QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Under Rule 14a-12 |

VISION-SCIENCES, INC.

|

| (Name of Registrant as Specified In Its Charter) |

NOT APPLICABLE

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

Notice of Annual Meeting of Stockholders

To be Held on Thursday, August 15, 2002

The Annual Meeting of Stockholders of Vision-Sciences, Inc. (the "Company") will be held at the offices of Hale and Dorr LLP, 26th Floor, 60 State Street, Boston, Massachusetts on Thursday, August 15, 2002 at 10:00 a.m., local time, to consider and act upon the following matters:

- (1)

- To elect Katsumi Oneda and Fred E. Silverstein, M.D. as Class II Directors, to serve for a three-year term; and

- (2)

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on June 28, 2002 will be entitled to notice of and to vote at the meeting or any adjournment thereof.

Natick, Massachusetts

July 11, 2002

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

PROXY STATEMENT

For the Annual Meeting of Stockholders

To Be Held on August 15, 2002

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Vision-Sciences, Inc. (the "Company") for use at the Annual Meeting of Stockholders to be held on August 15, 2002 at 10:00 a.m. at the offices of Hale and Dorr LLP, 60 State Street, Boston, Massachusetts and at any adjournment of that meeting. All proxies will be voted in accordance with the stockholders' instructions, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting.

The Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2002, as filed with the Securities and Exchange Commission ("SEC"), except for exhibits, was mailed to stockholders, along with these proxy materials, on or about July 11, 2002.

Voting Securities and Votes Required

At the close of business on June 28, 2002, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 27,198,712 shares of Common Stock of the Company, $.01 par value per share ("Common Stock"), constituting all of the voting stock of the Company. Holders of Common Stock are entitled to one vote per share.

The holders of a majority of the shares of Common Stock outstanding and entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

The affirmative vote of the holders of a plurality of the shares of Common Stock voting on the matter is required for the election of directors.

Shares that abstain from voting as to a particular matter, and shares held in "street name" by a broker or nominee who indicates on a proxy that he or she does not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and also will not be counted as shares voted on such matter. Accordingly, abstentions and "broker non-votes"

will have no effect on the voting on matters, such as the ones presented for stockholder approval at this Annual Meeting, that require the affirmative vote of a certain percentage of the shares voting on the matter.

Stock Ownership of Certain Beneficial Owners and Managers

The following table sets forth the beneficial ownership of the Company's Common Stock as of March 31, 2002 (i) by each person who is known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) by each current director or nominee for director, (iii) by each of the executive officers named in the Summary Compensation Table set forth under the caption "Executive Compensation" below and (iv) by all current directors and executive officers as a group:

Name and Address of

Beneficial Owner

| | Number of

Shares

Beneficially

Owned(1)

| | Percentage of

Outstanding Common Stock

Beneficially Owned(2)

| |

|---|

5% Stockholders

| | | | | |

Katsumi Oneda(3)

c/o Vision-Sciences, Inc.

Nine Strathmore Road

Natick, MA 01760 | | 6,785,830 | | 24.8 | % |

Lewis C. Pell(4)

c/o Machida Incorporated

40 Ramland Road South

Orangeburg, NY 10962 | | 6,631,955 | | 24.4 | % |

Asahi Optical Co., Ltd.

2-36-9, Maeno-cho

Itabashi-Ku

Tokyo 174-8639 Japan | | 2,000,000 | | 7.4 | % |

| Fred E. Silverstein, M.D.(5) | | 176,250 | | * | |

| Gerald B. Lichtenberger, Ph.D.(6) | | 284,500 | | 1.0 | % |

| Kenneth W. Anstey(7) | | 205,290 | | * | |

| William F. Doyle(8) | | 4,000 | | * | |

| John J. Wallace(9) | | 8,000 | | * | |

| Isao Fujimoto(10) | | 184,500 | | * | |

| James A. Tracy(11) | | 134,000 | | * | |

| Mark S. Landman(12) | | 120,000 | | * | |

| All current directors and executive officers as a group (12 persons)(13) | | 14,627,575 | | 52.2 | % |

- *

- Less than 1% of the shares of Common Stock outstanding.

- (1)

- Each person has sole investment and voting power with respect to the shares indicated, except as otherwise noted. The number of shares of Common Stock beneficially owned by each director, nominee for director or executive officer is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. The inclusion herein of any shares as beneficially owned does not constitute an admission of beneficial

-2-

ownership. Any reference in these footnotes to shares subject to stock options held by the person in question refers to stock options held by such person that are currently exercisable or exercisable within 60 days after March 31, 2002.

- (2)

- The number of shares deemed outstanding includes 27,198,712 shares outstanding as of May 31, 2002 and any shares subject to stock options held by the person or entity in question that are currently exercisable or exercisable within 60 days after March 31, 2002.

- (3)

- Includes 125,000 shares subject to stock options.

- (4)

- Includes 50,000 shares and 42,500 shares held of record and beneficially owned by Mr. Pell's wife and child, respectively. Mr. Pell disclaims beneficial ownership of these shares.

- (5)

- Includes 16,000 shares subject to stock options.

- (6)

- Includes 153,500 shares owned by Dr. Lichtenberger and an aggregate of 6,000 shares held of record and beneficially owned by Dr. Lichtenberger's two children. Dr. Lichtenberger disclaims beneficial ownership of these shares. Also includes 125,000 shares subject to stock options.

- (7)

- Includes 44,000 shares subject to stock options.

- (8)

- Comprised of 4,000 shares subject to stock options.

- (9)

- Comprised of 8,000 shares subject to stock options.

- (10)

- Includes 159,500 shares subject to stock options.

- (11)

- Includes 132,500 shares subject to stock options.

- (12)

- Comprised of 120,000 shares subject to stock options.

- (13)

- Includes, as to all directors and executive officers as a group, 818,500 shares subject to stock options that are currently exercisable or exercisable within 60 days after March 31, 2002. Also includes shares for which certain individuals have disclaimed beneficial ownership, as set forth in the above footnotes.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes, with members of each class holding office for staggered three-year terms. There are currently three Class I Directors, whose terms expire at the 2004 Annual Meeting of Stockholders, two Class II Directors, whose terms expire at the 2002 Annual Meeting of Stockholders, and two Class III Directors, whose terms expire at the 2003 Annual Meeting of Stockholders (in all cases subject to the election of their successors and to their earlier death, resignation or removal).

The persons named in the enclosed proxy will vote to elect Katsumi Oneda and Fred E. Silverstein, M.D. as Class II Directors, unless authority to vote for the election of Mr. Oneda or Dr. Silverstein is withheld by marking the proxy to that effect. Mr. Oneda and Dr. Silverstein are currently Class II Directors of the Company. Mr. Oneda and Dr. Silverstein have indicated willingness to serve, if elected, but if either is unable or unwilling to stand for election, proxies may be voted for a substitute nominee or nominees designated by the Board of Directors.

-3-

Set forth below is the name and certain information with respect to each director of the Company, including the nominees for Class II Directors.

Name

| | Class of

Director

| | Age

| | First Became a

Director

|

|---|

| William F. Doyle | | I | | 40 | | 2002 |

| Lewis C. Pell(3) | | I | | 59 | | 1987 |

| John J. Wallace(1) | | I | | 48 | | 2001 |

| Katsumi Oneda(3) | | II | | 64 | | 1987 |

| Fred E. Silverstein, M.D.(1)(2) | | II | | 60 | | 1990 |

| Kenneth W. Anstey(1)(2) | | III | | 56 | | 1993 |

| Gerald B. Lichtenberger, Ph.D. | | III | | 57 | | 1997 |

- (1)

- member of Audit Committee

- (2)

- member of Compensation Committee

- (3)

- member of Executive Committee

William F. Doyle has been a managing director of Insight Venture Partners since October 1999. He served as Vice President, Licensing and Acquisitions for Johnson & Johnson from October 1995 through October 1999.

Lewis C. Pell, a co-founder of the Company, has been Vice-Chairman of the Board of Directors of the Company since May 1992. Mr. Pell is a founder or co-founder and director of a number of other privately held medical device companies.

John J. Wallace has served as Chief Operating Officer of Nova Biomedical Corporation, a medical device company, since October 1991.

Katsumi Oneda, a co-founder of the Company, has been President, Chief Executive Officer and Chairman of the Board of Directors of the Company since October 1993. He served as Vice-Chairman of the Board of Directors of the Company from May 1992 to October 1993, as Honorary Chairman of the Board of Directors from October 1991 to October 1993 and as Chairman of the Board of Directors from September 1990 to October 1991. Mr. Oneda is a director of several private companies.

Fred E. Silverstein, M.D., served as a Professor of Medicine at the University of Washington from July 1989 to June 1994 and has been a partner of Frazier and Company, a healthcare investment company, since July 1994. Dr. Silverstein is a prominent practitioner and author in the field of gastroenterology. Dr. Silverstein is a director of several private medical device companies.

Kenneth W. Anstey served as President and Chief Executive Officer of Oratec Interventions Inc., a publicly traded medical device company, from July 1997 through May 2002. Mr. Anstey served as Chief Executive Officer of Biofield, Corp., a medical device company, from December 1995 to March 1997.

Gerald B. Lichtenberger, Ph.D., has served as Vice President, Business Development of the Company since 1997. Dr. Lichtenberger served as Executive Vice President, Chief Operating Officer and Secretary of the Company from December 1996 to December 1998. From June 1990 to December 1996, Dr. Lichtenberger served as President and a Director of iSight, Inc., a developer and manufacturer of digital video cameras and components.

-4-

Executive officers of the Company are generally elected by the Board of Directors on an annual basis and serve at the Board's discretion. No family relationship exists among any of the executive officers or directors of the Company.

Board and Committee Meetings

The Company has a standing Audit Committee of the Board of Directors, which reviews the Company's independent auditors' performance in the annual audit, reviews auditors' fees, discusses the Company's internal accounting control policies and procedures and considers and recommends the selection of the Company's independent auditors. The current members of the Audit Committee are Messrs. Anstey and Wallace and Dr. Silverstein.

The Company has a standing Compensation Committee of the Board of Directors, which sets the compensation levels of executive officers of the Company (subject to review by the Board of Directors), provides recommendations to the Board regarding compensation programs of the Company, administers the Company's 1990 Stock Option Plan (the "1990 Option Plan") and 2000 Stock Incentive Plan (the "2000 Plan") and authorizes option grants under the 2000 Plan to all employees of the Company. The Compensation Committee did not meet during the fiscal year ended March 31, 2002. The current members of the Compensation Committee are Mr. Anstey and Dr. Silverstein.

The Company does not have a standing Nominating Committee or a committee that performs functions similar to those of a nominating committee.

The Board of Directors met twice during the fiscal year ended March 31, 2002. Each incumbent director attended at least 75% of the aggregate of the number of Board meetings and the number of meetings held by all committees on which he then served except Mr. Pell, who attended one of the two meetings of the Board of Directors.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Company's Board of Directors is composed of three members and acts under a written charter first adopted and approved in March 2000. The members of the Audit Committee are independent directors, as defined by its charter and the rules of the Nasdaq Stock Market. | The Audit Committee held six meetings during the fiscal year ended March 31, 2002.

The Audit Committee reviewed the Company's audited financial statements for the fiscal year ended March 31, 2002 and discussed these financial statements with the Company's management. Management is responsible for the Company's internal controls and the financial reporting process. The Company's independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted accounting principles and to issue a report on those financial statements. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company's management, internal accounting and financial personnel and the independent auditors, the following:

- •

- the plan for, and the independent auditors' report on, each audit of the Company's financial statements;

- •

- the Company's financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders;

-5-

- •

- changes in the Company's accounting practices, principles, controls or methodologies;

- •

- significant developments or changes in accounting rules applicable to the Company; and

- •

- the adequacy of the Company's internal controls and financial personnel.

Management represented to the Audit Committee that the Company's financial statements had been prepared in accordance with generally accepted accounting principles.

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards ("SAS") 61,Communications with Audit Committees with Arthur Andersen LLP, the Company's independent auditors. SAS 61 requires the Company's independent auditors to discuss with the Company's Audit Committee, among other things, the following:

- •

- methods to account for significant or unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors' conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the financial statements.

The Company's independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditor's professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. The Audit Committee discussed with the independent auditors the matters disclosed in this letter and their independence from the Company. The Audit Committee also considered whether the independent auditors' provision of the other, non-audit related services to the Company which are referred to in "Independent Auditors Fees and Other Matters" is compatible with maintaining such auditors' independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended March 31, 2002.

-6-

Director Compensation

The Company's outside directors (currently, Dr. Silverstein and Messrs. Anstey, Doyle and Wallace) receive an annual director's fee in the amount of $10,000 payable quarterly. Directors are reimbursed for certain Company-related travel expenses.

Pursuant to the Company's 1993 Director Option Plan (the "1993 Director Plan"), a non-statutory stock option to purchase 20,000 shares of the Company's Common Stock at an exercise price equal to fair market value of the Common Stock on the date of grant was, or shall be, as the case may be, granted (i) on April 16, 1993, to a each person who was an outside director on such date and who did not have a consulting agreement with the Company at that time, and (ii) on the date of initial election to the board, to any outside director elected subsequent to August 16, 1993. In each case, the option becomes exercisable over a four-year period from the date of grant with one-fifth of the option being exercisable on the date of grant and an additional one-fifth becoming exercisable on each of the first, second, third and fourth anniversaries of the date of grant. In addition to the grants described above, on the date that all of a director's options, as described above, become fully vested, such director shall be granted an additional option to purchase 20,000 shares of the Company's Common Stock at a price equal to the fair market value at the time of grant, which option shall become exercisable over a four-year period from the date of grant as set forth above.

Pursuant to the 1993 Director Plan, in April 2001, upon his initial election to the Board, Mr. Wallace was granted an option to purchase 20,000 shares of the Company's Common Stock at an exercise price equal to the fair market value of the Common Stock on the date of the grant.

Pursuant to the 1993 Director Plan, in August 2001, upon the full vesting of his previous grant, Mr. Anstey was granted an option to purchase 20,000 shares of the Company's Common Stock at an exercise price equal to the fair market value of the Common Stock on the date of the grant.

Pursuant to the 1993 Director Plan, in January 2002, upon his initial election to the Board, Mr. Doyle was granted an option to purchase 20,000 shares of the Company's Common Stock at an exercise price equal to the fair market value of the Common Stock on the date of the grant.

-7-

Executive Compensation

Summary Compensation

The following table sets forth certain information concerning the compensation, for the fiscal years indicated, of the Company's Chief Executive Officer and each of the Company's four most highly compensated executive officers during the fiscal year ended March 31, 2002 (the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| | Annual Compensation(2)

| |

|

|---|

Name and

Principal Position(1)

| |

| | Securities

Underlying

Options

| | All Other

Compensation(3)

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

Katsumi Oneda(4)

President, Chief Executive Officer and

Chairman of the Board of Directors | | 2002

2001

2000 | | $

$

$ | 109,200

109,200

109,200 | | —

—

— | | —

—

— | | | —

—

— |

Gerald B. Lichtenberger

Vice President,

Business Development | | 2002

2001

2000 | | $

$

$ | 138,958

85,800

85,800 | | —

—

— | | —

50,000

— | | | —

—

— |

Isao Fujimoto

Vice President, Manufacturing and

Engineering, Industrial Segment | | 2002

2001

2000 | | $

$

$ | 116,513

115,937

111,478 | | —

—

— | | —

40,000

30,000 | | $

$

$ | 1,804

1,713

1,645 |

James A. Tracy

Vice President, Finance; Treasurer;

Chief Financial Officer and Controller | | 2002

2001

2000 | | $

$

$ | 119,714

103,810

99,892 | | —

—

— | | —

90,000

30,000 | | $

$

$ | 1,552

1,419

672 |

Mark S. Landman

Vice President, Operations,

Medical Segment | | 2002

2001

2000 | | $

$

$ | 119,717

101,833

98,005 | | —

—

— | | —

80,000

30,000 | | $

$

$ | 1,503

1,399

1,337 |

- (1)

- The rules of the SEC require that this table, the stock option grant table and the stock option exercise table which follow, present information concerning the Company's Chief Executive Officer as of March 31, 2002, the Company's fiscal year-end, any other person who served as the Company's Chief Executive Officer at any time during the fiscal year ended March 31, 2002, up to four of the Company's other most highly compensated executive officers (determined by reference to total annual salary and bonus earned by such officers) whose total salary and bonus exceeded $100,000 for the fiscal year ended March 31, 2002, and up to two individuals who would have been one of the four most highly compensated executive officers but for the fact that such individuals no longer served as executive officers of the Company on March 31, 2002.

- (2)

- In accordance with the rules of the SEC, other compensation in the form of perquisites and other personal benefits has been omitted because such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total annual salary and bonus for the Named Executive Officer.

- (3)

- Consists of Company contributions to 401(k) Plan.

- (4)

- All of Mr. Oneda's 2000 and 2001 salary has been accrued and will be paid to Mr. Oneda at such time as the Company generates a positive cash flow. Beginning in January 2002, Mr. Oneda resumed receiving his salary in cash.

-8-

Option Grant Table. No stock options were granted to the Named Executive Officers during the fiscal year ended March 31, 2002.

The following table sets forth certain information concerning stock options held as of March 31, 2002 by each of the Named Executive Officers. None of the Named Executive Officers exercised any options during the year ended March 31, 2002.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION VALUES

| | Number of Shares of Common Stock Underlying Unexercised Options at Fiscal Year-End

| |

| |

|

|---|

| | Value of Unexercised In-The-Money Options at Fiscal Year-End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Katsumi Oneda | | 125,000 | | 0 | | $ | 0 | | $ | 0 |

| Gerald B. Lichtenberger | | 125,000 | | 25,000 | | $ | 23,425 | | $ | 7,175 |

| Isao Fujimoto | | 159,500 | | 20,000 | | $ | 21,064 | | $ | 3,270 |

| James A. Tracy | | 132,500 | | 47,500 | | $ | 19,225 | | $ | 7,975 |

| Mark S. Landman | | 120,000 | | 40,000 | | $ | 15,900 | | $ | 7,775 |

- (1)

- Based on the fair market value of the Common Stock on March 31, 2002 ($1.35 per share), less the option exercise price.

Agreements with Named Executive Officers

Under the terms of a letter agreement between the Company and Mr. Tracy, the Company's Vice President of Finance and Chief Financial Officer, Mr. Tracy was granted an option to purchase 50,000 shares of the Company's Common Stock, at an exercise price equal to the closing price of the Common Stock on the date of the letter agreement. The options vest over a four-year period, but will vest immediately in the event that the Company is merged into or acquired by another entity. The letter agreement also provides that, in the event of a termination other than for cause, Mr. Tracy will receive a lump sum severance payment equal to three months' salary and continue to receive all benefits for a period of three months following termination.

Mr. Oneda has agreed to grant the Company an option to purchase certain securities held by him, as discussed immediately below.

Certain Relationships and Related Transactions

On April 5, 2002, the non-interested members of the Board of Directors authorized the Company to enter into an agreement with Messrs. Oneda and Pell, who are directors of the Company, whereby the Company would have an option to assume convertible capital notes (the "Notes") held by Messrs. Oneda and Pell in the aggregate principal amounts of approximately $600,000 each. The Notes are convertible into capital stock of 3DV Systems, Ltd., an Israeli corporation of which the Company held, as of March 31, 2002, approximately 24% of the outstanding shares. The Company may exercise its option to assume the Notes at its sole discretion, in exchange for payment of the respective principal amounts of the Notes.

-9-

In the fiscal year ended March 31, 2002, the Company purchased approximately $859,000 of flexible endoscope components from a subsidiary of Asahi Optical Co., Ltd. ("Asahi"), pursuant to a March 16, 1992 supply agreement between the Company and Asahi. Asahi is the record and beneficial holder of 7.4% of the Company's outstanding Common Stock.

The Company believes that the terms of the foregoing transactions are at least as favorable to the Company as could have been obtained from unaffiliated third parties.

The Company has a policy that transactions, if any, between the Company and its officers, directors or other affiliates must (a) be on terms no less favorable to the Company than could be obtained from unaffiliated third parties, (b) be approved by a majority of the members of the Board of Directors and (c) be approved by a majority of the disinterested members of the Board of Directors. In addition, any loans by the Company to its officers, directors or other affiliates must be for bona fide business purposes only.

Compensation Committee Report on Executive Compensation

The Company's executive compensation program is administered by the Compensation Committee, which is currently comprised of Kenneth W. Anstey and Fred E. Silverstein, M.D. The Compensation Committee is responsible for determining the compensation package of each executive officer and recommending it to the Board of Directors. In the fiscal year ended March 31, 2002, the Board of Directors did not modify or reject in any material way any action or recommendation of the Compensation Committee. In making decisions regarding executive compensation, the Compensation Committee considers the input of the Company's other directors, including the input of Mr. Oneda with respect to the compensation of the Company's executive officers other than Mr. Oneda.

Policies and Philosophy

The Company's executive compensation program is structured and administered to achieve three broad goals in a manner consistent with stockholder interests. First, the Compensation Committee structures executive compensation programs and decisions regarding individual compensation in a manner that the Compensation Committee believes will enable the Company to attract and retain key executives. Second, the Compensation Committee establishes compensation programs that are designed to reward executives for the achievement of specified business objectives of the Company, which are often targeted to the individual executive's particular business unit. Finally, the Compensation Committee designs the Company's executive compensation programs to provide executives with long-term ownership opportunities in the Company in an attempt to align executive and stockholder interests.

The Company has not to date generated significant revenues from the sales of its new products that incorporate its disposable EndoSheath technology. Accordingly, in evaluating both individual and corporate performance for purposes of determining salary levels and stock option grants, the Compensation Committee currently places significant emphasis on the progress and success of the Company with respect to matters such as product development, including product design and manufacturing, and enhancement of the Company's patent and licensing position as well as on the Company's overall financial performance and sales by product line.

-10-

Executive Officer Compensation in Fiscal 2002

The compensation programs for the Company's executives established by the Compensation Committee consist of two elements based upon the foregoing objectives: (i) base salary and benefits competitive with the marketplace; and (ii) stock-based equity incentives in the form of participation in the 2000 Plan. The Compensation Committee believes that providing base salaries and benefits to its executive officers that are competitive with the marketplace enables the Company to attract and retain key executives. The Compensation Committee generally provides executive officers discretionary stock option awards to reward them for achieving specified business objectives and to provide them with long-term ownership opportunities. In evaluating the salary level and equity incentives to award to each current executive officer, the Compensation Committee examines the progress which the Company has made in areas under the particular executive officer's supervision, such as manufacturing or sales, and the overall performance of the Company. The Compensation Committee does not establish specific goals or milestones which automatically trigger additional compensation for the executive officers but rather decides on each executive officer's compensation after taking into account actions by such officer to accomplish established Company goals.

In determining the salary of each executive officer, including the Named Executive Officers, the Compensation Committee and the Board of Directors consider numerous factors such as (i) the individual's performance, including the expected contribution of the executive officer to the Company's goals, (ii) the Company's long-term needs and goals, including attracting and retaining key management personnel and (iii) the Company's competitive position, including data on the payment of executive officers at comparable companies that are familiar to members of the Compensation Committee. The companies described under the caption "Comparative Stock Performance" below constitute a much broader group of companies at various stages of development than those considered by the Compensation Committee to compare compensation levels of the Company's executive officers. Rather, the companies used by the Compensation Committee to compare executive compensation are companies of which the members of the Compensation Committee have specific knowledge and are considered as of the time those companies were at similar stages of development as the Company. To the extent determined to be appropriate, the Compensation Committee also considers general economic conditions and the historic compensation levels of the individual. The Compensation Committee believes that the salary levels of the Company's executive officers are in the middle third when compared to the compensation levels of companies at similar stages of development as the Company.

Compensation of the Chief Executive Officer in Fiscal 2002

The compensation philosophy applied by the Committee in establishing the compensation for the Company's President and Chief Executive Officer is the same as for the other senior management of the Company—to provide a competitive compensation opportunity that rewards performance.

Mr. Oneda served in the positions of President, Chief Executive Officer and Chairman of the Board of Directors of the Company during the fiscal year ended March 31, 2002. In the fiscal year ended March 31, 1999, the Compensation Committee accepted Mr. Oneda's offer that his salary be reduced to $109,200, which is lower than the salaries of other officers of the Company. The Compensation Committee considers this to be in the lower third of the compensation of Chief Executive Officers at other publicly-traded companies at the same stage of development as the

-11-

Company. From October 1995 through December 2001, all of Mr. Oneda's salary had been accrued, and will be paid to Mr. Oneda at such time as the Company generates a positive cash flow. Beginning in January 2002, Mr. Oneda resumed receiving his salary in cash.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a federal income tax deduction to a public company for certain compensation in excess of $1,000,000 paid to the company's Chief Executive Officer and four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. Although the Company has not paid any of its executive officers annual compensation over $1,000,000 and has no current plan to do so, it currently intends to structure all future performance-based compensation of its executive officers in a manner that complies with this statute.

Compensation Committee Interlocks and Insider Participation

Mr. Anstey and Dr. Silverstein served as members of the Compensation Committee during the fiscal year ended March 31, 2002. No member of the Compensation Committee was at any time during the fiscal year ended March 31, 2002, an officer or employee of the Company nor has any member of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934.

None of the Company's executive officers has served as a director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director of or member of the Compensation Committee.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on its review of copies of reports filed by persons required to file such reports pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended ("Reporting Persons"), the Company believes that all filings required to be made by Reporting Persons of the Company were timely made in accordance with the requirements of the Exchange Act, except Mr. Anstey failed to timely file a Form 5 with respect to a stock option granted under the 1993 Director Plan in August 2001.

-12-

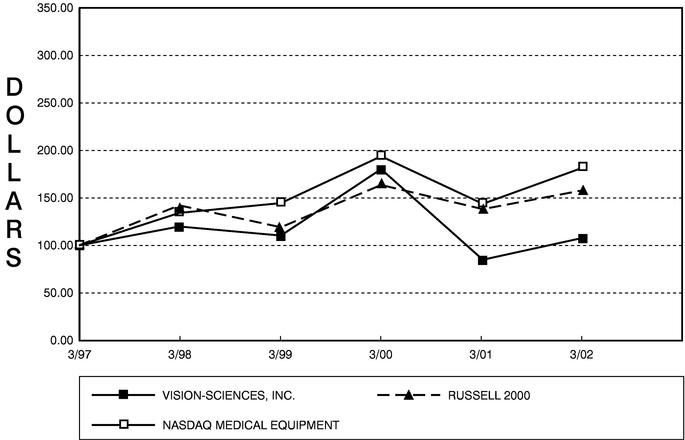

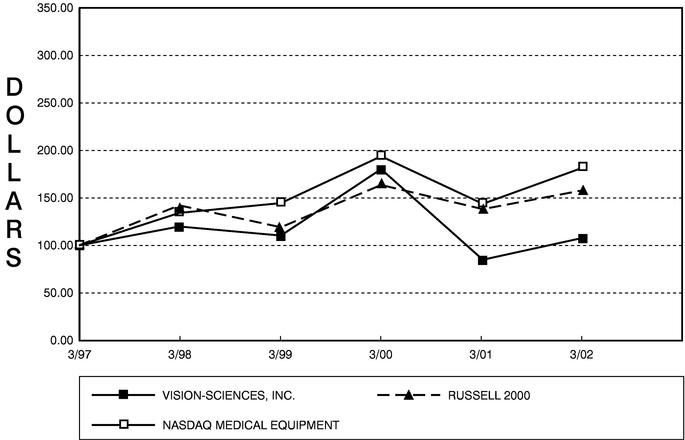

COMPARATIVE STOCK PERFORMANCE

The following graph compares the cumulative total stockholder return on the Common Stock of the Company between March 31, 1997 and March 31, 2002 (the end of fiscal 2002) with the cumulative total return of (i) the Russell 2000 Index and (ii) the Nasdaq Medical Equipment Index. This graph assumes the investment of $100 on March 31, 1997 in the Company's Common Stock, the Russell 2000 Index and the Nasdaq Medical Equipment Index Index, and assumes dividends are reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG VISION-SCIENCES, INC., THE RUSSELL 2000 INDEX

AND THE NASDAQ MEDICAL EQUIPMENT INDEX

The Company added the Nasdaq Medical Equipment Index to the comparative stock performance graph in this year's Proxy Statement. The Nasdaq Medical Equipment Index measures the performance of approximately 300 medical device companies of various sizes. This index replaces the JP Morgan H&Q Medical Products Index, which was included in last year's Proxy Statement but is no longer published.

Changes in Accountants

Upon the recommendation of the Audit Committee of Vision-Sciences, Inc. (the "Company"), on July 1, 2002, the Board of Directors of the Company decided to change the principal accountants for the Company from Arthur Andersen LLP ("Arthur Andersen") to BDO Seidman, LLP ("BDO Seidman") subject to the client acceptance procedures of BDO Seidman.

-13-

During the Company's two most recently completed fiscal years and the subsequent interim period preceding the decision to change principal accountants, there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of Arthur Andersen, would have caused it to make reference to the subject matter of the disagreement in connection with its report. Arthur Andersen's reports on the Company's financial statements for the past two years did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Company's two most recently completed fiscal years and the subsequent interim period preceding the decision to change principal accountants, there were no reportable events as defined in Regulation S-K Item 304(a)(1)(v).

The Company expects to engage BDO Seidman as the Company's principal accountants in July 2002, subject to the client acceptance procedures referred to above. During the Company's two most recent fiscal years and the subsequent interim period prior to engaging BDO Seidman, neither the Company nor anyone on its behalf consulted with BDO Seidman regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company by BDO Seidman that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue.

Representatives of BDO Seidman are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Independent Auditors Fees and Other Matters

Audit Fees. Andersen billed the Company an aggregate of $66,000 in fees for professional services rendered in connection with the audit of the Company's financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company's Quarterly Reports on Form 10-Q during the fiscal year ended March 31, 2002.

Financial Information Systems Design and Implementation Fees. Andersen did not bill the Company for any professional services rendered to the Company and its affiliates for the fiscal year ended March 31, 2002 in connection with financial information systems design or implementation, the operation of the Company's information system or the management of its local area network.

All Other Fees. Andersen billed the Company an aggregate of $45,000 in fees for tax planning, compliance and advisory services rendered to the Company and its affiliates for the fiscal year ended March 31, 2002.

OTHER MATTERS

The Board of Directors does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

-14-

Solicitation of Proxies

This solicitation of proxies is made on behalf of the Company and the Company will bear all costs of solicitation. In addition to solicitations by mail, the Company's directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and the Company will reimburse them for their out-of-pocket expenses in this connection.

Householding of Annual Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of the Company's Proxy Statement or Annual Report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you call or write the Company at the following address or phone number: Vision-Sciences, Inc., Nine Strathmore Road, Natick, Massachusetts 01760, Telephone: (508) 650-9971, Attention: James A. Tracy. If you want to receive separate copies of the Annual Report and Proxy Statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address and phone number.

Stockholder Proposals

Proposals of stockholders intended to be presented at the 2003 Annual Meeting of Stockholders must be received by the Company at its principal office in Natick, Massachusetts not later than March 13, 2003 for inclusion in the Proxy Statement for that meeting.

If a stockholder of the Company wishes to present a proposal before the 2003 Annual Meeting of Stockholders, but does not wish to have the proposal considered for inclusion in the Company's Proxy Statement and proxy card, such stockholder must give written notice to the Company at its principal office in Natick, Massachusetts not later than May 27, 2003. If the stockholder fails to provide timely notice of a proposal to be presented at the 2003 Annual Meeting, the proxies designated by the Board of Directors of the Company will have discretionary authority to vote on any such proposal.

July 11, 2002

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING AND YOUR COOPERATION WILL BE APPRECIATED. STOCKHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES.

-15-

VISION-SCIENCES, INC.

| PROXY | | THIS PROXY IS SOLICITED

ON BEHALF OF THE BOARD

OF DIRECTORS OF THE COMPANY | | PROXY |

|

|

PROXY FOR THE

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 15, 2002 |

|

|

The undersigned, revoking all prior proxies, hereby appoint(s) Katsumi Oneda, Gerald B. Lichtenberger and Peter B. Tarr, and each of them, with full power of substitution, as proxies to represent and vote, as designated herein, all shares of Common Stock of Vision-Sciences, Inc. (the "Company") which the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders of the Company to be held at the offices of Hale and Dorr LLP, 60 State Street, Boston, Massachusetts, on August 15, 2002 at 10:00 a.m., local time, and at any adjournment thereof.

This proxy when properly executed will be voted in the manner directed by the undersigned stockholder(s). IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSAL 1. Attendance of the undersigned at the meeting or any adjournment thereof will not be deemed to revoke this proxy unless the undersigned shall revoke this proxy in writing before it is exercised or affirmatively indicate his intent to vote in person.

TO BE SIGNED ON REVERSE SIDE

| (1) To elect the Class II Directors listed to the right: | | Nominees: | | Katsumi Oneda

Fred E. Silverstein |

| o FOR the nominees | | o WITHHOLD AUTHORITY to vote for the nominees |

FOR, except vote withheld from the following nominee:

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS OF THE COMPANY.

Signature:

| | Signature:

|

Date:

|

|

Date:

|

Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give title as such. If a corporation or a partnership, please sign by authorizing person.

QuickLinks

PROPOSAL 1: ELECTION OF DIRECTORS