, performed well as interest rates declined. Consumer staples, industrials and business services, and telecommunication stocks produced solid but milder gains. On the downside, financials fell sharply as banks tightened their lending standards, the housing market continued to weaken, and capital markets companies with exposure to subprime mortgages reported substantial losses. Consumer discretionary shares also declined amid concerns that a weaker economy and high energy costs would discourage consumer spending.

PERFORMANCE REVIEW

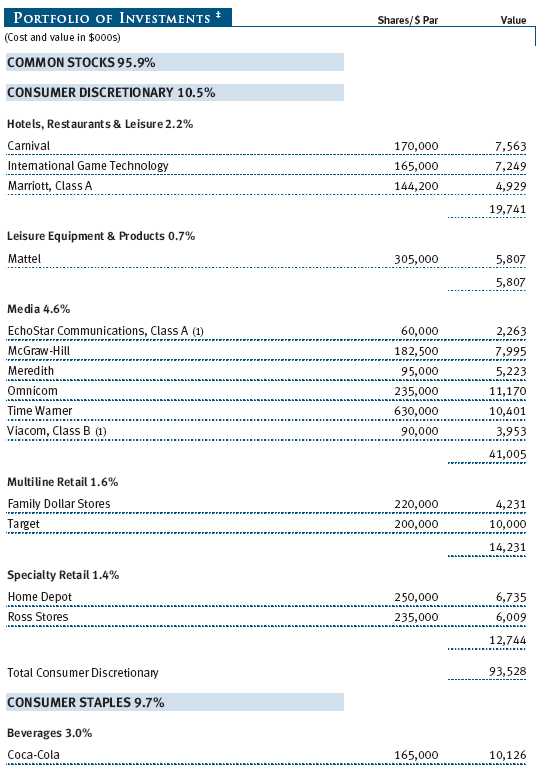

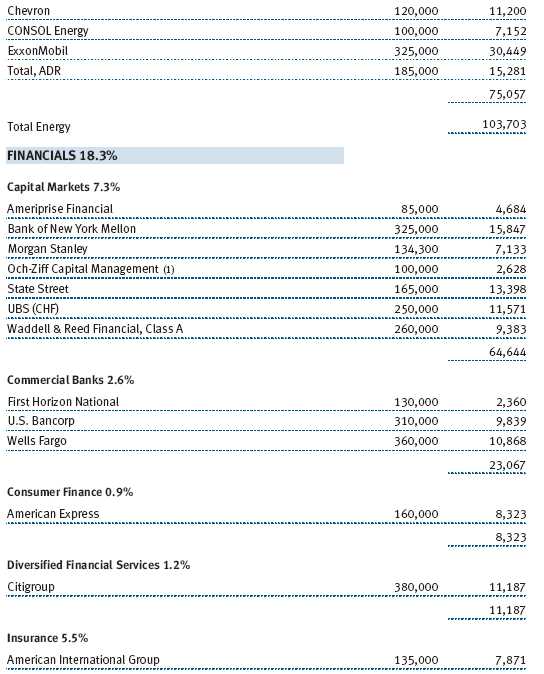

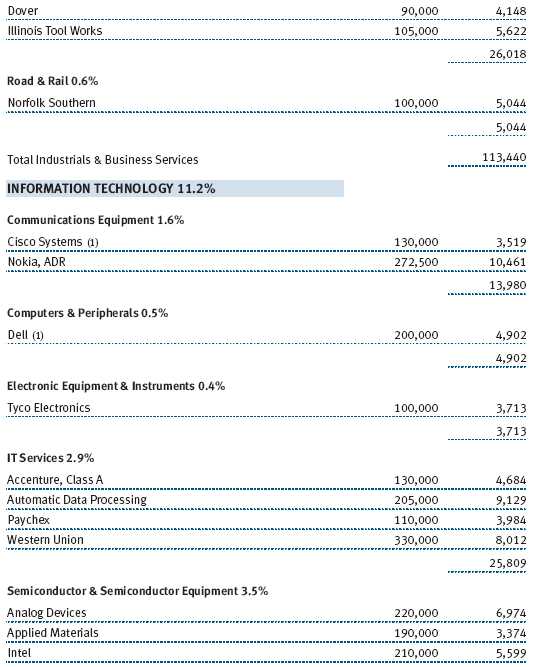

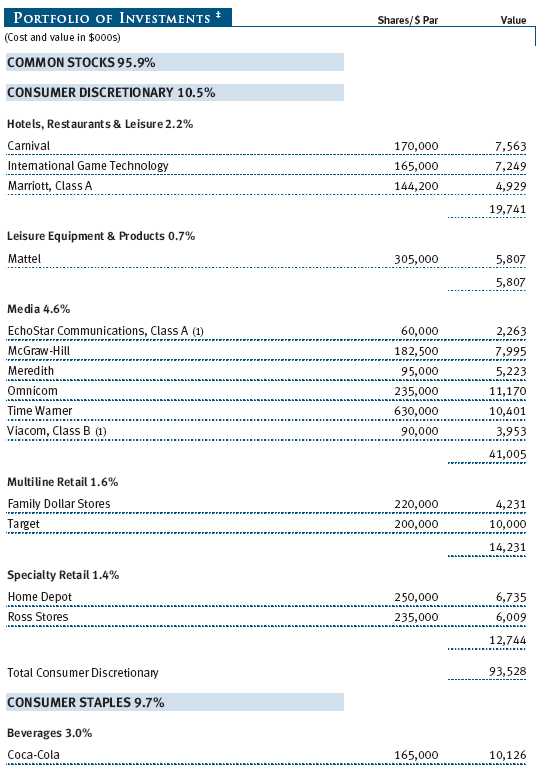

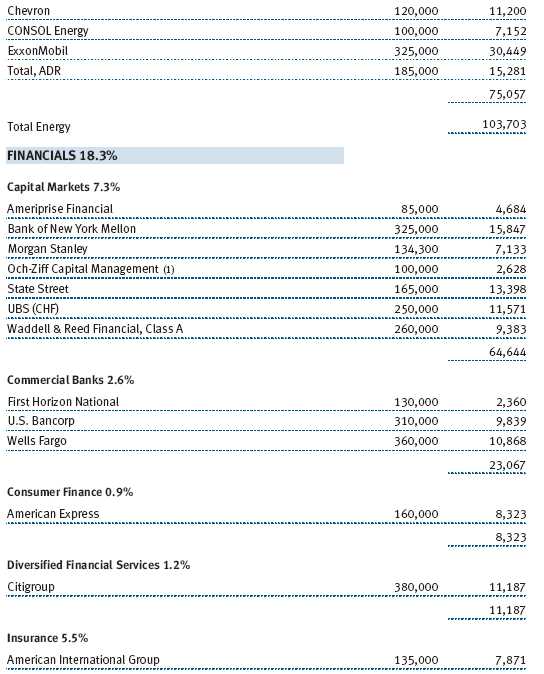

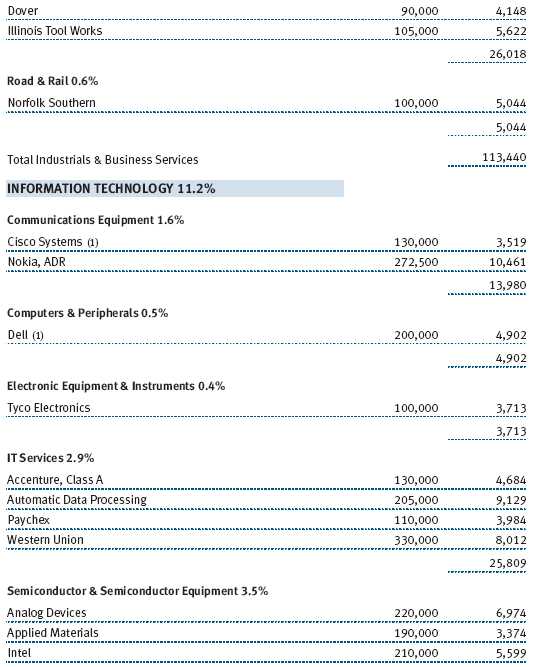

With energy stocks far and away the year’s strongest performers, it’s not surprising that our holdings in the sector generated the fund’s best contributions. ExxonMobil benefited from escalating oil prices, which flirted with $100 per barrel. Consol Energy, an Illinois Basin coal producer, rallied strongly into the fall as investors became aware of the surge in exports of domestic coal. Our top holding in the second half, and second-best contributor for the year, was Diamond Offshore Drilling, a well-run offshore drilling rig company that is paying out its excess cash in the form of large special dividends. Oil service companies are benefiting not only from demand by the publicly traded major oil companies, but the host government oil companies as well. (Please see the Portfolio of Investments for a complete listing of holdings and the amount each represents in the portfolio.)

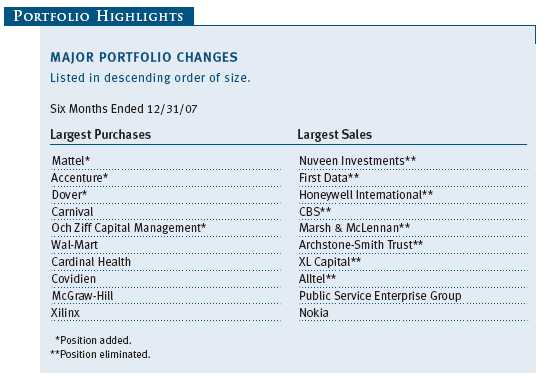

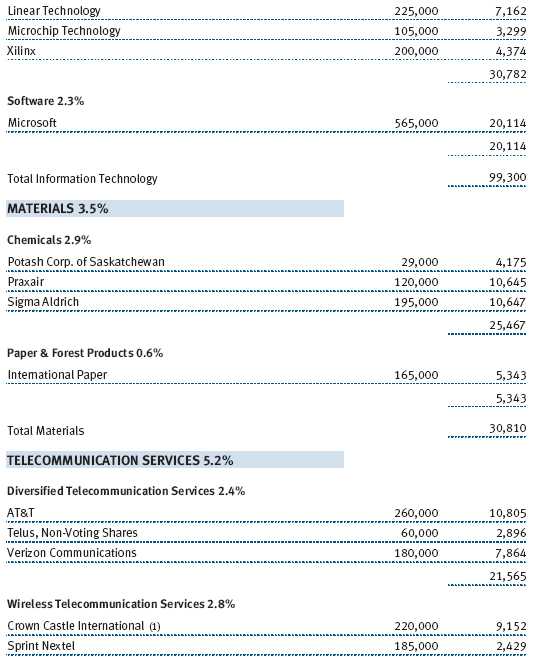

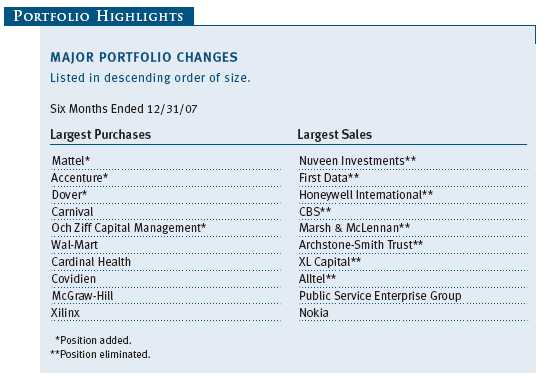

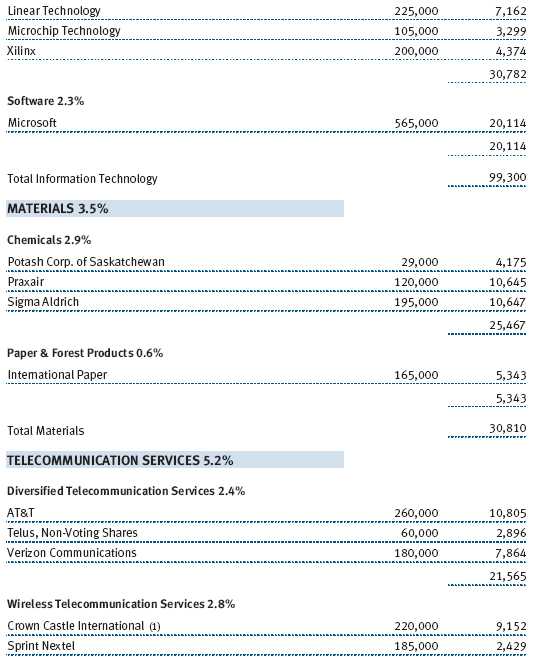

Information technology provided the fund’s top contributor for the year. Nokia is the number-one maker of cellular phones in the world and holds leading positions in large emerging growth markets such as China and India. We think the company is well positioned in terms of technology, distribution, and global brand. Microsoft was another top-10 contributor. The company reported strong earnings driven by sales of its Vista operating system, Office productivity suite, and gaming console Xbox. On the downside, our semiconductor holdings, including Xilinx, Analog Devices, and Microchip Technology, struggled. Within the sector, we added Accenture to the portfolio. The global consulting firm is seeing strong demand for its consulting and outsourcing services. Outsourcing, less cyclical than consulting, now makes up 40% of Accenture’s business, up from just 18% in 2001, resulting in a more stable overall business.

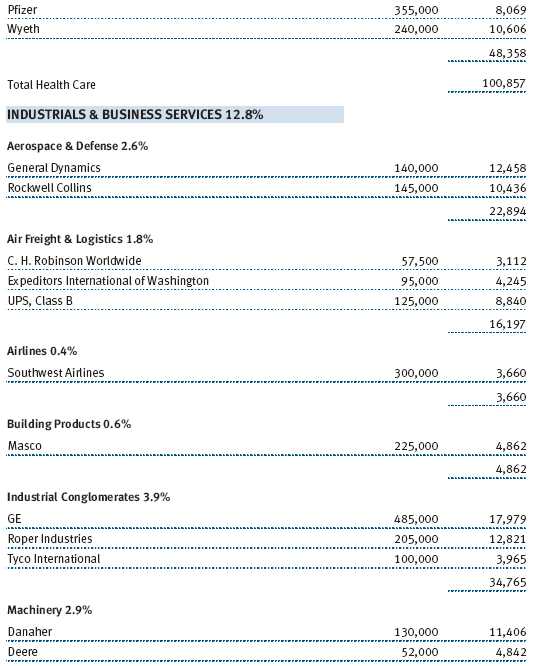

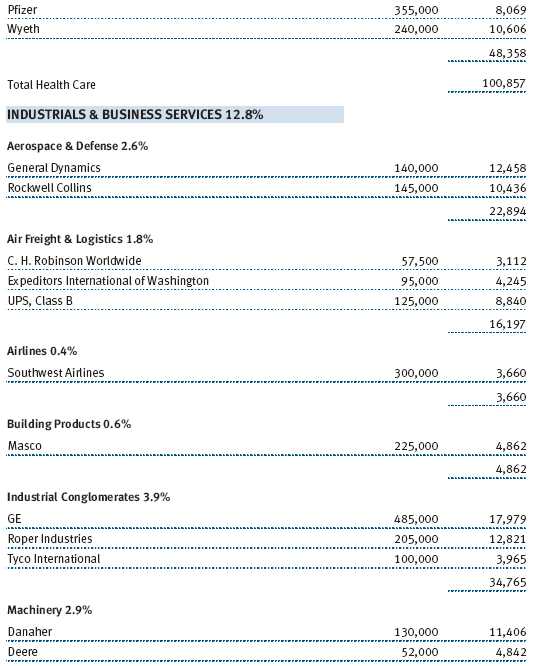

One of our favorite sectors, industrials and business services, continued to perform well, although results were weaker in the second half. Deere benefited from robust commodity prices that have dramatically improved farmers’ cash flow, driving strong demand for the company’s machinery. Chemical firm Sigma Aldrich was another top performer for the six months and year. Industrial conglomerate Tyco International was only a modest performer. It sold off in mid-August after the company reported quarterly results that were hurt by several one-time charges related to restructuring and shareholder litigation. Southwest Airlines declined as higher fuel costs, increased competition, and weakened consumer spending hurt the industry.

Materials posted strong gains in the second half, boosting full-year results. Among our better contributors was Potash Corporation of Saskatchewan. It’s one of the world’s leading producers of potash, a vital soil nutrient in great demand partly due to the increased production of corn for ethanol.

Our consumer discretionary holdings were major detractors for the year, with media companies McGraw-Hill and Time Warner especially hard hit. Retailers also suffered as the home real estate recession and weakening economy cut into consumer spending. Home Depot’s sales declined and the company was forced to lower the sale price of its supply business. Target and Family Dollar Stores also fell. We added a new position in the sector, toy maker Mattel. Despite recent toy recalls and a so-so near-term outlook, we believe Mattel’s valuation and free cash flow are attractive, and the company should benefit from its share repurchase program and four upcoming movie licenses.

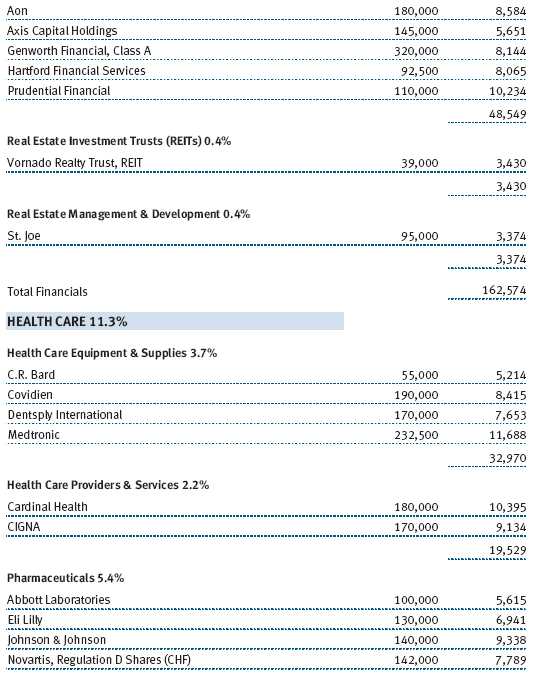

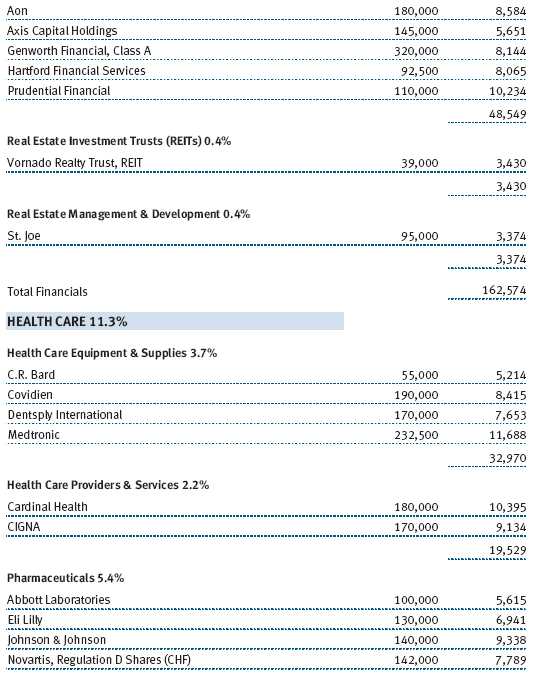

While our financials held up better than those in the index, they nevertheless were significant detractors. Citigroup, Wells Fargo, First Horizon National, and U.S. Bancorp all felt the impact of the meltdown of the subprime lending market. We lost Nuveen Investments to a takeover, and we eliminated insurers Marsh & McLennan and XL Capital. One of our largest purchases during the last six months was the addition of Och Ziff Capital Management on its initial public offering in November. It’s an alternative investment manager with a deep organization, high internal ownership, and strong performance across cycles (and especially in down markets), with a focus on risk controls.

OUTLOOK

The housing slowdown and fallout from the subprime lending debacle have clearly increased the risk of a recession, but the Fed preemptively cut its target interest rates by an additional 75 basis points (0.75%) on January 22 and is likely to continue to guide interest rates lower to promote growth. Still, we think the prospects for corporate earnings growth at many companies are good, especially outside the financials and consumer discretionary sectors. Valuations appear reasonable and have become more supportive due to the recent market decline. We hear a lot of discussion in the press about whether the economy is headed into recession. The performance of some sectors of the market, including consumer discretionary and financials, suggests we may already be in one. Uncertain times can create opportunity for long-term investors, and we are actively assessing the landscape for bargains among durable, dividend-paying stocks. Thank you for your continued confidence in T. Rowe Price.

Respectfully submitted,

Thomas J. Huber

President of the fund and chairman of its Investment Advisory Committee

January 23, 2008

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

As with all stock and bond mutual funds, a fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. Funds investing in stocks with a dividend orientation may have somewhat lower potential for price appreciation than those concentrating on rapidly growing firms. Also, a company may reduce or eliminate its dividend.

GLOSSARY

Dividend yield: The annual dividend of a stock divided by the stock’s price.

Beta: A measure of the market risk of a stock showing how responsive it is to a given market index, such as the S&P 500 Stock Index. By definition, the beta of the benchmark index is 1.00. A fund with a 1.10 beta is expected to perform 10% better than the index in up markets and 10% worse in down markets. Usually, higher betas represent riskier investments.

Free cash flow: The excess cash a company generates from its operations that can be taken out of the business for the benefit of shareholders, such as dividends, share repurchases, investments, and acquisitions.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/earnings ratio (P/E): A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Risk/reward: The relationship between the degree of risk associated with an investment and its return potential. Typically, the higher the potential return of an investment, the greater the risk.

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-capitalization U.S. companies.

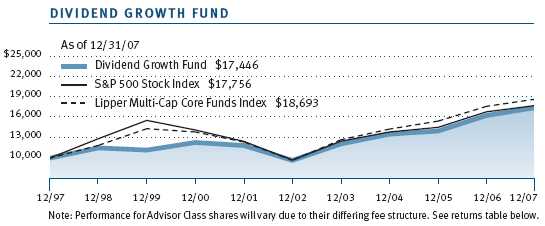

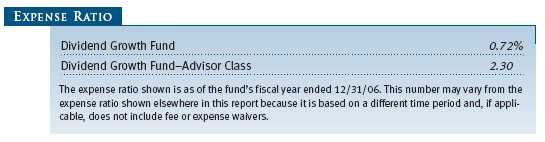

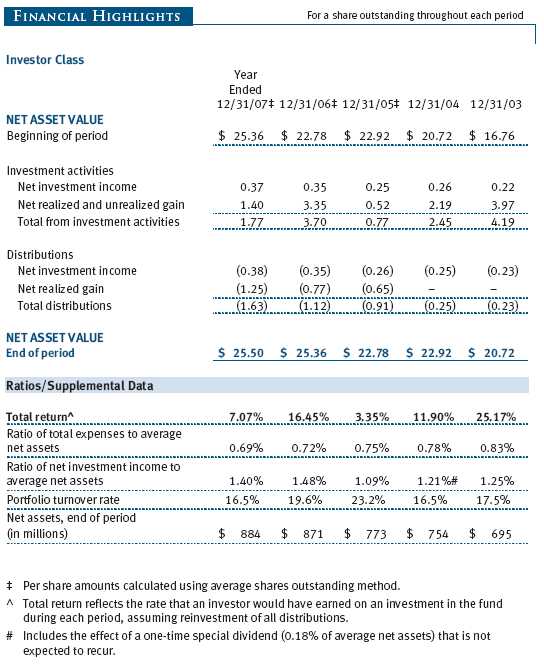

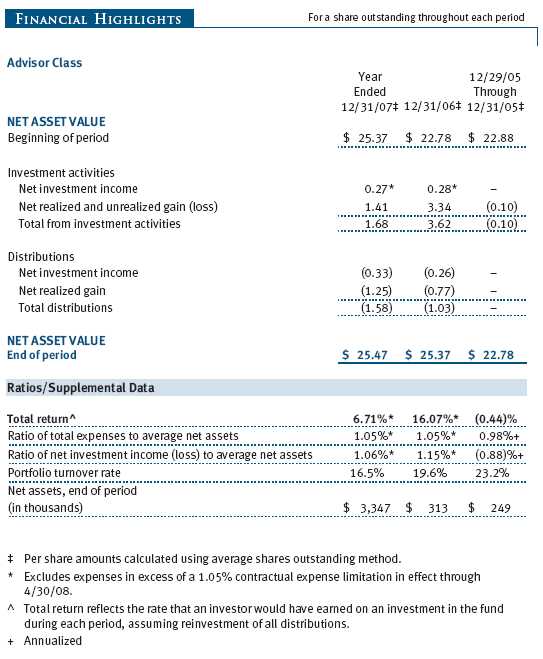

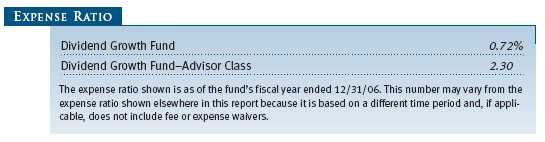

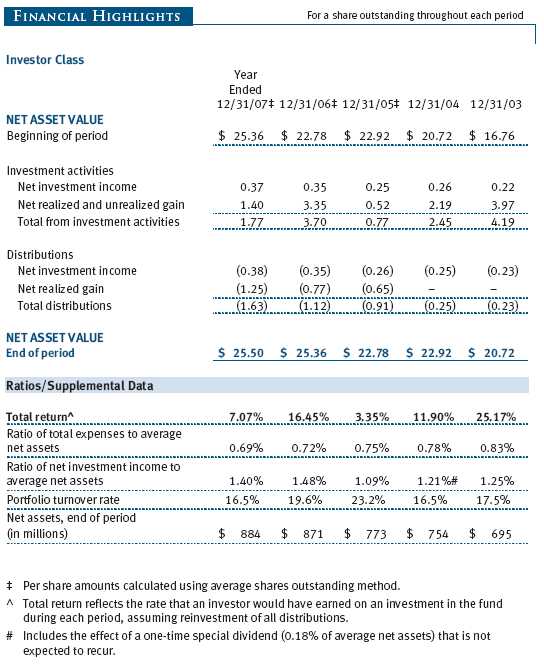

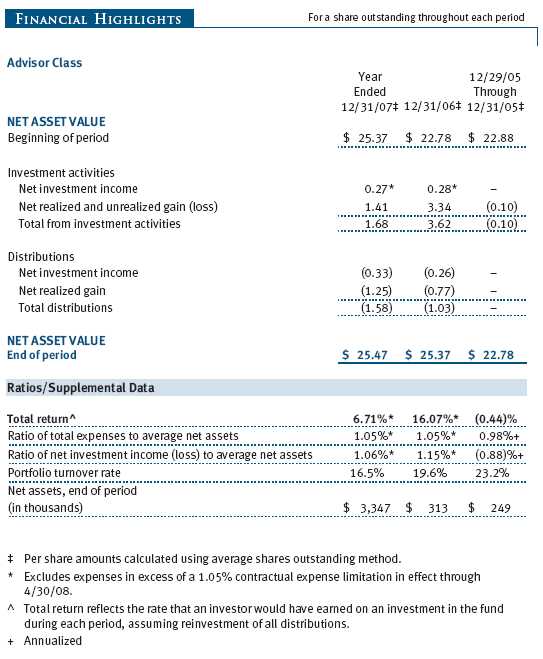

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

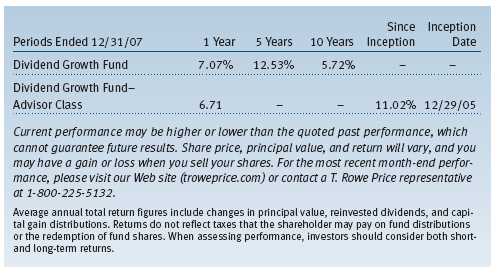

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

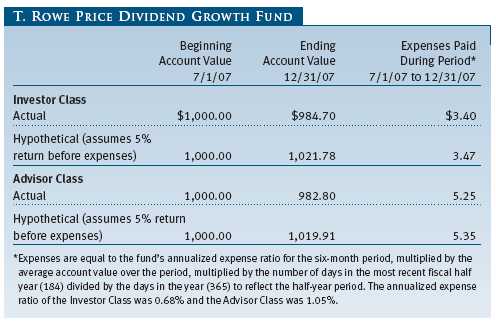

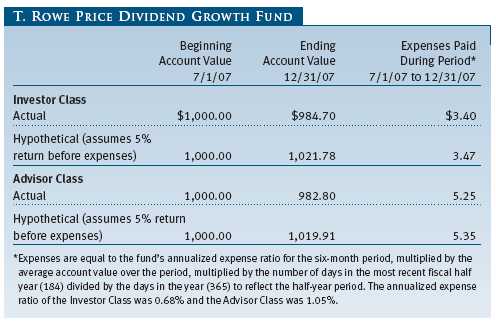

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee. Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

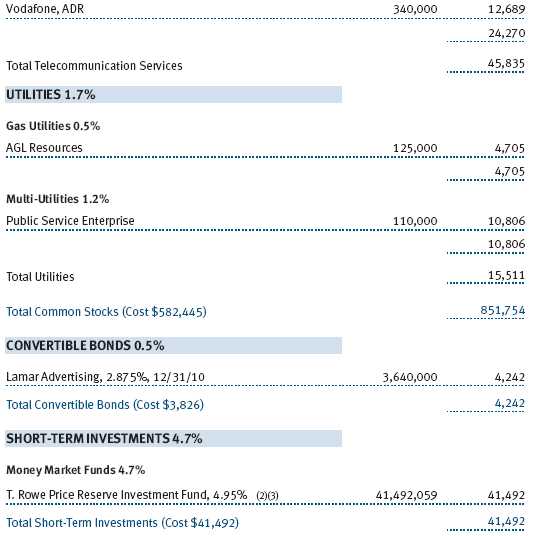

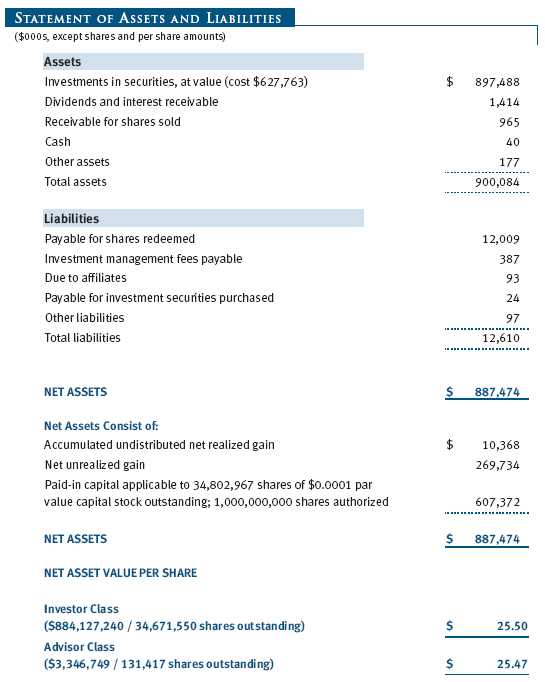

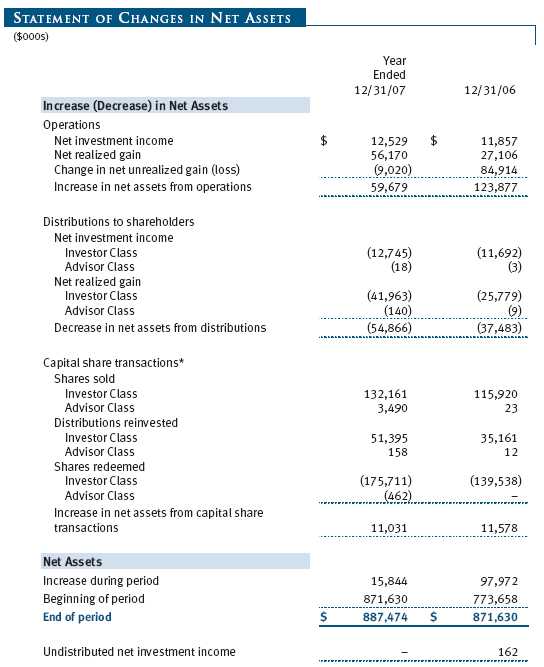

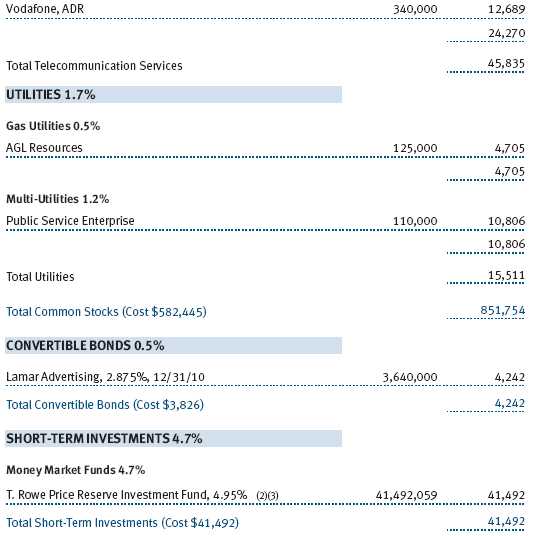

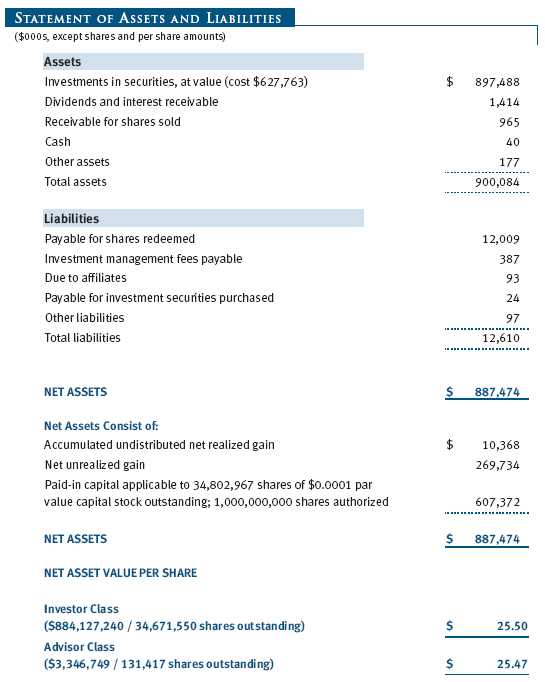

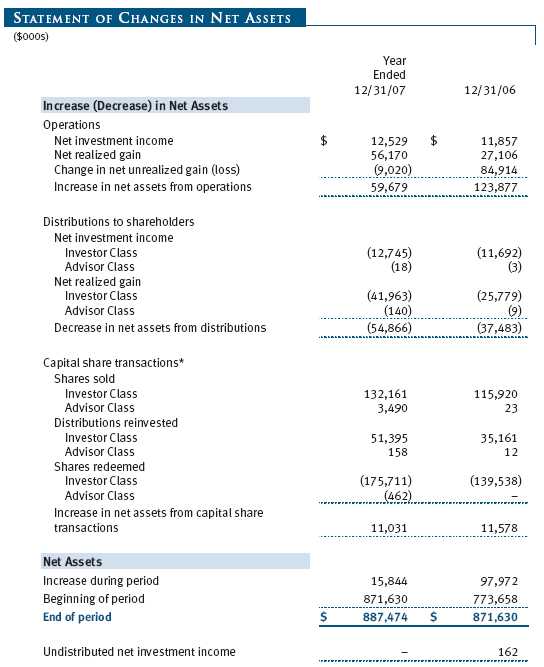

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price Dividend Growth Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income through investments primarily in dividend-paying stocks. The fund has two classes of shares: the Dividend Growth Fund original share class, referred to in this report as the Investor Class, offered since December 30, 1992, and Dividend Growth Fund—Advisor Class (Advisor Class), offered since December 29, 2005. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class, separate voting rights on matters that relate to both classes, and, in all other respects, the same rights and obligations as the other class.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities. Debt securities are generally traded in the over-the-counter market. Securities with original maturities of one year or more are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with original maturities of less than one year are valued at amortized cost in local currency, which approximates fair value when combined with accrued interest.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Most foreign markets close before the close of trading on the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, which in turn will affect the fund’s share price, the fund will adjust the previous closing prices to reflect the fair value of the securities as of the close of the NYSE, as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. In deciding whether to make fair value adjustments, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices. The fund cannot predict when and how often it will use closing prices and when it will adjust those prices to reflect fair value. As a means of evaluating its fair value process, the fund routinely compares closing market prices, the next day’s opening prices in the same markets, and adjusted prices.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $7,000 for the year ended December 31, 2007. Additionally, the fund earns credits on temporarily uninvested cash balances at the custodian that reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class on a quarterly basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

New Accounting Pronouncements Effective June 29, 2007, the fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxes, a clarification of FASB Statement No. 109, Accounting for Income Taxes. FIN 48 establishes financial accounting and disclosure requirements for recognition and measurement of tax positions taken or expected to be taken on an income tax return. The adoption of FIN 48 had no impact on the fund’s net assets or results of operations.

In September 2006, the FASB released the Statement of Financial Accounting Standard No. 157 (FAS 157), Fair Value Measurements. FAS 157 clarifies the definition of fair value and establishes the framework for measuring fair value, as well as proper disclosure of this methodology in the financial statements. It will be effective for the fund’s fiscal year beginning January 1, 2008. Management is evaluating the effects of FAS 157; however, it is not expected to have a material impact on the fund’s net assets or results of operations.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested in a money market pooled trust managed by the fund’s lending agent in accordance with investment guidelines approved by fund management. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the fund the next business day. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. At December 31, 2007, there were no securities on loan.

Other Purchases and sales of portfolio securities, other than short-term securities, aggregated $143,248,000 and $178,769,000, respectively, for the year ended December 31, 2007.

NOTE 3 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences.

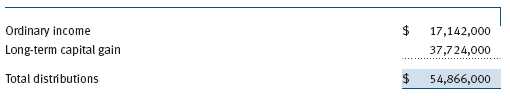

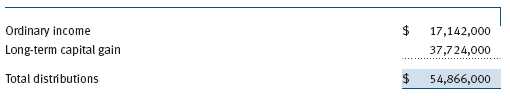

Distributions during the year ended December 31, 2007, were characterized as follows for tax purposes:

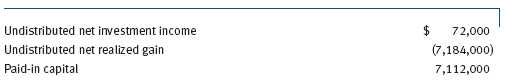

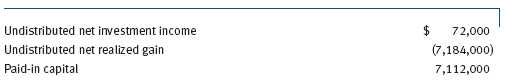

At December 31, 2007, the tax-basis components of net assets were as follows:

For the year ended December 31, 2007, the fund recorded the following permanent reclassifications to reflect tax character. Reclassifications to paid-in capital relate primarily to a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income and/or realized capital gain. Results of operations and net assets were not affected by these reclassifications.

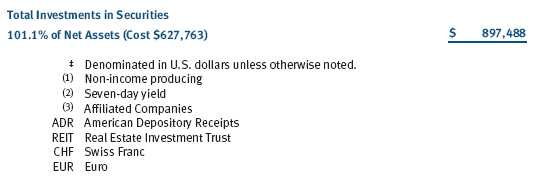

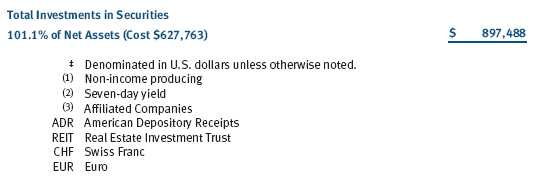

At December 31, 2007, the cost of investments for federal income tax purposes was $627,764,000.

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.20% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2007, the effective annual group fee rate was 0.30%.

The Advisor Class is also subject to a contractual expense limitation through April 30, 2008. During the limitation period, the manager is required to waive its management fee and/or reimburse expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses, that would otherwise cause the class’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation of 1.05%. The class is required to repay the manager for expenses previously reimbursed and management fees waived to the extent the class’s net assets have grown or expenses have declined sufficiently to allow repayment without causing the class’s expense ratio to exceed its expense limitation. However, no repayment will be made more than three years after the date of any reimbursement or waiver or later than April 30, 2010. Pursuant to this agreement, expenses in the amount of $3,000 were reimbursed by the manager during the year ended December 31, 2007. Including these amounts, expenses previously reimbursed by the manager in the amount of $6,000 remain subject to repayment at December 31, 2007.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the year ended December 31, 2007, expenses incurred pursuant to these service agreements were $110,000 for Price Associates, $788,000 for T. Rowe Price Services, Inc., and $269,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2007, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 351,908 shares of the Investor Class, representing 1% of the fund’s net assets.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of T. Rowe Price Dividend Growth Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Dividend Growth Fund, Inc. (the “Fund”) at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the fiscal periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007, by correspondence with the custodian and by agreement to the underlying ownership records for T. Rowe Price Reserve Investment Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 12, 2008

| TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/07 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

• $6,337,000 from short-term capital gains,

• $42,950,000 from long-term capital gains, which was subject to the 15% rate gains category

For taxable non-corporate shareholders, $16,872,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $14,753,000 of the fund’s income qualifies for the dividends-received deduction.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is governed by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name | |

| (Year of Birth) | Principal Occupation(s) During Past 5 Years and Directorships of |

| Year Elected* | Other Public Companies |

| |

| Jeremiah E. Casey | Director, National Life Insurance (2001 to 2005); Director, The Rouse |

| (1940) | Company, real estate developers (1990 to 2004); Director, Allfirst |

| 2005 | Financial Inc. (previously First Maryland Bancorp) (1983 to 2002) |

| |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 to pres- |

| (1945) | ent); Director, Vornado Real Estate Investment Trust (3/04 to present); |

| 2001 | Member, Advisory Board, Deutsche Bank North America (2004 to pres- |

| | ent); Director, Chairman of the Board, and Chief Executive Officer, The |

| | Rouse Company, real estate developers (1997 to 2004) |

| |

| Donald W. Dick, Jr. | Principal, EuroCapital Advisors, LLC, an acquisition and management |

| (1943) | advisory firm; Chairman, The Haven Group, a custom manufacturer of |

| 1992 | modular homes (1/04 to present) |

| |

| David K. Fagin | Chairman and President, Nye Corporation (6/88 to present); Chairman, |

| (1938) | Canyon Resources Corp. (8/07 to present); Director, Golden Star |

| 1992 | Resources Ltd. (5/92 to present); Director, Pacific Rim Mining Corp. |

| | (2/02 to present) |

| |

| Karen N. Horn | Director, Federal National Mortgage Association (9/06 to present); |

| (1943) | Managing Director and President, Global Private Client Services, Marsh |

| 2003 | Inc. (1999 to 2003); Director, Georgia Pacific (5/04 to 12/05), Eli Lilly |

| | and Company, and Simon Property Group |

| |

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) |

| (1941) | |

| 2005 | |

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate invest- |

| (1946) | ment company; Partner, Blackstone Real Estate Advisors, L.P. |

| 2001 | |

| *Each independent director oversees 121 T. Rowe Price portfolios and serves until retirement, resignation, or |

| election of a successor. |

| Inside Directors | |

| |

| Name | |

| (Year of Birth) | |

| Year Elected* | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past 5 Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, |

| (1956) | Director, and Vice President, T. Rowe Price Group, Inc.; Chairman of the |

| 2006 | Board, Director, and President, T. Rowe Price Investment Services, |

| [121] | Inc.; Chairman of the Board and Director, T. Rowe Price Global Asset |

| | Management Limited, T. Rowe Price Global Investment Services |

| | Limited, T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price |

| | Savings Bank, and T. Rowe Price Services, Inc.; Director, T. Rowe Price |

| | International, Inc.; Chief Executive Officer, Chairman of the Board, |

| | Director, and President, T. Rowe Price Trust Company; Chairman of |

| | the Board, all funds |

| |

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [68] | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Year of Birth) | |

| Title and Fund(s) Served | Principal Occupation(s) |

| |

| Peter J. Bates, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc.; formerly intern, T. Rowe Price (to |

| | 2004); Vice President of Finance, Rent-A-Center, |

| | Inc. (to 2003) |

| |

| Joseph A. Carrier, CPA (1960) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer, Dividend Growth Fund | Group, Inc., T. Rowe Price Investment Services, |

| | Inc., and T. Rowe Price Trust Company |

| |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc., T. Rowe Price International, Inc., |

| | and T. Rowe Price Trust Company |

| |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer, | T. Rowe Price; Vice President, T. Rowe Price |

| Dividend Growth Fund | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Trust Company |

| |

| Henry H. Hopkins (1942) | Director and Vice President, T. Rowe Price |

| Vice President, Dividend Growth Fund | Investment Services, Inc., T. Rowe Price Services, |

| | Inc., and T. Rowe Price Trust Company; Vice |

| | President, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, Inc., and |

| | T. Rowe Price Retirement Plan Services, Inc. |

| |

| Thomas J. Huber, CFA (1966) | Vice President, T. Rowe Price, T. Rowe Price |

| President, Dividend Growth Fund | Group, Inc., and T. Rowe Price Trust Company |

| |

| David M. Lee, CFA (1962) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc. |

| |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary, Dividend Growth Fund | T. Rowe Price Investment Services, Inc. |

| |

| Daniel Martino, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc.; formerly Research Analyst and |

| | Co-portfolio Manager, Taurus Asset Management |

| | and ONEX (to 2006) |

| Jason Nogueira, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc.; formerly Healthcare Equity Analyst, |

| | Putnam Investments (to 2004); student, Harvard |

| | Business School (to 2003) |

| |

| Timothy E. Parker (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc. |

| |

| Donald J. Peters (1959) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc. |

| |

| Karen M. Regan (1967) | Vice President, T. Rowe Price |

| Vice President, Dividend Growth Fund | |

| |

| William J. Stromberg, CFA (1960) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc., and T. Rowe Price Trust Company |

| |

| Eric L. Veiel, CFA (1972) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President, Dividend Growth Fund | Group, Inc.; formerly Senior Equity Analyst, |

| | Wachovia Securities (to 2005) |

| |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President, Dividend Growth Fund | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least |

| five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Ms. Karen N. Horn qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Ms. Horn is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,486,000 and $1,401,000, respectively, and were less than the aggregate fees billed for those same periods by the registrant’s principal accountant for audit services rendered to the T. Rowe Price Funds.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Dividend Growth Fund, Inc. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 19, 2008 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 19, 2008 |

| |

| |

| |

| By | /s/ Joseph A. Carrier |

| | Joseph A. Carrier |

| | Principal Financial Officer |

| |

| Date | February 19, 2008 |